UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM N-CSR

Investment Company Act file number: 811-02671

Deutsche DWS Municipal Trust

(Exact Name of Registrant as Specified in Charter)

875 Third Avenue

New York, NY 10022-6225

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, including Area Code: (212) 454-4500

Diane Kenneally

100 Summer Street

Boston, MA 02110

(Name and Address of Agent for Service)

| Date of fiscal year end: | 5/31 |

| Date of reporting period: | 5/31/2021 |

| ITEM 1. | REPORT TO STOCKHOLDERS |

| (a) |

| 2 | | DWS Strategic High Yield Tax-Free Fund |

| DWS Strategic High Yield Tax-Free Fund | | 3 |

| 4 | | DWS Strategic High Yield Tax-Free Fund |

| Portfolio Management Review | (Unaudited) |

| DWS Strategic High Yield Tax-Free Fund | | 5 |

| 6 | | DWS Strategic High Yield Tax-Free Fund |

| DWS Strategic High Yield Tax-Free Fund | | 7 |

| 8 | | DWS Strategic High Yield Tax-Free Fund |

| DWS Strategic High Yield Tax-Free Fund | | 9 |

| 10 | | DWS Strategic High Yield Tax-Free Fund |

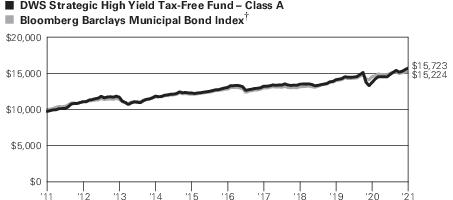

| Performance Summary | May 31, 2021 (Unaudited) |

| Class A | 1-Year | 5-Year | 10-Year |

| Average Annual Total Returns as of 5/31/21 | |||

| Unadjusted for Sales Charge | 14.56% | 3.81% | 4.92% |

| Adjusted

for the Maximum Sales Charge (max 2.75% load) |

11.41% | 3.23% | 4.63% |

| Bloomberg Barclays Municipal Bond Index† | 4.74% | 3.52% | 4.29% |

| Class C | 1-Year | 5-Year | 10-Year |

| Average Annual Total Returns as of 5/31/21 | |||

| Unadjusted for Sales Charge | 13.68% | 3.05% | 4.14% |

| Adjusted

for the Maximum Sales Charge (max 1.00% CDSC) |

13.68% | 3.05% | 4.14% |

| Bloomberg Barclays Municipal Bond Index† | 4.74% | 3.52% | 4.29% |

| Class S | 1-Year | 5-Year | 10-Year |

| Average Annual Total Returns as of 5/31/21 | |||

| No Sales Charges | 14.83% | 4.07% | 5.18% |

| Bloomberg Barclays Municipal Bond Index† | 4.74% | 3.52% | 4.29% |

| Institutional Class | 1-Year | 5-Year | 10-Year |

| Average Annual Total Returns as of 5/31/21 | |||

| No Sales Charges | 14.82% | 4.09% | 5.19% |

| Bloomberg Barclays Municipal Bond Index† | 4.74% | 3.52% | 4.29% |

| DWS Strategic High Yield Tax-Free Fund | | 11 |

| † | Bloomberg Barclays Municipal Bond Index covers the USD-denominated long-term tax exempt bond market. The index has four main sectors: state and local general obligation bonds, revenue bonds, insured bonds, and pre-refunded bonds. |

| 12 | | DWS Strategic High Yield Tax-Free Fund |

| Class A | Class C | Class S | Institutional

Class | |

| Net Asset Value | ||||

| 5/31/21 | $ 12.59 | $ 12.60 | $ 12.60 | $ 12.60 |

| 5/31/20 | $ 11.37 | $ 11.38 | $ 11.38 | $ 11.39 |

| Distribution Information as of 5/31/21 | ||||

| Income Dividends, Twelve Months | $ .42 | $ .32 | $ .45 | $ .45 |

| Capital Gain Distributions | $ .01 | $ .01 | $ .01 | $ .01 |

| May Income Dividend | $ .0345 | $ .0261 | $ .0372 | $ .0372 |

| SEC 30-day Yield‡‡ | 1.80% | 1.12% | 2.10% | 2.10% |

| Tax Equivalent Yield‡‡ | 3.04% | 1.89% | 3.55% | 3.55% |

| Current Annualized Distribution Rate‡‡ | 3.23% | 2.44% | 3.48% | 3.48% |

| ‡‡ | The SEC yield is net investment income per share earned over the month ended May 31, 2021, shown as an annualized percentage of the maximum offering price per share on the last day of the period. The SEC yield is computed in accordance with a standardized method prescribed by the Securities and Exchange Commission. The SEC yield would have been 1.75%, 1.08%, 1.99% and 2.01% for Class A, C, S and Institutional shares, respectively, had certain expenses not been reduced. Tax equivalent yield is based on the Fund’s yield and a marginal federal income tax rate of 40.8%. Current annualized distribution rate is the latest monthly dividend shown as an annualized percentage of net asset value on May 31, 2021. Distribution rate simply measures the level of dividends and is not a complete measure of performance. The current annualized distribution rate would have been 3.18%, 2.40%, 3.37% and 3.39% for Class A, C, S and Institutional shares, respectively, had certain expenses not been reduced. Yields and distribution rates are historical, not guaranteed and will fluctuate. |

| DWS Strategic High Yield Tax-Free Fund | | 13 |

| Portfolio Summary | (Unaudited) |

| Asset Allocation (As a % of Investment Portfolio excluding Open-End Investment Companies) | 5/31/21 | 5/31/20 |

| Revenue Bonds | 86% | 87% |

| General Obligation Bonds | 7% | 8% |

| Lease Obligations | 3% | 3% |

| Escrow to Maturity/Prefunded Bonds | 3% | 2% |

| Others | 1% | — |

| 100% | 100% |

| Interest Rate Sensitivity | 5/31/21 | 5/31/20 |

| Effective Maturity | 6.9 years | 10.0 years |

| Modified Duration | 6.0 years | 6.7 years |

| Quality (As a % of Investment Portfolio excluding Open-End Investment Companies) | 5/31/21 | 5/31/20 |

| AAA | 0% | 1% |

| AA | 6% | 11% |

| A | 20% | 24% |

| BBB | 28% | 26% |

| BB | 9% | 9% |

| B | 2% | 0% |

| CCC | 0% | — |

| CC | 1% | 1% |

| D | 2% | 1% |

| Not Rated | 32% | 27% |

| 100% | 100% |

| Top Five State/Territory Allocations (As a % of Investment Portfolio excluding Open-End Investment Companies) | 5/31/21 | 5/31/20 |

| Florida | 9% | 9% |

| New York | 9% | 8% |

| Texas | 8% | 8% |

| Illinois | 7% | 9% |

| Puerto Rico | 7% | 4% |

| 14 | | DWS Strategic High Yield Tax-Free Fund |

| Investment Portfolio | as of May 31, 2021 |

| Principal

Amount ($) |

Value ($) | ||

| Municipal Bonds and Notes 96.3% | |||

| Alabama 0.5% | |||

| Jefferson County, AL, Sewer Revenue, Series C, Step-up Coupon, 0% to 10/1/2023, 6.9% to 10/1/2050, INS: AGMC | 5,000,000 | 5,124,825 | |

| Arizona 3.1% | |||

| Arizona, State Industrial Development Authority, Education Facility Revenue, Odyssey Preparatory Academy Project, 144A, 5.0%, 7/1/2049 | 2,760,000 | 3,069,529 | |

| Arizona, State Industrial Development Authority, Education Revenue, BASIS School Projects: | |||

| Series G, 144A, 5.0%, 7/1/2047 | 1,000,000 | 1,134,759 | |

| Series D, 144A, 5.0%, 7/1/2051 | 1,035,000 | 1,171,986 | |

| Series G, 144A, 5.0%, 7/1/2051 | 550,000 | 622,794 | |

| Series A, 144A, 5.25%, 7/1/2047 | 1,000,000 | 1,125,845 | |

| Maricopa County, AZ, Industrial Development Authority, Education Revenue, Benjamin Franklin Charter School Project, Series A, 144A, 6.0%, 7/1/2052 | 1,000,000 | 1,193,584 | |

| Maricopa County, AZ, Industrial Development Authority, Education Revenue, Legacy Traditional Schools Project, Series B, 144A, 5.0%, 7/1/2049 | 1,490,000 | 1,719,728 | |

| Phoenix, AZ, Civic Improvement Corp., Rental Car Facility Revenue, Series A, 4.0%, 7/1/2045 | 6,500,000 | 7,069,237 | |

| Phoenix, AZ, Industrial Development Authority, Education Facility Revenue, Leman Academy of Excellence, ORO Valley Project: | |||

| Series A, 144A, 5.0%, 7/1/2038 | 1,380,000 | 1,423,805 | |

| Series A, 144A, 5.25%, 7/1/2048 | 1,750,000 | 1,804,856 | |

| Phoenix, AZ, Industrial Development Authority, Student Housing Revenue, Downtown Phoenix Student Housing LLC: | |||

| Series A, 5.0%, 7/1/2037 | 2,000,000 | 2,379,718 | |

| Series A, 5.0%, 7/1/2042 | 2,000,000 | 2,350,947 | |

| Pima County, AZ, Industrial Development Authority, Education Revenue, American Leadership Academy Project: | |||

| 144A, 5.0%, 6/15/2047 | 655,000 | 667,047 | |

| 144A, 5.0%, 6/15/2049 | 1,030,000 | 1,095,845 | |

| 144A, 5.0%, 6/15/2052 | 2,285,000 | 2,357,587 | |

| DWS Strategic High Yield Tax-Free Fund | | 15 |

| Principal

Amount ($) |

Value ($) | ||

| Tempe, AZ, Industrial Development Authority Revenue, Tempe Life Care Village, Inc.: | |||

| Series A, 6.25%, 12/1/2042 | 1,535,000 | 1,556,691 | |

| Series A, 6.25%, 12/1/2046 | 1,400,000 | 1,418,881 | |

| 32,162,839 | |||

| Arkansas 0.4% | |||

| Arkansas, State Development Finance Authority Industrial Development Revenue, Big River Steel Project, 144A, AMT, 4.75%, 9/1/2049 | 4,000,000 | 4,530,027 | |

| California 6.1% | |||

| California, County Tobacco Securitization Agency, Tobacco Settle Revenue, Series B-2, Zero Coupon, 6/1/2055 | 15,000,000 | 2,979,844 | |

| California, Golden State Tobacco Securitization Corp., Tobacco Settlement Revenue: | |||

| Series A-1, 5.0%, 6/1/2047 | 1,125,000 | 1,165,082 | |

| Series A-2, 5.0%, 6/1/2047 | 5,075,000 | 5,255,813 | |

| California, Morongo Band of Mission Indians Revenue, Series B, 144A, 5.0%, 10/1/2042 | 1,145,000 | 1,335,609 | |

| California, M-S-R Energy Authority, Series B, 7.0%, 11/1/2034, GTY: Citigroup Global Markets | 8,750,000 | 13,844,148 | |

| California, Public Finance Authority Revenue, Sharp Healthcare Obligated Group, Series B, 0.01% (a), 6/1/2021, LOC: Barclays Bank PLC | 2,000,000 | 2,000,000 | |

| California, River Islands Public Financing Authority, Special Tax, Community Facilities District No. 2019-1, Phase 2 Public Improvements: | |||

| 3.875%, 9/1/2049 | 2,630,000 | 2,776,744 | |

| 4.0%, 9/1/2046 | 4,895,000 | 5,291,822 | |

| California, State Municipal Finance Authority Revenue, LAX Integrated Express Solutions LLC, LINXS Apartment Project, Series A, AMT, 5.0%, 12/31/2047 | 2,075,000 | 2,518,130 | |

