Summary

Prospectus

May 1, 2022

Columbia Acorn Family of Funds

Managed by Columbia Wanger Asset Management, LLC

Columbia

Acorn International®

Before you invest, you may want to review the Fund’s

Prospectus, which contains more information about the Fund and its risks. You can find the Fund’s Prospectus, reports to shareholders, Statement of Additional Information and other information about the Fund online at

https://www.columbiathreadneedleus.com/resources/literature. If you hold your Fund shares through a financial intermediary (such as a broker-dealer or bank), you can get this information at no cost by contacting that financial intermediary. If you

hold your Fund shares directly with the Fund, you can get this information at no cost by calling 800.345.6611 or by sending an email to serviceinquiries@columbiathreadneedle.com. This Summary Prospectus incorporates by reference the Fund’s

Prospectus and Statement of Additional Information, both dated May 1, 2022.

As with all mutual funds, the Securities and

Exchange Commission has not approved or disapproved these securities or passed upon the adequacy of this prospectus. Any representation to the contrary is a criminal offense.

Investment Objective

Columbia Acorn International® (the Fund) seeks long-term capital appreciation.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if

you buy, hold and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below. You may

qualify for sales charge discounts if you and members of your immediate family invest, or agree to invest in the future, at least $50,000 in certain classes of shares of eligible funds distributed by Columbia Management Investment Distributors, Inc.

(the Distributor). More information is available about these and other sales charge discounts and waivers from your financial intermediary, and can be found in the Choosing a Share Class section beginning on

page 28 of the Fund’s prospectus, in Appendix A to the prospectus beginning on page A-1 and in Appendix S to the Statement of Additional Information (SAI) under Sales

Charge Waivers beginning on page S-1.

| Shareholder Fees (fees paid directly from your investment) | |||

| Class A | Class C | Classes

Adv, Inst, Inst2, Inst3 and R | |

| Maximum sales charge (load) imposed on purchases (as a % of offering price) | 5.75% | None | None |

| Maximum deferred sales charge (load) imposed on redemptions (as a % of the lower of the original purchase price or current net asset value) | 1.00% (a) | 1.00% (b) | None |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |||||||

| Class A | Class Adv | Class C | Class Inst | Class Inst2 | Class Inst3 | Class R | |

| Management fees | 0.79% | 0.79% | 0.79% | 0.79% | 0.79% | 0.79% | 0.79% |

| Distribution and/or service (12b-1) fees | 0.25% | 0.00% | 1.00% | 0.00% | 0.00% | 0.00% | 0.50% |

| Other expenses | 0.20% | 0.20% | 0.20% | 0.20% | 0.16% | 0.10% | 0.20% |

| Total annual Fund operating expenses(c) | 1.24% | 0.99% | 1.99% | 0.99% | 0.95% | 0.89% | 1.49% |

| Less: Fee waivers and/or expense reimbursements(d) | (0.01%) | (0.01%) | (0.01%) | (0.01%) | (0.03%) | (0.01%) | (0.01%) |

| Total annual Fund operating expenses after fee waivers and/or expense reimbursements | 1.23% | 0.98% | 1.98% | 0.98% | 0.92% | 0.88% | 1.48% |

| (a) | This charge is imposed on certain investments of between $1 million and $50 million redeemed within 18 months after purchase, as follows: 1.00% if redeemed within 12 months after purchase, and 0.50% if redeemed more than 12, but less than 18, months after purchase, with certain limited exceptions. |

| (b) | This charge applies to redemptions within 12 months after purchase, with certain limited exceptions. |

| (c) | “Total annual Fund operating expenses” include acquired fund fees and expenses (expenses the Fund incurs indirectly through its investments in other investment companies) and may be higher than the ratio of expenses to average net assets shown in the Financial Highlights section of this prospectus because the ratio of expenses to average net assets does not include acquired fund fees and expenses. |

