exhibit99-1.htm

Exhibit 99.1

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

The Clorox Company

(Dollars in millions, except per share amounts)

Management’s Discussion and Analysis of Financial Condition and Results of Operations (MD&A) is designed to provide a reader of the Company’s financial statements with a narrative from the perspective of management on the Company’s financial condition, results of operations, liquidity and certain other factors that may affect future results. In certain instances, parenthetical references are made to relevant sections of the Notes to Consolidated Financial Statements to direct the reader to a further detailed discussion. The MD&A should be read in conjunction with the Consolidated Financial Statements and Supplementary Data included in this Annual Report on Form 10-K. This MD&A includes the following sections:

- Executive Overview

- Results of Operations

- Financial Position and Liquidity

- Contingencies

- Quantitative and Qualitative Disclosures about Market Risk

- New Accounting Pronouncements

- Critical Accounting Policies and Estimates

EXECUTIVE OVERVIEW

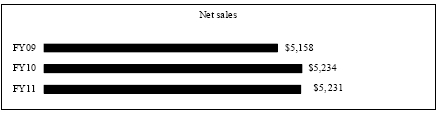

The Clorox Company (the Company or Clorox) is a leading manufacturer and marketer of consumer and institutional products with approximately 8,100 employees worldwide as of June 30, 2011, and fiscal year 2011 net sales of $5,231. The Company sells its products primarily through mass merchandisers, grocery stores and other retail outlets. Clorox markets some of consumers’ most trusted and recognized brand names, including its namesake bleach and cleaning products, Green Works® natural cleaners and laundry products, Poett® and Mistolín® cleaning products, Fresh Step® and Scoop Away® cat litter, Kingsford® charcoal, Hidden Valley® and K C Masterpiece® dressings and sauces, Brita® water-filtration systems, Glad® bags, wraps and containers, and Burt’s Bees® natural personal care products. The Company manufactures products in more than two dozen countries and markets them in more than 100 countries.

The Company primarily markets its leading brands in midsized categories considered to have attractive economic profit potential. Most of the Company’s products compete with other nationally-advertised brands within each category and with “private label” brands.

Strategic Goals and Initiatives

The Company has developed a strategy to guide it through its 100-year anniversary in 2013. As part of its strategy, the Company has established two main objectives: 1) to maximize economic profit across its categories, sales channels and countries; and 2) to be the best at building big-share brands in economically-attractive midsized categories.

The Company has established financial goals to measure its progress against its strategy. These goals include 3% to 5% annual sales growth before acquisitions and 75 to 100 basis points of annual improvement in earnings before interest and taxes margin. Additionally, the Company has plans to carefully manage the growth of its asset base. If these financial goals are achieved, the Company believes it can realize annual double-digit percentage economic profit growth (See “Economic profit” below) and free cash flow (See “Free cash flow” below) of 10% to 12% of net sales or more.

The Company plans to achieve these financial goals through its leading product portfolio and by leveraging its capabilities in the areas of the consumer, the customer and cost management. From a portfolio perspective, the Company plans to achieve its growth objectives both in and beyond its core categories. The Company is focused on creating value by investing in new and existing categories and products with profitable growth potential, particularly those categories and products aligned with global consumer trends in the areas of health and wellness, sustainability and affordability and appealing to a multicultural marketplace. To accomplish this, the Company is focusing on growing existing brands, expanding into adjacent product categories, entering new sales channels, increasing distribution within existing countries and pursuing new businesses in growing markets where the Company can profitably establish and sustain a competitive advantage.

The Company will continue to leverage and grow its capabilities in demand creation and strengthen consumer loyalty to its brands through its three strategic capabilities: Desire, Decide and Delight.

Desire is about deeply understanding consumers’ needs and creating integrated prepurchase communications that increase consumers’ awareness about how the Company’s brands meet their needs;

Decide is about winning at the store shelf, through superior packaging and execution of product assortment, merchandising, pricing and shelving; and

Delight is about continuing to offer high-quality, consumer-preferred products that exceed expectations, so the consumers will continue to purchase the Company’s products.

The Company will also continue to aggressively focus on consumer value, trade merchandising, pricing, product mix and cost management to enhance its margins and to offset the impact of volatile foreign currencies and commodity costs.

Fiscal Year 2011 Summary

Financial Highlights

The Company reported earnings from continuing operations for the fiscal year ended June 30, 2011, of $287 and diluted net earnings per share from continuing operations of $2.07 based on weighted average diluted shares outstanding of approximately 138 million. Excluding the non-cash goodwill impairment charge of $258, which the Company recorded in the quarter ended December 31, 2010, the Company reported earnings from continuing operations of $545 or $3.93 diluted net earnings per share from continuing operations.1 This compares to earnings from continuing operations for the fiscal year ended June 30, 2010, of $526 and diluted net earnings per share from continuing operations of $3.69 based on weighted average diluted shares outstanding of approximately 142 million. Restructuring and restructuring-related charges were $0.12 per diluted share for the fiscal year ended June 30, 2011 (See “Restructuring and asset impairment costs” below), as compared with $0.08 per diluted share for the fiscal year ended June 30, 2010. The negative impact of Venezuela foreign currency exchange on diluted earnings per share was $0.11 for the fiscal year ended June 30, 2011 (See “Venezuela” below), as compared to $0.23 for the fiscal year ended June 30, 2010.

In fiscal year 2011, the Company continued to face a challenging business and consumer environment. The Company addressed these challenges through pricing, primarily in international markets, product innovation and product improvements that meet consumer demands and delivering value to consumers and cost structure management.

Certain key fiscal year 2011 developments are summarized as follows:

- The Company’s fiscal year 2011 sales growth was flat, with the benefit of price increases offset by unfavorable product mix and the impact of customer pick-up allowances (See “Net sales” below). Net sales declines of 3% in the first half of fiscal year 2011 were offset by net sales growth of 3% in the second half of the fiscal year. The Company exceeded its innovation target from new products and packages, delivering 2.8% of incremental net sales.

- Cash provided by continuing operations was $690 or 13% of net sales. Free cash flow was $462 or 9% of net sales, reflecting changes in working capital and higher investments in global information technology systems and research and development facilities, which included $55 of capitalized costs and $29 of expenses (See “Operating Activities” below).

| 1 |

The Company’s management uses earnings from continuing operations excluding the non-cash goodwill impairment charge and diluted net earnings per share from continuing operations before non-cash goodwill impairment, both non-GAAP measures, to evaluate business performance. See “Results of Operations” for information as to why the Company believes this non-GAAP information is useful to investors. |

2

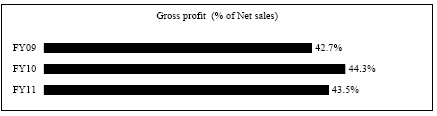

- The Company’s gross margin decreased to 43.5% in fiscal year 2011 from 44.3% in fiscal year 2010, which reflects the impact of higher commodity costs, higher manufacturing and logistics costs and unfavorable product mix, partially offset by strong cost savings and the benefit of price increases (See “Gross profit” below).

- The Company responded to cost pressures by taking pricing actions, which resulted in a gross margin benefit of approximately $65, and aggressively managing costs through initiatives, which generated approximately $110 of cost savings.

- In November 2010, the Company completed the sale of its global auto care businesses (Auto Businesses) and received cash consideration of $755 (See “Discontinued operations” below).

- In the quarter ended December 31, 2010, the Company recorded a non-cash goodwill impairment charge of $258 for the Burt’s Bees reporting unit (See “Goodwill impairment” below).

