Table of Contents

As filed with the Securities and Exchange Commission on June 13, 2024

File No. 000-56653

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1 to

FORM 10

GENERAL FORM FOR REGISTRATION OF SECURITIES

PURSUANT TO SECTION 12(b) OR 12(g) OF THE

SECURITIES EXCHANGE ACT OF 1934

FRANKLIN BSP REAL ESTATE DEBT BDC

(Exact name of registrant as specified in charter)

| Delaware | 99-1918767 | |

| (State or other jurisdiction of incorporation or registration) |

(I.R.S. Employer Identification No.) |

| 1345 Avenue of the Americas, Suite 32A, New York, NY |

10105 | |

| (Address of principal executive offices) | (Zip Code) |

| (212) 588-6700 | ||

| (Registrant’s telephone number, including area code) | ||

with copies to:

| Richard J. Byrne Franklin BSP Real Estate Debt BDC 1345 Avenue of the Americas, Suite 32A New York, NY 10105 |

Rajib Chanda Steven Grigoriou Simpson Thacher & Bartlett LLP 900 G. Street, N.W., Washington, DC 20001 |

Benjamin Wells Ryan Bekkerus Simpson Thacher & Bartlett LLP 425 Lexington Avenue New York, New York 10017 |

Securities to be registered pursuant to Section 12(b) of the Act:

None

Securities to be registered pursuant to Section 12(g) of the Act:

Common Shares, par value $0.001 per share

(Title of class)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☐ | |||

| Emerging growth company | ☒ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Table of Contents

| Page | ||||||

| 1 | ||||||

| 3 | ||||||

| Item 1. |

Business | 5 | ||||

| Item 1A. |

Risk factors | 56 | ||||

| Item 2. |

Financial information | 106 | ||||

| Item 3. |

Properties. | 114 | ||||

| Item 4. |

Security Ownership of Certain Beneficial Owners and Management | 115 | ||||

| Item 5. |

Trustees and Executive Officers | 116 | ||||

| Item 6. |

Executive Compensation | 123 | ||||

| Item 7. |

Certain Relationships and Related Transactions, and Trustee Independence | 124 | ||||

| Item 8. |

Legal Proceedings | 127 | ||||

| Item 9. |

Market Price of and Dividends on the Registrant’s Common Equity and Related Shareholder Matters | 128 | ||||

| Item 10. |

Recent Sales of Unregistered Securities | 130 | ||||

| Item 11. |

Description of Registrant’s Securities to be Registered | 131 | ||||

| Item 12. |

Indemnification of Trustees and Officers | 136 | ||||

| Item 13. |

Financial Statements and Supplementary Data | 137 | ||||

| Item 14. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 138 | ||||

| Item 15. |

Financial Statements and Exhibits | 139 | ||||

i

Table of Contents

Franklin BSP Real Estate Debt BDC is filing this amendment no. 1 to the registration statement on Form 10 (the “Registration Statement”) with the Securities and Exchange Commission (the “SEC”) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), on a voluntary basis in order to permit it to file an election to be regulated as a business development company (a “BDC”) under the Investment Company Act of 1940, as amended (the “1940 Act”), and to provide current public information to the investment community.

In this Registration Statement, except where the context suggests otherwise, the terms “we,” “us,” “our,” and the “Company” refer to Franklin BSP Real Estate Debt BDC. We refer to Benefit Street Partners L.L.C., in its role as our investment adviser, as our “Advisor,” and in its role as our administrator, as our “Administrator.” We refer to “Benefit Street Partners” or “BSP” to mean Benefit Street Partners L.L.C., together with any entity that is controlled by, controls or is under common control with Benefit Street Partners, and any of their respective predecessor entities; provided, however, this shall not include affiliates solely due to common ownership by Franklin Resources, Inc. We refer to “Other BSP Accounts” to mean investment funds, real estate investment trusts (“REITs”), vehicles, accounts, products and/or other similar arrangements sponsored, advised and/or managed by BSP, whether currently in existence or subsequently established (in each case, including any related successor funds, alternative vehicles, separately managed accounts, supplemental capital vehicles, surge funds, over-flow funds, co-investment vehicles and other entities formed in connection with BSP side-by-side or additional general partner investments with respect thereto).

The term “shareholders” refers to holders of our common shares of beneficial interest, par value $0.001 per share (“Common Shares”).

The Company is an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). As a result, the Company is eligible to take advantage of certain reduced disclosure and other requirements that are otherwise applicable to public companies including, but not limited to, not being subject to the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act of 2002. See “Item 1. Business—Regulation as a Business Development Company—JOBS Act.”

This Registration Statement does not constitute an offer of securities of the Company or any other BSP entity. Upon the effective date of this Registration Statement, we will be subject to the requirements of Section 13(a) of the Exchange Act, including the rules and regulations promulgated under the Exchange Act, which will require us, among other things, to file annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K. We will also be required to comply with all other obligations of the Exchange Act applicable to issuers filing registration statements pursuant to Section 12(g) of the Exchange Act. Additionally, we will be subject to the proxy rules in Section 14 of the Exchange Act and the Company, trustees, executive officers and principal shareholders will be subject to the reporting requirements of Sections 13 and 16 of the Exchange Act. The SEC maintains an Internet Website (http://www.sec.gov) that will contain the reports mentioned in this section.

We filed an election to be regulated as a BDC under the 1940 Act on June 6, 2024. Upon filing of such election, we became subject to the 1940 Act requirements applicable to BDCs.

Investing in our shares may be considered speculative and involves a high degree of risk, including the following:

| • | Our shares may not be transferred or resold unless it is made in accordance with applicable securities laws and is otherwise in compliance with the transfer restrictions set forth in our Declaration of Trust. |

| • | Our shares are not currently listed on an exchange, and it is uncertain whether they will be listed or whether a secondary market will develop. Therefore, our shares constitute illiquid investments. |

Table of Contents

| • | Investment in us is suitable only for sophisticated investors and requires the financial ability and willingness to accept the high risks and lack of liquidity inherent in an investment in us. |

| • | An investment in us may not be suitable for investors who may need the money they invest in a specified time frame. |

| • | Our distributions may be funded from unlimited amounts of offering proceeds or borrowings, which may constitute a return of capital and reduce the amount of capital available to us for investment. Any capital returned to you through distributions will be distributed after payment of fees and expenses. |

| • | The amount and frequency of our distributions are uncertain. There is a risk that shareholders may not receive distributions or that our distributions may not grow or may be reduced over time. |

As a result, there is a risk of a substantial loss of your investment. See “Item 1A. Risk Factors” for more information about these and other risks relating to our shares.

Table of Contents

Some of the statements in this Registration Statement constitute forward-looking statements because they relate to future events or our future performance or financial condition. The forward-looking statements contained in this Registration Statement may include statements as to:

| • | our future operating results; |

| • | our business prospects and the prospects of the assets in which we may invest; |

| • | changes in political, economic or industry conditions, the inflation and interest rate environment or conditions affecting the financial and capital markets; |

| • | the impact of the investments that we expect to make; |

| • | our ability to raise sufficient capital to execute our investment and lending strategies; |

| • | the ability of our portfolio companies to achieve their objectives; |

| • | our contractual arrangements and relationships with third parties; |

| • | our expected financings and investments; |

| • | the adequacy of our cash resources, financing sources and working capital; |

| • | the timing and amount of cash flows, distributions and dividends, if any, from the operations of our portfolio companies; |

| • | actual and potential conflicts of interest with our Advisor and its affiliates, and its senior investment team; |

| • | the dependence of our future success on the general economy and its effect on the industries in which we invest; |

| • | the ability to qualify and maintain our qualification as a REIT for U.S. federal income tax purposes under the Internal Revenue Code of 1986, as amended (the “Code”) and maintain our qualification as a BDC; |

| • | the timing, form and amount of any distributions; |

| • | the impact of fluctuations in interest rates on our business; |

| • | the valuation of any investments in portfolio companies, particularly those having no liquid trading market; |

| • | the impact of changes to generally accepted accounting principles, and the impact to the Company; |

| • | the impact of changes to tax legislation and, generally, our tax position; |

| • | the ability of our Advisor to locate suitable investments for us and to monitor and administer our investments; and |

| • | the ability of our Advisor and its affiliates to attract and retain highly talented professionals. |