| (d) | Columbia Wanger Asset Management, LLC (the Investment Manager) has contractually agreed to waive fees and reimburse certain expenses of the Fund, through April 30, 2023, so that ordinary operating expenses (excluding transaction costs and certain other investment-related expenses, interest and fees on borrowings and expenses associated with the Fund's investment in other investment companies, if any) do not exceed the annual rates of 1.23% for Class A shares, 0.98% for Class Adv shares, 1.98% for Class C shares, 0.98% for Class Inst shares, 0.92% for Class Inst2 shares, 0.88% for Class Inst3 shares and 1.48% for Class R shares. This arrangement may only be amended or terminated with approval from the Fund's Board of Trustees and the Investment Manager. The fee waivers and/or expense reimbursements shown in the table also reflect the contractual agreement of the Fund's transfer agent, Columbia Management Investment Services Corp. (the Transfer Agent), to waive a portion of its fees through April 30, 2023, such that the Fund's transfer agency fees do not exceed the annual rates of 0.04% of the average daily net assets of Class Inst2 shares and 0.00% of the average daily net assets of Class Inst3 shares. This arrangement may be terminated at the sole discretion of the Fund's Board of Trustees. |

Example

The following example is

intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example illustrates the hypothetical expenses that you would incur over the time periods indicated, and assumes that:

| ■ | you invest $10,000 in the applicable class of Fund shares for the periods indicated, |

| ■ | your investment has a 5% return each year, and |

| ■ | the Fund’s total annual operating expenses remain the same as shown in the Annual Fund Operating Expenses table above. |

| 1 | Columbia Acorn International® |

Since the waivers and/or reimbursements

shown in the Annual Fund Operating Expenses table above expire as indicated in the preceding table, they are only reflected in the 1 year example and the first year of the other examples. Although your actual

costs may be higher or lower, based on the assumptions listed above, your costs would be:

| 1 year | 3 years | 5 years | 10 years | |

| Class A (whether or not shares are redeemed) | $693 | $945 | $1,216 | $1,988 |

| Class Adv (whether or not shares are redeemed) | $100 | $314 | $ 546 | $1,212 |

| Class C (assuming redemption of all shares at the end of the period) | $301 | $623 | $1,072 | $2,122 |

| Class C (assuming no redemption of shares) | $201 | $623 | $1,072 | $2,122 |

| Class Inst (whether or not shares are redeemed) | $100 | $314 | $ 546 | $1,212 |

| Class Inst2 (whether or not shares are redeemed) | $ 94 | $300 | $ 523 | $1,164 |

| Class Inst3 (whether or not shares are redeemed) | $ 90 | $283 | $ 492 | $1,095 |

| Class R (whether or not shares are redeemed) | $151 | $470 | $ 812 | $1,779 |

Portfolio Turnover

The Fund may pay transaction costs, such as commissions, when

it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which

are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 27% of the average value of its portfolio.

Principal Investment Strategies

Under normal circumstances, the Fund invests at least 75% of

its net assets in foreign companies in developed markets (for example, Japan, Canada and the United Kingdom) and in emerging markets (for example, China, India and Brazil).

Under normal circumstances, the Fund invests a majority of its

net assets in the common stock of small- and mid-sized companies with market capitalizations generally in the range of market capitalizations in the MSCI ACWI ex USA SMID Cap Growth Index (Net), the Fund's primary benchmark, (the Index) at the time

of purchase (between $55.8 million and $29.7 billion as of March 31, 2022). The market capitalization range and composition of companies in the Index are subject to change. As such, the size of the companies in which the Fund invests may change. The

Fund determines a company’s market capitalization at the time of investment. As long as a majority of its net assets are invested in companies within the Index, the Fund may continue to hold and make new investments in a security even if

the company’s market capitalization grows beyond the market capitalization of the largest company within the Index or falls below the market capitalization of the smallest company within the Index. The Investment Manager from time to time

emphasizes one or more sectors in selecting the Fund’s investments, including the industrials and information technology sectors.

