UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-K

| [X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF |

| THE SECURITIES EXCHANGE ACT OF 1934 | |

| For the fiscal year ended December 31, 2016 | |

| OR | |

| [_] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF |

| THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 01-07698

ACME UNITED CORPORATION

Exact name of registrant as specified in its charter

| Connecticut | 06-0236700 |

| (State or other jurisdiction of | (I.R.S. Employer |

| incorporation or organization) | Identification No.) |

55 Walls Drive Fairfield, Connecticut |

06824 |

| (Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code (203) 254-6060

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered |

| $2.50 par value Common Stock | NYSE MKT |

Securities registered pursuant to Section 12 (g) of the Act: None

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES [_] NO [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES [_] NO [X]

Indicate by check mark whether the registrant (l) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

YES [X] NO [_]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (sec. 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES [X] NO [_]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (sec. 229.405) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [_]

| 1 |

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one).

| Large accelerated filer [_] | Accelerated filer [_] |

| Non-accelerated filer [_] | Smaller Reporting Company [X] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES [_] NO [X]

The aggregate market value of the voting and non-voting stock held by non-affiliates of the registrant as of the last business day of the registrant’s most recently completed second fiscal quarter was $53,187,468.

Registrant had 3,327,455 shares of its $2.50 par value Common Stock outstanding as of March 3, 2017.

Documents Incorporated By Reference

(1) Certain portions of the Company’s Proxy Statement for the Annual Meeting scheduled for April 24, 2017 are incorporated into the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2016, Part III.

| 2 |

|

Page |

|||||

| Part I | |||||

| Item 1. Business | 4 | ||||

| Item 1A. Risk Factors | 7 | ||||

| Item 1B. Unresolved Staff Comments | 13 | ||||

| Item 2. Properties | 13 | ||||

| Item 3. Legal Proceedings | 13 | ||||

| Item 4. Mine Safety Disclosures | 13 | ||||

| Part II | |||||

| Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 14 | ||||

| Item 6. Selected Financial Data | 15 | ||||

| Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations | 16 | ||||

| Item 7A. Quantitative and Qualitative Disclosures About Market Risk | 21 | ||||

| Item 8. Financial Statements and Supplementary Data | 22 | ||||

| Item 9. Changes In and Disagreements with Accountants on Accounting and Financial Disclosure | 44 | ||||

| Item 9A. Controls and Procedures | 44 | ||||

| Item 9B. Other Information | 45 | ||||

| Part III | |||||

| Item 10. Directors, Executive Officers and Corporate Governance | 45 | ||||

| Item 11. Executive Compensation | 47 | ||||

| Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 47 | ||||

| Item 13. Certain Relationships and Related Transactions, and Director Independence | 47 | ||||

| Item 14. Principal Accounting Fees and Services | 47 | ||||

| Part IV | |||||

| Item 15. Exhibits and Financial Statement Schedules | 48 | ||||

| Signatures | 51 | ||||

| 3 |

PART I

Item 1. Business

Overview

Acme United Corporation, a Connecticut corporation (together, with its subsidiaries, the "Company"), is a leading worldwide supplier of innovative cutting, measuring, first aid and sharpening products to the school, home, office, hardware, sporting goods and industrial markets The Company's operations are in the United States, Canada, Europe (located in Germany) and Asia (located in Hong Kong and China). The operations in the United States, Canada and Europe are primarily involved in product development, marketing, sales, administrative, manufacturing and distribution activities. The operations in Asia consist of sourcing, product development, production planning, quality control and sales activities. Total net sales in 2016 were $124.6 million. The Company was organized as a partnership in l867 and incorporated in l882 under the laws of the State of Connecticut.

The Company has grouped its operations into three reportable segments based on the Company’s geographical organization and structure: (1) United States (which includes its Asian operations); (2) Canada and (3) Europe. Net sales in 2016 for each of our segments were: United States (including direct import sales from Asia) - $110.8 million, Canada - $6.8 million, and Europe - $6.9 million. Refer to Note 10 of the Notes to Consolidated Financial Statements for additional segment information.

The Company sources most of its products from suppliers located outside the United States, primarily in Asia. The Company assembles its first aid kits primarily at its facility in Vancouver, WA. The components for the first aid kits are primarily sourced from U.S. suppliers.

Business Strategy

The Company’s business strategy includes the following key elements:

· a commitment to technological innovation achieved through consumer insight, creativity and speed to market;

· a broad selection of products in both brand and private label;

· prompt response;

· superior customer service; and

· value pricing.

Acquisitions

On February 1, 2017 the Company announced that it had acquired the assets of Spill Magic, Inc., for $7.2 million in cash. The Spill Magic products are leaders in in absorbents that encapsulate spills into dry powders that can be safely disposed. Many large retail chains use its products to remove liquids from broken glass containers, oil and gas spills, bodily fluids, and solvents. Its easy-to-use and environmentally friendly products permanently absorb the spills, leaving the floors underneath dry and reducing injuries from falls. Spill Magic also sells spill clean-up kits and blood borne pathogen kits for the safety market.

On February 1, 2016, the Company acquired the principal assets of Vogel Capital, Inc., d/b/a Diamond Machining Technology (“DMT”) based in Marlborough, MA for $7.0 million in cash. The DMT products are leaders in sharpening tools for knives, scissors, chisels, and other cutting tools. They complement the Company’s existing brands and products within the industrial, hardware, floral, food preparation and sporting goods markets.

Principal Products

The Company markets and sells under three main categories – School, Home and Office (Westcott® brand), First Aid & Safety (First Aid Only®, PhysiciansCare® Pac-Kit® and Spill Magic® brands) and Hardware, Industrial and Sporting Goods (Clauss®, Camillus®, Cuda® and DMT® brands).

| 4 |

School, Home and Office

Westcott

Westcott, with a history of quality dating back to 1872, provides innovative cutting and measuring products for the school, home and office. Principal products under the Westcott brand include scissors, rulers, pencil sharpeners, paper trimmers, lettering products and math tools. It is one of the leading scissor and ruler brands in North America. The iPoint pencil sharpener, introduced in 2008, and its successor, the iPoint Evolution, have won GOOD DESIGN awards from the Chicago Athenaeum, Museum of Architecture and Design.

Many of the Westcott branded cutting products contain patented titanium bonding and proprietary non-stick coatings, making the blades more than three times harder than stainless steel as well as reducing friction and corrosion. Significant product introductions in 2015 included a Carbo titanium line of scissors which are 8x harder than steel allowing the blades to stay shaper longer. Westcott also launched a line of safety ceramic utility cutters for use in home and office. Significant product introductions in 2016 included our new line of ergonomic scissors for children designed in tandem with the US Ergonomics Institute.

Hardware, Industrial and Sporting Goods

Clauss

Clauss, with its roots dating back to 1877, offers a line of quality cutting tools for professionals in the hardware & industrial, lawn & garden, food processing, sewing and housewares channels. Many of the Clauss products are enhanced with the Company’s patented titanium and proprietary non-stick coatings. In 2010, the Clauss AirShoc garden tools were awarded a GOOD DESIGN award. In 2013, Clauss launched a family of titanium bonded non-stick putty knives that are unique in their category.

Camillus

Since 1876 Camillus has been supplying the world with innovative and high quality knives. The Camillus brand has a strong heritage in the hunting, sporting and tactical markets. The Company acquired the brand in 2007 and re-launched it in 2009 with an updated and innovative line of fixed blade, folding knives and tactical tools. Many of the knives are enhanced with Titanium Carbonitride coatings to increase the hardness of the blade of up to 10 times that of untreated stainless steel.

