Summary

Prospectus | October 1, 2018

DWS Managed Municipal

Bond Fund

(formerly Deutsche

Managed Municipal Bond Fund)

| Class/Ticker | A | SMLAX | C | SMLCX | INST | SMLIX | S | SCMBX |

Before you invest, you may want to

review the fund’s prospectus, which contains more information about the fund and its risks. You can find the fund’s prospectus, Statement of Additional Information (SAI) and other information about the

fund online at dws.com/mutualpros. You can also get this information at no cost by e-mailing a request to service@dws.com, calling (800) 728-3337 or asking your financial advisor. The prospectus and SAI, both dated

October 1, 2018, as supplemented, are incorporated by reference into this Summary Prospectus.

Investment Objective

The fund seeks to provide income

exempt from regular federal income tax.

Fees and Expenses of the

Fund

These are the fees and expenses you

may pay when you buy and hold shares. You may qualify for sales charge discounts if you and your immediate family invest, or agree to invest in the future, at least $100,000 in DWS funds. More information about these

and other discounts and waivers is available from your financial advisor and in Choosing a Share Class in the prospectus (p. 29), Sales Charge Waivers and Discounts Available Through Intermediaries in the prospectus

(Appendix B, p. 65) and Purchase and Redemption of Shares in the fund’s SAI (p. II-15).

SHAREHOLDER FEES (paid directly from your investment)

| A | C | INST | S | |

| Maximum sales charge (load) imposed on purchases, as % of offering price | 2.75 | None | None | None |

| Maximum deferred sales charge (load), as % of redemption proceeds | None | 1.00 | None | None |

| Account Maintenance Fee (annually, for fund account balances below $10,000 and subject to certain exceptions) | $20 | $20 | None | $20 |

ANNUAL FUND OPERATING

EXPENSES

(expenses that you pay each year as a % of the value of your investment)

(expenses that you pay each year as a % of the value of your investment)

| A | C | INST | S | |

| Management fee | 0.33 | 0.33 | 0.33 | 0.33 |

| Distribution/service (12b-1) fees | 0.24 | 1.00 | None | None |

| Interest expense | 0.01 | 0.01 | 0.01 | 0.01 |

| Other expenses | 0.19 | 0.22 | 0.22 | 0.28 |

| Total other expenses | 0.20 | 0.23 | 0.23 | 0.29 |

| Total annual fund operating expenses | 0.77 | 1.56 | 0.56 | 0.62 |

| Fee waiver/expense reimbursement | 0.00 | 0.00 | 0.00 | 0.05 |

| Total annual fund operating expenses after fee waiver/expense reimbursement | 0.77 | 1.56 | 0.56 | 0.57 |

The Advisor has contractually agreed through

September 30, 2019 to waive its fees and/or reimburse fund expenses to the extent necessary to maintain the fund’s total annual operating expenses (excluding certain expenses such as extraordinary expenses,

taxes, brokerage, interest expense and acquired fund fees and expenses) at 0.56% for Class S. The agreement may only be terminated with the consent of the fund’s Board.

EXAMPLE

This Example is intended to help

you compare the cost of investing in the fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the fund for the time periods indicated and then redeem all of your shares

at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the fund's operating expenses (including one year of capped expenses in each period for Class S) remain the

same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| Years | A | C | INST | S |

| 1 | $351 | $259 | $57 | $58 |

| 3 | 514 | 493 | 179 | 193 |

| 5 | 691 | 850 | 313 | 341 |

| 10 | 1,203 | 1,856 | 701 | 769 |

You would pay the following

expenses if you did not redeem your shares:

| Years | A | C | INST | S |

| 1 | $351 | $159 | $57 | $58 |

| 3 | 514 | 493 | 179 | 193 |

| 5 | 691 | 850 | 313 | 341 |

| 10 | 1,203 | 1,856 | 701 | 769 |

1

PORTFOLIO TURNOVER

The fund pays transaction costs,

such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover may indicate higher transaction costs and may mean higher taxes if you are investing in a

taxable account. These costs are not reflected in annual fund operating expenses or in the expense example, and can affect the fund's performance. During the most recent fiscal year, the fund’s portfolio

turnover rate was 42% of the average value of its portfolio.

