UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM N-CSR

Investment Company Act file number: 811-02671

Deutsche DWS Municipal Trust

(Exact Name of Registrant as Specified in Charter)

875 Third Avenue

New York, NY 10022-6225

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, including Area Code: (212) 454-4500

Diane Kenneally

One International Place

Boston, MA 02110

(Name and Address of Agent for Service)

| Date of fiscal year end: | 10/31 |

| Date of reporting period: | 10/31/2019 |

| ITEM 1. | REPORT TO STOCKHOLDERS |

Table of Contents

Table of Contents

This report must be preceded or accompanied by a prospectus. To obtain a summary prospectus, if available, or prospectus for any of our funds, refer to the Account Management Resources information provided in the back of this booklet. We advise you to consider the Fund’s objectives, risks, charges and expenses carefully before investing. The summary prospectus and prospectus contain this and other important information about the Fund. Please read the prospectus carefully before you invest.

Bond investments are subject to interest-rate, credit, liquidity and market risks to varying degrees. When interest rates rise, bond prices generally fall. Credit risk refers to the ability of an issuer to make timely payments of principal and interest. Investing in derivatives entails special risks relating to liquidity, leverage and credit that may reduce returns and/or increase volatility. Although the Fund seeks income that is exempt from federal income taxes, a portion of the Fund’s distributions may be subject to federal, state and local taxes, including the alternative minimum tax. Please read the prospectus for details.

The brand DWS represents DWS Group GmbH & Co. KGaA and any of its subsidiaries such as DWS Distributors, Inc. which offers investment products or DWS Investment Management Americas, Inc. and RREEF America L.L.C. which offer advisory services.

NOT FDIC/NCUA INSURED NO BANK GUARANTEE MAY LOSE VALUE

NOT A DEPOSIT NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

| 2 | | | DWS Short-Term Municipal Bond Fund |

Table of Contents

Dear Shareholder:

The markets, both domestic and global, have been increasingly influenced by geopolitical concerns in recent months — most notably the trade conflict between China and the United States and uncertainty around the implementation of Britain’s exit from the European Union (“Brexit”). The result has been increased volatility and continued efforts by central banks to bolster economic growth through monetary policy.

Against this backdrop, our Americas Chief Investment Officer (“CIO”) remains constructive, albeit more cautious than at the beginning of the year. In our view, while tariffs raise concerns, particularly for commodity producing and manufacturing industries, including the world’s regional economies tilted toward such industries and still suffering from their own weak internal recoveries, a robust labor market and other key metrics suggest the underpinnings of the U.S. economy remain intact.

Of course, these issues and their potential implications bear close watching. Our CIO Office and global network of analysts diligently monitor these matters to determine when and what, if any, strategic or tactical adjustments may be warranted.

We invite you to access these views to better understand the changing landscape and, most important, what it may mean for you. The “Insights” section of our web site, dws.com, is home to our CIO View, which integrates the on-the-ground views of our worldwide network of economists, research analysts and investment professionals. This truly global perspective guides our strategic investment approach.

As always, we thank you for trusting DWS to help serve your investment needs.

Best regards,

|

Hepsen Uzcan

President, DWS Funds |

Assumptions, estimates and opinions contained in this document constitute our judgment as of the date of the document and are subject to change without notice. Any projections are based on a number of assumptions as to market conditions and there can be no guarantee that any projected results will be achieved. Past performance is not a guarantee of future results.

| DWS Short-Term Municipal Bond Fund | | | 3 |

Table of Contents

| Portfolio Management Review | (Unaudited) |

Overview of Market and Fund Performance

All performance information below is historical and does not guarantee future results. Returns shown are for Class A shares, unadjusted for sales charges. Investment return and principal fluctuate, so your shares may be worth more or less when redeemed. Current performance may differ from performance data shown. Please visit dws.com for the most recent month-end performance of all share classes. Fund performance includes reinvestment of all distributions. Unadjusted returns do not reflect sales charges and would have been lower if they had. Please refer to pages 8 through 10 for more complete performance information.

DWS Short-Term Municipal Bond Fund posted a total return for the 12 months ended October 31, 2019 of 3.83%. This compared to a return of 2.85% for the unmanaged Bloomberg Barclays 1-Year General Obligation Index and 4.44% for the unmanaged Bloomberg Barclays 3-Year (2–4) Municipal Bond Index.

Investment Process

Under normal market conditions, the Fund invests at least 80% of its assets in municipal securities that pay interest exempt from regular federal income tax. Portfolio management looks for securities that it believes offer the best value, typically weighing a number of factors, from economic outlooks and possible interest rate movements to characteristics of specific securities, such as coupon, maturity date and call date, credit condition and outlook, liquidity, and changes in supply and demand within the municipal bond market.

Performance for the broader fixed income markets was supported over the 12-month period by declining U.S. Treasury yields. The end of 2018 saw Treasury yields drop as investors sought a safe haven in the face of uncertainty around global growth and U.S. Federal Reserve (Fed) policy. Municipal bond market performance was constrained to a degree in late 2018 by outflows from tax-free mutual funds, although the impact was largely offset by moderate new issue supply.

Entering 2019, the Fed signaled patience with respect to future increases in its benchmark overnight lending rate, sparking a rebound in sentiment. Tax-free funds would see record inflows of $75 billion over the first ten months of 2019. Longer-maturity and lower quality municipal funds experienced the biggest inflows as investors sought incremental income in a low interest rate environment. September and October saw new

| 4 | | | DWS Short-Term Municipal Bond Fund |

Table of Contents

issue supply pick up notably as municipalities sought to take advantage of the favorable interest rate backdrop.

Positive and Negative Contributors to Performance

The Fund was positioned to benefit from the flattening of the municipal yield curve seen over the 12 months, adding to performance relative to both benchmarks. Specifically, an overweight to maturities in the 4- to 8-year range boosted performance as longer maturities experienced the most significant yield declines

| Municipal Bond Yield Curve (as of 10/31/19 and 10/31/18) |

Source: Thompson Reuters as of 10/31/19.

Chart is for illustrative purposes only and does not represent any DWS product.

The Fund’s overweight to issues rated A and BBB added to relative performance as lower quality credits outperformed the broader market. In sector terms, an overweight to corporate-backed bonds including prepaid gas, housing and airport revenue issues added to performance.

In an attempt to remain neutrally positioned vs. its peer group with respect to interest rate sensitivity, the Fund maintained an overall portfolio duration shorter than the Bloomberg Barclays 3-year (2-4) Municipal Bond Index and longer than the Bloomberg Barclays 1-year General Obligation Index. As municipal yields declined for the 12 months, this positioning detracted from performance vs. the 3-year index and added to performance vs. the 1-year index.

| DWS Short-Term Municipal Bond Fund | | | 5 |

Table of Contents

Outlook and Positioning

At the end of October 2019, the two-year municipal yield of 1.11% was 72.5% of the 1.53% yield on the comparable maturity U.S. Treasury as compared to 72.1% twelve months earlier. The five-year municipal yield of 1.15% was 75.7% of the 1.52% yield on the comparable maturity U.S. Treasury vs. 77.2% twelve months earlier. The 10-year municipal bond yield of 1.49% was 88.2% of the 1.69% comparable-maturity U.S. Treasury bond yield, as compared to 86.9% 12 months earlier.

“Performance for the broader fixed income markets was supported by declining U.S. Treasury yields.”

The municipal curve remains at below average steepness by historical standards, particularly between 2 and 10 years, diminishing the incremental income to be gained by holding longer-term issues. Given the flattening of the curve, we are focusing new purchases in the 2-year part of the curve.

We seek to add incremental exposure to lower quality paper in order to add income and return opportunities. We continue to perform careful analysis of each issue’s risk/reward profile given the environment of relatively tight spreads.

Portfolio Management Team

Ashton P. Goodfield, CFA, Managing Director

Portfolio Manager of the Fund. Began managing the Fund in 2003.

| – | Joined DWS in 1986. |

| – | Head of Municipal Bonds. |

| – | BA, Duke University. |

Matthew J. Caggiano, CFA, Managing Director

Portfolio Manager of the Fund. Began managing the Fund in 2014.

| – | Joined DWS in 1989. |

| – | BS, Pennsylvania State University; MS, Boston College. |

Peter Aloisi, CFA, Vice President

Portfolio Manager of the Fund. Began managing the Fund in 2014.

| – | Joined DWS in 2010 with five years of industry experience; previously, served as an Associate at Banc of America Securities. |

| – | BA and MBA, Boston College. |

The views expressed reflect those of the portfolio management team only through the end of the period of the report as stated on the cover. The management team’s views are subject to change at any time based on market and other conditions and should not be construed as a recommendation. Past performance is no guarantee of future results. Current and future portfolio holdings are subject to risk.

| 6 | | | DWS Short-Term Municipal Bond Fund |

Table of Contents

Terms to Know

Bloomberg Barclays 1-Year General Obligation Index is an unmanaged index including bonds with a minimum credit rating of BAA3, issued as part of a deal of at least $50 million, having an amount outstanding of at least $5 million, a maturity of one to two years, backed by the full faith and credit of an issuer with taxing power, and issued after December 31, 1990.

Bloomberg Barclays 3-Year (2-4) Municipal Bond Index is an unmanaged subset of the Bloomberg Barclays Municipal Bond Index. It includes maturities of two to four years.

Index returns do not reflect any fees or expenses and it is not possible to invest directly into an index.

The yield curve is a graph with a left-to-right line that shows how high or low yields are, from the shortest to the longest maturities. Typically (and when the yield curve is characterized as “steep,” this is especially true), the line rises from left to right as investors who are willing to tie up their money for a longer period are rewarded with higher yields.

Duration, which is expressed in years, measures the sensitivity of the price of a bond or bond fund to a change in interest rates.

Credit quality measures a bond issuer’s ability to repay interest and principal in a timely manner. Rating agencies assign letter designations, such as AAA, AA and so forth. The lower the rating, the higher the probability of default. Credit quality does not remove market risk and is subject to change.

Overweight means the Fund holds a higher weighting in a given sector or security than the benchmark.

Underweight means the Fund holds a lower weighting.

