PROSPECTUS

FILED PURSUANT TO RULE 424(b)(4)

REGISTRATION NO. 333-281693

1,250,000 Shares

HomesToLife Ltd

This is an initial public offering of ordinary shares, par value US$0.0001 per share (“Shares”) of HomesToLife Ltd, an exempted company with limited liability incorporated under the laws of Cayman Islands (“we,” “us,” “our,” “HomesToLife Cayman,” or the “Company”). We are offering on a firm commitment basis our Shares. Prior to this offering, there has been no public market for our Shares. The initial public offering price of our Shares in this offering is $4 per share. Our Shares have been approved to be listed on the Nasdaq Capital Market under the symbol “HTLM.”

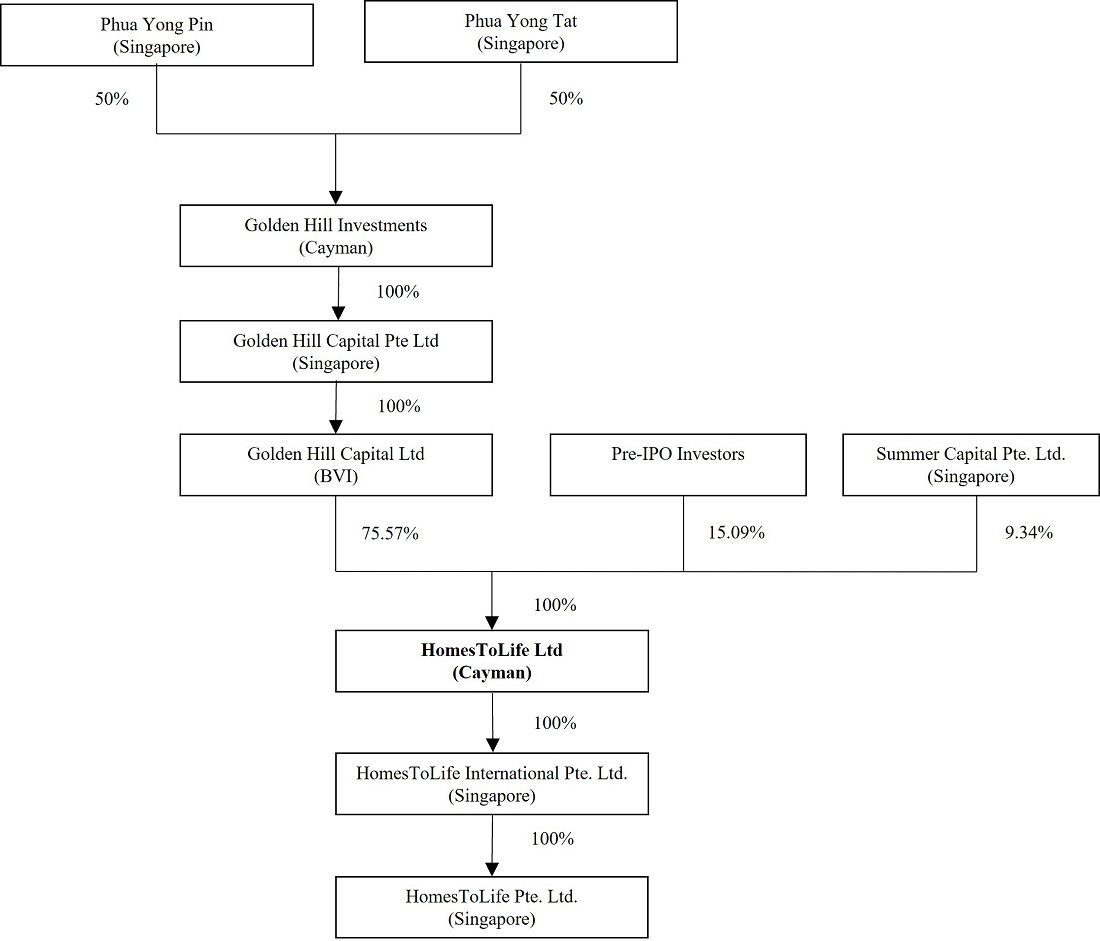

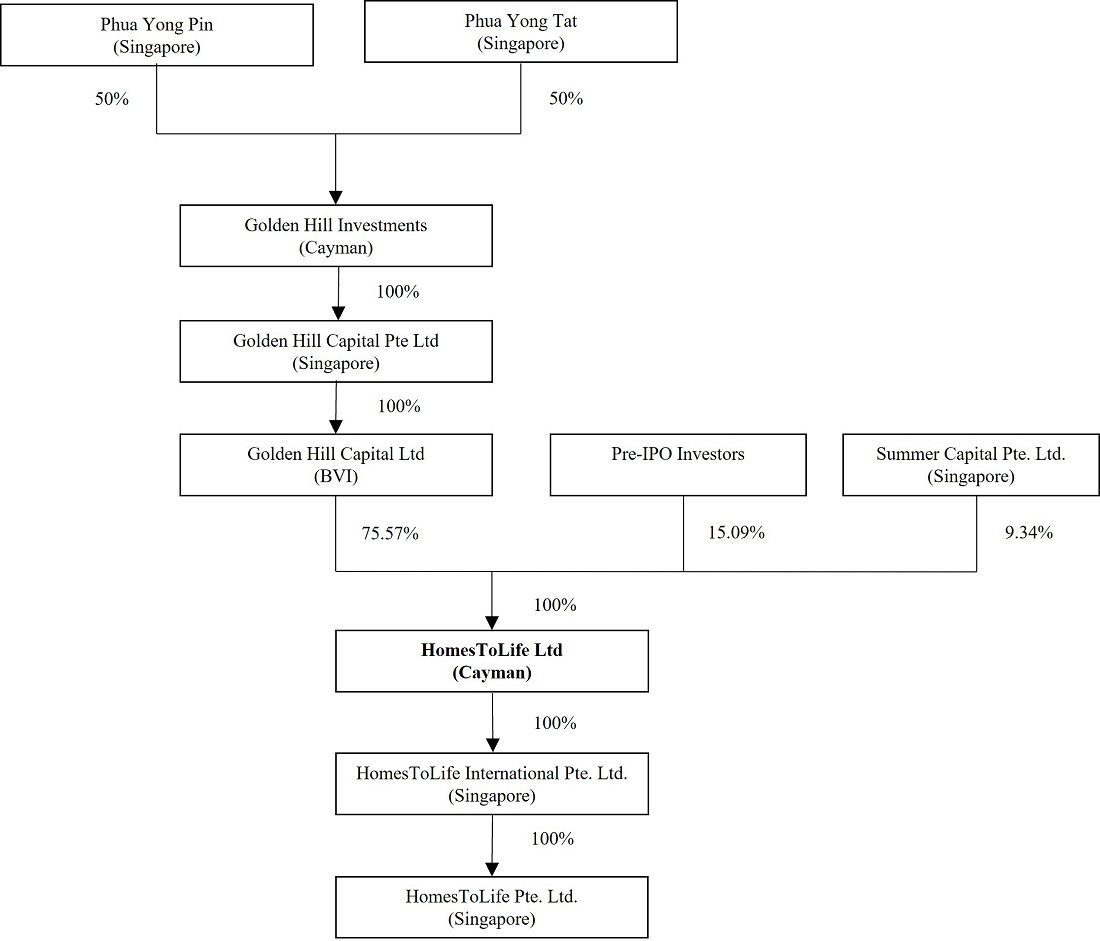

Upon the completion of this offering, we will be a “controlled company” as defined under corporate governance rules of Nasdaq, because our founders and Chairman/Vice Chairman, Messrs. Phua Yong Pin and Phua Yong Tat, will beneficially own approximately 75.6% of our then-issued and outstanding Shares and will be able to exercise approximately 69.1% of the total voting power of our issued and outstanding Shares immediately after the consummation of this offering, assuming the underwriters do not exercise its option to purchase additional Shares. Messrs. Phua Yong Pin and Phua Yong Tat will have the ability to control matters requiring shareholder approval, including the election of directors, amendment of organizational documents and approval of major corporate transactions. For further information, see “Principal Shareholders.” For more detailed description of risks related to being a “controlled company,” see “Risk Factors—Risks Related to Our Company—We will be a ‘controlled company’ within the meaning of the Nasdaq Listing Rules and, as a result, may rely on exemptions from certain corporate governance requirements that provide protection to shareholders of other companies.” At this time, we do not intend to rely on these exemptions to corporate governance requirements as a controlled company. However, we may elect to do so in the future.