| California, State Municipal Finance Authority Revenue, NorthBay Healthcare, Series A, 5.25%, 11/1/2047 | 2,135,000 | 2,491,276 | |

| California, State Public Finance Authority Revenue, ENSO Village Project: | |||

| Series A, 144A, 5.0%, 11/15/2046 (b) | 270,000 | 301,904 | |

| Series A, 144A, 5.0%, 11/15/2051 (b) | 135,000 | 150,427 | |

| California, Statewide Communities Development Authority Revenue, Loma Linda University Medical Center, Series A, 144A, 5.25%, 12/1/2056 | 5,515,000 | 6,224,437 | |

| California, Tobacco Securitization Authority of Northern California, Tobacco Settlement Revenue, Series B-2, Zero Coupon, 6/1/2060 | 16,675,000 | 4,080,089 | |

| 16 | | DWS Strategic High Yield Tax-Free Fund |

| Principal

Amount ($) |

Value ($) | ||

| Long Beach, CA, Bond Finance Authority, Natural Gas Purchase Revenue, Series A, 5.25%, 11/15/2023, GTY: Merrill Lynch & Co. | 620,000 | 694,553 | |

| Long Beach, CA, Carnival Cruise Terminal Financing, 144A, 7.282%, 11/1/2030, GTY: Carnival Corp. | 1,700,000 | 1,699,858 | |

| Riverside County, CA, Transportation Commission Toll Revenue Senior Lien, Series A, 5.75%, 6/1/2048 | 2,850,000 | 3,102,752 | |

| San Buenaventura, CA, Community Memorial Health Systems, Prerefunded, 7.5%, 12/1/2041 | 3,250,000 | 3,366,510 | |

| San Joaquin Hills, CA, Transportation Corridor Agency, Toll Road Revenue, Series A, 5.0%, 1/15/2050 | 3,555,000 | 4,001,284 | |

| 63,280,282 | |||

| Colorado 3.2% | |||

| Colorado, Brighton Crossing Metropolitan District No. 6 Ltd., Series A, 5.0%, 12/1/2050 | 1,000,000 | 1,103,969 | |

| Colorado, Broadway Park North Metropolitan District No. 2: | |||

| 144A, 5.0%, 12/1/2040 | 1,100,000 | 1,221,765 | |

| 144A, 5.0%, 12/1/2049 | 1,275,000 | 1,405,853 | |

| Colorado, Broadway Station Metropolitan District No. 3, Zero Coupon, 12/1/2049 | 2,000,000 | 1,375,322 | |

| Colorado, General Obligation, Series A, 144A, 5.0%, 12/1/2051 | 1,150,000 | 1,265,269 | |

| Colorado, High Performance Transportation Enterprise Revenue, C-470 Express Lanes, 5.0%, 12/31/2056 | 2,275,000 | 2,612,199 | |

| Colorado, North Range Metropolitan District No. 3, 5.25%, 12/1/2050 | 1,667,000 | 1,855,428 | |

| Colorado, Public Energy Authority, Natural Gas Purchased Revenue, 6.25%, 11/15/2028, GTY: Merrill Lynch & Co. | 6,365,000 | 8,036,590 | |

| Colorado, State Health Facilities Authority Revenue, Christian Living Community, 6.375%, 1/1/2041 | 1,615,000 | 1,651,183 | |

| Colorado, State Health Facilities Authority, Hospital Revenue, CommonSpirit Health Obligation Group, Series A-2, 4.0%, 8/1/2049 | 2,000,000 | 2,265,840 | |

| Colorado, State Health Facilities Authority, Hospital Revenue, Covenant Retirement Communities Obligated Group, Series A, 5.0%, 12/1/2043 | 1,630,000 | 1,917,837 | |

| Colorado, Trails At Crowfoot Metropolitan District No. 3, Series A, 5.0%, 12/1/2049 | 1,000,000 | 1,077,573 | |

| Denver, CO, Convention Center Hotel Authority Revenue: | |||

| 5.0%, 12/1/2033 | 500,000 | 587,299 | |

| 5.0%, 12/1/2034 | 1,000,000 | 1,171,669 | |

| 5.0%, 12/1/2040 | 2,060,000 | 2,388,521 | |

| DWS Strategic High Yield Tax-Free Fund | | 17 |

| Principal

Amount ($) |

Value ($) | ||

| Denver, CO, Health & Hospital Authority, Certificate of Participations, 5.0%, 12/1/2048 | 1,170,000 | 1,414,190 | |

| Denver, CO, Urban Renewal Authority, Tax Increment Revenue, 9th Urban Redevelopment Area, Series A, 144A, 5.25%, 12/1/2039 | 1,840,000 | 2,024,563 | |

| 33,375,070 | |||

| Connecticut 0.2% | |||

| Connecticut, State Health & Educational Facilities Authority Revenue, Covenant Home, Inc., Series B, 5.0%, 12/1/2040 | 870,000 | 1,024,402 | |

| Connecticut, State Health & Educational Facilities Authority Revenue, Sacred Heart University, Series K, 4.0%, 7/1/2045 | 1,030,000 | 1,194,509 | |

| 2,218,911 | |||

| District of Columbia 1.3% | |||

| District of Columbia, Latin American Montessori Bilingual Public Charter School, 5.0%, 6/1/2050 | 4,870,000 | 5,721,152 | |

| District of Columbia, Metropolitan Airport Authority, Dulles Toll Road Revenue, Dulles Metrorail & Capital Improvement Project, Series B, 4.0%, 10/1/2049 | 3,090,000 | 3,538,058 | |

| District of Columbia, Two Rivers Public Charter School, Inc.: | |||

| 5.0%, 6/1/2050 | 1,825,000 | 2,133,807 | |

| 5.0%, 6/1/2055 | 1,530,000 | 1,775,482 | |

| 13,168,499 | |||

| Florida 6.6% | |||

| Collier County, FL, Industrial Development Authority, Continuing Care Community Revenue, Arlington of Naples Project, Series A, 144A, 8.125%, 5/15/2044 * (c) | 2,310,000 | 1,570,800 | |

| Florida, Capital Project Finance Authority, Student Housing Revenue, Loan Program: | |||

| Series A-1, 5.0%, 10/1/2032 | 230,000 | 289,574 | |

| Series A-1, 5.0%, 10/1/2033 | 230,000 | 288,681 | |

| Series A-1, 5.0%, 10/1/2034 | 230,000 | 287,570 | |

| Series A-1, 5.0%, 10/1/2035 | 115,000 | 143,232 | |

| Florida, Capital Projects Finance Authority, Student Housing Revenue, Capital Projects Loan Program, Series A-2, 4.0%, 10/1/2024 | 3,700,000 | 3,694,527 | |

| Florida, Capital Trust Agency, Educational Facilities Authority, Charter Educational Foundation Project, Series A, 144A, 5.375%, 6/15/2048 | 1,840,000 | 2,060,799 | |

| Florida, Capital Trust Agency, Educational Growth Fund LLC, Charter School Portfolio Project, Series A-1, 144A, 5.0%, 7/1/2056 | 1,190,000 | 1,399,494 | |

| 18 | | DWS Strategic High Yield Tax-Free Fund |

| Principal

Amount ($) |

Value ($) | ||

| Florida, Development Finance Corp., Educational Facilities Revenue, Mater Academy Projects: | |||

| Series A, 5.0%, 6/15/2050 | 1,105,000 | 1,256,574 | |

| Series A, 5.0%, 6/15/2055 | 960,000 | 1,085,274 | |

| Florida, Development Finance Corp., Surface Transportation Facilities Revenue, Brightline Passenger Rail Project, Series B, 144A, AMT, 7.375%, 1/1/2049 | 4,250,000 | 4,614,382 | |

| Florida, Development Finance Corp., Surface Transportation Facilities Revenue, Virgin Trains USA Passenger Rail Project: | |||

| Series A, AMT, 144A, 6.375% (d), 1/1/2049 | 1,740,000 | 1,771,545 | |

| Series A, 144A, AMT, 6.5% (d), 1/1/2049 | 1,905,000 | 1,936,079 | |

| Florida, Higher Educational Facilities Financing Authority Revenue, Ringling College Project: | |||

| 5.0%, 3/1/2029 | 980,000 | 1,164,623 | |

| 5.0%, 3/1/2032 | 1,110,000 | 1,303,067 | |

| 5.0%, 3/1/2034 | 1,195,000 | 1,396,939 | |

| Florida, State Atlantic University Finance Corp., Capital Improvements Revenue, Student Housing Project, Series B, 4.0%, 7/1/2044 | 8,555,000 | 9,872,996 | |

| Florida, State Development Finance Corp., Learning Gate Community School Project: | |||

| Series A, 5.0%, 2/15/2038 | 500,000 | 555,614 | |

| Series A, 5.0%, 2/15/2048 | 1,150,000 | 1,271,764 | |

| Florida, State Higher Educational Facilities Financial Authority Revenue, Florida Institute of Technology, Series A, 4.0%, 10/1/2044 | 1,395,000 | 1,534,907 | |

| Florida, State Higher Educational Facilities Financial Authority Revenue, Florida Institution of Technology, 4.0%, 10/1/2049 | 1,905,000 | 2,085,613 | |

| Florida, State Higher Educational Facilities Financial Authority Revenue, Jacksonville University Project, Series A-1, 144A, 4.75%, 6/1/2038 | 1,750,000 | 2,077,861 | |

| Florida, State Mid-Bay Bridge Authority, Series A, 5.0%, 10/1/2035 | 1,030,000 | 1,181,617 | |

| Florida, Village Community Development District No. 12, Special Assessment Revenue: | |||

| 144A, 4.25%, 5/1/2043 | 2,385,000 | 2,661,290 | |

| 144A, 4.375%, 5/1/2050 | 2,000,000 | 2,231,328 | |

| Florida, Village Community Development District No. 9, Special Assessment Revenue, 5.5%, 5/1/2042 | 1,210,000 | 1,245,126 | |

| Greater Orlando, FL, Aviation Authority Airport Facilities Revenue, JetBlue Airways Corp. Project, 5.0%, 11/15/2026 | 3,500,000 | 3,729,564 | |

| DWS Strategic High Yield Tax-Free Fund | | 19 |

| Principal

Amount ($) |

Value ($) | ||

| Jacksonville, FL, Educational Facilities Revenue, Jacksonville University Project, Series B, 144A, 5.0%, 6/1/2053 | 3,250,000 | 3,830,253 | |

| Lake County, FL, Educational Facilities Revenue, Imagine South Lake Charter School Project: | |||

| Series A, 144A, 5.0%, 1/15/2049 | 825,000 | 906,269 | |

| Series A, 144A, 5.0%, 1/15/2054 | 850,000 | 930,598 | |

| Osceola County, FL, Transportation Revenue: | |||

| Series A-2, Zero Coupon, 10/1/2049 | 3,400,000 | 1,317,864 | |

| Series A-2, Zero Coupon, 10/1/2051 | 4,775,000 | 1,704,387 | |

| Series A-2, Zero Coupon, 10/1/2054 | 4,570,000 | 1,450,012 | |

| Seminole County, FL, Industrial Development Authority, Legacy Pointe At UCF Project: | |||

| Series A, 5.25%, 11/15/2039 | 445,000 | 460,065 | |

| Series A, 5.5%, 11/15/2049 | 3,635,000 | 3,761,480 | |

| Tampa, FL, The University of Tampa Project, Series A, 4.0%, 4/1/2050 | 1,210,000 | 1,380,609 | |

| 68,452,377 | |||

| Georgia 2.3% | |||

| Americus-Sumter County, GA, Hospital Authority, Magnolia Manor Obligated Group, Series A, Prerefunded, 6.375%, 5/15/2043 | 4,000,000 | 4,477,798 | |

