| 1933 Act File No. | 2-57181 |

| 1940 Act File No. | 811-2677 |

Form N-1A

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

| REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 | ||||

| Pre-Effective Amendment No. | ||||

| Post-Effective Amendment No. | 84 | |||

| and/or | ||||

| REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940 | ||||

| Amendment No. | 68 | |||

FEDERATED MUNICIPAL SECURITIES FUND, INC.

(Exact Name of Registrant as Specified in Charter)

Federated Investors Funds

4000 Ericsson Drive

Warrendale, PA 15086-7561

(Address of Principal Executive Offices)

(412) 288-1900

(Registrant’s Telephone Number, including Area Code)

John W. McGonigle, Esquire

Federated Investors Tower

Pittsburgh, Pennsylvania 15222-3779

(Name and Address of Agent for Service)

| It is proposed that this filing will become effective (check appropriate box): | |||

| immediately upon filing pursuant to paragraph (b) | |||

| on | pursuant to paragraph (b) | ||

| 60 days after filing pursuant to paragraph (a)(1) | |||

| X | on | July 27, 2017 | pursuant to paragraph (a)(1) |

| 75 days after filing pursuant to paragraph (a)(2) | |||

| on | pursuant to paragraph (a)(2) of Rule 485 | ||

| If appropriate, check the following box: | |||

| This post-effective amendment designates a new effective date for a previously filed post-effective amendment. | |||

| Shareholder Fees (fees paid directly from your investment) | A | B | C | F | IS |

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) | 4.50% | None | None | 1.00% | None |

Maximum Deferred Sales Charge (Load) (as a percentage of original purchase price or redemption proceeds, as applicable) | 0.00% | 5.50% | 1.00% | 1.00% | None |

Maximum Sales Charge (Load) Imposed on Reinvested Dividends (and other Distributions) (as a percentage of offering price) | None | None | None | None | None |

Redemption Fee (as a percentage of amount redeemed, if applicable) | None | None | None | None | None |

Exchange Fee | None | None | None | None | None |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |||||

Management Fee | 0.47% | 0.47% | 0.47% | 0.47% | 0.47% |

Distribution (12b-1) Fee | None | 0.75% | 0.75% | None | None |

Other Expenses | 0.47% | 0.47% | 0.47% | 0.47% | 0.23%1 |

Total Annual Fund Operating Expenses | 0.94% | 1.69% | 1.69% | 0.94% | 0.70% |

Fee Waivers and/or Expense Reimbursements2 | (0.06)% | 0.00% | 0.00% | (0.06)% | 0.00% |

Total Annual Fund Operating Expenses After Fee Waivers and/or Expense Reimbursements | 0.88% | 1.69% | 1.69% | 0.88% | 0.70% |

| 1 | Because the Fund's IS shares are new, “Other Expenses” are based on estimated amounts for the current fiscal year. |

| 2 | The Adviser and certain of its affiliates, on their own initiative, have agreed to waive certain amounts of their respective fees and/or reimburse expenses. Total annual fund operating expenses (excluding acquired fund fees and expenses, interest expense, extraordinary expenses, line of credit expenses and proxy-related expenses paid by the Fund, if any) paid by the Fund's A, F and IS classes (after the voluntary waivers and/or reimbursements) will not exceed 0.87%, 0.87% and 0.69% (the “Fee Limit”) up to but not including the later of (the “Termination Date”): (a) August 1, 2018; or (b) the date of the Fund's next effective Prospectus. While the Adviser and its affiliates currently do not anticipate terminating or increasing these arrangements prior to the Termination Date, these arrangements may only be terminated or the Fee Limit increased prior to the Termination Date with the agreement of the Fund's Board of Directors. |

| Share Class | 1 Year | 3 Years | 5 Years | 10 Years |

| A: | ||||

| Expenses assuming redemption | $542 | $736 | $947 | $1,553 |

| Expenses assuming no redemption | $542 | $736 | $947 | $1,553 |

| B: | ||||

| Expenses assuming redemption | $722 | $933 | $1,118 | $1,799 |

| Expenses assuming no redemption | $172 | $533 | $918 | $1,799 |

| Share Class | 1 Year | 3 Years | 5 Years | 10 Years |

| C: | ||||

| Expenses assuming redemption | $272 | $533 | $918 | $1.998 |

| Expenses assuming no redemption | $172 | $533 | $918 | $1,998 |

| F: | ||||

| Expenses assuming redemption | $295 | $497 | $615 | $1,243 |

| Expenses assuming no redemption | $195 | $397 | $615 | $1,243 |

| IS: | ||||

| Expenses assuming redemption | $72 | $224 | $390 | $871 |

| Expenses assuming no redemption | $72 | $224 | $390 | $871 |

| ■ | Tax-Exempt Securities Risk. The amount of public information available about tax-exempt securities is generally less than for corporate equities or bonds. The secondary market for tax-exempt securities also tends to be less well-developed and less liquid than many other securities markets, which may limit the Fund's ability to sell its tax-exempt securities at attractive prices. Special factors, such as legislative changes, and state and local economic and business developments, may adversely affect the yield and/or value of the Fund's investments in tax-exempt securities. Tax-exempt issuers can and have defaulted on obligations, been downgraded or commenced insolvency proceedings. Like other issuers and securities, the likelihood that the credit risk associated with such issuers and such securities will increase is greater during times of economic stress and financial instability. |

| ■ | Call Risk. The Fund's performance may be adversely affected by the possibility that an issuer of a security held by the Fund may redeem the security prior to maturity at a price below or above its current market value. |

| ■ | Credit Enhancement Risk. The securities in which the Fund invests may be subject to credit enhancement (for example, guarantees, letters of credit or bond insurance). If the credit quality of the credit enhancement provider (for example, a bank or bond insurer) is downgraded, the rating on a security credit enhanced by such credit enhancement provider also may be downgraded. Having multiple securities credit enhanced by the same enhancement provider will increase the adverse effects on the Fund that are likely to result from a downgrading of, or a default by, such an enhancement provider. Adverse developments in the banking or bond insurance industries also may negatively affect the Fund. |

| ■ | Leverage Risk. Leverage risk is created when an investment, which includes, for example, a derivative contract, exposes the Fund to a level of risk that exceeds the amount invested. Changes in the value of such an investment magnify the Fund's risk of loss and potential for gain. Investments can have these same results if their returns are based on a multiple of a specified index, security or other benchmark. |

| ■ | Liquidity Risk. Certain securities in which the Fund invests may be less readily marketable and may be subject to greater fluctuation in price than other securities. These features may make it more difficult to sell or buy a security at a favorable price or time. Noninvestment-grade securities generally have less liquidity than investment-grade securities. Liquidity risk also refers to the possibility that the Fund may not be able to sell a security or close out a derivative contract when it wants to. Over-the-counter derivative contracts generally carry greater liquidity risk than exchange-traded contracts. |

| ■ | Prepayment Risk. When homeowners prepay their mortgages in response to lower interest rates, the Fund will be required to reinvest the proceeds at the lower interest rates available. Also, when interest rates fall, the price of municipal mortgage-backed securities may not rise to as great an extent as that of other fixed-income securities. |

| ■ | Risk of Investing in Derivative Contracts and Hybrid Instruments. Derivative contracts and hybrid instruments involve risks different from, or possibly greater than, risks associated with investing directly in securities and other traditional investments. Specific risk issues related to the use of such contracts and instruments include valuation and tax issues, increased potential for losses and/or costs to the Fund, and a potential reduction in gains to the Fund. Each of these issues is described in greater detail in this Prospectus. Derivative contracts and hybrid instruments may also involve other risks described in this Prospectus, such as interest rate, credit, liquidity and leverage risks. |

| ■ | Risk Associated with Noninvestment-Grade Securities. The Fund may invest a portion of its assets in securities that are below investment-grade quality (which are also known as junk bonds), which may be subject to greater economic, credit and liquidity risks than investment-grade securities. |

| ■ | Risk Related to the Economy. The value of the Fund's portfolio may decline in tandem with a drop in the overall value of the markets in which the fund invests and/or the stock market. Economic, political and financial conditions, or industry or economic trends and developments, may, from time to time, and for varying periods of time, cause the Fund to experience volatility, illiquidity, shareholder redemptions or other potentially adverse effects. Among other investments, lower-grade bonds may be particularly sensitive to changes in the economy. |

| ■ | Sector Risk. A substantial part of the Fund's portfolio may be comprised of securities issued or credit enhanced by companies in similar businesses, or with other similar characteristics. As a result, the Fund will be more susceptible to any economic, business, political or other developments which generally affect these issuers or entities. |

| ■ | Tax Risk. In order to be tax-exempt, tax-exempt securities must meet certain legal requirements. Failure to meet such requirements may cause the interest received and distributed by the Fund to shareholders to be taxable. The federal income tax treatment of payments in respect of certain derivative contracts is unclear. The Fund also may invest in market discount bonds, enter into credit default swap arrangements and other derivative transactions, and engage in other |

| permissible activities that will likely cause the Fund to realize a limited amount of ordinary income or short-term capital gains (which are treated as ordinary income for federal income tax purposes). Consequently, for each of these reasons, the Fund may receive payments, and make distributions, that are treated as ordinary income for federal income tax purposes. Income from the Fund also may be subject to AMT. | |