Investing in our Shares involves a high degree of risk, including the risk of losing your entire investment. See “Risk Factors” beginning on page 7 to read about factors you should consider before buying our Shares.

The risks could result in a material change in the value of the securities we are registering for sale or could significantly limit or completely hinder our ability to offer or continue to offer securities to investors. Our Shares offered in this prospectus are shares of our Cayman Islands holding company, which has no material operations of its own and conducts substantially all of its operations through the operating entities established in Singapore. Investors of our Shares should be aware that they may never directly hold equity interests in our subsidiaries.

Please see “Risk Factors” beginning on page 7 of this prospectus for additional information.

We are both an “emerging growth company” and a “foreign private issuer” as defined under the U.S. federal securities laws and, as such, may elect to comply with certain reduced public company reporting requirements for this and future filings. See “Prospectus Summary—Implications of Being an Emerging Growth Company” and “Prospectus Summary—Implications of Being a Foreign Private Issuer.”

| Per Share | Total | |||||||

| Initial public offering price | $ | 4 | $ | 5,000,000 | ||||

| Underwriting discounts and commissions (7%) for sales to investors introduced by the underwriter (1) | $ | 0.28 | $ | 350,000 | ||||

| Proceeds, before expenses, to us (2) | $ | 3.72 | $ | 4,650,000 | ||||

(1) We have agreed to pay the underwriters a discount equal to seven percent (7%) of the gross proceeds of the offering from investors introduced by the underwriters. See “Underwriting” for additional disclosure regarding underwriting compensation payable by us.

(2) Our total cash expenses for this offering (including cash expenses payable to our underwriters for their out-of-pocket expenses) are approximately $1.7 million, exclusive of the underwriting discounts and the non-accountable expenses allowance. We have agreed to pay the underwriters a non-accountable expenses equal to one percent (1%) of the gross proceeds in this offering. See “Underwriting” for additional disclosure regarding underwriting compensation payable by us.

The underwriters are selling 1,250,000 Shares (or 1,437,500 Shares if the underwriters exercise their over-allotment option in full) in this offering on a firm commitment basis.

An underwriting discount or spread equal to seven percent (7%) of the offering price. The Registration Statement of which this prospectus is a part also covers the Shares issuable upon the exercise thereof. For additional information regarding our arrangement with the underwriters, please see “Underwriting” beginning on page 102.

We have granted the underwriters an option, exercisable for forty-five (45) days following the closing date of this offering, to purchase up to an additional fifteen percent (15%) of the Shares offered in this offering on the same terms to cover over-allotments.

The underwriters expect to deliver the Shares against payment in U.S. dollars to purchasers on or about October 2, 2024.

Neither the United States Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

US Tiger Securities Inc.

Prospectus dated September 30, 2024

TABLE OF CONTENTS

| i |

About this Prospectus

We and the underwriters have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses prepared by us or on our behalf or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the Shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted or where the person making the offer or sale is not qualified to do so or to any person to whom it is not permitted to make such offer or sale. For the avoidance of doubt, no offer or invitation to subscribe for Shares is made to the public in the Cayman Islands. The information contained in this prospectus is current only as of the date on the front cover of the prospectus. Our business, financial condition, results of operations, and prospects may have changed since that date.

Unless otherwise indicated, information contained in this prospectus concerning our industry, including our general expectations and market opportunity, is based on information from our own management estimates and research, as well as from industry and general publications and research, surveys and studies conducted by third parties. Management estimates are derived from publicly available information, our knowledge of our industry and assumptions based on such information and knowledge, which we believe to be reasonable. In addition, assumptions and estimates of our and our industry’s future performance are necessarily uncertain due to a variety of factors, including those described in “Risk Factors” beginning on page 7 of this prospectus. These and other factors could cause our future performance to differ materially from our assumptions and estimates.

For investors outside the United States: We have not done anything that would permit the offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the securities described herein and the distribution of this prospectus outside the United States.

Our financial statements are prepared and presented in accordance with U.S. GAAP. Our historical results do not necessarily indicate our expected results for any future periods.

| ii |

Conventions that Apply to this Prospectus

Throughout this prospectus, we use a number of key terms and provide a number of key performance indicators used by management. Unless the context otherwise requires, the following definitions apply throughout where the context so admits:

| ● | “Company,” “HomesToLife Cayman” or “our Company” means HomesToLife Ltd, an exempted company incorporated in the Cayman Islands with limited liability under the Companies Act on February 16, 2024. |

| ● | “Companies Act” means the Companies Act (2023 Revision) of the Cayman Islands, as amended, supplemented or modified from time to time. |

| ● | “Group”, “our Group”, “we”, “us”, or “our” means our Company and its subsidiaries or any of them, or where the context so requires, in respect of the period before our Company becoming the holding company of its present subsidiaries, such subsidiaries as if they were subsidiaries of our Company at the relevant time or the businesses which have since been acquired or carried on by them or as the case may be their predecessors. |

| ● | “HomesToLife Singapore” means HomesToLife Pte. Ltd., a company incorporated in Singapore on September 28, 1989, and an indirect wholly-owned subsidiary of our Company. |

| ● | “HTL Group” means collectively all of the entities controlled or owned by Major Shareholders. |

| ● | “Major Shareholders” means Messrs. Phua Yong Pin and Phua Yong Tat, who are also our founders and Chairman/Vice Chairman. |

| ● | “S$” or “SGD” means Singapore dollars(s), the lawful currency of Singapore. |

| ● | “SEC” or “Securities and Exchange Commission” means the United States Securities and Exchange Commission. |

| ● | “Securities Act” means the U.S. Securities Act of 1933, as amended, supplemented or modified from time to time. |

| ● | “Singapore Companies Act” means the Companies Act 1967 of Singapore, as amended, supplemented or modified from time to time. |

| ● | “US$”, “$” or “USD” means United States dollar(s), the lawful currency of the U.S. |

| ● | “U.S.” or “United States” means the United States of America. |

Unless the context indicates otherwise, all information in this prospectus assumes no exercise by the underwriters of their over-allotment option.

Our reporting currency is the Singapore dollar. This prospectus also contains translations of certain foreign currency amounts into U.S. dollars for the convenience of the reader. Unless otherwise stated, all translations of Singapore dollars into U.S. dollars were made at S$1.3186 to US$1.00. We make no representation that the Singapore dollar or U.S. dollar amounts referred to in this prospectus could have been or could be converted into U.S. dollars or Singapore dollars, as the case may be, at any particular rate or at all.

| iii |

The following summary is qualified in its entirety by, and should be read in conjunction with, the more detailed information and financial statements included elsewhere in this prospectus. In addition to this summary, we urge you to read the entire prospectus carefully, especially the risks of investing in our Shares, discussed under “Risk Factors,” before deciding whether to buy our Shares.

