Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-01829

Columbia Acorn Trust

(Exact name of registrant as specified in charter)

227 W. Monroe Street

Suite 3000

Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Ryan C. Larrenaga

c/o Columbia Management

Investment Advisers, LLC

225 Franklin Street

Boston, MA 02110

Alan Berkshire

Columbia Acorn Trust

227 West Monroe Street, Suite 3000

Chicago, Illinois 60606

Mary C. Moynihan

Perkins Coie LLP

700 13th Street, NW

Suite 600

Washington, DC 20005

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 634-9200

Date of fiscal year end: December 31

Date of reporting period: December 31, 2018

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Table of Contents

Item 1. Reports to Stockholders.

Table of Contents

Table of Contents

| 3 | |

|

|

5 |

|

|

7 |

|

|

10 |

|

|

12 |

|

|

14 |

|

|

16 |

|

|

19 |

|

|

21 |

|

|

23 |

|

|

25 |

|

|

27 |

|

|

29 |

|

|

32 |

|

|

34 |

|

|

37 |

|

|

39 |

|

|

41 |

|

|

44 |

|

|

83 |

|

|

87 |

|

|

91 |

|

|

100 |

|

|

132 |

|

|

151 |

|

|

152 |

|

|

153 |

|

|

156 |

| 157 |

Table of Contents

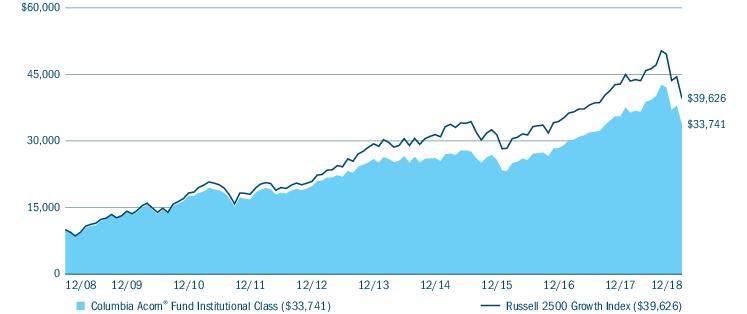

Columbia Acorn® Fund

| Columbia

Acorn Family of Funds | Annual Report 2018 |

3 |

Table of Contents

Columbia Acorn® Fund

| 4 | Columbia Acorn Family of Funds | Annual Report 2018 |

Table of Contents

Columbia Acorn® Fund

| Columbia

Acorn Family of Funds | Annual Report 2018 |

5 |

Table of Contents

Columbia Acorn® Fund

| 6 | Columbia Acorn Family of Funds | Annual Report 2018 |

Table of Contents

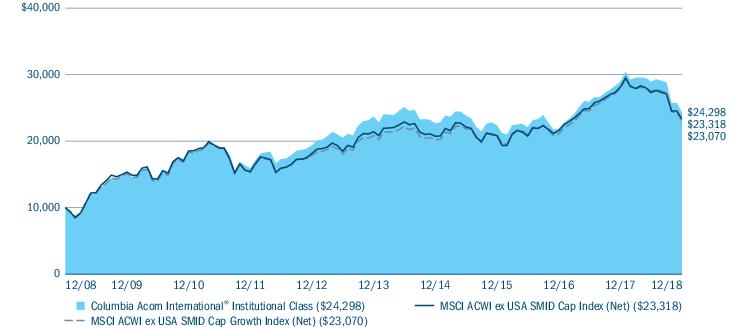

Columbia Acorn International®

| Columbia

Acorn Family of Funds | Annual Report 2018 |

7 |

Table of Contents

Columbia Acorn International®

| 8 | Columbia Acorn Family of Funds | Annual Report 2018 |

Table of Contents

Columbia Acorn International®

| Columbia

Acorn Family of Funds | Annual Report 2018 |

9 |

Table of Contents

Columbia Acorn International®

| 10 | Columbia Acorn Family of Funds | Annual Report 2018 |

Table of Contents

Columbia Acorn International®

| Columbia

Acorn Family of Funds | Annual Report 2018 |

11 |

Table of Contents

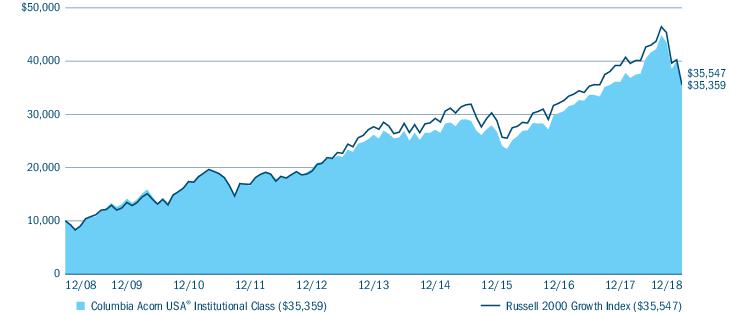

Columbia Acorn USA®

| 12 | Columbia Acorn Family of Funds | Annual Report 2018 |

Table of Contents

Columbia Acorn USA®

| Columbia

Acorn Family of Funds | Annual Report 2018 |

13 |

Table of Contents

Columbia Acorn USA®

| 14 | Columbia Acorn Family of Funds | Annual Report 2018 |

Table of Contents

Columbia Acorn USA®

| Columbia

Acorn Family of Funds | Annual Report 2018 |

15 |

Table of Contents

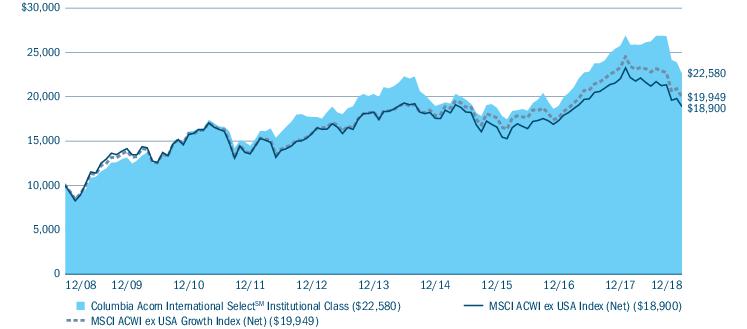

Columbia Acorn International SelectSM

| 16 | Columbia Acorn Family of Funds | Annual Report 2018 |

Table of Contents

Columbia Acorn International SelectSM

| Columbia

Acorn Family of Funds | Annual Report 2018 |

17 |

Table of Contents

Columbia Acorn International SelectSM

| Equity sector breakdown (%) (at December 31, 2018) | |

| Communication Services | 9.3 |

| Consumer Discretionary | 10.0 |

| Consumer Staples | 2.2 |

| Financials | 10.3 |

| Health Care | 9.2 |

| Industrials | 24.6 |

| Information Technology | 15.4 |

| Materials | 13.4 |

| Real Estate | 5.6 |

| Total | 100.0 |

| Country breakdown (%) (at December 31, 2018) | |

| Australia | 1.9 |

| Canada | 5.7 |

| China | 5.6 |

| Denmark | 3.7 |

| France | 2.1 |

| Germany | 11.9 |

| India | 5.0 |

| Italy | 4.5 |

| Japan | 16.6 |

| Mexico | 2.3 |

| Netherlands | 6.4 |

| Singapore | 2.2 |

| South Africa | 2.0 |

| South Korea | 5.5 |

| Sweden | 6.2 |

| Switzerland | 2.7 |

| Taiwan | 1.8 |

| United Kingdom | 10.7 |

| United States(a) | 3.2 |

| Total | 100.0 |

| (a) | Includes investments in Money Market Funds. |

| 18 | Columbia Acorn Family of Funds | Annual Report 2018 |

Table of Contents

Columbia Acorn International SelectSM

| Columbia

Acorn Family of Funds | Annual Report 2018 |

19 |

Table of Contents

Columbia Acorn International SelectSM

| 20 | Columbia Acorn Family of Funds | Annual Report 2018 |

Table of Contents

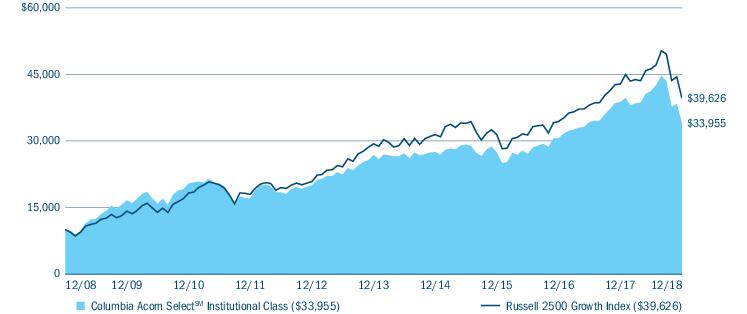

Columbia Acorn SelectSM

| Columbia

Acorn Family of Funds | Annual Report 2018 |

21 |

Table of Contents

Columbia Acorn SelectSM

| 22 | Columbia Acorn Family of Funds | Annual Report 2018 |

Table of Contents

Columbia Acorn SelectSM

| Columbia

Acorn Family of Funds | Annual Report 2018 |

23 |

Table of Contents

Columbia Acorn SelectSM

| 24 | Columbia Acorn Family of Funds | Annual Report 2018 |

Table of Contents

Columbia Thermostat FundSM

| Columbia

Acorn Family of Funds | Annual Report 2018 |

25 |

Table of Contents

Columbia Thermostat FundSM

| Portfolio breakdown (%) (at December 31, 2018) | |

| Equity Funds | 13.8 |

| Exchange-Traded Funds | 8.6 |

| Fixed-Income Funds | 77.6 |

| Total | 100.0 |

| 26 | Columbia Acorn Family of Funds | Annual Report 2018 |

Table of Contents

Columbia Thermostat FundSM

| Columbia

Acorn Family of Funds | Annual Report 2018 |

27 |

Table of Contents

Columbia Thermostat FundSM

| • | On October 24, the S&P 500® Index fell below 2,672 and the Fund reallocated to 25% stocks and 75% bonds on October 25. |

| • | On November 26, the S&P 500® Index rose above 2,672 and the Fund reallocated back to 20% stocks and 80% bonds on November 27. |

| • | On December 3, the S&P 500® Index rose above 2,779 and the Fund reallocated to 15% stocks and 85% bonds on December 4. |

| Stock Funds | Weightings

in category |

4th

quarter performance |

1

year performance |

| Columbia Large Cap Index Fund, Institutional 3 Class | 40% | -13.58% | -4.59% |

| Columbia Acorn Fund®, Institutional 3 Class | 10% | -19.74% | -4.98% |

| Columbia Acorn International®, Institutional 3 Class | 10% | -15.67% | -15.82% |

| Columbia Acorn SelectSM, Institutional 3 Class | 10% | -21.93% | -12.31% |

| Columbia Contrarian Core Fund, Institutional 3 Class | 10% | -14.78% | -8.81% |

