UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One) | |

þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended November 28, 2015

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ______________ to ______________

Commission File Number 1-11024

CLARCOR Inc. | |||

(Exact name of registrant as specified in its charter) | |||

DELAWARE | 36-0922490 | ||

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | ||

840 Crescent Centre Drive, Suite 600, Franklin, TN | 37067 | ||

(Address of principal executive offices) | (Zip Code) | ||

Registrant’s telephone number, including area code: | 615-771-3100 | ||

Securities registered pursuant to Section 12(b) of the Act: | |||

Title of each class | Name of each exchange on which registered | ||

Common Stock, par value $1.00 per share | New York Stock Exchange | ||

Preferred Stock Purchase Rights | New York Stock Exchange | ||

Securities registered pursuant to Section 12(g) of the Act: | |||

None | |||

(Title of Class) | |||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months. Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10‑K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer þ | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company ¨ |

(Do not check if a smaller reporting company) | |||

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2). Yes ¨ No þ

The aggregate market value of the Common Stock held by non-affiliates computed by reference to the price at which the Common Stock was last sold as of the last business day of registrant’s most recently completed second fiscal quarter was $3,070,453,750.

There were 48,747,796 shares of Common Stock outstanding as of January 19, 2016.

DOCUMENTS INCORPORATED BY REFERENCE

Certain portions of the registrant’s Proxy Statement for the 2016 Annual Meeting of Shareholders (“Proxy Statement”), currently anticipated to be held on March 29, 2016, are incorporated by reference in Part III of this Annual Report on Form 10-K. Such Proxy Statement will be filed with the Securities and Exchange Commission not later than 120 days after the conclusion of the registrant’s fiscal year ended November 28, 2015.

TABLE OF CONTENTS

Page | ||

PART I | ||

Item 1. | ||

Item 1A. | ||

Item 1B. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Additional Item | ||

PART II | ||

Item 5. | ||

Item 6. | ||

Item 7. | ||

Item 7A. | ||

Item 8. | ||

Item 9. | ||

Item 9A. | ||

Item 9B. | ||

PART III | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

PART IV | ||

Item 15. | ||

2

PART I

Item 1. Business.

(a) General Development of Business

CLARCOR Inc. (“CLARCOR”) was organized in 1904 as an Illinois corporation and in 1969 was reincorporated in the State of Delaware. As used herein, the “Company” and terms such as “we,” “us” or “our” refers to CLARCOR and its subsidiaries unless the context otherwise requires.

The Company’s fiscal year ends on the Saturday closest to November 30. For fiscal year 2015, the year ended on November 28, 2015 and included 52 weeks. For fiscal year 2014, the year ended on November 29, 2014 and included 52 weeks. For fiscal year 2013, the year ended on November 30, 2013 and included 52 weeks. In this 2015 Annual Report on Form 10-K (“2015 Form 10-K”), all references to fiscal years are shown to begin on December 1 and end on November 30 for clarity of presentation. Unless otherwise indicated, dollar amounts, other than per share data, are in thousands.

Certain Significant Developments

Acquisitions

On December 17, 2014, the Company acquired 100% of the outstanding shares of Filter Resources, Inc., Filtration, Inc. and Fabrication Specialties, Inc. (collectively, "Filter Resources"). The purchase price for Filter Resources was approximately $21.9 million. The operations of Filter Resources have been merged into the Company's PECOFacet group of companies, headquartered in Mineral Wells, Texas, and its results are included as part of the Company's Industrial/Environmental Filtration segment from the date of acquisition. Further information regarding this business acquisition is included in Note B to the Consolidated Financial Statements.

Dispositions

On June 27, 2015, the Company sold 100% of the outstanding shares of J.L. Clark, Inc. ("J.L. Clark") to CC Industries, Inc. ("CCI"), an affiliate of Chicago-based Henry Crown and Company, for approximately $45.2 million in cash. Headquartered in Rockford, Illinois and with manufacturing facilities in Lancaster, Pennsylvania, J.L. Clark designs and manufactures specialty metal and plastic packaging for a variety of consumer products customers. Prior to its divestiture, J.L. Clark was the sole operating company within the Company's Packaging segment. The sale of J.L. Clark is consistent with the Company's strategic focus on being a global provider of filtration products, systems and services. Further information regarding this business disposition is included in Note C to the Consolidated Financial Statements.

New Borrowings

On November 2, 2015, the Company entered into an amended and restated credit agreement, which amended and restated the credit agreement we originally entered into on April 5, 2012 and subsequently amended in November 2013, May 2014 and June 2015. Under the amended and restated credit agreement, the Company may borrow up to $700.0 million under senior credit facilities comprised of a $500.0 million revolving credit facility and $200.0 million of term loans. The new credit facilities refinanced $395.0 million of outstanding term loans using $200.0 million of term loan borrowings and $195.0 million of revolving credit borrowings. Further information regarding these new borrowings is included in Note J to our Consolidated Financial Statements.

Restructuring and Cost Reduction Initiatives

In November 2015, the Company announced a reduction-in-force as a part of a broader effort to more closely align operating expenses with the Company's long-term strategic initiatives and macroeconomic business conditions. The Company recognized approximately $5.6 million of pre-tax restructuring charges in fiscal year 2015 in connection with this reduction-in-force, consisting of severance and other employee termination benefits, substantially all of which are expected to be settled in cash. Further information regarding this restructuring is included in Note I to our Consolidated Financial Statements. In addition, as previously disclosed, we are undertaking several other cost reduction initiatives, including, but not limited to, leveraging purchasing and logistics spending across our historically decentralized business units and reducing discretionary selling and administrative expenses, and we are also evaluating potential facility consolidations.

3

(b) Financial Information About Industry Segments

During fiscal year 2015, the Company conducted business in three principal industry segments: (1) Engine/Mobile Filtration, (2) Industrial/Environmental Filtration and (3) Packaging. These segments are discussed in greater detail below. Financial information for each of the Company’s reportable segments for the fiscal years 2013 through 2015 is included in Note Q to our Consolidated Financial Statements. On June 27, 2015, the Company completed the disposition of J.L. Clark, Inc., which was the only operating company within the Company's Packaging segment. Further information regarding this disposition is included in Note C to our Consolidated Financial Statements.

(c) Narrative Description of Business

Engine/Mobile Filtration

The Company’s Engine/Mobile Filtration segment manufactures and sells filtration products for on-road and off-road mobile and stationary applications, including trucks, agricultural machinery, construction and mining equipment, power generation, marine, automobiles, transit buses, locomotives and other industrial and specialty applications. The segment’s filtration products are manufactured and sold throughout the world, primarily in the aftermarket, but also to first-fit original equipment manufacturers ("OEMs") and through original equipment suppliers and wholesale distribution channels.

The products manufactured and sold in the Engine/Mobile Filtration segment include both first-fit filtration systems as well as replacement products such as oil, air, fuel, coolant, transmission and hydraulic filters that are used in a wide variety of applications and in processes where filtration efficiency, capacity and reliability are critical. Most of these applications involve a process through which impurities in an air or fluid stream are removed by engineered filtration media such as semi-porous paper, corrugated paper, cotton, synthetic, chemical or membrane filter media with varying filtration efficiency characteristics. The impurities captured by the media are generally disposed of when the filter is changed.

Industrial/Environmental Filtration

The Company’s Industrial/Environmental Filtration segment manufactures and sells filtration products used in industrial and commercial processes, and in buildings and infrastructures of various types. The segment’s products are sold throughout the world, and include liquid process, natural gas and air filtration products and systems used to protect critical equipment, to support the processing and transportation of fuels and feedstocks, to maintain high interior air quality and to control exterior pollution.

