12.31.2014 10K

|

| | | | |

| | | | |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

FORM 10-K

|

| |

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

OR |

| |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________ to __________

Commission File Number 000-00255

|

| |

GRAYBAR ELECTRIC COMPANY, INC. |

(Exact name of registrant as specified in its charter) |

| |

New York | 13-0794380 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| |

34 North Meramec Avenue, St. Louis, Missouri | 63105 |

(Address of principal executive offices) | (Zip Code) |

| |

(314) 573 – 9200 |

(Registrant’s telephone number, including area code) |

|

| |

Securities registered pursuant to Section 12(b) of the Act: | None |

| |

Securities registered pursuant to Section 12(g) of the Act: | Common Stock - Par Value $1.00 Per Share with a |

| Stated Value of $20.00 |

|

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. |

YES ¨ NO x |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. |

YES ¨ NO x |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. |

YES x NO ¨ |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). |

YES x NO ¨ |

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x |

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. |

|

Large accelerated filer ¨ Accelerated filer¨ |

Non-accelerated filer x (Do not check if a smaller reporting company) Smaller reporting company ¨ |

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). |

YES ¨ NO x |

The aggregate stated value of the Common Stock beneficially owned with respect to rights of disposition by persons who are not affiliates (as defined in Rule 405 under the Securities Act of 1933) of the registrant on June 30, 2014, was approximately $313,052,400. Pursuant to a Voting Trust Agreement, dated as of March 16, 2007, approximately 83% of the outstanding shares of Common Stock was held of record by five Trustees who were each directors or officers of the registrant and who collectively exercised the voting rights with respect to such shares at such date. The registrant is 100% owned by its active and retired employees, and there is no public trading market for the registrant’s Common Stock. See Item 5 of this Annual Report on Form 10-K. |

|

The number of shares of Common Stock outstanding at March 1, 2015 was 15,994,205. |

|

DOCUMENTS INCORPORATED BY REFERENCE |

|

Portions of the documents listed below have been incorporated by reference into the indicated Part of this Annual Report on Form 10-K: Information Statement relating to the 2014 Annual Meeting of Shareholders – Part III, Items 10-14 |

Graybar Electric Company, Inc. and Subsidiaries

Annual Report on Form 10-K

For the Fiscal Year Ended December 31, 2014

Table of Contents

|

| | |

| | Page |

PART I |

Item 1. | | |

Item 1A. | | |

Item 1B. | | |

Item 2. | | |

Item 3. | | |

Item 4. | | |

Supplemental Item | | |

| | |

PART II |

Item 5. | | |

Item 6. | | |

Item 7. | | |

Item 7A. | | |

Item 8. | | |

Item 9. | | |

Item 9A. | | |

Item 9B. | | |

| | |

PART III |

Item 10. | | |

Item 11. | | |

Item 12. | | |

Item 13. | | |

Item 14. | | |

| | |

PART IV |

Item 15. | | |

| | |

Signatures | | |

Index to Exhibits | | |

Certifications | | |

PART I

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

The following discussion should be read in conjunction with the accompanying audited consolidated financial statements of Graybar Electric Company, Inc. and its Subsidiaries (collectively referred to as “Graybar” or the “Company”) and sometimes referred to as "we", "our", or "us", the notes thereto, and Management’s Discussion and Analysis of Financial Condition and Results of Operations as of and for the year ended December 31, 2014, included in this Annual Report on Form 10-K. The results shown herein are not necessarily indicative of the results to be expected in any future periods.

Certain statements, other than purely historical information, including estimates, projections, statements relating to our business plans, objectives, and expected operating results, and the assumptions upon which those statements are based, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (“PSLRA”), Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements generally are identified by the words “believes”, “projects”, “expects”, “anticipates”, “estimates”, “intends”, “strategy”, “plan”, “may”, “will”, “would”, “will be”, “will continue”, “will likely result”, and other similar expressions. We intend such forward-looking statements to be covered by the safe-harbor provisions for forward-looking statements contained in the PSLRA. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties that may cause actual results to differ materially from the forward-looking statements. Our ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse impact on our operations and future prospects on a consolidated basis include, but are not limited to: general economic conditions, particularly in the residential, commercial, and industrial building construction industries, cyber-attacks, volatility in the prices of industrial commodities, disruptions in our sources of supply, a sustained interruption in the operation of our information systems, increased funding requirements and expenses related to our pension plan, compliance with increasing governmental regulations, adverse legal proceedings or other claims, and the inability, or limitations on our ability, to raise debt or equity capital. These risks and uncertainties should also be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, unless otherwise required by applicable securities law. Further information concerning our business, including additional factors that could materially impact our financial results, is included herein and in our other filings with the United States Securities and Exchange Commission (the “SEC” or “Commission”). Actual results and the timing of events could differ materially from the forward-looking statements as a result of certain factors, a number of which are outlined in Item 1A., “Risk Factors”, of this Annual Report on Form 10-K for the year ended December 31, 2014.

All dollar amounts are stated in thousands ($000s) except for per share data.

Item 1. Business

The Company

Graybar is a leading North American distributor of electrical and communications and data networking products, and a provider of related supply chain management and logistics services. We primarily serve customers in the construction, and commercial, institutional and government ("CIG"), as well as the industrial and utility vertical markets ("vertical" or "verticals"), with products and services that support new construction, infrastructure updates, building renovation, facility maintenance, repair and operations ("MRO"), and original equipment manufacturers ("OEM").

Through a network of over 260 locations across the United States and Canada, our 8,250 employees serve more than 130,000 customers. Our business is primarily based in the United States ("U.S."). We also have subsidiary operations with distribution facilities in Canada and Puerto Rico.

We distribute approximately one million products purchased from more than 4,600 manufacturers and suppliers. We purchase all of the products we sell from others, and we do not manufacture any products.

We generally finance our inventory through the collection of trade receivables and trade accounts payable terms with our suppliers. Short-term borrowing facilities are also used to finance inventory purchases and other operating expenses when necessary, and we have not historically used long-term borrowings for this purpose.

In addition to our extensive product offering, we provide a wide range of supply chain management services that when combined with our network of locations are designed to deliver convenience, cost savings and improved efficiency for our customers.

We were incorporated in 1925 under the laws of the State of New York. Our active and retired employees own 100% of our stock. There is no public trading market for our common stock.

Our internet address is www.graybar.com. Our periodic filings with the SEC, including annual reports on Form 10-K, quarterly reports on Form 10-Q, and amendments to those reports, are available without charge on our website www.graybar.com/company/about/sec-filings, as soon as reasonably practicable after we file the reports with the SEC. Additionally, a copy of our SEC filings can be obtained at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549 on official business days or by calling the SEC at 1-800-SEC-0330. A copy of our electronically filed materials can also be obtained at: http://www.sec.gov.

Competition

Our industry is comprised of thousands of local and regional distributors, along with several large national and global distributors. Graybar is among the largest distributors of electrical and communications and data networking products to the construction, CIG, and industrial and utility verticals in the U.S. Our industry is highly competitive, and we estimate that the top five distributors account for approximately 32% of the total U.S. market. Some of our largest competitors have greater global geographic scope, which may provide them an advantage, particularly with certain multi-national customers.

Our industry is influenced by economic and regulatory factors that impact rates of new construction, as well as customers' decisions to invest in renovation and expansion of facilities and infrastructure. The industry is also affected by changes in technology, both in the products that are typically sold through distribution and in the ways customers choose to transact business with distributors. Driven by customers' omnichannel buying preferences and their desire to increase efficiency and productivity, e-commerce is becoming increasingly important to both manufacturers and distributors in our industry.

