UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number

(Exact name of registrant as specified in its charter)

|

||

(State or other jurisdiction of |

|

(IRS Employer |

incorporation or organization) |

|

identification No.) |

|

|

|

|

||

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12 (g) of the Act:

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

OTCQX |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files.)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of the "large accelerated filer," "accelerated filer," "smaller reporting company" and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer |

☐ |

Accelerated Filer |

☐ |

|

Emerging Growth Company |

|

☐ |

Smaller reporting company |

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404 (b) of the Sarbanes-Oxley Act (15 U.S.C.7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

As of June 30, 2022, the aggregate market value of the Class A voting stock held by non-affiliates of the Company was $

As of February 17, 2023, the Company had

Auditor Firm Id: |

Auditor Name: |

Auditor Location: |

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Company’s Proxy Statement for the 2023 Annual Meeting of Shareholders to be held on April 26, 2023, are incorporated by reference into Part III of this Form 10-K.

CAPITAL PROPERTIES, INC.

FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 2022

TABLE OF CONTENTS

|

|

Page |

|

|

|

|

|

|

Item 1. |

3 |

|

Item 2. |

6 |

|

Item 3. |

6 |

|

Item 4. |

6 |

|

|

|

|

|

|

|

|

|

|

Item 5. |

Markets for Registrant’s Common Equity and Related Shareholder Matters |

7 |

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

8 |

Item 8. |

10 |

|

Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosures |

22 |

Item 9A. |

22 |

|

Item 9B. |

22 |

|

Item 9C. |

Disclosures Regarding Foreign Jurisdictions That Prevents Inspections |

22 |

|

|

|

|

|

|

|

|

|

Item 10. |

23 |

|

Item 11. |

23 |

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

23 |

Item 13. |

Certain Relationships and Related Transactions and Director Independence |

23 |

Item 14. |

23 |

|

|

|

|

|

|

|

|

|

|

Item 15. |

24 |

|

|

25 |

2

PART I

FORWARD-LOOKING STATEMENTS

Certain portions of this report, and particularly the Management’s Discussion and Analysis of Financial Condition and Results of Operations, contain forward-looking statements within the meaning of Sections 27A of the Securities Act of 1933, as amended, and Sections 21E of the Securities Exchange Act of 1934, as amended, which represent the Company’s expectations or beliefs concerning future events. The Company cautions that these statements are further qualified by important factors that could cause actual results to differ materially from those in the forward-looking statements, including, without limitation, the following: the ability of the Company to generate adequate amounts of cash; the collectability of the excess of straight-line over contractual rent when due over the terms of the long-term leases; the commencement of additional long-term land leases; changes in economic conditions that may affect either the current or future development on the Company’s parcels; the long-term impact of the COVID-19 pandemic on the economy, parking operations, and the Company’s financial performance, and exposure to remediation and other costs associated with its former ownership of a petroleum storage facility. The Company does not undertake the obligation to update forward-looking statements in response to new information, future events or otherwise.

Item 1. Business

Organizational History

The Company was organized as a business corporation under the laws of Rhode Island in 1983 as Providence and Worcester Company and is the successor by merger in 1983 to a corporation also named Providence and Worcester Company which was organized under the laws of Delaware in 1979. In 1984, the Company’s name was changed to Capital Properties, Inc.

Business:

