|

1933 Act File No.

|

2-57181

|

|

1940 Act File No.

|

811-2677

|

|

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

|

||||

|

Pre-Effective Amendment No.

|

||||

|

Post-Effective Amendment No.

|

70

|

|||

|

and/or

|

||||

|

REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940

|

||||

|

Amendment No.

|

54

|

|||

|

It is proposed that this filing will become effective (check appropriate box):

|

|||

|

immediately upon filing pursuant to paragraph (b)

|

|||

|

X

|

on

|

May 27, 2011

|

pursuant to paragraph (b)

|

|

60 days after filing pursuant to paragraph (a)(1)

|

|||

|

on

|

pursuant to paragraph (a)(1)

|

||

|

75 days after filing pursuant to paragraph (a)(2)

|

|||

|

on

|

pursuant to paragraph (a)(2) of Rule 485

|

||

|

If appropriate, check the following box:

|

|||

|

This post-effective amendment designates a new effective date for a previously filed post-effective amendment.

|

|||

Federated Municipal Securities Fund, Inc.

PROSPECTUS

May 31, 2011

The information contained herein relates to all classes of the Fund's Shares, as listed below, unless otherwise noted.

CLASS A SHARES (TICKER LMSFX)

CLASS B SHARES (TICKER LMSBX)

CLASS C SHARES (TICKER LMSCX)

CLASS F SHARES (TICKER LMFFX)

A mutual fund seeking to provide for its shareholders a high level of current income which is exempt from federal regular income tax by investing at least a majority of its assets in a portfolio of: (1) long-term, tax-exempt securities; and (2) investment-grade, tax-exempt securities.

As with all mutual funds, the Securities and Exchange Commission (SEC) has not approved or disapproved these securities or passed upon the adequacy of this Prospectus. Any representation to the contrary is a criminal offense.

| Contents |

Federated Municipal Securities Fund, Inc. (the “Fund”)

RISK/RETURN SUMMARY: INVESTMENT OBJECTIVE

The Fund's investment objective is to provide for its shareholders a high level of current income which is exempt from federal regular income tax.

RISK/RETURN SUMMARY: FEES AND EXPENSES

This table describes the fees and expenses that you may pay if you buy and hold Class A Shares (A), Class B Shares (B), Class C Shares (C) or Class F Shares (F) of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000, or $1,000,000, in certain classes (e.g. A and F classes, respectively) of Federated funds. More information about these and other discounts is available from your financial professional and in the “What Do Shares Cost?” section of the Prospectus on page 25.

|

Shareholder Fees (fees paid directly from your investment)

|

A | B | C | F |

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) | 4.50% | None | None | 1.00% |

| Maximum Deferred Sales Charge (Load) (as a percentage of original purchase price or redemption proceeds, as applicable) | 0.00% | 5.50% | 1.00% | 1.00% |

| Maximum Sales Charge (Load) Imposed on Reinvested Dividends (and other Distributions) (as a percentage of offering price) | None | None | None | None |

| Redemption Fee (as a percentage of amount redeemed, if applicable) | None | None | None | None |

| Exchange Fee | None | None | None | None |

|

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

|

||||

| Management Fee | 0.53% | 0.53% | 0.53% | 0.53% |

| Distribution (12b-1) Fee | None | 0.75% | 0.75% | None |

| Other Expenses | 0.45% | 0.45% | 0.45% | 0.45% |

| Total Annual Fund Operating Expenses | 0.98% | 1.73% | 1.73% | 0.98% |

| Fee Waivers and/or Expense Reimbursements 1 | 0.11% | 0.00% | 0.00% | 0.11% |

| Total Annual Fund Operating Expenses After Fee Waivers and/or Expense Reimbursements | 0.87% | 1.73% | 1.73% | 0.87% |

| 1 | The Adviser and its affiliates have voluntarily agreed to waive their fees and/or reimburse expenses so that the total annual fund operating expenses paid by the Fund's A, B, C and F classes (after the voluntary waivers and/or reimbursements) will not exceed 0.87%, 1.76%, 1.76% and 0.87% (the “Fee Limit”), respectively, up to but not including the later of (the “Termination Date”): (a) June 1, 2012; or (b) the date of the Fund's next effective Prospectus. While the Adviser and its affiliates currently do not anticipate terminating or increasing these arrangements prior to the Termination Date, these arrangements may only be terminated or the Fee Limit increased prior to the Termination Date with the agreement of the Fund's Board of Directors. |

