Summary

Prospectus

May 1, 2014

Columbia Acorn

Family of Funds

Managed by Columbia Wanger Asset

Management, LLC

Columbia Acorn

SelectSM

| Class | Ticker Symbol | |

| Class A Shares | LTFAX | |

| Class B Shares | LTFBX | |

| Class C Shares | LTFCX | |

| Class I Shares | CACIX | |

| Class R4 Shares | CSSRX | |

| Class R5 Shares | CSLRX | |

| Class Y Shares | CSLYX | |

| Class Z Shares | ACTWX |

Before you invest, you may want to review the Fund’s Prospectus, which

contains more information about the Fund and its risks. You can find the Fund’s Prospectus, Statement of Additional Information and other information about the Fund online at

https://www.columbiamanagement.com/web/columbia/forms-literature/fund-literature. You can also get this information at no cost by calling 800.345.6611 or by sending an email to serviceinquiries@columbiamanagement.com. This Summary Prospectus

incorporates by reference the Fund’s Prospectus, dated May 1, 2014, and current Statement of Additional Information.

As with all mutual funds, the Securities and Exchange

Commission has not approved or disapproved these securities or passed upon the adequacy of this prospectus. Any representation to the contrary is a criminal offense.

Investment Objective

Columbia Acorn SelectSM (the Fund) seeks long-term capital appreciation.

Fees and Expenses of the Fund

This table describes the fees and expenses that you

may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and members of your immediate family invest, or agree to invest in the future, at least $50,000 in certain classes of shares of eligible funds

distributed by Columbia Management Investment Distributors, Inc. (the Distributor). More information about these and other discounts is available from your financial intermediary, and can be found in the Choosing a

Share Class section beginning on page 21 of the Fund’s prospectus and in Appendix S to the Statement of Additional Information (SAI) under Sales Charge Waivers beginning on page S-1.

| Shareholder Fees (fees paid directly from your investment) | ||||

| Class A | Class B | Class C | Classes

I, R4, R5, Y and Z | |

| Maximum sales charge (load) imposed on purchases (as a % of offering price) | 5.75% | None | None | None |

| Maximum deferred sales charge (load) imposed on redemptions (as a % of the lower of the original purchase price or current net asset value) | 1.00% (a) | 5.00% (b) | 1.00% (c) | None |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | ||||||||

| Class A | Class B | Class C | Class I | Class R4 | Class R5 | Class Y | Class Z | |

| Management fees | 0.84% | 0.84% | 0.84% | 0.84% | 0.84% | 0.84% | 0.84% | 0.84% |

| Distribution and/or service (12b-1) fees | 0.25% | 0.75% | 1.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Other expenses(d) | 0.22% | 0.46% | 0.20% | 0.09% | 0.19% | 0.14% | 0.09% | 0.19% |

| Total annual Fund operating expenses | 1.31% | 2.05% | 2.04% | 0.93% | 1.03% | 0.98% | 0.93% | 1.03% |

| (a) | This charge is imposed on certain investments of between $1 million and $50 million redeemed within 18 months of purchase, as follows: 1.00% if redeemed within 12 months of purchase, and 0.50% if redeemed more than 12, but less than 18, months after purchase, with certain limited exceptions. |

| (b) | This charge decreases over time. |

| (c) | This charge applies to redemptions within one year of purchase, with certain limited exceptions. |

| (d) | Other expenses for Class A, Class B, Class C, Class R4, Class R5 and Class Z shares have been restated to reflect contractual changes to certain fees paid by the Fund. |

Example

The following example is intended

to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example illustrates the hypothetical expenses that you would incur over the time periods indicated, and assumes that:

| ■ | you invest $10,000 in the applicable class of Fund shares for the periods indicated, |

| ■ | your investment has a 5% return each year, and |

| ■ | the Fund’s total annual operating expenses remain the same as shown in the Annual Fund Operating Expenses table above. |

Although your actual costs

may be higher or lower, based on the assumptions listed above, your costs would be:

| 1 year | 3 years | 5 years | 10 years | |

| Class A (whether or not shares are redeemed) | $701 | $966 | $1,252 | $2,063 |

| Class B (assuming redemption of all shares at the end of the period) | $708 | $943 | $1,303 | $2,189 |

| Class B (assuming no redemption of shares) | $208 | $643 | $1,103 | $2,189 |

| Class C (assuming redemption of all shares at the end of the period) | $307 | $640 | $1,098 | $2,369 |

| Class C (assuming no redemption of shares) | $207 | $640 | $1,098 | $2,369 |

| Class I (whether or not shares are redeemed) | $ 95 | $296 | $ 515 | $1,143 |

| Class R4 (whether or not shares are redeemed) | $105 | $328 | $ 569 | $1,259 |

| Class R5 (whether or not shares are redeemed) | $100 | $312 | $ 542 | $1,201 |

| Class Y (whether or not shares are redeemed) | $ 95 | $296 | $ 515 | $1,143 |

| Class Z (whether or not shares are redeemed) | $105 | $328 | $ 569 | $1,259 |

| 1 | Columbia Acorn SelectSM |

Portfolio Turnover

The Fund may pay transaction costs, such as

commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account.

