Table of Contents

As filed with the Securities and Exchange Commission on April 8, 2020

Securities Act File No. 333-236783

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-14

REGISTRATION STATEMENT

UNDER

| THE SECURITIES ACT OF 1933 | ☒ | |||||

| Pre-Effective Amendment No. | ☐ | |||||

| Post-Effective Amendment No. 1 | ☒ |

COLUMBIA ACORN TRUST

(Exact Name of Registrant as Specified in Charter)

27 West Monroe Street, Suite 3000

Chicago, Illinois 60606

Telephone number: 312.634.9200

| Ryan C. Larrenaga, Esq. c/o Columbia Management Investment Advisers, LLC 225 Franklin Street Boston, Massachusetts 02110 |

Matthew A. Litfin Louis J. Mendes Columbia Acorn Trust 71 S. Wacker, 25th Floor Chicago, Illinois 60606 |

Mary C. Moynihan Perkins Coie LLP 700 13th Street, N.W., Suite 600 Washington, D.C. 20005 |

(Name and Address of Agents for Service)

TITLE OF SECURITIES BEING REGISTERED:

Class A, Class Adv, Class C, Class Inst, Class Inst 2 and Class Inst 3 shares of Columbia Acorn International Select, a series of the Registrant.

Approximate Date of Proposed Public Offering: As soon as practicable after the effective date of this Registration Statement.

No filing fee is required because an indefinite number of shares have previously been registered pursuant to Rule 24f-2 under the Investment Company Act of 1940.

It is proposed that this filing will become effective immediately pursuant to Rule 485(b) under the Securities Act of 1933, as amended.

Table of Contents

Columbia Funds Series Trust

Columbia Select International Equity Fund

COMBINED PROXY STATEMENT/PROSPECTUS

April 8, 2020

Columbia Management Investment Advisers, LLC (“Columbia Threadneedle”) and Columbia Wanger Asset Management, LLC (“Columbia Wanger” and together the “Investment Managers” and each, an “Investment Manager”) have recommended a series of mutual fund liquidations and reorganizations as part of an initiative to streamline the product offerings of the mutual funds managed by the Investment Managers or their affiliates (the “Columbia Funds”). As part of this initiative, the board of trustees of Columbia Select International Equity Fund, a series of Columbia Funds Series Trust (the “Target Fund”), has approved a proposal (the “Proposal”) to reorganize the Target Fund into Columbia Acorn International Select, a series of Columbia Acorn Trust (the “Acquiring Fund”).

This is a brief overview of the Proposal. We encourage you to read the full text of the enclosed Combined Proxy Statement/Prospectus to obtain detailed information with respect to the Proposal.

Q: Why are you sending me this information?

The Target Fund is required to obtain shareholder approval for certain kinds of changes. As a shareholder of the Target Fund, you are being asked to vote on the reorganization involving the Target Fund (the “Reorganization”).

Q: Is my vote important?

Yes. While the board of trustees of the Target Fund (the “Target Fund Board”) has approved the Proposal and recommends that you approve it, the Proposal cannot go forward without the approval of shareholders of the Target Fund. The Target Fund will continue to contact shareholders asking them to vote until it is sure that a quorum will be reached, and may continue to contact shareholders thereafter.

Q: What is a fund reorganization?

A fund reorganization involves one fund transferring all of its assets and liabilities to another fund in exchange for shares of such fund. Once completed, shareholders of the fund being reorganized will hold shares of the acquiring fund.

Q: Why is the Reorganization being proposed?

The Investment Managers proposed the Reorganization primarily in order to streamline the product offerings of the Columbia Funds, so that management, distribution and other resources can be focused more effectively on a smaller group of Columbia Funds. Further, the Reorganization of the Target Fund into the Acquiring Fund will enable shareholders of the Target Fund to invest in a larger, potentially more efficient portfolio while continuing to pursue a similar investment objective. As noted below, it is expected that following the proposed Reorganization, the expenses borne by Target Fund shareholders as shareholders of the Acquiring Fund will be lower than the expenses they currently bear as shareholders of the Target Fund net of fee waivers and/or expense reimbursements that are in effect through April 30, 2022. See “Will there be any changes to my fees and expenses as a result of the Reorganization?” below.

Q: Will the portfolio manager or investment manager of my fund change as a result of the Reorganization?

Yes. The investment manager and portfolio managers of the Acquiring Fund are different than the investment manager and portfolio managers for the Target Fund. Columbia Threadneedle is the investment

Table of Contents

manager of the Target Fund and Columbia Wanger, an affiliate of Columbia Threadneedle, is the investment manager of the Acquiring Fund. The portfolio managers of the Acquiring Fund and Columbia Wanger will continue to manage the Acquiring Fund following the Reorganization.

Q: Will there be any changes to the options or services associated with my account as a result of the Reorganization?

No. Account-level features and options such as dividend distributions, dividend diversification, automatic investment plans, systematic withdrawals and dollar cost averaging currently set up with the Target Fund for your account will automatically carry over to your account in the Acquiring Fund. If you purchase shares through a broker-dealer or other financial intermediary, please contact your financial intermediary for additional details.

Q: What are the costs of the Reorganization?

You will not pay any sales charges in connection with the acquisition of shares of the Acquiring Fund issued in the Reorganization. Reorganization costs will be allocated to the Funds as provided in the Agreement and Plan of Reorganization (the “Agreement”). The Agreement provides that the Acquiring Fund will bear certain reorganization-related compliance testing costs associated with the Reorganization and that all other costs of the Reorganization will be allocated to the Target Fund. Other costs of the Reorganization include legal fees, auditor fees, and printing, mailing and proxy solicitation costs. The Agreement provides that, for the Funds, Reorganization costs will be limited to an amount that is not more than the anticipated reduction in expenses borne by a Fund’s shareholders during the first year following the Reorganization. Any amounts in excess of this limit will be borne by the Investment Managers. Reorganization costs are estimated to be $78,767 for the Target Fund and $4,000 for the Acquiring Fund. Should the Reorganization fail to occur, the Investment Managers will bear all costs associated with the Reorganization.

Q: Will there be any costs associated with portfolio repositioning?

Yes. Reorganization costs do not include repositioning costs arising from sales of portfolio assets by the Target Fund before the Reorganization, which costs will be borne by the Target Fund. If the Reorganization had occurred as of September 30, 2019, it is estimated that approximately 98% of the Target Fund’s investment portfolio would have been sold. If the repositioning had occurred as of September 30, 2019, the Target Fund would have borne approximately $237,092 in transaction costs. The actual transaction costs will vary based on market conditions at the time of sale and may vary significantly under volatile market conditions such as those experienced during the first quarter of 2020 arising from the public health crisis caused by the novel coronavirus known as COVID-19. Additional information regarding repositioning is discussed in the section of the Combined Proxy Statement/Prospectus entitled “Section A – Information on the Proposed Reorganization – Synopsis of the Proposal – Comparison of Fees and Expenses – Portfolio Turnover.”

Q: What are the U.S. federal income tax consequences of the Reorganization?

The Reorganization is expected to qualify as a tax-free reorganization for U.S. federal income tax purposes. Accordingly, it is expected that Target Fund shareholders will not recognize gain or loss as a direct result of a Reorganization and neither Target Fund will recognize gain or loss as a direct result of a Reorganization, except that gain or loss may be recognized by a Target Fund with respect to assets as to which unrealized gain or loss is required to be recognized under federal income tax principles at the termination of a taxable year or upon the transfer of such assets regardless of whether such transfer would otherwise be a non-taxable transaction, as described in more detail in the section of the Combined Proxy Statement/Prospectus entitled “Section A – Information on the Proposed Reorganization – Additional Information About the Reorganization – U.S. Federal Income Tax Status of the Reorganization.” A significant portion of the portfolio assets of the Target Fund is expected to be sold by the Target Fund prior to the Reorganization. All such sales will cause the Target Fund to incur transaction costs and are expected to result in an increased taxable distribution to shareholders of the Target

-2-

Table of Contents

Fund. Additionally, because the Reorganization will end the tax year of the Target Fund, it will accelerate distributions to shareholders from the Target Fund for its tax year ending on the date of the Reorganization. Those tax year-end distributions will be taxable, and will include any distributable, but not previously distributed, income and capital gains resulting from portfolio turnover prior to consummation of the Reorganization.

Q: Will there be any changes to my fees and expenses as a result of the Reorganization?