Overview

Our operating company, HomesToLife Singapore, is one of the leading home furniture retailers that offers and sells customized furniture solutions in Singapore. As of the date of this prospectus, it has six retail store locations, and among furniture companies that sell furniture manufactured from China and other Asian countries, HomesToLife Singapore is the second largest in Singapore by the number of retail store locations. It has helped homeowners create living spaces that reflect their individuality since 2014. Its product offerings include leather and fabric upholstered furniture, case goods and accessories, and offers a one-stop shop for retail customers to furnish their homes. HomesToLife Singapore offers and sells selected HTL Group’s products and brands of luxury contemporary furniture in Singapore, as well as products supplied by trusted third party suppliers. Pursuant to a 20-year exclusive Products Supply Agreement, with the exclusive period commencing from January 4, 2021, it has with HTL Marketing Pte. Ltd. (“HTL Marketing”), a HTL Group company owned and controlled by our controlling shareholders and Chairman/Vice Chairman, Messrs. Phua Yong Pin and Phua Yong Tat, HomesToLife Singapore has secured a long-term and reliable supply of leather and fabric upholstered furniture from partners within the HTL Group in different parts of China, and is able to offer its customers a wide selection of design, leather and fabric materials, configuration and function of sofas. For the fiscal year ended December 31, 2023, sales of leather and fabric upholstered furniture and case goods and accessories amounted to SGD5.9 million (US$4.5 million) and SGD0.9 million (US$0.7 million), representing approximately 87.3% and 12.7%, respectively, of our total sales revenue.

To target the premium mass market by providing customers high-quality luxury products with affordable, reliable and customizable options, HomesToLife Singapore also reserves and dedicates an exclusive space in certain HomesToLife Singapore retail stores in Singapore for the marketing and selling of furniture under HTL’s “Domicil” brand and “Fabbrica” brand, two European furniture brands offering premium and luxury products that are designed by top designers from around the world and targeted at the middle and upper class consumer markets.

“HomesToLife” has a long-standing pledge to offer fair prices, great value, consistent and reliable quality, and on-time delivery to its customers. It maintains a website: www.homestolife.com offering consumers a seamless shopping experience online and post-sales customer service support. HomesToLife Cayman plans to use a significant portion of the proceeds from its initial public offering (“IPO”) to fund the expansion of its business and opening of new store locations in other parts of Asia including, Taiwan, Korea, Indonesia and Malaysia. Its mission is to become a leading home furniture retailer in all of Asia.

Corporate Information

Our principal executive offices are located at 6 Raffles Boulevard, #02-01/02, Marina Square, Singapore 039594, and our phone number is +65 9730 3718. Our registered office is located at the offices of Tricor Services (Cayman Islands) Limited, at Third Floor, Century Yard, Cricket Square, P.O. Box 902, Grand Cayman, Ky1-1103, Cayman Islands. We maintain a corporate website at http://www.homestolife.com/. The information contained in, or accessible from, our website or any other website does not constitute a part of this prospectus. We have appointed Cogency Global Inc., located at 122 East 42nd Street, 18th Floor, New York, New York 10168, as our agent upon whom process may be served in any action brought against us under the securities laws of the United States.

| 1 |

Corporate Structure

The following diagram illustrates our corporate structure upon completion of the IPO based on a proposed number of 1,250,000 Shares being offered, assuming no exercise of the underwriters’ over-allotment option. For more details on our corporate history, please refer to “Our History and Structure.”

| 2 |

Summary of Risk Factors

Investing in our Shares involves significant risks. You should carefully consider all of the information in this prospectus before making an investment in our Shares. Below please find a summary of the principal risks we face, organized under relevant headings. These risks are discussed more fully in the section titled “Risk Factors.”

Risks Related to Our Business

| ● | We may incur losses in the future. | |

| ● | Our success depends on our ability to retain our core management team and other key personnel. | |

| ● | Our success depends in part on our ability to increase our net revenue per active customer. If our efforts to increase customer loyalty and repeat purchasing as well as maintain high levels of customer engagement are not successful, our growth prospects and net revenue will be materially adversely affected. | |

| ● | Our business depends on our ability to build and maintain strong brands. We may not be able to maintain and enhance our “HomesToLife” brand if we receive unfavorable customer complaints, negative publicity or otherwise fail to live up to consumers’ expectations, which could materially adversely affect our business, results of operations and growth prospects. | |

| ● | Our failure to operate effectively in a highly competitive and evolving industry could have a material adverse effect on our business. | |

| ● | Our business may be affected by increase in rental expenses or the termination of leases of our retail stores. | |

| ● | We may not succeed in implementing our business strategies and future expansion plan. | |

| ● | We may not be able to adequately protect our intellectual property rights and there may be copycat counterfeit competition and an inability to protect or use our intellectual property rights may adversely affect our business. | |

| ● | We may be subject to supply chain disruptions, which could have a material adverse effect on our business, financial condition and results of operations. |

Risks Related to Doing Business in Singapore

| ● | Any adverse material changes to the Singapore market (whether localized or resulting from global economic or other conditions) such as the occurrence of an economic recession, pandemic or widespread outbreak of an infectious disease (such as COVID-19), could have a material adverse effect on our business, results of operations and financial condition. Many of the economies in Asia, including Singapore, are experiencing substantial inflationary pressures which may prompt the governments to take action to control the growth of the economy and inflation that could lead to a significant decrease in our profitability in the future. | |

| ● | Our operating subsidiary is subject to the laws of Singapore, which differ in certain material respects from the laws of the United States. | |

| ● | Adverse change in government regulations may materially and adversely affect our operations and financial condition. | |

| ● | The ability of our subsidiary in Singapore to distribute dividends to us may be subject to restrictions under applicable laws. |

Risks Related to Our Corporate Structure, Our Securities and This Offering

| ● | We will incur significant expenses and devote other significant resources and management time as a result of being a public company, which may negatively impact our financial performance and could cause our results of operations and financial condition to suffer. | |

| ● | If we fail to implement and maintain an effective system of internal controls, we may be unable to accurately report our results of operations, meet our reporting obligations or prevent fraud, and investor confidence and the market price of our shares may be materially and adversely affected. | |

| ● | It may be difficult for you to enforce any judgment obtained in the United States against us, our Directors, Executive Officers or our affiliates. | |

| ● | We will be subject to changing laws, rules and regulations in the U.S. regarding regulatory matters, corporate governance and public disclosure that will increase both our costs and the risks associated with non-compliance. |

| 3 |

| ● | The market price of our Shares may be volatile or may decline regardless of our operating performance, and you may not be able to resell your shares at or above the public offering price. The sale or availability for sale of substantial amounts of our Shares could adversely affect their market price. | |

| ● | Securities analysts may not publish favorable research or reports about our business or may publish no in-formation at all, which could cause our stock price or trading volume to decline. Because our public offering price is substantially higher than our net tangible book value per share, you will experience immediate and substantial dilution. | |

| ● | As a company incorporated in the Cayman Islands, we may adopt certain home country practices in relation to corporate governance matters that differ significantly from corporate governance requirements of Nasdaq. These practices may afford less protection to shareholders than they would enjoy if we complied fully with corporate governance requirements of Nasdaq. | |

| ● | Judgments obtained against us by our shareholders may not be enforceable. | |

| ● | Assuming our Shares are listed on Nasdaq, we cannot assure you that we will be able to meet the continued listing standards of Nasdaq in the future. |

Impact of COVID-19

The COVID-19 outbreak has adversely affected (and a significant outbreak of other infectious diseases could result in an additional widespread health crisis that could adversely affect) the economies and financial markets worldwide, and the business of the Company could be materially and adversely affected by the COVID-19 outbreak and any such other outbreak. Furthermore, our business may be adversely affected if continued concerns relating to COVID-19 continue to restrict travel, or result in the Company’s personnel, suppliers, vendors and services providers being unavailable to pursue their business objectives free of COVID-19 related restrictions. The extent to which COVID-19 impacts our business in the future will depend on future developments, which are highly uncertain and cannot be predicted, including for example new information which may emerge concerning the severity of COVID-19 and the actions to contain COVID-19 or treat its impact. If the disruptions posed by COVID-19 or other matters of global concern continue for an extended period of time, our ability to pursue our business objectives may be materially adversely affected. In addition, our ability to raise equity and debt financing which may be adversely impacted by COVID-19 and other events, including as a result of increased market volatility, decreased market liquidity and third-party financing being unavailable on terms acceptable to us or at all.

