| Label |

Element |

Value |

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Registrant Name |

dei_EntityRegistrantName |

COLUMBIA ACORN TRUST

|

|

| Prospectus Date |

rr_ProspectusDate |

May 01, 2019

|

|

| Columbia Acorn International |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Risk/Return [Heading] |

rr_RiskReturnHeading |

SUMMARY OF THE FUND

|

|

| Objective [Heading] |

rr_ObjectiveHeading |

<b>Investment Objective </b>

|

|

| Objective, Primary [Text Block] |

rr_ObjectivePrimaryTextBlock |

Columbia Acorn International® (the Fund) seeks long-term capital appreciation.

|

|

| Expense [Heading] |

rr_ExpenseHeading |

<b>Fees and Expenses of the Fund </b>

|

|

| Expense Narrative [Text Block] |

rr_ExpenseNarrativeTextBlock |

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. An investor transacting in a class of Fund shares without any front-end sales charge, contingent deferred sales charge, or other asset-based fee for sales or distribution may be required to pay a commission to the financial intermediary for effecting such transactions. Such commission rates are set by the financial intermediary and are not reflected in the tables or the example below. You may qualify for sales charge discounts if you and members of your immediate family invest, or agree to invest in the future, at least $50,000 in certain classes of shares of eligible funds distributed by Columbia Management Investment Distributors, Inc. (the Distributor). More information is available about these and other sales charge discounts and waivers from your financial intermediary, and can be found in the Choosing a Share Class section beginning on page 24 of the Fund’s prospectus, in Appendix A to the prospectus beginning on page A-1 and in Appendix S to the Statement of Additional Information (SAI) under Sales Charge Waivers beginning on page S-1.

|

|

| Shareholder Fees Caption [Text] |

rr_ShareholderFeesCaption |

<b>Shareholder Fees (fees paid directly from your investment) </b>

|

|

| Operating Expenses Caption [Text] |

rr_OperatingExpensesCaption |

<b>Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) </b>

|

|

| Fee Waiver or Reimbursement over Assets, Date of Termination |

rr_FeeWaiverOrReimbursementOverAssetsDateOfTermination |

April 30, 2020

|

|

| Portfolio Turnover [Heading] |

rr_PortfolioTurnoverHeading |

<b>Portfolio Turnover </b>

|

|

| Portfolio Turnover [Text Block] |

rr_PortfolioTurnoverTextBlock |

The Fund may pay transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 32% of the average value of its portfolio.

|

|

| Portfolio Turnover, Rate |

rr_PortfolioTurnoverRate |

32.00%

|

|

| Expense Breakpoint Discounts [Text] |

rr_ExpenseBreakpointDiscounts |

You may qualify for sales charge discounts if you and members of your immediate family invest, or agree to invest in the future, at least $50,000 in certain classes of shares of eligible funds distributed by Columbia Management Investment Distributors, Inc. (the Distributor). More information is available about these and other sales charge discounts and waivers from your financial intermediary, and can be found in the Choosing a Share Class section beginning on page 24 of the Fund’s prospectus, in Appendix A to the prospectus beginning on page A-1 and in Appendix S to the Statement of Additional Information (SAI) under Sales Charge Waivers beginning on page S-1.

|

|

| Expense Breakpoint, Minimum Investment Required [Amount] |

rr_ExpenseBreakpointMinimumInvestmentRequiredAmount |

$ 50,000

|

|

| Expenses Restated to Reflect Current [Text] |

rr_ExpensesRestatedToReflectCurrent |

Other expenses have been restated to reflect current transfer agency fees paid by the Fund.

|

|

| Expenses Not Correlated to Ratio Due to Acquired Fund Fees [Text] |

rr_ExpensesNotCorrelatedToRatioDueToAcquiredFundFees |

“Total annual Fund operating expenses” include acquired fund fees and expenses (expenses the Fund incurs indirectly through its investments in other investment companies) and may be higher than the ratio of expenses to average net assets shown in the Financial Highlights section of this prospectus because the ratio of expenses to average net assets does not include acquired fund fees and expenses.

|

|

| Expense Example [Heading] |

rr_ExpenseExampleHeading |

<b>Example </b>

|

|

| Expense Example Narrative [Text Block] |

rr_ExpenseExampleNarrativeTextBlock |

The following example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example illustrates the hypothetical expenses that you would incur over the time periods indicated, and assumes that:- you invest $10,000 in the applicable class of Fund shares for the periods indicated,

- your investment has a 5% return each year, and

- the Fund’s total annual operating expenses remain the same as shown in the Annual Fund Operating Expenses table above.

Since the waivers and/or reimbursements shown in the Annual Fund Operating Expenses table above expire as indicated in the preceding table, they are only reflected in the 1 year example and the first year of the other examples. Although your actual costs may be higher or lower, based on the assumptions listed above, your costs would be:

|

|

| Strategy [Heading] |

rr_StrategyHeading |

<b>Principal Investment Strategies </b>

|

|

| Strategy Narrative [Text Block] |

rr_StrategyNarrativeTextBlock |

Under normal circumstances, the Fund invests at least 75% of its net assets in foreign companies in developed markets (for example, Japan, Canada and the United Kingdom) and in emerging markets (for example, China, India and Brazil).

