| Ryan C. Larrenaga c/o Columbia Management Investment Advisers, LLC 290 Congress Street Boston, MA 02210 |

Stephen Kusmierczak Daniel J. Beckman Columbia Acorn Trust 71 S. Wacker Drive Suite 2500 Chicago, IL 60606 |

Mary C. Moynihan Perkins Coie LLP 700 13th Street, N.W., Suite 800 Washington, D.C. 20005 | ||

| (Agents for service) | ||||

| ☐ | immediately upon filing pursuant to rule 485(b) |

| ☒ | on |

| ☐ | 60 days after filing pursuant to rule 485(a)(1) |

| ☐ | on pursuant to rule 485(a)(l) |

| ☐ | 75 days after filing pursuant to rule 485(a)(2) |

| ☐ | on pursuant to rule 485(a)(2). |

Acorn European FundSM

| |

3 |

| |

3 |

| |

3 |

| |

4 |

| |

5 |

| |

8 |

| |

9 |

| |

10 |

| |

10 |

| |

10 |

| |

11 |

| |

11 |

| |

11 |

| |

11 |

| |

16 |

| |

22 |

| |

22 |

| |

24 |

| |

25 |

| |

26 |

| |

26 |

| |

26 |

| |

32 |

| |

35 |

| |

39 |

| |

40 |

| |

42 |

| |

42 |

| |

43 |

| |

47 |

| |

49 |

| |

54 |

| |

56 |

| |

59 |

| |

59 |

| |

60 |

| |

63 |

| |

A-1 |

| | |||

| Class A | Class C | Classes Adv, Inst, Inst2 and Inst3 | |

| Maximum sales charge (load) imposed on purchases (as a % of offering price) | |||

| Maximum deferred sales charge (load) imposed on redemptions (as a % of the lower of the original purchase price or current net asset value) | |||

| | ||||||

| Class A | Class Adv | Class C | Class Inst | Class Inst2 | Class Inst3 | |

| Management fees | ||||||

| Distribution and/or service (12b-1) fees | ||||||

| Other expenses | ||||||

| Total annual Fund operating expenses | ||||||

| Fee waivers and/or expense reimbursements(c) | ( |

( |

( |

( |

( |

( |

| Total annual Fund operating expenses after fee waivers and/or expense reimbursements | ||||||

| (a) | |

| (b) | |

| (c) | |

| Prospectus 2023 | 3 |

| ■ | you invest $10,000 in the applicable class of Fund shares for the periods indicated, |

| ■ | your investment has a 5% return each year, and |

| ■ | the Fund’s total annual operating expenses remain the same as shown in the Annual Fund Operating Expenses table above. |

| 1 year | 3 years | 5 years | 10 years | |

| Class A (whether or not shares are redeemed) | $ |

$ |

$ |

$ |

| Class Adv (whether or not shares are redeemed) | $ |

$ |

$ |

$ |

| Class C (assuming redemption of all shares at the end of the period) | $ |

$ |

$ |

$ |

| Class C (assuming no redemption of shares) | $ |

$ |

$ |

$ |

| Class Inst (whether or not shares are redeemed) | $ |

$ |

$ |

$ |

| Class Inst2 (whether or not shares are redeemed) | $ |

$ |

$ |

$ |

| Class Inst3 (whether or not shares are redeemed) | $ |

$ |

$ |

$ |

| 4 | Prospectus 2023 |

| ■ | A strong business franchise that offers growth potential. |

| ■ | Products and services in which the company has a competitive advantage. |

| ■ | A stock price the Investment Manager believes is reasonable relative to the assets and earning power of the company. |

| ■ | Europe. The Fund is particularly susceptible to risks related to economic, political, regulatory or other events or conditions, including acts of war or other conflicts in the region, affecting issuers and countries in Europe. Countries in Europe are often closely connected and interdependent, and events in one European country can have an adverse impact on, and potentially spread to, other European countries. In addition, significant private or public debt problems in a single European Union (EU) country can pose economic risks to the EU as a whole. As a result, the Fund’s NAV may be more volatile than the NAV of a more geographically diversified fund. If securities of issuers in Europe fall out of favor, it may cause the Fund to underperform other funds that do not focus their investments in this region of the world. Any uncertainty caused by the departure of the United Kingdom (UK) from the EU, which occurred in January 2020, could have negative impacts on the UK and EU, as well as other European economies |

| Prospectus 2023 | 5 |

| and the broader global economy. These could include negative impacts on currencies and financial markets as well as increased volatility and illiquidity, and potentially lower economic growth in markets in Europe, which could adversely affect the value of your investment in the Fund. |

| 6 | Prospectus 2023 |

| ■ | Industrials Sector. The Fund is more susceptible to the particular risks that may affect companies in the industrials sector than if it were invested in a wider variety of companies in unrelated sectors. Companies in the industrials sector are subject to certain risks, including changes in supply and demand for their specific product or service and for industrial sector products in general, including decline in demand for such products due to rapid technological developments and frequent new product introduction. Performance of such companies may be affected by factors including government regulation, world events, economic conditions and risks for environmental damage and product liability claims. |

| ■ | Information Technology Sector. The Fund is more susceptible to the particular risks that may affect companies in the information technology sector than if it were invested in a wider variety of companies in unrelated sectors. Companies in the information technology sector are subject to certain risks, including the risk that new services, equipment or technologies will not be accepted by consumers and businesses or will become rapidly obsolete. Performance of such companies may be affected by factors including obtaining and protecting patents (or the failure to do so) and significant competitive pressures, including aggressive pricing of their products or services, new market entrants, competition for market share and short product cycles due to an accelerated rate of technological developments. Such competitive pressures may lead to limited earnings and/or falling profit margins. As a result, the value of their securities may fall or fail to rise. In addition, many information technology sector companies have limited operating histories and prices of these companies’ securities historically have been more volatile than other securities, especially over the short term. Some companies in the information technology sector are facing increased government and regulatory scrutiny and may be subject to adverse government or regulatory action, which could negatively impact the value of their securities. |

| ■ | Health Care Sector. The Fund is more susceptible to the particular risks that may affect companies in the health care sector than if it were invested in a wider variety of companies in unrelated sectors. Companies in the health care sector are subject to certain risks, including restrictions on government reimbursement for medical expenses, government approval of medical products and services, competitive pricing pressures, and the rising cost of medical products and services (especially for companies dependent upon a relatively limited number of products or services), among others. Performance of such companies may be affected by factors including government regulation, obtaining and protecting patents (or the failure to do so), product liability and other similar litigation as well as product obsolescence. |

| Prospectus 2023 | 7 |

| 8 | Prospectus 2023 |

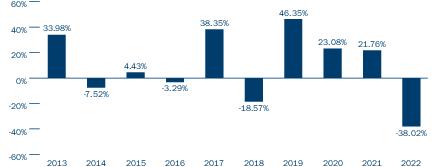

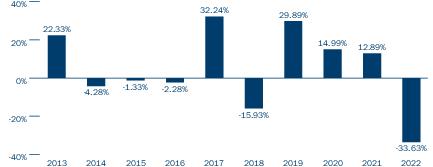

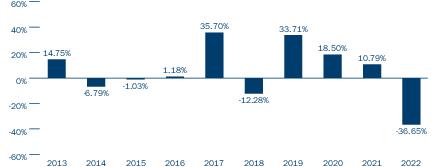

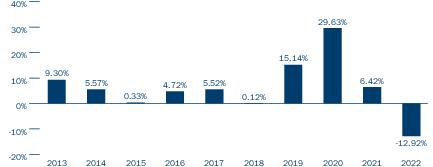

as of December 31 Each Year* |

Best and Worst Quarterly Returns During the Period Shown in the Bar Chart | ||

|

|||

| - | |||

| * | |

| Share Class Inception Date |

1 Year | 5 Years | 10 Years | |

| Class Inst | ||||

| returns before taxes | - |

|||

| returns after taxes on distributions | - |

|||

| returns after taxes on distributions and sale of Fund shares | - |

|||

| Class A returns before taxes | - |

|||

| Class Adv returns before taxes | - |

|||

| Class C returns before taxes | - |

|||

| Class Inst2 returns before taxes | - |

|||

| Class Inst3 returns before taxes | - |

|||

| MSCI AC Europe Small Cap Index (Net) (reflects reinvested dividends net of withholding taxes but reflects no deductions for fees, expenses or other taxes) | - |

- |

| Portfolio Management | Title | Role with Fund | Service with the Fund Since | |||

| Stephen Kusmierczak, CFA | International Team Head, Portfolio Manager and Analyst | Portfolio Manager or Co-Portfolio Manager since inception in 2011 |

2011 | |||

| Sebastien Pigeon, CFA | Portfolio Manager and Analyst | Co-Portfolio Manager since 2021 |