Columbia Wanger Asset Management, LLC, the Fund's investment

adviser (the Investment Manager), believes that stocks of small- and mid-sized companies, which generally are not as well known by financial analysts as larger companies, may offer higher return potential than stocks of larger companies. The Fund

also may invest in larger-sized companies.

The

Investment Manager typically seeks companies with:

| ■ | A strong business franchise that offers growth potential. |

| ■ | Products and services in which the company has a competitive advantage. |

| ■ | A stock price the Investment Manager believes is reasonable relative to the assets and earning power of the company. |

The Investment Manager may sell a portfolio holding if the

security reaches the Investment Manager's price target, if the company has a deterioration of fundamentals, such as failing to meet key operating benchmarks, or if the Investment Manager believes other securities are more attractive. The Investment

Manager also may sell a portfolio holding to fund redemptions.

Principal Risks

An investment in the Fund involves risks, including those

described below, among others. There is no assurance that the Fund will achieve its investment objective and you may lose money. The value of the Fund’s holdings may decline, and the Fund’s net

asset value (NAV) and share price may go down. An investment in the Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

| Columbia Acorn International® | 2 |

Active Management Risk. The

Investment Manager’s active management of the Fund could cause the Fund to underperform its benchmark index and/or other funds with similar investment objectives and/or strategies.

Market Risk. The Fund may

incur losses due to declines in the value of one or more securities in which it invests. These declines may be due to factors affecting a particular issuer, or the result of, among other things, political, regulatory, market, economic or social

developments affecting the relevant market(s) more generally. In addition, turbulence in financial markets and reduced liquidity in equity, credit and/or fixed income markets may negatively affect many issuers, which could adversely affect the

Fund’s ability to price or value hard-to-value assets in thinly traded and closed markets and could cause significant redemptions and operational challenges. Global economies and financial markets are increasingly interconnected, and

conditions and events in one country, region or financial market may adversely impact issuers in a different country, region or financial market. These risks may be magnified if certain events or developments adversely interrupt the global supply

chain; in these and other circumstances, such risks might affect companies worldwide. As a result, local, regional or global events such as terrorism, war, other conflicts, natural disasters, disease/virus outbreaks and epidemics or other public

health issues, recessions, depressions or other events – or the potential for such events – could have a significant negative impact on global economic and market conditions.

The large-scale invasion of Ukraine by Russia in February 2022

has resulted in sanctions and market disruptions including declines in regional and global stock and commodity markets and significant devaluations of Russian currency. The extent and duration of the military action are impossible to predict but

could be significant. Market disruption caused by the Russian military action, and any counter measures or responses thereto (including international sanctions, a downgrade in the country’s credit rating, purchasing and financing restrictions,

boycotts, tariffs, changes in consumer or purchaser preferences, cyberattacks and espionage) could have severe adverse impacts on regional and/or global securities and commodities markets, including markets for oil and natural gas. These impacts may

include reduced market liquidity, distress in credit markets, further disruption of global supply chains, increased risk of inflation, and limited access to investments in certain international markets and/or issuers. These developments and other

related events could negatively impact Fund performance.

The pandemic caused by coronavirus disease 2019 and its

variants (COVID-19) has resulted in, and may continue to result in, significant global economic and societal disruption and market volatility due to disruptions in market access, resource availability, facilities operations, imposition of tariffs,

export controls and supply chain disruption, among others. Such disruptions may be caused, or exacerbated by, quarantines and travel restrictions, workforce displacement and loss in human and other resources. The uncertainty surrounding the

magnitude, duration, reach, costs and effects of the global pandemic, as well as actions that have been or could be taken by governmental authorities or other third parties, present unknowns that are yet to unfold. The impacts, as well as the

uncertainty over impacts to come, of COVID-19 – and any other infectious illness outbreaks, epidemics and pandemics that may arise in the future – could negatively affect global economies and markets in ways that cannot necessarily be

foreseen. In addition, the impact of infectious illness outbreaks and epidemics in less developed countries may be greater due to generally less established healthcare systems, governments and financial markets. Public health crises caused by the

COVID-19 outbreak may exacerbate other pre-existing political, social and economic risks in certain countries or globally. The disruptions caused by COVID-19 could prevent the Fund from executing advantageous investment decisions in a timely manner

and negatively impact the Fund’s ability to achieve its investment objective. Any such events could have a significant adverse impact on the value and risk profile of the Fund.

