UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||||||||

For the fiscal year ended December 31 , 2020

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||||||||

For the transition period from _____ to _____

Commission File Number 1-5823

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||

| (Zip Code) | |||||||||||

| (Address of principal executive offices) | |||||||||||

(312 ) 822-5000

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

☒ | Accelerated filer | ☐ | Non-accelerated filer | ☐ | Smaller reporting company | Emerging growth company | |||||||||||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

As of February 5, 2021, 271,391,603 shares of common stock were outstanding. The aggregate market value of the common stock held by non-affiliates of the registrant as of June 30, 2020 was approximately $889 million based on the closing price of $32.15 per share of the common stock on the New York Stock Exchange on June 30, 2020.

DOCUMENTS INCORPORATED BY REFERENCE

| Item Number | Page Number | |||||||

| 1. | ||||||||

| 1A. | ||||||||

| 1B. | ||||||||

| 2. | ||||||||

| 3. | ||||||||

| 4. | ||||||||

| PART II | ||||||||

| 5. | ||||||||

| 6. | ||||||||

| 7. | ||||||||

| 7A. | ||||||||

| 8. | ||||||||

| 9. | ||||||||

| 9A. | ||||||||

| 9B. | ||||||||

| PART III | ||||||||

| 10. | ||||||||

| 11. | ||||||||

| 12. | ||||||||

| 13. | ||||||||

| 14. | ||||||||

| PART IV | ||||||||

| 15. | ||||||||

2

PART I

ITEM 1. BUSINESS

CNA Financial Corporation (CNAF) was incorporated in 1967 and is an insurance holding company. References to “CNA,” “the Company,” “we,” “our,” “us” or like terms refer to the business of CNAF and its subsidiaries. CNA's property and casualty and remaining life and group insurance operations are primarily conducted by Continental Casualty Company (CCC), The Continental Insurance Company, Western Surety Company, CNA Insurance Company Limited, Hardy Underwriting Bermuda Limited and its subsidiaries (Hardy), and CNA Insurance Company (Europe) S.A. Loews Corporation (Loews) owned approximately 89.6% of our outstanding common stock as of December 31, 2020.

Our insurance products primarily include commercial property and casualty coverages, including surety. Our services include warranty, risk management information services and claims administration. Our products and services are primarily marketed through independent agents, brokers and managing general underwriters to a wide variety of customers, including small, medium and large businesses, insurance companies, associations, professionals and other groups. The property and casualty insurance industry is highly competitive, both as it relates to rate and service. We compete with a large number of stock and mutual insurance companies, as well as other entities, for both distributors and customers.

Our commercial property and casualty underwriting operations presence in the United States of America (U.S.) consists of field underwriting locations and centralized processing operations which handle policy processing, billing and collection activities and also act as call centers to optimize service. Our claim operations in the U.S. consists of primary locations where we handle multiple claim types and key business functions, as well as regional claim offices which are aligned with our underwriting field structure. We have property and casualty underwriting operations in Canada, the United Kingdom (U.K.) and Continental Europe, as well as access to business placed at Lloyd's of London through Syndicate 382.

Our commercial property and casualty insurance operations are managed and reported in three business segments: Specialty, Commercial and International, which we refer to collectively as Property & Casualty Operations. Our operations outside of Property & Casualty Operations are managed and reported in two business segments: Life & Group and Corporate & Other. Each segment is managed separately due to differences in their markets and product mix. Discussion of each segment, including the products offered, customers served and distribution channels used, is set forth in the Management's Discussion and Analysis (MD&A) included under Item 7 and in Note O to the Consolidated Financial Statements included under Item 8.

Current Regulation

The insurance industry is subject to comprehensive and detailed regulation and supervision. Regulatory oversight by applicable agencies is exercised through review of submitted filings and information, examinations (both financial and market conduct), direct inquiries and interviews. Each domestic and foreign jurisdiction has established supervisory agencies with broad administrative powers relative to licensing insurers and agents, approving policy forms, establishing reserve requirements, prescribing the form and content of statutory financial reports and regulating capital adequacy and the type, quality and amount of investments permitted. Such regulatory powers also extend to premium rate regulations requiring rates not be excessive, inadequate or unfairly discriminatory. In addition to regulation of dividends by insurance subsidiaries, intercompany transfers of assets or payments may be subject to prior notice or approval by insurance regulators, depending on the size of such transfers and payments in relation to the financial position of the insurance subsidiaries making the transfer or payments.

As our insurance operations are conducted in both domestic and foreign jurisdictions, we are subject to a number of regulatory agency requirements applicable to a portion, or all, of our operations. These include but are not limited to, the State of Illinois Department of Insurance (which is our global group-wide supervisor), the U.K. Prudential Regulatory Authority and Financial Conduct Authority, the Office of Superintendent of Financial Institutions in Canada, the Luxembourg insurance regulator Commissariat aux Assurances (the CAA) and the Bermuda Monetary Authority.

3

The U.S. and foreign regulatory environment in which we operate is evolving on an ongoing basis and impacts aspects of corporate governance, risk management practices, public disclosures and cyber security. We continue to invest in the security of our systems and network on an enterprise-wide basis.

Domestic insurers are also required by state insurance regulators to provide coverage to certain insureds who would not otherwise be considered eligible by the insurers. Each state dictates the types of insurance and the level of coverage that must be provided to such involuntary risks. Our share of these involuntary risks is mandatory and generally a function of our respective share of the voluntary market by line of insurance in each state.

Further, domestic insurance companies are subject to state guaranty fund and other insurance-related assessments. Guaranty funds are governed by state insurance guaranty associations which levy assessments to meet the funding needs of insolvent insurer estates. Other insurance-related assessments are generally levied by state agencies to fund various organizations, including disaster relief funds, rating bureaus, insurance departments and workers' compensation second injury funds, and by industry organizations that assist in the statistical analysis and ratemaking process, and we have the ability to recoup certain of these assessments from policyholders.

Although the U.S. federal government does not currently directly regulate the business of insurance, federal legislative and regulatory initiatives can affect the insurance industry. These initiatives and legislation include proposals relating to terrorism and natural catastrophe exposures, cybersecurity risk management, federal financial services reforms and certain tax reforms.

The Terrorism Risk Insurance Program Reauthorization Act of 2019 (TRIPRA) provides for a federal government backstop for insured terrorism risks through the end of 2027. The mitigating effect of such law is part of the analysis of our overall risk posture for terrorism and, accordingly, our risk positioning may change if such law was modified.

Hardy, a specialized Lloyd's of London (Lloyd's) underwriter, is also supervised by the Council of Lloyd's, which is the franchisor for all Lloyd's operations. The Council of Lloyd's has wide discretionary powers to regulate Lloyd's underwriting, such as establishing the capital requirements for syndicate participation. In addition, the annual business plan of each syndicate is subject to the review and approval of the Lloyd's Franchise Board, which is responsible for business planning and monitoring for all syndicates.

The transition period for the U.K.’s exit from the European Union (E.U.), commonly referred to as “Brexit,” ended on December 31, 2020. To ensure the Company’s ability to operate effectively throughout the E.U. following the departure of the U.K. from the trading bloc, effective January 1, 2019, our E.U. business is no longer written by the U.K.-domiciled subsidiary Hardy, but through a European subsidiary established in Luxembourg. As a result, the complexity and cost of regulatory compliance of our European business has increased and will likely continue to result in elevated expenses.