| Columbia Dividend Income Fund, Institutional 3 Class | 10% | -9.64% | -4.28% |

| Columbia Large Cap Enhanced Core Fund, Institutional 3 Class | 10% | -14.11% | -4.68% |

| Weighted Average Equity Gain/Loss | 100% | -15.03% | -6.50% |

| Bond Funds | Weightings

in category |

4th

quarter performance |

1

year performance |

| Columbia U.S. Treasury Index Fund, Institutional 3 Class | 35% | 2.50% | 0.69% |

| Columbia Short Term Bond Fund, Institutional 3 Class | 25% | 0.32% | 0.76% |

| Columbia Quality Income Fund, Institutional 3 Class | 20% | 2.42% | 2.11% |

| Columbia Corporate Income Fund, Institutional 3 Class | 10% | -1.55% | -3.48% |

| Columbia Diversified Fixed Income Allocation ETF | 10% | -0.17% | -1.53% |

| Weighted Average Income Gain/Loss | 100% | 1.26% | 0.59% |

| 28 | Columbia Acorn Family of Funds | Annual Report 2018 |

Table of Contents

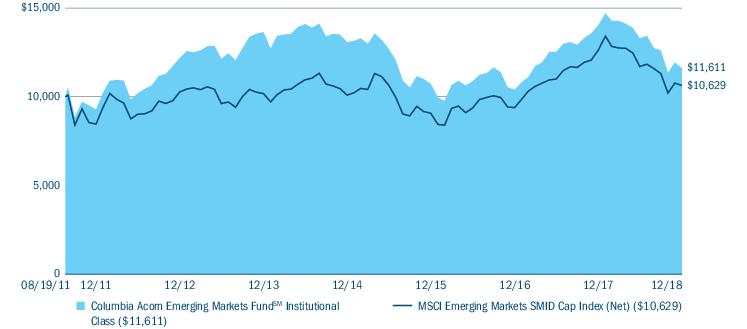

Columbia Acorn Emerging Markets FundSM

| Columbia

Acorn Family of Funds | Annual Report 2018 |

29 |

Table of Contents

Columbia Acorn Emerging Markets FundSM

| 30 | Columbia Acorn Family of Funds | Annual Report 2018 |

Table of Contents

Columbia Acorn Emerging Markets FundSM

| Country breakdown (%) (at December 31, 2018) | |

| Brazil | 7.9 |

| Cambodia | 2.9 |

| China | 6.4 |

| Egypt | 1.3 |

| Hong Kong | 5.8 |

| India | 10.7 |

| Indonesia | 4.7 |

| Japan | 1.3 |

| Malaysia | 1.1 |

| Mexico | 3.5 |

| Philippines | 2.4 |

| Poland | 1.0 |

| Russian Federation | 1.7 |

| South Africa | 7.8 |

| South Korea | 16.6 |

| Taiwan | 16.5 |

| Thailand | 4.0 |

| Turkey | 1.1 |

| United Kingdom | 1.4 |

| United States(a) | 1.9 |

| Total | 100.0 |

| (a) | Includes investments in Money Market Funds. |

| Columbia

Acorn Family of Funds | Annual Report 2018 |

31 |

Table of Contents

Columbia Acorn Emerging Markets FundSM

| 32 | Columbia Acorn Family of Funds | Annual Report 2018 |

Table of Contents

Columbia Acorn Emerging Markets FundSM

| Columbia

Acorn Family of Funds | Annual Report 2018 |

33 |

Table of Contents

Columbia Acorn European FundSM

| 34 | Columbia Acorn Family of Funds | Annual Report 2018 |

Table of Contents

Columbia Acorn European FundSM

| Columbia

Acorn Family of Funds | Annual Report 2018 |

35 |

Table of Contents

Columbia Acorn European FundSM

| 36 | Columbia Acorn Family of Funds | Annual Report 2018 |

Table of Contents

Columbia Acorn European FundSM

| Columbia

Acorn Family of Funds | Annual Report 2018 |

37 |

Table of Contents

Columbia Acorn European FundSM

| 38 | Columbia Acorn Family of Funds | Annual Report 2018 |

Table of Contents

| Fund | Ordinary

income |

Short-term

capital gain |

Long-term

capital gain |

Record

date |

Ex-dividend

date |

Payable

date |

| Columbia Acorn® Fund | ||||||

| Class A | None | None | 1.10962 | 12/10/2018 | 12/11/2018 | 12/11/2018 |

| Advisor Class | None | None | 1.10962 | 12/10/2018 | 12/11/2018 | 12/11/2018 |

| Class C | None | None | 1.10962 | 12/10/2018 | 12/11/2018 | 12/11/2018 |

| Institutional Class | None | None | 1.10962 | 12/10/2018 | 12/11/2018 | 12/11/2018 |

| Institutional 2 Class | None | None | 1.10962 | 12/10/2018 | 12/11/2018 | 12/11/2018 |

| Institutional 3 Class | None | None | 1.10962 | 12/10/2018 | 12/11/2018 | 12/11/2018 |

| Columbia Acorn International® | ||||||

| Class A | 0.04809 | None | 8.18055 | 12/17/2018 | 12/18/2018 | 12/18/2018 |

| Advisor Class | 0.16183 | None | 8.18055 | 12/17/2018 | 12/18/2018 | 12/18/2018 |

| Class C | None | None | 8.18055 | 12/17/2018 | 12/18/2018 | 12/18/2018 |

| Institutional Class | 0.16183 | None | 8.18055 | 12/17/2018 | 12/18/2018 | 12/18/2018 |

| Institutional 2 Class | 0.18913 | None | 8.18055 | 12/17/2018 | 12/18/2018 | 12/18/2018 |

| Institutional 3 Class | 0.21188 | None | 8.18055 | 12/17/2018 | 12/18/2018 | 12/18/2018 |

| Class R | None | None | 8.18055 | 12/17/2018 | 12/18/2018 | 12/18/2018 |

| Columbia Acorn USA® | ||||||

| Class A | None | 0.02122 | 1.59600 | 12/10/2018 | 12/11/2018 | 12/11/2018 |

| Advisor Class | None | 0.06105 | 1.59600 | 12/10/2018 | 12/11/2018 | 12/11/2018 |

| Class C | None | None | 1.59600 | 12/10/2018 | 12/11/2018 | 12/11/2018 |

| Institutional Class | None | 0.06105 | 1.59600 | 12/10/2018 | 12/11/2018 | 12/11/2018 |

| Institutional 2 Class | None | 0.07379 | 1.59600 | 12/10/2018 | 12/11/2018 | 12/11/2018 |

| Institutional 3 Class | None | 0.08175 | 1.59600 | 12/10/2018 | 12/11/2018 | 12/11/2018 |

| Columbia Acorn International SelectSM | ||||||

| Class A | None | None | 1.85474 | 12/17/2018 | 12/18/2018 | 12/18/2018 |

| Advisor Class | None | None | 1.85474 | 12/17/2018 | 12/18/2018 | 12/18/2018 |

| Class C | None | None | 1.85474 | 12/17/2018 | 12/18/2018 | 12/18/2018 |

| Institutional Class | None | None | 1.85474 | 12/17/2018 | 12/18/2018 | 12/18/2018 |

| Institutional 2 Class | None | None | 1.85474 | 12/17/2018 | 12/18/2018 | 12/18/2018 |

| Institutional 3 Class | None | None | 1.85474 | 12/17/2018 | 12/18/2018 | 12/18/2018 |

| Columbia Acorn SelectSM | ||||||

| Class A | None | 0.11555 | 1.43219 | 12/10/2018 | 12/11/2018 | 12/11/2018 |

| Advisor Class | None | 0.11555 | 1.43219 | 12/10/2018 | 12/11/2018 | 12/11/2018 |

| Class C | None | 0.11555 | 1.43219 | 12/10/2018 | 12/11/2018 | 12/11/2018 |

| Institutional Class | None | 0.11555 | 1.43219 | 12/10/2018 | 12/11/2018 | 12/11/2018 |

| Institutional 2 Class | None | 0.11555 | 1.43219 | 12/10/2018 | 12/11/2018 | 12/11/2018 |

| Institutional 3 Class | None | 0.11555 | 1.43219 | 12/10/2018 | 12/11/2018 | 12/11/2018 |

| Columbia Thermostat FundSM | ||||||

| Class A | 0.25408 | 0.10241 | 0.19687 | 12/20/2018 | 12/21/2018 | 12/21/2018 |

| Advisor Class | 0.29031 | 0.10241 | 0.19687 | 12/20/2018 | 12/21/2018 | 12/21/2018 |

| Class C | 0.14539 | 0.10241 | 0.19687 | 12/20/2018 | 12/21/2018 | 12/21/2018 |

| Institutional Class | 0.29031 | 0.10241 | 0.19687 | 12/20/2018 | 12/21/2018 | 12/21/2018 |

| Institutional 2 Class | 0.29610 | 0.10241 | 0.19687 | 12/20/2018 | 12/21/2018 | 12/21/2018 |

| Institutional 3 Class | 0.30335 | 0.10241 | 0.19687 | 12/20/2018 | 12/21/2018 | 12/21/2018 |

| Columbia

Acorn Family of Funds | Annual Report 2018 |

39 |

Table of Contents

| Fund | Ordinary

income |

Short-term

capital gain |

Long-term

capital gain |

Record

date |

Ex-dividend

date |

Payable

date |

| Columbia Acorn Emerging Markets FundSM | ||||||

| Class A | 0.17166 | None | None | 12/17/2018 | 12/18/2018 | 12/18/2018 |

| Advisor Class | 0.20305 | None | None | 12/17/2018 | 12/18/2018 | 12/18/2018 |

| Class C | 0.07750 | None | None | 12/17/2018 | 12/18/2018 | 12/18/2018 |

| Institutional Class | 0.20305 | None | None | 12/17/2018 | 12/18/2018 | 12/18/2018 |

| Institutional 2 Class | 0.21184 | None | None | 12/17/2018 | 12/18/2018 | 12/18/2018 |

| Institutional 3 Class | 0.21812 | None | None | 12/17/2018 | 12/18/2018 | 12/18/2018 |

| Columbia Acorn European FundSM | ||||||

| Class A | None | None | None | 12/17/2018 | 12/18/2018 | 12/18/2018 |

| Advisor Class | None | None | None | 12/17/2018 | 12/18/2018 | 12/18/2018 |

| Class C | None | None | None | 12/17/2018 | 12/18/2018 | 12/18/2018 |

| Institutional Class | None | None | None | 12/17/2018 | 12/18/2018 | 12/18/2018 |

| Institutional 2 Class | None | None | None | 12/17/2018 | 12/18/2018 | 12/18/2018 |

| Institutional 3 Class | None | None | None | 12/17/2018 | 12/18/2018 | 12/18/2018 |

| 40 | Columbia Acorn Family of Funds | Annual Report 2018 |

Table of Contents

(Unaudited)

