Table of Contents

1933 Act File No. 333-133163

United States Securities and Exchange Commission

Washington, D.C. 20549

Form S-1

Registration Statement

Under

The Securities Act of 1933

Post-Effective Amendment No. 16

Nationwide Life Insurance Company

(Exact name of registrant as specified in its charter)

| OHIO | 6311 | 31-4156830 |

| (State

or other jurisdiction of incorporation or organization) |

(Primary

Standard Industrial Classification Code Number) |

(I.R.S.

Employer Identification Number) |

One Nationwide Plaza, Columbus, Ohio 43215

(Address, including zip code, and telephone number, including area code,

of registrant's principal executive offices)

of registrant's principal executive offices)

Robert W.

Horner, III

Vice President – Corporate Governance and

Secretary

One Nationwide Plaza

One Nationwide Plaza

Columbus, Ohio 43215

Telephone: (614) 249-7111

(Name, address, including zip code, and telephone number, including area

code, of agent for service)

Approximate date of commencement of proposed sale to the public:

May 1, 2013

If any of the securities being registered on

this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box.☑

If the registrant elects to deliver its latest annual report

to security holders, or a complete and legible facsimile thereof, pursuant to Item 11(a)(1) of this Form, check the following box.□

If this Form is filed to register additional securities for an

offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

□

If this

Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. □

If this Form

is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. □

Indicate by

check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in

Rule 12b-2 of the Exchange Act.□

Large accelerated

filer□

Accelerated

filer□

Non-accelerated filer (Do not check if a smaller reporting

company)☑

Smaller reporting

Company□

Table of Contents

Guaranteed Term Options

(In a limited number of states, Guaranteed Term Options

are referred to as Target Term Options)

are referred to as Target Term Options)

NATIONWIDE LIFE

INSURANCE COMPANY

The

date of this prospectus is May 1, 2013.

| Certain state insurance laws applicable to these investment options may preclude, or be interpreted to preclude, Nationwide Life Insurance Company ("Nationwide") from providing a contractual guarantee in conjunction with the Specified Interest Rate. In such jurisdictions, the investment options are referred to as "Target Term Options" as opposed to "Guaranteed Term Options." Despite this distinction in terminology, Nationwide will administer all obligations described in this prospectus, regardless of the jurisdiction, in precisely the same manner. Thus, there will be no difference between the calculation, crediting, and administration of Specified Interest Rates in "Guaranteed Term Options" issued in states permitting a contractual guarantee, and the calculation, crediting, and administration of Specified Interest Rates in "Target Term Options" issued in states not permitting a contractual guarantee. |

This Prospectus must be read along with the appropriate variable

contract prospectus and the prospectuses describing the underlying mutual fund investment options. All of these prospectuses should be read carefully and maintained for future reference.

This Prospectus describes investment options referred to as

Guaranteed Term Options ("GTOs"), offered by Nationwide. The GTOs are available under certain variable annuity contracts or variable life insurance policies (collectively, "variable contracts") issued by Nationwide. Generally, the variable contracts

offered by Nationwide provide an array of underlying mutual fund investment options to which the contract owner allocates his or her purchase payments. The GTOs are separate, guaranteed interest investment options available under variable

contracts.

GTOs will produce a guaranteed annual

effective yield at the Specified Interest Rate so long as amounts invested are not withdrawn prior to the end of the guaranteed term. In the event of a withdraw from the GTO for any reason prior to the expiration of the Guaranteed Term, the amount

withdrawn may be subject to a market value adjustment. Please refer to the variable contract prospectus for specific information regarding variable contract transactions that may be subject to a Market Value Adjustment.

Variable contract prospectuses contain important disclosures

about the variable contract and the GTO, including information regarding variable contract charges and deductions that apply to the GTO, availability of GTO terms, and the applicability of the Market Value Adjustment. The prospectus for the variable

contract must be read along with this prospectus.

The

minimum amount that may be allocated to a GTO is $1,000 per allocation.

Nationwide established the Nationwide Multiple Maturity

Separate Account, pursuant to Ohio law, to aid in reserving and accounting for GTO obligations. However, all of the general assets of Nationwide are available for the purpose of meeting the guarantees of the GTOs. Amounts allocated to the GTOs are

generally invested in fixed income investments purchased by Nationwide. Variable contract owners allocating amounts to a GTO have no claim against any assets of Nationwide, including assets held in the Nationwide Multiple Maturity Separate

Account.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this Prospectus. Any representation to the contrary is a criminal offense.

The GTOs described in this Prospectus may not be available in

all state jurisdictions and, accordingly, representations made in this Prospectus do not constitute an offering in such jurisdictions.

| For information on how to contact Nationwide, see Nationwide Life Insurance Company. |

i

Table of Contents

| Page | |

|

|

1 |

|

|

2 |

|

|

2 |

|

|

3 |

|

|

3 |

|

|

3 |

|

|

4 |

|

|

4 |

|

|

6 |

|

|

6 |

|

|

6 |

|

|

6 |

|

|

6 |

|

|

6 |

|

|

7 |

|

|

7 |

|

|

7 |

|

|

7 |

|

|

A-1 |

|

|

B-1 |

Available

Information

Information about

Nationwide and the product may also be reviewed and copied at the SEC's Public Reference Room in Washington, D.C., or may be obtained, upon payment of a duplicating fee, by writing the Public Reference Section of the SEC at 100 F Street NE,

Washington, D.C. 20549. Additional information on the operation of the Public Reference Room may be obtained by calling the SEC at (202) 551-8090. The SEC also maintains a website (www.sec.gov) that contains the prospectus and other

information.

ii

Glossary

| Guaranteed Term – The period corresponding to a 1, 3, 5, 7 or 10 year GTO. Amounts allocated to a GTO will be credited with a Specified Interest Rate over the corresponding Guaranteed Term, so long as such amounts are not withdrawn from the GTO prior to the Maturity Date. Because every Guaranteed Term will end on the final day of a calendar quarter, the Guaranteed Term may last for up to three months beyond the 1, 3, 5, 7 or 10 year anniversary of the allocation to the GTO. |

| Guaranteed Term Option or GTO – An investment option offered under variable contracts that provides a Specified Interest Rate over Guaranteed Terms, so long as certain conditions are met. In some jurisdictions the GTO is referred to as a Target Term Option or TTO. |

| Market Value Adjustment – The upward or downward adjustment in value of amounts allocated to a GTO that are withdrawn from the GTO for any reason prior to the Maturity Date. |

| Maturity Date – The date on which a GTO matures. The date will be the last day of the calendar quarter during or within 30 days after the first, third, fifth, seventh or tenth anniversary on which amounts are allocated to a 1, 3, 5, 7 or 10 year GTO, respectively. |

| Maturity Period – The period during which the value of amounts allocated under a GTO may be withdrawn without any Market Value Adjustment. The Maturity Period will begin on the day following the Maturity Date and will end on the 30th day after the Maturity Date. |

| MVA Interest Rate – The rate of interest used in the Market Value Adjustment formula. Depending on the variable contracts under which the GTO is offered, the interest rate will be the Constant Maturity Treasury ("CMT") rates, or interest rate swaps, for maturity durations of 1, 3, 5, 7 and 10 years, as declared regularly by the Federal Reserve Board. |

| Specified Interest Rate – The interest rate guaranteed to be credited to amounts allocated to a GTO as long as the allocations are not withdrawn prior to the Maturity Date. The Specified Interest Rate will not be less than the minimum required by applicable state law. |

| Specified Value – The amount of a GTO allocation, plus interest accrued at the Specified Interest Rate, minus any other amounts withdrawn. The Specified Value is subject to a Market Value Adjustment at all times other than during the Maturity Period. |

1

Information about the GTOs

General

GTOs are guaranteed interest rate investment options available

under certain variable contracts issued by Nationwide. There are five different Guaranteed Terms: 1 year; 3 years; 5 years; 7 years; and 10 years. Not all Guaranteed Terms may be available in all states.

A GTO may be purchased using purchase payments made to the

variable contracts or by using funds transferred from other investment options available in the variable contracts. The minimum allocation to a GTO is $1,000 per allocation. Not all of the variable contracts issued by Nationwide offer GTOs. If GTOs

are available under a variable annuity contract or variable life insurance policy, the prospectus for the variable contract and this prospectus must be read together.

The guarantees associated with the GTOs are the exclusive

obligation of Nationwide. The Nationwide Multiple Maturity Separate Account, authorized and created in accordance with Ohio law, was established for the sole purpose of reserving and accounting for assets associated with the GTOs. Its assets are

owned by Nationwide. Contract owners with GTOs have no claim against, and maintain no interest in, the assets. Also, contract owners do not participate in the investment experience.

Amounts allocated to a GTO will be credited interest at the

Specified Interest Rate for the duration of the Guaranteed Term at a rate no less than the minimum required by applicable state law. Specified Interest Rates are declared periodically at Nationwide's sole discretion and available for new allocations

typically for one month. They may be available for longer or shorter periods depending on interest rate fluctuations in financial markets. During this time, any transfer allocation or new purchase payment allocation to a GTO will earn the Specified

Interest Rate effective for that Investment Period for the duration of the Guaranteed Term. Guaranteed Terms may extend up to three months beyond the 1-, 3-, 5-, 7- or 10-year term since GTO terms will always end on the final day of a calendar

quarter (see The Specified Interest Rate, The Investment Period, and Guaranteed Terms).