Capital adequacy and risk management regulations, referred to as Solvency II, apply to our European operations and are enacted by the European Commission, the executive body of the E.U. Additionally, the International Association of Insurance Supervisors (IAIS) continues to develop capital requirements as more fully discussed below.

Regulation Outlook

The IAIS has adopted a Common Framework (ComFrame) for the Supervision of Internationally Active Insurance Groups (IAIGs) which is focused on the effective group-wide supervision of internationally active insurance groups, such as CNA. As part of ComFrame, the IAIS is developing a global insurance capital standard for insurance groups. While the general parameters of ComFrame have been finalized, many critical areas of the global insurance capital standard are still under consideration. Certain jurisdictional regulatory regimes are subject to revision in response to these global developments.

The National Association of Insurance Commissioners (NAIC) has developed an approach to group capital regulation and solvency-monitoring activities using the Group Capital Calculation (GCC). While the current U.S. regulatory regime is based on legal entity regulation, the GCC will quantify risk across the insurance group and also provide additional financial information to regulators to assess the financial condition of non-insurance

4

entities. The GCC was recently adopted by the NAIC along with model legislative language designed to enable the framework once implemented by state legislatures. Alongside the GCC, the NAIC is also working with other interested jurisdictions, both domestic and international, to develop an Aggregation Method (AM) approach to assessing group capital. The AM is influenced by the GCC and calculated in a similar manner. By 2024, the IAIS will be assessing whether the AM provides comparable outcomes to the consolidated group insurance capital standard (ICS) being developed for use with IAIGs.

There have also been definitive developments with respect to prudential insurance supervision unrelated to the IAIS activities. On September 22, 2017, the U.S. Treasury Department, the U.S. Trade Representative (USTR) and the E.U. announced they had formally signed a covered agreement on Prudential Measures Regarding Insurance and Reinsurance (U.S.-E.U. Covered Agreement). The U.S.-E.U. Covered Agreement requires U.S. states to prospectively eliminate the requirement that domestic insurance companies must obtain collateral from E.U. reinsurance companies that are not licensed in their state (alien reinsurers) in order to obtain reserve credit under statutory accounting. In exchange, the E.U. will not impose local presence requirements on U.S. firms operating in the E.U., and effectively must defer to U.S. group capital regulation for these firms. On December 18, 2018, the U.S. Treasury Department, the USTR, and the U.K. announced they formally signed the Bilateral Agreement on Prudential Measures Regarding Insurance and Reinsurance (U.S.-U.K. Covered Agreement). This Agreement has similar terms as the U.S.-E.U. Covered Agreement. Because these covered agreements are not self-executing, U.S. state laws will need to be revised to change reinsurance collateral requirements to conform to the provisions within each of the agreements.

Both the reinsurance collateral requirement change and adoption of group capital regulation must be effected by the states within five years from the signing of the covered agreements, or states risk federal preemption. We will monitor the modification of state laws and regulations in order to comply with the provisions of the covered agreements and assess potential effects on our operations and prospects.

Human Capital

As of December 31, 2020, we had approximately 5,800 employees. We believe we are able to attract and retain top talent by creating a culture that challenges and engages our employees, offering them opportunities to learn, grow and achieve their career goals. Further, our commitment to a culture of inclusion is integral to our goal of attracting and retaining the best talent and ultimately driving our business performance. Our Diversity and Inclusion strategy includes employee-led resource groups, regular training and development for all employees and partnerships with diverse colleges, universities and non-profit organizations that share in our inclusion mission. We also have an established corporate social responsibility strategy with a focus on four core areas: education, environment, inclusion and well-being. Our employees participate in a wide array of volunteer activities and we support their charitable giving by matching employee contributions to qualified nonprofit organizations.

We offer comprehensive compensation and benefits packages to our employees including a 401k Plan, healthcare and insurance benefits, health savings and flexible spending accounts, paid time off and certain family assistance programs, including paid family leave, flexible work arrangements and adoption assistance plans, amongst others. We also offer stock-based compensation to certain management personnel as a way to attract and retain key talent. See Notes I and J to the Consolidated Financial Statements included under Item 8 for further discussion of our benefit plans and stock-based compensation.

In response to the COVID-19 pandemic in March 2020, we pivoted to a remote working environment for substantially all of our employees with a commitment to the safety of our employees and the communities we serve. In the fourth quarter we began re-opening some offices on a voluntary basis to accommodate employees seeking the flexibility to work from the office, while carefully monitoring the conditions in those areas and continuing to adhere to health and safety protocols.

Available Information

We file annual, quarterly and current reports, proxy statements and other documents with the Securities and Exchange Commission (SEC) under the Securities Exchange Act of 1934 (Exchange Act). The SEC maintains an internet site that contains reports, proxy and information statements and other information regarding issuers, including CNA. The public can obtain any documents that we file with the SEC at www.sec.gov.

5

We also make available free of charge on or through our internet website at www.cna.com our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC.

6

ITEM 1A. RISK FACTORS

Our business faces many risks and uncertainties. These risks and uncertainties could lead to events or circumstances that have a material adverse effect on our results of operations, equity, business and insurer financial strength and corporate debt ratings. We have described below material risks that we face. There may be additional risks that we do not yet know of or that we do not currently perceive to be material that may also affect our business. You should carefully consider and evaluate all of the information included in this report and any subsequent reports we may file with the SEC or make available to the public before investing in any securities we issue.

COVID-19 Risks

The COVID-19 pandemic and measures to mitigate the spread of the virus have resulted in significant risk across our enterprise, which have had, and may continue to have, material adverse impacts on our business, results of operations and financial condition, the extent of which cannot be determined with any certainty at this time.

The COVID-19 outbreak, and actions seeking to mitigate the spread of the virus, accelerated in both breadth and scope through early 2020, with the World Health Organization declaring it a pandemic on March 11, 2020. The situation has continued to evolve exponentially with implicated exposures increasing given sustained uncertainties across the global marketplace. Both the extensiveness of the pandemic itself, as well as the measures taken to mitigate the virus' spread globally, are unprecedented and their effects continue to be pervasive. While vaccination efforts have begun, in many geographic locations, the virus continues to spread. Accordingly, it remains the case that nearly a year past the initial identification of the threat, all of the direct and indirect consequences and implications of COVID-19 and measures to mitigate its spread are not yet known and may not emerge for some time.

Risks presented by the ongoing effects of COVID-19 that are known at this time include the following:

Broad economic impact

The economic effect of the pandemic has been broad in nature and has significantly impacted business operations across all industries, including ours. Depressed economic conditions have led to, and may continue to lead to, decreased insured exposures causing us to experience declines in premium volume, especially for lines of business that are sensitive to rates of economic growth and those that are impacted by audit premium adjustments. Significant decreases in premium volume directly and adversely impacts our underwriting expense ratio. We recorded a decrease in our estimated audit premiums during the second quarter of 2020 impacting our net earned premium and if general economic conditions do not improve, our net written premiums and net earned premiums may be depressed, which may have a material impact on our business, results of operations and financial condition, the extent of which cannot be determined with any certainty at this time.

