UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[X] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material Pursuant to § 240.14a-12

|

CHYRON CORPORATION

|

|

(Name of Registrant as Specified In Its Charter)

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate Number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

(5)

|

Total fee paid:

|

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

(3)

|

Filing Party:

|

|

|

(4)

|

Date Filed:

|

CHYRON CORPORATION

5 Hub Drive

Melville, New York 11747

(631) 845-2000

March 24, 2011

Dear Shareholders:

On behalf of the Board of Directors and management of Chyron Corporation (the “Company”), I cordially invite you to attend the 2011 Annual Meeting of Shareholders (the “Annual Meeting”) to be held on Tuesday, May 10, 2011, at 9:30 a.m., at Chyron Corporation, 5 Hub Drive, Melville, NY 11747.

The matters to be acted upon at the Annual Meeting are described in the Important Notice Regarding the Availability of Proxy Materials (the “Notice”) being sent to you electronically or by mail on or about the date hereof and in the Notice of Annual Meeting included with this Proxy Statement. In addition, the executive officers of the Company will review major developments here at Chyron, and they, the directors and the Company’s independent registered public accountants will be present to respond to appropriate questions that you may have.

Again this year we have provided access to our proxy materials over the Internet under the Securities and Exchange Commission’s “notice and access” rules. We have also made available the Company’s Annual Report on Form 10-K for the year ended December 31, 2010, which describes the financial and operational activities of the Company. We are constantly focused on improving the ways people connect with information and believe that providing our proxy materials over the Internet increases the ability of our shareholders to connect with the information they need, while reducing the environmental impact of our Annual Meeting. If you want more information, please see the “General Information Concerning the Annual Meeting” section of this Proxy Statement.

Whether or not you plan to attend the Annual Meeting, it is important that you cast your vote. Voting instructions appear within this Proxy Statement as well as in the proxy card or Notice you received. Please vote as soon as possible. Representation in person or by proxy of at least a majority of all outstanding shares of the Company’s Common Stock entitled to vote at the Annual Meeting is required to constitute a quorum.

We look forward to greeting our shareholders at the Annual Meeting.

|

Sincerely,

|

|

|

/s/ Michael Wellesley-Wesley

|

|

|

Michael Wellesley-Wesley

|

|

|

President, Chief Executive

|

|

|

Officer and Director

|

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE VOTE AS SOON AS POSSIBLE SO AS TO ENSURE A QUORUM AT THE MEETING.

CHYRON CORPORATION

5 Hub Drive

Melville, New York 11747

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 10, 2011

March 24, 2011

To the Shareholders of Chyron Corporation:

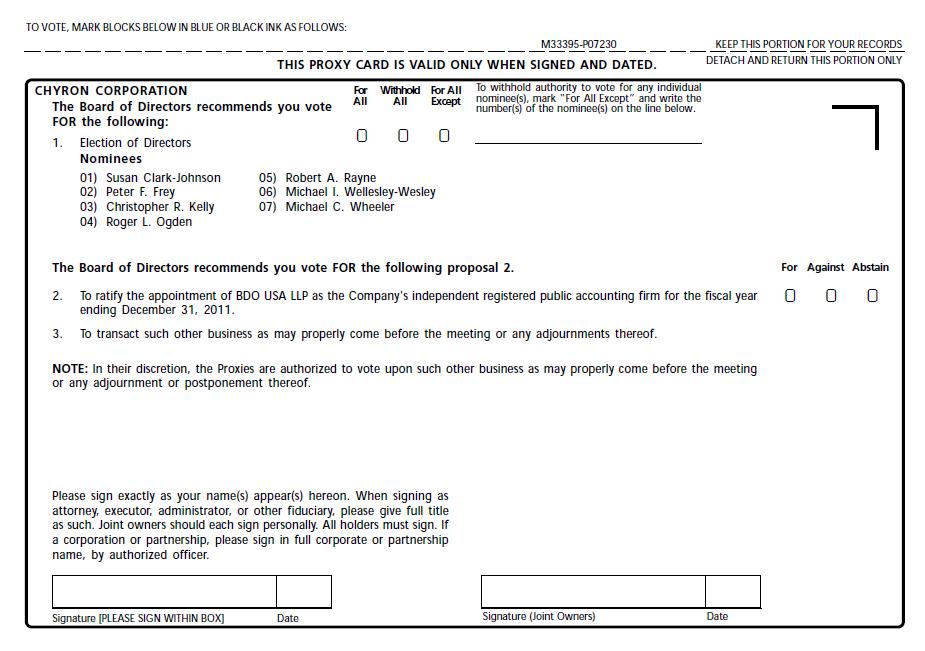

NOTICE IS HEREBY GIVEN that the 2011 Annual Meeting of Shareholders (the “Annual Meeting”) of Chyron Corporation, a New York corporation (hereinafter the “Company”), will be held at Chyron Corporation, 5 Hub Drive, Melville, NY 11747 on Tuesday, May 10, 2011 at 9:30 a.m. for the following purposes, each of which are more fully described in the attached Proxy Statement:

|

1.

|

To elect seven (7) directors of the Company to hold office until the next Annual Meeting or until their respective successors are duly elected and qualified, or until their earlier death, resignation or removal;

|

|

2.

|

To ratify the appointment of BDO USA, LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2011; and

|

|

3.

|

To transact such other business as may properly come before the Annual Meeting or any adjournments thereof.

|

The Board of Directors has fixed the close of business on March 22, 2011 as the record date for the determination of shareholders entitled to notice of, and to vote at, the Annual Meeting or any adjournments thereof. Representation in person or by proxy of at least a majority of all outstanding shares of Common Stock on the record date entitled to vote at the Annual Meeting is required to constitute a quorum. Accordingly, it is important that your stock be represented at the Annual Meeting. The list of shareholders entitled to vote at the Annual Meeting will be available for examination by any shareholder at the Company’s offices at 5 Hub Drive, Melville, New York, 11747, for the 10 calendar days immediately preceding May 10, 2011.

Whether or not you plan to attend the Annual Meeting, please vote by following the instructions on your Important Notice Regarding the Availability of Proxy Materials you received electronically or by mail, the section entitled “Information Concerning Vote - How Do I Vote?” of this Proxy Statement or, if you requested to receive printed proxy materials, your enclosed proxy card. You may change or revoke your proxy at any time before it is voted.

|

By Order of the Board of Directors,

|

|

|

/s/ Jerry Kieliszak

|

|

|

Jerry Kieliszak

|

|

|

Secretary

|

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 2011 ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 10, 2011

The Company’s Proxy Statement for the 2011 Annual Meeting of Shareholders and the Annual Report on Form 10-K for the fiscal year ended December 31, 2010, are available at www.proxyvote.com. To view these materials please have your 12-digit control number(s) available. The control number appears on your proxy card/notice.

|

CHYRON CORPORATION

TABLE OF CONTENTS

|

Page

|

|

|

GENERAL INFORMATION CONCERNING THE ANNUAL MEETING

|

1

|

|

PROPOSAL 1 - ELECTION OF DIRECTORS

|

7

|

|

COMPENSATION COMMITTEE REPORT

|

13

|

|

COMPENSATION DISCUSSION AND ANALYSIS

|

14

|

|

EXECUTIVE COMPENSATION

|

18

|

|

DIRECTOR COMPENSATION

|

34

|

|

INDEMNIFICATION OF DIRECTORS AND OFFICERS

|

35

|

|

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

|

36

|

|

EQUITY COMPENSATION PLAN INFORMATION

|

36

|

|

AUDIT COMMITTEE REPORT

|

37

|

|

PROPOSAL 2 - RATIFICATION OF THE APPOINTMENT OF INDEPENDENT

|

|

|

REGISTERED PUBLIC ACCOUNTING FIRM

|

38

|

|

PRINCIPAL SHAREHOLDERS

|

40

|

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

|

42

|

|

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

|

42

|

|

OTHER MATTERS ARISING AT THE ANNUAL MEETING

|

43

|

|

SHAREHOLDER PROPOSALS

|

43

|

|

ANNUAL REPORT ON FORM 10-K

|

43

|

CHYRON CORPORATION

5 Hub Drive

Melville, New York 11747

(631) 845-2000

PROXY STATEMENT

For Annual Meeting of Shareholders to be Held on May 10, 2011

GENERAL INFORMATION CONCERNING THE ANNUAL MEETING

Why am I Receiving These Materials?