Our pricing reflects the value associated with the products and services that we provide. We consider our prices to be generally competitive. We believe that, while price is an important customer consideration, the services we provide distinguishes us from many of our competitors, whether they are distributors or manufacturers selling direct. We view our ability to quickly supply our customers with a broad range of products through conveniently located distribution facilities as a competitive advantage that customers value. However, if a customer is not looking for one distributor to provide a wide range of products and does not require prompt delivery or other services, a competitor that does not provide this level of service may be in a position to offer a lower price.

Markets Served

Graybar serves a wide range of customers within certain primary verticals. The largest of these verticals is construction, which accounted for more than half our sales in 2014. Customers within this vertical include various types of contractors and installers that perform new construction and renovation of commercial and industrial facilities and utility infrastructure.

Our next largest vertical is CIG. This vertical includes a broad range of commercial office, warehouse, and retail facilities, federal, state, and local governmental agencies, education, and health care.

We also serve the industrial and utility vertical with products for MRO, OEM, broadband utility and electrical transmission and distribution infrastructure.

The following table provides the approximate percentages of our net sales attributable to each of the verticals we serve:

|

| | | |

Year Ended December 31, | 2014 | 2013 | 2012 |

Construction | 54.7% | 54.5% | 53.2% |

Commercial, Institutional & Government | 22.1% | 23.4% | 23.6% |

Industrial & Utility | 21.7% | 21.1% | 22.2% |

Products and Suppliers

We distribute approximately one million products purchased from more than 4,600 manufacturers and suppliers. Approximately 113,000 of these products are stocked in our warehouses, allowing us in most cases to provide customers with convenient, local access to the items they need every day. When the specialized nature or size of a particular shipment warrants, we arrange to ship products directly from our suppliers; otherwise, orders are filled from our own on-hand inventory. On a dollar volume basis, we filled approximately 56% of customer orders from our inventory in both 2014 and 2013.

Approximately 51% of the products we sold during 2014 were purchased from our top 25 suppliers. However, we generally have the ability to purchase from more than one supplier for any product type, which allows us to offer alternative sources of comparable products for nearly all products. The products we distribute can be generally identified as follows:

|

| |

• Building and Industrial Wire and Cable | |

• Switchgear and Distribution Equipment | |

• Communication Wire and Cable | |

| |

| |

| |

| |

| |

These products may be sold into any of the verticals we target, depending on a customer's needs. Our salesforce is empowered to sell any of these products or related services to any customer, in some cases, with the support of specialists who are trained in specific industries and/or new technologies.

Maintaining strong relationships with our suppliers is important to our business, and we enjoy longstanding relationships with several of our suppliers (or their predecessors). However, most of our supplier agreements are customarily nonexclusive national or regional distributorships, terminable upon 30 to 90 days' notice by either party.

Sales and Distribution

We sell products and services manufactured or provided by others primarily through a network of sales offices and distribution facilities located in thirteen geographical districts throughout the U.S. We operate multiple distribution facilities in each district, each of which carries an inventory of products and operates as a wholesale distributor for the territory in which it is located. Some districts have sales offices that do not carry inventory. In addition, we have seven national distribution centers and ten regional distribution centers containing inventories of both standard and specialized products. Both the national distribution centers and regional distribution centers replenish inventories carried at our other U.S. distribution facilities and make shipments directly to customers. We also have subsidiary operations with distribution facilities located in Canada and a single distribution facility in Puerto Rico.

The sales and distribution facilities operated by us at December 31, 2014 are shown below:

|

| | |

U.S. Locations | | |

District | Number of Sales and Distribution Facilities* | National Distribution Centers |

Atlanta | 22 | Austell, GA |

Boston | 13 | Fresno, CA |

California | 22 | Joliet, IL |

Chicago | 21 | Richmond, VA |

Dallas | 18 | Springfield, MO |

Minneapolis | 19 | Stafford, TX |

New York | 12 | Youngstown, OH |

Phoenix | 10 | |

Pittsburgh | 20 | |

Richmond | 19 | |

Seattle | 12 | |

St. Louis | 18 | |

Tampa | 19 | |

*Includes Regional Distribution Centers | |

International Locations | | |

| Number of Distribution Facilities | |

Graybar Electric Canada, Ltd.

Halifax, Nova Scotia, Canada | 30 | |

Graybar International, Inc.

Carolina, Puerto Rico | 1 | |

At December 31, 2014, we employed approximately 3,500 people in sales capacities. Approximately 1,600 of these sales personnel were inside and outside sales representatives working to generate sales with current and prospective customers. The remainder provided support services to our customers and our salesforce and consisted of sales and marketing managers, customer service representatives, quotation, and counter personnel.

We had orders on hand totaling $856,192 and $738,659 on December 31, 2014 and 2013, respectively. We expect that approximately 90% of the orders we had on hand at December 31, 2014 will be filled within the twelve-month period ending December 31, 2015. Generally, orders placed by customers and accepted by us have resulted in sales. However, customers from time to time request cancellation, and we have historically allowed such cancellations.

Foreign Sales

Sales to customers in foreign countries were made primarily by our subsidiaries in Canada and Puerto Rico and accounted for approximately 6% of consolidated sales in each of 2014, 2013, and 2012. Long-lived assets located outside the U.S. represented approximately 2% of our consolidated total assets at the end of 2014, 2013, and 2012. We do not have significant foreign currency exposure and, we do not believe there are any other significant risks attendant to our foreign operations.

Employees

At December 31, 2014, we employed approximately 8,250 people on a full-time basis. Approximately 150 of these people were covered by union contracts. We have not had a material work stoppage and consider our relations with our employees to be good.

Item 1A. Risk Factors

Our liquidity, financial condition, and results of operations are subject to various risks, including, but not limited to, those discussed below. The risks outlined below are those that we believe are currently the most significant, although additional risks not presently known to us or that we currently deem less significant may also impact our liquidity, financial condition, and results of operations.

Our sales fluctuate with general economic conditions, particularly in the residential, commercial, and industrial building construction industries. Our operating locations are widely distributed geographically across the U.S. and, to a lesser extent, Canada. Customers for our products and services are similarly diverse – we have approximately 130,000 customers and our largest customer accounts for only 3% of our total sales. While our geographic and customer concentrations are relatively low, our results of operations are, nonetheless, dependent on favorable conditions in both the general economy and the construction industry. In addition, conditions in the construction industry are greatly influenced by the availability of project financing and the cost of borrowing.

Our business and our reputation could be adversely affected by the failure to protect sensitive customer, employee or vendor data or to comply with evolving regulations relating to our obligation to protect our systems, assets and data from the threat of cyber-attacks. Cyber-attacks designed to gain access to sensitive information by breaching mission critical systems of large organizations are constantly evolving, and high profile electronic security breaches leading to unauthorized release of confidential information have occurred recently at a number of major U.S. companies, despite widespread recognition of the cyber-attack threat and improved data protection methods. While we have invested in the protection of our information technology and maintain what we believe are adequate security procedures and controls over financial and other individually identifiable customer, employee and vendor data provided to us, our business model is evolving rapidly and increasingly requires us to receive, retain and transmit certain information, including individually identifiable information, that our customers provide to purchase products or services, register on our websites, or otherwise communicate and interact with us. A breach in our systems that results in the unauthorized release of individually identifiable customer or other sensitive data could have a material adverse effect on our reputation and lead to financial losses from remedial actions, loss of business or potential liability. An electronic security breach resulting in the unauthorized release of sensitive data from our information systems could also materially increase the costs we already incur to protect against such risks. While we also seek to obtain assurances that third parties we interact with will protect confidential information, there is a risk that the confidentiality of data held or accessed by third parties may be compromised. In addition, as the regulatory environment relating to a company’s obligation to protect such sensitive data becomes stricter, a material failure on our part to comply with applicable regulations could subject us to fines or other regulatory sanctions and potentially to lawsuits.