| July 1, 2018 — December 31, 2018 | |||||||

| Account

value at the beginning of the period ($) |

Account

value at the end of the period ($) |

Expenses

paid during the period ($) |

Fund’s

annualized expense ratio (%) | ||||

| Actual | Hypothetical | Actual | Hypothetical | Actual | Hypothetical | Actual | |

| Columbia Acorn® Fund | |||||||

| Class A | 1,000.00 | 1,000.00 | 860.00 | 1,019.92 | 5.04 | 5.48 | 1.07 |

| Advisor Class | 1,000.00 | 1,000.00 | 860.70 | 1,021.19 | 3.87 | 4.20 | 0.82 |

| Class C | 1,000.00 | 1,000.00 | 857.20 | 1,016.12 | 8.57 | 9.30 | 1.82 |

| Institutional Class | 1,000.00 | 1,000.00 | 860.40 | 1,021.19 | 3.87 | 4.20 | 0.82 |

| Institutional 2 Class | 1,000.00 | 1,000.00 | 860.80 | 1,021.29 | 3.77 | 4.10 | 0.80 |

| Institutional 3 Class | 1,000.00 | 1,000.00 | 860.80 | 1,021.54 | 3.54 | 3.84 | 0.75 |

| Columbia

Acorn Family of Funds | Annual Report 2018 |

41 |

Table of Contents

(Unaudited)

| July 1, 2018 — December 31, 2018 | |||||||

| Account

value at the beginning of the period ($) |

Account

value at the end of the period ($) |

Expenses

paid during the period ($) |

Fund’s

annualized expense ratio (%) | ||||

| Actual | Hypothetical | Actual | Hypothetical | Actual | Hypothetical | Actual | |

| Columbia Acorn International® | |||||||

| Class A | 1,000.00 | 1,000.00 | 839.20 | 1,019.01 | 5.83 | 6.40 | 1.25 |

| Advisor Class | 1,000.00 | 1,000.00 | 840.50 | 1,020.32 | 4.62 | 5.07 | 0.99 |

| Class C | 1,000.00 | 1,000.00 | 836.00 | 1,015.21 | 9.31 | 10.21 | 2.00 |

| Institutional Class | 1,000.00 | 1,000.00 | 840.20 | 1,020.27 | 4.66 | 5.12 | 1.00 |

| Institutional 2 Class | 1,000.00 | 1,000.00 | 840.50 | 1,020.58 | 4.38 | 4.81 | 0.94 |

| Institutional 3 Class | 1,000.00 | 1,000.00 | 840.70 | 1,020.83 | 4.15 | 4.56 | 0.89 |

| Class R | 1,000.00 | 1,000.00 | 838.20 | 1,017.74 | 6.99 | 7.67 | 1.50 |

| Columbia Acorn USA® | |||||||

| Class A | 1,000.00 | 1,000.00 | 849.10 | 1,018.20 | 6.61 | 7.21 | 1.41 |

| Advisor Class | 1,000.00 | 1,000.00 | 849.80 | 1,019.46 | 5.44 | 5.94 | 1.16 |

| Class C | 1,000.00 | 1,000.00 | 845.80 | 1,014.39 | 10.10 | 11.03 | 2.16 |

| Institutional Class | 1,000.00 | 1,000.00 | 849.60 | 1,019.46 | 5.44 | 5.94 | 1.16 |

| Institutional 2 Class | 1,000.00 | 1,000.00 | 849.90 | 1,019.87 | 5.06 | 5.53 | 1.08 |

| Institutional 3 Class | 1,000.00 | 1,000.00 | 850.00 | 1,020.12 | 4.83 | 5.27 | 1.03 |

| Columbia Acorn International SelectSM | |||||||

| Class A | 1,000.00 | 1,000.00 | 859.90 | 1,018.25 | 6.60 | 7.16 | 1.40 |

| Advisor Class | 1,000.00 | 1,000.00 | 861.10 | 1,019.51 | 5.42 | 5.89 | 1.15 |

| Class C | 1,000.00 | 1,000.00 | 857.10 | 1,014.45 | 10.12 | 10.98 | 2.15 |

| Institutional Class | 1,000.00 | 1,000.00 | 861.10 | 1,019.51 | 5.42 | 5.89 | 1.15 |

| Institutional 2 Class | 1,000.00 | 1,000.00 | 861.40 | 1,019.97 | 5.00 | 5.43 | 1.06 |

| Institutional 3 Class | 1,000.00 | 1,000.00 | 861.60 | 1,020.22 | 4.76 | 5.17 | 1.01 |

| Columbia Acorn SelectSM | |||||||

| Class A | 1,000.00 | 1,000.00 | 822.20 | 1,019.56 | 5.26 | 5.83 | 1.14 |

| Advisor Class | 1,000.00 | 1,000.00 | 823.50 | 1,020.83 | 4.11 | 4.56 | 0.89 |

| Class C | 1,000.00 | 1,000.00 | 819.20 | 1,015.76 | 8.71 | 9.65 | 1.89 |

| Institutional Class | 1,000.00 | 1,000.00 | 823.50 | 1,020.83 | 4.11 | 4.56 | 0.89 |

| Institutional 2 Class | 1,000.00 | 1,000.00 | 823.30 | 1,021.14 | 3.84 | 4.25 | 0.83 |

| Institutional 3 Class | 1,000.00 | 1,000.00 | 824.40 | 1,021.39 | 3.61 | 4.00 | 0.78 |

| Columbia Acorn Emerging Markets FundSM | |||||||

| Class A | 1,000.00 | 1,000.00 | 872.30 | 1,017.64 | 7.21 | 7.77 | 1.52 |

| Advisor Class | 1,000.00 | 1,000.00 | 873.10 | 1,018.91 | 6.03 | 6.50 | 1.27 |

| Class C | 1,000.00 | 1,000.00 | 869.10 | 1,013.84 | 10.75 | 11.59 | 2.27 |

| Institutional Class | 1,000.00 | 1,000.00 | 873.90 | 1,018.91 | 6.03 | 6.50 | 1.27 |

| Institutional 2 Class | 1,000.00 | 1,000.00 | 873.90 | 1,019.31 | 5.65 | 6.09 | 1.19 |

| Institutional 3 Class | 1,000.00 | 1,000.00 | 873.40 | 1,019.56 | 5.41 | 5.83 | 1.14 |

| Columbia Acorn European FundSM | |||||||

| Class A | 1,000.00 | 1,000.00 | 807.50 | 1,017.99 | 6.64 | 7.42 | 1.45 |

| Advisor Class | 1,000.00 | 1,000.00 | 808.70 | 1,019.26 | 5.50 | 6.14 | 1.20 |

| Class C | 1,000.00 | 1,000.00 | 804.70 | 1,014.19 | 10.06 | 11.23 | 2.20 |

| Institutional Class | 1,000.00 | 1,000.00 | 808.70 | 1,019.26 | 5.50 | 6.14 | 1.20 |

| Institutional 2 Class | 1,000.00 | 1,000.00 | 809.20 | 1,019.62 | 5.18 | 5.78 | 1.13 |

| Institutional 3 Class | 1,000.00 | 1,000.00 | 809.30 | 1,019.82 | 5.00 | 5.58 | 1.09 (a) |

| 42 | Columbia Acorn Family of Funds | Annual Report 2018 |

Table of Contents

(Unaudited)

| July 1, 2018 — December 31, 2018 | ||||||||||

| Account

value at the beginning of the period ($) |

Account

value at the end of the period ($) |

Expenses

paid during the period ($) |

Fund’s

annualized expense ratio (%) |

Effective

expenses paid during the period ($) |

Fund’s

effective annualized expense ratio (%) | |||||

| Actual | Hypothetical | Actual | Hypothetical | Actual | Hypothetical | Actual | Actual | Hypothetical | Actual | |

| Class A | 1,000.00 | 1,000.00 | 993.70 | 1,022.81 | 2.53 | 2.56 | 0.50 | 4.40 | 4.46 | 0.87 |

| Advisor Class | 1,000.00 | 1,000.00 | 995.50 | 1,024.08 | 1.26 | 1.28 | 0.25 | 3.14 | 3.18 | 0.62 |

| Class C | 1,000.00 | 1,000.00 | 991.00 | 1,019.01 | 6.31 | 6.40 | 1.25 | 8.17 | 8.29 | 1.62 |

| Institutional Class | 1,000.00 | 1,000.00 | 995.40 | 1,024.08 | 1.26 | 1.28 | 0.25 | 3.14 | 3.18 | 0.62 |

| Institutional 2 Class | 1,000.00 | 1,000.00 | 995.90 | 1,024.33 | 1.01 | 1.03 | 0.20 | 2.88 | 2.92 | 0.57 |

| Institutional 3 Class | 1,000.00 | 1,000.00 | 996.40 | 1,024.58 | 0.76 | 0.77 | 0.15 | 2.63 | 2.67 | 0.52 |

| Columbia

Acorn Family of Funds | Annual Report 2018 |

43 |

Table of Contents

Columbia Acorn® Fund, December 31, 2018

| 44 | Columbia Acorn Family of Funds | Annual Report 2018 |

Table of Contents

Columbia Acorn® Fund, December 31, 2018

| Columbia

Acorn Family of Funds | Annual Report 2018 |

45 |

Table of Contents

Columbia Acorn® Fund, December 31, 2018

| 46 | Columbia Acorn Family of Funds | Annual Report 2018 |

Table of Contents

Columbia Acorn® Fund, December 31, 2018

| Columbia

Acorn Family of Funds | Annual Report 2018 |

47 |

Table of Contents

Columbia Acorn® Fund, December 31, 2018

| 48 | Columbia Acorn Family of Funds | Annual Report 2018 |

Table of Contents

Columbia Acorn® Fund, December 31, 2018

| Securities Lending Collateral 0.4% | ||

| Shares | Value ($) | |

| Dreyfus

Government Cash Management Fund, Institutional Shares, 2.372%(d),(e) |

15,645,500 | 15,645,500 |

| Total

Securities Lending Collateral (Cost: $15,645,500) |

15,645,500 | |

| Money Market Funds 1.1% | ||

| Columbia Short-Term Cash Fund, 2.459%(c),(d) | 41,013,366 | 41,009,265 |

| Total

Money Market Funds (Cost: $41,009,265) |

41,009,265 | |

| Total

Investments in Securities (Cost $3,238,971,455) |

3,814,221,434 | |

| Obligation to Return Collateral for Securities Loaned | (15,645,500) | |

| Other Assets & Liabilities, Net | (210,879) | |

| Net Assets | $3,798,365,055 | |

| (a) | Non-income producing security. |

| (b) | All or a portion of this security was on loan at December 31, 2018. The total market value of securities on loan at December 31, 2018 was $15,784,990. |

| (c) | As defined in the Investment Company Act of 1940, an affiliated company is one in which the Fund owns 5% or more of the company’s outstanding voting securities, or a company which is under common ownership or control with the Fund. Holdings and transactions in these affiliated companies during the year ended December 31, 2018 are as follows: |