Yes. It is expected that, following the proposed Reorganization, the expenses borne by Target Fund shareholders as shareholders of the Acquiring Fund will be lower than the expenses they currently bear, net of fee waivers and/or expense reimbursements that are in effect through April 30, 2022. Fees and expenses may increase if such fee waivers and/or expense reimbursements expire or are modified. Any expense savings will be realized only after recoupment of the costs of the Reorganization borne by the Funds. See the Combined Proxy Statement/Prospectus under “Section A – Information on the Proposed Reorganization – Synopsis – Comparison of Fees and Expenses.”

Q: If approved, when will the Reorganization happen?

The Reorganization will take place following shareholder approval of the Reorganization, and is scheduled to close in the third quarter of 2020.

Q: How does the Board recommend that I vote?

After careful consideration, the Target Fund Board recommends that you vote FOR the Proposal.

Q: How can I vote?

You can vote in one of four ways:

| • | By telephone (call the toll free number listed on your proxy card) |

| • | By Internet (log on to the Internet site listed on your proxy card) |

| • | By mail (using the enclosed postage prepaid envelope) |

| • | In person at the special shareholder meeting scheduled to occur at 225 Franklin Street, Boston, MA (32nd Floor, Room 3200) on June 30, 2020 |

The deadline for voting by telephone or Internet is 11:59 P.M. E.T. on June 29, 2020. We encourage you to vote as soon as possible to avoid the cost of additional solicitation efforts. Please refer to the enclosed proxy card for instructions for voting by telephone, Internet or mail.

Q: Will I be notified of the results of the vote?

Yes. The final voting results for the Proposal will be included in the Target Fund’s next report to shareholders following the special shareholder meeting.

Q: Whom should I call if I have questions?

If you have questions about the Proposal described in the Combined Proxy Statement/Prospectus or about voting procedures, please call the Target Fund’s proxy solicitor, Computershare Fund Services, toll free at (866) 456-7935. Shareholders of the Target Fund may also call (800) 345-6611 to request, at no charge, a copy of the Target Fund’s annual or semi-annual report to shareholders.

-3-

Table of Contents

NOTICE OF A SPECIAL MEETING OF SHAREHOLDERS

Columbia Funds Series Trust

Columbia Select International Equity Fund

To be held June 30, 2020

A special meeting of shareholders (the “Meeting”) of Columbia Select International Equity Fund (the “Target Fund”) will be held at 10:00 A.M. E.T. on June 30, 2020, at 225 Franklin Street, Boston, Massachusetts (32nd Floor, Room 3200). In light of the developing circumstances related to the novel coronavirus pandemic known as COVID-19, the Target Fund reserve the right to implement a virtual or hybrid meeting format to the extent necessary to comply with government directives or advisories. Shareholders are advised to monitor the Target Fund’s website for additional information. At the Meeting, shareholders will consider the following proposal (the “Proposal”), with respect to the Target Fund:

To approve the Agreement and Plan of Reorganization by and among Columbia Funds Series Trust, on behalf of its series Columbia Select International Equity Fund (the “Target Fund”), Columbia Acorn Trust, on behalf of its series Columbia Acorn International Select (the “Acquiring Fund”), Columbia Management Investment Advisers, LLC, the investment manager of the Target Fund, and Columbia Wanger Asset Management, LLC, the investment manager of the Acquiring Fund, pursuant to which the Target Fund will transfer that portion of its assets attributable to each class of its shares (in aggregate, all of its assets) to the Acquiring Fund, in exchange for shares of a corresponding class of shares of the Acquiring Fund and the assumption by the Acquiring Fund of all of the liabilities of the Target Fund.

Shareholders of the Target Fund will be asked to vote on the Proposal, and to transact such other business as may properly come before the Meeting.

Please carefully read the enclosed Combined Proxy Statement/Prospectus, which discusses the Proposal in more detail. If you were a shareholder of the Target Fund as of the close of business on March 20, 2020, you may vote at the Meeting or at any adjournment or postponement of the Meeting. You are welcome to attend the Meeting in person. If you cannot attend in person, please vote by mail, telephone or internet by following the instructions on the enclosed proxy card. If you have questions, please call the Target Fund’s proxy solicitor toll free at (800) 708-7953. It is important that you vote. The Board of Trustees of the Target Fund recommends that you vote FOR the Proposal.

By order of the Board of Trustees

Ryan C. Larrenaga, Secretary

April 8, 2020

Table of Contents

Columbia Funds Series Trust

Columbia Select International Equity Fund

COMBINED PROXY STATEMENT/PROSPECTUS

Dated April 8, 2020

This document is a proxy statement for Columbia Select International Equity Fund, a series of Columbia Funds Series Trust (the “Target Fund”) and a prospectus for Columbia Acorn International Select, a series of Columbia Acorn Trust (the “Acquiring Fund”). The mailing address and telephone number of the Target Fund and the Acquiring Fund is c/o Columbia Management Investment Services Corp., P.O. Box 219104, Kansas City, MO 64121-9104 and 800-345-6611. This Combined Proxy Statement/Prospectus and the enclosed proxy card were first mailed to shareholders of the Target Fund beginning on or about April 13, 2020. This Combined Proxy Statement/Prospectus contains information you should know before voting on the following proposal (the “Proposal”) with respect to the Target Fund. You should read this document carefully and retain it for future reference. The board of trustees of the Target Fund (the “Target Fund Board”) is soliciting proxies from shareholders of the Target Fund for a joint special meeting of shareholders (the “Meeting”).

| Proposal |

To be voted on by | |||

| To approve an Agreement and Plan of Reorganization by and among Columbia Funds Series Trust, on behalf of the Target Fund, Columbia Acorn Trust, on behalf of the Acquiring Fund, Columbia Management Investment Advisers, LLC, the investment manager of the Target Fund, and Columbia Wanger Asset Management, LLC, the investment manager of the Acquiring Fund, pursuant to which the Target Fund will transfer that portion of its assets attributable to each class of its shares to the Acquiring Fund in exchange for shares of the corresponding class of shares of the Acquiring Fund as noted below and the Acquiring Fund’s assumption of all liabilities and obligations of the Target Fund followed by the distribution of the Acquiring Fund’s shares to the Target Fund shareholders in complete liquidation of the Target Fund. | Columbia Select International Equity Fund | |||

| Columbia Select International Equity Fund |

Columbia Acorn | |||||

| Class A |

g | Class A | ||||

| Advisor Class |

g | Advisor Class | ||||

| Class C |

g | Class C | ||||

| Class Inst |

g | Class Inst | ||||

| Class Inst2 |

g | Class Inst2 | ||||

| Class Inst3 |

g | Class Inst3 | ||||

| Class R |

g | Class A | ||||

The Proposal will be considered by shareholders who owned shares of the Target Fund on March 20, 2020 at the Meeting that will be held at 10:00 A.M. ET on June 30, 2020, at 225 Franklin Street, Boston, Massachusetts (32nd Floor, Room 3200). The Target Fund and Acquiring Fund (each, a “Fund” and collectively, the “Funds”) are each a registered open-end management investment company (or a series thereof). Additional information regarding the Meeting, including the required votes, voting procedures and shareholder voting rights, can be found in “Section B – Proxy Voting and Shareholder Meeting Information” of this Combined Proxy Statement/Prospectus.

If shareholders of the Target Fund fail to approve the reorganization of the Target Fund into the Acquiring Fund (the “Reorganization”), the Target Fund Board will consider what other actions, if any, may be appropriate for the Target Fund.

Table of Contents

Where to Get More Information

The Statement of Additional Information of the Acquiring Fund relating to the Reorganization (the “Reorganization SAI”), dated April 8, 2020, has been filed with the SEC and is incorporated into this Combined Proxy Statement/Prospectus by reference. In addition, the following documents have been filed with the SEC and are incorporated into this Combined Proxy Statement/Prospectus by reference:

Columbia Acorn International Select (SEC file nos. 811-01829 and 002-34223)

| • |

Columbia Select International Equity Fund (SEC file nos. 811-09645 and 333-89661)

| • |

| • |

| • |

For a free copy of any of the documents listed above and/or to ask questions about this Combined Proxy Statement/Prospectus, please call the Target Fund’s proxy solicitor toll free at (800) 708-7953 or by written request at Computershare Fund Services, 2950 Express Drive South, Suite 210, Islandia, New York 11749.

Each of the Funds is subject to the information requirements of the Securities Exchange Act of 1934, as amended, and the Investment Company Act of 1940, as amended (the “1940 Act”), and files reports, proxy materials and other information with the SEC. Copies of these reports, proxy materials and other information may be obtained, after paying a duplicating fee, by electronic request at publicinfo@sec.gov, or by writing to the Public Reference Branch of the SEC Office of Consumer Affairs and Information Services, 100 F Street, N.E., Washington, D.C. 20549-0102. In addition, copies of these documents may be viewed online or downloaded from the SEC’s website at www.sec.gov.