Under normal circumstances, the Fund (i) invests a majority of its net assets in the common stock of small- and mid-sized companies with market capitalizations under $10 billion at the time of initial investment (“Focus Stocks”) and (ii) may also invest in companies with market capitalizations above $10 billion, provided that immediately after that investment a majority of the Fund’s net assets would be invested in Focus Stocks. The Fund may continue to hold, and make additional investments in, Focus Stocks whose market capitalizations have grown to exceed $10 billion, regardless of whether the Fund’s investments in Focus Stocks are a majority of the Fund’s net assets. The Fund may from time to time emphasize one or more sectors in selecting its investments.

Columbia Wanger Asset Management, LLC, the Fund's investment adviser (the Investment Manager), believes that stocks of small- and mid-sized companies, which generally are not as well known by financial analysts as larger companies, may offer higher return potential than stocks of larger companies. The Fund also may invest in larger-sized companies.

The Investment Manager typically seeks companies with:- A strong business franchise that offers growth potential.

- Products and services in which the company has a competitive advantage.

- A stock price the Investment Manager believes is reasonable relative to the assets and earning power of the company.

The Investment Manager may sell a portfolio holding if the security reaches the Investment Manager's price target, if the company has a deterioration of fundamentals, such as failing to meet key operating benchmarks, or if the Investment Manager believes other securities are more attractive. The Investment Manager also may sell a portfolio holding to fund redemptions.

|

|

| Risk [Heading] |

rr_RiskHeading |

<b>Principal Risks </b>

|

|

| Risk Narrative [Text Block] |

rr_RiskNarrativeTextBlock |

An investment in the Fund involves risks, including those described below. There is no assurance that the Fund will achieve its investment objective and you may lose money. The value of the Fund’s holdings may decline, and the Fund’s net asset value (NAV) and share price may go down. An investment in the Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

Active Management Risk. The Investment Manager’s active management of the Fund could cause the Fund to underperform its benchmark index and/or other funds with similar investment objectives and/or strategies.

Small- and Mid-Cap Company Securities Risk. Investments in small- and mid-cap companies often involve greater risks than investments in larger, more established companies because small- and mid-cap companies tend to have less predictable earnings and may lack the management experience, financial resources, product diversification and competitive strengths of larger companies. Securities of small- and mid-cap companies may be less liquid and more volatile than the securities of larger companies.

Market Risk. The market values of securities or other investments that the Fund holds will fall, sometimes rapidly or unpredictably, or fail to rise. An investment in the Fund could lose money over short or long periods.

Foreign Securities Risk. Investments in or exposure to foreign securities involve certain risks not associated with investments in or exposure to securities of U.S. companies. Foreign securities subject the Fund to the risks associated with investing in the particular country of an issuer, including political, regulatory, economic, social, diplomatic and other conditions or events (including, for example, military confrontations, war and terrorism), occurring in the country or region, as well as risks associated with less developed custody and settlement practices. Foreign securities may be more volatile and less liquid than securities of U.S. companies, and are subject to the risks associated with potential imposition of economic and other sanctions against a particular foreign country, its nationals or industries or businesses within the country. In addition, foreign governments may impose withholding or other taxes on the Fund’s income, capital gains or proceeds from the disposition of foreign securities, which could reduce the Fund’s return on such securities.

Operational and Settlement Risks of Foreign Securities. The Fund’s foreign securities are generally held outside the United States in the primary market for the securities in the custody of foreign sub-custodians. Some countries have limited governmental oversight and regulation, which increases the risk of corruption and fraud and the possibility of losses to the Fund. In particular, under certain circumstances, foreign securities may settle on a delayed delivery basis, meaning that the Fund may be required to make payment for securities before the Fund has actually received delivery of the securities or deliver securities prior to the receipt of payment. As a result, there is a risk that the security will not be delivered to the Fund or that payment will not be received. Losses can also result from lost, stolen or counterfeit securities; defaults by brokers and banks; failures or defects of the settlement system; or poor and improper record keeping by registrars and issuers.

Share Blocking. In certain non-U.S. markets, an issuer’s securities are blocked from trading for a specified number of days before and, in certain instances, after a shareholder meeting. The blocking period can last up to several weeks. Share blocking may prevent the Fund from buying or selling securities during this period. As a consequence of these restrictions, the Investment Manager, on behalf of the Fund, may abstain from voting proxies in markets that require share blocking.

Emerging Market Securities Risk. Securities issued by foreign governments or companies in emerging market countries, such as China, Russia and certain countries in Eastern Europe, the Middle East, Asia, Latin America or Africa, are more likely to have greater exposure to the risks of investing in foreign securities that are described in Foreign Securities Risk. In addition, emerging market countries are more likely to experience instability resulting, for example, from rapid changes or developments in social, political, economic or other conditions. Their economies are usually less mature and their securities markets are typically less developed with more limited trading activity (i.e., lower trading volumes and less liquidity) than more developed countries. Emerging market securities tend to be more volatile than securities in more developed markets. Many emerging market countries are heavily dependent on international trade and have fewer trading partners, which makes them more sensitive to world commodity prices and economic downturns in other countries, and some have a higher risk of currency devaluations.