| Issuer | Beginning

shares |

Shares

purchased |

Shares

sold |

Ending

shares |

Realized

gain (loss) — affiliated issuers ($) |

Net

change in unrealized appreciation (depreciation) — affiliated issuers ($) |

Dividend

— affiliated issuers ($) |

Value

— affiliated issuers at end of period ($) |

| Celldex Therapeutics, Inc† | ||||||||

| 8,126,489 | — | (8,126,489) | — | (17,193,753) | 1,501,758 | — | — | |

| Central Garden & Pet Co.‡ | ||||||||

| — | 876,522 | (193,000) | 683,522 | (1,317,892) | (2,815,890) | — | 23,547,333 | |

| Columbia Short-Term Cash Fund, 2.459% | ||||||||

| — | 911,010,611 | (869,997,245) | 41,013,366 | — | — | 626,471 | 41,009,265 | |

| Total of Affiliated Transactions | (18,511,645) | (1,314,132) | 626,471 | 64,556,598 | ||||

| † | Issuer was not an affiliate at the end of period. |

| ‡ | Issuer was not an affiliate at the beginning of period. |

| (d) | The rate shown is the seven-day current annualized yield at December 31, 2018. |

| (e) | Investment made with cash collateral received from securities lending activity. |

| ■ | Level 1 – quoted prices in active markets for identical securities |

| ■ | Level 2 – prices determined using other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk and others) |

| ■ | Level 3 – prices determined using significant unobservable inputs where quoted prices or observable inputs are unavailable or less reliable (including management’s own assumptions about the factors market participants would use in pricing an investment) |

| Columbia

Acorn Family of Funds | Annual Report 2018 |

49 |

Table of Contents

Columbia Acorn® Fund, December 31, 2018

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

| Level

1 quoted prices in active markets for identical assets ($) |

Level

2 other significant observable inputs ($) |

Level

3 significant unobservable inputs ($) |

Investments

measured at net asset value ($) |

Total ($) | |

| Investments in Securities | |||||

| Common Stocks | |||||

| Communication Services | 29,151,275 | — | — | — | 29,151,275 |

| Consumer Discretionary | 796,430,523 | — | — | — | 796,430,523 |

| Consumer Staples | 105,202,431 | — | — | — | 105,202,431 |

| Energy | 55,572,434 | — | — | — | 55,572,434 |

| Financials | 352,728,772 | — | — | — | 352,728,772 |

| Health Care | 755,995,058 | — | — | — | 755,995,058 |

| Industrials | 628,861,924 | — | — | — | 628,861,924 |

| Information Technology | 758,673,708 | — | — | — | 758,673,708 |

| Materials | 121,404,832 | — | — | — | 121,404,832 |

| Real Estate | 153,545,712 | — | — | — | 153,545,712 |

| Total Common Stocks | 3,757,566,669 | — | — | — | 3,757,566,669 |

| Securities Lending Collateral | 15,645,500 | — | — | — | 15,645,500 |

| Money Market Funds | — | — | — | 41,009,265 | 41,009,265 |

| Total Investments in Securities | 3,773,212,169 | — | — | 41,009,265 | 3,814,221,434 |

| 50 | Columbia Acorn Family of Funds | Annual Report 2018 |

Table of Contents

Columbia Acorn International®, December 31, 2018

| Columbia

Acorn Family of Funds | Annual Report 2018 |

51 |

Table of Contents

Columbia Acorn International®, December 31, 2018

| 52 | Columbia Acorn Family of Funds | Annual Report 2018 |

Table of Contents

Columbia Acorn International®, December 31, 2018

| Columbia

Acorn Family of Funds | Annual Report 2018 |

53 |

Table of Contents

Columbia Acorn International®, December 31, 2018

| 54 | Columbia Acorn Family of Funds | Annual Report 2018 |

Table of Contents

Columbia Acorn International®, December 31, 2018

| Securities Lending Collateral 1.2% | ||

| Shares | Value ($) | |

| Dreyfus

Government Cash Management Fund, Institutional Shares, 2.372%(c),(d) |

30,272,040 | 30,272,040 |

| Total

Securities Lending Collateral (Cost: $30,272,040) |

30,272,040 | |

| Total

Investments in Securities(e) (Cost: $2,089,696,030) |

2,497,205,475 | |

| Obligation to Return Collateral for Securities Loaned | (30,272,040) | |

| Other Assets & Liabilities, Net | 58,497,908 | |

| Net Assets | $2,525,431,343 | |

| (a) | Non-income producing security. |

| (b) | All or a portion of this security was on loan at December 31, 2018. The total market value of securities on loan at December 31, 2018 was $29,435,320. |

| (c) | The rate shown is the seven-day current annualized yield at December 31, 2018. |

| (d) | Investment made with cash collateral received from securities lending activity. |

| (e) | As defined in the Investment Company Act of 1940, an affiliated company is one in which the Fund owns 5% or more of the company’s outstanding voting securities, or a company which is under common ownership or control with the Fund. Holdings and transactions in these affiliated companies during the year ended December 31, 2018 are as follows: |

| Issuer | Beginning

shares |

Shares

purchased |

Shares

sold |

Ending

shares |

Realized

gain (loss) — affiliated issuers ($) |

Net

change in unrealized appreciation (depreciation) — affiliated issuers ($) |

Dividend

— affiliated issuers ($) |

Value

— affiliated issuers at end of period ($) |

| Columbia Short-Term Cash Fund, 2.459% | ||||||||

| — | 586,517,692 | (586,517,692) | — | — | — | 536,387 | — | |

| ADR | American Depositary Receipt |

| GDR | Global Depositary Receipt |

| ■ | Level 1 – quoted prices in active markets for identical securities |

| ■ | Level 2 – prices determined using other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk and others) |

| ■ | Level 3 – prices determined using significant unobservable inputs where quoted prices or observable inputs are unavailable or less reliable (including management’s own assumptions about the factors market participants would use in pricing an investment) |

| Columbia

Acorn Family of Funds | Annual Report 2018 |

55 |

Table of Contents

Columbia Acorn International®, December 31, 2018

The Committee meets as necessary, and no less frequently than quarterly, to determine fair values for securities for which market quotations are not readily available or for which Columbia Wanger Asset Management believes that available market quotations are unreliable. The Committee also reviews the continuing appropriateness of the Policies. In circumstances where a security has been fair valued, the Committee will also review the continuing appropriateness of the current value of the security. The Policies address, among other things: circumstances under which market quotations will be deemed readily available; selection of third party pricing vendors; appropriate pricing methodologies; events that require fair valuation and fair value techniques; circumstances under which securities will be deemed to pose a potential for stale pricing, including when securities are illiquid, restricted, or in default; and certain delegations of authority to determine fair values to the Fund’s investment manager. The Committee may also meet to discuss additional valuation matters, which may include review of back-testing results, review of time-sensitive information or approval of other valuation related actions, and to review the appropriateness of the Policies.

| Level

1 quoted prices in active markets for identical assets ($) |

Level

2 other significant observable inputs ($) |

Level

3 significant unobservable inputs ($) |

Total ($) | |

| Investments in Securities | ||||

| Common Stocks | ||||

| Australia | — | 78,801,950 | — | 78,801,950 |

| Belgium | — | 6,636,118 | — | 6,636,118 |

| Brazil | 51,788,618 | — | — | 51,788,618 |

| Cambodia | — | 27,726,048 | — | 27,726,048 |

| Canada | 160,901,151 | — | — | 160,901,151 |

| China | 33,782,951 | 19,235,178 | — | 53,018,129 |

| Denmark | — | 89,150,343 | — | 89,150,343 |

| France | — | 13,073,631 | — | 13,073,631 |

| Germany | — | 191,331,336 | — | 191,331,336 |

| Hong Kong | — | 27,842,521 | — | 27,842,521 |

| India | — | 60,020,704 | — | 60,020,704 |

| Indonesia | — | 11,953,196 | — | 11,953,196 |

| Ireland | — | 26,341,261 | — | 26,341,261 |

| Italy | — | 98,087,360 | — | 98,087,360 |

| Japan | — | 517,115,975 | — | 517,115,975 |

| Malta | — | 52,183,641 | — | 52,183,641 |

| Mexico | 46,836,600 | — | — | 46,836,600 |

| Netherlands | — | 37,938,182 | — | 37,938,182 |

| Norway | — | 9,490,714 | — | 9,490,714 |

| Philippines | — | 12,465,559 | — | 12,465,559 |

| Poland | — | 8,970,233 | — | 8,970,233 |

| Russian Federation | — | 22,252,823 | — | 22,252,823 |

| Singapore | — | 33,423,491 | — | 33,423,491 |

| South Africa | — | 34,715,868 | — | 34,715,868 |

| South Korea | — | 98,935,785 | — | 98,935,785 |

| Spain | — | 32,578,438 | — | 32,578,438 |

| Sweden | — | 109,043,166 | — | 109,043,166 |

| Switzerland | — | 61,781,061 | — | 61,781,061 |

| Taiwan | 11,133,254 | 62,917,611 | — | 74,050,865 |

| Thailand | — | 11,218,899 | — | 11,218,899 |

| United Kingdom | 18,991,050 | 343,325,952 | — | 362,317,002 |

| United States | 32,528,553 | — | — | 32,528,553 |

| Total Common Stocks | 355,962,177 | 2,098,557,044 | — | 2,454,519,221 |

| Preferred Stocks | ||||

| Germany | — | 12,414,214 | — | 12,414,214 |

| Total Preferred Stocks | — | 12,414,214 | — | 12,414,214 |

| Securities Lending Collateral | 30,272,040 | — | — | 30,272,040 |

| Total Investments in Securities | 386,234,217 | 2,110,971,258 | — | 2,497,205,475 |

| 56 | Columbia Acorn Family of Funds | Annual Report 2018 |

Table of Contents

Columbia Acorn International®, December 31, 2018

The Fund’s assets assigned to the Level 2 input category are generally valued using a market approach, in which a security’s value is determined through its correlation to prices and information from observable market transactions for similar or identical assets. Foreign equities are generally valued at the last sale price on the foreign exchange or market on which they trade. The Fund may use a statistical fair valuation model, in accordance with the policy adopted by the Board of Trustees, provided by an independent third party to value securities principally traded in foreign markets in order to adjust for possible stale pricing that may occur between the close of the foreign exchanges and the time for valuation. These models take into account available market data including intraday index, ADR, and ETF movements.