Please note that investments in the Funds are not bank deposits, are not federally insured, are not guaranteed by any bank or government agency and may lose value. There is no assurance that any Fund will achieve its investment objectives.

AS WITH ALL MUTUAL FUNDS, THE SEC HAS NOT APPROVED OR DISAPPROVED THESE SECURITIES OR PASSED ON THE ADEQUACY OF THIS COMBINED PROXY STATEMENT/PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

-2-

Table of Contents

| Page | ||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 2 | ||||

| 3 | ||||

| 4 | ||||

| 4 | ||||

| 4 | ||||

| 8 | ||||

| 10 | ||||

| 12 | ||||

| 13 | ||||

| 14 | ||||

| 18 | ||||

| 18 | ||||

| 18 | ||||

| 19 | ||||

| 19 | ||||

| 21 | ||||

| 22 | ||||

| SECTION B — PROXY VOTING AND SHAREHOLDER MEETING INFORMATION |

25 | |||

| 25 | ||||

| 25 | ||||

| 25 | ||||

| 26 | ||||

| 26 | ||||

| 26 | ||||

| 26 | ||||

| 27 | ||||

| 27 | ||||

| 27 | ||||

| 27 | ||||

| 27 | ||||

| SECTION C — ADDITIONAL INFORMATION APPLICABLE TO THE ACQUIRING FUND |

28 | |||

| 28 | ||||

| 33 | ||||

| 37 | ||||

| 37 | ||||

| 40 | ||||

| 41 | ||||

| 41 | ||||

| 41 | ||||

| 43 | ||||

| 43 | ||||

| 50 | ||||

| 51 | ||||

| 54 | ||||

| 61 | ||||

i

Table of Contents

| Page | ||||

| 66 | ||||

| 68 | ||||

| 70 | ||||

| 71 | ||||

| 74 | ||||

| EXHIBIT A — OWNERSHIP OF FUND SHARES AND FINANCIAL HIGHLIGHTS |

A-1 | |||

| A-1 | ||||

| A-4 | ||||

| B-1 | ||||

ii

Table of Contents

SECTION A — INFORMATION ON THE PROPOSED REORGANIZATION

The following information describes the proposed reorganization (the “Reorganization”) of Columbia Select International Equity Fund (the “Target Fund”) into Columbia Acorn International Select (the “Acquiring Fund”). The Target Fund and the Acquiring Fund are referred to individually as a “Fund” and collectively as the “Funds.”

Columbia Management Investment Advisers, LLC (“Columbia Threadneedle”) and Columbia Wanger Asset Management, LLC (“Columbia Wanger” and together with Columbia Threadneedle, the “Investment Managers” and each, an “Investment Manager”) have recommended a series of mutual fund liquidations and reorganizations as part of an initiative to streamline the product offerings of the mutual funds managed by the Investment Managers (the “Columbia Funds”). Reducing the number of Columbia Funds would also allow management, distribution and other resources to be focused more effectively on a smaller group of Columbia Funds and is intended to enhance the funds’ prospects for attracting additional assets by better differentiating the funds for potential shareholders (which may lead to a more concentrated selling effort). As part of this initiative, the Board of Trustees of Columbia Funds Series Trust (the “Target Fund Board”) has approved the Proposal to reorganize the Target Fund into the Acquiring Fund. The Reorganization is scheduled to close in the third quarter of 2020.

This Combined Proxy Statement/Prospectus is being used by the Target Fund to solicit proxies to vote at a special meeting of the shareholders (the “Meeting”). Shareholders of the Target Fund are being asked to consider a Proposal to approve the Agreement and Plan of Reorganization (the “Agreement”) providing for the Reorganization (the “Proposal”).

The following is a summary of the Proposal. More complete information appears later in this Combined Proxy Statement/Prospectus. You should carefully read the entire Combined Proxy Statement/Prospectus and the exhibits because they contain details that are not included in this summary.

How The Reorganization Will Work

| • | Pursuant to an Agreement and Plan of Reorganization (the “Agreement”), the Target Fund will transfer all of its assets to the Acquiring Fund in exchange for shares of the Acquiring Fund (“Acquisition Shares”) and the Acquiring Fund’s assumption of all obligations and liabilities of the Target Fund. Immediately after the closing, the Target Fund will liquidate and distribute pro rata to shareholders of record of each class of its shares the Acquisition Shares of the corresponding class of shares received by the Target Fund. |

| • | The Acquiring Fund will issue Acquisition Shares with an aggregate net asset value equal to the aggregate value of the assets that it receives from the Target Fund, net of liabilities and any expenses of the Reorganization payable by the Target Fund. Acquisition Shares of each class of shares of the Acquiring Fund will be distributed to the shareholders of the corresponding class of shares of the Target Fund in proportion to their holdings of such class of the Target Fund. Shareholders of the Target Fund will receive the same class of shares of the Acquiring Fund as they own at the time of the Reorganization except with respect to Class R shares. For example, holders of Class A shares of the Target Fund will receive Class A shares of the Acquiring Fund with the same aggregate net asset value as the aggregate net asset value of their Target Fund Class A shares. However, because the Acquiring Fund does not offer Class R shares, shareholders of Class R shares of the Target Fund will receive Class A shares of the Acquiring Fund. While the aggregate net asset value of your shares will not change as a result of the Reorganization, the number of shares you hold may differ based on each Fund’s net asset value. |

| • | The Acquiring Fund will bear the costs of certain Reorganization-related testing conducted by the Fund’s auditors in connection with the Reorganization. All other costs of the Reorganization will be borne by the Target Fund in accordance with the Agreement. The Funds will bear Reorganization costs only to the extent they are expected to be offset by the anticipated reduction in expenses borne by the Fund’s shareholders during the first year following the Reorganization. Any amounts in excess of this limit will be borne by the Investment Managers. A significant portion of the portfolio assets of the Target Fund is expected to be sold by the Target Fund before the Reorganization. All such sales will cause the Target Fund to incur transaction costs and are expected to result in an increased taxable distribution to shareholders. Reorganization costs do not include portfolio transaction costs incurred by the Target Fund prior to the Reorganization. Such |

-1-

Table of Contents

| transaction costs are described in more detail in the section of the Combined Proxy Statement/Prospectus entitled “Section A – Information on the Proposed Reorganization – Synopsis – Comparison of Fees and Expenses – Portfolio Turnover” with respect to the Reorganization. |

| • | The Reorganization is expected to qualify as a tax-free reorganization for U.S. federal income tax purposes. Accordingly, it is expected that Target Fund shareholders will recognize gain or loss as a direct result of a Reorganization and neither Target Fund will recognize gain or loss as a direct result of a Reorganization, except that gain or loss may be recognized by a Target Fund with respect to assets as to which unrealized gain or loss is required to be recognized under federal income tax principles at the termination of a taxable year or upon the transfer of such assets regardless of whether such transfer would otherwise be a non-taxable transaction, as described in more detail in the section of this Combined Proxy Statement/Prospectus entitled “Section A – Information on the Proposed Reorganization – Additional Information About the Reorganization – U.S. Federal Income Tax Status of the Reorganization.” |

| • | As part of the Reorganization of the Target Fund, systematic transactions (such as bank authorizations and systematic payouts) currently set up with the Target Fund for your Target Fund account will be transferred to your new Acquiring Fund account. If you purchase shares through a broker-dealer or other financial intermediary, please contact your financial intermediary for additional details. |

| • | Shareholders will not incur any sales charges in connection with the issuance of Acquisition Shares in connection with the Reorganization. Sales charges will apply to subsequent purchases unless a sales charge waiver applies. |

| • | After the Reorganization is completed, Target Fund shareholders will be shareholders of the same class of shares of the Acquiring Fund, except that shareholders of Class R shares of the Target Fund will be Class A shareholders of the Acquiring Fund, and the Target Fund will be dissolved. |