2015 |

| Prospectus 2023 | 9 |

| Online | Regular Mail | Express Mail | By Telephone | |||

| columbiathreadneedleus.com/investor/ | Columbia Management Investment Services Corp. P.O. Box 219104 Kansas City, MO 64121-9104 |

Columbia Management Investment Services Corp. c/o SS&C GIDS, Inc. 430 W 7th Street, Suite 219104 Kansas City, MO 64105-1407 |

800.422.3737 |

| Class | Category of eligible account | For accounts other than Systematic Investment Plan accounts (as described in the Fund’s Prospectus) |

For Systematic Investment Plan accounts |

| Classes A & C | All accounts other than IRAs | $2,000 | $100 |

| IRAs | $1,000 | $100 | |

| Classes Adv & Inst | All eligible accounts | $0, $1,000 or $2,000 depending upon the category of eligible investor |

$100 |

| Class Inst2 | All eligible accounts | None | N/A |

| Class Inst3 | All eligible accounts | $0, $1,000, $2,000 or $1 million depending upon the category of eligible investor |

$100 (for certain eligible investors) |

| 10 | Prospectus 2023 |

| ■ | A strong business franchise that offers growth potential. |

| ■ | Products and services in which the company has a competitive advantage. |

| ■ | A stock price the Investment Manager believes is reasonable relative to the assets and earning power of the company. |

| Prospectus 2023 | 11 |

| ■ | Europe. The Fund is particularly susceptible to risks related to economic, political, regulatory or other events or conditions, including acts of war or other conflicts in the region, affecting issuers and countries in Europe. Countries in Europe are often closely connected and interdependent, and events in one European country can have an adverse impact on, and potentially spread to, other European countries. Most developed countries in Western Europe are members of the EU, and many are also members of the European Economic and Monetary Union (EMU). European countries can be significantly affected by the tight fiscal and monetary controls that the EMU imposes on its members and with which candidates for EMU membership are required to comply. In addition, significant private or public debt problems in a single EU country can pose economic risks to the EU as a whole. Unemployment in Europe has historically been higher than in the United States and public deficits are an ongoing concern in many European countries. As a result, the Fund’s NAV may be more volatile than the NAV of a more geographically diversified fund. If securities of issuers in Europe fall out of favor, it may cause the Fund to underperform other funds that do not focus their investments in this region of the world. Any uncertainty caused by the departure of the UK from the EU, which occurred in January 2020, could have negative impacts on the UK and EU, as well as other European economies and the broader global economy. These could include negative impacts on currencies and financial markets as well as increased volatility and illiquidity, and potentially lower economic growth in markets in the UK, Europe and globally, which could adversely affect the value of your investment in the Fund. Any attempt by the Fund to hedge against or otherwise protect its portfolio or to profit from such circumstances may fail and, accordingly, an investment in the Fund could lose money over short or long periods. |

| 12 | Prospectus 2023 |

| Prospectus 2023 | 13 |

| 14 | Prospectus 2023 |

| ■ | Industrials Sector. The Fund is more susceptible to the particular risks that may affect companies in the industrials sector than if it were invested in a wider variety of companies in unrelated sectors. Companies in the industrials sector are subject to certain risks, including changes in supply and demand for their specific product or service and for industrial sector products in general, including decline in demand for such products due to rapid technological developments and frequent new product introduction. Performance of such companies may be affected by factors including government regulation, world events, economic conditions and risks for environmental damage and product liability claims. |

| ■ | Information Technology Sector. The Fund is more susceptible to the particular risks that may affect companies in the information technology sector than if it were invested in a wider variety of companies in unrelated sectors. Companies in the information technology sector are subject to certain risks, including the risk that new services, equipment or technologies will not be accepted by consumers and businesses or will become rapidly obsolete. Performance of such companies may be affected by factors including obtaining and protecting patents (or the failure to do so) and significant competitive pressures, including aggressive pricing of their products or services, new market entrants, competition for market share and short product cycles due to an accelerated rate of technological developments. Such competitive pressures may lead to limited earnings and/or falling profit margins. As a result, the value of their securities may fall or fail to rise. In addition, many information technology sector companies have limited operating histories and prices of these companies’ securities historically have been more volatile than other securities, especially over the short term. Some companies in the information technology sector are facing increased government and regulatory scrutiny and may be subject to adverse government or regulatory action, which could negatively impact the value of their securities. |

| ■ | Health Care Sector. The Fund is more susceptible to the particular risks that may affect companies in the health care sector than if it were invested in a wider variety of companies in unrelated sectors. Companies in the health care sector are subject to certain risks, including restrictions on government reimbursement for medical expenses, government approval of medical products and services, competitive pricing pressures, and the rising cost of medical products and services (especially for companies dependent upon a relatively limited number of products or services), among others. Performance of such companies may be affected by factors including government regulation, obtaining and protecting patents (or the failure to do so), product liability and other similar litigation as well as product obsolescence. |

| Prospectus 2023 | 15 |

| 16 | Prospectus 2023 |

| Prospectus 2023 | 17 |

| 18 | Prospectus 2023 |

| Prospectus 2023 | 19 |

| 20 | Prospectus 2023 |

| Columbia Acorn European Fund | |

| Class A | 1.45% |

| Class Adv | 1.20% |

| Class C | 2.20% |

| Class Inst | 1.20% |

| Class Inst2 | 1.14% |

| Class Inst3 | 1.11% |

| Prospectus 2023 | 21 |

| 22 | Prospectus 2023 |

| Portfolio Management | Title | Role with Fund | Service with the Fund Since | |||

| Stephen Kusmierczak, CFA | International Team Head, Portfolio Manager and Analyst | Portfolio Manager or Co-Portfolio Manager since inception in 2011 |

2011 | |||

| Sebastien Pigeon, CFA | Portfolio Manager and Analyst | Co-Portfolio Manager since 2021 |

2015 |

| Annual Administration Fee, as a % of Aggregate Daily Net Assets of the Trust: | |

| Up to $8 billion | 0.050% |

| $8 billion to $16 billion | 0.040% |

| $16 billion to $35 billion | 0.030% |

| $35 billion to $45 billion | 0.025% |

| $45 billion and over | 0.015% |

| Prospectus 2023 | 23 |

| ■ | the Investment Manager and other Ameriprise Financial affiliates may receive compensation and other benefits related to the management/administration of the Fund and the other Columbia Funds and the sale of their shares; |

| ■ | there may be competition for limited investment opportunities that must be allocated among the Fund, the other Columbia Funds and other clients and customers of the Investment Manager (which can include affiliates of the Investment Manager) that may have the same or similar investment objectives as the Fund; |

| 24 | Prospectus 2023 |

| ■ | management of the Fund may diverge from other Columbia Funds or other clients and customers of the Investment Manager or Ameriprise Financial affiliates, for example, advice given to the Fund may differ from, or conflict with, advice given to other funds or accounts; |

| ■ | there may be regulatory or investment restrictions imposed on the investment activities of the Investment Manager arising from the activities or holdings of other Columbia Funds or other clients or customers of the Investment Manager or Ameriprise Financial and its affiliates, for example, caps on the aggregate amount of certain types of investments or in holdings of particular portfolio companies that may be made by affiliated entities, including the Fund; |

| ■ | Ameriprise Financial or its affiliates may have potentially conflicting relationships with companies and other entities in which the Fund invests; and |

| ■ | there may be regulatory and other restrictions relating to the sharing of information between Ameriprise Financial and its affiliates, including the Investment Manager, for example, if an affiliated entity were in possession of non-public information, the Investment Manager might be prohibited by law from using that information in connection with the management of the Fund. |

| Prospectus 2023 | 25 |

| * | The website references in this prospectus are inactive links and information contained in or otherwise accessible through the referenced websites does not form a part of this prospectus. |

| 26 | Prospectus 2023 |

| ■ | The amount you plan to invest. |

| ■ | How long you intend to remain invested in the Fund. |

| ■ | The fees (e.g., sales charge or “load”) and expenses for each share class. |

| ■ | Whether you may be eligible for a reduction or waiver of sales charges when you buy or sell shares. |

| ■ | The net asset value (NAV) per share is the price of a share calculated by the Fund every business day. |

| ■ | The offering price per share is the NAV per share plus any front-end sales charge (or load) that applies. |

| Prospectus 2023 | 27 |

| Share Class | Eligible Investors; Minimum Initial Investments; Conversion Features(a) |

Front-End Sales Charges(b) |

Contingent Deferred Sales Charges (CDSCs)(b) |

Sales Charge Reductions/Waivers |

Maximum Distribution and/or Service (12b-1) Fees(c) |

| Class A | Eligibility: Available to the general public for investment Minimum Initial Investment: $2,000 ($1,000 for IRAs; $100 for monthly Systematic Investment Plan accounts (as described below)) |

