Exhibit 10.1

AGREEMENT OF PURCHASE AND SALE

AND JOINT ESCROW INSTRUCTIONS

ARTICLE I

SUMMARY AND DEFINITION OF BASIC TERMS

This Agreement of Purchase and Sale and Joint Escrow Instructions (the "Agreement"), dated as of the Effective Date set forth in Section 1 of the Summary of Basic Terms, below, is made by and between ACTH II LLC, a Delaware limited liability company ("Buyer"), and COHU, INC., a Delaware corporation ("Seller"). The terms set forth below shall have the meanings set forth below when used in the Agreement.

|

TERMS OF AGREEMENT |

DESCRIPTION | ||

| 1. |

Effective Date |

The date upon which Escrow Holder has received fully-executed counterparts of this Agreement from Buyer and Seller. | |

| 2. |

Building |

The building located on the Land situated in the City of Poway (the "City"), County of San Diego (the "County"), California, and commonly known as 12367 Crosthwaite Circle, Poway, California. | |

| 3. |

Broker |

CBRE (Louay Alsadek). | |

| 4. |

Buyer's Notice Address |

ACTH II LLC c/o CT Realty Corporation 65 Enterprise Aliso Viejo, CA 92656 Attn: Dominic Petrucci and Steven J. Provencio Fax No.: (949) 330-5771 Email: dpetrucci@ctrinvestors.com / sprovencio@ctrinvestors.com

65 Enterprise Aliso Viejo, CA 92656 Attn: Michael W. Traynham, Esq. Fax No.: (949) 330-5771 Email: mtraynham@ctrinvestors.com | |

| 5. |

Purchase Price |

$34,250,000.00. | |

| 6. |

Initial Deposit |

$250,000.00. | |

| 7. |

Additional Deposit |

$250,000.00. | |

| 8. |

Escrow Holder |

Chicago Title Company Email: lococoa@ctt.com | |

| 9. |

Contingency Date |

Thirty (30) days following the Effective Date. | |

| 10. |

Closing Date |

Thirty (30) days following the Contingency Date, subject to extension as provided in Section 3.2. | |

| 11. |

Title Company |

Chicago Title Company 2365 Northside Drive, Suite 500 San Diego, CA 92108 Attn: Tom Votel & Ken Cyr Fax No.: (619) 521-3608 Email: VotelT@CTT.com/Ken.Cyr@ctt.com | |

| 12. |

Seller's Representative |

John Allen, Jeffrey Jones and Gary Ingoglia. |

ARTICLE II

RECITALS

A. Seller owns that certain parcel of land more particularly described on Exhibit "A" attached hereto (the "Land"), which land is improved with the Building.

B. Seller desires to sell and convey to Buyer and Buyer desires to purchase and acquire from Seller the following:

i. The Land and all of Seller's right, title and interest in all rights, privileges, easements and appurtenances benefiting the Land and/or the Improvements, including, without limitation, Seller's interest, if any, in all mineral and water rights and all easements, rights-of-way and other appurtenances used or connected with the beneficial use or enjoyment of the Land and/or the Improvements (the Land, the Improvements and all such rights, privileges, easements and appurtenances are sometimes collectively hereinafter referred to as the "Real Property");

ii. The Building, associated parking and landscaped areas and all other improvements located on the Land (the "Improvements");

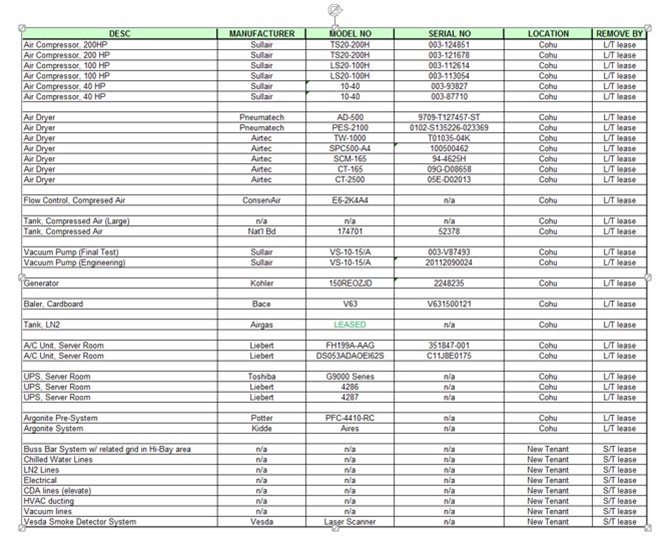

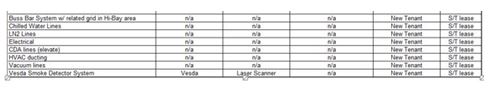

iii. The personal property, equipment, supplies and fixtures (collectively, the "Personal Property") owned by Seller and used or useful in the operation of the Real Property and specifically identified on the attached Exhibit "J", if any; and

iv. To the extent assignable, all of Seller's right, title and interest in any intangible property used or useful in connection with the foregoing, contract rights, warranties, guaranties, licenses, permits, entitlements, governmental approvals and certificates of occupancy which benefit the Real Property, the Improvements, and/or the Personal Property (the "Intangible Personal Property"). The Real Property, the Improvements, the Personal Property, and the Intangible Personal Property are sometimes collectively hereinafter referred to as the "Property."

C. Prior to the Contingency Date, Buyer will have the opportunity to conduct all due diligence with regard to the Property as set forth in Sections 4.1 and 4.2 below (collectively, the "Due Diligence Investigations").

ARTICLE III

AGREEMENT

NOW, THEREFORE, in consideration of the covenants contained herein and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, Buyer and Seller hereby agree as follows, and hereby instruct Escrow Holder as follows.

1. Purchase and Sale; Leaseback; Leases. Seller agrees to sell to Buyer, and Buyer agrees to purchase from Seller, the Property upon the terms and conditions set forth in this Agreement. Notwithstanding anything to the contrary contained herein, Seller shall lease the Property back from Buyer pursuant to, and in accordance with, the terms and conditions of the Lease in the form attached hereto as Exhibit "I" ("Leaseback Agreement"), which Leaseback Agreement will be executed and delivered by Buyer and Seller through escrow at Closing. For purposes of clarity, the parties hereby acknowledge and agree that a party's failure to execute and deliver the Leaseback Agreement, in the form attached hereto as Exhibit "I", through escrow at Closing as required by Section 5 below, shall constitute a material default under this Agreement by such party. In addition, Seller is not conveying or assigning to Buyer, and Seller is retaining all right, title and interest as lessor in and to, the following leases in effect as of the Effective Date (collectively, the "Leases"): (i) that certain Lease between Seller, as landlord, and Broadcast Microwave Services, Inc., as tenant, dated June 10, 2015 (together with all amendments and modifications thereto made prior to the Effective Date, collectively, the "BMS Lease"); (ii) that certain Lease between Seller, as landlord, and Sirius Acquisition, LLC, as tenant, dated June 3, 2014 (together with all amendments and modifications thereto prior to the Effective Date, collectively, the "Sirius Lease"); and (iii) that certain Lease between Seller, as landlord, and Alex Machining Corporation, as tenant, dated March 29, 2013 (together with all amendments and modifications thereto prior to the Effective Date, collectively, the "AMC Lease"). The tenants, licensees and/or occupants of the Property under the Leases are referred to herein collectively as the "Tenants" and individually as a "Tenant". The Tenants shall become subtenants of Seller for the remainder of the respective terms of the Leases from and after Closing.

2. Purchase Price.

2.1 Purchase Price. Buyer shall pay the Purchase Price for the Property as hereinafter provided in this Section 2.

2.1.1 Initial Deposit. Within two (2) Business Days after the Effective Date, Buyer shall deliver to Escrow Holder the Initial Deposit by cashier's check or wire transfer of immediately available funds. If Buyer fails to deliver the Initial Deposit to Escrow Holder strictly as and when contemplated herein, Seller shall have the right to terminate this Agreement by delivering written notice thereof to Buyer at any time prior to Escrow Holder's receipt of the Initial Deposit, and in the event of such termination Buyer shall be responsible for and shall pay any and all title and escrow cancellation fees and charges. The Initial Deposit shall remain fully refundable to Buyer until Buyer's delivery of Buyer's Approval Notice pursuant to Section 4.1.4 below. If Buyer fails to deliver Buyer's Approval Notice by the time specified in Section 4.1.4 below, this Agreement shall terminate and the Initial Deposit, together with interest accrued thereon, shall be returned to Buyer, without the need for, and despite any contrary instructions received from, Seller, and thereafter neither party shall have any further rights or obligations hereunder except for Seller's and Buyer's obligations and indemnities under this Agreement that by their terms expressly survive the termination of this Agreement.

2.1.2 Additional Deposit. Within one (1) Business Day after the Property Approval Period, and provided Buyer shall have delivered Buyer's Approval Notice (and therefore shall have not elected (or deemed to have elected) to terminate this Agreement pursuant to Section 4.1.4 below), Buyer shall deliver to Escrow Holder the Additional Deposit (the Initial Deposit, together with the Additional Deposit, if and when made by Buyer, and all interest that accrues on the Initial Deposit and the Additional Deposit while such amounts are held by Escrow Holder may be referred to herein collectively as the "Deposit"). Buyer's failure to timely deliver the Additional Deposit after delivering Buyer's Approval Notice shall constitute a material default by Buyer under this Agreement. If Buyer delivers Buyer's Approval Notice pursuant to Section 4.1.4 below, then, after the Contingency Date, the Deposit shall be: (i) applied and credited toward payment of the Purchase Price at the Close of Escrow, or (ii) retained by Seller as liquidated damages in accordance with the terms and conditions of Section 16.1 below unless this Agreement is terminated (or deemed terminated) by Buyer pursuant to an express termination right in favor of Buyer under this Agreement.