- Using free cash flow and approximately $520 of the proceeds from the sale of the Auto Businesses the Company repurchased approximately 9.8 million shares of its common stock at a cost of approximately $655.

- The Company also returned $303 of dividends to stockholders and announced an increase in the cash dividend to $2.40 per share from $2.20 per share.

- In fiscal year 2011, $300 of long-term debt became due and was paid. The Company funded the debt repayment through the issuance of commercial paper and the use of operating cash flows.

- Return on invested capital (ROIC) increased to 23.9% in fiscal year 2011 compared to 23.4% in fiscal year 2010 (Refer to Exhibit 99.4).2

- Economic profit was essentially flat, reflecting higher investments in global information technology systems and research and development facilities, which included $55 of capitalized costs and $29 of expenses (See “Economic profit” below and Exhibit 99.3).3

| 2 |

The Company’s management uses ROIC, a non-GAAP measure, to evaluate business performance, as it believes the presentation of ROIC provides additional information to investors about the current trends in the business. ROIC is a measure of how effectively the Company allocates capital. |

| |

|

| 3 |

The Company’s management uses economic profit, a non-GAAP measure, to evaluate business performance. See “Economic profit” below for information as to why the Company believes this non-GAAP information is useful to investors. |

RESULTS OF OPERATIONS

Management’s discussion and analysis of the Company’s results of operations, unless otherwise noted, compares fiscal year 2011 to fiscal year 2010, and fiscal year 2010 to fiscal year 2009, using percent changes calculated on a rounded basis, except as noted. The discussion of results of worldwide operations includes certain measures not defined by accounting principles generally accepted in the United States of America (non-GAAP measures), including earnings from continuing operations excluding the non-cash goodwill impairment charge, return on invested capital (ROIC), economic profit, diluted net earnings per share from continuing operations before the non-cash goodwill impairment charge, free cash flow as a percentage of net sales and earnings from continuing operations before income taxes and the non-cash goodwill impairment charge. Management believes these measures provide investors with additional information about the underlying results and trends of the Company. These non-GAAP financial measures may not be the same as similar measures presented by other companies. Information about these non-GAAP measures is set forth in the paragraphs in which they are discussed.

3

CONSOLIDATED RESULTS

Continuing Operations

Net sales in fiscal year 2011 were flat compared to fiscal year 2010 primarily due to the benefit of price increases offset by unfavorable product mix, the impact of customer pick-up allowances and unfavorable foreign exchange rates, primarily related to Venezuela. Volume was also flat, which reflected increased shipments of Burt’s Bees® natural personal care products, primarily driven by domestic lip balm strength and International market growth; increased shipments of Pine-Sol® cleaner, primarily due to increased merchandising events and distribution gains; and increased shipments of Fresh Step® cat litter, driven by product improvements and increased merchandising events. These increases were offset by lower shipments of Glad® food storage products and Glad® trash bags, primarily due to competitive activity. Category consumption on an all-outlet basis was down approximately 2% for fiscal year 2011; however, the Company increased its all-outlet market share by approximately 0.5%. In addition, strong retailer merchandising in the prior fiscal year, primarily related to Kingsford® charcoal products and Hidden Valley® bottled salad dressings, contributed to the Company’s flat sales.

Net sales in fiscal year 2010 increased 1% compared to fiscal year 2009. Volume increased 3%, primarily due to increased shipments of Clorox Disinfecting Wipes® and other disinfecting products to meet demand associated with the H1N1 flu pandemic, increased shipments of Hidden Valley® salad dressings and Kingsford® charcoal products due to promotional activities and increased shipments of Pine-Sol® cleaner due to increased distribution and promotional activities. Also contributing to the volume growth were increased shipments of Fresh Step® cat litter due to promotional activities and higher shipments of bleach and other disinfecting and fragranced cleaning products in Latin America due to increased demand largely as a result of the H1N1 flu pandemic. These increases were partially offset by lower shipments of Glad® food storage products due to competitive activity, category softness and the Company’s exit from a private label food bags business. Volume outpaced net sales growth primarily due to increased trade-promotion spending (approximately 130 basis points) and other factors, including the negative impact of foreign currencies (approximately 110 basis points), partially offset by pricing (approximately 140 basis points).

Gross profit decreased 2% in fiscal year 2011, from $2,319 to $2,273, and decreased 80 basis points as a percentage of net sales to 43.5%. Gross margin contraction in fiscal year 2011 reflects approximately 170 basis points from higher commodity costs, 60 basis points from higher manufacturing and logistics costs and 60 basis points from unfavorable product mix; these decreases were partially offset by 170 basis points from cost savings and 80 basis points from the benefit of price increases.

4

Gross profit increased 5% in fiscal year 2010, from $2,204 to $2,319, and increased 160 basis points as a percentage of net sales to 44.3%. Gross margin expansion in fiscal year 2010 reflects approximately 180 basis points from cost savings and 90 basis points from pricing, partially offset by 70 basis points from the impact of manufacturing and logistics costs, unfavorable foreign exchange rates and the impact of unfavorable product mix.

Diluted net earnings per share from continuing operations

The following is a reconciliation of diluted net earnings per share from continuing operations to diluted net earnings per share from continuing operations before the non-cash goodwill impairment charge:

| |

|

2011 |

|

2010 |

|

2009 |

| Net earnings per share from continuing operations |

|

$ |

2.07 |

|

|

$ |

3.69 |

|

|

$ |

3.33 |

|

| Add: Non-cash goodwill impairment per share |

|

|

1.86 |

|

|

|

- |

|

|

|

- |

|

| Net earnings per share from continuing operations |

|

|

|

|

|

|

|

|

|

|

|

|

| before non-cash goodwill impairment |

|

$ |

3.93 |

|

|

$ |

3.69 |

|

|

$ |

3.33 |

|

| Percent change from prior fiscal year |

|

|

6.5 |

% |

|

|

10.8 |

% |

|

|

24.3 |

% |

The Company’s management uses diluted net earnings per share from continuing operations before non-cash goodwill impairment, a non-GAAP measure, to evaluate business performance and believes that this information provides investors with additional information about the underlying results and trends of the Company. Excluding the non-cash goodwill impairment charge, the Company’s diluted net earnings per share from continuing operations increased $0.24 in fiscal year 2011, primarily driven by cost savings, the benefits of pricing, lower incentive compensation, lower interest expense, a lower tax rate and share repurchases. These increases were partially offset by higher commodity costs, unfavorable product mix and higher manufacturing and logistics costs.

Diluted net earnings per share from continuing operations increased by $0.36 in fiscal year 2010, primarily due to higher earnings from continuing operations. The increase in earnings from continuing operations was primarily due to price increases and the benefits of cost savings, lower interest expense and lower restructuring and restructuring-related charges. These factors were partially offset by the negative impact of inflationary pressure in Latin America, higher employee incentive compensation accruals, higher advertising costs and unfavorable foreign rates.

Economic profit (EP) is a non-GAAP measure used by the Company’s management to evaluate business performance and allocate resources, and is a component in determining management’s short-term incentive compensation and the Company’s contribution to employee profit sharing plans (for a detailed reconciliation of EP to earnings from continuing operations before income taxes of $563, the most comparable GAAP financial measure, refer to Exhibit 99.3). EP provides additional perspective to investors about financial returns generated by the business and represents profit generated over and above the cost of capital used by the business to generate that profit. EP is defined by the Company as earnings from continuing operations before income taxes, non-cash restructuring-related and asset impairment costs, non-cash goodwill impairment and interest expense; less an amount of tax based on the effective tax rate before the non-cash goodwill impairment charge and less a capital charge. EP decreased 0.5% in fiscal year 2011. EP increased 15.2% during fiscal year 2010, primarily due to higher earnings from continuing operations and lower interest expense.