Small- and Mid-Cap Company Securities Risk. Investments in small- and mid-cap companies often involve greater risks than investments in larger, more established companies because small- and mid-cap companies tend to have less predictable earnings and may lack the

management experience, financial resources, product diversification and competitive strengths of larger companies. Securities of small- and mid-cap companies may be less liquid and more volatile than the securities of larger companies.

Foreign Securities Risk.

Investments in or exposure to securities of foreign companies may involve heightened risks relative to investments in or exposure to securities of U.S. companies. Investing in securities of foreign companies subjects the Fund to the risks associated

with an issuer’s (and any of its related companies’) country of organization and places of business operations, including risks related to political, regulatory, economic, social, diplomatic and other conditions or events (including, for

example, military confrontations and actions, war, other conflicts, terrorism and disease/virus outbreaks and epidemics) occurring in the country or region, as well as risks associated with less developed custody and settlement practices. Foreign

securities may be more volatile and less liquid than securities of U.S. companies, and are subject to the risks associated with potential imposition of economic and other sanctions against a particular foreign country, its nationals or industries or

businesses within the country. In addition, foreign governments may impose withholding or other taxes on the Fund’s income, capital gains or proceeds from the disposition of foreign securities, which could reduce the Fund’s return on

such securities.

| 3 | Columbia Acorn International® |

Operational and Settlement Risks of Foreign Securities. The Fund’s foreign securities are generally held outside the United States in the primary market for the securities in the custody of foreign sub-custodians. Some countries have limited governmental oversight and

regulation, which increases the risk of corruption and fraud and the possibility of losses to the Fund. In particular, under certain circumstances, foreign securities may settle on a delayed delivery basis, meaning that the Fund may be required to

make payment for securities before the Fund has actually received delivery of the securities or deliver securities prior to the receipt of payment. As a result, there is a risk that the security will not be delivered to the Fund or that payment will

not be received. Losses can also result from lost, stolen or counterfeit securities; defaults by brokers and banks; failures or defects of the settlement system; or poor and improper record keeping by registrars and issuers.

Share Blocking. In certain

non-U.S. markets, an issuer’s securities are blocked from trading for a specified number of days before and, in certain instances, after a shareholder meeting. The blocking period can last up to several weeks. Share blocking may prevent the

Fund from buying or selling securities during this period. As a consequence of these restrictions, the Investment Manager, on behalf of the Fund, may abstain from voting proxies in markets that require share blocking.

Emerging Market Securities Risk. Securities issued by foreign governments or companies in emerging market countries, such as China, Russia and certain countries in Eastern Europe, the Middle East, Asia, Latin America or Africa, are more

likely to have greater exposure to the risks of investing in foreign securities that are described in Foreign Securities Risk. In addition, emerging market countries are more likely to experience instability resulting, for example, from rapid

changes or developments in social, political, economic or other conditions. Their economies are usually less mature and their securities markets are typically less developed with more limited trading activity (i.e., lower trading volumes and less

liquidity) than more developed countries. Emerging market securities tend to be more volatile, and may be more susceptible to market manipulation, than securities in more developed markets. Many emerging market countries are heavily dependent on

international trade and have fewer trading partners, which makes them more sensitive to world commodity prices and economic downturns in other countries, and some have a higher risk of currency devaluations. Due to the differences in the nature and

quality of financial information of issuers of emerging market securities, including auditing and financial reporting standards, financial information and disclosures about such issuers may be unavailable or, if made available, may be considerably

less reliable than publicly available information about other foreign securities.