| Atlanta, GA, Development Authority Revenue Bonds: | |||

| Series A-1, 5.0%, 7/1/2032 | 1,650,000 | 1,897,982 | |

| Series A-1, 5.0%, 7/1/2033 | 2,595,000 | 2,986,905 | |

| Series A-1, 5.0%, 7/1/2034 | 2,320,000 | 2,671,521 | |

| Atlanta, GA, Tax Allocation, Beltline Project: | |||

| Series B, 5.0%, 1/1/2029 | 3,450,000 | 4,170,099 | |

| Series B, 5.0%, 1/1/2030 | 1,715,000 | 2,067,351 | |

| Gainesville & Hall County, GA, Hospital Authority, Northeast Georgia Health System, Inc. Project, Series A, 5.5%, 8/15/2054 | 1,820,000 | 2,088,802 | |

| George L Smith II, GA, Congress Center Authority, Convention Center Hotel Second Tier, Series B, 144A, 5.0%, 1/1/2054 | 2,615,000 | 3,099,833 | |

| 23,460,291 | |||

| Illinois 7.7% | |||

| Chicago, IL, Board of Education: | |||

| Series B, 4.0%, 12/1/2035 | 2,500,000 | 2,591,058 | |

| Series A, 5.0%, 12/1/2033 | 740,000 | 913,559 | |

| Series A, 5.0%, 12/1/2041 | 3,930,000 | 4,009,758 | |

| Series H, 5.0%, 12/1/2046 | 1,690,000 | 1,990,786 | |

| Series A, 5.5%, 12/1/2039 | 2,900,000 | 2,966,766 | |

| 20 | | DWS Strategic High Yield Tax-Free Fund |

| Principal

Amount ($) |

Value ($) | ||

| Series E, 6.038%, 12/1/2029 | 1,500,000 | 1,747,457 | |

| Chicago, IL, General Obligation: | |||

| Series A, 5.0%, 1/1/2036 | 1,000,000 | 1,079,580 | |

| Series A, 5.0%, 1/1/2044 | 4,000,000 | 4,760,804 | |

| Series B, 5.432%, 1/1/2042 | 3,885,000 | 4,369,137 | |

| Series A, 5.5%, 1/1/2049 | 2,425,000 | 2,952,162 | |

| Series A, 6.0%, 1/1/2038 | 2,180,000 | 2,653,677 | |

| Series B, 6.314%, 1/1/2044 | 2,500,000 | 3,095,413 | |

| Chicago, IL, O’Hare International Airport, Special Facility Revenue, AMT, 5.0%, 7/1/2048 | 1,185,000 | 1,409,805 | |

| Chicago, IL, Transit Authority, Sales Tax Receipts Revenue: | |||

| Series A, 4.0%, 12/1/2050 | 1,400,000 | 1,598,986 | |

| Series A, 4.0%, 12/1/2055 | 1,390,000 | 1,581,677 | |

| Illinois, Metropolitan Pier & Exposition Authority Revenue, McCormick Place Expansion Project: | |||

| Series A, Zero Coupon, 12/15/2052, INS: AGMC | 7,000,000 | 2,778,617 | |

| Series B, 5.0%, 6/15/2052 | 4,435,000 | 4,578,610 | |

| Illinois, State Finance Authority Revenue, Friendship Village of Schaumburg, 5.125%, 2/15/2045 | 7,935,000 | 5,876,387 | |

| Illinois, State Finance Authority Revenue, OSF Healthcare Systems, Series A, Prerefunded, 5.0%, 5/15/2041 | 4,265,000 | 4,463,128 | |

| Illinois, State General Obligation: | |||

| Series A, 5.0%, 10/1/2033 | 4,970,000 | 6,054,783 | |

| Series B, 5.0%, 10/1/2033 | 3,150,000 | 3,837,539 | |

| 5.0%, 11/1/2034 | 1,500,000 | 1,745,592 | |

| 5.0%, 1/1/2035 | 300,000 | 341,948 | |

| Series A, 5.0%, 5/1/2035 | 2,295,000 | 2,761,056 | |

| 5.0%, 5/1/2039 | 2,600,000 | 2,838,217 | |

| Series A, 5.0%, 12/1/2042 | 3,610,000 | 4,238,425 | |

| Series A, 5.0%, 3/1/2046 | 535,000 | 665,226 | |

| 5.75%, 5/1/2045 | 1,470,000 | 1,898,544 | |

| 79,798,697 | |||

| Indiana 1.5% | |||

| Indiana, State Finance Authority Environmental Revenue, United Steel Corporation Project, Series A, 4.125%, 12/1/2026 | 1,250,000 | 1,367,170 | |

| Indiana, State Finance Authority Revenue, Educational Facilities, Rock Creek Community Academy Inc., Project: | |||

| Series A, 144A, 5.875%, 7/1/2038 | 1,340,000 | 1,542,552 | |

| Series A, 144A, 6.125%, 7/1/2048 | 3,660,000 | 4,207,065 | |

| DWS Strategic High Yield Tax-Free Fund | | 21 |

| Principal

Amount ($) |

Value ($) | ||

| Indiana, State Finance Authority Revenue, Greencroft Obligation Group, Series A, 7.0%, 11/15/2043 | 2,290,000 | 2,489,143 | |

| Indiana, State Finance Authority, Health Facilities Revenue, Baptist Healthcare System, Series A, 5.0%, 8/15/2051 | 5,000,000 | 5,984,224 | |

| 15,590,154 | |||

| Iowa 1.1% | |||

| Iowa, State Higher Education Loan Authority Revenue, Private College Facility, Des Moines University Project: | |||

| 4.0%, 10/1/2045 | 2,135,000 | 2,425,555 | |

| 4.0%, 10/1/2050 | 3,075,000 | 3,481,792 | |

| Iowa, State Higher Education Loan Authority, Loras College, 0.02% (a), 6/1/2021, LOC: Bank of America NA | 200,000 | 200,000 | |

| Iowa, State Higher Education Loan Authority, Private College, Loras College, 0.02% (a), 6/1/2021, LOC: Bank of America NA | 1,000,000 | 1,000,000 | |

| Iowa, State Student Loan Liquidity Corp., Senior Revenue, Series B, AMT, 3.0%, 12/1/2039 | 2,500,000 | 2,649,126 | |

| Iowa, Tobacco Settlement Authority, “2” , Series B, Zero Coupon, 6/1/2065 | 10,000,000 | 1,766,321 | |

| 11,522,794 | |||

| Kansas 0.1% | |||

| Wyandotte County, KS, Unified Government, Legends Apartments Garage & West Lawn Project, 4.5%, 6/1/2040 | 1,485,000 | 1,556,405 | |

| Kentucky 1.6% | |||

| Columbia, KY, Educational Development Revenue, Lindsey Wilson College Project, 5.0%, 12/1/2033 | 2,560,000 | 2,918,181 | |

| Kentucky, Public Transportation Infrastructure Authority Toll Revenue, 1st Tier-Downtown Crossing, Series A, 6.0%, 7/1/2053 | 7,195,000 | 7,974,886 | |

| Kentucky, State Economic Development Finance Authority, Owensboro Health, Inc., Obligated Group: | |||

| Series A, 5.0%, 6/1/2045 | 1,275,000 | 1,458,302 | |

| Series A, 5.25%, 6/1/2041 | 1,915,000 | 2,245,498 | |

| Louisville & Jefferson County, KY, Metropolitan Government Health System Revenue, Norton Healthcare, Inc., Series B, 0.01% (a), 6/1/2021, LOC: PNC Bank NA | 1,800,000 | 1,800,000 | |

| 16,396,867 | |||

| 22 | | DWS Strategic High Yield Tax-Free Fund |

| Principal

Amount ($) |

Value ($) | ||

| Louisiana 0.2% | |||

| Louisiana, New Orleans Aviation Board, General Airport North Terminal, Series B, AMT, 5.0%, 1/1/2048 | 710,000 | 846,927 | |

| Louisiana, Public Facilities Authority Revenue, Ochsner Clinic Foundation Project, Prerefunded, 5.0%, 5/15/2047 | 10,000 | 12,057 | |

| Shreveport, LA, Water & Sewer Revenue, Junior Lien, Series B, 4.0%, 12/1/2044, INS: AGMC | 1,000,000 | 1,138,237 | |

| 1,997,221 | |||

| Maine 0.9% | |||

| Maine, Health & Higher Educational Facilities Authority Revenue, Maine General Medical Center, Prerefunded, 6.75%, 7/1/2036 | 9,000,000 | 9,048,263 | |

| Maryland 1.7% | |||

| Maryland, State Economic Development Corp., Student Housing Revenue, Morgan State University Project: | |||

| 5.0%, 7/1/2050 | 310,000 | 381,661 | |

| 5.0%, 7/1/2056 | 540,000 | 661,836 | |

| Maryland, State Health & Higher Educational Facilities Authority Revenue, Adventist Healthcare, Series A, 6.125%, 1/1/2036 | 3,250,000 | 3,361,081 | |

| Maryland, State Health & Higher Educational Facilities Authority Revenue, Adventist Healthcare, Obligated Group, Series A, 5.5%, 1/1/2046 | 11,080,000 | 13,092,726 | |

| 17,497,304 | |||

| Massachusetts 0.4% | |||

| Massachusetts, Development Finance Agency Revenue, 5.0%, 7/1/2047 | 1,250,000 | 1,452,593 | |

| Massachusetts, State Development Finance Agency Revenue, Boston University, Series U-6C, 0.01% (a), 6/1/2021, LOC: TD Bank NA | 275,000 | 275,000 | |

| Massachusetts, State Educational Financing Authority, Series B, AMT, 3.0%, 7/1/2035 | 2,000,000 | 2,114,183 | |

| 3,841,776 | |||

| Michigan 1.6% | |||

| Kentwood, MI, Economic Development Corp., Limited Obligation, Holland Home, 5.625%, 11/15/2041 | 3,750,000 | 3,865,353 | |

| Michigan, Finance Authority Higher Facilities, Ltd. Obligation Revenue, Kettering University Project: | |||

| 4.0%, 9/1/2045 | 1,775,000 | 2,025,724 | |

| 4.0%, 9/1/2050 | 1,660,000 | 1,884,210 | |

| Michigan, Finance Authority Revenue, Tobacco Settlement Asset Backed Senior Capital Appreciation Bonds, Series B-2, Zero Coupon, 6/1/2065 | 40,000,000 | 5,240,036 | |

| DWS Strategic High Yield Tax-Free Fund | | 23 |

| Principal

Amount ($) |

Value ($) | ||

| Michigan, State Finance Authority Revenue, Detroit Water & Sewer Department: | |||

| Series C-3, 5.0%, 7/1/2033, INS: AGMC | 1,820,000 | 2,066,311 | |

| Series C, 5.0%, 7/1/2035 | 910,000 | 1,062,788 | |

| 16,144,422 | |||

| Minnesota 0.9% | |||

| Duluth, MN, Economic Development Authority, Health Care Facilities Revenue, Essentia Health Obligated Group: | |||

| Series A, 5.0%, 2/15/2048 | 1,000,000 | 1,198,587 | |

| Series A, 5.0%, 2/15/2053 | 2,815,000 | 3,361,084 | |

| Minnesota, State Housing Finance Agency, Series E, 3.5%, 7/1/2050 | 1,595,000 | 1,763,948 | |

| Minnesota, State Office of Higher Education Revenue, AMT, 2.65%, 11/1/2038 | 2,940,000 | 3,004,150 | |

| 9,327,769 | |||

| Mississippi 0.7% | |||

| Lowndes County, MS, Solid Waste Disposal & Pollution Control Revenue, Weyerhaeuser Co. Project, Series A, 6.8%, 4/1/2022 | 5,500,000 | 5,779,023 | |

| Warren County, MS, Gulf Opportunity Zone, International Paper Co., Series A, 5.375%, 12/1/2035 | 1,000,000 | 1,022,657 | |

