| Label |

Element |

Value |

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Registrant Name |

dei_EntityRegistrantName |

COLUMBIA ACORN TRUST

|

|

| Prospectus Date |

rr_ProspectusDate |

May 01, 2018

|

|

| Columbia Thermostat Fund |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Risk/Return [Heading] |

rr_RiskReturnHeading |

SUMMARY OF THE FUND

|

|

| Objective [Heading] |

rr_ObjectiveHeading |

Investment Objective

|

|

| Objective, Primary [Text Block] |

rr_ObjectivePrimaryTextBlock |

Columbia Thermostat FundSM (the Fund) seeks long-term capital appreciation.

|

|

| Expense [Heading] |

rr_ExpenseHeading |

Fees and Expenses of the Fund

|

|

| Expense Narrative [Text Block] |

rr_ExpenseNarrativeTextBlock |

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. An investor transacting in a class of Fund shares without any front-end sales charge, contingent deferred sales charge, or other asset-based fee for sales or distribution may be required to pay a commission to the financial intermediary for effecting such transactions. Such commission rates are set by the financial intermediary and are not reflected in the tables or the example below. You may qualify for sales charge discounts if you and members of your immediate family invest, or agree to invest in the future, at least $50,000 in certain classes of shares of eligible funds distributed by Columbia Management Investment Distributors, Inc. (the Distributor). More information is available about these and other sales charge discounts and waivers from your financial intermediary, and can be found in the

Choosing a Share Class

section beginning on page 51 of the Fund’s prospectus, in

Appendix A

to the prospectus beginning on page A-1 and in Appendix S to the Statement of Additional Information (SAI) under

Sales Charge Waivers

beginning on page S-1.

|

|

| Shareholder Fees Caption [Text] |

rr_ShareholderFeesCaption |

Shareholder Fees (fees paid directly from your investment)

|

|

| Operating Expenses Caption [Text] |

rr_OperatingExpensesCaption |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

|

|

| Fee Waiver or Reimbursement over Assets, Date of Termination |

rr_FeeWaiverOrReimbursementOverAssetsDateOfTermination |

April 30, 2019

June 30, 2019

|

|

| Portfolio Turnover [Heading] |

rr_PortfolioTurnoverHeading |

Portfolio Turnover

|

|

| Portfolio Turnover [Text Block] |

rr_PortfolioTurnoverTextBlock |

The Fund will indirectly bear the expenses associated with portfolio turnover of the underlying Portfolio Funds in which the Fund invests. Each Portfolio Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A Portfolio Fund’s higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when its shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 33% of the average value of its portfolio.

|

|

| Portfolio Turnover, Rate |

rr_PortfolioTurnoverRate |

33.00%

|

|

| Expense Breakpoint Discounts [Text] |

rr_ExpenseBreakpointDiscounts |

You may qualify for sales charge discounts if you and members of your immediate family invest, or agree to invest in the future, at least $50,000 in certain classes of shares of eligible funds distributed by Columbia Management Investment Distributors, Inc. (the Distributor). More information is available about these and other sales charge discounts and waivers from your financial intermediary, and can be found in the

Choosing a Share Class

section beginning on page 51 of the Fund’s prospectus, in

Appendix A

to the prospectus beginning on page A-1 and in Appendix S to the Statement of Additional Information (SAI) under

Sales Charge Waivers

beginning on page S-1.

|

|

| Expense Breakpoint, Minimum Investment Required [Amount] |

rr_ExpenseBreakpointMinimumInvestmentRequiredAmount |

$ 50,000

|

|

| Expenses Restated to Reflect Current [Text] |

rr_ExpensesRestatedToReflectCurrent |

Other expenses have been restated to reflect current transfer agency fees paid by the Fund.

Acquired fund (Portfolio Fund) fees and expenses (expenses the Fund incurs indirectly through its investments in other funds) have been restated to reflect the fees and expenses of the Fund’s current Portfolio Funds.

|

|

| Expenses Not Correlated to Ratio Due to Acquired Fund Fees [Text] |

rr_ExpensesNotCorrelatedToRatioDueToAcquiredFundFees |

"Total annual Fund operating expenses" include acquired fund (Portfolio Fund) fees and expenses (expenses the Fund incurs indirectly through its investments in other funds) and may be higher than "Total Net Expenses" shown in the Financial Highlights section of this prospectus because "Total Net Expenses" do not include Portfolio Fund (acquired fund) fees and expenses.

|

|

| Expense Example [Heading] |

rr_ExpenseExampleHeading |

Example

|

|

| Expense Example Narrative [Text Block] |

rr_ExpenseExampleNarrativeTextBlock |

The following example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example illustrates the hypothetical expenses that you would incur over the time periods indicated, and assumes that:- you invest $10,000 in the applicable class of Fund shares for the periods indicated,

- your investment has a 5% return each year, and

- the Fund’s total annual operating expenses remain the same as shown in the Annual Fund Operating Expenses table above.

Since the waivers and/or reimbursements shown in the Annual Fund Operating Expenses table above expire as indicated in the preceding table, they are only reflected in the 1 year example and the first year of the other examples. Although your actual costs may be higher or lower, based on the assumptions listed above, your costs would be:

|

|

| Strategy [Heading] |

rr_StrategyHeading |

Principal Investment Strategies

|

|

| Strategy Narrative [Text Block] |

rr_StrategyNarrativeTextBlock |

The Fund is primarily managed as a fund that invests in other funds (i.e., a "fund-of-funds") that seeks to achieve its investment objective by investing its assets among a selected group of underlying stock and bond mutual funds and exchanged-traded funds (ETFs) for which Columbia Wanger Asset Management, LLC, the Fund's investment adviser (the Investment Manager) or its affiliates, including Columbia Management Investment Advisers, LLC (Columbia Management), serves as investment adviser or principal underwriter (the Portfolio Funds). Under normal circumstances, the Fund allocates at least 95% of its net assets (stock/bond assets) among the Portfolio Funds according to an asset allocation table based on the current level of Standard & Poor's (S&P) 500® Index.

Generally, the Fund's allocation to stock funds increases as the S&P 500® Index declines and decreases as the S&P 500® Index rises. When the S&P 500® Index goes up in relation to trading range bands that are predetermined by the Investment Manager, the Fund sells a portion of its stock Portfolio Funds and invests more in the bond Portfolio Funds, and when the S&P 500® Index goes down in relation to the predetermined bands, the Fund increases its investment in the stock Portfolio Funds. Under normal circumstances, the Fund may invest up to 5% of net assets plus any cash received that day in cash, high quality short-term paper and government securities.

Although many asset allocation funds follow a basic approach of moving assets from stocks to bonds when the equity market goes up, and from bonds to stocks when the equity market goes down, some are run by investment managers who allocate fund assets by making subjective decisions based on complicated economic and financial models and complex graphs of market behavior. By contrast, the day-to-day investment decisions for the Fund are made according to a single predetermined allocation table set forth below. The temperature in your house is run by a single rule: your thermostat turns on the furnace if your house is too cold or turns on the air conditioner if your house is too warm. This Fund works the same way, so it is named Columbia Thermostat Fund.

Just as a thermostat may be set at different ranges for different seasons, the structure and allocation ranges of the Fund's asset allocation table may be changed from time to time between two forms, based on the Investment Manager's determination of whether it expects the equity market to be moving over the next year in a side-ways or non-directional pattern, which the Investment Manager terms an "expensive" market, or to be trending upward, which the Investment Manager terms a "normal" market. The Investment Manager's process and methodology for determining whether the current market is "expensive" or "normal" and the structure of each form of allocation table are described in more detail below under Determination of Current Market State. Such determination will be made on at least an annual basis and will be reflected in the asset allocation table disclosed in this prospectus. In general, the two different forms of allocation table are intended to maximize the capture of value under the two different sets of market conditions.