2.1.3 Interest Bearing Account. The Deposit shall be deposited by Escrow Holder in an interest-bearing account at a federally insured institution as Escrow Holder, Buyer and Seller deem appropriate and consistent with the timing requirements of this Agreement. The interest on the Deposit (while held by Escrow Holder) shall accrue to the benefit of the party receiving the Deposit pursuant to the terms of this Agreement, and Buyer and Seller hereby acknowledge that there may be penalties or interest forfeitures if the applicable instrument is redeemed prior to its specified maturity. Any interest earned on the Deposit shall be deemed to be a part of the Deposit for the purposes of this Agreement. Buyer agrees to provide its Federal Tax Identification Number to Escrow Holder upon the opening of Escrow.

2.1.4 Cash Balance. On or before one (1) Business Day prior to the Closing Date, Buyer shall deposit with Escrow Holder cash by means of a confirmed wire transfer through the Federal Reserve System the amount of the balance of the Purchase Price, as adjusted for any applicable closing costs and prorations allocated to Buyer pursuant to Sections 7 and 8 below.

2.2 Independent Contract Consideration. Concurrently with Buyer's delivery of the Deposit to Escrow Holder, Buyer shall deliver to Escrow Holder the sum of $100.00 (the "Independent Contract Consideration"), which shall be immediately released by Escrow Holder to Seller, and shall be accepted by Seller as the independent contract consideration for Seller's execution and delivery of this Agreement and the rights extended to Buyer hereunder. The Independent Contract Consideration is earned as of the execution hereof by Buyer and Seller, and is nonrefundable under all circumstances.

3. Escrow and Title.

3.1 Opening of Escrow. Buyer and Seller shall promptly deliver a fully executed copy of this Agreement to Escrow Holder, and the date of Escrow Holder's receipt thereof is referred to as the "Opening of Escrow". Escrow Holder shall promptly notify Buyer and Seller of the date of Opening of Escrow. Seller and Buyer shall execute and deliver to Escrow Holder any additional or supplementary instructions as may be reasonably necessary to implement the terms of this Agreement and close the transactions contemplated hereby, provided such instructions are consistent with and merely supplement this Agreement and shall not in any way modify, amend or supersede this Agreement. Such supplementary instructions, together with the escrow instructions set forth in this Agreement, as they may be amended from time to time by the parties, shall collectively be referred to as the "Escrow Instructions." The Escrow Instructions may be amended and supplemented by such standard terms and provisions as the Escrow Holder may request the parties hereto to execute; provided, however, that the parties hereto and Escrow Holder acknowledge and agree that in the event of a conflict between any provision of such standard terms and provisions supplied by the Escrow Holder and the Escrow Instructions, the Escrow Instructions shall prevail.

3.2 Close of Escrow/Closing. For purposes of this Agreement, the "Close of Escrow" or the "Closing" shall mean the date on which the Deed (as defined in Section 5.1.1 below) is recorded in the Official Records of the County where the Land is located (the "Official Records"). The Close of Escrow shall occur on the Closing Date. Notwithstanding the foregoing, Buyer shall have a one-time right to extend the Closing Date for up to an additional thirty (30) days, which right shall be exercised, if at all, by: (i) Buyer's delivery of written notice to Seller no later than three (3) Business Days prior to the original scheduled Closing Date, and (ii) concurrently therewith, Buyer's delivery of an additional $200,000.00 deposit with Escrow Holder (which additional sum shall not be considered part of the Deposit under this Agreement and as such not applicable to the Purchase Price at Closing and shall not be refundable to Buyer unless this Agreement is terminated by Buyer pursuant to Section 16.1 due to a Seller default).

3.3 Title Insurance. At the Close of Escrow, and as a condition thereto, the Title Company shall be prepared to issue to Buyer an ALTA extended coverage Owner's Policy of Title Insurance (the "Title Policy") with liability in the amount of the Purchase Price, showing title to the Property vested in Buyer, subject only to (i) the preprinted standard exceptions in such Title Policy, (ii) exceptions approved or deemed approved by Buyer pursuant to Section 4.2, (iii) the rights and interests, as tenants only, of the Tenants under the Leases and Seller under the Leaseback Agreement, (iv) non-delinquent real property taxes and special assessments, (v) any exceptions arising from Buyer's actions, and (vi) any matters which would be disclosed by an accurate survey or readily apparent from a reasonable visual inspection of the Property (collectively, the "Permitted Exceptions"). The Property Approval Period and Close of Escrow shall not be extended due to Buyer's Title Policy requirements, including without limitation the need to obtain an updated ALTA survey. Notwithstanding the foregoing, if Buyer elects not to pay for the additional premium for the ALTA extended coverage policy, or if Buyer does not timely provide Title Company with an updated ALTA survey in form sufficient for Title Company to issue such ALTA extended coverage policy at the Close of Escrow, then the Title Policy to be issued on the Close of Escrow shall be a standard coverage ALTA Owner's Policy of Title Insurance which may include, in addition to the Permitted Exceptions, a general survey exception.