The segment’s liquid process filtration products include specialty industrial process liquid filters; filters for pharmaceutical processes and beverages; filtration systems, filters and coalescers for the oil and natural gas industry; filtration systems for aircraft refueling, anti-pollution, sewage treatment and water recycling; bilge water separators; sand control filters for oil and gas drilling; and woven wire and metallic products for filtration of plastics and polymer fibers. These filters use a variety of string wound, meltblown, porous and sintered and non-sintered metal media, woven wire and absorbent media.

The segment’s air filtration products represent air filters and systems, including advanced medias and treatments and high efficiency first-fit systems. These products are used in gas turbine power generation systems, heavy industrial manufacturing processes, thermal power plants, commercial buildings, hospitals, general factories, residential buildings, residences, paint spray booths, medical devices and facilities, motor vehicle systems, aircraft cabins, clean rooms, compressors and compressor stations.

Packaging

The Company’s Packaging segment was conducted by a wholly-owned subsidiary, J.L. Clark, Inc. (“J.L. Clark”). On June 27, 2015, the Company completed the disposition of J.L. Clark. Further information regarding this disposition is included in Note C to our Consolidated Financial Statements.

Prior to this disposition, J.L. Clark manufactured a wide variety of different types and sizes of containers and packaging specialties. Metal, plastic and combination metal/plastic containers and closures manufactured by J.L. Clark are used in packaging a wide variety of dry and paste form products, such as food specialties (e.g., tea, coffee, spices, mints and other confections); smokeless tobacco products; lip balms; ointments; and consumer healthcare products. Other packaging products include shells for dry cell batteries, canisters for film and candles, spools for insulated and fine wire, and custom decorated flat metal sheets.

4

Distribution

Products in both the Engine/Mobile Filtration and Industrial/Environmental Filtration segments are sold primarily through a combination of independent distributors, OEMs and their dealer networks, retail stores and directly to end-use customers such as truck and equipment fleet users, manufacturing companies and contractors. In addition, both segments manufacture and distribute products worldwide through their respective foreign subsidiaries and through export sales from the United States to independent distributors and end-use customers. Prior to the disposition of J.L. Clark, the Packaging segment used an internal sales force and sold its products directly to customers for containers and packaging specialties.

Financial information related to the geographic areas in which the Company operates and sells its products is included in Note Q to our Consolidated Financial Statements.

Class of Products

No class of similar products accounted for 10% or more of the total sales of the Company in any of the Company’s last three fiscal years.

Raw Materials

The primary raw materials the Company uses to manufacture and package its products include various types of steel, adhesives, petrochemical-based materials, wood based products and filter medias made from materials such as wood pulps, metals, polyester, polypropylene, fiberglass and other synthetic fibers. All of these are purchased and are available from a variety of sources, although qualifying alternate suppliers for certain raw materials, principally certain filter media grades, can be a lengthy process. The Company generally experienced stable prices in fiscal year 2015, with raw material prices holding relatively steady or trending lower in some significant spend categories such as steel. The Company was able to procure adequate supplies of raw materials throughout fiscal year 2015 and does not anticipate procurement problems in 2016, although the Company does believe that raw material prices will generally rise over the long term.

Patents, Trademarks and Trade names

Certain features of some of the Company’s products are covered by domestic and, in some cases, foreign patents or patent applications. While these patents are valuable and important for certain products, the Company does not believe that its competitive position is dependent upon patent protection, although as discussed under the heading of “Risk Factors,” the Company believes that patent-related litigation may become more commonplace across all of its business segments, particularly with respect to its engine aftermarket business.

With respect to trademarks and trade names, the Company believes that the trademarks and trade names it uses in connection with certain products (such as “Baldwin,” “Purolator,” “PecoFacet,” “Fuel Manager,” “Altair” and “BHA”) are valuable and significant to its business.

Seasonality

In general, the Company’s products and service offerings are not seasonal in nature, although certain of our operating companies in all our segments experience modest seasonal increases and decreases with respect to products and services supplied to particular end-use customers or industries. These shifts are normally not material to the Company on a consolidated basis.

Customers

The 10 largest customers of the Engine/Mobile Filtration segment accounted for approximately 30% of the $605.5 million of fiscal year 2015 segment sales.

The 10 largest customers of the Industrial/Environmental Filtration segment accounted for approximately 13% of the $834.6 million of fiscal year 2015 segment sales.

The 10 largest customers of the Packaging segment prior to the disposition of J.L. Clark accounted for approximately 80% of the $40.9 million of fiscal year 2015 segment sales.

No single customer accounted for 10% or more of the Company’s consolidated fiscal year 2015 sales.

5

Backlog

At November 30, 2015, the Company had a backlog of open orders for products of approximately $243.4 million. The backlog figure for November 30, 2014 was approximately $276.2 million. The decrease in backlog at November 30, 2015 compared to November 30, 2014 was primarily due to declining order levels for filtration vessels in the natural gas market served by our Industrial/Environmental Filtration segment, as well as a decline in backlog from our Packaging segment due to the sale of J.L. Clark on June 27, 2015. The majority of the orders on hand at November 30, 2015 are expected to be filled during fiscal year 2016; some orders, primarily related to filtration systems for gas turbine air intake filtration applications, are expected to be filled during fiscal year 2017. The Company does not view its backlog as being insufficient, excessive or problematic, or a significant indication of fiscal year 2016 sales.

Competition

The Company encounters strong competition in the sale of all of its products. The Company competes in a number of filtration markets against a variety of competitors. The Company is unable to state its relative competitive position in all of these markets due to a lack of reliable industry-wide data. However, in the replacement market for heavy-duty liquid and air filters used in internal combustion engines, the Company believes that it is among the top five companies worldwide measured by annual sales. In addition, the Company believes that it is a leading manufacturer of liquid and air filters for diesel locomotives. The Company believes that for industrial and environmental filtration products, it is among the top ten companies worldwide measured by annual sales, and is a market leader with respect to filtration products used in the oil and gas industries and in gas turbine applications.

On June 27, 2015, the Company completed the disposition of J.L. Clark, Inc., which was the only operating company within the Company's Packaging segment. Prior to that disposition, in the Packaging segment the Company’s principal competitors included several manufacturers that often competed on a regional basis only and whose specialty packaging segments were smaller than the Company’s. Prior to that disposition, the Company also faced strong competition by manufacturers of paper, plastic and glass containers.

The Company believes that it is able to maintain its competitive position because of the quality and breadth of its products and services and the broad geographic scope of its operations. The Company’s products primarily compete on the basis of price, performance, speed of delivery, quality and customer support.

Product Development

The Company develops products on its own and in consultation or partnership with its customers. In addition to product testing and development that occurs at the Company’s various subsidiaries, in fiscal year 2015 the Company opened the CLARCOR Innovation Center, a standalone research and development ("R&D") center in Columbia, Tennessee (the “CIC”). The CIC houses research scientists and engineers, research and testing laboratories, pilot and production lines, and training facilities, and serves as the Company's central R&D center in support of the Company's operating subsidiaries. Build-out of the facility is expected to be completed in 2016.

The Company’s laboratories, including the CIC, test product components and completed products to ensure high-quality manufacturing results, evaluate competitive products, aid suppliers in the development of product components, and conduct controlled tests of newly designed filters and filtration systems for particular uses. Product development is concerned with the improvement and creation of new filters and filtration media and filtration systems in order to increase their performance characteristics, broaden their respective uses and counteract obsolescence.

In fiscal year 2015, the Company employed approximately 152 professional employees on either a full-time or part-time basis to conduct research activities relating to the development of new products or the improvement or redesign of its existing products. During this period, the Company spent approximately $21.7 million on such activities as compared with $18.1 million for fiscal year 2014 and $11.3 million for fiscal year 2013.