The Specified Interest Rate will be credited daily to amounts

allocated to a GTO to provide an annual effective yield. The Specified Interest Rate will continue to be credited as long as allocations remain in the GTO until the Maturity Date. Any withdrawal prior to the Maturity Date will be subject to a Market

Value Adjustment.

Nationwide applies the Market Value

Adjustment by using the Market Value Adjustment factor, which is derived from the Market Value Adjustment formula. The Market Value Adjustment factor is multiplied by the part of the Specified Value being withdrawn, resulting in either an increase

or decrease in the amount of the withdrawal. The Market Value Adjustment formula reflects the relationship between three components:

| (1) | the MVA Interest Rate for the period coinciding with the Guaranteed Term of the GTO at investment; |

| (2) | the MVA Interest Rate for the number of years remaining in a Guaranteed Term when the withdrawal from the GTO occurs; and |

| (3) | the number of days remaining in the Guaranteed Term of the GTO. |

Generally, the Market Value Adjustment formula approximates

the relationship between prevailing interest rates at the time of the GTO allocation, prevailing interest rates at the time of the withdrawal, and the amount of time remaining in a Guaranteed Term (see The Market

Value Adjustment).

Contract owners having GTOs

with Maturity Dates coinciding with the end of the calendar quarter will be notified of the impending expiration of the Guaranteed Term at least 15 days and at most 30 days prior to the end of each calendar quarter. Contract owners will then have

the option of directing the withdrawal of any amount in the GTO during the Maturity Period without any Market Value Adjustment. However, any amount withdrawn from the GTO during this period may be subject to a surrender charge assessed by the

variable contract. Please refer to the prospectus for the variable contract for more information about surrender charges.

If no direction is received by the 30th day following the

Maturity Date, amounts in the GTO will be automatically transferred (with no Market Value Adjustment) to the money market sub-account available in the variable contract. For the period commencing with the first day after the Maturity Date and ending

on the 30th day following the Maturity Date, the GTO will be credited with the same Specified Interest Rate in effect before the Maturity Date (see GTOs at Maturity).

The minimum amount of any allocation to a GTO is $1,000.

2

Under certain rare circumstances, when volatility in financial

markets compromises the ability of Nationwide to process allocations to or from the GTOs in an orderly manner, Nationwide may temporarily suspend the right to make additional allocations to the GTOs and/or to effect transfers or withdrawals from the

GTOs. Nationwide anticipates invoking this suspension only when these transactions cannot be executed by Nationwide in a manner consistent with its obligations to contract owners with existing or prospective interests in one or more GTOs. Under no

circumstances, however, will Nationwide limit a contract owner's right to make at least one allocation to a GTO and one withdrawal from a GTO in any calendar year. All contract owners will be promptly notified of Nationwide's determination to invoke

any suspension in the right to make allocations to or to effect withdrawals from the GTOs.

In addition, the variable contracts that offer GTOs may impose

certain restrictions on the transferability of invested assets within the variable contract. The variable product prospectus should be reviewed with regard to specific transfer limitation provisions.

The Specified Interest Rate

The Specified Interest Rate is the rate of interest guaranteed

by Nationwide to be credited to amounts allocated to the GTOs for the Guaranteed Term. Different Specified Interest Rates may be established for the five available GTO terms. Amounts withdrawn from a GTO prior to the maturity date will be subject to

a Market Value Adjustment.

Generally, Nationwide will

declare new Specified Interest Rates monthly. However, depending on interest rate fluctuations, Nationwide may declare new Specified Interest Rates more or less frequently.

Nationwide observes no specific method in establishing the

Specified Interest Rates. However, Nationwide will attempt to declare Specified Interest Rates that are related to interest rates associated with fixed-income investments available at the time and having durations and cash flow attributes compatible

with the Guaranteed Terms of the GTOs. In addition, the establishment of Specified Interest Rates may be influenced by other factors, including competitive considerations, administrative costs and general economic trends. Nationwide has no way of

precisely predicting what Specified Interest Rates may be declared in the future, however, the Specified Interest Rate will not be less than the minimum rate required by applicable state law.

The Investment Period

The Investment Period is the period of time during which a

particular Specified Interest Rate is in effect for new allocations to the available GTOs. All allocations made to a GTO during an Investment Period are credited with the Specified Interest Rate in effect at the time of allocation. An Investment

Period ends when a new Specified Interest Rate relative to the applicable GTO is declared. Subsequent declarations of new Specified Interest Rates have no effect on allocations made to GTOs during prior Investment Periods. Prior allocations to the

GTO will be credited with the Specified Interest Rate in effect when the allocation was made.

Interest at the Specified Interest Rate is credited to

allocations made to GTOs on a daily basis, resulting in an annual effective yield guaranteed by Nationwide, unless amounts are withdrawn from the GTO for any reason prior to the Maturity Date. Interest at the Specified Interest Rate will be credited

for the entire Guaranteed Term. If amounts are withdrawn from the GTO for any reason prior to the Maturity Date, a Market Value Adjustment will be applied to that amount.

Information concerning the Specified Interest Rates in effect

for the various GTOs can be obtained by contacting Nationwide.

Guaranteed Terms

The Guaranteed Term is the period of time corresponding to the

selected GTO for which the Specified Interest Rate is guaranteed to be in effect. A Guaranteed Term always expires on a Maturity Date which will be the last day of a calendar quarter. Consequently, a Guaranteed Term may last up to three months

longer than the anniversary date of the allocation to the GTO.

For example, if an allocation is made to a 10-year GTO on

August 1, 1999, the Specified Interest Rate for that GTO will be credited until September 30, 2009; the Guaranteed Term will begin on August 1, 1999, and end on September 30, 2009.

Guaranteed Terms will be exactly 1, 3, 5, 7 or 10 years only

when an allocation to a GTO occurs on the last day of a calendar quarter.

3

GTOs at Maturity

Nationwide will send notice to contract owners of impending

Maturity Dates (always the last day of a calendar quarter) at least 15 days and at most 30 days prior to the end of a Guaranteed Term. The notice will include the projected value of the GTO on the Maturity Date, and will also specify options that

contract owners have with respect to the maturing GTO.

Once the GTO matures, contract owners may:

| (1) | surrender the GTO, in part or in whole, without a Market Value Adjustment during the Maturity Period; however, any surrender charges that may be applicable under the variable contract will be assessed; |

| (2) | transfer (all or part) of the GTO, without a Market Value Adjustment, to any other permitted investment option under the variable contract, including any permitted underlying mutual fund sub-accounts, or another GTO of the same or different duration during the Maturity Period. A confirmation of any such transfer will be sent immediately after the transfer is processed; or |

| (3) | elect not to transfer or surrender all or a portion of the GTO, in which case the GTO will be automatically transferred to the available money market sub-account of the contract at the end of the Maturity Period. A confirmation will be sent immediately after the automatic transfer is executed. |

If no

direction is received by Nationwide prior to the Maturity Date, all amounts in that GTO will be transferred to the available money market sub-account of the variable contract.

The GTO will continue to be credited with the Specified

Interest Rate in effect before the Maturity Date during the Maturity Period, and prior to any of the transactions set forth in (1), (2), or (3) above.

Withdrawals Prior to the Maturity Date

Anytime value is removed from the GTO it will be referred to

in this prospectus as a withdrawal. However, under the variable contract, withdrawals of value from the GTO may be considered a transfer among investment options of the variable contract or a surrender. Depending upon the transaction and the terms

of the variable contract, additional conditions or charges may apply to withdrawals from the GTO. Please refer to the variable contract prospectus for information regarding transferring assets among investment options or taking surrenders from the

variable contract.

Withdrawals from the GTOs prior to

the Maturity Date will be subject to a Market Value Adjustment.

The Market Value Adjustment

The Market Value Adjustment is determined by multiplying a

Market Value Adjustment factor (arrived at by using the Market Value Adjustment formula) by the Specified Value, or the portion of the Specified Value being withdrawn. The Specified Value is the amount allocated to the GTO, plus interest accrued at

the Specified Interest Rate, minus prior withdrawals. The Market Value Adjustment may either increase or decrease the amount of the withdrawal.

The Market Value Adjustment is intended to approximate,

without duplicating, Nationwide's experience when it liquidates assets in order to satisfy contractual obligations. Such obligations arise when contract owners make withdrawals, or when the operation of the variable contract requires a distribution.

Nationwide does not make the adjustment on distributions to pay death benefits in certain jurisdictions. When liquidating assets, Nationwide may realize either a gain or a loss.

MVA Interest Rates

The Market Value Adjustment formula used to determine the

Market Value Adjustment factor is based on either the Constant Maturity Treasury (CMT) rates or interest rate swaps, depending on the variable contracts under which the GTO is offered. CMT rates and interest rate swaps are declared by the Federal

Reserve Board on a regular basis. Nationwide either uses CMT rates or interest rate swaps in its Market Value Adjustment formula because they represent a readily available and consistently reliable interest rate benchmark in financial markets, which

can be relied upon to reflect the relationship between Specified Interest Rates declared by Nationwide and the prospective interest rate fluctuations.

CMT rates and interest rate swaps for 1, 3, 5, 7 and 10 years

are published by the Federal Reserve Board on a regular basis. To the extent that the Market Value Adjustment formula shown below requires a rate associated with a maturity not published (such as a 4, 6, 8 or 9 year maturity), Nationwide will

calculate such rates based on the relationship of the published rates. For example, if the published 3-year rate is 6% and the published 5-year rate is 6.50%, the 4-year rate will be calculated as 6.25%.

