|

OHIO

|

6311

|

31-4156830

|

|

(State or other jurisdiction of incorporation or organization)

|

(Primary Standard Industrial Classification Code Number)

|

(I.R.S. Employer

Identification Number)

|

|

Approximate date of commencement of proposed sale to the public: April 29, 2011

|

|

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box.

|

[X]

|

|

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

|

[ ]

|

|

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

|

[ ]

|

|

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

|

[ ]

|

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

[ ]

|

|

Large accelerated filer

|

[ ]

|

|

Accelerated filer

|

[ ]

|

|

Non-accelerated filer (Do not check if a smaller reporting company)

|

[X]

|

|

Smaller reporting company

|

[ ]

|

|

·

|

Is NOT a bank deposit

|

|

·

|

Is NOT FDIC insured

|

|

·

|

Is NOT insured or endorsed by a bank or any government agency

|

|

·

|

Is NOT available in every state

|

|

SUMMARY OF THE CONTRACTS |

1

|

|

|

Preliminary note regarding terms used in this prospectus.

|

||

|

What is the Contract?

|

||

|

How does the Contract generally work?

|

||

|

How much will the Contract cost?

|

||

|

What are the requirements to purchase the Contract?

|

||

|

Who is Envestnet?

|

||

|

What are the Eligible Portfolios and how are they managed by Envestnet?

|

||

|

Eligible Portfolios Summary.

|

||

| Can a Contract be purchased by an Individual Retirement Account? | ||

|

Can the Contract Owner cancel the Contract?

|

||

|

Does the Contract contain any type of spousal benefit?

|

||

|

RISK FACTORS |

13

|

|

|

Your Account may perform well enough that you may not receive any Guaranteed Lifetime Payments from Nationwide under the Contract.

|

||

|

Your investment choices are limited by the Contract.

|

||

|

You may die before receiving payments from us.

|

||

|

Early Withdrawals or Excess Withdrawals will reduce or eliminate the Guarantee provided by your Contract.

|

||

|

The Fee will reduce the growth of Your Account.

|

||

|

Actions of your creditors may reduce or eliminate the Guarantee provided by your Contract.

|

||

|

Envestnet may no longer manage the Eligible Portfolios.

|

||

|

Nationwide determines that an Eligible Portfolio is no longer eligible as an investment option under the Contract.

|

||

|

Nationwide's claims paying ability.

|

||

|

Tax Consequences.

|

||

|

YOUR RELATIONSHIP WITH ENVESTNET AND NATIONWIDE |

14

|

|

|

The Contract.

|

||

|

Management of Your Account.

|

||

|

THE ACCOUNT PHASE |

15

|

|

|

What is the Guaranteed Lifetime Withdrawal Base and how is it calculated?

|

||

|

Can the Guaranteed Lifetime Withdrawal Base change?

|

||

|

Do Early Withdrawals and Excess Withdrawals affect the Guaranteed Lifetime Withdrawal Amount and the Guaranteed Lifetime Withdrawal Base differently?

|

||

|

What is the Withdrawal Start Date and what does it mean?

|

||

|

What is the Guaranteed Lifetime Withdrawal Amount and how is it calculated?

|

||

|

What if the Account Value and the Guaranteed Lifetime Withdrawal Base decline to zero during the Account Phase?

|

||

|

What if the Account Value falls to the Minimum Account Value before the Withdrawal Start Date but your Guaranteed Lifetime Withdrawal Base is above zero?

|

||

|

TRIGGERING THE ANNUITY PHASE |

19

|

|

|

What events will trigger the Annuity Phase?

|

||

|

How is the Contract transitioned into the Annuity Phase?

|

||

|

THE ANNUITY PHASE |

19

|

|

|

How much will each Guaranteed Lifetime Payment be?

|

||

|

Will the Guaranteed Lifetime Payments ever increase or decrease?

|

||

|

How often are the Guaranteed Lifetime Payments paid?

|

||

|

How long will the Guaranteed Lifetime Payments be paid?

|

||

|

TERMS AND CONDITIONS OF THE CONTRACT |

20

|

|

What does it mean to have a change in "terms and conditions" of the Contract?

|

|

|

How will a change to the terms and conditions of the Contract affect an existing Contract?

|

|

|

SPOUSAL CONTINUATION OPTION |

20

|

|

What is the Spousal Continuation Option?

|

|

|

Election of the Spousal Continuation Option.

|

|

|

How much does the Spousal Continuation Option cost?

|

|

|

Is it possible to pay for the Spousal Continuation Option but not receive a benefit from it?

|

|

|

THE CONTRACT FEE |

21

|

|

How much is the Contract Fee?

|

|

|

When and how is the Contract Fee assessed?

|

|

|

Will the Contract Fee be the same amount from quarter to quarter?

|

|

|

Will advisory and other fees impact the Account Value and the Guarantee under the Contract?

|

|

|

MANAGING WITHDRAWALS FROM YOUR ACCOUNT |

23

|

|

DEATH PROVISIONS |

24

|

|

MARRIAGE TERMINATION PROVISIONS |

25

|

|

Marriage termination in the Account Phase.

|

|

|

Marriage termination in the Annuity Phase.

|

|

|

SUSPENSION AND TERMINATION PROVISIONS |

26

|

|

What does it mean to have a suspended Contract?

|

|

|

What will cause a Contract to be suspended?

|

|

|

What can be done to take the Contract out of suspension?

|

|

|

Specific suspension events and their cures.

|

|

|

What will cause a Contract to be terminated?

|

|

|

DETERMINING WHETHER A CONTRACT IS RIGHT FOR YOU |

28

|

|

FEDERAL INCOME TAX CONSIDERATIONS |

29

|

|

Taxation of Distributions from the Contract.

|

|

|

Taxation of Eligible Portfolios or Former Eligible Portfolios that are not held by an Individual Retirement Account.

|

|

|

Additional Medicare Tax.

|

|

|

Section 1035 Exchanges.

|

|

|

Qualified Retirement Plans.

|

|

|

Income Tax Withholding.

|

|

|

State and Local Tax Considerations.

|

|

|

Non-Resident Aliens.

|

|

|

Payment of Advisory or Service Fees.

|

|

|

Seek Tax Advice.

|

|

|

PREMIUM TAXES |

32

|

|

MISCELLANEOUS PROVISIONS |

32

|

|

Ownership of the Contract.

|

|

|

Periodic communications to Contract Owners.

|

|

|

Amendments to the Contract.

|

|

|

Assignment.

|

|

|

Misstatements.