U.S. Federal Income Tax Consequences

The Reorganization is expected to qualify as a tax-free reorganization for U.S. federal income tax purposes and will not take place unless the Target Fund and the Acquiring Fund receive a satisfactory opinion of tax counsel substantially to the effect that the Reorganization will qualify as a tax-free reorganization, as described in more detail in the section entitled “Section A – Information on the Proposed Reorganization – Additional Information About the Reorganization – U.S. Federal Income Tax Status of the Reorganization.” Accordingly, subject to the limited exceptions described in that section, no gain or loss is expected to be recognized by the Target Fund or its shareholders as a direct result of the Reorganization. A significant portion of the portfolio assets of the Target Fund is expected to be sold by the Target Fund before the Reorganization. The actual tax effect of such sales will depend on the difference between the price at which such portfolio assets are sold and the tax basis of the Target Fund in such assets and the holding period of such assets. Capital gains recognized in all such sales on a net basis, after reduction by any available capital losses, will be distributed to shareholders as capital gain dividends (to the extent of net realized long-term capital gains over net realized short-term capital losses) and/or ordinary dividends (to the extent of net realized short-term capital gains over net realized long-term capital losses) during or with respect to the year of sale, and such distributions will be taxable to shareholders. Additionally, because the Reorganization will end the tax year of the Target Fund, it will accelerate distributions to shareholders from the Target Fund for its tax year ending on the date of the Reorganization. Those tax year-end distributions will be taxable, and will include any distributable, but not previously distributed, income and capital gains resulting from portfolio turnover prior to consummation of the Reorganization. At any time prior to the Reorganization, a shareholder may redeem shares of the Target Fund. Any such redemption would likely result in the recognition of gain or loss by the shareholder for U.S. federal income tax purposes. If a shareholder holds Target Fund shares in a non-taxable account, distributions and redemption proceeds with respect to those shares will not be currently taxable to the shareholder if those amounts remain in the non-taxable account.

-2-

Table of Contents

A Target Fund shareholder’s aggregate tax basis in the Acquisition Shares is expected to carry over from the shareholder’s Target Fund shares, and a Target Fund shareholder’s holding period in the Acquisition Shares is expected to include the shareholder’s holding period in the Target Fund shares.

For more information about the U.S. federal income tax consequences of the Reorganization, see the section entitled “Section A – Information on the Proposed Reorganization – Additional Information about the Reorganization – U.S. Federal Income Tax Status of the Reorganization.”

The Target Fund and Acquiring Fund will bear a portion of the out-of-pocket expenses associated with the Reorganization, as set forth below. The Agreement provides that the Acquiring Fund will bear the costs of certain Reorganization-related testing conducted by the Funds’ auditors in connection with the Reorganization and that all other Reorganization costs will be allocated to the Target Fund in accordance with the Agreement. Reorganization costs allocated to the Target Fund include, but are not limited to: (1) the expenses associated with the preparation, printing and mailing of this Combined Proxy Statement/Prospectus, other shareholder communications and filings with the Securities and Exchange Commission (“SEC”) and/or other governmental authorities in connection with the Reorganization; (2) legal, audit, custodial and other fees incurred in connection Reorganization; and (3) proxy solicitation costs (the “Reorganization Costs”). The Agreement provides that each Fund will bear Reorganization Costs to the extent that such fees and expenses do not exceed the anticipated reduction in expenses that shareholders of a Fund are expected to realize in the first year following the Reorganization. One-year cost savings are determined at the share class level for each Fund by comparing the net expense ratio pre-Reorganization to the net expense ratio post-Reorganization, as set forth in the Fees and Expenses section below. Any amounts in excess of this limit will be borne by the Investment Managers. Should the Reorganization fail to occur, the Investment Managers will bear all costs associated with the Reorganization.

The estimated Reorganization Costs expected to be borne by the Target Fund and Acquiring Fund, stated as an aggregate dollar amount and on a per-share basis based on shares outstanding as of December 31, 2019, are set forth below:

| Costs Estimated to be Borne |

||||||||

| Reorganization |

Total | Per Share | ||||||

| Columbia Select International Equity Fund |

$ | 78,767 | $ | 0.0047 | ||||

| Columbia Acorn International Select |

$ | 4,000 | $ | 0.0008 | ||||

Based on the operating expense ratios shown in the Fees and Expenses section for the Acquiring Fund, it is projected that, after the Reorganization, each class of shares of the Target Fund will benefit from expense savings that will offset the allocated Reorganization expenses over time, taking into account fee waivers and expense reimbursements. The time period estimated to recoup such costs is as follows:

| Fund |

Number of Months | |||

| Columbia Select International Equity Fund |

12 | |||

If a Target Fund shareholder redeems his or her Acquisition Shares prior to such time, the shareholder may not fully benefit from the projected expense savings of the Reorganization.

-3-

Table of Contents

SYNOPSIS OF THE PROPOSAL: COMPARISON OF COLUMBIA SELECT INTERNATIONAL EQUITY FUND AND COLUMBIA ACORN INTERNATIONAL SELECT

Comparison of the Target Fund and the Acquiring Fund

The Target Fund and the Acquiring Fund:

| • | Have similar investment objectives, strategies and policies. |

| • | Have the same policies for buying and selling shares and the same exchange rights. Please see “Section C – Additional Information Applicable to the Acquiring Fund” for a description of these policies for the Acquiring Fund. |

| • | Offer different share classes, as the Acquiring Fund does not offer Class R shares. Shareholders of Class R shares of the Target Fund will receive Class A shares of the Acquiring Fund, which are subject to lower total fees and expenses (see the tables below). The Acquiring Fund will waive any sales charges on Class A shares received in the Reorganization and will waive any investment minimums for former Class R Shareholders receiving Class A shares as part of the Reorganization. Sales charges will apply to subsequent purchases unless a sales charge waiver applies. For more information on features of Class A Shares, see “Section C – Additional Information about the Acquiring Fund.” |

| • | Have different investment managers. The Target Fund is managed by Columbia Threadneedle and the Acquiring Fund is managed by Columbia Wanger. Further, the Target Fund’s day-to-day portfolio management activities are managed by an affiliated sub-adviser, Threadneedle International Limited (“Threadneedle Ltd.”), an affiliate of Columbia Threadneedle and Columbia Wanger, each of which is a subsidiary of Ameriprise Financial, Inc. |

| • | Have different fiscal year ends. The Target Fund’s fiscal year end is February 28 and the Acquiring Fund’s fiscal year end is December 31. |

| • | Are structured as series of separate open-end management investment companies. The Acquiring Fund is organized as a series of a Massachusetts business trust. The Target Fund is organized as a series of a Delaware statutory trust. Please see Appendix B to this Combined Proxy Statement/Prospectus for more information regarding the differences between the rights of shareholders. |

Comparison of Fees and Expenses

The following tables describe the fees and expenses that you may pay if you buy and hold shares of a Fund. The purpose of the tables below is to assist you in understanding the various costs and expenses of investing in common shares of the Funds. An investor transacting in a class of Fund shares without any front-end sales charge, contingent deferred sales charge, or other asset-based fee for sales or distribution may be required to pay a commission to the financial intermediary for effecting such transactions. Such commission rates are set by the financial intermediary and are not reflected in the tables or the example below. You may qualify for sales charge discounts if you and members of your immediate family invest, or agree to invest in the future, at least $50,000 in certain classes of shares of eligible funds distributed by Columbia Management Investment Distributors, Inc. (the “Distributor”).

The information in the table reflects the fees and expenses for the Target Fund’s semi-annual period ended August 31, 2019 (annualized), for the Acquiring Fund’s fiscal year ended December 31, 2019 and the pro forma expenses for the fiscal year ended December 31, 2019 for the combined fund following the Reorganization.

Such information is based on current fees and expenses and assets as of the most recent annual or semi-annual period for each Fund. Actual fees and expenses of the combined fund will be based on the amount of Funds’ assets following the Reorganization. The assets of the Funds will vary based on market conditions, redemptions and other factors.