Free cash flow is a non-GAAP measure used by the Company’s management to help assess the cash generation ability of the business and funds available for investing activities, such as acquisitions, investing in the business to drive growth, and financing activities, including debt payments, dividend payments and share repurchases. Free cash flow is calculated as net cash provided by continuing operations less capital expenditures. Free cash flow does not represent cash available only for discretionary expenditures, since the Company has mandatory debt service requirements and other contractual and non-discretionary expenditures.

5

| |

|

2011 |

|

2010 |

|

2009 |

| Net cash provided by continuing operations |

|

$ |

690 |

|

|

$ |

764 |

|

|

$ |

664 |

|

| Less: capital expenditures |

|

|

(228 |

) |

|

|

(201 |

) |

|

|

(196 |

) |

| Free cash flow |

|

$ |

462 |

|

|

$ |

563 |

|

|

$ |

468 |

|

| Free cash flow as a percentage of net sales |

|

|

8.8 |

% |

|

|

10.8 |

% |

|

|

9.1 |

% |

Free cash flow as a percentage of net sales decreased in fiscal year 2011, primarily due to changes in working capital and higher capital expenditures for investments in global information technology systems and research and development facilities.

Free cash flow as a percentage of net sales increased in fiscal year 2010 primarily due to higher earnings from continuing operations and an increase in accrued liabilities, mainly driven by higher employee benefit accruals largely related to an increase in incentive compensation and a change in the timing of salary payments for a substantial number of the Company’s employees from semi-monthly to biweekly pay. These factors were partially offset by a $15 increase in pension plan contributions.

Expenses

| |

|

|

|

|

|

|

|

|

|

|

Change |

|

% of Net sales |

| |

|

2011 |

|

2010 |

|

2009 |

|

2011

to

2010 |

|

2010

to

2009 |

|

2011 |

|

2010 |

|

2009 |

| Selling and administrative expenses |

|

$ |

735 |

|

$ |

734 |

|

$ |

703 |

|

- |

% |

|

4 |

% |

|

14.1 |

% |

|

14.0 |

% |

|

13.6 |

% |

| Advertising costs |

|

|

502 |

|

|

494 |

|

|

474 |

|

2 |

|

|

4 |

|

|

9.6 |

|

|

9.4 |

|

|

9.2 |

|

| Research and development costs |

|

|

115 |

|

|

118 |

|

|

113 |

|

(3 |

) |

|

4 |

|

|

2.2 |

|

|

2.3 |

|

|

2.2 |

|

Selling and administrative expenses remained flat in fiscal year 2011, as increased investments in global information technology systems and research and development facilities were offset by lower employee incentive compensation costs and cost savings, primarily from the Company’s restructuring activities.

Selling and administrative expenses increased in fiscal year 2010 due to inflationary pressure in Latin America that contributed approximately 3% of the increase, higher employee incentive compensation accruals, investments in information technology systems, unfavorable foreign exchange rates, the international expansion of Burt’s Bees and higher legal costs. These costs were partially offset by cost savings from the Company’s restructuring activities.

Advertising costs increased in fiscal year 2011, as the Company increased its investment behind new products and its established brands, primarily related to Hidden Valley® and K C Masterpiece® dressings and sauces, the Brita® on-the-go water bottle, and International initiatives. These increases were partially offset by decreased investment behind Green Works® natural cleaning products and Glad® trash bags, and cost savings.

Advertising costs increased in fiscal year 2010 as the Company continued to support its established brands, including new initiatives in Latin America and promotional activities behind Clorox 2® stain fighter and color booster, and support of its new products, including Green Works® natural laundry detergent.

Research and development costs decreased in fiscal year 2011, primarily due to lower employee incentive compensation costs and decreased investment behind Green Works® natural cleaning products, partially offset by increased investment behind Burt’s Bees® natural personal care products, Brita® water-filtration products and International initiatives.

Research and development costs increased in fiscal year 2010 primarily due to continued expansion of Green Works® natural cleaning products and the Company’s continued support of product improvements and innovations.

6

Restructuring and asset impairment costs, goodwill impairment, interest expense, other (income) expense, net, and the effective tax rate on income from continuing operations

| |

|

2011 |

|

2010 |

|

2009 |

| Restructuring and asset impairment costs |

|

$ |

4 |

|

|

$ |

4 |

|

$ |

19 |

| Goodwill impairment |

|

|

258 |

|

|

|

- |

|

|

- |

| Interest expense |

|

|

123 |

|

|

|

139 |

|

|

161 |

| Other (income) expense, net |

|

|

(27 |

) |

|

|

25 |

|

|

25 |

| Income taxes from continuing operations |

|

|

276 |

|

|

|

279 |

|

|

237 |

Restructuring and asset impairment costs were $4, $4 and $19 in fiscal years 2011, 2010 and 2009, respectively, and were related to the Company’s supply chain and other restructuring activities. The Company’s restructuring plan involves simplifying its supply chain and other activities and includes reducing certain staffing levels, resulting in additional costs, including severance, and certain facilities related costs associated with this activity. The Company may, from time to time, decide to pursue additional restructuring-related initiatives to drive cost savings and efficiencies.

The accrued restructuring liability as of July 1, 2008 was $4. Since July 1, 2008, the Company has incurred total restructuring charges of $22 and made total restructuring payments of $24. The accrued restructuring liability as of June 30, 2011, was $2.

In addition, the Company incurred restructuring-related costs, primarily recorded in cost of products sold and selling and administrative expenses, associated with the Company’s restructuring activities, totaling $23, $13 and $18 in fiscal years 2011, 2010 and 2009, respectively. Total non-cash restructuring-related costs for fiscal years 2011, 2010 and 2009 were $6, $4 and $10, respectively.

The Company anticipates incurring approximately $20 to $30 of restructuring-related charges in fiscal year 2012, of which approximately $7 are expected to be non-cash. The Company anticipates approximately $13 to $20 of restructuring-related charges in selling and administrative expenses in Corporate, and $2 to $3 of cost of product sold charges in the Cleaning reportable segment and $5 to $7 in the Household reportable segment.

Goodwill impairment

During the fiscal 2011 second quarter, the Company identified challenges in increasing sales for the Burt’s Bees business in new international markets in accordance with projections, particularly in the European Union and Asia. Additionally, during the fiscal 2011 second quarter, the Company initiated its process for updating the three-year long-range financial and operating plan for the Burt’s Bees business. In addition to slower than projected growth of international sales and challenges in the timing of certain international expansion plans, the domestic natural personal care category had not recovered in accordance with the Company’s projections. Following the comprehensive reevaluation, the Company recognized an impairment charge during the fiscal 2011 second quarter.

The impairment charge is a result of changes in the assumptions used to determine the fair value of the Burt’s Bees business based on slower than forecasted category growth as well as recent challenges in international expansion plans, which have adversely affected the assumptions for international growth and the estimates of expenses necessary to achieve that growth. The revised assumptions reflect somewhat higher cost levels than previously projected. As a result of this assessment, the Company determined that the book value of the Burt’s Bees reporting unit exceeded its fair value, resulting in a non-cash impairment charge of $258 recognized in the second quarter ended December 31, 2010. The non-cash goodwill impairment charge is based on the Company’s current estimates regarding the future financial performance of the Burt’s Bees business and macroeconomic factors. There was no substantial tax benefit associated with this non-cash charge.