4

The Market Value Adjustment Formula

The Market Value Adjustment formula is used when a withdrawal

is made from a GTO during the Guaranteed Term. The Market Value Adjustment is a calculation expressing the relationship between three factors:

| (1) | the MVA Interest Rate for the period of time coinciding with the Guaranteed Term of the GTO; |

| (2) | the MVA Interest Rate for a period coinciding with the time remaining in the Guaranteed Term of a GTO when a withdrawal giving rise to a Market Value Adjustment occurs; and |

| (3) | the number of days remaining in the Guaranteed Term of the GTO. |

The formula for determining the Market Value Adjustment factor

is:

| [ | ] | t | |

| 1 + a | |||

| 1 + b + .0025 | |||

Where:

| a | = | the MVA Interest Rate for a period equal to the Guaranteed Term at the time of deposit in the GTO; |

| b | = | the MVA Interest Rate at the time of withdrawal for a period of time equal to the time remaining in the Guaranteed Term. In determining the number of years to maturity, any partial year will be counted as a full year, unless it would cause the number of years to exceed the Guaranteed Term; and |

| t | = | the number of days until the Maturity Date, divided by 365.25. |

In certain jurisdictions the denominator is 1+b without the

addition of .0025.

In the case of "a" above, the MVA

Interest Rate used will either be the CMT rate or interest rate swap, depending on the variable contract. For variable contracts using CMT rates, "a" will be the CMT rate declared on Fridays by the Federal Reserve Board, and placed in effect by

Nationwide for allocations made to the GTO on the following Wednesday through Tuesday. For variable contracts using interest rate swaps, "a" is the interest rate swap published by the Federal Reserve Board two days before the date the allocation to

the GTO was made.

In the case of "b" above, the MVA

Interest Rate used will either be the CMT rate or interest rate swap, depending on the variable contract. For variable contracts using CMT rates, "b" will be the CMT rate declared on Fridays by the Federal Reserve Board, and placed in effect by

Nationwide for withdrawals giving rise to a Market Value Adjustment on the following Wednesday through Tuesday. For variable contracts using interest rate swaps, "b" is the interest rate swap published by the Federal Reserve Board two days before

the date of withdrawal giving rise to a Market Value Adjustment.

The Market Value Adjustment factor will be equal to one during

the Investment Period.

The Market Value Adjustment

formula shown above also accounts for some of the administrative and processing expenses incurred when fixed-interest investments are liquidated. This is represented by the addition of .0025 in the Market Value Adjustment formula.

The result of the Market Value Adjustment formula shown above

is the Market Value Adjustment factor. The Market Value Adjustment factor is multiplied by the Specified Value, or that portion of the Specified Value being distributed from a GTO, in order to effect a Market Value Adjustment. The Market Value

Adjustment factor will either be greater than, less than, or equal to one and will be multiplied by the Specified Value (or a portion of the Specified Value) being withdrawn from the GTO for any reason. If the Market Value Adjustment factor is

greater than one, a gain will be realized by the contract owner. If the Market Value Adjustment factor is less than one, a loss will be realized. If the Market Value Adjustment factor is exactly one, no gain or loss will be realized.

If the Federal Reserve Board halts publication of CMT rates or

interest rate swaps, or if, for any other reason, they are not available, Nationwide will use appropriate rates based on U.S. Treasury Bond yields.

Examples of how to calculate Market Value Adjustments based on

CMT rates are provided in the Appendix.

5

Variable Contract Charges

The variable contracts under which GTOs are made available

have various fees and charges, some of which may be assessed against allocations made to GTOs. Contract charges assessed against allocations made to the GTOs will reduce the credited guaranteed interest rate by the amount of the applicable charge.

The variable contract prospectuses fully describe these fees and charges and any impact such charges may have on the credited guaranteed interest rate of the GTOs.

The variable contracts that offer the GTOs may also have

surrender charges. If a variable contract owner takes a withdrawal from the GTO (prior to the Maturity Date) that is also considered a surrender from the variable contract, the amount will be subject to a Market Value Adjustment in addition to any

surrender charge assessed pursuant to the terms of the variable contract. Please refer to the variable contract prospectus for more information about variable contract transactions that may incur surrender charges and/or a Market Value

Adjustment.

GTOs at Annuitization

GTOs are not available as investment options for variable

annuity contracts that are annuitized. If a variable annuity contract is annuitized prior to the Maturity Date of the GTO, a Market Value Adjustment will apply to amounts transferred from the GTO to other investment options under the variable

annuity contract (unless such an adjustment is not permitted in your jurisdiction).

Nationwide Life Insurance Company

Nationwide is a stock life insurance company organized under

Ohio law in March, 1929, with its home office at One Nationwide Plaza, Columbus, Ohio 43215. Nationwide is a provider of life insurance, annuities and retirement products. It is admitted to do business in all states, the District of Columbia and

Puerto Rico.

Nationwide is relying on the exemption

provided by Rule 12h-7 under the Securities Exchange Act of 1934 ("1934 Act"). In reliance on that exemption, Nationwide does not file periodic reports that would be otherwise required under the 1934 Act.

You can request additional information about Nationwide by

contacting us:

| • | In writing: P.O. Box 182021, Columbus, Ohio 43218-2021 |

| • | By telephone: 1-800-848-6331, TDD 1-800-238-3035 |

| • | By the internet: http://www.nationwide.com/nw/investor-relations/index.htm |

Investments

Nationwide intends to invest amounts allocated to GTOs in high

quality, fixed interest investments (investment grade bonds, mortgages, and collateralized mortgage obligations) in the same manner as Nationwide invests its general account assets. Nationwide takes into account the various maturity durations of the

GTOs (1, 3, 5, 7 and 10 years) and anticipated cash-flow requirements when making investments. Nationwide is not obligated to invest GTO allocations in accordance with any particular investment objective, but will generally adhere to Nationwide's

overall investment philosophy. The Specified Interest Rates declared by Nationwide for the various GTOs will not necessarily correspond to the performance of the non-unitized separate account.

Contracts and the Distribution (Marketing) of the GTOs

The GTOs are available only as investment options under

certain variable contracts issued by Nationwide. The appropriate variable contract prospectus and, if applicable, the Statement of Additional Information should be consulted for information regarding the distribution of the variable contracts.

Legal Opinion

Legal matters in connection with federal laws and regulations

affecting the issue and sale of the GTOs described in this Prospectus and the organization of Nationwide, its authority to issue GTOs under Ohio law, and the validity of the endorsement to the variable annuity contracts under Ohio law have been

passed on by Nationwide's Office of General Counsel.

6

Experts

The consolidated financial statements and

schedules of Nationwide Life Insurance Company and subsidiaries as of December 31, 2012 and 2011, and for each of the years in the three-year period ended December 31, 2012, have been included herein in reliance upon the report of KPMG LLP,

independent registered public accounting firm, and upon the authority of said firm as experts in accounting and auditing. KPMG LLP is located at 191 West Nationwide Blvd., Columbus, Ohio 43215.

Disclosure of Commission Position on Indemnification

Insofar as indemnification for liabilities arising under the

Securities Act of 1933 (the "1933 Act") may be permitted to directors, officers and controlling persons of Nationwide pursuant to the foregoing provisions, or otherwise, Nationwide has been advised that in the opinion of the Securities and Exchange

Commission such indemnification is against public policy as expressed in the 1933 Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses

incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being

registered, Nationwide will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as

expressed in the 1933 Act and will be governed by the final adjudication of such issue.

Legal Proceedings

Nationwide Life Insurance Company

Nationwide Financial Services, Inc. (NFS, or collectively with

its subsidiaries, "the Company") was formed in November 1996. NFS is the holding company for Nationwide Life Insurance Company (NLIC), Nationwide Life and Annuity Insurance Company (NLAIC) and other companies that comprise the life insurance and

retirement savings operations of the Nationwide group of companies (Nationwide). This group includes Nationwide Financial Network (NFN), an affiliated distribution network that markets directly to its customer base. NFS is incorporated in Delaware

and maintains its principal executive offices in Columbus, Ohio.

The Company is subject to legal and regulatory proceedings in

the ordinary course of its business. The Company's legal and regulatory matters include proceedings specific to the Company and other proceedings generally applicable to business practices in the industries in which the Company operates. The

Company's litigation and regulatory matters are subject to many uncertainties, and given their complexity and scope, their outcomes cannot be predicted. Regulatory proceedings also could affect the outcome of one or more of the Company's litigation

matters. Furthermore, it is often not possible to determine the ultimate outcomes of the pending regulatory investigations and legal proceedings or to provide reasonable ranges of potential losses with any degree of certainty. Some matters,

including certain of those referred to below, are in very preliminary stages, and the Company does not have sufficient information to make an assessment of the plaintiffs' claims for liability or damages. In some of the cases seeking to be certified

as class actions, the court has not yet decided whether a class will be certified or (in the event of certification) the size of the class and class period. In many of the cases, the plaintiffs are seeking undefined amounts of damages or other

relief, including punitive damages and equitable remedies, which are difficult to quantify and cannot be defined based on the information currently available. The Company believes, however, that based on currently known information, the ultimate

outcome of all pending legal and regulatory matters is not likely to have a material adverse effect on the Company's consolidated financial position. Nonetheless, given the large or indeterminate amounts sought in certain of these matters and the

inherent unpredictability of litigation, it is possible that such outcomes could materially affect the Company's consolidated financial position or results of operations in a particular quarter or annual period.