Operational and Settlement Risks of Securities in Emerging

Markets. Foreign sub-custodians in emerging markets may be recently organized, lack extensive operating experience or lack effective government oversight or regulation. In addition, there may be legal restrictions or

limitations on the ability of the Fund to recover assets held in custody by a foreign sub-custodian in the event of the bankruptcy of the sub-custodian. There may also be a greater risk that settlement may be delayed and that cash or securities of

the Fund may be lost because of failures of or defects in the system, including fraud or corruption. Settlement systems in emerging markets also have a higher risk of failed trades.

Risks Related to Currencies and Corporate Actions in Emerging

Markets. Risks related to currencies and corporate actions are also greater in emerging market countries than in developed countries. Emerging market currencies may not have an active trading market and are subject

to a higher risk of currency devaluations.

Risks

Related to Corporate and Securities Laws in Emerging Markets. Securities laws in emerging markets may be relatively new and unsettled and, consequently, there is a risk of rapid and unpredictable change in laws

regarding foreign investment, securities regulation, title to securities and shareholder rights.

Liquidity and Trading Volume Risk. Due to market conditions, including uncertainty regarding the price of a security, it may be difficult for the Fund to buy or sell portfolio securities at a desirable time or price, which could result in investment

losses. This risk of portfolio illiquidity is heightened with respect to small- and mid-cap securities, generally, and foreign small- and mid-cap securities in particular. The Fund may have to lower the selling price, liquidate other investments, or

forego another, more appealing investment opportunity as a result of illiquidity in the markets. The Fund may also be limited in its ability to execute favorable trades in portfolio securities in response to changes in share prices and fundamentals,

and may be forced to dispose of securities under disadvantageous circumstances and at a loss. As the Fund grows in size or, conversely, if it faces significant redemption pressure, these considerations take on increasing significance and may

adversely impact performance.

Geographic Focus

Risk. The Fund may be particularly susceptible to risks related to economic, political, regulatory or other events or conditions affecting issuers and countries within the specific geographic regions in which the

Fund invests. The Fund’s NAV may be more volatile than the NAV of a more geographically diversified fund.

| ■ | Asia Pacific Region. Many of the countries in the Asia Pacific region are considered underdeveloped or developing, including from a political, economic and/or social perspective, and may have relatively unstable governments and economies based on limited business, industries and/or natural resources or commodities. Events in any one |

| Columbia Acorn International® | 4 |

| country within the region may impact other countries in the region or the region as a whole. As a result, events in the region will generally have a greater effect on the Fund than if the Fund were more geographically diversified. This could result in increased volatility in the value of the Fund’s investments and losses for the Fund. Also, securities of some companies in the region can be less liquid than U.S. or other foreign securities, potentially making it difficult for the Fund to sell such securities at a desirable time and price. |

| ■ | Europe. The Fund is particularly susceptible to risks related to economic, political, regulatory or other events or conditions, including acts of war or other conflicts in the region, affecting issuers and countries in Europe. Countries in Europe are often closely connected and interdependent, and events in one European country can have an adverse impact on, and potentially spread to, other European countries. In addition, significant private and public sectors’ debt problems of a single European Union (EU) country can pose economic risks to the EU as a whole. As a result, the Fund’s NAV may be more volatile than the NAV of a more geographically diversified fund. If securities of issuers in Europe fall out of favor, it may cause the Fund to underperform other funds that do not focus their investments in this region of the world. The departure of the United Kingdom (UK) from the EU single market became effective January 1, 2021 with the end of the Brexit transition period and the post-Brexit trade deal between the UK and EU taking effect on December 31, 2020. The impact of any partial or complete dissolution of the EU on the UK and European economies and the broader global economy could be significant, resulting in negative impacts on currency and financial markets generally, such as increased volatility and illiquidity, and potentially lower economic growth in markets in Europe, which may adversely affect the value of your investment in the Fund. |