While our losses incurred during 2020 related to COVID-19 and measures to mitigate its spread represent our best estimate of our ultimate insurance losses resulting from events occurring during 2020 due to the pandemic and the consequent economic crisis, given the unprecedented nature of this event, a high level of uncertainty exists as to the potential impact on insurance losses from these events or other events that might occur in the future. The scope, duration and magnitude of the direct and indirect effects could continue to evolve, and could materially impact our ultimate loss estimate, including in lines of business where losses have already been incurred, as well as the potential for impacts in other lines unknown at this time. Continued spread of the virus, as well as new or extended shelter in place restrictions and full or partial business closures, could cause us to experience additional COVID-19 related catastrophe losses in future quarters, which could be material. For further discussion of risks associated with catastrophe losses, see the Risk Factor, "We are vulnerable to material losses from natural and man-made disasters."

7

Financial Markets and Investments

The COVID-19 pandemic has also significantly impacted financial markets. As investors have embarked on a flight to quality, risk free rates have decreased. In addition, liquidity concerns and overall economic uncertainties drove increased volatility in credit spreads and equity markets. While government actions to date have provided some stability to financial markets, economic prospects in the short term continue to be depressed and we remain in a historically low interest rate environment. The continued spread of the virus and the extension of efforts to mitigate the spread in numerous geographic areas will continue to cause substantial uncertainty on the timing and strength of any economic recovery and could continue to impact our investment portfolio results and valuations, and may result in additional volatility or losses in our investment portfolio, which could be material.

These significant financial market disruptions may have a material impact on our business, results of operations and financial condition, the extent of which cannot be determined with any certainty at this time. For further discussion of risks associated with our investments, see the Risk Factor, “We may incur significant realized and unrealized investment losses and volatility in net investment income arising from changes in the financial markets.”

Claims and related litigation

We have experienced, and are likely to continue to experience, increased claim submissions and litigation related to denial of claims based on policy coverage, in certain lines of business that are implicated by the pandemic and mitigating actions taken by our customers and governmental authorities in response to its spread. These lines include primarily healthcare professional liability, workers' compensation, commercial property-related business interruption coverage, management liability (directors and officers, employment practices, and professional liability lines) and trade credit. We have recorded significant losses in these areas during 2020 and may experience continued losses, which could be material. In addition, our surety lines may experience increased losses, particularly in construction surety, where there is significant risk that contractors will be adversely and materially impacted by a prolonged decline in economic conditions.

Increased frequency or severity in any or all of the foregoing lines, or others where the exposure has yet to emerge, may have a material impact on our business, results of operations and financial condition, the extent of which cannot be determined with any certainty at this time.

We have incurred and may continue to incur substantial expenses related to litigation activity in connection with COVID-related legal claims. These actions primarily relate to denial of claims submitted as a result of the pandemic and the mitigating actions under commercial property policies for business interruption coverage, including lockdowns and closing of certain businesses. The significance of such litigation, both in substance and volume, and the resultant activities we have initiated, including external counsel engagement, and the costs related thereto, may have a material impact on our business, results of operations and financial condition, the extent of which cannot be determined with any certainty at this time.

Regulatory impact

The regulatory environment is rapidly evolving in direct response to the pandemic and the related mitigating actions. Numerous regulatory authorities to which our business is subject have implemented or are contemplating broad and significant regulations restricting and governing insurance company operations during the pandemic crisis. Such actions include, but are not limited to, premium moratoriums, premium refunds and reductions, restrictions on policy cancellations and potential legislation-driven expansion of policy terms. To date, certain state authorities have ordered premium refunds and certain regulatory and legislative bodies have proposed requiring insurers to cover business interruption under policies that were not written to provide for such coverage under the current circumstances. In addition, certain states have directed expansion of workers’ compensation coverage through presumption of compensability of claims for a broad category of workers. This highly fluid and challenging regulatory environment, and the new regulations we are now, and may be, subject to may have a material impact on our business, results of operation and financial condition, the extent of which cannot be determined with any certainty at this time. For further discussion of risks associated with our regulatory environment, see the Risk Factor, “We are subject to extensive existing state, local, federal and foreign governmental regulations that restrict our ability to do business and generate revenues; additional

8

regulation or significant modification to existing regulations or failure to comply with regulatory requirements may have a materially adverse effect on our business, results of operations and financial condition.”

Business operational impact

Beginning in March 2020, we instituted mandatory work from home for our employees, with the exception of employees performing certain essential operations, across the United States and globally, including Canada, the U.K. and Europe, and moved to teleconference meetings only across the enterprise. As of the date of this report, the majority of our global workforce continues to work from home. The heightened security risks presented by widespread remote access to our computer systems, may have a material impact on our business, results of operations and financial condition, the extent of which cannot be determined with any certainty at this time. For further discussion of risks associated with the operation of our business functions, facilities and systems and our vendors' facilities and systems, see the Risk Factor, “Any significant interruption in the operation of our business functions, facilities and systems or our vendors' facilities and systems could result in a materially adverse effect on our operations.” For further discussion of risks associated with information security, see the Risk Factor, “Any significant breach in our data security infrastructure could disrupt business, cause financial losses and damage our reputation.”

In addition, in virtually all cases, our critical vendors have also had to impose workplace restrictions or work from home mandates on their employees, which may result in interruption in service delivery or failure by vendors to properly perform required services, including delivery in a manner more susceptible to significant information security risk. Such vendor issues may result in a material impact on our business, results of operations and financial condition, the extent of which cannot be determined with any certainty at this time. For further discussion of risks associated with vendors and third party service providers, see the Risk Factors, “Inability to detect and prevent significant employee or third party service provider misconduct, inadvertent errors and omissions, or exposure relating to functions performed on our behalf could result in a materially adverse effect on our business, results of operations and financial condition” and “Loss of key vendor relationships and issues relating to the transitioning of vendor relationships could compromise our ability to conduct business.”

Insurance Risks

If we determine that our recorded insurance reserves are insufficient to cover our estimated ultimate unpaid liability for claim and claim adjustment expenses, we may need to increase our insurance reserves which would result in a charge to our earnings.

We maintain insurance reserves to cover our estimated ultimate unpaid liability for claim and claim adjustment expenses, including the estimated cost of the claims adjudication process, for reported and unreported claims. Insurance reserves are not an exact calculation of liability but instead are complex management estimates developed utilizing a variety of actuarial reserve estimation techniques as of a given reporting date. The reserve estimation process involves a high degree of judgment and variability and is subject to a number of factors which are highly uncertain. These variables can be affected by both changes in internal processes and external events. Key variables include frequency of claims, claim severity, mortality, morbidity, discount rates, inflation, claim handling policies and procedures, case reserving approach, underwriting and pricing policies, changes in the legal and regulatory environment and the lag time between the occurrence of an insured event and the time of its ultimate settlement. Mortality is the relative incidence of death. Morbidity is the frequency and severity of injury, illness, sickness and diseases contracted.

There is generally a higher degree of variability in estimating required reserves for long-tail coverages, such as workers' compensation, general liability and professional liability, as they require a relatively longer period of time for claims to be reported and settled. The impact of changes in inflation and medical costs are also more pronounced for long-tail coverages due to the longer settlement period. Certain risks and uncertainties associated with our insurance reserves are outlined in the Critical Accounting Estimates and the Reserves - Estimates and Uncertainties sections of MD&A in Item 7.

We are subject to the uncertain effects of emerging or potential claims and coverage issues that arise as industry practices and legal, judicial, social, economic and other environmental conditions change. These issues have had, and may continue to have, a negative effect on our business, results of operations and financial condition

9

by either extending coverage beyond the original underwriting intent or by increasing the number or size of claims, resulting in further increases in our reserves. The effects of unforeseen emerging claim and coverage issues are extremely difficult to predict and may be material.