We have made these materials available to you on the Internet, or, upon your request, delivered printed versions of these materials in connection with the solicitation of proxies by the Board of Directors of Chyron Corporation, a New York corporation (the “Company”), for use at the Annual Meeting of Shareholders to be held on Tuesday, May 10, 2011, at 9:30 a.m. and at any and all adjournments thereof (the “Annual Meeting”), with respect to the matters referred to in the accompanying notice. The Annual Meeting will be held at Chyron Corporation, 5 Hub Drive, Melville, NY 11747. We plan on sending the Important Notice Regarding the Availability of Proxy Materials (the “Notice”) to all shareholders entitled to vote at the Annual Meeting on or about March 24, 2011. Although not part of this Proxy Statement, we have also made available with this Proxy Statement our Annual Report on Form 10-K for the year ended December 31, 2010 for the fiscal year ended December 31, 2010.

Important Message About Voting Your Shares

If you hold your shares in street name, it is critical that you cast your vote if you want your vote to be counted for Proposal 1 of this Proxy Statement for the election of directors. If you hold your shares in street name and you do not instruct your bank, broker or other holder of record how to vote on your behalf in the election of directors, no votes will be cast on Proposal 1 on your behalf. Your bank, broker or other holder of record will, however, continue to have discretion to vote any uninstructed shares on the ratification of the appointment of the Company’s independent registered public accounting firm (Proposal 2 of this Proxy Statement).

If you are a registered shareholder (shareholder of record) and you do not cast your vote, no votes will be cast on your behalf on any of the items of business at the Annual Meeting.

Why did I receive a notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials?

In accordance with rules adopted by the Securities and Exchange Commission (the “SEC”), we may furnish proxy materials, including this Proxy Statement and our Annual Report on Form 10-K, to our shareholders by providing access to such documents on the Internet instead of mailing printed copies. Most shareholders will not receive printed copies of the proxy materials unless they request them. Instead, the Notice, which was provided electronically or by mail to most of our shareholders, will instruct you how you may access and review all of the proxy materials on the Internet. The Notice also instructs you how you may submit your proxy on the Internet. If you would like to receive a paper or email copy of our proxy materials, you should follow the instructions for requesting such materials in the Notice.

1

Who Can Vote?

Only shareholders of record at the close of business on March 22, 2011 are entitled to notice of and to vote at the Annual Meeting. At the close of business on March 22, 2011, 16,221,704 shares of common stock, par value $.01 per share (the “Common Stock”), of the Company were issued and outstanding. This is our only class of voting stock. Each share of Common Stock entitles the record holder thereof to one vote on all matters properly brought before the Annual Meeting.

You do not need to attend the Annual Meeting to vote your shares. Shares represented by valid proxies, received in time for the Annual Meeting and not revoked prior to the Annual Meeting, will be voted at the Annual Meeting. For instructions on how to change or revoke your proxy, see “May I Change or Revoke My Proxy?” below.

How Do I Vote?

Whether you plan to attend the Annual Meeting or not, we urge you to vote by proxy. All shares represented by valid proxies that we receive through this solicitation, and that are not revoked, will be voted in accordance with your instructions on the proxy card or as instructed via Internet or telephone. You may specify whether your shares should be voted for all, some or none of the nominees for director or withheld from all or any one of the nominees for director and whether your shares should be voted for, against or abstain with respect to each of the other proposals. If you properly submit a proxy without giving specific instructions, your shares will be voted in accordance with the Board’s recommendations, as noted below. Voting by proxy will not affect your right to attend the Annual Meeting.

If you are a registered shareholder (shareholder of record) and:

|

·

|

you received a proxy card by mail, you may vote your shares in one of four ways:

|

|

·

|

Vote by mail by marking, signing and dating your proxy card and returning it in the business reply envelope provided and return it to Chyron Corporation, c/o Broadridge, 51 Mercedes Way, Edgewood, NY, USA 11717; or

|

|

·

|

Vote via the Internet by going to www.proxyvote.com, have your vote instruction form in hand, and follow the simple instructions. (When voting online, you may also give your consent to have all future proxy materials delivered to you electronically); or

|

|

·

|

Vote via telephone by calling, toll-free, 1-800-690-6903 and have your vote instruction form in hand and follow the recorded instructions; or

|

|

·

|

Attend and vote at the Annual Meeting in person.

|

|

·

|

you are enrolled in the electronic delivery program and/or received a Notice, you may vote your shares in one of three ways:

|

|

·

|

via the Internet (see instructions above); or

|

|

·

|

attend and vote at the Annual Meeting in person; or

|

|

·

|

if you request to receive a paper copy of the proxy materials, you can vote by mail (see instructions above).

|

Please note, voting via the Internet and telephone will only be available until 11:59 p.m. Eastern Time on May 9, 2011, the day prior to the Annual Meeting.

2

If your shares are held in street name, your broker, bank or other holder of record will provide you with a voting instruction card so you can instruct them how to vote your shares. As an alternative to submitting your voting instructions by mail, you may be able to submit your voting instructions via the Internet or by telephone. Please refer to the voting instruction card for more information about how to vote your street name shares. If your shares are held in street name, you are not a shareholder of record of those shares and you may not vote them in person at the Annual Meeting unless you have a legal proxy from the holder of record, which you should obtain from the holder of record and bring with you to the Annual Meeting.

How Does the Board of Directors Recommend That I Vote on the Proposals?

The Company’s Board of Directors recommends that you vote as follows:

|

·

|

“FOR” the election of the nominees for director;

|

|

·

|

“FOR” the ratification of the selection of our independent registered public accounting firm for the fiscal year ending December 31, 2011.

|

If any other matter is presented at the Annual Meeting, your proxy provides that your shares will be voted by the proxy holder listing in the proxy card in accordance with his best judgment. At the time this Proxy Statement was first made available, we knew of no matters that needed to be acted on at the Annual Meeting, other than those described in this Proxy Statement.

May I Change or Revoke My Proxy?

If you give us your proxy, you may change your vote or revoke your proxy at any time prior to the polling of votes at the Annual Meeting as follows:

For registered shareholders, if you voted by proxy card, you may revoke such proxy by notice in writing to the Secretary of the Company, or change your vote by signing another later dated proxy card and sending it to the Secretary of the Company, at the above address. If you voted by Internet or telephone, you may change your vote by voting again by Internet or telephone prior to the Annual Meeting. Alternatively, you may revoke your proxy or change your vote by attending the Annual Meeting and voting in person prior to the polling of votes.

For shares held in street name, you should contact your broker, bank or other nominee about revoking your proxy and changing your vote prior to the Annual Meeting.

Your most current proxy card or telephone or Internet vote is the one that will be counted.

What if I Receive More Than One Notice or Proxy Card?

You may receive more than one Notice or proxy card or voting instruction form if you hold shares of our common stock in more than one account, which may be in registered form or held in street name. Please vote in the manner described under “How Do I Vote?” for each account to ensure that all of your shares are voted.

3

Will My Shares be Voted if I Do Not Vote?