Spread refers to the yield advantage provided by credit sensitive securities relative to comparable maturity U.S. Treasuries. The yield spread for an individual security may tighten or widen depending on shifts in the outlook for timely repayment of principal and interest.

| DWS Short-Term Municipal Bond Fund | | | 7 |

Table of Contents

| Performance Summary | October 31, 2019 (Unaudited) |

| Class A | 1-Year | 5-Year | 10-Year | |||||||||

| Average Annual Total Returns as of 10/31/19 |

| |||||||||||

| No Sales Charges | 3.83% | 1.10% | 1.33% | |||||||||

| Bloomberg Barclays 1-Year G.O. Index† | 2.85% | 1.13% | 1.08% | |||||||||

| Bloomberg Barclays 3-Year (2–4) Municipal Bond Index†† |

4.44% | 1.51% | 1.85% | |||||||||

| Class C | 1-Year | 5-Year | 10-Year | |||||||||

| Average Annual Total Returns as of 10/31/19 |

| |||||||||||

| Unadjusted for Sales Charge | 3.05% | 0.35% | 0.59% | |||||||||

| Adjusted for the Maximum Sales Charge (max 1.00% CDSC) |

3.05% | 0.35% | 0.59% | |||||||||

| Bloomberg Barclays 1-Year G.O. Index† | 2.85% | 1.13% | 1.08% | |||||||||

| Bloomberg Barclays 3-Year (2–4) Municipal Bond Index†† |

4.44% | 1.51% | 1.85% | |||||||||

| Class S | 1-Year | 5-Year | 10-Year | |||||||||

| Average Annual Total Returns as of 10/31/19 | ||||||||||||

| No Sales Charges | 3.88% | 1.23% | 1.48% | |||||||||

| Bloomberg Barclays 1-Year G.O. Index† | 2.85% | 1.13% | 1.08% | |||||||||

| Bloomberg Barclays 3-Year (2–4) Municipal Bond Index†† |

4.44% | 1.51% | 1.85% | |||||||||

| Institutional Class | 1-Year | 5-Year | 10-Year | |||||||||

| Average Annual Total Returns as of 10/31/19 |

| |||||||||||

| No Sales Charges | 4.09% | 1.36% | 1.59% | |||||||||

| Bloomberg Barclays 1-Year G.O. Index† | 2.85% | 1.13% | 1.08% | |||||||||

| Bloomberg Barclays 3-Year (2–4) Municipal Bond Index†† |

4.44% | 1.51% | 1.85% | |||||||||

Performance in the Average Annual Total Returns table(s) above and the Growth of an Assumed $10,000 Investment line graph that follows is historical and does not guarantee future results. Investment return and principal fluctuate, so your shares may be worth more or less when redeemed. Current performance may differ from performance data shown. Please visit dws.com for the Fund’s most recent month-end performance. Fund performance includes reinvestment of all distributions. Unadjusted returns do not reflect sales charges and would have been lower if they had.

The gross expense ratios of the Fund, as stated in the fee table of the prospectus dated February 1, 2019 are 0.94%, 1.70%, 0.81% and 0.72% for Class A, Class C, Class S and Institutional Class shares, respectively, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report.

| 8 | | | DWS Short-Term Municipal Bond Fund |

Table of Contents

Index returns do not reflect any fees or expenses and it is not possible to invest directly into an index.

Performance figures do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. A portion of the Fund’s distributions may be subject to federal, state and local tax and the alternative minimum tax.

Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes only, and as such, the total return based on the unadjusted net asset value per share may differ from the total return reported in the financial highlights.

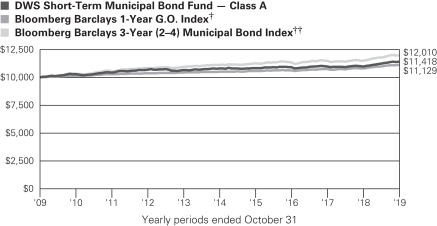

| Growth of an Assumed $10,000 Investment |

The growth of $10,000 is cumulative.

Performance of other share classes will vary based on the sales charges and the fee structure of those classes.

| † | The Bloomberg Barclays 1-Year General Obligation Index is an unmanaged index including bonds with a minimum credit rating of BAA3, issued as part of a deal of at least $50 million, having an amount outstanding of at least $5 million, a maturity of one to two years, backed by the full faith and credit of an issuer with taxing power. |

| †† | The Bloomberg Barclays 3-Year (2–4) Municipal Bond Index is an unmanaged subset of the Bloomberg Barclays Municipal Bond Index. It includes maturities of two to four years. |

| DWS Short-Term Municipal Bond Fund | | | 9 |

Table of Contents

| Class A | Class C | Class S | Institutional Class |

|||||||||||||

| Net Asset Value |

| |||||||||||||||

| 10/31/19 | $ | 10.15 | $ | 10.15 | $ | 10.13 | $ | 10.15 | ||||||||

| 10/31/18 | $ | 9.93 | $ | 9.93 | $ | 9.92 | $ | 9.93 | ||||||||

| Distribution Information as of 10/31/19 |

| |||||||||||||||

| Income Dividends, Twelve Months | $ | .16 | $ | .08 | $ | .17 | $ | .18 | ||||||||

| October Income Dividend | $ | .0111 | $ | .0049 | $ | .0124 | $ | .0133 | ||||||||

| SEC 30-day Yield‡‡ | .90% | .17% | 1.06% | 1.16% | ||||||||||||

| Tax Equivalent Yield‡‡ | 1.51% | .29% | 1.79% | 1.96% | ||||||||||||

| Current Annualized Distribution Rate‡‡ | 1.29% | .57% | 1.44% | 1.54% | ||||||||||||

| 10 | | | DWS Short-Term Municipal Bond Fund |

Table of Contents

Portfolio holdings and characteristics are subject to change.

For more complete details about the Fund’s investment portfolio, see page 12. A quarterly Fact Sheet is available on dws.com or upon request. Please see the Account Management Resources section on page 58 for contact information.

| DWS Short-Term Municipal Bond Fund | | | 11 |

Table of Contents

| Investment Portfolio | as of October 31, 2019 |

| Principal Amount ($) |

Value ($) | |||||||

| Municipal Bonds and Notes 104.7% |

| |||||||

| Alabama 1.1% |

| |||||||

| Alabama, Black Belt Energy Gas District Prepay Revenue, Series A, 4.0%, Mandatory Put 12/1/2023 @ 100, 12/1/2048 |

2,200,000 | 2,365,924 | ||||||

| Southeast Alabama, State Gas Supply District Revenue Project, Series A, 4.0%, Mandatory Put 6/1/2024 @ 100, 6/1/2049 |

1,200,000 | 1,311,132 | ||||||

|

|

|

|||||||

| 3,677,056 | ||||||||

| Arizona 2.1% |

| |||||||

| Arizona, State Certificate of Participations, Series A, 5.0%, 10/1/2026 |

2,500,000 | 3,098,025 | ||||||

| Arizona, State Health Facilities Authority, Banner Health, Series F, 1.08%**, 11/7/2019 |

1,985,000 | 1,985,000 | ||||||

| Arizona, State Health Facilities Authority, Banner Health Obligated Group, Series G, 1.08%**, 11/7/2019, LOC: Wells Fargo Bank NA |

285,000 | 285,000 | ||||||

| Chandler, AZ, State General Obligation, 4.0%, 7/1/2021 |

1,600,000 | 1,675,760 | ||||||

|

|

|

|||||||

| 7,043,785 | ||||||||

| California 16.0% |

| |||||||

| California, Bay Area Toll Authority, Toll Bridge Revenue, San Francisco Bay Area, Series C, 0.83%**, 11/7/2019, LOC: Bank of America NA |

700,000 | 700,000 | ||||||

| California, Eastern Municipal Water District, Water & Wastewater Revenue, Series B, 70% of 1-month USD-LIBOR + 0.300%, 1.722%*, Mandatory Put 10/1/2021 @ 100, 7/1/2030 |

2,000,000 | 2,001,180 | ||||||

| California, State General Obligation, Series 2019-MIZ9003, 144A, 1.29%**, 11/7/2019, LIQ: Mizuho Bank Ltd., LOC: Mizuho Bank Ltd. |

5,000,000 | 5,000,000 | ||||||

| California, San Diego Association of Governments, Capital Grant Receipts Revenue, Mid-Coast Corridor Transit Project, Series B, 1.8%, 11/15/2027 |

2,500,000 | 2,535,075 | ||||||

| California, School Finance Authority Revenue, Inspire Charter Schools Revenue, Series B, 144A, 3.0%, 7/15/2020 |

1,000,000 | 1,000,930 | ||||||

| California, State Department of Water Resources, Center Valley Project, Water Systems, Series AT, MUNIPSA + 0.370%, 1.49%*, Mandatory Put 12/1/2022 @ 100, 12/1/2035 |

4,000,000 | 4,013,040 | ||||||

| California, State General Obligation: |

1,250,000 | 1,253,400 | ||||||

| 5.0%, 4/1/2021 |

4,000,000 | 4,219,680 | ||||||

The accompanying notes are an integral part of the financial statements.

| 12 | | | DWS Short-Term Municipal Bond Fund |

Table of Contents

| Principal Amount ($) |

Value ($) | |||||||

| California, State Infrastructure & Economic Development Bank Revenue, 1.75%*, Mandatory Put 8/1/2026 @ 100, 8/1/2055 (a) |

1,100,000 | 1,106,314 | ||||||

| California, State Municipal Finance Authority Revenue, LAX Integrated Express Solutions LLC, APM Project: |

||||||||

| Series A, AMT, 5.0%, 12/31/2025 |

1,000,000 | 1,188,500 | ||||||

| Series A, AMT, 5.0%, 6/30/2026 |

500,000 | 598,800 | ||||||

| California, State Municipal Finance Authority Revenue, River Springs Charter School, 144A, 4.0%, 8/15/2020 |

1,000,000 | 1,013,030 | ||||||

| California, State Municipal Finance Authority, Solid Waste Disposal Revenue, Waste Management, Inc., Series A, AMT, 2.0%, Mandatory Put 12/1/2020 @ 100, 12/1/2044 |

2,000,000 | 2,007,420 | ||||||

| California, State Public Works Board, Lease Revenue, Judicial Council Projects, Series D, 5.0%, 12/1/2020 |

