UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

For the ended

or

For the transition period from _________ to ___________

Commission file number

(Exact name of registrant as specified in its charter)

|

|

|

| ||

(State or other jurisdiction of |

| (I.R.S. Employer Identification No.) |

incorporation or organization) |

|

|

|

|

|

|

| |

| ||

(Address of principal executive offices) |

| (Zip Code) |

|

|

|

Registrant's telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

| Trading Symbol |

| Name of each exchange on which registered |

|

| The |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes __

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes __

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Indicate by check mark whether the registrant has filed a report on and attestation to its management’ s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definition of “accelerated filer,” “large accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

Smaller Reporting Company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes __

The aggregate market value of common stock held by non-affiliates of the registrant on June 30, 2021, based on the closing price per share on such date was $

FRONTIER COMMUNICATIONS PARENT, INC., AND SUBSIDIARIES

TABLE OF CONTENTS

|

|

|

PART I |

| Page No. |

|

|

|

Item 1. | 2 | |

|

|

|

Item 1A. | 14 | |

|

|

|

Item 1B. | 24 | |

|

|

|

Item 2. | 24 | |

|

|

|

Item 3. | 24 | |

|

|

|

Item 4. | 25 | |

|

|

|

PART II |

|

|

|

|

|

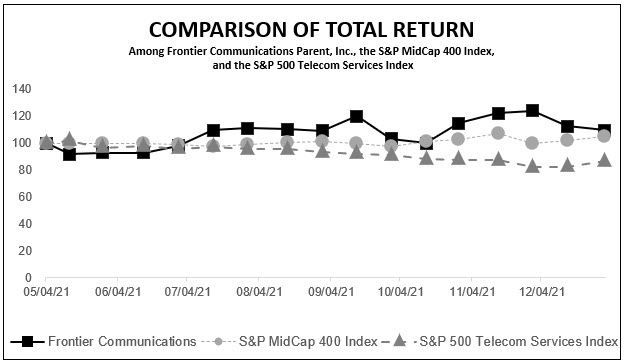

Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities | 26 |

|

|

|

Item 6. | 27 | |

|

|

|

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 28 |

|

|

|

Item 7A. | 44 | |

|

|

|

Item 8. | 45 | |

|

|

|

Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 45 |

|

|

|

Item 9A. | 45 | |

|

|

|

Item 9B. | 45 | |

|

|

|

PART III |

|

|

|

|

|

Item 10. | 46 | |

|

|

|

Item 11. | 49 | |

|

|

|

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 49 |

|

|

|

Item 13. | Certain Relationships and Related Transactions, and Director Independence | 49 |

|

|

|

Item 14. | 49 | |

|

|

|

PART IV |

|

|

|

|

|

Item 15. | 50 | |

|

|

|

| 53 | |

|

|

|

| F-1 |

FRONTIER COMMUNICATIONS PARENT, INC., AND SUBSIDIARIES

PART I

Unless the context indicates otherwise, the use of the terms the "Company,” “Frontier”, “we,” “us” or “our” shall refer to Frontier Communications Parent, Inc.

|

|

Item 1. | Business |

Overview

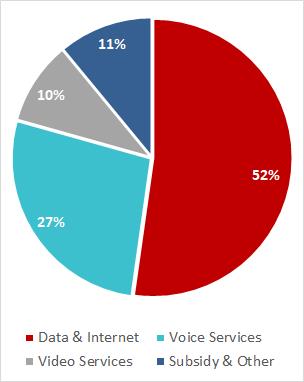

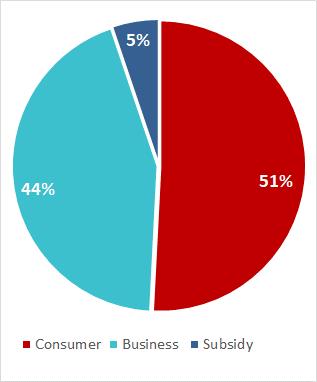

Frontier is a provider of communications services in the United States, with approximately 2.8 million broadband customers and 15,600 employees, operating in 25 states as of December 31, 2021. We offer a broad portfolio of communications services for consumer and business customers, which include data and Internet services, voice services, video services, and other.

For the year ended December 31, 2021, approximately 45% of our total revenue attributable to non-subsidy activities related to our fiber-optic products, with the other 55% relating to copper products. We generated revenue of approximately $6.4 billion for the year ended December 31, 2021.

|

|

|

|

|

Revenue by Product |

| Revenue by Customer |

| Revenue by Technology, Excluding Subsidy |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

On April 30, 2021, we emerged from bankruptcy, with a restructured balance sheet, a new management team, and a new purpose of “Building Gigabit America.” See “Emergence from Chapter 11 Bankruptcy; Basis of Presentation” below for a discussion of our reorganization and related financial reporting.

The Company has undertaken a significant transformation focused on its newly defined purpose. Key milestones in the last twelve months include:

Second Quarter 2021:

oA new board of directors, led by our Executive Chairman John Stratton.

oEmergence from bankruptcy and listing of our common stock on NASDAQ, trading under the ticker symbol “FYBR”.

oA new management team, including the appointment of our Chief Executive Officer (“CEO”) Nick Jeffery and numerous other senior leaders.

oStrategic review by new board and management team.

Third Quarter 2021:

oHeld inaugural Investor Day held in August, including results of strategic review.

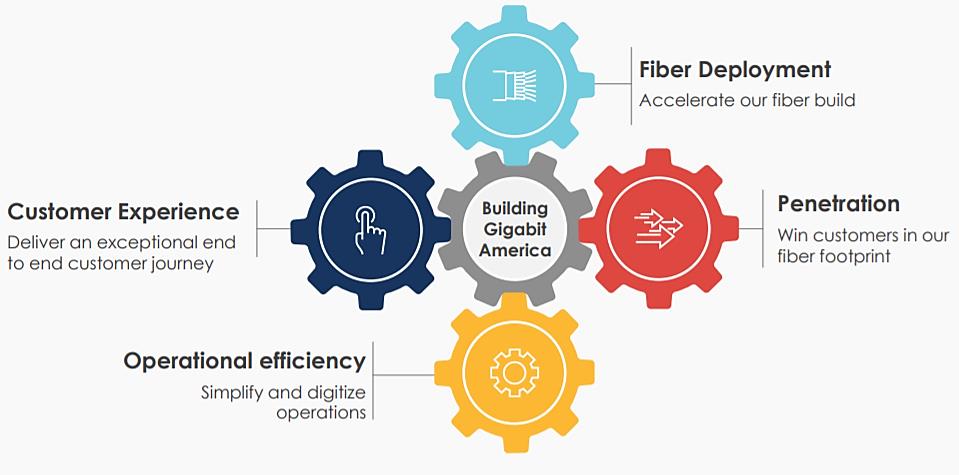

oAnnounced a new strategy, focused on four pillars: fiber deployment, fiber penetration, customer experience and operational efficiency.

oBuilt a record 185,000 new fiber locations.

FRONTIER COMMUNICATIONS PARENT, INC., AND SUBSIDIARIES

oAdded a record 29,000 fiber broadband customer net additions.

Fourth Quarter 2021:

oBuilt a new record high of 192,000 fiber locations.

oAdded a new record 45,000 fiber broadband customer net additions.

oFiber broadband customers net additions offset copper broadband net losses, resulting in positive total broadband customer net additions for the first time in more than five years.

oDelivered record-high Net Promoter Scores (NPS), with fiber NPS turning positive for the first time in company history.

oSuccessfully executed $1 billion debt offering.

oEntered into key strategic network agreements with AT&T.