-4-

Table of Contents

Shareholder Fees (fees paid directly from your investment)

| Columbia Select International Equity Fund (Current) |

Class A | Class Adv | Class C | Class Inst | Class Inst2 | Class Inst3 | Class R | |||||||||||||||||||||

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

5.75 | % | None | None | None | None | None | None | ||||||||||||||||||||

| Maximum deferred sales charge (load) imposed on redemptions (as a percentage of net asset value at the time of your purchase or redemption, whichever is lower) |

1.00 | %(a) | None | 1.00 | %(b) | None | None | None | None | |||||||||||||||||||

| Columbia Acorn International Select (Current and Pro Forma) |

Class A | Class Adv | Class C | Class Inst | Class Inst2 | Class Inst3 | Class R | |||||||||||||||||||||

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

5.75 | % | None | None | None | None | None | — | ||||||||||||||||||||

| Maximum deferred sales charge (load) imposed on redemptions (as a percentage of net asset value at the time of your purchase or redemption, whichever is lower) |

1.00 | %(a) | None | 1.00 | %(b) | None | None | None | — | |||||||||||||||||||

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

| Columbia Select International Equity Fund (Current) |

Class A | Class Adv | Class C | Class Inst | Class Inst2 | Class Inst3 | Class R | |||||||||||||||||||||

| Management fees |

0.87 | % | 0.87 | % | 0.87 | % | 0.87 | % | 0.87 | % | 0.87 | % | 0.87 | % | ||||||||||||||

| Distribution and/or service (12b-1) fees |

0.25 | % | 0.00 | % | 1.00 | % | 0.00 | % | 0.00 | % | 0.00 | % | 0.50 | % | ||||||||||||||

| Other expenses(c) |

0.35 | % | 0.35 | % | 0.35 | % | 0.35 | % | 0.19 | % | 0.12 | % | 0.35 | % | ||||||||||||||

| Total annual Fund operating expenses(d) |

1.47 | % | 1.22 | % | 2.22 | % | 1.22 | % | 1.06 | % | 0.99 | % | 1.72 | % | ||||||||||||||

| Columbia Acorn International Select (Current) |

Class A | Class Adv | Class C | Class Inst | Class Inst2 | Class Inst3 | Class R | |||||||||||||||||||||

| Management fees |

0.89 | % | 0.89 | % | 0.89 | % | 0.89 | % | 0.89 | % | 0.89 | % | — | |||||||||||||||

| Distribution and/or service (12b-1) fees |

0.25 | % | 0.00 | % | 1.00 | % | 0.00 | % | 0.00 | % | 0.00 | % | — | |||||||||||||||

| Other expenses(c) |

0.39 | % | 0.39 | % | 0.39 | % | 0.39 | % | 0.32 | % | 0.27 | % | — | |||||||||||||||

| Total annual Fund operating expenses(e) |

1.53 | % | 1.28 | % | 2.28 | % | 1.28 | % | 1.21 | % | 1.16 | % | — | |||||||||||||||

-5-

Table of Contents

| Columbia Acorn International Select (Pro Forma) |

Class A | Class Adv | Class C | Class Inst | Class Inst2 | Class Inst3 | Class R | |||||||||||||||||||||

| Management fees |

0.89 | % | 0.89 | % | 0.89 | % | 0.89 | % | 0.89 | % | 0.89 | % | — | |||||||||||||||

| Distribution and/or service (12b-1) fees |

0.25 | % | 0.00 | % | 1.00 | % | 0.00 | % | 0.00 | % | 0.00 | % | — | |||||||||||||||

| Other expenses(c) |

0.35 | % | 0.35 | % | 0.35 | % | 0.35 | % | 0.22 | % | 0.17 | % | — | |||||||||||||||

| Total annual Fund operating expenses(e) |

1.49 | % | 1.24 | % | 2.24 | % | 1.24 | % | 1.11 | % | 1.06 | % | — | |||||||||||||||

| Less: Fee waivers and/or expense reimbursements(f) |

(0.21 | )% | (0.21 | )% | (0.21 | )% | (0.21 | )% | (0.21 | )% | (0.21 | )% | — | |||||||||||||||

| Total annual Fund operating expenses after fee waivers and/or expense reimbursements |

1.28 | % | 1.03 | % | 2.03 | % | 1.03 | % | 0.90 | % | 0.85 | % | — | |||||||||||||||

| (a) | This charge is imposed on certain investments of between $1 million and $50 million redeemed within 18 months after purchase, as follows: 1.00% if redeemed within 12 months after purchase, and 0.50% if redeemed more than 12, but less than 18, months after purchase, with certain limited exceptions. |

| (b) | This charge applies to redemptions within 12 months after purchase, with certain limited exceptions. |

| (c) | Other expenses have been restated to reflect current fees paid by the Fund. |

| (d) | Columbia Management Investment Advisers, LLC and certain of its affiliates have contractually agreed to waive fees and/or to reimburse expenses (excluding transaction costs and certain other investment related expenses, interest, taxes, acquired fund fees and expenses, and infrequent and/or unusual expenses) through June 30, 2020, unless sooner terminated at the sole discretion of the Target Fund Board. Under this agreement, the Fund’s net operating expenses, subject to applicable exclusions, will not exceed the annual rates of 1.31% for Class A, 1.06% for Class Adv, 2.06% for Class C, 1.06% for Class Inst, 0.93% for Class Inst2, 0.86% for Class Inst3 and 1.56% for Class R. |

| (e) | Columbia Wanger has contractually agreed to waive fees and reimburse certain expenses of the Acquiring Fund, through April 30, 2020, so that ordinary operating expenses (excluding transaction costs and certain other investment-related expenses, interest and fees on borrowings and expenses associated with the Acquiring Fund’s investment in other investment companies, if any) do not exceed the annual rates of 1.31% for Class A shares, 1.06% for Class Adv shares, 2.06% for Class C shares, 1.06% for Class Inst shares, 0.97% for Class Inst2 shares and 0.92% for Class Inst3 shares. In addition, the Fund’s transfer agent, Columbia Management Investment Services Corp., has contractually agreed to waive a portion of its fees through June 30, 2020, such that the Acquiring Fund’s transfer agency fees do not exceed the annual rates of 0.05% of the average daily net assets of Class Inst2 shares and 0.00% of the average daily net assets of Class Inst3 shares. Columbia Wanger has further contractually agreed to waive fees and reimburse certain expenses of the Acquiring Fund, effective May 1, 2020 through April 30, 2021, so that ordinary operating expenses (excluding transaction costs and certain other investment-related expenses, interest and fees on borrowings and expenses associated with the Acquiring Fund’s investment in other investment companies, if any) do not exceed the annual rates of 1.28% for Class A shares, 1.03% for Class Adv shares, 2.03% for Class C shares, 1.03% for Class Inst shares, 0.96% for Class Inst2 shares and 0.91% for Class Inst3 shares. These arrangements may only be amended or terminated with approval from the Acquiring Fund’s Board of Trustees and Columbia Wanger. |

| (f) | Assuming approval by shareholders of the Reorganization, and effective upon the closing of the Reorganization, Columbia Wanger has further contractually agreed to waive fees and reimburse certain expenses, through April 30, 2022, so that ordinary operating expenses (excluding any Reorganization Costs, transaction costs and certain other investment-related expenses, interest and fees on borrowings and expenses associated with the Acquiring Fund’s investment in other investment companies, if any) do not exceed the annual rates of 1.28% for Class A shares, 1.03% for Class Adv shares, 2.03% for Class C shares, 1.03% for Class Inst shares, 0.90% for Class Inst2 shares and 0.85% for Class Inst3 shares. This arrangement may only be amended or terminated with approval from the Acquiring Fund’s Board of Trustees and Columbia Wanger. |

Expense examples

These examples are intended to help you compare the cost of investing in each Fund with the cost of investing in other mutual funds. These examples assume that you invest $10,000 in the applicable Fund for the time periods indicated and then redeem all of your shares at the end of those periods, both under the current arrangements and, for the Acquiring Fund, assuming completion of the proposed Reorganization. These examples also assume that your investment has a 5% return each year and that each Fund’s operating expenses remain the same. Since the waivers and/or reimbursements shown in the Annual Fund Operating Expenses table above for Columbia Acorn International Select (Pro Forma) expire as indicated in the preceding table, such waivers are only reflected in the 1 year example and the first year of the other examples and in the 1 year and the