Environmental Factors

The Company is not aware of any facts which would cause it to believe that it is in material violation of existing applicable standards with respect to emissions to the atmosphere, discharges to waters, or treatment, storage and disposal of solid or hazardous wastes.

6

The Company is party to various proceedings relating to environmental issues. The U.S. Environmental Protection Agency and/or other responsible state agencies have designated the Company as a potentially responsible party, along with other companies, in remedial activities for the cleanup of waste sites under the Comprehensive Environmental Response, Compensation, and Liability Act (commonly referred to as the federal Superfund statute). Additionally, the North Carolina Department of Environmental Protection has identified the property on which one of the Company's subsidiaries, CLARCOR Engine Mobile Solutions, currently operates as having concentrations of certain chemicals in groundwater that are above regulatory action levels.

Although it is not certain what future environmental claims, if any, may be asserted in connection with these known environmental matters, the Company currently believes that its potential liability for known environmental matters is not material and that it has adequately reserved for any associated liabilities based on the information available to the Company. However, environmental and related remediation costs are difficult to quantify for a number of reasons, including the number of parties involved, the difficulty in determining the nature and extent of the contamination at issue, the length of time remediation may require, the complexity of the environmental regulation, the continuing advancement of remediation technology, and the potential imposition of joint and several liability on each potentially responsible party for the cleanup.

The Company does anticipate, however, that it may be required to install additional pollution control equipment to augment or replace existing equipment in the future in order to meet applicable environmental standards. The Company is presently unable to predict the timing or the cost of any project of this nature and cannot give any assurance that the cost of such projects may not have a material adverse effect on earnings. However, the Company is not aware, at this time, of any other additional significant current or pending requirements to install such equipment at any of its facilities.

Employees

As of November 30, 2015, the Company had approximately 6,093 employees.

(d) Financial Information About Geographic Areas

Financial information relating to export sales and the Company’s operations in the United States and other countries is included in Note Q to our Consolidated Financial Statements. As noted therein, total international sales for the Company in fiscal years 2015, 2014 and 2013 were $436.6 million, $485.8 million and $351.8 million, respectively. In addition, see “Item 1A — Risk Factors” below for a discussion of certain risks of foreign operations.

(e) Available Information

Pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the Company files electronically with the Securities and Exchange Commission (“SEC”) required current reports on Form 8-K, quarterly reports on Form 10-Q and annual reports on Form 10-K; proxy materials; ownership reports for insiders as required by Section 16 of the Exchange Act; and registration statements on Form S-8, as necessary; and any other form or report as required.

Our corporate headquarters are located at 840 Crescent Centre Drive, Suite 600, Franklin, TN 37067, and our telephone number is (615) 771-3100. The Company’s corporate Internet site is www.clarcor.com. The Company makes available on that site, free of charge, its Form 10-Ks, Form 10-Qs, Form 8-Ks and amendments to such reports, as soon as reasonably practicable after such forms are electronically filed with, or furnished to, the SEC. The information contained on the Company’s website is not incorporated herein or otherwise considered to be a part of this 2015 Form 10-K.

The public may read and copy any materials that the Company files with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington D.C. 20549. Information regarding the SEC’s Public Reference Room can be obtained by calling the SEC at 1-800-SEC-0330. The SEC also maintains an Internet site (www.sec.gov) that contains reports, proxy information statements and other information regarding issuers that file electronically with the SEC.

Item 1A. Risk Factors.

Our business faces a variety of risks. These risks include those described below and may include additional risks and uncertainties not presently known to us or that we currently deem immaterial. If any of the events or circumstances described in the following risk factors occur, our business, financial condition or results of operations could be materially and adversely affected, and the trading price of our Common Stock could decline. These risk factors should be read in conjunction with the other information in this 2015 Form 10-K.

7

Our business is affected by the health of the markets we serve.

Our financial performance depends, in large part, on varying conditions in the markets that we serve, particularly the general industrial market, the trucking market, and the oil and gas market. Demand in the markets we serve fluctuates in response to overall economic conditions, although the replacement nature of our aftermarket products may help to mitigate the effects of these changes, particularly in our Engine/Mobile Filtration segment. In addition, a general economic downturn may have an adverse effect on sales of more expensive filtration systems and products, such as capital equipment sold by our PECOFacet division (which may be affected by, among other things, a decrease in the cost of oil and natural gas), CLARCOR Engine Mobile Solutions (which may be affected by, among other things, a decrease in the OEM market for heavy-duty engines, particularly in the agricultural sector) and CLARCOR Industrial Air (which may be affected by, among other things, a decrease in gas turbine system sales). An economic downturn in the markets we serve may result in reductions in sales and pricing of our products and an increase in the difficulty of collecting accounts receivable and the risk of excess and obsolete inventories, which could have a material adverse effect on our potential earnings and future results of operations.

Additionally, the recent decline in the price of oil and natural gas has had an adverse impact on us, including our PECOFacet division and certain of our other subsidiaries that sell products used in the exploration, extraction, storage and transmission of oil and natural gas, and we expect that a prolonged depression in the price of oil and natural gas would further adversely impact us. Depending on the length and extent of such depression, this could have a material adverse effect on our potential earnings and future results of operations.

Adverse U.S. and global economic conditions could materially and negatively affect our revenues, profitability and results of operations.

Our business depends on the strength of economies in various parts of the world, primarily in North America, but increasingly in Europe and China, and negative economic conditions in these economies could adversely impact our earnings in any particular period.

Although the U.S. economy has improved in recent years, challenging macroeconomic conditions in the U.S. adversely affected our business in fiscal 2015, and the U.S. continues to face near term challenges such as excessive federal and state government debt and regulatory uncertainty.

Our business was also adversely impacted in fiscal 2015 by negative global macroeonomic conditions. Moreover, declining or relatively flat growth persists in certain economic regions in which we conduct substantial operations, including in various member-states of the European Union. The continued effects of the global economic downturn and the rate of recovery may continue to have an adverse effect on our business, results of operations and financial condition, and on the general economic activity in many of the industries and markets in which we and our distributors, customers and suppliers operate. We cannot predict changes in worldwide or regional economic conditions, as such conditions are highly volatile and beyond our control. If these conditions persist or deteriorate, our business, results of operations and financial condition could be materially adversely affected.

While our current China sales are significantly less than either our U.S. or European sales, we anticipate China becoming more economically and strategically important to our business over time. If China experiences slowed or even negative economic growth, this would adversely impact our business there, as most of the sales we make in China are for domestic Chinese consumption and not for export. In addition, if adverse economic conditions in China were to cause a reduction of the level of infrastructure projects and lower diesel engine manufacturing volume in the country, this would likely have a negative effect on our Engine/Mobile Filtration segment sales there. This is because most of our current Engine/Mobile Filtration sales in China are to OEMs that make large diesel engines for heavy-duty equipment, which are used in such infrastructure projects.

We face customer concentration issues in certain geographic locations and/or in respect of certain of our businesses.

Although we serve a diverse customer base across the totality of our business, we do face customer concentration in certain geographic locations and in certain end-markets. For example, the majority of our Engine/Mobile Filtration segment sales in China are predominantly to a relatively small number of OEMs, including most notably Weichai Power Co. Ltd., a large Chinese diesel engine and truck manufacturer (“Weichai”). Our growth in China, a strategically important and potentially high growth market, currently depends in part on our ability to maintain a good and growing commercial relationship with Weichai and the other OEMs. If we are unsuccessful in this regard, this could have a material adverse effect on our potential earnings and future results of operations, and could significantly diminish the opportunities and growth in China for our Engine/Mobile Filtration segment.