1,000,000 | 1,042,440 | ||||||

| California, State University Revenue, Series A, 5.0%, 11/1/2021 (a) |

3,000,000 | 3,198,210 | ||||||

| California, Statewide Communities Development Authority Revenue, Viamonte Senior Living Project, Series B, 3.0%, 7/1/2025 |

1,500,000 | 1,530,330 | ||||||

| California, Statewide Communities Development Authority, Multi-Family Housing Revenue, Horizons Indio, Series F, AMT, 1.15%**, 11/7/2019, LOC: Citibank NA |

700,000 | 700,000 | ||||||

| Contra Costa, CA, Transportation Authority, Sales Tax Revenue, Series A, 70% of 1-month USD-LIBOR + 0.250%, 1.672%*, Mandatory Put 9/1/2021 @ 100, 3/1/2034 |

4,165,000 | 4,162,667 | ||||||

| Glendale, CA, Unified School District: |

| |||||||

| 5.0%, 9/1/2025 (a) |

500,000 | 591,490 | ||||||

| 5.0%, 9/1/2026 (a) |

500,000 | 606,070 | ||||||

| Newport Mesa, CA, Unified School District, Election of 2000: |

||||||||

| 5.0%, 8/1/2024 (a) |

1,200,000 | 1,373,988 | ||||||

| 5.0%, 8/1/2025 (a) |

1,300,000 | 1,527,123 | ||||||

| Port of Oakland, CA, Series O, AMT, 5.0%, 5/1/2020 |

3,000,000 | 3,055,860 | ||||||

| San Francisco City & County, CA, Multi Family Housing Revenue, Transbay Block 8 Tower Apartments: |

||||||||

| Series H-2, 1.17%**, 11/7/2019, LOC: Bank of China Ltd. |

635,000 | 635,000 | ||||||

| Series H-1, 1.19%**, 11/7/2019, LOC: Bank of China Ltd. |

275,000 | 275,000 | ||||||

| San Mateo County, CA, Joint Powers Financing Authority Lease Revenue, Series A, 5.0%, 7/15/2025 |

2,500,000 | 3,045,225 | ||||||

| Southern California, State Public Power Authority, Canyon Power Project, Series B, MUNIPSA + 0.250%, 1.37%*, Mandatory Put 5/1/2021 @ 100, 7/1/2040 |

2,500,000 | 2,500,350 | ||||||

| Stockton, CA, Public Financing Authority, Wastewater Revenue, 1.4%, 6/1/2022 |

1,500,000 | 1,498,050 | ||||||

| Tobacco Securitization Authority Of Southern, Tobacco Settlement Revenue, San Diego, Tobacco Securitization Corp., Class 2, Series B-1, 2.25%, 6/1/2029 (a) |

500,000 | 500,000 | ||||||

|

|

|

|||||||

| 52,879,172 | ||||||||

The accompanying notes are an integral part of the financial statements.

| DWS Short-Term Municipal Bond Fund | | | 13 |

Table of Contents

| Principal Amount ($) |

Value ($) | |||||||

| Colorado 2.2% |

| |||||||

| Cherry Creek, CO, School District No. 5, Series C, 5.0%, 12/15/2031 |

2,000,000 | 2,512,900 | ||||||

| Denver City & County, CO, Airport System Revenue, Series A, AMT, 5.0%, 12/1/2026 |

2,000,000 | 2,432,100 | ||||||

| Fort Collins, CO, Economic Development Revenue, Oakridge Project, Series A, AMT, 1.17%**, 11/7/2019, LOC: U.S. Bank NA |

590,000 | 590,000 | ||||||

| Holland Creek, Metropolitan District Revenue, 1.12%**, 11/7/2019, LOC: Bank of America NA |

1,550,000 | 1,550,000 | ||||||

|

|

|

|||||||

| 7,085,000 | ||||||||

| Connecticut 3.1% |

| |||||||

| Connecticut, State General Obligation, Series A, 5.0%, 3/15/2029 |

2,000,000 | 2,323,440 | ||||||

| Connecticut, State Health & Educational Facilities Authority Revenue, Yale University Issue, Series A-4, 2.0%, Mandatory Put 2/8/2022 @ 100, 7/1/2049 |

4,000,000 | 4,067,760 | ||||||

| Connecticut, State Housing Finance Authority, Housing Finance Mortgage Program: |

1,000,000 | 1,001,040 | ||||||

| Series C-1, 4.0%, 11/15/2047 |

1,490,000 | 1,589,010 | ||||||

| Connecticut, State Housing Finance Program Authority Revenue, Series A-1, 4.0%, 11/15/2047 |

1,135,000 | 1,210,285 | ||||||

|

|

|

|||||||

| 10,191,535 | ||||||||

| District of Columbia 0.8% |

| |||||||

| District of Columbia, Georgetown University Issue, Series C-1, 1.11%**, 11/7/2019, LOC: Sumitomo Mitsui Banking |

420,000 | 420,000 | ||||||

| District of Columbia, Housing Finance Agency, Multi-Family Housing Revenue, Nannie Helen Owner LLC, 1.45%, Mandatory Put 8/1/2022 @ 100, 2/1/2039 |

1,500,000 | 1,500,555 | ||||||

| District of Columbia, The PEW Charitable Trust, Series A, 1.14%**, 11/7/2019, LOC: PNC Bank NA |

865,000 | 865,000 | ||||||

|

|

|

|||||||

| 2,785,555 | ||||||||

| Florida 6.5% |

| |||||||

| Alachua County, FL, Housing Finance Authority, Multi-Family Revenue, Series A, AMT, 1.15%**, 11/7/2019, LIQ: Fannie Mae, LOC: Fannie Mae |

300,000 | 300,000 | ||||||

| Atlantic Beach, FL, Healthcare Facilities Revenue Fleet Landing Project, Series B-2, 3.0%, 11/15/2023 |

1,250,000 | 1,257,488 | ||||||

| Florida, Development Finance Corp., Surface Transportation Facilities Revenue, Virgin Trains U.S.A. Passenger Rail Project, Series B, AMT, 1.9%, Mandatory Put 3/17/2020 @ 100, 1/1/2049 |

2,000,000 | 2,002,540 | ||||||

The accompanying notes are an integral part of the financial statements.

| 14 | | | DWS Short-Term Municipal Bond Fund |

Table of Contents

| Principal Amount ($) |

Value ($) | |||||||

| Florida, Jacksonville Electric Authority, Water & Sewer System Revenue: |

||||||||

| Series A-2, 1.08%**, 11/7/2019, SPA: JPMorgan Chase Bank NA |

2,875,000 | 2,875,000 | ||||||

| Series B, 1.16%**, 11/7/2019, SPA: JPMorgan Chase Bank NA |

4,600,000 | 4,600,000 | ||||||

| Florida, Keys Aqueduct Authority, Water Revenue, 1.12%**, 11/7/2019, LOC: TD Bank NA |

475,000 | 475,000 | ||||||

| Florida, State Department Transportation, Right-of-Way Acquisition & Bridge Construction, Series A, 5.0%, 7/1/2020 |

1,975,000 | 2,024,967 | ||||||

| Lee County, FL, Airport Revenue, Series A, AMT, 5.5%, 10/1/2023 |

1,250,000 | 1,340,262 | ||||||

| Miami Beach, FL, Health Facilities Authority, Mount Sinai Medical Center of Florida, Inc., 5.0%, 11/15/2021 |

1,000,000 | 1,071,250 | ||||||

| Orange County, FL, Housing Finance Authority, Post Fountains Project, 1.15%**, 11/7/2019, LIQ: Fannie Mae |

110,000 | 110,000 | ||||||

| Volusia County, FL, School Board, Certificate of Participations: |

| |||||||

| 5.0%, 8/1/2021 (a) |

2,000,000 | 2,127,100 | ||||||

| 5.0%, 8/1/2022 (a) |

3,000,000 | 3,299,550 | ||||||

|

|

|

|||||||

| 21,483,157 | ||||||||

| Georgia 3.5% |

| |||||||

| Atlanta, GA, Airport Revenue, Series B, AMT, 5.0%, 1/1/2022 |

1,000,000 | 1,041,470 | ||||||

| Burke County, GA, Development Authority, Pollution Control Revenue, Oglethorpe Power Corp., Series E, 3.25%, Mandatory Put 2/3/2025 @ 100, 11/1/2045 |

1,200,000 | 1,252,152 | ||||||

| Columbia County, GA, Water & Sewerage Revenue: |

| |||||||

| 5.0%, 6/1/2021 (a) |

875,000 | 915,950 | ||||||

| 5.0%, 6/1/2022 (a) |

600,000 | 648,996 | ||||||

| Douglas County, GA, Development Authority, Pandosia LLC, Project, Series A, AMT, 1.19%**, 11/7/2019, LOC: Wells Fargo Bank NA |

200,000 | 200,000 | ||||||

| Georgia, Main Street Natural Gas, Inc., Gas Supply Revenue: |

| |||||||

| Series A, 4.0%, Mandatory Put 9/1/2023 @ 100, 4/1/2048, LIQ: Royal Bank of Canada |

1,865,000 | 2,016,830 | ||||||

| Series C, 4.0%, Mandatory Put 12/1/2023 @ 100, 8/1/2048 |

750,000 | 814,050 | ||||||

| Georgia, State General Obligation, Series C, 5.0%, 7/1/2021 |

4,325,000 | 4,601,367 | ||||||

|

|

|

|||||||

| 11,490,815 | ||||||||

| Illinois 7.2% |

| |||||||

| Chicago, IL, Waterworks Revenue, Second Lien, Series 2017-2, 5.0%, 11/1/2019 |

1,855,000 | 1,855,000 | ||||||

| Cook County, IL, Catholic Theological Union Project Revenue, 1.18%**, 11/7/2019, LOC: U.S. Bank NA |

356,000 | 356,000 | ||||||

| Cook County, IL, General Obligation, 5.0%, 11/15/2019 |

500,000 | 500,550 | ||||||

The accompanying notes are an integral part of the financial statements.

| DWS Short-Term Municipal Bond Fund | | | 15 |

Table of Contents

| Principal Amount ($) |

Value ($) | |||||||

| Granite City, IL, Waste Management, Inc. Project, AMT, 2.2%, Mandatory Put 5/1/2020 @ 100, 5/1/2027 |