In 2011, the Company signed an agreement with Les Stroud of the TV show Survivorman, to co-design and co-brand a line of knives and survival tools. The first knives were introduced in 2012 and include various types of folding and fixed blade knifes as well as machetes and survival tools.

In 2014, Camillus launched a wide variety of new products, including the Camillus Carnivore X machete, Ravenous tomahawk, Heat Sizzle and WildFire knives and the Trench multitool. In 2015, Camillus introduced Glide, its first pocket sharpener. In 2016, Camillus launched a new line of assisted folding knives using its patented linkage system and its ball-bearing assisted system.

Cuda

We launched the Cuda line of fishing tools and knives in 2015. Featuring titanium bonded steels and alloys, Cuda tools provide world class hardness, corrosion and adhesive resistance. In July of 2015, Cuda won Best of Show in the “Fish Smart” category at the ICast show in Orlando, Florida. In January 2016, Cuda won six GOOD DESIGN awards from the Chicago Athenaeum, Museum of Architecture and Design.

DMT

DMT products are leaders in sharpening tools for knives, scissors, chisels, skis, skates and many other edges that require sharpening. DMT was founded in 1976 by aerospace engineers. The DMT products use a proprietary process of finely dispersed diamonds bonded to the surfaces of sharpeners.

First Aid & Safety

First Aid Only

The First Aid Only brand offers first aid kits, refills, and safety products that meet regulatory requirements for a broad range of industries. The Smart Compliance® first aid kit is a simple and effective system for restocking workplace first aid cabinets.

| 5 |

Pac-Kit

The Pac-Kit brand offers first aid kits, industrial stations and refills, emergency medical travel and recreational kits for the industrial, safety, transportation and marine markets. The brand has a long history dating back to the 19th century. Although Pac-Kit’s products are similar to the PhysiciansCare brand, the Pac-Kit brand is especially known for its customized products which are designed to meet customer specifications.

PhysiciansCare

The PhysiciansCare brand offers a wide assortment of first aid kits, emergency and disaster kits, kit refills, hearing, eye, and head protection, as well as ergonomic supports and braces. PhysiciansCare also carries a branded line of over-the-counter medications, including the active ingredients aspirin, acetaminophen and ibuprofen.

Product Development

Our strong commitment to understanding our consumers and defining products that fulfill their needs through innovation drives our product development strategy, which we believe is and will be a key contributor to our success. The Company incurred research and development costs of $750,000 in 2016 and $690,000 in 2015.

Intellectual Property

The Company owns many patents and trademarks that are important to its business. The Company’s success depends in part on its ability to maintain patent protection for its products, to preserve its proprietary technology and to operate without infringing upon the patents or proprietary rights of others. The Company generally files patent applications in the United States and foreign countries where patent protection for its technology is appropriate and available. The Company also considers its trademarks important to the success of its business. The more significant trademarks include Westcott, Clauss, Camillus, PhysiciansCare, First Aid Only, Cuda, DMT and Pac-Kit. Patents and trademarks are amortized over their estimated useful lives. The weighted average amortization period remaining for intangible assets at December 31, 2016 was 8 years.

Product Distribution; Major Customers

Independent manufacturer representatives and direct sales are primarily used to sell the Company’s line of consumer products to wholesale, contract and retail stationery distributors, office supply super stores, school supply distributors, industrial distributors, wholesale florists, mass market retailers and hardware chains (including through their websites). The Company also sells a limited selection of its products directly to consumers through its own websites. In each 2016 and 2015, the Company had two customers that individually exceeded 10% of consolidated net sales. In 2016, net sales to these customers amounted to approximately 14% and 11%, respectively of consolidated net sales, and 12% for each in 2015.

Competition

The Company competes with many companies in each market and geographic area. The Company believes that the principal points of competition in these markets are product innovation, quality, price, merchandising, design and engineering capabilities, product development, timeliness and completeness of delivery, conformity to customer specifications and post-sale support. The major competitors in the cutting category are 3M and Fiskars Corporation. The major competitors in the measuring category are Maped and Staedtler. The major competitor in the pencil sharpener category is Bostitch. The major competitors in the first aid & safety category are Honeywell, 3M and Johnson & Johnson.

Seasonality

Traditionally, the Company’s sales are stronger in the second and third quarters of the fiscal year due to the seasonal nature of the back-to-school business.

| 6 |

Compliance with Environmental Laws

The Company believes that it is in compliance with applicable environmental laws. The Company anticipates that no material adverse financial impact will result from compliance with current environmental rules and regulations. On April 7, 2014, the Company sold its Fremont, NC distribution facility for $850,000 in cash. Under the terms of the sales agreement, the Company is responsible for environmental remediation on the property. As a result of studies and estimates prepared by an independent environmental consulting firm, and in conjunction with the sale of the property, the Company recorded a liability of $300,000 in the second quarter of 2014, related to the remediation of the property. The accrual included the total estimated costs of remedial activities and post-remediation operating and maintenance costs. Remediation work on the Fremont project began in the third quarter of 2014 and was completed in 2015. In addition to the remediation work, the Company, with the assistance of its independent environmental consulting firm, must continue to monitor contaminant levels on the property to ensure they comply with governmental standards. The Company expects that the monitoring period will last a period of five years after the completion of the remediation and be complete by the end of 2020.

See Note 16 of the Notes to Consolidated Financial Statements in this report for additional information regarding the cost of remediation and related matters, including ongoing monitoring of contaminant levels.

Employees

As of December 31, 2016, the Company employed 400 people, all of whom are full time and none of whom is covered by union contracts. Employee relations are considered good and no foreseeable problems with the work force are evident.

Available Information

The Company files its annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K pursuant to Section 13(a) of the Securities Exchange Act of 1934 with the SEC electronically. These filings may also be read and copied at the SEC’s Public Reference Room which is located at 100 F Street N.E., Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains a website that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The address of that site is http://www.sec.gov.

You may obtain at no charge, a copy of the Company’s annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K and amendments to those reports on the Company’s website at http://www.acmeunited.com or by contacting the Investor Relations Department at the Company’s corporate offices by calling (203) 254-6060. Such reports and other information are made available as soon as reasonably practicable after such material is filed with or furnished to the SEC.

Item 1A. Risk Factors

The Company is subject to a number of significant operational risks that might cause the Company’s actual results to vary materially from its forecasts, targets or projections, including:

| · | achieving planned revenue and profit growth in each of the Company's business segments; |

| · | changes in customer requirements and in the volume of sales to principal customers; |

| · | the timing of orders and shipments; |

| · | emergence of new competitors or consolidation of existing competitors; and |

| · | industry demand fluctuations. |

| 7 |

The Company’s expectations for both short and long-term future net revenues are based on the Company’s estimates of future demand. Orders from the Company’s principal customers are ultimately based on demand from end-users and end-user demand can be difficult to predict. Low end-user demand would negatively affect orders the Company receives from distributors and other principal customers which could, in turn adversely affect the Company’s revenues in any fiscal period. If the Company’s estimates of sales are not accurate and the Company experiences unforeseen variability in its revenues and operating results, the Company may be unable to adjust its expense levels accordingly and its profit margins could be adversely affected.

Because our products are primarily sold by third parties, our financial results depend in part on the financial health of these parties and any loss of a third party distributor could adversely affect the Company’s revenues.

A number of the Company’s products are sold through third-party distributors and large retailers. Some of our distributors also market products that compete with our products. Changes in the financial or business conditions or the purchasing decisions of these third parties or their customers could affect our sales and profitability.

Additionally, no assurances can be given that any or all of such distributors or retailers will continue their relationships with the Company. Distributors and other significant retail customers cannot easily be replaced and the loss of revenues and the Company’s inability to reduce expenses to compensate for the loss of revenues could adversely affect the Company’s net revenues and profit margins.