The Fund's current asset allocation table, which is set forth below, reflects the Investment Manager's determination that the equity market is currently "expensive." The structure of the Fund's current allocation table reflects the same form that has been in place since the Fund's inception in 2002.

| Stock/Bond Allocation Table | | | How the Fund will Invest

the Stock/Bond Assets | Level of the

S&P 500® Index | Stock

Percentage | Bond

Percentage | | over 2890 | 10% | 90% | | over 2779 – 2890 | 15% | 85% | | over 2672 – 2779 | 20% | 80% | | over 2569 – 2672 | 25% | 75% | | over 2470 – 2569 | 30% | 70% | | over 2375 – 2470 | 35% | 65% | | over 2284 – 2375 | 40% | 60% | | over 2196 – 2284 | 45% | 55% | | over 2110 – 2196 | 50% | 50% | | over 2026 – 2110 | 55% | 45% | | over 1945 – 2026 | 60% | 40% | | over 1867 – 1945 | 65% | 35% | | over 1792 – 1867 | 70% | 30% | | over 1720 – 1792 | 75% | 25% | | over 1651 – 1720 | 80% | 20% | | over 1585 – 1651 | 85% | 15% | | 1585 and under | 90% | 10% |

When the S&P 500® Index moves into a new band on the table, the Fund will rebalance the stock/bond mix to reflect the new S&P 500® Index price level by redeeming shares of some Portfolio Funds and purchasing shares of other Portfolio Funds. Any such rebalancing typically will be implemented promptly. However, there are two circumstances when a rebalancing may be implemented over a longer timeline. First, when a rebalancing or allocation table change would trigger a 10% point or greater change in stock and bond allocations or individual Portfolio Funds, the rebalancing may be implemented over a period of up to two weeks, if deemed by the Investment Manager to be in the best interest of shareholders. The second exception is a "31-day Rule;" in order to reduce taxable events and minimize short-term trading if the S&P 500® Index price moves back and forth across a band in the allocation table, after the Fund has increased its percentage allocation to either stock funds or bond funds, it will not decrease that allocation for at least 31 days. Following a change in the Fund's stock/bond mix, if the S&P 500® Index remains within the same band for a while, normal market fluctuations will change the values of the Fund's holdings of stock Portfolio Funds and bond Portfolio Funds. The Investment Manager will invest cash flows from sales (or redemptions) of Fund shares to bring the stock/bond mix back toward the allocation percentages for that S&P 500® Index band. For example, if the S&P 500® Index is in the 1792 band, and the value of the holdings of the stock Portfolio Funds has dropped to 68% of the value of the holdings of all Portfolio Funds, the Investment Manager would invest new cash in the stock Portfolio Funds (or cash for redemptions would come from the bond Portfolio Funds). If the 31-day Rule is in effect, the Investment Manager will invest new cash at the stock/bond percentage allocation as of the latest rebalancing.

As an illustrative example, suppose the following:

| Date | Level of the

S&P 500® Index | How the Fund will

invest the Stock/

Bond Assets | | Nov. 1 | We begin when the market is 2176 | 50% stocks, 50% bonds | | Dec. 1 | The S&P 500® goes to 2198 | rebalance 45% stocks, 55% bonds | | Dec. 6 | The S&P 500® drops back to 2186 | no reversal for 31 days | | Jan. 2 | The S&P 500® is at 2150 | rebalance 50% stocks, 50% bonds | | Jan. 20 | The S&P 500® drops to 2056 | rebalance 55% stocks, 45% bonds | | | The market has made a continuation move by going through a second action level, not a reversal move, so the 31-day Rule does not apply in this case. | | Jan. 30 | The S&P 500® goes up to 2115 | no reversal for 31 days | | Feb. 20 | The S&P 500® is at 2123 | rebalance 50% stocks, 50% bonds |

The Investment Manager chooses the Portfolio Funds to be generally consistent with the composition of the Fund's primary stock and bond benchmarks and to allow the Fund to participate in strategies the Investment Manager believes can provide additional return due to active management.

The following table shows the stock and bond Portfolio Funds that the Fund currently uses in its "fund-of-funds" structure and the current target percentage for each Portfolio Fund within the stock or bond asset class. As described more fully below, the Investment Manager may substitute or add additional Portfolio Funds at any time, including funds introduced after the date of this prospectus. The target percentage within each asset class category is achieved by rebalancing the investments within the asset class whenever the S&P 500® Index moves into a new band on the allocation table, subject to the 31-day Rule described above. The Fund will not liquidate its investment in one Portfolio Fund in order to invest in another Portfolio Fund except in connection with a rebalancing due to a move of the S&P 500® Index into a new band (or due to a change by the Investment Manager in the Portfolio Funds or to the relative target percentages among them). Until a subsequent rebalancing, the Fund's cash flows are invested in, or redeemed from, the Portfolio Funds in a manner that will reduce any deviation of the relative values of the Fund's holdings of the Portfolio Funds from the percentages shown below.

| Allocation of Stock/Bond Asset Within Asset Classes | | | Type of Fund | Allocation | | Stock Funds | | | | Columbia Acorn® Fund | Small/Mid-cap growth | 10% | | Columbia Acorn International® | Small/Mid-cap international growth | 10% | | Columbia Acorn SelectSM | Mid-cap growth | 10% | | Columbia Contrarian Core Fund | Large-cap blend | 10% | | Columbia Dividend Income Fund | Large-cap value | 10% | | Columbia Large Cap Enhanced Core Fund | Large-cap blend | 10% | | Columbia Large Cap Index Fund | Large-cap blend | 40% | | Total | | 100% | | | | | | Bond Funds | Type of Fund | Allocation | | Columbia Corporate Income Fund | Corporate bond | 10% | | Columbia Diversified Fixed Income Allocation ETF | Beta advantage multi-sector bond | 10% | | Columbia Quality Income Fund | Government bond | 20% | | Columbia Short Term Bond Fund | Short term bond | 25% | | Columbia U.S. Treasury Index Fund | U.S. Treasury notes/bonds | 35% | | Total | | 100% |

See the Portfolio Funds Summary section of this prospectus for information about the Portfolio Funds' investment objectives and principal investment strategies. Each of the Portfolio Funds is managed by the Investment Manager or its affiliates. The Fund does not pay any sales load on its purchases of shares of the Portfolio Funds.

The Investment Manager has the authority to review the Portfolio Funds and to change the relative percentages among them or to add or eliminate funds. Such review will occur on at least an annual basis and will be reflected in the Portfolio Funds table disclosed in this prospectus.

Determination of Market State

Just as a thermostat may be set at different ranges for different seasons, the Fund’s allocation of assets between stock and bond funds is expected to be set at different range bands depending principally on the Investment Manager’s view of how expensive the equity market is compared to historical levels.

At least annually, the Investment Manager will conduct a review of the current equity market price levels compared to historical price levels, and will determine if the equity market is in an “expensive” state, or a “normal” state. This review will begin with a comparison of the S&P 500® Index’s cyclically adjusted price-to-earnings ratio for the prior seven years against a 40-year history, but the Investment Manager will also take into account additional quantitative or qualitative market factors, including for example, trends in equity price measures and comparisons of equity prices against prices for other asset classes. Based on its determination of the current market state, the Investment Manager will select the form of allocation table to be effective in the Fund’s current prospectus. Also as part of this review, the Investment Manager will update the median historical information used in the table, and the resulting S&P 500® Index levels used to create the bands around the median, regardless of the market state.

As noted below, the form of table used for an “expensive” market is expected to be different from that used for a “normal” market.

Generally, the Investment Manager will determine the current state of the equity market to be “expensive” when its analysis of the S&P 500® Index’s cyclically adjusted price-to-earnings ratio for the prior seven years is within the top quartile of ratio observations over a 40-year history. The “expensive” equity market form of allocation table for the Fund is structured around an implied S&P 500® Index trading range median of 50% stocks/50% bonds (the 50/50 Band), with allocations to bonds decreasing through stratified range bands below the 50/50 Band and allocations to bonds increasing through stratified range bands above the 50/50 Band, as shown by the following example:

| “Expensive” Equity Market Form of Stock/Bond Allocation Table | | Level of the S&P 500® Index | Stock

Percentage | Bond

Percentage |

| above top of trading range below | 10% | 90% | | 4% trading range above top of range below | 15% | 85% | | 4% trading range above top of range below | 20% | 80% | | 4% trading range above top of range below | 25% | 75% | | 4% trading range above top of range below | 30% | 70% | | 4% trading range above top of range below | 35% | 65% |

| 4% trading range above top of range below | 40% | 60% |

| 4% trading range above top of range below | 45% | 55% |

| 4% trading range centered on implied median (50/50 Band)* | 50% | 50% |

| 4% trading range below bottom of range above | 55% | 45% |

| 4% trading range below bottom of range above | 60% | 40% | | 4% trading range below bottom of range above | 65% | 35% | | 4% trading range below bottom of range above | 70% | 30% | | 4% trading range below bottom of range above | 75% | 25% | | 4% trading range below bottom of range above | 80% | 20% | | 4% trading range below bottom of range above | 85% | 15% | | below bottom of trading range above | 90% | 10% |

*Implied median price level as calculated by the Investment Manager.