The financial services industry has been the subject of

increasing scrutiny on a broad range of issues by regulators and legislators. The Company and/or its affiliates have been contacted by, self reported or received subpoenas from state and federal regulatory agencies, including the Securities and

Exchange Commission, and other governmental bodies, state securities law regulators and state attorneys general for information relating to, among other things, sales compensation, the allocation of compensation, unsuitable sales or replacement

practices, and claims handling and escheatment practices. The Company is cooperating with and responding to regulators in connection with these inquiries and will cooperate with Nationwide Mutual Insurance Company (NMIC) in responding to these

inquiries to the extent that any inquiries encompass NMIC's operations.

7

In October 2012, NLIC and NLAIC entered into a Regulatory

Settlement Agreement with the Florida Office of Insurance Regulation and 21 other state Departments of Insurance to resolve a multi-state market conduct exam regarding claim settlement practices. The Regulatory Settlement Agreement applies

prospectively and requires NLIC and NLAIC to adopt and implement additional procedures relating to the use of to the Social Security Death Master File and identifying and locating beneficiaries once deaths are identified. In October 2012, NLIC and

NLAIC also entered into a Global Resolution Agreement to resolve the related unclaimed property audit.

On November 20, 2007, Nationwide Retirement Solutions, Inc.

(NRS) and NLIC were named in a lawsuit filed in the Circuit Court of Jefferson County, Alabama entitled Ruth A. Gwin and Sandra H. Turner, and a class of similarly situated individuals v. Nationwide Life Insurance

Company, Nationwide Retirement Solutions, Inc., Alabama State Employees Association, PEBCO, Inc. and Fictitious Defendants A to Z. On March 12, 2010, NRS and NLIC were named in a Second Amended Class Action Complaint filed in the Circuit

Court of Jefferson County, Alabama entitled Steven E. Coker, Sandra H. Turner, David N. Lichtenstein and a class of similarly situated individuals v. Nationwide Life Insurance Company, Nationwide Retirement

Solutions, Inc., Alabama State Employees Association, Inc., PEBCO, Inc. and Fictitious Defendants A to Z claiming to represent a class of all participants in the Alabama State Employees Association, Inc. (ASEA) Plan, excluding members of the

Deferred Compensation Committee, ASEA's directors, officers and board members, and PEBCO's directors, officers and board members. On October 22, 2010, the parties to this action executed a stipulation of settlement that agreed to certify a class for

settlement purposes only, that provided for payments to the settlement class, and that provided for releases, certain bar orders, and dismissal of the case. The settlement fund has been paid out. On December 6, 2011 the Court entered an Order that

NRS owes indemnification to ASEA and PEBCO for the Coker (Gwin) class action, and dismissed NLIC. The Company has resolved the indemnification claims of ASEA. On February 13, 2013, the Court issued its Order determining the amount of fees due to

PEBCO on its indemnification claim. The Company has until March 29, 2013 to file a notice of appeal. NRS continues to defend this case vigorously.

On August 15, 2001, NFS and NLIC were named in a lawsuit filed

in the United States District Court for the District of Connecticut entitled Lou Haddock, as trustee of the Flyte Tool & Die, Incorporated Deferred Compensation Plan, et al v. Nationwide Financial Services, Inc.

and Nationwide Life Insurance Company. On November 18, 2009, the plaintiffs filed a sixth amended complaint amending the list of named plaintiffs and claiming to represent a class of qualified retirement plan trustees under the Employee

Retirement Income Security Act of 1974 (ERISA) that purchased variable annuities from NLIC. The plaintiffs allege that they invested ERISA plan assets in their variable annuity contracts and that NLIC and NFS breached ERISA fiduciary duties by

allegedly accepting service payments from certain mutual funds. The complaint seeks disgorgement of some or all of the payments allegedly received by NFS and NLIC, other unspecified relief for restitution, declaratory and injunctive relief, and

attorneys' fees. On November 6, 2009, the Court granted the plaintiff's motion for class certification and certified a class of "All trustees of all employee pension benefit plans covered by ERISA which had variable annuity contracts with NFS and

NLIC or whose participants had individual variable annuity contracts with NFS and NLIC at any time from January 1, 1996, or the first date NFS and NLIC began receiving payments from mutual funds based on a percentage of assets invested in the funds

by NFS and NLIC, whichever came first, to the date of November 6, 2009." On October 21, 2010, the District Court dismissed NFS from the lawsuit. On February 6, 2012, the Second Circuit Court of Appeals vacated the November 6, 2009, order granting

class certification and remanded the class back to the District Court for further consideration. The plaintiffs have renewed their motion for class certification. On December 18, 2012, the District Court heard oral argument on the motion for class

certification. NLIC continues to defend this lawsuit vigorously.

On June 8, 2011, NMIC and NLIC were named in a lawsuit filed

in Court of Common Pleas, Cuyahoga County, Ohio entitled Stanley Andrews and Donald Clark, on their behalf and on behalf of the class defined herein v. Nationwide Mutual Insurance Company and Nationwide Life

Insurance Company. The lower court granted Nationwide's motion to dismiss. Plaintiffs appealed. The Court of Appeals affirmed the dismissal on October 24, 2012. Plaintiffs filed a petition for rehearing en banc on November 5, 2012. The Court

of Appeals denied the petition on December 14, 2012. Plaintiff filed a notice of appeal to the Ohio Supreme Court on January 24, 2013. Nationwide has 30 days to file an opposition memorandum. Nationwide filed its memorandum in opposition to

plaintiffs' petition for jurisdiction to the Ohio Supreme Court on February 27, 2013.

Lehman Brothers Holdings, Inc. (Debtors) and Giddens, James v

NLIC and NMIC, et al.In 2012 the Plaintiff, Debtor in Possession Lehman Brothers Special Financing, Inc., filed a class action in the United States Bankruptcy Court for the Southern District of New York seeking the

recovery of nearly $3 billion in assets from all the named defendants including NLIC and NMIC. This litigation arises from two collateralized debt obligation transactions, 801 Grand and Alta, which resulted in payments to NLIC and NMIC. In 2008, the

Plaintiff and its parent company, Lehman Brothers Holding, Inc. filed for bankruptcy which triggered an early termination of the above transactions. The Plaintiff seeks to have sums returned

8

to the bankruptcy estate in addition to prejudgment interest and costs. The

case is currently stayed and on February 13,2013, the Court extended the stay. Responsive pleadings are now due September 5, 2013. Lehman recently sent correspondence out to all defendants inviting settlement discussions which is under review.

9

Appendix A

Example A

Assume that a variable annuity contract owner made a $10,000

allocation on the last day of a calendar quarter into a 5-year Guaranteed Term Option. The Specified Interest Rate at the time is 8.5% and the 5-year CMT rate in effect is 8%. The variable annuity contract owner decides to surrender the GTO 985 days

from maturity. The Specified Value of the GTO is $12,067.96. At this time, the 3-year CMT rate is 7%. (985/365.25 is 2.69, which rounds up to 3, so the 3-year CMT Rate is used.)

| [ | ] | d | |||

| 1 + a | 365.25 | ||||

| MVA Factor | = | 1 + b + 0.0025 | |||

| [ | ] | 985 | |||

| 1 + 0.08 | 365.25 | ||||

| MVA Factor | = | 1 + 0.07 + 0.0025 | |||

| MVA Factor | = | 1.01897 | |||

| Surrender Value | = | Specified Value | x | MVA Factor | |

| Surrender Value | = | $12,067.96 | x | 1.01897 | |

| *Surrender Value | = | $12,296.89 | |||

| * | Assumes no variable annuity contract contingent deferred sales charges are applicable. In jurisdictions where the .0025 is not permitted in the denominator, the Surrender Value is $12,374.52. |

Specified Value (for purposes of this Example) = the amount of

the GTO allocation ($10,000), plus interest accrued at the Specified Interest Rate (8.5%).

| a | = | The CMT rate declared by the Federal Reserve Board on Friday, and placed in effect by Nationwide for allocations made to the GTO on the following Wednesday through Tuesday. |

| b | = | The CMT rate declared by the Federal Reserve Board on Friday, and placed in effect by Nationwide for withdrawals, transfers or other distributions giving rise to a Market Value Adjustment on the following Wednesday through Tuesday. |

| d | = | The number of days remaining in the Guaranteed Term. |

A-1

Example B

Assume that a variable annuity contract owner made a $10,000

allocation on the last day of a calendar quarter into a 5-year Guaranteed Term Option. The Specified Interest Rate at the time is 8.5% and the 5-year CMT rate in effect is 8%. The variable annuity contract owner decides to surrender his money 985

days from maturity. The Specified Value of the GTO is $12,067.96. At this time, the 3-year CMT rate is 9%. (985/365.25 is 2.69, which rounds up to 3, so the 3-year CMT Rate is used.)