Implications of Our Being an “Emerging Growth Company”

As a Company with less than $1.235 billion in revenue during our last fiscal year, we qualify as an “emerging growth Company” as defined in the Jumpstart Our Business Startups Act of 2012, or the “JOBS Act.” An “emerging growth Company” may take advantage of reduced reporting requirements that are otherwise applicable to larger public companies. In particular, as an emerging growth Company, we:

| ● | may present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations; | |

| ● | are not required to provide a detailed narrative disclosure discussing our compensation principles, objectives and elements and analyzing how those elements fit with our principles and objectives, which is commonly referred to as “compensation discussion and analysis”; |

| ● | are not required to obtain an attestation and report from our auditors on our management’s assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002; | |

| ● | are not required to obtain a non-binding advisory vote from our shareholders on executive compensation or golden parachute arrangements (commonly referred to as the “say-on-pay,” “say-on frequency,” and “say-on-golden-parachute” votes); | |

| ● | are exempt from certain executive compensation disclosure provisions requiring a pay-for-performance graph and chief executive officer pay ratio disclosure; | |

| ● | are eligible to claim longer phase-in periods for the adoption of new or revised financial accounting standards under §107 of the JOBS Act; and | |

| ● | will not be required to conduct an evaluation of our internal control over financial reporting until our second annual report on Form 20-F following the effectiveness of our initial public offering. |

| 4 |

Under the JOBS Act, we may take advantage of the above-described reduced reporting requirements and exemptions until we no longer meet the definition of an emerging growth Company. The JOBS Act provides that we would cease to be an “emerging growth Company” at the end of the fiscal year in which the fifth anniversary of our initial sale of common equity pursuant to a registration statement declared effective under the Securities Act of 1933, as amended (the “Securities Act”) occurred, if we have more than $1.235 billion in annual revenue, have more than $700 million in market value of our Shares held by non-affiliates, or issue more than $1 billion in principal amount of non-convertible debt over a three-year period.

Implications of Being a Foreign Private Issuer

We are a foreign private issuer within the meaning of the rules under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). As such, we are exempt from certain provisions applicable to United States domestic public companies. For example:

| ● | we are not required to provide as many Exchange Act reports, or as frequently, as a domestic public Company; | |

| ● | for interim reporting, we are permitted to comply solely with our home country requirements, which are less rigorous than the rules that apply to domestic public companies; | |

| ● | we are not required to provide the same level of disclosure on certain issues, such as executive compensation; |

| ● | we are exempt from provisions of Regulation FD aimed at preventing issuers from making selective disclosures of material information; | |

| ● | we are not required to comply with the sections of the Exchange Act regulating the solicitation of proxies, consents, or authorizations in respect of a security registered under the Exchange Act; and | |

| ● | we are not required to comply with Section 16 of the Exchange Act requiring insiders to file public reports of their share ownership and trading activities and establishing insider liability for profits realized from any “short-swing” trading transaction. |

We will be required to file an annual report on Form 20-F within four months of the end of each fiscal year. Press releases relating to financial results and material events will also be furnished to the SEC on Form 6-K. However, the information we are required to file with or furnish to the SEC will be less extensive and less timely compared to that required to be filed with the SEC by U.S. domestic issuers. As a result, you may not be afforded the same protections or information that would be made available to you were you investing in a U.S. domestic issuer.

The Nasdaq Listing Rules provide that a foreign private issuer may follow the practices of its home country, which for us is the Cayman Islands, rather than the rules of Nasdaq as to certain corporate governance requirements, including the requirement that the issuer have a majority of independent directors, the audit committee, compensation committee, and nominating and corporate governance committee requirements, the requirement to disclose third-party director and nominee compensation, and the requirement to distribute annual and interim reports. A foreign private issuer that follows a home country practice in lieu of one or more of the listing rules is required to disclose in its annual reports filed with the SEC each requirement that it does not follow and describe the home country practice followed by the issuer in lieu of such requirements. Although we do not currently intend to take advantage of these exceptions to the Nasdaq corporate governance rules, we may in the future take advantage of one or more of these exemptions. See “Risk Factors— Risks Related to Our Corporate Structure, Our Securities and This Offering—Because we are a foreign private issuer and are exempt from certain Nasdaq corporate governance standards applicable to U.S. issuers, you will have less protection than you would have if we were a domestic issuer.”

Implications of Being a Controlled Company

Upon the completion of this offering, our founders and Chairman/Vice Chairman, Messrs. Phua Yong Pin and Phua Yong Tat, will beneficially own 69.1% of our total issued and outstanding Shares, representing 69.1% of our total voting power, assuming that the underwriters do not exercise their option to purchase additional Shares, or 68.2% of our total issued and outstanding Shares, representing 68.2% of our total voting power, assuming that the option to purchase additional Shares is exercised by the underwriters in full. We will be a “controlled company” as defined under the Nasdaq Listing Rules because Messrs. Phua Yong Pin and Phua Yong Tat will hold more than 50% of the voting power for the election of directors. As a “controlled company,” we are permitted to elect not to comply with certain corporate governance requirements. At this time, we do not intend to rely on these exemptions to corporate governance requirements as a controlled company. However, we may elect to do so in the future. If we rely on these exemptions, you will not have the same protection afforded to shareholders of companies that are subject to these corporate governance requirements.

| 5 |

| Securities offered by us | 1,250,000 Shares | |

| Over-allotment option | We have granted the underwriters an option, exercisable for forty-five (45) days from the closing date of this offering, to purchase up to an aggregate of 187,500 additional Shares at the initial public offering price, less underwriting discounts. | |

| Price per Share | The initial public offering price in this offering is $4 per Share. | |

| Shares outstanding prior to completion of this offering | 13,250,000 Shares See “Description of Share Capital” for more information. | |

| Shares outstanding immediately after this offering | 14,500,000 Shares assuming no exercise of the underwriters’ over-allotment option.

14,687,500 Shares assuming full exercise of the underwriters’ over-allotment option. | |

| Listing | Our Shares have been approved to be listed on the Nasdaq Capital Market. | |

| Proposed Ticker symbol | “HTLM” | |

| Transfer Agent | Transhare Corporation | |

| Use of proceeds | We intend to use the proceeds from this offering for opening new stores in the East of Singapore and other Asian countries such as Taiwan, Republic of Korea, Indonesia, and Malaysia; for sales and marketing; and for IT. See “Use of Proceeds” on page 33 for more information. | |

| Lock-up | All of our directors, officers and the principal shareholders (5% or more shareholders) have agreed, subject to certain exceptions, not to sell, transfer, or dispose of, directly or indirectly, any of our Shares or securities convertible into or exercisable or exchangeable for our Shares for a period of six (6) months after the date of this prospectus. See “Shares Eligible for Future Sale” and “Underwriting” for more information. | |

| Risk factors | The Shares offered hereby involve a high degree of risk. You should read “Risk Factors” beginning on page 7 for a discussion of factors to consider before deciding to invest in our Shares. |

| 6 |

An investment in our Shares involves a high degree of risk. Before deciding whether to invest in our Shares, you should consider carefully the risks described below, together with all of the other information set forth in this prospectus, including the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our combined financial statements and related notes. If any of these risks actually occurs, our business, financial condition, results of operations, or cash flow could be materially and adversely affected, which could cause the trading price of our Shares to decline, resulting in a loss of all or part of your investment. The risks described below and discussed in other parts of this prospectus are not the only ones that we face. Additional risks not presently known to us or that we currently deem immaterial may also affect our business. You should only consider investing in our Shares if you can bear the risk of loss of your entire investment.

Risks Related to Our Business

We may incur losses in the future.

We anticipate that our operating expenses, together with the increased general administrative expenses of a public company upon completion of this offering, will increase in the foreseeable future as we seek to maintain and continue to grow our business and attract potential customers. These efforts may prove more expensive than we currently anticipate, and we may not succeed in increasing our revenue sufficiently to offset these higher expenses. As a result of the foregoing and other factors, we may incur net losses in the future and may be unable to achieve or maintain profitability on a quarterly or annual basis for the foreseeable future.