|

|

|

DISTRIBUTION (MARKETING) OF THE CONTRACT |

33

|

|

LEGAL OPINION |

33

|

|

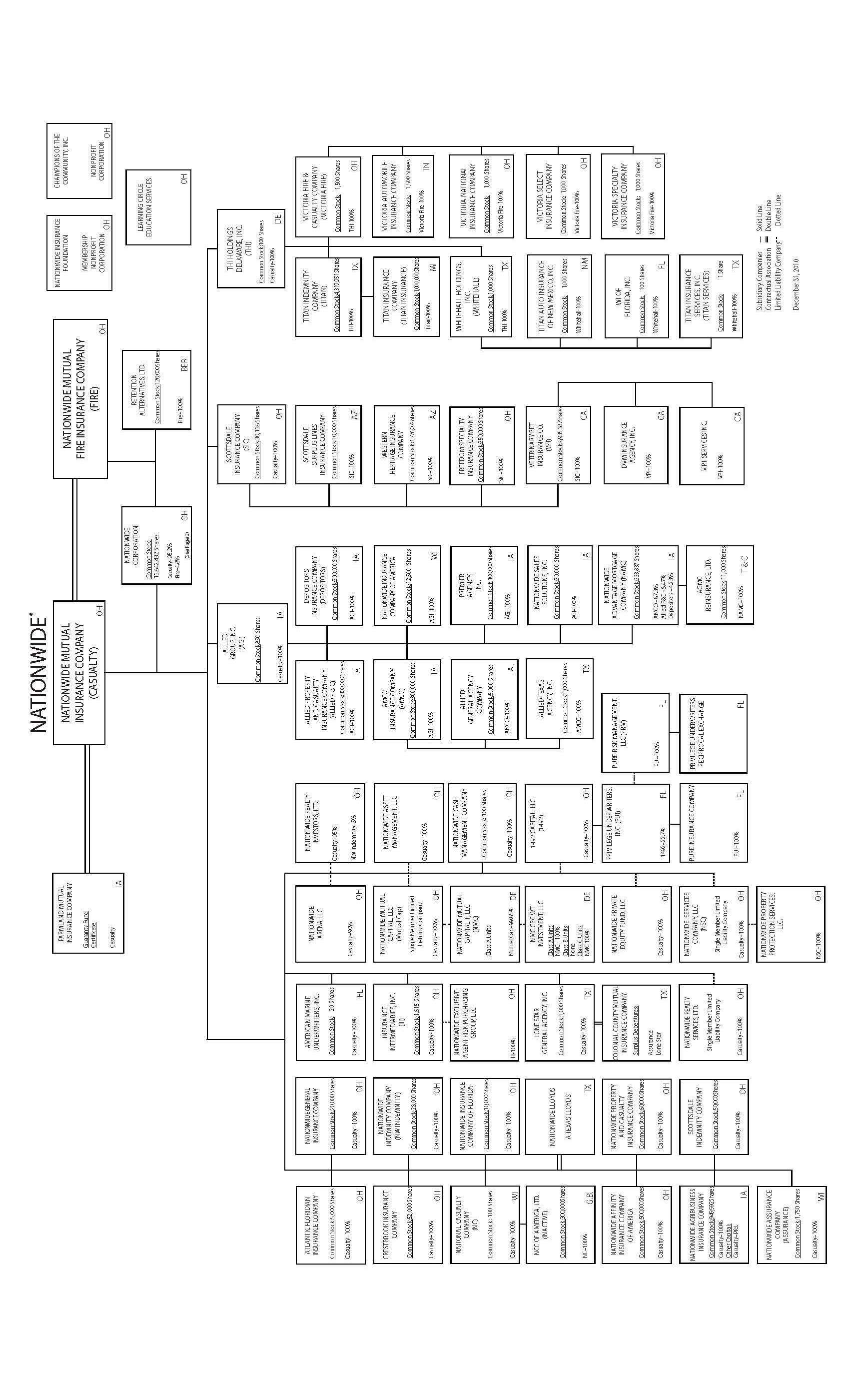

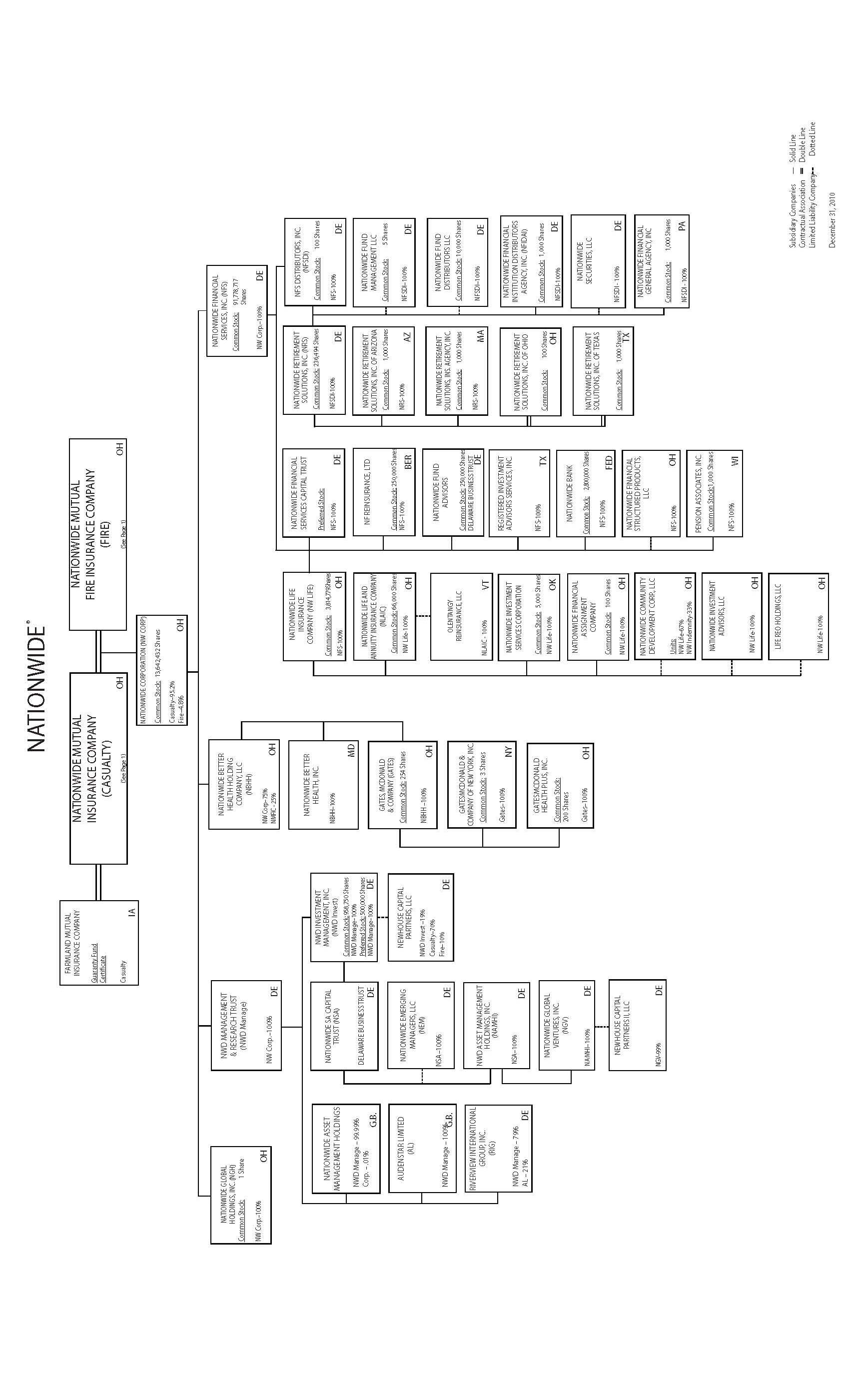

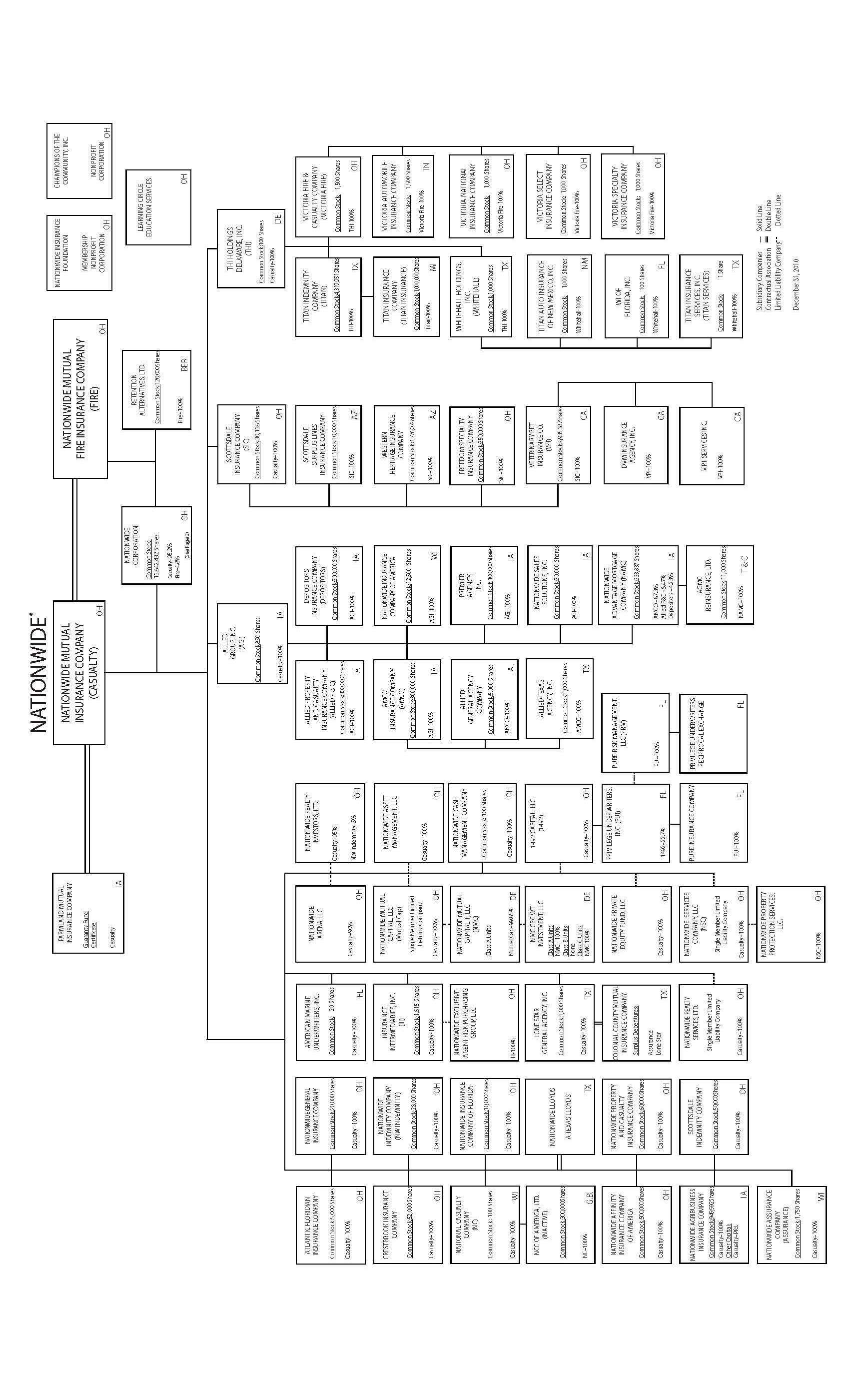

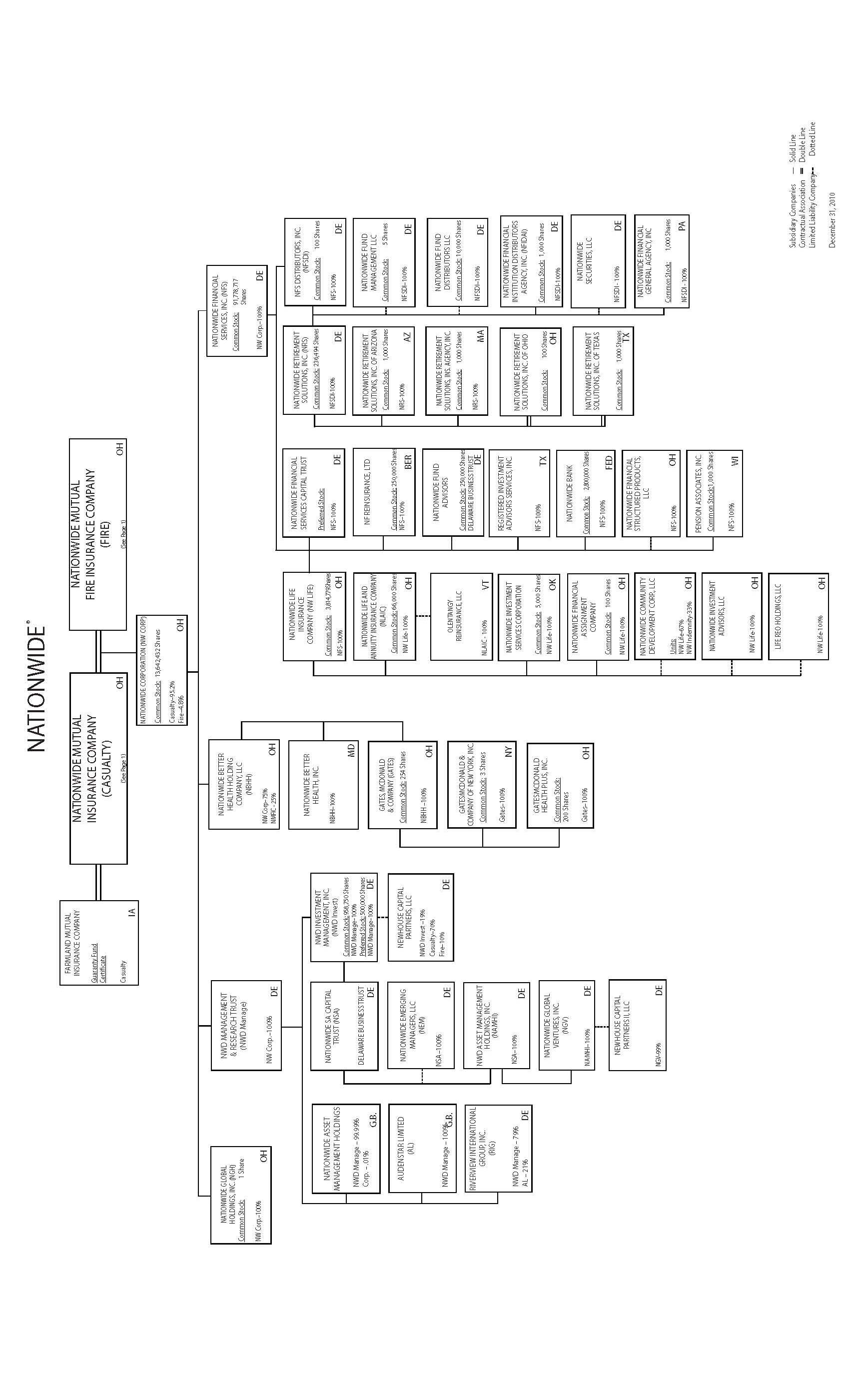

ABOUT NATIONWIDE |

33

|

|

EXPERTS |

34

|

|

DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION |

34

|

|

DEFINITIONS |

35

|

|

APPENDIX A |

A-1

|

|

Ø

|

"We," "us," "our," "Nationwide" or the "Company" means Nationwide Life Insurance Company.

|

|

Ø

|

"You" or "yours," "owner" or "Contract Owner" means the owner of the Contract. If more than one owner is named, each owner may also be referred to as a "Joint Owner." Joint Owners are permitted only when they are spouses as recognized by applicable Federal law.

|

|

Ø

|

"Your Account" means the account you own, the assets of which are allocated to an advisory account managed by Envestnet Asset Management, Inc. ("Envestnet"). Envestnet provides Your Account, which is offered through investment advisor representatives, and the Contract is offered by a registered representative affiliated with a broker-dealer firm ("Financial Advisors"). You must purchase a Contract with the assistance of these Financial Advisors. Financial Advisors assist clients in analyzing whether Envestnet's advisory accounts are appropriate for the client. If your Financial Advisor recommends an Envestnet account to you, upon your request, Envestnet will open Your Account.

|

|

·

|

Your Account Value, after reaching the day you are eligible to begin taking annual withdrawals of the Guaranteed Lifetime Withdrawal Amount (the "Withdrawal Start Date"), falls below the greater of $15,000 or the Guaranteed Lifetime Withdrawal Amount (the "Minimum Account Value");

|

|

·

|

Your Account Value is invested in the Minimum Account Value Eligible Portfolio, as discussed in "Suspension and Termination Provisions", and you reach your Withdrawal Start Date; or

|

|

·

|

You, after reaching the Withdrawal Start Date, affirmatively elect to begin the Annuity Phase by submitting the appropriate administrative forms.

|

|

During the Account Phase:

|

During the Annuity Phase:

|

|

|

Maximum Contract Fee Percentage

(as an annual percentage of your Guaranteed Lifetime Withdrawal Base, assessed quarterly)

|

2.00%1

|

0.00%

|

|

|

Who is Envestnet?

|

|

|

What are the Eligible Portfolios and how are they managed by Envestnet?

|

|

Eligible Portfolio

|

Annual Contract Fee Percentage

|

Target Allocations

|

||||||

|

PMC Select Portfolio -Conservative

|

0.90%

|

Large Cap Core

|

Large Cap Growth

|

Large Cap Value

|

Small Cap Core

|

Int'l Developed Markets

|

REITs

|

Long Bonds

|

|

0%

|

7.5-17.5%

|

7.5-17.5%

|

5-15%

|

5-15%

|

0%

|

0%

|

||

|

Composition

|

Intermediate Bonds

|

Int'l Bonds

|

Short Muni

|

Intermediate Muni

|

Long Muni

|

High Yield

|

Cash

|

|

|

45% equity

55% fixed

|

48-58%

|

0%

|

0%

|

0%

|

0%

|

0%

|

0-7%

|

|

|

Investment Strategy: Seeks to provide portfolio stability and current income with modest portfolio appreciation by investing in a combination of equity and fixed-income securities in similar weights. This portfolio is designed for investors with a need for regular income in the form of dividends and interest, as well as some desire for modest growth from the stock portion of their portfolio.

Benchmark: 10% Russell 2000, 10% MSCI EAFE, 12.5% Russell 1000 Growth, 12.5% Russell 1000 Value, 55% Lehman Aggregate Bond

|