In addition, words such as “anticipate,” “believe,” expect,” “intend,” “plan,” “will,” “may,” “continue,” “seek,” “estimate,” “would,” “could,” “should,” “target,” “project,” and variations of these words and similar expressions indicate a forward-looking statement, although not all forward-looking statements include these words. The forward-looking statements contained in this Registration Statement involve risks and uncertainties. Our actual results could differ materially from those implied or express in the forward-looking statements for any

1

Table of Contents

reason, including the factors set forth in “Item 1A. Risk Factors,” some of which also appear elsewhere in this Registration Statement. Examples of factors that could cause actual results to differ materially include:

| • | changes in the economy, particularly those affecting the real estate industry; |

| • | risks associated with possible disruption in our operations or the economy generally due to terrorism, war and military conflicts, natural disasters, epidemics or other events having a broad impact on the economy; |

| • | adverse conditions in the areas where our investments or the properties underlying such investments are located and local real estate conditions; |

| • | future changes in laws or regulations and conditions in our operating areas; |

| • | distributions are not guaranteed and may be funded from sources other than cash flow from operations, including, without limitation, borrowings, offering proceeds, the sale of our assets, and repayments of our real estate debt investments, and we have no limits on the amounts we may fund from such sources; |

| • | the purchase prices for our Common Shares are generally based on our net asset value (“NAV”) determined within 48 hours of the issuance of Common Shares and are not based on any public trading market; and |

| • | future changes in laws or regulations and conditions in our operating areas. |

Although we believe that the assumptions on which these forward-looking statements are based are reasonable, any of the assumptions could prove to be inaccurate, and as a result, the forward-looking statements based on those assumptions also could be inaccurate. In light of these and other uncertainties, the inclusion of a projection or forward-looking statement in this Registration Statement should not be regarded as a representation by us that our plans and objectives will be achieved. These risks and uncertainties include those described or identified in the section entitled “Item 1A. Risk Factors” and elsewhere in this Registration Statement. You should not place undue reliance on these forward-looking statements, which apply only as of the date of this Registration Statement. Moreover, we assume no duty and do not undertake to update the forward-looking statements and projections contained in this Registration Statement. The forward-looking statements and projections contained in this Registration Statement are excluded from the safe harbor protection provided by Section 27A of the Securities Act and Section 21E of the Exchange Act.

2

Table of Contents

The following is only a summary of the principal risks that may adversely affect our business, financial condition and results of operations and cash flows. The following should be read in conjunction with the complete discussion of the material risk factors we may face, which are set forth below under “Item 1A. Risk Factors.”

Some of the more significant risks relating to our business, our private offering and investment in our Common Shares include:

Risks Related to Our Organizational Structure

| • | The Company has no operating history and will begin operations upon the initial closing. |

| • | We are dependent on Benefit Street Partners and its affiliates, including the Advisor, and their key personnel who provide services to us through the Investment Advisory Agreement (as defined herein), and we may not find a suitable replacement for the Advisor if the Investment Advisory Agreement is terminated, or for these key personnel if they leave Benefit Street Partners or otherwise become unavailable to us. |

| • | Our Advisor manages our portfolio pursuant to broad investment guidelines and is not required to seek the approval of our Board of Trustees for each investment, financing, asset allocation or hedging decision made by it, which may result in our making riskier loans and other investments and which could materially and adversely affect us. |

| • | There is no public trading market for our Common Shares and we do not intend to effect a share repurchase program; therefore, you are not able to dispose of your Common Shares during the Term (as defined herein) of the Company unless approved by the Adviser. |

| • | We may pay distributions from sources other than our cash flow from operations, including, without limitation, borrowings, offering net proceeds and the sale of or repayments under our investments, and we have no limits on the amounts we may fund from such sources. |

| • | Valuations of our investments may reflect estimates of fair value and may not necessarily correspond to realizable value, which could adversely affect the value of your investment. |

| • | Our Board of Trustees may amend our Declaration of Trust without prior shareholder approval. |

Risks Related to Our Investments

| • | Our commercial real estate investments are subject to the risks typically associated with ownership of commercial real estate. |

| • | Commercial mortgage loans that the Company may originate or in which it may invest have certain distinct risk characteristics. |

| • | Most of our investments are illiquid and we may not be able to vary our portfolio in response to changes in economic and other conditions, which may result in losses to us. |

| • | During periods of rising interest rates, our interest expense increases may outpace any increases in interest we earn on our assets, and the value of our assets may decrease. |

| • | Real estate valuation is inherently subjective and uncertain. |

| • | We operate in a highly competitive market for investment opportunities and competition may limit our ability to originate and/or acquire desirable investments in our target assets and could also affect the pricing of these assets. |

3

Table of Contents

Risks Related to Debt Financing

| • | When we borrow money, the potential for loss on amounts invested in us will be magnified and may increase the risk of investing in us. Borrowed money may also adversely affect the return on our assets, reduce cash available for distribution to our shareholders and result in losses. |

| • | We may use repurchase agreements to finance our investments, which may expose us to risks that could result in losses, including due to cross-defaults and cross-collateralization under warehouse repurchase and credit facilities. |

| • | We may not be able to access financing sources on attractive terms, if at all, which could adversely affect our ability to fund and grow our business, or result in dilution to our existing shareholders. |

Risks Related to Our Relationship with the Advisor

| • | We depend on the Advisor to select our investments and otherwise conduct our business, and any material adverse change in its financial condition or our relationship with the Advisor could have a material adverse effect on our business and ability to achieve our investment objectives. |

Risks Related to Conflicts of Interest

| • | Various potential and actual conflicts of interest will arise, and these conflicts may not be identified or resolved in a manner favorable to us. |

| • | The Advisor faces a conflict of interest because the fees it receives for services performed are based in part on our NAV, which the Advisor is ultimately responsible for determining. |

| • | The fee structure set forth in the Investment Advisory Agreement may not create proper incentives for the Advisor. |

| • | Certain Other BSP Accounts have similar or overlapping investment objectives and guidelines, and we will not be allocated certain opportunities and may be allocated only opportunities with lower relative returns. |

Risks Related to Our REIT Status and Certain Other Tax Items

| • | Our failure to qualify as a REIT in any taxable year would subject us to U.S. federal income tax and applicable state and local taxes, which would reduce the amount of cash available for distribution to our shareholders. |

| • | Qualifying as a REIT involves highly technical and complex provisions of the Code. |

| • | Our Board of Trustees is authorized to revoke our REIT election without shareholder approval, which may cause adverse consequences to our shareholders. |

Risks Related to Our BDC Status

| • | Any failure on our part to maintain our status as a BDC would reduce our operating flexibility. |

| • | Regulations governing our operation as a BDC affect our ability to raise, and the way in which we raise, additional capital. |

| • | The Company may be precluded from investing in what the Advisor believes to be attractive investments if such investments are not qualifying assets for purposes of the 1940 Act. |

4

Table of Contents

| ITEM 1. | BUSINESS |

The Company

We are a newly formed, externally managed, non-diversified, closed-end management investment company that has elected to be regulated as a BDC under the 1940 Act and intends to elect to be treated for U.S. federal income tax purposes, and to qualify annually thereafter, as a REIT. We were formed as a Delaware statutory trust on March 11, 2024. As a BDC and a REIT, we must comply with certain regulatory requirements. See “—Regulation as a Business Development Company” and “—Certain U.S. Tax Considerations.”