5.75% maximum, declining to 0.00% on investments of $1 million or more | CDSC on certain investments of between $1 million and $50 million redeemed within 18 months after purchase charged as follows: • 1.00% CDSC if redeemed within 12 months after purchase and • 0.50% CDSC if redeemed more than 12, but less than 18, months after purchase | Reductions: yes, see Choosing a Share Class — Reductions/Waivers of Sales Charges – Class A Shares Front-End Sales Charge Reductions Waivers: yes, on Fund distribution reinvestments. For additional waivers, see Choosing a Share Class — Reductions/Waivers of Sales Charges – Class A Shares Front-End Sales Charge Waivers, as well as Choosing a Share Class — CDSC Waivers – Class A and Class C Financial intermediary-specific waivers are also available, see Appendix A |

Service Fee: 0.25% |

| Class Adv |

Eligibility: Available only to (i) omnibus retirement plans, including self-directed brokerage accounts within omnibus retirement plans that clear through institutional no transaction fee (NTF) platforms; retirement plans; (ii) trust companies or similar institutions; (iii) broker-dealers, banks, trust companies and similar institutions that clear Fund share transactions for their client or customer investment advisory or similar accounts through designated financial intermediaries and their mutual fund trading platforms that have been granted specific written authorization from the Transfer Agent with respect to Class Adv eligibility apart from selling, servicing or similar agreements; (iv) 501(c)(3) charitable organizations; (v) 529 plans; (vi) health savings accounts; (vii) investors participating in a fee-based advisory program sponsored by a financial intermediary or other entity that is not compensated by the Fund for those services, other than payments for shareholder servicing or sub-accounting performed in place | None | None | N/A | None |

| 28 | Prospectus 2023 |

| Share Class | Eligible Investors; Minimum Initial Investments; Conversion Features(a) |

Front-End Sales Charges(b) |

Contingent Deferred Sales Charges (CDSCs)(b) |

Sales Charge Reductions/Waivers |

Maximum Distribution and/or Service (12b-1) Fees(c) |

| of the Transfer Agent; and (viii) commissionable brokerage platforms where the financial intermediary, acting as broker on behalf of its customer, charges the customer a commission for effecting transactions in Fund shares, provided that the financial intermediary has an agreement with the Distributor that specifically authorizes offering Class Adv shares within such platform. Minimum Initial Investment: None, except in the case of (viii) above, which is $2,000 ($1,000 for IRAs; $100 for monthly Systematic Investment Plan accounts) |

|||||

| Class C | Eligibility: Available to the general public for investment Minimum Initial Investment: $2,000 ($1,000 for IRAs; $100 for monthly Systematic Investment Plan accounts) Conversion Feature: Yes. Effective April 1, 2021, Class C shares generally automatically convert to Class A shares of the same Fund in the month of or the month following the 8-year anniversary of the Class C shares purchase date. Prior to April 1, 2021, Class C shares generally automatically converted to Class A shares of the same Fund in the month of or the month following the 10-year anniversary of the Class C shares purchase date.(a) |

None | 1.00% on certain investments redeemed within one year of purchase | Waivers: yes, on Fund distribution reinvestments. For additional waivers, see Choosing a Share Class — CDSC Waivers – Class A and Class C Financial intermediary-specific CDSC waivers are also available, see Appendix A |

Distribution Fee: 0.75% Service Fee: 0.25% |

| Class Inst |

Eligibility: Available only to certain eligible investors, which are subject to different minimum investment requirements, ranging from $0 to $2,000, including investors who purchase Fund shares through commissionable brokerage platforms where the financial intermediary holds the shares in an omnibus account and, acting as broker on behalf of its customer, charges the customer a commission for effecting transactions in Fund shares, provided that the financial intermediary has an agreement with the Distributor that specifically authorizes offering Class Inst shares within such platform; closed to (i) accounts of financial intermediaries that clear Fund share transactions for their client or customer accounts through designated financial intermediaries and their mutual fund | None | None | N/A | None |

| Prospectus 2023 | 29 |

| Share Class | Eligible Investors; Minimum Initial Investments; Conversion Features(a) |

Front-End Sales Charges(b) |

Contingent Deferred Sales Charges (CDSCs)(b) |

Sales Charge Reductions/Waivers |

Maximum Distribution and/or Service (12b-1) Fees(c) |

| trading platforms that have been given specific written notice from the Transfer Agent of the termination of their eligibility for new purchases of Class Inst shares and (ii) omnibus group retirement plans, subject to certain exceptions(d) Minimum Initial Investment: See Eligibility above |

|||||

| Class Inst2 |

Eligibility: Available only to (i) certain registered investment advisers and family offices that clear Fund share transactions for their client or customer accounts through designated financial intermediaries and their mutual fund trading platforms that have been granted specific written authorization from the Transfer Agent with respect to Class Inst2 eligibility apart from selling, servicing or similar agreements; (ii) omnibus retirement plans(d); (iii) health savings accounts, provided that the financial intermediary has an agreement with the Distributor that specifically authorizes offering Class Inst2 shares within such platform and that Fund shares are held in an omnibus account; and (iv) institutional investors that are clients of the Columbia Threadneedle Global Institutional Distribution Team that invest in Class Inst2 shares for their own account through platforms approved by the Distributor or an affiliate thereof to offer and/or service Class Inst2 shares within such platform. Minimum Initial Investment: None |

None | None | N/A | None |

| Class Inst3 |

Eligibility: Available to: (i) group retirement plans that maintain plan-level or omnibus accounts with the Fund(d); (ii) institutional investors that are clients of the Columbia Threadneedle Global Institutional Distribution Team that invest in Class Inst3 shares for their own account through platforms approved by the Distributor or an affiliate thereof to offer and/or service Class Inst3 shares within such platform; (iii) collective trust funds; (iv) affiliated or unaffiliated mutual funds (e.g., funds operating as funds-of-funds); (v) fee-based platforms of financial intermediaries (or the clearing intermediary they trade through) that have an agreement with the |

None | None | N/A | None |

| 30 | Prospectus 2023 |

| Share Class | Eligible Investors; Minimum Initial Investments; Conversion Features(a) |

Front-End Sales Charges(b) |

Contingent Deferred Sales Charges (CDSCs)(b) |

Sales Charge Reductions/Waivers |

Maximum Distribution and/or Service (12b-1) Fees(c) |

| Distributor or an affiliate thereof that specifically authorizes the financial intermediary to offer and/or service Class Inst3 shares within such platform, provided also that Fund shares are held in an omnibus account; (vi) commissionable brokerage platforms where the financial intermediary, acting as broker on behalf of its customer, charges the customer a commission for effecting transactions in Fund shares, provided that the financial intermediary has an agreement with the Distributor that specifically authorizes offering Class Inst3 shares within such platform and that Fund shares are held in an omnibus account; (vii) health savings accounts, provided that the financial intermediary has an agreement with the Distributor that specifically authorizes offering Class Inst3 shares within such platform and that Fund shares are held in an omnibus account; and (viii) bank trust departments, subject to an agreement with the Distributor that specifically authorizes offering Class Inst3 shares and provided that Fund shares are held in an omnibus account. In each case above where noted that Fund shares are required to be held in an omnibus account, the Distributor, may, in its discretion, determine to waive this requirement. Minimum Initial Investment: No minimum for the eligible investors described in (i), (iii), (iv) and (v) above; $2,000 ($1,000 for IRAs; $100 for monthly Systematic Investment Plan accounts) for the eligible investors described in (vi) above; and $1 million for all other eligible investors, unless waived in the discretion of the Distributor |

|||||

| Class R | Eligibility: Available only to eligible retirement plans, health savings accounts and, in the sole discretion of the Distributor, other types of retirement accounts held through platforms maintained by financial intermediaries approved by the Distributor Minimum Initial Investment: None |