||||||||

|

Eligible Portfolio

|

Annual Contract Fee

Percentage

|

Target Allocations

|

||||||

|

PMC Select Portfolio – Conservative Growth

|

1.00%

|

Large Cap Core

|

Large Cap Growth

|

Large Cap Value

|

Small Cap Core

|

Int'l Developed Markets

|

REITs

|

Long Bonds

|

|

0%

|

12.5-22.5%

|

12.5-22.5%

|

5-15%

|

10-20%

|

0%

|

0%

|

||

|

Composition

|

Intermediate Bonds

|

Int'l Bonds

|

Short Muni

|

Intermediate Muni

|

Long Muni

|

High Yield

|

Cash

|

|

|

60% equity

40% fixed

|

33-43%

|

0%

|

0%

|

0%

|

0%

|

0%

|

0-7%

|

|

|

Investment Strategy: Seeks to provide portfolio growth with current income by investing in a combination of equity and fixed-income securities in similar weights. This portfolio is designed for investors who desire capital appreciation balanced with income and portfolio stability.

Benchmark: 10% Russell 2000, 15% MSCI EAFE, 17.5% Russell 1000 Growth, 17.5% Russell 1000 Value, 40% Lehman Aggregate Bond

|

||||||||

|

Eligible Portfolio

|

Annual Contract Fee

Percentage

|

Target Allocations

|

|||||||||

|

PMC Select Portfolio – Moderate

|

1.10%

|

Large Cap Core

|

Large Cap Growth

|

Large Cap Value

|

Small Cap Core

|

Int'l Developed Markets

|

REITs

|

Long Bonds

|

|||

|

0%

|

15-25%

|

15-25%

|

5-15%

|

15-25%

|

0%

|

0%

|

|||||

|

Composition

|

Intermediate Bonds

|

Int'l Bonds

|

Short Muni

|

Intermediate Muni

|

Long Muni

|

High Yield

|

Cash

|

||||

|

70% equity

30% fixed

|

23-33%

|

0%

|

0%

|

0%

|

0%

|

0%

|

0-7%

|

||||

|

Investment Strategy: Seeks to provide long-term appreciation with moderate current income by investing in a combination of equity and fixed-income securities, with a greater weighting to equities. This portfolio is designed for investors with a mid to long-term investment time horizon and willing to take on some risk in pursuit of better returns.

Benchmark: 10% Russell 2000, 20% MSCI EAFE, 20% Russell 1000 Growth, 20% Russell 1000 Value, 30% Lehman Aggregate Bond

|

|||||||||||

|

Eligible Portfolio

|

Annual Contract Fee Percentage

|

Target Allocations

|

|||||||||

|

PMC Select Portfolio (with Municipals) -

Conservative

|

0.90%

|

Large Cap Core

|

Large Cap Growth

|

Large Cap Value

|

Small Cap Core

|

Int'l Developed Markets

|

REITs

|

Long Bonds

|

|||

|

0%

|

7.5-17.5%

|

7.5-17.5%

|

5-15%

|

5-15%

|

0%

|

0%

|

|||||

|

Composition

|

Intermediate Bonds

|

Int'l Bonds

|

Short Muni

|

Intermediate Muni

|

Long Muni

|

High Yield

|

Cash

|

||||

|

45% equity

55% fixed

|

0%

|

0%

|

0%

|

0%

|

48-58%

|

0%

|

0-7%

|

||||

|

Investment Strategy: Seeks to provide portfolio stability and current income with modest portfolio appreciation by investing in a combination of equity and fixed-income securities in similar weights. This portfolio is designed for investors with a need for regular income in the form of dividends and interest, as well as some desire for modest growth from the stock portion of their portfolio. One of the primary reasons municipal bonds are considered separately from other types of bonds is their special ability to provide tax-exempt income. Interest paid by the issuer to bond holders is often exempt from all federal taxes, as well as state or local taxes depending on the state in which the issuer is located, subject to certain restrictions. Therefore, for taxable accounts, it can be a tax advantage to invest in municipal bonds in lieu of core fixed income investments.