4. Contingencies; Conditions Precedent to the Close of Escrow.

4.1 Buyer's Review.

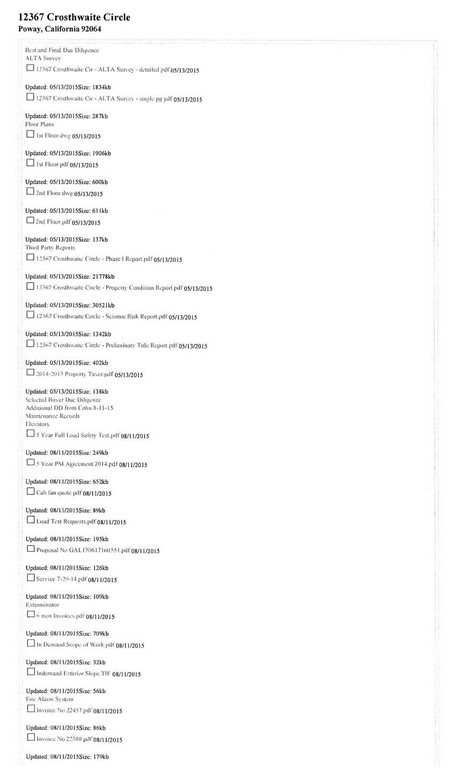

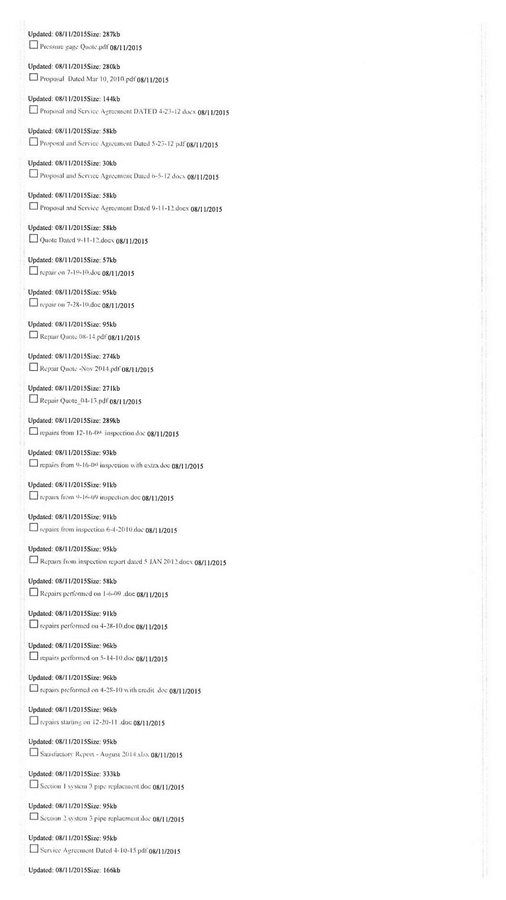

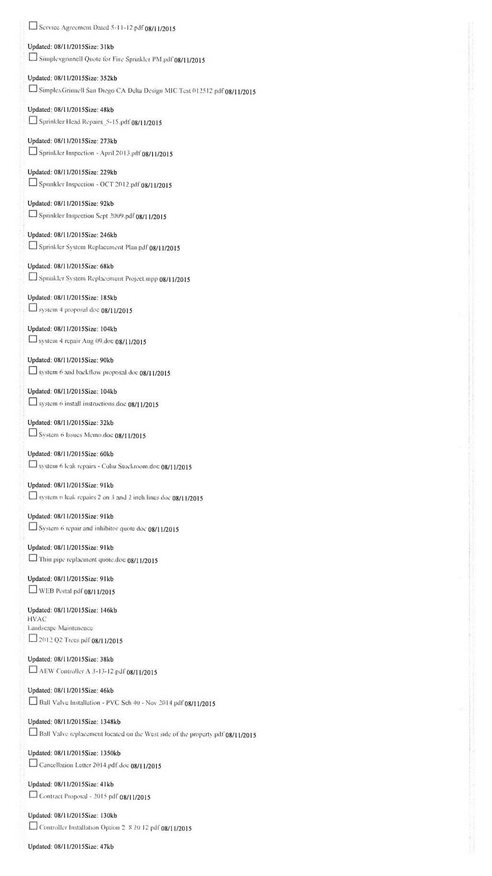

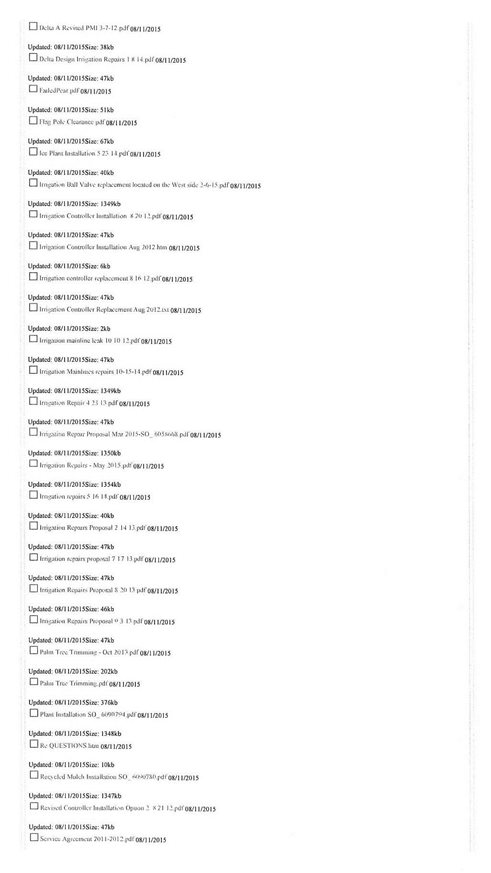

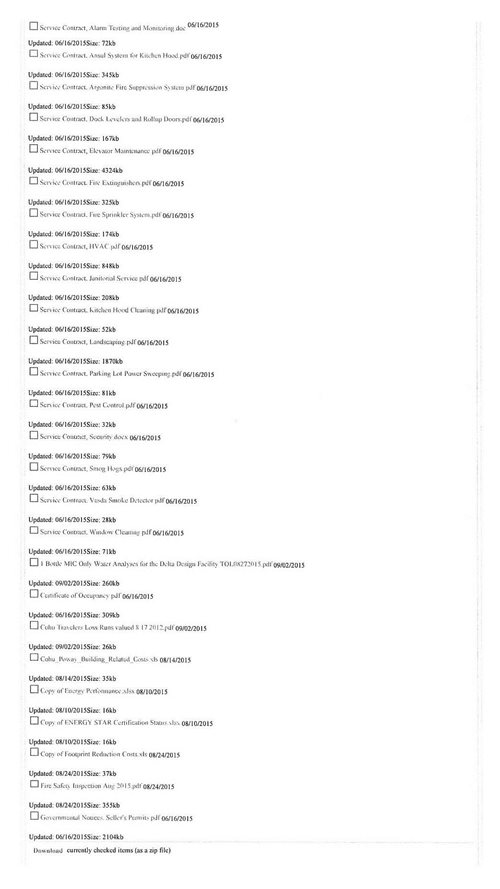

4.1.1 Delivery of Due Diligence Materials by Seller. To the extent within the possession or control of Seller and within three (3) Business Days following the Effective Date, Seller shall deliver to Buyer or make available to Buyer and Buyer's representatives on a CBRE website for inspection, the documents and materials identified on the attached Exhibit "K" (collectively, the "Due Diligence Items"). In addition, following reasonable prior telephonic or written notice from Buyer, Seller agrees to allow Buyer, its authorized agents or representatives, at Buyer's expense, to inspect and make copies of such other documents and property records relating to the ownership, operation and maintenance of the Property, which are not provided to Buyer as part of the Due Diligence Items and which are reasonably requested by Buyer, at Seller's offices. In addition, Seller shall promptly deliver to Buyer any additional material instruments and documents relating to the Property, except for Excluded Information, that Seller's Representative first discovers or obtains after the Effective Date; provided, however, that neither Seller nor Seller's Representative shall have any obligation whatsoever to undertake any search, investigation or inquiry for any such instruments and documents. Notwithstanding the foregoing, the Due Diligence Items shall not include, and Seller shall not be obligated to provide to Buyer, any confidential or privileged materials, any appraisals or other financial analysis prepared by or on behalf of Seller or any other proprietary materials of Seller (collectively, "Excluded Information". Except as expressly provided herein, Seller makes no representations or warranties regarding the accuracy of the Due Diligence Items or that the Due Diligence Items are complete copies of the same. Buyer acknowledges and understands that all such materials made available by Seller are only for Buyer's convenience in making its own examination and determination prior to the Contingency Date as to whether it wishes to purchase the Property, and, in so doing, Buyer shall, except as expressly provided herein or in any Other Document (defined below) and rely exclusively upon its own independent investigation and evaluation of every aspect of the Property and not on any materials supplied by Seller.

4.1.2 Inspection. Commencing upon the Effective Date and continuing until 5:00 p.m. (Pacific Time) on the Contingency Date (the "Property Approval Period"), Buyer shall have the right to review and investigate the Due Diligence Items, the physical and environmental condition of the Property, the character, quality, value and general utility of the Property, the zoning, land use, environmental and building requirements and restrictions applicable to the Property, the state of title to the Property, and any other factors or matters relevant to Buyer's decision to purchase the Property. Buyer, in Buyer's sole and absolute discretion, may determine whether or not the Property is acceptable to Buyer within the Property Approval Period and whether Buyer can secure appropriate financing thereon. Buyer shall provide Seller with at least one (1) Business Day's prior written notice of its desire to enter upon the Real Property for tenant interviews, inspection and/or testing and any such tenant interviews, inspections or testing shall be conducted at a time and manner reasonably approved by Seller and to minimize disruption or interference with any tenants. Seller shall have the right to be present at any such tenant interviews, inspections or testings. Prior to conducting any inspections or testing, Buyer or its consultants, shall deliver to Seller a certificate of insurance naming Seller as additional insured (on a primary, non-contributing basis) evidencing commercial general liability and property damage insurance with limits of not less than $2,000,000.00 in the aggregate for liability coverage and not less than $2,000,000.00 in the aggregate for property damage. Notwithstanding the foregoing, Buyer shall not be permitted to undertake any air sampling or any intrusive or destructive testing of the Property, including, without limitation, a "Phase II" environmental assessment (collectively, the "Intrusive Tests"), without in each instance first obtaining Seller's prior written consent thereto, which consent shall not be unreasonably withheld, conditioned or delayed if such Intrusive Tests are recommended by Buyer's "Phase I" Environmental Assessment. Buyer shall repair any damage to the Property caused by Buyer or its consultant's entry on the Property such that the affected areas of the Property are restored to the same condition in which it was found prior to such entry immediately after any and all testing and inspections conducted by or on behalf of Buyer, provided, however, that Buyer shall not be required to repair any damage (i) not caused by Buyer or its consultant's or (ii) that results solely from Buyer's or Buyer's consultant's mere discovery of any conditions on the Property. Buyer hereby indemnifies and holds Seller, Seller Parties and the Property harmless from any and all costs, loss, damages or expenses of any kind or nature actually incurred or suffered by Seller or any of the Seller Parties and arising out of or resulting from any entry and/or activities upon the Property by Buyer and/or Buyer's agents, employees, contractors or consultants (together, "Buyer Parties"); provided, however, such indemnification obligation shall not be applicable to Buyer's mere discovery of any pre-existing adverse physical condition at the Property. Buyer's indemnification obligations under this section shall survive the Close of Escrow or any termination of this Agreement. Without limiting the foregoing, Section 25359.7 of the California Health and Safety Code requires owners of non-residential real property who know, or have reasonable cause to believe, that any release of hazardous substance has come to be located on or beneath the real property to provide written notice of such to a buyer of the real property. Notwithstanding anything to the contrary contained herein, Buyer (i) hereby acknowledges Buyer's receipt of the foregoing notice given pursuant to Section 25359.7 of the California Health and Safety Code; (ii) has, or will have prior to the expiration of the Property Approval Period, fully investigated the condition of the Property; and (iii) after receiving advice of Buyer's legal counsel, waives any and all rights Buyer may have to assert that Seller has not complied with the requirements of Section 25359.7 of the California Health and Safety Code. For the purposes of this Agreement, "Seller Parties" shall mean Seller's affiliates, subsidiaries, property manager, asset manager, and their respective officers, directors, members, trustees, employees, consultants, attorneys, agents, representatives, contractors and subcontractors. Buyer's repair and indemnity obligations under this Section 4.1.1 shall survive the termination of this Agreement.

4.1.3 Reserved.

4.1.4 Termination. Buyer shall have the right, exercisable in Buyer's sole and absolute discretion at any time prior to the expiration of the Property Approval Period by written notice to Seller, to terminate this Agreement. If Buyer fails, prior to 5:00 p.m. (Pacific time) on the Contingency Date, to deliver written notice ("Buyer's Approval Notice") to Seller and Escrow Holder of Buyer's approval of the Property in the form attached hereto as Exhibit "D", Buyer shall be deemed to have disapproved the Property and this Agreement shall automatically terminate. If Buyer timely delivers Buyer's Approval Notice as provided in this Section 4.1.4, then Buyer shall be deemed to have elected to waive its right to terminate this Agreement pursuant to this Section 4.1.4 and proceed to Closing in accordance with the terms and conditions of this Agreement.