Operational and Settlement Risks of Securities in Emerging Markets. Foreign sub-custodians in emerging markets may be recently organized, lack extensive operating experience or lack effective government oversight or regulation. In addition, there may be legal restrictions or limitations on the ability of the Fund to recover assets held in custody by a foreign sub-custodian in the event of the bankruptcy of the sub-custodian. There may also be a greater risk that settlement may be delayed and that cash or securities of the Fund may be lost because of failures of or defects in the system, including fraud or corruption. Settlement systems in emerging markets also have a higher risk of failed trades.

Risks Related to Currencies and Corporate Actions in Emerging Markets. Risks related to currencies and corporate actions are also greater in emerging market countries than in developed countries. Emerging market currencies may not have an active trading market and are subject to a higher risk of currency devaluations.

Risks Related to Corporate and Securities Laws in Emerging Markets. Securities laws in emerging markets may be relatively new and unsettled and, consequently, there is a risk of rapid and unpredictable change in laws regarding foreign investment, securities regulation, title to securities and shareholder rights.

Liquidity and Trading Volume Risk. Due to market conditions, including uncertainty regarding the price of a security, it may be difficult for the Fund to buy or sell portfolio securities at a desirable time or price, which could result in investment losses. This risk of portfolio illiquidity is heightened with respect to small- and mid-cap securities, generally, and foreign small- and mid-cap securities in particular. The Fund may have to lower the selling price, liquidate other investments, or forego another, more appealing investment opportunity as a result of illiquidity in the markets. The Fund may also be limited in its ability to execute favorable trades in portfolio securities in response to changes in share prices and fundamentals, and may be forced to dispose of securities under disadvantageous circumstances and at a loss. As the Fund grows in size or, conversely, if it faces significant redemption pressure, these considerations take on increasing significance and may adversely impact performance.

Sector Risk. At times, the Fund may have a significant portion of its assets invested in securities of companies conducting business within one or more economic sectors. Companies in the same sector may be similarly affected by economic, regulatory, political or market events or conditions, which may make the Fund more vulnerable to unfavorable developments in that sector than funds that invest more broadly. Generally, the more the Fund diversifies its investments, the more it spreads risk and potentially reduces the risks of loss and volatility.

Industrials Sector. The Fund may be more susceptible to the particular risks that may affect companies in the industrials sector than if it were invested in a wider variety of companies in unrelated sectors. Companies in the industrials sector are subject to certain risks, including changes in supply and demand for their specific product or service and for industrial sector products in general, including decline in demand for such products due to rapid technological developments and frequent new product introduction. Performance of such companies may be affected by factors including government regulation, world events and economic conditions and risks for environmental damage and product liability claims.

Foreign Currency Risk. The performance of the Fund may be materially affected positively or negatively by foreign currency strength or weakness relative to the U.S. dollar, particularly if the Fund invests a significant percentage of its assets in foreign securities or other assets denominated in currencies other than the U.S. dollar.

Issuer Risk. An issuer in which the Fund invests may perform poorly, and the value of its securities may therefore decline, which may negatively affect the Fund’s performance. Underperformance may be caused by poor management decisions, competitive pressures, breakthroughs in technology, reliance on suppliers, labor problems or shortages, corporate restructurings, fraudulent disclosures, natural disasters or other events, conditions or factors.

Geographic Focus Risk. The Fund may be particularly susceptible to economic, political, regulatory or other events or conditions affecting issuers and countries within the specific geographic regions in which the Fund invests. The Fund’s NAV may be more volatile than the NAV of a more geographically diversified fund.

Asia Pacific Region. Many of the countries in the Asia Pacific region are considered underdeveloped or developing, including from a political, economic and/or social perspective, and may have relatively unstable governments and economies based on limited business, industries and/or natural resources or commodities. Events in any one country within the region may impact other countries in the region or the region as a whole. As a result, events in the region will generally have a greater effect on the Fund than if the Fund were more geographically diversified. This could result in increased volatility in the value of the Fund’s investments and losses for the Fund. Also, securities of some companies in the region can be less liquid than U.S. or other foreign securities, potentially making it difficult for the Fund to sell such securities at a desirable time and price.

Europe. The Fund is particularly susceptible to economic, political, regulatory or other events or conditions affecting issuers and countries in Europe. In addition, the private and public sectors’ debt problems of a single European Union (EU) country can pose significant economic risks to the EU as a whole. As a result, the Fund’s NAV may be more volatile than the NAV of a more geographically diversified fund. If securities of issuers in Europe fall out of favor, it may cause the Fund to underperform other funds that do not focus their investments in this region of the world. The United Kingdom (UK) was scheduled to give notice of its plans to leave the EU (commonly known as "Brexit") effective March 30, 2019, but that deadline was extended by the EU while the British Parliament considers ratification of the withdrawal agreement, and the future and full impact of Brexit remain uncertain. During this period and beyond, the impact of any partial or complete dissolution of the EU on the UK and European economies and the broader global economy could be significant, resulting in negative impacts on currency and financial markets generally, such as increased volatility and illiquidity, and potentially lower economic growth in markets in Europe, which may adversely affect the value of your investment in the Fund.