Benchmark: 10% Russell 2000, 10% MSCI EAFE, 12.5% Russell 1000 Growth, 12.5% Russell 1000 Value, 55% Lehman Muni Bond Composite

|

|||||||||||

|

Eligible Portfolio

|

Annual Contract Fee

Percentage

|

Target Allocations

|

||||||

|

PMC Select Portfolio (with Municipals) –

Conservative Growth

|

1.00%

|

Large Cap Core

|

Large Cap Growth

|

Large Cap Value

|

Small Cap Core

|

Int'l Developed Markets

|

REITs

|

Long Bonds

|

|

0%

|

12.5-22.5%

|

12.5-22.5%

|

5-15%

|

10-20%

|

0%

|

0%

|

||

|

Composition

|

Intermediate Bonds

|

Int'l Bonds

|

Short Muni

|

Intermediate Muni

|

Long Muni

|

High Yield

|

Cash

|

|

|

60% equity

40% fixed

|

0%

|

0%

|

0%

|

0%

|

33-43%

|

0%

|

0-7%

|

|

|

Investment Strategy: Seeks to provide portfolio growth with current income by investing in a combination of equity and fixed-income securities in similar weights. This portfolio is designed for investors who desire capital appreciation balanced with income and portfolio stability. One of the primary reasons municipal bonds are considered separately from other types of bonds is their special ability to provide tax-exempt income. Interest paid by the issuer to bond holders is often exempt from all federal taxes, as well as state or local taxes depending on the state in which the issuer is located, subject to certain restrictions. Therefore, for taxable accounts, it can be a tax advantage to invest in municipal bonds in lieu of core fixed income investments.

Benchmark: 10% Russell 2000, 15% MSCI EAFE, 17.5% Russell 1000 Growth, 17.5% Russell 1000 Value, 40% Lehman Muni Bond Composite

|

||||||||

|

Eligible Portfolio

|

Annual Contract Fee

Percentage

|

Target Allocations

|

||||||

|

PMC Select Portfolio (with Municipals) – Moderate

|

1.10%

|

Large Cap Core

|

Large Cap Growth

|

Large Cap Value

|

Small Cap Core

|

Int'l Developed Markets

|

REITs

|

Long Bonds

|

|

0%

|

15-25%

|

15-25%

|

5-15%

|

15-25%

|

0%

|

0%

|

||

|

Composition

|

Intermediate Bonds

|

Int'l Bonds

|

Short Muni

|

Intermediate Muni

|

Long Muni

|

High Yield

|

Cash

|

|

|

70% equity

30% fixed

|

0%

|

0%

|

0%

|

0%

|

23-33%

|

0%

|

0-7%

|

|

|

Investment Strategy: Seeks to provide long-term appreciation with moderate current income by investing in a combination of equity and fixed-income securities, with a greater weighting to equities. This portfolio is designed for investors with a mid to long-term investment time horizon and willing to take on some risk in pursuit of better returns. One of the primary reasons municipal bonds are considered separately from other types of bonds is their special ability to provide tax-exempt income. Interest paid by the issuer to bond holders is often exempt from all federal taxes, as well as state or local taxes depending on the state in which the issuer is located, subject to certain restrictions. Therefore, for taxable accounts, it can be a tax advantage to invest in municipal bonds in lieu of core fixed income investments.

Benchmark: 10% Russell 2000, 20% MSCI EAFE, 20% Russell 1000 Growth, 20% Russell 1000 Value, 30% Lehman Muni Bond Composite

|

||||||||

|

Eligible Portfolio

|

Annual Contract Fee

Percentage

|

Target Allocations

|

||||||

|

PMC SIGMATM Mutual Fund Solution – Conservative

|

1.00%

|

Large Cap Core

|

Large Cap Growth

|

Large Cap Value

|

Small Cap Core

|

Int'l Developed Markets

|

REITs

|

Long Bonds

|

|

10-20%

|

5-15%

|

0%

|

0-10%

|

5-15%

|

0-10%

|

5-15%

|

||

|

Composition

|

Intermediate Bonds

|

Int'l Bonds

|

Short Muni

|

Intermediate Muni

|

Long Muni

|

High Yield

|

Cash

|

|

|

45% equity

55% fixed

|

27-37%

|

0-10%

|

0%

|

0%

|

0%

|

0-10%

|

0-8%

|

|

|

Investment Strategy: The PMC SIGMATM Mutual Fund Solution - Conservative portfolio is designed for investors who desire a globally diversified portfolio managed within well defined levels of risk. The assets in the portfolio are allocated in accordance with the target allocations shown above. The target allocations are designed to achieve the portfolio's long-term return objectives, while limiting portfolio volatility. Over time, actual allocations will vary due to market movements, contributions and withdrawals. The portfolio will periodically be rebalanced to maintain (approximately) the target allocations. The long-term objective of the portfolio is 2% growth plus inflation as measured by the Consumer Price Index after deduction of all management fees. The portfolio is managed with the goal of keeping long-term volatility levels, on average, at 45% of the volatility of the S&P 500. The portfolio's return objective does not represent an estimate of future returns. The actual returns and volatility of the portfolio may vary significantly from the objectives.

Benchmark: 10% MSCI EAFE, 35% Russell 3000, 55% Lehman Govt/Credit

|

||||||||

|

Eligible Portfolio

|

Annual Contract Fee

Percentage

|

Target Allocations

|

||||||

|

PMC

SIGMATM Mutual Fund Solution – Conservative Growth

|

1.15%

|

Large Cap Core

|

Large Cap Growth

|

Large Cap Value

|

Small Cap Core

|

Int'l Developed Markets

|

REITs

|

Long Bonds

|

|

15-25%

|

10-20%

|

0%

|

0-10%

|

10-20%

|

0-10%

|

0%

|

||

|

Composition

|

Intermediate Bonds

|

Int'l Bonds

|

Short Muni

|

Intermediate Muni

|

Long Muni

|

High Yield

|

Cash

|

|

|

60 % equity

40% fixed

|

22-32%

|

0-10%

|

0%

|

0%

|

0%

|

0-10%

|

0-8%

|

|

|

Investment Strategy: The PMC SIGMATM Mutual Fund Solution - Conservative Growth portfolio is designed for investors who desire a globally diversified portfolio managed within well-defined levels of risk. The assets in the portfolio are allocated in accordance with the target allocations shown above. The target allocations are designed to achieve the portfolio's long term return objectives, while limiting portfolio volatility. Over time, actual allocations will vary due to market movements, contributions and withdrawals. The portfolio will periodically be rebalanced to maintain (approximately) the target allocations. The long-term objective of the portfolio is 3% growth plus inflation as measured by the Consumer Price Index after deduction of all management fees. The portfolio is managed with the goal of keeping long-term volatility levels, on average, at 60% of the volatility of the S&P 500. The portfolio's return objective does not represent an estimate of future returns. The actual returns and volatility of the portfolio may vary significantly from the objectives.

Benchmark: 15% MSCI EAFE, 45% Russell 3000, 40% Lehman Govt/Credit

|

||||||||

|

Eligible Portfolio

|

Annual Contract Fee

Percentage

|

Target Allocations

|

||||||

|

PMC SIGMATM Mutual Fund Solution – Moderate

|

1.30%

|

Large Cap Core

|

Large Cap Growth

|

Large Cap Value

|

Small Cap Core

|

Int'l Developed Markets

|

REITs

|

Long Bonds

|

|

20-30%

|

10-20%

|

0%

|

0-10%

|

15-25%

|

0-10%

|

0%

|

||

|

Composition

|

Intermediate Bonds

|

Int'l Bonds

|

Short Muni

|

Intermediate Muni

|

Long Muni

|

High Yield

|

Cash

|

|

|

70% equity

30% fixed

|

12-22%

|

0-10%

|

0%

|

0%

|

0%

|

0-10%

|

0-8%

|

|

|

Investment Strategy: The PMC SIGMATM Mutual Fund Solution - Moderate portfolio is designed for investors who desire a globally diversified portfolio managed within well defined levels of risk. The assets in the portfolio are allocated in accordance with the target allocations shown above. The target allocations are designed to achieve the portfolio's long-term return objectives, while limiting portfolio volatility. Over time, actual allocations will vary due to market movements, contributions and withdrawals. The portfolio will periodically be rebalanced to maintain (approximately) the target allocations. The long-term objective of the portfolio is 4% growth plus inflation as measured by the Consumer Price Index after deduction of all management fees. The portfolio is managed with the goal of keeping long-term volatility levels, on average, at 70% of the volatility of the S&P 500. The portfolio's return objective does not represent an estimate of future returns. The actual returns and volatility of the portfolio may vary significantly from the objectives.