| ■ | Issuer Credit Risk. It is possible that interest or principal on securities will not be paid when due. Noninvestment-grade securities generally have a higher default risk than investment-grade securities. Such non-payment or default may reduce the value of the Fund's portfolio holdings, its share price and its performance. |

| ■ | Counterparty Credit Risk. A party to a transaction involving the Fund may fail to meet its obligations. This could cause the Fund to lose money or to lose the benefit of the transaction or prevent the Fund from selling or buying other securities to implement its investment strategies. |

| ■ | Interest Rate Risk. Prices of fixed-income securities (including tax-exempt securities) generally fall when interest rates rise. The longer the duration of a fixed-income security, the more susceptible it is to interest rate risk. Recent and potential future changes in monetary policy made by central banks and/or their governments are likely to affect the level of interest rates. |

| ■ | Technology Risk. The Adviser uses various technologies in managing the Fund, consistent with its investment objective(s) and strategy described in this Prospectus. For example, proprietary and third-party data and systems are utilized to support decision making for the Fund. Data imprecision, software or other technology malfunctions, programming inaccuracies and similar circumstances may impair the performance of these systems, which may negatively affect Fund performance. |

| The Shares offered by this Prospectus are not deposits or obligations of any bank, are not endorsed or guaranteed by any bank and are not insured or guaranteed by the U.S. government, the Federal Deposit Insurance Corporation, the Federal Reserve Board or any other government agency. |

| Share Class | 1 Year | 5 Years | 10 Years | Start of Performance |

| A: | ||||

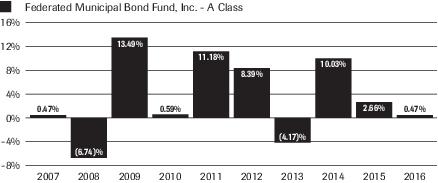

| Return Before Taxes | (4.06)% | 2.41% | 2.96% | - |

| Return After Taxes on Distributions | (4.06)% | 2.41% | 2.96% | - |

| Return After Taxes on Distributions and Sale of Fund Shares | (1.05)% | 2.60% | 3.10% | - |

| B: | ||||

| Return Before Taxes | (5.83% | 2.13% | 2.72% | - |

| C: | ||||

| Return Before Taxes | (1.44)% | 2.49% | 2.55% | - |

| F (start of performance 5/31/2007): | ||||

| Return Before Taxes | (1.63)% | 3.13% | - | 3.40% |

| IS : | ||||

| Return Before Taxes | 0.47% | 3.35% | 3.43% | - |

| S&P Municipal Bond Investment Grade Index1 (reflects no deduction for fees, expenses or taxes) | 0.46% | 3.32% | 4.17% | - |

| S&P Municipal Bond Index1,2 (reflects no deduction for fees, expenses or taxes) | 0.77% | 3.55% | 4.20% | - |

| S&P Municipal Bond Investment Grade, 3-year plus, Non-AMT Index3 (reflects no deduction for fees, expenses or taxes) | 0.40% | 3.77% | 4.59% | - |

| S&P Main 3-Year Plus Index4 (reflects no deduction for fees, expenses or taxes) | 0.72% | 4.02% | 4.61% | - |

| Morningstar Municipal National Long Funds Average5 | 0.00% | 3.60% | 3.63% | - |

| 1 | The S&P Municipal Bond Investment Grade Index is the investment-grade component of the S&P Municipal Bond Index (“Main Index”). The Main Index is a broad, comprehensive, market value-weighted index composed of approximately 55,000 bond issues that are exempt from U.S. federal income taxes or subject to the alternative minimum tax (AMT). Eligibility criteria for inclusion in the Main Index include, but are not limited to: the bond issuer must be a state (including the Commonwealth of Puerto Rico and U.S. territories) or a local government or a state or local government entity where interest on the bond is exempt from U.S. federal income taxes or subject to the AMT; the bond must be held by a mutual fund for which Standard & Poor's Securities Evaluations, Inc. provides prices; it must be denominated in U.S. dollars and have a minimum par amount of $2 million; and the bond must have a minimum term to maturity and/or call date greater than or equal to one calendar month. The Main Index is rebalanced monthly. |

| 2 | The Fund's Adviser has elected to change the benchmark from the S&P Municipal Bond Investment Grade Index to the Main Index to reflect the repositioning of the Fund's investment strategy. |

| 3 | The S&P Municipal Bond Investment Grade, 3-year plus, Non-AMT Index represents the portion of the SPMBIGI composed solely of bonds with remaining maturities of three years or more that are not subject to AMT. |

| 4 | The S&P Main 3-Year Plus Index consists of bonds in the Main Index that are rated at least BBB- by Standard & Poor's, Baa3 by Moody's or BBB- by Fitch Ratings. All bonds must also have a minimum maturity of three years and a maximum maturity of up to, but not including, fifteen years as measured from the rebalancing date |

| 5 | Morningstar figures represent the average of the total returns reported by all the mutual funds designated by Morningstar as falling into the respective category indicated. |

| ■ | current and expected U.S. economic growth; |

| ■ | current and expected interest rates and inflation; |

| ■ | the Federal Reserve's monetary policy; and |

| ■ | supply and demand factors related to the municipal market and the effect they may have on the returns offered for various bond maturities. |

| ■ | the economic feasibility of revenue bond financings and general purpose financings; |

| ■ | the financial condition of the issuer or guarantor; and |

| ■ | political developments that may affect credit quality. |

| ■ | increase or decrease the effective duration of the Fund portfolio; |

| ■ | obtain premiums from the sale of derivative contracts; |

| ■ | realize gains from trading a derivative contract; or |

| ■ | hedge against potential losses. |

| There can be no assurance that the Fund's use of derivative contracts or hybrid instruments will work as intended. |

| ■ | Fixed-income securities are fair valued using price evaluations provided by a pricing service approved by the Board of Directors (“Board”). |

| ■ | Derivative contracts listed on exchanges are valued at their reported settlement or closing price, except that options are valued at the mean of closing bid and asked quotations. |

| ■ | Over-the-counter (OTC) derivative contracts are fair valued using price evaluations provided by a pricing service approved by the Board. |

| If any price, quotation, price evaluation or other pricing source is not readily available when the NAV is calculated, or if the Fund cannot obtain price evaluations from a pricing service or from more than one dealer for an investment within a reasonable period of time as set forth in the Fund's valuation policies and procedures, or if information furnished by a pricing service, in the opinion of the Valuation Committee, is deemed not representative of the fair value of such security, the Fund uses the fair value of the investment determined in accordance with the procedures generally described below. There can be no assurance that the Fund could obtain the fair value assigned to an investment if it sold the investment at approximately the time at which the Fund determines its NAV per share. |

| Shares of other mutual funds are valued based upon their reported NAVs. The prospectuses for these mutual funds explain the circumstances under which they will use fair value pricing and the effects of using fair value pricing. |

| Minimum Initial/Subsequent Investment Amounts1 | Maximum Sales Charges | ||

| Shares Offered | Front-End Sales Charge2 | Contingent Deferred Sales Charge3 | |

| A | $1,500/$100 | 4.50% | 0.00% |

| B | $1,500/$100 | None | 5.50% |

| C | $1,500/$100 | None | 1.00% |

| F | $1,500/$100 | 1.00% | 1.00% |

| 1 | Please see “By Systematic Investment Program” for applicable minimum investment. Financial intermediaries may impose higher or lower minimum investment requirements on their customers than those imposed by the Fund. |

| To maximize your return and minimize the sales charges and marketing fees, purchases of the B class are generally limited to $100,000 and purchases of the C class are generally limited to $1,000,000. Purchases equal to or in excess of these limits may be made in the A class. If your Shares are held on the books of the Fund in the name of a financial intermediary, you may be subject to rules of your financial intermediary that differ from those of the Fund. See “Purchase Restrictions on B Class and C Class” below. After the B class has been held for eight years from the date of purchase, they will automatically convert to the A class. This conversion is a non-taxable event. | |

| 2 | Front-End Sales Charge is expressed as a percentage of public offering price. See “Sales Charge When You Purchase.” |

| 3 | See “Sales Charge When You Redeem.” |

| A: | ||

| Purchase Amount | Sales Charge as a Percentage of Public Offering Price | Sales Charge as a Percentage of NAV |

| Less than $100,000 | 4.50% | 4.71% |

| $100,000 but less than $250,000 | 3.75% | 3.90% |

| $250,000 but less than $500,000 | 2.50% | 2.56% |

| $500,000 but less than $1 million | 2.00% | 2.04% |

| $1 million or greater1 | 0.00% | 0.00% |

| 1 | A contingent deferred sales charge (CDSC) of 0.75% of the redemption amount applies to Shares originally purchased in an amount of $1 million or more and redeemed up to 24 months after purchase under certain investment programs where a financial intermediary received an advance payment on the transaction. CDSC exceptions may apply. See “Sales Charge When You Redeem.” |

| F: | ||

| Purchase Amount | Sales Charge as a Percentage of Public Offering Price | Sales Charge as a Percentage of NAV |

| Less than $1 million | 1.00% | 1.01% |

| $1 million or greater | 0.00% | 0.00% |

| ■ | Purchasing the A class or F class in greater quantities to reduce the applicable sales charge; |