To determine the fair value of the Burt’s Bees reporting unit, which is in the Lifestyle segment, the Company used a discounted cash flow (DCF) approach, as it believes that this approach is the most reliable indicator of fair value of the business. Under this approach, the Company estimated the future cash flows of the Burt’s Bees reporting unit and discounted these cash flows at a rate of return that reflects its relative risk.

7

The Company’s trademarks and definite-lived intangible assets for the Burt’s Bees reporting unit were included in the impairment testing. The impairment testing concluded that these assets were not impaired.

During the fiscal 2011 fourth quarter, the Company completed its annual impairment test of goodwill and indefinite-lived intangible assets and no instances of impairment were identified.

Interest expense decreased $16 in fiscal year 2011, primarily due to a decline in average debt balances.

Interest expense decreased in fiscal year 2010, primarily due to a lower weighted average interest rate paid on commercial paper and a decline in average debt balances.

Other (income) expense, net, of $(27) in fiscal year 2011 included $(13) of low-income housing partnership gains, $(9) of income from transition services related to the Company’s sale of its Auto Businesses, $(8) of equity earnings in unconsolidated affiliates and $(3) of interest income. Partially offsetting this income was $9 from the amortization of intangibles.

Other expense, net, of $25 in fiscal year 2010 included $26 of net foreign exchange transaction and re-measurement losses, primarily related to the Company’s subsidiary in Venezuela, $9 of the amortization of intangibles and $1 of other expenses. Partially offsetting these expenses were $(9) of equity earnings in unconsolidated affiliates and $(3) of interest income.

Other expense, net, of $25 in fiscal year 2009 included $27 of net foreign exchange transaction losses, primarily related to the Company’s subsidiary in Venezuela, $7 of the amortization of intangibles and $3 from the Company’s investments in low-income housing partnerships. Partially offsetting these expenses were $(8) of equity earnings in unconsolidated affiliates and $(4) of interest income.

The effective tax rate on income from continuing operations was 49.0%, 34.7% and 33.5% in fiscal years 2011, 2010 and 2009, respectively. The substantially higher tax rate in fiscal year 2011 resulted from the non-deductible non-cash goodwill impairment charge of $258 related to the Burt’s Bees reporting unit as there was no substantial tax benefit associated with this non-cash charge.

The fiscal year 2010 tax rate was higher than in fiscal year 2009 primarily due to favorable tax settlements in fiscal year 2009.

Discontinued operations

In September 2010, the Company entered into a definitive agreement to sell its Auto Businesses to an affiliate of Avista Capital Partners in an all-cash transaction. In November 2010, the Company completed the sale pursuant to the terms of a Purchase and Sale Agreement (Purchase Agreement) and received cash consideration of $755. The Company also received cash flows of approximately $30 related to net working capital that was retained by the Company as part of the sale. Included in earnings from discontinued operations for fiscal year ended June 30, 2011, is an after-tax gain on the transaction of $247.

Included in the transaction were substantially all of the Company’s Auto Businesses, the majority of which are in the U.S., Australia, Canada and Europe, including the worldwide rights to the market-leading Armor All® and STP® brands. As part of the transaction, the buyer acquired two auto care manufacturing facilities, one in the U.S. and one in the United Kingdom. Employees at these facilities, the Auto Businesses management team and other employees affiliated with the Auto Businesses transferred to the buyer. The results of the Auto Businesses have historically been part of the Company’s Cleaning and International reportable segments. In connection with the discontinued operations presentation in the consolidated financial statements, certain financial statement footnotes have also been updated to reflect the impact of discontinued operations.

8

As part of the Purchase Agreement, certain transition services are being provided to the buyer for a period of up to eighteen months from the date of sale. The purpose of these services is to provide short-term assistance to the buyer in assuming the operations of the Auto Businesses. These services do not confer to the Company the ability to influence the operating or financial policies of the Auto Businesses under their new ownership. The Company’s cash inflows and outflows from these services have not been nor are expected to be significant during the transition period. Income from these transition services for the fiscal year ended June 30, 2011 was $9 and is being reported in other (income) expense, net, in continuing operations. The costs associated with the services are reflected in continuing operations in the consolidated statements of earnings. Aside from the transition services, the Company has included the financial results of the Auto Businesses in discontinued operations for all periods presented. Assets related to the Auto Businesses are presented as assets held for sale, net, on the accompanying consolidated balance sheet as of June 30, 2010.

The following table presents the net sales and earnings attributable to the Auto Businesses, which includes the financial results up to November 5, 2010, the date of the sale, as of June 30:

| |

|

2011 |

|

2010 |

|

2009 |

| Net sales |

|

$ |

95 |

|

|

$ |

300 |

|

|

$ |

292 |

|

| Earnings before income taxes |

|

$ |

34 |

|

|

$ |

120 |

|

|

$ |

102 |

|

| Income tax expense on earnings |

|

|

(11 |

) |

|

|

(43 |

) |

|

|

(37 |

) |

| Gain on sale, net of tax |

|

|

247 |

|

|

|

- |

|

|

|

- |

|

| Earnings from discontinued operations |

|

$ |

270 |

|

|

$ |

77 |

|

|

$ |

65 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

The major classes of assets and liabilities of the Auto Businesses reflected as assets held for sale, net, as of June 30, 2010 were as follows:

| |

|

2010 |

| Receivables, net |

|

$ |

4 |

|

| Inventories, net |

|

|

35 |

|

| Other current assets |

|

|

1 |

|

| Property, plant and equipment, net |

|

|

13 |

|

| Goodwill |

|

|

347 |

|

| Trademarks and other intangible assets, net |

|

|

12 |

|

| Accounts payable and other liabilities |

|

|

(7 |

) |

| Total |

|

$ |

405 |

|

| |

|

|

|

|

SEGMENT RESULTS FROM CONTINUING OPERATIONS

The following presents the results of continuing operations from the Company’s reportable segments excluding certain unallocated costs included in Corporate (See Note 21 for a reconciliation of segment results to total Company results):

Cleaning

| |

|

|

|

|

|

|

|

|

|

|

Change |

| |

|

2011 |

|

2010 |

|

2009 |

|

2011

to

2010 |

|

2010

to

2009 |

| Net sales |

|

$ |

1,619 |

|

$ |

1,624 |

|

$ |

1,621 |

|

- |

% |

|

- |

% |

| Earnings from continuing operations before income taxes |

|

|

356 |

|

|

368 |

|

|

345 |

|

(3 |

) |

|

7 |

|

9

Fiscal year 2011 versus fiscal year 2010: Net sales were flat, volume increased and earnings from continuing operations before income taxes decreased during fiscal year 2011. Volume growth of 1% was primarily driven by increased shipments of disinfecting products in the Away From Home business. Also contributing to volume growth were increased shipments of several products, including Pine-Sol® cleaner, Clorox® Clean-Up® Cleaner with Bleach, Clorox® disinfecting bathroom cleaners and Clorox® Disinfecting Wipes, primarily behind strong merchandising activities. These increases were partially offset by lower shipments of laundry additives due to category softness; and lower shipments of Tilex® mold and mildew remover, due to competitive activity. Volume outpaced net sales primarily due to the impact of incremental customer pick-up allowances (approximately 60 basis points). The decrease in earnings from continuing operations before income taxes was primarily driven by lower sales, $27 of higher commodity costs, $17 of unfavorable product mix and other smaller items. These decreases were partially offset by $29 of cost savings, due to various manufacturing efficiencies and network consolidations, and $12 of lower advertising and sales promotion activities.