| 6,801,680 | |||

| Missouri 1.7% | |||

| Kansas City, MO, Land Clearance Redevelopment Authority Project Revenue, Convention Center Hotel Project: | |||

| Series B, 144A, 5.0%, 2/1/2040 | 1,300,000 | 1,410,928 | |

| Series B, 144A, 5.0%, 2/1/2050 | 3,605,000 | 3,888,199 | |

| Series A, 144A, 6.25%, 4/15/2049 | 3,750,000 | 3,740,265 | |

| Lee’s Summit, MO, Industrial Development Authority, Senior Living Facilities Revenue, John Knox Village Project: | |||

| Series A, 5.0%, 8/15/2046 | 2,500,000 | 2,726,743 | |

| Series A, 5.0%, 8/15/2051 | 1,000,000 | 1,089,077 | |

| Series A, 5.25%, 8/15/2039 | 1,710,000 | 1,864,285 | |

| Missouri, State Health & Educational Facilities Authority Revenue, Medical Research, Lutheran Senior Services, Series A, 5.0%, 2/1/2046 | 665,000 | 748,344 | |

| St. Louis, MO, Industrial Development Authority Financing Revenue, Ballpark Village Development Project, Series A, 4.75%, 11/15/2047 | 2,275,000 | 2,332,581 | |

| 17,800,422 | |||

| 24 | | DWS Strategic High Yield Tax-Free Fund |

| Principal

Amount ($) |

Value ($) | ||

| Nevada 0.4% | |||

| Nevada, Tahoe Douglas Visitors Authority, Stateline Revenue: | |||

| 5.0%, 7/1/2040 | 1,000,000 | 1,162,746 | |

| 5.0%, 7/1/2045 | 1,000,000 | 1,148,316 | |

| 5.0%, 7/1/2051 | 1,000,000 | 1,146,209 | |

| Reno, NV, Sales Tax Revenue, Transportation Rail Access, Series C, 144A, Zero Coupon, 7/1/2058 | 4,500,000 | 754,181 | |

| 4,211,452 | |||

| New Hampshire 0.1% | |||

| New Hampshire, State Health & Educational Facilities Authority Revenue, Hillside Village: | |||

| Series A, 144A, 6.125%, 7/1/2037 * (c) | 900,000 | 675,000 | |

| Series A, 144A, 6.25%, 7/1/2042 * (c) | 1,090,000 | 817,500 | |

| 1,492,500 | |||

| New Jersey 4.6% | |||

| Atlantic County, NJ, Improvement Authority Lease Revenue, Atlantic City Compus Phase II Project, Series A, 4.0%, 7/1/2053, INS: AGMC | 625,000 | 735,051 | |

| Atlantic County, NJ, Improvement Authority Lease Revenue, General Obligation Bonds, Atlantic City Compus Phase II Project, Series A, 4.0%, 7/1/2047, INS: AGMC | 465,000 | 550,465 | |

| Essex County, NJ, Improvement Authority Network LLC, Student Housing Project, Series A, 4.0%, 8/1/2060, INS: BAM | 1,685,000 | 1,977,292 | |

| New Jersey, Economic Development Authority, Self Designated Social Bonds: | |||

| Series QQQ, 4.0%, 6/15/2046 | 190,000 | 217,954 | |

| Series QQQ, 4.0%, 6/15/2050 | 190,000 | 217,025 | |

| New Jersey, State Covid-19 General Obligation Emergency Bonds: | |||

| Series A, 4.0%, 6/1/2030 | 860,000 | 1,063,109 | |

| Series A, 4.0%, 6/1/2031 | 860,000 | 1,078,732 | |

| Series A, 4.0%, 6/1/2032 | 415,000 | 528,505 | |

| New Jersey, State Economic Development Authority Revenue: | |||

| 5.0%, 6/15/2028 | 450,000 | 465,442 | |

| Series BBB, 5.5%, 6/15/2030 | 8,975,000 | 11,014,959 | |

| New Jersey, State Economic Development Authority Revenue, Black Horse EHT Urban Renewal LLC Project, Series A, 144A, 5.0%, 10/1/2039 | 3,645,000 | 3,704,346 | |

| DWS Strategic High Yield Tax-Free Fund | | 25 |

| Principal

Amount ($) |

Value ($) | ||

| New Jersey, State Economic Development Authority Revenue, White Horse HMT Urban Renewal LLC Project, 144A, 5.0%, 1/1/2040 | 1,625,000 | 1,645,985 | |

| New Jersey, State Economic Development Authority, Special Facilities Revenue, Continental Airlines, Inc. Project, Series B, AMT, 5.625%, 11/15/2030 | 2,500,000 | 2,806,308 | |

| New Jersey, State Health Care Facilities Financing Authority, 5.0%, 10/1/2038 | 4,000,000 | 4,782,456 | |

| New Jersey, State Health Care Facilities Financing Authority Revenue, University Hospital, Series A, 5.0%, 7/1/2046, INS: AGMC | 1,820,000 | 2,089,718 | |

| New Jersey, State Higher Education Assistance Authority, Student Loan Revenue: | |||

| Series B, AMT, 2.5%, 12/1/2040 | 1,035,000 | 1,051,015 | |

| Series B, AMT, 3.25%, 12/1/2039 | 1,500,000 | 1,622,892 | |

| Series B, AMT, 3.5%, 12/1/2039 | 1,800,000 | 1,982,580 | |

| New Jersey, State Transportation Trust Fund Authority: | |||

| Series A, 4.0%, 6/15/2039 (b) | 665,000 | 750,554 | |

| Series A, 4.0%, 6/15/2040 (b) | 830,000 | 934,760 | |

| Series A, 4.0%, 6/15/2041 (b) | 805,000 | 903,949 | |

| Series A, 4.0%, 6/15/2042 (b) | 510,000 | 570,990 | |

| Series AA, 4.0%, 6/15/2045 | 865,000 | 993,380 | |

| Series AA, 4.0%, 6/15/2050 | 960,000 | 1,092,826 | |

| New Jersey, State Turnpike Authority Revenue, Series A, 4.0%, 1/1/2051 | 4,000,000 | 4,720,618 | |

| 47,500,911 | |||

| New Mexico 0.3% | |||

| New Mexico, State Mortgage Finance Authority, “I” , Series D, 3.25%, 7/1/2044 | 3,410,000 | 3,619,137 | |

| New York 7.8% | |||

| Buffalo & Erie County, NY, Industrial Land Development Corp., D’Youville College Project, Series A, 4.0%, 11/1/2050 | 2,500,000 | 2,864,896 | |

| Dutchess County, NY, Local Development Corp., Bard College Project, Series A, 144A, 5.0%, 7/1/2051 | 380,000 | 465,037 | |

| Monroe County, NY, Industrial Development Corp. Revenue, St. Ann’s Community Project, 5.0%, 1/1/2050 | 3,750,000 | 4,100,502 | |

| New York, Brooklyn Arena Local Development Corp., Pilot Revenue, Barclays Center Project, Series A, 4.0%, 7/15/2035, INS: AGMC | 455,000 | 500,332 | |

| New York, General Obligation, Series E-5, 0.02% (a), 6/1/2021, LOC: TD Bank NA | 1,375,000 | 1,375,000 | |

| 26 | | DWS Strategic High Yield Tax-Free Fund |

| Principal

Amount ($) |

Value ($) | ||

| New York, Metropolitan Transportation Authority Revenue: | |||

| Series G-1, 0.02% (a), 6/1/2021, LOC: Barclays Bank PLC | 235,000 | 235,000 | |

| Series D, 5.0%, 11/15/2033 | 1,500,000 | 1,854,737 | |

| Series C-1, 5.0%, 11/15/2050 | 1,320,000 | 1,622,340 | |

| Series A-1, 5.0%, 11/15/2051 | 4,150,000 | 4,898,949 | |

| Series C-1, 5.25%, 11/15/2055 | 3,960,000 | 4,939,574 | |

| New York, Metropolitan Transportation Authority Revenue, Green Bond: | |||

| Series D-2, 4.0%, 11/15/2048 | 3,500,000 | 4,015,695 | |

| Series D-3, 4.0%, 11/15/2049 | 1,000,000 | 1,146,394 | |

| New York, Metropolitan Transportation Authority, Dedicated Tax Fund, Series A-1, 0.02% (a), 6/1/2021, LOC: TD Bank NA | 600,000 | 600,000 | |

| New York, State Dormitory Authority Revenues, Non-State Supported Debt, Orange Regional Medical Center, 144A, 5.0%, 12/1/2045 | 1,000,000 | 1,150,494 | |

| New York, State Housing Finance Agency Revenue, 160 Madison Avenue LLC, Series B, 0.04% (a), 6/1/2021, LOC: Landesbank Hessen-Thuringen | 200,000 | 200,000 | |

| New York, State Liberty Development Corp. Revenue, World Trade Center, “1-3” , 144A, 5.0%, 11/15/2044 | 2,000,000 | 2,213,303 | |

| New York, State Thruway Authority, Series N, 3.0%, 1/1/2049 | 2,500,000 | 2,641,315 | |

| New York, State Transportation Development Corp., Special Facilities Revenue, John F. Kennedy International Airport Project, AMT, 5.375%, 8/1/2036 | 900,000 | 1,130,002 | |

| New York, Transportation Development Corp., Special Facilities Revenue, Laguardia Airport Terminal C & D Redevelopment Project, AMT, 4.375%, 10/1/2045 | 1,500,000 | 1,780,437 | |

| New York, Triborough Bridge & Tunnel Authority Revenue, Series 4-C, 0.02% (a), 6/1/2021, LOC: U.S. Bank NA | 350,000 | 350,000 | |

| New York, TSASC, Inc.: | |||

| Series A, 5.0%, 6/1/2041 | 595,000 | 695,774 | |

| Series B, 5.0%, 6/1/2048 | 8,800,000 | 9,617,973 | |

| New York City, NY, Housing Development Corp., Multi-Family Housing Revenue: | |||

| Series E-1, 2.8%, 11/1/2034 | 5,000,000 | 5,265,461 | |

| Series E-1, 3.0%, 11/1/2039 | 3,000,000 | 3,160,793 | |

| New York Counties, NY, Tobacco Trust IV, Series F, Zero Coupon, 6/1/2060 | 190,000,000 | 11,679,509 | |

| New York, NY, General Obligation: | |||

| Series G-6, 0.01% (a), 6/1/2021, LOC: Mizuho Bank Ltd. | 5,645,000 | 5,645,000 | |

| DWS Strategic High Yield Tax-Free Fund | | 27 |

| Principal

Amount ($) |

Value ($) | ||

| Series A-3, 0.02% (a), 6/1/2021, LOC: Mizuho Bank Ltd. | 3,000,000 | 3,000,000 | |

| Series D-4, 0.02% (a), 6/1/2021, LOC: TD Bank NA | 1,850,000 | 1,850,000 | |

| Series I-4, 0.02% (a), 6/1/2021, LOC: TD Bank NA | 300,000 | 300,000 | |

| Orange County, NY, Senior Care Revenue, Industrial Development Agency, The Glen Arden Project, 5.7%, 1/1/2028 * (c) | 2,125,000 | 1,487,500 | |

| 80,786,017 | |||

| North Carolina 0.2% | |||

| North Carolina, State Housing Finance Agency, Series 42, 4.0%, 1/1/2050 | 1,930,000 | 2,143,670 | |

| North Dakota 0.2% | |||

| Grand Forks, ND, Health Care System Revenue, Altru Health System, 5.0%, 12/1/2032 | 2,000,000 | 2,023,245 | |