The “expensive” form of table has been in place since the Fund’s inception in 2002.

Generally, the Investment Manager will determine the current state of the equity market to be “normal” when its analysis of the S&P 500® Index’s cyclically adjusted price-to-earnings ratio for the prior seven years is outside the top quartile of ratio observations over a 40-year history. The “normal” equity market form allocation table for the Fund is also structured around the 50/50 Band, with allocations to bonds decreasing through stratified range bands below the 50/50 Band, and allocations to stocks and bonds set at 50% stocks/50% bonds for all trading levels above the 50/50 Band, as shown by the following example:

| “Normal” Equity Market Form of Stock/Bond Allocation Table

| | Level of the S&P 500® Index | Stock

Percentage | Bond

Percentage | | above trading range that is 2% below implied median (50/50 Band)* | 50% | 50% | | 4% trading range below bottom of range above | 55% | 45% | | 4% trading range below bottom of range above | 60% | 40% | | 4% trading range below bottom of range above | 65% | 35% | | 4% trading range below bottom of range above | 70% | 30% | | 4% trading range below bottom of range above | 75% | 25% | | 4% trading range below bottom of range above | 80% | 20% | | 4% trading range below bottom of range above | 85% | 15% | | below bottom of trading range above | 90% | 10% |

*Implied median price level as calculated by the Investment Manager.

The Investment Manager will conduct the market state review at least annually prior to the annual updating of this prospectus, and may, in its discretion, assess the market state on an "emergency" basis and make any changes deemed necessary to reflect, for example, a very significant move in market levels or a structural change affecting the markets.

Any such "emergency" changes by the Investment Manager, which are expected to be infrequent, would be disclosed in this prospectus.

|

|

| Risk [Heading] |

rr_RiskHeading |

Principal Risks

|

|

| Risk Narrative [Text Block] |

rr_RiskNarrativeTextBlock |

An investment in the Fund involves risks, including specific risks relating to the investment in the Fund based on its investment process and its "fund-of-funds" structure, as well as specific risks related to the individual Portfolio Funds in which it invests that in the aggregate are principal risks to the Fund, including among others, those described below. More information about the Portfolio Funds, including their principal risks, is available in their prospectuses. This prospectus is not an offer for any of the Portfolio Funds. There is no assurance that the Fund will achieve its investment objective and you may lose money. The value of the Fund's holdings may decline, and the Fund's net asset value (NAV) and share price may go down. An investment in the Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

Allocation Risk. The Investment Manager uses an asset allocation strategy in pursuit of its investment objective, there is a risk that the Fund's allocation among asset classes or investments will cause the Fund's shares to lose value or cause the Fund to underperform other funds with similar investment objectives and/or strategies, or that the investments themselves will not produce the returns expected.

Fund-of-Funds Risk. Determinations regarding asset classes or underlying funds and the Fund’s allocations thereto may not successfully achieve the Fund’s investment objective, in whole or in part. The ability of the Fund to realize its investment objective will depend, in large part, on the extent to which the underlying funds realize their investment objective. There is no guarantee that the underlying funds will achieve their respective investment objectives. The Fund is exposed to the same risks as the underlying funds in direct proportion to the allocation of its assets among the underlying funds. By investing in a combination of underlying funds, the Fund has exposure to the risks of many areas of the market. The performance of underlying funds could be adversely affected if other entities that invest in the same underlying funds make relatively large investments or redemptions in such underlying funds. The Fund, and its shareholders, indirectly bear a portion of the expenses of any funds in which the Fund invests. Because the expenses and costs of each underlying fund are shared by its investors, redemptions by other investors in an underlying fund could result in decreased economies of scale and increased operating expenses for such fund. The Investment Manager may have potential conflicts of interest in selecting affiliated funds over unaffiliated funds for investment by the Fund, and may also face potential conflicts of interest in selecting affiliated funds, because the fees the Investment Manager receives from some underlying funds may be higher than the fees paid by other underlying funds. Further, because of the Investment Manager’s confidence in its own strategies, investment philosophy and capacities, it will, in selecting underlying funds, at times prefer a fund in the Columbia Acorn Family of Funds over alternative investments. There can be no assurance, however, that a fund in the Columbia Acorn Family of Funds selected for inclusion in Columbia Thermostat Fund’s portfolio will, in fact, outperform similar funds managed by the Investment Manager’s affiliates.

The Fund is subject indirectly to the risks of the Portfolio Funds described below. Please see the Portfolio Funds Summary for information about which risks apply to which Portfolio Funds.

Market Risk. Market risk refers to the possibility that the market values of securities or other investments that the Fund holds will fall, sometimes rapidly or unpredictably, or fail to rise. An investment in the Fund could lose money over short or long periods.

Interest Rate Risk. Interest rate risk is the risk of losses attributable to changes in interest rates. In general, if prevailing interest rates rise, the values of loans and other debt instruments tend to fall, and if interest rates fall, the values of loans and other debt instruments tend to rise. Changes in the value of a debt instrument usually will not affect the amount of income the Fund receives from it but will generally affect the value of your investment in the Fund. Changes in interest rates may also affect the liquidity of the Fund's investments in debt instruments. In general, the longer the maturity or duration of a debt instrument, the greater its sensitivity to changes in interest rates. Interest rate declines also may increase prepayments of debt obligations, which, in turn, would increase prepayment risk. Similarly, a period of rising interest rates may negatively impact the Fund's performance. Actions by governments and central banking authorities can result in increases in interest rates. Such actions may negatively affect the value of debt instruments held by the Fund, resulting in a negative impact on the Fund's performance and NAV. Securities with floating interest rates are typically less sensitive to interest rate changes, but may decline in value if their interest rates do not rise as much as interest rates in general. Because rates on certain floating rate loans and other debt securities reset only periodically, changes in prevailing interest rates (and particularly sudden and significant changes) can be expected to cause fluctuations in the Fund's NAV. Any interest rate increases could cause the value of the Fund's investments in debt instruments to decrease. Rising interest rates may prompt redemptions from the Fund, which may force the Fund to sell investments at a time when it is not advantageous to do so, which could result in losses.

Credit Risk. Credit risk is the risk that the value of loans or other debt instruments may decline if the issuer thereof defaults or otherwise becomes unable or unwilling, or is perceived to be unable or unwilling, to honor its financial obligations, such as making payments to the Fund when due. Rating agencies assign credit ratings to certain debt instruments to indicate their credit risk. Unless otherwise provided in the Fund's Principal Investment Strategies, investment grade debt instruments are those rated at or above BBB- by Standard and Poor's Ratings Services, or equivalently rated by Moody's Investors Service, Inc. or Fitch, Inc., or, if unrated, determined by the management team to be of comparable quality. Conversely, below investment grade (commonly called "high-yield” or "junk”) debt instruments are those rated below BBB- by Standard and Poor's Ratings Services, or equivalently rated by Moody's Investors Service, Inc. or Fitch, Inc., or, if unrated, determined by the management team to be of comparable quality. A rating downgrade by such agencies can negatively impact the value of such instruments. Lower quality or unrated instruments held by the Fund may present increased credit risk as compared to higher-rated instruments. Non-investment grade debt instruments may be subject to greater price fluctuations and are more likely to experience a default than investment grade debt instruments and therefore may expose the Fund to increased credit risk. If the Fund purchases unrated instruments, or if the ratings of instruments held by the Fund are lowered after purchase, the Fund will depend on analysis of credit risk more heavily than usual.