The ability to deliver products to our customers in a timely manner and to satisfy our customers’ fulfillment standards are subject to several factors, some of which are beyond our control.

Customers place great emphasis on timely delivery of our products for specific selling seasons, especially during our second and third fiscal quarters, and on the fulfillment of consumer demand throughout the year. We cannot control all of the various factors that might affect product delivery to customers. Vendor production delays, difficulties encountered in shipping from overseas and customs clearance delays are on-going risks of our business. We also rely upon third-party carriers for our product shipments from our distribution centers to customers. Accordingly, we are subject to risks, including labor disputes, inclement weather, natural disasters, possible acts of terrorism, availability of shipping containers, and increased security restrictions associated with such carriers’ ability to provide delivery services to meet our shipping needs. Failure to deliver products to our customers in a timely and effective manner, often under special vendor requirements to use specific carriers and delivery schedules, could damage our reputation and brands and result in loss of customers or reduced orders.

Reliance on foreign suppliers could adversely affect the Company’s business.

The Company sources its products from suppliers located in Asia, Europe and the United States. The Company’s Asia vendors are located primarily in China, which subjects the Company to various risks within the region including regulatory, political, economic and foreign currency changes. The Company’s ability to select and retain reliable vendors and suppliers who provide timely deliveries of quality products efficiently will impact its success in meeting customer demand for timely delivery of quality products. The Company’s sourcing operations and its vendors are impacted by labor costs in China. Labor historically has been readily available at low cost relative to labor costs in North America. However, as China is experiencing rapid social, political and economic changes, labor costs have risen in some regions and there can be no assurance that labor will continue to be available to the Company in China at costs consistent with historical levels or that changes in labor or other laws will not be enacted which would have a material adverse effect on the Company’s operations in China. Interruption of supplies from any of the Company’s vendors, or the loss of one or more key vendors, could have a negative effect on the Company’s business and operating results.

Changes in currency exchange rates might negatively affect the profitability and business prospects of the Company and its overseas vendors. In particular, although the Chinese Renminbi has recently depreciated against the U.S. Dollar, if the Chinese Renminbi appreciates with respect to the U.S. Dollar in the future, the Company may experience cost increases on such purchases, and this can adversely impact profitability. Future interventions by China may result in further currency appreciation and increase our product costs over time. The Company may not be successful at implementing customer pricing or other actions in an effort to mitigate the related effects of the product cost increases.

Additional factors that could adversely affect the Company’s business include increases in transportation costs, new or increased import duties, transportation delays, work stoppages, capacity constraints and poor quality.

| 8 |

The Company’s operations are increasingly global in nature. Our business, financial condition and results of operations could be adversely affected by the political and economic conditions in the countries in which we conduct business, by fluctuations in currency exchange rates and other factors related to our international operations.

As our international operations and activities expand, we face increasing exposure to the risks of operating in foreign countries. These factors include:

| • | Changes generally in political, regulatory or economic conditions in the countries in which we conduct business. |

| • | Trade protection measures in favor of local producers of competing products, including government subsidies, tax benefits, changes in local tax rates, trade actions (such as anti-dumping proceedings) and other measures giving local producers a competitive advantage over the Company. |

| • |

Changes in foreign currency exchange rates which could adversely affect our competitive position, selling prices and manufacturing costs, and therefore the demand for our products in a particular market.

|

These risks could affect the cost of manufacturing and selling our products, our pricing, sales volume, and ultimately our financial performance. The likelihood of such occurrences and their potential effect on the Company vary from country to country and are unpredictable.

Continuing uncertainty in the global economy could negatively impact our business.

Uncertainty in the global economy could adversely affect our customers and our suppliers and businesses such as ours. In addition, any uncertainty could have a variety of negative effects on the Company, such as reduction in revenues, increased costs, lower gross margin percentages, increased allowances for doubtful accounts and/or write-offs of accounts receivable and could otherwise have material adverse effects on our business, results of operations, financial condition and cash flows.

The Company’s business is subject to risks associated with seasonality which could adversely affect its cash flow, financial condition, or results of operations.

The Company’s business, historically, has experienced higher sales volume in the second and third quarters of the calendar year, when compared to the first and fourth quarters. The Company is a major supplier of products related to the “back-to-school” season, which occurs principally during the months of May, June, July and August. If this typical seasonal increase in sales of certain portions of the Company’s product line does not materialize in any year, the Company could experience a material adverse effect on its business, financial condition and results of operations.

Failure to manage growth and continue to expand our operations successfully could adversely affect our financial results.

Our business has experienced significant historical growth over the years, and we expect our business to continue to grow organically and through strategic acquisitions. This growth places significant demands on management and operational systems. If we cannot effectively manage our growth, it is likely to result in operational inefficiencies and ineffective management of our business thus negatively impacting our operating results. To the extent we grow through strategic acquisitions, our success will depend on selecting the appropriate targets, integrating such acquisitions quickly and effectively and realizing any expected synergies and cost savings related to such acquisitions.

Loss of a major customer could result in a decrease in the Company’s future sales and earnings.

Sales of our products are primarily concentrated in a few major customers including office product superstores and mass market distributors. In each of 2016 and 2015, the Company had two customers that individually exceeded 10% of consolidated net sales. In 2016, net sales to these customers amounted to approximately 14% and 11%, respectively of consolidated net sales, and 12% for each in 2015. The Company anticipates that a limited number of customers may account for a substantial portion of its total net revenues for the foreseeable future. The business risks associated with this concentration, including increased credit risks for these and other customers and the possibility of related bad debt write-offs, could negatively affect our margins and profits. Additionally, the loss of a major customer, whether through competition or consolidation, or a disruption in sales to such a customer, could result in a decrease of the Company’s future sales and earnings.

| 9 |

The loss of key management could adversely affect the Company’s ability to run its business.

The Company’s success depends, to a large extent, on the continued service of its executive management team, operating officers and other key personnel. The Company must therefore continue to recruit, retain and motivate management and operating personnel sufficient to maintain its current business and support its projected growth. The Company’s inability to meet its staffing requirements in the future could adversely affect its results of operations.

Failure to protect the Company’s proprietary rights or the costs of protecting these rights could adversely affect its business.

The Company’s success depends in part on its ability to obtain patents and trademarks and to preserve other intellectual property rights covering its products and processes. The Company has obtained certain domestic and foreign patents, and intends to continue to seek patents on its inventions when appropriate. The process of seeking patent protection can be time consuming and expensive. There can be no assurance that pending patents related to any of the Company’s products will be issued, in which case the Company may not be able to legally prevent others from producing similar and/or compatible competing products. If other companies were to sell similar and/or compatible competing products, the Company’s results of operations could be adversely affected. Furthermore, there can be no assurance that the Company’s efforts to protect its intellectual property will be successful. Any infringement of the Company’s intellectual property or legal defense of such action could have a material adverse effect on the Company.

The Company is subject to intense competition in all of the markets in which it competes.

The Company’s products are sold in highly competitive markets including at mass merchants, high volume office supply stores and online. The Company believes that the principal points of competition in these markets are product innovation, quality, price, merchandising, design and engineering capabilities, product development, timeliness and completeness of delivery, conformity to customer specifications and post-sale support. Competitive conditions may require the Company to match or better competitors’ prices to retain business or market shares. The Company believes that its competitive position will depend on continued investment in innovation and product development, manufacturing and sourcing, quality standards, marketing and customer service and support. The Company’s success will depend in part on its ability to anticipate and offer products that appeal to the changing needs and preferences of our customers in the various market categories in which it competes. The Company may not have sufficient resources to make the investments that may be necessary to anticipate those changing needs and the Company may not anticipate, identify, develop and market products successfully or otherwise be successful in maintaining its competitive position. In addition there are numerous uncertainties inherent in successfully developing and commercializing innovative new products on a continuing basis, and new product launches may not provide expected growth results. There are no significant barriers to entry into the markets for most of the Company’s products.