| [ | ] | d | |||

| 1 + a | 365.25 | ||||

| MVA Factor | = | 1 + b + 0.0025 | |||

| [ | ] | 985 | |||

| 1 + 0.08 | 365.25 | ||||

| MVA Factor | = | 1 + 0.09 + 0.0025 | |||

| MVA Factor | = | 0.96944 | |||

| Surrender Value | = | Specified Value | x | MVA Factor | |

| Surrender Value | = | $12,067.96 | x | 0.96944 | |

| *Surrender Value | = | $11,699.17 | |||

| * | Assumes no variable annuity contract contingent deferred sales charges are applicable. In jurisdictions where the .0025 is not permitted in the denominator, the Surrender Value is $11,771.69. |

Specified Value (for purposes of this Example) = the amount of

the GTO allocation ($10,000), plus interest accrued at the Specified Interest Rate (8.5%).

| a | = | The CMT rate declared by the Federal Reserve Board on Friday, and placed in effect by Nationwide for allocations made to the GTO on the following Wednesday through Tuesday. |

| b | = | The CMT rate declared by the Federal Reserve Board on Friday, and placed in effect by Nationwide for withdrawals, transfers or other distributions giving rise to a Market Value Adjustment on the following Wednesday through Tuesday. |

| d | = | The number of days remaining in the Guaranteed Term. |

A-2

Example C

Assume that a variable annuity contract owner made a $10,000

allocation on the last day of a calendar quarter into a 5-year Guaranteed Term Option. The Specified Interest Rate at the time is 8.5% and the 5-year interest rate swap in effect is 8%. The variable annuity contract owner decides to surrender the

GTO 985 days from maturity. The Specified Value of the GTO is $12,067.96. At this time, the 3-year interest rate swap is 7%. (985/365.25 is 2.69, which rounds up to 3, so the 3-year interest rate swap is used.)

| [ | ] | d | |||

| 1 + a | 365.25 | ||||

| MVA Factor | = | 1 + b + 0.0025 | |||

| [ | ] | 985 | |||

| 1 + 0.08 | 365.25 | ||||

| MVA Factor | = | 1 + 0.07 + 0.0025 | |||

| MVA Factor | = | 1.01897 | |||

| Surrender Value | = | Specified Value | x | MVA Factor | |

| Surrender Value | = | $12,067.96 | x | 1.01897 | |

| *Surrender Value | = | $12,296.89 | |||

| * | Assumes no variable annuity contract contingent deferred sales charges are applicable. In jurisdictions where the .0025 is not permitted in the denominator, the Surrender Value is $12,374.52. |

Specified Value (for purposes of this Example) = the amount of

the GTO allocation ($10,000), plus interest accrued at the Specified Interest Rate (8.5%).

| a | = | The interest rate swap published by the Federal Reserve Board two days before the date the allocation to the GTO was made. If no interest rate swap is available for this date, then the most recent available rate prior to that date will be used. |

| b | = | The interest rate swap published by the Federal Reserve Board two days before the date of withdrawal, transfer or other distribution giving rise to a Market Value Adjustment. If no interest rate swap is available for this date, then the most recent available rate prior to that date will be used. |

| d | = | The number of days remaining in the Guaranteed Term. |

A-3

Example D

Assume that a variable annuity contract owner made a $10,000

allocation on the last day of a calendar quarter into a 5-year Guaranteed Term Option. The Specified Interest Rate at the time is 8.5% and the 5-year interest rate swap in effect is 8%. The variable annuity contract owner decides to surrender the

GTO 985 days from maturity. The Specified Value of the GTO is $12,067.96. At this time, the 3-year interest rate swap is 9%. (985/365.25 is 2.69, which rounds up to 3, so the 3-year interest rate swap is used.)

| [ | ] | d | |||

| 1 + a | 365.25 | ||||

| MVA Factor | = | 1 + b + 0.0025 | |||

| [ | ] | 985 | |||

| 1 + 0.08 | 365.25 | ||||

| MVA Factor | = | 1 + 0.09 + 0.0025 | |||

| MVA Factor | = | 0.96944 | |||

| Surrender Value | = | Specified Value | x | MVA Factor | |

| Surrender Value | = | $12,067.96 | x | 0.96944 | |

| *Surrender Value | = | $11,699.17 | |||

| * | Assumes no variable annuity contract contingent deferred sales charges are applicable. In jurisdictions where the .0025 is not permitted in the denominator, the Surrender Value is $11,771.69. |

Specified Value (for purposes of this Example) = the amount of

the GTO allocation ($10,000), plus interest accrued at the Specified Interest Rate (8.5%).

| a | = | The interest rate swap published by the Federal Reserve Board two days before the date the allocation to the GTO was made. If no interest rate swap is available for this date, then the most recent available rate prior to that date will be used. |

| b | = | The interest rate swap published by the Federal Reserve Board two days before the date of the withdrawal, transfer or other distribution giving rise to a Market Value Adjustment. If no interest rate swap is available for this date, then the most recent available rate prior to that date will be used. |

| d | = | The number of days remaining in the Guaranteed Term. |

A-4

The table set forth below illustrates the impact of a Market

Value Adjustment applied upon a full surrender of a 10-year GTO allocation, at various stages of the corresponding Guaranteed Term. These figures assume a $10,000 allocation to the 10-year GTO on the last day of a calendar quarter. These figures

assume a Specified Interest Rate of 8.5% on the date the allocation to the GTO was made. These figures are based on a 10-year CMT rate of 8% in effect on the date the allocation to the GTO was made (a in the Market Value Adjustment Formula) and

varying current yield CMT rates shown in the first column (b in the Market Value Adjustment Formula).

| Current Yield | Time

Remaining to the End of the Guaranteed Term |

Specified

Value |

Market

Value Adjustment |

Market

Value | ||||

|

12.00% |

9 Years | $10,850 | -29.35% | $ 7,665 | ||||

| 7 Years | $12,776 | -23.68% | $ 9,751 | |||||

| 5 Years | $15,040 | -17.56% | $12,399 | |||||

| 2 Years | $19,215 | -7.43% | $17,786 | |||||

| 180 Days | $21,733 | -1.88% | $21,323 | |||||

|

10.00% |

9 Years | $10,850 | -16.94% | $ 9,012 | ||||

| 7 Years | $12,776 | -13.44% | $11,059 | |||||

| 5 Years | $15,040 | -9.80% | $13,566 | |||||

| 2 Years | $19,215 | -4.04% | $18,438 | |||||

| 180 Days | $21,733 | -1.01% | $21,513 | |||||

|

9.00% |

9 Years | $10,850 | -9.84% | $ 9,782 | ||||

| 7 Years | $12,776 | -7.74% | $11,787 | |||||

| 5 Years | $15,040 | -5.59% | $14,199 | |||||

| 2 Years | $19,215 | -2.28% | $18,777 | |||||

| 180 Days | $21,733 | -0.57% | $21,610 | |||||

|

8.00% |

9 Years | $10,850 | -2.06% | $10,627 | ||||

| 7 Years | $12,776 | -1.61% | $12,571 | |||||

| 5 Years | $15,040 | -1.15% | $14,867 | |||||

| 2 Years | $19,215 | -0.46% | $19,126 | |||||

| 180 Days | $21,733 | -0.11% | $21,708 | |||||

|

7.00% |

9 Years | $10,850 | 6.47% | $11,552 | ||||

| 7 Years | $12,776 | 5.00% | $13,414 | |||||

| 5 Years | $15,040 | 3.55% | $15,573 | |||||

| 2 Years | $19,215 | 1.40% | $19,484 | |||||

| 180 Days | $21,733 | 0.34% | $21,808 | |||||

|

6.00% |

9 Years | $10,850 | 15.84% | $12,569 | ||||

| 7 Years | $12,776 | 12.11% | $14,324 | |||||

| 5 Years | $15,040 | 8.51% | $16,321 | |||||

| 2 Years | $19,215 | 3.32% | $19,853 | |||||

| 180 Days | $21,733 | 0.81% | $21,909 | |||||

|

4.00% |

9 Years | $10,850 | 37.45% | $14,914 | ||||

| 7 Years | $12,776 | 28.07% | $16,362 | |||||

| 5 Years | $15,040 | 19.33% | $17,948 | |||||

| 2 Years | $19,215 | 7.32% | $20,623 | |||||

| 180 Days | $21,733 | 1.76% | $22,115 |

A-5

Appendix B

NATIONWIDE LIFE INSURANCE COMPANY AND SUBSIDIARIES

2012 Form S-1 MD&A and

Consolidated Financial Statements

B-1

BUSINESS

Overview

Nationwide Life Insurance Company ("NLIC",

or collectively with its subsidiaries, "the Company") was incorporated in 1929 and is an Ohio domiciled stock life insurance company. The Company is a member of the Nationwide group of companies ("Nationwide"), which is comprised of Nationwide

Mutual Insurance Company ("NMIC") and all of its subsidiaries and affiliates.