These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 20% of the average value of its

portfolio.

Principal Investment Strategies

Under normal circumstances, the Fund invests a

majority of its net assets in the common stock of companies with market capitalizations under $20 billion at the time of initial investment. However, if the Fund's investments in such companies represent less than a majority of its net assets, the

Fund may continue to hold and to make additional investments in an existing company in its portfolio even if that company's capitalization has grown to exceed $20 billion. Under normal circumstances, the Fund may invest in companies with market

capitalizations above $20 billion at the time of initial investment, provided that immediately after that investment a majority of its net assets would be invested in companies whose market capitalizations were under $20 billion at the time of

initial investment.

Columbia Wanger Asset

Management, LLC, the Fund's investment adviser (the Investment Manager), believes that stocks of companies with market capitalizations under $20 billion, which generally are not as well known by financial analysts as larger companies, may offer

higher return potential than stocks of larger companies.

The Fund invests the majority of its assets in U.S.

companies, but also may invest up to 33% of its total assets in foreign companies in developed markets (for example, Japan, Canada and the United Kingdom) and in emerging markets (for example, China, India and Colombia).

The Fund invests in a limited number of companies

(generally between 30-60), offering the potential to provide above-average growth over time. In pursuit of the Fund’s objective, the individual portfolio manager may take advantage of the research and stock-picking capabilities of the

Investment Manager to select investments that are “best ideas,” but need not do so and will generally concentrate the Fund’s investments in those sectors, companies, geographic regions or industries that the portfolio manager

believes offer the most growth potential.

The

Investment Manager typically seeks companies with:

| ■ | A strong business franchise that offers growth potential. |

| ■ | Products and services in which the company has a competitive advantage. |

| ■ | A stock price the Investment Manager believes is reasonable relative to the assets and earning power of the company. |

The Fund may also invest in companies that the

Investment Manager believes have good operational fundamentals but that the Investment Manager believes are undervalued due to negative investor sentiment related to company-specific or market-related conditions. Investments in turnaround and

development stage companies may also be made when the Investment Manager believes potential returns outweigh risks of losses.

The Investment Manager may sell a portfolio holding

if the security reaches the Investment Manager's price target, if the company has a deterioration of fundamentals, such as failing to meet key operating benchmarks, or if the Investment Manager believes other securities are more attractive. The

Investment Manager also may sell a portfolio holding to fund redemptions.

Principal Risks

An investment in the Fund involves risk, including

those described below. There is no assurance that the Fund will achieve its investment objective and you may lose money. The value of the Fund’s holdings may decline, and the Fund’s net asset value

(NAV) and share price may go down.

Select

Portfolio Risk. Because the Fund may invest in a limited number of companies, the Fund as a whole is subject to greater risk of loss if any of its portfolio securities decline in price. In addition, the Fund’s

holdings and weightings will diverge significantly from its primary benchmark’s holdings and weightings and the Fund may therefore experience greater risk and volatility relative to the benchmark. Because the Fund may invest in more than one

company concentrated in a similar industry, sector or geographic region, the Fund may be even more concentrated than the number of companies it may hold would suggest.

Active Management Risk. The Investment Manager’s active management of the Fund could cause the Fund to underperform its benchmark index and/or other funds with similar investment objectives. The Fund may fail to achieve its investment

objective and you may lose money.

Market

Risk. Market risk refers to the possibility that the market values of securities or other investments that the Fund holds will fall, sometimes rapidly or unpredictably, or fail to rise. An investment in the

Fund could lose money over short or long periods. Although equity securities generally tend to have greater price volatility than debt securities, under certain market conditions debt securities may have comparable or greater price

volatility.

| Columbia Acorn SelectSM | 2 |

Small- and Mid-Cap Company Securities Risk. Investments in small- and mid-capitalization companies (small- and mid-cap companies) often involve greater risks than investments in larger, more established companies (larger companies) because small- and mid-cap

companies tend to have less predictable earnings and may lack the management experience, financial resources, product diversification and competitive strengths of larger companies. Securities of small- and mid-cap companies may be less liquid and

more volatile than the securities of larger companies.