Demand for high-speed broadband is growing rapidly, with data usage per household expected to grow significantly through higher over-the-top video consumption, more connected devices per household, and increased demand for upstream data (e.g., videoconferencing, gaming). We believe that fiber-optic service has competitive advantages to be able to meet this growing demand, including faster download speeds, faster upload speeds, and lower latency levels.

Given these product advantages, the Company announced a strategy that involves four key priorities: fiber deployment, fiber penetration, customer experience and operational efficiency.

Fiber Deployment: We announced our plan to accelerate our fiber build to reach approximately 10 million total fiber passings by December 31, 2025. We are prioritizing our build to locations which we estimate will provide the highest investment returns, and locations that are geographically clustered to accelerate the pace of the build. Over time, we expect our business mix will shift significantly, with a larger percentage of revenue coming from fiber as we implement our expansion plan.

In 2021, we built fiber to approximately 638,000 locations, resulting in 4.0 million total locations passed with fiber as of December 31, 2021. Our build plan remains on track and within the budget, and we have worked to solidify our fiber build supply chain, entering into multi-year agreements with key labor and equipment partners.

Fiber Penetration: We will deliver new best-in-market products to meet customer demands and increase penetration in our fiber footprint. We are targeting terminal penetration of 45% in markets we have passed with fiber.

In 2021, we added a record 99,000 fiber broadband customer net additions, with 75% of those in the second half of the year.

FRONTIER COMMUNICATIONS PARENT, INC., AND SUBSIDIARIES

These record fiber broadband net additions resulted in rising fiber broadband customer penetration across our footprint. In our Base Fiber footprint, which consists of the 3 million locations that we passed with fiber at the end of 2019, penetration increased to 41.9% at the end of 2021, up from 41.2% from the end of 2020. In our 2020 fiber build cohort, penetration increased to 22.4% at the twelve-month mark.

Customer Experience: We plan to deliver an exceptional experience throughout the customer journey. In 2021, we launched several partnerships to improve the customer experience including:

oRed Ventures: digital customer acquisition.

oeero, an Amazon company: delivering a fast, reliable whole-home Wi-Fi experience.

oYouTube TV: providing our customers with the lowest available price for streaming content in the market.

We have also made progress on our level of service to deliver an exceptional customer experience. Some key examples include:

oTotal churn and 90-day churn and call center volumes have declined since March 2021.

oOur Net Promoter Score (NPS) has increased since March 2021.

oCancellations between order and installation have decreased.

Operational Efficiency: Across the entire company, we have identified opportunities to simplify and digitize our operations, which we expect to yield annualized gross run rate cost savings of approximately $250 million by 2023. The initiatives that we implemented in 2021 realized approximately $90 million of annualized gross run rate cost savings as of December 31, 2021.

Frontier’s Service Territories

Customers

We conduct business with both consumer and business customers.

Consumer

Our consumer customers are residential customers in single or multiple dwelling units. We provide broadband, video, voice and other services and products to our consumer customers over both fiber and copper-based networks.

FRONTIER COMMUNICATIONS PARENT, INC., AND SUBSIDIARIES

Business

Our business customers include larger enterprise customers, small and medium businesses (“SMB”), and wholesale customers.

oLarger Enterprise: Fortune 1000, multi-location companies, large government entities, large educational institutions, and non-profits.

oMedium Business: Single or multi-location companies and mid-sized government entities, educational institutions, and non-profits.

oSmall Business: Mostly single-location companies, the smaller of which have purchase patterns similar to consumer customers.

oWholesale: Wholesale customers are often referred to as carriers or service providers and include national operators (such as AT&T and Verizon), local exchange companies that need to access locations within Frontier’s footprint to offer local services and wireless carriers, and integrated carriers that offer a variety of services across all of these categories. Wholesale customers buy both voice and data services to supplement their own network infrastructure.

We provide a broad range of services to our SMB and enterprise customers, including broadband, ethernet, traditional circuit-based services, software defined wide area network (“SDWAN”), managed Wi-Fi and cloud IT solutions, voice, and Unified Communications as a Service (“UCaaS”) services and Voice over Internet Protocol (“VoIP”). We also offer these customers advanced hardware and network solutions and services.

Services

We offer a broad portfolio of communications services for consumer and business customers. These services are offered on either a standalone basis or in a bundled package, depending on each customer’s needs.

Data and Internet services: We offer a comprehensive range of broadband and networking services. The principal consumer service we provide is broadband internet. Business services include a complete portfolio of ethernet services, dedicated Internet, SDWAN, managed Wi-Fi, time division multiplexing data transport services and optical transport services. These services are all supported by 24/7 technical support and an advanced network operations center. We also offer wireless broadband services (through unlicensed spectrum) in select markets utilizing networks that we own or operate.

Voice services: We provide voice services, including data-based VoIP and UCaaS, long-distance and voice messaging services, to consumer and business customers in all of our markets. These services are billed monthly in advance. Long-distance service to and from points outside our operating properties are provided by interconnection with the facilities of interexchange carriers. Our long-distance services are billed in advance for unlimited use service and billed in arrears for services on a per minute-of-use basis.

We also offer packages of communications services. These packages permit customers to bundle their products and services, including voice service, video and Internet services, and other product offerings.

Video services: We offer video services under the Frontier TV brand in portions of California, Texas, and Florida and under the Vantage brand in portions of Connecticut, North Carolina, South Carolina, Illinois, New York, and Ohio. We also offer satellite TV video service to our customers under an agency relationship with Dish Network Corp. (Dish) in additional markets.

Access services: We offer a range of access services. Our switched access services allow other carriers to use our facilities to originate and terminate their local and long-distance voice traffic. These services are generally offered on a month-to-month basis and the service is billed primarily on a minutes-of-use basis. Switched access charges are based on access rates filed with the Federal Communications Commission (“FCC”) for interstate services and with the respective state regulatory agency for intrastate services. See “Regulatory Environment” below.

Advanced hardware and network solutions: We offer our SMB and enterprise customers various hardware and network solutions utilizing cloud functionality, including end-to-end solutions like cloud managed services and Managed Wireless LAN. We offer third-party communications equipment tailored to their specific business needs by partnering with Mitel, Cisco, Ingram Micro, Airbus, Avaya, Hewlett Packard, and other equipment manufacturers.

Network Architecture and Technology

Our local exchange carrier networks consist of host central office and remote sites, primarily equipped with digital and Internet Protocol switches. The outside plant consists of transport and distribution delivery networks connecting our host central office with remote central offices and ultimately with our customers. We own fiber optic and copper cable, which have been deployed in our networks and are the primary transport technologies between our host and remote central offices and interconnection points with other communication carriers.

FRONTIER COMMUNICATIONS PARENT, INC., AND SUBSIDIARIES

We have expanded and enhanced our fiber optic and copper transport systems to support increasing demand for high bandwidth transport services. We routinely enhance our network and upgrade with the latest Internet protocol transport and routing equipment, reconfigurable optical add/drop multiplexers transport systems, passive optical network, very high speed digital subscriber line broadband equipment, and VoIP switches. These systems support advanced services such as ethernet, dedicated Internet, VoIP, and SDWAN. The network is designed with redundancy and auto-failover capability on our major circuits.