| Columbia

Acorn Family of Funds | Annual Report 2018 |

57 |

Table of Contents

Columbia Acorn USA®, December 31, 2018

| 58 | Columbia Acorn Family of Funds | Annual Report 2018 |

Table of Contents

Columbia Acorn USA®, December 31, 2018

| Columbia

Acorn Family of Funds | Annual Report 2018 |

59 |

Table of Contents

Columbia Acorn USA®, December 31, 2018

| 60 | Columbia Acorn Family of Funds | Annual Report 2018 |

Table of Contents

Columbia Acorn USA®, December 31, 2018

| Columbia

Acorn Family of Funds | Annual Report 2018 |

61 |

Table of Contents

Columbia Acorn USA®, December 31, 2018

| (a) | Non-income producing security. |

| (b) | All or a portion of this security was on loan at December 31, 2018. The total market value of securities on loan at December 31, 2018 was $3,898,417. |

| (c) | The rate shown is the seven-day current annualized yield at December 31, 2018. |

| (d) | Investment made with cash collateral received from securities lending activity. |

| (e) | As defined in the Investment Company Act of 1940, an affiliated company is one in which the Fund owns 5% or more of the company’s outstanding voting securities, or a company which is under common ownership or control with the Fund. Holdings and transactions in these affiliated companies during the year ended December 31, 2018 are as follows: |

| Issuer | Beginning

shares |

Shares

purchased |

Shares

sold |

Ending

shares |

Realized

gain (loss) — affiliated issuers ($) |

Net

change in unrealized appreciation (depreciation) — affiliated issuers ($) |

Dividend

— affiliated issuers ($) |

Value

— affiliated issuers at end of period ($) |

| Columbia Short-Term Cash Fund, 2.459% | ||||||||

| — | 97,052,141 | (90,499,999) | 6,552,142 | — | — | 84,599 | 6,551,486 | |

| ADR | American Depositary Receipt |

| ■ | Level 1 – quoted prices in active markets for identical securities |

| ■ | Level 2 – prices determined using other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk and others) |

| ■ | Level 3 – prices determined using significant unobservable inputs where quoted prices or observable inputs are unavailable or less reliable (including management’s own assumptions about the factors market participants would use in pricing an investment) |

| 62 | Columbia Acorn Family of Funds | Annual Report 2018 |

Table of Contents

Columbia Acorn USA®, December 31, 2018

foreign currency exchange contracts and short-term investments valued at amortized cost. Additionally, securities fair valued by Columbia Wanger Asset Management’s Valuation Committee (the Committee) that rely on significant observable inputs are also included in Level 2. Typical Level 3 securities include any security fair valued by the Committee that relies on significant unobservable inputs.

| Level

1 quoted prices in active markets for identical assets ($) |

Level

2 other significant observable inputs ($) |

Level

3 significant unobservable inputs ($) |

Investments

measured at net asset value ($) |

Total ($) | |

| Investments in Securities | |||||

| Common Stocks | |||||

| Communication Services | 2,222,948 | — | — | — | 2,222,948 |

| Consumer Discretionary | 48,906,442 | — | — | — | 48,906,442 |

| Consumer Staples | 16,910,686 | — | — | — | 16,910,686 |

| Energy | 2,901,672 | — | — | — | 2,901,672 |

| Financials | 35,734,193 | — | — | — | 35,734,193 |

| Health Care | 54,067,352 | — | — | — | 54,067,352 |

| Industrials | 30,290,767 | — | — | — | 30,290,767 |

| Information Technology | 56,526,233 | — | — | — | 56,526,233 |

| Materials | 7,136,257 | — | — | — | 7,136,257 |

| Real Estate | 10,521,693 | — | — | — | 10,521,693 |

| Total Common Stocks | 265,218,243 | — | — | — | 265,218,243 |

| Limited Partnerships | |||||

| Consumer Discretionary | 4,318,537 | — | — | — | 4,318,537 |

| Securities Lending Collateral | 4,068,915 | — | — | — | 4,068,915 |

| Money Market Funds | — | — | — | 6,551,486 | 6,551,486 |

| Total Investments in Securities | 273,605,695 | — | — | 6,551,486 | 280,157,181 |

| Columbia

Acorn Family of Funds | Annual Report 2018 |

63 |

Table of Contents

Columbia Acorn International SelectSM, December 31, 2018

| 64 | Columbia Acorn Family of Funds | Annual Report 2018 |

Table of Contents

Columbia Acorn International SelectSM, December 31, 2018

| Columbia

Acorn Family of Funds | Annual Report 2018 |

65 |

Table of Contents

Columbia Acorn International SelectSM, December 31, 2018

| (a) | Non-income producing security. |

| (b) | The rate shown is the seven-day current annualized yield at December 31, 2018. |

| (c) | As defined in the Investment Company Act of 1940, an affiliated company is one in which the Fund owns 5% or more of the company’s outstanding voting securities, or a company which is under common ownership or control with the Fund. Holdings and transactions in these affiliated companies during the year ended December 31, 2018 are as follows: |

| Issuer | Beginning

shares |

Shares

purchased |

Shares

sold |

Ending

shares |

Realized

gain (loss) — affiliated issuers ($) |

Net

change in unrealized appreciation (depreciation) — affiliated issuers ($) |

Dividend

— affiliated issuers ($) |

Value

— affiliated issuers at end of period ($) |

| Columbia Short-Term Cash Fund, 2.459% | ||||||||

| — | 23,901,675 | (20,418,900) | 3,482,775 | — | — | 34,282 | 3,482,426 | |

| ADR | American Depositary Receipt |

| ■ | Level 1 – quoted prices in active markets for identical securities |

| ■ | Level 2 – prices determined using other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk and others) |

| ■ | Level 3 – prices determined using significant unobservable inputs where quoted prices or observable inputs are unavailable or less reliable (including management’s own assumptions about the factors market participants would use in pricing an investment) |

| 66 | Columbia Acorn Family of Funds | Annual Report 2018 |

Table of Contents

Columbia Acorn International SelectSM, December 31, 2018

The following table is a summary of the inputs used to value the Fund’s investments at December 31, 2018:

| Level

1 quoted prices in active markets for identical assets ($) |

Level

2 other significant observable inputs ($) |

Level

3 significant unobservable inputs ($) |

Investments

measured at net asset value ($) |

Total ($) | |

| Investments in Securities | |||||

| Common Stocks | |||||

| Australia | — | 2,101,511 | — | — | 2,101,511 |

| Canada | 6,169,841 | — | — | — | 6,169,841 |

| China | 6,122,777 | — | — | — | 6,122,777 |

| Denmark | — | 4,064,135 | — | — | 4,064,135 |

| France | — | 2,242,812 | — | — | 2,242,812 |

| Germany | — | 10,316,637 | — | — | 10,316,637 |

| India | — | 5,463,785 | — | — | 5,463,785 |

| Italy | — | 4,929,736 | — | — | 4,929,736 |

| Japan | — | 18,055,860 | — | — | 18,055,860 |

| Mexico | 2,541,978 | — | — | — | 2,541,978 |

| Netherlands | — | 6,922,981 | — | — | 6,922,981 |

| Singapore | — | 2,442,747 | — | — | 2,442,747 |

| South Africa | — | 2,214,594 | — | — | 2,214,594 |

| South Korea | — | 5,949,943 | — | — | 5,949,943 |

| Sweden | — | 6,759,552 | — | — | 6,759,552 |

| Switzerland | — | 2,910,939 | — | — | 2,910,939 |

| Taiwan | — | 1,982,555 | — | — | 1,982,555 |

| United Kingdom | — | 11,705,616 | — | — | 11,705,616 |

| Total Common Stocks | 14,834,596 | 88,063,403 | — | — | 102,897,999 |

| Preferred Stocks | |||||

| Germany | — | 2,646,703 | — | — | 2,646,703 |

| Total Preferred Stocks | — | 2,646,703 | — | — | 2,646,703 |

| Money Market Funds | — | — | — | 3,482,426 | 3,482,426 |

| Total Investments in Securities | 14,834,596 | 90,710,106 | — | 3,482,426 | 109,027,128 |

| Columbia

Acorn Family of Funds | Annual Report 2018 |

67 |

Table of Contents

Columbia Acorn SelectSM, December 31, 2018

| 68 | Columbia Acorn Family of Funds | Annual Report 2018 |

Table of Contents

Columbia Acorn SelectSM, December 31, 2018

| Columbia

Acorn Family of Funds | Annual Report 2018 |

69 |

Table of Contents

Columbia Acorn SelectSM, December 31, 2018

| (a) | Non-income producing security. |

| (b) | The rate shown is the seven-day current annualized yield at December 31, 2018. |

| (c) | As defined in the Investment Company Act of 1940, an affiliated company is one in which the Fund owns 5% or more of the company’s outstanding voting securities, or a company which is under common ownership or control with the Fund. Holdings and transactions in these affiliated companies during the year ended December 31, 2018 are as follows: |

| Issuer | Beginning

shares |

Shares

purchased |

Shares

sold |

Ending

shares |

Realized

gain (loss) — affiliated issuers ($) |

Net

change in unrealized appreciation (depreciation) — affiliated issuers ($) |

Dividend

— affiliated issuers ($) |

Value

— affiliated issuers at end of period ($) |

| Columbia Short-Term Cash Fund, 2.459% | ||||||||

| — | 57,519,079 | (51,920,393) | 5,598,686 | — | — | 58,197 | 5,598,126 | |

| ■ | Level 1 – quoted prices in active markets for identical securities |

| ■ | Level 2 – prices determined using other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk and others) |

| ■ | Level 3 – prices determined using significant unobservable inputs where quoted prices or observable inputs are unavailable or less reliable (including management’s own assumptions about the factors market participants would use in pricing an investment) |

| 70 | Columbia Acorn Family of Funds | Annual Report 2018 |

Table of Contents

Columbia Acorn SelectSM, December 31, 2018

The following table is a summary of the inputs used to value the Fund’s investments at December 31, 2018:

| Level

1 quoted prices in active markets for identical assets ($) |

Level

2 other significant observable inputs ($) |

Level

3 significant unobservable inputs ($) |

Investments

measured at net asset value ($) |

Total ($) | |

| Investments in Securities | |||||

| Common Stocks | |||||

| Consumer Discretionary | 42,063,118 | — | — | — | 42,063,118 |

| Financials | 28,545,707 | — | — | — | 28,545,707 |

| Health Care | 46,190,029 | — | — | — | 46,190,029 |

| Industrials | 24,856,983 | — | — | — | 24,856,983 |

| Information Technology | 50,662,315 | — | — | — | 50,662,315 |

| Materials | 16,981,727 | — | — | — | 16,981,727 |

| Real Estate | 16,894,551 | — | — | — | 16,894,551 |

| Total Common Stocks | 226,194,430 | — | — | — | 226,194,430 |

| Limited Partnerships | |||||

| Financials | 4,193,625 | — | — | — | 4,193,625 |

| Money Market Funds | — | — | — | 5,598,126 | 5,598,126 |

| Total Investments in Securities | 230,388,055 | — | — | 5,598,126 | 235,986,181 |