High-Yield Investments Risk. Securities and other debt instruments held by the Fund that are rated below investment grade (commonly called “high-yield” or “junk” bonds) and unrated debt instruments of comparable quality expose the Fund to a greater risk of loss of principal and income than a fund that invests solely or primarily in investment grade debt instruments. In addition, these investments have greater price fluctuations, are less liquid and are more likely to experience a default than higher-rated debt instruments. High-yield debt instruments are considered to be predominantly speculative with respect to the issuer’s capacity to pay interest and repay principal.

Value Securities Risk. Value securities are securities of companies that may have experienced, for example, adverse business, industry or other developments or may be subject to special risks that have caused the securities to be out of favor and, in turn, potentially undervalued. The market value of a portfolio security may not meet the Investment Manager’s perceived value assessment of that security, or may decline in price, even though the Investment Manager believes the securities are already undervalued. There is also a risk that it may take longer than expected for the value of these investments to rise to the portfolio manager’s perceived value. In addition, value securities, at times, may not perform as well as growth securities or the stock market in general, and may be out of favor with investors for varying periods of time.

Growth Securities Risk. Growth securities typically trade at a higher multiple of earnings than other types of equity securities. Accordingly, the market values of growth securities may never reach their expected market value and may decline in price. In addition, growth securities, at times, may not perform as well as value securities or the stock market in general, and may be out of favor with investors for varying periods of time.

Sector Risk. At times, the Fund may have a significant portion of its assets invested in securities of companies conducting business in a related group of industries within a sector. Companies in the same sector may be similarly affected by economic, regulatory, political or market events or conditions, which may make the Fund more vulnerable to unfavorable developments in that sector than funds that invest more broadly. Generally, the more the Fund diversifies its investments, the more it spreads risk and potentially reduces the risks of loss and volatility.

Foreign Securities Risk. Investments in or exposure to foreign securities involve certain risks not associated with investments in or exposure to securities of U.S. companies. Foreign securities subject the Fund to the risks associated with investing in the particular country of an issuer, including political, regulatory, economic, social, diplomatic and other conditions or events (including, for example, military confrontations, war and terrorism), occurring in the country or region, as well as risks associated with less developed custody and settlement practices. Foreign securities may be more volatile and less liquid than securities of U.S. companies, and are subject to the risks associated with potential imposition of economic and other sanctions against a particular foreign country, its nationals or industries or businesses within the country. In addition, foreign governments may impose withholding or other taxes on the Fund’s income, capital gains or proceeds from the disposition of foreign securities, which could reduce the Fund’s return on such securities.

Operational and Settlement Risks of Foreign Securities. The Fund’s foreign securities are generally held outside the United States in the primary market for the securities in the custody of foreign sub-custodians. Some countries have limited governmental oversight and regulation, which increases the risk of corruption and fraud and the possibility of losses to the Fund. In particular, under certain circumstances, foreign securities may settle on a delayed delivery basis, meaning that the Fund may be required to make payment for securities before the Fund has actually received delivery of the securities or deliver securities prior to the receipt of payment. As a result, there is a risk that the security will not be delivered to the Fund or that payment will not be received. Losses can also result from lost, stolen or counterfeit securities; defaults by brokers and banks; failures or defects of the settlement system; or poor and improper record keeping by registrars and issuers.

Share Blocking. In certain non-U.S. markets, an issuer’s securities are blocked from trading for a specified number of days before and, in certain instances, after a shareholder meeting. The blocking period can last up to several weeks. Share blocking may prevent the Fund from buying or selling securities during this period. As a consequence of these restrictions, the Investment Manager, on behalf of the Fund, may abstain from voting proxies in markets that require share blocking.

Emerging Market Securities Risk. Securities issued by foreign governments or companies in emerging market countries, such as China, Russia and certain countries in Eastern Europe, the Middle East, Asia, Latin America or Africa, are more likely to have greater exposure to the risks of investing in foreign securities that are described in Foreign Securities Risk. In addition, emerging market countries are more likely to experience instability resulting, for example, from rapid changes or developments in social, political, economic or other conditions. Their economies are usually less mature and their securities markets are typically less developed with more limited trading activity (i.e., lower trading volumes and less liquidity) than more developed countries. Emerging market securities tend to be more volatile than securities in more developed markets. Many emerging market countries are heavily dependent on international trade and have fewer trading partners, which makes them more sensitive to world commodity prices and economic downturns in other countries, and some have a higher risk of currency devaluations.

Operational and Settlement Risks of Securities in Emerging Markets. Foreign sub-custodians in emerging markets may be recently organized, lack extensive operating experience or lack effective government oversight or regulation. In addition, there may be legal restrictions or limitations on the ability of the Fund to recover assets held in custody by a foreign sub-custodian in the event of the bankruptcy of the sub-custodian. There may also be a greater risk that settlement may be delayed and that cash or securities of the Fund may be lost because of failures of or defects in the system, including fraud or corruption. Settlement systems in emerging markets also have a higher risk of failed trades.

Risks Related to Currencies and Corporate Actions in Emerging Markets. Risks related to currencies and corporate actions are also greater in emerging market countries than in developed countries. Emerging market currencies may not have an active trading market and are subject to a higher risk of currency devaluations.

Risks Related to Corporate and Securities Laws in Emerging Markets. Securities laws in emerging markets may be relatively new and unsettled and, consequently, there is a risk of rapid and unpredictable change in laws regarding foreign investment, securities regulation, title to securities and shareholder rights.

Liquidity and Trading Volume Risk. Due to market conditions, including uncertainty regarding the price of a security, it may be difficult for the Fund to buy or sell portfolio securities at a desirable time or price, which could result in investment losses. This risk of portfolio illiquidity is heightened with respect to small- and mid-cap securities, generally, and foreign small- and mid-cap securities in particular. The Fund may have to lower the selling price, liquidate other investments, or forego another, more appealing investment opportunity as a result of illiquidity in the markets. As a result of significant and sustained reductions in emerging and developed international market trading volumes in the wake of the 2007-2009 financial crisis, it may take longer to buy or sell securities, which can exacerbate the Fund’s exposure to volatile markets. The Fund may also be limited in its ability to execute favorable trades in portfolio securities in response to changes in share prices and fundamentals, and may be forced to dispose of securities under disadvantageous circumstances and at a loss. As the Fund grows in size or, conversely, if it faces significant redemption pressure, these considerations take on increasing significance and may adversely impact performance.

Foreign Currency Risk. The performance of the Fund may be materially affected positively or negatively by foreign currency strength or weakness relative to the U.S. dollar, particularly if the Fund invests a significant percentage of its assets in foreign securities or other assets denominated in currencies other than the U.S. dollar.

Small- and Mid-Cap Company Securities Risk. Investments in small- and mid-capitalization companies (small- and mid-cap companies) often involve greater risks than investments in larger, more established companies (larger companies) because small- and mid-cap companies tend to have less predictable earnings and may lack the management experience, financial resources, product diversification and competitive strengths of larger companies. Securities of small- and mid-cap companies may be less liquid and more volatile than the securities of larger companies.

U.S. Government Obligations Risk. While U.S. Treasury obligations are backed by the “full faith and credit” of the U.S. Government, such securities are nonetheless subject to credit risk (i.e., the risk that the U.S. Government may be, or be perceived to be, unable or unwilling to honor its financial obligations, such as making payments). Securities issued or guaranteed by federal agencies or authorities and U.S. Government-sponsored instrumentalities or enterprises may or may not be backed by the full faith and credit of the U.S. Government.

Derivatives Risk. Derivatives may involve significant risks. Derivatives are financial instruments with a value in relation to, or derived from, the value of an underlying asset(s) or other reference, such as an index, rate or other economic indicator (each an underlying reference). Derivatives may include those that are privately placed or otherwise exempt from SEC registration, including certain Rule 144A eligible securities. Derivatives could result in Fund losses if the underlying reference does not perform as anticipated. Use of derivatives is a highly specialized activity that can involve investment techniques, risks, and tax planning different from those associated with more traditional investment instruments. The Fund’s derivatives strategy may not be successful and use of certain derivatives could result in substantial, potentially unlimited, losses to the Fund regardless of the Fund’s actual investment. A relatively small movement in the price, rate or other economic indicator associated with the underlying reference may result in substantial loss for the Fund. Derivatives may be more volatile than other types of investments. The value of derivatives may be influenced by a variety of factors, including national and international political and economic developments. Potential changes to the regulation of the derivatives markets may make derivatives more costly, may limit the market for derivatives, or may otherwise adversely affect the value or performance of derivatives. Derivatives can increase the Fund’s risk exposure to underlying references and their attendant risks, such as credit risk, market risk, foreign currency risk and interest rate risk, while exposing the Fund to correlation risk, counterparty risk, hedging risk, leverage risk, liquidity risk, pricing risk and volatility risk.