None | None | N/A | Distribution Fee: 0.50% |

| (a) | For more information on the conversion of Class C shares to Class A shares, see Choosing a Share Class — Sales Charges and Commissions — Class C Shares —Conversion to Class A Shares. |

| (b) | For more information on applicable sales charges, see Choosing a Share Class — Sales Charges and Commissions, and for information about certain exceptions to these sales charges, see Choosing a Share Class — Reductions/Waivers of Sales Charges. |

| Prospectus 2023 | 31 |

| (c) | These are the maximum applicable distribution and/or service fees under the Fund’s Rule 12b-1 plan. Because these fees are paid out of Fund assets on an ongoing basis, over time these fees will increase the cost of your investment and may cost you more than paying other types of distribution and/or service fees. For more information on distribution and service fees, see Choosing a Share Class — Distribution and Service Fees. |

| (d) | These share classes are closed to new accounts generally or to new accounts of certain categories of investors, subject to certain conditions, as summarized below and described in more detail under Buying, Selling and Exchanging Shares — Buying Shares — Eligible Investors: |

| 32 | Prospectus 2023 |

| ■ | depends on the amount you are investing (generally, the larger the investment, the smaller the percentage sales charge), and |

| ■ | is based on the total amount of your purchase and the value of your account (and any other accounts eligible for aggregation of which you or your financial intermediary notifies the Fund). |

| Class A Shares — Front-End Sales Charge — Breakpoint Schedule | ||||

| Breakpoint Schedule For: | Dollar amount of shares bought(a) |

Sales charge as a % of the offering price(b) |

Sales charge as a % of the net amount invested(b) |

Amount retained by or paid to financial intermediaries as a % of the offering price |

| Class A Shares | $0–$49,999 | 5.75% | 6.10% | 5.00% |

| $50,000–$99,999 | 4.50% | 4.71% | 3.75% | |

| $100,000–$249,999 | 3.50% | 3.63% | 3.00% | |

| $250,000–$499,999 | 2.50% | 2.56% | 2.15% | |

| $500,000–$999,999 | 2.00% | 2.04% | 1.75% | |

| $1,000,000 or more | 0.00% | 0.00% | 0.00%(c) | |

| (a) | Purchase amounts and account values may be aggregated among all eligible Fund accounts for the purposes of this table. See Choosing a Share Class — Reductions/Waivers of Sales Charges for a discussion of account value aggregation. |

| (b) | Because the offering price is calculated to two decimal places, the dollar amount of the sales charge as a percentage of the offering price and your net amount invested for any particular purchase of Fund shares may be higher or lower depending on whether downward or upward rounding was required during the calculation process. Purchase price includes the sales charge. |

| (c) | For information regarding cumulative commissions paid to your financial intermediary when you buy $1 million or more of Class A shares of a Fund, see Class A Shares — Commissions below. |

| Prospectus 2023 | 33 |

| ■ | If you purchased Class A shares without an initial sales charge because your accounts aggregated between $1 million and $50 million at the time of purchase, you will incur a CDSC if you redeem those shares within 18 months after purchase, which is charged as follows: 1.00% CDSC if shares are redeemed within 12 months after purchase; and 0.50% CDSC if shares are redeemed more than 12, but less than 18, months after purchase. |

| ■ | Subsequent Class A share purchases that bring your aggregate account value to $1 million or more (but less than $50 million) will also be subject to a CDSC if you redeem them within the time periods noted above. |

| Class A Shares — Commission Schedule (Paid by the Distributor to Financial Intermediaries) | |

| Purchase Amount | Commission Level* (as a % of net asset value per share) |

| $1 million – $2,999,999 | 1.00% |

| $3 million – $49,999,999 | 0.50% |

| $50 million or more | 0.25% |

| * | The commission level applies to the applicable asset level; therefore, for example, for a purchase of $5 million, the Distributor would pay a commission of 1.00% on the first $2,999,999 and 0.50% on the balance. |

| 34 | Prospectus 2023 |

| ■ | Class C share accounts that are Direct-at-Fund Accounts and Networked Accounts for which the Transfer Agent (and not your financial intermediary) sends you Fund account transaction confirmations and statements, convert on or about the 15th day of the month (if the 15th is not a business day, then the next business day thereafter) that they become eligible for automatic conversion provided that the Fund has records that Class C shares have been held for the requisite time period. |

| ■ | For purposes of determining the month when your Class C shares are eligible for conversion, the start of the holding period is the first day of the month in which your purchase was made. Your financial intermediary may choose a different day of the month to convert Class C shares. Please contact your financial intermediary for more information on calculating the holding period. |

| ■ | Any shares you received from reinvested distributions on these shares generally will convert to Class A shares at the same time. |

| ■ | You’ll receive the same dollar value of Class A shares as the Class C shares that were automatically converted. Class C shares that you received from an exchange of Class C shares of another Fund will convert based on the day you bought the original shares. |

| ■ | In addition to the above automatic conversion of Class C to Class A shares policy, the Transfer Agent seeks to convert Class C shares as soon as administratively feasible, regardless of how long such shares have been owned, to Class A shares of the same Fund for Direct-at-Fund Accounts (as defined below) that do not or no longer have a financial intermediary assigned to them. Direct-at-Fund Accounts that do not have a financial intermediary assigned to them are not permitted to purchase Class C shares; Class C share purchase orders received by Direct-at-Fund Accounts that do not have a financial intermediary assigned to the account will automatically be invested in Class A shares of the same Fund. |

| ■ | No sales charge or other charges apply in connection with these automatic conversions, and the conversions are free from U.S. federal income tax. |

| Prospectus 2023 | 35 |

| 36 | Prospectus 2023 |

| Prospectus 2023 | 37 |

| 38 | Prospectus 2023 |

| Repurchases (Reinstatements) | |

| Redeemed Share Class | Corresponding Repurchase Class |

| Class A | Class A |

| Class C | Class C |

| Distribution Fee |

Service Fee |

Combined Total | |

| Class A | None | 0.25% | 0.25% |

| Class Adv | None | None | None |

| Class C | 0.75% | 0.25% | 1.00% |

| Class Inst | None | None | None |

| Class Inst2 | None | None | None |

| Class Inst3 | None | None | None |

| Class R | 0.50% | None | 0.50% |

| Prospectus 2023 | 39 |

| 40 | Prospectus 2023 |

| Financial Intermediary Distribution Channel | Fee Rate |

| Retirement | up to 0.18% of Fund assets held by intermediaries or platforms charging an asset-based fee, or $18 per account held by intermediaries or platforms charging a per account fee |

| Fund supermarket transaction fee (TF) | up to 0.12% of Fund assets held by intermediaries or platforms charging an asset-based fee, or $16 per account held for intermediaries or platforms charging a per account fee |

| Fund supermarket no-transaction fee (NTF) | up to 0.18% of Fund assets held by intermediaries or platforms charging an asset-based fee, or $18 per account held by intermediaries or platforms charging a per account fee |

| Bank | up to 0.10% of Fund assets held by intermediaries or platforms charging an asset-based fee, or $20 per account held by intermediaries or platforms charging a per account fee |

| Broker-dealer | up to 0.13% of Fund assets held by intermediaries or platforms charging an asset-based fee, or $16 per account held by intermediaries or platforms charging a per account fee |

| Prospectus 2023 | 41 |

Number of outstanding shares of the class

| 42 | Prospectus 2023 |

| Prospectus 2023 | 43 |

| Minimum Account Balance | |

| Minimum Account Balance | |

| For all classes and account types except those listed below | $250 (None for accounts with Systematic Investment Plans) |

| Individual Retirement Accounts for all classes except those listed below | None |

| Class Adv, Class Inst2, Class Inst3 and Class R | None |

| 44 | Prospectus 2023 |

| Prospectus 2023 | 45 |

| ■ | negative impact on the Fund's performance; |

| ■ | potential dilution of the value of the Fund's shares; |

| ■ | interference with the efficient management of the Fund's portfolio, such as the need to maintain undesirably large cash positions, the need to use its line of credit or the need to buy or sell securities it otherwise would not have bought or sold; |

| ■ | losses on the sale of investments resulting from the need to sell securities at less favorable prices; |

| ■ | increased taxable gains to the Fund's remaining shareholders resulting from the need to sell securities to meet sell orders; and |

| ■ | increased brokerage and administrative costs. |

| 46 | Prospectus 2023 |

| Prospectus 2023 | 47 |

| 48 | Prospectus 2023 |

| Prospectus 2023 | 49 |

| 50 | Prospectus 2023 |

| Prospectus 2023 | 51 |

| Minimum Initial Investments | ||

| Minimum Initial Investment(a) |

Minimum Initial Investment for Accounts with Systematic Investment Plans | |

| For all classes and account types except those listed below | $2,000 | $100 |

| Individual Retirement Accounts for all classes except those listed below | $1,000 | $100 |

| Group retirement plans | None | N/A |

| Class Adv and Class Inst | $0, $1,000 or $2,000(b) | $100(b) |

| Class Inst2 and Class R | None | N/A |

| Class Inst3 | $0, $1,000, $2,000 or $1 million(c) | $100(c) |

| (a) | If your Class A, Class Adv, Class C, Class Inst, or Class Inst3 shares account balance falls below the minimum initial investment amount for any reason, including a market decline, you may be asked to increase it to the minimum initial investment amount or establish a monthly Systematic Investment Plan. If you do not do so, your account will be subject to a $20 annual low balance fee and/or shares may be automatically redeemed and the proceeds mailed to you if the account falls below the minimum account balance. See Buying, Selling and Exchanging Shares — Transaction Rules and Policies above. There is no minimum initial investment in Class A shares for accounts held in an omnibus account on a mutual fund only platform offered through your financial intermediary. |