8

Similarly, a significant percentage of the sales of the division of our Engine/Mobile Filtration segment that focuses on OEM customers, are to a relatively small number of OEMs, , or to other filter companies servicing the OEM market, and a significant percentage of the sales of gas turbine inlet systems and filters by our CLARCOR Industrial Air division, which is part of our Industrial/Environmental Filtration segment, are to divisions of General Electric Company. The success of these businesses currently depends in part on our ability to maintain a good and growing commercial relationship with the aforementioned customers. If we are unsuccessful in this regard, this could have a material adverse effect on our potential earnings and future results of operations.

We face heightened legal challenges from our competitors with respect to intellectual property, particularly in the area of patents.

We face increasing exposure to claims by others for infringement of intellectual property rights, particularly with respect to patents, which claims could result in significant costs or losses. This is especially important with respect to our Engine/Mobile Filtration segment, where many of our competitors are suppliers of ‘‘first-fit’’ products to OEMs and seek to control or at least gain an advantage in the aftermarket through aggressive and comprehensive patent strategies, sometimes in conjunction with the OEMs. These strategies may involve attempting to obtain as many patents as possible, including particularly with respect to the systems for attaching or sealing filters to their respective housings, deliberately delaying the final issuance of patents so as to be able to modify them in response to competitive product designs, and seeking multiple ‘‘continuations’’ of their patents in an attempt to have their patents more clearly apply to competitive product designs.

This increased exposure to patent claims is also becoming more relevant to our Industrial/Environmental Filtration segment, where we face sophisticated competitors that are larger and have greater financial resources than we do and that have complex patent portfolios that present potential obstacles to our growth.

While we spend (and intend to continue to spend) significant resources to combat these risks, including by understanding the patent landscape applicable to our operating companies, creating alternative products and product designs that fall outside of our competitors’ claimed patent rights, challenging patents which we believe to be invalid and attempting to build our own patent portfolio, there can be no guarantee that we will be successful. Any such failure could have a material adverse effect on our financial condition, results of operations, or business prospects.

We face heightened legal challenges with respect to protecting our own intellectual property, particularly overseas.

We have developed and actively pursue developing proprietary technology in the industries in which we operate, and rely on intellectual property laws and a number of patents to protect such technology. In doing so, we incur ongoing costs to enforce and defend our intellectual property. Despite our efforts in this regard, we may face situations where our own intellectual property rights are ignored, invalidated or circumvented, to our material detriment. This is of particular concern in China, where we anticipate the market for our products to develop substantially, and, with it, the incentive of third parties to infringe or challenge our intellectual property rights.

We could be adversely impacted by environmental matters and climate change and energy legislation and regulation.

Our operations are subject to U.S. and non-U.S. environmental laws and regulations governing emissions to air; discharges to water; the generation, handling, storage, transportation, treatment and disposal of waste materials; and the cleanup of contaminated properties. In this regard, the U.S. Environmental Protection Agency and/or other responsible state agencies have designated us as a potentially responsible party, along with other companies, in remedial activities for the cleanup of waste sites under the federal Superfund statute. Currently, we believe that any potential environmental liabilities with respect to our former or existing operations are not material, but there is no assurance that we will not be adversely impacted by such liabilities, costs or claims in the future, either under present laws and regulations or those that may be adopted or imposed in the future. In addition, environmental and related remediation costs are difficult to quantify for a number of reasons, including the number of parties involved, the difficulty in determining the nature and extent of the contamination at issue, the length of time remediation may require, the complexity of the environmental regulation, the continuing advancement of remediation technology, and the potential imposition of joint and several liability on each potentially responsible party for the cleanup.

Foreign, federal, state and local regulatory and legislative bodies have proposed various legislative and regulatory measures relating to climate change, regulating greenhouse gas emissions and energy policies. Due to the uncertainty in the regulatory and legislative processes, as well as the scope of such requirements and initiatives, we cannot currently determine the effect such legislation and regulation may have on our operations.

9

The potential physical impacts of climate change on our operations are also highly uncertain and would vary depending on type of physical impact and geographic location. Climate change physical impacts could include changing temperatures, water shortages, changes in weather and rainfall patterns, and changing storm patterns and intensities. The occurrence of one or more natural disasters, whether due to climate change or naturally occurring, such as tornadoes, hurricanes, earthquakes and other forms of severe weather in the U.S. or in a country in which we operate or in which our suppliers or customers are located could adversely impact our operations and financial performance. Such events could result in:

• | physical damage to and complete or partial closure of one or more of our manufacturing facilities; |

• | temporary or long-term disruption in the supply of raw materials from our suppliers; |

• | disruption in the transport of our products to customers and end users; and/or |

• | delay in the delivery of our products to our customers. |

Our operations outside of the United States are subject to political, investment and local business risks.

Approximately 30% of our fiscal 2015 sales resulted from exports to countries outside of the United States and from sales by our foreign business units. As part of our business strategy, we expect to expand our international operations through internal growth and acquisitions. Sales and operations outside of the United States, particularly in emerging markets, are subject to a variety of risks which are different from or additional to the risks the Company faces within the United States. Risks of doing business internationally include, among others:

• | local economic, political and social conditions, including potential hyper-inflationary conditions and political instability in certain countries; |

• | imposition of limitations on the remittance of dividends and payments by foreign subsidiaries; |

• | adverse currency exchange rate fluctuations, including significant devaluations of currencies; |

• | tax-related risks, including the imposition of taxes and the lack of beneficial treaties, which result in a higher effective tax rate for the Company; |

• | difficulties in enforcing agreements and collecting receivables through certain foreign legal systems; |

• | domestic and foreign customs, tariffs and quotas or other trade barriers; |

• | credit risk of local customers and distributors; |

• | increased costs for transportation and shipping; |

• | difficulties in protecting intellectual property; |

• | increased risk of corruption, self-dealing or other unethical practices that may be difficult to detect or remedy; |

• | risk of nationalization of private enterprises by foreign governments; |

• | managing and obtaining support and distribution channels for overseas operations; |

• | hiring and retaining qualified management personnel for our overseas operations; |

• | imposition or increase of restrictions on investment; and |

• | required compliance with a variety of local laws and regulations which may be materially different than those to which we are subject in the United States. |

As we continue to operate our business globally, our success will depend, in part, on our ability to anticipate and effectively manage these and other related risks, any of which could have a material adverse effect on our international operations or on our financial condition and results of operations.

We face significant competition in the markets we serve.

The markets in which we operate are highly competitive and highly fragmented. We compete worldwide with a number of other manufacturers and distributors that produce and sell similar products. Our products primarily compete on the basis of price, performance, speed of delivery, quality and customer support. Some of our competitors are companies, or divisions or operating units of companies, that have greater financial and other resources than we do. In addition, large customers continue to seek productivity gains and lower prices from us and their other suppliers. We may lose business or our margins may be negatively impacted if we are unable to deliver the best value to our customers. Any failure by us to compete effectively in the markets we serve could have a material adverse effect on our business, results of operations and financial condition.

Increasing costs for manufactured components, raw materials, transportation, energy and health care prices may adversely affect our profitability.

We use a broad range of manufactured components and raw materials in our products, including steel, steel-related components, filtration media, adhesives, plastics, paper and packaging materials. Components and materials comprise the largest component of our costs. Increases in the price of these items could further materially increase our operating costs and materially and adversely

10

affect our profit margins. Similarly, transportation, energy and health care costs have risen steadily over the past few years and represent an increasingly significant expense for the Company. Although we try to contain these costs wherever possible, and although we have historically been able to pass most increased costs in the form of price increases to our customers, we may be unsuccessful in doing so for competitive reasons, and even when successful, the timing of such price increases may lag significantly behind our incurrence of higher costs.