| ■ | Combining concurrent purchases of and/or current investments in the A class, B class, C class, F class and R class shares of any Federated fund made or held by Qualifying Accounts; the purchase amount used in determining the sales charge on your additional Share purchase will be calculated by multiplying the respective maximum public offering price times the number of the A class, B class, C class, F class and R class shares of any Federated fund currently held in Qualifying Accounts and adding the dollar amount of your current purchase; or |

| ■ | Signing a letter of intent to purchase a qualifying amount of the A class or F class within 13 months. (Call your financial intermediary or the Fund for more information.) The Fund's custodian will hold Shares in escrow equal to the maximum applicable sales charge. If you complete the Letter of Intent, the Custodian will release the Shares in escrow to your account. If you do not fulfill the Letter of Intent, the Custodian will redeem the appropriate amount from the Shares held in escrow to pay the sales charges that were not applied to your purchases. |

| ■ | within 120 days of redeeming Shares of an equal or greater amount; |

| ■ | through a program offered by a Financial Intermediary that provides for the purchase of Shares without imposition of a sales charge (for example, a wrap account, self-directed brokerage account, retirement, or other fee-based program offered by the Financial Intermediary) and where the Financial Intermediary has agreed with the Distributor not to receive a dealer reallowance on purchases under such program; |

| ■ | with reinvested dividends or capital gains; |

| ■ | issued in connection with the merger, consolidation or acquisition of the assets of another fund. Further, the sales charge will be eliminated on purchases of Shares made by a shareholder that originally became a shareholder of a Federated Fund pursuant to the terms of an agreement and plan of reorganization which permits shareholders to acquire Shares at NAV, provided that such purchased Shares are held directly with the Fund's transfer agent. If the Shares are held through a financial intermediary the sales charge waiver will not apply (A class only); |

| ■ | as a Federated Life Member (Federated shareholders who originally were issued shares through the “Liberty Account,” which was an account for the Liberty Family of Funds on February 28, 1987, or who invested through an affinity group prior to August 1, 1987, into the Liberty Account) (A class only); |

| ■ | as a Director, employee or former employee of the Fund, the Adviser, the Distributor and their affiliates, an employee of any financial intermediary that sells Shares according to a sales agreement with the Distributor, an immediate family member of these individuals or a trust, pension or profit-sharing plan for these individuals; or |

| ■ | pursuant to the exchange privilege. |

| ■ | Shares that are not subject to a CDSC; and |

| ■ | Shares held the longest. (To determine the number of years your Shares have been held, include the time you held shares of other Federated funds that have been exchanged for Shares of this Fund.) |

| A: | ||

| If you make a purchase of the A class in the amount of $1 million or more and your financial intermediary received an advance commission on the sale, you will pay a 0.75% CDSC on any such Shares redeemed within 24 months of the purchase. | ||

| B: | ||

| Shares Held Up To: | CDSC | |

| 1 Year | 5.50% | |

| 2 Years | 4.75% | |

| 3 Years | 4.00% | |

| 4 Years | 3.00% | |

| 5 Years | 2.00% | |

| 6 Years | 1.00% | |

| 7 Years or More | 0.00% | |

| C: | ||

| You will pay a 1.00% CDSC if you redeem Shares within 12 months of the purchase date. | ||

| F: | ||

| Purchase Amount | Shares Held | CDSC |

| Up to $2 million | 4 years or less | 1.00% |

| $2 million but less than $5 million | 2 years or less | 0.50% |

| $5 million or more | 1 year or less | 0.25% |

| ■ | following the death of the last surviving shareholder on the account or the post-purchase disability of all registered shareholders, as defined in Section 72(m)(7) of the Internal Revenue Code of 1986 (the beneficiary on an account with a Transfer on Death registration is deemed the last surviving shareholder on the account); |

| ■ | due to the termination of a trust following the death of the trustor/grantor or beneficiary, provided that the trust document specifically states that the trust is terminated upon the death; |

| ■ | representing minimum required distributions from an IRA or other retirement plan as required under the Internal Revenue Code; |

| ■ | purchased by Directors, employees of the Fund, the Adviser, the Distributor and their affiliates, by employees of a financial intermediary that sells Shares according to a sales agreement with the Distributor, by the immediate family members of the above persons, and by trusts, pension or profit-sharing plans for the above persons; |

| ■ | purchased through a program offered by a Financial Intermediary that provides for the purchase of Shares without imposition of a sales charge (for example, a wrap account, self-directed brokerage account, retirement, or other fee-based program offered by the Financial Intermediary) and where the Financial Intermediary has agreed with the Distributor not to receive an advance commission on purchases under such program; |

| ■ | purchased with reinvested dividends or capital gains; |

| ■ | redeemed by the Fund when it closes an account for not meeting the minimum balance requirements; or |

| ■ | purchased pursuant to the exchange privilege if the Shares were held for the applicable CDSC holding period (the holding period on the shares purchased in the exchange will include the holding period of the shares sold in the exchange); |

| ■ | purchased in the amount of $1 million or more and redeemed within 24 months of purchase if the Shares were originally purchased through a program offered by a Financial Intermediary that provides for the purchase of Shares without imposition of a sales charge (for example, a wrap account, self-directed brokerage account, retirement, or other fee-based program offered by the Financial Intermediary) and where the Financial Intermediary has agreed with the principal underwriter not to receive an advanced commission on purchases under such program; |

| ■ | which are qualifying redemptions of the B class under a Systematic Withdrawal Program; |

| ■ | representing a total or partial distribution from a qualified plan, which does not include account transfers, rollovers or redemptions for the purpose of reinvestment. For these purposes, qualified plan does not include an IRA, individual 401(k) or custodial account following retirement. |

| ■ | An investor participating in a wrap program or other fee-based program sponsored by a financial intermediary; |

| ■ | An investor participating in a no-load network or platform sponsored by a financial intermediary where Federated has entered into an agreement with the intermediary; |

| ■ | A trustee/director, employee or former employee of the Fund, the Adviser, the Distributor and their affiliates; an immediate family member of these individuals or a trust, pension or profit-sharing plan for these individuals; |

| ■ | An employer-sponsored retirement plan; |

| ■ | A trust institution investing on behalf of its trust customers; |

| ■ | Additional sales to an investor (including a natural person) who owned IS Class of the Fund as of December 31, 2008; |

| ■ | A Federated Fund; |

| ■ | An investor (including a natural person) who acquired IS Class of a Federated fund pursuant to the terms of an agreement and plan of reorganization which permits the investor to acquire such shares; and |

| ■ | In connection with an acquisition of an investment management or advisory business, or related investment services, products or assets, by Federated or its investment advisory subsidiaries, an investor (including a natural person) who: (1) becomes a client of an investment advisory subsidiary of Federated; or (2) is a shareholder or interest holder of a pooled investment vehicle or product that becomes advised or subadvised by a Federated investment advisory subsidiary as a result of such an acquisition other than as a result of a fund reorganization transaction pursuant to an agreement and plan of reorganization. |

| ■ | An investor, other than a natural person, purchasing IS Class directly from the Fund; and |

| ■ | In connection with an initial purchase of IS Class through an exchange, an investor (including a natural person) who owned IS Class of another Federated fund as of December 31, 2008. |

| A Class: | |

| Purchase Amount | Dealer Reallowance as a Percentage of Public Offering Price |

| Less than $100,000 | 4.00% |

| $100,000 but less than $250,000 | 3.25% |

| $250,000 but less than $500,000 | 2.25% |

| $500,000 but less than $1 million | 1.80% |

| $1 million or greater | 0.00% |

| F Class: | |

| Less than $250,000 | 1.00% |

| $250,000 or greater | 0.00% |

| A Class (for purchases over $1 million): | |

| Purchase Amount | Advance Commission as a Percentage of Public Offering Price |

| First $1 million - $5 million | 0.75% |

| Next $5 million - $20 million | 0.50% |

| Over $20 million | 0.25% |

| B Class: | |

| Advance Commission as a Percentage of Public Offering Price | |

| All Purchase Amounts | Up to 5.00% |

| C Class: | |

| Advance Commission as a Percentage of Public Offering Price | |

| All Purchase Amounts | 1.00% |

| F Class: | |

| Purchase Amount | Advance Commission as a Percentage of Public Offering Price |

| Less than $2 million | 1.00% |

| $2 million but less than $5 million | 0.50% |

| $5 million or greater | 0.25% |

| ■ | Establish an account with the financial intermediary; and |

| ■ | Submit your purchase order to the financial intermediary before the end of regular trading on the NYSE (normally 4:00 p.m. Eastern time). |

| ■ | Establish your account with the Fund by submitting a completed New Account Form; and |

| ■ | Send your payment to the Fund by Federal Reserve wire or check. |

Boston, MA

Dollar Amount of Wire

ABA Number 011000028

BNF: 23026552

Attention: Federated EDGEWIRE

Wire Order Number, Dealer Number or Group Number

Nominee/Institution Name

Fund Name and Number and Account Number

P.O. Box 8600

Boston, MA 02266-8600

30 Dan Road

Canton, MA 02021-2809

| ■ | meet any applicable shareholder eligibility requirements; |

| ■ | ensure that the account registrations are identical; |

| ■ | meet any applicable minimum initial investment requirements; and |

| ■ | receive a prospectus for the fund into which you wish to exchange. |

| An exchange is treated as a redemption and a subsequent purchase, and is a taxable transaction. The Fund reserves the right to reject any request to purchase or exchange Shares. The Fund may modify or terminate the exchange privilege at any time. |