We are externally managed by the Advisor. Our Advisor is a limited liability company that is registered as an investment advisor under the Investment Advisers Act of 1940, as amended (the “Advisers Act”). Our Advisor oversees the management of our activities and is responsible for making investment decisions with respect to our portfolio.

The Company’s investment objectives are to seek to provide high current income while maintaining downside protection.

The Company will seek to invest in assets that will enable it to:

| • | provide current income in the form of regular, stable cash distributions to achieve an attractive distribution yield; |

| • | preserve and protect invested capital, by primarily focusing on high-quality credit investments supported by current cash-flow and/or limited business plan risk in the underlying assets; |

| • | reduce downside risk by investing in loans with relatively low loan-to-value ratios, meaning we generally invest in less risky loans with low interest rates which are backed by high-quality real assets, with a focus on residential lending and with meaningful borrower equity; and |

| • | provide an investment alternative for shareholders seeking to allocate a portion of their long-term investment portfolios to commercial real estate (“CRE”) debt with expected lower volatility than publicly traded securities and compelling risk-adjusted returns compared to fixed income alternatives. |

We intend to use our proceeds from our private offering of common shares (the “offering”) to finance our investment objectives. The Company’s investment strategy is to originate, acquire, finance and manage a portfolio of primarily CRE investments, focused on senior secured, CRE loans across a wide range of geography. Under normal circumstances, we will invest directly or indirectly at least 80% of our total assets (i.e., net assets plus borrowings for investment purposes) in debt instruments issued by companies primarily engaged in the business of owning and/or operating real estate. Our 80% policy with respect to investments is not fundamental and may be changed by our Board of Trustees without shareholder approval. Shareholders will be provided with sixty (60) days’ notice in the manner prescribed by the SEC before we make any changes to this policy.

For over 50% of the Company’s portfolio, the Company intends to target middle market companies, which the Company generally defines as companies that have loans between $25 million and $100 million, although the Company may invest in larger or smaller companies. The Company will invest across a mix of asset classes, but intends to invest more than 50% of its portfolio in residential lending, that is, loans to companies that own residential properties, including multi-family homes. It is expected that most of the borrowers will be eligible portfolio companies, as such term is defined in the 1940 Act. To a lesser extent, the Company may invest in, or originate, other real-estate related debt and equity investments, which may include subordinated debt, commercial mortgage-backed securities (“CMBS”) and collateralized loan obligations (“CLOs”). The Company believes its real estate-related debt and equity investments will help manage cash before investing subscription proceeds into investments while also seeking attractive current income.

The Company will seek to focus on a flexible mix of credit and other real estate investments associated with high-quality assets to generate current cash flow. The Company seeks to identify attractive risk-reward investment opportunities with a focus on financing middle market investments. The Company expects to create

5

Table of Contents

synergies with Benefit Street Partner’s commercial real estate team’s existing debt sourcing capabilities by leveraging its significant scale and existing relationships to source high quality lending opportunities.

We may co-invest, subject to the conditions included in the exemptive order received by our Advisor from the SEC, with certain of our affiliates. See “—Allocation of Co-Investment Opportunities” and “Item 7. Certain Relationships and Related Transactions, and Trustee Independence” below. We believe that such co-investments afford us additional investment opportunities and an ability to build a diverse portfolio.

As a BDC, we are generally required to invest at least 70% of our total assets in securities of private and certain U.S. public companies (other than certain financial institutions), cash, cash equivalents and U.S. government securities and other limited float high quality debt investments that mature in one year or less.

We are permitted to borrow money from time to time within the levels permitted by the 1940 Act that are applicable to us. Subject to the receipt of certain approvals and compliance with certain disclosure requirements, we are permitted to reduce our asset coverage, as defined in the 1940 Act from 200% to 150% so long as we meet certain disclosure requirements. On April 8, 2024, our sole shareholder approved the reduced asset coverage requirements and declined the Company’s offer to repurchase all of its outstanding Common Shares. As a result, we are subject to the reduced asset coverage requirements in Section 61(a)(2) of the 1940 Act, which permit a BDC to double the maximum amount of leverage that it is permitted to incur by reducing the asset coverage requirements applicable to such BDC from 200% to 150%.

Our Advisor, BSP and Franklin Templeton

Our Advisor is served by Benefit Street Partners’ commercial real estate origination, investment and portfolio management team. BSP consists of over 100 investment professionals and over 250 total employees as of March 31, 2024.

BSP is a leading credit-focused alternative asset management firm with approximately $42 billion in assets under management as of December 31, 2023. Established in 2008, the BSP platform manages funds for institutions and high-net-worth investors across various credit funds and complementary strategies, including private/opportunistic debt, structured credit, high yield, special situations, and commercial real estate debt. These strategies complement each other as they all leverage the sourcing, analytical, compliance, and operational capabilities that encompass BSP’s robust platform.

Our Advisor’s core commercial real estate investment committee consists of Michael Comparato, Head of Real Estate, Senior Portfolio Manager of BSP Real Estate (“BSP RE”), Jerome Baglien, Chief Financial Officer and Chief Operating Officer of BSP RE, Tanya Mollova, Managing Director of BSP RE, and Matthew Jacobs, Managing Director and Chief Credit Officer of BSP RE, each with substantial experience in originating, underwriting and structuring real estate credit investments.

Franklin Resources, Inc. (“Franklin Templeton”) (NYSE: BEN), an affiliate of the Advisor, is a global investment management organization with subsidiaries and serving clients in over 150 countries. Franklin Templeton’s mission is to help clients achieve better outcomes through investment management expertise, wealth management and technology solutions. Through its specialist investment managers, the company offers specialization on a global scale, bringing extensive capabilities in fixed income, equity, alternatives, and multi-asset solutions. With more than 1,300 investment professionals, and offices in major financial markets around the world, the California-based company has more than 75 years of investment experience and approximately $1.6 trillion in assets under management as of January 31, 2024.

Investment Strategy

The Company’s investment strategy is to originate, acquire, finance and manage a portfolio of primarily CRE debt investments, focused on senior secured, CRE loans diversified across geography. More specifically, for at least 80% of our portfolio, we will target debt instruments issued by companies primarily engaged in the business of

6

Table of Contents

owning and/or operating real estate. The Company will focus its investments in the middle market across a diversified mix of asset classes, but maintain a focus on residential lending. It is expected that most of the borrowers will be eligible portfolio companies, as such term is defined in the 1940 Act. To a lesser extent, the Company may invest in, or originate, other real-estate related debt and equity investments, which may include subordinated debt, CMBS and CLOs. The Company believes its real estate-related debt and equity investments will help manage cash before investing subscription proceeds into investments while also seeking attractive current income.

The Company will seek to focus on a flexible mix of real estate investments, secured by high-quality assets to generate current cash flow. The Company seeks to identify attractive risk-reward investment opportunities by financing middle market investment companies. The Company expects to create synergies with Benefit Street Partner’s commercial real estate team’s existing debt sourcing capabilities by leveraging its significant scale and existing relationships to source high quality lending opportunities.

Before the Company has raised substantial proceeds in the offering and acquired a diversified portfolio of investments or during periods in which the Advisor determines that economic or market conditions are unfavorable to shareholders and a defensive strategy would benefit the Company, the Company may temporarily deviate from its investment strategy. During these periods, subject to compliance with the 1940 Act, the Company may expand or change its investment strategy and target assets temporarily, including by investing all or any portion of its assets in U.S. government securities, including bills, notes and bonds differing as to maturity and rates of interest that are either issued or guaranteed by the U.S. Treasury or by U.S. government agencies or instrumentalities; non-U.S. government securities that have received the highest investment grade credit rating; certificates of deposit issued against funds deposited in a bank or a savings and loan association; commercial paper; bankers’ acceptances; fixed time deposits; shares of money market funds; credit-linked notes; repurchase agreements with respect to any of the foregoing; or any other fixed income securities that the Advisor considers consistent with this temporary strategy. It is impossible to predict when, or for how long, the Company will use this temporary strategy. There can be no assurance that such strategy will be successful.