Our results of operations are impacted by changes in industrial commodity prices. Many of the products we sell are subject to wide and frequent price fluctuations because they are composed primarily of copper, steel, or petroleum-based resins, including poly-vinyl chlorides ("PVC"), industrial commodities that have been subject to price volatility during the past several years. Examples of such products include copper wire and cable and steel and PVC conduit, enclosures, and fittings. Our gross margin rate on these products is relatively constant over time, though not necessarily in the short term. Therefore, as the cost of these products to us declines, pricing to our customers may decrease. This impacts our results of operations by lowering both sales and gross margin. Rising prices have the opposite effect, increasing both sales and gross margin, assuming the quantities of the affected products sold remain constant.

We purchase all of the products we sell to our customers from other parties. As a wholesale distributor, our business and financial results are dependent on our ability to purchase products from manufacturers not controlled by our Company that we, in turn, sell to our customers. Approximately 51% of our purchases are made from only 25 manufacturers. A sustained disruption in our ability to source product from one or more of the largest of these vendors might have a material impact on our ability to fulfill customer orders resulting in lost sales and, in rare cases, damages for late or non-delivery.

Our daily activities are highly dependent on the uninterrupted operation of our information systems. We are a recognized industry leader for our use of information technology in all areas of our business – sales, customer service, inventory management, finance, accounting, and human resources. We maintain redundant information systems as part of our disaster recovery program and, if necessary, are able to operate in many respects using a paper-based system to help mitigate a complete interruption in our information processing capabilities. Nonetheless, our information systems remain vulnerable to natural disasters, wide-area telecommunications or power utility outages, terrorist or cyber-attack, or other major disruptions. A sustained interruption in the functioning of our information systems, however unlikely, could lower operating income by negatively impacting sales, expenses, or both.

We may experience losses or be subject to increased funding and expenses related to our pension plan. A decline in the market value of plan assets or a change in the interest rates used to measure the required minimum funding levels and the

pension obligation may increase the funding requirements of our defined benefit pension plan, the pension obligation itself, and pension expenses. Government regulations may accelerate the timing and amounts required to fund the plan. Demographic changes in our workforce, including longer life expectancies, increased numbers of retirements, and age at retirement may also cause funding requirements, pension expenses, and the pension obligation to be higher than expected. Any or all of these factors could have a negative impact on our liquidity, financial position, and/or our results of operations.

Compliance with increasing government regulations may result in increased costs and risks to the company. Our public company and multi-national customers are increasingly subject to government regulation globally. Existing and future laws and regulations may impede our growth. These regulations and laws may cover, among other things, taxation, privacy, data protection, pricing, content, copyrights, distribution, energy consumption, environmental regulation, electronic contracts and other communications and marketing, consumer protection, the design and operation of websites, and the characteristics and quality of products and services. Unfavorable regulations and laws could diminish the demand for our products and services and increase our cost of doing business. If we are not able to obtain for certain customers the information that they require in part as a result of these regulations, they may limit their business with us.

For example, in the U.S., as part of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, the SEC has promulgated disclosure requirements for companies that manufacture or contract to manufacture goods regarding the inclusion and origin of certain minerals in those products. Some of our customers that purchase products from us for inclusion in the products that they sell wish to rely on us to provide critical data regarding the parts they purchase, including conflict mineral and other responsive information to these regulations. We sell over one million products from over 4,600 manufacturers and suppliers, and we may not be able to easily verify the origins for conflict or other minerals used in the products we sell. Our suppliers, and especially those suppliers which are not themselves subject to direct regulation, may not provide conflict mineral and other regulatory information in a useful and systematic manner, if at all. On the other hand, some customers may demand that the products they purchase be "DRC conflict-free". Additionally, other customers may demand that we provide additional information (for which we also must depend on the manufacturer) to assist them in their compliance obligations under the laws of countries where we do not do business. These customer-driven requirements may increase our operating costs, and due to competitive pressures, we may not be able to increase our prices sufficiently to avoid a reduction in our income from operations.

We are subject to legal proceedings and other claims arising out of the conduct of our business. These proceedings and claims relate to public and private sector transactions, product liability, contract performance, and employment matters. On the basis of information currently available to us, we do not believe that existing proceedings and claims will have a material impact on our financial position or results of operations. However, litigation is unpredictable, and we could incur judgments or enter into settlements for current or future claims that could adversely affect our financial position or our results of operations in a particular period.

More specifically, with respect to asbestos litigation, as of December 31, 2014, approximately 3,070 individual cases and 67 multiple-plaintiff cases are pending that allege actual or potential asbestos-related injuries resulting from the use of or exposure to products allegedly sold by us. Additional claims will likely be filed against us in the future. Our insurance carriers have historically borne virtually all costs and liability with respect to this litigation and are continuing to do so. Accordingly, our future liability with respect to pending and unasserted claims is dependent on the continued solvency of our insurance carriers. Other factors that could impact this liability are: the number of future claims filed against us; the defense and settlement costs associated with these claims; changes in the litigation environment, including changes in federal or state law governing the compensation of asbestos claimants; adverse jury verdicts in excess of historic settlement amounts; and bankruptcies of other asbestos defendants. Because any of these factors may change, our future exposure is unpredictable and it is possible that we may incur costs that would have a material adverse impact on our liquidity, financial position, or results of operations in future periods.

Our borrowing agreements contain financial covenants and certain other restrictions on our activities and those of our subsidiaries. Our revolving credit facility and our private placement shelf agreement impose contractual limits on, among other things, our ability, and the ability of our subsidiaries, with respect to indebtedness, liens, changes in the nature of business, investments, mergers and acquisitions, the issuance of equity securities, the disposition of assets and the dissolution of certain subsidiaries, transactions with affiliates, restricted payments (subject to incurrence tests, with certain exceptions), as well as securitizations and factoring transactions. In addition, we are required to maintain acceptable financial ratios relating to debt leverage and interest coverage. Our failure to comply with these obligations may cause an event of default and may trigger an acceleration of the debt owed to our creditors or limit our ability to obtain additional credit under these facilities. While we expect to remain in compliance with the terms of our credit agreement, our failure to do so could have a negative impact on our ability to borrow funds and maintain acceptable levels of cash flow from financing activities.

The value of our common stock is dependent primarily upon the regular payment of dividends, which are paid at the discretion of our Board of Directors. The purchase price for our common stock under the Company’s purchase option is the same as the issue price. Accordingly, as long as Graybar exercises our option to purchase, appreciation in the value of an investment in our common stock is dependent solely on our ability and our Board of Directors' willingness to declare stock dividends. Although cash dividends have been paid on the common stock each year since 1929, as with any corporation’s common stock, payment of dividends is subject to the discretion of our Board of Directors.

There is no public trading market for our common stock. Our common stock is 100% owned by active and retired employees. Common stock may not be sold by the holder thereof, except after first offering it to the Company. We have always exercised this purchase option in the past and expect to continue to do so. As a result, no public trading market for our common stock exists, nor is one expected to develop. This lack of a public trading market for the Company’s common stock may limit our ability to raise large amounts of equity capital, which could constrain our long-term business growth.

Item 1B. Unresolved Staff Comments

Not applicable.

Item 2. Properties

We operate in thirteen geographical districts in the U.S., each of which maintains multiple distribution facilities that consist primarily of warehouse space. A small portion of each distribution facility is used for offices. Some districts have sales offices that do not carry an inventory of products. The number of facilities, excluding distribution centers, in a district varies from ten to twenty-two and totals 215 for all districts. The facilities range in size from approximately 1,000 to 132,000 square feet, with the average being approximately 31,000 square feet. We own 116 of these facilities and lease 99 of them for varying terms, with the majority having a remaining lease term of less than five years.

We have seven national distribution centers ranging in size from approximately 160,000 to 240,000 square feet. Five of the national distribution centers are owned and two are leased. The remaining lease terms on these two leased facilities are approximately two and four years, respectively.