| ■ | through a financial intermediary if you purchased Shares through a financial intermediary; or |

| ■ | directly from the Fund if you purchased Shares directly from the Fund. |

P.O. Box 8600

Boston, MA 02266-8600

30 Dan Road

Canton, MA 02021-2809

| ■ | Fund name and Share class, account number and account registration; |

| ■ | amount to be redeemed or exchanged; |

| ■ | signatures of all shareholders exactly as registered; and |

| ■ | if exchanging, the Fund name and Share class, account number and account registration into which you are exchanging. |

| ■ | your redemption will be sent to an address other than the address of record; |

| ■ | your redemption will be sent to an address of record that was changed within the last 30 days; |

| ■ | a redemption is payable to someone other than the shareholder(s) of record; or |

| ■ | transferring into another fund with a different shareholder registration. |

| ■ | An electronic transfer to your account at a financial institution that is an ACH member; or |

| ■ | Wire payment to your account at a domestic commercial bank that is a Federal Reserve System member. |

| ■ | to allow your purchase to clear (as discussed below); |

| ■ | during periods of market volatility; |

| ■ | when a shareholder's trade activity or amount adversely impacts the Fund's ability to manage its assets; or |

| ■ | during any period when the Federal Reserve wire or applicable Federal Reserve banks are closed, other than customary weekend and holiday closings. |

| ■ | when the NYSE is closed, other than customary weekend and holiday closings; |

| ■ | when trading on the NYSE is restricted, as determined by the SEC; |

| ■ | in which an emergency exists, as determined by the SEC, so that disposal of the Fund's investments or determination of its NAV is not reasonably practicable; or |

| ■ | as the SEC may by order permit for the protection of Fund shareholders. |

| You will not accrue interest or dividends on uncashed redemption checks from the Fund if those checks are undeliverable and returned to the Fund. |

| ■ | meet any applicable shareholder eligibility requirements; |

| ■ | ensure that the account registrations are identical; |

| ■ | meet any applicable minimum initial investment requirements; and |

| ■ | receive a prospectus for the fund into which you wish to exchange. |

| An exchange is treated as a redemption and a subsequent purchase, and is a taxable transaction. The Fund reserves the right to reject any request to purchase or exchange Shares. The Fund may modify or terminate the exchange privilege at any time. |

| In addition, the Fund may terminate your exchange privilege if your exchange activity is found to be excessive under the Fund's frequent trading policies. See “Account and Share Information–Frequent Trading Policies.” |

| ■ | you redeem 12% or less of your account value in a single year; |

| ■ | you reinvest all dividends and capital gains distributions; |

| ■ | your account has at least a $10,000 balance when you establish the SWP. (You cannot aggregate multiple B class accounts to meet this minimum balance.) and; |

| ■ | for all B class accounts established on or after August 2, 2010, the minimum SWP redemption amount is $50 per transaction, per fund, including transactions that qualify for a CDSC waiver as outlined in this Prospectus. |

| ■ | $1,500 for the A, B, C and F classes (or in the case of IRAs, $250); and |

| ■ | $25,000 for the IS class. |

| Before an account is closed, you will be notified and allowed at least 30 days to purchase additional Shares to meet the minimum. |

| Six Months Ended (unaudited) 9/30/2016 | Year Ended March 31, | |||||

| 2016 | 2015 | 2014 | 2013 | 2012 | ||

| Net Asset Value, Beginning of Period | $10.68 | $10.66 | $10.27 | $10.73 | $10.42 | $9.56 |

| Income From Investment Operations: | ||||||

| Net investment income1 | 0.16 | 0.33 | 0.34 | 0.35 | 0.36 | 0.38 |

| Net realized and unrealized gain (loss) on investments and futures contracts | 0.11 | 0.01 | 0.39 | (0.46) | 0.30 | 0.86 |

| TOTAL FROM INVESTMENT OPERATIONS | 0.27 | 0.34 | 0.73 | (0.11) | 0.66 | 1.24 |

| Less Distributions: | ||||||

| Distributions from net investment income | (0.16) | (0.32) | (0.34) | (0.35) | (0.35) | (0.38) |

| Net Asset Value, End of Period | $10.79 | $10.68 | $10.66 | $10.27 | $10.73 | $10.42 |

| Total Return2 | 2.51% | 3.31% | 7.16% | (0.97)% | 6.43% | 13.21% |

| Ratios to Average Net Assets: | ||||||

| Net expenses | 0.88%3 | 0.87% | 0.87% | 0.87% | 0.87% | 0.87% |

| Net investment income | 3.04% 3 | 3.10% | 3.23% | 3.42% | 3.33% | 3.79% |

| Expense waiver/reimbursement4 | 0.06%3 | 0.07% | 0.08% | 0.08% | 0.07% | 0.09% |

| Supplemental Data: | ||||||

| Net assets, end of period (000 omitted) | $325,842 | $331,876 | $346,803 | $355,711 | $454,722 | $437,968 |

| Portfolio turnover | 7% | 25% | 16% | 8% | 22% | 14% |

| 1 | Per share numbers have been calculated using the average shares method. |

| 2 | Based on net asset value, which does not reflect the sales charge, redemption fee or contingent deferred sales charge, if applicable. Total returns for periods of less than one year are not annualized. |

| 3 | Computed on an annualized basis. |

| 4 | This expense decrease is reflected in both the net expense and net investment income ratios shown above. |

| Six Months Ended (unaudited) 9/30/2016 | Year Ended March 31, | |||||

| 2016 | 2015 | 2014 | 2013 | 2012 | ||

| Net Asset Value, Beginning of Period | $10.69 | $10.66 | $10.27 | $10.73 | $10.42 | $9.56 |

| Income From Investment Operations: | ||||||

| Net investment income1 | 0.12 | 0.24 | 0.25 | 0.27 | 0.27 | 0.30 |

| Net realized and unrealized gain (loss) on investments and futures contracts | 0.09 | 0.03 | 0.39 | (0.47) | 0.31 | 0.86 |

| TOTAL FROM INVESTMENT OPERATIONS | 0.21 | 0.27 | 0.64 | (0.20) | 0.58 | 1.16 |

| Less Distributions: | ||||||

| Distributions from net investment income | (0.11) | (0.24) | (0.25) | (0.26) | (0.27) | (0.30) |

| Net Asset Value, End of Period | $10.79 | $10.69 | $10.66 | $10.27 | $10.73 | $10.42 |

| Total Return2 | 1.98% | 2.54% | 6.28% | (1.79)% | 5.57% | 12.25% |

| Ratios to Average Net Assets: | ||||||

| Net expenses | 1.69%3 | 1.69% | 1.70% | 1.71% | 1.69% | 1.72% |

| Net investment income | 2.23%3 | 2.28% | 2.40% | 2.59% | 2.52% | 2.95% |

| Expense waiver/reimbursement4 | 0.00%3 | 0.00%5 | 0.00% | 0.00% | 0.00%5 | 0.00%5 |

| Supplemental Data: | ||||||

| Net assets, end of period (000 omitted) | $4,878 | $5,732 | $7,303 | $8,292 | $11,434 | $11,174 |

| Portfolio turnover | $7 | 25% | 16% | 8% | 22% | 14% |

| 1 | Per share number has been calculated using the average shares method. |

| 2 | Based on net asset value, which does not reflect the sales charge, redemption fee or contingent deferred sales charge, if applicable. Total returns for periods of less than one year are not annualized. |

| 3 | Computed on an annualized basis. |

| 4 | This expense decrease is reflected in both the net expense and net investment income ratios shown above. |

| 5 | Represents less than 0.01%. |

| Six Months Ended (unaudited) 9/30/2016 | Year Ended March 31, | |||||

| 2016 | 2015 | 2014 | 2013 | 2012 | ||

| Net Asset Value, Beginning of Period | $10.69 | $10.66 | $10.27 | $10.73 | $10.42 | $9.56 |

| Income From Investment Operations: | ||||||

| Net investment income1 | 0.12 | 0.24 | 0.25 | 0.27 | 0.27 | 0.30 |

| Net realized and unrealized gain (loss) on investments and futures contracts | 0.10 | 0.03 | 0.39 | (0.47) | 0.31 | 0.86 |

| TOTAL FROM INVESTMENT OPERATIONS | 0.22 | 0.27 | 0.64 | (0.20) | 0.58 | 1.16 |

| Less Distributions: | ||||||

| Distributions from net investment income | (0.11) | (0.24) | (0.25) | (0.26) | (0.27) | (0.30) |

| Net Asset Value, End of Period | $10.80 | $10.69 | $10.66 | $10.27 | $10.73 | $10.42 |

| Total Return2 | 2.08% | 2.54% | 6.27% | (1.79)% | 5.57% | 12.25% |

| Ratios to Average Net Assets: | ||||||

| Net expenses | 1.69%3 | 1.69% | 1.70% | 1.71% | 1.69% | 1.72% |

| Net investment income | 2.22%3 | 2.28% | 2.40% | 2.59% | 2.52% | 2.95% |

| Expense waiver/reimbursement4 | 0.00%3 | 0.00%5 | 0.00% | 0.00% | 0.00%5 | 0.00%5 |