Market Opportunity

We expect the Company to benefit from dislocations in the broader market as the lending market has become more fractured and less centralized in money-center banks. This was a trend that began after the global financial crisis and continues today, particularly in the middle market segment. Additionally, the COVID-19 pandemic sidelined or limited competitors in the middle market space that were undercapitalized or dependent on bank financing for their positions. Additionally, dislocation in regional banks has introduced another limitation on credit providers in the middle market and we expect to be well poised to fill this void. With close to $1 trillion in real estate debt maturing over the next two years, the Company expects ample opportunities to take advantage of these trends.

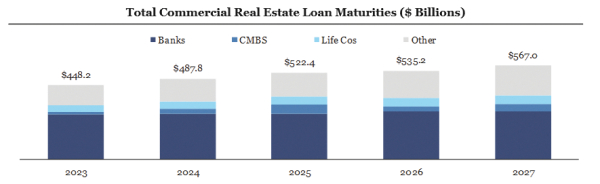

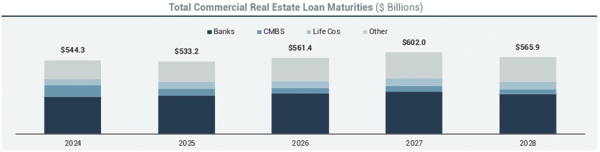

Large, persistent and compelling market opportunity. As of the third quarter of 2023, the U.S. real estate debt market is approximately $5.8 trillion, with over $1 trillion of real estate debt maturing in 2024 and 2025 that requires refinancing.

7

Table of Contents

Primarily comprised of multifamily lending by Fannie Mae and Freddie Mac. This could also include finance companies (private debt funds, REITs, CLOs, etc), pension funds, government or other sources.

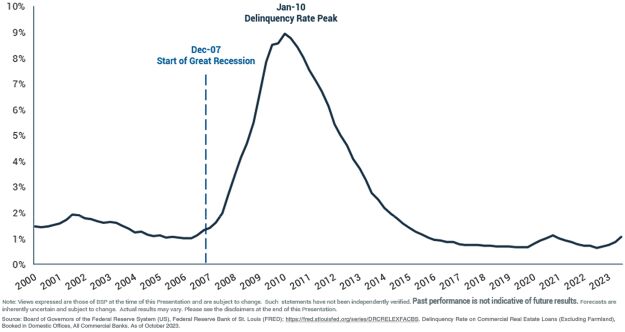

Lag in CRE loan defaults. Historically, commercial real estate loan delinquency rates peaked after approximately two years from the beginning of a recession. We expect the real estate dislocation to trail the capital markets dislocation.

We believe a combination of factors will drive refinancing opportunities for well capitalized funds. The Federal Reserve has aggressively raised interest rates with the 1-month SOFR rising from 0.05% to over 5.30% from January 2022 to January 2024. We expect this to result in refinancing and financing challenges for real estate equity investors. We believe existing borrowers will have trouble meeting the requirements for extension with declining debt service coverage and compounded by widening cap rates which, in our experience, will impact valuations.

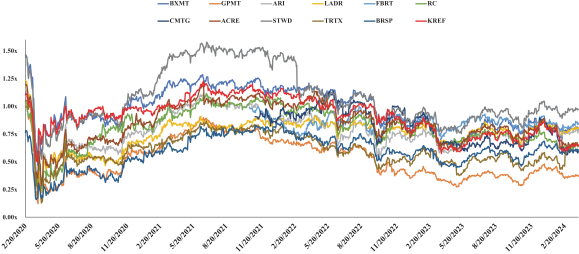

8

Table of Contents

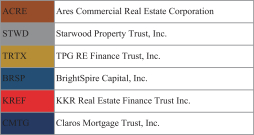

Real Estate Lending Market Is Facing a Shift From Public Lending to Private Lending. Real estate lending has been dramatically reduced due to the market sell off in the mortgage REIT industry. Price-to-book multiples, which are derived from a stock’s price-to-book ratios (i.e., a stock’s market value compared to its book value) of public real estate lending funds have decreased from approximately 1.15x to 0.70x in the last three and a half years, starting in February 2020 just before COVID-19, as shown in the graph below. At depressed valuation levels, issuance of real estate debt and equity becomes more expensive and/or impractical. Additionally, public mortgage REITs originated far less in recent periods compared to prior to the pandemic. In our view, this has left additional opportunities in the space for private lenders such as the Company.

|

|

|

9

Table of Contents

Investment Process

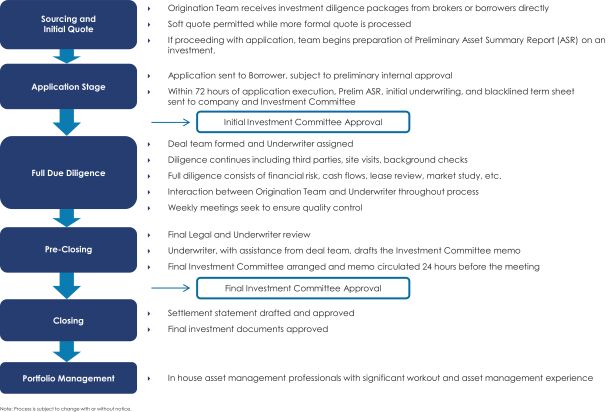

The Advisor utilizes a defined and systematic process across all investment types in its commercial real estate platform when analyzing and managing investments that details workflows and responsibilities from initial sizing through closing of an investment. Utilizing this single process allows the Advisor to take a hands-on approach and evaluate all investment equally in order to preserve and create value. The following chart illustrates our investment process for all of our investments.

Sourcing. The Advisor has developed a multi-channel sourcing network through its close relationships with developers, real estate sponsors, local brokers, banks, investment banks, B-piece buyers and other strategic partners. Given the large scale and consistent presence of the Advisor’s origination team across the platform, the commercial real estate team has historically had significant access to what the Advisor believes to be comparatively attractive deals in addition to the ability to negotiate relatively favorable terms. Leveraging relationships across the full private credit and real estate platforms has led to a meaningfully high percentage of repeat borrowers and, as a result, the Advisor is often awarded deals over competitors offering more favorable terms.

Approximately 50% of deals are sourced by the Advisor with incumbent relationships. The Advisor’s real estate team maintains an in-house underwriting team and originations are run out of offices in New York, California, Florida, Georgia, and Texas. The origination team has extensive experience across all property types and geographic areas. The origination team’s focus is on its individualized strategic relationships with broker and real estate owners’ clients directly, relationships that have been developed and maintained for on average over 15 years across the senior origination team.

Application Stage. We create a Preliminary Asset Summary Report (a “Prelim ASR”) within 72 hours of a term sheet on an investment being executed. This Prelim ASR is circulated to all members of the Advisor’s Real Estate team, including all investment committee members. The investment committee for the Company (the “Investment Committee”) is currently composed of Michael Comparato, Jerome Baglien, Matthew Jacobs, and

10

Table of Contents

Tanya Mollova. Creating the Prelim ASR at initial term sheet stage allows all Investment Committee members to have full understanding of forward pipeline investments, for the finance team to proactively identify proper financing sources and minimize time from closing to financing, and the asset management team to ensure proper structure for ongoing monitoring.