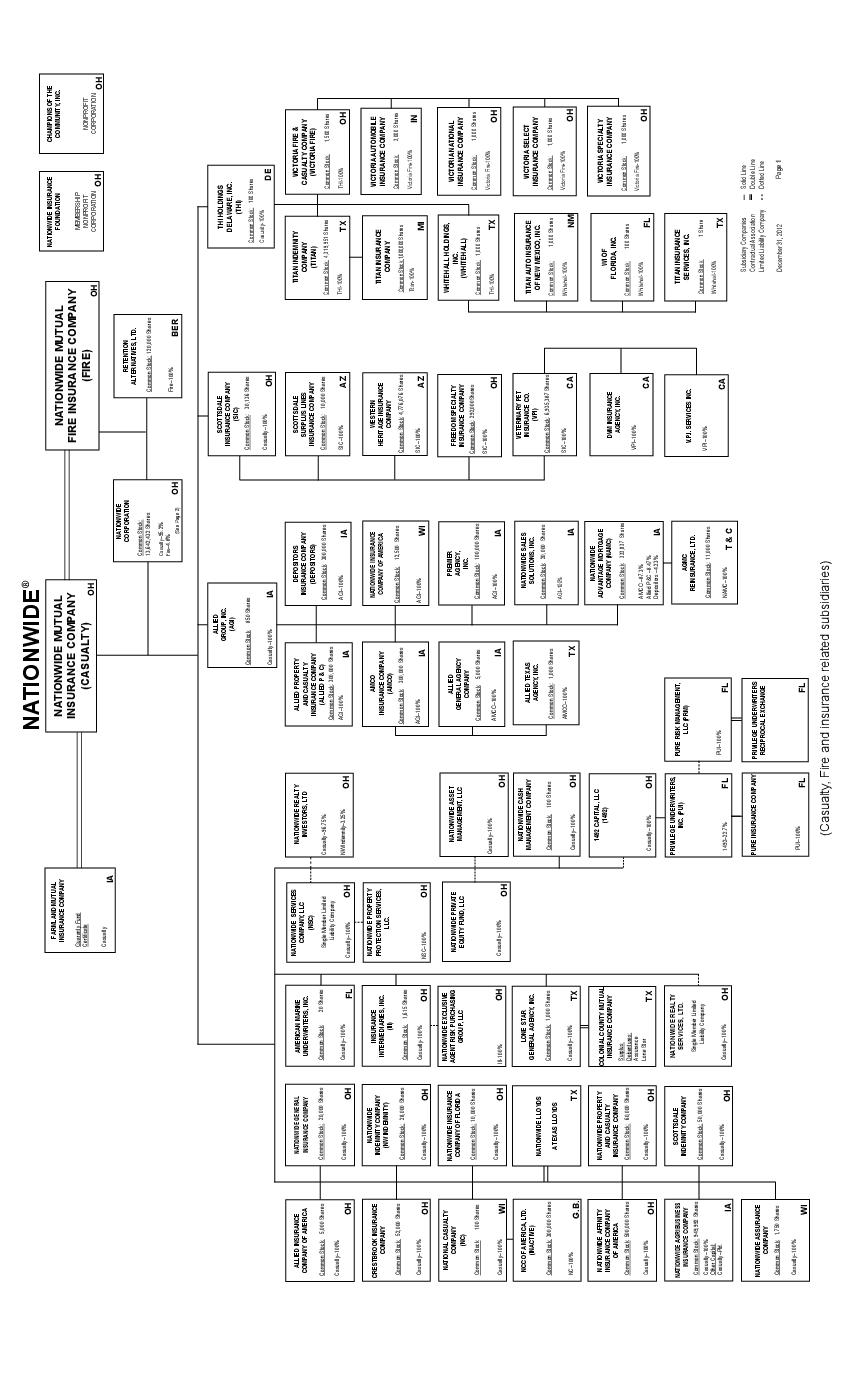

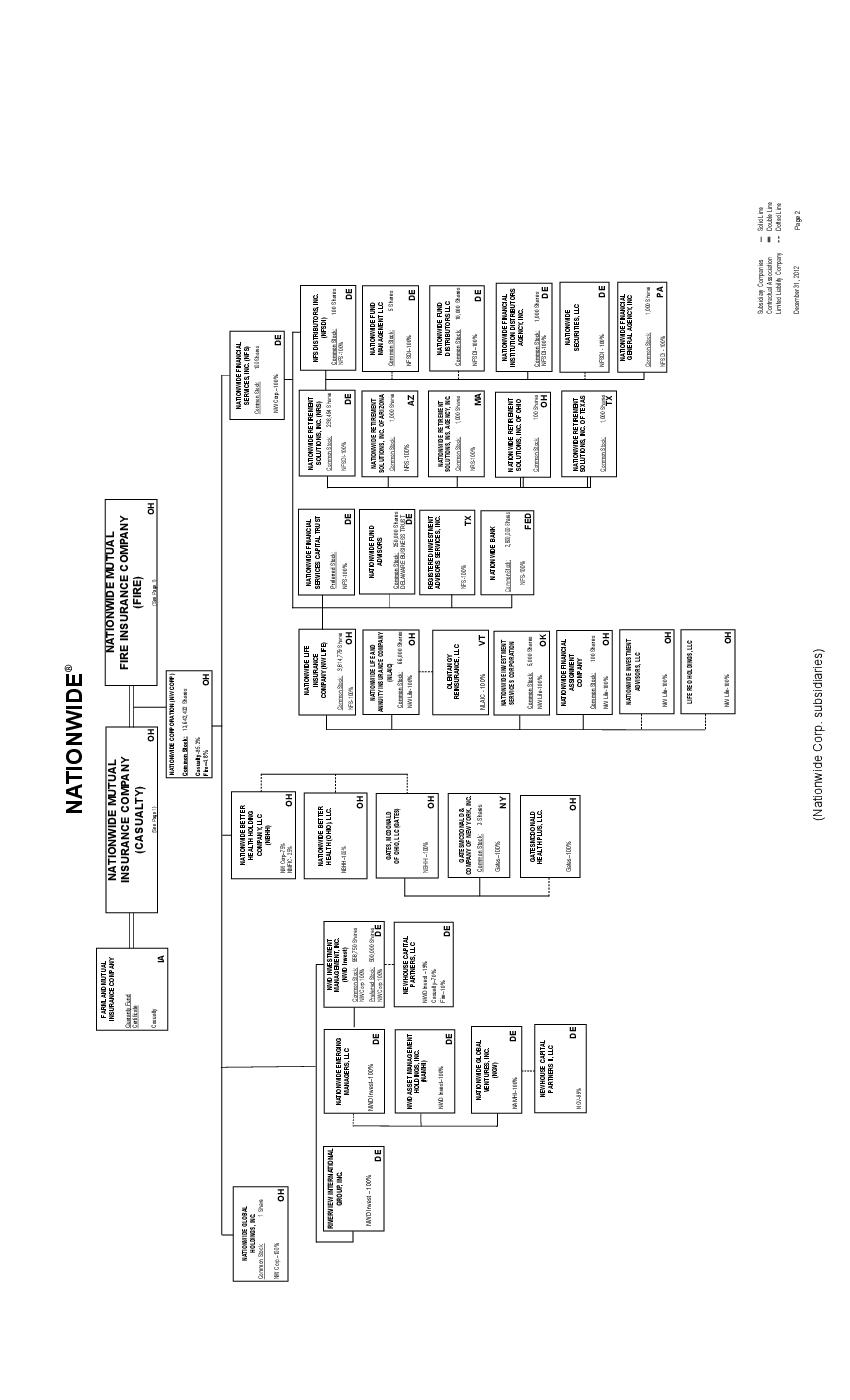

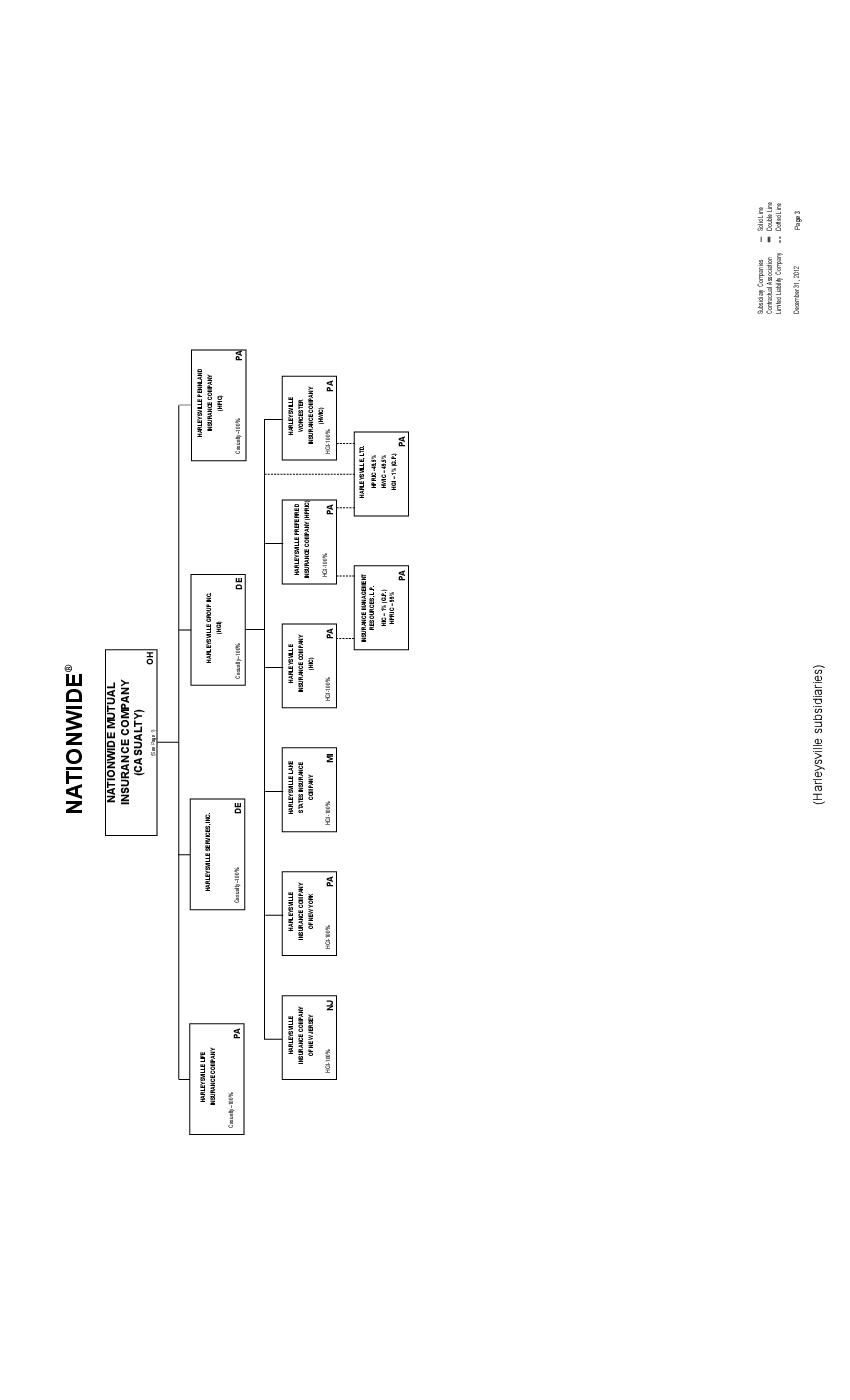

All of the outstanding shares of NLIC's common stock are owned

by Nationwide Financial Services, Inc. ("NFS"), a holding company formed by Nationwide Corporation ("Nationwide Corp."), a majority-owned subsidiary of NMIC.

Wholly-owned subsidiaries of NLIC as of December 31, 2012

include Nationwide Life and Annuity Insurance Company ("NLAIC") and Nationwide Investment Services Corporation ("NISC"). NLAIC primarily offers individual annuity contracts, universal life insurance, variable universal life insurance, term life

insurance and corporate-owned life insurance ("COLI") on a non-participating basis. NISC is a registered broker-dealer.

The Company is a leading provider of long-term savings and

retirement products in the United States of America ("U.S."). The Company develops and sells a diverse range of products including individual annuities, private and public sector group retirement plans, investment products sold to institutions, life

insurance and investment advisory services.

Business Segments

Management views the Company's business

primarily based on its underlying products and uses this basis to define its four reportable segments: Individual Products & Solutions – Annuity (formerly named Individual Investments), Retirement Plans, Individual Products & Solutions

– Life and Nationwide Business Solutions Group ("NBSG") (formerly named Individual Protection), and Corporate and Other.

The primary segment profitability measure that management uses

is a non-GAAP financial measure called pre-tax operating earnings (loss), which is calculated by adjusting income before federal income taxes to exclude: (1) net realized investment gains and losses, except for operating items (trading portfolio

realized gains and losses, trading portfolio valuation changes and net realized gains and losses related to hedges on guaranteed minimum death benefit ("GMDB") contracts); (2) other-than-temporary impairment losses; (3) the adjustment to

amortization of deferred policy acquisition costs ("DAC") and value of business acquired ("VOBA") related to net realized investment gains and losses; and (4) net losses attributable to noncontrolling interest.

The following table summarizes pre-tax operating earnings

(loss) by segment for the years ended:

| (in millions) | December 31, 2012 | December 31, 20111 | December 31, 20101 | |||

|

Individual Products & Solutions - Annuity |

$220 | $284 | $161 | |||

|

Retirement Plans |

$196 | $193 | $191 | |||

|

Individual Products & Solutions - Life and NBSG |

$241 | $283 | $263 | |||

|

Corporate and Other |

$ (82) | $ (55) | $ (36) |

| 1 | Prior year results reflect a change in accounting principle, as described in Note 2 of the audited consolidated financial statements included in the F pages of this report. |

Individual Products & Solutions - Annuity

The Individual Products & Solutions - Annuity segment

consists of individual annuity products marketed under the Nationwide DestinationSM and other Nationwide-specific or private label brands. Deferred annuity contracts provide the customer with

tax-deferred accumulation of savings and flexible payout options including lump sum, systematic withdrawal or a stream of payments for life. In addition, deferred variable annuity contracts provide the customer with access to a wide range of

investment options and asset protection features, while deferred fixed annuity contracts generate a return for the customer at a specified interest rate fixed for prescribed periods. Immediate annuities differ from deferred annuities in that the

initial premium is exchanged for a stream of income for a certain period and/or for the owner's lifetime without future access to the original investment. The majority of assets and recent sales for the Individual Products & Solutions - Annuity

segment consist of deferred variable annuities.

B-2

The following table summarizes selected

financial data for the Company's Individual Products & Solutions - Annuity segment for the years ended:

| (in millions) | December 31, 2012 | December 31, 2011 | December 31, 2010 | |||

|

Total revenues |

$ 1,660 | $ 1,483 | $ 1,342 | |||

|

Account values as of year end |

$56,786 | $52,733 | $49,211 |

Retirement Plans

The Retirement Plans segment is comprised of the Company's

private and public sector retirement plans business. The private sector primarily includes Internal Revenue Code ("IRC") Section 401 fixed and variable group annuity business, and the public sector primarily includes IRC Section 457 and Section

401(a) business, both in the form of full-service arrangements that provide plan administration and fixed and variable group annuities as well as administration-only business.