Our manufacturing operations are dependent upon third-party suppliers.

We obtain materials and manufactured components from third-party suppliers, and these suppliers, in turn, rely on other suppliers for raw materials and sub-components of the products they supply to us. Although the majority of the materials and components that we purchase can be obtained from multiple sources, this is not always the case, and even when such re-sourcing is possible, it may result in delays and increased costs to us. Any delay or disruption in the supply chain that provides us with necessary materials and components may affect our ability to manufacture or supply products to our customers or to do so in a timely fashion. Delays or inability to obtain supplies may result from a number of factors affecting our suppliers, including unavailability of raw materials, capacity constraints, labor disputes, the impaired financial condition of a particular supplier, suppliers’ allocations to other purchasers, weather emergencies or acts of war or terrorism. Any delay in receiving supplies could impair our ability to deliver products to our customers and, accordingly, could have a material adverse effect on our business, results of operations and financial condition. Moreover, if we are forced to seek alternative sources of raw materials or components, this may require us to qualify the products into which such materials and components are incorporated. Such qualification can be time consuming, costly and may not be successful. In such case, we may be unable to offer the affected products to our customers or be unable to supply the affected products at a profit, which could have a material adverse effect on our business and financial results. In 2015, a key supplier of wood pulp used in filtration media that is supplied to us and, we believe, other competitors of ours providing products similar to those provided by our Engine/Mobile filtration segment, ceased manufacturing such pulp, which has resulted in one or more of our media suppliers having to change certain grades of media and our having to qualify the new media grades in a wide number of our products. This effort is ongoing, and while we believe that we will be successful, we cannot guarantee this result. If we are unsuccessful, depending on the number of products that are impacted, this could negatively impact our ability to sell certain products, or to do so in a timely fashion, and materially and adversely impact our business, results of operations and financial condition.

Our success depends in part on our development of new and improved products, and we may fail to meet the needs of customers on a timely or cost-effective basis.

Our continued success depends on our ability to maintain technological capabilities, machinery and knowledge necessary to adapt to changing market demands as well as to develop and commercialize innovative products, such as innovative filtration media and higher efficiency filtration systems. We may not be able to develop new products as successfully as in the past or be able to keep pace with technological developments by our competitors and the industry generally. In addition, we may develop specific technologies and capabilities in anticipation of customers’ demands for new innovations and technologies. If such demand does not materialize, we may be unable to recover the costs incurred in such programs. If we are unable to recover these costs or if any such programs do not progress as expected, our business, financial condition or results of operations could be materially adversely affected.

The introduction of new and improved products and services could reduce our future sales.

Substantial changes or technological developments in the industries in which our products are used could reduce sales if these changes negatively impact the need for our products. For example, improvements in engine technology may reduce the need to make periodic filter changes and thus negatively impact our aftermarket filter sales for such engines.

Our ability to operate effectively could be impaired if we fail to attract and retain key personnel.

Our ability to operate our business and implement our strategies depends, in part, on the efforts of our executive officers and other key employees. Our management philosophy of cost-control means that we operate what we consider to be a very lean company with respect to personnel, and our commitment to a less centralized organization (discussed further below) also places greater emphasis on the strength of local management. Our future success will depend on, among other factors, our ability to attract and retain other qualified personnel, particularly management, research and development engineers and technical sales professionals. The loss of the services of any of our executive officers or other key employees or the failure to attract or retain other qualified personnel, domestically or abroad, could have a material adverse effect on our business or business prospects.

11

Our acquisition strategy may be unsuccessful.

As part of our growth strategy, we plan to continue to pursue acquisitions of other companies, assets and product lines that either complement or expand our existing business. We may be unable, however, to find or consummate future acquisitions at acceptable prices and terms. We continually evaluate potential acquisition opportunities in the ordinary course of business, including those that could be material in size and scope. Acquisitions, including our recent acquisitions of the Bekaert Business, CLARCOR Industrial Air, the Stanadyne Business and Filter Resources, involve a number of special risks and factors, such as:

• | the focus of management’s attention to the assimilation of the acquired companies and their employees and on the management of expanding operations; |

• | the incorporation of acquired products into our product line; |

• | the increasing demands on our operational and information technology systems; |

• | potentially insufficient internal controls over financial activities or financial reporting at an acquired company that could impact us on a consolidated basis; |

• | the failure to realize expected synergies; |

• | the potential loss of customers and other material business relations as a result of changes in control; |

• | the possibility that we have acquired substantial contingent or unanticipated legal liabilities; and |

• | the loss of key employees of the acquired businesses. |

Although we conduct what we believe to be a prudent level of investigation regarding the operating and financial condition of the businesses we purchase, an unavoidable level of risk remains regarding the actual operating condition of these businesses. Until we actually assume operating control of these business assets and their operations, we may not be able to fully ascertain the actual value or understand the potential liabilities of the acquired entities and their operations. This is particularly true with respect to non-U.S. acquisitions.

We compete for potential acquisitions based on a number of factors, including price, terms and conditions, size and ability to offer cash, stock or other forms of consideration. In pursuing acquisitions, we incur significant expenses and compete against other strategic and financial buyers, some of which are larger than we are and have greater financial and other resources than we have. Increased competition for acquisition candidates could result in fewer acquisition opportunities for us and higher acquisition prices. In addition, the negotiation of potential acquisitions may require members of management to divert their time and resources away from our operations.

We are a decentralized company, which presents certain risks.

The Company is relatively decentralized in comparison with its peers. While we believe this practice has catalyzed our growth and enabled us to remain responsive to opportunities and to our customers’ needs, it necessarily places significant control and decision-making powers in the hands of local management. This presents various risks, including the risk that we may be slower or less able to identify or react to problems affecting a key business than we would in a more centralized environment. In addition, it means that we may be slower to detect compliance related problems (e.g., a rogue employee undertaking activities that are prohibited by applicable law or by our internal policies) and that “company-wide” business initiatives, such as the integration of disparate information technology systems, are often more challenging and costly to implement, and their risk of failure higher, than they would be in a more centralized environment. Depending on the nature of the problem or initiative in question, such failure could materially adversely affect our business, financial condition or results of operations.

Our business operations may be adversely affected by information systems interruptions or intrusions.

We are dependent on various information technologies throughout our company to administer, store and support multiple business activities. If these systems are damaged, cease to function properly, or are subject to cyber-security attacks, such as those involving unauthorized access, malicious software and/or other intrusions, we could experience production downtimes, operational delays, other detrimental impacts on our operations or ability to provide products and services to our customers, the compromising of confidential or otherwise protected information, destruction or corruption of data, security breaches, other manipulation or improper use of our systems or networks, financial losses from remedial actions, loss of business or potential liability, and/or damage to our reputation. While we attempt to mitigate these risks by employing a number of measures, including technical security controls, employee training, comprehensive monitoring of our networks and systems, and maintenance of backup and protective systems, our systems, networks, products and services remain potentially vulnerable to known or unknown threats, any of which could have a material adverse affect on our business, financial condition or results of operations.

12

We may be subject to product liability risks.

The Company’s businesses expose it to potential product liability risks that are inherent in the design, manufacture and sale of its products and the products of third-party vendors that the Company uses or resells. Significant product liability claims could have a material adverse effect on the Company’s financial condition, liquidity and results of operations. Although the Company currently maintains what it believes to be suitable and adequate product liability insurance, there can be no assurance that the Company will be able to maintain its insurance on acceptable terms or that its insurance will provide adequate protection against all potential liabilities.