| (b) | The minimum initial investment in Class Adv shares is $2,000 ($1,000 for IRAs; $100 for monthly Systematic Investment Plan accounts) for commissionable brokerage platforms where the financial intermediary, acting as broker on behalf of its customers, charges the customer a commission for effecting transactions in Fund shares, provided that the financial intermediary has an agreement with the Distributor that specifically authorizes offering Class Adv shares within such platform; for all other eligible Class Adv share investors (see Buying Shares – Eligible Investors – Class Adv Shares above), there is no minimum initial investment. The minimum initial investment amount for Class Inst shares is $0, $1,000 or $2,000 depending upon the category of eligible investor. See — Class Inst Shares Minimum Initial Investments below. The minimum initial investment amount for monthly Systematic Investment Plan accounts is the same as the amount set forth in the first two rows of the table, as applicable. |

| (c) | There is no minimum initial investment in Class Inst3 shares for: group retirement plans that maintain plan-level or omnibus accounts with the Fund; collective trust funds; affiliated or unaffiliated mutual funds (e.g., funds operating as funds-of-funds); and fee -based platforms of financial intermediaries (or the clearing intermediary that they trade through) that have an agreement with the Distributor or an affiliate thereof that specifically authorizes the financial intermediary to offer and/or service Class Inst3 shares within such platform and Fund shares are held in an omnibus account. The minimum initial investment in Class Inst3 shares is $2,000 ($1,000 for IRAs; $100 for monthly Systematic Investment Plan accounts) for commissionable brokerage platforms where the financial intermediary, acting as broker on behalf of its customer, charges the customer a commission for effecting transactions in Fund shares, provided that the financial intermediary has an agreement with the Distributor that specifically authorizes offering Class Inst3 shares within such platform and Fund shares are held in an omnibus account. The minimum initial investment in Class Inst3 shares is $1 million, unless waived in the discretion of the Distributor, for the following investors: institutional investors that are clients of the Columbia Threadneedle Global Institutional Distribution Team that invest in Class Inst3 shares for their own account through platforms approved by the Distributor or an affiliate thereof to offer and/or service Class Inst3 shares within such platform; and bank trust departments, subject to an agreement with the Distributor that specifically authorizes offering Class Inst3 shares and provided that Fund shares are held in an omnibus account. The Distributor may, in its discretion, waive the $1 million minimum initial investment required for these Class Inst3 investors. In each case above where noted that Fund shares are required to be held in an omnibus account, the Distributor, may, in its discretion, determine to waive this requirement. |

| ■ | Any health savings account sponsored by a third party platform. |

| ■ | Any investor participating in an account sponsored by a financial intermediary or other entity (that provides services to the account) that is paid a fee-based advisory fee by the investor and that is not compensated by the Fund for those services, other than payments for shareholder servicing or sub-accounting performed in place of the Transfer Agent. |

| 52 | Prospectus 2023 |

| ■ | Any commissionable brokerage account, if a financial intermediary has received a written approval from the Distributor to waive the minimum initial investment in Class Inst shares. |

| ■ | Any Trustee (or family member) of Columbia Acorn Trust. |

| ■ | Any employee (or family member) of the Investment Manager. |

| ■ | Individual retirement accounts (IRAs) on commissionable brokerage platforms where the financial intermediary, acting as broker on behalf of its customer, charges the customer a commission for effecting transactions in Fund shares, provided that the financial intermediary has an agreement with the Distributor that specifically authorizes offering Class Inst shares within such platform. |

| ■ | Any current employee of Columbia Management Investment Advisers LLC, the Distributor or the Transfer Agent and immediate family members of any of the foregoing who share the same address are eligible to invest in Class Inst shares through an individual retirement account (IRA). If you maintain your account with a financial intermediary, you must contact that financial intermediary each time you seek to purchase shares to notify them that you qualify for Class Inst shares. If Class Inst shares are not available at your financial intermediary, you may consider opening a Direct-at-Fund Account. It is your obligation to advise your financial intermediary or (in the case of Direct-at-Fund Accounts) the Transfer Agent that you qualify for Class Inst shares; be prepared to provide proof thereof. |

| ■ | Investors (except investors in individual retirement accounts (IRAs)) who purchase Fund shares through commissionable brokerage platforms where the financial intermediary holds the shares in an omnibus account and, acting as broker on behalf of its customer, charges the customer a commission for effecting transactions in Fund shares provided that the financial intermediary has an agreement with the Distributor that specifically authorizes offering Class Inst shares within such platform. |

| ■ | Any current employee of Columbia Management Investment Advisers LLC, the Distributor or the Transfer Agent and immediate family members of any of the foregoing who share the same address are eligible to invest in Class Inst shares (other than individual retirement accounts (IRAs), for which the minimum initial investment is $1,000). If you maintain your account with a financial intermediary, you must contact that financial intermediary each time you seek to purchase shares to notify them that you qualify for Class Inst shares. If Class Inst shares are not available at your financial intermediary, you may consider opening a Direct-at-Fund Account. It is your obligation to advise your financial intermediary or (in the case of Direct-at-Fund Accounts) the Transfer Agent that you qualify for Class Inst shares; be prepared to provide proof thereof. |

| ■ | Certain financial institutions and intermediaries, such as insurance companies, trust companies, banks, endowments, investment companies or foundations, buying shares for their own account, including Ameriprise Financial and its affiliates and/or subsidiaries. |

| ■ | Bank trust departments that assess their clients an asset-based fee. |

| ■ | Any trustee or director (or family member of a trustee or director) of a fund distributed by the Distributor (other than the Columbia Acorn Funds). |

| ■ | Certain other investors as set forth in more detail in the SAI. |

| Prospectus 2023 | 53 |

| ■ | Once the Transfer Agent or your financial intermediary receives your purchase order in “good form,” your purchase will be made at the Fund’s next calculated public offering price per share, which is the NAV per share plus any sales charge that applies (i.e., the trade date). |

| ■ | Once the Fund receives your purchase request in “good form,” you cannot cancel it after the market closes. |

| ■ | You generally buy Class A shares at the public offering price per share because purchases of these share classes are generally subject to a front-end sales charge. |

| ■ | You buy Class Adv, Class C, Class Inst, Class Inst2, Class Inst3 and Class R shares at NAV per share because no front-end sales charge applies to purchases of these share classes. |

| ■ | The Distributor and the Transfer Agent reserve the right to cancel your order request if the Fund does not receive payment within two business days of receiving your purchase order request. The Fund will return any payment received for orders that have been cancelled, but no interest will be paid on that money. |

| ■ | Financial intermediaries are responsible for sending your purchase orders to the Transfer Agent and ensuring that the Fund receives your money on time. |

| ■ | Shares purchased are recorded on the books of the Fund. The Fund does not issue certificates. |

| ■ | You generally may make a purchase only into a Fund that is accepting investments. |

| 54 | Prospectus 2023 |

| Prospectus 2023 | 55 |

| ■ | Once the Transfer Agent or your financial intermediary receives your redemption order in “good form,” your shares will be sold at the Fund’s next calculated NAV per share (i.e., the trade date). Any applicable CDSC will be deducted from the amount you're selling and the balance will be remitted to you. |

| ■ | Once the Fund receives your redemption request in “good form,” you cannot cancel it after the market closes. |

| ■ | The Distributor, in its sole discretion, reserves the right to liquidate Fund shares (of any class of the Fund) held in an omnibus account of a financial intermediary that clears Fund share transactions through a clearing intermediary or platform that charges certain maintenance fees to the Fund if the value of the omnibus account, at the Fund share class (i.e., CUSIP) level, falls below $100,000 (a CUSIP Liquidation Event). The Distributor will provide at least 90 days’ notice of a CUSIP Liquidation Event to financial intermediaries with impacted omnibus accounts. Shareholders invested in the Fund through such omnibus accounts can request through their financial intermediary a tax-free exchange to Class A shares or shareholders can consider holding their Fund shares in a Direct-at-Fund Account, provided requirements to transfer the account are fulfilled. You should discuss your options with your financial intermediary. |

| ■ | If you sell your shares that are held in a Direct-at-Fund Account, we will normally send the redemption proceeds by mail or electronically transfer them to your bank account the next business day after the trade date. Note that your bank may take up to three business days to post an electronic funds transfer from your account. |

| ■ | If you sell your shares through a financial intermediary, the Funds will normally send the redemption proceeds to your financial intermediary within two business days after the trade date. |

| ■ | No interest will be paid on uncashed redemption checks. |

| ■ | Other restrictions may apply to retirement accounts. For information about these restrictions, contact your retirement plan administrator. |

| ■ | For broker-dealer and wrap fee accounts: The Fund reserves the right to redeem your shares if your account falls below the Fund's minimum initial investment requirement. The Fund will notify your broker-dealer prior to redeeming shares, and will provide details on how to avoid such redemption. |