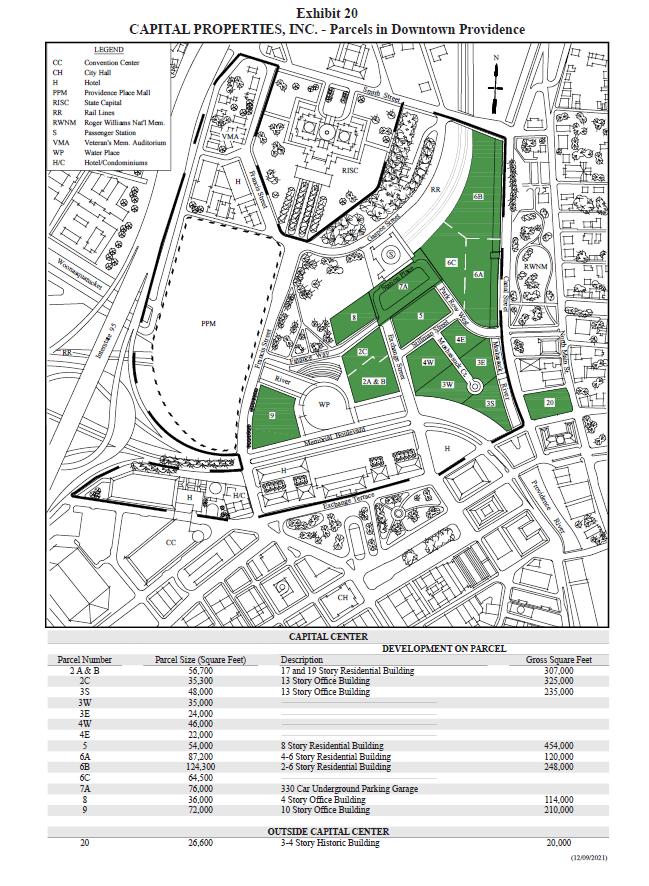

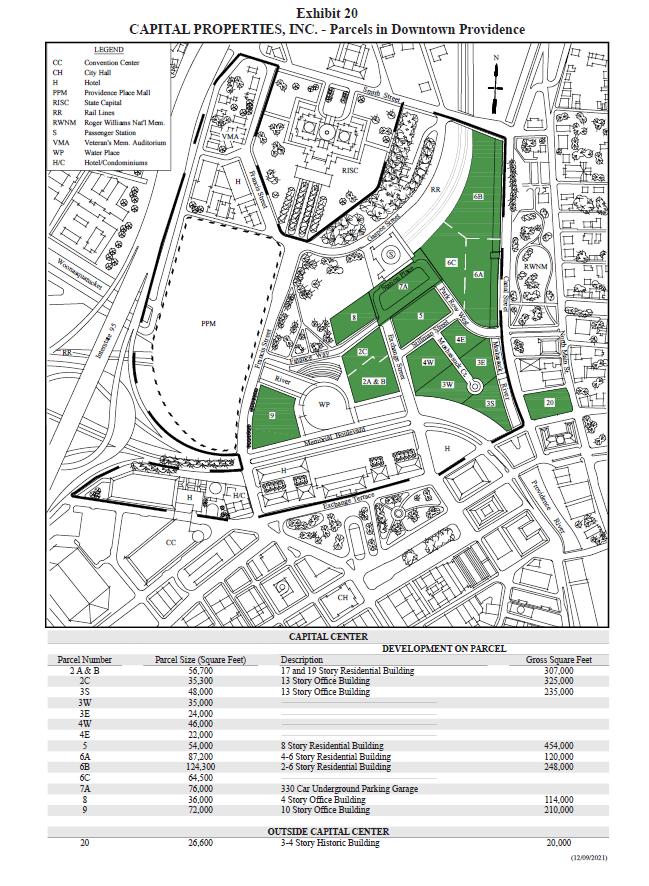

The Company’s principal business is the leasing of Company-owned land in Capital Center (“Capital Center”) and property adjacent to Capital Center (Parcel 20) in downtown Providence, Rhode Island under long-term ground leases with terms of 99 years or more.* (Hereinafter, the land in Capital Center and Parcel 20 are referred to as parcels within the “Capital Center Area”). The Company owns approximately 18 acres in Capital Center consisting of 13 individual parcels. Capital Center (approximately 77 acres of land) is the result of a development project undertaken by the State of Rhode Island, the City of Providence, the National Railroad Passenger Corporation (“Amtrak”) and the Company during the 1980’s in which two rivers, the Moshassuck and the Woonasquatucket, were moved, Amtrak’s Northeast Corridor rail line was relocated, a new Amtrak/commuter railroad station was constructed and significant public improvements were made to improve pedestrian and vehicular traffic in the area. The Company has not acted, and does not intend to act, as a developer with respect to any Company-owned parcels.

Under the Company’s standard Ground Leases, the tenant is responsible for all property related operating expenses, such as real estate taxes, maintenance and insurance as well as all costs associated with the development and construction of the related improvements. Each Ground Lease contains provisions permitting the tenant to develop the parcel under certain terms and conditions and provides for periodic rent increases based on either a specific percentage, consumer price index (“CPI”), appraisal or combination thereof and sometimes includes percentage rent participation (contingent rent). The Ground Leases also provide that the tenants are responsible for insuring the Company against various hazards and events as well as indemnifying the Company with respect to all of the tenant’s activities on the land. The Ground Leases contain other terms and conditions customary to such instruments.

While seeking developers, the Company also leases Parcels 3E, 3W, 4E, 4W and a portion of Parcel 20 in the Capital Center Area for public parking purposes to Metropark, Ltd.

*Generally speaking, a ground lease is a lease by the owner of the land (in this case, the Company) to the owners/operators of the real estate improvements built thereon by such owners/operators (“Ground Leases”).

3

Parcel 20

Parcel 20 consists of a parcel of land adjacent to the Capital Center, part of which is undeveloped and part of which contains a three/four-story 20,000 square foot building (the “Steeple Street Building”).

In May 2018, the Company and a tenant entered into an Amended and Restated Ground Lease for Parcel 20. On December 1, 2018, the tenant took possession of Parcel 20 and the Company conveyed title to the Steeple Street Building to the tenant. Effective October 31, 2021 the lease with the tenant was terminated due to the tenant's failure to pay the first and second quarter real estate taxes along with any related penalties and interest.

The Parcel 20 Steeple Street Building (“Building”) lease was originally accounted for as a sales-type lease due to the transfer of the Building to the tenant. The land directly under the Building was allocated in the determination of the value of the property transferred in accordance with ASC 360-20, Property, Plant and Equipment – Real Estate Sales. Since the initial investment by the tenant was insufficient to recognize the transaction as a sale, in accordance with ASC 360-20, the Company reported the acquisition period rent and an allocable portion of the ground rent collected as deferred revenue on its consolidated balance sheets. Upon termination of the lease, the $293,000 of deferred revenue through October 31, 2021 was recognized as leasing revenue in the consolidated statements of income and retained earnings. With the termination of the Parcel 20 lease, the Company became obligated for the real property taxes.

*************** **************** ***************

All of the properties described above are shown on the map contained in Exhibit 20.

Billboard Lease

The Company, through its wholly-owned subsidiary Tri-State Displays, Inc. leases 23 outdoor advertising locations containing 44 billboard faces along interstate and primary highways in Rhode Island and Massachusetts to Lamar Outdoor Advertising, LLC (“Lamar”) under a lease which expires in 2049 (the “Lamar Lease”). All but one of these locations are controlled by the Company through permanent easements granted to the Company pursuant to an agreement between the Company and the Providence & Worcester Railroad Company (“Railroad”); the remaining location is leased by the Company from a third party with a remaining term of two years.

Lamar has a right of first refusal for additional billboard location sites acquired by the Company in New England and Metropolitan New York City.

The Lamar lease provides, among other things, for annual base rent increases of 2.75% in June for each leased billboard location and participation in the revenue generated by each billboard, as defined in the agreement. The Lamar lease contains other terms and conditions customary to such instruments.

4

A summary of the long-term leases is as follows:

Parcels in Capital Center Area |

|

||||||||||||||||||||||||

Parcel Number |

|

Type of Building (s) |

|

Building Gross Square Feet |

|

|

Number of Residential Units |

|

Term of |

|

Termination |

|

Options |

|

Current |

|

|

|

Next Periodic |

|

Annual Rent After Next Adjustment or Type of Next Adjustment |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

2 |

|

17-story & 19-story Residential and |

|

|

307,000 |

|

|

193 |

|

103 |

|

2108 |

|

Two 75-Year |

|

$ |

503,000 |

|

|

|

2023 |

|

COLA |

|

|

|

|

13-story Office |

|

|

325,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

3S |

|

13-story Office |

|

|

235,000 |

|

|

|

|

99 |

|

2087 |

|

None |

|

$ |

618,000 |

|

|

|

2024 |

|

$ |

788,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

5 |

|

8-story Residential |

|

|

454,000 |

|

|

225 |

|

149 |

|

2142 |

|

None |

|

$ |

540,000 |

|

* |

|

2033 |

|

Appraisal |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

6A |

|

4-6 story Residential |

|

|

120,000 |

|

|

96 |

|

99 |

|

2107 |

|

Two 50-Year |

|

$ |

367,000 |

|

|

|

2024 |

|

$ |

404,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

6B |

|

2-6 story Residential |

|

|

248,000 |

|

|

169 |

|

99 |

|

2107 |

|

Two 50-Year |

|

$ |

214,000 |

|

|

|

2024 |

|

$ |

235,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

7A |

|

Underground Public Parking Garage |

|

|

|

|

330 parking spaces |

|

99 |

|

2104 |

|

Two 75-Year |

|

$ |

200,000 |

|

|

|

2027 |

|

COLA |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

8 |

|

4-story Office |

|

|

114,000 |

|

|

|

|

99 |

|

2090 |

|

None |

|

$ |

290,000 |

|

* |

|

2025 |

|

COLA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

9 |

|

10-Story Office |

|

|

210,000 |

|

|

|

|

149 |

|

2153 |

|

None |

|

$ |

397,000 |

|

|

|

2026 |

|

$ |

417,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Billboard Lease |

|

||||||||||||||||||||||||

NA |

|

Billboard |

|

|

|

|

|

|

39 |

|

2049 |

|

** |

|

$ |

1,020,000 |

|

*** |

|

2023 |

|

$ |

1,048,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

COLA |

|

Cost-of-living adjustment |

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

* |

|

Lease provides for rent participation (contingent rent) equal to 1% of Gross Revenue. |

|

||||||||||||||||||||||

** |

|

Lease term is extended for four (4) years if an electronic billboard is constructed on a leased location. |

|

||||||||||||||||||||||

*** |

|

Lease provides for rent participation equal to 30% of Revenue, as defined in the agreement for each standard billboard and 20% of Revenue for each electronic billboard. |