Fiscal year 2010 versus fiscal year 2009: Net sales were flat while volume and earnings from continuing operations before income taxes increased during fiscal year 2010. Volume growth of 4% was primarily due to increased shipments of Clorox Disinfecting Wipes® and other disinfecting products to meet demand associated with the H1N1 flu pandemic. Also contributing to the volume growth were increased shipments of Pine-Sol® cleaner and Clorox® toilet bowl cleaners due to increased distribution and promotional activities. These increases were partially offset by lower shipments of the Green Works® line of natural cleaners due to category softness. Volume outpaced net sales growth primarily due to unfavorable product mix (approximately 220 basis points) and increased trade-promotion spending (approximately 150 basis points). The increase in earnings from continuing operations before income taxes was primarily driven by $34 of cost savings, due to network consolidations and various manufacturing efficiencies, and $16 of favorable commodity costs, primarily resin and chlor-alkali. These increases were partially offset by $24 from the impact of unfavorable product mix.

Household

| |

|

|

|

|

|

|

|

|

|

|

Change |

| |

|

2011 |

|

2010 |

|

2009 |

|

2011

to

2010 |

|

2010

to

2009 |

| Net sales |

|

$ |

1,611 |

|

$ |

1,663 |

|

$ |

1,726 |

|

(3 |

)% |

|

(4 |

)% |

| Earnings from continuing operations before income taxes |

|

|

278 |

|

|

290 |

|

|

289 |

|

(4 |

) |

|

- |

|

Fiscal year 2011 versus fiscal year 2010: Net sales, volume and earnings from continuing operations before income taxes decreased during fiscal year 2011. Volume decline of 2% was primarily driven by lower shipments of Glad® food-storage products due, primarily, to competitive activity and lower shipments of Kingsford® charcoal products. Also contributing to volume decline was lower shipments of Glad® trash bags primarily due to competitive activity and the impact of price increases. These decreases were partially offset by increased shipments of Fresh Step® cat litter, driven by product improvements and increased merchandising events; and increased shipments of Glad® premium trash bags, primarily due to product improvements. The variance between net sales and volume was primarily due to the impact of incremental customer pick-up allowances (approximately 110 basis points) and unfavorable product mix (approximately 60 basis points), partially offset by the benefits of pricing (approximately 90 basis points). The decrease in earnings from continuing operations before income taxes was primarily due to lower sales and $30 of higher commodity costs, primarily resin, partially offset by $30 of cost savings due to various manufacturing efficiencies and product improvements, and other smaller items.

Fiscal year 2010 versus fiscal year 2009: Earnings from continuing operations before income taxes were flat while net sales and volume decreased during fiscal year 2010. Volume decline of 1% was primarily driven by lower shipments of Glad® food-storage products primarily due to competitive activity, category softness and the Company’s exit from a private label food bags business, partially offset by increased shipments of Kingsford® charcoal products and Fresh Step® cat litter, due to increased promotional activities. The variance between volume and net sales was primarily due to price declines on Glad® trash bags implemented in the previous fiscal year (approximately 230 basis points) and increased trade-promotion spending in response to competitive activity (approximately 150 basis points). The flat earnings from continuing operations before income taxes reflects $38 of cost savings, primarily associated with the Company’s diversification of its supplier base and various manufacturing efficiencies, partially offset by a $26 impact of price declines on Glad® trash bags implemented in the previous fiscal year and other items.

10

Lifestyle

| |

|

|

|

|

|

|

|

|

|

|

|

Change |

| |

|

2011 |

|

2010 |

|

2009 |

|

2011

to

2010 |

|

2010

to

2009 |

| Net sales |

|

$ |

883 |

|

|

$ |

864 |

|

$ |

813 |

|

2 |

% |

|

6 |

% |

| (Losses) earnings from continuing operations before |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| income taxes |

|

|

(1 |

) |

|

|

303 |

|

|

270 |

|

(100 |

) |

|

12 |

|

| Non-cash goodwill impairment |

|

|

258 |

|

|

|

- |

|

|

- |

|

* |

|

|

- |

|

| Earnings from continuing operations before |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| income taxes and non-cash goodwill impairment charge |

|

$ |

257 |

|

|

$ |

303 |

|

$ |

270 |

|

(15 |

)% |

|

12 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| * |

The percentage change is not included because there was no non-cash goodwill impairment charge in fiscal year 2010. |

The Company’s management uses earnings from continuing operations before income taxes and the non-cash goodwill impairment charge, a non-GAAP measure, to evaluate business performance and believes that this information provides investors with additional information about the underlying results and trends of this segment.

Fiscal year 2011 versus fiscal year 2010: Net sales and volume increased while earnings from continuing operations decreased during fiscal year 2011. Volume growth of 3% was primarily driven by increased shipments of Burt’s Bees® natural personal care products, due to domestic lip balm strength and International market growth. Also contributing to the growth in volume was increased shipments of Hidden Valley® salad dressings and increased shipments of the new Brita® on-the-go water bottle. These increases were partially offset by lower shipments of K C Masterpiece® barbeque sauces. Volume outpaced net sales growth primarily due to higher trade-promotion spending (approximately 30 basis points). The decrease in earnings from continuing operations before income taxes was primarily due to the non-cash goodwill impairment charge of $258 for the Burt’s Bees business. The decrease in earnings from continuing operations before income taxes and the non-cash goodwill impairment charge was primarily due to $21 of higher advertising costs in support of product innovation; $7 of higher commodity costs, primarily soybean oil and garlic; $7 of higher selling and administrative expenses; and $6 of higher manufacturing and logistics costs. These factors were partially offset by higher sales and $9 of cost savings, due to various manufacturing efficiencies, and other smaller items.

Fiscal year 2010 versus fiscal year 2009: Volume, net sales and earnings from continuing operations before income taxes increased during fiscal year 2010. Volume growth of 9% was primarily driven by increased shipments of Hidden Valley® salad dressings due to promotional activities, Brita® pour-through water-filtration products due to merchandising and Burt’s Bees® natural personal care products due to international expansion. Volume growth outpaced net sales growth primarily due to increased trade-promotion spending (approximately 140 basis points) and product mix (approximately 140 basis points). The increase in earnings from continuing operations before income taxes was primarily due to higher sales, $14 of favorable commodity costs, primarily soybean oil, $8 of cost savings and other items, partially offset by $11 of higher advertising costs.

International

| |

|

|

|

|

|

|

|

|

|

|

Change |

| |

|

2011 |

|

2010 |

|

2009 |

|

2011

to

2010 |

|

2010

to

2009 |

| Net sales |

|

$ |

1,118 |

|

$ |

1,083 |

|

$ |

998 |

|

3 |

% |

|

9 |

% |

| Earnings from continuing operations before income taxes |

|

|

147 |

|

|

144 |

|

|

121 |

|

2 |

|

|

19 |

|

Fiscal year 2011 versus fiscal year 2010: Net sales and earnings from continuing operations before income taxes increased while volume was flat during fiscal year 2011. Net sales growth outpaced volume growth primarily due to the benefit of price increases (approximately 650 basis points), partially offset by the impact of unfavorable foreign exchange rates (approximately 150 basis points) and unfavorable product mix (approximately 110 basis points). The increase in earnings from continuing operations before income taxes was primarily due to $71 from the benefit of price increases, primarily due to inflation in Latin America; $17 from the benefit of cost savings; and $15 from favorable foreign currency exchange. These increases were partially offset by $28 of unfavorable manufacturing and logistics costs, primarily due to inflation in Latin America; $25 of higher selling and administration costs, primarily associated with investments in information technology systems; $22 of higher commodity costs behind inflationary pressures in Latin America and other smaller items.