Convertible Securities Risk. Convertible securities are subject to the usual risks associated with debt instruments, such as interest rate risk and credit risk. Convertible securities also react to changes in the value of the common stock into which they convert, and are thus subject to market risk. The Fund may also be forced to convert a convertible security at an inopportune time, which may decrease the Fund’s return.

Forward Commitments on Mortgage-Backed Securities (including Dollar Rolls) Risk. When purchasing mortgage-backed securities in the “to be announced” (TBA) market (MBS TBAs), the seller agrees to deliver mortgage-backed securities for an agreed upon price on an agreed upon date, but may make no guarantee as to the specific securities to be delivered. In lieu of taking delivery of mortgage-backed securities, the Fund could enter into dollar rolls, which are transactions in which the Fund sells securities to a counterparty and simultaneously agrees to purchase those or similar securities in the future at a predetermined price. Dollar rolls involve the risk that the market value of the securities the Fund is obligated to repurchase may decline below the repurchase price, or that the counterparty may default on its obligations. These transactions may also increase the Fund’s portfolio turnover rate. If the Fund reinvests the proceeds of the security sold, the Fund will also be subject to the risk that the investments purchased with such proceeds will decline in value (a form of leverage risk). MBS TBAs and dollar rolls are subject to the risk that the counterparty to the transaction may not perform or be unable to perform in accordance with the terms of the instrument.

Mortgage- and Other Asset-Backed Securities Risk. The value of any mortgage-backed and other asset-backed securities held by the Fund may be affected by, among other things, changes or perceived changes in: interest rates; factors concerning the interests in and structure of the issuer or the originator of the mortgages or other assets; the creditworthiness of the entities that provide any supporting letters of credit, surety bonds or other credit enhancements; or the market's assessment of the quality of underlying assets. Payment of principal and interest on some mortgage-backed securities (but not the market value of the securities themselves) may be guaranteed by the full faith and credit of a particular U.S. Government agency, authority, enterprise or instrumentality, and some, but not all, are also insured or guaranteed by the U.S. Government. Mortgage-backed securities issued by non-governmental issuers (such as commercial banks, savings and loan institutions, private mortgage insurance companies, mortgage bankers and other secondary market issuers) may entail greater risk than obligations guaranteed by the U.S. Government. Mortgage- and other asset-backed securities are subject to prepayment risk, which is the possibility that the underlying mortgage or other asset may be refinanced or prepaid prior to maturity during periods of declining or low interest rates, causing the Fund to have to reinvest the money received in securities that have lower yields. Rising or high interest rates tend to extend the duration of mortgage- and other asset-backed securities, making their prices more volatile and more sensitive to changes in interest rates.

Stripped Securities Risk. Stripped securities are the separate income or principal components of debt securities. These securities are particularly sensitive to changes in interest rates, and therefore subject to greater fluctuations in price than typical interest bearing debt securities.

Prepayment and Extension Risk. Prepayment and extension risk is the risk that a bond or other security or investment might, in the case of prepayment risk, be called or otherwise converted, prepaid or redeemed before maturity and, in the case of extension risk, that the investment might not be called as expected. In the case of prepayment risk, if the investment is converted, prepaid or redeemed before maturity, the portfolio manager may not be able to invest the proceeds in other investments providing as high a level of income, resulting in a reduced yield to the Fund. In the case of mortgage- or asset-backed securities, as interest rates decrease or spreads narrow, the likelihood of prepayment increases. Conversely, extension risk is the risk that an unexpected rise in interest rates will extend the life of a mortgage- or asset-backed security beyond the prepayment time. If the Fund’s investments are locked in at a lower interest rate for a longer period of time, the portfolio manager may be unable to capitalize on securities with higher interest rates or wider spreads.

Reinvestment Risk. Reinvestment risk is the risk that the Fund will not be able to reinvest income or principal at the same return it is currently earning.

Depositary Receipts Risk. Depositary receipts are receipts issued by a bank or trust company reflecting ownership of underlying securities issued by foreign companies. Some foreign securities are traded in the form of American Depositary Receipts and/or Global Depositary Receipts. Depositary receipts involve risks similar to the risks associated with investments in foreign securities, including those associated with investing in the particular country of an issuer, which may be related to the particular political, regulatory, economic, social and other conditions or events, including, for example, military confrontations, war and terrorism, occurring in the country and fluctuations in such country's currency, as well as market risk tied to the underlying foreign company. In addition, holders of depositary receipts may have limited voting rights, may not have the same rights afforded to stockholders of a typical domestic company in the event of a corporate action, such as an acquisition, merger or rights offering, and may experience difficulty in receiving company stockholder communications. There is no guarantee that a financial institution will continue to sponsor a depositary receipt, or that a depositary receipt will continue to trade on an exchange, either of which could adversely affect the liquidity, availability and pricing of the depositary receipt. Changes in foreign currency exchange rates will affect the value of depositary receipts and, therefore, may affect the value of your investment in the Fund.

Derivatives Risk – Futures Contracts Risk. A futures contract is an exchange-traded derivative transaction between two parties in which a buyer (holding the “long” position) agrees to pay a fixed price (or rate) at a specified future date for delivery of an underlying reference from a seller (holding the “short” position). The seller hopes that the market price on the delivery date is less than the agreed upon price, while the buyer hopes for the contrary. Certain futures contract markets are highly volatile, and futures contracts may be illiquid. Futures exchanges may limit fluctuations in futures contract prices by imposing a maximum permissible daily price movement. The Fund may be disadvantaged if it is prohibited from executing a trade outside the daily permissible price movement. At or prior to maturity of a futures contract, the Fund may enter into an offsetting contract and may incur a loss to the extent there has been adverse movement in futures contract prices. The liquidity of the futures markets depends on participants entering into offsetting transactions rather than making or taking delivery. To the extent participants make or take delivery, liquidity in the futures market could be reduced. Because of the low margin deposits normally required in futures trading, it is possible that the Fund may employ a high degree of leverage in the portfolio. As a result, a relatively small price movement in a futures contract may result in substantial losses to the Fund, exceeding the amount of the margin paid. For certain types of futures contracts, losses are potentially unlimited. Futures markets are highly volatile and the use of futures may increase the volatility of the Fund’s NAV. Futures contracts executed (if any) on foreign exchanges may not provide the same protection as U.S. exchanges. Futures contracts can increase the Fund’s risk exposure to underlying references and their attendant risks, such as credit risk, market risk, foreign currency risk and interest rate risk, while also exposing the Fund to correlation risk, counterparty risk, hedging risk, leverage risk, liquidity risk, pricing risk and volatility risk.

Changing Distribution Level Risk. The Fund will normally receive income which may include interest, dividends and/or capital gains, depending upon its investments. The amount of the distributions the Fund pays will vary and generally depends on the amount of income the Fund earns (less expenses) on its portfolio holdings, and capital gains or losses it recognizes. A decline in the Fund's income or net capital gains from its investments may reduce its distribution level.

Rule 144A and Other Exempted Securities Risk. The Fund may invest in privately placed and other securities or instruments exempt from SEC registration (collectively “private placements”), subject to liquidity and other regulatory restrictions. In the U.S. market, private placements are typically sold only to qualified institutional buyers, or qualified purchasers, as applicable. An insufficient number of buyers interested in purchasing private placements at a particular time could adversely affect the marketability of such investments and the Fund might be unable to dispose of them promptly or at reasonable prices, subjecting the Fund to liquidity risk. The Fund may invest in private placements determined to be liquid as well as those determined to be illiquid. Even if determined to be liquid, the Fund’s holdings of private placements may increase the level of Fund illiquidity if eligible buyers are unable or unwilling to purchase them at a particular time. Issuers of Rule 144A eligible securities are required to furnish information to potential investors upon request. However, the required disclosure is much less extensive than that required of public companies and is not publicly available since the offering is not filed with the SEC. Further, issuers of Rule 144A eligible securities can require recipients of the offering information (such as the Fund) to agree contractually to keep the information confidential, which could also adversely affect the Fund’s ability to dispose of the security.

