| Class | Ticker Symbol | |

| Class A Shares | CTFAX | |

| Class C Shares | CTFDX | |

| Class R4 Shares | CTORX | |

| Class R5 Shares | CQTRX | |

| Class Y Shares | CYYYX | |

| Class Z Shares | COTZX |

| Shareholder Fees (fees paid directly from your investment) | |||

| Class A | Class C | Classes

R4, R5, Y and Z | |

| Maximum sales charge (load) imposed on purchases (as a % of offering price) | 5.75% | None | None |

| Maximum deferred sales charge (load) imposed on redemptions (as a % of the lower of the original purchase price or current net asset value) | 1.00% (a) | 1.00% (b) | None |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | ||||||

| Class A | Class C | Class R4 | Class R5 | Class Y | Class Z | |

| Management fees | 0.10% | 0.10% | 0.10% | 0.10% | 0.10% | 0.10% |

| Distribution and/or service (12b-1) fees | 0.25% | 1.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Other expenses | 0.17% | 0.17% | 0.18% | 0.15% | 0.10% | 0.16% |

| Acquired fund fees and expenses | 0.52% | 0.52% | 0.52% | 0.52% | 0.52% | 0.52% |

| Total annual Fund operating expenses(c) | 1.04% | 1.79% | 0.80% | 0.77% | 0.72% | 0.78% |

| Fee waivers and/or expense reimbursements(d) | (0.02%) | (0.02%) | (0.03%) | (0.01%) | (0.01%) | (0.01%) |

| Total annual Fund operating expenses after fee waivers and/or expense reimbursements | 1.02% | 1.77% | 0.77% | 0.76% | 0.71% | 0.77% |

| (a) | This charge is imposed on certain investments of between $1 million and $50 million redeemed within 18 months after purchase, as follows: 1.00% if redeemed within 12 months after purchase, and 0.50% if redeemed more than 12, but less than 18, months after purchase, with certain limited exceptions. |

| (b) | This charge applies to redemptions within 12 months after purchase, with certain limited exceptions. |

| (c) | “Total annual Fund operating expenses” include acquired fund (Portfolio Fund) fees and expenses (expenses the Fund incurs indirectly through its investments in other funds) and may be higher than “Total Net Expenses” shown in the Financial Highlights section of this prospectus because “Total Net Expenses” do not include Portfolio Fund (acquired fund) fees and expenses. |

| (d) | Columbia Wanger Asset Management, LLC (the Investment Manager) has contractually agreed to waive fees and reimburse certain expenses of the Fund so that ordinary operating expenses (excluding transaction costs and certain other investment-related expenses, interest and fees on borrowings and expenses associated with the Fund’s investment in the Portfolio Funds (acquired funds)), do not exceed the annual rates of 0.50% for Class A shares, 1.25% for Class C shares, 0.25% for Class R4 shares, 0.24% for Class R5 shares, 0.19% for Class Y shares and 0.25% for Class Z shares, through April 30, 2017. This arrangement may only be modified or amended with approval from the Fund and the Investment Manager. |

| ■ | you invest $10,000 in the applicable class of Fund shares for the periods indicated, |

| ■ | your investment has a 5% return each year, and |

| ■ | the Fund’s total annual operating expenses remain the same as shown in the Annual Fund Operating Expenses table above. |

| 1 | Columbia Thermostat FundSM |

| 1 year | 3 years | 5 years | 10 years | |

| Class A (whether or not shares are redeemed) | $673 | $885 | $1,114 | $1,771 |

| Class C (assuming redemption of all shares at the end of the period) | $280 | $561 | $ 968 | $2,104 |