4.1.5 Due Diligence Materials. In the event Buyer does not purchase the Property for any reason other than a Seller Default, within five (5) Business Days after the date this Agreement is terminated Buyer shall return to Seller all documents, information and other materials supplied by Seller to Buyer, and, at Seller's written request, without warranty or representation of any kind, any inspection reports, studies, surveys, and other reports and/or test results (collectively, "Third-Party Reports") (provided the same do not restrict such delivery to a third party) relating to the Property which were prepared by third-party consultants retained by Buyer in contemplation of this Agreement and in Buyer's possession or control and, if so requested by Seller, Seller shall reimburse Buyer for the cost of all such Third-Party Reports. Buyer's and Seller's obligations under this Section 4.1.4 shall survive the termination of this Agreement.

4.2 Title Report and Additional Title Matters.

4.2.1 Title Report. Within five (5) Business Days after the Effective Date, Seller shall obtain and deliver to Buyer a preliminary title report for the Property prepared by Title Company (the "PTR"), together with copies of all underlying title documents described in the PTR and the most current ALTA survey of the Property in Seller's possession ("Survey"). Buyer shall have until ten (10) Business Days prior to the Contingency Date (the "Title Notice Date") to provide written notice (the "Title Notice") to Seller and Escrow Holder of any matters shown by the PTR or Survey which are not satisfactory to Buyer. If Seller has not received the Title Notice from Buyer by the Title Notice Date, that shall be deemed, subject to Section 4.1.4 above, Buyer's unconditional approval of the condition of title to the Property and the Survey, except that prior to the Closing Date, Seller shall be required to remove any and all liens secured by deeds of trust securing loans made to Seller and delinquent real property taxes and assessments and remove or endorse over (to Buyer's reasonable satisfaction) any mechanics' liens relating to work contracted for by Seller and any judgment liens against Seller (herein "Monetary Liens"). Except as expressly provided herein, Seller shall have no obligation whatsoever to expend or agree to expend any funds, to undertake or agree to undertake any obligations or otherwise to cure or agree to cure any title objections other than Monetary Liens. To the extent Buyer timely delivers a Title Notice, then Seller shall deliver, no later than five (5) Business Days after receipt of Buyer's Title Notice, written notice to Buyer and Escrow Holder identifying which disapproved items Seller shall undertake to cure or not cure ("Seller's Response"); however, Seller must cure the Monetary Liens. If Seller does not deliver a Seller's Response prior to such date, Seller shall be deemed to have elected to not remove or otherwise cure any exceptions disapproved by Buyer. If Seller elects, or is deemed to have elected, not to remove or otherwise cure an exception disapproved in Buyer's Title Notice, Buyer shall have until 5:00 p.m. (Pacific time) on the Contingency Date to (i) deliver Buyer's Approval Notice to Seller and Escrow Holder thereby waiving any objection to the PTR or the Survey other than Monetary Liens and exceptions that Seller has elected to cure prior to Closing, or (ii) terminate this Agreement and the Escrow by not timely delivering Buyer's Approval Notice, in which case Escrow Holder shall return to Buyer the Deposit. Notwithstanding anything to the contrary contained herein, Buyer's delivery of Buyer's Approval Notice shall be deemed Buyer's affirmative approval of the actual or deemed Seller Response. If Seller and Escrow Holder have not received Buyer's Approval Notice from Buyer by the Contingency Date, that shall be deemed Buyer's disapproval of the Seller Response and election to terminate the Agreement and Escrow. In addition, if Buyer delivers a Buyer's Approval Notice, all matters (except for Monetary Liens) shown in the PTR and the Survey with respect to which Buyer fails to give a Title Notice on or before 5:00 p.m. (Pacific Time) on the Title Notice Date shall be deemed to be approved by Buyer.

4.2.2 Additional Title Matters. In the event Title Company issues any amendment or supplement to the PTR after the Title Notice Date showing any additional exception to title that is not included in the PTR (a "New Exception"), Buyer shall be entitled to object to any such New Exception by delivering a Title Notice to Seller and Escrow Holder on or before the date that is three (3) Business Days after Buyer's receipt of written notice of the New Exception from Title Company; provided, however, Buyer may not object to (and shall be deemed to have approved) any New Exception (i) caused by the acts or omissions of Buyer or Buyer Parties, or (ii) resulting from Buyer's delivery of a new survey or an update to the Survey to Title Company after the Title Notice Date. If Buyer fails to deliver a Title Notice objecting to a New Exception (other than a Monetary Lien) within such three (3) Business Day period, Buyer shall be deemed to have accepted such New Exception. Seller shall have three (3) Business Days after receipt of the Title Notice to provide a Seller's Response. Seller shall be deemed to have elected not to remove or cure the New Exception if Seller fails deliver a Seller's Response within such three (3) Business Days. If Seller elects or is deemed to have elected not to remove or cure such New Exception, Buyer shall have two (2) Business Days after the date of Seller's Response, or two (2) Business Days after the expiration of the three (3) Business Day period for Seller to deliver a Seller's Response if Seller fails to deliver a Seller's Response within such three (3) Business Day period, to give Seller and Escrow Holder written notice that Buyer either waives Buyer's prior objection to the New Exception, or that Buyer elects to terminate this Agreement, in which case Escrow Holder shall return to Buyer the Deposit. Except with respect to Monetary Liens, if Buyer fails to timely deliver any such notice, Buyer shall be deemed to have waived its prior objection to such New Exception. If necessary, the Closing Date shall automatically be extended to allow for the running of the notice and cure periods described in this paragraph. Notwithstanding the foregoing to the contrary, Buyer need give no notice of its disapproval of any New Exception which constitutes a Monetary Lien, all of which Seller shall remove or endorse over (to Buyer's satisfaction) at or before Closing.

4.3 Buyer's Conditions Precedent to Closing: The Close of Escrow and Buyer's obligations with respect to the transactions contemplated by this Agreement are subject to the satisfaction or waiver of the following conditions:

4.3.1 Title Policy. On or before the Closing Date, Title Company shall have unconditionally and irrevocably committed to issue to Buyer the Title Policy described in Section 3.3, subject only to the payment of the applicable premium pursuant to Section 7 below.

4.3.2 Seller's Performance. On or before the Closing Date, Seller shall have duly performed in all material respects each and every material covenant of Seller hereunder including without limitation, Seller's timely delivery of the items specified to be delivered by Seller in Section 5.1 below.

4.3.3 Accuracy No Breach of Representations and Warranties. All representations and warranties made by Seller in Section 11.1 shall be true and correct in all material respects as of the Closing Date as if made on and as of the Closing Date, subject to Section 11.2.

4.3.4 Tenant Estoppel Certificates. On or before the Closing, Buyer shall have received estoppel certificates (collectively, "Estoppel Certificates" and individually, an "Estoppel Certificate") reasonably satisfactory to Buyer, which Seller shall use its good faith efforts to obtain, duly executed by Broadcast Microwave Services, Inc., Alex Machining Corporation and Sirius Acquisition, LLC (the "Existing Tenants"), dated not earlier than forty-five (45) days prior to the original Closing Date set forth in this Agreement (i.e., without extension thereof). The Estoppel Certificates shall be in the form of Exhibit "G" attached hereto or such other form as is required by or is otherwise consistent in all material respects with the requirements of the applicable Lease. Seller shall deliver to Buyer, for Buyer's approval, executed Estoppel Certificates promptly after Seller's receipt of the same. Buyer's failure to disapprove an executed Estoppel Certificate within five (5) Business Days following Buyer's receipt thereof shall be deemed to constitute Buyer's approval thereof; provided, however, that Buyer shall not have the right to disapprove an executed Estoppel Certificate satisfying the criteria above (or terminate this Agreement based thereon after the Contingency Date) unless it: (a) discloses material adverse economic terms of the applicable Lease that were not disclosed to Buyer (whether in the applicable Lease, this Agreement or any other document delivered to Buyer) prior to the date which is five (5) Business Days prior to the expiration of the Property Approval Period, (b) alleges a material default of Seller (as landlord) under the applicable Lease, (c) discloses a material dispute between the Seller (as landlord) and the Tenant in connection with the applicable Lease, or (d) contains any material adverse modification or qualification or the insertion therein of any other materially adverse information by the Tenant; provided, however, and notwithstanding the foregoing, Buyer shall not have the right to disapprove any Estoppel Certificate or to terminate this Agreement after the expiration of the Property Approval Period based upon (i) any matter disclosed in writing to Buyer prior to the date which is five (5) Business Days prior to the expiration of the Property Approval Period, or (ii) any matter disclosed in writing to Buyer after the Property Approval Period which is not disapproved in writing by Buyer to Seller within five (5) Business Days after Buyer receives written notice thereof (which disapproval notice shall constitute Buyer's election to terminate this Agreement). If Seller has been unable to timely obtain an Estoppel Certificate from a Tenant as provided herein, Seller may deliver its own certificate to Buyer ("Seller's Lease Certificate") in the form attached hereto as Exhibit "H" for such Tenants that did not deliver an Estoppel Certificate so as to provide Estoppel Certificates and Seller Lease Certificates that, taken together, shall satisfy this condition. In the event that after delivery of a Seller's Lease Certificate Seller receives an Estoppel Certificate from any Tenant for whom Seller previously delivered a Seller's Lease Certificate, Seller may deliver such Estoppel Certificate to Buyer and the corresponding Seller's Lease Certificate shall be automatically canceled upon Buyer's approval thereof (with Buyer's right to disapprove such Estoppel Certificate governed by the provisions set forth above). The immediately preceding sentence shall survive the Close of Escrow. Notwithstanding the foregoing, Buyer shall not be required to accept Seller's Lease Certificates for more than twenty (20%) of the leased rentable square footage of the Property or any Tenant occupying more than 50,000 rentable square feet at the Property. In addition, Seller will reasonably cooperate with Buyer and Buyer's lender, at no cost to Seller, to deliver to all Tenants a Subordination, Non-Disturbance and Attornment Agreement ("SNDAs"), in the form required by Buyer's lender in connection with its acquisition of the Property. The failure of Buyer or Buyer's lender to obtain an executed SNDAs shall not be a contingency to the Closing and shall not extend the Closing Date.