In light of the many uncertainties associated with establishing the estimates and making the judgments necessary to establish reserve levels, we continually review and change our reserve estimates in a regular and ongoing process as experience develops from the actual reporting and settlement of claims and as the legal, regulatory and economic environment evolves. If our recorded reserves are insufficient for any reason, the required increase in reserves would be recorded as a charge against our earnings in the period in which reserves are determined to be insufficient. These charges could be substantial.

Our actual experience could vary from the key assumptions used to determine active life reserves for long term care policies.

Our active life reserves for long term care policies are based on our best estimate assumptions as of September 30, 2020, due to a reserve unlocking at that date. Key assumptions include morbidity, persistency (the percentage of policies remaining in force), discount rate and future premium rate increases. Estimating future experience for long term care policies is highly uncertain because the adequacy of the reserves is contingent upon actual experience and our future expectations related to these key assumptions. If actual or expected future experience differs from these assumptions, the reserves may not be adequate, requiring us to add reserves. The required increase in reserves would be recorded as a charge against our earnings in the period in which reserves are determined to be insufficient. These charges could be substantial. See the Life & Group Policyholder Reserves portion of Reserves - Estimates and Uncertainties section of MD&A in Item 7 for more information.

Morbidity and persistency experience, inclusive of mortality, can be volatile and may be negatively affected by many factors including, but not limited to, policyholder behavior, judicial decisions regarding policy terms, socioeconomic factors, cost of care inflation, changes in health trends and advances in medical care.

A prolonged period during which investment returns remain at levels lower than those anticipated in our reserving would result in shortfalls in investment income on assets supporting our obligations under long term care policies, which may require changes to our reserves. This risk is more significant for our long term care products because the long potential duration of the policy obligations exceeds the duration of the supporting investment assets. Further, changes to the Internal Revenue Code may also affect the rate at which we discount our reserves. In addition, we may not receive regulatory approval for the level of premium rate increases we request. Any adverse deviation between the level of future premium rate increases approved and the level included in our reserving assumptions may require an increase to our reserves.

We are vulnerable to material losses from natural and man-made disasters.

Catastrophe losses are an inevitable part of our business. Various events can cause catastrophe losses. These events can be natural or man-made, and may include hurricanes, windstorms, earthquakes, hail, severe winter weather, fires, floods, riots, strikes, civil unrest, cyber attacks, pandemics and acts of terrorism. The frequency and severity of these catastrophe events are inherently unpredictable. In addition, longer-term natural catastrophe trends may be changing and new types of catastrophe losses may be developing due to climate change, a phenomenon that has been associated with extreme weather events linked to rising temperatures and includes effects on global weather patterns, greenhouse gases, sea, land and air temperatures, sea levels, rain, hail and snow.

The extent of our losses from catastrophes is a function of the total amount of our insured exposures in the affected areas, the frequency and severity of the events themselves, the level of reinsurance coverage, reinsurance reinstatement premiums and state residual market assessments, if any. It can take a long time for the ultimate cost of any catastrophe losses to us to be finally determined, as a multitude of factors contribute to such costs, including evaluation of general liability and pollution exposures, infrastructure disruption, business interruption and reinsurance collectibility. Further, significant catastrophic events or a series of catastrophic events have the potential to impose financial stress on the reinsurance industry, which could impact our ability to collect amounts owed to us by reinsurers, thereby resulting in higher net incurred losses.

10

Reinsurance coverage for terrorism events is provided only in limited circumstances, especially in regard to “unconventional” terrorism acts, such as nuclear, biological, chemical or radiological attacks. Our principal reinsurance protection against these large-scale terrorist attacks is the coverage currently provided through TRIPRA through December 31, 2027. However, such coverage is subject to a mandatory deductible and other limitations. It is also possible that future legislation could change or eliminate the program, which could adversely affect our business by increasing our exposure to terrorism losses, or by lowering our business volume through efforts to avoid that exposure. For a further discussion of TRIPRA, see Part II, Item 7, MD&A - Catastrophes and Related Reinsurance.

As a result of the items discussed above, catastrophe losses are particularly difficult to estimate, could cause us to exhaust our available reinsurance limits and could adversely affect the cost and availability of reinsurance. Accordingly, catastrophic events could have a material adverse effect on our business, results of operations, financial condition and liquidity.

We have exposures related to asbestos and environmental pollution (A&EP) claims, which could result in material losses.

Our property and casualty insurance subsidiaries have exposures related to A&EP claims. Our experience has been that establishing claim and claim adjustment expense reserves for casualty coverages relating to A&EP claims is subject to uncertainties that are greater than those presented by other claims. Additionally, traditional actuarial methods and techniques employed to estimate the ultimate cost of claims for more traditional property and casualty exposures are less precise in estimating claim and claim adjustment expense reserves for A&EP. As a result, estimating the ultimate cost of both reported and unreported A&EP claims is subject to a higher degree of variability. On August 31, 2010, we completed a retroactive reinsurance transaction under which substantially all of our legacy A&EP liabilities were ceded to National Indemnity Company (NICO), a subsidiary of Berkshire Hathaway Inc., subject to an aggregate limit of $4 billion (Loss Portfolio Transfer). The cumulative amount ceded under the Loss Portfolio Transfer as of December 31, 2020 is $3.3 billion. If the other parties to the Loss Portfolio Transfer do not fully perform their obligations, net losses incurred on A&EP claims covered by the Loss Portfolio Transfer exceed the aggregate limit of $4 billion, or we determine we have exposures to A&EP claims not covered by the Loss Portfolio Transfer, we may need to increase our recorded net reserves which would result in a charge against our earnings. These charges could be substantial. Additionally, if the A&EP claims exceed the limit of the Loss Portfolio Transfer, we will need to assess whether to purchase additional limit or to reassume claim handling responsibility for A&EP claims from an affiliate of NICO. Any additional reinsurance premium or future claim handling costs would also reduce our earnings.

We are exposed to, and may face adverse developments related to, mass tort claims that could arise from our insureds’ sale or use of potentially harmful products or substances, changes to the social and legal environment, issues related to altered interpretation of coverage and other new and emerging claim theories.

We face potential exposure to various types of new and emerging mass tort claims, including those related to exposure to potentially harmful products or substances such as glyphosate, lead paint and opioids; claims arising from changes that expand the right to sue, remove limitations on recovery, extend the statutes of limitations or otherwise repeal or weaken tort reforms, such as those related to abuse reviver statutes, including New York reviver statutes; and claims related to new and emerging theories of liability, such as those related to global warming and climate change. Evolving judicial interpretations and new legislation regarding the application of various tort theories and defenses, including application of various theories of joint and several liability, as well as the application of insurance coverage to these claims, give rise to new claimant activity. Emerging mass tort claim activity, including activity based on such changing judicial interpretations and recent and proposed legislation, could have a material adverse effect on our business, results of operations and financial condition.

11

We may not be able to obtain sufficient reinsurance at a cost or on terms and conditions we deem acceptable, which could result in increased exposure to risk or a decrease in our underwriting commitments.

A primary reason we purchase reinsurance is to manage our exposure to risk. Under our ceded reinsurance arrangements, another insurer assumes a specified portion of our exposure in exchange for a specified portion of policy premiums. Market conditions determine the availability and cost of the reinsurance protection we purchase, which affects the level of our business and profitability, as well as the level and types of risk we retain. If we are unable to obtain sufficient reinsurance at a cost or on terms and conditions we deem acceptable, we may have increased exposure to risk, which could be material. Alternatively, we may be unwilling to bear the increased risk, which would reduce the level of our underwriting commitments.