If you are a registered shareholder, your shares will not be voted if you do not vote as described above under “How Do I Vote?”. If your shares are held in street name and you do not provide voting instructions to the broker, bank, or other holder of record that holds your shares as described above under “How Do I Vote?”, the broker, bank or other holder of record has the authority to vote your unvoted shares on the proposal for the ratification of the independent registered public accounting firm even if it does not receive instructions from you, but cannot vote for you on the proposal for the election of the nominees for director. Therefore, we encourage you to provide voting instructions. This ensures your shares will be voted at the Annual Meeting in the manner you desire. If your broker cannot vote your shares on a particular matter because it has not received instructions from you and does not have discretionary voting authority on that matter or because your broker chooses not to vote on a matter for which it does have discretionary voting authority, this is referred to as a “broker non-vote.”

Your bank, broker or other nominee no longer has the ability to vote your uninstructed shares in the election of directors. Therefore, if you hold your shares in street name, it is critical that you cast your vote if you want your vote to be counted for the election of directors (Proposal 1) of this Proxy Statement. In the past, if you held your shares in street name and you did not indicate how you wanted your shares voted in the election of directors, your bank, broker or other nominee was allowed to vote your shares on your behalf in the election of directors as it felt appropriate. Thus, if you hold your shares in street name and you do not instruct your bank, broker or other nominee how to vote in the election of directors, no votes will be cast on this proposal on your behalf.

Voting Procedures

All votes will be tabulated by the inspector of elections appointed for the Annual Meeting who shall separately tabulate affirmative and negative votes, withheld votes, abstentions and, if applicable, any broker non-votes.

What Constitutes a Quorum for the Annual Meeting?

The presence, in person or by proxy, of the holders of a majority of all outstanding shares of common stock entitled to vote at the Annual Meeting is necessary to constitute a quorum. Votes of shareholders of record who are present at the Annual Meeting, in person or by proxy, abstentions and any broker non-votes will be counted in determining whether a quorum exists.

What Vote is Required to Approve Each Proposal and How are Votes Counted?

|

Proposal 1 – Election of Directors

|

The nominees for director who receive the most votes (also known as a “plurality” of the votes cast) will be elected. You may vote either FOR all of the nominees, WITHHOLD your vote from all of the nominees or WITHHOLD your vote from any one or more of the nominees. Votes that are withheld will not be included in the vote tally for the election of directors. Brokerage firms do not have the authority to vote customers’ unvoted shares held by the firms in street name for the election of directors. As a result, any shares not voted by a customer will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote.

|

4

|

Proposal 2 – Ratification of the Appointment of Independent Registered Public Accounting Firm

|

The affirmative vote of the majority of the votes cast affirmatively or negatively for this proposal is required to ratify the selection of our independent registered public accounting firm. Abstentions will have no effect on the results of this vote. Brokerage firms have authority to vote customers’ unvoted shares held by the firms in street name on this proposal. If a broker does not exercise this authority, such broker non-votes will have no effect on the results of this vote. We are not required to obtain the approval of our shareholders to select our independent registered public accounting firm. However, if our shareholders do not ratify the selection of BDO USA, LLP as our independent registered public accounting firm for 2011, our Audit Committee of our Board of Directors will reconsider its selection.

|

In their best judgment, the proxies, Messrs. Michael Wellesley-Wesley and Roger Ogden, are authorized to consider and vote upon such matters incident to the conduct of the Annual Meeting and upon such other business matters or proposals as may properly come before the Annual Meeting that the Board of Directors of the Company does not know within a reasonable time prior to this solicitation will be presented at the Annual Meeting. At the time this Proxy Statement was made publicly available, we knew of no matters that needed to be acted on at the Annual Meeting, other than those discussed in this Proxy Statement.

We will keep all the proxies, ballots and voting tabulations private. We only let our Inspectors of Election, Broadridge Financial Services, Inc., examine these documents. Management will not know how you voted on a specific proposal unless it is necessary to meet legal requirements. We will, however, forward to management any written comments you make, on the proxy card or elsewhere.

Under the New York Business Corporation Law, shareholders are not entitled to dissenter’s rights of appraisal with respect to any matters to be considered and voted on at the Annual Meeting, and the Company will not independently provide shareholders with any such right.

Costs of Solicitation of Proxies

We will pay all of the costs of soliciting these proxies. Our directors and employees may solicit proxies in person or by telephone or fax. We may also solicit proxies by email from shareholders who are our employees or who previously requested to receive proxy materials electronically. We will pay our employees and directors no additional compensation for these services. We will ask banks, brokers and other nominees to forward these proxy materials to their principals and to obtain authority to execute proxies. We will then reimburse them for their expenses.

Householding of Annual Disclosure Documents

The Company has adopted a procedure regarding the delivery of annual disclosure documents termed “Householding,” as it is permitted to do by the SEC. Under this procedure a single copy of the Notice and, if applicable, the Annual Report and Proxy Statement, is sent to any address at which two or more shareholders reside if it appears that they are members of the same family, or, with their prior express or implied consent. By utilizing householding, the Company saves on printing, mailing and processing costs in connection with its solicitation of proxies. Shareholders who participate in householding will continue to be able to access and receive separate proxy cards. If a single copy of the Notice, and if applicable, the Annual Report and Proxy Statement, was delivered to your address that you share with another shareholder and you wish to receive a separate copy at no charge, please contact Broadridge Financial Services, Inc., the Company’s proxy services provider, via the Internet at

5

www.proxyvote.com, by calling toll-free 1-800-579-1639 or via email (send a blank email with your 12-digit control number, located on your proxy notice, in the subject line to this email address: sendmaterial@proxyvote.com).

If you are a registered shareholder and share an address and last name with one or more other registered shareholders and you wish to continue to receive separate Notices and, if applicable, Annual Reports and Proxy Statements, you may revoke your consent to householding by writing to Broadridge Financial Services, Inc., Householding Department, 51 Mercedes Way, Edgewood, N.Y. 11717 or by calling toll-free 1-800-542-1061 and following the voice prompts. You will be removed from the householding program within 30 days of receipt of the revocation of your consent.

If you are receiving more than one copy of the Notice and, if applicable, the Annual Report and Proxy Statement, at the address you share with one or more other registered shareholders, you may elect to participate in the householding program by writing to Broadridge Financial Services, Inc., Householding Department, 51 Mercedes Way, Edgewood, N.Y. 11717.

If your shares are held in street name, please contact your bank, broker or other holder of record to request information about householding.

Electronic Access and Delivery

The Notice will provide you with instructions regarding how to view our proxy materials for the Annual Meeting on the Internet and instruct us to send our future proxy materials to you electronically by email.

Choosing to receive your future proxy materials by email will save us the cost of printing and mailing documents to you and will reduce the impact of printing and mailing these materials on the environment. If you choose to receive future proxy materials by email, you will receive an email next year with instructions containing a link to those materials and a link to the proxy voting site. Your election to receive proxy materials by email will remain in effect until you terminate it.

Registered shareholders who receive a printed Annual Report, Proxy Statement and proxy materials in the mail may sign up for electronic delivery instead by going to www.proxyvote.com. If you vote through the Internet, you may also elect electronic delivery by following the instructions that appear after you have voted. Street name shareholders may also have the opportunity to receive copies of these documents electronically. Please check the information provided in the proxy materials mailed to you by your bank, broker or other nominee regarding the availability of electronic delivery.

If you are enrolled in electronic delivery but you nonetheless wish to receive a printed Annual Report and Proxy Statement, you may request one at no charge by contacting Broadridge via the Internet at www.proxyvote.com, by calling toll-free 1-800-579-1639 or via email (send a blank email with your 12-digit control number, located on your proxy notice, in the subject line to this email address: sendmaterial@proxyvote.com).