Benchmark: 20% MSCI EAFE, 50% Russell 3000, 30% Lehman Govt/Credit

|

||||||||

|

Eligible Portfolio

|

Annual Contract Fee

Percentage

|

Target Allocations

|

||||||

|

PMC SIGMATM Mutual Fund Solution (with Municipals) –

Conservative

|

1.00%

|

Large Cap Core

|

Large Cap Growth

|

Large Cap Value

|

Small Cap Core

|

Int'l Developed Markets

|

REITs

|

Long Bonds

|

|

10-20%

|

5-15%

|

0%

|

0-10%

|

5-15%

|

0-10%

|

0%

|

||

|

Composition

|

Intermediate Bonds

|

Int'l Bonds

|

Short Muni

|

Intermediate Muni

|

Long Muni

|

High Yield

|

Cash

|

|

|

45% equity

55% fixed

|

0%

|

0%

|

2-12%

|

40-50%

|

0%

|

0%

|

0-8%

|

|

|

Investment Strategy: The PMC SIGMATM Mutual Fund Solution - Conservative (with Municipals) portfolio is designed for investors who desire a globally diversified portfolio managed within well-defined levels of risk. The assets in the portfolio are allocated in accordance with the target allocations shown above. The target allocations are designed to achieve the portfolio's long-term return objectives, while limiting portfolio volatility. Over time, actual allocations will vary due to market movements, contributions and withdrawals. The portfolio will periodically be rebalanced to maintain (approximately) the target allocations. The long-term objective of the portfolio is 2% growth plus inflation as measured by the Consumer Price Index after deduction of all management fees. The portfolio is managed with the goal of keeping long-term volatility levels, on average, at 45% of the volatility of the S&P 500. The portfolio's return objective does not represent an estimate of future returns. The actual returns and volatility of the portfolio may vary significantly from the objectives. One of the primary reasons municipal bonds are considered separately from other types of bonds is their special ability to provide tax-exempt income. Interest paid by the issuer (i.e., the municipality, state or local government) to bond holders is often exempt from all federal taxes, as well as state or local taxes depending on the state in which the issuer is located, subject to certain restrictions. Therefore, for taxable accounts, it can be a tax advantage to invest in municipal bonds in lieu of core fixed income investments.

Benchmark: 10% MSCI EAFE, 55% Lehman Muni Bond Composite, 35% Russell 3000

|

||||||||

|

Eligible Portfolio

|

Annual Contract Fee

Percentage

|

Target Allocations

|

||||||

|

PMC SIGMATM Mutual Fund Solution (with Municipals) – Conservative Growth

|

1.15%

|

Large Cap Core

|

Large Cap Growth

|

Large Cap Value

|

Small Cap Core

|

Int'l Developed Markets

|

REITs

|

Long Bonds

|

|

15-25%

|

10-20%

|

0%

|

0-10%

|

10-20%

|

0-10%

|

0%

|

||

|

Composition

|

Intermediate Bonds

|

Int'l Bonds

|

Short Muni

|

Intermediate Muni

|

Long Muni

|

High Yield

|

Cash

|

|

|

60% equity

40% fixed

|

0%

|

0%

|

2-12%

|

25-35%

|

0%

|

0%

|

0-8%

|

|

|

Investment Strategy: The PMC SIGMATM Mutual Fund Solution - Conservative Growth (with Municipals) portfolio is designed for investors who desire a globally diversified portfolio managed within well-defined levels of risk. The assets in the portfolio are allocated in accordance with the target allocations shown above. The target allocations are designed to achieve the portfolio's long-term return objectives, while limiting portfolio volatility. Over time, actual allocations will vary due to market movements, contributions and withdrawals. The portfolio will periodically be rebalanced to maintain (approximately) the target allocations. The long-term objective of the portfolio is 3% growth plus inflation as measured by the Consumer Price Index after deduction of all management fees. The portfolio is managed with the goal of keeping long-term volatility levels, on average, at 60% of the volatility of the S&P 500. The portfolio's return objective does not represent an estimate of future returns. The actual returns and volatility of the portfolio may vary significantly from the objectives. One of the primary reasons municipal bonds are considered separately from other types of bonds is their special ability to provide tax-exempt income. Interest paid by the issuer (i.e., the municipality, state or local government) to bond holders is often exempt from all federal taxes, as well as state or local taxes depending on the state in which the issuer is located, subject to certain restrictions. Therefore, for taxable accounts, it can be a tax advantage to invest in municipal bonds in lieu of core fixed income investments.

Benchmark: 10% MSCI EAFE, 55% Lehman Muni Bond Composite, 35% Russell 3000

|

||||||||

|

Eligible Portfolio

|

Annual Contract Fee

Percentage

|

Target Allocations

|

||||||

|

PMC

SIGMATM

Mutual Fund Solution (with Municipals) – Moderate

|

1.30%

|

Large Cap Core

|

Large Cap Growth

|

Large Cap Value

|

Small Cap Core

|

Int'l Developed Markets

|

REITs

|

Long Bonds

|

|

20-30%

|

10-20%

|

0%

|

0-10%

|

15-25%

|

0-10%

|

0%

|

||

|

Composition

|

Intermediate Bonds

|

Int'l Bonds

|

Short Muni

|

Intermediate Muni

|

Long Muni

|

High Yield

|

Cash

|

|

|

70% equity

30% fixed

|

0%

|

0%

|

0%

|

22-32%

|

0%

|

0%

|

0-8%

|

|

|

Investment Strategy: The PMC SIGMATM Mutual Fund Solution - Moderate (with Municipals) portfolio is designed for investors who desire a globally diversified portfolio managed within well-defined levels of risk. The assets in the portfolio are allocated in accordance with the target allocations shown above. The target allocations are designed to achieve the portfolio's long term return objectives, while limiting portfolio volatility. Over time, actual allocations will vary due to market movements, contributions and withdrawals. The portfolio will periodically be rebalanced to maintain (approximately) the target allocations. The long-term objective of the portfolio is 4% growth plus inflation as measured by the Consumer Price Index after deduction of all management fees. The portfolio is managed with the goal of keeping long-term volatility levels, on average, at 70% of the volatility of the S&P 500. The portfolio's return objective does not represent an estimate of future returns. The actual returns and volatility of the portfolio may vary significantly from the objectives. One of the primary reasons municipal bonds are considered separately from other types of bonds is their special ability to provide tax-exempt income. Interest paid by the issuer (i.e., the municipality, state or local government) to bond holders is often exempt from all federal taxes, as well as state or local taxes depending on the state in which the issuer is located, subject to certain restrictions. Therefore, for taxable accounts, it can be a tax advantage to invest in municipal bonds in lieu of core fixed income investments.

Benchmark: 20% MSCI EAFE, 30% Lehman Muni Bond Composite, 50% Russell 3000

|

||||||||

|

|

Definitions:

|

|

|

High Yield- An asset class that aims at high (relative) current yield from fixed income securities, has no quality or maturity restrictions, and tends to invest in lower grade debt issues.

|

|

|

Intermediate Bonds- An asset class that invests at least 65% of its assets in U.S. Treasury bills, notes and bonds with dollar-weighted average maturities of five to ten years.

|

|

|

Intermediate Muni- An asset class that limits assets to those securities that are exempt from taxation in a bond issued by a city or other local government or its agencies with an average maturity of five to ten years.

|

|

|

Int'l Bonds- An asset class that invests primarily in non-U.S. dollar and U.S. dollar debt securities of issuers located in at least three countries, excluding the U.S., except in periods of market weakness.

|

|

|

Int'l Developed Markets- An asset class that invests assets in securities with primary trading markets outside of the United States in developed international markets.

|

|

|

Large Cap Core- An asset class that, by portfolio practice, invests most of its U.S. equity assets in companies with large market capitalizations (typically $10+ billion companies). The Large Cap Core asset class seeks long-term growth of capital by investing in companies that are considered to be a blend between growth and value. The asset class will normally have an average price-to-earnings ratio, price-to-book ratio, and three-year earnings growth figure, as compared to the U.S. diversified large-cap asset class universe average.

|

|

|

Large Cap Growth- An asset class that, by portfolio practice, invests most of its U.S. equity assets in companies with large market capitalizations (typically $10+ billion companies). A Large Cap Growth asset class normally invests in companies with long-term earnings expected to grow significantly faster than the earnings of the stocks represented in a major unmanaged stock index. The asset class will normally have an above-average price-to-earnings ratio, price-to-book ratio, and three-year earnings growth figure, as compared to the U.S. diversified large-cap asset class universe average.

|

|

|

Large Cap Value- An asset class that, by portfolio practice, invests most of its U.S. equity assets in companies with large market capitalizations (typically $10+ billion companies). The Large Cap Value asset class seeks long-term growth of capital by investing in companies that are considered to be undervalued relative to a major unmanaged stock index based on price-to-current earnings, book value, asset value, or other factors. The asset class will normally have a below-average price-to-earnings ratio, price-to-book ratio, and three-year earnings growth figure, as compared to the U.S. diversified large-cap asset class universe average.

|

|

|

Long Bonds- An asset class that invests at least 65% of assets in U.S. Treasury bills, notes and bonds with dollar-weighted average maturities of ten to thirty years.

|

|

|

Long Muni- An asset class that limits assets to those securities that are exempt from taxation in a bond issued by a city or other local government or its agencies with an average maturity of ten to thirty years.

|

|

|

REITs- A security that sells like a stock on the major exchanges and invests in real estate directly, either through properties or mortgages.

|

|

|

Short Muni- An asset class that limits assets to those securities that are exempt from taxation in a bond issued by a city or other local government or its agencies with an average maturity of less than five years.

|

|

|

Small Cap Core- An asset class that, by portfolio practice, invests most of its U.S. equity assets in companies with small market capitalizations (typically under $2 billion companies). The Small-Cap core asset class seeks long-term growth of capital by investing in companies that are considered to be a blend between growth and value. The asset class will normally have an average price-to-earnings ratio, price-to-book ratio, and three-year earnings growth figure, as compared to the U.S. diversified small-cap asset class universe average.

|

|

|

Benchmark Indices:

|

|

These allocations are projections only and may be changed from time to time. Actual allocations are not limited to the ranges shown and ranges may vary from those shown above. The Envestnet Investment Committee monitors each Eligible Portfolio's and Former Eligible Portfolio's holdings and cash flow and will periodically adjust the Eligible Portfolio's and Former Eligible Portfolio's asset allocation to realign it with its profile and individual strategies. This means that allocation changes will be made as needed in the view of the Envestnet Investment Committee.