Our global operations are subject to laws and regulations that impose significant compliance costs and create reputational and legal risk.

Due to the international scope of our operations, we are subject to a complex system of commercial and trade regulations around the world, and our foreign operations are governed by laws, rules and business practices that often differ from those of the U.S. We cannot predict the nature, scope or effect of future regulatory requirements to which our operations might be subject or the manner in which existing laws might be administered or interpreted, which could have a material and negative impact on our business and our results of operation. For example, recent years have seen an increase in the development and enforcement of laws regarding trade compliance and anti-corruption, such as the U.S. Foreign Corrupt Practices Act and similar laws in other countries. While we maintain a variety of internal policies and controls and take steps, including periodic training and internal audits, that we believe are reasonably calculated to discourage, prevent and detect violations of such laws, we cannot guarantee that such actions will be effective or sufficient or that individual employees will not engage in inappropriate behavior in contravention of our policies and instructions. Such conduct, or even the allegation thereof, could result in costly investigations and the imposition of severe criminal or civil sanctions, could disrupt our business, and could materially and adversely affect our reputation, business and results of operations or financial condition.

The Company may be subject to risks relating to changes in its tax rates or exposure to additional income tax liabilities.

The Company is subject to income taxes in the United States and various non-U.S. jurisdictions. Domestic and international tax liabilities are subject to the allocation of income among various tax jurisdictions. The Company’s effective tax rate could be affected by changes in the mix of earnings among countries with differing statutory tax rates, changes in the valuation allowance of deferred tax assets or changes in tax laws or regulations. The amount of income taxes paid is subject to regular audits by United States federal, state and local tax authorities and by non-U.S. tax authorities. If these audits result in assessments different from amounts reserved, future financial results may include unfavorable adjustments to the Company’s tax liabilities, which could have an adverse effect on the Company’s results of operations and liquidity.

We face certain risks associated with potential labor disruptions.

Some of our employees around the world are covered by collective bargaining agreements and/or are represented by unions or workers' councils. While we believe that our relations with our employees are generally good, we cannot provide assurances that the Company will be completely free of labor disruptions such as work stoppages, work slowdowns, union organizing campaigns, strikes, lockouts or that any existing labor disruption will be favorably resolved. We could incur additional costs and/or experience work stoppages that could adversely affect our business operations through a loss of revenue and strained relationships with customers.

Changes in our product mix impact our financial performance.

We sell products that have varying profit margins. Our financial performance can be impacted depending on the mix of products we sell during a given period. Our outlook assumes a certain geographic mix of sales as well as a product mix of sales. If actual results vary from this projected geographic and product mix of sales, our results could be negatively impacted.

We face the challenge of accurately aligning our capacity with our demand.

We can experience capacity constraints and longer lead times for certain products in times of growing demand while we can also experience idle capacity as economies slow or demand for certain products decline. Accurately forecasting our expected volumes and appropriately adjusting our capacity have been, and will continue to be, important factors in determining our results of operations. We cannot guarantee that we will be able to increase manufacturing capacity to a level that meets demand for our products, which could prevent us from meeting increased customer demand and could harm our business. However, if we overestimate our demand and overbuild our capacity, we may have significantly underutilized assets and we may experience

13

reduced margins. If we do not accurately align our manufacturing capabilities with demand it could have a material adverse effect on our results of operations.

Our cost savings and restructuring initiatives could have adverse effects on our business.

In November 2015, we announced a reduction-in-force as a part of a broader effort to more closely align our operating expenses with our long-term strategic initiatives and current macroeconomic conditions which adversely affected approximately 200 employees. In addition, as previously disclosed, we are undertaking several other cost reduction initiatives, including, but not limited to, leveraging purchasing and logistics spending across our historically decentralized business units and reducing discretionary selling and administrative expenses, and are also evaluating potential facility consolidations. These cost savings and restructuring initiatives and our regular ongoing cost reduction activities reduce our available talent, assets and other resources and could slow improvements in our products and services, adversely affect our ability to respond to customers and limit our ability to increase production quickly if demand for our products increases. In addition, the costs associated with such cost reduction initiatives may be greater than anticipated, and we may be unable to realize anticipated cost savings or other contemplated benefits in connection with this reduction in workforce and other cost reduction initiatives, including as the result of delays in implementing planned cost reduction initiatives. Any of the circumstances described above could adversely impact our business.

Item 1B. Unresolved Staff Comments.

Not applicable.

Item 2. Properties.

The various properties owned and leased by the Company and its operating units as of November 30, 2015, are considered by it to be in generally good repair and well maintained. Plant asset additions in fiscal year 2016 are estimated to be between $45 and $55 million for land, buildings, furniture, production equipment and machinery, and computer and communications equipment.

The following is a description of the real property owned or leased by the Company or its affiliated entities as of November 30, 2015, broken down by business segment. All acreage and square foot measurements are approximate.

Corporate Headquarters

The Company’s corporate headquarters are located in Franklin, Tennessee, and housed in 26,084 square feet of office space under lease to the Company. The Company also owns approximately 62,500 square feet of office and R&D space in Columbia, Tennessee, which is occupied by the CIC. The Company also owns a parcel of undeveloped land in Rockford, Illinois totaling 6 acres, which parcel of land is classified as an asset held for sale at November 30, 2015 (refer to Note A to the Consolidated Financial Statements for related information).

Engine/Mobile Filtration Segment

United States Facilities

Location | Approximate Size | Owned or Leased | ||

Gothenburg, NE | 19 acre site with 100,000 sq ft of manufacturing space. | Owned | ||

Kearney, NE | 42 acre site with 982,800 sq ft of manufacturing and warehousing space, 25,000 sq ft of research and development space and 53,000 sq ft of office space. | Owned | ||

Kearney, NE | 244,696 sq ft of warehousing space. | Leased | ||

Lancaster, PA | 11.4 acre site with 168,000 sq ft of manufacturing and office space. | Owned | ||

Yankton, SD | 283,600 sq ft of manufacturing space. | Owned | ||

Washington, NC | 185,000 sq ft of manufacturing and office space. | Owned | ||

East Hartford, CT | 47,900 sq ft of office and R&D space. | Leased | ||

14

International Facilities

Location | Approximate Size | Owned or Leased | ||

Runcorn, Cheshire, England | 157,800 sq ft of manufacturing, warehousing and office space. | Owned | ||

Capetown, South Africa | 127,000 sq ft of manufacturing, warehousing and office space. | Owned | ||

Weifang, People’s Republic of China | 14 buildings, constituting 348,000 sq ft of manufacturing, warehousing and office space. | Leased | ||

Weifang, People’s Republic of China | 58,233 sq ft of manufacturing, warehousing and office space. | Leased | ||

El Marques, Mexico | 3 acre site with 78,000 sq ft of manufacturing, warehousing and office space. | Owned | ||

Casablanca, Morocco | 4 acre site with 53,800 sq ft of manufacturing, warehousing and office space. | Owned | ||

In addition to the above properties, the Engine/Mobile Filtration segment leases and operates smaller facilities in Australia, Belgium, Canada, South Africa and the United Kingdom in order to manufacture and/or distribute filtration products.

