these awards, including the price, if any, at which shares of

common stock may be purchased pursuant to any Other Stock-Based Award granted under the New Plan. Other Stock-Based Awards will be evidenced by an award agreement containing such terms and provisions, consistent with the New Plan, as the

Committee may approve.

Performance Criteria. The performance criteria that the Committee selects for purposes of establishing performance goal(s) applicable to performance-based awards under the New Plan may be based on the

attainment of specific levels of performance by us (or one of our subsidiaries, divisions, or operational units) in respect of any of the following metrics, in addition to any other factors or metrics determined by the Committee, whether

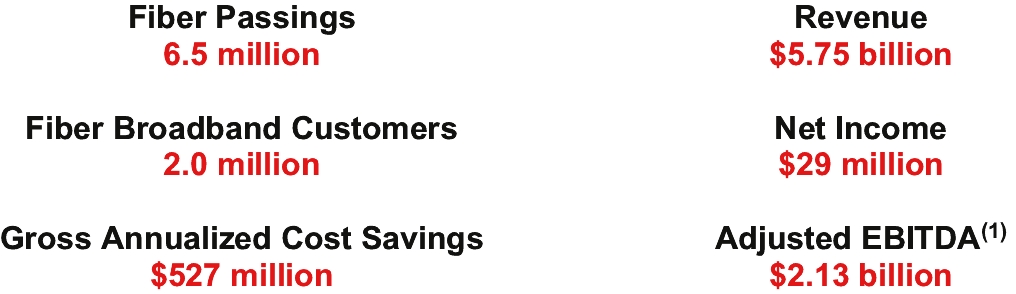

determined on a GAAP or non-GAAP basis: revenue, operating income, contribution, day sales outstanding, return on net assets, return on stockholders’ equity, return on assets, return on capital, stockholder returns (on an absolute or relative

basis), profit margin, operating margin, contribution margin, earnings per share, net earnings, operating earnings, free cash flow, cash flow from operations, earnings before interest, taxes, depreciation and amortization (EBITDA), including

adjusted EBITDA, number of customers, operating expenses, capital expenses, customer acquisition costs, share price, actual or relative total shareholder return, sales, bookings, change in customer base, units passed with fiber, broadband

metrics, fiber specific metrics, or market share.

The Committee is authorized, in its sole discretion, to adjust

or modify the calculation of a performance goal in order to prevent the dilution or enlargement of the rights of participants, including, without limitation (a) in the event of, or in anticipation of, any unusual or extraordinary corporate

item, transaction, event or development affecting the Company; or (b) in recognition of, or in anticipation of, any other unusual or nonrecurring events affecting the Company, or the financial statements of the Company, or in response to, or in

anticipation of, changes in applicable laws, regulations, accounting principles, or business conditions.

Dividends

No dividends or dividend equivalents will be paid on any award made under the New Plan prior

to the vesting of such award. In the sole discretion of the Committee, a restricted stock award, RSU award, performance award, or an Other Stock-Based Award may provide the participant with dividends or dividend equivalents, payable in cash,

shares of common stock, other securities, or other property on a deferred basis; provided that such dividends or dividend equivalents will be subject to the same vesting conditions as the award to which such dividends or dividend equivalents

relate.

Amendments

Our board of directors may amend, alter, suspend, discontinue, or terminate the New Plan

without further approval by our stockholders, except where (i) the amendment would materially increase the benefits accruing to participants under the New Plan, (ii) the amendment would materially increase the number of securities which may be

issued under the New Plan, (iii) the amendment would materially modify the requirements for participation in the New Plan, (iv) the amendment would increase the Director Compensation Limit or (v) stockholder approval is required by applicable law

or NASDAQ Stock Market, LLC rules and regulations. If any amendment, alteration, suspension, discontinuance, or termination of the New Plan would impair the rights of any participant, holder, or beneficiary of a previously granted award, the

amendment, alteration, suspension, discontinuance, or termination will not be effective with respect to such person without the written consent of the affected participant, holder, or beneficiary.

Change in Control

In the event of a “change in control” (as defined in the New Plan), to the extent outstanding

awards under the New Plan are not assumed, converted or replaced, all outstanding awards then held by a participant which are nonexercisable or otherwise unvested will automatically become fully exercisable or otherwise vested, as the case may

be, and any specified performance goals will be deemed to be satisfied at target, immediately prior to the consummation of such change in control, unless the applicable award agreement provides to the contrary.

To the extent outstanding awards are assumed, converted or replaced in the event of a change

in control, (i) any outstanding awards that are subject to performance goals will be assumed, converted, or replaced by the resulting or continuing entity as if target performance had been achieved as of the date of the change in control (unless

the