Principal Investment

Strategy

Main investments. Under normal circumstances, the fund invests at least 80% of net assets, plus the amount of any borrowings for investment purposes, in securities issued by municipalities across the United

States and in other securities whose income is free from regular federal income tax. The fund may invest up to 20% of net assets in securities whose income is subject to the federal alternative minimum tax

(AMT).

The fund can buy many types of

municipal securities of all maturities. These may include revenue bonds (which are backed by revenues from a particular source) and general obligation bonds (which are typically backed by the issuer's ability to levy

taxes). They may also include municipal lease obligations and investments representing an interest therein.

The fund normally invests at least

65% of total assets in municipal securities rated in the three highest credit rating categories. The fund may invest up to 10% of total assets in high yield debt securities (commonly referred to as junk bonds) of the

fifth and sixth highest credit rating categories (i.e., as low as grade B). Compared to investment-grade debt securities, junk bonds generally pay higher yields, have higher volatility and higher risk of default on

payments of interest or principal.

The fund may also invest in

exchange-traded funds (ETFs). The fund’s investments in ETFs will be limited to 5% of total assets in any one ETF and 10% of total assets in the aggregate in ETFs.

Management process. Portfolio management looks for securities that appear to offer the best opportunity to meet the fund's objective. In making its buy and sell decisions, portfolio management typically

weighs a number of factors against each other, from economic outlooks and possible interest rate movements to characteristics of specific securities, such as coupon, maturity date and call date, and changes in supply

and demand within the municipal bond market.

Although portfolio management may

adjust the fund’s duration (a measure of sensitivity to interest rates) over a wider range, they generally intend to keep the fund’s duration similar to that of the Bloomberg Barclays Municipal Bond Index,

which is generally between five and nine years.

Main Risks

There are several risk factors that

could hurt the fund’s performance, cause you to lose money or cause the fund’s performance to trail that of other investments. The fund may not achieve its investment objective, and is not intended to be a

complete investment program. An investment in the fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency.

Interest rate risk. When interest rates rise, prices of debt securities generally decline. The longer the duration of the fund’s debt securities, the more sensitive the fund will be to interest rate

changes. (As a general rule, a 1% rise in interest rates means a 1% fall in value for every year of duration.) Recent and potential future changes in monetary policy made by central banks or governments are likely to

affect the level of interest rates. Rising interest rates may prompt redemptions from the fund, which may force the fund to sell investments at a time when it is not advantageous to do so, which could result in

losses. The fund may be subject to a greater risk of rising interest rates due to the current period of historically low rates.

Credit risk. The fund's performance could be hurt if an issuer of a debt security suffers an adverse change in financial condition that results in the issuer not making timely payments of interest or

principal, a security downgrade or an inability to meet a financial obligation. Credit risk is greater for lower-rated securities.

Because the issuers of high yield

debt securities, or junk bonds (debt securities rated below the fourth highest credit rating category), may be in uncertain financial health, the prices of their debt securities can be more vulnerable to bad economic

news, or even the expectation of bad news, than investment-grade debt securities. Credit risk for high yield securities is greater than for higher-rated securities.

For securities that rely on

third-party guarantors to support their credit quality, the same risks may apply if the financial condition of the guarantor deteriorates or the guarantor ceases to insure securities. Because guarantors may insure

many types of securities, including subprime mortgage bonds and other high-risk bonds, their financial condition could deteriorate as a result of events that have little or no connection to securities owned by the

fund.

Focus risk. To the extent that the fund focuses on investments from a single state, region or sector of the municipal securities market, its performance can be more volatile than that of a fund that

invests more broadly. As an example, factors affecting a state, region or sector such as severe fiscal difficulties, an economic downturn, court rulings, increased expenditures on domestic security or reduced monetary

support from the federal government could over time impair a state, region or sector's ability to repay its obligations.

| 2 | DWS Managed Municipal Bond Fund |

Summary

Prospectus October 1, 2018

Municipal securities risk. The fund could be impacted by events in the municipal securities market, including the supply and demand for municipal securities. Negative events, such as severe fiscal difficulties,

bankruptcy of one or more issuers, an economic downturn, unfavorable legislation, court rulings or political developments, or reduced monetary support from the federal government could hurt fund performance. The value

of municipal securities is strongly influenced by the value of tax-exempt income to investors and changes in tax and other laws, including changes to individual or corporate tax rates, could alter the attractiveness

and overall demand for municipal securities.