We connect to households and business locations in our service territory using a combination of fiber optic, copper, and wireless technologies. In some cases, we provide direct fiber into a residence (Fiber-to-the-home) or a business premises. In other cases, a location is served with a hybrid combination of fiber and copper. Residences in our service territory are served by fiber-to-the-home and by fiber-to-the-node (fiber carries the traffic to an intermediate location where the signals are converted to copper wire for the final delivery to the household). We provide data, video, and voice services to customers over both of these architectures. Additionally, fixed wireless broadband (FWB) is part of our broadband strategy and is deployed for some business ethernet services. FWB is delivered by the use of an antenna on a Frontier base location and another antenna at the customer location.

Competition

Competition within the communications industry is intense. For the vast majority of our premises passed, we currently face competition from either zero or one wireline competitor. In addition, we operate in many dense, urban markets with favorable demographic characteristics that correlate to higher broadband usage. As an example, we have a strong presence in Texas, Florida, and California, the three states in the U.S. with the highest population gains from 2010 to 2020. Given our footprint, we believe we are well positioned to capitalize on attractive demographic trends.

However, technological advances as well as regulatory and legislative changes have enabled a wide range of historically non-traditional communications service providers to compete with traditional providers, including Frontier. More market participants are now competing to meet the communications needs of the same customer base, thus increasing competitive pressures. We face competition from cable, wireless and wireline carriers, satellite, fiber “overbuilders” and Over-the-Top (“OTT”) companies. Many of these service providers are not subject to the same regulations as traditional communications providers and have lower cost structures than we do. The industry has also experienced substantial consolidation in recent years. Many of our competitors are larger, have stronger brand recognition, have more service offerings, and have greater financial resources than we currently do. All of these factors create potential downward pressure on the demand for and pricing of our services. Competition includes the following:

-Cable operators: In a majority of our markets, cable operators offer high speed Internet, video, and voice services, and compete with us aggressively for consumer and business customers on speed and price primarily by marketing with significant promotional period pricing.

-Wireless carriers: Wireless operators offer broadband, video and voice services and compete with us for consumer and business customers by offering increasingly larger data packages that utilize the latest 5G technology to mobile customers. As a result, the percentage of premises with landline telephone service has been declining, a trend we expect will continue.

-Online video providers: Many consumers are opting for OTT video services rather than traditional, multi-channel video. In response, we have made investments in our network to deliver OTT video content to consumers who might not opt for traditional video services. Additionally, we have developed partnerships with leading OTT providers such as DirectTV Stream and YouTubeTV to offer their services to our customers. The percentage of premises with a traditional, multi-channel video product has declined, a trend we expect will continue.

Competition for consumer customers is based on price, bandwidth, quality, and speed of service, including promotions as well as bundling of service offerings. Competition comes from other communications providers, cable operators, Competitive Local Exchange Companies (CLECs), and other enterprises. Our focus is to improve our customers’ experience through the deployment of efficient responses for their specific needs. This will improve the overall service quality provided and encourage migration to higher speed Internet services. Some consumer customers prefer the convenience and discounts available when voice, data, Internet and or video services are bundled by a single provider. To address this demand, we offer satellite TV video service through a partnership with Dish in areas where we don’t otherwise have our own video capabilities.

Competition for business customers is also based on price, bandwidth, quality, and speed of service, including pricing and promotions and bundled offerings. Competition comes from other communications providers, cable operators, CLECs, and other enterprises. As compared to our consumer customers, business customers often require more sophisticated and more data-centered solutions (e.g., IP PBX, E911 networks, ethernet and SIP trunking). In order to differentiate ourselves from other service providers, Frontier delivers end-to-end solutions such as cloud managed services and managed wireless LAN.

As customers continue to migrate to OTT video models, broadband is a core growth component for attracting and retaining consumer customers as well as our smaller business customers. We are committed to growing our customer base through providing higher broadband speeds and capacity that will enable us to reach new markets, target new customers and grow the business while maximizing our full geographic footprint.

FRONTIER COMMUNICATIONS PARENT, INC., AND SUBSIDIARIES

In addition to the focus on our broadband capabilities, we must continue to evolve our other product offerings to meet the changing needs of the market, provide strong customer service and support, invest in our network to enable adequate capacity and capabilities, and package our offerings at attractive prices. We are continuing to execute on our initiatives to build out our fiber network, drive operational performance, invest in our fiber network, win customers in our footprint, deliver on exceptional customer journey, and simplify our operations.

Regulatory Environment

Some of our operations are subject to regulation by the FCC and various state regulatory agencies, often called public service or utility commissions. We expect federal and state lawmakers, the FCC, and the state regulatory agencies to continue to revise the statutes and regulations governing communications services.

Regulation of Our Business

We are subject to federal, state, and local regulation and we have various regulatory authorizations for our regulated service offerings. At the federal level, the FCC generally exercises jurisdiction over information services, interstate, or international telecommunications services and over facilities to the extent they are used to provide, originate, or terminate interstate or international services. State regulatory commissions generally exercise jurisdiction over intrastate telecommunications services and the facilities used to provide, originate, or terminate those services. Most of our local exchange companies operate as incumbent carriers in the states in which they operate and are certified in those states to provide local telecommunications services. Certain federal and state agencies, including attorneys general, monitor and exercise oversight related to consumer protection issues, including marketing, sales, provision of services, and service charges. In addition, local governments often regulate the public rights-of-way necessary to install and operate networks and may require service providers to obtain licenses or franchises regulating their use of public rights-of-way. Municipalities and other local government agencies also may regulate other limited aspects of our business, by requiring us to obtain cable franchises and construction permits and to abide by applicable building codes.

Some state regulatory agencies have substantial oversight over incumbent telephone companies, and their interconnection with competitive providers and provision of non-discriminatory network access to certain network elements to them. Under the Federal Telecommunications Act of 1996, state regulatory commissions have jurisdiction to set certain rates, arbitrate, and review interconnection disputes and agreements between incumbent telephone companies and CLECs, in accordance with rules set by the FCC. The FCC and some state regulatory commissions also impose fees on providers of telecommunications services to support the federal and state universal service programs. Many of the states in which we operate require prior approvals or notifications for certain acquisitions and transfers of assets, customers, or ownership of regulated entities. The FCC and certain states also require certain approvals or notifications to discontinue the use of certain telecommunications facilities and the provision of some services.

Additionally, in some states we are subject to operating restrictions and minimum service quality standards. Failure to meet such restrictions may result in penalties or other obligations, including subjecting the Company to additional reporting and compliance obligations. As part of its required regulatory approval to emerge from Chapter 11, the Company has also agreed to and been required by certain states to comply with additional service quality, expenditures, reporting and other requirements. We also are required to report certain financial information. At the federal level and in a number of the states in which we operate, we are subject to price cap or incentive regulation plans under which prices for regulated services are capped. Some of these plans have limited terms and, as they expire, we may need to renegotiate with various states. These negotiations could impact rates, service quality and/or infrastructure requirements, which could also impact our earnings and capital expenditures. In other states in which we operate, we are subject to regulation that limits levels of earnings and returns on investments. We continue to advocate for no or reduced regulation with the regulatory agencies in those states. In some of the states we operate in we have already been successful in reducing or eliminating price regulation on end-user services.