We also have ten regional distribution centers ranging in size from 130,000 to 210,000 square feet. Four of the ten regional distribution centers are owned and the others are leased. The remaining lease terms on the leased regional distribution centers are between one and nine years.

We maintain thirty distribution facilities in Canada, of which nineteen are owned and eleven are leased. The majority of the leased facilities have a remaining lease term of less than five years. The facilities range in size from approximately 5,000 to 60,000 square feet. We have a 22,000 square foot facility in Puerto Rico, the lease on which expires in 2019.

Our headquarters are located in St. Louis, Missouri in an 83,000 square foot building owned by us. We also own a 200,000 square foot operations and administration center in St. Louis.

Item 3. Legal Proceedings

There are presently no pending legal proceedings that are expected to have a material impact on the Company or its subsidiaries.

Item 4. Mine Safety Disclosures

Not applicable.

Supplemental Item. Executive Officers of the Registrant

The following table lists the name, age as of March 1, 2015, position, offices and certain other information with respect to the executive officers of the Company. The term of office of each executive officer will expire upon the appointment of his or her successor by the Board of Directors.

|

| | |

Name | Age | Business experience last five years |

S. S. Clifford | 44 | Senior Vice President - Supply Chain Management, February 2015 to present; Vice President - Chief Information Officer, April 2010 to January 2015; Director IT Planning & Process Improvement, September 2008 to March 2010. |

M. W. Geekie | 53 | Senior Vice President, Secretary and General Counsel, August 2008 to present; Deputy General Counsel, February 2008 to August 2008. |

R. R. Harwood | 58 | Senior Vice President and Chief Financial Officer, January 2013 to present; District Vice President – Dallas District, October 2004 to December 2012. |

W. P. Mansfield | 52 | Senior Vice President - Sales and Marketing, April 2014 to present; Vice President - Marketing, April 2012 to March 2014; Vice President - Industrial and Commercial, January 2011 to March 2012; Vice President - Industrial Market, February 2010 to December 2010; Director Comm/Data Sales, April 2006 to February 2010. |

K. M. Mazzarella | 54 | Chairman of the Board, January 2013 to present; President and Chief Executive Officer, June 2012 to present; Executive Vice President, Chief Operating Officer, December 2010 to May 2012; Senior Vice President – Sales and Marketing, March 2010 to November 2010; Senior Vice President – Sales and Marketing, Comm/Data, April 2008 to February 2010. |

B. L. Propst | 45 | Senior Vice President – Human Resources, June 2009 to present. |

J. N. Reed | 57 | Vice President and Treasurer, April 2000 to present. |

On February 1, 2015, L. R. Giglio, Senior Vice President, Operations of the Company, retired as an officer and director.

PART II

Item 5. Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Our common stock is 100% owned by active and retired employees, and there is no public trading market for our common stock. Since 1928, substantially all of the issued and outstanding shares of common stock have been held of record by voting trustees under successive voting trust agreements. Under applicable New York law, a voting trust may not have a term greater than ten years. The 2007 Voting Trust Agreement expires by its terms on March 15, 2017. At December 31, 2014, approximately 83% of the common stock was held in this voting trust. The participation of shareholders in the voting trust is voluntary at the time the voting trust is created but is irrevocable during its term. Shareholders who elect not to participate in the voting trust hold their common stock as shareholders of record.

No holder of our common stock or voting trust interests representing our common stock ("common stock", "common shares", or "shares") may sell, transfer or otherwise dispose of any shares without first offering us the option to purchase those shares at the price at which they were issued. Additionally, a shareholder is entitled to any cash dividends, if any, accrued for the quarter in which the purchase offer is made, adjusted pro rata for the number of days such shares were held prior to the dividend record date. We also have the option to purchase at the issue price the common shares of any shareholder who ceases to be an employee for any reason other than death or retirement on a pension (except a deferred pension), and on the first anniversary of any holder's death. In the past, we have always exercised these purchase options and we expect to continue to do so in the foreseeable future. However, we can make no assurance that we will continue to exercise our purchase option in the future. All outstanding shares of the Company have been issued at $20.00 per share.

The following table sets forth information regarding purchases of common stock by the Company, all of which were made pursuant to the foregoing provisions:

|

| | | |

Issuer Purchases of Equity Securities |

Period | Total Number of Shares Purchased | Average Price Paid Per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs |

October 1 to October 31, 2014 | 45,739 | $20.00 | N/A |

November 1 to November 30, 2014 | 32,177 | $20.00 | N/A |

December 1 to December 31, 2014 | 14,482 | $20.00 | N/A |

Total | 92,398 | $20.00 | N/A |

|

| | | | | | |

Capital Stock at December 31, 2014 |

Title of Class | Number of Security Holders | Number of Shares |

Voting Trust Interests issued with respect to Common Stock | 5,421 |

| | 13,146,878 |

| |

Common Stock | 895 |

| | 2,713,052 |

| |

Total | 6,316 |

| | 15,859,930 |

| |

|

| | | | | | |

Dividend Data (in dollars per share) | Year Ended December 31, |

Period | 2014 |

| 2013 |

|

First Quarter | $ | 0.30 |

| $ | 0.30 |

|

Second Quarter | 0.30 |

| 0.30 |

|

Third Quarter | 0.30 |

| 0.30 |

|

Fourth Quarter | 3.10 |

| 1.50 |

|

Total | $ | 4.00 |

| $ | 2.40 |

|

On December 12, 2013, our Board of Directors declared a 2.5% stock dividend to shareholders of record on January 2, 2014. Shares representing this dividend were issued on February 3, 2014.

Company Performance

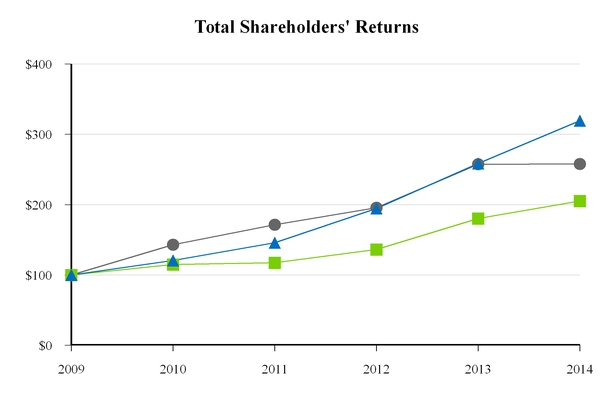

The following graph shows a five-year comparison of cumulative total shareholders’ returns for Graybar Electric Company, Inc.'s common stock, the Standard & Poor’s 500 Composite Stock Index, and a Comparable Company Index consisting of public firms selected by us as being representative of our line of business.

|

| | | | | | | | | | | | | | | | | | |

| 2009 |

| 2010 |

| 2011 |

| 2012 |

| 2013 |

| 2014 |

|

Graybar Graybar | $ | 100.00 |

| $ | 120.78 |

| $ | 145.87 |

| $ | 194.67 |

| $ | 258.44 |

| $ | 319.39 |

|

S&P 500 S&P 500 | $ | 100.00 |

| $ | 115.07 |

| $ | 117.49 |

| $ | 136.30 |

| $ | 180.44 |

| $ | 205.14 |

|

Comparable Company Index Comparable Company Index | $ | 100.00 |

| $ | 143.18 |

| $ | 171.51 |

| $ | 195.65 |

| $ | 257.44 |

| $ | 257.65 |

|

The comparison above assumes $100.00 invested on December 31, 2009 and reinvestment of dividends (including the $1.10 per share cash dividend paid by us on January 4, 2010).

The companies included in the Comparable Company Index are Anixter International Inc., Applied Industrial Technologies, Inc., W. W. Grainger, Inc., Owens & Minor, Inc., Park-Ohio Holdings Corp., Watsco, Inc., and WESCO International, Inc.