| ■ | Also keep in mind the Funds' Small Account Policy, which is described above in Buying, Selling and Exchanging Shares — Transaction Rules and Policies. |

| 56 | Prospectus 2023 |

| ■ | Exchanges are made at the NAV next calculated (plus any applicable sales charge) after your exchange order is received in “good form” (i.e., the trade date). |

| ■ | Once the Fund receives your exchange request in “good form,” you cannot cancel it after the market closes. |

| ■ | The rules for buying shares of a Fund generally apply to exchanges into that Fund, including, if your exchange creates a new Fund account, it must satisfy the minimum investment amount, unless a waiver applies. |

| ■ | Shares of the purchased Fund may not be used on the same day for another exchange or sale. |

| ■ | If you exchange shares from Class A shares of Columbia Government Money Market Fund to a non-money market Fund, any further exchanges must be between shares of the same class. For example, if you exchange from Class A shares of Columbia Government Money Market Fund into Class C shares of a non-money market Fund, you may not exchange from Class C shares of that non-money market Fund back to Class A shares of Columbia Government Money Market Fund or Class A shares of any other Fund. |

| ■ | A sales charge may apply when you exchange shares of a Fund that were not assessed a sales charge at the time you purchased such shares. If you invest through a Direct-at-Fund Account in Columbia Government Money Market Fund, Columbia Large Cap Enhanced Core Fund, Columbia Large Cap Index Fund, Columbia Mid Cap Index Fund, Columbia Small Cap Index Fund, Columbia Ultra Short Duration Municipal Bond Fund, Columbia Ultra Short Term Bond Fund, Columbia U.S. Treasury Index Fund or any other Columbia Fund that does not impose a front-end sales charge and then you exchange into a Fund that does assess a sales charge, your transaction is subject to a front-end sales charge if you exchange into Class A shares and to a CDSC if you exchange into Class C shares of the Columbia Funds. |

| ■ | If you purchased Class A shares of a Columbia Fund that imposes a front-end sales charge (and you paid any applicable sales charge) and you then exchange those shares into Columbia Government Money Market Fund, Columbia Large Cap Enhanced Core Fund, Columbia Large Cap Index Fund, Columbia Mid Cap Index Fund, Columbia Small Cap Index Fund, Columbia Ultra Short Duration Municipal Bond Fund, Columbia Ultra Short Term Bond Fund, Columbia U.S. Treasury Index Fund or any other Columbia Fund that does not impose a front-end sales charge, you may exchange that amount to Class A of another Fund in the future, including dividends earned on that amount, without paying a sales charge. |

| ■ | If your shares are subject to a CDSC, you will not be charged a CDSC upon the exchange of those shares. Any CDSC will be deducted when you sell the shares you received from the exchange. The CDSC imposed at that time will be based on the period that begins when you bought shares of the original Fund and ends when you sell the shares of the Fund you received from the exchange. Any applicable CDSC charged will be the CDSC of the original Fund. |

| ■ | You may make exchanges only into a Fund that is legally offered and sold in your state of residence. Contact the Transfer Agent or your financial intermediary for more information. |

| ■ | You generally may make an exchange only into a Fund that is accepting investments. |

| ■ | The Fund may change or cancel your right to make an exchange by giving the amount of notice required by regulatory authorities (generally 60 days for a material change or cancellation). |

| ■ | Unless your account is part of a tax-advantaged arrangement, an exchange for shares of another Fund is a taxable event, and you may recognize a gain or loss for tax purposes. |

| ■ | Changing your investment to a different Fund will be treated as a sale and purchase, and you will be subject to applicable taxes on the sale and sales charges on the purchase of the new Fund. |

| Prospectus 2023 | 57 |

| ■ | Class Inst shares of a Fund may be exchanged for Class A or Class Inst shares of another Fund. In certain circumstances, the front-end sales charge applicable to Class A shares may be waived on exchanges of Class Inst shares for Class A shares. See Buying, Selling and Exchanging Shares — Buying Shares — Eligible Investors — Class Inst Shares for details. |

| 58 | Prospectus 2023 |

| ■ | It can earn income on its investments. Examples of fund income are interest paid on money market instruments and bonds, and dividends paid on common stocks. |

| ■ | A mutual fund can also have capital gains if the value of its investments increases. While a fund continues to hold an investment, any gain is generally unrealized. If the fund sells an investment, it generally will realize a capital gain if it sells that investment for a higher price than its adjusted cost basis, and will generally realize a capital loss if it sells that investment for a lower price than its adjusted cost basis. Capital gains and losses are either short-term or long-term, depending on whether the fund holds the securities for one year or less (short-term) or more than one year (long-term). |

| Declaration and Distribution Schedule | |

| Declarations | Semiannually |

| Distributions | Semiannually |

| Prospectus 2023 | 59 |

| ■ | The Fund intends to qualify and to be eligible for treatment each year as a regulated investment company. A regulated investment company generally is not subject to tax at the fund level on income and gains from investments that are distributed to shareholders. However, the Fund's failure to qualify for treatment as a regulated investment company would result in Fund-level taxation, and consequently, a reduction in income available for distribution to you and in the NAV of your shares. Even if the Fund qualifies for treatment as a regulated investment company, the Fund may be subject to federal excise tax on certain undistributed income or gains. |

| ■ | Otherwise taxable distributions generally are taxable to you when paid, whether they are paid in cash or automatically reinvested in additional Fund shares. Dividends paid in January are deemed paid on December 31 of the prior year if the dividend was declared and payable to shareholders of record in October, November, or December of such prior year. |

| ■ | Distributions of the Fund's ordinary income and net short-term capital gain, if any, generally are taxable to you as ordinary income. Distributions of the Fund's net long-term capital gain, if any, generally are taxable to you as long-term capital gain. Whether capital gains are long-term or short-term is determined by how long the Fund has owned the investments that generated them, rather than how long you have owned your shares. Certain events may require the Fund to sell significant amounts of appreciated securities and make large dividends relative to the Fund’s NAV. Such events may include large net shareholder redemptions, portfolio rebalancing or fund mergers. The Fund generally provides estimates of expected capital gain dividends (if any) prior to the distribution on columbiathreadneedleus.com. |

| ■ | From time to time, a distribution from the Fund could constitute a return of capital. A return of capital is a return of an amount of your original investment and is not a distribution of income or capital gain from the Fund. Therefore, a return of capital is not taxable to you so long as the amount of the distribution does not exceed your tax basis in your Fund shares. A return of capital reduces your tax basis in your Fund shares, with any amounts exceeding such basis generally taxable as capital gain. |

| ■ | If you are an individual and you meet certain holding period and other requirements for your Fund shares, a portion of your distributions may be treated as “qualified dividend income” taxable at the lower net long-term capital gain rates instead of the higher ordinary income rates. Qualified dividend income is income attributable to the Fund's dividends received from certain U.S. and foreign corporations, as long as the Fund meets certain holding period and other requirements for the stock producing such dividends. |

| ■ | Certain high-income individuals (as well as estates and trusts) are subject to a 3.8% tax on net investment income. For individuals, the 3.8% tax applies to the lesser of (1) the amount (if any) by which the taxpayer's modified adjusted gross income exceeds certain threshold amounts or (2) the taxpayer's “net investment income.” |

| ■ | Certain derivative instruments when held in the Fund's portfolio subject the Fund to special tax rules, the effect of which may be to, among other things, accelerate income to the Fund, defer Fund losses, cause adjustments in the holding periods of Fund portfolio securities, or convert capital gains into ordinary income, short-term capital losses into long-term capital losses or long-term capital gains into short-term capital gains. These rules could therefore affect the amount, timing and/or character of distributions to shareholders. |

| ■ | Generally, a Fund realizes a capital gain or loss on an option when the option expires, or when it is exercised, sold or otherwise terminated. However, if an option is a “section 1256 contract,” which includes most traded options on a broad-based index, and the Fund holds such option at the end of its taxable year, the Fund is deemed to sell such option at fair market value at such time and recognize any gain or loss thereon, which is generally deemed to be 60% long-term and 40% short-term capital gain or loss, as described further in the SAI. |

| 60 | Prospectus 2023 |

| ■ | Income and proceeds received by the Fund from sources within foreign countries may be subject to foreign taxes. If at the end of the taxable year more than 50% of the value of the Fund's assets consists of securities of foreign corporations, and the Fund makes a special election, you will generally be required to include in your income for U.S. federal income tax purposes your share of the qualifying foreign income taxes paid by the Fund in respect of its foreign portfolio securities. You may be able to claim a foreign tax credit or deduction in respect of this amount, subject to certain limitations. There is no assurance that the Fund will make this election for a taxable year, even if it is eligible to do so. |