6

PROPOSAL 1 - ELECTION OF DIRECTORS

Upon recommendation of the Corporate Governance and Nominating Committee, the Board of Directors has nominated the seven persons listed below to be elected as directors at the Annual Meeting and to hold office until the next Annual Meeting or until their respective successors have been duly elected and qualified, or until their earlier death, resignation or removal. It is intended that each proxy received by the Company will be voted FOR the election, as directors of the Company, of the nominees listed below, unless authority is withheld by the shareholder executing such proxy. Shares may not be voted cumulatively. A plurality of the votes cast at the Annual Meeting is required to elect each nominee as a director. Each of such nominees has consented to being nominated and to serve as a director of the Company if elected. If any nominee should become unavailable for election or unable to serve, it is intended that the proxies will be voted for a substitute nominee designated by the Board of Directors. At the present time, the Board of Directors knows of no reason why any nominee might be unavailable for election or unable to serve. The proxies cannot be voted for a greater number of persons than the number of nominees named herein.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THIS PROPOSAL.

PROXIES SOLICITED BY THE BOARD WILL BE VOTED IN FAVOR OF THIS PROPOSAL UNLESS A SHAREHOLDER INDICATES OTHERWISE ON THE PROXY.

Director Nominees

On March 16, 2011, our Board of Directors voted to nominate each of the individuals listed below for election at the Annual Meeting for a term to serve until the next Annual Meeting or until their respective successors have been duly elected and qualified, or until their earlier death, resignation or removal. The following table sets forth certain information with respect to the nominees for director:

|

Director of the

|

||

|

Name

|

Company Position and Offices Held

|

Company Since

|

|

Susan Clark-Johnson

|

Director, Member of the Audit Committee and

|

March 2010

|

|

Member of the Compensation Committee

|

||

|

Peter F. Frey

|

Director, Chairman of the Audit Committee

|

May 2008

|

|

Christopher R. Kelly

|

Director, Member of the Compensation

|

August 1999

|

|

Committee, Chairman of the Corporate

|

||

|

Governance and Nominating Committee

|

||

|

Roger L. Ogden

|

Chairman of the Board of Directors,

|

May 2008

|

|

Member of the Audit Committee and Chairman

|

||

|

of the Compensation Committee

|

||

|

Robert A. Rayne

|

Director, Member of the Corporate Governance

|

May 2008

|

|

and Nominating Committee

|

||

|

Michael I. Wellesley-Wesley

|

President, Chief Executive Officer and Director

|

May 1995

|

|

Michael C. Wheeler

|

Director

|

February 2006

|

7

Set forth below are the names of the persons nominated as directors, their ages, their offices in the Company, if any, their principal occupations or employment for the past five years, their specific experience, qualifications, attributes, skills or other areas of expertise that they possess that is relevant to their service as a director, and the names of other public companies in which such persons hold, or in the past five years have held, directorships.

Susan Clark-Johnson, age 64, has served as Executive Director of the Morrison Institute for Public Policy at Arizona State University since May 2009. She served as President of the Gannett Newspaper Division of Gannett Co., Inc., a publicly traded company, from September 2005 until her retirement in May 2008. From August 2000 until September 2005, she was Chairman and CEO of Phoenix Newspapers, Inc. The Board selected Ms. Clark-Johnson to serve as a director because it believes she brings a breadth of operational and managerial experience, both domestically and internationally, in the newspaper industry. Ms. Clark-Johnson currently serves as a member of the board of directors of Pinnacle West Capital Corporation, a publicly-traded holding company which, through its affiliates, provides energy and energy-related products to customers in Arizona and conducts real estate development and investment activities in the western United States.

Peter F. Frey, age 51, is a private investor and a retired partner of TRG Management, an emerging markets asset management/hedge fund business, where he was responsible for sales, marketing and product development from March 2003 until he retired in June 2007. Prior to this he spent more than 17 years at JP Morgan, mostly in the Emerging Markets Group, where he held a series of increasingly significant positions including Global Head of Sales, was Managing Director from 1993 to 2001 and, during his last two years at JP Morgan, was Co-Head of U.S. Fixed Income Sales. The Board selected Mr. Frey to serve as a director because it believes he possesses extensive knowledge of the capital markets, and his experience in sales and marketing provides Company management with assistance in developing stronger customer relationships. He is a member of the board of trustees of Exit Art, a non-profit cultural organization in New York City, and is a member of Vassar College’s President’s Advisory Council.

Christopher R. Kelly, age 51, has been the owner of Fortuna Investments since 1997, where he specializes in private investments and venture capital. The Board selected Mr. Kelly to serve as a director because it believes he possesses valuable broadcast industry expertise, having served in senior management positions in broadcast companies for 17 years, and, as a private investor since 1997, brings extensive knowledge of the capital markets. He is currently a member of the board of directors of Epoll, a privately held online research company, Altrec, a privately held online retailer, and Thoughtful Media, a privately held entertainment marketing solutions company. He formerly served, until 2009, as a director of Ensequence, a privately held interactive television software and professional services company.

Roger L. Ogden, age 65, currently serves as an independent consultant to several broadcast related companies. From August 1997 to July 2005 he served as President and General Manager of KUSA Television in Denver, Colorado where he had overall management responsibility for this local NBC affiliate station, and as a Senior Vice President of the Gannett Television Division of Gannett Co., Inc. From July 2005 until his retirement in July 2007, he was President and CEO of the Gannett Television Division, where he had overall responsibility for 23 television stations owned by Gannett and also served as Senior Vice President of Design, Innovation and Strategy for Gannett Co., Inc., encouraging development of new business ideas and improved processes, from June 2006 until July 2007. The Board selected Mr. Ogden to serve as a director, and since October 2008 as Chairman of the Board, due to his extensive experience in the broadcast industry for 35 years, including top leadership positions at major companies including NBC, General Electric and Gannett; his international experience including President of NBC/CNBC Europe for two years; and his experience as a current director and chairman of the compensation committee of the board of directors at E.W. Scripps Company, a publicly traded media

8

company with interests in newspaper publishing, broadcast television stations, and licensing and syndication.

Robert A. Rayne, age 62, having been the Chief Executive Officer of LMS Capital plc, an international investment company, since June 2006, when the investment business of London Merchant Securities plc was demerged and LMS Capital was formed to hold this business, became Chairman in May 2010. Mr. Rayne was employed by London Merchant Securities from 1968 to February 2007 and served as its Chief Executive Officer from May 2001 to February 2007. The Board selected Mr. Rayne to serve as a director because it believes he possesses a wealth of experience as a director and investor in broadcasting and related businesses. He served for nine years as a director and then Chairman of the board of a U.K. radio station, was an investor and director of one of the major teleprompting companies in the U.K. and U.S., and was involved in the consortium that produced one of the U.K.’s first satellite companies in the early 1980’s prior to its acquisition. He is a member of the board of directors of the following publicly-traded companies: Weatherford International Inc., a provider of advanced products and services serving the oil well and gas industries; Derwent London plc, a leading central London, U.K. real estate investment trust, where he also serves as Non-Executive Chairman of the board; and LMS Capital plc. Until January 2007, he served as a director of London Merchant Securities Ltd (formerly plc), a publicly traded property and development company. Additionally, Mr. Rayne serves, and over the past five years has served, as a director of numerous privately held companies.

Michael I. Wellesley-Wesley, age 58, is the Company’s President and Chief Executive Officer, a position he has held since February 2003. Prior to this, he served as a consultant to the Company from July 2001. He formerly held the position of Chairman of the Board of Directors of the Company through February 2002 and previously served as Chief Executive Officer of the Company from July 1995 through June 1997. The Board selected Mr. Wellesley-Wesley to serve as a director because he is the Company’s President and Chief Executive Officer and has 15 years of experience as a director, Chairman and/or CEO of the Company and it believes he possesses extensive experience in television cable program networks and broadcast solutions. His past experience includes serving as a director of Financial News Network for seven years, Chief Operating Officer for Financial News Network, Infotechnology and United Press International for a combined two years, and a director of Data Broadcasting Corporation, a publicly held provider of financial information services, for three years, and was a Managing Director of Soundview Ventures for two years.