The Eligible Portfolios and Former Eligible Portfolios managed by Envestnet are subject to the same risks faced by similar advisory accounts available in the market, including, without limitation, market risk (the risk of an overall down market), interest rate risk (the risk that rising or declining interest rates will hurt your investment returns), idiosyncratic risk (the risk that an individual asset will hurt your returns), and concentration risk (the risk that due to concentrations in a certain segment of the market which performs poorly, your returns are lower than the overall market). The Eligible Portfolios may not achieve their respective investment objectives regardless of whether or not you purchase the Contract.

Some Eligible Portfolios may not be available through your Financial Advisor. For more information about any of the Eligible Portfolios, please read the prospectuses, Form ADV or other disclosure provided by your Financial Advisor.

You and your Financial Advisor manage Your Account. Envestnet does not receive any compensation from Nationwide associated with the sale of the Contracts or for administrative services associated with the Contract. The Financial Advisor and his or her firm do not receive any compensation from the sale of the Contract. Rather, they receive an advisory fee for advice provided in connection with the PMC Select Portfolios or the PMC SIGMATM Mutual Fund Solution portfolios, regardless of whether you purchase the Contract.

|

|

·

|

advising us and Envestnet that you want to terminate the Contract; or

|

|

·

|

liquidating all of the investments in Your Account.

|

|

1.

|

The Annual Benefit Base Review. The Contract contains an anniversary step-up feature (the "Annual Benefit Base Review") where if, on any Contract Anniversary, Your Account Value exceeds the Guaranteed Lifetime Withdrawal Base, we will automatically increase your Guaranteed Lifetime Withdrawal Base to equal that Account Value. The automatic Annual Benefit Base Review will continue until any terms and conditions associated with the Contract change. See "Terms and Conditions of the Contract" for an explanation of the impact upon the Guaranteed Lifetime Withdrawal Base if there is a terms and conditions change.

|

|

|

2.

|

Additional Deposits to Your Account. The Contract permits you to make Additional Deposits to Your Account during the Account Phase. Additional Deposits will result in an immediate increase to your Guaranteed Lifetime Withdrawal Base equal to the dollar amount of the Additional Deposit.

|

|

|

3.

|

Early Withdrawals from Your Account. An Early Withdrawal is any withdrawal you take from Your Account prior to your Withdrawal Start Date (discussed later in this provision). Early Withdrawals will result in a decrease to your Guaranteed Lifetime Withdrawal Base. The amount of that decrease will be the greater of (a) or (b), where:

|

|

(a)

|

= the dollar amount of the Early Withdrawal; and

|

|

(b)

|

=

|

a "proportional amount" derived from the following calculation: (A ÷ B) × C, where:

|

|

A =

|

the dollar amount of the Early Withdrawal;

|

|

B =

|

Your Account Value on the date of the Early Withdrawal; and

|

|

C =

|

your Guaranteed Lifetime Withdrawal Base on the date of the Early Withdrawal.

|

|

Example Early Withdrawal Calculations

|

||||

|

In this example, the Account Value is greater than the Guaranteed Lifetime Withdrawal Base.

|

In this example, the Account Value is less than the Guaranteed Lifetime Withdrawal Base:

|

|||

|

At the time of the Early Withdrawal:

|

At the time of the Early Withdrawal:

|

|||

|

Account Value=

|

$500,000

|

Account Value=

|

$400,000

|

|

|

Guaranteed Lifetime Withdrawal

Base=

|

$450,000

|

Guaranteed Lifetime Withdrawal

Base=

|

$450,000

|

|

|

Withdrawal Amount=

|

$15,000

|

Withdrawal Amount=

|

$15,000

|

|

|

Guaranteed Lifetime Withdrawal Base reduction calculations:

|

Guaranteed Lifetime Withdrawal Base reduction calculations:

|

|||

|

Dollar amount=

|

$15,000

|

Dollar amount=

|

$15,000

|

|

|

Proportional amount

($15,000 ÷ $500,000) x $450,000=

|

$13,500

|

Proportional amount

($15,000 ÷ $400,000) x $450,000=

|

$16,875

|

|

|

After the Early Withdrawal:

|

After the Early Withdrawal:

|

|||

|

Account Value

($500,000 - $15,000)=

|

$485,000

|

Account Value

($400,000 - $15,000)=

|

$385,000

|

|

|

Guaranteed Lifetime Withdrawal

Base

($450,000 - $15,000)=

|

$435,000

|

Guaranteed Lifetime Withdrawal

Base

($450,000 - $16,875)=

|

$433,125

|

|

|

4.

|

Excess Withdrawals from Your Account. Excess Withdrawals are any withdrawals taken after your Withdrawal Start Date that, during any calendar year, exceed the Guaranteed Lifetime Withdrawal Amount (discussed later in this provision). Excess Withdrawals will result in a decrease to your Guaranteed Lifetime Withdrawal Base. The amount of that decrease will be the greater of (a) or (b), where:

|

|

(a)

|

= the dollar amount of the Excess Withdrawal (the amount withdrawn during any calendar year in excess of the Guaranteed Lifetime Withdrawal Amount); and

|

|

|

(b)

|

=

|

a "proportional amount" derived from the following calculation: (A ÷ B) × C, where:

|

|

|

B =

|

Your Account Value (which will be reduced by any Guaranteed Lifetime Withdrawal Amount taken) on the date of the Excess Withdrawal; and

|

|

Example Excess Withdrawal Calculations

|

||||

|

In this example, the Account Value is greater than the Guaranteed Lifetime Withdrawal Base:

|

In this example, the Account Value is less than the Guaranteed Lifetime Withdrawal Base:

|

|||

|

At the time of the Excess Withdrawal:

|

At the time of the Excess Withdrawal:

|

|||

|

Account Value=

|

$500,000

|

Account Value=

|

$400,000

|

|

|

Guaranteed Lifetime Withdrawal

Base=

|

$450,000

|

Guaranteed Lifetime Withdrawal

Base=

|

$450,000

|

|

|

Guaranteed Lifetime Withdrawal

Amount=

|

$22,500

|

Guaranteed Lifetime Withdrawal

Amount=

|

$22,500

|

|

|

Withdrawal Amount=

|

$30,000

|

Withdrawal Amount=

|

$30,000

|

|

|

Excess Withdrawal Amount

($30,000 - $22,500)=

|

$7,500

|

Excess Withdrawal Amount

($30,000 - $22,500)=

|

$7,500

|

|

|

Guaranteed Lifetime Withdrawal Base reduction calculations:

|

Guaranteed Lifetime Withdrawal Base reduction calculations:

|

|||

|

Dollar amount=

|

$7,500

|

Dollar amount=

|

$7,500

|

|

|

Proportional amount

($7,500 ÷ $477,500) x $450,000=

|

$7,068

|

Proportional amount

($7,500 ÷ $377,500) x $450,000=

|

$8,940

|

|

|

After the Excess Withdrawal:

|

After the Excess Withdrawal:

|

|||

|

Account Value

($500,000 - $30,000)=

|

$470,000

|

Account Value

($400,000 - $30,000)=

|

$370,000

|

|

|

Guaranteed Lifetime Withdrawal

Base

($450,000 - $7,500)=

|

$442,500

|

Guaranteed Lifetime Withdrawal

Base

($450,000 - $8,940)=

|

$441,060

|

|

|

Guaranteed Lifetime Withdrawal Amount

|

=

|

Guaranteed Lifetime Withdrawal Base

|

X

|

Guaranteed Lifetime Withdrawal Percentage

|

|

(the amount you can withdraw each calendar year after your Withdrawal Start Date without reducing your Guaranteed Lifetime Withdrawal Base)

|

(your highest Account Value on any Contract Anniversary, adjusted for Additional Deposits, Early Withdrawals, and Excess Withdrawals)

|

5%

(4.5% if the Spousal Continuation Option is elected)

|

|

·

|

Your Account Value, after reaching the Withdrawal Start Date, falls below the greater of $15,000 or the Guaranteed Lifetime Withdrawal Amount (the "Minimum Account Value");

|

|

·

|

Your Account Value is invested in the Minimum Account Value Eligible Portfolio, as discussed in "Suspension and Termination Provisions", and you reach your Withdrawal Start Date; or

|

|

·

|

You, after reaching the Withdrawal Start Date, affirmatively elect to begin the Annuity Phase by submitting the appropriate administrative forms.

|

|

(1)

|

The Spousal Continuation Option must be elected at the time of application, and both spouses cannot be older than 85 years old at that time.

|

|

(2)

|

Both spouses (or a revocable trust of which either or both of the spouses is/are grantor(s)) must be named as owners of Your Account and Co-Annuitants of Your Contract. For Contracts issued to IRAs and Roth IRAs, you and your spouse must be Co-Annuitants, and the person for whom the IRA or Roth IRA was established must name their spouse as the sole beneficiary of Your Account.

|

|

(3)

|

If your marriage terminates due to divorce, dissolution, or annulment, or a Co-Annuitant dies either prior to the Withdrawal Start Date or after the Withdrawal Start Date but no withdrawals have been taken, we will remove the Spousal Continuation Option from your Contract upon notification from the remaining owner of the contract and evidence of the marriage termination that is satisfactory to Nationwide. After removal of the Spousal Continuation Option, the Guaranteed Lifetime Withdrawal Percentage will be 5%. Once the Spousal Continuation Option is removed from the Contract, the option may not be re-elected or added to cover a subsequent spouse.

|

|

(4)

|

If your marriage terminates due to divorce, dissolution, or annulment, or a Co-Annuitant dies on or after the Withdrawal Start Date, and you have taken one or more withdrawals, you may not remove the Spousal Continuation Option from the Contract. The remaining owner of the Contract will continue to receive withdrawals at the Guaranteed Lifetime Withdrawal Percentage of 4.5% for the duration of his or her lifetime, and upon notification from you in a form acceptable to Nationwide, your former spouse will no longer be eligible to receive withdrawals.