Issuer Risk. An

issuer in which the Fund invests may perform poorly, and the value of its securities may therefore decline, which would negatively affect the Fund’s performance. Poor performance may be caused by poor management decisions, competitive

pressures, breakthroughs in technology, reliance on suppliers, labor problems or shortages, corporate restructurings, fraudulent disclosures, natural disasters or other events, conditions or factors.

Opportunistic Investing Risk. Undervalued securities involve the risk that they may never reach their expected full market value, either because the market fails to recognize the security's intrinsic worth or the expected value was misgauged.

Undervalued securities also may decline in price even though the Investment Manager believes they are already undervalued. Turnaround companies may never improve their fundamentals, may take much longer than expected to improve, or may improve much

less than expected. Development stage companies could fail to develop and deplete their assets, resulting in large percentage losses.

Sector Risk. At

times, the Fund may have a significant portion of its assets invested in securities of companies conducting business in a related group of industries within an economic sector. Companies in the same economic sector may be similarly

affected by economic, regulatory, political or market events or conditions, which may make the Fund more vulnerable to unfavorable developments in that economic sector than funds that invest more broadly. The more a fund diversifies its

investments, the more it spreads risk and potentially reduces the risks of loss and volatility.

Foreign Securities Risk. Investments in or exposure to foreign securities involve certain risks not associated with investments in or exposure to securities of U.S. companies. Foreign securities subject the Fund to the risks associated with

investing in the particular country of an issuer, including the political, regulatory, economic, social, diplomatic and other conditions or events occurring in the country or region, as well as risks associated with less developed custody and

settlement practices. Foreign securities may be more volatile and less liquid than investments in securities of U.S. companies, and are subject to the risks associated with potential imposition of economic and other sanctions against a particular

foreign country, its nationals or industries or businesses within the country. The performance of the Fund may be negatively impacted by fluctuations in a foreign currency’s strength or weakness relative to the U.S. dollar.

Operational and Settlement Risks of Foreign

Securities. The Fund’s foreign securities are generally held outside the United States in the primary market for the securities in the custody of foreign sub-custodians. Some countries have limited governmental

oversight and regulation, which increases the risk of corruption and fraud and the possibility of losses to the Fund. In particular, under certain circumstances, foreign securities may settle on a delayed delivery basis, meaning that the Fund may be

required to make payment for securities before the Fund has actually received delivery of the securities or deliver securities prior to the receipt of payment. As a result, there is a risk that the security will not be delivered to the Fund or that

payment will not be received. Losses can also result from lost, stolen or counterfeit securities; defaults by brokers and banks; failures or defects of the settlement system; or poor and improper record keeping by registrars and

issuers.

Share Blocking. In certain non-U.S. markets, an issuer’s securities are blocked from trading for a specified number of days before and, in certain instances, after a shareholder meeting. The blocking period can last up to several

weeks. Share blocking may prevent the Fund from buying or selling securities during this period. As a consequence of these restrictions, the Investment Manager, on behalf of the Fund, may abstain from voting proxies in markets that require share

blocking.

Emerging Market Securities

Risk. Securities issued by foreign governments or companies in emerging market countries, like Russia and those in Eastern Europe, the Middle East, Asia, Latin America or Africa, are more likely to have greater

exposure to the risks of investing in foreign securities that are described in Foreign Securities Risk. In addition, emerging market countries are more likely to experience instability resulting, for example, from rapid changes or developments in

social, political and economic conditions. Their economies are usually less mature and their securities markets are typically less developed with more limited trading activity (i.e., lower trading volumes and less liquidity) than more developed

countries. Emerging market securities tend to be more volatile than securities in more developed markets. Many emerging market countries are heavily dependent on international trade and have fewer trading partners, which makes them more sensitive to

world commodity prices and economic downturns in other countries, and some have a higher risk of currency devaluations.

Operational and Settlement Risks of Securities in

Emerging Markets. Foreign sub-custodians in emerging markets may be recently organized, lack extensive operating experience or lack effective government oversight or regulation. In addition, there may be legal

restrictions or limitations on the ability of the Fund to recover assets held in custody by a foreign sub-custodian in the event of the bankruptcy of the sub-custodian. There may also be a greater risk that settlement may be delayed and that cash or

securities of the Fund may be lost because of failures of or defects in the system, including fraud or corruption. Settlement systems in emerging markets also have a higher risk of failed trades.

| 3 | Columbia Acorn SelectSM |

Risks Related to Currencies and Corporate Actions in

Emerging Markets. Risks related to currencies and corporate actions are also greater in emerging market countries than in developed countries. Emerging market currencies may not be traded and are subject to a higher

risk of currency devaluations.