Michael C. Wheeler, age 61, has, since April 1999, served as Managing Partner of Westerly Partners, LLC, an investment advisory firm providing strategic, financial and technology solutions to early stage companies focused on new media and technology industries. The Board selected Mr. Wheeler to serve as a director because of his over forty years of experience, including senior management positions, at broadcast media and entertainment companies including CBS, NBC, Viacom and MTV. Mr. Wheeler serves as a director of Permission TV, a privately held online video platform company. He formerly served as a director at Firebrand Media Inc., a privately held multimedia programming company.

Board of Directors and Committees of the Board of Directors

The Board of Directors currently consists of seven directors, all of whom are standing for re-election at this year’s Annual Meeting of Shareholders. Six of the seven directors standing for re-election are “independent directors” as defined in the corporate governance rules of The NASDAQ Stock Market LLC (“NASDAQ”). Mr. Wellesley-Wesley, the Company’s Chief Executive Officer, does not meet that definition by virtue of his current employment with the Company. The Corporate Governance and Nominating Committee considered whether Mr. Wheeler qualifies as an independent director under NASDAQ rules, given his agreements with the Company in 2010, 2009 and 2008 as disclosed under

9

“Certain Relationships and Related Transactions” in this Proxy Statement, and concluded that he qualifies as an independent director because he did not receive in excess of $120,000 during any period of twelve consecutive months within the preceding three years for service other than as a director and because his agreements with the Company do not interfere with his exercise of independent judgment in carrying out his responsibilities as a director.

Attendance at Board and Shareholder Meetings

During 2010, the Board of Directors held five meetings and the various committees of the Board of Directors held a total of twelve meetings. Each director attended at least 75% of the meetings of the Board of Directors and the committees on which he or she served.

The Company’s directors and the nominees for director are planning to attend the Company’s Annual Meeting of shareholders, either in person or by telephone. Four members of our Board of Directors attended last year’s annual meeting.

Committees of the Board of Directors

The Board of Directors currently has a standing Compensation Committee, Audit Committee and Corporate Governance and Nominating Committee.

Compensation Committee. The current members of the Compensation Committee are Messrs. Ogden, who serves as Chairman, and Kelly, and Ms. Clark-Johnson, all of whom are independent directors under the corporate governance rules of NASDAQ. During 2010, the Compensation Committee held five meetings. The Compensation Committee is responsible for reviewing and making recommendations to the Board of Directors on all matters concerning the remuneration of the Company’s executive officers, including administering the Company’s 2008 Long-Term Incentive Plan and other compensation plans. In particular, the Compensation Committee is responsible for the determination of the compensation of our Chief Executive Officer, Chief Financial Officer and Chief Operating Officer. In meeting this responsibility, neither the Compensation Committee nor management relies on the services of compensation consultants. The charter of the Compensation Committee is posted on the Company’s website at www.chyron.com, click on Investors, and then click on Corporate Governance. Please also see the report of the Compensation Committee set forth elsewhere in this Proxy Statement.

Audit Committee. The current members of the Audit Committee are Messrs. Frey, who serves as Chairman, and Ogden, and Ms. Clark-Johnson. All of the Audit Committee members are qualified under the audit committee independence standards promulgated by NASDAQ and the SEC. The Audit Committee held six meetings during 2010. The Audit Committee is responsible for approval of the engagement of the Company’s independent registered public accountants and for: reviewing the financial reports and other financial related information released by the Company to the public, or in certain circumstances, governmental bodies; reviewing the Company’s system of internal controls regarding finance, accounting, business conduct and ethics and legal compliance that management and the Board have established; reviewing the Company’s accounting and financial reporting processes; reviewing and appraising with management the performance of the Company’s independent registered public accountants; and providing an open avenue of communication between the independent registered public accountants and the Board. The charter of the Audit Committee is posted on the Company’s website at www.chyron.com, click on Investors, and then click on Corporate Governance. Please also see the report of the Audit Committee set forth elsewhere in this Proxy Statement.

10

The Board of Directors has determined that Ms. Clark-Johnson and Messrs. Frey and Ogden meet the definition of “financially sophisticated” as required by the corporate governance rules of NASDAQ and that none of the Audit Committee members meet the definition of an “audit committee financial expert,” under the SEC rules. However, the Board of Directors has concluded that maintaining an audit committee without an “audit committee financial expert” is acceptable because the Board believes that the members of the Audit Committee possess the experience necessary to carry out the duties and responsibilities of the Audit Committee.

Corporate Governance and Nominating Committee. The current members of the Corporate Governance and Nominating Committee are Messrs. Kelly, who serves as Chairman, Rayne and Wheeler (who was appointed to the committee on March 16, 2011). All of the Corporate Governance and Nominating Committee members are independent directors under the corporate governance rules of NASDAQ. The Corporate Governance and Nominating Committee held one meeting during 2010. The Corporate Governance and Nominating Committee is responsible for reviewing and making recommendations to the Board regarding matters concerning corporate governance, reviewing the composition and evaluating the performance of the Board, recommending persons for election to the Board, evaluating director compensation, reviewing the composition of the committees of the Board and recommending persons to be members of such committees, reviewing and maintaining compliance of committee membership with applicable regulatory requirements, and reviewing conflicts of interest of members of the Board and corporate officers. The charter of the Corporate Governance and Nominating Committee is posted on the Company’s website at www.chyron.com, click on Investors, and then click on Corporate Governance.

Board Leadership Structure and Role in Risk Oversight

The Company has an independent director who serves as Chairman of the Board and a different individual who serves as Chief Executive Officer because it believes that separating these two roles provides a proper system of checks and balances over the duties and responsibilities of the two positions.

Management is responsible for managing the risks that we face. The Board of Directors is responsible for overseeing management’s approach to risk management that is designed to support the achievement of organizational objectives, including strategic objectives, to improve long-term organizational performance and enhance shareholder value. The involvement of the full Board of Directors in reviewing the Company’s strategic objectives and plans is a key part of the Board’s assessment of management’s approach and tolerance to risk. A fundamental part of risk management is not only understanding the risks a company faces and what steps management is taking to manage those risks, but also understanding what level of risk is appropriate for the Company. In setting the Company’s business strategy, the Board assesses the various risks being mitigated by management and determines what constitutes an appropriate level of risk for the Company.

While the Board has ultimate oversight responsibility for overseeing management’s risk management process, various committees of the Board assist it in fulfilling that responsibility. The Audit Committee assists the Board in its oversight of risk management in the areas of financial reporting, internal controls and compliance with legal and regulatory requirements; the Corporate Governance and Nominating Committee reviews legal and regulatory compliance risks; and the Compensation Committee assists the Board in its oversight of the evaluation and management of any risks related to the Company’s compensation policies and practices.

11

Procedures for Nominating Directors

In identifying and evaluating candidates to be nominated as directors, the Corporate Governance and Nominating Committee seeks individuals with stated relevant experience that can add to the ability of the Board of Directors to fulfill its fiduciary obligation. For all potential candidates, the Corporate Governance and Nominating Committee may consider all factors it deems relevant, such as a candidate’s personal integrity and sound judgment, business and professional skills and experience, independence, knowledge of the industry in which the Company operates, possible conflicts of interest, diversity, the extent to which the candidate would fill a present need on the Board, and concern for the long-term interests of the shareholders. With respect to evaluating and recommending persons for election to the Board, the Company does not have a formal diversity policy. However, while there is not a formal policy, the Corporate Governance and Nominating Committee and other members of the Board of Directors each evaluate a candidate’s experience or expertise, particularly related to industries which the Company sells to or plans to sell to, educational background, ethnicity, gender, demonstrated business acumen, experience serving on other boards, and other factors that, in their opinion, are relevant to the selection process.