| Supplemental Data: | ||||||

| Net assets, end of period (000 omitted) | $20,242 | $20,372 | $19,001 | $18,047 | $27,246 | $25,267 |

| Portfolio turnover | 7% | 25% | 16% | 8% | 22% | 14% |

| 1 | Per share number has been calculated using the average shares method. |

| 2 | Based on net asset value, which does not reflect the sales charge, redemption fee or contingent deferred sales charge, if applicable. Total returns for periods of less than one year are not annualized. |

| 3 | Computed on an annualized basis. |

| 4 | This expense decrease is reflected in both the net expense and net investment income ratios shown above. |

| 5 | Represents less than 0.01%. |

| Six Months Ended (unaudited) 9/30/2016 | Year Ended March 31, | |||||

| 2016 | 2015 | 2014 | 2013 | 2012 | ||

| Net Asset Value, Beginning of Period | $10.68 | $10.66 | $10.27 | $10.73 | $10.42 | $9.56 |

| Income From Investment Operations: | ||||||

| Net investment income1 | 0.16 | 0.33 | 0.34 | 0.35 | 0.36 | 0.38 |

| Net realized and unrealized gain (loss) on investments and futures contracts | 0.11 | 0.01 | 0.39 | (0.46) | 0.30 | 0.86 |

| TOTAL FROM INVESTMENT OPERATIONS | 0.27 | 0.34 | 0.73 | (0.11) | 0.66 | 1.24 |

| Less Distributions: | ||||||

| Distributions from net investment income | (0.16) | (0.32) | (0.34) | (0.35) | (0.35) | (0.38) |

| Net Asset Value, End of Period | $10.79 | $10.68 | $10.66 | $10.27 | $10.73 | $10.42 |

| Total Return2 | 2.51% | 3.31% | 7.17% | (0.97)% | 6.43% | 13.21% |

| Ratios to Average Net Assets: | ||||||

| Net expenses | 0.88%3 | 0.87% | 0.87% | 0.87% | 0.87% | 0.87% |

| Net investment income | 3.03%3 | 3.09% | 3.23% | 3.42% | 3.33% | 3.79% |

| Expense waiver/reimbursement4 | 0.06%3 | 0.07% | 0.08% | 0.08% | 0.07% | 0.09% |

| Supplemental Data: | ||||||

| Net assets, end of period (000 omitted) | $28,513 | $24,558 | $20,604 | $19,359 | $25,420 | $19,575 |

| Portfolio turnover | 7% | 25% | 16% | 8% | 22% | 14% |

| 1 | Per share number has been calculated using the average shares method. |

| 2 | Based on net asset value, which does not reflect the sales charge, redemption fee or contingent deferred sales charge, if applicable. Total returns for periods of less than one year are not annualized. |

| 3 | Computed on an annualized basis. |

| 4 | This expense decrease is reflected in both the net expense and net investment income ratios shown above. |

| FEDERATED MUNICIPAL SECURITIES FUND, INC. - A CLASS | |||||

| ANNUAL EXPENSE RATIO: 0.94% | |||||

| MAXIMUM FRONT-END SALES CHARGE: 4.50% | |||||

| Year | Hypothetical Beginning Investment | Hypothetical Performance Earnings | Investment After Returns | Hypothetical Expenses | Hypothetical Ending Investment |

| 1 | $10,000.00 | $477.50 | $10,027.50 | $541.59 | $9,937.73 |

| 2 | $9,937.73 | $496.89 | $10,434.62 | $95.31 | $10,341.20 |

| 3 | $10,341.20 | $517.06 | $10,858.26 | $99.18 | $10,761.05 |

| 4 | $10,761.05 | $538.05 | $11,299.10 | $103.21 | $11,197.95 |

| 5 | $11,197.95 | $559.90 | $11,757.85 | $107.40 | $11,652.59 |

| 6 | $11,652.59 | $582.63 | $12,235.22 | $111.76 | $12,125.69 |

| 7 | $12,125.69 | $606.28 | $12,731.97 | $116.30 | $12,617.99 |

| 8 | $12,617.99 | $630.90 | $13,248.89 | $121.02 | $13,130.28 |

| 9 | $13,130.28 | $656.51 | $13,786.79 | $125.93 | $13,663.37 |

| 10 | $13,663.37 | $683.17 | $14,346.54 | $131.04 | $14,218.10 |

| Cumulative | $5,748.89 | $1,552.74 | |||

| FEDERATED MUNICIPAL SECURITIES FUND, INC. - B CLASS | |||||

| ANNUAL EXPENSE RATIO: 1.69% | |||||

| MAXIMUM FRONT-END SALES CHARGE: NONE | |||||

| Year | Hypothetical Beginning Investment | Hypothetical Performance Earnings | Investment After Returns | Hypothetical Expenses | Hypothetical Ending Investment |

| 1 | $10,000.00 | $500.00 | $10,500.00 | $171.80 | $10,331.00 |

| 2 | $10,331.00 | $516.55 | $10,847.55 | $177.48 | $10,672.96 |

| 3 | $10,672.96 | $533.65 | $11,206.61 | $183.36 | $11,026.23 |

| 4 | $11,026.23 | $551.31 | $11,577.54 | $189.43 | $11,391.20 |

| 5 | $11,391.20 | $569.56 | $11,960.76 | $195.70 | $11,768.25 |

| 6 | $11,768.25 | $588.41 | $12,356.66 | $202.18 | $12,157.78 |

| 7 | $12,157.78 | $607.89 | $12,765.67 | $208.87 | $12,560.20 |

| 8 | $12,560.20 | $628.01 | $13,188.21 | $215.78 | $12,975.94 |

| Converts from B to A | Annual Expense Ratio: 0.94% | ||||

| 9 | $12,975.94 | $648.80 | $13,624.74 | $124.45 | $13,502.76 |

| 10 | $13,502.76 | $675.14 | $14,177.90 | $129.50 | $14,050.97 |

| Cumulative | $5,819.32 | $1,798.55 | |||

| FEDERATED MUNICIPAL SECURITIES FUND, INC. - C CLASS | |||||

| ANNUAL EXPENSE RATIO: 1.69% | |||||

| MAXIMUM FRONT-END SALES CHARGE: NONE | |||||

| Year | Hypothetical Beginning Investment | Hypothetical Performance Earnings | Investment After Returns | Hypothetical Expenses | Hypothetical Ending Investment |

| 1 | $10,000.00 | $500.00 | $10,500.00 | $171.80 | $10,331.00 |

| 2 | $10,331.00 | $516.55 | $10,847.55 | $177.48 | $10,672.96 |

| 3 | $10,672.96 | $533.65 | $11,206.61 | $183.36 | $11,026.23 |

| 4 | $11,026.23 | $551.31 | $11,577.54 | $189.43 | $11,391.20 |

| 5 | $11,391.20 | $569.56 | $11,960.76 | $195.70 | $11,768.25 |

| 6 | $11,768.25 | $588.41 | $12,356.66 | $202.18 | $12,157.78 |

| 7 | $12,157.78 | $607.89 | $12,765.67 | $208.87 | $12,560.20 |

| 8 | $12,560.20 | $628.01 | $13,188.21 | $215.78 | $12,975.94 |

| 9 | $12,975.94 | $648.80 | $13,624.74 | $222.92 | $13,405.44 |

| 10 | $13,405.44 | $670.27 | $14,075.71 | $230.30 | $13,849.16 |

| Cumulative | $5,814.45 | $1,997.82 | |||

| FEDERATED MUNICIPAL SECURITIES FUND, INC. - F CLASS | |||||

| ANNUAL EXPENSE RATIO: 0.94% | |||||

| MAXIMUM FRONT-END SALES CHARGE: 1.00% | |||||

| Year | Hypothetical Beginning Investment | Hypothetical Performance Earnings | Investment After Returns | Hypothetical Expenses | Hypothetical Ending Investment |

| 1 | $10,000.00 | $495.00 | $10,395.00 | $194.95 | $10,301.94 |

| 2 | $10,301.94 | $515.10 | $10,817.04 | $98.80 | $10,720.20 |

| 3 | $10,720.20 | $536.01 | $11,256.21 | $102.82 | $11,155.44 |

| 4 | $11,155.44 | $557.77 | $11,713.21 | $106.99 | $11,608.35 |

| 5 | $11,608.35 | $580.42 | $12,188.77 | $111.33 | $12,079.65 |

| 6 | $12,079.65 | $603.98 | $12,683.63 | $115.85 | $12,570.08 |

| 7 | $12,570.08 | $628.50 | $13,198.58 | $120.56 | $13,080.43 |

| 8 | $13,080.43 | $654.02 | $13,734.45 | $125.45 | $13,611.50 |

| 9 | $13,611.50 | $680.58 | $14,292.08 | $130.55 | $14,164.13 |

| 10 | $14,164.13 | $708.21 | $14,872.34 | $135.85 | $14,739.19 |

| Cumulative | $5,959.59 | $1,243.15 | |||

| FEDERATED MUNICIPAL SECURITIES FUND - IS CLASS | |||||

| ANNUAL EXPENSE RATIO: 0.70% | |||||

| MAXIMUM FRONT-END SALES CHARGE: NONE | |||||

| Year | Hypothetical Beginning Investment | Hypothetical Performance Earnings | Investment After Returns | Hypothetical Expenses | Hypothetical Ending Investment |