| Class C (assuming no redemption of shares) | $180 | $561 | $ 968 | $2,104 |

| Class R4 (whether or not shares are redeemed) | $ 79 | $252 | $ 441 | $ 987 |

| Class R5 (whether or not shares are redeemed) | $ 78 | $245 | $ 427 | $ 953 |

| Class Y (whether or not shares are redeemed) | $ 73 | $229 | $ 400 | $ 894 |

| Class Z (whether or not shares are redeemed) | $ 79 | $248 | $ 432 | $ 965 |

| Columbia Thermostat FundSM | 2 |

| Stock/Bond Allocation Table | ||

| How

the Fund will Invest the Stock/Bond Assets | ||

| Level

of the S&P 500® Index |

Stock

Percentage |

Bond

Percentage |

| over 2250 | 10% | 90% |

| over 2175 – 2250 | 15% | 85% |

| over 2100 – 2175 | 20% | 80% |

| over 2025 – 2100 | 25% | 75% |

| over 1950 – 2025 | 30% | 70% |

| over 1875 – 1950 | 35% | 65% |

| over 1800 – 1875 | 40% | 60% |

| over 1725 – 1800 | 45% | 55% |

| over 1650 – 1725 | 50% | 50% |

| over 1575 – 1650 | 55% | 45% |

| over 1500 – 1575 | 60% | 40% |

| over 1425 – 1500 | 65% | 35% |

| over 1350 – 1425 | 70% | 30% |

| over 1275 – 1350 | 75% | 25% |

| over 1200 – 1275 | 80% | 20% |

| over 1125 – 1200 | 85% | 15% |

| 1125 and under | 90% | 10% |

| Date | Level

of the S&P 500® Index |

How

the Fund will invest the Stock/ Bond Assets |

| Nov. 1 | We begin when the market is 1705 | 50% stocks, 50% bonds |

| Dec. 1 | The S&P 500® goes to 1726 | rebalance 45% stocks, 55% bonds |

| Dec. 6 | The S&P 500® drops back to 1715 | no reversal for 31 days |

| Jan. 2 | The S&P 500® is at 1660 | rebalance 50% stocks, 50% bonds |

| 3 | Columbia Thermostat FundSM |

| Date | Level

of the S&P 500® Index |

How

the Fund will invest the Stock/ Bond Assets |

| Jan. 20 | The S&P 500® drops to 1645 | rebalance 55% stocks, 45% bonds |

| The market has made a continuation move by going through a second action level, not a reversal move, so the 31-day Rule does not apply in this case. | ||

| Jan. 30 | The S&P 500® goes up to 1651 | no reversal for 31 days |

| Feb. 20 | The S&P 500® is at 1660 | rebalance 50% stocks, 50% bonds |

| Allocation of Stock/Bond Asset Within Asset Classes | ||

| Type of Fund | Allocation | |

| Stock Funds | ||

| Columbia Acorn® Fund | Small/Mid-cap growth | 10% |

| Columbia Acorn International® | Small/Mid-cap international growth | 20% |

| Columbia Acorn SelectSM | Mid-cap growth | 10% |

| Columbia Contrarian Core Fund | Large-cap blend | 20% |

| Columbia Dividend Income Fund | Large-cap value | 20% |

| Columbia Large Cap Enhanced Core Fund | Large-cap blend | 10% |

| Columbia Select Large Cap Growth Fund | Large-cap growth | 10% |

| Total | 100% | |

| Bond Funds | Type of Fund | Allocation |

| Columbia Income Opportunities Fund | High-yield bond | 10% |

| Columbia Short Term Bond Fund | Short term bond | 40% |

| Columbia Total Return Bond Fund | Intermediate-term bond | 20% |

| Columbia U.S. Government Mortgage Fund | Government bond | 20% |

| Columbia U.S. Treasury Index Fund | U.S. Treasury notes/bonds | 10% |

| Total | 100% | |

| ■ | Should the stock/bond allocation table be revised (perhaps because the stock market has made a long-term move outside of the bands set forth above)? |

| ■ | Should there be a change in the Portfolio Funds or should there be a change in the percentage allocations among the stock/bond funds (perhaps because of a change of portfolio managers, change of investment style, change in relative valuation or a reorganization of a Portfolio Fund)? |