Full Due Diligence. The due diligence team consists typically of a dedicated underwriter, who reports directly to the Chief Credit Officer of the Advisor, a team analyst and an internal legal team member. The underwriter is responsible for all aspects of the diligence process, including financial and tenant analysis, third-party report engagement, market reconnaissance, sponsorship diligence, site inspections, cash flow modeling, and investment memo creation. The underwriter will leverage the team analyst, under its direction, for certain aspects of the process. Additionally, the underwriter may use various third-party research sources to augment their diligence process, though always maintains full responsibility for the process. The diligence team additionally includes an internal legal team member, who reports to the Real Estate General Counsel of the Advisor, as well as outside counsel to perform legal due diligence and draft documents.

Pre-Closing and Investment Committee. The Advisor’s Real Estate team utilizes its extensive internal underwriting process to evaluate and mitigate risk. Prior to the team issuing an application to proceed with underwriting, all potential transactions are reviewed by either the Chief Credit Officer of the Advisor or Head of BSP RE to identify any upfront risks and ensure proper mitigation is achievable. To the extent a transaction proceeds to underwriting, the underwriting process for every investment is headed by a member of the internal dedicated underwriting team of BSP RE, whose sole function is to identify and mitigate transaction risks.

Upon completion of full due diligence, the deal team formally presents the investment opportunity to the Investment Committee for approval, which is required for deal approval and funding, future funding/additional capital advances, modifications to legal documents, sales, and material deviations from business plans. Majority vote is required but unanimous vote has been the standard historically. Senior business personnel oversee the financing, operations, and monitoring of investments.

Closing. To fund and execute a debt investment, numerous approvals and documentation are required prior to funding to help eliminate any transaction errors. First, the deal team is required to provide an Investment Committee memo which details the rationale of the investment. The investment memo is signed off and approved by the Investment Committee. The day of funding, the deal team provides a loan funding package to the finance and operations team. The loan funding package includes all approvals of the investment from the Investment Committee, the operations loan onboarding sheet, sources and uses summary and a tax checklist. Ultimately before the finance team sends out any cash for deal funding, the legal team signs off on the wire instructions to ensure the cash is provided to the correct party. Once the deal is funded, the finance team sends an email to the deal team and legal team with the federal reference wire number to ensure the cash can be tracked back to the correct party.

Post-Close Monitoring. The internal asset management team consists of nine people and while everyone has some level of familiarity with the entire portfolio, the assets are split amongst the personnel based largely on sponsorship and geographic concentrations.

On an asset level, the Advisor’s asset management team is responsible for monthly and quarterly reporting on our investments. We perform an asset-by-asset review of all our positions every quarter for performance, risk, and any material updates. Any interim updates to assets are communicated on an as-needed basis to senior BSP RE management.

Investment and Monitoring

BSP manages multiple real estate debt funds with similar investing mandates to the Company and BSP believes that the policies and guidelines that apply to BSP’s real estate debt funds are highly relevant and applicable to the Company.

11

Table of Contents

Transcending all components of BSP’s investment strategy is the overarching goal of downside protection at the Company-level through best-in-class portfolio management. BSP seeks to accomplish this objective through disciplined application of risk management best practices across the portfolio combined with Company-level diversification across several discrete dimensions. BSP’s risk management practices are grounded in an established investment process comprising systematic underwriting, rigorous due diligence, third-party reports, and Investment Committee approval accompanied by a proprietary and dynamic post-investment monitoring system for regularly updating issuer data.

| • | On a quarterly basis, the Investment Committee performs a review of the real estate debt and equity investments and then approves the valuation of such investments. |

| • | On a quarterly basis, for securities, position reconciliations are performed against a third party statement. |

| • | For real estate properties, a site visit is performed prior to acquisition and title/deed of each properties are obtained at acquisition. |

Our investment process is segregated by underwriting and origination with separate teams and leadership on the two sides of the business. Investments are approved by the Investment Committee prior to funding and BSP has a closing process in place to ensure all proper authorizations are in place.

On an asset level, our asset management team monitors monthly and quarterly reporting on our investments. Quarterly we perform an asset-by-asset review of all our positions to review performance, risk, and any material updates. Any interim updates to assets are communicated on an as-needed basis to senior BSP RE management.

In addition, all assets are visited by a BSP team member at a minimum once per annum. Further, as many of the properties are undergoing construction, BSP engages an engineer to visit the properties and inspect work on our behalf, as needed.

We assess any potential impairments or reserves on our loans via our risk rating and valuation process, generally on a quarterly basis. There may additionally be events that could trigger inter-quarter assessments based on failed covenants or borrower developments.

As part of our quarterly asset review process (“QAR”), we assign internal credit ratings on all loans originated. See below for the detail on the risk rating scale. Risk rating categories range from “1” to “5” with “1” representing the lowest risk of loss and “5” representing the highest risk of loss with the ratings updated quarterly. At the time of origination or purchase, loans held for investment are ranked as a “2” and will move accordingly going forward based on the ratings which are defined as follows:

| 1) | Very Low Risk: Investment exceeding fundamental performance expectations and/or capital gain expected. Trends and risk factors since time of investment are favorable. |

| 2) | Low Risk: Performing consistent with expectations and a full return of principal and interest expected. Trends and risk factors are neutral to favorable. |

| 3) | Average Risk: Performing investments requiring closer monitoring. Trends and risk factors show some deterioration. |

| 4) | High Risk/Delinquent/Potential for Loss: Underperforming investment with the potential of some interest loss but still expecting a positive return on investment. Trends and risk factors are negative. |

| 5) | Impaired/Defaulted/Loss Likely: Underperforming investment with expected loss of interest and some principal. |

Operationally, we have our team assess the best course of action to mitigate the exposure to the Company which will be a process by which the asset management and legal teams will determine our various courses of

12

Table of Contents

action and the likely impacts of each. The senior management team will then determine how they want to proceed. The primary goal of this is to minimize any potential losses and maximize the Company returns.

In times of heightened market volatility or other stress, the investment process remains the same, however, volatility may inform our decisions on making new investments, adjusting the required return for those investments and making any amendments to existing investments.

The Advisor may utilize interest rate caps and/or fixed-to-floating on real estate assets that we own in order to mitigate interest rate exposure.

The Company expects to benefit from dislocations in the broader market whereby the lending market has become more fractured and less centralized in money-center banks. This was a trend that began after the last financial crisis and continues today, particularly in the middle market segment. Additionally, the current market environment has sidelined or limited competitors in the middle market space that were undercapitalized or dependent on bank financing for their positions. Further, dislocation in regional banks has introduced another limitation on credit providers in the middle market and we anticipate being well poised to fill this void. With $1.6 trillion in real estate debt maturing over the next three years as of June 30, 2023, the Company believes there will be ample opportunities for the Company to take advantage of these trends.

In addition, there will be opportunities as it relates to refinancing risk. The federal reserve has aggressively raised interest rates with the 1-month SOFR rising from 0.05% to over 5.00% in a very limited amount of time. We expect this to result in refinancing and financing challenges for real estate equity investors. Existing borrowers will have trouble meeting the requirements for extension with declining debt service coverage compounded by widening cap rates, which will impact valuations.

Term

The Company is non-exchange traded, meaning its Common Shares are not listed for trading on a stock exchange or other securities market, and a fixed-term BDC, meaning it is an investment vehicle of defined duration. The Company’s Shares are intended to be sold by the Company on a continuous basis during the Investment Period (as defined below) at a price generally equal to the Company’s NAV per Share.