| 1 | $10,000.00 | $500.00 | $10,500.00 | $71.51 | $10,430.00 |

| 2 | $10,430.00 | $521.50 | $10,951.50 | $74.58 | $10,878.49 |

| 3 | $10,878.49 | $543.92 | $11,422.41 | $77.79 | $11,346.27 |

| 4 | $11,346.27 | $567.31 | $11,913.58 | $81.13 | $11,834.16 |

| 5 | $11,834.16 | $591.71 | $12,425.87 | $84.62 | $12,343.03 |

| 6 | $12,343.03 | $617.15 | $12,960.18 | $88.26 | $12,873.78 |

| 7 | $12,873.78 | $643.69 | $13,517.47 | $92.05 | $13,427.35 |

| 8 | $13,427.35 | $671.37 | $14,098.72 | $96.01 | $14,004.73 |

| 9 | $14,004.73 | $700.24 | $14,704.97 | $100.14 | $14,606.93 |

| 10 | $14,606.93 | $730.35 | $15,337.28 | $104.45 | $15,235.03 |

| FEDERATED MUNICIPAL SECURITIES FUND - IS CLASS | |||||

| ANNUAL EXPENSE RATIO: 0.70% | |||||

| MAXIMUM FRONT-END SALES CHARGE: NONE | |||||

| Year | Hypothetical Beginning Investment | Hypothetical Performance Earnings | Investment After Returns | Hypothetical Expenses | Hypothetical Ending Investment |

| Cumulative | $6,087.24 | $870.54 | |||

| ■ | Employer-sponsored retirement, deferred compensation and employee benefit plans (including health savings accounts) and trusts used to fund those plans, provided that the shares are not held in a commission-based brokerage account and shares are held for the benefit of the plan |

| ■ | Shares purchased by or through a 529 Plan |

| ■ | Shares purchased through a Merrill Lynch affiliated investment advisory program |

| ■ | Shares purchased by third-party investment advisors on behalf of their advisory clients through Merrill Lynch's platform |

| ■ | Shares of funds purchased through the Merrill Edge Self-Directed platform |

| ■ | Shares purchased through reinvestment of capital gains distributions and dividend reinvestment when purchasing shares of the same fund (but not any other fund within the fund family) |

| ■ | Shares exchanged from Class C shares of the same fund in the month of or following the 10-year anniversary of the purchase date |

| ■ | Employees and registered representatives of Merrill Lynch or its affiliates and their family members |

| ■ | Directors or Trustees of the Fund, and employees of the Fund's investment adviser or any of its affiliates, as described in this prospectus |

| ■ | Shares purchased from the proceeds of redemptions within the same fund family, provided: (1) the repurchase occurs within 90 days following the redemption; (2) the redemption and purchase occur in the same account; and (3) redeemed shares were subject to a front-end or deferred sales load (known as Rights of Reinstatement) |

| ■ | Death or disability of the shareholder |

| ■ | Shares sold as part of a systematic withdrawal plan as described in the Fund's prospectus |

| ■ | Return of excess contributions from an IRA Account |

| ■ | Shares sold as part of a required minimum distribution for IRA and retirement accounts due to the shareholder reaching age 70 1⁄2 |

| ■ | Shares sold to pay Merrill Lynch fees but only if the transaction is initiated by Merrill Lynch |

| ■ | Shares acquired through a right of reinstatement |

| ■ | Shares held in retirement brokerage accounts, that are converted to a lower cost share class due to transfer to certain fee based accounts or platforms (applicable to A and C shares only). The CDSC applicable to the converted shares will be waived, and Merrill Lynch will remit to the Fund's Distributor a portion of the waived CDSC. Such portion shall be equal to the number of months remaining on the CDSC period divided by the total number of months of the CDSC period. |

Breakpoints, Rights of Accumulation and Letters of Intent

| ■ | Breakpoints as described in this prospectus |

| ■ | Rights of Accumulation (ROA) which entitle shareholders to breakpoint discounts will be automatically calculated based on the aggregated holding of fund family assets held by accounts within the purchaser's household at Merrill Lynch. Eligible fund family assets not held at Merrill Lynch may be included in the ROA calculation only if the shareholder notifies his or her financial advisor about such assets. |

| ■ | Letters of Intent (LOI) which allow for breakpoint discounts based on anticipated purchases within a fund family, through Merrill Lynch, over a 13-month period of time |

Federated Investors Funds

4000 Ericsson Drive

Warrendale, PA 15086-7561

or call 1-800-341-7400.

CUSIP 313913204

CUSIP 313913303

CUSIP 313913402

CUSIP TBD

2017 ©Federated Investors, Inc.

| Shareholder Fees (fees paid directly from your investment) | T |

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) | 2.50% |

Maximum Deferred Sales Charge (Load) (as a percentage of original purchase price or redemption proceeds, as applicable) | None |

Maximum Sales Charge (Load) Imposed on Reinvested Dividends (and other Distributions) (as a percentage of offering price) | None |

Redemption Fee (as a percentage of amount redeemed, if applicable) | None |

Exchange Fee | None |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |

Management Fee | 0.48% |

Distribution (12b-1) Fee | None |

Other Expenses1 | 0.48% |

Total Annual Fund Operating Expenses | 0.96% |

Fee Waivers and/or Expense Reimbursements2 | (0.08)% |

Total Annual Fund Operating Expenses After Fee Waivers and/or Expense Reimbursements | 0.88% |

| 1 | Because the Fund's T Shares are new, “Other Expenses” are based on estimated amounts for the current fiscal year. |

| 2 | The Adviser and certain of its affiliates, on their own initiative, have agreed to waive certain amounts of their respective fees and/or reimburse expenses. Total annual fund operating expenses (excluding acquired fund fees and expenses, interest expense, extraordinary expenses, line of credit expenses and proxy-related expenses paid by the Fund, if any) paid by the Fund's T class (after the voluntary waivers and/or reimbursements) will not exceed 0.87% (the “Fee Limit”) up to but not including the later of (the “Termination Date”): (a) April 1, 2018; or (b) the date of the Fund's next effective Prospectus. While the Adviser and its affiliates currently do not anticipate terminating or increasing these arrangements prior to the Termination Date, these arrangements may only be terminated or the Fee Limit increased prior to the Termination Date with the agreement of the Fund's Board of Directors. |

| 1 Year | $345 |

| 3 Years | $548 |

| 5 Years | $768 |

| 10 Years | $1,399 |

| ■ | Tax-Exempt Securities Risk. The amount of public information available about tax-exempt securities is generally less than for corporate equities or bonds. The secondary market for tax-exempt securities also tends to be less well-developed and less liquid than many other securities markets, which may limit the Fund's ability to sell its tax-exempt securities at attractive prices. Special factors, such as legislative changes, and state and local economic and business developments, may adversely affect the yield and/or value of the Fund's investments in tax-exempt securities. Tax-exempt issuers can and have defaulted on obligations, been downgraded or commenced insolvency proceedings. Like other issuers and securities, the likelihood that the credit risk associated with such issuers and such securities will increase is greater during times of economic stress and financial instability. |

| ■ | Call Risk. The Fund's performance may be adversely affected by the possibility that an issuer of a security held by the Fund may redeem the security prior to maturity at a price below or above its current market value. |

| ■ | Credit Enhancement Risk. The securities in which the Fund invests may be subject to credit enhancement (for example, guarantees, letters of credit or bond insurance). If the credit quality of the credit enhancement provider (for example, a bank or bond insurer) is downgraded, the rating on a security credit enhanced by such credit enhancement provider also may be downgraded. Having multiple securities credit enhanced by the same enhancement provider will increase the adverse effects on the Fund that are likely to result from a downgrading of, or a default by, such an enhancement provider. Adverse developments in the banking or bond insurance industries also may negatively affect the Fund. |

| ■ | Leverage Risk. Leverage risk is created when an investment, which includes, for example, a derivative contract, exposes the Fund to a level of risk that exceeds the amount invested. Changes in the value of such an investment magnify the Fund's risk of loss and potential for gain. Investments can have these same results if their returns are based on a multiple of a specified index, security or other benchmark. |

| ■ | Liquidity Risk. Certain securities in which the Fund invests may be less readily marketable and may be subject to greater fluctuation in price than other securities. These features may make it more difficult to sell or buy a security at a favorable price or time. Noninvestment-grade securities generally have less liquidity than investment-grade securities. Liquidity risk also refers to the possibility that the Fund may not be able to sell a security or close out a derivative contract when it wants to. Over-the-counter derivative contracts generally carry greater liquidity risk than exchange-traded contracts. |

| ■ | Prepayment Risk. When homeowners prepay their mortgages in response to lower interest rates, the Fund will be required to reinvest the proceeds at the lower interest rates available. Also, when interest rates fall, the price of municipal mortgage-backed securities may not rise to as great an extent as that of other fixed-income securities. |

| ■ | Risk of Investing in Derivative Contracts and Hybrid Instruments. Derivative contracts and hybrid instruments involve risks different from, or possibly greater than, risks associated with investing directly in securities and other traditional investments. Specific risk issues related to the use of such contracts and instruments include valuation and tax issues, increased potential for losses and/or costs to the Fund, and a potential reduction in gains to the Fund. Each of these issues is described in greater detail in this Prospectus. Derivative contracts and hybrid instruments may also involve other risks described in this Prospectus, such as interest rate, credit, liquidity and leverage risks. |