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Major tenants:

The following table sets forth those major tenants whose revenues exceed 10 percent of the Company’s leasing revenues for the years ended December 31, 2022 and 2021:

Parcel |

|

|

|

2022 |

|

|

2021 |

|

||

NA |

|

Lamar Outdoor Advertising, LLC |

|

$ |

1,255,000 |

|

|

$ |

1,129,000 |

|

Parcel 5 |

|

HGIT Center Place |

|

|

625,000 |

|

|

|

618,000 |

|

Parcel 3S |

|

1701 R.C. Sarasota Invest, LLC |

|

|

618,000 |

|

|

|

618,000 |

|

Parcel 2 |

|

Waterplace Condominiums |

|

|

503,000 |

|

|

|

503,000 |

|

|

|

|

|

$ |

3,001,000 |

|

|

$ |

2,868,000 |

|

Competition

The Company competes for tenants with other owners of undeveloped real property in downtown Providence. The Company maintains no listing of other competitive properties and will not engage in a competitive bid arrangement with proposed developers. The Company’s refusal to sell the land that it owns may restrict the number of interested developers.

Employees

As of December 31, 2022, the Company has two full-time and one part-time employee.

5

Environmental

Prior to February 2017, the Company operated a petroleum storage facility (“Terminal”) through two of its wholly owned subsidiaries. On February 10, 2017, the Terminal was sold to Sprague Operating Resources, LLC (“Sprague”) which results in the Terminal’s operations being classified as discontinued operations for all periods presented. As part of the Terminal Sale Agreement, the Company agreed to complete the environmental remediation and pay for the costs related to a 1994 storage tank fuel oil leak which allowed the escape of a small amount of fuel oil. In February 2020, the Company filed a revised Remediation Action Work Plan (“RAWP”) with Rhode Island Department of Environmental Management (“RIDEM”) to incorporate technical details associated with the preferred remedial activities and to update the 2018 RAWP. During 2022, the remediation system was modified to address operational issues which impeded remediation activities. For the year ended December 31, 2022, the Company incurred costs of $112,000 and increased the environmental remediation liability by $160,000 resulting in a liability of $406,000 at December 31, 2022. Any subsequent increases or decreases to the expected cost of remediation will be recorded in Company’s consolidated income statements as gain or loss on sale of discontinued operations.

Insurance

The Company maintains what management believes to be adequate levels of insurance.

Item 2. Properties

The Company owns approximately 18 acres and a historic building in the Capital Center Area of Providence, Rhode Island. With the exception of Parcel 6C and the Steeple Street Building, all of the Company’s real property is leased either under long-term leases or short-term leases as more particularly described in Item 1, Business. Effective October 31, 2021, the Parcel 20 lease was terminated by the Company. The Company also owns or controls 23 locations in Rhode Island and Massachusetts on which 44 billboard faces have been constructed. All but one of these locations are owned by the Company under permanent easements from the Railroad; the remaining location is leased from an unrelated third party with a remaining term of two years.

Item 3. Legal Proceedings

In connection with the sale of the Company’s petroleum storage terminal in 2017, the Company and the buyer, Sprague, entered into an agreement relating to the construction of a breasting dolphin pursuant to which any construction costs incurred in excess of the contract cost of the construction would be shared equally between the Company and Sprague subject to certain limitations. In November 2019, Sprague asserted that it was owed $427,000 and the Company asserted that its obligation under the Agreement could not exceed $104,000. Mediation efforts were unsuccessful and in July 2021, Sprague commenced an action against the Company in the Rhode Island Superior Court (Superior Court) seeking monetary damages of $427,000, interest and attorney’s fees. In December 2022, the Superior Court denied Sprague’s Motion for Summary Judgment filed in September 2022 and granted in part and denied in part the Company’s Cross Motion for Summary Judgment also filed in September 2022. The Company anticipates that the matter will go to trial late in 2023 or early in 2024. The Company intends to vigorously defend against the claims being asserted by Sprague.

Item 4. Mine Safety Disclosure – Not applicable

6

PART II

Item 5. Market for Registrant’s Common Equity and Related Stockholder Matters

The Company’s Class A Common Stock is traded on the OTCQX, symbol “CPTP.” The following table shows the high and low trading prices for the Company’s Class A Common Stock during the quarterly periods indicated as obtained from the OTCQX, together with cash dividends paid per share during such periods.

|

|

Trading Prices |

|

|

Dividends |

|

|

||||||

|

|

High |

|

|

Low |

|

|

Declared |

|

|

|||

2022 |

|

|

|

|

|

|

|

|

|

|

|||

1st Quarter |

|

$ |

13.46 |

|

|

$ |

12.00 |

|

|

$ |

0.07 |

|

|

2nd Quarter |

|

|

12.99 |

|

|

|

11.95 |

|

|

|

0.07 |

|

|

3rd Quarter |

|

|

12.12 |

|

|

|

10.59 |

|

|

|

0.07 |

|

|

4th Quarter |

|

|

12.20 |

|

|

|

11.00 |

|

|

|

0.07 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

2021 |

|

|

|

|

|

|

|

|

|

|

|||

1st Quarter |

|

$ |

12.50 |

|

|

$ |

11.80 |

|

|

$ |

0.07 |

|

|

2nd Quarter |

|

|

14.00 |

|

|

|

11.48 |

|

|

|

0.07 |

|

|

3rd Quarter |

|

|

14.20 |

|

|

|

11.80 |

|

|

|

0.07 |

|

|

4th Quarter |

|

|

15.00 |

|

|

|

11.75 |

|

|

|

0.07 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|||||||||||||

|

|||||||||||||

At February 17, 2023, there were 331 holders of record of the Company’s Class A Common Stock.

7

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Our consolidated financial statements are prepared in accordance with accounting principles generally accepted in the United States (“GAAP”). The following discussion of our financial condition and results of operations excludes the results of our discontinued operations unless otherwise noted. See Note 8, “Discontinued operations and environmental incident” in the accompanying Consolidated Financial Statements for further discussion of these operations.

Critical accounting policies:

The Securities and Exchange Commission (“SEC”) has issued guidance for the disclosure of “critical accounting policies.” The SEC defines such policies as those that require application of management’s most difficult, subjective or complex judgments, often as a result of the need to make estimates about the effect of matters that are inherently uncertain and may change in subsequent periods.

The Company’s significant accounting policies are described in Note 2 in the accompanying Consolidated Financial Statements. Not all of these significant accounting policies require management to make difficult, subjective or complex judgments or estimates. Management believes that the Company’s revenue recognition policy for long-term leases with scheduled rent increases meets the SEC definition of “critical.”