4.3.5 No Casualty or Condemnation. No casualty or condemnation shall have occurred pursuant to which Buyer has elected to terminate the Agreement in accordance with Section 13 below.

4.4 Failure of Conditions Precedent to Buyer's Obligations; Extension of Closing Date. Buyer's obligations with respect to the transactions contemplated by this Agreement are subject to the satisfaction of the conditions precedent to such obligations for Buyer's benefit set forth in Section 4.3 (collectively, "Buyer's Closing Conditions"). If Buyer (i) fails to deliver the Buyer's Approval Notice to Escrow Holder or (ii) terminates this Agreement by written notice to Seller because of the failure of any such condition precedent, then Escrow Holder shall return the Deposit to Buyer in accordance with Buyer's written instructions within five (5) Business Days following the effective date of such termination, Seller and Buyer shall each pay one-half (1/2) of any Escrow cancellation fees or charges, and except for Seller's and Buyer's indemnity and confidentiality obligations under the Agreement which expressly survive termination of the Agreement, the parties shall have no further rights or obligations to one another under this Agreement. Notwithstanding any term or provision contained in this Agreement to the contrary, if Seller is unable to timely satisfy the conditions precedent to Buyer's obligation to effect the Closing under Section 4.3 above (other than Seller's timely delivery of any of the items specified to be delivered by Seller in Section 5.1 below), then, following written notice delivered to Buyer no later than five (5) Business Days prior to the Closing Date, Seller may, at its election, extend the Closing Date for one or more periods not to exceed fifteen (15) days, in the aggregate, in connection with Seller's satisfaction of any such Buyer's Closing Condition under Section 4.3 above. If, after any such extension, the conditions precedent to Buyer's obligation to effect the Closing under Section 4.3 above continue not to be satisfied (and Buyer has not waived the same in writing), or if Seller does not elect to extend the Closing Date as provided hereunder, and, in either case, such failure of condition precedent is not the direct result of Buyer's default hereunder, then Buyer shall, within five (5) Business Days following the expiration of the foregoing applicable period (or in the event Seller elects not to extend the Closing Date as provided hereunder), have the right to terminate this Agreement by written notice thereof to Seller, or waive Seller's failure to satisfy such condition precedent and proceed to Closing on or before the expiration of the applicable period for Seller's satisfaction of such condition, it being further provided that Buyer's failure to deliver a written notice electing to waive Seller's failure to satisfy such condition precedent and proceed to Closing on or before the expiration of the applicable period for Seller's satisfaction of such condition shall be deemed Buyer's election to terminate this Agreement. If this Agreement is so terminated, then Buyer shall be entitled to the return of the Deposit and neither party shall have any further obligations hereunder, except those expressly stated to survive the termination hereof. Notwithstanding the foregoing, in the event that the failure of any such Buyer's Closing Condition also constitutes a default hereunder by Seller, Buyer also shall be entitled to pursue its rights and remedies under Section 16.1 hereof.

4.5 Conditions Precedent to Seller's Obligations. The Close of Escrow and Seller's obligations with respect to the transactions contemplated by this Agreement are subject to the timely satisfaction or waiver of the following conditions:

4.5.1 Buyer's Performance. Buyer shall have duly performed in all material respects each and every material covenant of Buyer hereunder, including without limitation, Buyer's timely delivery of the Purchase Price pursuant to the provisions of Section 2 above; and

4.5.2 Accuracy No Breach of Representations and Warranties. Buyer's representations and warranties set forth in Section 11.2 of this Agreement shall be true and correct in all material respects as of the Closing Date as if made on and as of the Closing Date.

Notwithstanding the foregoing, in the event that the failure of any such condition also constitutes a default hereunder by Buyer, Seller also shall be entitled to pursue its rights and remedies under Section 16.2 hereof.

5. Deliveries to Escrow Holder.

5.1 Seller's Deliveries. Seller hereby covenants and agrees to deliver or cause to be delivered to Escrow Holder at least one (1) Business Day prior to the Closing Date (or other date specified) the following instruments and documents, the delivery of each of which shall be a condition to the Close of Escrow:

5.1.1 Deed. A Grant Deed (the "Deed") in the form of Exhibit "B" attached hereto, duly executed and acknowledged in recordable form by Seller, conveying Seller's interest in the Real Property to Buyer;

5.1.2 Non-Foreign Certifications. FIRPTA and California 593-C Certificates duly executed by Seller in the forms prepared by Escrow Holder or otherwise reasonably required by Buyer (the "Tax Certificates");

5.1.3 Leaseback Agreement. Two (2) counterparts of the Leaseback Agreement duly executed by Seller;

5.1.4 Bill of Sale. Two (2) counterparts of a Bill of Sale ("Bill of Sale") duly executed by Seller in the form attached hereto as Exhibit "E" conveying Seller's right, title and interest in and to the Personal Property;

5.1.5 General Assignment. Two (2) counterparts of a General Assignment duly executed by Seller in the form of Exhibit "F" attached hereto (the "General Assignment");

5.1.6 Notice of Sirius Lease Termination. A notice to Sirius Acquisition, LLC, terminating the Sirius Lease as required by the Leaseback Agreement.

5.1.7 Insurance Certificates. Copies of the insurance certificates (the "Tenant Insurance Certificates") required to be delivered by Seller as the tenant under the Leaseback Lease;

5.1.8 Proof of Authority. Such proof of Seller's authority and authorization to enter into this Agreement and the transactions contemplated hereby, and such proof of the power and authority of the individual(s) executing and/or delivering any instruments, documents or certificates on behalf of Seller to act for and bind Seller, as may be reasonably required by Title Company;

5.1.9 Title Company Documents. A standard title company owners' affidavit, closing statement(s) and such other documents that may reasonably be required by the Title Company and/or Escrow Holder to issue the Title Policy and close the purchase and sale of the Property in accordance with this Agreement, each in a form reasonably acceptable to Seller; and

5.1.10 Miscellaneous. To the extent in Seller's possession, originals of the warranties assigned to Buyer and all keys, security codes, maintenance records, plans, permits, certificates of occupancy, surveys and building specifications pertaining to the Property, provided that, at Seller's election, these documents may be delivered outside of Escrow on or within a reasonable period of time after the Closing (not to exceed five (5) Business Days).

5.2 Buyer's Deliveries. Buyer hereby covenants and agrees to deliver or cause to be delivered to Escrow Holder at least one (1) Business Day prior to the Closing Date the following funds, instruments and documents, the delivery of each of which shall be a condition to the Close of Escrow:

5.2.1 Buyer's Funds. The Purchase Price, plus such additional funds, if any, necessary to comply with Buyer's obligations hereunder regarding prorations, credits, costs and expenses, less the Deposit;

5.2.2 Leaseback Agreement. Two (2) counterparts of the Leaseback Agreement duly executed by Buyer;

5.2.3 General Assignment. Two (2) counterparts of the General Assignment duly executed by Buyer;

5.2.4 Reserved.

5.2.5 Bill of Sale. Two (2) counterparts of the Bill of Sale duly executed by Buyer; and

5.2.6 Proof of Authority. Such proof of Buyer's authority and authorization to enter into this Agreement and the transactions contemplated hereby, and such proof of the power and authority of the individual(s) executing and/or delivering any instruments, documents or certificates on behalf of Buyer to act for and bind Buyer, as may be reasonably required by Title Company.

6. Deliveries Upon Close of Escrow. Upon the Close of Escrow, Escrow Holder shall promptly undertake all of the following:

6.1 Tax Filings. The Title Company shall file the information return for the sale of the Property required by Section 6045 of the Internal Revenue Code of 1986, as amended, and the Income Tax Regulations thereunder.