Growth Securities Risk. Growth securities typically trade at a higher multiple of earnings than other types of equity securities. Accordingly, the market values of growth securities may never reach their expected market value and may decline in price. In addition, growth securities, at times, may not perform as well as value securities or the stock market in general, and may be out of favor with investors for varying periods of time.

|

|

| Risk Lose Money [Text] |

rr_RiskLoseMoney |

There is no assurance that the Fund will achieve its investment objective and you may lose money.

|

|

| Risk Not Insured Depository Institution [Text] |

rr_RiskNotInsuredDepositoryInstitution |

An investment in the Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

|

|

| Bar Chart and Performance Table [Heading] |

rr_BarChartAndPerformanceTableHeading |

<b>Performance Information </b>

|

|

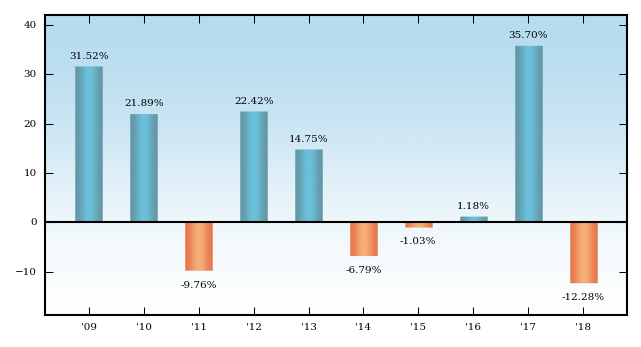

| Performance Narrative [Text Block] |

rr_PerformanceNarrativeTextBlock |

The following bar chart and table show you how the Fund has performed in the past, and can help you understand the risks of investing in the Fund. The bar chart shows how the Fund’s Class Inst share performance has varied for each full calendar year shown. The table below the bar chart compares the Fund’s returns for the periods shown with those of the MSCI ACWI ex USA SMID Cap Growth Index (Net), the Fund's primary benchmark, and those of the MSCI ACWI ex USA SMID Cap Index (Net), the Fund's secondary benchmark. The MSCI ACWI ex USA SMID Cap Growth Index (Net) captures mid- and small-cap securities exhibiting overall growth style characteristics across 22 developed markets countries and 24 emerging markets countries. The MSCI ACWI ex USA SMID Cap Index (Net) captures mid- and small-cap representation across 22 of 23 developed markets countries (excluding the United States) and 24 emerging market countries. As of March 31, 2019, the MSCI ACWI ex USA SMID Cap Index (Net) had 5,063 constituents and covered approximately 28% of the free float-adjusted market capitalization in each country. Effective May 1, 2019, the MSCI ACWI ex USA SMID Cap Growth Index (Net) became the Fund’s primary benchmark; prior to May 1, 2019, this index was the Fund’s secondary benchmark. Also effective May 1, 2019, the MSCI ACWI ex USA SMID Cap Index (Net) became the Fund’s secondary benchmark; prior to May 1, 2019 this index was the Fund’s primary benchmark. The Investment Manager switched the Fund’s primary and secondary benchmarks because the Investment Manager believes that the Fund’s portfolio more closely aligns with the MSCI ACWI ex USA SMID Cap Growth Index (Net). The Investment Manager believes that the MSCI ACWI ex USA SMID Cap Index (Net) continues to provide a meaningful additional basis for comparing the Fund's performance because the Fund’s portfolio will generally be closely aligned with the index from an investment style perspective.

The performance of one or more share classes shown in the Average Annual Total Returns table below includes the Fund’s Class Inst share returns (adjusted to reflect the higher class-related operating expenses of such classes, where applicable) for periods prior to the indicated inception date of such share classes. Except for differences in fees and expenses, all share classes of the Fund would have substantially similar annual returns because all share classes of the Fund invest in the same portfolio of securities.

The after-tax returns shown in the Average Annual Total Returns table below are calculated using the highest historical individual U.S. federal marginal income tax rates in effect during the period indicated in the table and do not reflect the impact of state, local or foreign taxes. Your actual after-tax returns will depend on your personal tax situation and may differ from those shown in the table. In addition, the after-tax returns shown in the table do not apply to shares held in tax-advantaged accounts such as 401(k) plans or Individual Retirement Accounts (IRAs). The after-tax returns are shown only for Class Inst shares and will vary for other share classes. Returns after taxes on distributions and sale of Fund shares are higher than before-tax returns for certain periods shown because they reflect the tax benefit of capital losses realized on the redemption of Fund shares.

The Fund’s past performance (before and after taxes) is no guarantee of how the Fund will perform in the future. Updated performance information can be obtained by calling toll-free 800.345.6611 or visiting columbiathreadneedleus.com.

|

|

| Performance Information Illustrates Variability of Returns [Text] |

rr_PerformanceInformationIllustratesVariabilityOfReturns |

The following bar chart and table show you how the Fund has performed in the past, and can help you understand the risks of investing in the Fund. The bar chart shows how the Fund’s Class Inst share performance has varied for each full calendar year shown. The table below the bar chart compares the Fund’s returns for the periods shown with those of the MSCI ACWI ex USA SMID Cap Growth Index (Net), the Fund's primary benchmark, and those of the MSCI ACWI ex USA SMID Cap Index (Net), the Fund's secondary benchmark.