Risks

Related to Corporate and Securities Laws in Emerging Markets. Securities laws in emerging markets may be relatively new and unsettled and, consequently, there is a risk of rapid and unpredictable change in laws

regarding foreign investment, securities regulation, title to securities and shareholder rights.

Liquidity and Trading Volume Risk. Because the Fund may invest a percentage of its assets in foreign securities, it may be subject to the liquidity and trading volume risks associated with international investing. Due to market conditions, including

uncertainty regarding the price of a security, it may be difficult for the Fund to buy or sell foreign portfolio securities at a desirable time or price, which could result in investment losses. This risk of portfolio illiquidity is heightened with

respect to small- and mid-cap securities, generally, and foreign small- and mid-cap securities in particular. The Fund may have to lower the selling price, liquidate other investments, or forego another, more appealing investment opportunity as a

result of illiquidity in the markets. As a result of significant and sustained reductions in emerging and developed international market trading volumes in the wake of the 2007-2009 financial crisis, it may take longer to buy or sell these

securities, which can exacerbate the Fund’s exposure to volatile markets. The Fund may also be limited in its ability to execute favorable trades in foreign portfolio securities in response to changes in company prices and fundamentals, and

may be forced to dispose of securities under disadvantageous circumstances and at a loss. As the Fund grows in size, these considerations take on increasing significance and may adversely impact performance.

Foreign Currency Risk. The performance of the Fund may be materially affected positively or negatively by foreign currency strength or weakness relative to the U.S. dollar, particularly if the Fund invests a significant percentage of its

assets in foreign securities or other assets denominated in currencies other than the U.S. dollar.

Performance Information

The following bar chart and table show you how the

Fund has performed in the past, and can help you understand the risks of investing in the Fund. The bar chart shows how the Fund’s Class Z share performance has varied for each full calendar year shown. The table below the bar chart compares

the Fund’s returns for the periods shown with the Standard & Poor’s (S&P) MidCap 400® Index, the Fund’s primary benchmark, and the S&P 500® Index. The S&P MidCap 400® Index is a market value-weighted index that tracks the performance of 400 mid-cap U.S.

companies. The S&P 500® Index tracks the performance of 500 widely held, large-capitalization U.S. stocks. Although the Fund typically invests in companies with market

capitalizations under $20 billion at the time of investment, the comparison to the S&P 500® Index is presented to show performance against a widely recognized market index.

The performance of one or more share classes shown

in the Average Annual Total Returns table below includes the Fund’s Class Z share returns (adjusted to reflect the higher class-related operating expenses of such classes, where applicable) for periods

prior to the indicated inception date of such share classes. Except for differences in fees and expenses, all share classes of the Fund would have substantially similar annual returns because all share classes of the Fund invest in the same

portfolio of securities.

The after-tax returns

shown in the Average Annual Total Returns table below are calculated using the highest historical individual U.S. federal marginal income tax rates and do not reflect the impact of state, local or foreign

taxes. Your actual after-tax returns will depend on your personal tax situation and may differ from those shown in the table. In addition, the after-tax returns shown in the table do not apply to shares held in tax-deferred accounts such as 401(k)

plans or Individual Retirement Accounts (IRAs).

The after-tax

returns are shown only for Class Z shares and will vary for other share classes.

The Fund’s past performance (before and after

taxes) is no guarantee of how the Fund will perform in the future. Updated performance information can be obtained by calling toll-free 800.345.6611 or visiting columbiamanagement.com.

| Columbia Acorn SelectSM | 4 |

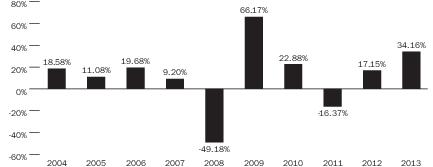

| Year

by Year Total Return (%) as of December 31 Each Year* |

Best

and Worst Quarterly Returns During the Period Shown in the Bar Chart | ||

|

Best | 2nd Quarter 2009 | 28.11% |

| Worst | 4th Quarter 2008 | -30.14% | |

| * | Year to Date return as of March 31, 2014: -0.34% |

Average Annual Total Returns After

Applicable Sales Charges (for periods ended December 31, 2013)

| Share

Class Inception Date |

1 Year | 5 Years | 10 Years | |

| Class Z | 11/23/1998 | |||

| returns before taxes | 34.16% | 21.83% | 8.91% | |

| returns after taxes on distributions | 26.88% | 20.06% | 7.91% | |

| returns after taxes on distributions and sale of Fund shares | 24.55% | 17.83% | 7.28% | |