6.2 Prorations. Prorate all matters referenced in Section 8 based upon the statement delivered into Escrow signed by the parties;

6.3 Recording. Cause the Deed and any other documents which the parties hereto may direct, to be recorded in the Official Records in the order directed by the parties;

6.4 Buyer Funds. Disburse from funds deposited by Buyer with Escrow Holder towards payment of all items and costs (including, without limitation, the Purchase Price) chargeable to the account of Buyer pursuant hereto in payment of such items and costs and disburse the balance of such funds, if any, to Buyer;

6.5 Documents to Seller. Deliver to Seller counterpart originals of the Leaseback Agreement and the General Assignment executed by Buyer and a conformed recorded copy of the recorded Deed;

6.6 Documents to Buyer. Deliver to Buyer an original of the Tax Certificates and Bill of Sale, the Tenant Insurance Certificates and counterpart originals of the Leaseback Agreement and the General Assignment executed by Seller, a conformed recorded copy of the Deed, and, when issued, the Title Policy;

6.7 Title Policy. Direct the Title Company to issue the Title Policy to Buyer; and

6.8 Seller Funds. Deduct all items chargeable to the account of Seller pursuant to Section 7. If, as the result of the net prorations and credits pursuant to Section 8, amounts are to be charged to the account of Seller, deduct the total amount of such charges (unless Seller elects to deposit additional funds for such items in Escrow); and if amounts are to be credited to the account of Seller, disburse such amounts to Seller, or in accordance with Seller's instructions, at Close of Escrow. Disburse the net proceeds of the Purchase Price to Seller, or as otherwise directed by Seller, promptly upon the Close of Escrow in accordance with Seller's wire transfer instructions.

7. Costs and Expenses. Seller shall pay (i) that portion of the Title Policy premium for ALTA owner's standard coverage and all costs related to the removal or cure of title exceptions that Seller has agreed or is required to remove or cure pursuant to Section 4.2 above, (ii) all documentary transfer taxes assessed by the County and City, and (iii) one-half (½) of the Escrow Holder's fee. In addition Seller shall pay outside of Escrow all legal and professional fees and costs of attorneys and other consultants and agents retained by Seller. Buyer shall pay through Escrow (x) all document recording charges, (y) the additional Title Policy premium for ALTA extended coverage and any title endorsements requested by Buyer, and (z) one-half (½) of the Escrow Holder's fee. Buyer shall pay outside of Escrow all costs and expenses related to the Due Diligence Investigations, charges for any new survey or updates to the Survey requested by Buyer and all legal and professional fees and costs of attorneys and other consultants and agents retained by Buyer. All other costs and charges, if any, shall be charged to Seller or Buyer as customarily charged to sellers and buyers in accordance with common escrow practices in the County.

8. Prorations. The following prorations between Seller and Buyer shall be made by Escrow Holder computed as of the Close of Escrow:

8.1 Taxes and Assessments. In light of Seller's obligations as tenant under the Leaseback Agreement, there shall be no pro-ration of real estate taxes and assessments. Seller shall be responsible for all delinquent and non-delinquent real property taxes and assessments on the Property accrued as of the Closing.

8.2 Excise, Transfer and Sales Taxes. Buyer and Seller agree that no portion of the Purchase Price will be allocated to the Personal Property or Intangible Personal Property, and each party will reflect such allocation in any tax of similar filings. Therefore, there will be no excise, transfer and use taxes imposed with respect to the conveyance of any personal property contemplated by this Agreement.

8.3 Operating Expenses. Any common area maintenance, elevator maintenance, taxes other than real estate taxes such as rental taxes, other expenses incurred in operating the Property that Seller pays on an estimated or other basis, and any other costs incurred in the ordinary course of business or the management and operation of the Property, shall be prorated on an accrual basis. Seller shall pay all such expenses that accrue prior to the Close of Escrow and Buyer shall pay all such expenses accruing on the Close of Escrow and thereafter. Seller and Buyer shall obtain billings as of the Close of Escrow to aid in such prorations. In light of Seller's obligations as tenant under the Leaseback Agreement, there shall be no proration of utilities as of the Closing. Seller shall be responsible for all utility charges accruing prior to and, subject to and as provided in the Leaseback Agreement, following the Closing.

8.4 Base Rent; Security Deposit. At Closing, Seller shall, as the tenant under the Leaseback Agreement, pay, or Buyer shall be credited, for (i) "Base Rent" payable under the Leaseback Agreement for the month in which the Closing occurs as provided in the Leaseback Agreement; and (ii) the "Security Deposit" required under the Leaseback Agreement.

At least two (2) Business Days prior to the Close of Escrow, the parties shall agree upon all of the prorations to be made and submit a statement to Escrow Holder setting forth the same. In the event that any prorations, apportionments or computations made under this Section 8 shall require final adjustment, then the parties shall make the appropriate adjustments promptly when accurate information becomes available and either party hereto shall be entitled to an adjustment to correct the same, but in no event shall such final adjustment occur later than two hundred seventy (270) days following the Close of Escrow. Any corrected adjustment or proration shall be paid in cash to the party entitled thereto. The provisions of this Section 8 shall survive the Close of Escrow.

9. Covenants of Seller. Seller hereby covenants with Buyer, as follows:

9.1 Contracts. Following the Effective Date, Seller shall not enter into any new contract pertaining to the Property, which by its terms cannot be terminated on or before the Closing, without the express written approval of Buyer, which approval shall not be unreasonably delayed, conditioned or withheld, provided that following the Contingency Date, Buyer shall have the right to withhold such consent in its sole and absolute discretion. Buyer's consent to such new contract shall be deemed to have been given if Buyer does not notify Seller to the contrary in writing within five (5) Business Days after Seller provides written notice to Buyer of such new contract.

9.2 Leases. Between the Effective Date and the Closing Seller will not enter into any new Leases that are for a period which will survive Closing or otherwise affect the use, operation or enjoyment of the Property after Closing (collectively, "New Leases") without Buyer's prior written consent, which consent following the Contingency Date, Buyer shall have the right to withhold in its sole and absolute discretion. Seller will provide Buyer with copies of all lease proposals and letters of intent upon the delivery or receipt thereof.

9.3 Operation in the Ordinary Course. Subject to Sections 9.1 and 9.2 above, from the Effective Date until the Close of Escrow, Seller shall (i) operate and manage the Property in the ordinary course and consistent with Seller's past practices, (ii) maintain all present services and amenities, (iii) maintain the Property in good condition, repair and working order, excepting normal wear and tear and casualty damage (and Seller shall not be required to make capital improvements), and (iv) keep on hand sufficient materials, supplies, equipment and other personal property for the efficient operation and management of the Property. None of the Personal Property shall be removed from the Real Property, unless replaced by unencumbered personal property of equal or greater utility and value. Without limitation of the foregoing, Seller will keep in full force and effect all existing insurance policies affecting the Property or any portion thereof through the Close of Escrow. Seller shall remain responsible for all charges, bills and invoices for utilities, labor, goods, materials and services of any kind relating to the Property for the period prior to the Closing Date and Seller shall not, directly or indirectly, (x) take action so as to cause the further encumbrance of the Property, or (y) take action so as to cause the recording of any lien thereon.

10. AS-IS Sale and Purchase.

10.1 Buyer's Acknowledgment. As a material inducement to Seller to enter into this Agreement and to convey the Property to Buyer, Buyer hereby acknowledges and agrees that:

10.1.1 AS-IS. Except as otherwise expressly set forth in this Agreement, and subject to Seller's representation and warranties set forth in this Agreement and/or in any Other Document, Buyer is purchasing the Property in its existing condition, "AS-IS, WHERE-IS, WITH ALL FAULTS," and upon the Closing Date has made or has waived all inspections and investigations of the Property and its vicinity which Buyer believes are necessary to protect its own interest in, and its contemplated use of, the Property.

10.1.2 No Representations. Other than the express representations and warranties of Seller contained in this Agreement and/or in any Other Document, neither Seller, nor any Seller Parties have made any representation, warranty, inducement, promise, agreement, assurance or statement, oral or written, of any kind to Buyer upon which Buyer is relying, or in connection with which Buyer has made or will make any decisions concerning the Property or its vicinity including, without limitation, its use, condition, value, compliance with "Governmental Regulations," the existence or absence of Hazardous Substances, or the permissibility, feasibility, or convertibility of all or any portion of the Property for any particular use or purpose, including, without limitation, its present or future prospects for sale, lease, development, occupancy or suitability as security for financing. As used herein, the term "Governmental Regulations" means any laws (including Environmental Laws), ordinances, rules, requirements, resolutions, policy statements and regulations (including, without limitation, those relating to land use, subdivision, zoning, Hazardous Substances, occupational health and safety, the Americans with Disabilities Act, water, earthquake hazard reduction, and building and fire codes) of any governmental or quasi-governmental body or agency claiming jurisdiction over the Property. As used in this Agreement, the following definitions shall apply: "Environmental Laws" shall mean all federal, state and local laws, ordinances, rules and regulations now or hereafter in force, as amended from time to time, and all federal and state court decisions, consent decrees and orders interpreting or enforcing any of the foregoing, in any way relating to or regulating human health or safety, or industrial hygiene or environmental conditions, or protection of the environment, or pollution or contamination of the air, soil, surface water or groundwater, and includes, without limitation, the Comprehensive Environmental Response, Compensation and Liability Act of 1980, 42 U.S.C. § 9601, et seq., the Resource Conservation and Recovery Act, 42 U.S.C. § 6901, et seq., and the Clean Water Act, 33 U.S.C. § 1251, et seq., and any similar law of the State of California. "Hazardous Substances" shall mean any substance or material that is described as a toxic or hazardous substance, waste or material or a pollutant or contaminant, or words of similar import, in any of the Environmental Laws, and includes asbestos, petroleum (including crude oil or any fraction thereof, natural gas, natural gas liquids, liquefied natural gas, or synthetic gas usable for fuel, or any mixture thereof), petroleum-based products and petroleum additives and derived substances, lead-based paint, mold, fungi or bacterial matter, polychlorinated biphenyls, urea formaldehyde, radon gas, radioactive matter, medical waste, and chemicals which may cause cancer or reproductive toxicity.