The Board of Directors may consider candidates nominated by shareholders as well as from other sources, such as other directors or officers, third party search firms or other appropriate sources. A shareholder who wishes to nominate a director must submit a nomination in writing to the Company’s Chairman of the Board, with a copy to the Company’s President and CEO, at Chyron Corporation, 5 Hub Drive, Melville, NY 11747, by December 3, 2011. In general, persons recommended by shareholders will be considered on the same basis as candidates from other sources. Such nominee must meet the standards set forth above and there must be a vacancy on the Board of Directors. The Company has not received any recommended nominees from a security holder or group of security holders that beneficially own more than 5% of the Company’s voting Common Stock. The Company does not pay any third party a fee to assist in the process nor in identifying and evaluating candidates.

Shareholder Communications with the Board

Shareholders who have questions or concerns should contact the Company’s Investor Relations contact, KCSA Strategic Communications, by telephone at (212) 682-6300 or by email by going to our website www.chyron.com and clicking on Investors, and then clicking on Investor Contact. Additionally, the Company has a process in place to facilitate shareholder communications to our Board of Directors. To send an email to an individual director or all of the directors as a group, please go to the Company’s website at www.chyron.com, click on Investors then Corporate Governance, and then click on Contact the Board. You will be asked to provide your contact information and your comments, to select the individual director or the entire group of directors for your communication to be sent to, and then click submit. The Chyron Corporation Board of Directors has requested that certain items which are unrelated to the duties and responsibilities of the Board be excluded from communications to the Board, such as: product complaints; product inquiries; new product suggestions; resumes and other forms of job inquiries; surveys; and, business solicitations or advertisements.

12

Executive Officers

In addition to Mr. Wellesley-Wesley, the other executive officer of the Company is:

Jerry Kieliszak, age 58, is Senior Vice President, Chief Financial Officer, Treasurer and Corporate Secretary, reporting to Mr. Wellesley-Wesley, President and CEO. Mr. Kieliszak has served as Chyron’s Senior Vice President, Chief Financial Officer and Treasurer since joining the Company in March 2002, and was named Corporate Secretary by the Board of Directors in May 2008. He is responsible for the Company’s finance, investor relations, legal, human resources, administration and information technology areas. From 2000 to 2001 he was Executive Vice President and Chief Financial Officer of CoreCommerce, an e-commerce business-to-business software development company, with responsibility for business development, finance, human resources and information technology. Until 2000, Mr. Kieliszak was, for eleven years, Vice President and Chief Financial Officer of ABT Corporation, an international project management software development company, where he was responsible for operations, finance, legal, shareholder relations, human resources, administration and information technology. Prior to ABT Corporation, Mr. Kieliszak was with the New York City office of Price Waterhouse, most recently as a Senior Manager. He holds an MBA degree with a specialty in Finance and is a Certified Public Accountant in New York State.

Code of Conduct and Ethics

The Company has adopted a Code of Ethics for Senior Financial Officers which is applicable to its principal executive officer, its principal financial officer, its principal accounting officer or controller, and any other persons performing similar functions, and a Code of Business Conduct and Ethics which applies to all officers, directors and employees (collectively, the “Codes of Ethics”). To view the full text of the Codes of Ethics please go to the Company’s website at www.chyron.com, click on Investors, and then click on Corporate Governance. Disclosure regarding any amendments to, or waivers from, the Codes of Ethics that apply to our directors and principal executive, financial and accounting officers will be included in a Current Report on Form 8-K within four business days following the date of the amendment or waiver, unless website posting of such amendments or waivers is then permitted by the rules of NASDAQ.

COMPENSATION COMMITTEE REPORT

The Compensation Committee has reviewed and discussed with management the following Compensation Discussion and Analysis section of the Company’s 2011 Proxy Statement. Based on its review and discussions with management, the Compensation Committee recommended to the Board of Directors that the Compensation Discussion and Analysis be included in the Company’s Proxy Statement for 2011 and incorporated by reference in the Company’s 2010 Annual Report on Form 10-K.

The Compensation Committee:

Roger L. Ogden, Chairman

Susan Clark-Johnson

Christopher R. Kelly

March 16, 2011

13

COMPENSATION DISCUSSION AND ANALYSIS

The Summary Compensation Table and other tables that follow describe the compensation for 2010 to our President and Chief Executive Officer (“CEO”), Senior Vice President and Chief Financial Officer (“CFO”) and Senior Vice President and Chief Operating Officer (“COO”). These were the only named executive officers of the Company. The Compensation Committee currently consists of three directors who are independent as that term is defined by the corporate governance rules of the NASDAQ. It is the duty of the Compensation Committee to develop, administer and review the Company’s compensation plans, programs and policies, to monitor the performance and compensation of the Company’s named executive officers and other members of management and to make appropriate recommendations and reports to the Board of Directors relating to executive compensation. Mr. Wellesley-Wesley, an employee-director, abstains from any vote by the Board of Directors relating to matters involving executive compensation.

Compensation Objectives and Components

The objective of the Company’s compensation program is to attract and retain the best possible executive talent; to motivate its executive officers to enhance the Company’s growth and profitability and increase shareholder value; to recognize individual initiative, leadership, achievement, and other contributions; and to reward superior performance and contributions to the achievement of the Company’s objectives. The focus is to tie short-term and long-term incentives to the achievement of measurable corporate performance objectives, and to align executives’ incentives with shareholder value creation. To achieve these objectives, the Compensation Committee has developed and maintains an executive compensation package that ties a substantial portion of the executives’ overall compensation to the Company’s financial performance. The compensation package consists of the following components:

|

·

|

salary;

|

|

·

|

annual performance-based cash and/or equity awards;

|

|

·

|

long-term incentive equity awards; and

|

|

·

|

other fringe benefits and perquisites.

|

The Compensation Committee believes that various elements of this package effectively achieve the objectives of aligning compensation with performance measures that are directly related to the Company’s financial goals and creation of shareholder value without encouraging it’s executives to take unnecessary and excessive risks. Benchmarking of executive compensation packages is performed by comparing compensation of the named executive officers to compensation studies performed by independent third party organizations. The various elements and mix of this package are determined on a negotiated basis at the time and then are determined by the Compensation Committee annually as part of the executive officer’s annual performance review. Each of these components is designed to meet the program’s objectives of providing a combination of fixed or variable short-term performance-based cash and/or equity awards and long-term equity awards.

The Compensation Committee annually reviews and makes recommendations to the Board of Directors with respect to the appropriate salary, annual performance-based awards, long-term equity awards and other fringe benefits and perquisites for the named executive officers.

14

Salary

Salary is paid to the named executive officers on a bi-weekly basis. This is a fixed element of compensation. Salaries of the named executive officers are reviewed annually. In reaching the decision on salary changes, the Compensation Committee considers individual performance as well as informal assessments of prevailing salary levels and other incentives for similar roles in other companies by reviewing studies performed by third party independent organizations.

As a cash conservation measure, beginning on August 2, 2009, the Company implemented salary reductions of 5% for employees earning $100,000 or more per year in base salary, including the named executive officers, and salary reductions of 3% for those employees with an annual base salary of $50,000 to $100,000. These salary reductions continued until February 1, 2010, when they were discontinued. Based on its assessment of the base salaries of Messrs. Kieliszak and Prince in relation to those of executives with the same or similar responsibilities at similarly sized publicly held companies, as reported in a published annual survey conducted by a national compensation survey and services company, the Compensation Committee approved an increase effective May 8, 2010 in annual base salary for Mr. Kieliszak from $205,000 to $240,000 per annum, and for Mr. Prince from $205,000 to $265,000 per annum. Effective September 1, 2010, in connection with the renewal of his employment agreement, the Compensation Committee approved an increase in the base salary of Mr. Wellesley-Wesley from $464,100 to $473,382 per annum.