| Ohio 4.4% | |||

| Buckeye, OH, Tobacco Settlement Financing Authority: | |||

| “2” , Series B-3, Zero Coupon, 6/1/2057 | 20,000,000 | 3,221,482 | |

| “2” , Series B-2, 5.0%, 6/1/2055 | 5,500,000 | 6,375,810 | |

| Centerville, OH, Health Care Revenue, Graceworks Lutheran Services, 5.25%, 11/1/2047 | 2,480,000 | 2,624,994 | |

| Cleveland-Cuyahoga County, OH, Port Authority Cultural Facility Revenue, Playhouse Square Foundation Project, 5.5%, 12/1/2053 | 7,140,000 | 8,325,269 | |

| Hamilton County, OH, Health Care Revenue, Life Enriching Communities Project: | |||

| 5.0%, 1/1/2051 | 1,270,000 | 1,400,218 | |

| Series A, 5.0%, 1/1/2052 | 1,000,000 | 1,122,797 | |

| Ohio, Akron, Bath & Copley Joint Township Hospital District Revenue, 5.25%, 11/15/2046 | 10,345,000 | 12,207,528 | |

| Ohio, State Air Quality Development Authority, Exempt Facilities Revenue, Pratt Paper LLC Project: | |||

| AMT, 144A, 4.25%, 1/15/2038, GTY: Pratt Industries, Inc. | 725,000 | 818,456 | |

| AMT, 144A, 4.5%, 1/15/2048, GTY: Pratt Industries, Inc. | 3,115,000 | 3,539,636 | |

| Ohio, State Hospital Revenue, Aultman Health Foundation, 144A, 5.0%, 12/1/2048 | 6,000,000 | 6,365,560 | |

| Ohio, State Hospital Revenue, University Hospital Health System, Series A, 0.02% (a), 6/1/2021, LOC: PNC Bank NA | 150,000 | 150,000 | |

| 46,151,750 | |||

| 28 | | DWS Strategic High Yield Tax-Free Fund |

| Principal

Amount ($) |

Value ($) | ||

| Oklahoma 0.8% | |||

| Oklahoma, State Development Finance Authority, Health System Revenue, OU Medicine Project: | |||

| Series B, 5.5%, 8/15/2052 | 1,635,000 | 2,018,513 | |

| Series B, 5.5%, 8/15/2057 | 4,235,000 | 5,216,284 | |

| Tulsa County, OK, Industrial Authority, Senior Living Community Revenue, Montereau, Inc. Project, 5.25%, 11/15/2045 | 1,175,000 | 1,327,468 | |

| 8,562,265 | |||

| Oregon 0.0% | |||

| Clackamas County, OR, Hospital Facilities Authority Revenue, Mary’s Woods at Marylhurst, Inc. Project, Series A, 5.0%, 5/15/2038 | 195,000 | 212,746 | |

| Pennsylvania 3.4% | |||

| Chester County, PA, Industrial Development Authority, Special Obligation Revenue, Woodlands at Graystone Neighborhood Improvement Project, 144A, 5.125%, 3/1/2048 | 499,000 | 589,696 | |

| Lancaster County, PA, Hospital Authority, Brethren Village Project: | |||

| 5.125%, 7/1/2037 | 900,000 | 998,692 | |

| 5.25%, 7/1/2041 | 900,000 | 996,472 | |

| Pennsylvania, Economic Development Finance Authority, U.S. Airways Group, Series B, 8.0%, 5/1/2029, GTY: American Airlines, Inc. | 905,000 | 909,881 | |

| Pennsylvania, Economic Development Financing Authority, Exempt Facilities Revenue, PPL Energy Supply LLC, Series A-RE, 6.4%, 12/1/2038 | 5,000,000 | 4,906,653 | |

| Pennsylvania, Higher Education Assistance Agency Education Loan Revenue: | |||

| Series A, AMT, 2.45%, 6/1/2041 | 4,875,000 | 4,934,777 | |

| Series A, AMT, 2.625%, 6/1/2042 (b) | 1,005,000 | 1,007,646 | |

| Pennsylvania, State Economic Development Financing Authority Revenue, Bridges Finco LP, 5.0%, 12/31/2034 | 8,005,000 | 9,392,845 | |

| Pennsylvania, State Housing Finance Agency, Single Family Mortgage Revenue, Series 132A, 3.5%, 4/1/2051 | 1,690,000 | 1,833,382 | |

| Pennsylvania, State Turnpike Commission Revenue: | |||

| Series A, 4.0%, 12/1/2043 | 3,800,000 | 4,514,441 | |

| Series A, 4.0%, 12/1/2044 | 660,000 | 780,869 | |

| Series A, 4.0%, 12/1/2045 | 220,000 | 259,804 | |

| Series A, 4.0%, 12/1/2046 | 440,000 | 519,028 | |

| DWS Strategic High Yield Tax-Free Fund | | 29 |

| Principal

Amount ($) |

Value ($) | ||

| Series A, 4.0%, 12/1/2050 | 3,500,000 | 4,109,327 | |

| Series A-1, 5.0%, 12/1/2041 | 20,000 | 23,506 | |

| 35,777,019 | |||

| South Carolina 2.4% | |||

| South Carolina, State Jobs-Economic Development Authority, Hospital Revenue, Conway Hospitals, Inc., 5.25%, 7/1/2047 | 2,290,000 | 2,675,588 | |

| South Carolina, State Public Service Authority Revenue, Series E, 5.25%, 12/1/2055 | 10,360,000 | 12,235,947 | |

| South Carolina, State Public Service Authority Revenue, Santee Cooper, Series A, Prerefunded, 5.75%, 12/1/2043 | 8,890,000 | 10,118,432 | |

| 25,029,967 | |||

| South Dakota 0.2% | |||

| Lincon County, SD, Economic Development Revenue, Augustana Collage Assocition Project: | |||

| Series A, 4.0%, 8/1/2051 | 625,000 | 698,096 | |

| Series A, 4.0%, 8/1/2056 | 625,000 | 691,163 | |

| Series A, 4.0%, 8/1/2061 | 810,000 | 885,988 | |

| 2,275,247 | |||

| Tennessee 1.1% | |||

| Metropolitan Nashville, TN, Airport Authority Revenue, Series B, AMT, 4.0%, 7/1/2054 | 1,500,000 | 1,717,554 | |

| Nashville & Davidson County, TN, Metropolitan Development & Housing Agency, Tax Increment Revenue, Fifth Broadway Development District, 144A, 5.125%, 6/1/2036 | 900,000 | 1,035,832 | |

| Nashville & Davidson County, TN, Metropolitan Government Health & Education Facilities Board Revenue, Blakeford At Green Hills Corp., Series A, 4.0%, 11/1/2055 | 8,000,000 | 8,544,274 | |

| 11,297,660 | |||

| Texas 8.3% | |||

| Central Texas, Regional Mobility Authority Revenue, Capital Appreciation: | |||

| Zero Coupon, 1/1/2030 | 5,000,000 | 4,267,625 | |

| Zero Coupon, 1/1/2032 | 3,500,000 | 2,825,432 | |

| Clifton, TX, Higher Education Finance Corp., Education Revenue: | |||

| Series A, 5.75%, 8/15/2038 | 2,810,000 | 3,254,786 | |

| Series D, 6.125%, 8/15/2048 | 4,485,000 | 5,211,305 | |

| 30 | | DWS Strategic High Yield Tax-Free Fund |

| Principal

Amount ($) |

Value ($) | ||

| Houston, TX, Airport System Revenue, Special Facilities United Airlines, Inc., Airport Improvement Projects, Series C, AMT, AMT, 5.0%, 7/15/2027 | 3,000,000 | 3,566,534 | |

| Houston, TX, Airport Systems Revenue, Special Facilities Continental Airlines, Inc. Terminal Projects, AMT, 6.625%, 7/15/2038 | 2,000,000 | 2,018,817 | |

| Matagorda County, TX, Navigation District No. 1, Pollution Control Revenue, AEP Texas Central Co. Project, Series A, 4.4%, 5/1/2030, INS: AMBAC | 7,000,000 | 8,536,733 | |

| Newark, TX, Higher Education Finance Corp., Education Revenue, Austin Achieve Public School, Inc., 5.0%, 6/15/2048 | 1,440,000 | 1,481,217 | |

| San Antonio, TX, Convention Center Hotel Finance Corp., Contract Revenue, Empowerment Zone, Series A, AMT, 5.0%, 7/15/2039, INS: AMBAC | 8,000,000 | 8,005,794 | |

| Tarrant County, TX, Cultural Education Facilities Finance Corp. Revenue, Trinity Terrace Project, The Cumberland Rest, Inc., Series A-1, 5.0%, 10/1/2044 | 1,575,000 | 1,720,076 | |

| Tarrant County, TX, Cultural Education Facilities Finance Corp., Hospital Revenue, Methodist Hospitals of Dallas Project, Series A, 0.02% (a), 6/1/2021, LOC: TD Bank NA | 500,000 | 500,000 | |

| Temple, TX, Tax Increment, Reinvestment Zone No. 1, Series A, 144A, 5.0%, 8/1/2038 | 2,830,000 | 3,119,817 | |

| Temple, TX, Tax Increment, Reinvestment Zone No. One: | |||

| Series A, 4.0%, 8/1/2039, INS: BAM (b) | 195,000 | 227,378 | |

| Series A, 4.0%, 8/1/2041, INS: BAM (b) | 235,000 | 273,380 | |

| Texas, Love Field Airport Modernization Corp., Special Facilities Revenue, Southwest Airlines Co. Project, 5.25%, 11/1/2040 | 7,445,000 | 7,594,741 | |

| Texas, New Hope Cultural Education Facilities Finance Corp., Educational Revenue, Cumberland Academy Project, Series A, 144A, 5.0%, 8/15/2050 | 3,550,000 | 3,848,684 | |

| Texas, New Hope Cultural Education Facilities Finance Corp., Retirement Facilities Revenue, Presbyterian Village North Project: | |||

| 5.0%, 10/1/2039 | 1,820,000 | 1,955,790 | |

| Series A, 5.25%, 10/1/2055 | 8,000,000 | 8,684,164 | |

| Texas, New Hope Cultural Education Facilities Finance Corp., Senior Living Revenue, Bridgemoor Plano Project, Series A, 7.25%, 12/1/2053 | 6,605,000 | 5,979,766 | |

| Texas, Private Activity Bond, Surface Transportation Corp. Revenue, Senior Lien Revenue, Infrastructure Group LLC, I-635 Managed Lanes Project: | |||

| Series A, 4.0%, 6/30/2038 | 380,000 | 451,523 | |

| Series A, 4.0%, 12/31/2038 | 380,000 | 450,909 | |

| DWS Strategic High Yield Tax-Free Fund | | 31 |

| Principal

Amount ($) |

Value ($) | ||

| Series A, 4.0%, 6/30/2039 | 290,000 | 343,394 | |

| Series A, 4.0%, 12/31/2039 | 335,000 | 396,304 | |

| Series A, 4.0%, 6/30/2040 | 275,000 | 324,726 | |

| Texas, State Municipal Gas Acquisition & Supply Corp. I, Gas Supply Revenue, Series D, 6.25%, 12/15/2026, GTY: Merrill Lynch & Co. | 7,615,000 | 8,929,696 | |

| Texas, State Private Activity Bond, Surface Transportation Corp. Revenue, Senior Lien, North Tarrant Express Mobility Partners Segments LLC, AMT, 6.75%, 6/30/2043 | 2,220,000 | 2,520,518 | |

| 86,489,109 | |||

| Utah 1.1% | |||

| Utah, Infrastructure Agency Telecommunication Revenue: | |||

| 4.0%, 10/15/2041 | 600,000 | 697,683 | |

| Series 2019, 4.0%, 10/15/2042 | 2,350,000 | 2,692,560 | |

| Utah, State Charter School Finance Authority, St. George Campus Project, Series A, 144A, 5.0%, 6/15/2052 | 1,130,000 | 1,287,790 | |