2,000,000 | 2,006,340 | ||||||

| Illinois, Railsplitter Tobacco Settlement Authority Revenue, 5.25%, 6/1/2020 |

2,000,000 | 2,044,040 | ||||||

| Illinois, State Development Finance Authority, Industrial Revenue, Uhlich Childrens Home Project, 1.13%**, 11/7/2019, LOC: U.S. Bank NA |

1,100,000 | 1,100,000 | ||||||

| Illinois, State Development Finance Authority, Solid Waste Disposal Revenue, Waste Management, Inc. Project, AMT, 1.6%*, Mandatory Put 11/2/2020 @ 100, 11/1/2044 (a) |

2,000,000 | 2,000,980 | ||||||

| Illinois, State Educational Facilities Authority, Aurora University, 1.12%**, 11/7/2019, LOC: Harris NA |

400,000 | 400,000 | ||||||

| Illinois, State Educational Facilities Authority, University of Chicago, Series B, 1.875%, Mandatory Put 2/13/2020 @ 100, 7/1/2025 |

1,250,000 | 1,252,187 | ||||||

| Illinois, State General Obligation: |

| |||||||

| Series A, 5.0%, 12/1/2019 |

2,000,000 | 2,004,520 | ||||||

| Series D, 5.0%, 11/1/2020 |

1,000,000 | 1,028,510 | ||||||

| Series A, 5.0%, 10/1/2021 |

1,000,000 | 1,055,110 | ||||||

| Series B, 5.0%, 10/1/2021 |

1,000,000 | 1,055,110 | ||||||

| Illinois, State Sales Tax Revenue, Junior Obligation, Series A, 5.0%, 6/15/2022 |

1,500,000 | 1,606,545 | ||||||

| Lake County, IL, Forest Preservation District, Series A, 67% of 3-month USD-LIBOR + 0.480%, 1.899%*, 12/15/2020 |

2,615,000 | 2,619,132 | ||||||

| Morton Grove, IL, Cultural Facilities Revenue, Holocaust Museum & Education, 1.14%**, 11/7/2019, LOC: Bank of America NA |

795,000 | 795,000 | ||||||

| University of Illinois, IL, Health Services System, 1.13%**, 11/7/2019, LOC: Wells Fargo Bank NA |

330,000 | 330,000 | ||||||

| Will County, IL, Community Unit School District No. 210, Lincoln-Way, ETM, Zero Coupon, 1/1/2022, INS: AGMC |

1,815,000 | 1,756,648 | ||||||

|

|

|

|||||||

| 23,765,672 | ||||||||

| Indiana 0.5% |

| |||||||

| Indiana, State Finance Authority, Health Systems Revenue, Sisters of St. Francis Health, Series F, 1.18%**, 11/7/2019, LOC: Bank of NY Mellon |

600,000 | 600,000 | ||||||

| Indiana, State Finance Authority, Hospital Revenue, Indiana University Health Obligated Group, Series 2015B, 1.65%, Mandatory Put 7/1/2022 @ 100, 12/1/2042 |

1,000,000 | 1,005,920 | ||||||

|

|

|

|||||||

| 1,605,920 | ||||||||

| Iowa 1.1% |

| |||||||

| Des Moines, IA, Special Facility Revenue, Elliott Aviation Project, AMT, 1.17%**, 11/7/2019, LOC: U.S. Bank NA |

2,975,000 | 2,975,000 | ||||||

| Iowa, State Finance Authority, Midwestern Disaster Area Revenue, Fertilizer Co. Project, 3.125%, 12/1/2022 |

500,000 | 506,785 | ||||||

|

|

|

|||||||

| 3,481,785 | ||||||||

The accompanying notes are an integral part of the financial statements.

| 16 | | | DWS Short-Term Municipal Bond Fund |

Table of Contents

| Principal Amount ($) |

Value ($) | |||||||

| Kentucky 1.2% |

| |||||||

| Kentucky, Asset/Liability Commission, General Fund Revenue, Series A, 3.0%, 6/25/2020 |

2,320,000 | 2,346,796 | ||||||

| Kentucky, State Public Energy Authority, Gas Supply Revenue, Series B, 4.0%, Mandatory Put 1/1/2025 @ 100, 1/1/2049 |

1,435,000 | 1,587,971 | ||||||

|

|

|

|||||||

| 3,934,767 | ||||||||

| Louisiana 0.3% |

| |||||||

| Louisiana, State Housing Finance Agency, Canterbury House Apartments, 1.11%**, 11/7/2019, LOC: Fannie Mae |

550,000 | 550,000 | ||||||

| Louisiana, State Public Facilities Authority Revenue, Christus Health, Series B-2, 1.13%**, 11/7/2019, LOC: Bank of NY Mellon |

550,000 | 550,000 | ||||||

|

|

|

|||||||

| 1,100,000 | ||||||||

| Maine 0.1% |

| |||||||

| Maine, State Housing Authority Mortgage Revenue, Series A-1, AMT, 4.5%, 11/15/2028 |

460,000 | 474,260 | ||||||

| Maryland 1.3% |

| |||||||

| Maryland, State Health & Higher Educational Facilities Authority Revenue, Broadmead, Inc., Series B, 2.875%, 7/1/2023 |

1,750,000 | 1,830,675 | ||||||

| Montgomery County, MD, Public Improvements Project, Series A, 5.0%, 11/1/2021 |

2,215,000 | 2,381,081 | ||||||

|

|

|

|||||||

| 4,211,756 | ||||||||

| Massachusetts 2.1% |

| |||||||

| Massachusetts, State Development Finance Agency Revenue, Brandeis University, Series S-1, 5.0%, 10/1/2027 |

1,115,000 | 1,414,612 | ||||||

| Massachusetts, State Development Finance Agency, Solid Waste Disposal Revenue, Waste Management, Inc., Project, 144A, AMT, 2.15%, Mandatory Put 5/1/2020 @ 100, 5/1/2027, GTY: Waste Management, Inc. |

250,000 | 250,732 | ||||||

| Massachusetts, State General Obligation, Series A, 5.0%, 7/1/2021 |

5,000,000 | 5,318,650 | ||||||

|

|

|

|||||||

| 6,983,994 | ||||||||

| Michigan 3.7% |

| |||||||

| Michigan, State Building Authority Revenue, Series I, 5.0%, 10/15/2021 |

500,000 | 536,860 | ||||||

| Michigan, State Finance Authority Revenue, Series A-1, 4.0%, 8/20/2020 |

1,500,000 | 1,533,435 | ||||||

| Michigan, State Finance Authority Revenue, Hospital McLaren Health Care Corp., 68% of 1-month USD-LIBOR + 0.400%, 1.614%*, Mandatory Put 10/15/2021 @ 100, 10/15/2030 |

1,860,000 | 1,864,762 | ||||||

The accompanying notes are an integral part of the financial statements.

| DWS Short-Term Municipal Bond Fund | | | 17 |

Table of Contents

| Principal Amount ($) |

Value ($) | |||||||

| Michigan, State Hospital Finance Authority Revenue, Ascension Health Senior Credit Group, Series B, 5.0%, 11/15/2020 |

3,000,000 | 3,003,540 | ||||||

| Michigan, State Housing Development Authority, Series A-1, 1.5%, 10/1/2022 |

550,000 | 550,115 | ||||||

| Wayne County, MI, Airport Authority Revenue, Series A, AMT, 4.0%, 12/1/2020, INS: AGMC |

4,600,000 | 4,732,618 | ||||||

|

|

|

|||||||

| 12,221,330 | ||||||||

| Minnesota 2.4% |

| |||||||

| Minnesota, Housing Facilities Revenue, Beacon Hill, 1.11%**, 11/7/2019, LIQ: Fannie Mae, LOC: Fannie Mae |

475,000 | 475,000 | ||||||

| Minnesota, State General Obligation: |

| |||||||

| Series A, 5.0%, 8/1/2021 |

1,800,000 | 1,920,744 | ||||||

| Series D, 5.0%, 8/1/2021 |

5,060,000 | 5,399,425 | ||||||

|

|

|

|||||||

| 7,795,169 | ||||||||

| Missouri 0.8% |

| |||||||

| Missouri, State Health & Educational Facilities Authority Revenue, Lutheran Senior Services Project, Series B, 2.875%, Mandatory Put 2/1/2022 @ 100, 2/1/2034 |

460,000 | 462,328 | ||||||

| Missouri, State Housing Development Commission, Single Family Mortgage Revenue, Special Homeownership Loan Program Market Bonds, Series E-1, 5.0%, 11/1/2027 |

35,000 | 35,000 | ||||||

| Missouri, State Public Utilities Commission Revenue, Interim Construction Notes, Series 2019, 1.5%, 3/1/2021 |

2,000,000 | 2,003,100 | ||||||

|

|

|

|||||||

| 2,500,428 | ||||||||

| Nebraska 0.3% |

| |||||||

| Nebraska, State Investment Finance Authority, Multi Family Revenue, Irvington Heights, Series A, AMT, 1.18%**, 11/7/2019, LOC: Citibank NA |

1,000,000 | 1,000,000 | ||||||

| Nevada 0.4% |

| |||||||

| Nevada, Director of the State of Department of Business & Industry, Republic Services, Inc. Project, 144A, AMT, 1.875%, Mandatory Put 12/2/2019 @ 100, 12/1/2026 |

1,000,000 | 1,000,240 | ||||||

| Nevada, State Housing Division, Multi-Unit Housing, AMT, 1.23%**, 11/7/2019, LOC: Citibank NA |

365,000 | 365,000 | ||||||

|

|

|

|||||||

| 1,365,240 | ||||||||

| New Jersey 3.8% |

| |||||||

| New Jersey, State Economic Development Authority, Motor Vehicle Surcharge Revenue, Series A, 3.125%, 7/1/2029 |

320,000 | 323,936 | ||||||

| New Jersey, State Higher Education Assistance Authority, Student Loan Revenue, Series A, 2.375%, 12/1/2029 |

1,200,000 | 1,211,868 | ||||||

The accompanying notes are an integral part of the financial statements.

| 18 | | | DWS Short-Term Municipal Bond Fund |

Table of Contents

| Principal Amount ($) |

Value ($) | |||||||

| New Jersey, State Housing & Mortgage Finance Agency, Multi-Family Conduit Revenue, Pilgrim Baptist Village I&II Project, Series E, 1.5%, Mandatory Put 9/1/2021 @ 100, 9/1/2022 |