Federal Regulatory Environment

Frontier, along with all telecommunications providers, is subject to FCC rules governing certain of our operations and services, including the privacy of specified customer information. Among other things, these privacy-related rules obligate carriers to implement procedures to: protect specified customer information from inappropriate disclosure; obtain customer permission to use specified information in marketing; authenticate customers before disclosing account information; and annually certify compliance with the FCC’s rules. Although most of these regulations are generally consistent with our business plans, they may restrict our flexibility in operating our business.

Some regulations are, or could in the future be, the subject of judicial proceedings, legislative hearings and administrative proposals or challenges that could change the manner in which the entire industry operates or the way we provide our services. Neither the outcome of any of these developments, nor their potential impact on us, can be predicted at this time. Regulatory oversight and requirements can change rapidly in the communications industry, and such changes may have an adverse effect on us.

FRONTIER COMMUNICATIONS PARENT, INC., AND SUBSIDIARIES

The current status of material regulatory initiatives is as follows:

Connect America Fund (“CAF”)/ Rural Digital Opportunity Fund (“RDOF”): In 2015, Frontier accepted the FCC’s CAF Phase II offer in 29 states, which provided $332 million in annual support and in return the Company is committed to make broadband with at least 10 Mbps downstream/1 Mbps upstream speeds available to approximately 774,000 high-cost unserved or underserved locations within its footprint. This amount included approximately 41,000 locations and $19 million in annual support related to the four states of the Northwest Operations, which were disposed on May 1, 2020. The deployment deadline for the CAF phase II program was December 31, 2021 and funding ended on that date. Thereafter, the FCC will review carriers’ CAF II program completion data, and if the FCC determines that the Company did not satisfy certain applicable CAF Phase II requirements, Frontier could be required to return a portion of the funds previously received and may be subject to certain other requirements and obligations.

On January 30, 2020, the FCC adopted an order establishing RDOF, a competitive reverse auction to provide support to serve high cost areas. The FCC announced the results of its RDOF Phase I auction on December 7, 2020. Frontier was awarded approximately $371 million over ten years to build gigabit-capable broadband over a fiber-to-the-premises network to approximately 127,000 locations in eight states (California, Connecticut, Florida, Illinois, New York, Pennsylvania, Texas, and West Virginia). Frontier submitted its Long Form application to the FCC on January 29, 2021 and is awaiting the FCC approval of its application. Frontier will be required to complete the buildout to the RDOF locations six years after funding starts, with interim target milestones over this period.

As part of its RDOF order, the FCC indicated it would hold a follow-on auction for the unawarded funding following the Phase I auction. However, it remains uncertain whether any such follow-on auction will occur given the recent passage of significant federal funding for broadband infrastructure funding.

COVID-19 Initiatives: The Federal government has undertaken several measures to address the ongoing impacts of the COVID-19 pandemic and to facilitate enhanced access to high speed broadband, including through several new funding programs. As these large amounts of federal funding flow through the broadband ecosystem, we will evaluate and pursue funding opportunities that make sense for our business. Frontier does not know what funding it may receive or the impact these programs may have, if any, in the future.

Specifically, as part of the Consolidated Appropriations Act of 2021 passed in December 2020, Congress provided $3.2 billion nationally to help support access to broadband services. In furtherance of this objective, the FCC created the Emergency Broadband Benefit to provide an up to $50 (up to $75 on tribal lands) monthly benefit for qualifying low-income consumers to purchase broadband. Frontier participated in the program and plans to participate in the successor Affordable Connectivity Program (“ACP”) when the programs transition in early 2022.

In March 2021, Congress passed the American Rescue Plan Act (“ARPA”) of 2021, which created a new $10 billion Coronavirus Capital Projects Fund that is available to the states for critical capital projects, including broadband infrastructure products, that directly enable work, education, and health monitoring. The ARPA also dedicated $350 billion to State and Local Coronavirus Fiscal Recovery Funds, which give states and localities the discretion to target a portion of the funding to broadband infrastructure, among many other permissible expenditure categories. States and localities continue to decide how they will distribute this funding, including whether to use it to fund broadband infrastructure. The ARPA also included $7.2 billion nationally for schools and libraries (the Emergency Connectivity Fund) that provides support for connectivity that enables remote learning. The FCC established rules prioritizing funding for off-campus services and devices, and the FCC is continuing to distribute funding under this program. For information on the tax-related legislative response to the COVID-19 pandemic, see “Risk Factors” in Part I, Item 1A of this Annual Report on Form 10-K.

In November 2021, Congress passed the Infrastructure Investment and Jobs Act (“IIJA”). The IIJA provides $42.5 billion nationally for the National Telecommunications and Information Administration (“NTIA”) to distribute to the states to provide service first to areas unserved by 25/3 Mbps and then to underserved areas, which is defined as less than 100/20 Mbps. Each state will receive a minimum of $100 million, with the remainder of program funding distributed based on the extent of high-cost areas and then the number of unserved locations in each state relative to the total number of unserved locations in the country. NTIA cannot begin distributing funding to states until the FCC has completed broadband mapping, which is not expected until the second half of 2022. States are expected to award funding they receive through competitive grant processes. In the IIJA, Congress also provides $14.2 billion for the ACP, which is the follow-on low-income program to the EBB. The IIJA includes certain changes for the ACP including, it reduces the maximum available subsidy per household from $50 to $30 (while keeping it at $75 on tribal lands), expands the eligibility pool for the subsidy, and requires that customers be able to apply the credit to any Internet service offering, among other things.

The IIJA also funds several other programs dedicated to broadband expansion and upgrades, including a $2 billion tribal broadband program, a $2 billion Rural Utilities Service loan and grants program, a $1 billion middle mile grants program, in addition to other smaller amounts or amounts less directly related to deployment and adoption.

FRONTIER COMMUNICATIONS PARENT, INC., AND SUBSIDIARIES

Current and Potential Internet Regulatory Obligations: On October 1, 2019, the D.C. Circuit Court largely upheld the FCC decision in its 2018 Restoring Internet Freedom Order to reclassify broadband as an “information service.” However, the Court invalidated the FCC’s preemption of a state’s ability to pass their own network neutrality rules and remanded back to the FCC other parts of the 2018 Order. California’s network neutrality provisions have gone into effect and remain the subject of litigation in the Eastern District of California. It is unclear whether pending or future appeals will have any impact on the regulatory structure, and it is unclear what impact federal legislative or regulatory actions will have on net neutrality issues.

Privacy: Privacy-related legislation has been considered in a number of states. Legislative and regulatory action could result in increased costs of compliance, claims against broadband Internet access service providers and others, and increased uncertainty in the value and availability of data. On June 28, 2018, the state of California enacted comprehensive privacy legislation that, effective as of January 1, 2020, gives California consumers the right to know what personal information is being collected about them, and whether and to whom it is sold or disclosed, and to access and request deletion of this information. Subject to certain exceptions, it also gives consumers the right to opt-out of the sale of personal information. The law applies the same rules to all companies that collect consumer information.

Video Programming

Federal, state, and local governments extensively regulate the video services industry. Our linear video services are subject to, among other things: subscriber privacy regulations; requirements that we carry a local broadcast station or obtain consent to carry a local or distant broadcast station; rules for franchise renewals and transfers; the manner in which program packages are marketed to subscribers; and program access requirements.

We provide video programming in some of our markets including California, Connecticut, Florida, Indiana, and Texas pursuant to franchises, permits and similar authorizations issued by state and local franchising authorities. Most franchises are subject to termination proceedings in the event of a material breach or expire in the ordinary course. In addition, most franchises require payment of a franchise fee as a requirement to the granting of authority.