Select Portfolio Risk. Because the Fund may invest in a limited number of companies, the Fund as a whole is subject to greater risk of loss if any of its portfolio securities decline in price. In addition, the Fund’s holdings and weightings will diverge significantly from its primary benchmark’s holdings and weightings and the Fund may therefore experience greater risk and volatility relative to the benchmark. Because the Fund may invest in more than one company concentrated in a similar industry, sector or geographic region, the Fund may be even more concentrated than the number of companies it may hold would suggest.

Derivatives Risk – Swaps Risk. In a typical swap transaction, two parties agree to exchange the return earned on a specified underlying reference for a fixed return or the return from another underlying reference during a specified period of time. Swaps may be difficult to value and may be illiquid. Swaps could result in Fund losses if the underlying asset or reference does not perform as anticipated. Swaps create significant investment leverage such that a relatively small price movement in a swap may result in immediate and substantial losses to the Fund. The Fund may only close out a swap with its particular counterparty, and may only transfer a position with the consent of that counterparty. Certain swaps, such as short swap transactions and total return swaps, have the potential for unlimited losses, regardless of the size of the initial investment. Swaps can increase the Fund’s risk exposure to underlying references and their attendant risks, such as credit risk, market risk, foreign currency risk and interest rate risk, while also exposing the Fund to correlation risk, counterparty risk, hedging risk, inflation risk, leverage risk, liquidity risk, pricing risk and volatility risk.

Highly Leveraged Transactions Risk. The loans or other debt instruments in which the Fund invests may include highly leveraged transactions whereby the borrower assumes large amounts of debt in order to have the financial resources to attempt to achieve its business objectives. Loans or other debt instruments that are part of highly leveraged transactions involve a greater risk (including default and bankruptcy) than other investments.

Issuer Risk. An issuer in which the Fund invests or to which it has exposure may perform poorly, and the value of its securities may therefore decline, which would negatively affect the Fund's performance. Poor performance may be caused by poor management decisions, competitive pressures, breakthroughs in technology, reliance on suppliers, labor problems or shortages, corporate restructurings, fraudulent disclosures, natural disasters or other events, conditions or factors. The market capitalization of an issuer may also impact its risk profile. Investments in larger, more established companies may involve certain risks associated with their larger size. For instance, larger, more established companies may be less able to respond quickly to new competitive challenges, such as changes in consumer tastes or innovation from smaller competitors. Also, larger companies are sometimes less able to attain the high growth rates of successful smaller companies, especially during extended periods of economic expansion.

Counterparty Risk. Counterparty risk is the risk that a counterparty to a transaction in a financial instrument held by the Fund or by a special purpose or structured vehicle invested in by the Fund may become insolvent or otherwise fail to perform its obligations. As a result, the Fund may obtain no or limited recovery of its investment, and any recovery may be significantly delayed.

Exchange-Traded Fund (ETF) Risk. ETFs are subject to, among other risks, tracking risk and passive and, in some cases, active investment risk. An ETF's share price may not track its specified market index (if any) and may trade below its NAV. Certain ETFs use a "passive" investment strategy and do not take defensive positions in volatile or declining markets. Other ETFs are actively managed ETFs (i.e., they do not track a particular benchmark), which are subject to active management risk. An active secondary market in ETF shares may not develop or be maintained and may be halted or interrupted due to actions by its listing exchange, unusual market conditions or other reasons. There can be no assurance that an ETF's shares will continue to be listed on an active exchange. In addition, shareholders bear expenses incurred through ownership of the ETF. There is a risk that ETFs may terminate due to extraordinary events. For example, any of the service providers to ETFs, such as the trustee or sponsor, may close or otherwise fail to perform their obligations to the ETF, and the ETF may not be able to find a substitute service provider. Also, certain ETFs may be dependent upon licenses to use various indexes as a basis for determining their compositions and/or otherwise to use certain trade names. If these licenses are terminated, the ETFs may also terminate. In addition, an ETF may terminate if its net assets fall below a certain amount.

Liquidity Risk. Liquidity risk is the risk associated with any event, circumstance, or characteristic of an investment or market that negatively impacts the Fund's ability to sell, or realize the proceeds from the sale of, an investment at a desirable time or price. Liquidity risk may arise because of, for example, a lack of marketability of the investment, which means that when seeking to sell its portfolio investments, the Fund could find that selling is more difficult than anticipated, especially during times of high market volatility. Decreases in the number of financial institutions, including banks and broker-dealers, willing to make markets (match up sellers and buyers) in the Fund's investments or decreases in their capacity or willingness to trade such investments may increase the Fund's exposure to this risk. The debt market has experienced considerable growth, and financial institutions making markets in instruments purchased and sold by the Fund (e.g., bond dealers) have been subject to increased regulation. The impact of that growth and regulation on the ability and willingness of financial institutions to engage in trading or "making a market" in such instruments remains unsettled. Certain types of investments, such as lower-rated securities or those that are purchased and sold in over-the-counter markets, may be especially subject to liquidity risk. Securities or other assets in which the Fund invests may be traded in the over-the-counter market rather than on an exchange and therefore may be more difficult to purchase or sell at a fair price, which may have a negative impact on the Fund's performance. Market participants attempting to sell the same or a similar instrument at the same time as the Fund could exacerbate the Fund's exposure to liquidity risk. The Fund may have to accept a lower selling price for the holding, sell other liquid or more liquid investments that it might otherwise prefer to hold (thereby increasing the proportion of the Fund's investments in less liquid or illiquid securities), or forego another more appealing investment opportunity. Certain investments that were liquid when purchased by the Fund may later become illiquid, particularly in times of overall economic distress. Changing regulatory, market or other conditions or environments (for example, the interest rate or credit environments) may also adversely affect the liquidity and the price of the Fund's investments. Judgment plays a larger role in valuing illiquid or less liquid investments as compared to valuing liquid or more liquid investments. Price volatility may be higher for illiquid or less liquid investments as a result of, for example, the relatively less frequent pricing of such securities (as compared to liquid or more liquid investments). Generally, the less liquid the market at the time the Fund sells a portfolio investment, the greater the risk of loss or decline of value to the Fund. Overall market liquidity and other factors can lead to an increase in redemptions, which may negatively impact Fund performance and NAV, including, for example, if the Fund is forced to sell investments in a down market.

The Fund is subject indirectly to the following risks of Portfolio Funds seeking returns that correspond to a stated market index (the Index).

Active Management Risk. Due to its active management, the Fund could underperform its benchmark index and/or other funds with similar investment objectives and/or strategies.

Index Fund Risk. An index fund seeks to track the performance of the Index by using indexing strategies and, therefore, would not necessarily sell a security because the security's issuer was in financial trouble or defaulted, or whose credit rating was downgraded, unless that security was removed from the Index. The decision of whether to remove a security from an index is made by an independent index provider who is not affiliated with the Fund or the Investment Manager or its affiliates.

Index Methodology Risk. An index fund seeks performance that corresponds to the performance of the Index. There is no guarantee or assurance that the Index will achieve high, or even positive, returns. The Index may underperform more traditional indices. The Fund could lose value while other indices or measures of market performance increase in value or performance. In addition, the Fund may be subject to the risk that the index provider may not follow its stated methodology for construction of the Index and/or achieve the index provider's intended performance objective. Errors may result in a negative performance impact to the Fund and its shareholders.

