| FEDERATED MUNICIPAL SECURITIES FUND INC | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Fund Summary Information Federated Municipal Securities Fund, Inc. (the "Fund") |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

RISK/RETURN SUMMARY: INVESTMENT OBJECTIVE |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The Fund's investment objective is to provide for its shareholders a high level of current income which is exempt from federal regular income tax. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

RISK/RETURN SUMMARY: FEES AND EXPENSES |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

This table describes the fees and expenses that you may pay if you buy and hold Class A Shares (A), Class B Shares (B), Class C Shares (C) or Class F Shares (F) of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000, or $1,000,000, in certain classes (e.g. A and F classes, respectively) of Federated funds. More information about these and other discounts is available from your financial professional and in the "What Do Shares Cost?" section of the Prospectus on page 25. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Shareholder Fees (fees paid directly from your investment) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Example | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 for the time periods indicated and then redeem all of your Shares at the end of those periods. Expenses assuming no redemption are also shown. The Example also assumes that your investment has a 5% return each year and that the operating expenses are as shown in the table and remain the same. Although your actual costs and returns may be higher or lower, based on these assumptions your costs would be: |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Portfolio Turnover |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund Shares are held in a taxable account. These costs, which are not reflected in Annual Fund Operating Expenses or in the Example, affect the Fund's performance. During the most recent fiscal year, the Fund's portfolio turnover rate was 21% of the average value of its portfolio. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

RISK/RETURN SUMMARY: INVESTMENTS, RISKS and PERFORMANCE

What are the Fund's Main Investment Strategies? |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The Fund pursues its objective by investing its assets so that, normally (except as discussed herein), distributions of annual interest income are exempt from federal regular income tax. The Fund's investment adviser ("Adviser") also normally (except as discussed herein) will invest the Fund's assets entirely in securities whose interest is not subject to (or not a specific preference item for purposes of) the federal alternative minimum tax for individuals and corporations (AMT), such that, normally, distributions of annual interest income also are exempt from the AMT. However, in certain circumstances (such as, for example, when there is a lack of supply of non-AMT securities, when there are advantageous market conditions, or if there are changes in the tax laws relating to AMT), to pursue the Fund's investment objective, the Adviser may invest the Fund's assets in securities that may be subject to AMT. When there is a lack of supply of non-AMT securities and/or other circumstances that exist, such circumstances may result in the Fund acquiring AMT securities that are consistent with the Fund's investment objective. These acquisitions may occur in the ordinary course or in connection with fund reorganization transactions i.e., transactions in which the Fund acquires the portfolio securities of other mutual funds), an issuer bankruptcy or another event or circumstance. In such circumstances, interest from the Fund's investments may be subject to the AMT. The Fund does not limit itself to securities of a particular maturity range. Currently, the Fund invests at least a majority of its assets in long-term, tax-exempt securities (i.e., securities with stated maturities of 10 years or more). The Fund also will invest at least a majority of its assets in securities rated investment grade (or unrated securities of comparable quality), and may purchase securities rated below investment grade (or unrated securities of comparable quality), which are also known as junk bonds, up to 49% of its assets. Investment-grade securities are securities that receive investment-grade ratings (i.e., generally ratings in the first, second, third or fourth highest rating category) by a nationally recognized statistical rating organization (NRSRO) or unrated securities of comparable quality. For example, securities rated "AAA," "AA," "A" or "BBB" by Standard & Poor's, an NRSRO, would be rated in the first, second, third or fourth ratings category, respectively. Securities rated below investment grade (or noninvestment-grade securities) are securities that do not receive investment-grade ratings (i.e., generally ratings below one of the four highest rating categories) by an NRSRO or unrated securities of comparable quality. For example, securities rated "B" or "BB" by Standard & Poor's, an NRSRO, would be noninvestment-grade securities. The Fund does not have a specific minimum quality rating. The types of securities in which the Fund may principally invest include tax-exempt securities, such as the following types: general obligation bonds, special revenue bonds, private activity bonds, tax increment financing bonds, municipal leases, zero-coupon securities, inverse floaters, municipal mortgage-backed securities, planned amortization classes, variable rate demand instruments, municipal notes and municipal auction rate securities. Certain of the tax-exempt securities in which the Fund invests may be subject to credit enhancement. The Fund also may principally invest in derivative contracts (such as, for example, futures contracts, options contracts and swap contracts) and hybrid instruments to implement its investment strategies as more fully described in this Prospectus. The Fund also may invest in certain securities or other investments as described herein (such as market discount bonds, credit default swaps and other derivative transactions) that will likely cause the Fund to realize a limited amount of ordinary income or short-term capital gains (which are treated as ordinary income for federal income tax purposes). |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

What are the Main Risks of Investing in the Fund? |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

All mutual funds take investment risks. Therefore, it is possible to lose money by investing in the Fund. The primary factors that may reduce the Fund's returns include:

The Shares offered by this Prospectus are not deposits or obligations of any bank, are not endorsed or guaranteed by any bank and are not insured or guaranteed by the U.S. government, the Federal Deposit Insurance Corporation, the Federal Reserve Board or any other government agency. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

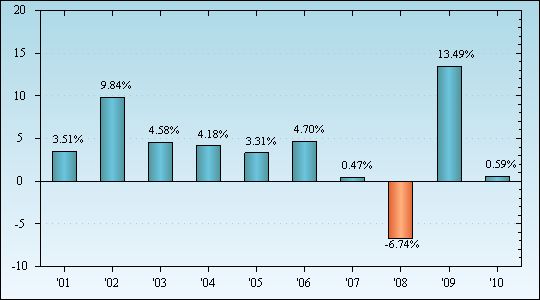

Performance: Bar Chart and TableRisk/Return Bar Chart |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The bar chart and performance table below reflect historical performance data for the Fund and are intended to help you analyze the Fund's investment risks in light of its historical returns. The bar chart shows the variability of the Fund's A class total returns on a calendar year-by-year basis. The Average Annual Total Return table shows returns averaged over the stated periods, and includes comparative performance information. The Fund's performance will fluctuate, and past performance (before and after taxes) is not necessarily an indication of future results. Updated performance information for the Fund is available under the "Products" section at FederatedInvestors.com or by calling 1-800-341-7400. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Federated Municipal Securities Fund, Inc. - Class A Shares |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The total returns shown in the bar chart do not reflect the payment of any sales charges or recurring shareholder account fees. If these charges or fees had been included, the returns shown would have been lower. The Fund's A class total return for the three-month period from January 1, 2011 to March 31, 2011, was 0.33%. Within the periods shown in the bar chart, the Fund's A class highest quarterly return was 7.91% (quarter ended September 30, 2009). Its lowest quarterly return was (5.51)% (quarter ended December 31, 2010). |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Average Annual Total Return Table |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

In addition to Return Before Taxes, Return After Taxes is shown for the Fund's A class to illustrate the effect of federal taxes on Fund returns. After-tax returns are shown only for the A class and after-tax returns for the B, C and F classes will differ from those shown below for the A class. Actual after-tax returns depend on each investor's personal tax situation, and are likely to differ from those shown. After-tax returns are calculated using a standard set of assumptions. The stated returns assume the highest historical federal income and capital gains tax rates. These after-tax returns do not reflect the effect of any applicable state and local taxes. After-tax returns are not relevant to investors holding Shares through tax-deferred programs, such as IRA or 401(k) plans. Historical returns do not include the effect of a 1.00% front-end sales charge on C class shares purchased prior to February 1, 2007. Effective February 1, 2007, this sales charge was eliminated. (For the Periods Ended December 31, 2010) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||