| ■ | Risk Associated with Noninvestment-Grade Securities. The Fund may invest a portion of its assets in securities that are below investment-grade quality (which are also known as junk bonds), which may be subject to greater economic, credit and liquidity risks than investment-grade securities. |

| ■ | Risk Related to the Economy. The value of the Fund's portfolio may decline in tandem with a drop in the overall value of the markets in which the fund invests and/or the stock market. Economic, political and financial conditions, or industry or economic trends and developments, may, from time to time, and for varying periods of time, cause the Fund to experience volatility, illiquidity, shareholder redemptions or other potentially adverse effects. Among other investments, lower-grade bonds may be particularly sensitive to changes in the economy. |

| ■ | Sector Risk. A substantial part of the Fund's portfolio may be comprised of securities issued or credit enhanced by companies in similar businesses, or with other similar characteristics. As a result, the Fund will be more susceptible to any economic, business, political or other developments which generally affect these issuers or entities. |

| ■ | Tax Risk. In order to be tax-exempt, tax-exempt securities must meet certain legal requirements. Failure to meet such requirements may cause the interest received and distributed by the Fund to shareholders to be taxable. The federal income tax treatment of payments in respect of certain derivative contracts is unclear. The Fund also may invest in market discount bonds, enter into credit default swap arrangements and other derivative transactions, and engage in other permissible activities that will likely cause the Fund to realize a limited amount of ordinary income or short-term capital gains (which are treated as ordinary income for federal income tax purposes). Consequently, for each of these reasons, the Fund may receive payments, and make distributions, that are treated as ordinary income for federal income tax purposes. Income from the Fund also may be subject to AMT. |

| ■ | Issuer Credit Risk. It is possible that interest or principal on securities will not be paid when due. Noninvestment-grade securities generally have a higher default risk than investment-grade securities. Such non-payment or default may reduce the value of the Fund's portfolio holdings, its share price and its performance. |

| ■ | Counterparty Credit Risk. A party to a transaction involving the Fund may fail to meet its obligations. This could cause the Fund to lose money or to lose the benefit of the transaction or prevent the Fund from selling or buying other securities to implement its investment strategies. |

| ■ | Interest Rate Risk. Prices of fixed-income securities (including tax-exempt securities) generally fall when interest rates rise. The longer the duration of a fixed-income security, the more susceptible it is to interest rate risk. Recent and potential future changes in monetary policy made by central banks and/or their governments are likely to affect the level of interest rates. |

| ■ | Technology Risk. The Adviser uses various technologies in managing the Fund, consistent with its investment objective(s) and strategy described in this Prospectus. For example, proprietary and third-party data and systems are utilized to support decision making for the Fund. Data imprecision, software or other technology malfunctions, programming inaccuracies and similar circumstances may impair the performance of these systems, which may negatively affect Fund performance. |

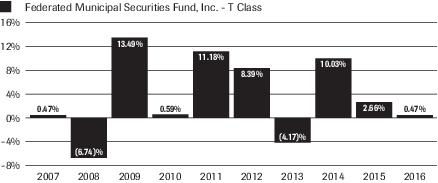

| Share Class | 1 Year | 5 Years | 10 Years | |

| T: | ||||

| Return Before Taxes | (4.06)% | 2.41% | 2.96% | |

| Return After Taxes on Distributions | (4.06)% | 2.41% | 2.96% | |

| Return After Taxes on Distributions and Sale of Fund Shares | (1.05)% | 2.60% | 3.10% | |

| S&P Municipal Bond Investment Grade Index1 (reflects no deduction for fees, expenses or taxes) | 0.46% | 3.32% | 4.17% | |

| S&P Municipal Bond Index1,2 (reflects no deduction for fees, expenses or taxes) | 0.77% | 3.55% | 4.20% | |

| S&P Municipal Bond Investment Grade, 3-year plus, Non-AMT Index3 (reflects no deduction for fees, expenses or taxes) | 0.40% | 3.77% | 4.59% | |

| S&P Main 3-Year Plus Index4 (reflects no deduction for fees, expenses or taxes) | 0.72% | 4.02% | 4.61% | |

| Morningstar Municipal National Long Funds Average5 | 0.00% | 3.60% | 3.63% |

| 1 | The S&P Municipal Bond Investment Grade Index is the investment-grade component of the S&P Municipal Bond Index (“Main Index”). The Main Index is a broad, comprehensive, market value-weighted index composed of approximately 55,000 bond issues that are exempt from U.S. federal income taxes or subject to the alternative minimum tax (AMT). Eligibility criteria for inclusion in the Main Index include, but are not limited to: the bond issuer must be a state (including the Commonwealth of Puerto Rico and U.S. territories) or a local government or a state or local government entity where interest on the bond is exempt from U.S. federal income taxes or subject to the AMT; the bond must be held by a mutual fund for which Standard & Poor's Securities Evaluations, Inc. provides prices; it must be denominated in U.S. dollars and have a minimum par amount of $2 million; and the bond must have a minimum term to maturity and/or call date greater than or equal to one calendar month. The Main Index is rebalanced monthly. |

| 2 | The Fund's Adviser has elected to change the benchmark from the S&P Municipal Bond Investment Grade Index to the Main Index to reflect the repositioning of the Fund's investment strategy. |

| 3 | The S&P Municipal Bond Investment Grade, 3-year plus, Non-AMT Index represents the portion of the SPMBIGI composed solely of bonds with remaining maturities of three years or more that are not subject to AMT. |

| 4 | The S&P Main 3-Year Plus Index consists of bonds in the Main Index that are rated at least BBB- by Standard & Poor's, Baa3 by Moody's or BBB- by Fitch Ratings. All bonds must also have a minimum maturity of three years and a maximum maturity of up to, but not including, fifteen years as measured from the rebalancing date |

| 5 | Morningstar figures represent the average of the total returns reported by all the mutual funds designated by Morningstar as falling into the respective category indicated |

| ■ | current and expected U.S. economic growth; |

| ■ | current and expected interest rates and inflation; |

| ■ | the Federal Reserve's monetary policy; and |

| ■ | supply and demand factors related to the municipal market and the effect they may have on the returns offered for various bond maturities. |

| ■ | the economic feasibility of revenue bond financings and general purpose financings; |

| ■ | the financial condition of the issuer or guarantor; and |

| ■ | political developments that may affect credit quality. |

| ■ | increase or decrease the effective duration of the Fund portfolio; |

| ■ | obtain premiums from the sale of derivative contracts; |

| ■ | realize gains from trading a derivative contract; or |

| ■ | hedge against potential losses. |

| There can be no assurance that the Fund's use of derivative contracts or hybrid instruments will work as intended. |

| ■ | Fixed-income securities are fair valued using price evaluations provided by a pricing service approved by the Board of Directors (“Board”). |

| ■ | Derivative contracts listed on exchanges are valued at their reported settlement or closing price, except that options are valued at the mean of closing bid and asked quotations. |

| ■ | Over-the-counter (OTC) derivative contracts are fair valued using price evaluations provided by a pricing service approved by the Board. |

| Minimum Initial/Subsequent Investment Amounts1 | Maximum Sales Charges | ||

| Shares Offered | Front-End Sales Charge2 | Contingent Deferred Sales Charge | |

| T | $1,500/$100 | 2.50% | None |

| 1 | The minimum initial and subsequent investment amounts for Individual Retirement Accounts (IRAs) are generally $250 and $100, respectively. There is no minimum initial or subsequent investment amount required for employer-sponsored retirement plans; however, such accounts remain subject to the Fund's policy on “Accounts with Low Balances” as discussed later in this Prospectus. Please see “By Systematic Investment Program” for applicable minimum investment. Financial intermediaries may impose higher or lower minimum investment requirements on their customers than those imposed by the Fund. |

| 2 | Front-End Sales Charge is expressed as a percentage of public offering price. See “Sales Charge When You Purchase.” |

| T: | ||

| Purchase Amount | Sales Charge as a Percentage of Public Offering Price | Sales Charge as a Percentage of NAV |

| Less than $250,000 | 2.50% | 2.56% |

| $250,000 but less than $500,000 | 2.00% | 2.04% |

| $500,000 but less than $1 million | 1.50% | 1.52% |

| $1 million or greater | 1.00% | 1.01% |

| T: | |

| Purchase Amount | Dealer Reallowance as a Percentage of Public Offering Price |

| Less than $250,000 | 2.50% |

| $250,000 but less than $500,000 | 2.00% |

| $500,000 but less than $1 million | 1.50% |

| $1 million or greater | 1.00% |

| ■ | Establish an account with the financial intermediary; and |

| ■ | Submit your purchase order to the financial intermediary before the end of regular trading on the NYSE (normally 4:00 p.m. Eastern time). |

| ■ | Establish your account with the Fund by submitting a completed New Account Form; and |

| ■ | Send your payment to the Fund by Federal Reserve wire or check. |

Boston, MA

Dollar Amount of Wire

ABA Number 011000028

BNF: 23026552

Attention: Federated EDGEWIRE

Wire Order Number, Dealer Number or Group Number

Nominee/Institution Name

Fund Name and Number and Account Number

P.O. Box 8600

Boston, MA 02266-8600

30 Dan Road

Canton, MA 02021-2809

| ■ | through a financial intermediary if you purchased Shares through a financial intermediary; or |