| Utah, State Charter School Financing Authority Revenue, Freedom Academy Foundation Project, 144A, 5.375%, 6/15/2048 | 6,490,000 | 7,259,149 | |

| 11,937,182 | |||

| Virginia 2.3% | |||

| Lynchburg, VA, Economic Development Authority, Hospital Revenue, Centra Health Obligated Group, Series B, 0.02% (a), 6/1/2021, LOC: Truist Bank | 500,000 | 500,000 | |

| Prince William County, VA, Industrial Development Authority, Residential Care Facilities, Westminster at Lake Ridge: | |||

| 5.0%, 1/1/2037 | 1,000,000 | 1,052,437 | |

| 5.0%, 1/1/2046 | 1,530,000 | 1,587,195 | |

| Roanoke County, VA, Economic Development Authority, RSDL Care Facilities Revenue, Richfield Living: | |||

| Series 2020, 5.0%, 9/1/2050 | 1,740,000 | 1,698,067 | |

| Series A, 5.375%, 9/1/2054 | 1,500,000 | 1,517,295 | |

| Virginia, Marquis Community Development Authority Revenue: | |||

| Series C, Zero Coupon, 9/1/2041 | 7,906,000 | 461,854 | |

| 144A, Step-up Coupon, 0% to 9/1/2021, 7.5% to 9/1/2045 | 1,640,000 | 787,200 | |

| Series B, 5.625%, 9/1/2041 | 5,332,000 | 2,630,293 | |

| Virginia, Peninsula Town Center, Community Development Authority Revenue, Special Obligation: | |||

| 144A, 5.0%, 9/1/2037 | 1,400,000 | 1,538,357 | |

| 32 | | DWS Strategic High Yield Tax-Free Fund |

| Principal

Amount ($) |

Value ($) | ||

| 144A, 5.0%, 9/1/2045 | 4,100,000 | 4,492,703 | |

| Virginia, Small Business Financing Authority, Private Activity Revenue, Transform 66 P3 Project, AMT, 5.0%, 12/31/2052 | 5,250,000 | 6,316,910 | |

| Virginia, State Small Business Financing Authority Revenue, Elizabeth River Crossings LLC Project, 6.0%, 1/1/2037 | 1,640,000 | 1,735,600 | |

| 24,317,911 | |||

| Washington 3.7% | |||

| Klickitat County, WA, Public Hospital District No. 2 Revenue, Skyline Hospital: | |||

| 5.0%, 12/1/2037 | 1,025,000 | 1,078,433 | |

| 5.0%, 12/1/2046 | 2,000,000 | 2,077,257 | |

| Washington, Port of Seattle Revenue, AMT, 5.0%, 4/1/2044 | 2,000,000 | 2,445,203 | |

| Washington, Port of Seattle, Industrial Development Corp., Special Facilities- Delta Airlines, AMT, 5.0%, 4/1/2030 | 2,000,000 | 2,139,019 | |

| Washington, State Convention Center Public Facilities District: | |||

| 5.0%, 7/1/2043 | 3,835,000 | 4,562,670 | |

| 5.0%, 7/1/2048 | 5,000,000 | 5,930,468 | |

| Washington, State Higher Educational Facilities Authority, Seattle University Project: | |||

| 4.0%, 5/1/2045 | 3,950,000 | 4,536,948 | |

| 4.0%, 5/1/2050 | 1,020,000 | 1,164,941 | |

| Washington, State Housing Finance Commission Municipal Certificates, “A” , Series A-1, 3.5%, 12/20/2035 | 1,235,000 | 1,437,578 | |

| Washington, State Housing Finance Commission, Non-Profit Housing Revenue, Rockwood Retirement Communities Project: | |||

| Series A, 144A, 5.0%, 1/1/2051 | 1,945,000 | 2,177,304 | |

| Series A, 144A, 7.375%, 1/1/2044 | 6,000,000 | 6,540,780 | |

| Washington, State Housing Finance Commission, The Hearthstone Project: | |||

| Series A, 144A, 5.0%, 7/1/2038 | 775,000 | 839,384 | |

| Series A, 144A, 5.0%, 7/1/2048 | 1,735,000 | 1,855,644 | |

| Series A, 144A, 5.0%, 7/1/2053 | 1,125,000 | 1,200,531 | |

| 37,986,160 | |||

| West Virginia 0.1% | |||

| West Virginia, State Economic Development Authority, Arch Resources Project, Series A, AMT, 4.125% (d), 7/1/2045, Series A | 1,215,000 | 1,250,220 | |

| DWS Strategic High Yield Tax-Free Fund | | 33 |

| Principal

Amount ($) |

Value ($) | ||

| Wisconsin 3.8% | |||

| Wisconsin, Health Educational Facilities Authority, Covenant Communities, Inc. Project: | |||

| Series A-1, 5.0%, 7/1/2043 | 4,000,000 | 4,358,420 | |

| Series B, 5.0%, 7/1/2048 | 910,000 | 948,460 | |

| Wisconsin, Public Finance Authority Educational Facility Revenue, Noorba College of Osteopathic Media Project, Series B, 144A, 6.5%, 6/1/2045 | 6,000,000 | 5,883,367 | |

| Wisconsin, Public Finance Authority, Apartment Facilities Revenue, Senior Obligation Group, AMT, 5.0%, 7/1/2042 | 3,500,000 | 3,633,303 | |

| Wisconsin, Public Finance Authority, Education Revenue, Mountain Island Charter School Ltd.: | |||

| 5.0%, 7/1/2047 | 2,000,000 | 2,136,299 | |

| 5.0%, 7/1/2052 | 910,000 | 970,149 | |

| Wisconsin, Public Finance Authority, Education Revenue, North Carolina Leadership Academy, 144A, 5.0%, 6/15/2049 | 520,000 | 565,481 | |

| Wisconsin, Public Finance Authority, Hospital Revenue, Series A, 4.0%, 10/1/2049 | 5,000,000 | 5,677,215 | |

| Wisconsin, Public Finance Authority, Senior Living Community First Mortgage Revenue, Cedars Obligated Group: | |||

| 144A, 5.5%, 5/1/2039 | 635,000 | 651,340 | |

| 144A, 5.75%, 5/1/2054 | 5,620,000 | 5,745,020 | |

| Wisconsin, Public Finance Authority, Senior Living Revenue, Mary’s Woods at Marylhurst Project, Series A, 144A, 5.25%, 5/15/2047 | 4,545,000 | 4,991,687 | |

| Wisconsin, State Health & Educational Facilities Authority Revenue, Benevolent Corp. Cedar Community Project: | |||

| 5.0%, 6/1/2037 | 1,970,000 | 2,145,526 | |

| 5.0%, 6/1/2041 | 1,910,000 | 2,068,135 | |

| 39,774,402 | |||

| Guam 0.6% | |||

| Guam, Government Waterworks Authority, Water & Wastewater System Revenue: | |||

| 5.0%, 7/1/2040 | 1,040,000 | 1,208,459 | |

| Series A, 5.0%, 1/1/2050 | 655,000 | 799,910 | |

| Guam, International Airport Authority Revenue: | |||

| Series C, AMT, 6.25%, 10/1/2034 | 500,000 | 542,520 | |

| Series C, AMT, 6.375%, 10/1/2043 | 1,610,000 | 1,741,220 | |

| 34 | | DWS Strategic High Yield Tax-Free Fund |

| Principal

Amount ($) |

Value ($) | ||

| Guam, Port Authority Revenue, Series A, 5.0%, 7/1/2048 | 800,000 | 943,122 | |

| Guam, Power Authority Revenue, Series A, 5.0%, 10/1/2034 | 1,200,000 | 1,261,947 | |

| 6,497,178 | |||

| Puerto Rico 6.7% | |||

| Puerto Rico, Aqueduct & Sewer Authority Revenue, Series A, 5.25%, 7/1/2029 | 1,000,000 | 1,058,363 | |

| Puerto Rico, Commonwealth Aqueduct and Sewer Authority: | |||

| Series A, 144A, 5.0%, 7/1/2035 | 5,000,000 | 5,957,494 | |

| Series A, 144A, 5.0%, 7/1/2047 | 10,000,000 | 11,737,025 | |

| Puerto Rico, Commonwealth Public Improvement: | |||

| Series A, 5.0%, 7/1/2041 * (c) | 1,955,000 | 1,573,775 | |

| Series B, 5.75%, 7/1/2038 * (c) | 2,000,000 | 1,762,500 | |

| Puerto Rico, Electric Power Authority Revenue: | |||

| Series TT, 5.0%, 7/1/2025 * (c) | 920,000 | 880,900 | |

| Series 1, 5.0%, 7/1/2028 * (c) | 1,785,000 | 1,709,138 | |

| Series 1, 5.0%, 7/1/2032 * (c) | 5,000,000 | 4,787,500 | |

| Series 1, 5.25%, 7/1/2027 * (c) | 2,000,000 | 1,920,000 | |

| Series XX, 5.25%, 7/1/2040 * (c) | 4,000,000 | 3,840,000 | |

| Series WW, 5.5%, 7/1/2038 * (c) | 2,900,000 | 2,791,250 | |

| Puerto Rico, GDB Debt Recovery Authority, PIK, 7.5%, 8/20/2040 | 9,080,717 | 8,013,733 | |

| Puerto Rico, General Obligation, Series A, 8.0%, 7/1/2035 * (c) | 2,500,000 | 2,018,750 | |

| Puerto Rico, Sales Tax Financing Corp., Sales Tax Revenue: | |||

| Series A-1, Zero Coupon, 7/1/2046 | 32,904,000 | 10,712,555 | |

| Series A-1, 4.75%, 7/1/2053 | 6,800,000 | 7,644,315 | |

| Puerto Rico, The Childrens Trust Fund, Tobacco Settlement Revenue, Series A, Series A, Zero Coupon, 5/15/2057 | 50,000,000 | 3,336,910 | |

| 69,744,208 | |||

| Total Municipal Bonds and Notes (Cost $904,891,065) | 1,002,176,851 | ||

| DWS Strategic High Yield Tax-Free Fund | | 35 |

| Principal

Amount ($) |

Value ($) | ||

| Underlying Municipal Bonds of Inverse Floaters (e) 6.2% | |||

| Florida 2.3% | |||

| Florida, Airport Facilities Revenue, Series B, 4.0%, 9/1/2044 (f) | 10,000,000 | 11,518,053 | |

| Trust: Airport Facilities Revenue, Series XM0780, 144A, 13.96%, 9/1/2027, Leverage Factor at purchase date: 4 to 1 | |||

| Miami-Dade County, FL, Transit Sales Surtax Revenue, Series A, 4.0%, 7/1/2049 (f) | 10,000,000 | 11,815,034 | |

| Trust: Transit Sales Surtax Revenue, Series XM0901, 144A, 14.23%, 7/1/2028, Leverage Factor at purchase date: 4 to 1 | |||

| 23,333,087 | |||

| Michigan 1.1% | |||

| Michigan, State Building Authority Revenue, Facilities Program, Series I, 5.0%, 4/15/2034 (f) | 10,000,000 | 11,825,536 | |

| Trust: State Building Authority Revenue, Series 2015-XM0123, 144A, 13.508%, 10/15/2023, Leverage Factor at purchase date: 3 to 1 | |||

| New York 1.1% | |||

| New York, State Thruway Authority General Revenue, Series B, 4.0%, 1/1/2053 (f) | 10,000,000 | 11,486,384 | |

| Trust: State Thruway Authority General Revenue, Series XM0880, 144A, 13.81%, 1/1/2028, Leverage Factor at purchase date: 4 to 1 | |||

| Washington 1.7% | |||

| Washington, State General Obligation, Series A-1, 5.0%, 8/1/2037 (f) | 15,000,000 | 17,591,195 | |