The Company’s long-term leases (land and billboard) have original terms of 30 to 149 years. The Company follows GAAP in accounting for its leases by recognizing rental income on the straight-line basis over the term of the leases. Where the straight-line income exceeds the actual contractual payments (“Excess”), the Company evaluates the collectability of the entire stream of remaining lease payments on a lease-by-lease basis. If the remaining lease payments are not deemed to be probable of collection, in accordance with GAAP, lease revenue is recorded at the lower of straight-line rental income or the contractual amount paid.

The number of years remaining on the Company’s leases range from twenty-seven (27) years to one hundred-thirty-one (131) years with total rents yet to be collected from tenants (without regard to CPI and appraisal adjustments) under the lease ranging from $19.5 million to $363.4 million. Given the length of the remaining lease term and the magnitude of the amount yet to be collected, along with the consideration of other factors, the Company has concluded that the remaining stream of lease payments is not probable of collection and as such, reports lease revenue based on the contractual amount paid.

Historically, the Company generates adequate liquidity to fund its operations.

Cash and cash commitments:

The Company had cash and cash equivalents of $1,476,000 and $1,443,000 at December 31, 2022 and 2021, respectively, inclusive of a money market account totaling $1,273,000 and $1,355,000 in each of the aforementioned years. The Company and its subsidiary each maintain checking accounts and one money market account in a financial institution which is insured by the Federal Deposit Insurance Corporation to a maximum of $250,000. The Company periodically evaluates the financial stability of the financial institutions at which the Company’s funds are held.

Under the terms of each applicable long-term land lease, the contractual adjustments for the last two years were:

Parcel Number |

|

Monthly Increase |

|

Effective Date of Increase |

|

Type of Adjustment |

Parcel 9 |

|

$1,575 |

|

April 1, 2021 |

|

Base ground rent increase |

Parcel 7A |

|

$2,539 |

|

April 1, 2022 |

|

Base ground rent increase |

The City of Providence (“City”) conducted a City-wide property revaluation for 2022. This revaluation increased the assessed value of the Company’s parcels that are available for lease by 26.5%, resulting in an annual property tax increase of $139,000 that was to be borne entirely by the Company. The Company's appeal of the assessed values for certain of its parcels was successful and resulted in a reduction of the assessed value to an amount less than the 2021 assessed value and in an annual property tax reduction in 2022 taxes as originally assessed of $165,000, which amount was recorded in the fourth quarter of 2022.

Through February 17, 2023 all tenants have paid their monthly rent in accordance with their lease agreements except for Metropark, the tenant that operates public parking on the Company’s undeveloped parcels other than Parcel 6C. The Company continues to report revenue from Metropark on a cash basis as the move by many companies to a hybrid workplace model has reduced demand for parking spaces. Metropark has not fully paid the rent per the original lease agreement executed in 2017 since April 2020. On July 31, 2020, Metropark and the Company entered into an agreement for

8

revenue sharing at various percentages until parking revenues received by Metropark equal or exceed $70,000 per month whereupon Metropark would be obligated to resume regularly scheduled rental payments under the 2017 lease. Upon resumption of regularly scheduled rent payments, Metropark and the Company will share fifty (50) percent of the monthly revenue in excess of $70,000 until the arrearage has been paid in full. If prior to payment in full of the arrearage one or more of the lots is removed from the Metropark lease for development, the amount of the then unpaid arrearage in the ratio of the number of parking spaces on the removed lot to the total parking spaces on all lots prior to such lot’s removal shall be deemed paid in full. At December 31, 2022 the total rent arrearage is $1,031,000 and has been fully reserved. The Company does not know when or if Metropark’s operations will return to pre-pandemic levels.

The Company expects that revenue from Metropark will continue to be recognized on a cash basis for a significant portion of 2023.

The Terminal Sale Agreement and related documentation provides that the Company is required to secure an approved remediation plan and to remediate contamination caused by a leak in 1994 from a storage tank at the Terminal. At December 31, 2022, the Company’s accrual for the remaining cost of remediation was $406,000 of which $132,000 is expected to be expended in 2023. The Terminal Sale Agreement also contained a cost sharing provision for a breasting dolphin whereby any construction costs in excess of the contract cost of construction would be borne equally by Sprague and the Company subject to certain limitations, including, in the Company’s opinion, a 20% cap on the increase from the initial estimate subject to the sharing arrangement. In November 2019, Sprague asserted that it was owed $427,000 and the Company asserted that its obligation under the Agreement could not exceed $104,000. Mediation efforts were unsuccessful and in July 2021, Sprague commenced an action against the Company in the Rhode Island Superior Court (Superior Court) seeking monetary damages of $427,000, plus interest and attorney’s fees. In December 2022, the Superior Court denied Sprague’s Motion for Summary Judgment filed in September 2022 and granted in part and denied in part the Company’s Cross Motion for Summary Judgment also filed in September 2022. The Company anticipates that the matter will go to trial late in 2023 or early in 2024. The Company intends to vigorously defend against the claims being asserted by Sprague. See Note 8, “Discontinued operations and environmental incident” in the accompanying Consolidated Financial Statements.

In 2022, the Company declared and paid dividends of $1,848,000 or $0.28 per share.

The declaration of future dividends will depend on future earnings and financial performance.

Year Ended December 31, 2022 Compared to Year Ended December 31, 2021:

Leasing revenue increased $265,000 from 2021 due to a full year of operations associated with Parcel 20 ($273,000), an increase in cash collections from Metropark ($161,000) and an increase in rent (contractual and contingent) from tenants ($168,000) offset by a decrease in revenue associated with the termination of the Parcel 20 lease ($337,000).

Operating expenses increased $76,000 due principally to costs associated with the operations of Steeple Street Building ($91,000) and offset by a decrease in property taxes resulting from the appeal ($15,000).

General and administrative expense decreased $83,000 due principally to a decrease in professional fees ($74,000) and a net decrease in various other expenses ($9,000).

For the years ended December 31, 2022 and 2021, the Company’s effective income tax rate from continuing operations is 27% and 28%, respectively.

9

Item 8. Financial Statements and Supplementary Data

CAPITAL PROPERTIES, INC. AND SUSIDIARY

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

10

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Shareholders of

Capital Properties, Inc.

Providence, Rhode Island

Opinion on the Financial Statements

We have audited the accompanying consolidated balance sheets of Capital Properties, Inc. (the “Company”) as of December 31, 2022 and 2021, and the related consolidated statements of income and retained earnings, and cash flows for each of the years in the two-year period ended December 31, 2022, and the related notes (collectively referred to as the “consolidated financial statements”). In our opinion, the consolidated financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2022 and 2021, and the results of its operations and its cash flows for each of the years in the two-year period ended December 31, 2022, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s consolidated financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the consolidated financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the consolidated financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements. We believe our audits provide a reasonable basis for our opinion.