| ■ | directly from the Fund if you purchased Shares directly from the Fund. |

P.O. Box 8600

Boston, MA 02266-8600

30 Dan Road

Canton, MA 02021-2809

| ■ | Fund name and Share class, account number and account registration; |

| ■ | amount to be redeemed; and |

| ■ | signatures of all shareholders exactly as registered. |

| Call your financial intermediary or the Fund if you need special instructions. |

| ■ | your redemption will be sent to an address other than the address of record; |

| ■ | your redemption will be sent to an address of record that was changed within the last 30 days; |

| ■ | a redemption is payable to someone other than the shareholder(s) of record; or |

| ■ | transferring into another fund with a different shareholder registration. |

| ■ | An electronic transfer to your account at a financial institution that is an ACH member; or |

| ■ | Wire payment to your account at a domestic commercial bank that is a Federal Reserve System member. |

| ■ | to allow your purchase to clear (as discussed below); |

| ■ | during periods of market volatility; |

| ■ | when a shareholder's trade activity or amount adversely impacts the Fund's ability to manage its assets; or |

| ■ | during any period when the Federal Reserve wire or applicable Federal Reserve banks are closed, other than customary weekend and holiday closings. |

| ■ | when the NYSE is closed, other than customary weekend and holiday closings; |

| ■ | when trading on the NYSE is restricted, as determined by the SEC; |

| ■ | in which an emergency exists, as determined by the SEC, so that disposal of the Fund's investments or determination of its NAV is not reasonably practicable; or |

| ■ | as the SEC may by order permit for the protection of Fund shareholders. |

| ■ | $1,500 for the T class (or in the case of IRAs, $250). |

| Six Months Ended (unaudited) 9/30/2016 | Year Ended March 31, | |||||

| 2016 | 2015 | 2014 | 2013 | 2012 | ||

| Net Asset Value, Beginning of Period | $10.68 | $10.66 | $10.27 | $10.73 | $10.42 | $9.56 |

| Income From Investment Operations: | ||||||

| Net investment income1 | 0.16 | 0.33 | 0.34 | 0.35 | 0.36 | 0.38 |

| Net realized and unrealized gain (loss) on investments and futures contracts | 0.11 | 0.01 | 0.39 | (0.46) | 0.30 | 0.86 |

| TOTAL FROM INVESTMENT OPERATIONS | 0.27 | 0.34 | 0.73 | (0.11) | 0.66 | 1.24 |

| Less Distributions: | ||||||

| Distributions from net investment income | (0.16) | (0.32) | (0.34) | (0.35) | (0.35) | (0.38) |

| Net Asset Value, End of Period | $10.79 | $10.68 | $10.66 | $10.27 | $10.73 | $10.42 |

| Total Return2 | 2.51% | 3.31% | 7.16% | (0.97)% | 6.43% | 13.21% |

| Ratios to Average Net Assets: | ||||||

| Net expenses | 0.88%3 | 0.87% | 0.87% | 0.87% | 0.87% | 0.87% |

| Net investment income | 3.04% 3 | 3.10% | 3.23% | 3.42% | 3.33% | 3.79% |

| Expense waiver/reimbursement4 | 0.06%3 | 0.07% | 0.08% | 0.08% | 0.07% | 0.09% |

| Supplemental Data: | ||||||

| Net assets, end of period (000 omitted) | $325,842 | $331,876 | $346,803 | $355,711 | $454,722 | $437,968 |

| Portfolio turnover | 7% | 25% | 16% | 8% | 22% | 14% |

| 1 | Per share numbers have been calculated using the average shares method. |

| 2 | Based on net asset value, which does not reflect the sales charge, redemption fee or contingent deferred sales charge, if applicable. Total returns for periods of less than one year are not annualized. |

| 3 | Computed on an annualized basis. |

| 4 | This expense decrease is reflected in both the net expense and net investment income ratios shown above. |

| FEDERATED MUNICIPAL SECURITIES FUND, INC. - T CLASS | |||||

| ANNUAL EXPENSE RATIO: 0.96% | |||||

| MAXIMUM FRONT-END SALES CHARGE: 2.50% | |||||

| Year | Hypothetical Beginning Investment | Hypothetical Performance Earnings | Investment After Returns | Hypothetical Expenses | Hypothetical Ending Investment |

| 1 | $10,000.00 | $487.50 | $10,237.50 | $345.49 | $10,143.90 |

| 2 | $10,143.90 | $507.20 | $10,651.10 | $99.35 | $10,553.71 |

| 3 | $10,553.71 | $527.69 | $11,081.40 | $103.36 | $10,980.08 |

| 4 | $10,980.08 | $549.00 | $11,529.08 | $107.54 | $11,423.68 |

| 5 | $11,423.68 | $571.18 | $11,994.86 | $111.88 | $11,885.20 |

| 6 | $11,885.20 | $594.26 | $12,479.46 | $116.40 | $12,365.36 |

| 7 | $12,365.36 | $618.27 | $12,983.63 | $121.11 | $12,864.92 |

| 8 | $12,864.92 | $643.25 | $13,508.17 | $126.00 | $13,384.66 |

| 9 | $13,384.66 | $669.23 | $14,053.89 | $131.09 | $13,925.40 |

| 10 | $13,925.40 | $696.27 | $14,621.67 | $136.38 | $14,487.99 |

| Cumulative | $5,863.85 | $1,398.60 | |||

Federated Investors Funds

4000 Ericsson Drive

Warrendale, PA 15086-7561

or call 1-800-341-7400.

2017 ©Federated Investors, Inc.

| ■ | Buy call options on a Reference Instrument in anticipation of an increase in the value of the Reference Instrument; and |

| ■ | Write call options on a Reference Instrument to generate income from premiums, and in anticipation of a decrease or only limited increase in the value of the Reference Instrument. If the Fund writes a call option on a Reference Instrument that it owns and that call option is exercised, the Fund foregoes any possible profit from an increase in the market price of the Reference Instrument over the exercise price plus the premium received. |

| ■ | Buy put options on a Reference Instrument in anticipation of a decrease in the value of the Reference Instrument; and |

| ■ | Write put options on a Reference Instrument to generate income from premiums, and in anticipation of an increase or only limited decrease in the value of the Reference Instrument. In writing puts, there is a risk that the Fund may be required to take delivery of the Reference Instrument when its current market price is lower than the exercise price. |

| ■ | utility companies will be divided according to their services, for example, gas, gas transmissions, electric and telephone will each be considered a separate industry; |

| ■ | financial service companies will be classified according to the end users of their services, for example, automobile finance, bank finance and diversified finance will each be considered a separate industry; and |

| ■ | asset-backed securities will be classified according to the underlying assets securing such securities. |

| ■ | Equity securities listed on a U.S. securities exchange or traded through the U.S. national market system are valued at their last reported sale price or official closing price in their principal exchange or market. If a price is not readily available, such equity securities are valued based upon the mean of closing bid and asked quotations from one or more dealers. |

| ■ | Other equity securities traded primarily in the United States are valued based upon the mean of closing bid and asked quotations from one or more dealers. |

| ■ | Equity securities traded primarily through securities exchanges and regulated market systems outside the United States are valued at their last reported sale price or official closing price in their principal exchange or market. These prices may be adjusted for significant events occurring after the closing of such exchanges or market systems as described below. If a price is not readily available, such equity securities are valued based upon the mean of closing bid and asked quotations from one or more dealers. |

| ■ | Fixed-income securities are fair valued using price evaluations provided by a pricing service approved by the Board. The methods used by pricing services to determine such price evaluations are described below. If a price evaluation from a pricing service is not readily available, such fixed-income securities are fair valued based upon price evaluations from one or more dealers. |

| ■ | Futures contracts listed on exchanges are valued at their reported settlement price. Option contracts listed on exchanges are valued based upon the mean of closing bid and asked quotations reported by the exchange or from one or more futures commission merchants. |

| ■ | OTC derivative contracts are fair valued using price evaluations provided by a pricing service approved by the Board. The methods used by pricing services to determine such price evaluations are described below. If a price evaluation from a pricing service is not readily available, such derivative contracts are fair valued based upon price evaluations from one or more dealers or using a recognized pricing model for the contract. |

| ■ | Shares of other mutual funds or non-exchange-traded investment companies are valued based upon their reported NAVs. The prospectuses for these mutual funds explain the circumstances under which they will use fair value pricing and the effects of using fair value pricing. |

| ■ | With respect to securities traded principally in foreign markets, significant trends in U.S. equity markets or in the trading of foreign securities index futures contracts; |

| ■ | Political or other developments affecting the economy or markets in which an issuer conducts its operations or its securities are traded; and |

| ■ | Announcements concerning matters such as acquisitions, recapitalizations or litigation developments, or a natural disaster affecting the issuer's operations or regulatory changes or market developments affecting the issuer's industry. |

| 2016 | 2015 | 2014 | ||||

| Total Sales Charges | Amount Retained | Total Sales Charges | Amount Retained | Total Sales Charges | Amount Retained | |

| Class A Shares | $118,318 | $16,334 | $182,414 | $20,838 | $367,956 | $45,161 |