11

Fiscal year 2010 versus fiscal year 2009: Net sales, volume and earnings from continuing operations before income taxes increased during fiscal year 2010. Volume growth of 3% was primarily driven by increased shipments of bleach and other disinfecting and fragranced cleaning products in Latin America due to increased demand largely as a result of the H1N1 flu pandemic. Net sales growth outpaced volume growth primarily due to the impact of price increases (approximately 1,040 basis points), partially offset by the impact of unfavorable foreign exchange rates (approximately 200 basis points). The increase in earnings from continuing operations before income taxes was primarily due to $113 from the impact of price increases and $21 of cost savings, which include more efficient sourcing of raw materials and the consolidation of certain manufacturing facilities. This was partially offset by $53 of foreign currency exchange losses in Venezuela consisting of $19 of translation losses, $24 of transaction losses resulting from converting local currency to U.S. dollars using the parallel market currency exchange rate for inventory purchases, and $10 of re-measurement losses. Also contributing to the offset was $16 of higher advertising costs, primarily to support new initiatives in Latin America, $13 of higher selling and administrative expenses, primarily due to inflationary pressures in Latin America and other items.

Venezuela

Prior to December 31, 2009, the Company translated its Venezuelan subsidiary’s financial statements using Venezuela’s official currency exchange rate, which had been fixed by the Venezuelan government at 2.15 bolivar fuertes (VEFs) to the U.S. dollar. Effective December 31, 2009, the Company began translating its Venezuelan subsidiary’s financial statements using the parallel market currency exchange rate (exchange rates negotiated with local financial intermediaries), the rate at which the Company expected to be able to remit dividends or return capital. The rate used at December 31, 2009, was 5.87 VEFs to the U.S. dollar. On a pre-tax basis, this change in the rate used for converting these currencies resulted in a one time re-measurement loss of $12 during the Company’s fiscal quarter ended December 31, 2009, which related primarily to U.S. dollar denominated inventory purchases.

Effective January 1, 2010, the financial statements for the Company’s Venezuelan subsidiary have been consolidated under the rules governing the translation of financial information in a highly inflationary economy. Under U.S. GAAP, an economy is considered highly inflationary if the cumulative inflation rate for a three-year period meets or exceeds 100 percent. If a subsidiary is considered to be in a highly inflationary economy, the financial statements of the subsidiary must be re-measured into the Company’s reporting currency (U.S. dollar) and future exchange gains and losses from the re-measurement of non-U.S. dollar monetary assets and liabilities are reflected in current net earnings, rather than exclusively in the equity section of the balance sheet, until such time as the economy is no longer considered highly inflationary. Nonmonetary assets and liabilities, such as inventory, property, plant and equipment and prepaid expenses, are recorded in U.S. dollars at the historical rates at the time of acquisition of such assets or liabilities.

In May 2010, the Venezuela government suspended the functioning of the parallel currency exchange market and in June 2010, the Venezuela Central Bank established an alternative currency exchange market. This alternative market includes volume restrictions on the amount of U.S. dollars which may be converted each month. In June 2010, the Company began utilizing the exchange rate at which the Company was purchasing U.S. dollars through the alternative market, which was 5.3 VEFs to the U.S. dollar at that time, as the translation rate for the Company’s Venezuelan subsidiary’s financial statements.

For fiscal years 2011 and 2010, Venezuela's net sales and total assets represented approximately 2% and 1% of the total Company's net sales and total assets, respectively.

Corporate

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Change |

| |

|

2011 |

|

2010 |

|

2009 |

|

2011

to

2010 |

|

2010

to

2009 |

| Losses from continuing operations before income taxes |

|

$ |

(217 |

) |

|

$ |

(300 |

) |

|

$ |

(316 |

) |

|

(28 |

)% |

|

(5 |

)% |

Fiscal year 2011 versus fiscal year 2010: The decrease in losses from continuing operations before income taxes was primarily due to lower employee benefit and incentive compensation costs; lower interest expense, primarily due to a decline in average debt balances; low-income housing partnership gains; cost savings associated with the Company’s restructuring initiatives; and income from transition services related to the sale of the Auto Businesses.

Fiscal year 2010 versus fiscal year 2009: The decrease in losses from continuing operations before income taxes was primarily due to a decrease in restructuring costs, cost savings associated with the Company’s restructuring initiatives, and lower interest expense primarily due to a decrease in average interest rate paid on commercial paper borrowings and a decline in average debt balances. These decreases were partially offset by higher employee incentive compensation costs.

12

FINANCIAL POSITION AND LIQUIDITY

Management’s discussion and analysis of the Company’s financial position and liquidity describes its consolidated operating, investing and financing activities, contractual obligations and off balance sheet arrangements.

The following table summarizes cash activities:

| |

|

2011 |

|

2010 |

|

2009 |

| Net cash provided by continuing operations |

|

$ |

690 |

|

|

$ |

764 |

|

|

$ |

664 |

|

| Net cash provided by (used for) investing activities from continuing operations |

|

|

544 |

|

|

|

(229 |

) |

|

|

(196 |

) |

| Net cash used for financing activities |

|

|

(1,078 |

) |

|

|

(706 |

) |

|

|

(540 |

) |

The Company’s cash position includes amounts held by foreign subsidiaries, and as a result the repatriation of certain cash balances from some of the Company’s foreign subsidiaries could result in additional tax costs. However, these cash balances are generally available without legal restriction to fund local business operations. In addition, a portion of the Company’s cash balances is held in U.S. dollars by foreign subsidiaries, whose functional currency is their local currency. Such U.S. dollar balances are reported on the foreign subsidiaries books, in their functional currency, with the impact from foreign currency exchange rate differences recorded in other (income) expense, net. The Company’s cash holdings as of the end of fiscal years 2011 and 2010 were as follows:

| |

|

2011 |

|

2010 |

|

2009 |

| Non-U.S. dollar balances held by non-U.S. dollar functional currency subsidiaries |

|

$ |

98 |

|

$ |

42 |

|

$ |

74 |

| U.S. dollar balances held by non-U.S. dollar functional currency subsidiaries |

|

|

15 |

|

|

13 |

|

|

52 |

| Non-U.S. dollar balances held by U.S. dollar functional currency subsidiaries |

|

|

26 |

|

|

7 |

|

|

13 |

| U.S. dollar balances held by U.S. dollar functional currency subsidiaries |

|

|

120 |

|

|

25 |

|

|

67 |

| Total |

|

$ |

259 |

|

$ |

87 |

|

$ |

206 |

| |

|

|

|

|

|

|

|

|

|

The Company’s total cash balance increased $172 as of June 30, 2011, as compared to June 30, 2010. The increase was primarily attributable to the expiration of a U.S. federal tax law in June 2011 that provided tax relief for U.S. companies to borrow from their foreign subsidiaries on a short-term basis, borrowings which the Company used to pay down commercial paper balances in fiscal year 2010. As of June 30, 2010, the Company had short-term intercompany borrowings, with an initial maturity of 60 days, from its foreign subsidiaries of $155, pursuant to the provisions of this tax relief.