Market risk. Deteriorating market conditions might cause a general weakness in the market that reduces the prices of securities in that market. Developments in a particular class of debt securities or

the stock market could also adversely affect the fund by reducing the relative attractiveness of debt securities as an investment.

Security selection risk. The securities in the fund’s portfolio may decline in value. Portfolio management could be wrong in its analysis of municipalities, industries, companies, economic trends, the

relative attractiveness of different securities or other matters.

Counterparty risk. A financial institution or other counterparty with whom the fund does business, or that underwrites, distributes or guarantees any investments or contracts that the fund owns or is

otherwise exposed to, may decline in financial health and become unable to honor its commitments. This could cause losses for the fund or could delay the return or delivery of collateral or other assets to the

fund.

Tax risk. Income from municipal securities held by the fund could be declared taxable because of unfavorable changes in tax laws, adverse interpretations by the Internal Revenue Service or state tax

authorities, or noncompliant conduct of a securities issuer. In such event, the value of such securities would likely fall hurting fund performance and shareholders may be required to pay additional taxes. In

addition, a portion of the fund’s otherwise exempt-interest distributions may be taxable to those shareholders subject to the federal AMT.

Liquidity risk. In certain situations, it may be difficult or impossible to sell an investment and/or the fund may sell certain investments at a price or time that is not advantageous in order to meet

redemption requests or other cash needs. Unusual market conditions, such as an unusually high volume of redemptions or other similar conditions could increase liquidity risk for the fund, and in extreme conditions,

the fund could have difficulty meeting redemption requests.

Prepayment and extension risk. When interest rates fall, issuers of high interest debt obligations may pay off the debts earlier than expected (prepayment risk), and the fund may have to reinvest the proceeds at lower

yields. When interest rates rise, issuers of lower interest debt

obligations may pay off the debts later than

expected (extension risk), thus keeping the fund’s assets tied up in lower interest debt obligations. Ultimately, any unexpected behavior in interest rates could increase the volatility of the fund’s share

price and yield and could hurt fund performance. Prepayments could also create capital gains tax liability in some instances.

Pricing risk. If market conditions make it difficult to value some investments, the fund may value these investments using more subjective methods, such as fair value pricing. In such cases, the value

determined for an investment could be different from the value realized upon such investment’s sale. As a result, you could pay more than the market value when buying fund shares or receive less than the market

value when selling fund shares.

ETF risk. Because ETFs trade on a securities exchange, their shares may trade at a premium or discount to their net asset value. An ETF is subject to the risks of the assets in which it invests as

well as those of the investment strategy it follows. The fund incurs brokerage costs when it buys and sells shares of an ETF and also bears its proportionate share of the ETF’s fees and expenses, which are

passed through to ETF shareholders.

Fees and expenses incurred by an

ETF may include trading costs, operating expenses, licensing fees, trustee fees and marketing expenses. With an index ETF, these costs may contribute to the ETF not fully matching the performance of the index it is

designed to track.

Operational and technology

risk. Cyber-attacks, disruptions, or failures that affect the fund’s service providers or counterparties, issuers of securities held by the fund, or other market participants may adversely

affect the fund and its shareholders, including by causing losses for the fund or impairing fund operations.

Past Performance

How a fund's returns vary from year

to year can give an idea of its risk; so can comparing fund performance to overall market performance (as measured by an appropriate market index). Past performance may not indicate future results. All performance

figures below assume that dividends and distributions were reinvested. For more recent performance figures, go to dws.com (the Web site does not form a part of this prospectus) or call the phone number included in

this prospectus.

| 3 | DWS Managed Municipal Bond Fund |

Summary

Prospectus October 1, 2018

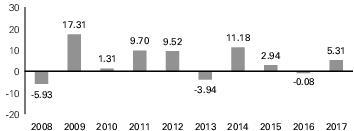

CALENDAR YEAR TOTAL RETURNS

(%) (Class A)

These year-by-year returns do not

include sales charges, if any, and would be lower if they did. Returns for other classes were different and are not shown here.

| Returns | Period ending | |

| Best Quarter | 9.03% | September 30, 2009 |

| Worst Quarter | -4.74% | December 31, 2010 |

| Year-to-Date | -0.78% | June 30, 2018 |

Average Annual Total

Returns

(For periods ended 12/31/2017 expressed as a %)