Critical Audit Matter

The critical audit matter communicated below is a matter arising from the current period audit of the consolidated financial statements that was communicated or required to be communicated to the audit committee and that: (1) relates to accounts or disclosures that are material to the consolidated financial statements and (2) involved our especially challenging, subjective, or complex judgments. The communication of a critical audit matter does not alter in any way our opinion on the consolidated financial statements taken as a whole, and we are not, by communicating the critical audit matter below, providing a separate opinion on the critical audit matter or on the accounts or disclosures to which it relates.

Revenue Recognition – Refer to Note 2 to the Consolidated Financial Statements

Critical Audit Matter Description

The Company derives revenue from long-term leases with original terms ranging from 30 years to 149 years. Effective January 1, 2019 the Company adopted ASC 842, Leases, and elected the “package of practical expedients” which permits the Company not to reassess under the new standard prior conclusions about lease identification, lease classification, and initial indirect costs and determined that all pre-existing leases were properly accounted for as operating. The long-term leases contain periodic rent increases based on either a specific percentage, market appraisals, changes in the consumer price index or combination thereof. In accordance with generally accepted accounting principles, lease income should be recognized on a straight-line basis. Where straight-line income exceeds the actual contractual payments (the “Excess”), the Excess should only be recognized to the extent it

11

is collectable. In accordance with ASC 842, if collectability of the lease payments is not probable, lease income shall be limited to the lesser of the income that would be recognized in accordance with ASC 842 (straight-line basis) or the actual lease payment, including variable payments that have been collected from the lessee. The Company evaluates the entire stream of remaining lease payments on a lease-by-lease basis. Analysis of collectability from the lessee (tenant) is subjective and complex and is dependent on many factors including historical experience and the creditworthiness of the tenant. The creditworthiness of the tenant can, and often is, significantly influenced by major factors including the creditworthiness of multiple sub-tenants. The inability to access reliable credit information on all parties impacting the probability of collection creates a collectability constraint. Management updates its collectability analysis of long-term leases annually and has determined that collection of the entire remaining stream of remaining lease payments is not probable. Accordingly lease revenue, including variable payments, is recorded when received from the lessee.

How the Critical Audit Matter was Addressed in the Audit

Our audit procedures related to the recognition of long-term lease revenue on a straight-line basis included the following, among others:

/s/ Stowe & Degon, LLC

We have served as the Company’s auditor since 2016.

Westborough, Massachusetts

February 17, 2023

12

CAPITAL PROPERTIES, INC. AND SUBSIDIARY

CONSOLIDATED BALANCE SHEETS

|

|

December 31, |

|

|||||

|

|

2022 |

|

|

2021 |

|

||

ASSETS |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

Properties and equipment (net of accumulated depreciation) (Note 3) |

|

$ |

|

|

$ |

|

||

Cash and cash equivalents |

|

|

|

|

|

|

||

Prepaid and other |

|

|

|

|

|

|

||

Prepaid income taxes |

|

|

|

|

|

|

||

Deferred income taxes, discontinued operations |

|

|

|

|

|

|

||

|

|

$ |

|

|

$ |

|

||

|

|

|

|

|

|

|

||

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

Liabilities: |

|

|

|

|

|

|

||

Property taxes |

|

$ |

|

|

$ |

|

||

Other |

|

|

|

|

|

|

||

Deferred income taxes, net |

|

|

|

|

|

|

||

Environmental remediation accrual, discontinued operations (Note 8) |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

Shareholders’ equity: |

|

|

|

|

|

|

||

Class A common stock, $ |

|

|

|

|

|

|

||

Capital in excess of par |

|

|

|

|

|

|

||

Retained earnings |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

|

|

$ |

|

|

$ |

|

||

See accompanying notes to Consolidated Financial Statements.

13

CAPITAL PROPERTIES, INC. AND SUBSIDIARY

CONSOLIDATED STATEMENTS OF INCOME AND RETAINED EARNINGS

|

|

December 31, |

|

|||||

|

|

2022 |

|

|

2021 |

|

||

|

|

|

|

|

|

|

||

Leasing revenue |

|

$ |

|

|

$ |

|

||

|

|

|

|

|

|

|

||

Expenses: |

|

|

|

|

|

|

||

Operating |

|

|

|

|

|

|

||

General and administrative |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

Income from continuing operations before income taxes |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

Income tax expense: |

|

|

|

|

|

|

||

Current |

|

|

|

|

|

|

||

Deferred |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

Income from continuing operations |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

Loss on sale of discontinued operations, net of tax (Note 8) |

|

|

( |

) |

|

|

- |

|

|

|

|

|

|

|

|

||

Net income |

|

|

|

|

|

|

||

Retained earnings, beginning |

|

|

|

|

|

|

||

Dividends on common stock based on |

|

|

( |

) |

|

|

( |

) |

Retained earnings, ending |

|

$ |

|

|

$ |

|

||

Basic income (loss) per common share based upon |

|

|

|

|

|

|

||

Continuing operations |

|

$ |

|

|

$ |

|

||

Discontinued operations |

|

|

( |

) |

|

|

- |

|

Total basic income per common share |

|

$ |

|

|

$ |

|

||

See accompanying notes to Consolidated Financial Statements.

14

CAPITAL PROPERTIES, INC. AND SUBSIDIARY

CONSOLIDATED STATEMENTS OF CASH FLOWS

|

|

December 31, |

|

|||||

|

|

2022 |

|

|

2021 |

|

||

Cash flows from operating activities: |

|

|

|

|

|

|

||

Continuing operations: |

|

|

|

|

|

|

||

Income from continuing operations |

|

$ |

|

|

$ |

|

||

Adjustments to reconcile income from continuing operations to net |

|

|

|

|

|

|

||

Depreciation |

|

|

|

|

|

|

||

Deferred income taxes |

|

|

|

|

|

|

||

Deferred revenue, Parcel 20 |

|

|

- |

|

|

|

( |

) |

Changes in assets and liabilities: |

|

|

|

|

|

|

||

Income taxes |

|

|

|

|

|

- |

|

|

Prepaid and other |

|

|

( |

) |

|

|

( |

) |

Property taxes |

|

|

( |

) |

|

|

|

|

Other |

|

|

|

|

|

( |

) |

|

Net cash provided by operating activities, continuing operations |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

Cash flows from investing activities: |

|

|

|

|

|

|

||

Discontinued operations: |

|

|

|

|

|

|

||

Loss on sale of discontinued operation |

|

|

( |

) |

|

|

- |

|

Cash used to settle obligations |

|

|

( |

) |

|

|

( |

) |

Noncash adjustment to loss on sale of discontinued operations |

|

|

|

|

|

|

||

Net cash (used in) investing activities |

|

|

( |

) |

|

|

( |

) |

|

|

|

|

|

|

|

||

Cash flows from financing activities, payment of dividends |

|

|

( |

) |

|

|

( |

) |

|

|

|

|

|

|

|

||

Increase (decrease) in cash and cash equivalents |

|

|

|

|

|

( |

) |

|

Cash and cash equivalents, beginning |

|

|

|

|

|

|

||

Cash and cash equivalents, ending |

|

$ |

|

|

$ |

|

||

|

|

|

|

|

|

|

||

Supplemental disclosures: |

|

|

|

|

|

|

||

Cash paid for income taxes |

|

$ |

|

|

$ |

|

||

|

|

|

|

|

|

|

||

See accompanying notes to Consolidated Financial Statements.