If we fail to manage our growth effectively, our business, financial condition and operating results could be harmed.

Our historical growth rates may not be sustainable or indicative of future growth. To manage our growth effectively, we must continue to implement our operational plans and strategies, improve and expand our infrastructure of people and information systems and expand, train and manage our employee base. If our new hires perform poorly, if we are unsuccessful in hiring, training, managing and integrating these new employees and staff, or if we are not successful in retaining our existing employees and staff, our business may be harmed. We also face significant competition for personnel. Failure to manage our hiring needs effectively or successfully integrate our new hires may have a material adverse effect on our business, financial condition and operating results. Properly managing our growth will also require us to establish consistent policies across regions and functions, and a failure to do so could likewise harm our business.

Additionally, the growth of our business places significant demands on our operations, as well as our management and other employees. Further, we have faced and may continue to face a number of challenges to our expansion into physical retail locations, including locating retail space with a cost and geographic profile that will allow us to operate in highly desirable shopping locations, hiring in-store talent and expanding our physical retail operations in a cost-effective manner. We have entered into and may continue to enter into long-term leases before we know whether our physical retail strategy or a particular geography will be successful. We are also required to manage relationships with a growing number of suppliers, customers and other third parties across the world. Our information technology systems and our internal controls and procedures may not be adequate to support future growth of our supplier and employee base.

Failure to manage our growth and organizational change effectively could lead us to over-invest or under-invest in technology and operations; result in weaknesses in our infrastructure, systems or controls; give rise to operational mistakes, losses or loss of productivity or business opportunities; reduce customer satisfaction; limit our ability to respond to competitive pressures; and result in loss of employees and reduced productivity of remaining employees. If we are unable to manage the growth of our organization effectively, our business, financial condition and operating results may be materially adversely affected.

| 7 |

If we fail to acquire new customers, reactivate prior customers or retain existing customers, or fail to do so in a cost-effective manner, our business, financial condition and operating results could be harmed.

Our success depends on our ability to acquire and retain customers in a cost-effective manner. In order to expand our customer base, we must appeal to and acquire customers who have historically used other means of commerce to purchase home goods and may prefer alternatives to our offerings, such as the websites of our competitors or our suppliers’ own websites. We have made significant investments related to customer acquisition and expect to continue to spend significant amounts to acquire additional customers and to reactivate prior customers. Our paid advertising efforts are primarily online channel advertising, including social media advertising, search engine marketing and paid engagement of online media companies. We engage influencers or key opinion leaders within the community via product sponsorship. We also conduct offline advertisements including printed display ads, direct mailing and magazine advertisements. These efforts are expensive and may not result in the cost-effective acquisition of customers. Our marketing expenses have varied from period to period, and we expect this trend to continue as we test new channels and refine our marketing strategies. We may increase or decrease our marketing spend within a period, based on the degree of our achievement of intended results, which may result in increased or decreased customer engagement in any given period. We cannot assure you that the net profit from new or returning customers we acquire will ultimately exceed the cost of acquiring those customers. Additionally, actions by third parties to block or impose restrictions on the delivery of certain advertisements could also adversely impact our business. If we fail to deliver a quality shopping experience, or if consumers do not perceive the products we offer to be of high value and quality, we may not be able to acquire new customers or retain existing customers. If we are unable to acquire new customers or reactivate prior customers who purchase products in numbers sufficient to grow our business, we may not be able to generate the scale necessary to drive beneficial network effects with our suppliers or efficiencies in our logistics network, our net revenue may decrease, and our business, financial condition and operating results may be materially adversely affected.

We also utilize non-paid advertising. Our website benefits significantly from direct searches via various platforms. In addition, our non-paid advertising strategy includes leveraging the value of our organic social media content and user-generated content within our community. Although we employ search engine optimization and search engine marketing strategies, our ability to maintain and increase the number of visitors directed to our website and application is not entirely within our control. Search engines frequently update and change the logic that determines the placement and display of results of a user’s search, such that the purchased or algorithmic placement of links to our sites can be negatively affected. Moreover, a search engine could, for competitive or other purposes, alter its search algorithms or results, causing our sites to place lower in search query results. A major search engine could change its algorithms in a manner that negatively affects our paid or non-paid search ranking, and competitive dynamics could impact the effectiveness of search engine marketing or search engine optimization. We also obtain a significant amount of traffic via social networking websites or other channels used by our current and prospective customers. As e-commerce and social networking continue to rapidly evolve, we must continue to establish relationships with these channels and may be unable to develop or maintain these relationships on acceptable terms. If we are unable to cost-effectively drive traffic to our sites, our ability to acquire new customers, reactivate prior customers or retain our existing customers and our financial condition would suffer.

Further, some of our new customers originate from word of mouth or other non-paid referrals from existing customers. If our efforts to satisfy our existing customers are not successful, we may not be able to acquire new customers or reactivate prior customers through these referrals, which may adversely affect how we continue to grow our business, or may require us to incur significantly higher marketing expenses in order to acquire new customers.

Our success depends in part on our ability to increase our net revenue per active customer. If our efforts to increase customer loyalty and repeat purchasing as well as maintain high levels of customer engagement are not successful, our growth prospects and net revenue will be materially adversely affected.

Our ability to grow our business depends on our ability to generate increased net revenue and repeat purchases from our customer base. Since our customer base in almost exclusively retail in nature, that would require us to maintain high levels of customer engagement. To do this, we must continue to provide our customers and potential customers with a unified, convenient, efficient and differentiated shopping experience by:

| ● | maintaining high quality of products; | |

| ● | providing superior pre-sale consulting, and post-sale customer support, services; | |

| ● | delivering products on time and without damage; and | |

| ● | maintaining and further developing our online platforms to reduce conversion time from retail furniture consumers to customers. |

| 8 |

If we fail to increase net revenue per active customer, generate repeat purchases or maintain high levels of customer engagement, our growth prospects, operating results and financial condition could be materially adversely affected.

We have faced and will continue to face price competition in the future. In addition, competitors with whom we compete, or who can obtain better pricing, more favorable contractual terms and conditions, or more favorable mix of products during periods of limited supply may be able to offer lower prices than we are able to offer. Our operating results and financial condition may be adversely affected by these and other industry-wide pricing pressures.

Our business depends on our ability to build and maintain strong brands. We may not be able to maintain and enhance our “HomesToLife” brand if we receive unfavorable customer complaints, negative publicity or otherwise fail to live up to consumers’ expectations, which could materially adversely affect our business, results of operations and growth prospects.

We mainly engaged in the sales of (i) upholstered sofas under the brands “Domicil,” “Fabbrica” and other HTL brands; and (ii) to a lesser extent, complementary furniture pieces, such as case goods, tables, bedding and mattress. Our ability to maintain and enhance our one-stop shop concept depends largely on our ability to maintain customer confidence in our product offerings, including by customizing our recommendations of high quality furniture to fit customers’ living style; maintaining product availability and delivering products on time and without damage. If customers do not have a satisfactory shopping experience, they may seek out alternative offerings from our competitors and may not return to our retail stores as often in the future, or at all. In addition, unfavorable publicity regarding, product quality or availability, poor customer service, delivery problems, competitive pressures, litigation or regulatory activity, could seriously harm our reputation. Such negative publicity also could have an adverse effect on the size, engagement and loyalty of our customer base and result in decreased net revenue, which could adversely affect our business and financial results.

In addition, maintaining and enhancing our “HomesToLife” brand name may require us to make substantial investments, and these investments may not be successful. If we fail to promote and maintain our brand, or if we incur excessive expenses in this effort, our business, operating results and financial condition may be materially adversely affected. We anticipate that, as our market becomes increasingly competitive, maintaining and enhancing our brand may become increasingly difficult and expensive. Maintaining and enhancing our brand will depend largely on our ability to provide high quality products to our customers.