Compromises of our information systems or unauthorized access to confidential information or our customers' or associates' personal information may materially harm our business or damage our reputation.

Through our sales and marketing activities and our business operations, we collect and store confidential information and certain personal information from our customers and associates. We also process payment card information and check information. In addition, in the normal course of business, we gather and retain personal information about our associates and generate and have access to confidential business information. Although we have taken steps designed to safeguard such information, there can be no assurance that such information will be protected against unauthorized access or disclosure. Computer hackers may attempt to penetrate our or our vendors' network security and, if successful, misappropriate such information. An Acme United associate, contractor or other third-party with whom we do business may also attempt to circumvent our security measures in order to obtain such information or inadvertently cause a breach involving such information. We could be subject to liability for failure to comply with privacy and information security laws, for failing to protect personal information, or for misusing personal information, such as use of such information for an unauthorized marketing purpose. Loss or misuse of confidential or personal information could disrupt our operations, damage our reputation, and expose us to claims from customers, financial institutions, regulators, payment card associations, employees and other persons, any of which could have an adverse effect on our business, financial condition and results of operations.

The Company may not be able to maintain or to raise prices in response to inflation and increasing costs.

Future market and competitive pressures may prohibit the Company from raising prices to offset increased product costs, freight costs and other inflationary items or to offset currency fluctuations. The inability to pass these costs through to the Company’s customers could have a negative effect on its results of operations.

| 10 |

The Company may need to raise additional capital to fund its operations.

The Company’s management believes that, under current conditions, the Company’s current cash and cash equivalents, cash generated by operations, together with the borrowing availability under its revolving loan agreement with HSBC Bank N.A., will be sufficient to fund planned operations for the next twelve months. However, if the Company is unable to generate sufficient cash from operations, it may be required to find additional funding sources. If adequate financing is unavailable or is unavailable on acceptable terms, the Company may be unable to maintain, develop or enhance its operations, products and services, take advantage of future opportunities or adequately respond to competitive pressures.

Changes in interest rates could adversely affect us.

We have exposure to increases in interest rates under our revolving credit loan agreement with HSBC, N.A. which presently bears interest at a rate of LIBOR plus 2%. In response to the last global economic recession, actions of the U.S. Federal Reserve and other central banking institutions, were taken to create and maintain a low interest rate environment. However, in December 2015, the U.S. Federal Reserve raised its benchmark interest rate by a quarter of a percentage point for the first time since 2006. The U.S. Federal Reserve raised this rate by an additional quarter of a percentage point in December 2016 and indicated that additional increases would likely be forthcoming in 2017. While it is unclear whether these actions suggest a change in previous monetary policy positions, any such change or market expectation of such change may result in significantly higher long-term interest rates. Increases in interest rates would increase our interest costs on our variable-rate debt, as well as any future fixed rate debt we may incur at higher interest rates, and interest which we pay reduces our cash available for working capital, acquisitions, and other uses.

Product liability claims or regulatory actions could adversely affect the Company's financial results and reputation.

Claims for losses or injuries allegedly caused by some of the Company’s products arise in the ordinary course of its business. In addition to the risk of substantial monetary judgments, product liability claims or regulatory actions could result in negative publicity that could harm the Company’s reputation in the marketplace or the value of its brands. The Company also could be required to recall possible defective products, which could result in adverse publicity and significant expenses. Although the Company maintains product liability insurance coverage, potential product liability claims are subject to a deductible or could be excluded under the terms of the policy.

The Company is subject to environmental regulation and environmental risks.

The Company is subject to national, state, provincial and/or local environmental laws and regulations that impose limitations and prohibitions on the discharge and emission of, and establish standards for the use, disposal and management of, certain materials and waste. These environmental laws and regulations also impose liability for the costs of investigating and cleaning up sites, and certain damages resulting from present and past spills, disposals, or other releases of hazardous substances or materials. Environmental laws and regulations can be complex and may change often. Capital and operating expenses required to comply with environmental laws and regulations can be significant, and violations may result in substantial fines and penalties. In addition, environmental laws and regulations, such as the Comprehensive Environmental Response, Compensation and Liability Act, or CERCLA, in the United States impose liability on several grounds for the investigation and cleanup of contaminated soil, ground water and buildings and for damages to natural resources on a wide range of properties. For example, contamination at properties formerly owned or operated by the Company, as well as at properties it will own and operate, and properties to which hazardous substances were sent by the Company, may result in liability for the Company under environmental laws and regulations. The costs of complying with environmental laws and regulations and any claims concerning noncompliance, or liability with respect to contamination in the future could have a material adverse effect on the Company’s financial condition or results of operations. Refer to Note 16 – Sale of Property - of the Notes to Consolidated Financial Statements for further discussion of the environmental costs related to the sale in 2014 of property owned by the Company in Fremont, NC.

| 11 |

The ability to deliver products to our customers in a timely manner and to satisfy our customers’ fulfillment standards are subject to several factors, some of which are beyond our control.

Customers place great emphasis on timely delivery of our products for specific selling seasons, especially during our second and third fiscal quarters, and on the fulfillment of consumer demand throughout the year. We cannot control all of the various factors that might affect product delivery to customers. Vendor production delays, difficulties encountered in shipping from overseas and customs clearance delays are on-going risks of our business. We also rely upon third-party carriers for our product shipments from our distribution centers to customers. Accordingly, we are subject to risks, including labor disputes, inclement weather, natural disasters, possible acts of terrorism, availability of shipping containers, and increased security restrictions associated with such carriers’ ability to provide delivery services to meet our shipping needs. Failure to deliver products to our customers in a timely and effective manner, often under special vendor requirements to use specific carriers and delivery schedules, could damage our reputation and brands and result in loss of customers or reduced orders.

Our shares of common stock are thinly traded and our stock price may be volatile.

Because our common stock is thinly traded, its market price may fluctuate significantly more than the stock market in general or the stock prices of other companies listed on major stock exchanges. There were approximately 2,903,424 shares of our common stock held by non-affiliates as of December 31, 2016. Thus, our common stock will be less liquid than the stock of companies with broader public ownership, and, as a result, the trading price for shares of our common stock may be more volatile. Among other things, trading of a relatively small volume of our common stock may have a greater impact on the trading price for our stock than would be the case if our public float were larger.

| 12 |

Item 1B. Unresolved Staff Comments

Not applicable to smaller reporting companies.

Item 2. Properties

| Location | Square Footage |

Purpose | |

| Owned | |||

| Rocky Mount, NC | 340,000 | Warehousing and distribution | |

| Solingen, Germany | 35,000 | Warehousing, distribution and administrative | |

| 375,000 | |||

| Leased | |||

| Fairfield, CT | 15,400 | Administrative | |

| Bentonville, AK | 1,500 | Administrative | |

| Vancouver, WA | 53,000 | Manufacturing, warehousing and distribution | |

| Marlborough, MA | 28,000 | Manufacturing, warehousing and distribution | |

| Santa Ana, CA | 10,000 | Manufacturing, warehousing, distribution and administrative | |

| Smyrna, TN | 13,000 | Manufacturing, warehousing and distribution | |

| Mount Forest, Ontario, Canada | 42,500 | Warehousing and distribution | |

| Orangeville, Ontario, Canada | 2,850 | Administrative | |

| Hong Kong, China | 2,750 | Administrative | |

| Guangzhou, China | 3,500 | Administrative | |

| Ningbo, China | 1,800 | Administrative | |

| 174,300 | |||

| Total | 549,300 |

Management believes that the Company's facilities, whether leased or owned, are adequate to meet its current needs and should continue to be adequate for the foreseeable future.