3,000,000 | 3,006,540 | ||||||

| New Jersey, State Housing & Mortgage Finance Agency, Multi-Family Conduit Revenue, Oceanport Gardens, Series C, 1.58%, Mandatory Put 6/1/2020 @ 100, 6/1/2022 |

1,000,000 | 1,000,850 | ||||||

| New Jersey, State Transportation Trust Fund Authority, Series A, 5.0%, 12/15/2026 |

3,000,000 | 3,553,950 | ||||||

| New Jersey, State Transportation Trust Fund Authority, Federal Highway Reimbursement Notes, Series A, 5.0%, 6/15/2024 |

1,000,000 | 1,147,930 | ||||||

| New Jersey, Tobacco Settlement Financing Corp., Series A, 5.0%, 6/1/2025 |

1,955,000 | 2,290,576 | ||||||

|

|

|

|||||||

| 12,535,650 | ||||||||

| New Mexico 0.6% |

| |||||||

| New Mexico, Mortgage Finance Authority, Single Family Mortgage, “I”, Series A-1, 4.0%, 1/1/2049 |

905,000 | 982,848 | ||||||

| Santa Fe, NM, Retirement Facility Revenue, El Castillo Retirement Project, Series B-1, 2.625%, 5/15/2025 (a) |

1,000,000 | 1,001,270 | ||||||

|

|

|

|||||||

| 1,984,118 | ||||||||

| New York 6.7% |

| |||||||

| New York, Metropolitan Transportation Authority Revenue: |

| |||||||

| Series A, 4.0%, 2/3/2020 |

2,000,000 | 2,012,940 | ||||||

| Series B-1, 5.0%, 5/15/2022 |

2,000,000 | 2,173,140 | ||||||

| Series D-1, 5.0%, 9/1/2022 |

2,000,000 | 2,194,140 | ||||||

| New York, State Dormitory Authority Revenue, Non-State Supported Debt, Montefiore Obligation Group, Series A, 5.0%, 8/1/2026 |

2,000,000 | 2,418,920 | ||||||

| New York, State Housing Finance Agency Revenue, Series K, 1.45%, 5/1/2023 |

2,500,000 | 2,504,725 | ||||||

| New York, State Housing Finance Agency, Service Contract Revenue, Series M-1, 1.08%**, 11/7/2019, LOC: Bank of America NA |

250,000 | 250,000 | ||||||

| New York, State Mortgage Agency, Homeowner Mortgage Revenue, Series 195, 4.0%, 10/1/2046 |

2,370,000 | 2,510,588 | ||||||

| New York, State Transportation Development Corp., Special Facility Revenue, Delta Air Lines, Inc., LaGuardia Airport Terminals C&D Redevelopment, AMT, 5.0%, 1/1/2023 |

3,000,000 | 3,298,710 | ||||||

| New York, NY, General Obligation: |

| |||||||

| Series A-4, 1.11%**, 11/7/2019, LOC: Bank of Tokyo-Mitsubishi UFJ |

175,000 | 175,000 | ||||||

| Series B-3, 1.38%**, 11/1/2019 |

3,000,000 | 3,000,000 | ||||||

| Suffolk County, NY, Revenue Anticipation Notes, 2.75%, 3/20/2020 |

1,500,000 | 1,509,375 | ||||||

|

|

|

|||||||

| 22,047,538 | ||||||||

The accompanying notes are an integral part of the financial statements.

| DWS Short-Term Municipal Bond Fund | | | 19 |

Table of Contents

| Principal Amount ($) |

Value ($) | |||||||

| North Carolina 1.3% |

| |||||||

| North Carolina, State Capital Facilities Finance Agency, Educational Facilities Revenue, Salem Academy & College Project, 1.15%**, 11/7/2019, LOC: Branch Banking & Trust |

310,000 | 310,000 | ||||||

| North Carolina, State Housing Finance Agency, Home Ownership Revenue: |

||||||||

| Series 38-B, 4.0%, 7/1/2047 |

810,000 | 867,154 | ||||||

| Series 41, 4.0%, 1/1/2050 |

1,500,000 | 1,639,935 | ||||||

| Wake County, NC, General Obligation, Series C, 5.0%, 11/1/2022 |

1,425,000 | 1,587,108 | ||||||

|

|

|

|||||||

| 4,404,197 | ||||||||

| North Dakota 0.4% |

| |||||||

| North Dakota, State Housing Finance Agency, Home Mortgage Housing Finance Program, Series A, 4.0%, 7/1/2047 |

1,220,000 | 1,303,180 | ||||||

| Ohio 1.8% |

| |||||||

| Cleveland, OH, Airport System Revenue, Series A, AMT, 5.0%, 1/1/2025 |

1,000,000 | 1,165,450 | ||||||

| Columbus, OH, Regional Airport Authority Capital Funding Revenue, Oasbo Expaned Asset, Series SR, 1.11%**, 11/7/2019, LOC: U.S. Bank NA |

450,000 | 450,000 | ||||||

| Columbus, OH, State General Obligation, Series A, 5.0%, 2/15/2022 |

2,405,000 | 2,613,129 | ||||||

| Ohio, American Municipal Power, Inc., Combined Hydroelectric Project, Series A, 2.25%, Mandatory Put 8/15/2021 @ 100, 2/15/2048 |

1,000,000 | 1,008,580 | ||||||

| Ohio, State Infrastructure Improvement: |

| |||||||

| Series B, 1.03%**, 11/7/2019 |

300,000 | 300,000 | ||||||

| Series A, 1.04%**, 11/7/2019, LOC: TD Bank NA |

350,000 | 350,000 | ||||||

|

|

|

|||||||

| 5,887,159 | ||||||||

| Oklahoma 0.3% |

| |||||||

| Oklahoma, State Municipal Power Authority, SIFMA Index, Series A, MUNIPSA + 0.390%, 1.51%*, 1/1/2023 |

820,000 | 818,475 | ||||||

| Oregon 1.2% |

| |||||||

| Oregon, State Housing & Community Services Department, Mortgage Revenue, Series A, 3.5%, 7/1/2036 |

1,770,000 | 1,846,517 | ||||||

| Oregon, State Housing & Community Services Department, Mortgage Revenue, Single Family Mortgage Program, Series B, AMT, 5.0%, 7/1/2030 |

510,000 | 526,228 | ||||||

| Washington Multnomah & Yamhill Counties, OR, Hillsboro School District No. 1J, 5.0%, 6/15/2031 |

1,180,000 | 1,462,233 | ||||||

|

|

|

|||||||

| 3,834,978 | ||||||||

The accompanying notes are an integral part of the financial statements.

| 20 | | | DWS Short-Term Municipal Bond Fund |

Table of Contents

| Principal Amount ($) |

Value ($) | |||||||

| Pennsylvania 6.1% |

| |||||||

| Pennsylvania, Commonwealth Financing Authority, Tobacco Master Settlement Payment Revenue Bonds, 5.0%, 6/1/2026 |

2,000,000 | 2,405,260 | ||||||

| Pennsylvania, State Public School Building Authority, School District Project, Series A, 1.14%**, 11/7/2019, LOC: PNC Bank NA |

745,000 | 745,000 | ||||||

| Pennsylvania, State Economic Development Financing Authority, Economic Development Revenue, Kingsley Association Project, 1.14%**, 11/7/2019, LOC: PNC Bank NA |

225,000 | 225,000 | ||||||

| Pennsylvania, State Higher Educational Facilities Authority, AICUP Program, Series J2, 1.14%**, 11/7/2019, LOC: PNC Bank NA |

260,000 | 260,000 | ||||||

| Pennsylvania, State Higher Educational Facilities Authority, Association of Independent Colleges & Universities, 1.14%**, 11/7/2019, LOC: PNC Bank NA |

875,000 | 875,000 | ||||||

| Pennsylvania, State Housing Finance Agency, Single Family Mortgage Revenue: |

||||||||

| Series 119, 3.5%, 10/1/2041 |

1,265,000 | 1,315,220 | ||||||

| Series 122, 4.0%, 10/1/2046 |

3,530,000 | 3,772,123 | ||||||

| Pennsylvania, State Intergovernmental Cooperation Authority, Philadelphia Funding Program, Series 2020, 5.0%, 6/15/2022 (a) |

2,730,000 | 2,950,611 | ||||||

| Pennsylvania, State Turnpike Commission Revenue: |

| |||||||

| Series B, MUNIPSA + 0.500%, 1.62%*, 12/1/2021 |

2,000,000 | 2,006,440 | ||||||

| Series B-1, MUNIPSA + 0.880%, 2.0%*, 12/1/2020 |

2,000,000 | 2,007,620 | ||||||

| Philadelphia, PA, General Obligation, Series B, 1.11%**, 11/7/2019, LOC: Barclays Bank PLC |

500,000 | 500,000 | ||||||

| Philadelphia, PA, School District: |

| |||||||

| Series C, 4.0%, 3/31/2020 |

2,000,000 | 2,021,580 | ||||||

| Series 2020, 5.0%, 9/1/2022 (a) |

1,000,000 | 1,072,900 | ||||||

|

|

|

|||||||

| 20,156,754 | ||||||||

| Rhode Island 0.6% |

| |||||||

| Rhode Island, State Housing & Mortgage Finance Corp., Revenue, Multi-Family Development Sustainability Bonds, Series 1-A, 1.7%, Mandatory Put 10/1/2022 @ 100, 10/1/2049 |

2,115,000 | 2,116,121 | ||||||

| South Dakota 0.8% | ||||||||

| South Dakota, Housing Development Authority, Homeownership Mortgage: |

||||||||

| Series B, 4.0%, 11/1/2047 |

2,035,000 | 2,188,642 | ||||||

| Series A, AMT, 4.5%, 5/1/2031 |

450,000 | 469,980 | ||||||

|

|

|

|||||||

| 2,658,622 | ||||||||

The accompanying notes are an integral part of the financial statements.

| DWS Short-Term Municipal Bond Fund | | | 21 |

Table of Contents

| Principal Amount ($) |

Value ($) | |||||||

| Tennessee 1.5% | ||||||||

| Sevier County, TN, Public Building Authority, Local Government Public Improvement VII, Series B-1, 1.15%**, 11/7/2019, LOC: Bank of America NA |