-6-

Table of Contents

first and second year of the other examples for Acquiring Fund Pro Forma.. Although your actual costs may be higher or lower, based on the assumptions listed above, your costs would be:

| Columbia Select International Equity Fund (Current) | 1 year | 3 years | 5 years | 10 years | ||||||||||||

| Class A (whether or not shares are redeemed) |

$ | 716 | $ | 1,013 | $ | 1,332 | $ | 2,231 | ||||||||

| Class Adv (whether or not shares are redeemed) |

$ | 124 | $ | 387 | $ | 670 | $ | 1,477 | ||||||||

| Class C (assuming redemption of all shares at the end of the period) |

$ | 325 | $ | 694 | $ | 1,190 | $ | 2,554 | ||||||||

| Class C (assuming no redemption of shares) |

$ | 225 | $ | 694 | $ | 1,190 | $ | 2,554 | ||||||||

| Class Inst (whether or not shares are redeemed) |

$ | 124 | $ | 387 | $ | 670 | $ | 1,477 | ||||||||

| Class Inst2 (whether or not shares are redeemed) |

$ | 108 | $ | 337 | $ | 585 | $ | 1,294 | ||||||||

| Class Inst3 (whether or not shares are redeemed) |

$ | 101 | $ | 315 | $ | 547 | $ | 1,213 | ||||||||

| Class R (whether or not shares are redeemed) |

$ | 175 | $ | 542 | $ | 933 | $ | 2,030 | ||||||||

| Columbia Acorn International Select (Current) | ||||||||||||||||

| Class A (whether or not shares are redeemed) |

$ | 722 | $ | 1,031 | $ | 1,361 | $ | 2,294 | ||||||||

| Class Adv (whether or not shares are redeemed) |

$ | 130 | $ | 406 | $ | 702 | $ | 1,545 | ||||||||

| Class C (assuming redemption of all shares at the end of the period) |

$ | 331 | $ | 712 | $ | 1,220 | $ | 2,615 | ||||||||

| Class C (assuming no redemption of shares) |

$ | 231 | $ | 712 | $ | 1,220 | $ | 2,615 | ||||||||

| Class Inst (whether or not shares are redeemed) |

$ | 130 | $ | 406 | $ | 702 | $ | 1,545 | ||||||||

| Class Inst2 (whether or not shares are redeemed) |

$ | 123 | $ | 384 | $ | 665 | $ | 1,466 | ||||||||

| Class Inst3 (whether or not shares are redeemed) |

$ | 118 | $ | 368 | $ | 638 | $ | 1,409 | ||||||||

| Columbia Acorn International Select (Pro Forma) |

|

|||||||||||||||

| Class A (whether or not shares are redeemed) |

$ | 698 | $ | 979 | $ | 1,303 | $ | 2,217 | ||||||||

| Class Adv (whether or not shares are redeemed) |

$ | 105 | $ | 351 | $ | 640 | $ | 1,462 | ||||||||

| Class C (assuming redemption of all shares at the end of the period) |

$ | 306 | $ | 659 | $ | 1,161 | $ | 2,541 | ||||||||

| Class C (assuming no redemption of shares) |

$ | 206 | $ | 659 | $ | 1,161 | $ | 2,541 | ||||||||

| Class Inst (whether or not shares are redeemed) |

$ | 105 | $ | 351 | $ | 640 | $ | 1,462 | ||||||||

| Class Inst2 (whether or not shares are redeemed) |

$ | 92 | $ | 310 | $ | 570 | $ | 1,313 | ||||||||

| Class Inst3 (whether or not shares are redeemed) |

$ | 87 | $ | 294 | $ | 543 | $ | 1,255 | ||||||||

Portfolio Turnover

Each Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. Those costs, which are not reflected in annual Fund operating expenses or in the expense examples, affect a Fund’s performance. During the most recent fiscal year, each Fund’s portfolio turnover rate was the following percentage of the average value of the Fund’s portfolio:

| Fund |

Percentage of the Average Value of the Fund’s Portfolio |

|||

| Columbia Select International Equity Fund |

34 | % | ||

| Columbia Acorn International Select |

46 | % | ||

A significant portion of the Target Fund’s portfolio assets is expected to be sold by the Target Fund following shareholder approval and prior to the Reorganization. If the Reorganization had occurred as of September 30, 2019, it is estimated that approximately 98% of the Target Fund’s investment portfolio would have been sold. It is estimated that such portfolio repositioning as of September 30, 2019 would have resulted in

-7-

Table of Contents

brokerage commissions or other transaction costs of approximately $237,092 (0.09% of the assets of the Target Fund) and increased distributions of net capital gain and net investment income of approximately $1.99 per share.

The repositioning may result in the Target Fund selling securities in greater volumes or in a shorter period of time than it normally would, which may impact the market price received in such sales.

These transaction costs represent expenses of the Target Fund that will not be subject to the Target Fund’s expense cap and will be borne by the Target Fund and indirectly borne by the Target Fund’s shareholders. Capital gains from such portfolio sales may result in increased distributions of net capital gain and net investment income.

The above information is presented for informational purposes as of a specific point in time in the past. Actual market prices, capital gains and transaction costs will depend on market conditions at the time of sale and may vary significantly from the information shown, particularly in light of uncertainty regarding the economic and financial repercussions resulting from the COVID-19 public health crisis.

Comparison of Investment Objectives and Principal Investment Strategies, and Non-Fundamental Investment Policies

The investment objectives and principal investment strategies of the Target Fund and the Acquiring Fund are set forth in the table below. Each Fund’s investment objective and non-fundamental investment policies (including its principal and additional investment strategies) can be changed by the applicable Board of Trustees without shareholder approval. There is no assurance a Fund’s investment objective will be achieved.

The Target Fund’s investment policy with respect to 80% of its net assets may be changed by the Target Fund Board without shareholder approval as long as shareholders are given 60 days’ advance written notice of the change.

The Funds have substantially similar investment objectives and similar principal investment strategies; however, there are certain differences in the Funds’ principal investment strategies. Both Funds invest significantly in equity securities of foreign companies, including developed and emerging market issuers. However, the Target Fund may invest in equity securities of issuers of any market capitalization, whereas the Acquiring Fund focuses on common stock of small- and mid-sized companies with market capitalizations under $25 billion at the time of initial investment. Additionally, the Target Fund may invest in special situations whereas the Acquiring Fund does not have a stated policy regarding these investments. Allocations to different geographic regions are related to the different investment processes of the Target Fund’s and Acquiring Funds’ respective Investment Managers. The Funds do not concentrate in any industry, but may focus on different industry sectors.

-8-

Table of Contents

| Columbia Select International Equity Fund |

Columbia Acorn International Select | |||

| Investment Objective | The Fund seeks long-term capital growth. | The Fund seeks long-term capital appreciation. | ||

| Principal Investment Strategy | Under normal circumstances, the Fund invests at least 80% of its net assets (including the amount of any borrowings for investment purposes) in equity securities (including common stock, preferred stock, and depositary receipts) of established companies located in at least three countries other than the United States, including emerging market countries.

The Fund invests in companies that are believed to have the potential for growth. |

Under normal circumstances, the Fund invests at least 65% of its net assets in foreign companies in developed markets (for example, Japan, Canada and the United Kingdom). The Fund also may invest up to 35% of its total assets in companies in emerging markets (for example, China, India and Brazil). | ||

| Geographic Concentration | From time to time, the Fund may focus its investments in certain countries or geographic areas, including Europe and Japan. | The Fund generally invests in at least three countries other than the United States but may invest up to 25% of its total assets in securities of U.S. issuers. | ||

| Number of Holdings | The Fund typically employs a focused portfolio investing style, which results in fewer holdings than a fund that seeks to achieve its investment objective by investing in a greater number of issuers. | The Fund invests in a limited number of foreign companies (generally between 30 and 60), offering the potential to provide above-average growth over time. | ||

| Diversification | The Fund is diversified. | The Fund is diversified. | ||

| Market capitalization of holdings | The Fund may invest in equity securities of issuers of any market capitalization. | Under normal circumstances, the Fund (i) invests a majority of its net assets in the common stock of small- and mid-sized companies with market capitalizations under $25 billion at the time of initial investment (“Focus Stocks”) and (ii) may also invest in companies with market capitalizations above $25 billion, provided that immediately after that investment a majority of the Fund’s net assets would be invested in Focus Stocks. The Fund may continue to hold, and make additional investments in, Focus Stocks whose market capitalizations have grown to exceed $25 billion, regardless of whether the Fund’s investments in Focus Stocks are a majority of the Fund’s net assets. | ||

| Industry Concentration | The Fund may from time to time emphasize one or more sectors in selecting its investments, including the financial services sector and the industrials sector. | The Fund may from time to time emphasize one or more sectors in selecting its investments. | ||

| Special Situations | The Fund may invest in companies involved in initial public offerings, tender offers, mergers, other corporate restructurings and other special situations. | — |

-9-

Table of Contents

Additional Information About the Funds’ Principal Investment Strategies

Target Fund. The Target Fund’s investment sub-adviser, Threadneedle Ltd., chooses investments for the Fund by:

| • | Deploying an integrated approach to equity research that incorporates regional analyses, an international sector strategy, and stock specific perspectives; |

| • | Conducting detailed research on companies in a consistent, strategic and macroeconomic framework; |

| • | Looking for catalysts of change and identifying the factors driving markets, which will vary over economic and market cycles; and |

| • | Implementing rigorous risk control processes that seek to ensure that the risk and return characteristics of the Fund’s portfolio are consistent with established portfolio management parameters. |

A number of factors may prompt the portfolio management team to sell securities. A sale may result from a change in the composition of the Fund’s benchmark or a change in sector strategy. A sale may also be prompted by factors specific to a stock, such as valuation or company fundamentals.