Strategic Risks

We face intense competition in our industry; we may be adversely affected by the cyclical nature of the property and casualty business and the evolving landscape of our distribution network.

All aspects of the insurance industry are highly competitive and we must continuously allocate resources to refine and improve our insurance products and services to remain competitive. We compete with a large number of stock and mutual insurance companies and other entities, some of which may be larger or have greater financial or other resources than we do, for both distributors and customers. This includes agents, brokers and managing general underwriters who may increasingly compete with us to the extent that markets continue to provide them with direct access to providers of capital seeking exposure to insurance risk. Insurers compete on the basis of many factors, including products, price, services, ratings and financial strength. The competitor landscape has evolved substantially in recent years, with significant consolidation and new market entrants, such as insurtech firms, resulting in increased pressures on our ability to remain competitive, particularly in obtaining pricing that is both attractive to our customer base and risk-appropriate to us.

In addition, the property and casualty market is cyclical and has experienced periods characterized by relatively high levels of price competition, resulting in less restrictive underwriting standards and relatively low premium rates, followed by periods of relatively lower levels of competition, more selective underwriting standards and relatively high premium rates. During periods in which price competition is high, we may lose business to competitors offering competitive insurance products at lower prices. As a result, our premium levels and expense ratio could be materially adversely impacted.

We market our insurance products worldwide primarily through independent insurance agents, insurance brokers, and managing general underwriters who also promote and distribute the products of our competitors. Any change in our relationships with our distribution network agents, brokers or managing general underwriters, including as a result of consolidation and their increased promotion and distribution of our competitors' products, could adversely affect our ability to sell our products. As a result, our business volume and results of operations could be materially adversely impacted.

We may be adversely affected by technological changes or disruptions in the insurance marketplace.

Technological changes in the way insurance transactions are completed in the marketplace, and our ability to react effectively to such change, may present significant competitive risks. For example, more insurers are utilizing "big data" analytics to make underwriting and other decisions that impact product design and pricing. If such utilization is more effective than how we use similar data and information, we will be at a competitive disadvantage. There can be no assurance that we will continue to compete effectively with our industry peers due to technological changes; accordingly, this may have a material adverse effect on our business, results of operations and financial condition.

In addition, agents and brokers, technology companies, or other third parties may create alternate distribution channels for commercial business that may adversely impact product differentiation and pricing. For example, they may create a digitally enabled distribution channel that may adversely impact our competitive position. Our efforts or the efforts of agents and brokers with respect to new products or alternate distribution channels, as well as changes in the way agents and brokers utilize greater levels of data and technology, could adversely

12

impact our business relationship with independent agents and brokers who currently market our products, resulting in a lower volume and/or profitability of business generated from these sources.

We face considerable competition within our industry for qualified, specialized talent and any significant inability to attract and retain talent may adversely affect the execution of our business strategies.

The successful execution of our business plan depends on our ability to attract and retain qualified talent. Due to the intense competition in our industry and from businesses outside the industry for qualified employees, especially those in key positions and those possessing highly specialized knowledge and industry experience in areas such as underwriting, data and analytics and technology, we may encounter obstacles to our ability to attract and retain such employees, which could materially adversely affect our business, results of operations and financial condition.

We are controlled by a single stockholder which could result in potential conflicts of interest.

Loews beneficially owned approximately 89.6% of our outstanding shares of common stock as of December 31, 2020, and is in a position to control actions that require the consent of stockholders, including the election of directors, amendment of our Restated Certificate of Incorporation and any merger or sale of substantially all of our assets. In addition, five officers of Loews currently serve on our Board of Directors. We have also entered into services agreements and a registration rights agreement with Loews, and we may in the future enter into other agreements with Loews. It is possible that potential conflicts of interest could arise in the future for our directors who are also officers of Loews with respect to a number of areas relating to the past and ongoing relationships of Loews and us, including tax and insurance matters, financial commitments and sales of common stock pursuant to registration rights or otherwise.

Financial Risks

We may incur significant realized and unrealized investment losses and volatility in net investment income arising from changes in the financial markets.

Our investment portfolio is exposed to various risks, such as interest rate, credit spread, issuer default, equity prices and foreign currency, which are unpredictable. Financial markets are highly sensitive to changes in economic conditions, monetary policies, tax policies, domestic and international geopolitical issues and many other factors. Changes in financial markets including fluctuations in interest rates, credit, equity prices and foreign currency prices and many other factors beyond our control can adversely affect the value of our investments, the realization of investment income and the rate at which we discount certain liabilities. Our investment portfolio is also subject to increased valuation uncertainties when investment markets are illiquid. The valuation of investments is more subjective when markets are illiquid, thereby increasing the risk that the estimated fair value (i.e., the carrying amount) of the portion of our investment portfolio that is carried at fair value in our financial statements is not reflective of the prices at which actual transactions could occur.

We have significant holdings in fixed maturity investments that are sensitive to changes in interest rates. A decline in interest rates may reduce the returns earned on new fixed maturity investments, thereby reducing our net investment income, while an increase in interest rates may reduce the value of our existing fixed maturity investments, which could reduce our net unrealized gains included in Accumulated other comprehensive income (AOCI). The value of our fixed maturity investments is also subject to risk that certain investments may default or become impaired due to deterioration in the financial condition of issuers of the investments we hold or in the underlying collateral of the security.

In addition, we invest a portion of our assets in limited partnerships and common stock which are subject to greater market volatility than our fixed maturity investments. Limited partnership investments generally provide a lower level of liquidity than fixed maturity or equity investments which may also limit our ability to withdraw funds from these investments. The timing and amount of income or losses on such investments is inherently variable and can contribute to volatility in reported earnings.

Further, we hold a portfolio of commercial mortgage loans. We are subject to risk related to the recoverability of loan balances, which is influenced by declines in the estimated cash flows from underlying property leases, fair value of collateral, refinancing risk and the creditworthiness of tenants of credit tenant loan properties,

13

where lease payments directly service the loan. Any changes in actual or expected collections would result in a charge to earnings.

As a result of these factors, we may not earn an adequate return on our investments, may be required to write-down the value of our investments and may incur losses on the disposition of our investments all of which could materially adversely affect our business, results of operations and financial condition.

Operational Risks

We use analytical models to assist our decision making in key areas such as pricing, reserving and capital modeling and may be adversely affected if actual results differ materially from the model outputs and related analyses.

We use various modeling techniques and data analytics (e.g., scenarios, predictive, stochastic and/or forecasting) to analyze and estimate exposures, loss trends and other risks associated with our assets and liabilities. This includes both proprietary and third party modeled outputs and related analyses to assist us in decision-making related to underwriting, pricing, capital allocation, reserving, investing, reinsurance and catastrophe risk, among other things. We incorporate numerous assumptions and forecasts about the future level and variability of policyholder behavior, loss frequency and severity, interest rates, equity markets, inflation, capital requirements, and currency exchange rates, among others. The modeled outputs and related analyses from both proprietary models and third parties are subject to various assumptions, uncertainties, model design errors and the inherent limitations of any statistical analysis. Further, climate change may make modeled outcomes less certain or produce new, non-modeled risks.