15

Industrial/Environmental Filtration Segment

United States Facilities

Location | Approximate Size | Owned or Leased | ||

Auburn Hills, MI | 32,300 sq ft of warehousing and office space. | Leased | ||

Birmingham, AL | 10,000 sq ft of warehouse space. | Owned | ||

Cincinnati, OH | 17 acre site with 154,000 sq ft of manufacturing and office space. | Owned | ||

Campbellsville, KY | 100 acre site with 250,401 sq ft of manufacturing and office space. | Owned | ||

Corona, CA | 179,790 sq feet of manufacturing, warehousing and office space. | Leased | ||

Dallas, TX | 144,824 sq feet of manufacturing, warehousing and office space. | Leased | ||

Greensboro, NC | 21 acre site with 75,000 sq ft of manufacturing, warehousing and office space. | Owned | ||

Greensboro, NC | 100,000 sq ft of manufacturing, warehousing and office space. | Owned | ||

Goodlettsville, TN | 35,000 sq ft of warehouse space. | Owned | ||

Houston, TX | 80,000 sq ft of manufacturing, warehousing and office space. | Leased | ||

Houston, TX | 10,300 sq ft of warehouse space. | Leased | ||

Houston, TX | 4,000 sq ft of warehousing and office space. | Leased | ||

Houston, TX | 10,600 sq ft of warehousing space. | Leased | ||

Houston, TX | 29,200 sq ft of manufacturing space. | Leased | ||

Jeffersonville, IN | 607,500 sq feet of manufacturing, warehousing and office space. | Leased | ||

Lake Charles, LA | 21,000 sq ft of manufacturing space. | Leased | ||

Lenexa, KS | 17,800 sq ft of warehousing and office space. | Leased | ||

Mineral Wells, TX | 46 acre site with 308,947 sq feet of manufacturing, warehousing and office space. | Owned | ||

Mineral Wells, TX | 30,000 sq ft of manufacturing space. | Leased | ||

Mineral Wells, TX | 19,950 sq ft of warehousing space. | Owned | ||

Mineral Wells, TX | 16,500 sq ft of manufacturing and warehousing space. | Owned | ||

Mineral Wells, TX | 35,000 sq ft of warehousing space. | Leased | ||

Ottawa, KS | 41,000 sq ft of manufacturing and office space. | Owned | ||

Ottawa, KS | 22,500 sq ft of warehousing space. | Leased | ||

Pittston, PA | 250,000 sq feet of manufacturing, warehousing and office space. | Leased | ||

Stilwell, OK | 11 acre site with 75,000 sq feet of manufacturing, warehousing and office space. | Leased | ||

Sacramento, CA | 36,000 sq feet of manufacturing, warehousing and office space. | Owned | ||

Shelby, NC | 48,000 sq ft of manufacturing, warehousing and office space. | Owned | ||

Tulsa, OK | 38,000 sq ft of manufacturing and office space. | Leased | ||

Vineland, NJ | 78,100 sq ft of manufacturing, warehousing and office space. | Owned/Leased | ||

Slater, MO | 55,000 sq ft of manufacturing, warehousing and office space. | Owned | ||

Slater, MO | 217,000 sq ft of manufacturing, warehousing and office space. | Owned | ||

Lee's Summit, MO | 49,250 sq ft of manufacturing, warehousing and office space. | Owned | ||

Overland Park, KS | 38,800 sq ft of office space. | Leased | ||

Salisbury, MO | 53,400 sq ft of warehousing space. | Owned | ||

16

International Facilities

Location | Approximate Size | Owned or Leased | ||

Calgary, Alberta, Canada | 25,200 sq feet of manufacturing, warehousing and office space. | Owned | ||

St. Catharines, Ontario, Canada | 6,250 sq ft of warehouse space. | Leased | ||

La Coruña, Spain | 4 acre site with 64,600 sq ft of manufacturing and office space. | Owned | ||

Pujiang City, People’s Republic of China | 54,000 sq ft of manufacturing, warehousing and office space. | Leased | ||

Queretaro, Mexico | 5 acre site with 82,500 sq ft of manufacturing, warehousing and office space. | Owned | ||

Quzhou, People’s Republic of China | 215,278 sq ft of manufacturing, warehousing and office space. | Leased | ||

Henderson, Australia | 47,598 sq ft of manufacturing and office space. | Leased | ||

Spirimont, Belgium | 48,800 sq ft of manufacturing, warehousing and office space. | Owned | ||

Karawang, Indonesia | 47,360 sq ft of manufacturing, warehousing and office space. | Owned | ||

Alton, United Kingdom | 64,400 sq ft of manufacturing, warehousing and office space. | Owned/Leased | ||

In addition to the above properties, the Industrial/Environmental Filtration segment leases and operates smaller facilities in the following locations in order to manufacture, distribute and/or service filtration products: United States: Atlanta, GA; Auburn, WA; Birmingham, AL; Evansville, WY; Chantilly, VA; Charleston, SC; Columbus, OH; Denver, CO; Carrollton, TX; Dalton, GA; Farmington, NM; Fresno, CA; Gonzales, LA; Hayward, CA; Jackson, MS; Kansas City, MO; Louisville, KY; Nederland, TX; Ontario, CA; Shakopee, MN; Phoenix, AZ; Portland, OR; Vernal, UT; Wichita, KS; West Chester, OH; Williston, ND. International: Brazil; China; France; Germany; India; Italy; Malaysia; Netherlands; United Arab Emirates; United Kingdom; Japan; Mexico.

Item 3. Legal Proceedings.

From time to time, the Company is subject to lawsuits, investigations and disputes (some of which involve substantial amounts claimed) arising out of the conduct of its business, including matters relating to commercial transactions, product liability, intellectual property and other matters. The Company recognizes a liability for any contingency that is probable of occurrence and reasonably estimable. The Company continually assesses the likelihood of adverse judgments of outcomes in these matters, as well as potential ranges of possible losses (taking into consideration any insurance recoveries), based on a careful analysis of each matter with the assistance of outside legal counsel and, if applicable, other experts. Included in these matters are the following:

TransWeb/3M

On May 21, 2010, 3M Company and 3M Innovative Properties (“3M”) brought a lawsuit against TransWeb, LLC ("TransWeb") in the United States District Court for the District of Minnesota, alleging that certain TransWeb products infringe multiple claims of certain 3M patents. Shortly after receiving service of process in this litigation, TransWeb filed its own complaint against 3M in the United States District Court for the District of New Jersey, seeking a declaratory judgment that the asserted patents are invalid and that the products in question do not infringe. 3M withdrew its Minnesota action, and the parties litigated the matter in New Jersey. The litigation in question was filed and underway before the Company acquired TransWeb in December 2010, but the Company assumed the risk of this litigation as a result of the acquisition.

During the litigation TransWeb sought judgment that (i) the asserted 3M patents are invalid, the TransWeb products in question do not infringe, and the 3M patents are unenforceable due to inequitable conduct by 3M in obtaining the patents, and (ii) 3M violated U.S. federal antitrust laws under theories of Walker Process fraud and sham litigation. Following a 2012 trial in which a six-member jury unanimously found in TransWeb's favor on all counts other than sham litigation, on April 21, 2014 the U.S. District Court for the District of New Jersey issued a ruling in favor of TransWeb and awarded TransWeb approximately $26.1 million in damages.

17

3M timely exercised its automatic right to appeal the court's judgment to the U.S. Court of Appeals for the Federal Circuit, and the matter is currently under active appeal before such tribunal.

Other

The Company is party to various proceedings relating to environmental issues. The U.S. Environmental Protection Agency and/or other responsible state agencies have designated the Company as a potentially responsible party, along with other companies, in remedial activities for the cleanup of waste sites under the Comprehensive Environmental Response, Compensation, and Liability Act (commonly referred to as the federal Superfund statute).

Although it is not certain what future environmental claims, if any, may be asserted in connection with these known environmental matters, the Company currently believes that its potential liability for known environmental matters is not material and that it has adequately reserved for any associated liabilities based on the information available to the Company. However, environmental and related remediation costs are difficult to quantify for a number of reasons, including the number of parties involved, the difficulty in determining the nature and extent of the contamination at issue, the length of time remediation may require, the complexity of the environmental regulation, the continuing advancement of remediation technology, and the potential imposition of joint and several liability on each potentially responsible party for the cleanup.