The market value of our common stock, in the absence of a public trading market, assumes continuation of our practice of issuing and purchasing offered shares at $20.00 per share.

Item 6. Selected Financial Data

This summary should be read in conjunction with the accompanying consolidated financial statements and the notes to the consolidated financial statements included in Item 8., “Financial Statements and Supplementary Data”, of this Annual Report on Form 10-K.

Five Year Summary of Selected Consolidated Financial Data

(Stated in thousands, except for per share data)

|

| | | | | | | | | | | | | | | |

For the Years Ended December 31, | 2014 | 2013 | 2012 | 2011 | 2010 |

Gross Sales | $ | 6,004,179 |

| $ | 5,682,084 |

| $ | 5,434,509 |

| $ | 5,395,239 |

| $ | 4,634,231 |

|

Cash Discounts | (25,318 | ) | (22,943 | ) | (21,228 | ) | (20,439 | ) | (17,854 | ) |

Net Sales | $ | 5,978,861 |

| $ | 5,659,141 |

| $ | 5,413,281 |

| $ | 5,374,800 |

| $ | 4,616,377 |

|

Gross Margin | $ | 1,118,547 |

| $ | 1,044,156 |

| $ | 1,018,362 |

| $ | 995,259 |

| $ | 866,641 |

|

Net Income attributable to Graybar Electric Company, Inc. | $ | 87,428 |

| $ | 81,063 |

| $ | 86,291 |

| $ | 81,425 |

| $ | 41,998 |

|

Average common shares outstanding(A) | 15,848 |

| 15,936 |

| 15,969 |

| 15,837 |

| 15,758 |

|

Net Income attributable to Graybar Electric Company, Inc. per share of Common Stock(A) | $ | 5.52 |

| $ | 5.09 |

| $ | 5.40 |

| $ | 5.14 |

| $ | 2.67 |

|

Cash Dividends per share of Common Stock | $ | 4.00 |

| $ | 2.40 |

| $ | 3.00 |

| $ | 2.00 |

| $ | 2.00 |

|

Total assets(B) | $ | 1,939,113 |

| $ | 1,779,505 |

| $ | 1,704,197 |

| $ | 1,719,176 |

| $ | 1,536,578 |

|

Total liabilities(B) | $ | 1,257,132 |

| $ | 1,108,724 |

| $ | 1,103,981 |

| $ | 1,147,782 |

| $ | 977,771 |

|

Shareholders’ equity | $ | 681,981 |

| $ | 670,781 |

| $ | 600,216 |

| $ | 571,394 |

| $ | 558,807 |

|

Working capital(C) | $ | 446,550 |

| $ | 450,718 |

| $ | 425,573 |

| $ | 395,965 |

| $ | 417,826 |

|

Long-term debt | $ | 11,595 |

| $ | 2,731 |

| $ | 1,990 |

| $ | 10,345 |

| $ | 64,859 |

|

(A)All periods prior to 2014 adjusted for the declaration of a 2.5% stock dividend declared in December 2013, a 20% stock dividend declared in December 2012, a 10% stock dividend declared in December 2011, and a 10% stock dividend declared in December 2010. Prior to these adjustments, the average common shares outstanding for the years ended December 31, 2013, 2012, 2011, and 2010 were 15,936, 15,580, 12,876, and 11,647, respectively.

(B) Reclassifications made to prior year financial statements to conform to December 31, 2014 financial statement presentation.

(C)Working capital is defined as total current assets less total current liabilities.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Management’s Discussion and Analysis provides a narrative on the Company’s results of operations, financial condition, liquidity, and cash flows for the three-year period ended December 31, 2014. This discussion should be read in conjunction with the accompanying consolidated financial statements and the notes to the consolidated financial statements included in Item 8., “Financial Statements and Supplementary Data”, of this Annual Report on Form 10-K.

Business Overview

After setting gross sales records in each of the first three quarters of 2014, we finished with more than $6 billion in gross sales for the first time in our history. Our extensive product offering and supply chain services, combined with our strategic investments in new locations, salesforce expansion, and e-commerce capabilities, produced growth that exceeded the overall market, a 5.6% increase in net sales compared to industry reported growth of 3.4%. Net sales in our construction vertical increased by 5.4% over 2013, and our industrial and utility vertical finished 8.4% higher than 2013. Our CIG vertical experienced a slight decrease in net sales from 2013 of 0.8%.

Throughout 2014, we continued focusing on improving our gross margin rate, having started several new gross margin improvement initiatives, and we finished at 18.7% compared to 18.5% in 2013. The increase in sales and gross margin rate translates into an increase in gross margin of $74,391 or 7.1% over 2013. Our strategic investments increased selling, general, and administrative expense 7.1%. The higher sales and gross margin increased net income to $87,428, a new net income record.

Based on our increase in orders on hand during the fourth quarter, we expect sales strength in the first part of 2015. The general economy continues to grow, but there are indications of a slowing in the second half of the year. We expect to continue our investment in new locations and sales force expansion in 2015. A focus on our core business coupled with the strategic investments made in 2014 will continue to drive growth through the first half of 2015.

Consolidated Results of Operations

The following table sets forth certain information relating to our operations stated in thousands of dollars and as a percentage of net sales for the years ended December 31, 2014, 2013, and 2012:

|

| | | | | | | | | | | | | | | | | | | |

| 2014 | | 2013 | | 2012 |

| Dollars | Percent | | Dollars | | Percent | | Dollars | | Percent |

Net Sales | $ | 5,978,861 |

| 100.0 | % | | $ | 5,659,141 |

| | 100.0 | % | | $ | 5,413,281 |

| | 100.0 | % |

Cost of merchandise sold | (4,860,314 | ) | (81.3 | ) | | (4,614,985 | ) | | (81.5 | ) | | (4,394,919 | ) | | (81.2 | ) |

Gross Margin | 1,118,547 |

| 18.7 |

| | 1,044,156 |

| | 18.5 |

| | 1,018,362 |

| | 18.8 |

|

Selling, general and administrative expenses | (935,132 | ) | (15.6 | ) | | (873,415 | ) | | (15.4 | ) | | (871,374 | ) | | (16.1 | ) |

Depreciation and amortization | (39,151 | ) | (0.7 | ) | | (36,944 | ) | | (0.7 | ) | | (32,449 | ) | | (0.6 | ) |

Other income, net | 3,918 |

| 0.1 |

| | 2,495 |

| | — |

| | 33,143 |

| | 0.6 |

|

Income from Operations | 148,182 |

| 2.5 |

| | 136,292 |

| | 2.4 |

| | 147,682 |

| | 2.7 |

|

Interest expense, net | (1,371 | ) | — |

| | (1,341 | ) | | — |

| | (2,234 | ) | | — |

|

Income before provision for income taxes | 146,811 |

| 2.5 |

| | 134,951 |

| | 2.4 |

| | 145,448 |

| | 2.7 |

|

Provision for income taxes | (59,125 | ) | (1.0 | ) | | (53,677 | ) | | (1.0 | ) | | (58,850 | ) | | (1.1 | ) |

Net Income | 87,686 |

| 1.5 |

| | 81,274 |

| | 1.4 |

| | 86,598 |

| | 1.6 |

|

Net income attributable to noncontrolling interests | (258 | ) | — |

| | (211 | ) | | — |

| | (307 | ) | | — |

|

Net Income attributable to Graybar Electric Company, Inc. | $ | 87,428 |

| 1.5 | % | | $ | 81,063 |

| | 1.4 | % | | $ | 86,291 |

| | 1.6 | % |

2014 Compared to 2013

Net sales totaled $5,978,861 for the year ended December 31, 2014, compared to $5,659,141 for the year ended December 31, 2013, an increase of $319,720, or 5.6%. Net sales in our construction and industrial and utility verticals increased over 2013 by 5.4% and 8.4%, respectively. Our CIG vertical decreased in net sales by 0.8% from 2013.