| Columbia

Acorn Family of Funds | Annual Report 2018 |

71 |

Table of Contents

Columbia Thermostat FundSM, December 31, 2018

| 72 | Columbia Acorn Family of Funds | Annual Report 2018 |

Table of Contents

Columbia Thermostat FundSM, December 31, 2018

| (a) | As defined in the Investment Company Act of 1940, an affiliated company is one in which the Fund owns 5% or more of the company’s outstanding voting securities, or a company which is under common ownership or control with the Fund. Holdings and transactions in these affiliated companies during the year ended December 31, 2018 are as follows: |

| Issuer | Beginning

shares |

Shares

purchased |

Shares

sold |

Ending

shares |

Realized

gain (loss) — affiliated issuers ($) |

Net

change in unrealized appreciation (depreciation) — affiliated issuers ($) |

Dividend

— affiliated issuers ($) |

Capital

gain distributions — affiliated issuers ($) |

Value

— affiliated issuers at end of period ($) |

| Columbia Acorn International®, Institutional 3 Class | |||||||||

| 364,288 | 887,730 | (941,849) | 310,169 | 2,697,722 | (5,859,756) | 106,587 | 2,302,914 | 9,252,339 | |

| Columbia Acorn SelectSM, Institutional 3 Class | |||||||||

| 487,249 | 1,985,785 | (1,797,080) | 675,954 | 1,031,031 | (2,714,823) | — | 1,684,028 | 8,665,733 | |

| Columbia Acorn® Fund, Institutional 3 Class | |||||||||

| 519,202 | 1,965,073 | (1,857,767) | 626,508 | 983,805 | (1,101,780) | — | 1,077,762 | 8,702,202 | |

| Columbia Contrarian Core Fund, Institutional 3 Class | |||||||||

| 323,920 | 1,226,247 | (1,144,671) | 405,496 | 1,465,203 | (2,537,859) | 120,465 | 701,285 | 8,868,206 | |

| Columbia Corporate Income Fund, Institutional 3 Class | |||||||||

| — | 9,635,083 | (3,850,425) | 5,784,658 | (534,317) | (1,572,715) | 1,651,038 | — | 55,648,413 | |

| Columbia Diversified Fixed Income Allocation ETF | |||||||||

| — | 4,851,268 | (1,914,699) | 2,936,569 | (882,908) | (1,402,651) | 1,808,254 | — | 55,413,057 | |

| Columbia Dividend Income Fund, Institutional 3 Class | |||||||||

| 759,793 | 1,643,587 | (1,949,568) | 453,812 | 4,740,549 | (4,596,821) | 185,099 | 457,730 | 9,080,772 | |

| Columbia Income Opportunities Fund, Institutional 3 Class | |||||||||

| 7,774,323 | 59,913 | (7,834,236) | — | 2,103,636 | (3,913,900) | 696,670 | — | — | |

| Columbia Large Cap Enhanced Core Fund, Institutional 3 Class | |||||||||

| 345,654 | 1,314,270 | (1,234,411) | 425,513 | 1,528,052 | (2,330,223) | 137,052 | 969,978 | 8,935,764 | |

| Columbia Large Cap Index Fund, Institutional 3 Class | |||||||||

| — | 2,843,203 | (2,008,711) | 834,492 | 2,392 | (4,908,597) | 764,736 | 2,706,588 | 35,799,703 | |

| Columbia Quality Income Fund, Institutional 3 Class | |||||||||

| 28,648,549 | 9,836,816 | (17,649,152) | 20,836,213 | (1,722,301) | (210,216) | 3,639,432 | — | 111,473,738 | |

| Columbia Select Large Cap Equity Fund, Institutional 3 Class | |||||||||

| 595,505 | 330,247 | (925,752) | — | 1,195,080 | (595,150) | — | — | — | |

| Columbia Select Large Cap Growth Fund, Institutional 3 Class | |||||||||

| 492,597 | 265,317 | (757,914) | — | 3,424,753 | (1,924,787) | — | — | — | |

| Columbia Short Term Bond Fund, Institutional 3 Class | |||||||||

| 31,104,620 | 5,601,572 | (22,601,330) | 14,104,862 | (1,829,652) | (312,909) | 2,723,852 | — | 138,791,841 | |

| Columbia Short-Term Cash Fund, 2.459% | |||||||||

| — | 55,337,290 | (55,337,290) | — | — | — | 17,487 | — | — | |

| Columbia Total Return Bond Fund, Institutional 3 Class | |||||||||

| 17,065,809 | 71,871 | (17,137,680) | — | (2,138,391) | (854,368) | 764,183 | — | — | |

| Columbia U.S. Treasury Index Fund, Institutional 3 Class | |||||||||

| 6,949,835 | 24,121,919 | (13,313,385) | 17,758,369 | (2,697,300) | 2,412,676 | 3,707,127 | — | 194,631,722 | |

| Total of Affiliated Transactions | 9,367,354 | (32,423,879) | 16,321,982 | 9,900,285 | 645,263,490 | ||||

| (b) | Non-income producing security. |

| ■ | Level 1 – quoted prices in active markets for identical securities |

| Columbia

Acorn Family of Funds | Annual Report 2018 |

73 |

Table of Contents

Columbia Thermostat FundSM, December 31, 2018

| ■ | Level 2 – prices determined using other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk and others) |

| ■ | Level 3 – prices determined using significant unobservable inputs where quoted prices or observable inputs are unavailable or less reliable (including management’s own assumptions about the factors market participants would use in pricing an investment) |

| Level

1 quoted prices in active markets for identical assets ($) |

Level

2 other significant observable inputs ($) |

Level

3 significant unobservable inputs ($) |

Total ($) | |

| Investments in Securities | ||||

| Equity Funds | 89,304,719 | — | — | 89,304,719 |

| Exchange-Traded Funds | 55,413,057 | — | — | 55,413,057 |

| Fixed-Income Funds | 500,545,714 | — | — | 500,545,714 |

| Total Investments in Securities | 645,263,490 | — | — | 645,263,490 |

| 74 | Columbia Acorn Family of Funds | Annual Report 2018 |

Table of Contents

Columbia Acorn Emerging Markets FundSM, December 31, 2018

| Columbia

Acorn Family of Funds | Annual Report 2018 |

75 |

Table of Contents

Columbia Acorn Emerging Markets FundSM, December 31, 2018

| 76 | Columbia Acorn Family of Funds | Annual Report 2018 |

Table of Contents

Columbia Acorn Emerging Markets FundSM, December 31, 2018

| (a) | Non-income producing security. |

| (b) | The rate shown is the seven-day current annualized yield at December 31, 2018. |

| (c) | As defined in the Investment Company Act of 1940, an affiliated company is one in which the Fund owns 5% or more of the company’s outstanding voting securities, or a company which is under common ownership or control with the Fund. Holdings and transactions in these affiliated companies during the year ended December 31, 2018 are as follows: |

| Issuer | Beginning

shares |

Shares

purchased |

Shares

sold |

Ending

shares |

Realized

gain (loss) — affiliated issuers ($) |

Net

change in unrealized appreciation (depreciation) — affiliated issuers ($) |

Dividend

— affiliated issuers ($) |

Value

— affiliated issuers at end of period ($) |

| Columbia Short-Term Cash Fund, 2.459% | ||||||||

| — | 19,123,347 | (18,016,331) | 1,107,016 | — | — | 17,928 | 1,106,905 | |

| ADR | American Depositary Receipt |

| GDR | Global Depositary Receipt |

| ■ | Level 1 – quoted prices in active markets for identical securities |

| ■ | Level 2 – prices determined using other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk and others) |

| ■ | Level 3 – prices determined using significant unobservable inputs where quoted prices or observable inputs are unavailable or less reliable (including management’s own assumptions about the factors market participants would use in pricing an investment) |

| Columbia

Acorn Family of Funds | Annual Report 2018 |

77 |

Table of Contents

Columbia Acorn Emerging Markets FundSM, December 31, 2018

The following table is a summary of the inputs used to value the Fund’s investments at December 31, 2018:

| Level

1 quoted prices in active markets for identical assets ($) |

Level

2 other significant observable inputs ($) |

Level

3 significant unobservable inputs ($) |

Investments

measured at net asset value ($) |

Total ($) | |

| Investments in Securities | |||||

| Common Stocks | |||||

| Brazil | 4,680,402 | — | — | — | 4,680,402 |

| Cambodia | — | 1,737,310 | — | — | 1,737,310 |

| China | 2,193,048 | 1,601,248 | — | — | 3,794,296 |

| Egypt | — | 766,333 | — | — | 766,333 |

| Hong Kong | — | 3,452,492 | — | — | 3,452,492 |

| India | — | 6,317,287 | — | — | 6,317,287 |

| Indonesia | — | 2,747,663 | — | — | 2,747,663 |

| Japan | — | 746,540 | — | — | 746,540 |

| Malaysia | — | 647,846 | — | — | 647,846 |

| Mexico | 2,043,112 | — | — | — | 2,043,112 |

| Philippines | — | 1,426,653 | — | — | 1,426,653 |

| Poland | — | 592,329 | — | — | 592,329 |

| Russian Federation | — | 1,018,775 | — | — | 1,018,775 |

| South Africa | — | 4,601,394 | — | — | 4,601,394 |

| South Korea | — | 9,816,324 | — | — | 9,816,324 |

| Taiwan | 334,995 | 9,414,077 | — | — | 9,749,072 |

| Thailand | — | 2,346,837 | — | — | 2,346,837 |

| Turkey | — | 671,508 | — | — | 671,508 |

| United Kingdom | — | 796,315 | — | — | 796,315 |

| Total Common Stocks | 9,251,557 | 48,700,931 | — | — | 57,952,488 |

| Money Market Funds | — | — | — | 1,106,905 | 1,106,905 |

| Total Investments in Securities | 9,251,557 | 48,700,931 | — | 1,106,905 | 59,059,393 |

| 78 | Columbia Acorn Family of Funds | Annual Report 2018 |

Table of Contents

Columbia Acorn European FundSM, December 31, 2018

| Columbia

Acorn Family of Funds | Annual Report 2018 |

79 |

Table of Contents

Columbia Acorn European FundSM, December 31, 2018

| 80 | Columbia Acorn Family of Funds | Annual Report 2018 |

Table of Contents

Columbia Acorn European FundSM, December 31, 2018

| (a) | Non-income producing security. |

| (b) | The rate shown is the seven-day current annualized yield at December 31, 2018. |

| (c) | As defined in the Investment Company Act of 1940, an affiliated company is one in which the Fund owns 5% or more of the company’s outstanding voting securities, or a company which is under common ownership or control with the Fund. Holdings and transactions in these affiliated companies during the year ended December 31, 2018 are as follows: |

| Issuer | Beginning

shares |

Shares

purchased |

Shares

sold |

Ending

shares |

Realized

gain (loss) — affiliated issuers ($) |

Net

change in unrealized appreciation (depreciation) — affiliated issuers ($) |

Dividend

— affiliated issuers ($) |

Value

— affiliated issuers at end of period ($) |

| Columbia Short-Term Cash Fund, 2.459% | ||||||||

| — | 15,561,882 | (15,428,486) | 133,396 | — | — | 11,604 | 133,382 | |

| ADR | American Depositary Receipt |

| GDR | Global Depositary Receipt |

| ■ | Level 1 – quoted prices in active markets for identical securities |

| ■ | Level 2 – prices determined using other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk and others) |