15

CAPITAL PROPERTIES, INC. AND SUBSIDIARY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

YEARS ENDED DECEMBER 31, 2022 AND 2021

The operations of Capital Properties, Inc. and its wholly-owned subsidiary, Tri-State Displays, Inc. (collectively “the Company”) consist of the long-term leasing of certain of its real estate interests in the Capital Center area in downtown Providence, Rhode Island (upon the commencement of which the tenants have been required to construct buildings thereon, with the exception of the parking garage and Parcel 20) and the leasing of locations along interstate and primary highways in Rhode Island and Massachusetts to Lamar Outdoor Advertising, LLC (“Lamar”) which has constructed outdoor advertising boards thereon. The Company anticipates that the future development of its remaining properties in the Capital Center area will consist primarily of long-term ground leases. Pending this development, the Company leases these undeveloped parcels (other than Parcel 6C) for public parking to Metropark, Ltd.

Principles of consolidation:

The accompanying consolidated financial statements include the accounts and transactions of the Company and its wholly-owned subsidiary. All significant intercompany accounts and transactions have been eliminated in consolidation.

Use of estimates:

The preparation of consolidated financial statements in conformity with accounting principles generally accepted in the United States (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements. Estimates also affect the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

Fair value of financial instruments:

The Company believes that the fair values of its financial instruments, including cash and cash equivalents and payables, approximate their respective book values because of their short-term nature. The fair values described herein were determined using significant other observable inputs (Level 2) as defined by GAAP.

Properties and equipment:

Properties and equipment are stated at cost. Acquisitions and additions are capitalized while routine maintenance and repairs, which do not improve the asset or extend its life, are charged to expense when incurred. Depreciation is being provided by the straight-line method over the estimated useful lives of the respective assets.

Cash and cash equivalents:

The Company considers all highly liquid investments with a maturity of three months or less when purchased to be cash equivalents. Cash equivalents include money market accounts totaling $

Environmental incidents:

The Company accrues a liability when an environmental incident has occurred and the costs are estimable. The Company does not record a receivable for recoveries from third parties for environmental matters until it has determined that the amount of the collection is reasonably assured. The accrued liability is relieved when the Company pays the liability or a third party assumes the liability. Upon determination that collection is reasonably assured or a third party assumes the liability, the Company records the amount as a reduction of expense.

Revenues:

The Company’s properties leased to others are under operating leases. The Company reports leasing revenue when earned under the operating method.

16

Certain of the Company’s long-term leases (land and billboard) provide for presently known scheduled rent increases over the remaining terms (

The Company reports contingent revenue in the period in which the factors occur on which the contingent payments are predicated.

Income taxes:

The Company and its subsidiary file consolidated income tax returns.

The Company provides for income taxes based on income reported for financial reporting purposes.

Based on its evaluation, the Company has concluded that there are no significant uncertain tax positions requiring recognition in the consolidated financial statements. The Company will report any tax-related interest and penalties related to uncertain tax positions as a component of income tax expense. The Company’s federal and state income tax returns are generally open for examination for the past three years.

Legal fees:

The Company recognizes legal fees as incurred.

Basic earnings per common share:

Basic earnings per common share are computed by dividing net income by the weighted average number of common shares outstanding during the period.

Recently issued accounting pronouncements

Properties and equipment consist of the following:

|

|

Estimated |

|

|

December 31, |

|

||||||

|

|

Life in Years |

|

|

2022 |

|

|

2021 |

|

|||

|

|

|

|

|

|

|

|

|

|

|||

Land and land improvements on lease or held for lease |

|

|

|

|

$ |

|

|

$ |

|

|||

Building and improvements, Steeple Street (Note 6) |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|||

Less accumulated depreciation: |

|

|

|

|

|

|

|

|

|

|||

Land improvements on lease or held for lease |

|

|

|

|

|

|

|

|

|

|||

Steeple Street property (Note 6) |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

$ |

|

|

$ |

|

|||

17

Liabilities, other consist of the following:

|

|

December 31, |

|

|||||

|

|

2022 |

|

|

2021 |

|

||

Accrued professional fees |

|

$ |

|

|

$ |

|

||

Deposits and prepaid rent |

|

|

|

|

|

|

||

Accrued payroll and related costs |

|

|

|

|

|

|

||

Other |

|

|

|

|

|

|

||

|

|

$ |

|

|

$ |

|

||

In March 2021, the Company entered into a financing agreement (“Agreement”) with BankRI that provides for a revolving line-of-credit (“Line”) with a maximum borrowing capacity of $

Long-term land leases:

Through December 31, 2022, excluding Parcel 6C and Parcel 20, the Company had entered into

In September 2021, the Company sent a Notice of Default (“Default Notice”) to the tenant of Parcel 20 for the nonpayment of September’s rent and the 2021 first quarter property taxes. Subsequently, the tenant cured the rent default. On October 6, 2021 the tenant was sent a Notice of Lease Termination (“Termination Notice”) informing the tenant that the lease would terminate on October 18, 2021 unless the failure to pay the first quarter real estate taxes along with any related penalties and interest was cured. Subsequently, it was agreed that, provided the first and second quarter real estate taxes and any related penalties and interest were paid in full by October 31, 2021, the lease would not be terminated. Since payment was not made, the lease was terminated effective October 31, 2021.

The Parcel 20 Steeple Street Building (“Building”) lease was originally accounted for as a sales-type lease due to the transfer of the Building to the tenant. The land directly under the Building was allocated in the determination of the value of the property transferred in accordance with ASC 360-20, Property, Plant and Equipment - Real Estate Sales. Since the initial investment by the tenant was insufficient to recognize the transaction as a sale, in accordance with ASC 360-20, the Company reported the acquisition period rent and an allocable portion of the ground rent collected as deferred revenue on its consolidated balance sheet. Upon termination of the lease, deferred revenue of $

Under the

Under

18

The City of Providence (“City”) conducted a City-wide property revaluation for 2022. This revaluation increased the assessed value of the Company’s parcels that are available for lease by

Lamar lease:

Tri-State Display’s, Inc., leases

Parking lease:

The Company leases the undeveloped parcels of land in or adjacent to the Capital Center area (other than Parcel 6C) for public parking purposes to Metropark under a