In addition, the effectiveness of any model can be degraded by operational risks, including the improper use of the model, input errors, data errors and human error. As a result, actual results may differ materially from our modeled results. The profitability and financial condition of the Company substantially depends on the extent to which our actual experience is consistent with assumptions we use in our models and ultimate model outputs. If, based upon these models or other factors, we misprice our products or fail to appropriately estimate the risks we are exposed to, our business, results of operations and financial condition may be materially adversely affected.

Any significant interruption in the operation of our business functions, facilities and systems or our vendors' facilities and systems could result in a materially adverse effect on our operations.

Our business is highly dependent upon our ability to perform, in an efficient and uninterrupted manner, through our employees or vendor relationships, necessary business functions (such as internet support and 24-hour call centers), processing new and renewal business and processing and paying claims and other obligations. Our or our vendors' facilities and systems could become unavailable, inoperable, or otherwise impaired from a variety of causes, including natural events, such as hurricanes, tornadoes, windstorms, earthquakes, severe winter weather and fires, or other events, such as explosions, terrorist attacks, computer security breaches or cyber attacks, riots, hazardous material releases, medical epidemics or pandemics, utility outages, interruptions of our data processing and storage systems or the systems of third-party vendors, or unavailability of communications facilities. Likewise, we could experience a significant failure, interruption or corruption of one or more of our or our vendors' information technology, telecommunications, or other systems for various reasons, including significant failures or interruptions that might occur as existing systems are replaced or upgraded.

The shut-down or unavailability of one or more of our or our vendors' systems or facilities for any reason could significantly impair our ability to perform critical business functions on a timely basis. In addition, because our information technology and telecommunications systems interface with and depend on third-party systems, we could experience service denials if demand for such service exceeds capacity or a third-party system fails or experiences an interruption. If sustained or repeated, such events could result in a deterioration of our ability to write and process new and renewal business, provide customer service, pay claims in a timely manner, or perform other necessary business functions, including the ability to issue financial statements in a timely manner.

The foregoing risks could expose us to monetary and reputational damages. Potential exposures include substantially increased compliance costs and required computer system upgrades and security-related

14

investments. If our business continuity plans or system security does not sufficiently address these risks, they could have a material adverse effect on our business, results of operations and financial condition.

Any significant breach in our data security infrastructure could disrupt business, cause financial losses and damage our reputation.

A significant breach of our data security infrastructure may result from actions by our employees, vendors, third-party administrators, or unknown third parties or through cyber attacks. Such a breach could affect our data framework or cause a failure to protect the personal information of our customers, claimants or employees, or sensitive and confidential information regarding our business and may result in operational impairments and financial losses, as well as significant harm to our reputation. The risk of a breach could increase as vendors increasingly offer cloud-based software services rather than software services which can be run within our data centers or as we choose to move additional functions to the cloud.

The breach of confidential information also could give rise to legal liability and regulatory action under data protection and privacy laws, as well as evolving regulation in this regard. Any such legal or regulatory action could have a material adverse effect on our business, results of operations and financial condition.

Inability to detect and prevent significant employee or third party service provider misconduct, inadvertent errors and omissions, or exposure relating to functions performed on our behalf could result in a materially adverse effect on our business, results of operations and financial condition.

We may incur losses which arise from employees or third party service providers engaging in intentional, negligent or inadvertent misconduct, fraud, errors and omissions, failure to comply with internal guidelines, including with respect to underwriting authority, or failure to comply with regulatory requirements. Our or our third party service providers' controls may not be able to detect all possible circumstances of such non-compliant activity and the internal structures in place to prevent this activity may not be effective in all cases. Any losses relating to such non-compliant activity could adversely affect our business, results of operations and financial condition.

Portions of our insurance business is underwritten and serviced by third parties. With respect to underwriting, our contractual arrangements with third parties will typically grant them limited rights to write new and renewal policies, subject to contractual restrictions and obligations, including requiring them to underwrite within the terms of our licenses. Should these third parties issue policies that exceed these contractual restrictions, we could be deemed liable for such policies and subject to regulatory fines and penalties for any breach of licensing requirements. It is possible that in such circumstance we might not be fully indemnified for such third parties’ contractual breaches.

Additionally, we rely on certain third-party claims administrators, including the administrators of our long term care claims, to perform significant claim administration and claim adjudication functions. Any failure by such administrator to properly perform service functions may result in losses as a result of over-payment of claims, legal claims against us and adverse regulatory enforcement exposure.

We have also licensed certain systems from third parties. We cannot be certain that we will have access to these systems or that our information technology or application systems will continue to operate as intended.

These risks could adversely impact our reputation and client relationships and have a material adverse effect on our business, results of operations and financial condition.

Loss of key vendor relationships and issues relating to the transitioning of vendor relationships could compromise our ability to conduct business.

In the event that one or more of our vendors suffers a bankruptcy, is sold to another entity, sustains a significant business interruption or otherwise becomes unable to continue to provide products or services at the requisite level, we may be adversely affected. We may suffer operational impairments and financial losses associated with transferring business to a new vendor, assisting a vendor with rectifying operational difficulties, failure by vendors to properly perform service functions or assuming previously outsourced operations ourselves. Our inability to provide for appropriate servicing if a vendor becomes unable to fulfill its contractual obligations to

15

us, either through transitioning to another service provider temporarily or permanently or assuming servicing internally, may have a materially adverse effect on our business, results of operations and financial condition.

We are subject to capital adequacy requirements and, if we are unable to maintain or raise sufficient capital to meet these requirements, regulatory agencies may restrict or prohibit us from operating our business.

Insurance companies such as ours are subject to capital adequacy standards set by regulators to help identify companies that merit further regulatory attention. In the U.S., these standards apply specified risk factors to various asset, premium and reserve components of our legal entity statutory basis of accounting financial statements. Current rules, including those promulgated by insurance regulators and specialized markets, such as Lloyd's, require companies to maintain statutory capital and surplus at a specified minimum level determined using the applicable jurisdiction's regulatory capital adequacy formula. If we do not meet these minimum requirements, we may be restricted or prohibited from operating our business in the applicable jurisdictions and specialized markets. If we are required to record a material charge against earnings in connection with a change in estimated insurance reserves or the occurrence of a catastrophic event, or if we incur significant losses related to our investment portfolio, which severely deteriorates our capital position, we may violate these minimum capital adequacy requirements unless we are able to raise sufficient additional capital. We may be limited in our ability to raise significant amounts of capital on favorable terms or at all.

The IAIS has adopted a common framework for the supervision of internationally active insurance groups and continues to develop a group basis Insurance Capital Standard (ICS). The NAIC is also developing a group capital standard that is intended to be comparable to the ICS. The development and adoption of these capital standards could increase our prescribed capital requirement, the level at which regulatory scrutiny intensifies, as well as significantly increase our cost of regulatory compliance.

Our insurance subsidiaries, upon whom we depend for dividends in order to fund our corporate obligations, are limited by insurance regulators in their ability to pay dividends.

We are a holding company and are dependent upon dividends, loans and other sources of cash from our subsidiaries in order to meet our obligations. Ordinary dividend payments, or dividends that do not require prior approval by the insurance subsidiaries' domiciliary insurance regulator, are generally limited to amounts determined by formulas that vary by jurisdiction. If we are restricted from paying or receiving intercompany dividends, by regulatory rule or otherwise, we may not be able to fund our corporate obligations and debt service requirements or pay our stockholders dividends from available cash. As a result, we would need to pursue other sources of capital which may be more expensive or may not be available at all.