1,385,000 | 1,385,000 | ||||||

| Tennessee, Housing Development Agency, Residential Financing Program Revenue, Series 1C, 3.0%, 7/1/2038 |

670,000 | 684,680 | ||||||

| Tennessee, State Energy Acquisition Corp., Gas Revenue, Series A, 4.0%, Mandatory Put 5/1/2023 @ 100, 5/1/2048 |

2,250,000 | 2,399,467 | ||||||

| Tennessee, State Housing Development Agency, Homeownership Program: |

||||||||

| Series 2C, 4.0%, 7/1/2038 |

180,000 | 185,105 | ||||||

| Series 1A, AMT, 4.5%, 1/1/2038 |

200,000 | 206,418 | ||||||

|

|

|

|||||||

| 4,860,670 | ||||||||

| Texas 14.1% | ||||||||

| Allen, TX, Independent School District Building, 5.0%, 2/15/2024 |

315,000 | 330,533 | ||||||

| Alvin, TX, Independent School District, Series B, 1.25%, Mandatory Put 8/15/2022 @ 100, 2/15/2033 |

2,000,000 | 1,992,000 | ||||||

| Bexar County, TX, Certificates Obligation, Series B, 5.0%, 6/15/2021 |

4,000,000 | 4,246,840 | ||||||

| Goose Creek, TX, Consolidated Independent School District, Series B, 3.0%, Mandatory Put 10/1/2020 @ 100, 10/1/2049 |

1,000,000 | 1,014,930 | ||||||

| Gulf Coast, TX, Waste Disposal Authority Revenue, Waste Management of Texas, Series B, AMT, 2.15%, Mandatory Put 5/1/2020 @ 100, 5/1/2028 |

250,000 | 250,733 | ||||||

| Harris County, TX, Cultural Education Facilities Finance Corp. Revenue, Memorial Herman Hospital Health System, Series B, MUNIPSA + 0.580%, 1.7%*, Mandatory Put 12/1/2019 @ 100, 12/1/2042 |

4,000,000 | 4,000,440 | ||||||

| Harris County, TX, Flood Control District, Series A, 5.25%, 10/1/2021 |

1,465,000 | 1,578,904 | ||||||

| Houston, TX, Minnetonka Airport Systems Revenue, Beacon Hill, Series C, AMT, 5.0%, 7/1/2026 |

2,500,000 | 3,016,825 | ||||||

| Houston, TX, Airport Systems Revenue: |

||||||||

| Series A, AMT, 5.0%, 7/1/2025 |

500,000 | 590,855 | ||||||

| Series A, AMT, 5.0%, 7/1/2026 |

1,000,000 | 1,206,730 | ||||||

| Houston, TX, Independent School District, Series A-2, 2.25%, Mandatory Put 6/1/2022 @ 100, 6/1/2039 |

1,000,000 | 1,025,990 | ||||||

| Houston, TX, Utility System Revenue, Series C, 70% of 1-month USD-LIBOR + 0.360%, 1.61%*, Mandatory Put 8/1/2021 @ 100, 5/15/2034 |

1,575,000 | 1,576,055 | ||||||

| Katy, TX, Katy Independent School District, Series 2015-C, 67% of 1-month USD-LIBOR + 0.280%, 1.562%*, Mandatory Put 8/16/2021 @ 100, 8/15/2036 |

1,000,000 | 1,000,020 | ||||||

The accompanying notes are an integral part of the financial statements.

| 22 | | | DWS Short-Term Municipal Bond Fund |

Table of Contents

| Principal Amount ($) |

Value ($) | |||||||

| Mission, TX, Economic Development Corp., Solid Waste Disposal Revenue, Republic Services, Inc. Project, AMT, 1.55%*, Mandatory Put 2/3/2020 @ 100, 1/1/2026 |

1,000,000 | 1,000,000 | ||||||

| Richardson, TX, Independent School District, 5.0%, 2/15/2021 |

2,000,000 | 2,097,820 | ||||||

| Round Rock, TX, Independent School District, 5.0%, 8/1/2021 |

4,275,000 | 4,559,458 | ||||||

| Tarrant County, TX, Cultural Education Facilities Finance Corp., Hospital Revenue, Scott & White Healthcare, Prerefunded 8/15/2020 @ 100, 5.25%, 8/15/2021 |

2,435,000 | 2,510,630 | ||||||

| Tarrant County, TX, Cultural Education Facilities Finance Corp., Revenue, Christus Health: |

||||||||

| Series C-1, 1.13%**, 11/7/2019, LOC: Sumitomo Mitsui Banking |

4,075,000 | 4,075,000 | ||||||

| Series C-4, 1.13%**, 11/7/2019, LOC: Bank of Montreal |

200,000 | 200,000 | ||||||

| Tarrant County, TX, Housing Finance Corp., Multi-Family Housing Gateway Apartments, 1.12%**, 11/7/2019, LIQ: Fannie Mae, LOC: Fannie Mae |

530,000 | 530,000 | ||||||

| Texas, Cypress Fairbanks Independent School District, School Building, Series A-2, 1.25%, Mandatory Put 8/15/2022 @ 100, 2/15/2036 |

2,000,000 | 1,993,620 | ||||||

| Texas, Eagle Mountain & Saginaw Independent School District, 5.0%, 8/15/2030 |

1,985,000 | 2,379,459 | ||||||

| Texas, Grand Parkway Transportation Corp., 5.0%, 2/1/2023 |

1,040,000 | 1,156,948 | ||||||

| Texas, Love Field Airport Modernization Corp., General Airport Revenue, AMT, 5.0%, 11/1/2021 |

500,000 | 535,950 | ||||||

| Texas, State Transportations, 4.0%, 8/27/2020 |

3,000,000 | 3,068,730 | ||||||

| Texas, State Veterans, 1.25%**, 11/7/2019, LIQ: Federal Home Loan Bank |

590,000 | 590,000 | ||||||

|

|

|

|||||||

| 46,528,470 | ||||||||

| Virginia 1.7% | ||||||||

| Chesapeake Bay, VA, Bridge & Tunnel District Revenue, First Tier General Resolution, 5.0%, 11/1/2023 |

1,250,000 | 1,421,588 | ||||||

| Fairfax County, VA, Economic Development Authority Revenue, Wiehle Avenue Metrorail Station Parking Project: |

||||||||

| 5.0%, 8/1/2021 (a) |

1,650,000 | 1,724,761 | ||||||

| 5.0%, 8/1/2022 (a) |

1,000,000 | 1,080,070 | ||||||

| Peninsula, VA, Ports Authority, Coal Terminal Revenue, Dominion Terminal Associates Project, Series 2003, 1.7%, Mandatory Put 10/1/2022 @ 100, 10/1/2033 |

1,410,000 | 1,408,745 | ||||||

|

|

|

|||||||

| 5,635,164 | ||||||||

| Washington 2.7% | ||||||||

| Seattle, WA, Municipal Light & Power Revenue, Series C-1, MUNIPSA + 0.490%, 1.61%*, Mandatory Put 11/1/2023 @ 100, 11/1/2046 |

2,000,000 | 2,010,700 | ||||||

The accompanying notes are an integral part of the financial statements.

| DWS Short-Term Municipal Bond Fund | | | 23 |

Table of Contents

| Principal Amount ($) |

Value ($) | |||||||

| Washington, Energy Northwest Electric Revenue, Columbia Generating Station, Series A, 5.0%, 7/1/2021 |

4,620,000 | 4,914,432 | ||||||

| Washington, State Housing Finance Commission, Transforming Age Projects, Series B, 144A, 2.375%, 1/1/2026 |

2,000,000 | 2,002,400 | ||||||

|

|

|

|||||||

| 8,927,532 | ||||||||

| West Virginia 0.7% | ||||||||

| West Virginia, State Economic Development Authority, Solid Waste Disposal Facilities Revenue, Wheeling Power Co., Mitchell Project, Series A, AMT, 3.0%, Mandatory Put 4/1/2022 @ 100, 6/1/2037, LOC: Freddie Mac |

2,250,000 | 2,323,170 | ||||||

| Wisconsin 2.0% | ||||||||

| Wisconsin, PMA Levy & Aid Anticipation Notes Program, Note Participations, Series A, 3.0%, 10/23/2020 |

2,465,000 | 2,507,028 | ||||||

| Wisconsin, Public Finance Authority, Solid Waste Disposal Revenue, Waste Management, Inc. Project, Series A-2, AMT, 1.53%*, Mandatory Put 2/3/2020 @ 100, 10/1/2025, GTY: Waste Management Holdings |

750,000 | 750,000 | ||||||

| Wisconsin, State Health & Educational Facilities Authority Revenue, Advocate Aurora Health Credit Group, Series C-4, MUNIPSA + 0.650%, 1.77%*, Mandatory Put 7/31/2024 @ 100, 8/15/2054 |

1,000,000 | 1,003,510 | ||||||

| Wisconsin, State Housing & Economic Development Authority, Home Ownership Revenue, Series A, AMT, 3.5%, 3/1/2046 |

2,315,000 | 2,413,990 | ||||||

|

|

|

|||||||

| 6,674,528 | ||||||||

| Other 1.7% | ||||||||

| Federal Home Loan Mortgage Corp., Multi-Family Variable Rate Certificates: |

||||||||

| “A”, Series M-051, 1.33%**, 11/7/2019, LIQ: Freddie Mac |

2,990,000 | 2,990,000 | ||||||

| “A”, Series M-055, MUNIPSA +0.210%, 1.53%*, 6/15/2035, |

2,015,000 | 2,015,000 | ||||||

| “A”, Series M-024, AMT, 2.304%, 5/15/2027, LIQ: Freddie Mac |

575,000 | 579,261 | ||||||

|

|

|

|||||||

| 5,584,261 | ||||||||

| Total Municipal Bonds and Notes (Cost $341,218,303) |

345,356,983 | |||||||

| Preferred Shares of Closed-End Investment Companies 1.2% |

| |||||||

| California | ||||||||

| California, Nuveen AMT-Free Quality Municipal Income Fund, Series D, 1.64%, 11/1/2019 (Cost $4,000,000) |

4,000,000 | 4,000,000 | ||||||

The accompanying notes are an integral part of the financial statements.

| 24 | | | DWS Short-Term Municipal Bond Fund |

Table of Contents

| Shares | Value ($) | |||||||

| Open-End Investment Company 0.5% | ||||||||

| BlackRock Liquidity Funds MuniCash Portfolio, Institutional Shares, 1.04%*** (Cost $1,832,470) |

1,832,063 | 1,832,246 | ||||||

| % of Net Assets |

Value ($) | |||||||

| Total Investment Portfolio (Cost $347,050,773) | 106.4 | 351,189,229 | ||||||

| Other Assets and Liabilities, Net | (6.4 | ) | (21,265,614 | ) | ||||

|

|

||||||||

| Net Assets | 100.0 | 329,923,615 | ||||||

| * | Variable or floating rate security. These securities are shown at their current rate as of October 31, 2019. For securities based on a published reference rate and spread, the reference rate and spread are indicated within the description above. Certain variable rate securities are not based on a published reference rate and spread but adjust periodically based on current market conditions, prepayment of underlying positions and/or other variables. |

| ** | Variable rate demand notes and variable rate demand preferred shares are securities whose interest rates are reset periodically (usually daily mode or weekly mode) by remarketing agents based on current market levels, and are not directly set as a fixed spread to a reference rate. These securities may be redeemed at par by the holder at any time, and are shown at their current rates as of October 31, 2019. Date shown reflects the earlier of demand date or stated maturity date. |

| *** | Current yield; not a coupon rate. |

| (a) | When-issued security. |

144A: Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers.