Correlation/Tracking Error Risk. An index fund's value will generally decline when the performance of the Index declines. A number of factors may affect the Fund's ability to achieve a high degree of correlation with the Index, and there is no guarantee that the Fund will achieve a high degree of correlation. Failure to achieve such degree of correlation may prevent the Fund from achieving its investment objective. The factors that may adversely affect the Fund's correlation with the Index include the size of the Fund's portfolio, fees, expenses, transaction costs, income items, valuation methodology, accounting standards, the effectiveness of sampling techniques (if applicable), changes in the Index and disruptions or illiquidity in the markets for the securities in which the Fund invests. While the Fund typically attempts to track the performance of the Index by investing all, or substantially all, of its assets in the securities that make up the Index in approximately the same proportion as their weighting in the Index, at times, the Fund may not have investment exposure to all securities in the Index, or its weighting of investment exposure to securities may be different from that of the Index. In addition, the Fund may invest in securities not included in the Index. The Fund may take or refrain from taking investment positions for various reasons, such as tax efficiency purposes, or to comply with regulatory restrictions, which may negatively affect the Fund's correlation with the Index. The Fund may also be subject to large movements of assets into and out of the Fund, potentially resulting in the Fund being over- or under-exposed to certain securities comprising the Index and may be impacted by Index reconstitutions and Index rebalancing events. Holding cash balances may detract from the Fund's ability to track the Index. In addition, the Fund's NAV may deviate from the Index if the Fund fair values a portfolio security at a price other than the price used by the Index for that security. The Fund also bears management and other expenses and transaction costs in trading securities, which the Index does not bear. Accordingly, the Fund's performance will likely fail to match the performance of the Index, after taking expenses into account. Any of these factors could decrease correlation between the performance of the Fund and the Index and may hinder the Fund's ability to meet its investment objective. It is not possible to invest directly in an index.

New Fund Risk. Columbia Diversified Fixed Income Allocation ETF is a newly-formed Fund. Accordingly, investors in the Fund bear the risk that the Fund may not be successful in implementing its investment strategy of replicating the Index, which could result in the Fund being liquidated at any time without shareholder approval and/or at a time that may not be favorable for shareholders. Such a liquidation could have negative tax consequences for shareholders.

|

|

| Risk Lose Money [Text] |

rr_RiskLoseMoney |

There is no assurance that the Fund will achieve its investment objective and you may lose money.

|

|

| Risk Not Insured Depository Institution [Text] |

rr_RiskNotInsuredDepositoryInstitution |

An investment in the Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

|

|

| Bar Chart and Performance Table [Heading] |

rr_BarChartAndPerformanceTableHeading |

Performance Information

|

|

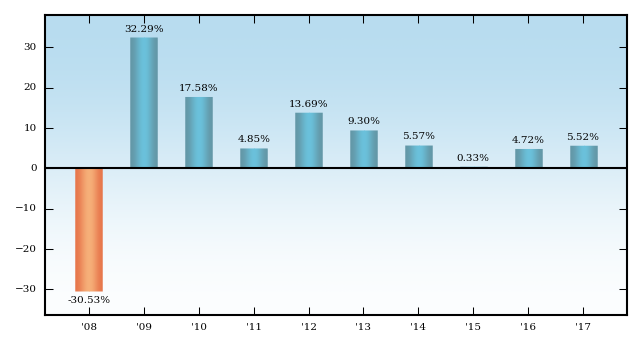

| Performance Narrative [Text Block] |

rr_PerformanceNarrativeTextBlock |

The following bar chart and table show you how the Fund has performed in the past, and can help you understand the risks of investing in the Fund. The bar chart shows how the Fund’s Class Inst share performance has varied for each full calendar year shown. The table below the bar chart compares the Fund’s returns for the periods shown with those of two broad-based indexes: the S&P 500® Index, the Fund’s primary benchmark for equity securities, and the Bloomberg Barclays U.S. Aggregate Bond Index, the Fund’s primary benchmark for debt securities. The table below also compares the Fund's returns with a secondary, custom index, the Blended Benchmark. The S&P 500® Index tracks the performance of 500 widely held, large-capitalization U.S. stocks. The Bloomberg Barclays U.S. Aggregate Bond Index is a market value-weighted index that tracks the daily price, coupon, pay-downs, and total return performance of fixed-rate, publicly placed, dollar-denominated, and non-convertible investment grade debt issues with at least $250 million par amount outstanding and with at least one year to final maturity. The Blended Benchmark was established by the Investment Manager to show how the Fund’s performance compares to an equally weighted custom composite of the Fund’s primary equity and primary debt benchmarks, the S&P 500® Index and the Bloomberg Barclays U.S. Aggregate Bond Index, respectively. The percentage of the Fund’s assets allocated to underlying stock and bond Portfolio Funds will vary, and accordingly the composition of the Fund’s portfolio will not always reflect the composition of the Blended Benchmark.

The performance of one or more share classes shown in the Average Annual Total Returns table below includes the Fund’s Class Inst share returns (adjusted to reflect the higher class-related operating expenses of such classes, where applicable) for periods prior to the indicated inception date of such share classes. Except for differences in fees and expenses, all share classes of the Fund would have substantially similar annual returns because all share classes of the Fund invest in the same portfolio of securities.

The after-tax returns shown in the Average Annual Total Returns table below are calculated using the highest historical individual U.S. federal marginal income tax rates in effect during the period indicated in the table and do not reflect the impact of state, local or foreign taxes. Your actual after-tax returns will depend on your personal tax situation and may differ from those shown in the table. In addition, the after-tax returns shown in the table do not apply to shares held in tax-advantaged accounts such as 401(k) plans or Individual Retirement Accounts (IRAs). The after-tax returns are shown only for Class Inst shares and will vary for other share classes.

The Fund’s performance prior to May 2018 reflects returns achieved following a principal investment strategy with a single form of allocation table. While the Fund now follows a principal investment strategy with two potential forms of allocation table, as described above in the Principal Investment Strategies section, the form of the Fund’s currently effective allocation table has been in place since the Fund’s inception in 2002. The Fund's performance prior to May 2018 reflects the current form of allocation table.

The Fund’s past performance (before and after taxes) is no guarantee of how the Fund will perform in the future. Updated performance information can be obtained by calling toll-free 800.345.6611 or visiting columbiathreadneedle.com/us.

|

|

| Performance Information Illustrates Variability of Returns [Text] |

rr_PerformanceInformationIllustratesVariabilityOfReturns |

The following bar chart and table show you how the Fund has performed in the past, and can help you understand the risks of investing in the Fund. The bar chart shows how the Fund’s Class Inst share performance has varied for each full calendar year shown. The table below the bar chart compares the Fund’s returns for the periods shown with those of two broad-based indexes: the S&P 500® Index, the Fund’s primary benchmark for equity securities, and the Bloomberg Barclays U.S. Aggregate Bond Index, the Fund’s primary benchmark for debt securities. The table below also compares the Fund's returns with a secondary, custom index, the Blended Benchmark.

|

|

| Performance Additional Market Index [Text] |

rr_PerformanceAdditionalMarketIndex |

The Blended Benchmark was established by the Investment Manager to show how the Fund’s performance compares to an equally weighted custom composite of the Fund’s primary equity and primary debt benchmarks, the S&P 500® Index and the Bloomberg Barclays U.S. Aggregate Bond Index, respectively. The percentage of the Fund’s assets allocated to underlying stock and bond Portfolio Funds will vary, and accordingly the composition of the Fund’s portfolio will not always reflect the composition of the Blended Benchmark.

|

|

| Performance Availability Phone [Text] |

rr_PerformanceAvailabilityPhone |

800.345.6611

|

|

| Performance Availability Website Address [Text] |

rr_PerformanceAvailabilityWebSiteAddress |

columbiathreadneedle.com/us

|

|

| Performance Past Does Not Indicate Future [Text] |

rr_PerformancePastDoesNotIndicateFuture |

The Fund’s past performance (before and after taxes) is no guarantee of how the Fund will perform in the future.