|

|

(5)

|

For Contracts with non-natural owners (other than IRAs), one spouse must be the Annuitant and the other spouse must be the Co-Annuitant.

|

|

(6)

|

Upon either Co-Annuitant's death, the surviving spouse must keep Your Account open and comply with all of the requirements of this Contract.

|

|

(7)

|

The Withdrawal Start Date is the date the younger spouse turns 65.

|

|

(8)

|

If you enter the Annuity Phase of the Contract, both you and your spouse must be named primary beneficiaries of the Contract at that time to ensure the Guaranteed Lifetime Payments will continue for both lives.

|

|

Contract Fee Percentage:

|

1.10%

|

|

Number of days in calendar quarter:

|

90

|

|

Number of days in the calendar year:

|

365

|

|

Guaranteed Lifetime Withdrawal Base

(as of the end of the previous quarter):

|

$500,000

|

|

Contract Fee Calculation:

$500,000 x 1.10% x (90 ÷ 365) =

|

$1,356

|

|

First:

|

Early Withdrawals and Excess Withdrawals will reduce your Guaranteed Lifetime Withdrawal Base. The reduction may be substantial, especially if Your Account Value is significantly lower than it was when the Guaranteed Lifetime Withdrawal Base was last computed or adjusted.

|

|

Second:

|

Once you are ready to begin taking withdrawals of the Guaranteed Lifetime Withdrawal Amount from Your Account, consider setting up a quarterly, monthly or other systematic withdrawal program through your advisor, custodian or other service provider. Doing so may help limit the risk that you will make an Excess Withdrawal.

|

|

Third:

|

Consider the timing of your withdrawals. Because your Guaranteed Lifetime Withdrawal Base can increase on your Contract Anniversary via the automatic Annual Benefit Base Review, the higher Your Account Value is on your Contract Anniversary, the more likely you will receive an increase in your Guaranteed Lifetime Withdrawal Base. You might have a higher Guaranteed Lifetime Withdrawal Base if you defer withdrawals until after your Contract Anniversary.

|

|

Fourth:

|

Consider that the longer you wait to begin taking withdrawals of the Guaranteed Lifetime Withdrawal Amount, the less likely it is that you will receive any Guaranteed Lifetime Payments. Taking withdrawals reduces Your Account Value. If you wait to begin taking withdrawals, you are likely to reach the Minimum Account Value later in your life, and at the same time, your remaining life expectancy will be shorter.

|

|

Annuitant's Death in

Account Phase

|

Annuitant's Death in

Annuity Phase

|

||

|

Sole Contract Owner

|

Sole Annuitant

(no Spousal Continuation Option)

|

The Contract terminates and we will make no payments under the Contract. We will return that portion of the current quarter's Contract Fee attributable to the time period between your death and the end of the current calendar quarter.

|

We will calculate the remaining amount of transferred Account Value that has not yet been paid to you in the form of Guaranteed Lifetime Payments. We will make payments to your beneficiary in the same frequency as the Account Phase in the amount equal to your Guaranteed Lifetime Withdrawals until that amount has been paid. If all remaining transferred Account Value has already been paid to you at the time of your death in the form of Guaranteed Lifetime Payments, we will make no further payments.

|

|

Co-Annuitants (spouses with the Spousal Continuation Option)

|

If the owner/Co-Annuitant of the Contract dies, the Contract will continue with the surviving Co-Annuitant as the sole Contract Owner and sole Annuitant.

|

· If the owner/Co-Annuitant of the Contract dies, we will continue to make Guaranteed Lifetime Payments to the surviving owner/Co-Annuitant for the duration of his or her lifetime.

· Upon the surviving owner/Co-Annuitant's death, we will calculate the remaining amount of transferred Account Value that has not yet been paid in the form of Guaranteed Lifetime Payments. We will make payments to your beneficiary in the same frequency as the Account Phase in the amount equal to the Guaranteed Lifetime Withdrawals until that amount has been paid.

|

|

Annuitant's Death in

Account Phase

|

Annuitant's Death in

Annuity Phase

|

||

|

Joint Contract Owners

(spouses)

|

Sole Annuitant

(no Spousal Continuation Option)

|

If a Joint Owner who is the Annuitant dies, the Contract terminates and we will make no payments under the Contract. We will return that portion of the current quarter's Contract Fee attributable to the time period between your death and the end of the current calendar quarter.

|

If a Joint Owner who is the Annuitant dies, we will calculate the remaining amount of transferred Account Value that has not yet been paid to you in the form of Guaranteed Lifetime Payments. We will make payments to your beneficiary in the same frequency as the Account Phase in the amount equal to your Guaranteed Lifetime Withdrawals until that amount has been paid. If all remaining transferred Account Value has already been paid to you at the time of your death in the form of Guaranteed Lifetime Payments, we will make no further payments.

|

|

If a Joint Owner who is not the Annuitant dies, the Contract will continue with the surviving Joint Owner/Annuitant as the sole Contract Owner.

|

If a Joint Owner who is not the Annuitant dies, the Contract will continue with the surviving Joint Owner/Annuitant as the sole Contract Owner receiving Guaranteed Lifetime Payments.

|

||

|

Co-Annuitants

(spouses with the Spousal Continuation Option)

|

If a Joint Owner/Co-Annuitant dies, the Contract will continue with the surviving Joint Owner/Co-Annuitant as the sole Contract Owner and sole Annuitant.

|

· If a Joint Owner/Co-Annuitant dies, we will continue to make Guaranteed Lifetime Payments to the surviving Joint Owner/Co-Annuitant for the duration of his or her lifetime.

· Upon the surviving Joint Owner/Co-Annuitant's death, we will calculate the remaining amount of transferred Account Value that has not yet been paid in the form of Guaranteed Lifetime Payments. We will make payments to your beneficiary in the same frequency as the Account Phase in the amount equal to the Guaranteed Lifetime Withdrawals until that amount has been paid.

|

|

·

|

If you remain the sole owner of Your Account, there will be no change to the Contract.

|

|

·

|

If your former spouse becomes the sole owner of Your Account, the Contract will be issued as a new Contract, with a new Guaranteed Lifetime Withdrawal Base with your former spouse as Contract Owner and Annuitant, and the Contract will terminate upon the death of the Annuitant. Alternately, the former spouse may elect to terminate the Contract.

|

|

·

|

If Your Account is divided between you and your former spouse, the Contract will be reissued as two Contracts (one to each of the former spouses). The Guarantee will not carry over and a new Guaranteed Lifetime Withdrawal Base will be established. Each former spouse will be the named Contract Owner and Annuitant of their respective reissued Contract, and each Contract will terminate upon the death of the respective Annuitant. Alternately, each former spouse may elect to terminate their respective Contract.

|

|

·

|

If Your Account is taken over solely by one of the Joint Owners (the "Receiving Joint Owner"), the Receiving Joint Owner may elect whether to have the Contract reissued with him/her as the sole Contract Owner and Annuitant, or continue the Contract with both former spouses remaining as Joint Owners and the Receiving Joint Owner as the Annuitant. In either situation, the Contract will terminate upon the death of the Annuitant. Alternately, the Receiving Joint Owner may elect to terminate the Contract.

|

|

·

|

If Your Account is divided between the Joint Owners (the former spouses), the Contract will be reissued as two Contracts (one to each of the former spouses), with the contractual Guarantee divided in proportion to the division of the assets in Your Account and a new Guaranteed Lifetime Withdrawal Base will be established for each Contract. The Joint Owners may remain as Joint Owners on each reissued Contract, with one former spouse named as Annuitant on each of the Contracts, or each may become the sole Contract Owner and Annuitant on their respective reissued Contract. In either situation, the Contract will terminate upon the death of the Annuitant. Alternately, each former spouse may elect to terminate their respective Contract.

|

|

·

|

You do not comply with any provision of this prospectus, including, but not limited to, the requirement that you invest the assets in Your Account in and as required by an Eligible Portfolio or Former Eligible Portfolio and the requirement that you execute an agreement that provides for the deduction and remittance of the Contract Fee;

|

|

·

|

Your Account Value falls below the Minimum Account Value;

|

|

·

|

Envestnet no longer manages the Eligible Portfolios or Former Eligible Portfolios; or

|

|

·

|

You make an Additional Deposit to Your Account without Home Office approval when the value of Your Account already exceeds $2,000,000, or you make an Additional Deposit to Your Account that causes Your Account to exceed $2,000,000.

|

|

1.

|

Make Additional Deposits to Your Account to bring Your Account Value above the Minimum Account Value;

|

|

2.

|

Transfer Your Account Value to the Minimum Account Value Eligible Portfolio. The Minimum Account Value Eligible Portfolio is only available to Contract Owners whose Account Value falls below the Minimum Account Value before the Withdrawal Start Date; or

|

|

3.

|

Terminate the Contract.

|

|

Minimum Account Value Eligible Portfolio

|

Target Allocations

|

Contract Fee

Percentage

|

||

|

PMC Core Fixed Income Fund

|

Bonds

|

Cash

|

Other

|

0.90%

|

|

Composition

100% Fixed

|

||||

|

Investment Objective - designed for investors who desire

a diversified fixed income portfolio managed within well-defined levels of risk. The objective of the fund is to provide current income consistent with low volatility of principal.