|

|

| Performance Availability Phone [Text] |

rr_PerformanceAvailabilityPhone |

800.345.6611

|

|

| Performance Availability Website Address [Text] |

rr_PerformanceAvailabilityWebSiteAddress |

columbiathreadneedleus.com

|

|

| Performance Past Does Not Indicate Future [Text] |

rr_PerformancePastDoesNotIndicateFuture |

<b>The Fund’s past performance (before and after taxes) is no guarantee of how the Fund will perform in the future.</b>

|

|

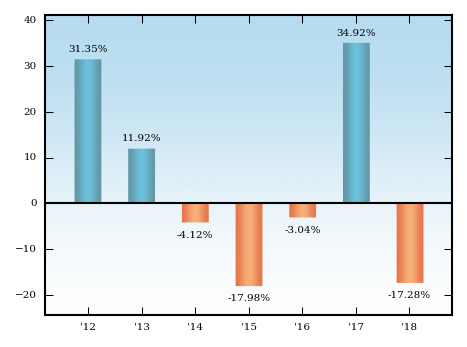

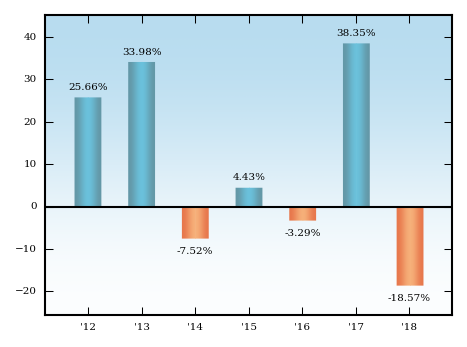

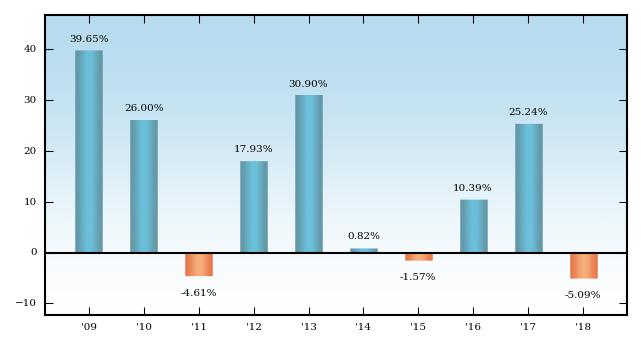

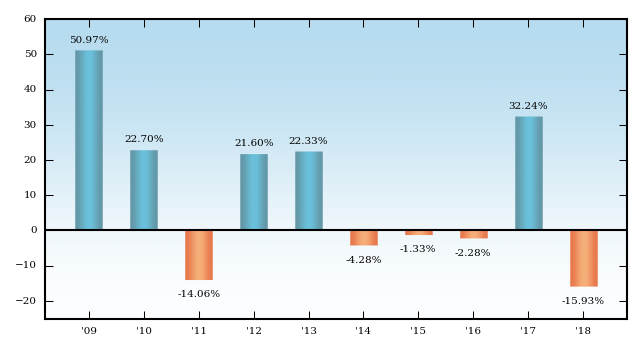

| Bar Chart [Heading] |

rr_BarChartHeading |

<b>Year by Year Total Return (%)<br/> as of December 31 Each Year</b>

|

|

| Bar Chart Closing [Text Block] |

rr_BarChartClosingTextBlock |

Best and Worst Quarterly Returns

During the Period Shown in the Bar Chart

Best 2nd Quarter 2009 33.30%

Worst 3rd Quarter 2011 -18.23%

|

|

| Performance Table Heading |

rr_PerformanceTableHeading |

<b>Average Annual Total Returns After Applicable Sales Charges (for periods ended December 31, 2018)</b>

|

|

| Performance Table Market Index Changed |

rr_PerformanceTableMarketIndexChanged |

Effective May 1, 2019, the MSCI ACWI ex USA SMID Cap Growth Index (Net) became the Fund’s primary benchmark; prior to May 1, 2019, this index was the Fund’s secondary benchmark. Also effective May 1, 2019, the MSCI ACWI ex USA SMID Cap Index (Net) became the Fund’s secondary benchmark; prior to May 1, 2019 this index was the Fund’s primary benchmark. The Investment Manager switched the Fund’s primary and secondary benchmarks because the Investment Manager believes that the Fund’s portfolio more closely aligns with the MSCI ACWI ex USA SMID Cap Growth Index (Net). The Investment Manager believes that the MSCI ACWI ex USA SMID Cap Index (Net) continues to provide a meaningful additional basis for comparing the Fund's performance because the Fund’s portfolio will generally be closely aligned with the index from an investment style perspective.

|

|

| Performance Table Uses Highest Federal Rate |

rr_PerformanceTableUsesHighestFederalRate |

The after-tax returns shown in the Average Annual Total Returns table below are calculated using the highest historical individual U.S. federal marginal income tax rates in effect during the period indicated in the table and do not reflect the impact of state, local or foreign taxes.

|

|

| Performance Table Not Relevant to Tax Deferred |

rr_PerformanceTableNotRelevantToTaxDeferred |

In addition, the after-tax returns shown in the table do not apply to shares held in tax-advantaged accounts such as 401(k) plans or Individual Retirement Accounts (IRAs).

|

|

| Performance Table One Class of after Tax Shown [Text] |

rr_PerformanceTableOneClassOfAfterTaxShown |

The after-tax returns are shown only for Class Inst shares and will vary for other share classes.

|

|

| Performance Table Explanation after Tax Higher |

rr_PerformanceTableExplanationAfterTaxHigher |

Returns after taxes on distributions and sale of Fund shares are higher than before-tax returns for certain periods shown because they reflect the tax benefit of capital losses realized on the redemption of Fund shares.