Following the initial closing, the Company will have an investment period (the “Investment Period”) of 18 months during which it may invest capital commitments and reinvest proceeds in line with the Company’s investment strategy. Upon the expiration of the Investment Period, any unfunded capital commitments outstanding as of such date shall be canceled and the Company shall not be permitted thereafter to call any unfunded capital commitments or reinvest proceeds, except for as deemed necessary by the Advisor to preserve or enhance the value of the Company’s existing investments. Upon the expiration the Investment Period, the Company would commence an orderly wind-down of the investments, which could include a determination by the Advisor that it is in the best interests of the Company to hold the investments to maturity. The “Term” of the Company shall mean the Investment Period plus the time required to complete the orderly disposition of investments, and in no case shall extend beyond the 4 year anniversary of the end of the Investment Period. We are not obligated by our Declaration of Trust or otherwise to effect a liquidity event at any time. The Board of Trustees would need the consent of the shareholders for the Company to cease to be treated as a BDC.

The Company does not intend to list the Common Shares on a securities exchange and does not expect there to be a public market for the Shares. As a result, the ability to sell Shares is limited.

13

Table of Contents

Management and Other Agreements

Investment Advisory Agreement

We entered into an investment advisory agreement (the “Investment Advisory Agreement”) with our Advisor in which the Advisor, subject to the overall supervision of our Board of Trustees, will manage the day-to-day operations of, and provides investment advisory services to us. Our Board approved an amendment and restatement of the Investment Advisory Agreement (the “Amended and Restated Investment Advisory Agreement”). The Advisor and its affiliates also provide investment advisory services to other funds that have investment mandates that are similar, in whole or in part, with ours. The Advisor and its affiliates serve as investment adviser or sub-adviser to private funds, registered open-end funds, a BDC, an interval fund and a public real estate investment trust. In addition, any affiliated fund currently formed or formed in the future and managed by the Advisor or its affiliates may have overlapping investment objectives with our own and, accordingly, may invest in asset classes similar to those targeted by us. However, in certain instances due to regulatory, tax, investment, or other restrictions, certain investment opportunities may not be appropriate for either us or other funds managed by the Advisor or its affiliates.

We will pay the Advisor a fee for its services under the Investment Advisory Agreement consisting of two components: a base management fee (the “Management Fee”) and an incentive fee (the “Incentive Fee”). The cost of both the Management Fee and the Incentive Fee will ultimately be borne by the shareholders.

Management Fee

The Management Fee will be calculated at an annual rate of 0.50% of the Company’s Average Gross Assets (as defined below) payable quarterly in arrears. Management Fees for any partial month or quarter will be prorated.

“Average Gross Assets” shall mean the average value of the Company’s gross assets at the end of the two most recently completed calendar quarters. For these purposes, “gross assets” means the Company’s total assets determined on a consolidated basis in accordance with generally accepted accounting principles in the United States (“GAAP”), and excluding undrawn commitments but including assets purchased with borrowed amounts.

Incentive Fee

The incentive fee will consist of two parts. The first part, referred to as the “Incentive Fee on Income,” shall be calculated and payable quarterly in arrears based on the Company’s “Pre-Incentive Fee Net Investment Income” (as defined below) for the immediately preceding quarter.

“Pre-Incentive Fee Net Investment Income” means interest income, dividend income and any other income (including any other fees, such as commitment, origination, structuring, diligence and consulting fees or other fees that the Company receives from portfolio companies) accrued during the calendar quarter, minus the Company’s operating expenses for the quarter (including the Management Fee, expenses payable under the Administration Agreement and any interest expense and dividends paid on any issued and outstanding preferred share, but excluding the Incentive Fee). Pre-Incentive Fee Net Investment Income includes, in the case of investments with a deferred interest feature (such as original issue discount debt instruments with payment-in-kind interest and zero coupon securities), accrued income that the Company has not yet received in cash. Pre-Incentive Fee Net Investment Income does not include any realized capital gains, realized capital losses or unrealized capital appreciation or depreciation. For purposes of computing the Company’s Pre-Incentive Fee Net Investment Income, the calculation methodology will look through total return swaps (to the extent the Company invests in any, which it does not currently intend to) as if the Company owned the referenced assets directly.

The payment of the Incentive Fee on Income shall be subject to payment of a preferred return to investors each quarter, expressed as a quarterly rate of return on the value of the Company’s gross assets at the end of the most recently completed calendar quarter, subject to a “catch up” feature (as described below)

14

Table of Contents

The calculation of the Incentive Fee on Income is as follows:

| • | No Incentive Fee on Income shall be payable to the Advisor in any calendar quarter in which the Company’s Pre-Incentive Fee Net Investment Income does not exceed the preferred return rate of 1.25% per quarter (or 5.00% annualized) (the “Preferred Return”) on gross assets; |

| • | 100% of the dollar amount of the Company’s Pre-Incentive Fee Net Investment Income, if any, that exceeds the Preferred Return but is less than or equal to 1.429% in any calendar quarter (or 5.71% annualized) shall be payable to the Advisor. This portion of the Incentive Fee on Income is referred to as the “catch up” and is intended to provide the Advisor with an incentive fee of 12.5% on all of the Company’s Pre-Incentive Fee Net Investment Income when the Company’s Pre-Incentive Fee Net Investment Income reaches 1.429% (or 5.71% annualized) in any calendar quarter; and |

| • | For any quarter in which the Company’s Pre-Incentive Fee Net Investment Income exceeds 1.429% in any calendar quarter (or 5.71% annualized), the Incentive Fee on Income shall equal 12.5% of the dollar amount of the Company’s Pre-Incentive Fee Net Investment Income as the Preferred Return and catch up will have been achieved. |

The second part of the incentive fee, referred to as the “Incentive Fee on Capital Gains During Operations,” shall be calculated based on the Company’s “Capital Gains During Operations” (as defined below) and payable in arrears as of the end of each calendar year (or upon termination of the Investment Advisory Agreement, if earlier).

“Capital Gains During Operations” means the Company’s cumulative realized capital gains from the date of the Company’s election to be regulated as a BDC through the end of such calendar year, computed net of all realized capital losses and unrealized capital depreciation on a cumulative basis. For the purpose of computing the Company’s Capital Gains During Operations, the calculation methodology will look through derivative financial instruments or swaps as if the Company owned the reference assets directly. Therefore, realized gains and realized losses on the disposition of any reference assets, as well as unrealized depreciation on reference assets retained in the derivative financial instrument or swap, will be included on a cumulative basis in the calculation of the Company’s Capital Gains During Operations.

The Incentive Fee on Capital Gains During Operations equals 12.5% of the Company’s Capital Gains During Operations, less the aggregate amount of any previously paid Incentive Fee on Capital Gains During Operations.

Fee Waivers

Notwithstanding the foregoing, the Advisor entered into a voluntary fee waiver agreement (the “Fee Waiver Agreement”) with the Company. Pursuant to the Fee Waiver Agreement, the Advisor will irrevocably waive the Management Fee during the Term of the Company. The Advisor will also waive any Incentive Fee for a period of 12 months after the initial closing of the Company’s private placement of Common Shares. Any waived fees are not subject to recoupment.

Duration and Termination

The Advisor serves as our investment adviser pursuant to the Investment Advisory Agreement. Unless terminated earlier, it will remain in effect for an initial term of two years and then continue for successive one-year periods if approved annually by our Board of Trustees or by the affirmative vote of the holders of a majority of our outstanding voting securities, including, in either case, approval by a majority of our trustees who are not interested persons, as such term is defined in Section 2(a)(19) of the 1940 Act (the “Independent Trustees”). The Investment Advisory Agreement will automatically terminate in the event of its assignment. The Investment Advisory Agreement may be terminated by us without penalty upon not less than 60 days’ written notice and by the Advisor upon not less than 60 days’ written notice. Any termination by us must be authorized either by our Board of Trustees or by vote of our shareholders.