The following table summarizes selected financial data for the

Company's Retirement Plans segment for the years ended:

| (in millions) | December 31, 2012 | December 31, 2011 | December 31, 2010 | |||

|

Total revenues |

$ 830 | $ 811 | $ 789 | |||

|

Account values as of year end |

$26,644 | $24,871 | $25,208 |

Individual Products & Solutions

– Life and NBSG

The Individual Products &

Solutions - Life and NBSG segment consists of life insurance products, including individual variable universal life, COLI and bank-owned life insurance ("BOLI") products, traditional life insurance products and fixed universal life insurance

products. Life insurance products provide a death benefit and generally allow the customer to build cash value on a tax-advantaged basis.

The following table summarizes selected financial data for the

Company's Individual Products & Solutions - Life and NBSG segment for the years ended:

| (in millions) | December 31, 2012 | December 31, 2011 | December 31, 2010 | |||

|

Total revenues |

$ 1,514 | $ 1,459 | $ 1,437 | |||

|

Life insurance policy reserves as of year end |

$ 22,427 | $ 20,928 | $ 20,628 | |||

|

Life insurance in force as of year end |

$155,699 | $148,930 | $144,175 |

Corporate and Other

The Corporate and Other segment includes non-operating

realized gains and losses and related amortization, including mark-to-market adjustments on embedded derivatives, net of economic hedges, related to products with living benefits included in the Individual Products & Solutions - Annuity segment;

other-than-temporary impairment losses; and other revenues and expenses not allocated to other segments. Additionally, this segment includes the medium-term note ("MTN") program which concluded in the fourth quarter of 2012.

The following table summarizes selected financial data for the

Company's Corporate and Other segment for the years ended:

| (in millions) | December 31, 2012 | December 31, 2011 | December 31, 2010 | |||

|

Operating revenues |

$24 | $ 68 | $ 80 | |||

|

Funding agreements backing MTNs |

$ - | $292 | $799 |

Additional information related to

the Company's business segments is included in Note 18 to the audited consolidated financial statements included in the F pages of this report.

Marketing and Distribution

The Company sells its products through a

diverse distribution network. Unaffiliated entities that sell the Company's products to their own customer bases include independent broker-dealers, financial institutions, wirehouse and regional firms, pension plan administrators, and life

insurance specialists. Representatives of affiliates who market products directly to a customer base include Nationwide Retirement Solutions, Inc. ("NRS"), and Nationwide Financial Network ("NFN") producers, which includes the agency distribution

force of the Company's ultimate parent company, NMIC. The Company believes its broad range of competitive products, strong distributor relationships and diverse distribution network position it to compete effectively in the rapidly growing

retirement savings market.

B-3

Unaffiliated Distribution

Independent Broker-Dealers and Regional Firms. The Company sells individual annuities, group retirement plans and life insurance through independent broker-dealers (including brokerage general agencies and producer groups in the Individual Products &

Solutions - Life and NBSG segment) and regional firms in each state and the District of Columbia. The Company believes that it has developed strong broker-dealer relationships based on its diverse product mix, large selection of fund options and

administrative technology. In addition to such relationships, the Company believes its financial strength and the Nationwide brand name are competitive advantages in these distribution channels. The Company regularly seeks to expand this

distribution network.

Financial Institutions and

Wirehouses. The Company markets individual variable and fixed annuities (under its brand names and on a private label basis), private sector retirement plans and life insurance through financial institutions

and wirehouses, consisting primarily of banks and their subsidiaries. The Company believes that it has competitive advantages in this distribution channel, including its expertise in training financial institution personnel to sell annuities, life

insurance and pension products, its breadth of product offerings, its financial strength, the Nationwide brand name, and the ability to offer private label products.

Pension Plan

Administrators. The Company markets group retirement plans organized pursuant to IRC Section 401 and sponsored by employers as part of employee retirement programs through regional pension plan administrators.