Many franchises establish comprehensive facilities and service requirements, as well as specific customer service standards and monetary penalties for non-compliance. In many cases, franchises are terminable if the franchisee fails to comply with material provisions set forth in the franchise agreement governing system operations. We believe that we are in compliance and meeting all material standards and requirements. Franchises are generally granted for fixed terms and must be periodically renewed. Local franchising authorities may resist granting a renewal if either past performance or the prospective operating proposal is considered inadequate.

Our agreement with Verizon for use of the FiOS brand and trademark in markets acquired from them expired on March 31, 2021 and was not renewed or extended. Frontier rebranded our related data and video services as Frontier FiberOptic Internet and Frontier TV, respectively.

Environmental Regulation

The local exchange carrier subsidiaries we operate are subject to federal, state, and local laws, and regulations governing the use, storage, disposal of, and exposure to hazardous materials, the release of pollutants into the environment and the remediation of contamination. As an owner and former owner of property, we are subject to environmental laws that could impose liability for the entire cost of cleanup at contaminated sites, including sites formerly owned by us, regardless of fault or the lawfulness of the activity that resulted in contamination. We believe that our operations are in substantial compliance with applicable environmental laws and regulations.

Segment Information

The Company’s operations are managed and reported to our CEO, the Company’s chief operating decision maker, on a consolidated basis. The CEO assesses performance and allocates resources based on the consolidated results of operations. Under this organizational and reporting structure, the Company has one reportable segment.

Intellectual Property

We own or have licenses to various trademarks, trade names and intellectual property rights that are necessary for the operation of our business.

We own or have the rights to use various trademarks, service marks and trade names referred to in this report. Solely for convenience, we refer to trademarks, service marks and trade names in this report without the ™, SM and ® symbols. Such references are not intended to indicate, in any way, that we will not assert, to the fullest extent permitted by law, our rights to our trademarks, service marks and trade names. Other trademarks, trade names or service marks appearing in this report are the property of their respective owners.

Human Capital Management

Our greatest asset is our people. As of December 31, 2021, we have approximately 15,600 employees and serve approximately 2.8 million broadband customers across 25 states. A highly engaged workforce is the best way we can deliver for our customers,

FRONTIER COMMUNICATIONS PARENT, INC., AND SUBSIDIARIES

realize our purpose, and transform our business. Our new Board and leadership team are committed to creating a best-in-class culture and improving our human capital management, including talent engagement and development, health and safety, and diversity, equity, and inclusion. In 2021, our new CEO Nick Jeffery rallied our workforce around the single purpose of Building Gigabit America. Our human resource programs support that ambition.

Talent engagement and development

A culture built upon listening is critical to our transformation into a thriving technology company. To drive change, our culture must be grounded in transparent, two-way communication with actionable feedback in every part of our organization.

In 2021 our new leadership team conducted a critical employee survey to evaluate employee engagement and satisfaction. This “People Pulse Survey” revealed key insights into how our culture was driving our business results. As a result, we made changes to policies, programs, and how we communicate. Our leadership team also began hosting regular all-hands meetings to share progress on priorities and solicit feedback from employees. For example, our CEO’s bi-monthly “Listen Live” events are open to all employees. During these calls, we discuss new products and programs, recognize individuals who exceed expectations, and answer our employees’ questions directly.

Talent development is also a focus for the new leadership team. In 2021, we provided training for customer-facing employees. Armed with a fuller knowledge of our technology, these employees can create a better customer experience. Additionally, we offer leadership development training to build our internal talent pipeline, and tuition reimbursement programs to support personal and professional growth.

Health and Safety

The safety of our employees is our top priority, and we are committed to providing a safe working environment. This starts at the top, with monthly executive reviews designed to monitor existing and emerging health and safety risks associated with our business and identify opportunities for training and other mitigation programs.

In 2021, the COVID-19 pandemic continued and so did the demand for our services. In turn, we evolved our COVID-19 safety protocol program to protect our employees and our customers. Our quick and decisive action helped avoid significant outbreaks in our employee population and minimized the impact on customers.

As a standard practice, we maintain environmental, health, and safety compliance programs, including ongoing safety training for our field technicians. In 2021, we added technical safety programs as we expanded our fiber build across the country. On average, new Frontier technicians receive a minimum of 160 hours of training.

Diversity, Equity, and Inclusion

We know a diverse workforce is a stronger workforce. In 2021, we refocused our diversity, equity, and inclusion efforts at the top. Our Board and our new senior management team are comprised of individuals that bring a wealth of diverse skills, talents, gender, ethnicity, and experience to their leadership of our company. Organization-wide, we also began an internal campaign to strengthen our culture with a year-long diversity celebration that educates and inspires our workforce.

Our Workforce

Our employee base decreased by approximately 4% from approximately 16,200 employees as of December 31, 2020 to 15,600 at December 31, 2021. During 2021, restructuring and organizational realignment resulted in the separation of approximately 350 employees. Approximately 70% of our total employees are represented by unions and are subject to collective bargaining agreements. The term of our collective bargaining agreements is typically three years and at any point in time we generally have several agreements under negotiation and on extension. Approximately 23% of our unionized employees are covered by collective agreements that are scheduled to expire in 2022. We consider our relations with our employees to be good.

In addition, our workforce is currently supplemented by approximately 370 contract workers, primarily supporting the technology and field operations groups. We are a federal contractor and follow the rules set forth by the Department of Labor Office of Compliance (OFCCP), including those applicable to recruiting, hiring and diversity.

Emergence from Chapter 11 Bankruptcy; Basis of Presentation

On April 14, 2020, Frontier Communications Corporation (“Old Frontier”) and certain of its subsidiaries (collectively, the “Debtors”) filed voluntary petitions for relief (the “Chapter 11 Cases”) under Chapter 11 of the United States Bankruptcy Code. On August 27, 2020, the Bankruptcy Court entered the Confirmation Order, which approved and confirmed the Plan of Reorganization (the “Plan”). On April 30, 2021, (the “Effective Date”), the Company emerged from Chapter 11 pursuant to a series of transactions under the Plan. On the Effective Date, among other things, all of the obligations under Old Frontier’s unsecured senior notes were cancelled, all of Old Frontier’s equity existing as of the Effective Date was cancelled, and the Company issued 244,401,000 shares of common stock that were transferred to holders of the allowed senior notes claims (as defined in the Plan.) Further, in connection with the satisfaction of the conditions to effectiveness as set forth in the Confirmation Order and in the Plan, Frontier Communications Holdings, LLC completed a series of transactions whereby it assumed all of the outstanding indebtedness of Old Frontier and issued the “Takeback Notes.”

FRONTIER COMMUNICATIONS PARENT, INC., AND SUBSIDIARIES

Upon the Company’s emergence from the Chapter 11 Cases, the Company adopted fresh start accounting, which resulted in a new basis of accounting and the Company became a new entity for financial reporting purposes. As a result of the application of fresh start accounting and the effects of the implementation of the Plan, the consolidated financial statements after the Effective Date are not comparable with the consolidated financial statements on or before that date. Refer to Note 4 – “Fresh Start Accounting” to the audited consolidated financial statements, in Part II, Item 8 of this Annual Report on Form 10-K, for additional information related to fresh start accounting.

In this report, references to “Successor” relate to our financial position and results of operations after the Effective Date and references to “Predecessor” refer to the financial position and results of operations of Old Frontier and its subsidiaries on or before the Effective Date.