| Trust: State General Obligation, Series XM0127, 144A, 17.87%, 8/1/2023, Leverage Factor at purchase date: 4 to 1 | |||

| Total Underlying Municipal Bonds of Inverse Floaters (Cost $60,835,358) | 64,236,202 | ||

| Corporate Bonds 0.6% | |||

| Industrials 0.3% | |||

| Delta Air Lines, Inc., 3.75%, 10/28/2029 | 3,500,000 | 3,491,332 | |

| Utilities 0.3% | |||

| Talen Energy Supply LLC, 6.5%, 6/1/2025 | 3,000,000 | 2,535,000 | |

| Total Corporate Bonds (Cost $6,021,901) | 6,026,332 | ||

| 36 | | DWS Strategic High Yield Tax-Free Fund |

| Principal

Amount ($) |

Value ($) | ||

| Government & Agency Obligations 0.2% | |||

| U.S. Treasury Obligations | |||

| U.S. Treasury Note, 0.875%, 11/15/2030 (Cost $2,448,753) | 2,500,000 | 2,346,094 | |

| Shares | Value ($) | ||

| Open-End Investment Companies 0.1% | |||

| BlackRock Liquidity Funds MuniCash Portfolio, Institutional Shares, 0.01% (g) (Cost $662,096) | 661,284 | 661,416 | |

| %

of Net Assets |

Value ($) | ||

| Total Investment Portfolio (Cost $974,859,173) | 103.4 | 1,075,446,895 | |

| Floating Rate Notes (e) | (3.9) | (40,420,000) | |

| Other Assets and Liabilities, Net | 0.5 | 5,001,478 | |

| Net Assets | 100.0 | 1,040,028,373 | |

| * | Non-income producing security. |

| (a) | Variable rate demand notes are securities whose interest rates are reset periodically (usually daily mode or weekly mode) by remarketing agents based on current market levels, and are not directly set as a fixed spread to a reference rate. These securities may be redeemed at par by the holder at any time, and are shown at their current rates as of May 31, 2021. Date shown reflects the earlier of demand date or stated maturity date. |

| (b) | When-issued security. |

| (c) | Defaulted security or security for which income has been deemed uncollectible. |

| (d) | Variable or floating rate security. These securities are shown at their current rate as of May 31, 2021. For securities based on a published reference rate and spread, the reference rate and spread are indicated within the description above. Certain variable rate securities are not based on a published reference rate and spread but adjust periodically based on current market conditions, prepayment of underlying positions and/or other variables. Securities with a floor or ceiling feature are disclosed at the inherent rate, where applicable. |

| (e) | Securities represent the underlying municipal obligations of inverse floating rate obligations held by the Fund. The Floating Rate Notes represents leverage to the Fund and is the amount owed to the floating rate note holders. |

| (f) | Security forms part of the below inverse floater. The Fund accounts for these inverse floaters as a form of secured borrowing, by reflecting the value of the underlying bond in the investments of the Fund and the amount owed to the floating rate note holder as a liability. |

| (g) | Current yield; not a coupon rate. |

| 144A: Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. |

| AGMC: Assured Guaranty Municipal Corp. |

| AMBAC: Ambac Financial Group, Inc. |

| DWS Strategic High Yield Tax-Free Fund | | 37 |

| AMT: Subject to alternative minimum tax. |

| BAM: Build America Mutual |

| GTY: Guaranty Agreement |

| INS: Insured |

| LOC: Letter of Credit |

| PIK: Denotes that all or a portion of the income is paid in-kind in the form of additional principal. |

| Prerefunded: Bonds which are prerefunded are collateralized usually by U.S. Treasury securities which are held in escrow and used to pay principal and interest on tax-exempt issues and to retire the bonds in full at the earliest refunding date. |

| Assets | Level 1 | Level 2 | Level 3 | Total |

| Municipal Investments (a) | $ — | $1,066,413,053 | $— | $1,066,413,053 |

| Corporate Bonds (a) | — | 6,026,332 | — | 6,026,332 |

| Government & Agency Obligations | — | 2,346,094 | — | 2,346,094 |

| Open-End Investment Companies | 661,416 | — | — | 661,416 |

| Total | $661,416 | $1,074,785,479 | $ — | $1,075,446,895 |

| (a) | See Investment Portfolio for additional detailed categorizations. |

| 38 | | DWS Strategic High Yield Tax-Free Fund |

| Assets | |

| Investment in securities, at value (cost $974,859,173) | $ 1,075,446,895 |

| Receivable for investments sold | 380,823 |

| Receivable for Fund shares sold | 353,509 |

| Interest receivable | 13,909,542 |

| Other assets | 48,288 |

| Total assets | 1,090,139,057 |

| Liabilities | |

| Payable for investments purchased | 2,535,542 |

| Payable for investments purchased — when-issued securities | 5,036,538 |

| Payable for Fund shares redeemed | 613,360 |

| Payable for floating rate notes issued | 40,420,000 |

| Distributions payable | 675,480 |

| Accrued management fee | 270,304 |

| Accrued Trustees' fees | 8,648 |

| Other accrued expenses and payables | 550,812 |

| Total liabilities | 50,110,684 |

| Net assets, at value | $ 1,040,028,373 |

| Net Assets Consist of | |

| Distributable earnings (loss) | 8,870,405 |

| Paid-in capital | 1,031,157,968 |

| Net assets, at value | $ 1,040,028,373 |

| DWS Strategic High Yield Tax-Free Fund | | 39 |

| Net Asset Value | |

| Class A | |

| Net

Asset Value and redemption price per share ($216,107,579 ÷ 17,170,903 outstanding shares of beneficial interest, $.01 par value, unlimited shares authorized) |

$ 12.59 |

| Maximum offering price per share (100 ÷ 97.25 of $12.59) | $ 12.95 |

| Class C | |

| Net

Asset Value, offering and redemption price (subject to contingent deferred sales charge) per share ($14,464,398 ÷ 1,148,211 outstanding shares of beneficial interest, $.01 par value, unlimited shares authorized) |

$ 12.60 |

| Class S | |

| Net

Asset Value, offering and redemption price per share ($567,067,086 ÷ 45,016,262 outstanding shares of beneficial interest, $.01 par value, unlimited shares authorized) |

$ 12.60 |

| Institutional Class | |

| Net

Asset Value, offering and redemption price per share ($242,389,310 ÷ 19,234,199 outstanding shares of beneficial interest, $.01 par value, unlimited shares authorized) |

$ 12.60 |

| 40 | | DWS Strategic High Yield Tax-Free Fund |

| Investment Income | |

| Income: | |

| Interest | $ 44,559,521 |

| Expenses: | |

| Management fee | 4,141,617 |

| Administration fee | 988,049 |

| Services to shareholders | 1,369,576 |

| Distribution and service fees | 749,119 |

| Custodian fee | 14,123 |

| Professional fees | 92,870 |

| Reports to shareholders | 73,370 |

| Registration fees | 87,873 |

| Trustees' fees and expenses | 28,463 |

| Interest expense and fees on floating rate notes issued | 312,175 |

| Other | 55,938 |

| Total expenses before expense reductions | 7,913,173 |

| Expense reductions | (869,366) |

| Total expenses after expense reductions | 7,043,807 |

| Net investment income | 37,515,714 |

| Realized and Unrealized Gain (Loss) | |

| Net realized gain (loss) from investments | (10,310,502) |

| Change in net unrealized appreciation (depreciation) on investments | 112,033,252 |

| Net gain (loss) | 101,722,750 |

| Net increase (decrease) in net assets resulting from operations | $ 139,238,464 |

| DWS Strategic High Yield Tax-Free Fund | | 41 |

| Years Ended May 31, | ||

| Increase (Decrease) in Net Assets | 2021 | 2020 |

| Operations: | ||

| Net investment income | $ 37,515,714 | $ 42,713,965 |

| Net realized gain (loss) | (10,310,502) | 902,349 |

| Change

in net unrealized appreciation (depreciation) |

112,033,252 | (70,228,793) |

| Net increase (decrease) in net assets resulting from operations | 139,238,464 | (26,612,479) |

| Distributions to shareholders: | ||

| Class A | (6,907,768) | (7,243,884) |

| Class C | (714,324) | (1,196,641) |

| Class S | (21,089,131) | (25,982,423) |

| Institutional Class | (8,622,243) | (7,930,714) |

| Total distributions | (37,333,466) | (42,353,662) |

| Fund share transactions: | ||

| Proceeds from shares sold | 290,828,855 | 397,606,177 |

| Reinvestment of distributions | 31,367,643 | 36,106,905 |

| Payments for shares redeemed | (380,419,816) | (456,815,594) |

| Net increase (decrease) in net assets from Fund share transactions | (58,223,318) | (23,102,512) |

| Increase (decrease) in net assets | 43,681,680 | (92,068,653) |

| Net assets at beginning of period | 996,346,693 | 1,088,415,346 |

| Net assets at end of period | $1,040,028,373 | $ 996,346,693 |

| 42 | | DWS Strategic High Yield Tax-Free Fund |

| DWS Strategic High Yield Tax-Free Fund — Class A | |||||

| Years Ended May 31, | |||||

| 2021 | 2020 | 2019 | 2018 | 2017 | |

| Selected Per Share Data | |||||

| Net asset value, beginning of period | $11.37 | $12.13 | $12.08 | $12.27 | $12.59 |

| Income (loss) from investment operations: | |||||

| Net investment income | .42 | .45 | .46 | .44 | .49 |

| Net realized and unrealized gain (loss) | 1.23 | (.77) | .08 | (.19) | (.33) |

| Total from investment operations | 1.65 | (.32) | .54 | .25 | .16 |

| Less distributions from: | |||||

| Net investment income | (.42) | (.44) | (.46) | (.43) | (.47) |

| Net realized gains | (.01) | (.00) * | (.03) | (.01) | (.01) |

| Total distributions | (.43) | (.44) | (.49) | (.44) | (.48) |

| Net asset value, end of period | $12.59 | $11.37 | $12.13 | $12.08 | $12.27 |

| Total Return (%)a,b | 14.56 | (2.74) | 4.62 | 2.11 | 1.29 |

| Ratios to Average Net Assets and Supplemental Data | |||||

| Net assets, end of period ($ millions) | 216 | 181 | 195 | 225 | 264 |

| Ratio of expenses before expense reductions (including interest expense) (%)c | .90 | .95 | .98 | .95 | .95 |

| Ratio of expenses after expense reductions (including interest expense) (%)c | .87 | .91 | .91 | .91 | .93 |

| Ratio of expenses after expense reductions (excluding interest expense) (%) | .84 | .85 | .86 | .87 | .88 |

| Ratio of net investment income (%) | 3.51 | 3.72 | 3.87 | 3.61 | 3.93 |

| Portfolio turnover rate (%) | 59 | 52 | 47 | 34 | 54 |

| a | Total return does not reflect the effect of any sales charges. |

| b | Total return would have been lower had certain expenses not been reduced. |

| c | Interest expense represents interest and fees on short-term floating rate notes issued in conjunction with inverse floating rate securities. Interest income from such transactions is included in income from investment operations. |

| * | Amount is less than $.005. |

| DWS Strategic High Yield Tax-Free Fund | | 43 |

| DWS Strategic High Yield Tax-Free Fund — Class C | |||||

| Years Ended May 31, | |||||

| 2021 | 2020 | 2019 | 2018 | 2017 | |

| Selected Per Share Data | |||||

| Net asset value, beginning of period | $11.38 | $12.13 | $12.09 | $12.28 | $12.59 |