Benchmark: Lehman Aggregate Bond

|

76-86%

|

7-17%

|

0-10%

|

|

|

Ø

|

If you decide to transfer to a third party account approved by us, please keep in mind the following:

|

|

·

|

The charges for those products may be higher than the Contract Fee Percentage assessed in connection with your Contract;

|

|

·

|

You will not be charged any transfer fees by us other than the termination fees imposed by your custodian consistent with your custodial agreement; and

|

|

·

|

The value of the Guarantee transferred will be equal to the Guaranteed Lifetime Withdrawal Base on the Valuation Day of the transfer (a Valuation Day is any day the New York Stock Exchange is open for trading).

|

|

Ø

|

If you decide to transfer Your Account Value to an annuity contract that we, or one of our affiliates, offer, the amount transferred to the new annuity contract will be equal to the value of Your Account on the Valuation Day of the transfer, and your Guarantee will continue.

|

|

Ø

|

If you choose not to transfer Your Account Value, or fail to transfer Your Account Value before the end of the suspension period, the Contract and the Guarantee will terminate.

|

|

Ø

|

If you cure the issue before the termination date in a manner acceptable to us, the termination will not take effect.

|

|

Ø

|

If you decide to transfer to a third party account approved by us, please keep in mind the following:

|

|

·

|

The charges for those products may be higher than the Contract Fee Percentage assessed in connection with your Contract;

|

|

·

|

You will not be charged any transfer fees by us other than the termination fees imposed by your custodian consistent with your custodial agreement; and

|

|

·

|

The value of the Guarantee transferred will be equal to the Guaranteed Lifetime Withdrawal Base on the Valuation Day of the transfer.

|

|

Ø

|

If you decide to transfer Your Account Value to an annuity contract that we, or one of our affiliates, offer, the amount transferred to the new annuity contract will be equal to the value of Your Account on the Valuation Day of the transfer and your Guarantee will continue.

|

|

Excludable Amount

|

=

|

Guaranteed Lifetime Withdrawal

|

X

|

Contract Owner's investment in the Contract

|

|

the expected total amount of Guaranteed Lifetime Payments over the life of the Contract*

|

|

·

|

If you do not provide us with a taxpayer identification number; or

|

|

·

|

If we receive notice from the Internal Revenue Service that the taxpayer identification number furnished by you is incorrect.

|

|

·

|

Provide us with a properly completed withholding contract claiming the treaty benefit of a lower tax rate or exemption from tax; and

|

|

·

|

Provide us with an individual taxpayer identification number.

|

|

·

|

Sufficient evidence that the distribution is connected to the non-resident alien's conduct of business in the United States;

|

|

·

|

Sufficient evidence that the distribution is includable in the non-resident alien's gross income for United States federal income tax purposes; and

|

|

·

|

A properly completed withholding contract claiming the exemption.

|

|

Account Phase- The phase of the Contract from the time the Contract is issued until the Annuity Phase.

|

|

Account Value- The value of the assets in Your Account, as determined as of the close of business on a Valuation Date.

|

|

Additional Deposit(s) - Payments applied to Your Account after the Contract is issued.

|

|

Annuitant- The person whose life span is used to measure the Guarantee during the Account Phase and Annuity Phase under the Contract.

|

|

Annuity- The supplemental immediate fixed income annuity contract issued to you when you begin the Annuity Phase of the Contract.

|

|

Annuity Commencement Date- The date the Annuity is issued.

|

|

Annuity Phase- The phase of the Contract during which we are obligated to make Guaranteed Lifetime Payments to the Annuitant.

|

|

Client Agreement- The agreement you sign that, among other things, authorizes Envestnet to deduct the Contract Fee from Your Account and remit it to us on a quarterly basis and authorizes Envestnet to act as your investment advisor for the limited purpose of buying and selling securities within Your Account in order to maintain the allocations according to the Eligible Portfolio you select.

|

|

Co-Annuitant- If the Contract is jointly owned and you elect the Spousal Continuation Option, you must name a spouse as Co-Annuitant, which is the second person whose life span is used to measure the Guarantee during the Account Phase and Annuity Phase under the Contract.

|

|

Contract- A binding legal agreement between you and Nationwide. The Contract document contains critical information specific to your supplemental immediate fixed income annuity, including any endorsements or riders.

|

|

Contract Anniversary- The anniversary of the date we issue your Contract.

|

|

Contract Fee or Fee- The fee that is assessed quarterly from Your Account during the Account Phase and remitted to us by Envestnet.

|

|

Contract Fee Percentage- The annual percentage that is multiplied by your Guaranteed Lifetime Withdrawal Base to determine your Contract Fee.

|

|

Contract Owner or you- The person, entity and/or joint Contract Owner that maintains all rights under the Contract, including the right to direct who receives Guaranteed Lifetime Payments.

|

|

Contract Year- The one-year period starting on the date we issue the Contract and each Contract Anniversary thereafter.

|

|

Early Withdrawal- Any withdrawal you take from Your Account prior to the Withdrawal Start Date.

|

|

Excess Withdrawal- The portion of a withdrawal that is in excess of the Guaranteed Lifetime Withdrawal Amount.

|

|

General Account- An account that includes our company assets, which are available to our creditors.

|

|

Guarantee- Our obligation to pay you Guaranteed Lifetime Payments from us for the rest of your life, or your spouse's life if you elected the Spousal Continuation Option, provided that you comply with the terms of the Contract.

|

|

Guaranteed Lifetime Payments- Payments you receive during the Annuity Phase from Nationwide.

|

|

Guaranteed Lifetime Withdrawals- Withdrawals you make after the Withdrawal Start Date during the Account Phase. The amount of each Guaranteed Lifetime Withdrawal will be equal to your most recent Guaranteed Lifetime Withdrawal Amount.

|

|

Guaranteed Lifetime Withdrawal Amount- The amount that you can withdraw from Your Account each calendar year without reducing your Guaranteed Lifetime Withdrawal Base. This amount is non-cumulative, meaning that withdrawals not taken cannot be carried over from one year to the next.

|

|

Guaranteed Lifetime Withdrawal Base- The amount multiplied by the Guaranteed Lifetime Withdrawal Percentage to determine the Guaranteed Lifetime Withdrawal Amount. The Guaranteed Lifetime Withdrawal Base may increase or decrease, as described in this prospectus.

|

|

Guaranteed Lifetime Withdrawal Percentage- The percentage multiplied by the Guaranteed Lifetime Withdrawal Base to determine the Guaranteed Lifetime Withdrawal Amount.

|

|

Home Office- Our Home Office that is located at the address shown on the cover page of the prospectus.

|

|

Individual Retirement Account or IRA- An account that qualifies for favorable tax treatment under Section 408(a) of the Internal Revenue Code, but does not include Roth IRAs.

|

|

Joint Owner- One of two Contract Owners, each of which owns an undivided interest in the Contract. Joint owners must be spouses as recognized under applicable federal law.

|

|

Nationwide, we or us- Nationwide Life Insurance Company.

|

|

Non-Qualified Contract- A contract that does not qualify for favorable tax treatment under the Internal Revenue Code as an IRA, Roth IRA, SEP IRA, or Simple IRA.

|

|

Roth IRA- An account that qualifies for favorable tax treatment under Section 408A of the Internal Revenue Code.

|

|

SEC or Commission- Securities and Exchange Commission.

|

|

SEP IRA- An account that qualifies for favorable tax treatment under Section 408(k) of the Internal Revenue Code.

|

|

Simple IRA- An account that qualifies for favorable tax treatment under Section 408(p) of the Internal Revenue Code.

|

|

Valuation Date- Each day the New York Stock Exchange is open for business. The value of Your Account is generally determined at the end of each Valuation Date, which is generally at 4:00 pm EST, but may be earlier on certain days when the New York Stock Exchange is closed early.

|

|

Withdrawal Start Date- The date you are eligible to begin taking annual withdrawals of the Guaranteed Lifetime Withdrawal Amount from Your Account without decreasing your Guaranteed Lifetime Withdrawal Base. It is the date that you (or in the case of Co-Annuitants, the younger Co-Annuitant) turn age 65.

|

|

You- In this prospectus, "you" means the Contract Owner and/or Joint owners.

|

|

Your Account- The account you own that is managed by Envestnet.

|

|

(in millions)

|

2010

|

2009

|

2008

|

|||||

|

Individual Investments

|

$ 185

|

$ 288

|

$ (240)

|

|||||

|

Retirement Plans

|

$ 192

|

$ 136

|

$ 142

|

|||||

|

Individual Protection

|

$ 261

|

$ 192

|

$ 255

|

|||||

|

Corporate and Other

|

$ (36)

|

$ (4)

|

$ (127)

|

|

(in millions)

|

2010

|

2009

|

2008

|

||

|

Total revenues

|

$ 1,342

|

$ 1,107

|

$ 1,363

|

||

|

Account values as of year end

|

$ 49,211

|

$ 44,411

|

$ 39,551

|

|

(in millions)

|

2010

|

2009

|

2008

|

||

|

Total revenues

|

$ 789

|

$ 772

|

$ 772

|

||

|

Account values as of year end

|

$ 25,208

|

$ 24,133

|

$ 22,123

|

|

(in millions)

|

2010

|

2009

|

2008

|

||

|

Total revenues

|

$ 1,437

|

$ 1,405

|

$ 1,378

|

||

|

Life insurance policy reserves as of year end

|

$ 20,628

|

$ 19,175

|

$ 18,219

|

||

|

Life insurance in force as of year end

|

$ 144,175

|

$ 132,357

|

$ 132,992

|

|

(in millions)

|

2010

|

2009

|

2008

|

||

|

Operating revenues

|

$ 80

|

$ 145

|

$ 122

|

||

|

Funding agreements backing medium-term notes

|

$ 799

|

$ 1,652

|

$ 3,217

|

|

·

|

Systemic Risk and Reporting. Insurance holding companies could potentially be designated by the newly-created Financial Stability Oversight Council to pose systemic risk to the U.S. financial system. Such nonbank financial firms would be subject to supervision by the Federal Reserve under heightened prudential standards. The new Office of Financial Research and Federal Insurance Office will collect information from insurers; although they are required to the extent possible to rely upon the reports of existing regulatory authorities. |

|

·

|