Gross margin increased $74,391, or 7.1%, to $1,118,547 for the year ended December 31, 2014, from $1,044,156 for the year ended December 31, 2013. The increase resulted from a combination of an improved gross margin as a percent of net sales and an increase in net sales for the year ended December 31, 2014, compared to the year ended December 31, 2013. Our gross margin rate was 18.7% for the year ended December 31, 2014, up from 18.5% in 2013.

Selling, general and administrative expenses ("SG&A") increased $61,717, or 7.1%, to $935,132 for the year ended December 31, 2014 mainly due to higher compensation-related costs resulting from our sales force expansion initiative and normal compensation increases for our existing workforce. SG&A as a percentage of net sales for the year ended December 31, 2014 was 15.6% compared to 15.4% for the year ended December 31, 2013.

Depreciation and amortization expenses ("Depreciation") for the year ended December 31, 2014 increased $2,207, or 6.0%, to $39,151 from $36,944 for the year ended December 31, 2013. This increase was due to an increase in property, at cost. Depreciation as a percentage of net sales remained consistent at 0.7% for the years ended December 31, 2014 and 2013.

Other income, net totaled $3,918 for the year ended December 31, 2014, compared to $2,495 for the year ended December 31, 2013. Other income, net consists primarily of gains on the disposal of property, trade receivable interest charges to customers, and other miscellaneous income items related to our business activities.

Interest expense, net increased $30, or 2.2%, to $1,371 for the year ended December 31, 2014, from $1,341 for the year ended December 31, 2013. Long-term debt outstanding, including current portion, was $17,836 at December 31, 2014, compared to $5,174 at December 31, 2013. The long-term debt outstanding, including current portion increase was primarily due to capital lease financing transactions.

Income before provision for income taxes totaled $146,811 for the year ended December 31, 2014; an increase of $11,860, or 8.8%, compared to $134,951 for the year ended December 31, 2013. The increase was generated by our ability to manage our growth in SG&A and Depreciation at levels that were less than our growth in gross margin.

Our provision for income taxes increased $5,448, or 10.1%, to $59,125 for the year ended December 31, 2014 from $53,677 for the year ended December 31, 2013, as a result of higher income before provision for income taxes and settlement of our Internal Revenue Service examination. Our effective tax rate was 40.3% for the year ended December 31, 2014, up from

39.8% for the year ended December 31, 2013. The effective tax rates for the years ended December 31, 2014 and 2013 were higher than the 35.0% U.S. federal statutory rate primarily due to state and local income taxes.

Net income attributable to Graybar Electric Company, Inc. for the year ended December 31, 2014 increased $6,365, or 7.9%, to $87,428 from $81,063 for the year ended December 31, 2013.

2013 Compared to 2012

Net sales totaled $5,659,141 for the year ended December 31, 2013, compared to $5,413,281 for the year ended December 31, 2012, an increase of $245,860, or 4.5%. Net sales in our construction and CIG verticals increased over 2012 by 7.2% and 3.8%, respectively. Our industrial and utility vertical experienced a decrease in net sales from 2012 of 0.7%.

Gross margin increased $25,794, or 2.5%, to $1,044,156 for the year ended December 31, 2013, from $1,018,362 for the year ended December 31, 2012. The increase was primarily due to increased net sales for the year ended December 31, 2013, compared to the year ended December 31, 2012. Our gross margin rate was 18.5% for the year ended December 31, 2013, down from 18.8% in 2012.

SG&A increased $2,041, or 0.2%, to $873,415 for the year ended December 31, 2013, compared to $871,374 for the year ended December 31, 2012, mainly due to higher compensation-related costs. SG&A as a percentage of net sales for the year ended December 31, 2013 were 15.4%, down from 16.1% in 2012.

Depreciation for the year ended December 31, 2013 increased $4,495, or 13.9%, to $36,944 from $32,449 for the year ended December 31, 2012. This increase was due to an increase in property, at cost. Depreciation as a percentage of net sales for the year ended December 31, 2013 was 0.7%, up from 0.6% in 2012.

Other income, net consists primarily of gains on the disposal of property, trade receivable interest charges to customers, and other miscellaneous income items related to our business activities. Other income, net totaled $2,495 for the year ended December 31, 2013, compared to $33,143 for the year ended December 31, 2012. The decrease in other income, net was due to substantial net gains on the disposal of property for the year ended December 31, 2012, that were not repeated for the year ended December 31, 2013. Losses on the disposal of property were $418 for the year ended December 31, 2013, compared to gains on the disposal of property of $30,638 for the year ended December 31, 2012. There were also $1,066 in impairment losses recorded during the year ended December 31, 2012, primarily on assets that were held for sale. There were no impairment losses recorded during the year ended December 31, 2013.

Income from operations totaled $136,292 for the year ended December 31, 2013, a decrease of $11,390, or 7.7%, from $147,682 for the year ended December 31, 2012. The decrease was due to the substantial decrease in other income, net as well as increases in SG&A and Depreciation.

Interest expense, net decreased $893, or 40.0%, to $1,341 for the year ended December 31, 2013, from $2,234 for the year ended December 31, 2012. This reduction was primarily due to lower levels of outstanding long-term debt during the year ended December 31, 2013, compared to 2012. Long-term debt outstanding, including current portion, was $5,174 at December 31, 2013, compared to $11,995 at December 31, 2012.

The decrease in income from operations and lower interest expense, net resulted in income before provision for income taxes of $134,951 for the year ended December 31, 2013, a decrease of $10,497, or 7.2%, compared to $145,448 for the year ended December 31, 2012.

Our total provision for income taxes decreased $5,173, or 8.8%, to $53,677 for the year ended December 31, 2013, from $58,850 for the year ended December 31, 2012, as a result of lower income before provision for income taxes. Our effective tax rate was 39.8% for the year ended December 31, 2013, down from 40.5% for the year ended December 31, 2012. The effective tax rates for the years ended December 31, 2013 and 2012 were higher than the 35.0% U.S. federal statutory rate primarily due to state and local income taxes.

Net income attributable to Graybar Electric Company, Inc. for the year ended December 31, 2013 decreased $5,228, or 6.1%, to $81,063 from $86,291 for the year ended December 31, 2012.

Financial Condition and Liquidity

Summary

We manage our liquidity and capital levels so that we have the capacity to invest in the growth of our business, finance anticipated capital expenditures, make dividend and benefit payments, finance information technology needs, meet debt service obligations, fund acquisitions and finance other miscellaneous cash outlays. We believe that maintaining a strong company financial condition enables us to competitively access multiple financing channels, maintain an optimal cost of capital and enable our company to invest in strategic long-term growth plans.

We have historically funded our working capital requirements using cash flows generated by the collection of trade receivables and trade accounts payable terms with our suppliers, supplemented by short-term bank lines of credit. Capital expenditures have been financed primarily by cash from working capital management, short-term bank lines of credit and long-term debt.

Cash Flows

The following table summarizes our cash flows from operating, investing and financing activities for each of the past three years: |

| | | | | | | | | | | |

Total cash provided by (used in): | 2014 | | 2013 | | 2012 |

Operating Activities | $ | 135,749 |

| | $ | 90,888 |

| | $ | 59,857 |

|

Investing Activities | (51,097 | ) | | (57,776 | ) | | (26,805 | ) |

Financing Activities | (85,559 | ) | | (36,121 | ) | | (67,345 | ) |

Net Decrease in Cash | $ | (907 | ) | | $ | (3,009 | ) | | $ | (34,293 | ) |

Our cash was $33,758 at December 31, 2014, a decrease of $907, or 2.6%, from $34,665 at December 31, 2013. Our working capital management allowed us to fund our business growth, increase our cash dividend payment, and decrease our short-term borrowings.