Available Information

We make available, free of charge on our website, our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to these reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, as soon as practicable after we electronically file these documents with, or furnish them to, the SEC. These documents may be accessed through our website at www.frontier.com under “Investor Relations.” The information posted or linked on our website is not part of, or incorporated by reference into, this report. We also make our Annual Report available in printed form upon request at no charge.

We make available on our website, as noted above, or in printed form upon request, free of charge, our Corporate Governance Guidelines, Code of Business Conduct and Ethics, Specific Code of Business Conduct and Ethics Provisions for Certain Officers, and the charters for the Audit, Compensation and Human Capital, and Nominating and Corporate Governance Committees of the Board of Directors. Stockholders may request printed copies of these materials by writing to: 401 Merritt 7, Norwalk, Connecticut 06851 Attention: Corporate Secretary.

FRONTIER COMMUNICATIONS PARENT, INC., AND SUBSIDIARIES

Forward-Looking Statements

This Annual Report on Form 10-K contains "forward-looking statements," related to future events. Forward-looking statements address our expectations or beliefs concerning future events, including, without limitation, our future operating and financial performance, our ability to implement strategic initiatives, our ability to comply with the covenants in the agreements governing our indebtedness and other matters. These statements are made on the basis of management’s views and assumptions, as of the time the statements are made, regarding future events and performance and contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “may,” “will,” “would,” or “target.” Forward-looking statements by their nature address matters that are, to different degrees, uncertain. We do not intend, nor do we undertake any duty, to update any forward-looking statements.

A wide range of factors could materially affect future developments and performance, including but not limited to:

our significant indebtedness, our ability to incur substantially more debt in the future, and covenants in the agreements governing our current indebtedness that may reduce our operating and financial flexibility;

declines in Adjusted EBITDA relative to historical levels that we are unable to offset;

our ability to successfully implement strategic initiatives, including our fiber buildout and other initiatives to enhance revenue and realize productivity and service improvements;

our ability to secure necessary construction resources, materials and permits for our fiber buildout initiative in a timely and cost-effective manner;

potential disruptions in our supply chain and the effects of inflation resulting from the COVID-19 pandemic, the global microchip shortage, or otherwise, which could adversely impact our business and hinder our fiber expansion plans;

our ability to effectively manage our operations, operating expenses, capital expenditures, debt service requirements and cash paid for income taxes and liquidity;

competition from cable, wireless and wireline carriers, satellite, fiber “overbuilders” and OTT companies, and the risk that we will not respond on a timely or profitable basis;

our ability to successfully adjust to changes in the communications industry, including the effects of technological changes and competition on our capital expenditures, products, and service offerings;

risks related to disruption in our networks, infrastructure and information technology that result in customer loss and/or incurrence of additional expenses;

the impact of potential information technology or data security breaches or other cyber-attacks or other disruptions;

our ability to retain or attract new customers and to maintain relationships with customers;

our reliance on a limited number of key supplies and vendors;

declines in revenue from our voice services, switched and nonswitched access and video and data services that we cannot stabilize or offset with increases in revenue from other products and services;

our ability to secure, continue to use or renew intellectual property and other licenses used in our business;

our ability to hire or retain key personnel;

our ability to dispose of certain assets or asset groups or to make acquisition of certain assets on terms that are attractive to us, or at all;

the effects of changes in the availability of federal and state universal service funding or other subsidies to us and our competitors and our ability to obtain future subsidies;

our ability to comply with the applicable CAF II and RDOF requirements and the risk of penalties or obligations to return certain CAF II and RDOF funds;

our ability to defend against litigation and potentially unfavorable results from current pending and future litigation;

our ability to comply with applicable federal and state consumer protection requirements;

FRONTIER COMMUNICATIONS PARENT, INC., AND SUBSIDIARIES

the effects of governmental legislation and regulation on our business, including costs, disruptions, possible limitations on operating flexibility and changes to the competitive landscape resulting from such legislation or regulation;

the impact of regulatory, investigative, and legal proceedings and legal compliance risks;

our ability to effectively manage service quality in the states in which we operate and meet mandated service quality metrics;

the effects of changes in income tax rates, tax laws, regulations, or rulings, or federal or state tax assessments, including the risk that such changes may benefit our competitors more than us, as well as potential future decreases in the value of our deferred tax assets;

the effects of changes in accounting policies or practices;

our ability to successfully renegotiate union contracts;

the effects of increased medical expenses and pension and postemployment expenses;

changes in pension plan assumptions, interest rates, discount rates, regulatory rules, and/or the value of our pension plan assets;

the likelihood that our historical financial information may no longer be indicative of our future performance; and our implementation of fresh start accounting;

the impact of adverse changes in economic, political and market conditions in the areas that we serve, the U.S. and globally, including but not limited to, disruption in our supply chain, inflation in pricing for key materials or labor, or other adverse changes resulting from epidemics, pandemics and outbreaks of contagious diseases, including the COVID-19 pandemic, natural disasters, economic or political instability or other adverse public health developments;

potential adverse impacts of the COVID-19 pandemic on our business and operations, including potential disruptions to the work of our employees arising from health and safety measures such as social distancing, working remotely and recent applicable federal, state and local mandates and prohibitions, our ability to effectively manage increased demand on our network, our ability to maintain relationships with our current or prospective customers and vendors and the ability of our vendors to perform under current or proposed arrangements with us;

potential adverse impacts of climate change and increasingly stringent environmental laws, rules and regulations, and customer expectations;

market overhang due to substantial common stock holdings by our former creditors;

certain provisions of Delaware law and our certificate of incorporation that may prevent efforts by our stockholders to change the direction or management of our company; and

certain other factors set forth in our other filings with the SEC.

This list of factors that may affect future performance and the accuracy of forward-looking statements is illustrative and is not intended to be exhaustive. Any of the foregoing events, or other events, could cause our results to vary from management’s forward-looking statements included in this report. You should consider these important factors, as well as the risks set forth under Item 1A. “Risk Factors,” in evaluating any statement in this report or otherwise made by us or on our behalf. We have no obligation to update or revise these forward-looking statements and do not undertake to do so.

Investors should also be aware that while we do, at various times, communicate with securities analysts, it is against our policy to disclose to them selectively any material non-public information or other confidential information. Accordingly, investors should not assume that we agree with any statement or report issued by an analyst, irrespective of the content of the statement or report. To the extent that reports issued by securities analysts contain any projections, forecasts or opinions, such reports are not our responsibility.

FRONTIER COMMUNICATIONS PARENT, INC., AND SUBSIDIARIES

ITEM 1A. Risk Factors

Before you make an investment decision with respect to any of our securities, you should carefully consider all the information we have included in this Annual Report on Form 10-K and our subsequent filings with the SEC. In particular, you should carefully consider the risk factors described below and the risks and uncertainties related to “Forward-Looking Statements,” any of which could materially adversely affect our business, operating results, financial condition and the actual outcome of matters as to which forward-looking statements are made in this annual report. The risks and uncertainties described below are not the only ones facing Frontier.

Additional risks and uncertainties that are not presently known to us or that we currently deem immaterial or that are not specific to us, such as general economic conditions, may also adversely affect our business and operations. The following risk factors should be read in conjunction with the balance of this annual report, including the consolidated financial statements and related notes included in this report.