Item 3. Legal Proceedings

There are no pending material legal proceedings to which the Company is a party or, to the actual knowledge of the Company, contemplated by any governmental agency.

Item 4. Mine Safety Disclosures

Not Applicable

| 13 |

PART II

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

The Company's Common Stock is traded on the NYSE MKT under the symbol "ACU". The following table sets forth the high and low sale prices on the NYSE MKT for the Common Stock for the periods indicated:

Year Ended December 31, 2016 | High | Low | Dividends Declared | |||||||||

| Fourth Quarter | $ | 26.66 | $ | 19.49 | $ | .10 | ||||||

| Third Quarter | 22.19 | 18.42 | .10 | |||||||||

| Second Quarter | 18.85 | 15.95 | .10 | |||||||||

| First Quarter | 17.97 | 13.01 | .10 | |||||||||

| Year Ended December 31, 2015 | ||||||||||||

| Fourth Quarter | $ | 18.25 | $ | 15.58 | $ | .10 | ||||||

| Third Quarter | 18.50 | 15.99 | .09 | |||||||||

| Second Quarter | 19.74 | 17.05 | .09 | |||||||||

| First Quarter | 20.30 | 17.34 | .09 | |||||||||

As of March 3, 2017 there were approximately 2,168 holders of record of the Company's Common Stock.

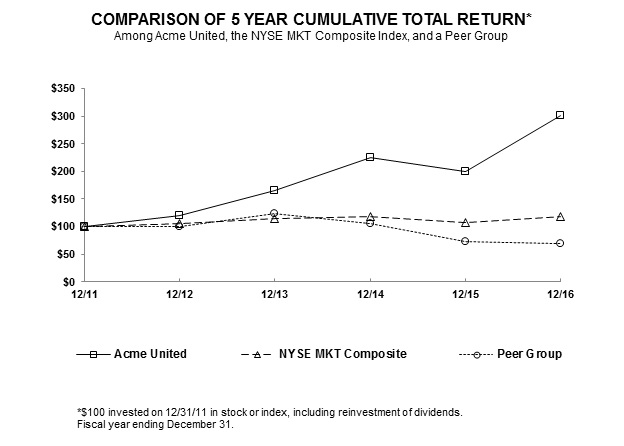

Performance Graph

The graph below compares the yearly cumulative total shareholder return on the Company’s Common Stock with the yearly cumulative total return of the following for the period 2011 to 2016: (a) the NYSE MKT Index and (b) a diversified peer group of companies that, like the Company, (i) are currently listed on the NYSE MKT, and (ii) have a market capitalization of $80 million to $90 million.

The Company does not believe that it can reasonably identify a peer group of companies, on an industry or line-of-business basis, for the purpose of developing a comparative performance index. While the Company is aware that some other publicly-traded companies market products in the Company’s line-of-business, none of these other companies provide most or all of the products offered by the Company, and many offer products or services not offered by the Company. Moreover, some of these other companies that engage in the Company’s line-of-business do so through divisions or subsidiaries that are not publicly-traded. Furthermore, many of these other companies are substantially more highly capitalized than the Company. For these reasons, any such comparison would not, in the opinion of the Company, provide a meaningful index of comparative performance.

The comparisons in the graph below are based on historical data and are not indicative of, or intended to forecast, the possible future performance of the Company’s Common Stock.

| 14 |

Issuer Purchases of Equity Securities

On November 22, 2010, the Company announced a Common Stock repurchase program of up to a total 200,000 shares. The program does not have an expiration date. During the twelve months ended December 31, 2016, the Company repurchased 61,493 shares of its Common Stock. As of December 31, 2016, 41,227 shares may be purchased in the future under the repurchase program announced in 2010.

Item 6. Selected Financial Data

FIVE YEAR SUMMARY OF SELECTED FINANCIAL DATA

(All figures in thousands except per share data)

| 2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||||||

| Net sales | $ | 124,574 | $ | 109,812 | $ | 107,222 | $ | 89,577 | $ | 84,370 | ||||||||||

| Net income | $ | 5,851 | $ | 4,794 | $ | 4,789 | $ | 4,003 | $ | 3,549 | ||||||||||

| Total assets | $ | 92,066 | $ | 81,421 | $ | 79,308 | $ | 68,079 | $ | 67,828 | ||||||||||

| Long-term debt, less current portion | $ | 32,936 | $ | 25,913 | $ | 24,147 | $ | 22,912 | $ | 24,320 | ||||||||||

| Net income | ||||||||||||||||||||

| Per share (Basic) | $ | 1.76 | $ | 1.44 | $ | 1.48 | $ | 1.26 | $ | 1.14 | ||||||||||

| Per share (Diluted) | $ | 1.64 | $ | 1.30 | $ | 1.36 | $ | 1.22 | $ | 1.13 | ||||||||||

| Dividends per share | $ | 0.40 | $ | 0.37 | $ | 0.34 | $ | 0.31 | $ | 0.28 | ||||||||||

| 15 |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Forward-Looking Information

The Company may from time to time make written or oral “forward-looking statements” including statements contained in this report and in other communications by the Company, which are made in good faith pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Such statements are based on our beliefs as well as assumptions made by and information currently available to us. When used in this document, words like “may,” “might,” “will,” “except,” “anticipate,” “believe,” “potential,” and similar expressions are intended to identify forward-looking statements. Actual results could differ materially from our current expectations.

These forward-looking statements include statements of the Company’s plans, objectives, expectations, estimates and intentions, which are subject to change based on various important factors (some of which are beyond the Company’s control). The following factors, in addition to others not listed, could cause the Company’s actual results to differ materially from those expressed in forward looking statements: the strength of the domestic and local economies in which the Company conducts operations, the impact of uncertainties in global economic conditions, changes in client needs and consumer spending habits, the impact of competition and technological change on the Company, the Company’s ability to manage its growth effectively, including its ability to successfully integrate any business or property which it might acquire, and currency fluctuations. For a more detailed discussion of these and other factors affecting us, see the Risk Factors described in Item 1A of this Annual Report on Form 10-K. The Company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise, except as required by law.

Critical Accounting Policies

The following discussion and analysis of financial condition and results of operations are based upon the Company’s consolidated financial statements, which have been prepared in conformity with accounting principles generally accepted in the United States of America. The Company’s significant accounting policies are more fully described in Note 2 of the Notes to Consolidated Financial Statements. Certain accounting estimates are particularly important to the understanding of the Company’s financial position and results of operations and require the application of significant judgment by the Company’s management and can be materially affected by changes from period to period in economic factors or conditions that are outside the control of management. The Company’s management uses its judgment to determine the appropriate assumptions to be used in the determination of certain estimates. Those estimates are based on historical operations, future business plans and projected financial results, the terms of existing contracts, the observance of trends in the industry, information provided by customers and information available from other outside sources, as appropriate. The following discusses the Company’s critical accounting policies and estimates:

Estimates. Operating results may be affected by certain accounting estimates. The most sensitive and significant accounting estimates in the financial statements relate to customer rebates, valuation allowances for deferred income tax assets, obsolete and slow moving inventories, potentially uncollectible accounts receivable, pension liability and accruals for income taxes. Although the Company’s management has used available information to make judgments on the appropriate estimates to account for the above matters, there can be no assurance that future events will not significantly affect the estimated amounts related to these areas where estimates are required. However, historically, actual results have not been materially different than original estimates.

Revenue Recognition. The Company recognizes revenue from the sales of its products when ownership transfers to the customers, which occurs either at the time of shipment or upon delivery based upon contractual terms with the customer. The Company recognizes customer program costs, including rebates, cooperative advertising, slotting fees and other sales related discounts, as a reduction to sales.