The COVID-19 pandemic continues to have an adverse impact on Metropark’s parking operations as the move by many companies to a hybrid workplace model (one that mixes in-office and remote work) has resulted in lower demand for parking spaces. The Company and Metropark continue to operate under the June 30, 2020 revenue sharing agreement that provides for revenue sharing at various percentages until parking revenues received by Metropark equal or exceed $

At December 31, 2022 and 2021, the receivable from Metropark equaled $

Minimum future contractual rental payments, inclusive of presently known scheduled rent increases to be received from non-cancellable long-term leases as of December 31, 2022 are:

Year ending December 31, |

|

|

|

|

2023 |

|

$ |

|

|

2024 |

|

|

|

|

2025 |

|

|

|

|

2026 |

|

|

|

|

2027 |

|

|

|

|

2028 - 2153 |

|

|

|

|

|

|

$ |

|

|

19

Consistent with prior conclusions, the Company has determined that, at this time, the excess of straight-line rentals over contractual payments is not probable of collection. Accordingly, the Company has not included any part of that amount in revenue. As a matter of information only, as of December 31, 2022 the excess of straight-line rentals (calculated by excluding variable payments) over contractual payments was $

In the event of tenant default, the Company has the right to reclaim its leased land together with any improvements thereon, subject to the right of any leasehold mortgagee to enter into a new lease with the Company with the same terms and conditions as the lease in default.

The following table sets forth those major tenants whose revenues exceed 10 percent of the Company’s revenues for the years ended December 31, 2022 and 2021:

|

|

2022 |

|

|

2021 |

|

||

Lamar Outdoor Advertising, LLC |

|

$ |

|

|

$ |

|

||

HGIT Center Place |

|

|

|

|

|

|

||

1701 R.C. Sarasota Invest, LLC |

|

|

|

|

|

|

||

Waterplace Condominiums |

|

|

|

|

|

|

||

|

|

$ |

|

|

$ |

|

||

For the years ended December 31, 2022 and 2021, income tax expense from continuing operations is comprised of the following components:

|

|

2022 |

|

|

2021 |

|

||

Current: |

|

|

|

|

|

|

||

Federal |

|

$ |

|

|

$ |

|

||

State |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

Deferred: |

|

|

|

|

|

|

||

Federal |

|

|

|

|

|

|

||

State |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

|

|

$ |

|

|

$ |

|

||

For the years ended December 31, 2022 and 2021, a reconciliation of the income tax provision from continuing operations as computed by applying the United States income tax rate of

|

|

2022 |

|

|

2021 |

|

||

Computed "expected" tax |

|

$ |

|

|

$ |

|

||

Increase in "expected" tax resulting from state income tax, |

|

|

|

|

|

|

||

Nondeductible expenses and other |

|

|

|

|

|

|

||

|

|

$ |

|

|

$ |

|

||

20

Deferred income taxes are recorded based upon differences between financial statement and tax basis amounts of assets and liabilities.

|

|

2022 |

|

|

2021 |

|

||

Gross deferred tax liabilities: |

|

|

|

|

|

|

||

Property having a financial statement basis in excess of |

|

$ |

|

|

$ |

|

||

Accounts receivable |

|

|

|

|

|

|

||

Deferred income - Conversion to cash basis of |

|

|

|

|

|

|

||

Insurance premiums and accrued leasing revenues |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

Gross deferred tax assets: |

|

|

|

|

|

|

||

Allowance for doubtful accounts |

|

|

( |

) |

|

|

( |

) |

Prepaid rent |

|

|

( |

) |

|

|

( |

) |

Accounts payable and accrued expenses |

|

|

( |

) |

|

|

( |

) |

Accrued property taxes |

|

|

( |

) |

|

|

( |

) |

|

|

|

( |

) |

|

|

( |

) |

|

|

$ |

|

|

$ |

|

||

Prior to February 2017, the Company operated a petroleum storage facility (“Terminal”) through

As part of the Terminal Sale Agreement, the Company agreed to retain and pay for the environmental remediation costs associated with a 1994 storage tank fuel oil leak which allowed the escape of a small amount of fuel oil. The Company continues the remediation activities set forth in the Remediation Action Work Plan (“RAWP”) filed with the Rhode Island Department of Environmental Management (“RIDEM”). During 2022, the remediation system was modified to address operational issues which impeded remediation activities. For the year ended December 31, 2022, the Company incurred costs of $

The Terminal Sale Agreement also contained a cost sharing provision for the breasting dolphin whereby any construction costs incurred more than the contract cost of construction would be borne equally by Sprague and the Company subject to certain limitations, including, in the Company’s opinion, a

For the year ended December 31, 2022, loss from discontinued operations includes remediation costs of $

21

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

There were no changes in, or disagreements with, accountants on accounting or financial disclosure as defined by Item 304 of Regulation S-K.

Item 9A. Controls and Procedures

Under the supervision of the Company’s management, including its principal executive officer and principal financial officer, the Company has evaluated the effectiveness of the design and operation of its disclosure controls and procedures (as defined in Rule 13a-15 under the Securities Exchange Act of 1934) as of the end of the period covered by this report. Based upon this evaluation, the principal executive officer and principal financial officer have concluded that, as of such date, the Company’s disclosure controls and procedures were effective in making them aware on a timely basis of the material information relating to the Company required to be included in the Company’s periodic filings with the Securities and Exchange Commission.

Management's Annual Report on Internal Control over Financial Reporting

The Company’s management is responsible for establishing and maintaining adequate internal control over financial reporting (as such term is defined in Rules 13a-15(f) and 15d-15(f) under the Exchange Act). The Company’s internal control over financial reporting is designed to provide reasonable assurance regarding the reliability of its financial reporting and the preparation of published financial statements in accordance with United States generally accepted accounting principles.

However, because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Therefore, even those systems determined to be effective can provide only reasonable assurance with respect to financial statement preparation and presentation. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or the degree of compliance with policies may deteriorate.

Management conducted its evaluation of the effectiveness of its internal control over financial reporting based on the framework in “2013 Internal Control-Integrated Framework” issued by the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”) as of December 31, 2022.

Based on this assessment, the principal executive officer and principal financial officer believe that as of December 31, 2022, the Company’s internal control over financial reporting was effective based on criteria set forth by COSO in “2013 Internal Control-Integrated Framework.”

This annual report does not include an attestation report of the Company’s independent registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by the Company’s independent registered public accounting firm pursuant to rules of the Securities and Exchange Commission that permit the Company to provide only management’s report in this annual report.

Changes in Internal Control over Financial Reporting

During the quarter ended December 31, 2022, there has been no change in the Company’s internal control over financial reporting (as defined in Rule 13a-15(f) and 15d-15(f) under the Exchange Act) that has materially affected, or is reasonably likely to materially affect, the Company’s internal control over financial reporting.

Item 9B. Other Information

None.

Item 9C. Disclosures Regarding Foreign Jurisdictions That Prevent Inspections

Not applicable.