|

|

| Columbia Acorn International | Class A |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum sales charge (load) imposed on purchases (as a % of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

5.75%

|

|

| Maximum deferred sales charge (load) imposed on redemptions (as a % of the lower of the original purchase price or current net asset value) |

rr_MaximumDeferredSalesChargeOverOther |

1.00%

|

[1] |

| Management fees |

rr_ManagementFeesOverAssets |

0.77%

|

|

| Distribution and/or service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

0.25%

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.23%

|

[2] |

| Acquired fund fees and expenses |

rr_AcquiredFundFeesAndExpensesOverAssets |

0.01%

|

|

| Total annual Fund operating expenses |

rr_ExpensesOverAssets |

1.26%

|

[3] |

| Less: Fee waivers and/or expense reimbursements |

rr_FeeWaiverOrReimbursementOverAssets |

(0.02%)

|

[4] |

| Total annual Fund operating expenses after fee waivers and/or expense reimbursements |

rr_NetExpensesOverAssets |

1.24%

|

|

| Expenses Deferred Charges [Text Block] |

rr_ExpensesDeferredChargesTextBlock |

This charge is imposed on certain investments of between $1 million and $50 million redeemed within 18 months after purchase, as follows: 1.00% if redeemed within 12 months after purchase, and 0.50% if redeemed more than 12, but less than 18, months after purchase, with certain limited exceptions.

|

|

| 1 year |

rr_ExpenseExampleYear01 |

$ 694

|

|

| 3 years |

rr_ExpenseExampleYear03 |

950

|

|

| 5 years |

rr_ExpenseExampleYear05 |

1,225

|

|

| 10 years |

rr_ExpenseExampleYear10 |

2,008

|

|

| 1 year |

rr_ExpenseExampleNoRedemptionYear01 |

694

|

|

| 3 years |

rr_ExpenseExampleNoRedemptionYear03 |

950

|

|

| 5 years |

rr_ExpenseExampleNoRedemptionYear05 |

1,225

|

|

| 10 years |

rr_ExpenseExampleNoRedemptionYear10 |

$ 2,008

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

(20.96%)

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

(0.92%)

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

8.31%

|

|

| Share Class Inception Date |

rr_AverageAnnualReturnInceptionDate |

Oct. 16, 2000

|

|

| Columbia Acorn International | Class Adv |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum sales charge (load) imposed on purchases (as a % of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) imposed on redemptions (as a % of the lower of the original purchase price or current net asset value) |

rr_MaximumDeferredSalesChargeOverOther |

none

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.77%

|

|

| Distribution and/or service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

none

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.23%

|

[2] |

| Acquired fund fees and expenses |

rr_AcquiredFundFeesAndExpensesOverAssets |

0.01%

|

|

| Total annual Fund operating expenses |

rr_ExpensesOverAssets |

1.01%

|

[3] |

| Less: Fee waivers and/or expense reimbursements |

rr_FeeWaiverOrReimbursementOverAssets |

(0.02%)

|

[4] |

| Total annual Fund operating expenses after fee waivers and/or expense reimbursements |

rr_NetExpensesOverAssets |

0.99%

|

|

| 1 year |

rr_ExpenseExampleYear01 |

$ 101

|

|

| 3 years |

rr_ExpenseExampleYear03 |

320

|

|

| 5 years |

rr_ExpenseExampleYear05 |

556

|

|

| 10 years |

rr_ExpenseExampleYear10 |

1,234

|

|

| 1 year |

rr_ExpenseExampleNoRedemptionYear01 |

101

|

|

| 3 years |

rr_ExpenseExampleNoRedemptionYear03 |

320

|

|

| 5 years |

rr_ExpenseExampleNoRedemptionYear05 |

556

|

|

| 10 years |

rr_ExpenseExampleNoRedemptionYear10 |

$ 1,234

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

(15.90%)

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

0.47%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

9.26%

|

|

| Share Class Inception Date |

rr_AverageAnnualReturnInceptionDate |

Nov. 08, 2012

|

|

| Columbia Acorn International | Class C |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum sales charge (load) imposed on purchases (as a % of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) imposed on redemptions (as a % of the lower of the original purchase price or current net asset value) |

rr_MaximumDeferredSalesChargeOverOther |

1.00%

|

[5] |

| Management fees |

rr_ManagementFeesOverAssets |

0.77%

|

|

| Distribution and/or service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

1.00%

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.23%

|

[2] |

| Acquired fund fees and expenses |

rr_AcquiredFundFeesAndExpensesOverAssets |

0.01%

|

|

| Total annual Fund operating expenses |

rr_ExpensesOverAssets |

2.01%

|

[3] |

| Less: Fee waivers and/or expense reimbursements |

rr_FeeWaiverOrReimbursementOverAssets |

(0.02%)

|

[4] |

| Total annual Fund operating expenses after fee waivers and/or expense reimbursements |

rr_NetExpensesOverAssets |

1.99%

|

|

| Expenses Deferred Charges [Text Block] |

rr_ExpensesDeferredChargesTextBlock |

This charge applies to redemptions within 12 months after purchase, with certain limited exceptions.