AGMC: Assured Guaranty Municipal Corp.

AMT: Subject to alternative minimum tax.

ETM: Bonds bearing the description ETM (escrow to maturity) are collateralized usually by U.S. Treasury securities which are held in escrow and used to pay principal and interest on bonds so designated.

GTY: Guaranty Agreement

INS: Insured

LIBOR: London Interbank Offered Rate

LIQ: Liquidity Facility

LOC: Letter of Credit

MUNIPSA: SIFMA Municipal Swap Index Yield

Prerefunded: Bonds which are prerefunded are collateralized usually by U.S. Treasury securities which are held in escrow and used to pay principal and interest on tax-exempt issues and to retire the bonds in full at the earliest refunding date.

SIFMA: Securities Industry and Financial Markets Association

SPA: Standby Bond Purchase Agreement

The accompanying notes are an integral part of the financial statements.

| DWS Short-Term Municipal Bond Fund | | | 25 |

Table of Contents

Fair Value Measurements

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds and credit risk). Level 3 includes significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments). The level assigned to the securities valuations may not be an indication of the risk or liquidity associated with investing in those securities.

The following is a summary of the inputs used as of October 31, 2019 in valuing the Fund’s investments. For information on the Fund’s policy regarding the valuation of investments, please refer to the Security Valuation section of Note A in the accompanying Notes to Financial Statements.

| Assets | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Municipal Bonds and Notes (b) | $ | — | $ | 345,356,983 | $ | — | $ | 345,356,983 | ||||||||

| Preferred Shares of Closed-End Investment Companies | — | 4,000,000 | — | 4,000,000 | ||||||||||||

| Open-End Investment Companies | 1,832,246 | — | — | 1,832,246 | ||||||||||||

| Total | $ | 1,832,246 | $ | 349,356,983 | $ | — | $ | 351,189,229 | ||||||||

| (b) | See Investment Portfolio for additional detailed categorizations. |

The accompanying notes are an integral part of the financial statements.

| 26 | | | DWS Short-Term Municipal Bond Fund |

Table of Contents

Statement of Assets and Liabilities

| as of October 31, 2019 | ||||

| Assets | ||||

| Investments in securities, at value (cost $347,050,773) | $ | 351,189,229 | ||

| Receivable for investments sold | 306,893 | |||

| Receivable for Fund shares sold | 1,763,755 | |||

| Interest receivable | 2,729,387 | |||

| Other assets | 25,099 | |||

| Total assets | 356,014,363 | |||

| Liabilities | ||||

| Payable for investments purchased — when-issued securities | 25,551,231 | |||

| Payable for Fund shares redeemed | 176,392 | |||

| Distributions payable | 46,191 | |||

| Accrued management fee | 59,039 | |||

| Accrued Trustees’ fees | 3,825 | |||

| Other accrued expenses and payables | 254,070 | |||

| Total liabilities | 26,090,748 | |||

| Net assets, at value | $ | 329,923,615 | ||

| Net Assets Consist of | ||||

| Distributable earnings (loss) | 4,627,797 | |||

| Paid-in capital | 325,295,818 | |||

| Net assets, at value | $ | 329,923,615 | ||

The accompanying notes are an integral part of the financial statements.

| DWS Short-Term Municipal Bond Fund | | | 27 |

Table of Contents

| Statement of Assets and Liabilities as of October 31, 2019 (continued) |

| Net Asset Value | ||||

| Class A |

||||

| Net Asset Value, offering and redemption price per share ($180,043,257 ÷ 17,741,971 outstanding shares of beneficial interest, $.01 par value, unlimited number of shares authorized) |

$ | 10.15 | ||

| Class C |

||||

| Net Asset Value, offering and redemption price (subject to contingent deferred sales charge) per share ($4,800,391 ÷ 473,156 outstanding shares of beneficial interest, $.01 par value, unlimited number of shares authorized) |

$ | 10.15 | ||

| Class S |

||||

| Net Asset Value, offering and redemption price per share ($51,327,764 ÷ 5,064,468 outstanding shares of beneficial interest, $.01 par value, unlimited number of shares authorized) |

$ | 10.13 | ||

| Institutional Class |

||||

| Net Asset Value, offering and redemption price per share ($93,752,203 ÷ 9,236,358 outstanding shares of beneficial interest, $.01 par value, unlimited number of shares authorized) |

$ | 10.15 | ||

The accompanying notes are an integral part of the financial statements.

| 28 | | | DWS Short-Term Municipal Bond Fund |

Table of Contents

| for the year ended October 31, 2019 | ||||

| Investment Income | ||||

| Income: | ||||

| Interest | $ | 6,215,859 | ||

| Expenses: | ||||

| Management fee | 1,067,768 | |||

| Administration fee | 273,910 | |||

| Services to shareholders | 283,361 | |||

| Distribution and service fees | 368,588 | |||

| Custodian fee | 9,691 | |||

| Professional fees | 77,444 | |||

| Reports to shareholders | 41,773 | |||

| Registration fees | 73,918 | |||

| Trustees’ fees and expenses | 15,092 | |||

| Other | 44,229 | |||

| Total expenses before expense reductions | 2,255,774 | |||

| Expense reductions | (527,473 | ) | ||

| Total expenses after expense reductions | 1,728,301 | |||

| Net investment income | 4,487,558 | |||

| Realized and Unrealized Gain (Loss) | ||||

| Net realized gain (loss) from investments | 873,003 | |||

| Change in net unrealized appreciation (depreciation) on investments | 4,653,730 | |||

| Net gain (loss) | 5,526,733 | |||

| Net increase (decrease) in net assets resulting from operations | $ | 10,014,291 | ||

The accompanying notes are an integral part of the financial statements.

| DWS Short-Term Municipal Bond Fund | | | 29 |

Table of Contents

Statements of Changes in Net Assets

| Years Ended October 31, | ||||||||

| Increase (Decrease) in Net Assets | 2019 | 2018 | ||||||

| Operations: | ||||||||

| Net investment income | $ | 4,487,558 | $ | 4,164,152 | ||||

| Net realized gain (loss) | 873,003 | (335,382 | ) | |||||

| Change in net unrealized appreciation (depreciation) | 4,653,730 | (3,954,052 | ) | |||||

| Net increase (decrease) in net assets resulting from operations | 10,014,291 | (125,282 | ) | |||||

| Distributions to shareholders: | ||||||||

| Class A |

(1,913,708 | ) | (1,769,452 | ) | ||||

| Class C |

(55,977 | ) | (103,493 | ) | ||||

| Class S |

(830,261 | ) | (1,144,219 | ) | ||||

| Institutional Class |

(1,688,481 | ) | (1,146,988 | ) | ||||

| Total distributions | (4,488,427 | ) | (4,164,152 | ) | ||||

| Fund share transactions: | ||||||||

| Proceeds from shares sold | 262,220,245 | 101,157,385 | ||||||

| Reinvestment of distributions | 4,163,043 | 3,709,411 | ||||||

| Payments for shares redeemed | (166,995,064 | ) | (168,044,444 | ) | ||||

| Net increase (decrease) in net assets from Fund share transactions | 99,388,224 | (63,177,648 | ) | |||||

| Increase (decrease) in net assets | 104,914,088 | (67,467,082 | ) | |||||

| Net assets at beginning of period | 225,009,527 | 292,476,609 | ||||||

| Net assets at end of period | $ | 329,923,615 | $ | 225,009,527 | ||||

The accompanying notes are an integral part of the financial statements.

| 30 | | | DWS Short-Term Municipal Bond Fund |

Table of Contents

| Years Ended October 31, |

||||||||||||||||||||

| Class A | 2019 | 2018 | 2017 | 2016 | 2015 | |||||||||||||||

| Selected Per Share Data |

|

|||||||||||||||||||

| Net asset value, beginning of period | $ | 9.93 | $ | 10.10 | $ | 10.16 | $ | 10.21 | $ | 10.26 | ||||||||||

| Income (loss) from investment operations: |

|

|||||||||||||||||||

| Net investment incomea |

.15 | .17 | .13 | .12 | .09 | |||||||||||||||

| Net realized and unrealized gain (loss) |

.23 | (.17 | ) | (.06 | ) | (.05 | ) | (.05 | ) | |||||||||||

| Total from investment operations |

.38 | — | .07 | .07 | .04 | |||||||||||||||

| Less distributions from: |

|

|||||||||||||||||||

| Net investment income |

(.16 | ) | (.17 | ) | (.13 | ) | (.12 | ) | (.09 | ) | ||||||||||

| Net asset value, end of period | $ | 10.15 | $ | 9.93 | $ | 10.10 | $ | 10.16 | $ | 10.21 | ||||||||||

| Total Return (%)b,c | 3.83 | (.02 | ) | .67 | .66 | .42 | ||||||||||||||

| Ratios to Average Net Assets and Supplemental Data |

| |||||||||||||||||||

| Net assets, end of period ($ millions) | 180 | 104 | 121 | 158 | 189 | |||||||||||||||

| Ratio of expenses before expense reductions (%) | .91 | .94 | .91 | .90 | .89 | |||||||||||||||

| Ratio of expenses after expense reductions (%) | .72 | .71 | .73 | .73 | .76 | |||||||||||||||

| Ratio of net investment income (%) | 1.54 | 1.67 | 1.26 | 1.15 | .91 | |||||||||||||||

| Portfolio turnover rate (%) | 109 | 117 | 89 | 81 | 26 | |||||||||||||||

| a | Based on average shares outstanding during the period. |

| b | Total return does not reflect the effect of any sales charges. Effective February 11, 2019, sales charges were eliminated on new Fund share purchases. |

| c | Total return would have been lower had certain expenses not been reduced. |