| ■ | Level 3 – prices determined using significant unobservable inputs where quoted prices or observable inputs are unavailable or less reliable (including management’s own assumptions about the factors market participants would use in pricing an investment) |

| Columbia

Acorn Family of Funds | Annual Report 2018 |

81 |

Table of Contents

Columbia Acorn European FundSM, December 31, 2018

The following table is a summary of the inputs used to value the Fund’s investments at December 31, 2018:

| Level

1 quoted prices in active markets for identical assets ($) |

Level

2 other significant observable inputs ($) |

Level

3 significant unobservable inputs ($) |

Investments

measured at net asset value ($) |

Total ($) | |

| Investments in Securities | |||||

| Common Stocks | |||||

| Belgium | — | 934,923 | — | — | 934,923 |

| Denmark | — | 2,871,842 | — | — | 2,871,842 |

| France | — | 1,254,481 | — | — | 1,254,481 |

| Germany | — | 14,085,173 | — | — | 14,085,173 |

| Ireland | — | 1,482,461 | — | — | 1,482,461 |

| Italy | — | 4,744,558 | — | — | 4,744,558 |

| Malta | — | 2,066,850 | — | — | 2,066,850 |

| Netherlands | — | 1,196,405 | — | — | 1,196,405 |

| Norway | — | 1,622,706 | — | — | 1,622,706 |

| Poland | — | 682,911 | — | — | 682,911 |

| Russian Federation | — | 709,256 | — | — | 709,256 |

| Spain | — | 2,584,602 | — | — | 2,584,602 |

| Sweden | — | 9,594,484 | — | — | 9,594,484 |

| Switzerland | — | 6,367,377 | — | — | 6,367,377 |

| Turkey | — | 482,515 | — | — | 482,515 |

| United Kingdom | 572,653 | 16,091,737 | — | — | 16,664,390 |

| Total Common Stocks | 572,653 | 66,772,281 | — | — | 67,344,934 |

| Preferred Stocks | |||||

| Germany | — | 1,028,762 | — | — | 1,028,762 |

| Total Preferred Stocks | — | 1,028,762 | — | — | 1,028,762 |

| Money Market Funds | — | — | — | 133,382 | 133,382 |

| Total Investments in Securities | 572,653 | 67,801,043 | — | 133,382 | 68,507,078 |

| 82 | Columbia Acorn Family of Funds | Annual Report 2018 |

Table of Contents

December 31, 2018

| Columbia

Acorn® Fund |

Columbia

Acorn International® |

Columbia

Acorn USA® |

Columbia

Acorn International SelectSM | |

| Assets | ||||

| Investments in securities, at value* | ||||

| Unaffiliated issuers (cost $3,171,598,967, $2,089,696,030, $261,136,745, $94,583,254, respectively) | $3,749,664,836 | $2,497,205,475 | $273,605,695 | $105,544,702 |

| Affiliated issuers (cost $67,372,488, $—, $6,551,486, $3,482,426, respectively) | 64,556,598 | — | 6,551,486 | 3,482,426 |

| Cash | — | 881,393 | — | — |

| Receivable for: | ||||

| Investments sold | 4,386,731 | 93,079,902 | — | — |

| Capital shares sold | 1,590,680 | 2,218,588 | 429,796 | 577,678 |

| Dividends | 1,802,158 | 3,428,676 | 207,917 | 146,848 |

| Securities lending income | 931 | 2,686 | 2,192 | — |

| Foreign tax reclaims | 1,655 | 3,721,154 | 666 | 90,220 |

| Expense reimbursement due from Investment Manager | — | — | 113 | 823 |

| Prepaid expenses | 109,536 | 79,140 | 8,265 | 2,627 |

| Trustees’ deferred compensation plan | 2,835,892 | 1,504,437 | 276,041 | — |

| Total assets | 3,824,949,017 | 2,602,121,451 | 281,082,171 | 109,845,324 |

| Liabilities | ||||

| Due upon return of securities on loan | 15,645,500 | 30,949,500 | 4,068,915 | — |

| Payable for: | ||||

| Investments purchased | — | 1,554,956 | — | — |

| Capital shares purchased | 7,153,106 | 15,192,880 | 611,722 | 434,662 |

| Distributions to shareholders | — | — | — | 290 |

| Investment advisory fee | 209,609 | 164,564 | 20,836 | 7,948 |

| Distribution and/or service fees | 22,301 | 8,423 | 1,373 | 763 |

| Transfer agent fees | 413,846 | 333,921 | 37,896 | 12,675 |

| Administration fees | 15,509 | 10,425 | 1,124 | 447 |

| Trustees’ fees | — | 1,196 | — | 54,676 |

| Compensation of chief compliance officer | 7,825 | 7,005 | 566 | 201 |

| Audit fees | 50,745 | 71,565 | 42,555 | 47,115 |

| Line of credit borrowings | — | 26,500,000 | — | — |

| Other expenses | 229,629 | 391,236 | 27,379 | 20,366 |

| Trustees’ deferred compensation plan | 2,835,892 | 1,504,437 | 276,041 | — |

| Total liabilities | 26,583,962 | 76,690,108 | 5,088,407 | 579,143 |

| Net assets applicable to outstanding capital stock | $3,798,365,055 | $2,525,431,343 | $275,993,764 | $109,266,181 |

| Represented by | ||||

| Paid in capital | 3,028,984,376 | 1,956,301,316 | 254,180,717 | 96,794,836 |

| Total distributable earnings (loss) (Note 2) | 769,380,679 | 569,130,027 | 21,813,047 | 12,471,345 |

| Total - representing net assets applicable to outstanding capital stock | $3,798,365,055 | $2,525,431,343 | $275,993,764 | $109,266,181 |

| * Includes the value of securities on loan | 15,784,990 | 29,435,320 | 3,898,417 | — |

| Columbia

Acorn Family of Funds | Annual Report 2018 |

83 |

Table of Contents

December 31, 2018

| Columbia

Acorn® Fund |

Columbia

Acorn International® |

Columbia

Acorn USA® |

Columbia

Acorn International SelectSM | |

| Class A | ||||

| Net assets | $768,031,089 | $296,348,606 | $49,178,788 | $26,072,692 |

| Shares outstanding | 72,139,876 | 10,051,829 | 4,784,721 | 1,112,431 |

| Net asset value per share(a) | $10.65 | $29.48 | $10.28 | $23.44 |

| Maximum sales charge | 5.75% | 5.75% | 5.75% | 5.75% |

| Maximum offering price per share(b) (calculated by dividing the net asset value per share by 1.0 minus the maximum sales charge for Class A shares) | $11.30 | $31.28 | $10.91 | $24.87 |

| Advisor Class | ||||

| Net assets | $40,425,118 | $12,739,847 | $14,578,534 | $1,201,169 |

| Shares outstanding | 2,966,578 | 427,006 | 1,058,459 | 50,042 |

| Net asset value per share(c) | $13.63 | $29.84 | $13.77 | $24.00 |

| Class C | ||||

| Net assets | $81,148,832 | $22,816,836 | $4,608,374 | $2,752,067 |

| Shares outstanding | 17,315,664 | 825,742 | 1,020,158 | 128,151 |

| Net asset value per share(a) | $4.69 | $27.63 | $4.52 | $21.48 |

| Institutional Class | ||||

| Net assets | $2,816,947,535 | $1,824,055,421 | $149,048,190 | $69,412,599 |

| Shares outstanding | 216,971,605 | 61,805,503 | 11,550,958 | 2,915,082 |

| Net asset value per share(c) | $12.98 | $29.51 | $12.90 | $23.81 |

| Institutional 2 Class | ||||

| Net assets | $37,124,324 | $160,488,316 | $3,331,598 | $1,200,215 |

| Shares outstanding | 2,698,576 | 5,442,302 | 240,150 | 49,992 |

| Net asset value per share(c) | $13.76 | $29.49 | $13.87 | $24.01 |

| Institutional 3 Class | ||||

| Net assets | $54,688,157 | $198,933,497 | $55,248,280 | $8,627,439 |

| Shares outstanding | 3,936,739 | 6,668,546 | 3,942,177 | 359,474 |

| Net asset value per share(c) | $13.89 | $29.83 | $14.01 | $24.00 |

| Class R | ||||

| Net assets | $— | $10,048,820 | $— | $— |

| Shares outstanding | — | 341,363 | — | — |

| Net asset value per share(c) | $— | $29.44 | $— | $— |

| (a) | Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge. |

| (b) | On sales of $50,000 or more the offering price is reduced. |

| (c) | Redemption price per share is equal to net asset value. |

| 84 | Columbia Acorn Family of Funds | Annual Report 2018 |

Table of Contents

December 31, 2018

| Columbia

Acorn SelectSM |

Columbia

Thermostat FundSM |

Columbia

Acorn Emerging Markets FundSM |

Columbia

Acorn European FundSM | |

| Assets | ||||

| Investments in securities, at value | ||||

| Unaffiliated issuers (cost $218,754,444, $—, $57,098,961, $64,555,660, respectively) | $230,388,055 | $— | $57,952,488 | $68,373,696 |

| Affiliated issuers (cost $5,598,126, $648,924,554, $1,106,905, $133,382, respectively) | 5,598,126 | 645,263,490 | 1,106,905 | 133,382 |

| Cash | — | 91,999 | — | — |

| Foreign currency (cost $—, $—, $67,088, $—, respectively) | — | — | 67,389 | — |

| Receivable for: | ||||

| Investments sold | — | 4,104,364 | 308,319 | 11,585 |

| Capital shares sold | 163,091 | 773,879 | 83,568 | 212,414 |

| Dividends | 257,610 | 1,154,819 | 160,858 | 26,315 |

| Securities lending income | 103 | — | — | — |

| Foreign tax reclaims | — | — | 10,310 | 163,345 |

| Expense reimbursement due from Investment Manager | — | 2,158 | 2,829 | 2,900 |