| ■ | Japan. The Fund is particularly susceptible to the social, political, economic, regulatory and other conditions or events that may affect Japan’s economy. The Japanese economy is heavily dependent upon international trade, including, among other things, the export of finished goods and the import of oil and other commodities and raw materials. Because of its trade dependence, the Japanese economy is particularly exposed to the risks of currency fluctuation, foreign trade policy and regional and global economic disruption, including the risk of increased tariffs, embargoes, and other trade limitations or factors. Strained relationships between Japan and its neighboring countries, including China, South Korea and North Korea, based on historical grievances, territorial disputes, and defense concerns, may also cause uncertainty in Japanese markets. As a result, additional tariffs, other trade barriers, or boycotts may have an adverse impact on the Japanese economy. Japanese government policy has been characterized by economic regulation, intervention, protectionism and large government deficits. The Japanese economy is also challenged by an unstable financial services sector, highly leveraged corporate balance sheets and extensive cross-ownership among major corporations. Structural social and labor market changes, including an aging workforce, population decline and traditional aversion to labor mobility may adversely affect Japan’s economic competitiveness and growth potential. The potential for natural disasters, such as earthquakes, volcanic eruptions, typhoons and tsunamis, could also have significant negative effects on Japan’s economy. As a result of the Fund’s investment in Japanese securities, the Fund’s NAV may be more volatile than the NAV of a more geographically diversified fund. If securities of issuers in Japan fall out of favor, it may cause the Fund to underperform other funds that do not focus their investments in Japan. |

Sector Risk. At times, the

Fund may have a significant portion of its assets invested in securities of companies conducting business within one or more economic sectors, including the industrials and information technology sectors. Companies in the same sector may be

similarly affected by economic, regulatory, political or market events or conditions, which may make the Fund more vulnerable to unfavorable developments in that sector than funds that invest more broadly. Generally, the more broadly the Fund

invests, the more it spreads risk and potentially reduces the risks of loss and volatility.

| ■ | Industrials Sector. The Fund is more susceptible to the particular risks that may affect companies in the industrials sector than if it were invested in a wider variety of companies in unrelated sectors. Companies in the industrials sector are subject to certain risks, including changes in supply and demand for their specific product or service and for industrial sector products in general, including decline in demand for such products due to rapid technological developments and frequent new product introduction. Performance of such companies may be affected by factors including government regulation, world events, economic conditions and risks for environmental damage and product liability claims. |

| ■ | Information Technology Sector. The Fund is more susceptible to the particular risks that may affect companies in the information technology sector than if it were invested in a wider variety of companies in unrelated sectors. Companies in the information technology sector are subject to certain risks, including the risk that new services, equipment or technologies will not be accepted by consumers and businesses or will become rapidly obsolete. Performance of such companies may be affected by factors including obtaining and protecting patents (or the failure to do so) and significant competitive pressures, including aggressive pricing of their products or services, new market entrants, competition for market share and short product cycles due to an accelerated rate of |

| 5 | Columbia Acorn International® |

| technological developments. Such competitive pressures may lead to limited earnings and/or falling profit margins. As a result, the value of their securities may fall or fail to rise. In addition, many information technology sector companies have limited operating histories and prices of these companies’ securities historically have been more volatile than other securities, especially over the short term. Some companies in the information technology sector are facing increased government and regulatory scrutiny and may be subject to adverse government or regulatory action, which could negatively impact the value of their securities. |

Foreign Currency Risk. The

performance of the Fund may be materially affected positively or negatively by foreign currency strength or weakness relative to the U.S. dollar, particularly if the Fund invests a significant percentage of its assets in foreign securities or other

assets denominated in currencies other than the U.S. dollar.

Issuer Risk. An issuer in

which the Fund invests may perform poorly, and the value of its securities may therefore decline, which may negatively affect the Fund’s performance. Underperformance of an issuer may be caused by poor management decisions, competitive

pressures, breakthroughs in technology, reliance on suppliers, labor problems or shortages, corporate restructurings, fraudulent disclosures, natural disasters, military confrontations and actions, war, terrorism, disease/virus outbreaks and

epidemics or other events, conditions and factors.