Customer complaints or negative publicity about our stores, products, delivery times, company practices, employees, customer data handling and security practices or customer support, could rapidly and severely diminish consumer confidence in us and result in harm to our “HomesToLife” brand name and decreased revenue, whether or not the complaints and negative sentiment are based in fact.

Our physical retail stores may not achieve sales or operations targets and may negatively impact our financial results.

We operate six physical retail stores in Singapore. We believe that continued expansion into new physical retail stores represents a growth opportunity for us. Our growth strategy is dependent on our ability to identify and open future store locations in new and existing markets. Our ability to open stores in a timely and successful manner depends in part on the following factors: the availability of desirable store locations; the availability and costs of construction labor and materials; local permitting timelines; the ability to negotiate acceptable lease and development terms at reasonable rates, including the length of rental periods and renewal options and the ability to obtain termination rights; our ability to obtain all required approvals and comply with other regulatory requirements; our relationships with current and prospective landlords; the ability to secure and manage the inventory necessary for the launch and operation of new stores; the availability of capital funding for expansion; and general economic conditions. Any or all of these factors and conditions could materially adversely affect our growth and profitability.

New store openings may negatively impact our financial results due to the effect of store opening costs and lower sales during the initial period following opening. New stores, particularly those in new markets, build their brand recognition and customer base over time and, as a result, may have lower margins and incur higher operating expenses. We may not anticipate all of the challenges imposed by the expansion of our operations into new geographic markets. We may not manage our expansion effectively, and our failure to achieve or properly execute our expansion plans could limit our growth or have a material adverse effect on our business, financial condition and results of operations.

| 9 |

Our efforts to expand our business into new geographic markets internationally will subject us to additional business, legal, financial and competitive risks, may not be successful and could adversely affect our profitability and operating results.

Our business success depends to some extent on our ability to expand our existing one-stop shop concept and product offerings into new geographic markets from time to time. Our plan to expand and further penetrate in the Singapore and Asian home furnishings market may be subject to risks such as:

| ● | costs associated with expanding our physical retail locations; | |

| ● | costs associated with strengthening information technology infrastructure to support anticipated growth in sales and supply volume; | |

| ● | challenges in recruiting and retaining experienced sales, customer services and management personnel; | |

| ● | costs associated with potential strategic acquisitions; and | |

| ● | burdens of complying with a wide variety of local laws and regulations. |

The occurrence of any of these risks could negatively affect our expansion plan and consequently our business and operating results.

With the proceeds of the IPO, we have plans to open new HomesToLife stores in not only Singapore, but also Taiwan, Korea, Indonesia and Malaysia over the next twelve months, and other parts of Asia in longer term. Expanding internationally is time-consuming, requires significant amounts of management time and resources, substantial upfront investments, including investments in marketing, information technology and additional personnel. Expanding our one-stop shop concept internationally is particularly challenging because it requires us to gain country-specific knowledge about consumers, regional competitors and local laws, construct catalogs specific to the country, open new physical stores, and build local logistics capabilities. These technological and logistical challenges can result in failures or other quality issues that may cause customer dissatisfaction and harm our reputation and brand. In the future, we may also consider incorporating the franchise model in our international expansion plan although there is no assurance at this time that that is what we will do. We also cannot guarantee the success of the franchise model. We may not be able to generate satisfactory net revenue from these efforts to offset related costs. Any lack of market acceptance of our efforts to expand our one-stop shop concept and product offerings into new geographic markets could have a material adverse effect on our business, prospects, financial condition and operating results.

In addition, our current and potential competitors in these new geographic markets may have greater brand recognition, financial resources, longer operating histories and larger customer bases than we do in these markets. If we are not successful to recoup our investments in these new markets, our business, financial condition and operating results may be materially adversely affected.

The upholstered furniture industry we are in is heavily reliant on consumer spending, housing market conditions, and design trends.

The upholstered furniture industry is heavily reliant on consumer spending, housing market conditions, and design trends. We target the premium mass market and at the middle and upper class consumer markets. If there is a decline of discretionary consumer spending or purchasing power in that demographics due to general economic conditions or other reasons, our business and operating results will be adversely affected. We target the customers who may be purchasing their second or third home and prefer furniture of premium quality at affordable prices. An unfavorable housing market condition can have material adverse effect on our business and operating results. We sell luxury contemporary leather and fabric upholstered furniture, such as, sofas, armchairs, recliners, and related accessories in Singapore. If we fail to move with the latest changes to the popular design trends in the market we operate, our business and operating results will suffer.

A cybersecurity attack, data breach or other security incident could impact our sites, networks, systems, platforms, confidential information and assets causing damage and substantial harm to our business and operating results, reputation and brand, and resulting in proceedings or actions against us by government regulatory bodies or private parties.

We collect, maintain, transmit and store data about our customers, employees, contractors, suppliers, vendors and others, including payment information and personally identifiable information, as well as other personal, confidential and proprietary information. In certain instances, we leverage and rely on third-party service providers to collect, maintain, transmit and store certain proprietary, personal and confidential information on our behalf, such as credit card data. To protect such data and other information from being breached, compromised or lost, we maintain and regularly assess against industry standard cybersecurity safeguards and best practices.

| 10 |

Like many businesses, despite all of our efforts to defend against cyber threats and respond to incidents, we, and our third party service providers, have in the past and will in the future continue to be subject to cyber-attacks, cyber security threats and attempts to compromise and penetrate our data security systems and disrupt our operations. Recent cybersecurity incidents impacting large institutions, including those resulting in the compromise of sensitive data and the disruption of critical systems, suggest that the risk of such cyber events is significant, even when reasonable measures to protect the confidentiality, integrity, and availability of information are implemented. This may be as a result of deliberate malicious attempts to infiltrate our systems, including but not limited to, state-sponsored attackers or cybercriminal efforts, zero-day vulnerabilities, phishing attacks, software supply chain compromises, or non-malicious factors, including but not limited to, disruptions during the process of upgrading or replacing computer software or hardware, errors by the vendors we rely upon, or other disruptions that may jeopardize the security of our assets or information. We and our service providers may not anticipate or prevent all types of attacks until after they have already been launched and techniques used to obtain unauthorized access may change frequently and may not be known in the market. Security incidents such as ransomware attacks are becoming increasingly prevalent and severe, as well as increasingly difficult to detect. In addition, security breaches or data and asset leaks can also occur as a result of non-technical issues, including intentional or inadvertent actions by our employees or by persons with whom we have commercial relationships. Further, the prevalence of remote work by some of our employees and those of our third-party service providers creates increased risk that a cybersecurity incident may occur.

In addition to data loss and compromise, cybersecurity incidents or breaches of our security measures or those of our third-party service providers could result in interruption, disruption or malfunction of operations; costs relating to breach remediation, deployment or training of additional personnel and protection technologies, responses to governmental investigations and media inquiries and coverage; engagement of third party experts and consultants; litigation, regulatory action and other potential liabilities. Any compromise or breach of our security measures, or those of our third-party service providers, could violate applicable privacy, data security and other laws and regulations, and cause significant legal and financial exposure, adverse publicity and a loss of confidence in our security measures, which could have a material adverse effect on our business, financial condition and operating results. Our reputation and brand could be damaged, our business may suffer, we could be required to expend significant capital and other resources to alleviate problems caused by such incidents and we could be exposed to a risk of loss, litigation or regulatory action and possible liability. Although we maintain cyber liability insurance, we cannot be certain that our coverage will be adequate for liabilities actually incurred or that insurance will continue to be available to us on economically reasonable terms, or at all. We may need to devote significant resources to protect against security breaches or to address problems caused by breaches, diverting resources from the growth and expansion of our business.

Our failure to operate effectively in a highly competitive and evolving industry could have a material adverse effect on our business.

Our business is rapidly evolving and intensely competitive, with numerous competitors including furniture stores, big box retailers, department stores, specialty retailers and online retailers and marketplaces in Singapore.