Acquiring Fund. In pursuit of the Acquiring Fund’s investment objective, the portfolio managers will take advantage of the research and stock-picking capabilities of Columbia Wanger and will generally concentrate the Fund’s investments in those sectors, companies, geographic regions or industries that the portfolio managers believe offer the best investment return potential. Columbia Wanger typically seeks companies with:

| • | A strong business franchise that offers growth potential. |

| • | Products and services in which the company has a competitive advantage. |

| • | A stock price Columbia Wanger believes is reasonable relative to the assets and earning power of the company. |

Columbia Wanger may sell a portfolio holding if the security reaches Columbia Wanger’s price target, if the company has a deterioration of fundamentals, such as failing to meet key operating benchmarks, or if Columbia Wanger believes other securities are more attractive. Columbia Wanger also may sell a portfolio holding to fund redemptions.

Comparison of Fundamental Investment Policies

Each Fund has adopted certain fundamental and non-fundamental investment restrictions. The fundamental investment restrictions (i.e., those which may not be changed without shareholder approval) are listed below. Each Fund’s fundamental investment restrictions are substantially similar.

The fundamental investment restrictions cannot be changed without the consent of the holders of a majority of the outstanding shares of the applicable Fund. The term “majority of the outstanding shares” means the vote of (i) 67% or more of a Fund’s shares present at a meeting, if more than 50% of the outstanding shares of the Fund are present or represented by proxy, or (ii) more than 50% of a Fund’s outstanding shares, whichever is less.

| Columbia Select International Equity Fund |

Columbia Acorn International Select | |||

| Buy or sell real estate | The Fund may not purchase or sell real estate, except the Fund may purchase securities of issuers which deal or invest in real estate and may purchase securities which are secured by real estate or interests in real estate. | The Fund may not purchase and sell real estate or interests in real estate, although it may invest in marketable securities of enterprises which invest in real estate or interests in real estate. |

-10-

Table of Contents

| Columbia Select International Equity Fund |

Columbia Acorn International Select | |||

| Buy or sell commodities | The Fund may not purchase or sell commodities, except that the Fund may, to the extent consistent with its investment objective, invest in securities of companies that purchase or sell commodities or which invest in such programs, and purchase and sell options, forward contracts, futures contracts, and options on futures contracts. This limitation does not apply to foreign currency transactions, including, without limitation, forward currency contracts. | The Fund may not purchase and sell commodities or commodity contracts, except that it may enter into (a) futures and options on futures and (b) foreign currency contracts. | ||

| Issuer diversification | The Fund may not purchase securities (except securities issued or guaranteed by the U.S. government, its agencies or instrumentalities) of any one issuer if, as a result, more than 5% of its total assets will be invested in the securities of such issuer or it would own more than 10% of the voting securities of such issuer, except that: (i) up to 25% of its total assets may be invested without regard to these limitations; and (ii) a Fund’s assets may be invested in the securities of one or more management investment companies to the extent permitted by the 1940 Act, the rules and regulations thereunder, and any exemptive relief obtained by the Fund. | The Fund may not, with respect to 75% of the value of the Fund’s total assets, invest more than 5% of its total assets (valued at the time of investment) in securities of a single issuer, except securities issued or guaranteed by the government of the U.S., or any of its agencies or instrumentalities.

The Fund may not acquire securities of any one issuer which at the time of investment (a) represent more than 10% of the voting securities of the issuer or (b) have a value greater than 10% of the value of the outstanding securities of the issuer.

The Fund may not invest more than 25% of its total assets in a single issuer (other than U.S. government securities) | ||

| Concentrate in any one industry | The Fund may not purchase any securities which would cause 25% or more of the value of its total assets at the time of purchase to be invested in the securities of one or more issuers conducting their principal business activities in the same industry, provided that: (a) there is no limitation with respect to obligations issued or guaranteed by the U.S. government, any state or territory of the United States, or any of their agencies, instrumentalities or political subdivisions; and (b) notwithstanding this limitation or any other fundamental investment limitation, assets may be invested in the securities of one or more management investment companies to the extent permitted by the 1940 Act, the rules and regulations thereunder and any exemptive relief obtained by the Fund. | The Fund may not invest more than 25% of its total assets in the securities of companies in a single industry (excluding U.S. government securities). |

-11-

Table of Contents

| Columbia Select International Equity Fund |

Columbia Acorn International Select | |||

| Act as an underwriter | The Fund may not underwrite any issue of securities within the meaning of the 1933 Act except when it might technically be deemed to be an underwriter either: (i) in connection with the disposition of a portfolio security; or (ii) in connection with the purchase of securities directly from the issuer thereof in accordance with its investment objective. This restriction shall not limit the Fund’s ability to invest in securities issued by other registered management investment companies. | The Fund may not underwrite the distribution of securities of other issuers; however, the Fund may acquire “restricted” securities which, in the event of a resale, might be required to be registered under the Securities Act of 1933 on the ground that the Fund could be regarded as an underwriter as defined by that act with respect to such resale. | ||

| Lending | The Fund may not make loans, except to the extent permitted by the 1940 Act, the rules and regulations thereunder and any exemptive relief obtained by the Fund. | The Fund may not make loans, but this restriction shall not prevent the Fund from (a) investing in debt securities, (b) investing in repurchase agreements, or (c) lending its portfolio securities, provided that it may not lend securities if, as a result, the aggregate value of all securities loaned would exceed 33% of its total assets(taken at market value at the time of such loan). | ||

| Borrow money | The Fund may not borrow money except to the extent permitted by the 1940 Act, the rules and regulations thereunder and any exemptive relief obtained by the Fund. | The Fund may not borrow money except (a) from banks for temporary or emergency purposes in amounts not exceeding 33% of the value of the Fund’s total assets at the time of borrowing, and (b) in connection with transactions in options, futures and options on futures. | ||

| Issue senior securities | The Fund may not issue senior securities except to the extent permitted by the 1940 Act, the rules and regulations thereunder and any exemptive relief obtained by the Fund. | The Fund may not issue any senior security except to the extent permitted under the 1940 Act. | ||

| Margin purchases | — | The Fund may not make margin purchases of securities, except for use of such short-term credits as are needed for clearance of transactions and except in connection with transactions in options, futures and options on futures. |

The Acquiring Fund’s investment objectives, principal investment strategies, fundamental and non-fundamental investment policies and holdings may expose the Target Fund’s shareholders to new or increased risks. A comparison of the principal risks of investing in the Target Fund and the Acquiring Fund is provided under “Comparison of Principal Risks” below.

The principal risks associated with investments in the Acquiring Fund and the Target Fund are similar, except as described below. The Target Fund and the Acquiring Fund are generally subject to similar principal

-12-

Table of Contents

risks (given their substantially similar investment strategies). The Acquiring Fund is subject to the principal risks described in “Section C – Additional Information Applicable to the Acquiring Fund” below. The Target Fund is subject to each of those risks, though the Target Fund does not identify exposure to foreign currencies and developing countries as separate principal risks, as is the case with the Acquiring Fund. The Target Fund remains subject to these risks and they are covered as part of the broader risks associated with foreign securities investments. The actual risks of investing in each Fund depend on the securities held in each Fund’s portfolio and on market conditions, both of which change over time.

The following table provides a comparison of the types of principal investment risks associated with an investment in each Fund:

| Principal Investment Risks |

Columbia Select International Equity Fund |

Columbia Acorn International Select |

||||||

| Active Management Risk |

X | X | ||||||

| Depositary Receipts Risk |

X | — | ||||||

| Emerging Market Securities Risk |

X | X | ||||||

| Focused/Select Portfolio Risk |

X | X | ||||||

| Foreign Currency Risk |

X | X | ||||||

| Foreign Securities Risk |

X | X | ||||||

| Geographic Focus Risk |

X | X | ||||||

| Growth Securities Risk |

X | X | ||||||

| Issuer Risk |

X | X | ||||||

| Large-Cap Company Securities Risk |

— | X | ||||||

| Liquidity Risk |

X | — | ||||||

| Liquidity and Trading Volume Risk |

— | X | ||||||

| Market Risk |

X | X | ||||||

| Preferred Stock Risk |

X | — | ||||||

| Sector Risk |

X | X | ||||||

| Small- and Mid-Cap Company Securities Risk |

— | X | ||||||

| Special Situations Risk |

X | — | ||||||

Comparison of Management of the Funds

Columbia Threadneedle serves as the investment manager to the Target Fund and is responsible for overseeing the Target Fund’s sub-adviser, Threadneedle Ltd. who provides day-to-day portfolio management services to the Target Fund. Columbia Wanger serves as the investment manager to the Acquiring Fund. Columbia Threadneedle, Threadneedle Ltd. and Columbia Wanger are each direct or indirect wholly-owned subsidiaries of Ameriprise Financial, Inc. Both Funds obtain investment management services from their respective investment manager according to terms of advisory agreements that are substantially similar, except for the fee rate and certain differences related to the difference in investment manager and board of trustees. The table below shows the current contractual management fee schedule for each Fund. The effective management fee as of each Fund’s fiscal year end was 0.87% for the Target Fund and 0.89% for the Acquiring Fund. The Acquiring Fund’s management fee schedule will apply following completion of the Reorganization.