The accompanying notes are an integral part of the financial statements.

| DWS Short-Term Municipal Bond Fund | | | 31 |

Table of Contents

| Years Ended October 31, | ||||||||||||||||||||

| Class C | 2019 | 2018 | 2017 | 2016 | 2015 | |||||||||||||||

| Selected Per Share Data |

|

|||||||||||||||||||

| Net asset value, beginning of period | $ | 9.93 | $ | 10.10 | $ | 10.16 | $ | 10.20 | $ | 10.26 | ||||||||||

| Income (loss) from investment operations: |

|

|||||||||||||||||||

| Net investment incomea |

.08 | .09 | .05 | .04 | .02 | |||||||||||||||

| Net realized and unrealized gain (loss) |

.22 | (.17 | ) | (.06 | ) | (.04 | ) | (.06 | ) | |||||||||||

| Total from investment operations |

.30 | (.08 | ) | (.01 | ) | .00 | * | (.04 | ) | |||||||||||

| Less distributions from: | ||||||||||||||||||||

| Net investment income |

(.08 | ) | (.09 | ) | (.05 | ) | (.04 | ) | (.02 | ) | ||||||||||

| Net asset value, end of period | $ | 10.15 | $ | 9.93 | $ | 10.10 | $ | 10.16 | $ | 10.20 | ||||||||||

| Total Return (%)b,c | 3.05 | (.77 | ) | (.08 | ) | .01 | (.43 | ) | ||||||||||||

| Ratios to Average Net Assets and Supplemental Data |

| |||||||||||||||||||

| Net assets, end of period ($ millions) | 5 | 8 | 14 | 20 | 25 | |||||||||||||||

| Ratio of expenses before expense reductions (%) | 1.70 | 1.70 | 1.68 | 1.67 | 1.67 | |||||||||||||||

| Ratio of expenses after expense reductions (%) | 1.47 | 1.46 | 1.48 | 1.48 | 1.51 | |||||||||||||||

| Ratio of net investment income (%) | .85 | .90 | .51 | .40 | .16 | |||||||||||||||

| Portfolio turnover rate (%) | 109 | 117 | 89 | 81 | 26 | |||||||||||||||

| a | Based on average shares outstanding during the period. |

| b | Total return does not reflect the effect of any sales charges. |

| c | Total return would have been lower had certain expenses not been reduced. |

| * | Amount is less than $.005. |

The accompanying notes are an integral part of the financial statements.

| 32 | | | DWS Short-Term Municipal Bond Fund |

Table of Contents

| Years Ended October 31, |

||||||||||||||||||||

| Class S | 2019 | 2018 | 2017 | 2016 | 2015 | |||||||||||||||

| Selected Per Share Data | ||||||||||||||||||||

| Net asset value, beginning of period | $ | 9.92 | $ | 10.09 | $ | 10.15 | $ | 10.19 | $ | 10.25 | ||||||||||

| Income (loss) from investment operations: |

|

|||||||||||||||||||

| Net investment incomea |

.17 | .18 | .14 | .13 | .11 | |||||||||||||||

| Net realized and unrealized gain (loss) |

.21 | (.17 | ) | (.06 | ) | (.04 | ) | (.06 | ) | |||||||||||

| Total from investment operations |

.38 | .01 | .08 | .09 | .05 | |||||||||||||||

| Less distributions from: |

|

|||||||||||||||||||

| Net investment income |

(.17 | ) | (.18 | ) | (.14 | ) | (.13 | ) | (.11 | ) | ||||||||||

| Net asset value, end of period | $ | 10.13 | $ | 9.92 | $ | 10.09 | $ | 10.15 | $ | 10.19 | ||||||||||

| Total Return (%)b | 3.88 | .12 | .82 | .91 | .48 | |||||||||||||||

| Ratios to Average Net Assets and Supplemental Data |

| |||||||||||||||||||

| Net assets, end of period ($ millions) | 51 | 46 | 113 | 81 | 74 | |||||||||||||||

| Ratio of expenses before expense reductions (%) | .75 | .81 | .81 | .74 | .76 | |||||||||||||||

| Ratio of expenses after expense reductions (%) | .57 | .56 | .58 | .58 | .61 | |||||||||||||||

| Ratio of net investment income (%) | 1.72 | 1.78 | 1.41 | 1.30 | 1.06 | |||||||||||||||

| Portfolio turnover rate (%) | 109 | 117 | 89 | 81 | 26 | |||||||||||||||

| a | Based on average shares outstanding during the period. |

| b | Total return would have been lower had certain expenses not been reduced. |

The accompanying notes are an integral part of the financial statements.

| DWS Short-Term Municipal Bond Fund | | | 33 |

Table of Contents

| Years Ended October 31, |

||||||||||||||||||||

| Institutional Class | 2019 | 2018 | 2017 | 2016 | 2015 | |||||||||||||||

| Selected Per Share Data |

|

|||||||||||||||||||

| Net asset value, beginning of period | $ | 9.93 | $ | 10.10 | $ | 10.16 | $ | 10.20 | $ | 10.26 | ||||||||||

| Income (loss) from investment operations: |

|

|||||||||||||||||||

| Net investment incomea |

.18 | .19 | .15 | .14 | .12 | |||||||||||||||

| Net realized and unrealized gain (loss) |

.22 | (.17 | ) | (.06 | ) | (.04 | ) | (.06 | ) | |||||||||||

| Total from investment operations |

.40 | .02 | .09 | .10 | .06 | |||||||||||||||

| Less distributions from: |

|

|||||||||||||||||||

| Net investment income |

(.18 | ) | (.19 | ) | (.15 | ) | (.14 | ) | (.12 | ) | ||||||||||

| Net asset value, end of period | $ | 10.15 | $ | 9.93 | $ | 10.10 | $ | 10.16 | $ | 10.20 | ||||||||||

| Total Return (%)b | 4.09 | .23 | .92 | 1.02 | .58 | |||||||||||||||

| Ratios to Average Net Assets and Supplemental Data |

| |||||||||||||||||||

| Net assets, end of period ($ millions) | 94 | 67 | 45 | 40 | 101 | |||||||||||||||

| Ratio of expenses before expense reductions (%) | .69 | .72 | .66 | .65 | .64 | |||||||||||||||

| Ratio of expenses after expense reductions (%) | .48 | .46 | .48 | .48 | .51 | |||||||||||||||

| Ratio of net investment income (%) | 1.79 | 1.95 | 1.51 | 1.39 | 1.15 | |||||||||||||||

| Portfolio turnover rate (%) | 109 | 117 | 89 | 81 | 26 | |||||||||||||||

| a | Based on average shares outstanding during the period. |

| b | Total return would have been lower had certain expenses not been reduced. |

The accompanying notes are an integral part of the financial statements.

| 34 | | | DWS Short-Term Municipal Bond Fund |

Table of Contents

| Notes to Financial Statements |

A. Organization and Significant Accounting Policies

DWS Short-Term Municipal Bond Fund (the “Fund”) is a diversified series of Deutsche DWS Municipal Trust (the “Trust”), which is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company organized as a Massachusetts business trust.

The Fund offers multiple classes of shares which provide investors with different purchase options. Prior to February 11, 2019, Class A shares were subject to an initial sales charge. Class C shares are not subject to an initial sales charge but are subject to higher ongoing expenses than Class A shares and a contingent deferred sales charge payable upon certain redemptions within one year of purchase. Class C shares automatically convert to Class A shares in the same fund after 10 years, provided that the fund or the financial intermediary through which the shareholder purchased the Class C shares has records verifying that the Class C shares have been held for at least 10 years. Class S shares are not subject to initial or contingent deferred sales charges and are only available to a limited group of investors. Institutional Class shares are not subject to initial or contingent deferred sales charges and are generally available only to qualified institutions.

Investment income, realized and unrealized gains and losses, and certain fund-level expenses and expense reductions, if any, are borne pro rata on the basis of relative net assets by the holders of all classes of shares, except that each class bears certain expenses unique to that class such as distribution and service fees, services to shareholders and certain other class-specific expenses. Differences in class-level expenses may result in payment of different per share dividends by class. All shares of the Fund have equal rights with respect to voting subject to class-specific arrangements.

The Fund’s financial statements are prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) which require the use of management estimates. Actual results could differ from those estimates. The Fund qualifies as an investment company under Topic 946 of Accounting Standards Codification of U.S. GAAP. The policies described below are followed consistently by the Fund in the preparation of its financial statements.

Security Valuation. Investments are stated at value determined as of the close of regular trading on the New York Stock Exchange on each day the exchange is open for trading.

| DWS Short-Term Municipal Bond Fund | | | 35 |

Table of Contents

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds and credit risk). Level 3 includes significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments). The level assigned to the securities valuations may not be an indication of the risk or liquidity associated with investing in those securities.

Municipal debt securities are valued at prices supplied by independent pricing services approved by the Fund’s Board, whose valuations are intended to reflect the mean between the bid and asked prices. Such services may use various pricing techniques which take into account appropriate factors such as yield, quality, coupon rate, maturity, type of issue, trading characteristics and other data, as well as broker quotes. If the pricing services are unable to provide valuations, the securities are valued at the mean of the most recent bid and asked quotations or evaluated prices, as applicable, obtained from one or more broker-dealers. These securities are generally categorized as Level 2.

Preferred shares of closed-end investment companies held by the Fund are reflected as Level 2 because the securities are valued at amortized cost (which approximates fair value) and, accordingly, the inputs used to determine value are not quoted prices in an active market.

Investments in open-end investment companies are valued at their net asset value each business day and are categorized as Level 1.