|

|

| 1 year |

rr_ExpenseExampleYear01 |

$ 302

|

|

| 3 years |

rr_ExpenseExampleYear03 |

629

|

|

| 5 years |

rr_ExpenseExampleYear05 |

1,081

|

|

| 10 years |

rr_ExpenseExampleYear10 |

2,336

|

|

| 1 year |

rr_ExpenseExampleNoRedemptionYear01 |

202

|

|

| 3 years |

rr_ExpenseExampleNoRedemptionYear03 |

629

|

|

| 5 years |

rr_ExpenseExampleNoRedemptionYear05 |

1,081

|

|

| 10 years |

rr_ExpenseExampleNoRedemptionYear10 |

$ 2,336

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

(17.38%)

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

(0.49%)

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

8.13%

|

|

| Share Class Inception Date |

rr_AverageAnnualReturnInceptionDate |

Oct. 16, 2000

|

|

| Columbia Acorn International | Class Inst |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum sales charge (load) imposed on purchases (as a % of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) imposed on redemptions (as a % of the lower of the original purchase price or current net asset value) |

rr_MaximumDeferredSalesChargeOverOther |

none

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.77%

|

|

| Distribution and/or service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

none

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.23%

|

[2] |

| Acquired fund fees and expenses |

rr_AcquiredFundFeesAndExpensesOverAssets |

0.01%

|

|

| Total annual Fund operating expenses |

rr_ExpensesOverAssets |

1.01%

|

[3] |

| Less: Fee waivers and/or expense reimbursements |

rr_FeeWaiverOrReimbursementOverAssets |

(0.02%)

|

[4] |

| Total annual Fund operating expenses after fee waivers and/or expense reimbursements |

rr_NetExpensesOverAssets |

0.99%

|

|

| 1 year |

rr_ExpenseExampleYear01 |

$ 101

|

|

| 3 years |

rr_ExpenseExampleYear03 |

320

|

|

| 5 years |

rr_ExpenseExampleYear05 |

556

|

|

| 10 years |

rr_ExpenseExampleYear10 |

1,234

|

|

| 1 year |

rr_ExpenseExampleNoRedemptionYear01 |

101

|

|

| 3 years |

rr_ExpenseExampleNoRedemptionYear03 |

320

|

|

| 5 years |

rr_ExpenseExampleNoRedemptionYear05 |

556

|

|

| 10 years |

rr_ExpenseExampleNoRedemptionYear10 |

$ 1,234

|

|

| 2009 |

rr_AnnualReturn2009 |

50.97%

|

[6] |

| 2010 |

rr_AnnualReturn2010 |

22.70%

|

[6] |

| 2011 |

rr_AnnualReturn2011 |

(14.06%)

|

[6] |

| 2012 |

rr_AnnualReturn2012 |

21.60%

|

[6] |

| 2013 |

rr_AnnualReturn2013 |

22.33%

|

[6] |

| 2014 |

rr_AnnualReturn2014 |

(4.28%)

|

[6] |

| 2015 |

rr_AnnualReturn2015 |

(1.33%)

|

[6] |

| 2016 |

rr_AnnualReturn2016 |

(2.28%)

|

[6] |

| 2017 |

rr_AnnualReturn2017 |

32.24%

|

[6] |

| 2018 |

rr_AnnualReturn2018 |

(15.93%)

|

[6] |

| Year to Date Return, Label |

rr_YearToDateReturnLabel |

Year to Date return

|

|

| Bar Chart, Year to Date Return, Date |

rr_BarChartYearToDateReturnDate |

Mar. 31, 2019

|

|

| Bar Chart, Year to Date Return |

rr_BarChartYearToDateReturn |

12.50%

|

|

| Highest Quarterly Return, Label |

rr_HighestQuarterlyReturnLabel |

Best

|

|

| Highest Quarterly Return, Date |

rr_BarChartHighestQuarterlyReturnDate |

Jun. 30, 2009

|

|

| Highest Quarterly Return |

rr_BarChartHighestQuarterlyReturn |

33.30%

|

|

| Lowest Quarterly Return, Label |

rr_LowestQuarterlyReturnLabel |

Worst

|

|

| Lowest Quarterly Return, Date |

rr_BarChartLowestQuarterlyReturnDate |

Sep. 30, 2011

|

|

| Lowest Quarterly Return |

rr_BarChartLowestQuarterlyReturn |

(18.23%)

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

(15.93%)

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

0.52%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

9.28%

|

|

| Share Class Inception Date |

rr_AverageAnnualReturnInceptionDate |

Sep. 23, 1992

|

|

| Columbia Acorn International | Class Inst2 |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum sales charge (load) imposed on purchases (as a % of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) imposed on redemptions (as a % of the lower of the original purchase price or current net asset value) |

rr_MaximumDeferredSalesChargeOverOther |

none

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.77%

|

|

| Distribution and/or service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

none

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.16%

|

[2] |

| Acquired fund fees and expenses |

rr_AcquiredFundFeesAndExpensesOverAssets |

0.01%

|

|

| Total annual Fund operating expenses |

rr_ExpensesOverAssets |

0.94%

|

[3] |

| Less: Fee waivers and/or expense reimbursements |

rr_FeeWaiverOrReimbursementOverAssets |

(0.02%)

|

[4] |

| Total annual Fund operating expenses after fee waivers and/or expense reimbursements |

rr_NetExpensesOverAssets |

0.92%

|

|

| 1 year |

rr_ExpenseExampleYear01 |

$ 94

|

|

| 3 years |

rr_ExpenseExampleYear03 |

298

|

|

| 5 years |

rr_ExpenseExampleYear05 |

518

|

|

| 10 years |

rr_ExpenseExampleYear10 |

1,153

|

|

| 1 year |

rr_ExpenseExampleNoRedemptionYear01 |

94

|

|

| 3 years |

rr_ExpenseExampleNoRedemptionYear03 |

298

|

|

| 5 years |

rr_ExpenseExampleNoRedemptionYear05 |

518

|

|

| 10 years |

rr_ExpenseExampleNoRedemptionYear10 |

$ 1,153

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

(15.85%)