| Columbia Select International Equity Fund |

Columbia Acorn International Select |

|||||||||

| Assets |

Fee | Assets |

Fee | |||||||

| Up to $500 million |

0.870% | Up to $500 million |

0.890% | |||||||

| $500 million to $1 billion |

0.820% | $500 million and over |

0.850% | |||||||

| $1 billion to $1.5 billion |

0.770% | |||||||||

| $1.5 billion to $3 billion |

0.720% | |||||||||

| $3 billion to $6 billion |

0.700% | |||||||||

| $6 billion to $12 billion |

0.680% | |||||||||

| $12 billion and over |

0.670% | |||||||||

-13-

Table of Contents

Each Fund is governed by a board of trustees, which is responsible for overseeing the Fund. The Target Fund is overseen by the Board of Trustees Columbia Funds Series Trust and the Acquiring Fund is overseen by the Board of Trustees Columbia Acorn Trust. For a listing of the members of each Fund’s Board, please refer to the Fund’s Statement of Additional Information.

The Funds have different investment managers and different portfolio management teams. “Section C – Additional Information Applicable to the Acquiring Fund” below describes the employment history of the portfolio managers of the Acquiring Fund. The Statement of Additional Information of each Fund provides additional information about portfolio manager compensation, other accounts managed and ownership of each Fund’s shares.

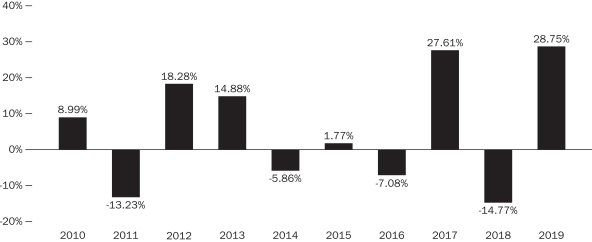

The following bar charts and tables show, respectively:

| • | how each Fund’s performance has varied for each full calendar year shown in the bar chart; and |

| • | how each Fund’s average annual total returns compare to certain measures of market performance shown in the table. |

The bar charts and tables show some of the risks of investing in the Funds. The bar chart shows how each Fund’s Class Inst share performance has varied for each full calendar year shown. If the sales charges were reflected, returns shown would be lower. The table below the bar chart compares each Fund’s returns for the periods shown with a broad measure of market performance and, for the Acquiring Fund, another measure of performance for a market in which the Fund may invest.

The performance of share classes launched subsequent to Class Inst shares shown in the table below includes a Fund’s Class Inst share returns (adjusted to reflect the related operating expenses of such classes, if higher) for periods prior to the indicated inception date of such share classes. Except for differences in fees and expenses, all share classes of a Fund would have substantially similar annual returns because all share classes of the Fund invest in the same portfolio of securities. Share classes with expenses that are higher than Class Inst shares will have lower performance.

The after-tax returns shown in the Average Annual Total Returns table below are calculated using the highest historical individual U.S. federal marginal income tax rates in effect during the period indicated in the table and do not reflect the impact of state, local or foreign taxes. Your actual after-tax returns will depend on your personal tax situation and may differ from those shown in the table. In addition, the after-tax returns shown in the table do not apply to shares held in tax-advantaged accounts such as 401(k) plans or IRAs. The after-tax returns are shown only for Class Inst shares and will vary for other share classes.

The Target Fund’s performance prior to May 2015 reflects returns achieved pursuant to different principal investment strategies. If the Fund’s current strategies had been in place for the prior periods, results shown may have been different.

-14-

Table of Contents

Columbia Select International Equity Fund

CLASS INST SHARE PERFORMANCE

(based on calendar years)

During the periods shown in the bar chart, the highest return for a calendar quarter was 19.27% (third quarter 2010) and the lowest return for a calendar quarter was (21.90)% (third quarter 2011).

Average Annual Total Returns After Applicable Sales Charges (for periods ended December 31, 2019)

| Share Class Inception Date |

1 year | 5 years | 10 years | |||||||||||||

| Class Inst |

12/02/1991 | |||||||||||||||

| returns before taxes |

28.75% | 5.78% | 4.82% | |||||||||||||

| returns after taxes on distributions |

28.43% | 5.55% | 4.66% | |||||||||||||

| returns after taxes on distributions and sale of Fund shares |

17.46% | 4.60% | 3.95% | |||||||||||||

| Class A returns before taxes |

06/03/1992 | 21.10% | 4.27% | 3.94% | ||||||||||||

| Class Adv returns before taxes |

11/08/2012 | 28.72% | 5.77% | 4.82% | ||||||||||||

| Class C returns before taxes |

06/17/1992 | 26.41% | 4.72% | 3.78% | ||||||||||||

| Class Inst2 returns before taxes |

11/08/2012 | 28.88% | 5.95% | 4.94% | ||||||||||||

| Class Inst3 returns before taxes |

03/07/2011 | 29.06% | 6.00% | 5.02% | ||||||||||||

| Class R returns before taxes |

01/23/2006 | 28.10% | 5.26% | 4.31% | ||||||||||||

| MSCI EAFE Index (Net) (reflects reinvested dividends net of withholding taxes but reflects no deductions for fees, expenses or other taxes ) |

22.01% | 5.67% | 5.50% | |||||||||||||

-15-

Table of Contents

Columbia Acorn International Select

CLASS INST SHARE PERFORMANCE

(based on calendar years)

During the periods shown in the bar chart, the highest return for a calendar quarter was 17.11% (third quarter 2010) and the lowest return for a calendar quarter was (15.84)% (fourth quarter 2018).

Average Annual Total Returns After Applicable Sales Charges (for periods ended December 31, 2019)

| Share Class Inception Date |

1 year | 5 years | 10 years | |||||||||||||

| Class Inst |

11/23/1998 | |||||||||||||||

| returns before taxes |

33.71% | 9.77% | 8.66% | |||||||||||||

| returns after taxes on distributions |

30.96% | 8.82% | 7.29% | |||||||||||||

| returns after taxes on distributions and sale of Fund shares |

22.02% | 7.69% | 6.86% | |||||||||||||

| Class A returns before taxes |

10/16/2000 | 25.70% | 8.20% | 7.70% | ||||||||||||

| Class Adv returns before taxes |

11/08/2012 | 33.73% | 9.77% | 8.65% | ||||||||||||

| Class C returns before taxes |

10/16/2000 | 31.31% | 8.66% | 7.51% | ||||||||||||

| Class Inst2 returns before taxes |

11/08/2012 | 33.82% | 9.86% | 8.71% | ||||||||||||

| Class Inst3 returns before taxes |

11/08/2012 | 33.90% | 9.91% | 8.75% | ||||||||||||

| MSCI ACWI ex USA Growth Index (Net) (reflects reinvested dividends net of withholding taxes but reflects no deductions for fees, expenses or other taxes) |

27.34% | 7.30% | 6.24% | |||||||||||||

| MSCI ACWI ex USA Index (Net) (reflects reinvested dividends net of withholding taxes but reflects no deductions for fees, expenses or other taxes) |

21.51% | 5.51% | 4.97% | |||||||||||||

-16-

Table of Contents

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of the Funds through a broker-dealer or other financial intermediary (such as a bank), the Funds and its related companies – including the Investment Managers, Distributor and Columbia Management Investment Services Corp. (the “Transfer Agent”) – may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your financial advisor to recommend the fund over another investment. These potential conflicts of interest may be heightened with respect to broker-dealers owned by Ameriprise Financial, Inc. and/or its affiliates. Ask your financial advisor or visit your financial intermediary’s website for more information.

-17-

Table of Contents

ADDITIONAL INFORMATION ABOUT THE REORGANIZATION

The Board of Trustees of each Fund has approved the Agreement. While shareholders are encouraged to review the Agreement, which has been filed with the SEC as an exhibit to the registration statement of which this Combined Proxy Statement/Prospectus is a part, the following is a summary of certain terms of the Agreement: