| OMB APPROVAL |

|

OMB Number: 3235-0570 Expires: March 31, 2017 Estimated average burden hours per response: 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-02699 | |||

| AIM Growth Series (Invesco Growth Series) | ||||

| (Exact name of registrant as specified in charter) | ||||

| 11 Greenway Plaza, Suite 1000 Houston, Texas 77046 | ||||

| (Address of principal executive offices) (Zip code) | ||||

| Sheri Morris 11 Greenway Plaza, Suite 1000 Houston, Texas 77046 | ||||

| (Name and address of agent for service) | ||||

| Registrant’s telephone number, including area code: | (713) 626-1919 | |||

| Date of fiscal year end: |

12/31 | |||

| Date of reporting period: |

12/31/16 | |||

Item 1. Report to Stockholders.

|

| ||||

|

Annual Report to Shareholders

|

December 31, 2016

| ||

|

| ||||

| Invesco Alternative Strategies Fund

Nasdaq: A: LQLAX ∎ C: LQLCX ∎ R: LQLRX ∎ Y: LQLYX ∎ R5: LQLFX ∎ R6: LQLSX | ||||

Letters to Shareholders

|

Philip Taylor |

Dear Shareholders: This annual report includes information about your Fund, including performance data and a complete list of its investments as of the close of the reporting period. Inside is a discussion of how your Fund was managed and the factors that affected its performance during the reporting period. The reporting period began with significant stock market volatility in the US and abroad; this volatility was the result of investor uncertainty about global economic growth and monetary policy. After recovering, markets declined sharply following UK voters’ decision in June to leave the European Union. Relatively quickly, however, markets recovered, reaching record highs later in the summer. Demand was strong for income-producing investments, particularly those perceived to be lower risk; this benefited bonds as well as dividend-paying stocks for much of the reporting period. While economic news in the US was generally |

positive during the reporting period, news overseas was less upbeat. The European Central Bank and central banks in China and Japan – as well as other countries – maintained extraordinarily accommodative monetary policies in response to economic weakness. After months of uncertainty, the surprise outcome of the US presidential election in November triggered a major stock market rally, with most market indexes reaching new record highs in December. As expected, the US Federal Reserve raised interest rates in December – its only rate increase during the reporting period and only its second increase since 2006. The Fed cited optimistic economic data for its decision, and Fed-watchers suggested that future rate increases might be announced more quickly than previously forecast.

Short-term market volatility can prompt some investors to abandon their investment plans – and can cause others to settle for whatever returns the market has to offer. The investment professionals at Invesco, in contrast, invest with high conviction. This means that, no matter the asset class or the strategy, each investment team has a passion to exceed. We want to help investors achieve better outcomes, such as seeking higher returns, helping mitigate risk and generating income. Of course, investing with high conviction can’t guarantee a profit or ensure success; no investment strategy can. To learn more about how we invest with high conviction, visit invesco.com/HighConviction.

You, too, can invest with high conviction by maintaining a long-term investment perspective and by working with your financial adviser on a regular basis. During periods of short-term market volatility or uncertainty, your financial adviser can keep you focused on your long-term investment goals – a new home, a child’s college education or a secure retirement. He or she also can share research about the economy, the markets and individual investment options.

Visit our website for more information on your investments

Our website, invesco.com/us, offers a wide range of market insights and investment perspectives. On the website, you’ll find detailed information about our funds, including performance, holdings and portfolio manager commentaries. You can access information about your account by completing a simple, secure online registration. Click on the “Need to register” link in the “Account Access” box on our homepage to get started.

In addition to the resources accessible on our website and through our mobile app, you can obtain timely updates to help you stay informed about the markets, the economy and investing by connecting with Invesco on Twitter, LinkedIn or Facebook. You can access our blog at blog.invesco.us.com. Our goal is to provide you the information you want, when and where you want it.

Finally, I’m pleased to share with you Invesco’s commitment to both the Principles for Responsible Investment and to considering environmental, social and governance issues in our robust investment process. I invite you to learn more at invesco.com/esg.

Have questions?

For questions about your account, contact an Invesco client services representative at 800 959 4246. For Invesco-related questions or comments, please email me directly at phil@invesco.com.

All of us at Invesco look forward to serving your investment management needs. Thank you for investing with us.

Sincerely,

Philip Taylor

Senior Managing Director, Invesco Ltd.

| 2 | Invesco Alternative Strategies Fund |

|

Bruce Crockett |

Dear Fellow Shareholders: Among the many important lessons I’ve learned in more than 40 years in a variety of business endeavors is the value of a trusted advocate. As independent chair of the Invesco Funds Board, I can assure you that the members of the Board are strong advocates for the interests of investors in Invesco’s mutual funds. We work hard to represent your interests through oversight of the quality of the investment management services your funds receive and other matters important to your investment, including but not limited to: ∎ Ensuring that Invesco offers a diverse lineup of mutual funds that your financial adviser can use to strive to meet your financial needs as your investment goals change over time. ∎ Monitoring how the portfolio management teams of the Invesco funds are performing in light of changing economic and market conditions. |

| ∎ | Assessing each portfolio management team’s investment performance within the context of the investment strategy described in the fund’s prospectus. |

| ∎ | Monitoring for potential conflicts of interests that may impact the nature of the services that your funds receive. |

We believe one of the most important services we provide our fund shareholders is the annual review of the funds’ advisory and sub-advisory contracts with Invesco Advisers and its affiliates. This review is required by the Investment Company Act of 1940 and focuses on the nature and quality of the services Invesco provides as the adviser to the Invesco funds and the reasonableness of the fees that it charges for those services. Each year, we spend months carefully reviewing information received from Invesco and a variety of independent sources, such as performance and fee data prepared by Lipper, Inc. (a subsidiary of Broadridge Financial Solutions, Inc.), an independent, third-party firm widely recognized as a leader in its field. We also meet with our independent legal counsel and other independent advisers to review and help us assess the information that we have received. Our goal is to assure that you receive quality investment management services for a reasonable fee.

I trust the measures outlined above provide assurance that you have a worthy advocate when it comes to choosing the Invesco Funds.

As always, please contact me at bruce@brucecrockett.com with any questions or concerns you may have. On behalf of the Board, we look forward to continuing to represent your interests and serving your needs.

Sincerely,

Bruce L. Crockett

Independent Chair

Invesco Funds Board of Trustees

| 3 | Invesco Alternative Strategies Fund |

Management’s Discussion of Fund Performance

| 4 | Invesco Alternative Strategies Fund |

| 5 | Invesco Alternative Strategies Fund |

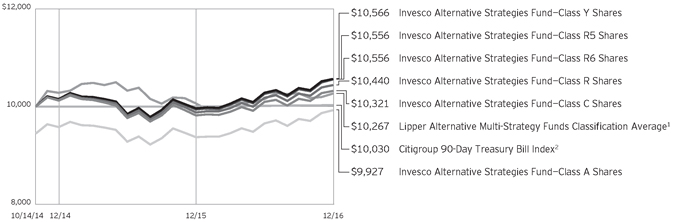

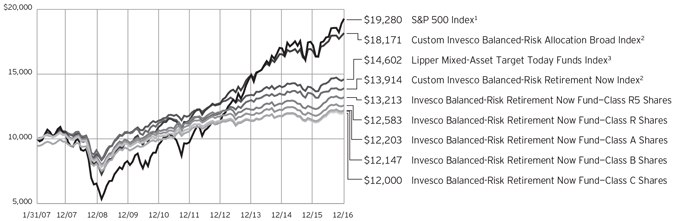

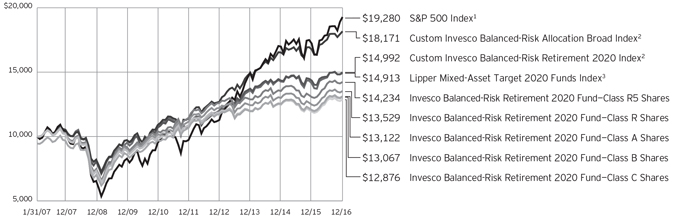

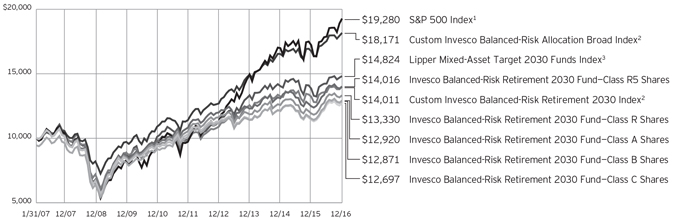

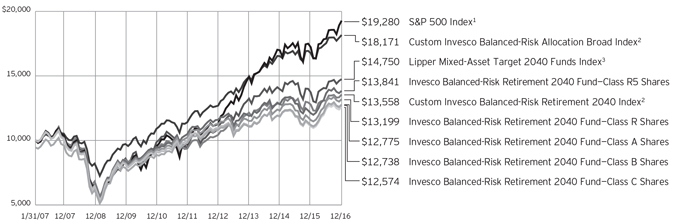

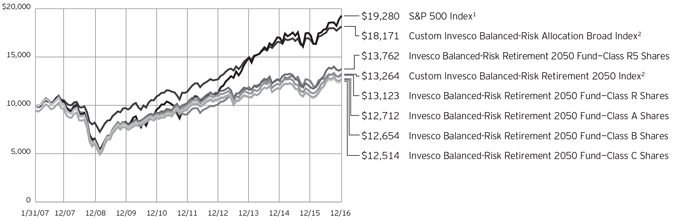

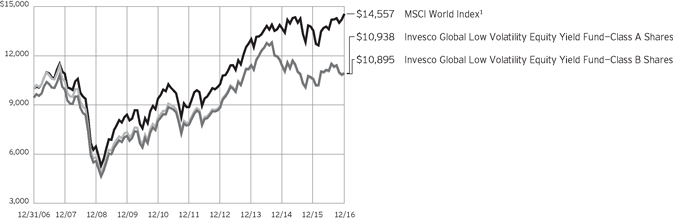

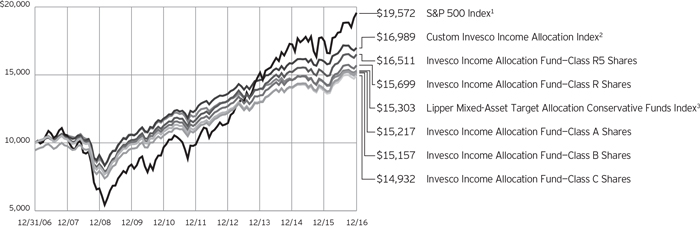

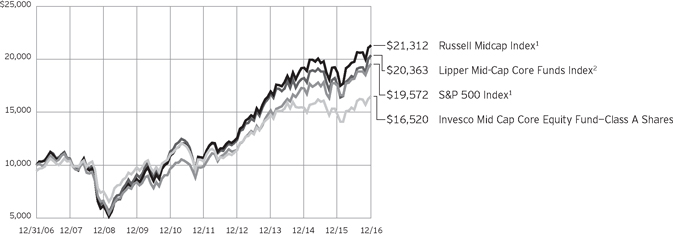

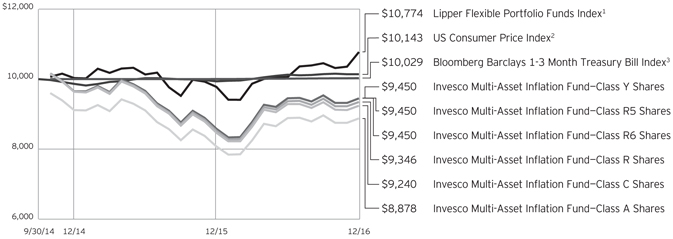

Your Fund’s Long-Term Performance

Results of a $10,000 Investment – Oldest Share Class(es) since Inception

Fund and index data from 10/14/14

1 Source: Lipper Inc.

2 Source: FactSet Research Systems Inc.

| 6 | Invesco Alternative Strategies Fund |

| 7 | Invesco Alternative Strategies Fund |

Invesco Alternative Strategies Fund’s investment objective is long-term capital appreciation.

| ∎ | Unless otherwise stated, information presented in this report is as of December 31, 2016, and is based on total net assets. |

| ∎ | Unless otherwise noted, all data provided by Invesco. |

| ∎ | To access your Fund’s reports/prospectus, visit invesco.com/fundreports. |

|

This report must be accompanied or preceded by a currently effective Fund prospectus, which contains more complete information, including sales charges and expenses. Investors should read it carefully before investing. |

|

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE |

| 8 | Invesco Alternative Strategies Fund |

| 9 | Invesco Alternative Strategies Fund |

| 10 | Invesco Alternative Strategies Fund |

| 11 | Invesco Alternative Strategies Fund |

| 12 | Invesco Alternative Strategies Fund |

| 13 | Invesco Alternative Strategies Fund |

Schedule of Investments

December 31, 2016

Invesco Alternative Strategies Fund

Schedule of Investments in Affiliated Issuers–98.66%(a)

| % of Net Assets 12/31/16 |

Value 12/31/15 |

Purchases at Cost |

Proceeds from Sales |

Change in Unrealized Appreciation (Depreciation) |

Realized Gain (Loss) |

Dividend Income |

Shares 12/31/16 |

Value 12/31/16 |

||||||||||||||||||||||||||||

| Alternative Funds–4.32% |

| |||||||||||||||||||||||||||||||||||

| Powershares DB Base Metals Fund–ETF(b) |

2.38 | % | $ | 19,970 | $ | 23,727 | $ | (14,073 | ) | $ | 8,979 | $ | (1,736 | ) | $ | — | 2,471 | $ | 36,867 | |||||||||||||||||

| Powershares DB Silver Fund–ETF(b) |

1.94 | % | 16,534 | 21,998 | (9,917 | ) | 1,597 | (181 | ) | — | 1,208 | 30,031 | ||||||||||||||||||||||||

| Total Alternative Funds |

36,504 | 45,725 | (23,990 | ) | 10,576 | (1,917 | ) | — | 66,898 | |||||||||||||||||||||||||||

| Asset Allocation Funds–34.06% |

| |||||||||||||||||||||||||||||||||||

| Invesco Balanced-Risk Allocation Fund - Class R6 |

16.86 | % | 136,551 | 206,428 | (81,929 | ) | 6,881 | 3,838 | 10,420 | 24,550 | 261,214 | |||||||||||||||||||||||||

| Invesco Balanced-Risk Commodity Strategy Fund - Class R6 |

2.28 | % | 18,186 | 24,746 | (9,441 | ) | 2,752 | (941 | ) | 939 | 5,184 | 35,302 | ||||||||||||||||||||||||

| Invesco Macro Allocation Strategy Fund - Class R6(c) |

14.92 | % | 132,724 | 181,051 | (70,610 | ) | (11,151 | ) | (961 | ) | 28,995 | 25,060 | 231,053 | |||||||||||||||||||||||

| Total Asset Allocation Funds |

287,461 | 412,225 | (161,980 | ) | (1,518 | ) | 1,936 | 40,354 | 527,569 | |||||||||||||||||||||||||||

| Domestic Equity Funds–20.93% |

| |||||||||||||||||||||||||||||||||||

| Invesco All Cap Market Neutral Fund - Class R6(b) |

17.08 | % | 152,531 | 208,893 | (109,070 | ) | 14,847 | (2,484 | ) | — | 25,101 | 264,570 | ||||||||||||||||||||||||

| Invesco Long/Short Equity Fund - Class R6(b) |

3.85 | % | 30,984 | 45,436 | (22,356 | ) | 5,848 | 100 | — | 5,071 | 59,633 | |||||||||||||||||||||||||

| Total Domestic Equity Funds |

183,515 | 254,329 | (131,426 | ) | 20,695 | (2,384 | ) | — | 324,203 | |||||||||||||||||||||||||||

| Fixed-Income Funds–1.98% |

| |||||||||||||||||||||||||||||||||||

| Invesco Floating Rate Fund - Class R6 |

1.98 | % | 17,349 | 14,990 | (3,099 | ) | 1,799 | (338 | ) | 1,133 | 4,055 | 30,701 | ||||||||||||||||||||||||

| Foreign Equity Funds–32.89% |

| |||||||||||||||||||||||||||||||||||

| Invesco Global Infrastructure Fund - Class R6 |

3.87 | % | 36,420 | 46,602 | (25,372 | ) | 4,385 | (2,177 | ) | 971 | 6,402 | 59,858 | ||||||||||||||||||||||||

| Invesco Global Market Neutral Fund - Class R6(b) |

18.18 | % | 162,257 | 224,386 | (104,067 | ) | 1,214 | (2,187 | ) | — | 28,048 | 281,603 | ||||||||||||||||||||||||

| Invesco Macro Long/Short Fund - Class R6 |

10.84 | % | 104,523 | 117,555 | (59,187 | ) | 8,405 | (3,352 | ) | 1,179 | 17,586 | 167,944 | ||||||||||||||||||||||||

| Total Foreign Equity Funds |

303,200 | 388,543 | (188,626 | ) | 14,004 | (7,716 | ) | 2,150 | 509,405 | |||||||||||||||||||||||||||

| Real Estate Funds–3.86% |

| |||||||||||||||||||||||||||||||||||

| Invesco Global Real Estate Fund - Class R6 |

3.86 | % | 35,061 | 43,428 | (16,662 | ) | (846 | ) | (1,280 | ) | 2,352 | 4,858 | 59,701 | |||||||||||||||||||||||

| Money Market Funds–0.62% |

| |||||||||||||||||||||||||||||||||||

| Government & Agency Portfolio–Institutional Class, 0.43%(e) |

0.35 | % | — | 120,197 | (114,738 | ) | — | — | 5 | 5,459 | 5,459 | |||||||||||||||||||||||||

| Liquid Assets Portfolio–Institutional Class, 0.37%(e) |

0.00 | % | 20,576 | 407,032 | (427,608 | ) | — | — | 19 | — | — | |||||||||||||||||||||||||

| Premier Portfolio–Institutional Class, 0.65%(e) |

0.00 | % | 20,576 | 407,032 | (427,608 | ) | — | — | 18 | — | — | |||||||||||||||||||||||||

| Treasury Portfolio–Institutional Class, 0.37%(e) |

0.27 | % | — | 80,132 | (76,049 | ) | — | — | 3 | 4,083 | 4,083 | |||||||||||||||||||||||||

| Total Money Market Funds |

41,152 | 1,014,393 | (1,046,003 | ) | — | — | 45 | 9,542 | ||||||||||||||||||||||||||||

| TOTAL INVESTMENTS IN AFFILIATED ISSUERS (Cost $1,521,983) |

98.66 | % | $ | 904,242 | $ | 2,173,633 | $ | (1,571,786 | ) | $ | 44,710 | $ | (11,699 | )(d) | $ | 46,034 | $ | 1,528,019 | ||||||||||||||||||

| OTHER ASSETS LESS LIABILITIES |

1.34 | % | 20,809 | |||||||||||||||||||||||||||||||||

| NET ASSETS |

100.00 | % | $ | 1,548,828 | ||||||||||||||||||||||||||||||||

Investment Abbreviations:

ETF – Exchange Traded Fund

Notes to Schedule of Investments:

| (a) | Each underlying fund and the Fund are affiliated by either having the same investment adviser or an investment adviser under common control with the Fund’s investment adviser. |

| (b) | Non-income producing security. A security is determined to be non-income producing if the security has not declared a distribution in more than one year from the report date. |

| (c) | Effective July 27, 2016, Invesco Global Markets Strategy Fund was renamed as Invesco Macro Allocation Strategy Fund. |

| (d) | Includes $10,555, $147 and $379 of capital gains distributions from affiliated underlying funds for Invesco Balanced-Risk Allocation Fund, Invesco All Cap Market Neutral Fund and Invesco Long/Short Equity Fund, respectively. |

| (e) | The rate shown is the 7-day SEC standardized yield as of December 31, 2016. |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

14 Invesco Alternative Strategies Fund

Statement of Assets and Liabilities

December 31, 2016

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

15 Invesco Alternative Strategies Fund

Statement of Operations

For the year ended December 31, 2016

| Investment income: |

| |||

| Dividends from affiliated underlying funds |

$ | 46,034 | ||

| Other Income |

140 | |||

| Total investment income |

46,174 | |||

| Expenses: |

||||

| Advisory fees |

1,777 | |||

| Administrative services fees |

50,000 | |||

| Custodian fees |

8,998 | |||

| Distribution fees: |

||||

| Class A |

1,652 | |||

| Class C |

1,436 | |||

| Class R |

88 | |||

| Transfer agent fees — A, C, R and Y |

4,564 | |||

| Transfer agent fees — R5 |

10 | |||

| Transfer agent fees — R6 |

10 | |||

| Trustees’ and officers’ fees and benefits |

19,372 | |||

| Registration and filing fees |

71,639 | |||

| Reports to shareholders |

15,336 | |||

| Professional services fees |

35,362 | |||

| Other |

12,306 | |||

| Total expenses |

222,550 | |||

| Less: Fees waived and expenses reimbursed |

(216,224 | ) | ||

| Net expenses |

6,326 | |||

| Net investment income |

39,848 | |||

| Realized and unrealized gain (loss) from investments in affiliated underlying fund shares: |

||||

| Net realized gain (loss) on sales of affiliated underlying fund shares |

(22,780 | ) | ||

| Net realized gain from distributions of affiliated underlying fund shares |

11,081 | |||

| (11,699 | ) | |||

| Change in net unrealized appreciation of affiliated underlying fund shares |

44,710 | |||

| Net gain from affiliated underlying funds |

33,011 | |||

| Net increase in net assets resulting from operations |

$ | 72,859 | ||

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

16 Invesco Alternative Strategies Fund

Statement of Changes in Net Assets

For the years ended December 31, 2016 and 2015

| 2016 | 2015 | |||||||

| Operations: |

|

|||||||

| Net investment income |

$ | 39,848 | $ | 25,273 | ||||

| Net realized gain (loss) |

(11,699 | ) | (6,746 | ) | ||||

| Change in net unrealized appreciation (depreciation) |

44,710 | (31,377 | ) | |||||

| Net increase (decrease) in net assets resulting from operations |

72,859 | (12,850 | ) | |||||

| Distributions to shareholders from net investment income: |

||||||||

| Class A |

(28,320 | ) | (20,322 | ) | ||||

| Class C |

(4,558 | ) | (2,788 | ) | ||||

| Class R |

(575 | ) | (723 | ) | ||||

| Class Y |

(17,612 | ) | (10,795 | ) | ||||

| Class R5 |

(353 | ) | (411 | ) | ||||

| Class R6 |

(353 | ) | (411 | ) | ||||

| Total distributions from net investment income |

(51,771 | ) | (35,450 | ) | ||||

| Distributions to shareholders from net realized gains: |

||||||||

| Class A |

(264 | ) | (1,156 | ) | ||||

| Class C |

(52 | ) | (174 | ) | ||||

| Class R |

(6 | ) | (43 | ) | ||||

| Class Y |

(155 | ) | (591 | ) | ||||

| Class R5 |

(3 | ) | (22 | ) | ||||

| Class R6 |

(3 | ) | (22 | ) | ||||

| Total distributions from net realized gains |

(483 | ) | (2,008 | ) | ||||

| Share transactions–net: |

||||||||

| Class A |

354,562 | 366,449 | ||||||

| Class C |

56,719 | 83,830 | ||||||

| Class R |

(620 | ) | 1,256 | |||||

| Class Y |

234,568 | (38,255 | ) | |||||

| Net increase in net assets resulting from share transactions |

645,229 | 413,280 | ||||||

| Net increase in net assets |

665,834 | 362,972 | ||||||

| Net assets: |

||||||||

| Beginning of year |

882,994 | 520,022 | ||||||

| End of year (includes undistributed net investment income of $(796) and $(1,721), respectively) |

$ | 1,548,828 | $ | 882,994 | ||||

Notes to Financial Statements

December 31, 2016

NOTE 1—Significant Accounting Policies

Invesco Alternative Strategies Fund (the “Fund”) is a series portfolio of AIM Growth Series (Invesco Growth Series) (the “Trust”). The Trust is organized as a Delaware statutory trust and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end series management investment company consisting of seventeen separate series portfolios, each authorized to issue an unlimited number of shares of beneficial interest. The assets, liabilities and operations of each portfolio are accounted for separately. Information presented in these financial statements pertains only to the Fund. Matters affecting each portfolio or class will be voted on exclusively by the shareholders of such portfolio or class.

The Fund’s investment objective is long-term capital appreciation.

The Fund is a “fund of funds”, in that it invests in other mutual funds (“underlying funds”) advised by Invesco Advisers, Inc. (the “Adviser” or “Invesco”) and exchange-traded funds advised by Invesco PowerShares Capital Management LLC (“PowerShares Capital”), an affiliate of Invesco. Invesco and PowerShares Capital are affiliates of each other as they are indirect, wholly-owned subsidiaries of Invesco Ltd. Invesco may change the Fund’s asset class allocations or the underlying funds without shareholder approval. The underlying funds may engage in a number of investment techniques and practices, which involve certain risks. Each underlying fund’s accounting policies are outlined in the underlying fund’s financial statements and are publicly available.

17 Invesco Alternative Strategies Fund

The Fund currently consists of six different classes of shares: Class A, Class C, Class R, Class Y, Class R5 and Class R6. Class Y shares are available only to certain investors. Class A shares are sold with a front-end sales charge unless certain waiver criteria are met and under certain circumstances load waived shares may be subject to contingent deferred sales charges (“CDSC”). Class C shares are sold with a CDSC. Class R, Class Y, Class R5 and Class R6 shares are sold at net asset value.

The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 946, Financial Services — Investment Companies.

The following is a summary of the significant accounting policies followed by the Fund in the preparation of its financial statements.

| A. | Security Valuations — Securities of investment companies that trade on an exchange are valued at the last sales price or official closing price as of the close of the customary trading session on the exchange where the security is principally traded. Investments in shares of funds that are not traded on an exchange are valued at the end-of-day net asset value per share of such fund. Securities in the underlying funds, including restricted securities, are valued in accordance with the valuation policy of such fund. The policies of the underlying funds affiliated with the Fund as a result of having the same investment adviser are set forth below. |

A security listed or traded on an exchange (except convertible securities) is valued at its last sales price or official closing price as of the close of the customary trading session on the exchange where the security is principally traded, or lacking any sales or official closing price on a particular day, the security may be valued at the closing bid price on that day. Securities traded in the over-the-counter market are valued based on prices furnished by independent pricing services or market makers. When such securities are valued by an independent pricing service they may be considered fair valued. Futures contracts are valued at the final settlement price set by an exchange on which they are principally traded. Listed options are valued at the mean between the last bid and asked prices from the exchange on which they are principally traded. Options not listed on an exchange are valued by an independent source at the mean between the last bid and asked prices. For purposes of determining net asset value (“NAV”) per share, futures and option contracts generally are valued 15 minutes after the close of the customary trading session of the New York Stock Exchange (“NYSE”).

Senior secured floating rate loans and senior secured floating rate debt securities are fair valued using an evaluated quote provided by an independent pricing service. Evaluated quotes provided by the pricing service may reflect appropriate factors such as ratings, tranche type, industry, company performance, spread, individual trading characteristics, institution-size trading in similar groups of securities and other market data.

Investments in open-end and closed-end registered investment companies that do not trade on an exchange are valued at the end-of-day net asset value per share. Investments in open-end and closed-end registered investment companies that trade on an exchange are valued at the last sales price or official closing price as of the close of the customary trading session on the exchange where the security is principally traded.

Debt obligations (including convertible securities) and unlisted equities are fair valued using an evaluated quote provided by an independent pricing service. Evaluated quotes provided by the pricing service may be determined without exclusive reliance on quoted prices, and may reflect appropriate factors such as institution-size trading in similar groups of securities, developments related to specific securities, dividend rate (for unlisted equities), yield (for debt obligations), quality, type of issue, coupon rate (for debt obligations), maturity (for debt obligations), individual trading characteristics and other market data. Debt obligations are subject to interest rate and credit risks. In addition, all debt obligations involve some risk of default with respect to interest and/or principal payments.

Foreign securities’ (including foreign exchange contracts) prices are converted into U.S. dollar amounts using the applicable exchange rates as of the close of the NYSE. If market quotations are available and reliable for foreign exchange-traded equity securities, the securities will be valued at the market quotations. Because trading hours for certain foreign securities end before the close of the NYSE, closing market quotations may become unreliable. If between the time trading ends on a particular security and the close of the customary trading session on the NYSE, events occur that the Adviser determines are significant and make the closing price unreliable, the Fund may fair value the security. If the event is likely to have affected the closing price of the security, the security will be valued at fair value in good faith using procedures approved by the Board of Trustees. Adjustments to closing prices to reflect fair value may also be based on a screening process of an independent pricing service to indicate the degree of certainty, based on historical data, that the closing price in the principal market where a foreign security trades is not the current value as of the close of the NYSE. Foreign securities’ prices meeting the approved degree of certainty that the price is not reflective of current value will be priced at the indication of fair value from the independent pricing service. Multiple factors may be considered by the independent pricing service in determining adjustments to reflect fair value and may include information relating to sector indices, American Depositary Receipts and domestic and foreign index futures. Foreign securities may have additional risks including exchange rate changes, potential for sharply devalued currencies and high inflation, political and economic upheaval, the relative lack of issuer information, relatively low market liquidity and the potential lack of strict financial and accounting controls and standards.

Securities for which market prices are not provided by any of the above methods may be valued based upon quotes furnished by independent sources. The last bid price may be used to value equity securities. The mean between the last bid and asked prices is used to value debt obligations, including corporate loans.

Securities for which market quotations are not readily available or became unreliable are valued at fair value as determined in good faith by or under the supervision of the Trust’s officers following procedures approved by the Board of Trustees. Issuer specific events, market trends, bid/asked quotes of brokers and information providers and other market data may be reviewed in the course of making a good faith determination of a security’s fair value.

The Fund may invest in securities that are subject to interest rate risk, meaning the risk that the prices will generally fall as interest rates rise and, conversely, the prices will generally rise as interest rates fall. Specific securities differ in their sensitivity to changes in interest rates depending on their individual characteristics. Changes in interest rates may result in increased market volatility, which may affect the value and/or liquidity of certain Fund investments.

Valuations change in response to many factors including the historical and prospective earnings of the issuer, the value of the issuer’s assets, general economic conditions, interest rates, investor perceptions and market liquidity. Because of the inherent uncertainties of valuation, the values reflected in the financial statements may materially differ from the value received upon actual sale of those investments.

| B. | Securities Transactions and Investment Income — Securities transactions are accounted for on a trade date basis. Realized gains or losses on sales are computed on the basis of specific identification of the securities sold. Distributions from ordinary income from underlying |

18 Invesco Alternative Strategies Fund

| funds, if any, are recorded as dividend income on ex-dividend date. Distributions from gains from underlying funds, if any, are recorded as realized gains on the ex-dividend date. The following policies are followed by the underlying funds: Interest income (net of withholding tax, if any) is recorded on the accrual basis from settlement date. Bond premiums and discounts are amortized and/or accreted for financial reporting purposes. Paydown gains and losses on mortgage and asset-backed securities are recorded as adjustments to interest income. |

The Fund may periodically participate in litigation related to Fund investments. As such, the Fund may receive proceeds from litigation settlements. Any proceeds received are included in the Statement of Operations as realized gain (loss) for investments no longer held and as unrealized gain (loss) for investments still held.

The Fund allocates income and realized and unrealized capital gains and losses to a class based on the relative net assets of each class.

| C. | Distributions — Distributions from net investment income and net realized capital gain, if any, are generally declared and paid annually and recorded on the ex-dividend date. The Fund may elect to treat a portion of the proceeds from redemptions as distributions for federal income tax purposes. |

| D. | Federal Income Taxes — The Fund intends to comply with the requirements of Subchapter M of the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”), necessary to qualify as a regulated investment company and to distribute substantially all of the Fund’s taxable earnings to shareholders. As such, the Fund will not be subject to federal income taxes on otherwise taxable income (including net realized capital gain) that is distributed to shareholders. Therefore, no provision for federal income taxes is recorded in the financial statements. |

The Fund recognizes the tax benefits of uncertain tax positions only when the position is more likely than not to be sustained. Management has analyzed the Fund’s uncertain tax positions and concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions. Management is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next 12 months.

The Fund files tax returns in the U.S. Federal jurisdiction and certain other jurisdictions. Generally, the Fund is subject to examinations by such taxing authorities for up to three years after the filing of the return for the tax period.

| E. | Expenses — Expenses included in the accompanying financial statements reflect the expenses of the Fund and do not include any expenses of the underlying funds. The effects of the underlying funds’ expenses are included in the realized and unrealized gain/loss on the investments in the underlying funds. Estimated expenses of the underlying funds are discussed further in Note 10. |

Fees provided for under the Rule 12b-1 plan of a particular class of the Fund and which are directly attributable to that class are charged to the operations of such class. Transfer agency fees and expenses and other shareholder recordkeeping fees and expenses attributable to Class R5 and Class R6 are allocated to each share class based on relative net assets. Transfer agency fees and expenses and other shareholder recordkeeping fees and expenses relating to all other classes are allocated among those classes based on relative net assets. All other expenses are allocated among the classes based on relative net assets.

| F. | Accounting Estimates — The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period including estimates and assumptions related to taxation. Actual results could differ from those estimates by a significant amount. In addition, the Fund monitors for material events or transactions that may occur or become known after the period-end date and before the date the financial statements are released to print. |

| G. | Indemnifications — Under the Trust’s organizational documents, each Trustee, officer, employee or other agent of the Trust is indemnified against certain liabilities that may arise out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts, including the Fund’s servicing agreements, that contain a variety of indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. The risk of material loss as a result of such indemnification claims is considered remote. |

NOTE 2—Advisory Fees and Other Fees Paid to Affiliates

The Trust has entered into a master investment advisory agreement with Invesco Advisers, Inc. (the “Adviser” or “Invesco”). Under the terms of the investment advisory agreement, the Fund pays an advisory fee to the Adviser based on the annual rate of 0.15% of the Fund’s average daily net assets.

Under the terms of a master sub-advisory agreement between the Adviser and each of Invesco Asset Management Deutschland GmbH, Invesco Asset Management Limited, Invesco Asset Management (Japan) Limited, Invesco Hong Kong Limited, Invesco Senior Secured Management, Inc. and Invesco Canada Ltd. and a separate sub-advisory agreement with Invesco PowerShares Capital Management LLC (collectively, the “Affiliated Sub-Advisers”) the Adviser, not the Fund, will pay 40% of the fees paid to the Adviser to any such Affiliated Sub-Adviser(s) that provide(s) discretionary investment management services to the Fund based on the percentage of assets allocated to such Affiliated Sub-Adviser(s).

The Adviser had contractually agreed, through at least April 30, 2017, to reimburse expenses to the extent necessary to limit total annual fund operating expenses after expense reimbursement (including prior fiscal year-end Acquired Fund Fees and Expenses of 1.02% and excluding certain items discussed below) of Class A, Class C, Class R, Class Y, Class R5 and Class R6 shares to 1.75%, 2.50%, 2.00%, 1.50%, 1.50% and 1.50%, respectively, of average daily net assets (the “expense limits”). Effective January 1, 2017, the Adviser has contractually agreed, through at least April 30, 2018, to waive advisory fees and/or reimburse expenses to the extent necessary to limit total annual fund operating expenses after fee waiver and/or expense reimbursement (including restated prior fiscal year-end Acquired Fund Fees and Expenses of 1.14% and excluding certain items discussed below) of Class A, Class C, Class R, Class Y, Class R5 and Class R6 shares to 1.44%, 2.19%, 1.69%, 1.19%, 1.19% and 1.19%, respectively, of average daily net assets. In determining the Adviser’s obligation to reimburse expenses, the following expenses are not taken into account, and could cause the total annual fund operating expenses after expense reimbursement to exceed the numbers reflected above: (1) interest; (2) taxes; (3) dividend expense on short sales; (4) extraordinary or non-routine items, including litigation expenses; and (5) expenses that the Fund has incurred but did not actually pay because of an expense offset arrangement. Acquired Fund Fees and Expenses are not operating expenses of the Fund directly, but are fees and expenses, including management fees of the investment companies in which the Fund invests. Unless Invesco continues the fee waiver agreement, it will terminate on April 30, 2018. During its term, the fee waiver agreement cannot be terminated or amended to increase the expense limits without approval of the Board of Trustees.

19 Invesco Alternative Strategies Fund

Further, the Adviser has contractually agreed, through at least June 30, 2018, to waive the advisory fee payable by the Fund in an amount equal to 100% of the net advisory fees the Adviser receives from the affiliated money market funds on investments by the Fund of uninvested cash in such affiliated money market funds.

For the year ended December 31, 2016, the Adviser waived advisory fees of $1,777, reimbursed fund level expenses of $209,863 and reimbursed class level expenses of $2,588, $562, $69, $1,345, $10 and $10 of Class A, Class C, Class R, Class Y, Class R5 and Class R6 shares, respectively.

The Trust has entered into a master administrative services agreement with Invesco pursuant to which the Fund has agreed to pay Invesco for certain administrative costs incurred in providing accounting services to the Fund. For the year ended December 31, 2016, expenses incurred under the agreement are shown in the Statement of Operations as Administrative services fees.

The Trust has entered into a transfer agency and service agreement with Invesco Investment Services, Inc. (“IIS”) pursuant to which the Fund has agreed to pay IIS a fee for providing transfer agency and shareholder services to the Fund and reimburse IIS for certain expenses incurred by IIS in the course of providing such services. IIS may make payments to intermediaries that provide omnibus account services, sub-accounting services and/or networking services. All fees payable by IIS to intermediaries that provide omnibus account services or sub-accounting are charged back to the Fund, subject to certain limitations approved by the Trust’s Board of Trustees. For the year ended December 31, 2016, expenses incurred under the agreement are shown in the Statement of Operations as Transfer agent fees.

The Trust has entered into master distribution agreements with Invesco Distributors, Inc. (“IDI”) to serve as the distributor for the Class A, Class C, Class R, Class Y, Class R5 and Class R6 shares of the Fund. The Trust has adopted plans pursuant to Rule 12b-1 under the 1940 Act with respect to the Fund’s Class A, Class C and Class R shares (collectively, the “Plans”). The Fund, pursuant to the Plans, pays IDI compensation at the annual rate of 0.25% of the Fund’s average daily net assets of Class A shares, 1.00% of the average daily net assets of Class C shares and 0.50% of the average daily net assets of Class R shares. Of the Plan payments, up to 0.25% of the average daily net assets of each class of shares may be paid to furnish continuing personal shareholder services to customers who purchase and own shares of such classes. Any amounts not paid as a service fee under the Plans would constitute an asset-based sales charge. Rules of the Financial Industry Regulatory Authority (“FINRA”) impose a cap on the total sales charges, including asset-based sales charges, that may be paid by any class of shares of the Fund. For the year ended December 31, 2016, expenses incurred under the Plans are shown in the Statement of Operations as Distribution fees.

Front-end sales commissions and CDSC (collectively, the “sales charges”) are not recorded as expenses of the Fund. Front-end sales commissions are deducted from proceeds from the sales of Fund shares prior to investment in Class A shares of the Fund. CDSC are deducted from redemption proceeds prior to remittance to the shareholder. During the year ended December 31, 2016, IDI advised the Fund that IDI retained $619 in front-end sales commissions from the sale of Class A shares.

The underlying Invesco funds pay no distribution fees for Class Y and Class R6 shares, and the Fund pays no sales loads or other similar compensation to IDI for acquiring underlying fund shares.

Certain officers and trustees of the Trust are officers and directors of the Adviser, IIS and/or IDI.

NOTE 3—Additional Valuation Information

GAAP defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date, under current market conditions. GAAP establishes a hierarchy that prioritizes the inputs to valuation methods, giving the highest priority to readily available unadjusted quoted prices in an active market for identical assets (Level 1) and the lowest priority to significant unobservable inputs (Level 3), generally when market prices are not readily available or are unreliable. Based on the valuation inputs, the securities or other investments are tiered into one of three levels. Changes in valuation methods may result in transfers in or out of an investment’s assigned level:

| Level 1 — | Prices are determined using quoted prices in an active market for identical assets. |

| Level 2 — | Prices are determined using other significant observable inputs. Observable inputs are inputs that other market participants may use in pricing a security. These may include quoted prices for similar securities, interest rates, prepayment speeds, credit risk, yield curves, loss severities, default rates, discount rates, volatilities and others. |

| Level 3 — | Prices are determined using significant unobservable inputs. In situations where quoted prices or observable inputs are unavailable (for example, when there is little or no market activity for an investment at the end of the period), unobservable inputs may be used. Unobservable inputs reflect the Fund’s own assumptions about the factors market participants would use in determining fair value of the securities or instruments and would be based on the best available information. |

As of December 31, 2016, all of the securities in this Fund were valued based on Level 1 inputs (see the Schedule of Investments for security categories). The level assigned to the securities valuations may not be an indication of the risk or liquidity associated with investing in those securities.

NOTE 4—Trustees’ and Officers’ Fees and Benefits

Trustees’ and Officers’ Fees and Benefits include amounts accrued by the Fund to pay remuneration to certain Trustees and Officers of the Fund. Trustees have the option to defer compensation payable by the Fund, and Trustees’ and Officers’ Fees and Benefits also include amounts accrued by the Fund to fund such deferred compensation amounts. Those Trustees who defer compensation have the option to select various Invesco Funds in which their deferral accounts shall be deemed to be invested. Obligations under the deferred compensation plan represent unsecured claims against the general assets of the Fund.

20 Invesco Alternative Strategies Fund

NOTE 5—Cash Balances

The Fund is permitted to temporarily carry a negative or overdrawn balance in its account with State Street Bank and Trust Company, the custodian bank. Such balances, if any at period-end, are shown in the Statement of Assets and Liabilities under the payable caption Amount due custodian. To compensate the custodian bank for such overdrafts, the overdrawn Fund may either (1) leave funds as a compensating balance in the account so the custodian bank can be compensated by earning the additional interest; or (2) compensate by paying the custodian bank at a rate agreed upon by the custodian bank and Invesco, not to exceed the contractually agreed upon rate.

NOTE 6—Distributions to Shareholders and Tax Components of Net Assets

Tax Character of Distributions to Shareholders Paid During the Fiscal Years Ended December 31, 2016 and 2015:

| 2016 | 2015 | |||||||

| Ordinary income |

$ | 45,686 | $ | 33,975 | ||||

| Long-term capital gain |

6,568 | 3,483 | ||||||

| Total distributions |

$ | 52,254 | $ | 37,458 | ||||

Tax Components of Net Assets at Period-End:

| 2016 | ||||

| Undistributed long-term gain |

$ | 1,842 | ||

| Net unrealized appreciation (depreciation) — investments |

(28,876 | ) | ||

| Temporary book/tax differences |

(3,889 | ) | ||

| Shares of beneficial interest |

1,579,751 | |||

| Total net assets |

$ | 1,548,828 | ||

The difference between book-basis and tax-basis unrealized appreciation (depreciation) is due to differences in the timing of recognition of gains and losses on investments for tax and book purposes. The Fund’s net unrealized appreciation (depreciation) difference is attributable primarily to wash sales.

The temporary book/tax differences are a result of timing differences between book and tax recognition of income and/or expenses. The Fund’s temporary book/tax differences are the result of the trustee deferral of compensation and retirement plan benefits.

Capital loss carryforward is calculated and reported as of a specific date. Results of transactions and other activity after that date may affect the amount of capital loss carryforward actually available for the Fund to utilize. The ability to utilize capital loss carryforward in the future may be limited under the Internal Revenue Code and related regulations based on the results of future transactions.

The Fund does not have a capital loss carryforward as of December 31, 2016.

NOTE 7—Investment Securities

The aggregate amount of investment securities (other than short-term securities, U.S. Treasury obligations and money market funds, if any) purchased and sold by the Fund during the year ended December 31, 2016 was $1,159,240 and $525,783, respectively. Cost of investments on a tax basis includes the adjustments for financial reporting purposes as of the most recently completed federal income tax reporting period-end.

| Unrealized Appreciation (Depreciation) of Investment Securities on a Tax Basis | ||||

| Aggregate unrealized appreciation of investment securities |

$ | 28,646 | ||

| Aggregate unrealized (depreciation) of investment securities |

(57,522 | ) | ||

| Net unrealized appreciation (depreciation) of investment securities |

$ | (28,876 | ) | |

Cost of investments for tax purposes is $1,556,895.

NOTE 8—Reclassification of Permanent Differences

Primarily as a result of differing book/tax treatment of overdistributions and distributions from underlying funds, on December 31, 2016, undistributed net investment income was increased by $12,848, undistributed net realized gain (loss) was decreased by $10,898 and shares of beneficial interest was decreased by $1,950. This reclassification had no effect on the net assets of the Fund.

21 Invesco Alternative Strategies Fund

NOTE 9—Share Information

| Summary of Share Activity | ||||||||||||||||

| Years ended December 31, | ||||||||||||||||

| 2016(a) | 2015 | |||||||||||||||

| Shares | Amount | Shares | Amount | |||||||||||||

| Sold: |

||||||||||||||||

| Class A |

48,683 | $ | 463,511 | 43,322 | $ | 426,003 | ||||||||||

| Class C |

9,826 | 92,030 | 8,520 | 81,281 | ||||||||||||

| Class R |

— | — | 92 | 896 | ||||||||||||

| Class Y |

47,768 | 455,982 | 12,130 | 118,904 | ||||||||||||

| Issued as reinvestment of dividends: |

||||||||||||||||

| Class A |

2,632 | 25,054 | 1,826 | 17,090 | ||||||||||||

| Class C |

459 | 4,337 | 276 | 2,579 | ||||||||||||

| Class R |

28 | 266 | 39 | 360 | ||||||||||||

| Class Y |

1,471 | 14,034 | 729 | 6,833 | ||||||||||||

| Reacquired: |

||||||||||||||||

| Class A |

(14,078 | ) | (134,003 | ) | (7,914 | ) | (76,644 | ) | ||||||||

| Class C |

(4,246 | ) | (39,648 | ) | (3 | ) | (30 | ) | ||||||||

| Class R |

(96 | ) | (886 | ) | — | — | ||||||||||

| Class Y |

(24,896 | ) | (235,448 | ) | (16,471 | ) | (163,992 | ) | ||||||||

| Net increase in share activity |

67,551 | $ | 645,229 | 42,546 | $ | 413,280 | ||||||||||

| (a) | There are entities that are record owners of more than 5% of the outstanding shares of the Fund and in the aggregate own 48% of the outstanding shares of the Fund. IDI has an agreement with these entities to sell Fund shares. The Fund, Invesco and/or Invesco affiliates may make payments to these entities, which are considered to be related to the Fund, for providing services to the Fund, Invesco and/or Invesco affiliates including but not limited to services such as securities brokerage, distribution, third party record keeping and account servicing. The Fund has no knowledge as to whether all or any portion of the shares owned of record by these entities are also owned beneficially. |

| In addition, 24% of the outstanding shares of the Fund are owned by the Adviser or an affiliate at the Adviser. |

22 Invesco Alternative Strategies Fund

NOTE 10—Financial Highlights

The following schedule presents financial highlights for a share of the Fund outstanding throughout the periods indicated.

| Net asset value, beginning of period |

Net investment income(a) |

Net gains (losses) on securities (both realized and unrealized) |

Total from investment operations |

Dividends from net investment income |

Distributions from net realized gains |

Total distributions |

Net asset value, end of period |

Total return(b) |

Net assets, end of period (000’s omitted) |

Ratio of expenses to average net assets with fee waivers and/or expenses absorbed(c) |

Ratio of expenses to average net assets without fee waivers and/or expenses absorbed |

Ratio of net investment income to average net assets |

Portfolio turnover(d) |

|||||||||||||||||||||||||||||||||||||||||||

| Class A |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended 12/31/16 |

$ | 9.32 | $ | 0.32 | $ | 0.24 | $ | 0.56 | $ | (0.34 | ) | $ | (0.00 | ) | $ | (0.34 | ) | $ | 9.54 | 5.97 | % | $ | 856 | 0.51 | %(e) | 18.77 | %(e) | 3.39 | %(e) | 45 | % | |||||||||||||||||||||||||

| Year ended 12/31/15 |

9.95 | 0.41 | (0.62 | ) | (0.21 | ) | (0.40 | ) | (0.02 | ) | (0.42 | ) | 9.32 | (2.15 | ) | 489 | 0.52 | 47.31 | 4.19 | 52 | ||||||||||||||||||||||||||||||||||||

| Year ended 12/31/14(f) |

10.00 | 0.15 | (0.01 | ) | 0.14 | (0.19 | ) | — | (0.19 | ) | 9.95 | 1.39 | 152 | 0.52 | (g) | 97.85 | (g) | 6.96 | (g) | 3 | ||||||||||||||||||||||||||||||||||||

| Class C |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended 12/31/16 |

9.28 | 0.25 | 0.22 | 0.47 | (0.27 | ) | (0.00 | ) | (0.27 | ) | 9.48 | 5.10 | 160 | 1.26 | (e) | 19.52 | (e) | 2.64 | (e) | 45 | ||||||||||||||||||||||||||||||||||||

| Year ended 12/31/15 |

9.95 | 0.33 | (0.62 | ) | (0.29 | ) | (0.36 | ) | (0.02 | ) | (0.38 | ) | 9.28 | (2.90 | ) | 101 | 1.27 | 48.06 | 3.44 | 52 | ||||||||||||||||||||||||||||||||||||

| Year ended 12/31/14(f) |

10.00 | 0.14 | (0.02 | ) | 0.12 | (0.17 | ) | — | (0.17 | ) | 9.95 | 1.23 | 21 | 1.27 | (g) | 98.60 | (g) | 6.21 | (g) | 3 | ||||||||||||||||||||||||||||||||||||

| Class R |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended 12/31/16 |

9.31 | 0.30 | 0.22 | 0.52 | (0.31 | ) | (0.00 | ) | (0.31 | ) | 9.52 | 5.64 | 18 | 0.76 | (e) | 19.02 | (e) | 3.14 | (e) | 45 | ||||||||||||||||||||||||||||||||||||

| Year ended 12/31/15 |

9.95 | 0.39 | (0.63 | ) | (0.24 | ) | (0.38 | ) | (0.02 | ) | (0.40 | ) | 9.31 | (2.38 | ) | 18 | 0.77 | 47.56 | 3.94 | 52 | ||||||||||||||||||||||||||||||||||||

| Year ended 12/31/14(f) |

10.00 | 0.15 | (0.02 | ) | 0.13 | (0.18 | ) | — | (0.18 | ) | 9.95 | 1.34 | 18 | 0.77 | (g) | 98.10 | (g) | 6.71 | (g) | 3 | ||||||||||||||||||||||||||||||||||||

| Class Y |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended 12/31/16 |

9.34 | 0.35 | 0.23 | 0.58 | (0.35 | ) | (0.00 | ) | (0.35 | ) | 9.57 | 6.28 | 495 | 0.26 | (e) | 18.52 | (e) | 3.64 | (e) | 45 | ||||||||||||||||||||||||||||||||||||

| Year ended 12/31/15 |

9.96 | 0.44 | (0.63 | ) | (0.19 | ) | (0.41 | ) | (0.02 | ) | (0.43 | ) | 9.34 | (1.89 | ) | 256 | 0.27 | 47.06 | 4.44 | 52 | ||||||||||||||||||||||||||||||||||||

| Year ended 12/31/14(f) |

10.00 | 0.16 | (0.01 | ) | 0.15 | (0.19 | ) | — | (0.19 | ) | 9.96 | 1.54 | 309 | 0.27 | (g) | 97.60 | (g) | 7.21 | (g) | 3 | ||||||||||||||||||||||||||||||||||||

| Class R5 |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended 12/31/16 |

9.33 | 0.35 | 0.22 | 0.57 | (0.35 | ) | (0.00 | ) | (0.35 | ) | 9.55 | 6.18 | 10 | 0.26 | (e) | 18.23 | (e) | 3.64 | (e) | 45 | ||||||||||||||||||||||||||||||||||||

| Year ended 12/31/15 |

9.95 | 0.44 | (0.63 | ) | (0.19 | ) | (0.41 | ) | (0.02 | ) | (0.43 | ) | 9.33 | (1.89 | ) | 9 | 0.27 | 46.77 | 4.44 | 52 | ||||||||||||||||||||||||||||||||||||

| Year ended 12/31/14(f) |

10.00 | 0.16 | (0.02 | ) | 0.14 | (0.19 | ) | — | (0.19 | ) | 9.95 | 1.44 | 10 | 0.27 | (g) | 96.70 | (g) | 7.21 | (g) | 3 | ||||||||||||||||||||||||||||||||||||

| Class R6 |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended 12/31/16 |

9.33 | 0.35 | 0.22 | 0.57 | (0.35 | ) | (0.00 | ) | (0.35 | ) | 9.55 | 6.18 | 10 | 0.26 | (e) | 18.23 | (e) | 3.64 | (e) | 45 | ||||||||||||||||||||||||||||||||||||

| Year ended 12/31/15 |

9.95 | 0.44 | (0.63 | ) | (0.19 | ) | (0.41 | ) | (0.02 | ) | (0.43 | ) | 9.33 | (1.89 | ) | 9 | 0.27 | 46.77 | 4.44 | 52 | ||||||||||||||||||||||||||||||||||||

| Year ended 12/31/14(f) |

10.00 | 0.16 | (0.02 | ) | 0.14 | (0.19 | ) | — | (0.19 | ) | 9.95 | 1.44 | 10 | 0.27 | (g) | 96.70 | (g) | 7.21 | (g) | 3 | ||||||||||||||||||||||||||||||||||||

| (a) | Calculated using average shares outstanding. |

| (b) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset value and returns for shareholder transactions. Does not include sales charges and is not annualized for periods less than one year, if applicable. |

| (c) | In addition to the fees and expenses which the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of the underlying funds in which the Fund invests. Because the underlying funds have varied expenses and fee levels and the Fund may own different proportions at different times, the amount of fees and expenses incurred indirectly by the Fund will vary. Estimated underlying fund expenses are not expenses that are incurred directly by the Fund. They are expenses that are incurred directly by the underlying funds and are deducted from the value of the funds the Fund invests in. The effect of the estimated underlying fund expenses that the Fund bears indirectly is included in the Fund’s total return. Estimated acquired fund fees from underlying funds were 1.14%, 1.02% and 1.73% for the years ended December 31, 2016 and December 31, 2015 and the period October 14, 2014 (commencement date) through December 31, 2014, respectively. |

| (d) | Portfolio turnover is calculated at the fund level and is not annualized for periods less than one year, if applicable. |

| (e) | Ratios are based on average daily net assets (000’s omitted) of $661, $144, $18, $343, $10 and $10 for Class A, Class C, Class R, Class Y, Class R5 and Class R6 shares, respectively. |

| (f) | Commencement date of October 14, 2014. |

| (g) | Annualized. |

23 Invesco Alternative Strategies Fund

Report of Independent Registered Public Accounting Firm

To the Board of Trustees of AIM Growth Series (Invesco Growth Series)

and Shareholders of the Invesco Alternative Strategies Fund:

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of the Invesco Alternative Strategies Fund (one of the portfolios constituting the AIM Growth Series (Invesco Growth Series), hereafter referred to as the “Fund”) as of December 31, 2016, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the two years in the period then ended and for the period October 14, 2014 (commencement of operations) through December 31, 2014, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities as of December 31, 2016 by correspondence with the custodian and transfer agent, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Houston, Texas

February 23, 2017

24 Invesco Alternative Strategies Fund

Calculating your ongoing Fund expenses

Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments or contingent deferred sales charges on redemptions, if any; and (2) ongoing costs, including distribution and/or service (12b-1) fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period July 1, 2016, through December 31, 2016.

In addition to the fees and expenses which the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of the underlying funds in which the Fund invests. The amount of fees and expenses incurred indirectly by the Fund will vary because the underlying funds have varied expenses and fee levels and the Fund may own different proportions of the underlying funds at different times. Estimated underlying fund expenses are not expenses that are incurred directly by the Fund. They are expenses that are incurred directly by the underlying funds and are deducted from the value of the underlying funds the Fund invests in. The effect of the estimated underlying fund expenses that the Fund bears indirectly are included in the Fund’s total return.

Actual expenses

The table below provides information about actual account values and actual expenses. You may use the information in this table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the table under the heading entitled “Actual Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The table below also provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return.

The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as sales charges (loads) on purchase payments or contingent deferred sales charges on redemptions, if any. Therefore, the hypothetical information is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, expenses shown in the table do not include the expenses of the underlying funds, which are borne indirectly by the Fund. If transaction costs and indirect expenses were included, your costs would have been higher.

| Class | Beginning Account Value (07/01/16) |

ACTUAL | HYPOTHETICAL (5% annual return before expenses) |

Annualized Expense Ratio2 |

||||||||||||||||||||

| Ending Account Value (12/31/16)1 |

Expenses Paid During Period2,3 |

Ending Account Value (12/31/16) |

Expenses Paid During Period2,4 |

|||||||||||||||||||||

| A | $ | 1,000.00 | $ | 1,027.80 | $ | 2.40 | $ | 1,022.77 | $ | 2.39 | 0.47 | % | ||||||||||||

| C | 1,000.00 | 1,022.40 | 6.20 | 1,019.00 | 6.19 | 1.22 | ||||||||||||||||||

| R | 1,000.00 | 1,025.60 | 3.67 | 1,021.52 | 3.66 | 0.72 | ||||||||||||||||||

| Y | 1,000.00 | 1,027.60 | 1.12 | 1,024.03 | 1.12 | 0.22 | ||||||||||||||||||

| R5 | 1,000.00 | 1,027.60 | 1.12 | 1,024.03 | 1.12 | 0.22 | ||||||||||||||||||

| R6 | 1,000.00 | 1,027.60 | 1.12 | 1,024.03 | 1.12 | 0.22 | ||||||||||||||||||

| 1 | The actual ending account value is based on the actual total return of the Fund for the period July 1, 2016 through December 31, 2016, after actual expenses and will differ from the hypothetical ending account value which is based on the Fund’s expense ratio and a hypothetical annual return of 5% before expenses. |

| 2 | Expenses are equal to the Fund’s annualized expense ratio as indicated above multiplied by the average account value over the period, multiplied by 184/366 to reflect the most recent fiscal half year. Effective January 1, 2017, the Fund’s adviser has contractually agreed to waive advisory fees and/or reimburse expenses to the extent necessary to limit total annual fund operating expenses of Class A, Class C, Class R, Class Y, Class R5 and Class R6 shares to 0.30%, 1.05%, 0.55%, 0.05%, 0.05% and 0.05% of average daily net assets, respectively. The annualized ratios restated as if these agreements had been in effect throughout the entire most recent fiscal half year are 0.30%, 1.05%, 0.55%, 0.05%, 0.05% and 0.05% for Class A, Class C, Class R, Class Y, Class R5 and Class R6 shares, respectively. |

| 3 | The actual expenses paid restated as if the changes discussed above had been in effect throughout the entire most recent fiscal half year are $1.53, $5.34, $2.80, $0.25, $0.25 and $0.25 for Class A, Class C, Class R, Class Y, Class R5 and Class R6 shares, respectively. |

| 4 | The hypothetical expenses paid restated as if the changes discussed above had been in effect throughout the entire most recent fiscal half year are $1.53, $5.33, $2.80, $0.25, $0.25 and $0.25 for Class A, Class C, Class R, Class Y, Class R5 and Class R6 shares, respectively. |

25 Invesco Alternative Strategies Fund

Tax Information

Form 1099-DIV, Form 1042-S and other year-end tax information provide shareholders with actual calendar year amounts that should be included in their tax returns. Shareholders should consult their tax advisors.

The following distribution information is being provided as required by the Internal Revenue Code or to meet a specific state’s requirement.

The Fund designates the following amounts or, if subsequently determined to be different, the maximum amount allowable for its fiscal year ended December 31, 2016:

| Federal and State Income Tax |

||||

| Long-Term Capital Gain Distributions |

$ | 6,568 | ||

| Qualified Dividend Income* |

4.90 | % | ||

| Corporate Dividends Received Deduction* |

1.15 | % | ||

| U.S. Treasury Obligations* |

1.85 | % | ||

| * | The above percentages are based on ordinary income dividends paid to shareholders during the Fund’s fiscal year. |

Distribution Information

Correction Notice

Shareholders were sent a notice from the Fund that set forth an estimate on a per share basis of the source or sources from which the distribution was paid in December of 2016. Subsequently, certain of these estimates have been corrected. Listed below is a written statement of the sources of this distribution, as corrected, on a generally accepted accounting principles (“GAAP”) basis.

| Net Income | Gain from Sale of Securities |

Return of Principal | Total Distribution | |||||||||||||||

| 12/19/2016 | Class A | $ | 0.2773 | $ | 0.000 | $ | 0.0588 | $ | 0.3361 | |||||||||

| 12/19/2016 | Class C | $ | 0.2140 | $ | 0.000 | $ | 0.0588 | $ | 0.2728 | |||||||||

| 12/19/2016 | Class R | $ | 0.2560 | $ | 0.000 | $ | 0.0588 | $ | 0.3148 | |||||||||

| 12/19/2016 | Class Y | $ | 0.2967 | $ | 0.000 | $ | 0.0588 | $ | 0.3555 | |||||||||

| 12/19/2016 | Class R5 | $ | 0.2967 | $ | 0.000 | $ | 0.0588 | $ | 0.3555 | |||||||||

| 12/19/2016 | Class R6 | $ | 0.2967 | $ | 0.000 | $ | 0.0588 | $ | 0.3555 | |||||||||

Please note that the information in the preceding chart is for financial accounting purposes only. Shareholders should be aware that the tax treatment of distributions likely differs from GAAP treatment. Form 1099-DIV for the calendar year will report distributions for U.S. federal income tax purposes. This Notice is sent to comply with certain U.S. Securities and Exchange Commission requirements.