The Company also has linked pension plan administrators to the financial planning community to sell group pension products. The Company targets employers with 25 to 2,000 employees because it believes that these plan sponsors tend to require

extensive record-keeping services from pension plan administrators and therefore are more likely to become long-term customers.

Life Insurance

Specialists. The Company markets COLI and BOLI through life insurance specialists, which are firms that specialize in the design, implementation and administration of executive benefit plans.

Affiliated Distribution

NRS.

The Company markets various products and services to the public sector, primarily on a retail basis, through several sales organizations. The Company markets group variable annuities and fixed annuities as well as administration and record-keeping

services to state and local governments for use in their IRC Section 457 and Section 401(a) retirement programs. The Company maintains endorsement arrangements with state and local government entities, including the National Association of Counties

("NACo") and The International Association of Fire Fighters ("IAFF").

NFN Producers. NFN

producers distribute Nationwide life insurance, annuity, mutual fund and group annuity products to individuals through Nationwide exclusive agents and independent agents. Nationwide agents sell traditional, universal and variable universal life

insurance products and individual annuities through the licensed agency distribution force of NMIC. Nationwide agents primarily target the holders of personal automobile and homeowners' insurance policies issued by NMIC and affiliated

companies.

Reinsurance

The Company follows the industry practice of

reinsuring with other companies a portion of its life insurance and annuity risks in order to reduce net liability on individual risks, to provide protection against large losses, obtain greater diversification of risks and statutory capital relief.

The maximum amount of individual ordinary life insurance retained by the Company on any one life is $10 million. The Company cedes insurance on both an automatic basis, whereby risks are ceded to a reinsurer on specific blocks of business where the

underlying risks meet certain predetermined criteria, and on a facultative basis, whereby the reinsurer's prior approval is required for each risk reinsured.

The Company has entered into reinsurance contracts with

certain unaffiliated reinsurers to cede a portion of its general account life, annuity and health business. Total amounts recoverable under these reinsurance contracts including ceded reserves, paid and unpaid claims, and certain other amounts

totaled $684 million and $704 million as of December 31, 2012 and 2011, respectively. Under the terms of the contracts, specified assets are generally placed in trusts as collateral for the recoveries. The trust assets are invested in investment

grade securities, the fair value of which must at all times be greater than or equal to 100% or 102% of the reinsured reserves, as outlined in each of the underlying contracts. Certain portions of the Company's variable annuity guaranteed benefit

risks are also reinsured. These treaties reduce the Company's exposure to death benefit and income benefit guarantee risk in the Individual Products & Solutions - Annuity segment. The Company has no other material reinsurance arrangements with

unaffiliated reinsurers.

B-4

The Company's only material reinsurance

agreements with affiliates are the modified coinsurance agreements pursuant to which NLIC ceded to other members of Nationwide all of its accident and health insurance business not ceded to unaffiliated reinsurers, as described in Note 17 to the

audited consolidated financial statements included in the F pages of this report.

Ratings

Ratings with respect to claims-paying ability and financial

strength are one factor in establishing the competitive position of insurance companies. These ratings represent each agency's opinion of an insurance company's financial strength, operating performance, strategic position and ability to meet its

obligations to policyholders. Such factors are important to policyholders, agents and intermediaries. They are not evaluations directed toward the protection of investors and are not recommendations to buy, sell or hold securities. Rating agencies

utilize quantitative and qualitative analysis, including the use of key performance indicators, financial and operating ratios and proprietary capital models to establish ratings for the Company and certain subsidiaries. The Company's ratings are

continuously evaluated relative to its performance as measured using these metrics and the impact that changes in the underlying business in which it is engaged can have on such measures. In an effort to minimize the adverse impact of this risk, the

Company maintains regular communications with the rating agencies, performs evaluations utilizing its own calculations of these key metrics and considers such evaluation in the way it conducts its business.

Ratings are important to maintaining public

confidence in the Company and its ability to market its annuity and life insurance products. Rating agencies continually review the financial performance and condition of insurers, including the Company. Any lowering of the Company's ratings could

have an adverse effect on the Company's ability to market its products and could increase the rate of surrender of the Company's products. Both of these consequences could have an adverse effect on the Company's liquidity and, under certain

circumstances, net income. NLIC and NLAIC each have financial strength ratings of "A+" (Superior) from A.M. Best Company, Inc. ("A.M. Best"). Their claims-paying ability/financial strength are rated "A1" (Good) by Moody's Investors Service, Inc.

("Moody's") and "A+" (Strong) by Standard & Poor's Rating Services ("S&P"). The Company's financial strength is also reflected in the ratings of its commercial paper, which is rated "AMB-1" by A.M. Best, "P-1" by Moody's and "A-1" by

S&P.

These ratings are subject to

ongoing review by A.M. Best, Moody's and S&P, and the maintenance of such ratings cannot be assured. If any rating is reduced from its current level, the Company's financial position and results of operations could be adversely affected.

Competition

The Company competes with many other

insurers as well as non-insurance financial services companies, some of whom offer alternative products and, with respect to other insurers, have higher ratings than the Company. While no single company dominates the marketplace, many of the

Company's competitors have greater financial resources and larger market share than the Company. Competition in the Company's lines of business primarily is based on price, product features, commission structure, perceived financial strength,

claims-paying ability, customer and producer service, and name recognition.

Regulation

Regulation at State Level

NLIC and NLAIC, as with other insurance companies, are subject

to regulation by the states in which they are domiciled and/or transact business. All states have enacted legislation that requires each insurance holding company and each insurance company in an insurance holding company system to register with the

insurance regulatory authority of the insurance company's state of domicile and annually furnish financial and other information concerning the operations of companies within the holding company system that materially affect the operations,

management or financial condition of the insurers within such system. Under such laws, a state insurance authority usually must approve in advance the direct or indirect acquisition of 10% or more of the voting securities of an insurance company

domiciled in its state.

NLIC and NLAIC are subject to the insurance

holding company laws in the State of Ohio. Under such laws, all transactions within an insurance holding company system affecting insurers must be fair and equitable, and each insurer's policyholder surplus following any such transaction must be

reasonable in relation to the insurer's outstanding liabilities and adequate to its financial needs. The State of Ohio insurance holding company laws also require prior notice or regulatory approval of the change of control of an insurer or its

holding company, material intercorporate transfers of assets within the holding company structure and certain other material transactions involving entities within the holding company structure.

B-5

NLIC and NLAIC are regulated and supervised

in the jurisdictions in which they do business. Among other things, states regulate operating licenses; agent licenses; advertising and marketing practices; the form and content of insurance policies, including pricing; the type and amount of

investments; statutory capital requirements; payment of dividends by insurance subsidiaries; assessments by guaranty associations; affiliate transactions and claims practices. The Company cannot predict the effect that any proposed or future

legislation may have on the financial condition or results of operations of the Company.

Insurance companies are required to file detailed annual and

quarterly statutory financial statements with state insurance regulators in each of the states in which they do business, and their business and accounts are subject to examination by such regulators at any time. In addition, insurance regulators

periodically examine an insurer's financial condition, adherence to statutory accounting practices, and compliance with insurance department rules and regulations. Applicable state insurance laws, rather than federal bankruptcy laws, apply to the

liquidation or restructuring of insurance companies. Changes in regulations, or in the interpretation of existing laws or regulations, may adversely impact pricing, reserve adequacy or exposure to litigation and could increase the costs of

regulatory compliance by the Company's insurance subsidiaries. Any proposed or future state legislation or regulations may negatively impact the Company's financial position or results of operations. Effective with the annual reporting period ending

December 31, 2010, the National Association of Insurance Commissioners ("NAIC") adopted revisions to the Annual Financial Reporting Model Regulation, or the Model Audit Rule ("MAR"), related to auditor independence, corporate governance and

internal control over financial reporting. The adopted revisions require that NLIC and NLAIC each file reports with state insurance departments regarding management's assessment of internal controls over financial reporting. The requirements of the

revised MAR did not impact the Company's financial position or results of operations.

As part of their routine regulatory oversight process, state

insurance departments periodically conduct detailed examinations of the books, records and accounts of insurance companies domiciled in their states. Such examinations generally are conducted in coordination with the insurance departments of other

domestic states under guidelines promulgated by the NAIC. The most recently completed financial examination of NLIC and NLAIC was conducted by the Ohio Department of Insurance ("ODI") for the five-year period ended December 31, 2006 on behalf of

itself and several other states. The examination was completed during the first quarter of 2008 and did not result in any significant issues or adjustments. The ODI has begun an exam of the five- year period ended December 31, 2011 on behalf of

itself and several other states which is expected to be completed in 2013.

The Company files income tax returns in the U.S. federal

jurisdiction and various state jurisdictions. With few exceptions, the Company is no longer subject to U.S. federal, state or local income tax examinations by tax authorities through the 2008 tax year. The IRS is conducting an examination of the

Company's U.S. income tax returns for the years 2009 through 2010. Any adjustments that may result from IRS examination of tax returns are not expected to have a material effect on the results of operations, cash flows or financial position of the

Company.

State insurance regulatory authorities

regularly make inquiries, hold investigations and administer market conduct examinations with respect to insurers' compliance with applicable insurance laws and regulations. NLIC and NLAIC are currently undergoing regulatory market conduct

examinations in four states. NLIC and NLAIC continuously monitor sales, marketing and advertising practices and related activities of their agents and personnel and provide continuing education and training in an effort to ensure compliance with