We expect competition generally to continue to increase. We believe that our ability to compete successfully depends upon many factors both within and beyond our control, including:

●the size and composition of our customer base;

●the number of suppliers and products we feature in our stores and on our websites;

●our selling and marketing efforts;

●our ability to anticipate consumer demand and preferences;

●the quality, price and reliability of products we offer;

●the convenience of the shopping experience that we provide;

●the adequacy of our customer service;

●our ability to distribute our products and manage our operations; and

●our reputation and brand strength.

Some of our current competitors have, and potential competitors may have, longer operating histories, greater brand recognition, larger fulfillment infrastructures, greater technical capabilities, faster and less costly shipping and assembling, lower prices, significantly greater financial, marketing and other resources and larger customer bases than we do. These factors may allow our competitors to derive greater net revenue and profits from their existing customer base, acquire customers at lower costs or respond more quickly than we can to new or emerging technologies and changes in consumer habits.

| 11 |

Our marketing efforts to help grow our business may not be effective, and failure to effectively develop and expand our sales and marketing capabilities could harm our ability to increase our customer base and achieve broader market acceptance of our products and services.

Our success will depend, in part, on our ability to attract new consumers and retain existing customers. We may have to incur significantly higher and more sustained advertising and promotional expenditures in order to attract additional consumers to our stores and convert them into purchasing customers.

In addition, if we do not have a clear and relevant promotional calendar to engage our customers, especially in the current macroeconomic environment, our customers may purchase fewer goods from us or we may have to increase our promotional activities. If the shopping experience we provide does not appeal to consumers or meet the expectations of existing customers, we may not acquire new customers at sustainable rates, acquired customers may not become repeat customers and existing customers’ buying patterns and levels may decrease.

Our business may be affected by increase in rental expenses or the termination of leases of our retail stores.

We operate our own retail stores under the name “HomesToLife” by offering a one-stop solution to retail customers to address their furniture needs. As of December 31, 2023, we have in operation six retail stores owned and operated by us under our brand name “HomesToLife” in Singapore. The retail stores are essential to our business as they are an important distribution channel of our products. However, there is no assurance that we can renew the existing tenancies upon their respective expiry or can renew the same on terms and conditions no less favorable to us that the existing ones. Failure to renew the existing tenancies on terms and conditions acceptable to us may lead to disruption of our business and additional costs being incurred for relocation and renovation. If we are unable to find alternative locations that are suitable or on commercially acceptable terms in a timely manner, it may lead to reduction in the number of retail stores and our business, results of operation and financial condition may be adversely affected.

Furthermore, rental expenditure is one of the major costs in our business operation. For the two fiscal years ended December 31, 2023 and 2022, payments on lease liabilities, which represent rental costs, accounted to SGD1.4 million (US$1.1 million) and SGD1.3 million, respectively. Any substantial increase in rental expenses of our retail venues may increase our cost of operation and may adversely affect our profitability and financial positions.

We materially rely on HTL Marketing Pte. Ltd. (“HTL Marketing”) and HTL Manufacturing Pte. Ltd. (“HTL Manufacturing”), our sofa suppliers, which are related parties to us. Such arrangement materially and adversely exposes us to unique risk. Any disruption in the supplier’s relationship could have a material adverse effect on our business. Any disruption in the manufacturing of sofas and our inability to identify alternative sofa suppliers may materially and adversely affect our business operations and financial results.

We materially rely on HTL Marketing and HTL Manufacturing, which are related parties to us for supply of goods. For the year ended December 31, 2023, our purchases from HTL Marketing and HTL Manufacturing amount-ed to SGD1.9 million and nil, representing 78% and nil of our purchases, respectively. For the year ended December 31, 2022, our purchases from HTL Marketing and HTL Manufacturing amounted to SGD1.3 million and SGD1.0 million, representing 47% and 35% of our purchases, respectively.

Such arrangements materially and adversely exposes us to a unique risk. Our business relies solely and heavily on a stable and adequate supply of sofas from the sofa manufacturers. If our business relationships with the sofa suppliers are interrupted or terminated, this may lead to a material interruption of our operations or a suspension of our ability to procure sofas or delays in fulfilling our customer orders until we find another supplier that can supply our sofa products. Although we have entered into long term agreements with the sofa manufacturers, there is no assurance that the agreements can be renewed on commercially favorable terms upon their expiration.

Any disruption in our supplier relationships could have a material adverse effect on our business. Events that adversely affect our suppliers could impair our ability to obtain the sofa supply that we desire. Such events include problems with our suppliers’ businesses, finances, labor relations, ability to obtain raw materials, costs, production, quality control, insurance and reputation, as well as natural disasters, pandemics, or other catastrophic occurrences. A failure by any current or future supplier to comply with the environmental, safety or other laws and regulations, meet require timelines, and hire and retain qualified employees may disrupt our supply of products.

In the event of any early termination or non-renewal of our agreements with the sofa manufacturers, or in the event of any disruption, delay or inability on the part of our suppliers to manufacture sufficient and quality products to us, we cannot assure you that we would be able to identify alternative suppliers on commercially acceptable terms which may thereby result in material and adverse effects on our business, financial conditions and operating results. Failure to find a suitable replacement, even on temporary basis, would have an adverse effect on our brand image, financial conditions, and the result of operations.

| 12 |

If our sofa manufacturers fail to deliver the sofa supply we need on the terms we have agreed, it may be challenging to secure alternative sources at commercially acceptable prices or on other satisfactory terms, in a timely manner. Any extended delays in securing an alternative source could result in late shipments of our products to our customers, which could materially and adversely affect our customer relationship, our brand image, profitability, results of operations, and financial condition. If we experience significant increased demand for our products, there can be no assurance that additional supplies of sofas will be available for us when required on acceptable terms, or at all, or our suppliers would allocate sufficient capacity to us in order to meet our requirements, fulfill our orders in a timely manner or meet our strict quality standards. Even if our existing suppliers are able to meet our needs or if we are able to find new manufacturers, we may encounter delays in production, inconsistencies in quality and additional costs. We are not likely to be able to pass the increased costs to the customer immediately, if at all, which may decrease or eliminate our profitability in any period. Any delays or interruption in or increased costs of purchases could have a material and adverse effect on our ability to meet customers’ demand for our products and result in lower net sales and profitability both in the short and long term.

The supply and price of our products are influenced by a number of factors, some of which are beyond our control.

As we do not manufacture our products and instead source them from suppliers in the PRC and a few other Asian countries, the price, quality and supply of our products may be influenced by a number of factors that are beyond our control, including but not limited to the prices of raw materials, the imposition of import or export tariffs or sales taxes, the quality control of our suppliers, logistics costs, shipment delay, bad weather and natural hazards. Any of the above mentioned factors could impact on the price, quality and supply of our products which could materially and adversely affect our business, results of operation and financial condition.

We may be subject to product liability and other similar claims and lawsuits if people or property are harmed by the products we sell.

We source our products from suppliers and are subject to the inherent risks associated therewith, including product recalls, product liability claims, quality control and regulatory action relating to safety, personal injury, death or environmental or property damage. Our suppliers may not have adequate financial resources or insurance coverage to fulfill their obligations under any product warranties given by them. Seeking indemnifications from our suppliers may potentially lead to litigation and claims against us by our customers which may have an adverse effect on our reputation and brand image, lead to negative publicity and, regardless of the validity of such claims, may reduce our sales which may in turn adversely affect our financial performance. We may also be held liable for purchase or import of products made of restricted materials or failing safety standards under the relevant laws and regulations governing the supplier and/or our business operations in Singapore. In addition, if complaints from customers escalate into legal claims, resources such as time and legal costs would have to be incurred to address such claims, thereby further affecting our business and financial performance.

Seasonal trends in our business create variability in our financial and operating results and place increased strain on our operations.