15

Table of Contents

In determining whether to approve the Investment Advisory Agreement, our Board of Trustees requested information from the Advisor that enabled it to evaluate a number of factors relevant to its determination. These factors included the nature, extent and quality of services provided to us by the Advisor, the costs of providing services to us, the profitability of the relationship between us and the Advisor, comparative information on fees and expenses borne by other comparable BDCs or registered investment companies and, as applicable, other advised accounts, and the extent to which economies of scale would be realized as we grow and whether fee levels reflect these economies of scale for the benefit of our investors. Based on the information reviewed and the considerations detailed above, our Board of Trustees, including all of the Independent Trustees, concluded that the investment advisory fee rates and terms are fair and reasonable in relation to the services provided and approved the Investment Advisory Agreement as being in the best interests of our shareholders.

Indemnification

The Investment Advisory Agreement and the Amended and Restated Investment Advisory Agreement provide that, absent willful misfeasance, bad faith or gross negligence in the performance of its duties, or by reason of the reckless disregard of its duties and obligations, the Advisor and its officers, managers, partners, members (and their members, including the owners of their members), agents, employees, controlling persons, and any other person or entity affiliated with it are entitled to indemnification from us for any damages, liabilities, costs and expenses (including reasonable attorneys’ fees and amounts reasonably paid in settlement) arising from the rendering of the Advisor’s services under the Investment Advisory Agreement and the Amended and Restated Investment Advisory Agreement or otherwise as our investment adviser.

Administration Agreement

We entered into the Administration Agreement in which the Administrator provides us with office facilities and certain administrative services necessary for us to conduct our business. We will reimburse the Administrator quarterly for all administrative costs and expenses incurred by the Administrator in performing its obligations and providing personnel and facilities under the Administration Agreement and annually for overhead expenses incurred in the course of performing its obligations under the Administration Agreement, including rent, travel, and the allocable portion of the cost of our Chief Compliance Officer and Chief Financial Officer and their respective staffs, including operations and tax professionals, and administrative staff providing support services in respect of us.

Our Board of Trustees, including a majority of the Independent Trustees, will review the reimbursement of costs and expenses to our Administrator to determine if the provisions of the Administration Agreement are carried out satisfactorily and to determine whether the reimbursement of costs and expenses under the Administration Agreement are reasonable and appropriate. Our Board of Trustees will also review the methodology employed in determining how costs and expenses are allocated to us and the proposed allocation of administrative expenses among us and affiliates of our Administrator.

Custodial Agreement

Our wholly-owned subsidiary, FBRED BDC Finance, LLC, entered into a custodial agreement (the “Custodial Agreement”) with ComputerShare Trust Company, N.A. (the “Custodian”), which also serves as our Custodian. Under the Custodial Agreement, the Custodian shall be responsible for maintaining continuous custody of our assets in accordance with customary standards for such custody. We pay the Custodian an acceptance fee, review fee, release fee, monthly safekeeping fee per commercial property and legal fees at costs.

Expense Limitation Agreement

The Advisor and the Company entered into an Expense Limitation Agreement (the “Expense Limitation Agreement”). Under the Expense Limitation Agreement, the Advisor has agreed on a quarterly basis to reimburse

16

Table of Contents

the Company’s Specified Expenses (as defined below) to the extent such annualized Specified Expenses exceed 0.10% of the Company’s quarter-end NAV (the “Expense Cap”). Any reimbursement is not subject to recoupment.

“Specified Expenses” include the Company’s initial organizational and offering costs, as well as the Company’s annualized operating expenses, inclusive of any fees the Company has agreed to bear pursuant to 4(b) of the Administration Agreement, but excluding (i) expenses directly related to the interest costs and structuring costs for borrowing and line(s) of credit, (ii) any taxes, litigation and extraordinary expenses related to any structuring, litigation or other actions taken by the Advisor to preserve or enhance the value of the Investments for the Shareholders and (iii) the Incentive Fees.

The Expense Limitation Agreement shall be in effect during the Term of the Company, unless and until the Board approves its modification or termination.

Private Placement

We intend to offer and sell our Common Shares in a private placement to be conducted in reliance on Regulation D under the Securities Act (“Regulation D”) or Regulation S under the Securities Act (“Regulation S”). Investors in our private placement will be required to be “accredited investors” as defined in Regulation D of the Securities Act or non-U.S. persons under Regulation S. Each investor in the private placement will make a capital commitment (the “Capital Commitments”) to purchase Common Shares pursuant to a subscription agreement (a “Subscription Agreement”). Investors will be required to make capital contributions to purchase Common Shares (the “Drawdown Purchase Price”) each time we deliver a drawdown notice (the “Drawdown Notice”), which will be delivered at least ten business days prior to the required funding date (the “Drawdown Date”), in an aggregate amount not to exceed their respective Capital Commitments. All purchases will generally be made pro rata in accordance with the investors’ Capital Commitments, at a per-share price as determined by the Board of Trustees in accordance with the limitations under Section 23 of the 1940 Act (which generally prohibits us from issuing Common Shares at a price below the then-current NAV of the Common Shares as determined within 48 hours, excluding Sundays and holidays, of such issuance (taking into account any investment valuation adjustments from the latest quarterly valuation date in accordance with the Company’s valuation policy), subject to certain exceptions); provided that the Company retains the right to make non-pro rata capital drawdowns for any reason in the Company’s sole discretion, including, without limitation, if the Company determines that it is necessary or advisable in light of applicable legal, tax, regulatory and other considerations, such as to comply with Section 12d(1) of the 1940 Act or the ownership limits as set forth in our Declaration of Trust. As set forth in each Subscription Agreement, in the event that an investor fails to pay all or any portion of a Drawdown Purchase Price pursuant to a Drawdown Notice, and such default remains uncured for a period of thirty days (such investor, a “Defaulting Subscriber”), the Company will be permitted to pursue any remedies against the Defaulting Subscriber available under the Subscription Agreement or at law or at equity, including prohibiting the Defaulting Subscriber from purchasing additional Common Shares or causing the Defaulting Subscriber to forfeit 50% of the Defaulting Subscriber’s Common Shares to the other shareholders.

An investor will be released from any obligation to purchase additional Common Shares on the earlier of (i) the date that such investor’s Capital Commitment is fully called and (ii) the end of the Investment Period, except to the extent deemed necessary by the Advisor to preserve or enhance the value of the Company’s existing investments.

The private placement is expected to commence shortly after the filing of our election to be regulated as a BDC under the 1940 Act.

Competition

We will compete for investments with a number of capital providers, including BDCs, REITs, other investment funds (including private debt and equity funds and venture capital funds), special purpose acquisition

17

Table of Contents

company sponsors, investment banks with underwriting activities, hedge funds that invest in private investments in public equities, traditional financial services companies such as commercial banks, and other sources of financing, including the broadly syndicated loan market and high yield capital market. Many of these capital providers have greater financial and managerial resources than we do. In addition, many of our competitors are not subject to the regulatory restrictions that the 1940 Act imposes on us as a BDC. For additional information concerning the competitive risks we expect to face, see “Item 1A. Risk Factors—Risks Related to Our Investments—We operate in a highly competitive market for investment opportunities and competition may limit our ability to originate and/or acquire desirable investments in our target assets and could also affect the pricing of these assets.”

Allocation of Investment Opportunities

General

The Advisor provides investment management services to other BDCs, REITs, registered investment companies, investment funds, client accounts and proprietary accounts that the Advisor may establish.

The Advisor and its affiliates will share any investment and sale opportunities with its other clients and the Company in accordance with the Advisers Act and firm-wide allocation policies, which generally provide for sharing pro rata based on targeted acquisition size or targeted sale size. Subject to the Advisers Act and as further set forth herein, certain other clients may receive certain priority or other allocation rights with respect to certain investments, subject to various conditions set forth in such other clients’ respective governing agreements.