| ■ | A sale, redemption or exchange of Fund shares is a taxable event. This includes redemptions where you are paid in securities. Your sales, redemptions and exchanges of Fund shares (including those paid in securities) usually will result in a taxable capital gain or loss to you, equal to the difference between the amount you receive for your shares (or are deemed to have received in the case of exchanges) and your adjusted tax basis in the shares, which is generally the amount you paid (or are deemed to have paid in the case of exchanges) for them. Any such capital gain or loss generally will be long-term capital gain or loss if you have held your Fund shares for more than one year at the time of sale or exchange. In certain circumstances, capital losses may be converted from short-term to long-term; in other circumstances, capital losses may be disallowed under the “wash sale” rules. |

| ■ | For sales, redemptions and exchanges of shares that were acquired in a non-qualified account after 2011, the Fund generally is required to report to shareholders and the Internal Revenue Service (IRS) cost basis information with respect to those shares. The Fund uses average cost basis as its default method of calculating cost basis. For more information regarding average cost basis reporting, other available cost basis methods, and selecting or changing to a different cost basis method, please see the SAI, columbiathreadneedleus.com, or contact the Fund at 800.345.6611. If you hold Fund shares through a financial intermediary (e.g., a brokerage firm), you should contact your financial intermediary to learn about its cost basis reporting default method and the reporting elections available to your account. |

| ■ | The Fund is required by federal law to withhold tax on any taxable or tax-exempt distributions and redemption proceeds paid to you (including amounts paid to you in securities and amounts deemed to be paid to you upon an exchange of shares) if: you have not provided a correct TIN or have not certified to the Fund that withholding does not apply, the IRS has notified us that the TIN listed on your account is incorrect according to its records, or the IRS informs the Fund that you are otherwise subject to backup withholding. |

| Prospectus 2023 | 61 |

| Prospectus 2023 | 63 |

| Net asset value, beginning of period |

Net investment income (loss) |

Net realized and unrealized gain (loss) |

Total from investment operations |

Distributions from net investment income |

Total distributions to shareholders | |

| Class A | ||||||

| Year Ended 12/31/2022 | $33.33 | 0.06(c) | (12.78) | (12.72) | — | — |

| Year Ended 12/31/2021 | $27.49 | (0.14) | 6.04 | 5.90 | (0.06) | (0.06) |

| Year Ended 12/31/2020 | $22.52 | (0.12) | 5.22 | 5.10 | (0.13) | (0.13) |

| Year Ended 12/31/2019 | $15.56 | 0.06 | 7.09 | 7.15 | (0.19) | (0.19) |

| Year Ended 12/31/2018 | $19.27 | 0.11 | (3.70) | (3.59) | (0.12) | (0.12) |

| Advisor Class | ||||||

| Year Ended 12/31/2022 | $33.68 | 0.11(c) | (12.92) | (12.81) | — | — |

| Year Ended 12/31/2021 | $27.78 | (0.10) | 6.13 | 6.03 | (0.13) | (0.13) |

| Year Ended 12/31/2020 | $22.70 | (0.06) | 5.27 | 5.21 | (0.13) | (0.13) |

| Year Ended 12/31/2019 | $15.68 | 0.12 | 7.13 | 7.25 | (0.23) | (0.23) |

| Year Ended 12/31/2018 | $19.36 | 0.19 | (3.75) | (3.56) | (0.12) | (0.12) |

| Class C | ||||||

| Year Ended 12/31/2022 | $32.35 | (0.10) (c) | (12.40) | (12.50) | — | — |

| Year Ended 12/31/2021 | $26.83 | (0.36) | 5.88 | 5.52 | — | — |

| Year Ended 12/31/2020 | $22.15 | (0.27) | 5.08 | 4.81 | (0.13) | (0.13) |

| Year Ended 12/31/2019 | $15.33 | (0.06) | 6.93 | 6.87 | (0.05) | (0.05) |

| Year Ended 12/31/2018 | $19.12 | (0.02) | (3.65) | (3.67) | (0.12) | (0.12) |

| Institutional Class | ||||||

| Year Ended 12/31/2022 | $33.51 | 0.11(c) | (12.85) | (12.74) | — | — |

| Year Ended 12/31/2021 | $27.64 | (0.06) | 6.06 | 6.00 | (0.13) | (0.13) |

| Year Ended 12/31/2020 | $22.59 | (0.06) | 5.24 | 5.18 | (0.13) | (0.13) |

| Year Ended 12/31/2019 | $15.60 | 0.12 | 7.10 | 7.22 | (0.23) | (0.23) |

| Year Ended 12/31/2018 | $19.27 | 0.15 | (3.70) | (3.55) | (0.12) | (0.12) |

| Institutional 2 Class | ||||||

| Year Ended 12/31/2022 | $33.92 | 0.12(c) | (13.00) | (12.88) | — | — |

| Year Ended 12/31/2021 | $27.98 | (0.12) | 6.21 | 6.09 | (0.15) | (0.15) |

| Year Ended 12/31/2020 | $22.84 | (0.05) | 5.32 | 5.27 | (0.13) | (0.13) |

| Year Ended 12/31/2019 | $15.78 | 0.14 | 7.17 | 7.31 | (0.25) | (0.25) |

| Year Ended 12/31/2018 | $19.46 | 0.19 | (3.75) | (3.56) | (0.12) | (0.12) |

| 64 | Prospectus 2023 |

| Net asset value, end of period |

Total return(a) |

Total gross expense ratio to average net assets(b) |

Total net expense ratio to average net assets(b) |

Net investment income (loss) ratio to average net assets |

Portfolio turnover |

Net assets, end of period (000's) | |

| Class A | |||||||

| Year Ended 12/31/2022 | $20.61 | (38.16%) | 1.80% (d), (e) | 1.45% (d), (e), (f) | 0.25% | 31% | $28,892 |

| Year Ended 12/31/2021 | $33.33 | 21.47% | 1.63% (e) | 1.44% (e), (f) | (0.45%) | 21% | $66,374 |

| Year Ended 12/31/2020 | $27.49 | 22.80% | 1.86% (e) | 1.45% (e) | (0.54%) | 45% | $42,059 |

| Year Ended 12/31/2019 | $22.52 | 45.96% | 1.88% | 1.44% | 0.33% | 30% | $33,361 |

| Year Ended 12/31/2018 | $15.56 | (18.78%) | 1.81% (e) | 1.45% (e) | 0.57% | 39% | $22,870 |

| Advisor Class | |||||||

| Year Ended 12/31/2022 | $20.87 | (38.03%) | 1.55% (d), (e) | 1.20% (d), (e), (f) | 0.47% | 31% | $1,161 |

| Year Ended 12/31/2021 | $33.68 | 21.75% | 1.37% (e) | 1.19% (e), (f) | (0.32%) | 21% | $3,083 |

| Year Ended 12/31/2020 | $27.78 | 23.10% | 1.61% (e) | 1.20% (e) | (0.29%) | 45% | $1,781 |

| Year Ended 12/31/2019 | $22.70 | 46.30% | 1.63% | 1.19% | 0.60% | 30% | $1,906 |

| Year Ended 12/31/2018 | $15.68 | (18.53%) | 1.55% (e) | 1.19% (e) | 0.97% | 39% | $1,496 |

| Class C | |||||||

| Year Ended 12/31/2022 | $19.85 | (38.64%) | 2.54% (d), (e) | 2.20% (d), (e), (f) | (0.47%) | 31% | $2,372 |

| Year Ended 12/31/2021 | $32.35 | 20.57% | 2.39% (e) | 2.19% (e), (f) | (1.20%) | 21% | $7,078 |

| Year Ended 12/31/2020 | $26.83 | 21.87% | 2.61% (e) | 2.20% (e) | (1.27%) | 45% | $5,705 |

| Year Ended 12/31/2019 | $22.15 | 44.79% | 2.64% | 2.19% | (0.30%) | 30% | $6,186 |

| Year Ended 12/31/2018 | $15.33 | (19.34%) | 2.56% (e) | 2.20% (e) | (0.12%) | 39% | $8,770 |

| Institutional Class | |||||||

| Year Ended 12/31/2022 | $20.77 | (38.02%) | 1.54% (d), (e) | 1.20% (d), (e), (f) | 0.46% | 31% | $38,307 |

| Year Ended 12/31/2021 | $33.51 | 21.76% | 1.38% (e) | 1.19% (e), (f) | (0.21%) | 21% | $111,462 |

| Year Ended 12/31/2020 | $27.64 | 23.08% | 1.61% (e) | 1.20% (e) | (0.29%) | 45% | $55,171 |

| Year Ended 12/31/2019 | $22.59 | 46.35% | 1.63% | 1.19% | 0.64% | 30% | $49,616 |

| Year Ended 12/31/2018 | $15.60 | (18.57%) | 1.56% (e) | 1.20% (e) | 0.80% | 39% | $32,813 |