Allowance for doubtful accounts. The Company provides an allowance for doubtful accounts based upon a review of outstanding accounts receivable, historical collection information and existing economic conditions. The allowance for doubtful accounts represents estimated uncollectible accounts receivables associated with potential customer defaults on contractual obligations, usually due to potential insolvencies. The allowance includes amounts for certain customers where a risk of default has been specifically identified. In addition, the allowance includes a provision for customer defaults based on historical experience. The Company actively monitors its accounts receivable balances, and its historical experience of annual accounts receivable write offs has been negligible.

| 16 |

Customer Rebates. Customer rebates and incentives are a common practice in the office products industry. We incur customer rebate costs to obtain favorable product placement, to promote sell-through of products and to maintain competitive pricing. Customer rebate costs and incentives, including volume rebates, promotional funds, catalog allowances and slotting fees, are accounted for as a reduction to gross sales. These costs are recorded at the time of sale and are based on individual customer contracts. Management periodically reviews accruals for these rebates and allowances, and adjusts accruals when appropriate.

Obsolete and Slow Moving Inventory. Inventories are stated at the lower of cost, determined on the first-in, first-out method, or market. An allowance is established to adjust the cost of inventory to its net realizable value. Inventory allowances are recorded for obsolete or slow moving inventory based on assumptions about future demand and marketability of products, the impact of new product introductions and specific identification of items, such as discontinued products. These estimates could vary significantly from actual requirements if future economic conditions, customer inventory levels or competitive conditions differ from expectations.

Income Taxes. Deferred income tax liabilities or assets are established for temporary differences between financial and tax reporting bases and are subsequently adjusted to reflect changes in tax rates expected to be in effect when the temporary differences reverse. A valuation allowance is recorded to reduce deferred income tax assets to an amount that is more likely than not to be realized.

Intangible Assets and Goodwill. Intangible assets with finite useful lives are recorded at cost upon acquisition and amortized over the term of the related contract, if any, or useful life, as applicable. Intangible assets held by the Company with finite useful lives include patents and trademarks. The weighted average amortization period for intangible assets at December 31, 2016 was 8 years. The Company periodically reviews the values recorded for intangible assets and goodwill to assess recoverability from future operations whenever events or changes in circumstances indicate that its carrying amount may not be recoverable. At December 31, 2016 and 2015, the Company assessed the recoverability of its long-lived assets and goodwill and believed that there were no events or circumstances present that would that would require a test of recoverability on those assets. As a result, there was no impairment of the carrying amounts of such assets and no reduction in their estimated useful lives. The net book value of the Company’s intangible assets was $13,988,186 as of December 31, 2016, compared to $11,950,991 as of December 31, 2015, and the net book value of the Company’s goodwill was approximately $3,948,000 at December 31, 2016 and $1,406,000 at December 31, 2015.

Pension Obligation. The pension benefit obligation is based on various assumptions used by third-party actuaries in calculating this amount. These assumptions include discount rates, expected return on plan assets, mortality rates and other factors. Revisions in assumptions and actual results that differ from the assumptions affect future expenses, cash funding requirements and obligations. Our funding policy is to fund the plan in accordance with applicable requirements of the Internal Revenue Code and regulations.

These assumptions are reviewed annually and updated as required. The Company has a frozen defined benefit pension plan. Two assumptions, the discount rate and the expected return on plan assets, are important elements of expense and liability measurement.

We determine the discount rate used to measure plan liabilities as of the December 31 measurement date. The discount rate reflects the current rate at which the associated liabilities could be effectively settled at the end of the year. In estimating this rate, we look at rates of return on fixed-income investments of similar duration to the liabilities in the plan that receive high, investment grade ratings by recognized ratings agencies. Using these methodologies, we determined a discount rate of 3.40% to be appropriate as of December 31, 2016, which is a decrease of 0.1 percentage point from the rate used as of December 31, 2015.

The expected long-term rate of return on assets considers the Company’s historical results and projected returns for similar allocations among asset classes. In accordance with generally accepted accounting principles, actual results that differ from the Company’s assumptions are accumulated and amortized over future periods and, therefore, affect expense and obligation in future periods. For the U.S. pension plan, our assumption for the expected return on plan assets was 6.0% for 2016. For more information concerning these costs and obligations, see the discussion in Note 6 – Pension and Profit Sharing, in the Notes to the Company’s Consolidated Financial Statements in this report.

| 17 |

Accounting for Stock-Based Compensation. Stock based compensation cost is measured at the grant date fair value of the award and is recognized as expense over the requisite service period. The Company uses the Black-Scholes option - pricing model to determine fair value of the awards, which involves certain subjective assumptions. These assumptions include estimating the length of time employees will retain their vested stock options before exercising them (“expected term”), the estimated volatility of the Company’s common stock price over the expected term (“volatility”) and the number of options for which vesting requirements will not be completed (“forfeitures”). Changes in the subjective assumptions can materially affect estimates of fair value stock-based compensation, and the related amount recognized on the consolidated statements of operations. Refer to Note 11 - Stock Option Plans - in the Notes to Consolidated Financial Statements in this report for a more detailed discussion.

Results of Operations 2016 Compared with 2015

On April 7, 2014, the Company sold its Fremont, NC distribution facility for $850,000 in cash. The facility originally served as a manufacturing site for the Company’s scissors and rulers. In conjunction with the sale of the property, the Company recorded a liability of $300,000 in the second quarter of 2014, related to environmental remediation of the property. The accrual included the total estimated costs of remedial activities and post-remediation operating and maintenance costs. The balance remaining in the accrual at December 31, 2016 was approximately $57,000. Additional information concerning the sale of the property is set forth in Note 16 – Sale of Property, in the Notes to Condensed Consolidated Financial Statements in this report.

On February 1, 2016, the Company purchased certain assets of Vogel Capital, Inc., d/b/a Diamond Machining Technology (DMT), located in Marlborough, MA. DMT products are leaders in sharpening tools for knives, scissors, chisels and other cutting tools. The DMT products use finely dispersed diamonds on the surfaces of sharpeners. The Company purchased inventory, accounts receivable, equipment, patents, trademarks and other intellectual property for $6.97 million using funds borrowed under its revolving credit facility with HSBC. Additional information concerning the acquisition of DMT assets is set forth in Note 17 – Business Combinations, in the Notes to Condensed Consolidated Financial Statements in this report.

Net Sales

In 2016, sales increased by $14,762,000, or 13%, to $124,574,000 compared to $109,812,000 in 2015.

The U.S. segment sales increased by $14,144,000 or 15% in 2016 compared to 2015. The increase in net sales for the twelve months ended December 31, 2016 in the U.S. segment was primarily due to increased sales of Westcott school and office products, Camillus knives, Cuda fishing tools and first aid products. Revenues from the acquisition of DMT contributed $5.1 million.

Sales in Canada were constant in U.S. dollars but increased 4% in local currency in 2016 compared to 2015.

European sales increased by $572,000 or 9% in both U.S. dollars and local currency in 2016 compared to 2015. The increase in sales in Europe in 2016 was primarily due to sales of DMT products and increased market share in the office products channel.

Gross Profit

Gross profit was 36.6% of net sales in 2016 compared to 36.0% in 2015.