Operating Activities

Cash flows from operations for the year ended December 31, 2014 improved by $44,861 when compared to the year ended December 31, 2013, primarily due to improved earnings from 2013 to 2014 and our policy of continuing to manage working capital assets to a relatively consistent turnover level comparable to the prior year.

Investing Activities

Net cash used by investing activities decreased by $6,679 for the year ended December 31, 2014 when compared to the year ended December 31, 2013, primarily due to lower capital expenditures in 2014. Our investing activities consisted of capital expenditures for property and proceeds from the disposal of property.

Financing Activities

Net cash used by financing activities increased by $49,438 for the year ended December 31, 2014, compared to the year ended December 31, 2013 primarily due to:

| |

• | Payments on short-term borrowings |

| |

• | Increased dividend payments on common stock |

| |

• | Increased treasury stock purchases |

| |

• | Lower proceeds from and increased payments to noncontrolling interests' stock |

| |

• | Higher payments on capital leases |

The above factors were offset by the following:

| |

• | Lower long-term debt payments |

| |

• | Increased sales of common stock |

Liquidity

We had a $550,000 revolving credit facility with $483,658 in available capacity at December 31, 2014. At December 31, 2013, we had a $500,000 revolving credit facility with $416,847 in available capacity. In addition, in September 2014, we established a $100,000 uncommitted private placement shelf agreement, with no notes outstanding at December 31, 2014. For further discussion related to our revolving credit facility and our private placement shelf agreement, refer to Note 9, "Debt", of the notes to the consolidated financial statements located in Item 8.

At December 31, 2014, we had letters of credit of $5,725 outstanding, of which none were issued under the $550,000 revolving credit facility. At December 31, 2013, we had letters of credit of $6,886 outstanding, of which $711 were issued under the $500,000 revolving credit facility. The letters of credit are used primarily to support certain workers compensation insurance policies.

Contractual Obligations and Commitments

We had the following contractual obligations as of December 31, 2014:

|

| | | | | | | | | | | | | | | | | | | |

| |

| | Payments due by period |

Contractual obligations | Total | | 2015 | | 2016

and

2017 | | 2018

and

2019 | | After

2019 |

Long-term debt obligations | $ | 5,595 |

| | $ | 3,730 |

| | $ | 1,865 |

| |

|

| |

|

|

Capital lease obligations | $ | 15,668 |

| | $ | 3,115 |

| | $ | 4,821 |

| | $ | 2,370 |

| | $ | 5,362 |

|

Operating lease obligations | 81,884 |

| | 20,996 |

| | 34,355 |

| | 19,210 |

| | 7,323 |

|

Purchase obligations | 660,152 |

| | 660,152 |

| |

|

| |

|

| |

|

|

Total | $ | 763,299 |

| | $ | 687,993 |

| | $ | 41,041 |

| | $ | 21,580 |

| | $ | 12,685 |

|

Long-term debt and capital lease obligations consist of both principal and interest payments.

Purchase obligations consist of open purchase orders issued in the normal course of business. Many of these purchase obligations may be cancelled with limited or no financial penalties.

The table above does not include $142,523 of accrued, unfunded pension obligations, $86,092 of accrued, unfunded employment-related benefit obligations, of which $77,355 is related to our postretirement benefit plan, and $3,104 in contingent payments for uncertain tax positions because it is not certain when these obligations will be settled or paid.

We also expect to make contributions totaling approximately $40,000 to our defined benefit pension plan and fund $1,573 for nonqualified benefits during 2015 that are not included in the table. We contributed $40,000 to our defined benefit pension plan and funded $2,865 for nonqualified benefits in 2014.

Critical Accounting Estimates

Our consolidated financial statements are prepared in accordance with generally accepted accounting principles in the U.S. ("GAAP"). In connection with the preparation of our financial statements we are required to make estimates and assumptions about future events and apply judgments that affect the reported amounts of assets, liabilities, revenue, expenses and the related disclosures. We base our estimates, assumptions and judgments on historical experience, current trends and other factors that management believes to be relevant at the time our consolidated financial statements are prepared. On a regular basis, we review the accounting policies, estimates, assumptions, and judgments to ensure that our financial statements are presented fairly and in accordance with GAAP. However, because future events and their effects cannot be determined with certainty, actual results could differ from our estimates and assumptions, and such differences could be material.

Our significant accounting policies are discussed in Note 2, "Summary of Significant Accounting Policies", of the notes to the consolidated financial statements located in Item 8., “Financial Statements and Supplementary Data”, of this Annual Report on Form 10-K. We believe that the following accounting estimates are the most critical to aid in fully understanding and evaluating our reported financial results, and they require our most difficult, subjective or complex judgments, resulting from the need to make estimates about the effect of matters inherently uncertain. We have reviewed these critical accounting estimates and related disclosures with the Audit Committee of our Board.

Income Taxes

We recognize deferred tax assets and liabilities to reflect the future tax consequences of events that have been recognized in the financial statements or tax returns. Uncertainty exists regarding tax positions taken in previously filed tax returns still subject to examination and positions expected to be taken in future returns. A deferred tax asset or liability results from the temporary difference between an item’s carrying value as reflected in the financial statements and its tax basis, and is calculated using enacted applicable tax rates. We assess the likelihood that our deferred tax assets will be recovered from future taxable income and, to the extent it believes that recovery is not likely, a valuation allowance is established. Changes in the valuation allowance, when recorded, are included in the provision for income taxes in the consolidated financial statements. We classify interest expense and penalties as part of our provision for income taxes based upon applicable federal and state interest/underpayment percentages.

Merchandise Inventory

We value our inventories at the lower of cost (determined using the last-in, first-out (“LIFO”) cost method) or market. LIFO accounting is a method of accounting that, compared with other inventory accounting methods, generally provides better matching of current costs with current sales. In assessing the ultimate realization of inventories, we make judgments as to our return rights to suppliers and future demand requirements and record an inventory reserve for obsolete inventory. If actual future demand, market conditions, or supplier return provisions are less favorable than those projected by management, additional inventory write-downs may be required. For years ended December 31, 2014, 2013 and 2012 there were no material differences between our estimated reserve levels and actual write-offs.

Pension and Postretirement Benefits Plans

We account for our pension and postretirement benefit obligations in accordance with the accounting standards for defined benefit pension and other postretirement plans. These standards require the use of several important assumptions, including the discount rate and expected long-term rate of return on plan assets, among others, in determining our obligations and the annual cost of our pension and postretirement benefits. These assumptions are assessed annually in consultation with independent actuaries and investment advisors as of December 31 and adjustments are made as needed.

The following table presents key assumptions used to measure the pension and postretirement benefits obligations at December 31:

|

| | | | |

| Pension Benefits | Postretirement Benefits |

| 2014 | 2013 | 2014 | 2013 |

Discount rate | 4.08% | 4.87% | 3.77% | 4.34% |

Expected return on plan assets | 6.25% | 6.00% | — | — |

To determine the long-term rate of return, we consider the historical experience and expected future long-term performance of the plan assets, as well as the current and expected allocation of the plan assets. The pension plan’s asset allocation as of December 31, 2014, was approximately 67% fixed income investments, 18% equity securities and 15% other investments, in line with our policy ranges. We periodically evaluate the allocation of plan assets among the different investment classes to ensure that they are within policy guidelines and ranges. Although we do not currently expect to change the assumed rate of return in the near term, holding all other assumptions constant, we estimate that a 1% decrease in the expected return on plan assets would have increased our 2014 pension expense by approximately $4,600. Our expected rate of return on plan assets assumption will remain consistent for fiscal year 2015 at 6.25%.