|

|

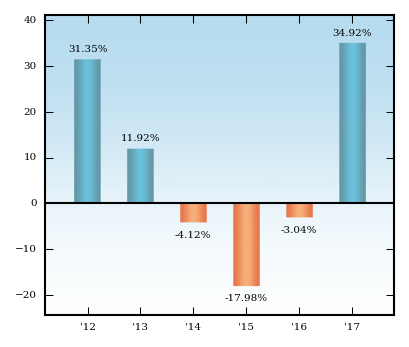

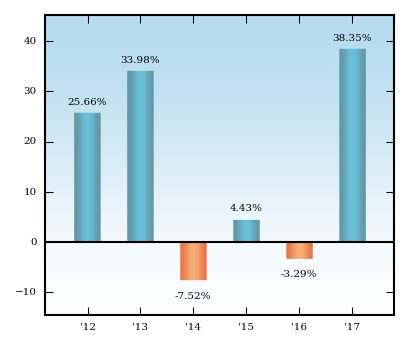

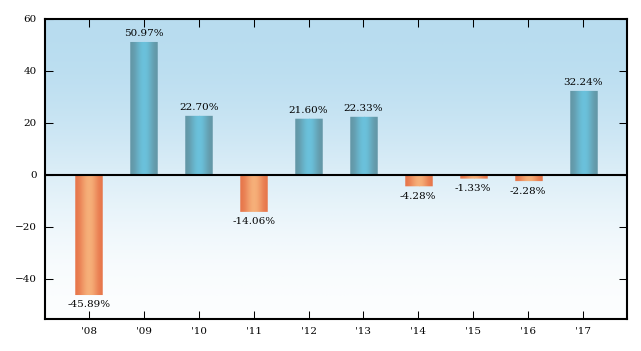

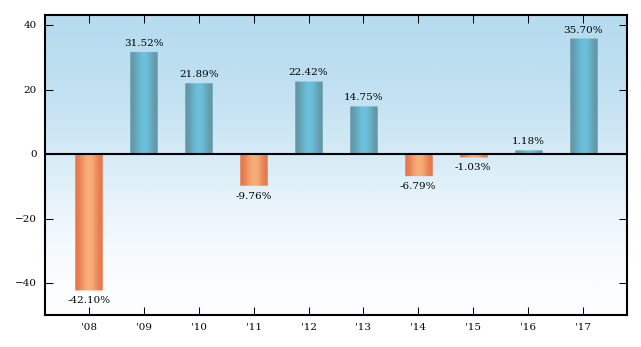

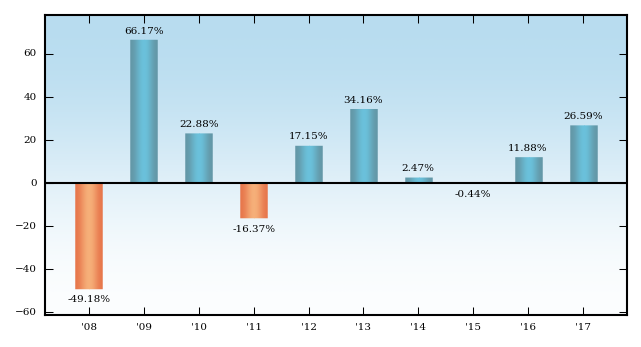

| Bar Chart [Heading] |

rr_BarChartHeading |

Year by Year Total Return (%)

as of December 31 Each Year

|

|

| Bar Chart Closing [Text Block] |

rr_BarChartClosingTextBlock |

Best and Worst Quarterly Returns

During the Period Shown in the Bar Chart

Best 2nd Quarter 2009 19.33%

Worst 4th Quarter 2008 -19.26%

|

|

| Performance Table Heading |

rr_PerformanceTableHeading |

Average Annual Total Returns After Applicable Sales Charges (for periods ended December 31, 2017)

|

|

| Performance Table Uses Highest Federal Rate |

rr_PerformanceTableUsesHighestFederalRate |

The after-tax returns shown in the Average Annual Total Returns table below are calculated using the highest historical individual U.S. federal marginal income tax rates in effect during the period indicated in the table and do not reflect the impact of state, local or foreign taxes.

|

|

| Performance Table Not Relevant to Tax Deferred |

rr_PerformanceTableNotRelevantToTaxDeferred |

In addition, the after-tax returns shown in the table do not apply to shares held in tax-advantaged accounts such as 401(k) plans or Individual Retirement Accounts (IRAs).

|

|

| Performance Table One Class of after Tax Shown [Text] |

rr_PerformanceTableOneClassOfAfterTaxShown |

The after-tax returns are shown only for Class Inst shares and will vary for other share classes.

|

|

| Columbia Thermostat Fund | Class A |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum sales charge (load) imposed on purchases (as a % of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

5.75%

|

|

| Maximum deferred sales charge (load) imposed on redemptions (as a % of the lower of the original purchase price or current net asset value) |

rr_MaximumDeferredSalesChargeOverOther |

1.00%

|

[1] |

| Management fees |

rr_ManagementFeesOverAssets |

0.10%

|

|

| Distribution and/or service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

0.25%

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.19%

|

[2] |

| Acquired fund fees and expenses |

rr_AcquiredFundFeesAndExpensesOverAssets |

0.35%

|

[3] |

| Total annual Fund operating expenses |

rr_ExpensesOverAssets |

0.89%

|

[4] |

| Fee waivers and/or expense reimbursements |

rr_FeeWaiverOrReimbursementOverAssets |

(0.04%)

|

[5] |

| Total annual Fund operating expenses after fee waivers and/or expense reimbursements |

rr_NetExpensesOverAssets |

0.85%

|

|

| Expenses Deferred Charges [Text Block] |

rr_ExpensesDeferredChargesTextBlock |

This charge is imposed on certain investments of between $1 million and $50 million redeemed within 18 months after purchase, as follows: 1.00% if redeemed within 12 months after purchase, and 0.50% if redeemed more than 12, but less than 18, months after purchase, with certain limited exceptions.

|

|

| 1 year |

rr_ExpenseExampleYear01 |

$ 657

|

|

| 3 years |

rr_ExpenseExampleYear03 |

839

|

|

| 5 years |

rr_ExpenseExampleYear05 |

1,036

|

|

| 10 years |

rr_ExpenseExampleYear10 |

1,605

|

|

| 1 year |

rr_ExpenseExampleNoRedemptionYear01 |

657

|

|

| 3 years |

rr_ExpenseExampleNoRedemptionYear03 |

839

|

|

| 5 years |

rr_ExpenseExampleNoRedemptionYear05 |

1,036

|

|

| 10 years |

rr_ExpenseExampleNoRedemptionYear10 |

$ 1,605

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

(0.86%)

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

3.55%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

4.24%

|

|

| Share Class Inception Date |

rr_AverageAnnualReturnInceptionDate |

Mar. 03, 2003

|

|

| Columbia Thermostat Fund | Class Adv |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum sales charge (load) imposed on purchases (as a % of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) imposed on redemptions (as a % of the lower of the original purchase price or current net asset value) |

rr_MaximumDeferredSalesChargeOverOther |

none

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.10%

|

|

| Distribution and/or service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

none

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.19%

|

[2] |

| Acquired fund fees and expenses |

rr_AcquiredFundFeesAndExpensesOverAssets |

0.35%

|

[3] |

| Total annual Fund operating expenses |

rr_ExpensesOverAssets |

0.64%

|

[4] |

| Fee waivers and/or expense reimbursements |

rr_FeeWaiverOrReimbursementOverAssets |

(0.04%)

|

[5] |

| Total annual Fund operating expenses after fee waivers and/or expense reimbursements |

rr_NetExpensesOverAssets |

0.60%

|

|

| 1 year |

rr_ExpenseExampleYear01 |

$ 61

|

|

| 3 years |

rr_ExpenseExampleYear03 |

201

|

|

| 5 years |

rr_ExpenseExampleYear05 |

353

|

|

| 10 years |

rr_ExpenseExampleYear10 |

795

|

|

| 1 year |

rr_ExpenseExampleNoRedemptionYear01 |

61

|

|

| 3 years |

rr_ExpenseExampleNoRedemptionYear03 |

201

|

|

| 5 years |

rr_ExpenseExampleNoRedemptionYear05 |

353

|

|

| 10 years |

rr_ExpenseExampleNoRedemptionYear10 |

$ 795

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

5.49%

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

5.04%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

5.12%

|

|

| Share Class Inception Date |

rr_AverageAnnualReturnInceptionDate |

Nov. 08, 2012

|

|

| Columbia Thermostat Fund | Class C |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum sales charge (load) imposed on purchases (as a % of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum deferred sales charge (load) imposed on redemptions (as a % of the lower of the original purchase price or current net asset value) |

rr_MaximumDeferredSalesChargeOverOther |

1.00%

|

[6] |

| Management fees |

rr_ManagementFeesOverAssets |

0.10%

|

|

| Distribution and/or service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

1.00%

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.19%

|

[2] |

| Acquired fund fees and expenses |

rr_AcquiredFundFeesAndExpensesOverAssets |