Rating agencies may downgrade their ratings of us, thereby adversely affecting our ability to write insurance at competitive rates or at all and increasing our cost of capital.

Ratings are an important factor in establishing the competitive position of insurance companies. Our insurance company subsidiaries, as well as our public debt, are rated by rating agencies, including, A.M. Best Company (A.M. Best), Moody's Investors Service, Inc. (Moody's), Standard & Poor's (S&P) and Fitch Ratings, Inc. (Fitch). Ratings reflect the rating agency's opinions of an insurance company's or insurance holding company's financial strength, capital adequacy, enterprise risk management practices, operating performance, strategic position and ability to meet its obligations to policyholders and debt holders.

The rating agencies may take action to lower our ratings in the future as a result of any significant financial loss or changes in the methodology or criteria applied by the rating agencies. The severity of the impact on our business is dependent on the level of downgrade and, for certain products, which rating agency takes the rating action. Among the adverse effects in the event of such downgrades would be the inability to obtain a material volume of business from certain major insurance brokers, the inability to sell a material volume of our insurance products to certain markets and the required collateralization of certain future payment obligations or reserves. Further, if one or more of our corporate debt ratings were downgraded, we may find it more difficult to access the capital markets and we may incur higher borrowing costs.

In addition, it is possible that a significant lowering of the corporate debt ratings of Loews by certain of the rating agencies could result in an adverse effect on our ratings, independent of any change in our circumstances.

16

For further discussion of our ratings, see the Ratings subsection within the Liquidity and Capital Resources section of MD&A in Item 7.

We are subject to extensive existing state, local, federal and foreign governmental regulations that restrict our ability to do business and generate revenues; additional regulation or significant modification to existing regulations or failure to comply with regulatory requirements may have a materially adverse effect on our business, results of operations and financial condition.

The insurance industry is subject to comprehensive and detailed regulation and supervision. Most insurance regulations are designed to protect the interests of our policyholders and third-party claimants, rather than our investors. Each jurisdiction in which we do business has established supervisory agencies that regulate the manner in which we do business. Any changes in regulation could impose significant burdens on us. In addition, the Lloyd's marketplace sets rules under which its members, including our Hardy syndicate, operate.

These rules and regulations relate to, among other things, the standards of solvency (including risk-based capital measures), government-supported backstops for certain catastrophic events (including terrorism), investment restrictions, accounting and reporting methodology, establishment of reserves and potential assessments of funds to settle covered claims against impaired, insolvent or failed private or quasi-governmental insurers.

Regulatory powers also extend to premium rate regulations which require that rates not be excessive, inadequate or unfairly discriminatory. State jurisdictions ensure compliance with such regulations through market conduct exams, which may result in losses to the extent non-compliance is ascertained, either as a result of failure to document transactions properly or failure to comply with internal guidelines, or otherwise. The jurisdictions in which we do business may also require us to provide coverage to persons whom we would not otherwise consider eligible or restrict us from withdrawing from unprofitable lines of business or unprofitable market areas. Each jurisdiction dictates the types of insurance and the level of coverage that must be provided to such involuntary risks. Our share of these involuntary risks is mandatory and generally a function of our respective share of the voluntary market by line of insurance in each jurisdiction.

17

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

We lease our principal executive offices in Chicago, Illinois, as well as other property and casualty insurance offices throughout the U.S. We also lease offices in Canada, the U.K., Belgium, Denmark, France, Germany, Italy, Luxembourg and the Netherlands, primarily for branch and insurance business operations in those locations.

We consider our properties to be in generally good condition, well maintained and suitable and adequate to carry on our business.

ITEM 3. LEGAL PROCEEDINGS

Information on our legal proceedings is set forth in Note F to the Consolidated Financial Statements included under Item 8.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

18

PART II

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock is listed on the New York Stock Exchange and the Chicago Stock Exchange under the symbol CNA.

As of February 5, 2021, we had 271,391,603 shares of common stock outstanding and approximately 89.6% of our outstanding common stock was owned by Loews. We had 866 stockholders of record as of February 5, 2021 according to the records maintained by our transfer agent.

Our Board of Directors has approved an authorization to purchase, in the open market or through privately negotiated transactions, our outstanding common stock, as our management deems appropriate. No repurchases of our common stock were made in the three months ended December 31, 2020.

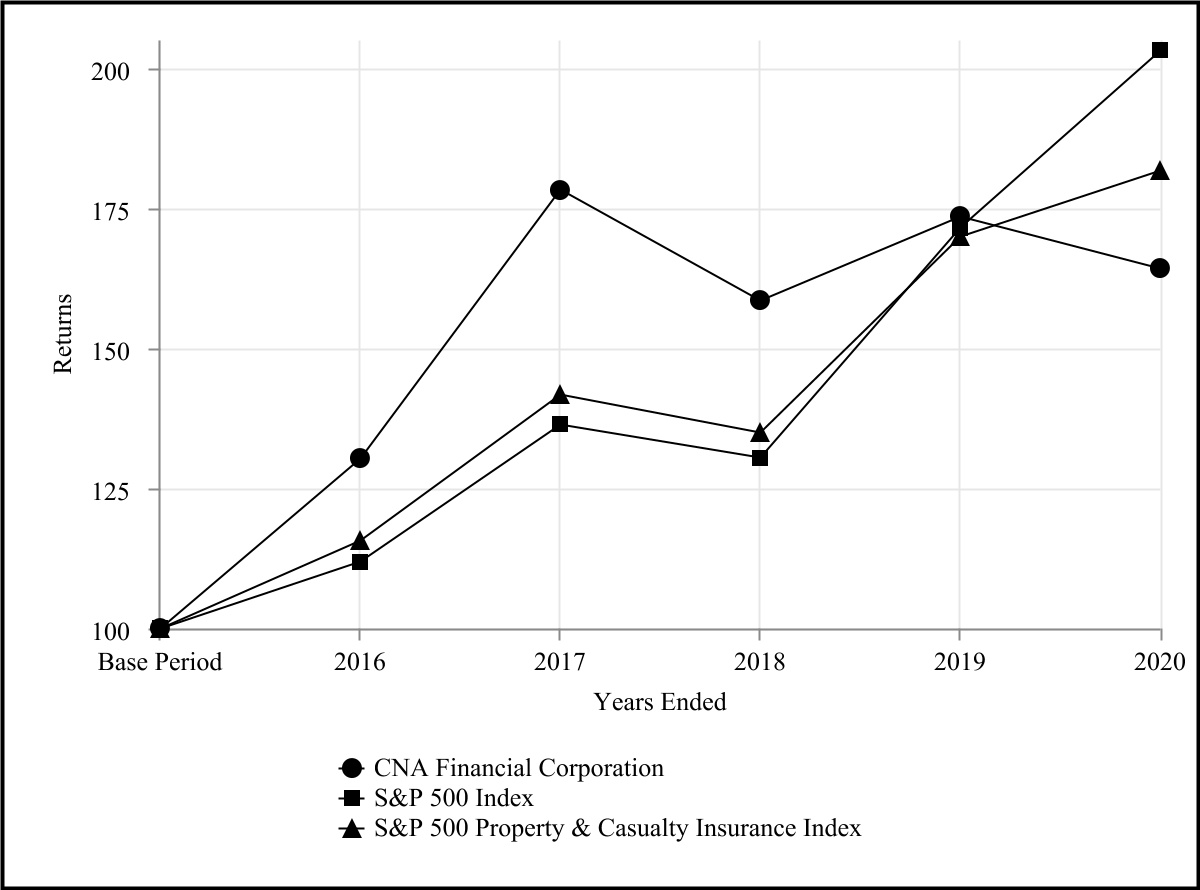

The following graph compares the five-year total return of our common stock, the Standard & Poor's 500 (S&P 500) Index and the S&P 500 Property & Casualty Insurance Index. The graph assumes that the value of the investment in our common stock and each index was $100 at the base period, January 1, 2016, and that dividends, if any, were reinvested in the stock or index.