Risks Related to Our Indebtedness

We have a significant amount of indebtedness and we may still be able to incur substantially more debt in the future. Such debt and debt service obligations may adversely affect us.

As of December 31, 2021, we have indebtedness of approximately $8 billion of which approximately $7 billion is secured. We may also be able to incur substantial additional indebtedness in the future. Although the terms of the agreements currently governing our existing indebtedness restrict our and our restricted subsidiaries’ ability to incur additional indebtedness and liens, such restrictions are subject to several exceptions and qualifications, and the indebtedness and/or liens incurred in compliance with such restrictions may be substantial. Also, these restrictions do not prevent us or our restricted subsidiaries from incurring obligations that do not constitute indebtedness. In addition, to the extent other new debt is added to our and our subsidiaries’ current debt levels, the substantial leverage risks described below would increase.

The potential significant negative consequences on our financial condition and results of operations that could result from our substantial debt include:

limitations on our ability to obtain additional debt or equity financing on favorable terms or at all;

instances in which we are unable to comply with the covenants contained in our indentures and credit agreement or to generate cash sufficient to make required debt payments, which circumstances have the potential of accelerating the maturity of some or all of our outstanding indebtedness;

the allocation of a substantial portion of our cash flow from operations to service our debt, thus reducing the amount of our cash flows available for other purposes, including capital expenditures that would otherwise improve our competitive position, results of operations or stock price;

requiring us to sell debt or equity securities or to sell some of our core assets, possibly on unfavorable terms, to meet payment obligations;

compromising our flexibility to plan for, or react to, competitive challenges in our business and the telecommunications industry;

increasing our vulnerability to general adverse economic and industry conditions, including increases in interest rates, particularly given our indebtedness that bears interest at variable rates, as well as to catastrophic events; and

the possibility of our being put at a competitive disadvantage with competitors who, relative to their size, do not have as much debt as we do, and competitors who may be in a more favorable position to access additional capital resources.

In addition, our First Lien Notes and Second Lien Notes (including the Takeback Notes), as well as our subsidiary indebtedness, are rated below “investment grade” by independent rating agencies. This has resulted in higher borrowing costs for us. These rating agencies may lower our debt ratings further, if in the rating agencies’ judgment such an action is appropriate. A further lowering of a rating would likely increase our future borrowing costs and reduce our access to capital. Our negotiations with vendors, customers and business partners can be negatively impacted if they deem us a credit risk as a result of our credit rating.

FRONTIER COMMUNICATIONS PARENT, INC., AND SUBSIDIARIES

The agreements governing our current indebtedness contain various covenants that impose restrictions on us and certain of our subsidiaries that may reduce our operating and financial flexibility and we may not be able to satisfy our obligations under these or other, future debt arrangements.

The agreements governing our existing indebtedness contain covenants that, among other things, limit our ability and the ability of certain of our subsidiaries to:

incur additional debt and issue preferred stock;

incur or create liens;

redeem and/or prepay certain debt;

pay dividends on our stock or repurchase stock;

make certain investments;

engage in specified sales of assets;

enter into transactions with affiliates; and

engage in consolidation, mergers, and acquisitions.

In addition, our credit facilities require us to comply with specified financial ratios, including a maximum first lien coverage ratio. Any future indebtedness may also require us to comply with similar or other covenants.

These restrictions on our ability to operate our business could seriously harm our business by, among other things, limiting our ability to take advantage of financings, mergers, acquisitions, and other corporate opportunities. Various risks, uncertainties and events beyond our control could affect our ability to comply with these covenants. Failure to comply with any of the covenants in our financing agreements could result in a default under those agreements and under other agreements containing cross-default provisions. A default would permit lenders to accelerate the maturity for the debt under these agreements and to foreclose upon any collateral securing the debt. Under these circumstances, we might not have sufficient funds or other resources to satisfy all of our obligations. In addition, the limitations imposed by financing agreements on our ability to incur additional debt and to take other actions might significantly impair our ability to obtain other financing. This could have serious consequences to our financial condition and results of operations.

Frontier is primarily a holding company and, as a result, we rely on the receipt of funds from our subsidiaries in order to meet our cash needs and service our indebtedness, including the notes.

Frontier is primarily a holding company and its principal assets consist of the shares of capital stock or other equity instruments of its subsidiaries. As a holding company, we depend on distributions, transfers, and other intracompany payments with our subsidiaries to fund our obligations. The operating results of our subsidiaries at any given time may not be sufficient to make distributions, transfers, or other payments to us in order to allow us to make payments on our indebtedness. In addition, the payment of these distributions, transfers, and other payments, as well as other transfers of assets, between our subsidiaries and from our subsidiaries to us may be subject to legal, regulatory, or contractual restrictions. Some state regulators have imposed, and others may consider imposing on regulated companies, including us, cash management practices that could limit the ability of such regulated companies to transfer cash between subsidiaries or to the parent company. While none of the existing state regulations materially affect our cash management, any changes to the existing regulations or imposition of new regulations or restrictions may materially adversely affect our ability to transfer cash within our consolidated companies.

We expect to make contributions to our pension plan in future years, the amount of which will be impacted by volatility in asset values related to Frontier’s pension plan and/or changes in pension plan assumptions.

Under IRS regulations, we are required to make minimum contributions to our pension plan annually, based upon, among other factors, the value of plan assets relative to the funding target. We made contributions of $42 million and $64 million to our pension plan in 2021 and 2020, respectively. Our required contributions for plan years 2021 and 2020, calculated as of January 1 of the relevant year, were approximately $172 million and $127 million, respectively. In 2021, we received an IRS waiver of the minimum funding standard under Section 412(c) of the Internal Revenue Code, and Section 302(c) of the Employee Retirement Income Security Act of 1974 for the 2020 minimum required distribution. With this waiver, we are spreading the 2020 minimum required contribution over the five subsequent plan years, in addition to the minimum contributions owed for those plan years. Further, we have adopted certain provisions of the American Rescue Plan Act, or ARPA, effective for 2019 and 2020, which decreased the minimum required contributions for those years.

We expect to make contributions to our pension plan in future years and the amount of required contributions for future years could be significant. Volatility in our asset values, liability calculations, or returns may impact the costs of maintaining our pension plan and our future funding requirements. Any future contribution to our pension plan could be material and could have a material adverse effect on our liquidity by reducing cash flows.

FRONTIER COMMUNICATIONS PARENT, INC., AND SUBSIDIARIES

Significant changes in discount rates, rates of return on pension assets, mortality tables and other factors could adversely affect our earnings and equity and increase our pension funding requirements.

Pension costs and obligations are determined using actual results as well as actuarial valuations that involve several assumptions. The most critical assumptions are the discount rate, the long-term expected return on assets and mortality tables. Other assumptions include salary increases, lump sum payments, and retirement age. Some of these assumptions, such as the discount rate and return on pension assets, are reflective of economic conditions and impacted by factors such as inflationary pressures that are largely out of our control. Changes in the pension assumptions could have a material impact on pension costs and obligations, and could in turn have a material adverse effect on our earnings, equity, and funding requirements.

Risks Related to Our Business

If our fiber expansion plan or other initiatives to increase our revenues, customer trends, profitability and cash flows are unsuccessful, our financial position and results of operations will be negatively and adversely impacted.