Annual Performance-Based Cash and/or Equity Awards

The annual performance-based awards component is primarily designed to achieve our short-term earnings objectives, and is based on a management incentive compensation plan (the “Plan”) approved by the Compensation Committee. The target incentive award levels for this element of compensation are 70% of base salary earnings for the CEO and 60% of base salary earnings for the CFO and COO. For 2010, the Plan contained two performance conditions, each worth one-half of the total target award. The first performance condition was achievement of budgeted adjusted EBITDA and the second performance condition was achievement of budgeted non-GAAP cash flows. As a cash conservation measure, the payout of any award achieved was designed to be in cash equal to the required payroll and withholding taxes due on the total award, with the balance of the total award payable in common stock of the Company based on the closing market price on the date of the Board’s approval of the Company’s independent registered public accountants’ report on their audit of the Company’s financial statements for the year ended December 31, 2010 (which date was March 16, 2011). The adjusted EBITDA target was equal to earnings before interest, taxes, depreciation, amortization, share-based awards and management incentive compensation expense budgeted for the year 2010 (the “adjusted EBITDA target level”). The non-GAAP cash flows target was equal to net income adjusted for non-cash operating expenses and taxes and management incentive compensation plan expense, plus cash provided by, or less cash used in, investing and financing activities, budgeted for the year 2010 (“non-GAAP cash flows target level”). Additionally, there was a service condition that the recipient must have been employed by the Company at the time of the payout of any award under the Plan. The performance and service conditions and other terms of the Plan were approved by the Compensation Committee for all members of the Plan, including the CEO, CFO and COO. As the Plan was originally approved for 2010, the incentive awards based on the performance objectives ranged from a minimum award of 75% of target award for achievement of 75% of each of the performance conditions to a maximum incentive award of 150% of target incentive award for achievement of 125% or more of each of the performance conditions. This was based on a formula whereby the incentive award achievement percentages grew in proportion to the achieved performance condition percentages up to 100%, and then the incentive award percentages grew at twice the rate as the performance condition percentages achieved for achievement over 100% and up to 125% of the performance condition target levels. In February 2011, in consideration for and in recognition of

15

Management’s continuing efforts in achieving operating results and cash balances in light of the continuing economic recession during 2010, the Compensation Committee approved a reduction in the minimum incentive award and performance conditions achievement percentages from 75% to 0%. For 2010, the Company achieved 41% of the adjusted EBITDA performance target and 46% of the non-GAAP cash flow performance target. As a result of the Compensation Committee’s lowering of the minimum performance conditions achievement percentages, Messrs. Wellesley-Wesley, Kieliszak and Prince earned management incentive compensation plan awards of $140,346, $58,693 and $62,917, respectively. Under the terms of the Plan, payout of the award to each recipient was in cash equal to the payroll and withholding taxes due on the recipient’s award, which cash was then remitted by the Company to the appropriate taxing authorities on the recipient’s behalf, and the remainder of the award was paid to the recipient in shares of common stock of the Company. In determining how many shares should be paid to the recipient, the dollar value of the balance of the award was divided by the closing market price of the Company’s common stock on March 16, 2011, the day that the Board met with the Company’s independent registered public accountants and accepted their report on their audit of the Company’s financial statements for the prior year. The cash portion of the payout on the above incentive awards used to pay payroll and withholding taxes for Messrs. Wellesley-Wesley, Kieliszak and Prince was $56,798, $23,136 and $24,442, respectively, and the number of Common Stock issued to them, based on the closing market price of the Company’s Common Stock of $2.31 on March 16, 2011 was 36,168, 15,393 and 16,657 respectively.

Long-Term Incentive Equity Awards

The granting of equity awards, including stock options or restricted stock units (RSUs”), which may either be time-based vesting awards (usually vest one-third at each of the first, second and third anniversary dates from the date of grant) or may be financial performance-related vesting awards, is designed to achieve the Company’s long-term objective of enhancing shareholder value by incentivizing the named executive officers to effectively manage the Company to achieve increased market value. Stock options granted to executive officers and all other employees during the year are designed as incentive stock options (“ISOs”) up to permitted levels of the U.S. Internal Revenue Code (the “Code”) and thereafter are non-qualified stock options (“NQSOs”). All options are granted at exercise prices equal to the closing market price on the grant date. In lieu of stock options, RSUs, which are settled in the Company’s Common Stock on vesting dates, have been awarded to management and select employees during 2010. The decision to award RSUs rather than stock options for 2010 was made by the Compensation Committee and approved by the Board of Directors because they felt that it is advantageous to the Company to award RSUs because an RSU award uses fewer shares than a stock option award to deliver equivalent value, and that by imposing performance or service conditions on the RSUs, the Company can use the RSUs to drive performance and retention. Equity awards to named executive officers and the rest of the management team are typically granted annually in the month of May at pre-scheduled meetings of the Compensation Committee and the Board of Directors. It is the Company’s policy to grant equity awards to employees only during periods other than “blackout periods.” A blackout period is defined in the Company’s insider trading policy as the period beginning after the last day of each quarter and continuing until the second trading day after information relating to the results of operations (earnings report) for such quarter have been announced to the public, but a blackout period may be extended for persons covered by the insider trading policy who have knowledge of material non-public information, for the duration of the period that information remains material non-public information. Equity award grant amounts to the CEO, CFO and COO, and all other employees as well as any non-employees, are approved by the Compensation Committee. While specific target equity awards are not set for the named executive officers each year, in determining an appropriate amount of equity awards to grant to the named executive officers, the Compensation Committee evaluates and considers Company performance against budget and individual performance, and reviews the equity awards

16

ownership of the named executive officers and other employees in relation to the Company’s fully diluted shares.

On May 19, 2010, upon recommendation of the Compensation Committee, the Board approved two RSU awards, granted on May 26, 2010 following the Company’s filing on that date of a Registration Statement on Form S-8 to register the underlying common shares, to the named executive officers and other members of the management group, as well as to several other key employees. The first was the annual management equity award for 2010, in which RSUs were awarded to the management team, including the CEO, CFO and COO. These time-based RSUs vest in equal amounts on each of the first, second and third anniversaries from grant date. The second was an award under the Key Management Medium-Term Incentive Plan to the CEO, CFO, COO and certain other members of the management team and other key employees. These performance-based RSUs only vest if two performance conditions are achieved, these being achievement of a designated level of revenues in 2012 or 2013, and the other being achievement of a designated level of operating income, before share-based compensation expense, in 2012 or 2013. As a condition of vesting of the awards, the recipient must be employed by the Company on the vesting date (except in the event of a change-in-control as explained elsewhere in this Proxy Statement).

Other Fringe Benefits and Perquisites

The Company provides several benefit plans, including the Chyron Employees’ Pension Plan (the “Pension Plan”) and the Chyron Corporation Employees’ 401(k) Plan (the “401(k) Plan”) to its named executive officers and most other U.S. employees. The Pension Plan was closed to new entrants effective October 1, 2006. The Company also provides other benefits, including medical and dental plans, life and accidental death insurance, short-term and long-term disability insurance, and paid sick leave, vacation and holidays, to all U.S. employees, including the named executive officers.

The Company pays certain perquisites to its CEO as part of his total compensation package. No perquisites are paid to the CFO or COO. In 2010, perquisites paid to the CEO included a commutation allowance to defray his costs of commuting to work, in lieu of a leased automobile, and reimbursement towards his U.S. personal income tax preparation fees. These are explained in more detail in the 2010 All Other Compensation table below.