In addition, as a BDC regulated under the 1940 Act, the Company is subject to certain limitations relating to co-investments and joint transactions with affiliates, which likely in certain circumstances limit the Company’s ability to make investments or enter into other transactions alongside other clients.

Co-Investment Relief

The Advisor and its affiliates received an exemptive order from the SEC on May 1, 2018 (the “Order”) that permits us, among other things, to co-invest with certain other persons, including certain affiliates of the Advisor and certain funds managed and controlled by the Advisor and its affiliates, subject to certain terms and conditions. Pursuant to such order, we are permitted to co-invest with one or more BDCs and/or other funds advised by our Adviser and its affiliates if a “required majority” (as defined in Section 57(o) of the 1940 Act) of our eligible trustees make certain conclusions in connection with a co-investment transaction, including that (1) the terms of the transaction, including the consideration to be paid, are reasonable and fair to us and our shareholders and do not involve overreaching in respect of us or our shareholders on the part of any person concerned, (2) the transaction is consistent with the interests of our shareholders and our investment objective and strategies, and (3) the investment by our affiliates would not disadvantage us and our participation would not be on a basis different from or less advantageous than that of others.

Valuation Procedures

The Board of Trustees has designated the Advisor as its “valuation designee” pursuant to Rule 2a-5 under the 1940 Act. The Advisor, acting pursuant to delegated authority from, and under the oversight of our Board of Trustees, assists the Board of Trustees in its determination of the NAV of our investment portfolio at least quarterly or more frequently as needed for a Drawdown Date. The NAV per share of our outstanding Common Shares is determined by dividing the value of total assets minus liabilities by the total number of shares outstanding. Securities for which market quotations are readily available are valued at the reported closing price on the valuation date. Securities for which market quotations are not readily available are valued at fair value as determined by the Advisor. In connection with that determination, the Advisor facilitates the preparation, through

18

Table of Contents

the use each quarter of independent valuation firms, portfolio company valuations using relevant inputs, including but not limited to, indicative dealer quotes, values of like securities, the most recent portfolio company financial statements and forecasts.

We classify the fair value measurements of our assets and liabilities into a fair value hierarchy in accordance with Accounting Standards Codification (“ASC”) Topic 820, Fair Value Measurement, based on the markets in which the assets and liabilities are traded and the reliability of the assumptions used to determine fair value. The guidance defines fair value as the price that would be received from the sale of an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The guidance also establishes a three-tier fair value hierarchy, which prioritizes the inputs used in measuring fair value. These tiers include: Level 1, defined as observable inputs such as quoted prices in active markets; Level 2, which includes inputs such as quoted prices for similar securities in active markets and quoted prices for identical securities where there is little or no activity in the market; and Level 3, defined as unobservable inputs for which little or no market data exists, therefore requiring an entity to develop its own assumptions.

With respect to investments for which market quotations are not readily available, the Advisor undertakes a multi-step valuation process each quarter, as described below:

| • | Each portfolio company or investment will be valued by the Advisor, with assistance from one or more independent valuation firms engaged by our Board of Trustees; |

| • | The independent valuation firm(s) conduct independent appraisals and make an independent assessment of the value of each investment; and |

| • | The Advisor determines the fair value of each investment, in good faith, based on the input of the independent valuation firm (to the extent applicable). |

In circumstances where the Advisor deems appropriate, the Advisor’s internal valuation team values certain investments. When performing the internal valuations, the Advisor utilizes similar valuation techniques as an independent third-party pricing service would use. Such valuations will be approved by an internal valuation committee of the Advisor, with oversight from the Board of Trustees.

Determination of fair values involves subjective judgments and estimates. Below is a description of factors that the Advisor may consider when valuing our debt and equity investments.

Securities for which market quotations are readily available on an exchange are valued at the reported closing price on the valuation date. The Advisor may also obtain quotes with respect to certain of our investments from pricing services or brokers or dealers in order to value assets. When doing so, the Advisor determines whether the quote obtained is readily available according to GAAP to determine the fair value of the security. If determined to be readily available, the Advisor uses the quote obtained.

Investments without a readily available market quotation are primarily valued using a market approach, an income approach, or both approaches, as appropriate. The market approach uses prices and other relevant information generated by market transactions involving identical or comparable assets or liabilities (including a business). The income approach uses valuation techniques to convert future amounts (for example, cash flows or earnings) to a single present amount (discounted). The measurement is based on the value indicated by current market expectations about those future amounts. In following these approaches, the types of factors that the Advisor may take into account in fair value pricing our investments include, as relevant: available current market data, including relevant and applicable market trading and transaction comparables, applicable market yields and multiples, security covenants, call protection provisions, information rights, the nature and realizable value of any collateral, the portfolio company’s ability to make payments, its earnings and discounted cash flows, the markets in which the portfolio company does business, comparisons of financial ratios of peer companies that are public, M&A comparables, and enterprise values, among other factors. When available, broker quotations and/or quotations provided by pricing services are considered as an input in the valuation process.

19

Table of Contents

Regulation as a Business Development Company

General

The following discussion is a general summary of the material prohibits and descriptions governing BDCs. It does not purport to be a complete description of all of the laws and regulations affecting BDCs. Under the 1940 Act, a BDC may not acquire any asset other than assets of the type listed in Section 55(a) of the 1940 Act, which are referred to as “Qualifying Assets”, unless, at the time the acquisition is made, Qualifying Assets represent at least 70% of the company’s total assets. The principal categories of Qualifying Assets relevant to our business are any of the following:

| 1. | Securities purchased in transactions not involving any public offering from the issuer of such securities, which issuer (subject to certain limited exceptions) is an Eligible Portfolio Company (as defined below), or from any person who is, or has been during the preceding 13 months, an affiliated person of an Eligible Portfolio Company, or from any other person, subject to such rules as may be prescribed by the SEC. An Eligible Portfolio Company is defined in the 1940 Act as any issuer which: |

| a. | is organized under the laws of, and has its principal place of business in, the United States; |

| b. | is not an investment company (other than a small business investment company wholly owned by the BDC) or a company that would be an investment company but for certain exclusions under the 1940 Act; and |

| c. | satisfies any of the following: |

| i. | does not have any class of securities that is traded on a national securities exchange; |

| ii. | has a class of securities listed on a national securities exchange, but has an aggregate market value of outstanding voting and non-voting common equity of less than $250 million; |

| iii. | is controlled by a BDC or a group of companies including a BDC and the BDC has an affiliated person who is a trustee of the Eligible Portfolio Company; or |

| iv. | is a small and solvent company having total assets of not more than $4.0 million and capital and surplus of not less than $2.0 million. |

| 2. | Securities of any Eligible Portfolio Company that we control. |

| 3. | Securities purchased in a private transaction from a U.S. issuer that is not an investment company or from an affiliated person of the issuer, or in transactions incident thereto, if the issuer is in bankruptcy and subject to reorganization or if the issuer, immediately prior to the purchase of its securities was unable to meet its obligations as they came due without material assistance other than conventional lending or financing arrangements. |

| 4. | Securities of an Eligible Portfolio Company purchased from any person in a private transaction if there is no ready market for such securities and we already own 60% of the outstanding equity of the Eligible Portfolio Company. |

| 5. | Securities received in exchange for or distributed on or with respect to securities described in (1) through (4) above, or pursuant to the exercise of warrants or rights relating to such securities. |

| 6. | Cash, cash equivalents, U.S. government securities or high-quality debt securities maturing in one year or less from the time of investment. |

In addition, a BDC must be operated for the purpose of making investments in the types of securities described in (1), (2) or (3) above.

Temporary Investments

Pending investment in other types of “qualifying assets,” as described above, our investments may consist of cash, cash equivalents, U.S. government securities or high-quality debt securities maturing in one year or less

20

Table of Contents