| Company / Index | Base Period | 2016 | 2017 | 2018 | 2019 | 2020 | |||||||||||||||||||||||||||||

| CNA Financial Corporation | $ | 100.00 | $ | 130.24 | $ | 178.35 | $ | 158.44 | $ | 173.46 | $ | 164.11 | |||||||||||||||||||||||

| S&P 500 Index | 100.00 | 111.96 | 136.40 | 130.42 | 171.49 | 203.04 | |||||||||||||||||||||||||||||

| S&P 500 Property & Casualty Insurance Index | 100.00 | 115.71 | 141.61 | 134.97 | 169.88 | 181.70 | |||||||||||||||||||||||||||||

19

ITEM 6. SELECTED CONSOLIDATED FINANCIAL DATA

The following table presents selected consolidated financial data. The table should be read in conjunction with Item 7 Management's Discussion and Analysis of Financial Condition and Results of Operations and Item 8 Financial Statements and Supplementary Data of this Form 10-K.

| As of or for the years ended December 31 | |||||||||||||||||||||||||||||

| (In millions, except per share data) | 2020 | 2019 | 2018 | 2017 | 2016 | ||||||||||||||||||||||||

| Results of Operations: | |||||||||||||||||||||||||||||

| Revenues | $ | 10,808 | $ | 10,767 | $ | 10,134 | $ | 9,542 | $ | 9,366 | |||||||||||||||||||

| Net income | 690 | 1,000 | 813 | 899 | 859 | ||||||||||||||||||||||||

| Basic earnings per share | 2.54 | 3.68 | 2.99 | 3.32 | 3.18 | ||||||||||||||||||||||||

| Diluted earnings per share | 2.53 | 3.67 | 2.98 | 3.30 | 3.17 | ||||||||||||||||||||||||

| Dividends declared per common share | 3.48 | 3.40 | 3.30 | 3.10 | 3.00 | ||||||||||||||||||||||||

| Financial Condition: | |||||||||||||||||||||||||||||

| Total investments | $ | 50,293 | $ | 47,744 | $ | 44,486 | $ | 46,870 | $ | 45,420 | |||||||||||||||||||

| Total assets | 64,026 | 60,612 | 57,152 | 56,567 | 55,233 | ||||||||||||||||||||||||

| Insurance reserves | 41,143 | 38,614 | 36,764 | 37,212 | 36,431 | ||||||||||||||||||||||||

| Long and short term debt | 2,776 | 2,679 | 2,680 | 2,858 | 2,710 | ||||||||||||||||||||||||

| Stockholders' equity | 12,707 | 12,215 | 11,217 | 12,244 | 11,969 | ||||||||||||||||||||||||

| Book value per common share | 46.82 | 45.00 | 41.32 | 45.15 | 44.25 | ||||||||||||||||||||||||

20

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

2019 Compared with 2018

This section of this Form 10-K generally discusses 2020 and 2019 results and year-to-year comparisons between 2020 and 2019. A discussion of changes in our results of operations from 2019 to 2018 has been omitted from this Form 10-K, but may be found in “Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” of our Form 10-K for the year ended December 31, 2019, filed with the SEC on February 11, 2020.

Index to this MD&A

Management's discussion and analysis of financial condition and results of operations is comprised of the following sections:

| Page No. | |||||

21

OVERVIEW

The following discussion should be read in conjunction with Item 1A Risk Factors, Item 6 Selected Financial Data and Item 8 Financial Statements and Supplementary Data of this Form 10-K.

CRITICAL ACCOUNTING ESTIMATES

The preparation of Consolidated Financial Statements in conformity with GAAP requires us to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the Consolidated Financial Statements and the amount of revenues and expenses reported during the period. Actual results may differ from those estimates.

Our Consolidated Financial Statements and accompanying notes have been prepared in accordance with GAAP applied on a consistent basis. We continually evaluate the accounting policies and estimates used to prepare the Consolidated Financial Statements. In general, our estimates are based on historical experience, evaluation of current trends, information from third-party professionals and various other assumptions that are believed to be reasonable under the known facts and circumstances.

The accounting estimates discussed below are considered by us to be critical to an understanding of our Consolidated Financial Statements as their application places the most significant demands on our judgment. Note A to the Consolidated Financial Statements included under Item 8 should be read in conjunction with this section to assist with obtaining an understanding of the underlying accounting policies related to these estimates. Due to the inherent uncertainties involved with these types of judgments, actual results could differ significantly from our estimates and may have a material adverse impact on our results of operations, financial condition, equity, business, and insurer financial strength and corporate debt ratings.

Insurance Reserves

Insurance reserves are established for both short and long-duration insurance contracts. Short-duration contracts are primarily related to property and casualty insurance policies where the reserving process is based on actuarial estimates of the amount of loss, including amounts for known and unknown claims. Long-duration contracts are primarily related to long term care policies and are estimated using actuarial estimates about morbidity and persistency as well as assumptions about expected investment returns and future premium rate increases. The reserve for unearned premiums represents the portion of premiums written related to the unexpired terms of coverage. The reserving process is discussed in further detail in the Reserves-Estimates and Uncertainties section below.

Long Term Care Reserves

Future policy benefit reserves for our long term care policies are based on certain assumptions, including morbidity, persistency, inclusive of mortality, discount rates and future premium rate increases. The adequacy of the reserves is contingent upon actual experience and our future expectations related to these key assumptions. If actual or expected future experience differs from these assumptions, the reserves may not be adequate, requiring us to add to reserves.

A prolonged period during which investment returns remain at levels lower than those anticipated in our reserving discount rate assumption could result in shortfalls in investment income on assets supporting our obligations under long term care policies, which may also require an increase to our reserves. In addition, we may not receive regulatory approval for the level of premium rate increases we request.

These changes to our reserves could materially adversely impact our results of operations, financial condition and equity. The reserving process is discussed in further detail in the Reserves - Estimates and Uncertainties section below.

Reinsurance and Insurance Receivables

Exposure exists with respect to the collectibility of ceded property and casualty and life reinsurance to the extent that any reinsurer is unable to meet its obligations or disputes the liabilities we have ceded under reinsurance agreements. An allowance for uncollectible reinsurance is recorded on the basis of periodic evaluations of balances due from reinsurers, reinsurer financial strength rating and solvency, industry

22

experience and current and forecast economic conditions. Further information on our reinsurance receivables is in Note G to the Consolidated Financial Statements included under Item 8.

Additionally, exposure exists with respect to the collectibility of amounts due from policyholders related to insurance contracts, including amounts due from insureds under high deductible policies and retrospectively rated policies. An allowance for uncollectible insurance receivables is recorded on the basis of periodic evaluations of balances due from insureds, currently as well as in the future, historical business default data, management's experience and current and forecast economic conditions.