(For periods ended 12/31/2017 expressed as a %)

After-tax returns (which are shown

only for Class A and would be different for other classes) reflect the historical highest individual federal income tax rates, but do not reflect any state or local taxes. Your actual after-tax returns may be

different. After-tax returns are not relevant to shares held in an IRA, 401(k) or other tax-advantaged investment plan.

| Class Inception | 1 Year | 5 Years | 10 Years | |

| Class A before tax | 6/11/2001 | 2.42 | 2.39 | 4.22 |

| After tax on distributions | 2.40 | 2.37 | 4.20 | |

| After tax on distributions, with sale | 2.49 | 2.61 | 4.18 | |

| Class C before tax | 6/11/2001 | 4.48 | 2.15 | 3.70 |

| Class S before tax | 10/14/1976 | 5.64 | 3.18 | 4.72 |

| INST Class before tax | 8/19/2002 | 5.66 | 3.22 | 4.77 |

| Bloomberg Barclays Municipal Bond Index (reflects no deduction for fees, expenses or taxes) | 5.45 | 3.02 | 4.46 |

Management

Investment Advisor

DWS Investment Management Americas,

Inc.

Portfolio Manager(s)

Ashton P. Goodfield, CFA, Managing

Director. Portfolio Manager of the fund. Began managing the fund in 1998.

Matthew J. Caggiano, CFA, Managing

Director. Portfolio Manager of the fund. Began managing the fund in 1999.

Michael J. Generazo, Director. Portfolio Manager of the fund. Began managing the fund in 2010.

Purchase and Sale of Fund

Shares

Minimum Initial

Investment ($)

| Non-IRA | IRAs | UGMAs/ UTMAs | Automatic Investment Plans | |

| A C | 1,000 | 500 | 1,000 | 500 |

| INST | 1,000,000 | N/A | N/A | N/A |

| S | 2,500 | 1,000 | 1,000 | 1,000 |

For participants in all group retirement plans, and

in certain fee-based and wrap programs approved by the Advisor, there is no minimum initial investment and no minimum additional investment for Class A, C and S shares. For Section 529 college savings plans, there is

no minimum initial investment and no minimum additional investment for Class S shares. In certain instances, the minimum initial investment may be waived for Institutional Class shares. There is no minimum additional

investment for Institutional Class shares. The minimum additional investment in all other instances is $50.

To Place Orders

| New Accounts | DWS PO Box 219356 Kansas City, MO 64121-9356 | |

| Additional Investments | DWS PO Box 219154 Kansas City, MO 64121-9154 | |

| Exchanges and Redemptions | DWS PO Box 219557 Kansas City, MO 64121-9557 | |

| Expedited Mail | DWS 210 West 10th Street Kansas City, MO 64105-1614 | |

| Web Site | dws.com | |

| Telephone | (800) 728-3337, M – F 8 a.m. – 7 p.m. ET | |

| TDD Line | (800) 972-3006, M – F 8 a.m. – 7 p.m. ET | |

The fund is generally open on days

when the New York Stock Exchange is open for regular trading. Initial investments must be sent by mail. You can make additional investments or sell shares of the fund on any business day by visiting our Web site, by

mail, or by telephone; however you may have to elect certain privileges on your initial account application. If you are working with a financial advisor, contact your financial advisor for assistance with buying or

selling fund shares. A financial advisor separately may impose its own policies and procedures for buying and selling fund shares.

Institutional Class shares are

generally available only to qualified institutions. Class S shares are only available to a limited group of investors.

Tax Information

The fund's income dividends are

generally exempt from regular federal income tax. A portion of the fund's dividends may be subject to federal income tax, including the federal alternative minimum tax.

| 4 | DWS Managed Municipal Bond Fund |

Summary

Prospectus October 1, 2018

Payments to Broker-Dealers

and

Other Financial Intermediaries

Other Financial Intermediaries

If you purchase the fund through a

broker-dealer or other financial intermediary (such as a bank), the fund, the Advisor, and/or the Advisor’s affiliates may pay the intermediary for the sale of fund shares and related services. These payments

may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the fund over another investment. Ask your salesperson or visit your financial

intermediary’s Web site for more information.

| 5 | DWS Managed Municipal Bond Fund |

Summary Prospectus October 1, 2018 DMMBF-SUM