| Columbia Thermostat FundSM | 4 |

| 5 | Columbia Thermostat FundSM |

| Columbia Thermostat FundSM | 6 |

| 7 | Columbia Thermostat FundSM |

| Columbia Thermostat FundSM | 8 |

| 9 | Columbia Thermostat FundSM |

| Columbia Thermostat FundSM | 10 |

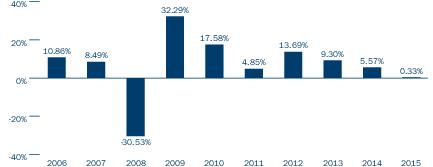

| Year

by Year Total Return (%) as of December 31 Each Year* |

Best

and Worst Quarterly Returns During the Period Shown in the Bar Chart | ||

|

Best | 2nd Quarter 2009 | 19.33% |

| Worst | 4th Quarter 2008 | -19.26% | |

| * | Year to Date return as of March 31, 2016: 1.84% |

| Share

Class Inception Date |

1 Year | 5 Years | 10 Years | |

| Class Z | 09/25/2002 | |||

| returns before taxes | 0.33% | 6.66% | 6.02% | |

| returns after taxes on distributions | -1.14% | 5.33% | 4.68% | |

| returns after taxes on distributions and sale of Fund shares | 0.50% | 4.80% | 4.41% | |

| Class A returns before taxes | 03/03/2003 | -5.70% | 5.13% | 5.13% |

| Class C returns before taxes | 03/03/2003 | -1.65% | 5.59% | 4.96% |

| Class R4 returns before taxes | 11/08/2012 | 0.33% | 6.65% | 6.01% |

| Class R5 returns before taxes | 11/08/2012 | 0.33% | 6.67% | 6.02% |

| Class Y returns before taxes | 11/08/2012 | 0.32% | 6.69% | 6.04% |

| S&P 500® Index (reflects no deductions for fees, expenses or taxes) | 1.38% | 12.57% | 7.31% | |

| Barclays U.S. Aggregate Bond Index (reflects no deductions for fees, expenses or taxes) | 0.55% | 3.25% | 4.51% | |

| 50/50 Blended Benchmark (an equally weighted custom composite of the Fund's primary benchmarks for equity and debt securities, established by the Investment Manager; reflects no deductions for fees, expenses or taxes) | 1.21% | 8.02% | 6.22% |

| Portfolio Manager | Title | Role with Fund | Service with the Fund Since | |||

| David L. Frank, CFA | Portfolio Manager and Analyst | Co-manager since 2016 | 2002 | |||

| Christopher J. Olson, CFA | Portfolio Manager and Analyst | Co-manager since 2014 | 2002 |

| Online | Regular Mail | Express Mail | By Telephone | |||

| columbiathreadneedle.com/us | Columbia

Funds, c/o Columbia Management Investment Services Corp. P.O. Box 8081 Boston, MA 02266-8081 |

Columbia

Funds, c/o Columbia Management Investment Services Corp. 30 Dan Road, Suite 8081 Canton, MA 02021-2809 |

800.422.3737 |

| 11 | Columbia Thermostat FundSM |

| Class | Category of eligible account | For

accounts other than systematic investment plan accounts |

For

systematic investment plan accounts |

| Classes A & C | All accounts other than IRAs | $2,000 | $100 |

| IRAs | $1,000 | $100 | |

| Classes R4 & Y | All eligible accounts | None | N/A |

| Class R5 | Combined underlying accounts of eligible registered investment advisers | $100,000 | N/A |

| Omnibus retirement plans | None | N/A | |

| Class Z | All eligible accounts | $0,

$1,000 or $2,000 depending upon the category of eligible investor |

$100 |

| Columbia Thermostat FundSM | 12 |

| columbiathreadneedle.com/us | SUM235_12_F01_(05/16) |