| Reimbursement due from affiliates | — | — | 34,559 | — |

| Prepaid expenses | 6,886 | 15,615 | 1,703 | 2,317 |

| Trustees’ deferred compensation plan | 224,321 | — | — | — |

| Total assets | 236,638,192 | 651,406,324 | 59,728,928 | 68,925,954 |

| Liabilities | ||||

| Payable for: | ||||

| Investments purchased | — | 1,150,770 | 154,489 | — |

| Capital shares purchased | 905,354 | 7,130,394 | 218,393 | 320,904 |

| Distributions to shareholders | 726 | — | — | — |

| Foreign capital gains taxes deferred | — | — | 135,319 | — |

| Investment advisory fee | 12,522 | 5,321 | 6,060 | 6,684 |

| Distribution and/or service fees | 2,183 | 17,728 | 1,213 | 1,186 |

| Transfer agent fees | 28,692 | 81,274 | 9,973 | 8,281 |

| Administration fees | 963 | 2,660 | 242 | 281 |

| Trustees’ fees | — | 188,422 | 36,705 | 11,215 |

| Compensation of chief compliance officer | 506 | 1,261 | 151 | 184 |

| Audit fees | 42,555 | 29,275 | 46,555 | 46,555 |

| Line of credit borrowings | — | 900,000 | — | — |

| Other expenses | 25,725 | 46,337 | 33,559 | 25,083 |

| Trustees’ deferred compensation plan | 224,321 | — | — | — |

| Total liabilities | 1,243,547 | 9,553,442 | 642,659 | 420,373 |

| Net assets applicable to outstanding capital stock | $235,394,645 | $641,852,882 | $59,086,269 | $68,505,581 |

| Represented by | ||||

| Paid in capital | 218,476,056 | 643,710,407 | 132,797,066 | 73,645,664 |

| Total distributable earnings (loss) (Note 2) | 16,918,589 | (1,857,525) | (73,710,797) | (5,140,083) |

| Total - representing net assets applicable to outstanding capital stock | $235,394,645 | $641,852,882 | $59,086,269 | $68,505,581 |

| Columbia

Acorn Family of Funds | Annual Report 2018 |

85 |

Table of Contents

December 31, 2018

| Columbia

Acorn SelectSM |

Columbia

Thermostat FundSM |

Columbia

Acorn Emerging Markets FundSM |

Columbia

Acorn European FundSM | |

| Class A | ||||

| Net assets | $90,910,517 | $193,683,129 | $22,442,224 | $22,869,836 |

| Shares outstanding | 8,792,082 | 13,981,533 | 2,090,050 | 1,469,338 |

| Net asset value per share(a) | $10.34 | $13.85 | $10.74 | $15.56 |

| Maximum sales charge | 5.75% | 5.75% | 5.75% | 5.75% |

| Maximum offering price per share(b) (calculated by dividing the net asset value per share by 1.0 minus the maximum sales charge for Class A shares) | $10.97 | $14.69 | $11.40 | $16.51 |

| Advisor Class | ||||

| Net assets | $4,303,906 | $11,815,825 | $827,541 | $1,496,254 |

| Shares outstanding | 341,793 | 861,043 | 76,280 | 95,426 |

| Net asset value per share(c) | $12.59 | $13.72 | $10.85 | $15.68 |

| Class C | ||||

| Net assets | $3,854,873 | $166,291,602 | $9,137,920 | $8,770,220 |

| Shares outstanding | 644,600 | 11,916,020 | 859,659 | 572,257 |

| Net asset value per share(a) | $5.98 | $13.96 | $10.63 | $15.33 |

| Institutional Class | ||||

| Net assets | $119,464,556 | $253,123,490 | $25,476,033 | $32,812,674 |

| Shares outstanding | 9,930,227 | 18,549,554 | 2,361,942 | 2,103,001 |

| Net asset value per share(c) | $12.03 | $13.65 | $10.79 | $15.60 |

| Institutional 2 Class | ||||

| Net assets | $2,026,841 | $16,477,695 | $509,088 | $2,554,012 |

| Shares outstanding | 159,922 | 1,199,450 | 46,881 | 161,896 |

| Net asset value per share(c) | $12.67 | $13.74 | $10.86 | $15.78 |

| Institutional 3 Class | ||||

| Net assets | $14,833,952 | $461,141 | $693,463 | $2,585 |

| Shares outstanding | 1,157,432 | 33,622 | 64,444 | 166 |

| Net asset value per share(c) | $12.82 | $13.72 | $10.76 | $15.53 (d) |

| (a) | Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge. |

| (b) | On sales of $50,000 or more the offering price is reduced. |

| (c) | Redemption price per share is equal to net asset value. |

| (d) | Net asset value per share rounds to this amount due to fractional shares outstanding. |

| 86 | Columbia Acorn Family of Funds | Annual Report 2018 |

Table of Contents

Year Ended December 31, 2018

| Columbia

Acorn® Fund |

Columbia

Acorn International® |

Columbia

Acorn USA® |

Columbia

Acorn International SelectSM | |

| Net investment income | ||||

| Income: | ||||

| Dividends — unaffiliated issuers | $40,215,192 | $78,585,732 | $2,972,412 | $2,099,316 |

| Dividends — affiliated issuers | 626,471 | 536,387 | 84,599 | 34,282 |

| Income from securities lending — net | 502,608 | 342,516 | 91,717 | 5,971 |

| Foreign taxes withheld | (57,682) | (6,663,081) | (27,973) | (181,289) |

| Total income | 41,286,589 | 72,801,554 | 3,120,755 | 1,958,280 |

| Expenses: | ||||

| Investment advisory fee | 31,455,072 | 31,457,852 | 3,140,973 | 1,078,537 |

| Distribution and/or service fees | ||||

| Class A | 2,213,309 | 1,045,019 | 131,655 | 69,152 |

| Class C | 1,801,003 | 475,857 | 78,536 | 44,592 |

| Class R | — | 62,582 | — | — |

| Transfer agent fees | ||||

| Class A | 827,283 | 493,300 | 69,469 | 40,116 |

| Advisor Class | 44,227 | 70,199 | 24,394 | 1,732 |

| Class C | 169,788 | 56,660 | 10,414 | 6,464 |

| Institutional Class | 3,250,553 | 3,199,384 | 259,819 | 113,281 |

| Institutional 2 Class | 26,443 | 182,441 | 4,517 | 586 |

| Institutional 3 Class | 1,036 | 3,933 | 479 | 72 |

| Class R | — | 14,752 | — | — |

| Administration fees | 2,242,562 | 1,942,209 | 162,955 | 57,783 |

| Trustees’ fees | 439,810 | 416,578 | 30,279 | 11,552 |

| Custodian fees | 33,494 | 721,391 | 9,636 | 27,812 |

| Printing and postage fees | 291,152 | 370,546 | 41,675 | 26,720 |

| Registration fees | 101,887 | 123,067 | 86,514 | 87,348 |

| Audit fees | 59,296 | 135,947 | 46,378 | 57,848 |

| Legal fees | 680,107 | 596,467 | 49,255 | 17,628 |

| Line of credit interest | — | 39 | 4,314 | — |

| Compensation of chief compliance officer | 15,223 | 14,746 | 789 | 430 |

| Other | 197,785 | 214,665 | 24,892 | 16,344 |

| Total expenses | 43,850,030 | 41,597,634 | 4,176,943 | 1,657,997 |

| Fees waived or expenses reimbursed by Investment Manager and its affiliates | — | — | (55,563) | (162,309) |

| Fees waived by transfer agent | ||||

| Class A | (207,556) | (33,492) | — | — |

| Advisor Class | (11,155) | (5,914) | — | — |

| Class C | (43,718) | (4,316) | — | — |

| Institutional Class | (818,422) | (217,251) | — | — |

| Institutional 2 Class | (844) | (12,355) | (491) | (127) |

| Institutional 3 Class | (1,036) | (3,933) | (479) | (72) |

| Class R | — | (983) | — | — |

| Expense reduction | (7,700) | (8,672) | (1,420) | (640) |

| Total net expenses | 42,759,599 | 41,310,718 | 4,118,990 | 1,494,849 |

| Net investment income (loss) | (1,473,010) | 31,490,836 | (998,235) | 463,431 |

| Columbia

Acorn Family of Funds | Annual Report 2018 |

87 |

Table of Contents

Year Ended December 31, 2018

| Columbia

Acorn® Fund |

Columbia

Acorn International® |

Columbia

Acorn USA® |

Columbia

Acorn International SelectSM | |

| Realized and unrealized gain (loss) — net | ||||

| Net realized gain (loss) on: | ||||

| Investments — unaffiliated issuers | $587,314,313 | $781,221,077 | $51,544,360 | $15,599,401 |

| Investments — affiliated issuers | (18,511,645) | — | — | — |

| Foreign currency translations | — | (1,618,469) | — | (50,130) |

| Futures contracts | — | (11,785,180) | — | — |

| Net realized gain | 568,802,668 | 767,817,428 | 51,544,360 | 15,549,271 |

| Net change in unrealized appreciation (depreciation) on: | ||||

| Investments — unaffiliated issuers | (728,314,990) | (1,335,717,769) | (53,702,262) | (30,643,125) |

| Investments — affiliated issuers | (1,314,132) | — | — | — |

| Foreign currency translations | — | (194,316) | — | (2,994) |

| Foreign capital gains tax | — | — | — | 14,814 |

| Net change in unrealized appreciation (depreciation) | (729,629,122) | (1,335,912,085) | (53,702,262) | (30,631,305) |

| Net realized and unrealized loss | (160,826,454) | (568,094,657) | (2,157,902) | (15,082,034) |

| Net decrease in net assets resulting from operations | $(162,299,464) | $(536,603,821) | $(3,156,137) | $(14,618,603) |

| 88 | Columbia Acorn Family of Funds | Annual Report 2018 |

Table of Contents

Year Ended December 31, 2018

| Columbia

Acorn SelectSM |

Columbia

Thermostat FundSM |

Columbia

Acorn Emerging Markets FundSM |

Columbia

Acorn European FundSM | |

| Net investment income | ||||

| Income: | ||||

| Dividends — unaffiliated issuers | $3,347,404 | $19,032 | $1,922,434 | $2,340,365 |

| Dividends — affiliated issuers | 58,197 | 16,321,982 | 17,928 | 11,604 |

| Interest | — | 222 | — | — |

| Income from securities lending — net | 2,667 | — | 16,126 | 23,913 |

| Foreign taxes withheld | (16,284) | — | (147,060) | (204,779) |

| Total income | 3,391,984 | 16,341,236 | 1,809,428 | 2,171,103 |

| Expenses: | ||||

| Investment advisory fee | 2,574,956 | 757,511 | 1,095,287 | 1,249,377 |

| Distribution and/or service fees | ||||

| Class A | 272,434 | 570,205 | 73,655 | 83,804 |

| Class C | 142,517 | 2,074,515 | 131,023 | 142,068 |

| Transfer agent fees | ||||

| Class A | 151,648 | 233,742 | 36,608 | 37,977 |

| Advisor Class | 7,574 | 14,440 | 1,369 | 3,943 |

| Class C | 19,909 | 212,564 | 16,233 | 16,086 |

| Institutional Class | 214,329 | 299,164 | 52,690 | 57,968 |

| Institutional 2 Class | 1,199 | 8,682 | 479 | 2,714 |

| Institutional 3 Class | 188 | 54 | 25 | 5 |

| Administration fees | 144,437 | 361,110 | 41,876 | 51,074 |

| Trustees’ fees | 28,573 | 73,555 | 8,905 | 10,316 |