Growth Securities Risk. Growth

securities typically trade at a higher multiple of earnings than other types of equity securities. Accordingly, the market values of growth securities may never reach their expected market value and may decline in price. In addition,

growth securities, at times, may not perform as well as value securities or the stock market in general, and may be out of favor with investors for varying periods of time.

Performance Information

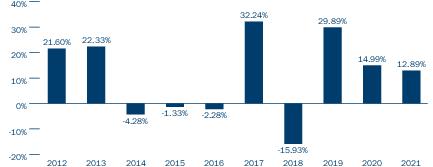

The following bar chart and table show you how the Fund has

performed in the past, and can help you understand the risks of investing in the Fund. The bar chart shows how the Fund’s Class Inst share performance has varied for each full calendar year shown. The table below the bar chart compares the

Fund’s returns for the periods shown with those of the MSCI ACWI ex USA SMID Cap Growth Index (Net), the Fund's primary benchmark, and those of the MSCI ACWI ex USA SMID Cap Index (Net), the Fund's secondary benchmark. The MSCI ACWI ex USA

SMID Cap Growth Index (Net) captures mid- and small-cap securities exhibiting overall growth style characteristics across 22 developed market countries and 24 emerging market countries. The MSCI ACWI ex USA SMID Cap Index (Net) captures mid- and

small-cap representation across 22 of 23 developed market countries (excluding the United States) and 24 emerging market countries. As of March 31, 2022, the MSCI ACWI ex USA SMID Cap Index (Net) had 5,541 constituents and covered approximately

28% of the free float-adjusted market capitalization in each country.

The performance of one or more share classes shown in the Average Annual Total Returns table below includes the Fund’s Class Inst share returns (adjusted to reflect the higher class-related operating expenses of such classes, where applicable) for periods prior to

the indicated inception date of such share classes. Except for differences in fees and expenses, all share classes of the Fund would have substantially similar annual returns because all share classes of the Fund invest in the same portfolio of

securities.

The after-tax returns shown in the Average Annual Total Returns table below are calculated using the highest historical individual U.S. federal marginal income tax rates in effect during the period indicated in the table and do not reflect the

impact of state, local or foreign taxes. Your actual after-tax returns will depend on your personal tax situation and may differ from those shown in the table. In addition, the after-tax returns shown in the table do not apply to shares held in

tax-advantaged accounts such as 401(k) plans or Individual Retirement Accounts (IRAs). The after-tax returns are shown only for Class Inst shares and will vary for other share classes.

The Fund’s past performance (before and after taxes) is no

guarantee of how the Fund will perform in the future. Updated performance information can be obtained by calling toll-free 800.345.6611 or visiting columbiathreadneedleus.com.

| Columbia Acorn International® | 6 |

| Year

by Year Total Return (%) as of December 31 Each Year* |

Best

and Worst Quarterly Returns During the Period Shown in the Bar Chart | ||

|

Best | 2nd Quarter 2020 | 27.28% |

| Worst | 1st Quarter 2020 | -28.50% | |

| * | Year to Date return as of March 31, 2022: -18.81% |

Average Annual

Total Returns After Applicable Sales Charges (for periods ended December 31, 2021)

| Share

Class Inception Date |

1 Year | 5 Years | 10 Years | |

| Class Inst | 09/23/1992 | |||

| returns before taxes | 12.89% | 13.39% | 9.91% | |

| returns after taxes on distributions | 8.95% | 9.65% | 7.59% | |

| returns after taxes on distributions and sale of Fund shares | 10.26% | 10.03% | 7.69% | |

| Class A returns before taxes | 10/16/2000 | 6.17% | 11.78% | 8.98% |

| Class Adv returns before taxes | 11/08/2012 | 12.88% | 13.39% | 9.88% |

| Class C returns before taxes | 10/16/2000 | 10.81% | 12.26% | 8.80% |

| Class Inst2 returns before taxes | 08/02/2011 | 12.97% | 13.46% | 9.97% |

| Class Inst3 returns before taxes | 11/08/2012 | 13.00% | 13.51% | 10.01% |

| Class R returns before taxes | 08/02/2011 | 12.34% | 12.83% | 9.29% |

| MSCI ACWI ex USA SMID Cap Growth Index (Net) (reflects reinvested dividends net of withholding taxes but reflects no deductions for fees, expenses or other taxes) | 8.51% | 12.25% | 9.34% | |

| MSCI ACWI ex USA SMID Cap Index (Net) (reflects reinvested dividends net of withholding taxes but reflects no deductions for fees, expenses or other taxes) | 10.16% | 10.30% | 8.63% |