In determining the discount rate, we use yields on high-quality fixed-income investments (including among other things, Moody’s Aa corporate bond yields) that match the duration and expected cash flows of the pension obligations. To the extent the discount rate increases or decreases, our pension and postretirement obligations are decreased or increased accordingly. Holding all other assumptions constant, we estimate that a 1% decrease in the discount rate used to calculate both pension expense for 2014 and the pension liability as of December 31, 2014 would have increased pension expense by $7,700 and the pension liability by $77,000. Similarly, a 1% decrease in the discount rate would have increased postretirement benefits expense by $200 and the December 31, 2014 postretirement benefits liability by $6,700.

New Accounting Standards

Our adoption of new accounting standards are discussed in Note 2, "Summary of Significant Accounting Policies", of the notes to the consolidated financial statements located in Item 8., "Financial Statements and Supplementary Data:, of this Annual Report on Form 10-K.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

Market risk is the risk of loss arising from adverse changes in market rates and prices, including commodity prices, foreign currency exchange rates, interest rates, and equity prices. Our primary exposures to market risk are commodity price risk, foreign currency exchange rate risk, and interest rate risk associated with debt obligations.

Commodity Price Risk

We have exposure to commodity price risk on products we purchase for resale. Examples of such products include copper wire and cable, steel conduit, enclosures, fittings, and PVC products.

Foreign Currency Exchange Rate Risk

The functional currency for our Canadian subsidiary is the Canadian dollar. Accordingly, its balance sheet amounts are translated at the exchange rates in effect at year-end and its income and expenses are translated using average exchange rates prevailing during the year. Currency translation adjustments are included in accumulated other comprehensive loss. Exposure to foreign currency exchange rate fluctuations is not material.

Interest Rate Risk

Our interest expense is sensitive to changes in the general level of market interest rates. Changes in interest rates have different impacts on the fixed-rate and variable-rate portions of our debt portfolio. A change in market interest rates on the fixed-rate portion of our debt portfolio impacts the fair value of the financial instrument, but has no impact on interest incurred or cash flows. A change in market interest rates on the variable-rate portion of our debt portfolio impacts the interest incurred and cash flows, but does not impact the fair value of the financial instrument. To mitigate the cash flow impact of interest rate fluctuations on the cost of financing our capital assets, we generally endeavor to maintain a significant portion of our long-term debt as fixed-rate in nature.

Based on $66,342 in variable-rate debt outstanding at December 31, 2014, a 1% increase in interest rates would increase our interest expense by $663 per year.

The following table provides information about financial instruments that are sensitive to changes in interest rates. The table presents principal payments on debt and related weighted-average interest rates by expected maturity dates: |

| | | | | | | | | | | | | | | | | | | |

| |

| |

| |

| |

| |

| |

| December 31, 2014 | |

Debt Instruments | 2015 | 2016 | 2017 | 2018 | 2019 | After 2019 | Total |

| Fair Value |

|

| |

| |

| | | | | | |

Long-term, fixed-rate debt | $ | 6,241 |

| 4,174 |

| 1,445 |

| 964 |

| 667 |

| 4,345 |

| $ | 17,836 |

| $ | 16,505 |

|

Weighted-average interest rate | 2.53 | % | 3.30 | % | 6.35 | % | 6.74 | % | 7.11 | % | 6.90 | % | | |

| |

| |

| |

| |

| |

| |

| |

| |

|

Short-term, variable-rate borrowings | $ | 66,342 |

| — |

| — |

| — |

| — |

| — |

| $ | 66,342 |

| $ | 66,342 |

|

Weighted-average interest rate | 1.52 | % |

|

|

|

|

|

|

|

|

|

| | |

The fair value of long-term debt is estimated by calculating future cash flows at interpolated Treasury yields with similar maturities, plus an estimate of our credit spread as of December 31, 2014.

CAUTION REGARDING FORWARD-LOOKING STATEMENTS:

For additional information related to risks associated with our future performance, see Part I, "Caution Regarding Forward-looking Statements" above and Item 1A. Risk Factors of this Form 10-K.

Item 8. Financial Statements and Supplementary Data

[THE REST OF THIS PAGE INTENTIONALLY LEFT BLANK]

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Board of Directors and Shareholders of

Graybar Electric Company, Inc.

We have audited the accompanying consolidated balance sheets of Graybar Electric Company, Inc. and Subsidiaries (the Company) as of December 31, 2014 and 2013, and the related consolidated statements of income, comprehensive income, changes in shareholders’ equity, and cash flows for each of the three years in the period ended December 31, 2014. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. We were not engaged to perform an audit of the Company’s internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the consolidated financial position of Graybar Electric Company, Inc. and Subsidiaries at December 31, 2014 and 2013, and the consolidated results of their operations and their cash flows for each of the three years in the period ended December 31, 2014, in conformity with U.S. generally accepted accounting principles.

/s/ Ernst & Young LLP

St. Louis, Missouri

March 12, 2015

Graybar Electric Company, Inc. and Subsidiaries

Consolidated Statements of Income

|

| | | | | | | | | |

| For the Years Ended December 31, |

(Stated in thousands, except per share data) | 2014 | 2013 | 2012 |

Net Sales | $ | 5,978,861 |

| $ | 5,659,141 |

| $ | 5,413,281 |

|

Cost of merchandise sold | (4,860,314 | ) | (4,614,985 | ) | (4,394,919 | ) |

Gross Margin | 1,118,547 |

| 1,044,156 |

| 1,018,362 |

|

Selling, general and administrative expenses | (935,132 | ) | (873,415 | ) | (871,374 | ) |

Depreciation and amortization | (39,151 | ) | (36,944 | ) | (32,449 | ) |

Other income, net | 3,918 |

| 2,495 |

| 33,143 |

|

Income from Operations | 148,182 |

| 136,292 |

| 147,682 |

|

Interest expense, net | (1,371 | ) | (1,341 | ) | (2,234 | ) |

Income before provision for income taxes | 146,811 |

| 134,951 |

| 145,448 |

|

Provision for income taxes | (59,125 | ) | (53,677 | ) | (58,850 | ) |

Net Income | 87,686 |

| 81,274 |

| 86,598 |

|

Net income attributable to noncontrolling interests | (258 | ) | (211 | ) | (307 | ) |

Net Income attributable to Graybar Electric Company, Inc. | $ | 87,428 |

| $ | 81,063 |

| $ | 86,291 |

|

Net Income attributable to Graybar Electric Company, Inc. per share of Common Stock | $ | 5.52 |

| $ | 5.09 |

| $ | 5.40 |

|

The accompanying Notes to Consolidated Financial Statements are an integral part of the Consolidated Financial Statements.

Graybar Electric Company, Inc. and Subsidiaries

Consolidated Statements of Comprehensive Income

|

| | | | | | | | | | | |

| For the Years Ended December 31, |

(Stated in thousands) | 2014 | | 2013 | | 2012 |

Net Income | $ | 87,686 |

| | $ | 81,274 |

| | $ | 86,598 |

|

Other Comprehensive Income | | | | | |

Foreign currency translation | (6,643 | ) | | (5,553 | ) | | 1,802 |

|

Pension and postretirement benefits liability adjustment | | | | | |

(net of tax of $3,477, $(20,270), and $11,735, respectively) | (5,461 | ) | | 31,838 |

| | (18,433 | ) |

Total Other Comprehensive Income (Loss) | (12,104 | ) | | 26,285 |

| | (16,631 | ) |

Comprehensive Income | $ | 75,582 |

| | $ | 107,559 |

| | $ | 69,967 |

|

Less: comprehensive income (loss) attributable to noncontrolling interests, net of tax | (16 | ) | | 45 |

| | 126 |

|

Comprehensive Income attributable to Graybar Electric Company, Inc. | $ | 75,598 |

| | $ | 107,514 |

| | $ | 69,841 |

|

The accompanying Notes to Consolidated Financial Statements are an integral part of the Consolidated Financial Statements.