10.1.3 No Implied Warranties. Excluding any express representation or warranty set forth herein or in any Other Document, Seller hereby specifically disclaims: (a) all warranties implied by law arising out of or with respect to the execution of this Agreement, any aspect or element of the Property, or the performance of Seller's obligations hereunder including, without limitation, all implied warranties of merchantability, habitability and/or fitness for a particular purpose; and (b) any warranty, guaranty or representation, oral or written, past, present or future, of, as to, or concerning (i) the nature and condition of the Property or other items conveyed hereunder, including, without limitation, the water, soil, and geology, the suitability thereof and of the Property or other items conveyed hereunder for any and all activities and uses which Buyer may elect to conduct thereon, the existence of any environmental hazards or conditions thereon (including but not limited to the presence of asbestos or other Hazardous Substances) or compliance with applicable Environmental Laws; (ii) the nature and extent of any right-of-way, lease, possession, lien, encumbrance, license, reservation, condition or otherwise; and (iii) the compliance of the property or other items conveyed hereunder or its operation with any governmental regulations.

10.1.4 Information Supplied by Seller. Buyer specifically acknowledges and agrees that, except as expressly contained in this Agreement, the Seller has made no representation or warranty of any nature concerning the accuracy or completeness of any documents delivered or made available for inspection by Seller to Buyer, including, without limitation, the Due Diligence Items, and that Buyer has undertaken such inspections of the Property as Buyer deems necessary and appropriate and that, subject to Seller's representation and warranties set forth in this Agreement and/or in any Other Document, Buyer is relying solely upon such investigations and not on any of the Due Diligence Items or any other information provided to Buyer by or on behalf of Seller. As to the Due Diligence Items, Buyer specifically acknowledges that they may have been prepared by third parties with whom Buyer has no privity and Buyer acknowledges and agrees that, except as expressly provided herein, no warranty or representation, express or implied, has been made, nor shall any be deemed to have been made, to Buyer with respect thereto, either by the Seller Parties or by any third parties that prepared the same.

10.1.5 Release. As of the Close of Escrow, Buyer on behalf of itself and on behalf of the Buyer Parties hereby forever, fully and irrevocably release Seller and Seller Parties from any and all claims that Buyer or Buyer Parties may have or thereafter acquire against Seller or Seller Parties for any cost, loss, liability, damage, expense, demand, action or cause of action ("Claims") arising from or related to any matter of any nature relating to, and condition of, the Property including any latent or patent construction defects, errors or omissions, compliance with law matters, Hazardous Substances and other environmental matters within, under or upon, or in the vicinity of the Property, any statutory or common law right Buyer or Buyer Parties may have to receive disclosures from Seller or Seller Parties, including, without limitation, any disclosures as to the Property's location within areas designated as subject to flooding, fire, seismic or earthquake risks by any federal, state or local entity, the need to obtain flood insurance, the certification of water heater bracing and/or the advisability of obtaining title insurance, the energy use of the Property, or any other condition or circumstance affecting the Property, its financial viability, use or operation, or any portion thereof. This release includes Claims of which Buyer or Buyer Parties are presently unaware or which Buyer or Buyer Parties do not presently suspect to exist in its favor which, if known by Buyer or Buyer Parties, would materially affect Buyer's or Buyer Parties' release of Seller or Seller Parties. In connection with the general release set forth in this Section 10.1.5, Buyer specifically waives on its behalf and behalf of Buyer Parties the provisions of California Civil Code Section 1542, which provides as follows:

"A GENERAL RELEASE DOES NOT EXTEND TO CLAIMS WHICH THE CREDITOR DOES NOT KNOW OR SUSPECT TO EXIST IN HIS OR HER FAVOR AT THE TIME OF EXECUTING THE RELEASE, WHICH IF KNOWN BY HIM OR HER MUST HAVE MATERIALLY AFFECTED HIS OR HER SETTLEMENT WITH THE DEBTOR."

Notwithstanding anything to the contrary set forth in this Section 10.1.5, the foregoing release is not intended to and does not cover (i) Fraud (as defined below), (ii) any Claims arising from a breach of Seller's express representations or warranties set forth in this Agreement or in any Other Document, (iii) any other breach by Seller of an express obligation of Seller under this Agreement which by its terms survives the Close of Escrow, under the Leaseback Agreement or under any Other Document, or (iv) injuries to persons or property during Seller's ownership of the Property to the extent that the same are covered by insurance maintained by Seller (herein collectively the ""Excluded Claims"). The term "Fraud" means a final judicial determination by a court of competent jurisdiction that Seller deliberately and intentionally concealed or affirmatively misrepresented in writing any material, adverse facts relative to the Property as of Closing that (a) would be reasonably likely to be expected to cause Buyer to terminate the Escrow had such facts been disclosed to Buyer prior to Closing, and (b) are or were known by Seller prior to Closing.

Buyer also agrees never to commence, aid in any way, participate in, or prosecute against Seller or Seller Parties any action or other proceeding based upon any losses, liabilities, damages, claims, demands, causes of action, costs and expenses covered in this Section 10.1.5 (other than the Excluded Claims).

10.1.6 Natural Hazard Disclosure. Buyer and Seller acknowledge that Seller is required to disclose if any of the Property lies within the following natural hazard areas or zones: (i) a special flood hazard area designated by the Federal Emergency Management Agency; (ii) an area of potential flooding; (iii) a very high fire hazard severity zone; (iv) a wild land area that may contain substantial forest fire risks and hazards; (v) an earthquake fault or special studies zone; or (vi) a seismic hazard zone. Buyer acknowledges that Seller will employ the services of Disclosure Source ("Natural Hazard Expert") to examine the maps and other information specifically made available to the public by government agencies and to report the results of its examination to Buyer in writing. The written report prepared by the Natural Hazard Expert regarding the results of its examination fully and completely discharges Seller from its disclosure obligations referred to herein, and, for the purposes of this Agreement, the provisions of Civil Code Section 1103.4 regarding the non-liability of Seller for errors and/or omissions not within its personal knowledge shall be deemed to apply, and the Natural Hazard Expert shall be deemed to be an expert dealing with matters within the scope of its expertise with respect to the examination and written report regarding the natural hazards referred to above.

10.1.7 Energy Performance Disclosure Waiver. Buyer acknowledges that Seller may be required to disclose certain information concerning the energy performance of the Property pursuant to California Public Resources Code Section 25402.10 and the regulations adopted pursuant thereto (collectively the "Energy Disclosure Requirements"). Buyer hereby waives any rights under the Energy Disclosure Requirements and further waives any right to receive the Disclosure Summary Sheet, Statement of Energy Performance, Data Checklist, and Facility Summary, all as defined in the Energy Disclosure Requirements (collectively, the "Energy Disclosure Information"). Buyer, on its behalf and on behalf of Buyer Parties, hereby forever releases Seller and Seller Parties of any liability under the Energy Disclosure Requirements, including, without limitation, any liability of Seller or Seller Parties' arising as a result of Seller's or Seller Parties' failure to provide to Buyer the Energy Disclosure Information. Buyer's approval of the condition of the Property pursuant to the terms of this Agreement shall be deemed to be Buyer's approval of the energy performance of the Property. The terms of this Section shall survive the recordation of the Deed or earlier termination of this Agreement.

11. Seller's Representations and Warranties.

11.1 Representations and Warranties. Seller represents and warrants to Buyer as of the Effective Date as follows:

11.1.1 Formation; Authority. Seller is duly formed, validly existing, and in good standing under laws of the state of its formation. Seller has full power and authority to enter into this Agreement and to perform this Agreement. The execution, delivery and performance of this Agreement by Seller have been duly and validly authorized by all necessary action on the part of Seller and all required consents and approvals have been duly obtained. All requisite action has been taken by Seller in connection with the entering into of this Agreement and the instruments referenced herein and the consummation of the transactions contemplated hereby. The individual(s) executing this Agreement and the instruments referenced herein on behalf of Seller have the legal power, right and actual authority to bind Seller to the terms and conditions hereof and thereof.

11.1.2 No Conflict. The execution, delivery and performance of this Agreement and the Closing hereunder will not conflict with any agreement, contract or law applicable to Seller nor constitute a default under any agreement or instrument to which Seller is a party or by which Seller or the Property are bound.

11.1.3 Options. Seller has not entered, with any other party, into any existing or pending written contracts of sale, leases, options to purchase or rights of first refusal (or the like) with respect to the Property.

11.1.4 Leases. Subject to Seller's right to enter into New Leases pursuant to Section 9.2 above with Buyer's written consent, and other than the Leases identified in Section 1 above and the Leaseback Agreement, Seller has not entered into any other written leases, licenses or other similar occupancy agreements with respect to the leasing or occupancy of the Property. The copies of the Leases delivered or to be delivered to Buyer pursuant to this Agreement are or will be true, correct, and complete copies of all of the Leases in effect with respect to the Property as of the date of their delivery and at Closing there will be no unpaid tenant improvements, leasing concessions or brokerage commission due that have not been disclosed to Buyer in writing. Seller has not received any written notice of any default by Seller that is uncured under any Lease.