| Income (loss) from investment operations: | |||||

| Net investment income | .33 | .36 | .37 | .35 | .39 |

| Net realized and unrealized gain (loss) | 1.22 | (.76) | .07 | (.19) | (.31) |

| Total from investment operations | 1.55 | (.40) | .44 | .16 | .08 |

| Less distributions from: | |||||

| Net investment income | (.32) | (.35) | (.37) | (.34) | (.38) |

| Net realized gains | (.01) | (.00) * | (.03) | (.01) | (.01) |

| Total distributions | (.33) | (.35) | (.40) | (.35) | (.39) |

| Net asset value, end of period | $12.60 | $11.38 | $12.13 | $12.09 | $12.28 |

| Total Return (%)a,b | 13.68 | (3.39) | 3.75 | 1.35 | .61 |

| Ratios to Average Net Assets and Supplemental Data | |||||

| Net assets, end of period ($ millions) | 14 | 33 | 52 | 88 | 109 |

| Ratio of expenses before expense reductions (including interest expense) (%)c | 1.66 | 1.71 | 1.75 | 1.71 | 1.72 |

| Ratio of expenses after expense reductions (including interest expense) (%)c | 1.62 | 1.66 | 1.66 | 1.66 | 1.68 |

| Ratio of expenses after expense reductions (excluding interest expense) (%) | 1.59 | 1.60 | 1.61 | 1.62 | 1.63 |

| Ratio of net investment income (%) | 2.77 | 2.97 | 3.10 | 2.86 | 3.18 |

| Portfolio turnover rate (%) | 59 | 52 | 47 | 34 | 54 |

| a | Total return does not reflect the effect of any sales charges. |

| b | Total return would have been lower had certain expenses not been reduced. |

| c | Interest expense represents interest and fees on short-term floating rate notes issued in conjunction with inverse floating rate securities. Interest income from such transactions is included in income from investment operations. |

| * | Amount is less than $.005. |

| 44 | | DWS Strategic High Yield Tax-Free Fund |

| DWS Strategic High Yield Tax-Free Fund — Class S | |||||

| Years Ended May 31, | |||||

| 2021 | 2020 | 2019 | 2018 | 2017 | |

| Selected Per Share Data | |||||

| Net asset value, beginning of period | $11.38 | $12.14 | $12.09 | $12.28 | $12.60 |

| Income (loss) from investment operations: | |||||

| Net investment income | .45 | .47 | .49 | .47 | .51 |

| Net realized and unrealized gain (loss) | 1.23 | (.76) | .08 | (.18) | (.32) |

| Total from investment operations | 1.68 | (.29) | .57 | .29 | .19 |

| Less distributions from: | |||||

| Net investment income | (.45) | (.47) | (.49) | (.47) | (.50) |

| Net realized gains | (.01) | (.00) * | (.03) | (.01) | (.01) |

| Total distributions | (.46) | (.47) | (.52) | (.48) | (.51) |

| Net asset value, end of period | $12.60 | $11.38 | $12.14 | $12.09 | $12.28 |

| Total Return (%)a | 14.83 | (2.49) | 4.88 | 2.37 | 1.55 |

| Ratios to Average Net Assets and Supplemental Data | |||||

| Net assets, end of period ($ millions) | 567 | 576 | 661 | 1,204 | 1,336 |

| Ratio of expenses before expense reductions (including interest expense) (%)b | .73 | .80 | .84 | .81 | .82 |

| Ratio of expenses after expense reductions (including interest expense) (%)b | .62 | .66 | .66 | .66 | .68 |

| Ratio of expenses after expense reductions (excluding interest expense) (%) | .59 | .60 | .61 | .62 | .63 |

| Ratio of net investment income (%) | 3.76 | 3.97 | 4.07 | 3.86 | 4.16 |

| Portfolio turnover rate (%) | 59 | 52 | 47 | 34 | 54 |

| a | Total return would have been lower had certain expenses not been reduced. |

| b | Interest expense represents interest and fees on short-term floating rate notes issued in conjunction with inverse floating rate securities. Interest income from such transactions is included in income from investment operations. |

| * | Amount is less than $.005. |

| DWS Strategic High Yield Tax-Free Fund | | 45 |

| DWS Strategic High Yield Tax-Free Fund — Institutional Class | |||||

| Years Ended May 31, | |||||

| 2021 | 2020 | 2019 | 2018 | 2017 | |

| Selected Per Share Data | |||||

| Net asset value, beginning of period | $11.39 | $12.14 | $12.10 | $12.29 | $12.60 |

| Income (loss) from investment operations: | |||||

| Net investment income | .45 | .49 | .49 | .47 | .51 |

| Net realized and unrealized gain (loss) | 1.22 | (.77) | .07 | (.18) | (.31) |

| Total from investment operations | 1.67 | (.28) | .56 | .29 | .20 |

| Less distributions from: | |||||

| Net investment income | (.45) | (.47) | (.49) | (.47) | (.50) |

| Net realized gains | (.01) | (.00) * | (.03) | (.01) | (.01) |

| Total distributions | (.46) | (.47) | (.52) | (.48) | (.51) |

| Net asset value, end of period | $12.60 | $11.39 | $12.14 | $12.10 | $12.29 |

| Total Return (%)a | 14.82 | (2.41) | 4.80 | 2.37 | 1.64 |

| Ratios to Average Net Assets and Supplemental Data | |||||

| Net assets, end of period ($ millions) | 242 | 207 | 181 | 159 | 250 |

| Ratio of expenses before expense reductions (including interest expense) (%)b | .68 | .74 | .70 | .70 | .69 |

| Ratio of expenses after expense reductions (including interest expense) (%)b | .62 | .66 | .66 | .66 | .67 |

| Ratio of expenses after expense reductions (excluding interest expense) (%) | .59 | .60 | .61 | .62 | .62 |

| Ratio of net investment income (%) | 3.76 | 3.97 | 4.13 | 3.86 | 4.17 |

| Portfolio turnover rate (%) | 59 | 52 | 47 | 34 | 54 |

| a | Total return would have been lower had certain expenses not been reduced. |

| b | Interest expense represents interest and fees on short-term floating rate notes issued in conjunction with inverse floating rate securities. Interest income from such transactions is included in income from investment operations. |

| * | Amount is less than $.005. |

| 46 | | DWS Strategic High Yield Tax-Free Fund |

| A. | Organization and Significant Accounting Policies |

| DWS Strategic High Yield Tax-Free Fund | | 47 |

| 48 | | DWS Strategic High Yield Tax-Free Fund |

| DWS Strategic High Yield Tax-Free Fund | | 49 |

| 50 | | DWS Strategic High Yield Tax-Free Fund |

| Undistributed tax-exempt income | $ 12,345,526 |

| Undistributed ordinary income | $ 108,904 |

| Capital loss carryforwards | $ (103,632,000) |

| Net unrealized appreciation (depreciation) on investments | $ 102,402,388 |

| Years Ended May 31, | ||

| 2021 | 2020 | |

| Distributions from tax-exempt income | $ 36,891,337 | $ 42,175,072 |

| Distributions from ordinary income* | $ 442,129 | $ 178,590 |

| * | For tax purposes, short-term capital gain distributions are considered ordinary income distributions. |

| DWS Strategic High Yield Tax-Free Fund | | 51 |

| B. | Purchases and Sales of Securities |

| Purchases | Sales | |

| Non-U.S. Treasury Obligations | $601,938,769 | $622,481,811 |

| U.S. Treasury Obligations | $ 7,341,241 | $ 4,726,152 |

| C. | Related Parties |

| 52 | | DWS Strategic High Yield Tax-Free Fund |

| First $300 million of the Fund’s average daily net assets | .455% |

| Next $200 million of such net assets | .405% |

| Next $500 million of such net assets | .380% |

| Next $500 million of such net assets | .360% |

| Next $500 million of such net assets | .350% |

| Over $2 billion of such net assets | .340% |

| Class A | .85% |

| Class C | 1.60% |

| Class S | .60% |

| Institutional Class | .60% |

| Class A | .83% | |

| Class C | 1.58% | |

| Class S | .58% | |

| Institutional Class | .58% |

| DWS Strategic High Yield Tax-Free Fund | | 53 |

| Class A | $ 58,552 |

| Class C | 11,597 |

| Class S | 648,314 |

| Institutional Class | 150,903 |

| $ 869,366 |

| Services to Shareholders | Total

Aggregated |

Unpaid

at May 31, 2021 |

| Class A | $ 7,765 | $ 1,243 |

| Class C | 646 | 92 |

| Class S | 61,047 | 10,226 |

| Institutional Class | 1,125 | 123 |

| $ 70,583 | $ 11,684 |

| 54 | | DWS Strategic High Yield Tax-Free Fund |

| Sub-Recordkeeping | Total

Aggregated |

| Class A | $ 146,576 |

| Class C | 22,617 |

| Class S | 844,957 |

| Institutional Class | 254,491 |

| $ 1,268,641 |

| Distribution Fee | Total

Aggregated |

Unpaid

at May 31, 2021 |

| Class C | $ 194,762 | $ 11,002 |

| Service Fee | Total

Aggregated |

Unpaid

at May 31, 2021 |

Annual

Rate |

| Class A | $ 489,138 | $ 83,937 | .25% |

| Class C | 65,219 | 8,322 | .25% |

| $ 554,357 | $ 92,259 |

| DWS Strategic High Yield Tax-Free Fund | | 55 |

| D. | Investing in High-Yield Debt Securities |

| E. | Line of Credit |

| 56 | | DWS Strategic High Yield Tax-Free Fund |

| F. | Fund Share Transactions |

| Year

Ended May 31, 2021 |

Year

Ended May 31, 2020 | |||

| Shares | Dollars | Shares | Dollars | |

| Shares sold | ||||

| Class A | 3,640,049 | $ 44,237,425 | 3,349,029 | $ 40,589,341 |

| Class C | 182,279 | 2,206,373 | 308,202 | 3,712,529 |

| Class S | 13,825,223 | 165,704,485 | 19,782,231 | 231,962,939 |

| Institutional Class | 6,508,930 | 78,680,572 | 10,203,041 | 121,341,368 |

| $ 290,828,855 | $ 397,606,177 | |||

| Shares issued to shareholders in reinvestment of distributions | ||||

| Class A | 495,086 | $ 6,006,038 | 541,994 | $ 6,504,435 |

| Class C | 53,903 | 652,609 | 80,431 | 967,648 |

| Class S | 1,542,781 | 18,712,420 | 1,912,717 | 23,004,338 |

| Institutional Class | 493,545 | 5,996,576 | 469,051 | 5,630,484 |

| $ 31,367,643 | $ 36,106,905 | |||

| Shares redeemed | ||||

| Class A | (2,850,677) | $ (34,443,706) | (4,083,826) | $ (48,841,422) |

| Class C | (1,963,639) | (23,954,420) | (1,766,242) | (21,374,138) |

| Class S | (20,930,196) | (249,695,387) | (25,576,804) | (299,895,328) |

| Institutional Class | (5,970,749) | (72,326,303) | (7,368,477) | (86,704,706) |

| $ (380,419,816) | $ (456,815,594) | |||

| DWS Strategic High Yield Tax-Free Fund | | 57 |

| Year

Ended May 31, 2021 |

Year

Ended May 31, 2020 | |||

| Shares | Dollars | Shares | Dollars | |

| Net increase (decrease) | ||||

| Class A | 1,284,458 | $ 15,799,757 | (192,803) | $ (1,747,646) |

| Class C | (1,727,457) | (21,095,438) | (1,377,609) | (16,693,961) |

| Class S | (5,562,192) | (65,278,482) | (3,881,856) | (44,928,051) |

| Institutional Class | 1,031,726 | 12,350,845 | 3,303,615 | 40,267,146 |

| $ (58,223,318) | $ (23,102,512) | |||

| G. | Other — COVID-19 Pandemic |

| 58 | | DWS Strategic High Yield Tax-Free Fund |

| DWS Strategic High Yield Tax-Free Fund | | 59 |

| 60 | | DWS Strategic High Yield Tax-Free Fund |