Historically, we have experienced surges in orders associated with promotional activities and seasonal trends. This activity may place additional demands on our staff in our retail stores and our logistics network and could cause or exacerbate slowdowns or interruptions. Any such service interruptions could prevent us from efficiently receiving or fulfilling orders, which may reduce the volume or quality of goods or services we sell and may cause customer dissatisfaction and harm our reputation and brand. We generally record a higher volume of order in March, April, June, August, November and December. In addition, the comparison of our revenue and operating results between different periods in any given financial year may not be relied upon as indicators of our performance. Any unpredictable and material changes in the market during our peak seasons may materially and adversely affect our financial condition and profitability.

| 13 |

Merchandise returns could harm our business.

We allow our customers to return products, subject to our return policy. While our current merchandise returns are minimal, if merchandise returns are significant in the future, our business, prospects, financial condition and results of operations could be affected. Further, we modify our policies relating to returns from time to time, which may result in customer dissatisfaction or an increase in the number of product returns. Many of our products are large and require special handling and delivery. From time to time, our products are damaged in transit, which can increase return rates and affect our brand image and reputation.

We are subject to risks related to online transactions and payment methods.

We accept payments using a variety of methods, including credit card, debit card, electronic and mobile payment technologies, credit accounts (including promotional financing), gift cards and customer invoicing. We rely on third parties to provide many of these payment methods and payment processing services, including certain promotional financing. As we offer new payment options to consumers, we may be subject to additional regulations, compliance requirements and fraud. For certain payment methods, including credit and debit cards, we pay interchange and other fees, which may increase over time and raise our operating costs and lower profitability. As our business changes, we may also be subject to different rules under existing standards, which may require new assessments that involve costs above what we currently pay for compliance. If we fail to comply with the rules or requirements of any provider of a payment method we accept, if the volume of fraud in our transactions limits or terminates our rights to use payment methods we currently accept, or if a data breach occurs relating to our payment systems, we may, among other things, be subject to fines or higher transaction fees and may lose, or face restrictions placed upon, our ability to accept credit card and debit card payments from consumers or to facilitate other types of online payments. If any of these events were to occur, our business, financial condition and operating results could be materially and adversely affected.

We rarely, if not never, have received orders placed with fraudulent credit card data, we may, in the future, suffer losses as a result of orders placed with such fraudulent credit card data even if the associated financial institution approved payment of the orders. Under current credit card practices, we may be liable for fraudulent credit card transactions. We may, in the future, also suffer losses from other online transaction fraud, including fraudulent returns. If we are unable to detect or control credit card or transaction fraud, our liability for these transactions could harm our business, financial condition and operating results.

We may not succeed in implementing our business strategies and future expansion plan.

We cannot guarantee our business strategies and future expansion plans as proposed will be successful as there are a number of factors which are beyond our control and may affect our business prospects such as economic and political conditions, global economic conditions, change in government regulations and customers’ behavior. In particular, there is no assurance that we will be able to find suitable locations for the opening of new retail stores on terms commercially acceptable to us. On the other hand, such expansion may put pressure on our managerial, financial and operational resources. If we are unable to manage our expansion and the rising costs associated with such expansion effectively, our financial condition and result of operation may be adversely affected.

We may be subject to risks associated with debt financing, including rising interest rates.

Due to our working capital requirements to support our day-to-day operations and business expansion, we may finance all or a substantial portion of our costs through bank loans and credit facilities.

While we believe that we have sufficient capital from our available cash resources, our cash generated from our business operations and our credit facilities to meet our current working capital and capital expenditure requirements, we may require additional debt financing to operate our business, implement our future business strategies and/or acquire complementary businesses.

Our ability to obtain debt financing depends on a number of factors including our financial strength, creditworthiness and prospects, as well as other factors beyond our control, including general economic, liquidity and political conditions. There is no assurance that we will be able to secure adequate debt financing on terms acceptable to us, or at all. In the event that we are unable to secure adequate debt financing on terms acceptable to us, we may not be able to implement our business strategies and our business and prospects could be materially and adversely affected as a result. Rising interest rates may increase the Company’s operational costs of funds.

Any disruptions, volatility or uncertainty of the credit markets could limit our ability to borrow funds or cause our borrowings to become more expensive. As such, we may be forced to pay unattractive interest rates, thereby increasing our interest expense, decreasing our profitability and reducing our financial flexibility if we take on additional debt financing. Any material increase in interest rates would also increase our cost of borrowing and debt financing costs, which may weaken our ability to obtain further future debt financing.

| 14 |

Further, debt financing may restrict our freedom to operate our business as it may require conditions and/or covenants that:

| a. | limit our ability to pay dividends or require us to seek consent for the payment of dividends; | |

| b. | require us to dedicate a portion of our cash flow from operations to repayments of our debt, thereby reducing the availability of our cash flow for capital expenditures, working capital and other general corporate purposes; and | |

| c. | limit our flexibility in planning for, or reacting to, changes in our business and our industry. |

Our success depends on our ability to retain our core management team and other key personnel.

Our performance depends on the continued service and performance of our directors, officers and senior management as they are expected to play an important role in guiding the implementation of our business strategies and future plans. If any of our directors, officers or any members of our senior management were to terminate their service or employment, there can be no assurance that we would be able to find suitable replacements in a timely manner, at acceptable cost or at all. The loss of services of key personnel or the inability to identify, hire, train and retain other qualified and managerial personnel in the future may materially and adversely affect our business, financial condition, results of operations and prospects.

Our directors’ and executive officers’ other business activities may pose conflicts of time commitment and conflicts of interest.

Our directors and executive officers have other business interests outside the Company that could potentially give rise to conflicts of time commitment. For example, our directors and executive officers own and/or are employed in executive positions in other HTL Group companies that operate and conduct business outside of Asia, including in the retail sale of such upholstered furniture and related goods, as well as in the manufacturing of such upholstered furniture and related goods.

Below is a chart showing the approximate percentages of the time historically devoted by certain directors and officers to matters concerning the Company and other companies.

| Name | Title | To Company | To other companies | |||||||

| Phua Yong Pin | Chairman | 10 | % | 90 | % | |||||

| Phua Yong Tat | Vice-Chairman | 10 | % | 90 | % | |||||

| Phua Mei Ming | Chief Executive Officer | 50 | % | 50 | % | |||||

| Chew Kwang Yong | Chief Financial Officer | 30 | % | 70 | % | |||||

As these directors and officers devote considerable time and effort to other companies, these sort of business activities could both distract them from focusing on the Company and pose a conflict of time commitment.

Our management team has limited experience managing a public company listed in the U.S.

While the members of our management team have experience in managing a publicly traded company on the Singapore stock exchange in various capacities, most members of our management team have not previously served as management of a publicly traded company on a US stock exchange and may not have experience complying with the increasingly complex laws pertaining to such public companies. Our management team may not successfully or efficiently manage a public company that is subject to significant regulatory oversight and reporting obligations under the U.S. federal securities laws as well as the continuous scrutiny of securities analysts and investors. These new obligations and constituents will require significant attention from our management and could divert their attention away from the day-to-day management of our business, which could adversely affect our business and financial performance.

We are exposed to legal or other proceedings or to other disputes or claims.

In the event that our customers do not make payment in a timely manner, we may seek to enforce our contractual rights and seek recourse via litigation or arbitration. These legal procedures are time-consuming and the settlement of a contract dispute may require additional financial and other resources. Failure to secure adequate payments in time or to manage past due receivables effectively could have a material and adverse effect on our business, financial condition, results of operations and prospects.

Further, disputes and claims may arise, from time to time, between our Group and our customers, suppliers or sub-contractors for various reasons such as delays, unsatisfactory service delivery and alleged breaches of service contracts. To date, we have not been the subject of workplace safety and/or negligence claims from employees and/or members of the public, but there is a risk that such claims may be made against us in the future. These disputes, if remain unresolved or worsen, may eventually result in legal or other proceedings and therefore cause disruptions and delays to our operations, in addition to the extra costs that may be incurred in their settlement or other resolution. Our resources may also be diverted to defend the claims, thereby adversely affecting our Group’s business, financial condition, results of operations and prospects.