| Class A returns before taxes | 10/16/2000 | 26.07% | 20.03% | 7.95% |

| Class B returns before taxes | 10/16/2000 | 27.81% | 20.48% | 7.87% |

| Class C returns before taxes | 10/16/2000 | 31.85% | 20.52% | 7.74% |

| Class I returns before taxes | 09/27/2010 | 34.31% | 21.92% | 8.95% |

| Class R4 returns before taxes | 11/08/2012 | 34.16% | 21.82% | 8.91% |

| Class R5 returns before taxes | 11/08/2012 | 34.21% | 21.84% | 8.91% |

| Class Y returns before taxes | 11/08/2012 | 34.30% | 21.85% | 8.92% |

| S&P MidCap 400® Index (reflects no deductions for fees, expenses or taxes) | 33.50% | 21.89% | 10.36% | |

| S&P 500® Index (reflects no deductions for fees, expenses or taxes) | 32.39% | 17.94% | 7.41% |

Fund Management

Investment Manager:

Columbia Wanger Asset Management, LLC

| Portfolio Manager | Title | Role with Fund | Service with the Fund Since | |||

| Robert A. Chalupnik, CFA | Portfolio Manager and Analyst | Lead manager or co-manager since 2011 | 2000 |

Purchase and Sale of Fund

Shares

You may purchase or redeem shares of

the Fund on any business day by contacting the Fund in the ways described below:

| Online | Regular Mail | Express Mail | By Telephone | |||

| columbiamanagement.com | Columbia

Funds, c/o Columbia Management Investment Services Corp. P.O. Box 8081 Boston, MA 02266-8081 |

Columbia

Funds, c/o Columbia Management Investment Services Corp. 30 Dan Road, Suite 8081 Canton, MA 02021-2809 |

800.422.3737 |

You may purchase shares

and receive redemption proceeds by electronic funds transfer, by check or by wire. If you maintain your account with a broker-dealer or other financial intermediary, you must contact that financial intermediary to buy, sell or exchange shares of the

Fund through your account with the intermediary.

| 5 | Columbia Acorn SelectSM |

The minimum initial investment amounts for the share

classes offered by the Fund are shown below:

Minimum

Initial Investment

| Class | Category of eligible account | For

accounts other than systematic investment plan accounts |

For

systematic investment plan accounts |

| Classes A, B* & C | All accounts other than IRAs | $2,000 | $100 |

| IRAs | $1,000 | $100 | |

| Classes I & R4 | All eligible accounts | None | None |

| Class R5 | Combined underlying accounts of eligible registered investment advisers | $100,000 | N/A |

| Omnibus retirement plans | None | N/A | |

| Class Y | Omnibus retirement plans with at least $10 million in plan assets | None | N/A |

| All other eligible omnibus retirement plans | $500,000 | N/A | |

| Class Z | All eligible accounts | $0,

$1,000 or $2,000 depending upon the category of eligible investor |

$100 |

| * | Class B shares are generally closed to new and existing shareholders. |

There is no minimum additional investment for any

share class.

Tax Information

The Fund normally distributes net investment income

and net realized capital gains, if any, to shareholders. These distributions are generally taxable to you as ordinary income or capital gains, unless you are investing through a tax-advantaged account, such as a 401(k) plan or an IRA. If you are

investing through a tax-advantaged account, you may be taxed upon withdrawals from that account.

Payments to Broker-Dealers and Other Financial

Intermediaries

If you purchase the Fund

through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies – including the Investment Manager, the Distributor and Columbia Management Investment Services Corp. (the Transfer Agent) – may

pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your financial advisor to recommend the Fund over another investment.

These potential conflicts of interest may be heightened with respect to broker-dealers owned by Ameriprise Financial and/or its affiliates. In addition, the Fund reimburses the Transfer Agent for the costs of shareholder services that vary across

financial intermediaries. The Fund seeks to provide such reimbursements to the Transfer Agent at levels it believes to be reasonable, but because of the variety of type and cost of services provided by different intermediaries, there can be no

assurance that the Fund is able to identify to which specific services the reimbursements relate. Ask your financial advisor or visit your financial intermediary's website for more information.

| Columbia Acorn SelectSM | 6 |

Columbia Acorn Family of

Funds

225 Franklin Street, Boston, MA 02110

800.345.6611 columbiamanagement.com

| © 2014 Columbia Management Investment Distributors, Inc. | SUM113_12_D01_(05/14) |