Operating Activities

Net cash provided by continuing operations decreased to $690 in fiscal year 2011 from $764 in fiscal year 2010. The year-over-year decrease was primarily driven by higher fiscal year 2010 incentive compensation payments paid in fiscal year 2011, as compared to fiscal year 2009 incentive compensation payments paid in 2010, and other working capital changes.

As of June 30, 2011 and 2010, total current liabilities exceeded total current assets (excluding assets held for sale) by $86 and $561, respectively, which was primarily attributable to the Company’s focus on maintaining receivable, inventory and payable balances at levels consistent with the Company’s business plan and $300 of long-term debt classified in current liabilities at June 30, 2010 which became due and was paid in fiscal year 2011.

Investing Activities

In fiscal year 2011, investing activities included $747 of proceeds from the sale of the Auto Businesses, net of transaction costs. Capital expenditures were $228, $201 and $196, respectively, in fiscal years 2011, 2010 and 2009. Capital spending as a percentage of net sales was 4.4% for fiscal year 2011, and 3.8% for both fiscal year 2010 and 2009. The Company estimates capital spending during fiscal year 2012 will be in the range of $240 to $250. The increase in fiscal year 2011 capital spending, and anticipated increase in fiscal year 2012, are primarily associated with the Company’s investments in global information technology systems and investments in research and development facilities.

In January 2010, the Company acquired the assets of Caltech Industries, Inc., a company that provides disinfectants for the health care industry, for an aggregate price of $24, with the objective of expanding the Company’s capabilities in the areas of health and wellness. In connection with the purchase, the Company acquired Caltech Industries’ workforce. The Company paid for the acquisition in cash.

13

Net assets acquired, at fair value, included $2 of inventory and $4 of other assets, $9 of goodwill, $6 of trademarks, $2 of customer list, $2 of product formulae and $1 of other liabilities. The trademarks, customer list and product formulae are amortized over a period of 3, 15 and 10 years, respectively. Goodwill represents a substantial portion of the acquisition price.

Financing Activities

Capital Resources and Liquidity

Credit Arrangements

At June 30, 2011, the Company had a $1.1 billion revolving credit agreement with an expiration date of April 2013. There were no borrowings under this revolving credit arrangement, which the Company believes is available and will continue to be available for general corporate purposes and to support commercial paper issuances. The revolving credit agreement includes certain restrictive covenants. The primary restrictive covenant is a maximum ratio of total debt to earnings before interest, taxes, depreciation and amortization (EBITDA) for the trailing 4 quarters (EBITDA ratio), as defined in the Company’s revolving credit agreement, of 3.25 times. EBITDA, as defined, may not be comparable to similarly titled measures used by other entities.

The following table sets forth the calculation of the EBITDA ratio, as contractually defined, at June 30:

| |

|

2011 |

|

2010 |

|

2009 |

| Net earnings |

|

$ |

557 |

|

|

$ |

603 |

|

|

$ |

537 |

|

| Add back: |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense |

|

|

123 |

|

|

|

139 |

|

|

|

161 |

|

| Income tax expense |

|

|

366 |

|

|

|

322 |

|

|

|

274 |

|

| Depreciation and amortization |

|

|

173 |

|

|

|

185 |

|

|

|

190 |

|

| Goodwill impairment charge |

|

|

258 |

|

|

|

- |

|

|

|

- |

|

| Certain asset impairment charges |

|

|

- |

|

|

|

- |

|

|

|

3 |

|

| Deduct: |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest income |

|

|

(3 |

) |

|

|

(3 |

) |

|

|

(4 |

) |

| Gain on sale |

|

|

(326 |

) |

|

|

- |

|

|

|

- |

|

| EBITDA |

|

$ |

1,148 |

|

|

$ |

1,246 |

|

|

$ |

1,161 |

|

| Total debt |

|

$ |

2,584 |

|

|

$ |

2,795 |

|

|

$ |

3,149 |

|

| EBITDA ratio |

|

|

2.25 |

|

|

|

2.24 |

|

|

|

2.71 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

The Company is in compliance with all restrictive covenants and limitations as of June 30, 2011. The Company anticipates being in compliance with all restrictive covenants for the foreseeable future. The Company continues to monitor the financial markets and assess its ability to fully draw on its revolving credit facility, but currently expects that any drawing on the facility will be fully funded.

The Company had $31 of foreign and other credit lines at June 30, 2011, of which $23 was available for borrowing.

Based on the Company’s working capital requirements, the current borrowing availability under its credit agreements, its credit ratings, and its anticipated ability to generate positive cash flows from operations in the future, the Company believes it will have the funds necessary to meet its financing requirements and other fixed obligations as they become due. Should the Company undertake transactions requiring funds in excess of its current cash levels and available credit lines, it might consider the issuance of debt or other securities to finance acquisitions, repurchase shares, refinance debt or fund other activities for general business purposes. The Company’s access to or cost of such additional funds could be adversely affected by any decrease in credit ratings, which were the following as of June 30:

| |

|

2011 |

|

2010 |

| |

|

Short-term |

|

Long-term |

|

Short-term |

|

Long-term |

| Standard & Poor’s |

|

A-2 |

|

BBB+ |

|

A-2 |

|

BBB+ |

| Moody’s |

|

P-2 |

|

Baa1 |

|

P-2 |

|

Baa2 |

14

Share Repurchases and Dividend Payments

The Company has three share repurchase programs: two open-market purchase programs and a program to offset the impact of share dilution related to share-based awards (the Evergreen Program). In May 2008, the Company’s Board of Directors approved an open-market purchase program with a total authorization of $750, of which $229 remains available as of June 30, 2011. In May 2011, the Board of Directors approved a second open-market purchase program with a total authorization of $750, all of which remains available as of June 30, 2011. The Evergreen Program has no authorization limit as to amount or timing of repurchases.

Total share repurchases in fiscal years 2011 and 2010 were $655 (approximately 9.8 million shares) and $150 (approximately $2.4 million shares), respectively. Share repurchases under the open-market purchase program were $521 (approximately 7.7 million shares) for fiscal year 2011. The Company did not repurchase any shares in fiscal years 2010 and 2009 under the open-market purchase program. Share repurchases under the Evergreen Program were $134 (approximately 2.1 million shares) and $150 (approximately 2.4 million shares) in fiscal years 2011 and 2010, respectively. The Company did not repurchase any shares in fiscal year 2009 under the Evergreen Program.

During fiscal years 2011, 2010 and 2009, the Company declared dividends per share of $2.25, $2.05 and $1.88, respectively. During fiscal years 2011, 2010 and 2009, the Company paid dividends per share of $2.20, $2.00 and $1.84, respectively.