We must produce adequate revenues and operating cash flows that, when combined with cash on hand and borrowing under our revolving credit facility and other financings, will be sufficient to service our debt, fund our capital expenditures, taxes, pension and other employee benefit obligations and other operating expenses. We continue to experience revenue declines as compared to prior years. We have undertaken, and expect to continue to undertake, programs and initiatives with the objective of improving revenues, customer trends, profitability, and cash flows by enhancing our operations and customer service and support processes. In particular, under our fiber expansion plan we intend to grow our fiber network and optimize our existing copper network at attractive internal rates of return (IRRs) in order to increase our revenues and customer trends, and in turn increase our profitability and cash flows. We have historically experienced significant challenges in achieving such improvements. In addition, these programs and initiatives require significant investment and other resources and may divert attention from ongoing operations and other strategic initiatives.

There can be no assurance that our current and future initiatives and programs will be successful, or that the actual returns from these programs and initiatives will not be lower than anticipated or take longer to realize than we anticipate. For example, we may not reach our targets to expand and penetrate our existing fiber network on the timelines we anticipate, or at all. If current and future programs and initiatives are unsuccessful, result in lower returns than we anticipate, or take longer than we anticipate, it could have a material adverse effect on our financial position and our results of operations.

The effects of the COVID-19 pandemic, including its impact on market conditions, may adversely impact our business and hinder our fiber expansion plans. In addition, we continue to evaluate the potential impact to our business and results of operations of certain federal, state, and local regulatory requirements in response to COVID-19.

The outbreak of COVID-19 and the resulting economic downturn adversely affected the financial markets and the economy more generally, which could adversely impact our business. As of December 31, 2021, the markets remain volatile and the economic outlook remains uncertain.

While overall the operational and financial impacts to our business of the COVID-19 pandemic for the year ended December 31, 2021 were not significant, we continue to closely monitor the evolution of the pandemic, including new COVID-19 variants, as well as the ongoing impact to our employees, our customers, our business and our results of operations. We have experienced a slowdown in service activations for certain customers; to date, these negative impacts have been partially offset by higher consumer activations and lower churn, but there can be no assurance they will continue to be offset. We also continue to closely track our customers’ payment activity as well as external factors, including the expiration of federal wage subsidies for individuals and small businesses which could materially impact payment trends. With more people working from home, we have experienced higher demands on our network and higher sales activity for our consumer broadband service offering. This sustained increase in network demand could lead to reduced network availability and potential outages, which may impair our ability to meet customer service level commitments, lead to higher costs, higher customer churn and potential increased regulatory actions. These potential changes, among others, could have a material financial impact to Frontier.

Our response to COVID-19 has included several operational safety precautions. We continue to monitor the applicable federal, state, or local requirements and any potential impact it may have on our workforce.

Potential longer-term impacts of COVID-19 on our business include the potential for higher borrowing costs and incremental financing needs. Our analysis of the potential impact of COVID-19 is subject to change. We are unable to predict the timing, duration or intensity of the COVID-19 pandemic and its effects on the business and general economic conditions in the United States of America and the markets in which we operate. Our financial condition, results of operations, liquidity and cash flows could be significantly affected by the continuing COVID-19 pandemic.

Potential disruptions in our supply chain and the effects of inflation, resulting from the COVID-19 pandemic, the global microchip shortage, or otherwise, may adversely impact our business and hinder our fiber expansion plans.

Through December 31, 2021, we had not experienced any significant disruptions in our supply chain; however, some of our business partners, have been impacted by COVID-related workforce absences and other disruptions which have affected our

FRONTIER COMMUNICATIONS PARENT, INC., AND SUBSIDIARIES

service levels and distribution of work. In particular, network electronics that require microchip processors have experienced supply chain constraints due to the global microchip shortage.

While we have endeavored to diversify our supplier and contractor base, we cannot assure you that we will not experience significant shortages or delays in our supply chain relating to materials, labor, and other inputs necessary to our fiber expansion plans. Any such shortages or delays may adversely impact our ability to reach our fiber expansion targets on budget and on time.

In addition, during fiscal 2021 we began to experience the impact of inflation-sensitive items, including upward pressure on the cost of materials, labor, and other items that are critical to our business. We continue to monitor these impacts closely and, if costs continue to rise, may be unable to recoup losses or offset diminished margins by passing these costs through to our customers or implementing offsetting cost reductions.

The communications industry is very competitive, and some of our competitors have superior resources which may place us at a disadvantage.

We face competition in every aspect of our business. Through mergers and various service expansion strategies, service providers are striving to provide integrated solutions both within and across geographic markets. Our competitors include cable companies, wireless and wireline carriers, satellite, fiber “overbuilders” and OTT companies, some of which may be subject to less regulation than we are. These entities may provide services competitive with the services that we offer or intend to introduce. For example, our competitors may seek to introduce networks in our markets that are competitive with or superior to our copper-based networks in those markets. Several competitors were successful bidders in the RDOF auction in areas within Frontier’s service footprint and we expect these competitors will deploy expanded services in these areas that will compete with our services. We also believe that wireless, cable, and other providers have increased their penetration of various services in our markets. We expect that competition will remain robust. Our revenue and cash flow will be adversely impacted if we cannot reverse our customer losses or continue to provide high-quality services.

Some of our competitors have market presence, engineering, technical, marketing, and financial capabilities which are substantially greater than ours. In addition, some of these competitors have less debt and are able to raise capital at a lower cost than we are able to. Consequently, some of these competitors may be able to develop and expand their communications and network infrastructures more quickly, adapt more swiftly to new or emerging technologies and changes in customer requirements, including leading edge technologies such as artificial intelligence, machine learning and various types of data science, as well as take advantage of acquisition and other opportunities more readily and devote greater resources to the marketing and sale of their products and services than we will be able to. Additionally, the greater brand name recognition of some competitors may require us to price our services at lower levels in order to retain or obtain customers. Finally, the cost advantages and greater financial resources of some of these competitors may give them the ability to reduce their prices for an extended period of time if they so choose. Our business and results of operations may be materially adversely impacted if we are not able to effectively compete.

We cannot predict which of the many possible future technologies, products or services will be important to maintain our competitive position or what expenditures will be required to develop and provide these technologies, products, or services. Our ability to compete successfully will depend on the effectiveness of capital expenditure investments in infrastructure, products and services, our marketing efforts, our ability to deliver high quality customer service, our ability to anticipate and respond to various competitive factors affecting the industry, including a changing regulatory environment that may affect our business and that of our competitors differently, new services that may be introduced, changes in consumer preferences, or habits, demographic trends, economic conditions and pricing strategies by competitors. Increasing competition may reduce our revenues and increase our marketing and other costs as well as require us to increase our capital expenditures and thereby decrease our cash flows.

We may be unable to meet the technological needs or expectations of our customers and may lose customers as a result.

The communications industry is subject to significant changes in technology and replacing or upgrading our infrastructure to keep pace with such technological changes could result in significant capital expenditures. If we do not replace or upgrade technology and equipment and manage broadband speeds and capacity as necessary, we may be unable to compete effectively because we will not be able to meet the needs or expectations of our customers.

In addition, enhancements to product offerings may influence our customers to consider other service providers, such as cable operators or wireless providers. We may be unable to attract new or retain existing customers from cable companies due to their deployment of enhanced broadband and VoIP technology. In addition, new capacity services for broadband technologies may permit our competitors to offer broadband data services to our customers throughout most or all of our service areas. Any resulting inability to attract new or retain existing customers could adversely impact our business and results of operations in a material manner.

FRONTIER COMMUNICATIONS PARENT, INC., AND SUBSIDIARIES