Selling, General and Administrative

Selling, general and administrative expenses were $37,113,000 in 2016 compared with $32,214,212 in 2015, an increase of $4,899,000 or 15%. SG&A expenses were 30% of net sales in 2016 compared to 29% in 2015. The increase in SG&A expenses was primarily the result of incremental fixed costs resulting from the acquisition of DMT assets and increases in delivery costs and sales commissions which resulted from higher sales and higher personnel related costs, which include compensation and recruiting costs.

| 18 |

Operating Income

Operating income was $8,442,000 in 2016, compared with $7,347,000 in 2015. Operating income in the U.S. increased by approximately $622,000 primarily as a result of higher sales. Operating income in Canada increased by approximately $510,000 principally due to higher sales. Operating income in the European segment decreased by approximately $40,000. Although sales and related gross margin increased in 2016 in Europe, the Company made investments in increased headcount for sales and logistics personnel.

Interest Expense, Net

Net interest expense for 2016 was $869,000, compared with $565,000 for 2015, an increase of $304,000. The increase in interest expense, net for 2016, was primarily the result of higher average borrowings during 2016 under the Company’s bank revolving credit facility compared to 2015.

Other Expense, Net

Net other expense was $77,000 in 2016 compared to net other expense of $167,000 in 2015. The decrease in other expense, net for 2016, was primarily due to lower losses from foreign currency transactions.

Income Tax

The effective tax rate in 2016 was 22%, compared to 28% in 2015. Excluding the impact of a charitable product donation in 2016, the effective tax rate would have been 25%. The 3 point decline in the effective tax rate was due to a lower proportion of earnings from operations in the United States, which has a higher tax rate than the countries in which our subsidiaries operate, compared to 2015.

Off-Balance Sheet Transactions

The Company did not engage in any off-balance sheet transactions during 2016.

Liquidity and Capital Resources

During 2016, working capital increased by approximately $5.0 million compared to December 31, 2015. Inventory increased by approximately $1.7 million, or 5%, which corresponds to the increase in sales. The Company expects that changes in inventory levels will continue to be consistent with changes in sales, including the seasonal impact on the Company’s revenue stream. Inventory turnover, calculated using a twelve month average inventory balance, increased to 2.1 from 2.0 at December 31, 2015. The reserve for slow moving and obsolete inventory was $677,253 at December 31, 2016 compared to $698,592 at December 31, 2015. We do not anticipate significant increases in the allowance for slow moving and obsolete inventory in the ordinary course of business during 2017.

Receivables increased by approximately $400,000. The average number of days sales outstanding in accounts receivable was 64 days in 2016 compared to 64 days in 2015. Accounts payable and other current liabilities increased by approximately $.9 million.

At December 31, 2016, total debt outstanding under the Company’s revolving credit facility increased by approximately $7.0 million compared to total debt at December 31, 2015. The change in debt was primarily due to borrowings to fund the acquisition of assets of DMT on February 1, 2016. As of December 31, 2016, $32,935,858 was outstanding and $17,064,142 was available for borrowing under the Company’s revolving credit facility.

| 19 |

On May 6, 2016, the Company amended its revolving credit loan agreement with HSBC Bank, N.A. The amended facility provides for borrowings of up to an aggregate of $50 million at an interest rate of LIBOR plus 2.0%. In addition, the Company must pay a facility fee, payable quarterly, in an amount equal to two tenths of one percent (.20%) per annum of the average daily unused portion of the revolving credit line. All principal amounts outstanding under the agreement are required to be repaid in a single amount on May 6, 2019, the date the agreement expires; interest is payable monthly. Funds borrowed under the agreement may be used for working capital, acquisitions, general operating expenses, share repurchases and certain other purposes. Under the revolving loan agreement, the Company is required to maintain specific amounts of tangible net worth, a specified debt service coverage ratio and a fixed charge coverage ratio and must have annual net income greater than $0, measured as of the end of each fiscal year. At December 31, 2016, the Company was in compliance with the covenants then in effect under the loan agreement with HSBC.

Capital expenditures during 2016 and 2015 were $1,809,823 and $1,756,732, respectively, which were, in part, financed with borrowings under the Company’s revolving credit facility. Capital expenditures in 2017 are expected to increase approximately $1.0 million over 2016 to increase capacity and upgrade equipment at the Company’s recently acquired DMT and Spill Magic facilities.

The Company believes that cash on hand, and cash generated from operating activities, together with funds available under its revolving credit facility, are expected, under current conditions, to be sufficient to finance the Company’s planned operations for at least the next twelve months.

Recently Issued Accounting Standards

In February 2016, the FASB issued guidance that will change the requirements for accounting for leases. The principal change under the new accounting guidance is that lessees under leases classified as operating leases will recognize a right-of-use asset and a lease liability. Current lease accounting does not require lessees to recognize assets and liabilities arising under operating leases on the balance sheet. Under the new guidance, lessees (including lessees under leases classified as finance leases and operating leases) will recognize a right-to-use asset and a lease liability on the balance sheet, initially measured as the present value of lease payments under the lease. Expense recognition and cash flow presentation guidance will be based upon whether the lease is classified as an operating lease or a finance lease (the classification criteria for distinguishing between finance leases and operating leases is substantially similar to the classification criteria for distinguishing between capital leases and operating leases under current guidance). The standard is effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2018. Early adoption is permitted. The new standard must be adopted using a modified retrospective transition approach for capital and operating leases existing at, or entered into after, the beginning of the earliest comparative period presented in the financial statements; the guidance provides certain practical expedients. The Company is currently evaluating this guidance to determine its impact on the Company’s results of operations, cash flows and financial position.

In March 2016, the FASB issued ASU 2016-09 to improve the accounting for employee share-based payments. This standard simplifies several aspects of the accounting for share-based payment award transactions, including the income tax consequences, classification of awards as either equity or liabilities, and classification on the statement of cash flows, as part of FASB’s simplification initiative to reduce cost and complexity in accounting standards while maintaining or improving the usefulness of the information provided to the users of financial state. The Company is still evaluating whether the adoption of this standard on January 1, 2017 will have a material impact on its consolidated financial statements.

In August 2015, the FASB issued ASU No. 2015-14, which defers the effective date of ASU No. 2014-09, Revenue from Contracts with Customers (Topic 606) by one year. ASU 2015-14 is a comprehensive new revenue recognition model requiring a company to recognize revenue to depict the transfer of goods or services to a customer at an amount reflecting the consideration it expects to receive in exchange for those goods or services. As a result, the ASU is now effective for fiscal years, and interim periods within those years, beginning after December 15, 2017, which for us is the first quarter of 2018. Earlier application is permitted for fiscal years beginning after December 15, 2016, including interim reporting periods within those years, which for us is the first quarter of 2017. We do not expect this ASU to have a material impact on our financial position, results of operations or disclosures.

| 20 |

In November 2015, the FASB issued ASU 2015-17, "Balance Sheet Classification of Deferred Taxes" (Topic 740), which simplifies the presentation of deferred income taxes. This ASU requires that deferred tax assets and liabilities be classified as non-current in a statement of financial position. ASU 2015-17 may be adopted either prospectively or retrospectively and is effective for reporting periods beginning after December 15, 2016, with early adoption permitted. The Company expects the adoption of this ASU to result in a reclassification of its net current deferred tax asset to the net non-current deferred tax asset on it consolidated balance sheet.

In July 2015, the FASB issued ASU 2015-11, "Simplifying the Measurement of Inventory" (Topic 330). The new guidance changes the subsequent measurement of inventory from lower of cost or market to lower of cost and net realizable value. ASU 2015-11 should be applied on a prospective basis and is effective for the Company beginning in the first fiscal quarter of 2017. Early adoption is permitted. The Company does not expect the adoption of this guidance to have a material impact on its financial position, results of operations or cash flows.