The following is a summary of the Company’s gross share repurchases and cash dividends paid during the last three fiscal years:

| |

|

2011 |

|

2010 |

|

2009 |

| Total share repurchases |

|

$ |

655 |

|

$ |

150 |

|

$ |

- |

| Cash dividends paid |

|

|

303 |

|

|

282 |

|

|

258 |

Contractual Obligations

The Company had contractual obligations at June 30, 2011, payable or maturing in the following fiscal years:

| |

|

2012 |

|

2013 |

|

2014 |

|

2015 |

|

2016 |

|

Thereafter |

|

Total |

| Long-term debt maturities including interest |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| payments (See Note 10) |

|

$ |

110 |

|

$ |

948 |

|

$ |

63 |

|

$ |

638 |

|

$ |

329 |

|

$ |

436 |

|

$ |

2,524 |

| Notes and loans payable (See Note 10) |

|

|

459 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

459 |

| Purchase obligations(1) |

|

|

266 |

|

|

62 |

|

|

48 |

|

|

31 |

|

|

19 |

|

|

30 |

|

|

456 |

| Operating leases (See Note 17) |

|

|

33 |

|

|

31 |

|

|

28 |

|

|

26 |

|

|

24 |

|

|

112 |

|

|

254 |

| ITS Agreement (service agreement only)(2) |

|

|

35 |

|

|

34 |

|

|

9 |

|

|

- |

|

|

- |

|

|

- |

|

|

78 |

| Contributions to non-qualified supplemental |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| post retirement plans (3) |

|

|

14 |

|

|

13 |

|

|

13 |

|

|

13 |

|

|

15 |

|

|

88 |

|

|

156 |

| Venture Agreement terminal obligation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (See Note 12) |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

277 |

|

|

277 |

| Total |

|

$ |

917 |

|

$ |

1,088 |

|

$ |

161 |

|

$ |

708 |

|

$ |

387 |

|

$ |

943 |

|

$ |

4,204 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) |

|

Purchase obligations are defined as purchase agreements that are enforceable and legally binding and that specify all significant terms, including quantity, price and the approximate timing of the transaction. For purchase obligations subject to variable price and/or quantity provisions, an estimate of the price and/or quantity has been made. Examples of the Company’s purchase obligations include contracts to purchase raw materials, commitments to contract manufacturers, commitments for information technology and related services, advertising contracts, utility agreements, capital expenditure agreements, software acquisition and license commitments, and service contracts. Any amounts reflected in the consolidated balance sheet as accounts payable and accrued liabilities are excluded from the table above. |

15

| (2) |

|

In October 2006, the Company entered into an Information Technology Services (ITS) agreement with Hewlett-Packard (HP), a third-party service provider. Upon the terms and subject to the conditions set forth in the ITS Agreement, HP is providing certain information technology and related services. The services began in March 2007 and will continue through October 2013. The total minimum contractual obligations at June 30, 2011, are $82, of which $4 are included in operating leases. The minimum contractual obligations are based on an annual service fee that is adjusted periodically based upon updates to services and equipment provided. Included in the ITS Agreement are certain acceleration payment clauses if the Company terminates the contract without cause. |

| |

| (3) |

|

Represents expected payments through 2020. Based on the accounting rules for retirement and postretirement benefit plans, the liabilities reflected in the Company’s consolidated balance sheets differ from these expected future payments (See Note 20). |

At June 30, 2011, the liability recorded for uncertain tax positions, excluding associated interest and penalties, was approximately $97. In the twelve months succeeding June 30, 2011, audit resolutions could potentially reduce total unrecognized tax benefits by up to $11, primarily as a result of cash settlement payments. Since the ultimate amount and timing of further cash settlements cannot be predicted due to the high degree of uncertainty, liabilities for uncertain tax positions are excluded from the contractual obligation table (See Note 19).

Off Balance Sheet Arrangements

In conjunction with divestitures and other transactions, the Company may provide typical indemnifications (e.g., indemnifications for representations and warranties and retention of previously existing environmental, tax and employee liabilities) for which terms vary in duration and potential amount of the total obligation and, in many circumstances, are not explicitly defined. The Company has not made, nor does it anticipate making, any payments relating to its indemnifications, and believes that any potential payments would not have a material effect on its financial position, results of operations or cash flows, either individually or in the aggregate.

At June 30, 2011, the Company is a party to letters of credit of $16, primarily related to one of its insurance carriers.

The Company has not recorded any liabilities on any of the aforementioned guarantees at June 30, 2011.

CONTINGENCIES

The Company is involved in certain environmental matters, including Superfund and other response actions at various locations. The Company has a recorded liability of $15 and $16 at June 30, 2011 and 2010, respectively, for its share of aggregate future remediation costs related to these matters. One matter in Dickinson County, Michigan, for which the Company is jointly and severally liable, accounts for a substantial majority of the recorded liability at both June 30, 2011 and 2010. The Company has agreed to be liable for 24.3% of the aggregate remediation and associated costs for this matter pursuant to a cost-sharing arrangement with a third party. With the assistance of environmental consultants, the Company maintains an undiscounted liability representing its current best estimate of its share of the capital expenditures, maintenance and other costs that may be incurred over an estimated 30-year remediation period. Currently, the Company cannot accurately predict the timing of future payments that may be made under this obligation. In addition, the Company’s estimated loss exposure is sensitive to a variety of uncertain factors, including the efficacy of remediation efforts, changes in remediation requirements and the timing, varying costs and alternative clean-up technologies that may become available in the future. Although it is possible that the Company’s exposure may exceed the amount recorded, any amount of such additional exposures, or range of exposures, is not estimable at this time.

The Company is subject to various other lawsuits and claims relating to issues such as contract disputes, product liability, patents and trademarks, advertising, employee and other matters. Based on the Company’s analysis of these claims and litigation, it is the opinion of management that the ultimate disposition of these matters, including the environmental matter described above, to the extent not previously provided for, will not have a material adverse effect, individually or in the aggregate, on the Company’s consolidated financial statements taken as a whole.

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

As a multinational company, the Company is exposed to the impact of foreign currency fluctuations, changes in commodity prices, interest-rate risk and other types of market risk. In the normal course of business, where available at a reasonable cost, the Company manages its exposure to market risk using contractual agreements and a variety of derivative instruments. The Company’s objective in managing its exposure to market risk is to limit the impact of fluctuations on earnings and cash flow through the use of swaps, forward purchases and futures contracts. Derivative contracts are entered into for non-trading purposes with major credit-worthy institutions, thereby decreasing the risk of credit loss.

16

The Company uses different methodologies, when necessary, to estimate the fair value of its derivative contracts. The estimated fair values of the majority of the Company’s contracts are based on quoted market prices, traded exchange market prices, or broker price quotations, and represent the estimated amounts that the Company would pay or receive to terminate the contracts.

Sensitivity Analysis

For fiscal year 2011, the Company’s exposure to market risk was estimated using sensitivity analyses, which illustrate the change in the fair value of a derivative financial instrument assuming hypothetical changes in foreign exchange rates, commodity prices or interest rates. The results of the sensitivity analyses for foreign currency derivative contracts, commodity derivative contracts and interest rate contracts are summarized below. Actual changes in foreign exchange rates, commodity prices or interest rates may differ from the hypothetical changes, and any changes in the fair value of the contracts, real or hypothetical, would be partly to fully offset by an inverse change in the value of the underlying hedged items.

The changes in the fair value of derivatives are recorded as either assets or liabilities in the balance sheet with an offset to net earnings or other comprehensive income, depending on whether or not, for accounting purposes, the derivative is designated and qualified as a hedge. In the event the Company has contracts not designated as hedges for accounting purposes, the Company recognizes the changes in the fair value of these contracts in other (income) expense, net.

Foreign Currency Derivative Contracts

The Company seeks to minimize the impact of certain foreign currency fluctuations by hedging transactional exposures with foreign-currency forward contracts. At June 30, 2011, the Company’s foreign-currency transactional exposures pertaining to derivative contracts exist with the Canadian and Australian dollars. Based on a hypothetical decrease or increase of 10% in the value of the U.S. dollar against the Canadian and Australian dollars at June 30, 2011, the estimated fair value of the Company’s foreign currency derivative contracts would decrease or increase by $4, respectively, with the corresponding impact included in accumulated other comprehensive net losses.

Commodity Derivative Contracts