Fund Management

Investment Manager: Columbia

Wanger Asset Management, LLC

| Portfolio Management | Title | Role with Fund | Service with the Fund Since | |||

| Tae Han (Simon) Kim, CFA | Director of International Research, Portfolio Manager and Analyst | Co-Portfolio

Manager since 2017 |

2011 | |||

| Hans F. Stege | Portfolio Manager and Analyst | Co-Portfolio

Manager since 2020 |

2017 |

Purchase and Sale of Fund

Shares

You may purchase or redeem shares of the Fund on

any business day by contacting the Fund in the ways described below:

| Online | Regular Mail | Express Mail | By Telephone | |||

| columbiathreadneedleus.com/investor/ | Columbia

Management Investment Services Corp. P.O. Box 219104 Kansas City, MO 64121-9104 |

Columbia

Management Investment Services Corp. c/o DST Asset Manager Solutions, Inc. 430 W 7th Street, Suite 219104 Kansas City, MO 64105-1407 |

800.422.3737 |

You may purchase shares and receive

redemption proceeds by electronic funds transfer, by check or by wire. If you maintain your account with a broker-dealer or other financial intermediary, you must contact that financial intermediary to buy, sell or exchange shares of the Fund

through your account with the intermediary.

| 7 | Columbia Acorn International® |

The minimum initial investment amounts for the share classes

offered by the Fund are shown below:

Minimum Initial

Investment

| Class | Category of eligible account | For

accounts other than Systematic Investment Plan accounts (as described in the Fund’s Prospectus) |

For

Systematic Investment Plan accounts |

| Classes A & C | All accounts other than IRAs | $2,000 | $100 |

| IRAs | $1,000 | $100 | |

| Classes Adv & Inst | All eligible accounts | $0,

$1,000 or $2,000 depending upon the category of eligible investor |

$100 |

| Classes Inst2 & R | All eligible accounts | None | N/A |

| Class Inst3 | All eligible accounts | $0,

$1,000, $2,000 or $1 million depending upon the category of eligible investor |

$100

(for certain eligible investors) |

More information about these minimums can be found in the Buying, Selling and Exchanging Shares - Buying Shares section of the prospectus. There is no minimum additional investment for any share class.

Tax Information

The Fund normally distributes net investment income and net

realized capital gains, if any, to shareholders. These distributions are generally taxable to you as ordinary income, qualified dividend income or capital gains, unless you are investing through a tax-advantaged account, such as a 401(k) plan or an

IRA. If you are investing through a tax-advantaged account, you may be taxed upon withdrawals from that account.

Payments to Broker-Dealers and Other Financial

Intermediaries

If you purchase the Fund through a

broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies – including the Investment Manager, the Distributor and Columbia Management Investment Services Corp. (the Transfer Agent) – may pay the

intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your financial advisor to recommend the Fund over another investment. These

potential conflicts of interest may be heightened with respect to broker-dealers owned by Ameriprise Financial, Inc. (Ameriprise Financial) and/or its affiliates. Ask your financial advisor or visit your financial intermediary's website for more

information.

| Columbia Acorn International® | 8 |

Columbia

Acorn Family of Funds

Columbia Threadneedle

Investments is the global brand name of the Columbia and Threadneedle group of companies.

The Fund is distributed by Columbia Management Investment

Distributors, Inc., 290 Congress Street, Boston, MA 02210.

© 2022 Columbia Management Investment Advisers, LLC. All rights

reserved.

| columbiathreadneedleus.com | SUM111_12_M01_(05/22) |