Item 7A. Quantitative and Qualitative Disclosure about Market Risk

Not applicable to smaller reporting companies.

| 21 |

Item 8. Financial Statements and Supplementary Data

Acme United Corporation and Subsidiaries

CONSOLIDATED STATEMENTS OF OPERATIONS

| For the years ended December 31, | ||||||||

| 2016 | 2015 | |||||||

| Net sales | $ | 124,574,371 | $ | 109,811,768 | ||||

| Cost of goods sold | $ | 79,019,315 | 70,250,550 | |||||

| Gross profit | 45,555,056 | 39,561,218 | ||||||

| Selling, general and administrative expenses | 37,113,000 | 32,214,212 | ||||||

| Operating income | 8,442,056 | 7,347,006 | ||||||

| Non operating items: | ||||||||

| Interest: | ||||||||

| Interest expense | (868,626 | ) | (570,080 | ) | ||||

| Interest income | 119 | 4,868 | ||||||

| Interest expense, net | (868,507 | ) | (565,212 | ) | ||||

| Other expense | (76,846 | ) | (167,397 | ) | ||||

| Total other expense, net | (945,353 | ) | (732,609 | ) | ||||

| Income before income tax expense | 7,496,703 | 6,614,397 | ||||||

| Income tax expense | 1,645,705 | 1,820,872 | ||||||

| Net income | $ | 5,850,998 | $ | 4,793,525 | ||||

| Earnings per share: | ||||||||

| Basic | $ | 1.76 | $ | 1.44 | ||||

| Diluted | $ | 1.64 | $ | 1.30 | ||||

See accompanying Notes to Consolidated Financial Statements.

| 22 |

Acme United Corporation and Subsidiaries

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

| For the Years Ended | ||||||||

| December 31, | ||||||||

| 2016 | 2015 | |||||||

| Net income | $ | 5,850,998 | $ | 4,793,525 | ||||

| Other comprehensive (loss) gain - | ||||||||

| Foreign currency translation | (89,556 | ) | (830,867 | ) | ||||

| Change in net prior service credit | ||||||||

| and actuarial gains (losses), net of | ||||||||

| income tax expense | 284,145 | (52,825 | ) | |||||

| Total other comprehensive gain (loss) | 194,589 | (883,692 | ) | |||||

| Comprehensive income | $ | 6,045,587 | $ | 3,909,833 | ||||

See accompanying Notes to Consolidated Financial Statements.

| 23 |

Acme United Corporation and Subsidiaries

CONSOLIDATED BALANCE SHEETS

| December 31, | December 31, | |||||||

| 2016 | 2015 | |||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 5,910,770 | $ | 2,425,891 | ||||

| Accounts receivable, less allowance | 20,020,984 | 19,565,088 | ||||||

| Inventories | 37,237,861 | 35,507,591 | ||||||

| Deferred income taxes | 501,708 | 389,961 | ||||||

| Prepaid expenses and other current assets | 1,791,871 | 1,744,956 | ||||||

| Total current assets | 65,463,194 | 59,633,487 | ||||||

| Property, plant and equipment: | ||||||||

| Land | 412,598 | 417,209 | ||||||

| Buildings | 5,668,866 | 5,418,101 | ||||||

| Machinery and equipment | 13,428,678 | 10,254,070 | ||||||

| Total property, plant and equipment | 19,510,142 | 16,089,380 | ||||||

| Less: accumulated depreciation | 11,537,242 | 8,687,902 | ||||||

| Net plant, property and equipment | 7,972,900 | 7,401,478 | ||||||

| Intangible assets, less accumulated amortization | 13,988,186 | 11,950,991 | ||||||

| Goodwill | 3,948,235 | 1,406,000 | ||||||

| Deferred income taxes | 668,641 | 880,917 | ||||||

| Other assets | 24,936 | 148,493 | ||||||

| Total assets | $ | 92,066,092 | $ | 81,421,366 | ||||

| LIABILITIES | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | 7,338,798 | $ | 6,664,160 | ||||

| Other accrued liabilities | 5,480,950 | 5,272,593 | ||||||

| Total current liabilities | 12,819,748 | 11,936,753 | ||||||

| Long-term debt | 32,935,858 | 25,912,652 | ||||||

| Other accrued liabilities - non current | 190,140 | 388,400 | ||||||

| Total liabilities | 45,945,746 | 38,237,805 | ||||||

| STOCKHOLDERS' EQUITY | ||||||||

| Common stock, par value $2.50: authorized 8,000,000 | ||||||||

| shares; issued - 4,788,965 shares in 2016 and 4,751,060 shares in 2015, including treasury stock | 11,971,657 | 11,876,895 | ||||||

| Treasury stock, at cost, 1,464,010 in 2016 | ||||||||

| and 1,402,517 shares in 2015 | (13,870,041 | ) | (12,962,947 | ) | ||||

| Additional paid-in capital | 8,493,256 | 9,460,008 | ||||||

| Accumulated other comprehensive loss | (2,336,201 | ) | (2,530,790 | ) | ||||

| Retained earnings | 41,861,675 | 37,340,395 | ||||||

| Total stockholders' equity | 46,120,346 | 43,183,561 | ||||||

| Total liabilities and stockholders' equity | $ | 92,066,092 | $ | 81,421,366 | ||||

See accompanying Notes to Consolidated Financial Statements.

| 24 |

Acme United Corporation and Subsidiaries

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY

| Outstanding Shares of Common Stock | Common Stock | Treasury Stock |

Additional Paid-In Capital |

Accumulated Other Comprehensive Loss | Retained Earnings | Total | |

| Balances, December 31, 2014 | 3,291,352 | 11,632,805 | (12,283,251) | 7,941,330 | (1,647,098) | 33,784,270 | 39,428,056 |

| Net income | 4,793,525 | 4,793,525 | |||||

| Total other comprehensive loss | (883,692) | (883,692) | |||||

| Stock compensation expense | 513,986 | 513,986 | |||||

| Distribution to shareholders | (1,237,400) | (1,237,400) | |||||

| Issuance of common stock | 97,636 | 244,090 | 1,004,692 | 1,248,782 | |||

| Purchase of treasury stock | (40,445) | (679,696) | (679,696) | ||||

| Balances, December 31, 2015 | 3,348,543 | 11,876,895 | (12,962,947) | 9,460,008 | (2,530,790) | 37,340,395 | 43,183,561 |

| Net income | 5,850,998 | 5,850,998 | |||||

| Total other comprehensive loss | 194,589 | 194,589 | |||||

| Stock compensation expense | 440,536 | 440,536 | |||||

| Tax benefit from exercise of | |||||||

| employee stock options | 567,309 | 567,309 | |||||

| Distribution to shareholders | (1,329,717) | (1,329,717) | |||||

| Issuance of common stock | 37,905 | 94,762 | 299,776 | 394,538 | |||

| Cash settlement of stock options | (2,274,374) | (2,274,374) | |||||

| Purchase of treasury stock | (61,493) | (907,094) | (907,094) | ||||

| Balances, December 31, 2016 | 3,324,955 | 11,971,657 | (13,870,041) | 8,493,256 | (2,336,201) | 41,861,675 | 46,120,346 |

See accompanying Notes to Consolidated Financial Statements.

| 25 |

Acme United Corporation and Subsidiaries

CONSOLIDATED STATEMENTS OF CASH FLOWS

| For the years ended December 31, | ||||||||

| 2016 | 2015 | |||||||

| Operating activities: | ||||||||

| Net income | $ | 5,850,998 | $ | 4,793,525 | ||||

| Adjustments to reconcile net income to net | ||||||||

| cash provided by operating activities | ||||||||

| Depreciation | 1,490,805 | 1,318,357 | ||||||

| Amortization | 930,941 | 734,496 | ||||||

| Stock compensation expense | 440,536 | 513,986 | ||||||

| Deferred income taxes | 100,529 | (201,553 | ) | |||||

| Changes in operating assets and liabilities | ||||||||