| Institutional 2 Class | |||||||

| Year Ended 12/31/2022 | $21.04 | (37.97%) | 1.40% (d), (e) | 1.14% (d), (e) | 0.48% | 31% | $2,863 |

| Year Ended 12/31/2021 | $33.92 | 21.80% | 1.32% (e) | 1.14% (e) | (0.38%) | 21% | $25,882 |

| Year Ended 12/31/2020 | $27.98 | 23.23% | 1.58% (e) | 1.14% (e) | (0.24%) | 45% | $3,855 |

| Year Ended 12/31/2019 | $22.84 | 46.33% | 1.60% | 1.13% | 0.73% | 30% | $2,175 |

| Year Ended 12/31/2018 | $15.78 | (18.44%) | 1.50% (e) | 1.13% (e) | 0.96% | 39% | $2,554 |

| Prospectus 2023 | 65 |

| Net asset value, beginning of period |

Net investment income (loss) |

Net realized and unrealized gain (loss) |

Total from investment operations |

Distributions from net investment income |

Total distributions to shareholders | |

| Institutional 3 Class | ||||||

| Year Ended 12/31/2022 | $33.38 | 0.13(c) | (12.80) | (12.67) | — | — |

| Year Ended 12/31/2021 | $27.54 | (0.05) | 6.05 | 6.00 | (0.16) | (0.16) |

| Year Ended 12/31/2020 | $22.48 | (0.02) | 5.21 | 5.19 | (0.13) | (0.13) |

| Year Ended 12/31/2019 | $15.53 | 0.14 | 7.06 | 7.20 | (0.25) | (0.25) |

| Year Ended 12/31/2018 | $19.17 | (0.04) | (3.48) | (3.52) | (0.12) | (0.12) |

| Notes to Financial Highlights | |

| (a) | Had the Investment Manager and/or Transfer Agent not waived fees and/or reimbursed a portion of expenses, total return would have been reduced. |

| (b) | In addition to the fees and expenses that the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of any other funds in which it invests, if any. Such indirect expenses are not included in the Fund's reported expense ratios. |

| (c) | Net investment income per share includes special dividends. The effect of these dividends amounted to $0.01 per share. |

| (d) | Ratios include Trustees’ fees deferred during the current period as well as any gains or losses on the Trustees’ deferred compensation balances as a result of market fluctuations. If these had been excluded, expenses would have been higher by 0.01%. |

| (e) | Ratios include line of credit interest expense which is less than 0.01%. |

| (f) | The benefits derived from expense reductions had an impact of less than 0.01%. |

| 66 | Prospectus 2023 |

| Net asset value, end of period |

Total return(a) |

Total gross expense ratio to average net assets(b) |

Total net expense ratio to average net assets(b) |

Net investment income (loss) ratio to average net assets |

Portfolio turnover |

Net assets, end of period (000's) | |

| Institutional 3 Class | |||||||

| Year Ended 12/31/2022 | $20.71 | (37.96%) | 1.47% (d), (e) | 1.11% (d), (e) | 0.56% | 31% | $41 |

| Year Ended 12/31/2021 | $33.38 | 21.83% | 1.32% (e) | 1.10% (e) | (0.15%) | 21% | $60 |

| Year Ended 12/31/2020 | $27.54 | 23.24% | 1.52% (e) | 1.10% (e) | (0.08%) | 45% | $69 |

| Year Ended 12/31/2019 | $22.48 | 46.42% | 1.54% | 1.09% | 0.74% | 30% | $19 |

| Year Ended 12/31/2018 | $15.53 | (18.51%) | 1.41% (e) | 1.08% (e) | (0.21%) | 39% | $3 |

| Prospectus 2023 | 67 |

| ■ | Employer-sponsored retirement plans (e.g., 401(k) plans, 457 plans, employer-sponsored 403(b) plans, profit sharing and money purchase pension plans and defined benefit plans). For purposes of this provision, employer-sponsored retirement plans do not include SEP IRAs, Simple IRAs or SAR-SEPs. |

| ■ | Shares purchased through reinvestment of capital gains distributions and dividend reinvestment when purchasing shares of the same fund (but not any other fund within the Columbia Fund family). |

| ■ | Shares exchanged from Class C shares of the same fund in the month of or following the 7-year anniversary of the purchase date. To the extent that the Fund’s Class C Shares – Conversion to Class A Shares policy (stated outside this Appendix A) provides for a waiver with respect to exchanges of Class C shares or the conversion of Class C shares following a shorter holding period, that waiver will apply. |

| ■ | Employees and registered representatives of Ameriprise Financial Services or its affiliates and their immediate family members. |

| ■ | Shares purchased by or through qualified accounts (including IRAs, Coverdell Education Savings Accounts, 401(k)s, 403(b) TSCAs subject to ERISA and defined benefit plans) that are held by a covered family member, defined as an Ameriprise financial advisor and/or the advisor’s spouse, advisor’s lineal ascendant (mother, father, grandmother, grandfather, great grandmother, great grandfather), advisor’s lineal descendant (son, step-son, daughter, step-daughter, grandson, granddaughter, great grandson, great granddaughter) or any spouse of a covered family member who is a lineal descendant. |

| ■ | Shares purchased from the proceeds of redemptions from another fund in the Columbia Fund family, provided (1) the repurchase occurs within 90 days following the redemption, (2) the redemption and purchase occur in the same account, and (3) redeemed shares were subject to a front-end or deferred sales load (i.e. Rights of Reinstatement). |

| A-1 | Prospectus 2023 |

| ■ | Shares purchased through reinvestment of capital gains distributions and dividend reinvestment when purchasing shares of the same Columbia Fund. |

| ■ | Share purchases by employees and registered representatives of Baird or its affiliates and their family members as designated by Baird. |

| ■ | Shares purchased with the proceeds of redemptions from another Columbia Fund, provided (1) the repurchase occurs within 90 days following the redemption, (2) the redemption and purchase occur in the same accounts, and (3) redeemed shares were subject to a front-end or deferred sales charge (known as rights of reinstatement). |

| ■ | A shareholder in the Fund’s Class C shares will have their shares converted at net asset value to Class A shares of the same Columbia Fund if the shares are no longer subject to CDSC and the conversion is in line with the policies and procedures of Baird. |

| ■ | Employer-sponsored retirement plans or charitable accounts in a transactional brokerage account at Baird, including 401(k) plans, 457 plans, employer-sponsored 403(b) plans, profit sharing and money purchase pension plans and defined benefit plans. For purposes of this provision, employer-sponsored retirement plans do not include SEP IRAs, Simple IRAs or SAR-SEPs. |

| ■ | Shares sold due to death or disability of the shareholder. |

| ■ | Shares sold as part of a systematic withdrawal plan as described in this prospectus. |

| ■ | Shares purchased due to returns of excess contributions from an IRA account. |

| ■ | Shares sold as part of a required minimum distribution for IRA and retirement accounts due to the shareholder reaching the qualified age based on applicable IRS regulations. |

| ■ | Shares sold to pay Baird fees but only if the transaction is initiated by Baird. |

| ■ | Shares acquired through a right of reinstatement. |

| ■ | Breakpoints as described in this prospectus. |

| ■ | Rights of accumulations which entitle shareholders to breakpoint discounts will be automatically calculated based on the aggregated holding of Columbia Fund assets held by accounts within the purchaser’s household at Baird. Eligible Columbia Fund assets not held at Baird may be included in the rights of accumulations calculation only if the shareholder notifies his or her financial advisor about such assets. |

| ■ | Letters of Intent (LOI) allow for breakpoint discounts based on anticipated purchases of Columbia Funds through Baird, over a 13-month period of time. |

| Prospectus 2023 | A-2 |

| ■ | Breakpoint pricing, otherwise known as volume pricing, at dollar thresholds as described in this prospectus. |

| ■ | The applicable sales charge on a purchase of Class A shares is determined by taking into account all share classes (except certain money market funds and any assets held in group retirement plans) of Columbia Funds and Future Scholars Program held by the shareholder or in an account grouped by Edward Jones with other accounts for the purpose of providing certain pricing considerations ("pricing groups"). If grouping assets as a shareholder, this includes all share classes held on the Edward Jones platform and/or held on another platform. The inclusion of eligible Columbia Fund assets in the ROA calculation is dependent on the shareholder notifying Edward Jones of such assets at the time of calculation. Money market funds are included only if such shares were sold with a sales charge at the time of purchase or acquired in exchange for shares purchased with a sales charge. |

| ■ | The employer maintaining a SEP IRA plan and/or SIMPLE IRA plan may elect to establish or change ROA for the IRA accounts associated with the plan to a plan-level grouping as opposed to including all share classes at a shareholder or pricing group level. |

| ■ | ROA is determined by calculating the higher of cost minus redemptions or market value (current shares x NAV). |