22

PART III

Item 10. Directors, Executive Officers and Corporate Governance

The information concerning directors required by this item, including the Audit Committee and the Audit Committee financial expert, is incorporated by reference to the Sections entitled “Election of Directors,” “Section 16(a) Beneficial Ownership Reporting Compliance,” “Security Ownership of Certain Beneficial Owners and Management” and “Audit Committee Report” in the Company’s Definitive Proxy for the 2023 Annual Meeting of Shareholders to be filed with the SEC.

The following are the executive officers of the Registrant:

Name |

|

Age |

|

Office Held at Capital |

|

Date of First Election to Office |

Robert H. Eder |

|

90 |

|

Chairman/President |

|

1995 |

Susan R. Johnson |

|

63 |

|

Treasurer |

|

2017 |

Stephen J. Carlotti |

|

80 |

|

Secretary |

|

1998 |

All officers hold their respective offices until their successors are duly elected and qualified. Mr. Carlotti is a partner in the law firm, Hinckley, Allen & Snyder LLP, which firm provides legal services to the Company.

Code of Ethics:

The Company has adopted a Code of Ethics which applies to all directors, officers and employees of the Company and its subsidiary including the Principal Executive Officer and the Treasurer (who is both the principal accounting and financial officer), which meets the requirement of a “code of ethics” as defined in Item 406 of Regulation S-K. The Company will provide a copy of the Code to shareholders pursuant to any request directed to the Treasurer at the Company’s principal offices. The Company intends to disclose any amendments to, or waiver of, any provisions of the Code for the Principal Executive Officer or Treasurer, or any person performing similar functions.

The additional information required by this item is incorporated by reference to the Section entitled “Corporate Governance” in the Company’s Definitive Proxy Statement for the 2023 Annual Meeting of Shareholders to be filed with the Securities and Exchange Commission.

Item 11. Executive Compensation

The information required by this item is incorporated by reference to the Sections entitled “Compensation of Directors,” “Compensation Discussion and Analysis,” and “Executive Compensation” in the Company’s Definitive Proxy Statement for the 2023 Annual Meeting of Shareholders to be filed with the Securities and Exchange Commission.

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

The information required by this item is incorporated by reference to the Section entitled “Security Ownership of Certain Beneficial Owners and Management” in the Company’s Definitive Proxy Statement for the 2023 Annual Meeting of Shareholders to be filed with the Securities and Exchange Commission.

The information required by this item is incorporated by reference to the Sections entitled “Election of Directors” and “Transactions with Management” in the Company’s Definitive Proxy Statement for the 2023 Annual Meeting of Shareholders to be filed with the Securities and Exchange Commission.

Item 14. Principal Accountant Fees and Services

The information required by this item is incorporated by reference to the Section entitled “Independent Registered Public Accountants” in the Company’s Definitive Proxy Statement for the 2023 Annual Meeting of Shareholders to be filed with the Securities and Exchange Commission.

23

PART IV

Item 15. Exhibits and Financial Statement Schedules

2.1 |

|

|||

|

|

|

||

3.1 |

|

|||

|

|

|

||

3.2 |

|

|||

|

|

|

||

10 |

|

|||

|

Lease between Metropark, Ltd. and Company: |

|||

|

|

|||

|

|

|||

|

|

|

||

20 |

|

Map of the Company's parcels in Downtown Providence, Rhode Island |

||

|

|

|

||

21 |

|

|||

|

|

|

||

31.1 |

|

Rule 13a-14(a) Certification of Chairman and Principal Executive Officer |

||

|

|

|

||

31.2 |

|

Rule 13a-14(a) Certification of Treasurer and Principal Financial Officer |

||

|

|

|

||

32.1 |

|

|||

|

|

|

||

32.2 |

|

|||

|

|

|

||

101 |

|

The following financial information from the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, filed with the Securities and Exchange Commission on February 17, 2023, formatted in eXtensible Business Reporting Language: |

||

|

|

|

||

|

|

|

||

|

(i) |

Consolidated Balance Sheets as of December 31, 2022 and 2021 |

||

|

|

|

||

|

(ii) |

Consolidated Statements of Income and Retained Earnings for the Years ended December 31, 2022 and 2021 |

||

|

|

|

||

|

(iii) |

Consolidated Statements of Cash Flows for the Years ended December 31, 2022 and 2021 |

||

|

|

|

||

|

(iv) |

Notes to Consolidated Financial Statements. |

||

|

|

|

||

104 |

|

The cover page from the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 has been formatted in Inline XBRL. |

||

|

|

|

||

|

|

|

||

|

|

|

||

* Pursuant to Item 601(b)(2) of Regulation S-K promulgated by the SEC, certain schedules to the Asset Purchase Agreement have been omitted. The registrant hereby agrees to furnish supplementally to the SEC, upon its request, any or all omitted schedules.

24

SIGNATURES

In accordance with the requirements of the Exchange Act, the Issuer caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

CAPITAL PROPERTIES, INC. |

|

|

|

By |

/s/ Robert H. Eder |

|

Robert H. Eder |

|

Chairman/President and Principal Executive Officer |

DATED: February 17, 2023

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed by the following persons on behalf of the Company and on the dates indicated.

/s/ Robert H. Eder |

|

February 17, 2023 |

Robert H. Eder |

|

|

Chairman/President, Director and |

|

|

Principal Executive Officer |

|

|

|

|

|

/s/ Susan R. Johnson |

|

February 17, 2023 |

Susan R. Johnson |

|

|

Treasurer, Principal Financial Officer |

|

|

and Principal Accounting Officer |

|

|

|

|

|

/s/ Daniel T. Noreck |

|

February 17, 2023 |

Daniel T. Noreck |

|

|

Director |

|

|

|

|

|

/s/ Steven G. Triedman |

|

February 17, 2023 |

Steven G. Triedman |

|

|

Director |

|

|

25

Exhibit 21

Capital Properties, Inc. and Subsidiary

Subsidiary of the Company

Subsidiary |

|

State of Incorporation or Formation |

|

|

|

|

|

|

Tri-State Displays, Inc. |

|

Rhode Island |

|

|

|

Exhibit 31.1

CAPITAL PROPERTIES, INC. AND SUBSIDIARY

Certification Pursuant to

Section 302 of the Sarbanes-Oxley Act of 2002

I, Robert H. Eder, certify that:

Date: February 17, 2023 |

|

/s/ Robert H. Eder |

Robert H. Eder |

Chairman/President and Principal Executive Officer |

Exhibit 31.2

CAPITAL PROPERTIES, INC. AND SUBSIDIARIES

Certification Pursuant to

Section 302 of the Sarbanes-Oxley Act of 2002

I, Susan R. Johnson, certify that:

Date: February 17, 2023 |

|

/s/ Susan R. Johnson |

Susan R. Johnson |

Treasurer and Principal Financial Officer |

Exhibit 32.1

CAPITAL PROPERTIES, INC. AND SUBSIDIARY

Certification Pursuant to

18 U.S.C. Section 1350,