11.1.5 Contracts. To Seller's knowledge, and except as provided in the Due Diligence Items or as shown in the PTR, Seller is not currently a party to any management, service, supply, security, maintenance or other similar contracts or agreements, oral or written, that will affect the Property after Closing. The copies of the contracts delivered or to be delivered to Buyer pursuant to this Agreement are or will be true, correct, and complete copies of all of the contracts to which Seller is a party and in effect with respect to the Property as of the date of their delivery. Seller has not received any written notice of any default by Seller that is uncured under any contract.

11.1.6 Code Compliance. Except as otherwise disclosed in the Due Diligence Items or any other written information delivered by Seller to Buyer within three (3) Business Days after the Effective Date, Seller has not received any written notice from any governmental agency that the Property or any condition existing thereon or any present use thereof violates any law or regulations applicable to the Property, including, without limitation, any environmental law, ordinance or regulation and/or the Americans with Disabilities Act.

11.1.7 Litigation. Except as otherwise disclosed in the Due Diligence Items or any other written information delivered to Buyer within three (3) Business Days after the Effective Date, Seller has not received written notice of any litigation, arbitration or other legal or administrative suit, action, proceeding or investigation of any kind pending or threatened against or involving Seller relating to the Property or any part thereof, including, but not limited to, any condemnation action relating to the Property or any part thereof, which has not been adjudicated or dismissed prior to the Effective Date.

11.1.8 Foreign Person. Seller is not a "foreign person" as defined in Section 1445 of the Internal Revenue Code of 1986, as amended, and the Income Tax Regulations thereunder.

11.1.9 Hazardous Substances. Seller has provided Buyer with a true and complete copy of the most current Phase 1 environmental site assessment report pertaining to the Property in Seller's possession and except as otherwise disclosed in such Phase 1 environmental site assessment report, the other Due Diligence Items or any other written information delivered by Seller to Buyer within three (3) Business Days after the Effective Date, Seller has not received written notice of any release of Hazardous Substances has come to be located upon or under the Property. Except as otherwise disclosed in the Due Diligence Items or any other written information delivered by Seller to Buyer within three (3) Business Days after the Effective Date, Seller has not received written notice of any proceeding or inquiry by any governmental authority with respect to the presence of Hazardous Materials upon or under the Property or the migration thereof from or to other property.

11.1.10 Due Diligence Items. To Seller's knowledge, the copies of the Due Diligence Items delivered or made available to Buyer pursuant to Section 4.1.1 above constitute true and complete copies of such documents in Seller's possession. The schedule of Building-related expenses for the Property delivered or to be delivered to Buyer were prepared by or for Seller in the ordinary course of its business. Other than the Excluded Information, Seller's Representative has not intentionally elected to withhold materials, reports or other written information known to Seller concerning the Property in the nature of the Due Diligence Items on the grounds that it contains information which would have a materially adverse impact on the value or use of the Property.

11.1.11 Insolvency. No attachments, execution proceedings, assignments for the benefit of creditors, insolvency, bankruptcy, reorganization or other proceedings, whether voluntary or involuntary, are pending or to Seller's knowledge, threatened against Seller, nor are any of such proceedings contemplated by Seller.

11.1.12 OFAC. Seller is not a person or entity with whom U.S. persons or entities are restricted from doing business under regulations of the Office of Foreign Asset Control ("OFAC") of the Department of the Treasury (including those named on OFAC's Specially Designated Nationals and Blocked Persons List) or under any statute or executive order (including the September 24, 2001, Executive Order Blocking Property and Prohibiting Transactions with Persons Who Commit, Threaten to Commit, or Support Terrorism).

11.2 Subsequent Changes. If, after Effective Date, Seller first becomes aware of any fact or circumstance which would result in any of its representations or warranties contained herein being untrue or incorrect, then Seller will promptly give notice of such changed fact or circumstance to Buyer. Upon Buyer becoming actually aware of any fact or circumstance which would result in a breach of one of Seller's representations or warranties contained herein, Buyer, as its sole remedy, shall have the option of (i) waiving the breach of the representation or warranty and proceeding with the Close of Escrow, or (ii) terminating this Agreement, in which event the Deposit and any other funds deposited by Buyer into the Escrow and all interest earned thereon shall be returned to Buyer and, if (x) the representation and warranty was untrue when made as of the Effective Date, or (y) the failure of such representation and warranty to be true also constitutes, or was otherwise caused, a breach by Seller of any of its obligations under this Agreement (e.g., prior to the Effective Date, Seller had received written notice of an uncured release of Hazardous Substances under the Property and failed to include such notice in the Due Diligence Documents) or was otherwise caused by the affirmative acts or omissions of Seller in violation of a specific obligation expressly set forth in this Agreement, then Buyer may also pursue its remedies under Section 16.1 hereof. Any such election shall be made by Buyer not later than the earlier to occur of the Scheduled Closing Date or the date which is seven (7) days after the expiration of the notice and cure period set forth in Section 16.5 below. If Buyer does not so timely elect to terminate this Agreement pursuant to this Section 11.2, then Buyer shall be deemed to have elected to waive its rights to terminate this Agreement by reason of the existence of such fact or circumstance, elected to acquire the Property on the terms set forth in this Agreement, and waived all remedies at law or in equity with respect to any representations or warranties resulting from the facts or circumstances disclosed by Seller in its notice to Buyer.

11.3 Seller's Knowledge. Whenever phrases such as "to Seller's knowledge", "known to Seller" or "Seller has no knowledge" or similar phrases are used herein, they will be deemed to refer exclusively to matters within the current actual (as opposed to constructive) knowledge of the Seller's Representative. No duty of inquiry or investigation on the part of Seller or Seller's Representative will be required or implied by the making of any representation or warranty which is so limited to matters within Seller's actual knowledge, and Buyer agrees and acknowledges that in no event shall Seller's Representative have any personal liability therefor. Seller represents and warrants to Buyer that Seller's Representative is a person who has significant knowledge of the matters described in the representations and warranties in this Agreement which are limited by the knowledge of Seller.

11.4 Survival. All of the representations and warranties of Seller contained herein, and any representations and warranties of Seller contained in any document delivered to Buyer at Closing, shall not be deemed to have merged with the Deed and will survive Closing for a period of nine (9) months after the Closing Date ("Survival Period"). No claim for a breach of any representation or warranty of Seller will be actionable or payable if (i) Buyer does not notify Seller in writing of such breach and commence a "legal action" thereon within the Survival Period, or (ii) the breach in question results from or is based on a condition, state of facts or other matter which was actually known to Buyer prior to Closing.

12. Buyer's Representations and Warranties. Buyer represents and warrants to Seller as of the Effective Date, and as of the Closing Date, as follows:

12.1 Formation; Authority. Buyer is duly formed, validly existing and in good standing under laws of the state of its formation. Buyer has full power and authority to enter into this Agreement and has, or prior to Closing will have, full power and authority to consummate the Closing under this Agreement. The execution, delivery and, performance of this Agreement by Buyer have been duly and validly authorized by all necessary action on the part of Buyer and all required consents and approvals have been duly obtained. Subject to the preceding provisions of this Section 12.1, all requisite action has been taken by Buyer in connection with the entering into of this Agreement and the instruments referenced herein and the consummation of the transactions contemplated hereby. The individual(s) executing this Agreement and the instruments referenced herein on behalf of Buyer have the legal power, right and actual authority to bind Buyer to the terms and conditions hereof and thereof.

12.2 No Conflicts. Neither the execution of this Agreement nor the consummation of the transactions contemplated in this Agreement will constitute a violation of, be in conflict with, or constitute a default under (or with the passage of time or delivery of notice, or both, would constitute a default under) any term or provision of Buyer's operating agreement or any other agreement or other instrument to which Buyer is bound.

12.3 Funds. Buyer has (or shall have at Closing) the requisite funds in cash or cash equivalents to pay the Purchase Price and any other sums due and owing from Buyer under this Agreement; it being agreed and acknowledged that in no event shall this Agreement or the Close of Escrow be contingent or conditioned upon Buyer obtaining financing or other funds necessary to pay the Purchase Price and any other sums due and owing from Buyer under this Agreement.

12.4 OFAC. Buyer is not a person or entity with whom U.S. persons or entities are restricted from doing business under regulations of the OFAC (including those named on OFAC's Specially Designated Nationals and Blocked Persons List) or under any statute or executive order (including the September 24, 2001, Executive Order Blocking Property and Prohibiting Transactions with Persons Who Commit, Threaten to Commit, or Support Terrorism).

12.5 Survival. All of the representations and warranties of Buyer contained herein, and any representations and warranties of Buyer contained in any document delivered to Seller at Closing, shall not be deemed to have merged with the Deed and will survive Closing for the Survival Period. No claim for a breach of any representation or warranty of Buyer will be actionable or payable if (i) Seller does not notify Buyer in writing of such breach and commence a "legal action" thereon within the Survival Period, or (ii) the breach in question results from or is based on a condition, state of facts or other matter which was actually known to Seller prior to Closing.

13. Casualty and Condemnation.