17

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table shows the total compensation earned by each of the named executive officers for the years ended December 31, 2010, 2009 and 2008. We have no other executive officers.

|

Name & Principal Position

|

Year

|

Salary1

|

Bonus2

|

Stock Award3

|

Option Award4

|

Non-Equity Incentive Plan Compen-sation5

|

Change in Pension Value and Non-qualified Deferred Compen-sation Earnings6

|

All Other Compen-sation7

|

Total

|

||||||||||||||||||||||||

|

($)

|

($)

|

($)

|

($)

|

($)

|

($)

|

($)

|

($)

|

||||||||||||||||||||||||||

|

(a)

|

(b)

|

(c)

|

(d)

|

(e)

|

(f)

|

(g)

|

(h)

|

(i)

|

(j)

|

||||||||||||||||||||||||

|

Michael

|

|||||||||||||||||||||||||||||||||

|

Wellesley-Wesley

|

2010

|

464,207 | 0 | 64,887 | 0 | 140,346 | 42,171 | 35,387 | 746,998 | ||||||||||||||||||||||||

|

President & Chief

|

2009

|

455,175 | 21,420 | 114,596 | 65,472 | 0 | 31,673 | 53,517 | 741,853 | ||||||||||||||||||||||||

|

Executive Officer

|

2008

|

448,800 | 0 | 0 | 326,317 | 0 | 28,371 | 26,452 | 829,940 | ||||||||||||||||||||||||

|

Jerry Kieliszak

|

2010

|

225,356 | 0 | 43,258 | 0 | 58,693 | 43,761 | 9,734 | 380,802 | ||||||||||||||||||||||||

|

SVP & Chief

|

2009

|

201,058 | 4,731 | 44,643 | 65,472 | 0 | 32,037 | 8,952 | 356,893 | ||||||||||||||||||||||||

|

Financial Officer

|

2008

|

202,671 | 0 | 0 | 217,544 | 0 | 30,233 | 6,117 | 456,565 | ||||||||||||||||||||||||

|

Kevin Prince

|

2010

|

240,740 | 0 | 43,258 | 0 | 62,917 | 29,602 | 720 | 377,237 | ||||||||||||||||||||||||

|

SVP & Chief

|

2009

|

201,058 | 4,731 | 44,643 | 65,472 | 0 | 21,724 | 720 | 338,348 | ||||||||||||||||||||||||

|

Operating Officer

|

2008

|

200,268 | 0 | 0 | 217,544 | 0 | 21,086 | 960 | 439,858 | ||||||||||||||||||||||||

|

1 Represents base salary earned during the respective fiscal year ended December 31.

|

|

2 Represents bonuses paid in 2009 for salary deferral from August 2008 to February 2009.

|

|

3 Represents the aggregate grant date fair value of time-based vesting RSUs awarded, computed in accordance with FASB ASC Topic 718. There can be no assurance that these amounts will be realized by the executive officers because they must be employed by the Company on the vesting dates in order to receive the underlying shares of Common Stock on the vesting dates. Excluded from the above table is the possible compensation costs of $310,375, $309,181 and $310,375, as measured at the award date under FASB ASC Topic 718 assuming full achievement of the financial performance targets, associated with 162,500, 161,875 and 162,500 RSUs awarded on May 26, 2010 under the Key Management Medium-Term Incentive Plan to Messrs. Wellesley-Wesley, Kieliszak and Prince, respectively, because the RSUs are solely performance-based awards, vesting of which will occur only if certain financial targets are achieved in 2012 or 2013, and the outcome of achieving such targets is not sufficiently probable at the award date to result in recording of any current compensation expense. These performance-based RSUs only vest if one or both performance conditions are achieved, these being achievement of a designated level of revenues in 2012 or 2013, achievement of which is worth half of the target award, and the other being achievement of a designated level of operating income, before share-based compensation expense, in 2012 or 2013, achievement of which is worth half of the target award. There can be no assurance that these amounts will be realized by the executive officers because the financial performance targets may not be achieved and the executive officers must be employed by the Company on the vesting dates in order to receive the underlying shares of Common Stock on the vesting dates.

|

|

4 Represents the grant date fair value of stock options awarded to the named executive officers in the years indicated, as explained in footnote 8 to the Company’s financial statements for the year ended December 31, 2010. There can be no assurance that these amounts will ever be realized by the executive officers because, for instance, the options could expire unexercised, they could be forfeited following termination of employment, or they could be out-of-the money for their term.

|

|

5 Represents payouts under a management incentive compensation plan approved by the Compensation Committee and Board of Directors. See the Annual Performance-Based Cash and/or Equity Awards section above for further information.

|

18

|

6 Represents the actuarial increase in the present value of the named executive officer’s benefits under the Pension Plan, a tax-qualified, non-contributory defined benefit plan established to provide pension benefits to employees of the Company meeting Pension Plan eligibility criteria. Present values for 2010 are based on certain assumptions which are discussed in the narrative following the 2010 Pension Benefits table below. For additional information on the Pension Plan, refer to the footnotes to the Company’s financial statements for the year ended December 31, 2010.

|

|

7 Represents perquisites, Company matching contributions to the 401(k) Plan and group term life insurance premiums, as itemized in the All Other Compensation table below.

|

The following table shows the components of the “All Other Compensation” column of the Summary Compensation Table for the year ended December 31, 2010.

All Other Compensation

|

Tax

|

Company Match

|

Life

|

||||||||||||||||||

|

Commutation

|

Preparation

|

on Qualified

|

Insurance

|

|||||||||||||||||

|

Allowance1

|

Fees2

|

401(k)Plan3

|

Premiums4

|

Total

|

||||||||||||||||

|

Name

|

($)

|

($)

|

($)

|

($)

|

($)

|

|||||||||||||||

|

Michael Wellesley-Wesley

|

18,000 | 2,000 | 14,667 | 720 | 35,387 | |||||||||||||||

|

Jerry Kieliszak

|

0 | 0 | 9,014 | 720 | 9,734 | |||||||||||||||

|

Kevin Prince

|

0 | 0 | 0 | 720 | 720 | |||||||||||||||

|

1 Mr. Wellesley-Wesley receives a commutation allowance of $18,000 per year, payable in bi-weekly installments, to defray his costs of commuting to work, in lieu of a leased automobile.

|

||||||||||||||||||||

|

2 The Company reimburses Mr. Wellesley-Wesley for professional tax assistance in preparing his U.S. personal income to tax returns, as a provision of his employment agreement, up to $5,000 per year.

|

||||||||||||||||||||

|

3 Represents the Company matching contribution that the Company makes for all employees who participate in the 401(k) Plan. Mr. Prince did not participate in the 401(k) plan.

|

||||||||||||||||||||

|

4 Represents Company paid premiums for group term life insurance for the named executive officer. The Company provides group term life insurance for all of its U.S. employees equal to 250% of the insured’s annual salary capped at $250,000 of insurance, except for the named executive officers for whom the insurance provided is $500,000 each.

|

||||||||||||||||||||

Non-Equity Incentive Plan Compensation

The following Non-Equity Incentive Plan Compensation table provides information about annual performance-based cash awards earned by the named executive officers for 2010 under the 2010 management incentive compensation plan. See the Annual Performance-Based Cash and/or Equity Awards section above for a discussion of the policy and terms of these awards.

|

Name

|

Target as

a % of

Salary

|

Payout

Range as

a % of

Salary

|

Target

Award ($)

|

Maximum

Award ($)

|

Actual

Award ($)1

|

Actual

Award as

a % of

Salary

|

||||||||||||||||||

|

Michael Wellesley-Wesley

|

70 | % | 0% - 105 | % | 325,820 | 488,730 | 140,346 | 30 | % | |||||||||||||||

|

Jerry Kieliszak

|