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

0.57%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

9.31%

|

|

| Share Class Inception Date |

rr_AverageAnnualReturnInceptionDate |

Aug. 02, 2011

|

|

| Columbia Acorn International | Class Inst3 |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum sales charge (load) imposed on purchases (as a % of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) imposed on redemptions (as a % of the lower of the original purchase price or current net asset value) |

rr_MaximumDeferredSalesChargeOverOther |

none

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.77%

|

|

| Distribution and/or service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

none

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.12%

|

[2] |

| Acquired fund fees and expenses |

rr_AcquiredFundFeesAndExpensesOverAssets |

0.01%

|

|

| Total annual Fund operating expenses |

rr_ExpensesOverAssets |

0.90%

|

[3] |

| Less: Fee waivers and/or expense reimbursements |

rr_FeeWaiverOrReimbursementOverAssets |

(0.02%)

|

[4] |

| Total annual Fund operating expenses after fee waivers and/or expense reimbursements |

rr_NetExpensesOverAssets |

0.88%

|

|

| 1 year |

rr_ExpenseExampleYear01 |

$ 92

|

|

| 3 years |

rr_ExpenseExampleYear03 |

287

|

|

| 5 years |

rr_ExpenseExampleYear05 |

498

|

|

| 10 years |

rr_ExpenseExampleYear10 |

1,108

|

|

| 1 year |

rr_ExpenseExampleNoRedemptionYear01 |

92

|

|

| 3 years |

rr_ExpenseExampleNoRedemptionYear03 |

287

|

|

| 5 years |

rr_ExpenseExampleNoRedemptionYear05 |

498

|

|

| 10 years |

rr_ExpenseExampleNoRedemptionYear10 |

$ 1,108

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

(15.82%)

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

0.62%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

9.35%

|

|

| Share Class Inception Date |

rr_AverageAnnualReturnInceptionDate |

Nov. 08, 2012

|

|

| Columbia Acorn International | Class R |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum sales charge (load) imposed on purchases (as a % of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) imposed on redemptions (as a % of the lower of the original purchase price or current net asset value) |

rr_MaximumDeferredSalesChargeOverOther |

none

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.77%

|

|

| Distribution and/or service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

0.50%

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.23%

|

[2] |

| Acquired fund fees and expenses |

rr_AcquiredFundFeesAndExpensesOverAssets |

0.01%

|

|

| Total annual Fund operating expenses |

rr_ExpensesOverAssets |

1.51%

|

[3] |

| Less: Fee waivers and/or expense reimbursements |

rr_FeeWaiverOrReimbursementOverAssets |

(0.02%)

|

[4] |

| Total annual Fund operating expenses after fee waivers and/or expense reimbursements |

rr_NetExpensesOverAssets |

1.49%

|

|

| 1 year |

rr_ExpenseExampleYear01 |

$ 152

|

|

| 3 years |

rr_ExpenseExampleYear03 |

475

|

|

| 5 years |

rr_ExpenseExampleYear05 |

822

|

|

| 10 years |

rr_ExpenseExampleYear10 |

1,800

|

|

| 1 year |

rr_ExpenseExampleNoRedemptionYear01 |

152

|

|

| 3 years |

rr_ExpenseExampleNoRedemptionYear03 |

475

|

|

| 5 years |

rr_ExpenseExampleNoRedemptionYear05 |

822

|

|

| 10 years |

rr_ExpenseExampleNoRedemptionYear10 |

$ 1,800

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

(16.32%)

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

(0.06%)

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

8.62%

|

|

| Share Class Inception Date |

rr_AverageAnnualReturnInceptionDate |

Aug. 02, 2011

|

|

| Columbia Acorn International | returns after taxes on distributions | Class Inst |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

(20.84%)

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

(1.51%)

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

7.84%

|

|

| Share Class Inception Date |

rr_AverageAnnualReturnInceptionDate |

Sep. 23, 1992

|

|

| Columbia Acorn International | returns after taxes on distributions and sale of Fund shares | Class Inst |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

(5.49%)

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

0.61%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

7.74%

|

|

| Share Class Inception Date |

rr_AverageAnnualReturnInceptionDate |

Sep. 23, 1992

|

|

| Columbia Acorn International | MSCI ACWI ex USA SMID Cap Growth Index (Net) (reflects reinvested dividends net of withholding taxes but reflects no deductions for fees, expenses or other taxes) |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

(17.28%)

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

2.09%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

8.72%

|

|

| Columbia Acorn International | MSCI ACWI ex USA SMID Cap Index (Net) (reflects reinvested dividends net of withholding taxes but reflects no deductions for fees, expenses or other taxes) |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

(17.06%)

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

1.75%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

8.84%

|

|

|

|