26 Invesco Alternative Strategies Fund

Trustees and Officers

The address of each trustee and officer is AIM Growth Series (Invesco Growth Series) (the “Trust”), 11 Greenway Plaza, Suite 1000, Houston, Texas 77046-1173. The trustees serve for the life of the Trust, subject to their earlier death, incapacitation, resignation, retirement or removal as more specifically provided in the Trust’s organizational documents. Each officer serves for a one year term or until their successors are elected and qualified. Column two below includes length of time served with predecessor entities, if any.

| Name, Year of Birth and Position(s) Held with the Trust |

Trustee and/ or Officer Since |

Principal Occupation(s) During Past 5 Years |

Number of Funds in Fund Complex Overseen by Trustee |

Other Directorship(s) Past 5 Years | ||||

| Interested Persons | ||||||||

| Martin L. Flanagan1 — 1960 Trustee | 2007 | Executive Director, Chief Executive Officer and President, Invesco Ltd. (ultimate parent of Invesco and a global investment management firm); Advisor to the Board, Invesco Advisers, Inc. (formerly known as Invesco Institutional (N.A.), Inc.); Trustee, The Invesco Funds; Vice Chair, Investment Company Institute; and Member of Executive Board, SMU Cox School of Business

Formerly: Chairman and Chief Executive Officer, Invesco Advisers, Inc. (registered investment adviser); Director, Chairman, Chief Executive Officer and President, Invesco Holding Company (US) Inc. (formerly IVZ Inc.) (holding company), Invesco Group Services, Inc. (service provider) and Invesco North American Holdings, Inc. (holding company); Director, Chief Executive Officer and President, Invesco Holding Company Limited (parent of Invesco and a global investment management firm); Director, Invesco Ltd.; Chairman, Investment Company Institute and President, Co-Chief Executive Officer, Co-President, Chief Operating Officer and Chief Financial Officer, Franklin Resources, Inc. (global investment management organization) |

144 | None | ||||

| Philip A. Taylor2 — 1954 Trustee and Senior Vice President |

2006 | Head of the Americas and Senior Managing Director, Invesco Ltd.; Director, Co-Chairman, Co-President and Co-Chief Executive Officer, Invesco Advisers, Inc. (formerly known as Invesco Institutional (N.A.), Inc.) (registered investment adviser); Director, Chairman, Chief Executive Officer and President, Invesco Management Group, Inc. (formerly known as Invesco AIM Management Group, Inc.) (financial services holding company); Director and Chairman, Invesco Investment Services, Inc. (formerly known as Invesco AIM Investment Services, Inc.) (registered transfer agent) Chief Executive Officer, Invesco Corporate Class Inc. (corporate mutual fund company) Director, Chairman and Chief Executive Officer, Invesco Canada Ltd. (formerly known as Invesco Trimark Ltd./Invesco Trimark Ltèe) (registered investment adviser and registered transfer agent); Trustee and Senior Vice President, The Invesco Funds; Director, Invesco Investment Advisers LLC (formerly known as Van Kampen Asset Management).

Formerly: Director, Chief Executive Officer and President, Van Kampen Exchange Corp.; President and Principal Executive Officer, The Invesco Funds (other than AIM Treasurer’s Series Trust (Invesco Treasurer’s Series Trust), Short-Term Investments Trust and Invesco Management Trust); Executive Vice President, The Invesco Funds (AIM Treasurer’s Series Trust (Invesco Treasurer’s Series Trust), Short-Term Investments Trust and Invesco Management Trust only); Director and President, INVESCO Funds Group, Inc. (registered investment adviser and registered transfer agent); Director and Chairman, IVZ Distributors, Inc. (formerly known as INVESCO Distributors, Inc.) (registered broker dealer); Director, President and Chairman, Invesco Inc. (holding company), Invesco Canada Holdings Inc. (holding company), Trimark Investments Ltd./Placements Trimark Ltèe and Invesco Financial Services Ltd/Services Financiers Invesco Ltèe; Chief Executive Officer, Invesco Canada Fund Inc. (corporate mutual fund company); Director and Chairman, Van Kampen Investor Services Inc.; Director, Chief Executive Officer and President, 1371 Preferred Inc. (holding company) and Van Kampen Investments Inc.; Director and President, AIM GP Canada Inc. (general partner for limited partnerships) and Van Kampen Advisors, Inc.; Director and Chief Executive Officer, Invesco Trimark Dealer Inc. (registered broker dealer); Director, Invesco Distributors, Inc. (formerly known as Invesco AIM Distributors, Inc.) (registered broker dealer); Manager, Invesco PowerShares Capital Management LLC; Director, Chief Executive Officer and President, Invesco Advisers, Inc.; Director, Chairman, Chief Executive Officer and President, Invesco AIM Capital Management, Inc.; President, Invesco Trimark Dealer Inc. and Invesco Trimark Ltd./Invesco Trimark Ltèe; Director and President, AIM Trimark Corporate Class Inc. and AIM Trimark Canada Fund Inc.; Senior Managing Director, Invesco Holding Company Limited; Director and Chairman, Fund Management Company (former registered broker dealer); President and Principal Executive Officer, The Invesco Funds (AIM Treasurer’s Series Trust (Invesco Treasurer’s Series Trust), and Short-Term Investments Trust only); President, AIM Trimark Global Fund Inc. and AIM Trimark Canada Fund Inc. |

144 | None |

| 1 | Mr. Flanagan is considered an interested person (within the meaning of Section 2(a)(19) of the 1940 Act) of the Trust because he is an officer of the Adviser to the Trust, and an officer and a director of Invesco Ltd., ultimate parent of the Adviser. |

| 2 | Mr. Taylor is considered an interested person (within the meaning of Section 2(a)(19) of the 1940 Act) of the Trust because he is an officer and a director of the Adviser. |

T-1 Invesco Alternative Strategies Fund

Trustees and Officers—(continued)

| Name, Year of Birth and Position(s) Held with the Trust |

Trustee and/ or Officer Since |

Principal Occupation(s) During Past 5 Years |

Number of Funds in Fund Complex Overseen by Trustee |

Other Directorship(s) Past 5 Years | ||||

| Independent Trustees | ||||||||

| Bruce L. Crockett — 1944 Trustee and Chair |

2001 | Chairman, Crockett Technologies Associates (technology consulting company)

Formerly: Director, Captaris (unified messaging provider); Director, President and Chief Executive Officer, COMSAT Corporation; Chairman, Board of Governors of INTELSAT (international communications company); ACE Limited (insurance company); Independent Directors Council and Investment Company Institute |

144 | Chairman of the Audit Committee, ALPS (Attorneys Liability Protection Society) (insurance company) Member of the Audit Committee, Ferroglobe PLC (metallurgical company) and Investment Company Institute; Member of the Executive Committee and Chair of the Governance Committee, Independent Directors Council | ||||

| David C. Arch — 1945 Trustee |

2010 | Chairman of Blistex Inc., a consumer health care products manufacturer | 144 | Board member of the Illinois Manufacturers’ Association | ||||

| James T. Bunch — 1942 Trustee |

2003 | Managing Member, Grumman Hill Group LLC (family office/private equity investments)

Formerly: Chairman of the Board, Denver Film Society, Chairman of the Board of Trustees, Evans Scholarship Foundation; Chairman, Board of Governors, Western Golf Association |

144 | Trustee, Evans Scholarship Foundation; Chairman of the Board, Denver Film Society | ||||

| Jack M. Fields — 1952 Trustee |

2001 | Chief Executive Officer, Twenty First Century Group, Inc. (government affairs company); and Discovery Learning Alliance (non-profit)

Formerly: Owner and Chief Executive Officer, Dos Angeles Ranch L.P. (cattle, hunting, corporate entertainment); Director, Insperity, Inc. (formerly known as Administaff); Chief Executive Officer, Texana Timber LP (sustainable forestry company); Director of Cross Timbers Quail Research Ranch (non-profit); and member of the U.S. House of Representatives |

144 | None | ||||

| Eli Jones — 1961 Trustee |

2016 | Professor and Dean, Mays Business School — Texas A&M University

Formerly: Professor and Dean, Walton College of Business, University of Arkansas and E.J. Ourso College of Business, Louisiana State University and Director, Arvest Bank |

144 | Director of Insperity, Inc. (formerly known as Administaff) | ||||

| Prema Mathai-Davis — 1950 Trustee |

2001 | Retired.

Formerly: Chief Executive Officer, YWCA of the U.S.A. |

144 | None | ||||

| Larry Soll — 1942 Trustee |

2003 | Retired.

Formerly: Chairman, Chief Executive Officer and President, Synergen Corp. (a biotechnology company) |

144 | None | ||||

| Raymond Stickel, Jr. — 1944 Trustee |

2005 | Retired.

Formerly: Director, Mainstay VP Series Funds, Inc. (25 portfolios) and Partner, Deloitte & Touche |

144 | None | ||||

| Robert C. Troccoli — 1949 Trustee |

2016 | Adjunct Professor, University of Denver — Daniels College of Business

Formerly: Senior Partner, KPMG LLP |

144 | None | ||||

| Other Officers | ||||||||

| Sheri Morris — 1964 President, Principal Executive Officer and Treasurer |

1999 | President, Principal Executive Officer and Treasurer, The Invesco Funds; Vice President, Invesco Advisers, Inc. (formerly known as Invesco Institutional (N.A.), Inc.) (registered investment adviser); and Vice President, PowerShares Exchange-Traded Fund Trust, PowerShares Exchange-Traded Fund Trust II, PowerShares India Exchange-Traded Fund Trust, PowerShares Actively Managed Exchange-Traded Fund Trust, and PowerShares Actively Managed Exchange-Traded Commodity Fund Trust