In addition to the matters cited above, the Company is involved in legal actions arising in the normal course of business. The Company records provisions with respect to identified claims or lawsuits when it is probable that a liability has been incurred and the amount of the loss can be reasonably estimated. Claims and lawsuits are reviewed quarterly and provisions are taken or adjusted to reflect the status of a particular matter.

Item 4. Mine Safety Disclosures.

Not applicable.

18

ADDITIONAL ITEM: Executive Officers of the Registrant

The following individuals are the executive officers of the Company as of January 22, 2016:

Name | Age at 11/30/2015 | Year Elected to Office | ||

Christopher L. Conway | 60 | 2010 | ||

Chairman of the Board, President and Chief Executive Officer. Mr. Conway has been employed by the Company or its affiliates since 2006, when he was named Vice President of Manufacturing of Baldwin Filters, Inc. In September 2007, Mr. Conway was promoted to the position of President of Facet USA, Inc., another affiliate of the Company. He was then named President of the Company’s PECOFacet division in December 2007 and continued in that role until being named as President and Chief Operating Officer of the Company in May 2010. On December 13, 2011, Mr. Conway assumed the position of President and Chief Executive Officer. Prior to joining the Company or its affiliates, Mr. Conway served for two years as the Chief Operating Officer of Cortron Corporation, Inc., a small manufacturing start-up based in Minneapolis, Minnesota. | ||||

David J. Fallon | 46 | 2010 | ||

Vice President-Finance & Chief Financial Officer. Mr. Fallon has been employed by the Company since 2009, when he was elected Vice President-Finance. He was elected Chief Financial Officer in 2010. Prior to joining the Company, Mr. Fallon held various positions for Noble International, Ltd. and its affiliates, including the position of Chief Financial Officer of Noble International, Ltd. immediately prior to his employment with the Company. | ||||

David J. Lindsay | 60 | 1995 | ||

Vice President-Administration and Chief Administrative Officer. Mr. Lindsay has been employed by the Company in various administrative positions since 1987. He was elected Vice President-Group Services in 1991, Vice President-Administration in 1994 and Vice President-Administration and Chief Administrative Officer in 1995. | ||||

Jacob Thomas | 48 | 2015 | ||

President-CLARCOR Engine/Mobile Filtration Group. Mr. Thomas joined the Company in September 2015, in his current role. Prior to joining CLARCOR, Mr. Thomas served as President of the Diaphragm and Dosing Pumps Group of IDEX Corporation from 2014 to 2015. Mr. Thomas previously held executive positions with Terex Corporation from 2007 to 2014, including President of its Latin America business. Prior to joining Terex, Mr. Thomas held roles of increasing responsibility at Navistar International Corporation, Case Corporation and Ford Motor Company. | ||||

Richard M. Wolfson | 49 | 2006 | ||

Vice President-General Counsel and Secretary. Mr. Wolfson was employed by the Company and elected Vice President, General Counsel and Secretary in 2006. Prior to joining the Company, he was a principal of the InterAmerican Group, an advisory services and private equity firm, from 2001 until 2006. | ||||

Keith White | 44 | 2014 | ||

President-CLARCOR Industrial Air Filtration Group. Mr. White has been employed by the Company since 2013, when he was elected President-CLARCOR Industrial Air. He was elected President-CLARCOR Industrial Air Filtration Group in 2014. Prior to joining the Company, Mr. White held various positions for General Electric Company and its affiliates from 2001 to December 2013. He was most recently with GE Power & Water - Filtration beginning in 2011, where he was General Manager and then President. GE Power & Water - Air Filtration supported GE Oil and Gas, GE Power Generation and other GE business segments. It had annual sales of approximately $270 million and had approximately 800 employees. | ||||

Each executive officer of the Company is elected by the Board of Directors for a term which begins at the Board of Directors Meeting at which he or she is elected, typically held at the time of the Annual Meeting of Shareholders, and ends on the date of the next Annual Meeting of Shareholders or upon their earlier death, resignation or removal in accordance with the Company’s By-Laws.

19

PART II

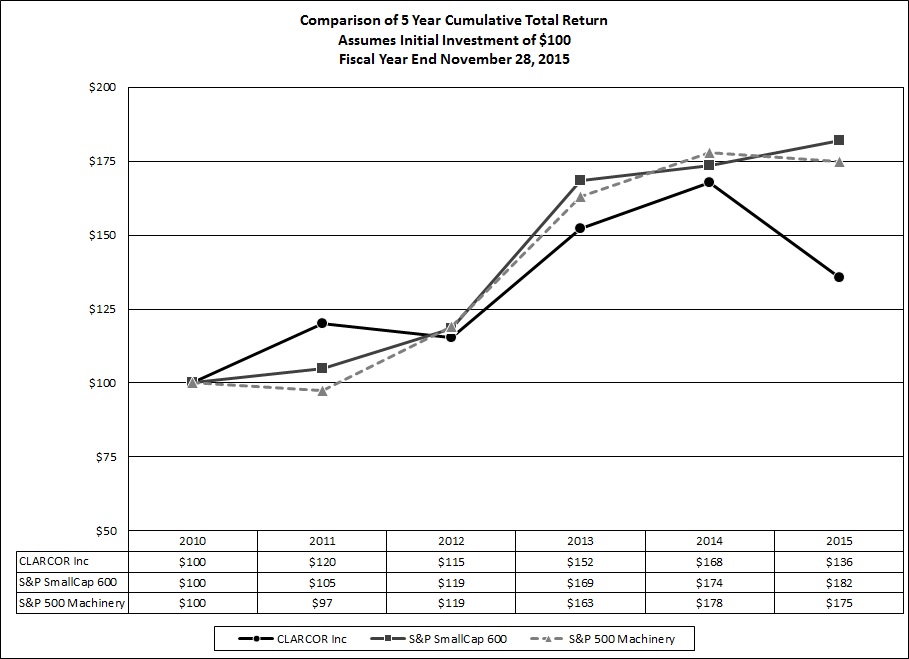

Item 5. Market for the Registrant’s Common Equity, Related Stockholder Matters, Issuer Purchase of Equity Securities and Five-Year Performance of the Company.

The Company’s Common Stock is listed on the New York Stock Exchange; it is traded under the symbol CLC. The following table sets forth the high and low market prices as quoted during the relevant periods on the New York Stock Exchange and dividends per share paid for each quarter of the last two fiscal years.

Market Price | ||||||||||||

Quarter Ended | High | Low | Dividends | |||||||||

February 28, 2015 | $ | 68.72 | $ | 60.52 | $ | 0.2000 | ||||||

May 30, 2015 | $ | 67.10 | $ | 60.95 | $ | 0.2000 | ||||||

August 29, 2015 | $ | 64.68 | $ | 53.17 | $ | 0.2000 | ||||||

November 28, 2015 | $ | 56.70 | $ | 46.05 | $ | 0.2200 | ||||||

Total Dividends | $ | 0.8200 | ||||||||||

Market Price | ||||||||||||

Quarter Ended | High | Low | Dividends | |||||||||

March 1, 2014 | $ | 65.08 | $ | 52.70 | $ | 0.1700 | ||||||

May 31, 2014 | $ | 59.15 | $ | 54.16 | $ | 0.1700 | ||||||

August 30, 2014 | $ | 64.11 | $ | 57.79 | $ | 0.1700 | ||||||

November 29, 2014 | $ | 67.60 | $ | 58.55 | $ | 0.2000 | ||||||

Total Dividends | $ | 0.7100 | ||||||||||