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 for the time periods indicated and then redeem all of your Shares at the end of those periods. Expenses assuming no redemption are also shown. The Example also assumes that your investment has a 5% return each year and that the operating expenses are as shown in the table and remain the same. Although your actual costs and returns may be higher or lower, based on these assumptions your costs would be:

| Share Class | 1 Year | 3 Years | 5 Years | 10 Years |

| A: |

| Expenses assuming redemption | $545 | $748 | $967 | $1,597 |

| Expenses assuming no redemption | $545 | $748 | $967 | $1,597 |

| B: |

| Expenses assuming redemption | $726 | $945 | $1,139 | $1,842 |

| Expenses assuming no redemption | $176 | $545 | $939 | $1,842 |

| C: |

| Expenses assuming redemption | $276 | $545 | $939 | $2,041 |

| Expenses assuming no redemption | $176 | $545 | $939 | $2,041 |

| F: |

| Expenses assuming redemption | $299 | $509 | $636 | $1,289 |

| Expenses assuming no redemption | $199 | $409 | $636 | $1,289 |

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund Shares are held in a taxable account. These costs, which are not reflected in Annual Fund Operating Expenses or in the Example, affect the Fund's performance. During the most recent fiscal year, the Fund's portfolio turnover rate was 21% of the average value of its portfolio.

RISK/RETURN SUMMARY: INVESTMENTS, RISKS and PERFORMANCE

What are the Fund's Main Investment Strategies?

The Fund pursues its objective by investing its assets so that, normally (except as discussed herein), distributions of annual interest income are exempt from federal regular income tax. The Fund's investment adviser (“Adviser”) also normally (except as discussed herein) will invest the Fund's assets entirely in securities whose interest is not subject to (or not a specific preference item for purposes of) the federal alternative minimum tax for individuals and corporations (AMT), such that, normally, distributions of annual interest income also are exempt from the AMT. However, in certain circumstances (such as, for example, when there is a lack of supply of non-AMT securities, when there are advantageous market conditions, or if there are changes in the tax laws relating to AMT), to pursue the Fund's investment objective, the Adviser may invest the Fund's assets in securities that may be subject to AMT. When there is a lack of supply of non-AMT securities and/or other circumstances that exist, such

circumstances may result in the Fund acquiring AMT securities that are consistent with the Fund's investment objective. These acquisitions may occur in the ordinary course or in connection with fund reorganization transactions i.e., transactions in which the Fund acquires the portfolio securities of other mutual funds), an issuer bankruptcy or another event or circumstance. In such circumstances, interest from the Fund's investments may be subject to the AMT.The Fund does not limit itself to securities of a particular maturity range. Currently, the Fund invests at least a majority of its assets in long-term, tax-exempt securities (i.e., securities with stated maturities of 10 years or more).

The Fund also will invest at least a majority of its assets in securities rated investment grade (or unrated securities of comparable quality), and may purchase securities rated below investment grade (or unrated securities of comparable quality), which are also known as junk bonds, up to 49% of its assets. Investment-grade securities are securities that receive investment-grade ratings (i.e., generally ratings in the first, second, third or fourth highest rating category) by a nationally recognized statistical rating organization (NRSRO) or unrated securities of comparable quality. For example, securities rated “AAA,” “AA,” “A” or “BBB” by Standard & Poor's, an NRSRO, would be rated in the first, second, third or fourth ratings category, respectively. Securities rated below investment grade (or noninvestment-grade securities) are securities that do not receive investment-grade ratings (i.e., generally ratings below one of the four highest rating categories) by an NRSRO or unrated securities of comparable quality. For example, securities rated “B” or “BB” by Standard & Poor's, an NRSRO, would be noninvestment-grade securities. The Fund does not have a specific minimum quality rating.

The types of securities in which the Fund may principally invest include tax-exempt securities, such as the following types: general obligation bonds, special revenue bonds, private activity bonds, tax increment financing bonds, municipal leases, zero-coupon securities, inverse floaters, municipal mortgage-backed securities, planned amortization classes, variable rate demand instruments, municipal notes and municipal auction rate securities. Certain of the tax-exempt securities in which the Fund invests may be subject to credit enhancement. The Fund also may principally invest in derivative contracts (such as, for example, futures contracts, options contracts and swap contracts) and hybrid instruments to implement its investment strategies as more fully described in this Prospectus.

The Fund also may invest in certain securities or other investments as described herein (such as market discount bonds, credit default swaps and other derivative transactions) that will likely cause the Fund to realize a limited amount of ordinary income or short-term capital gains (which are treated as ordinary income for federal income tax purposes).

What are the Main Risks of Investing in the Fund?

All mutual funds take investment risks. Therefore, it is possible to lose money by investing in the Fund. The primary factors that may reduce the Fund's returns include:

- Interest Rate Risks. Prices of fixed-income securities (including tax-exempt securities) generally fall when interest rates rise. Interest rate changes have a greater effect on prices of fixed-income securities with longer durations.

- Issuer Credit Risk. There is a possibility that issuers of securities in which the Fund may invest may default on the payment of interest or principal on the securities when due, which would cause the Fund to lose money. Noninvestment-grade securities generally have a higher default risk than investment grade securities.

- Counterparty Credit Risk. A party to a transaction involving the Fund may fail to meet its obligations. This could cause the Fund to lose the benefit of the transaction or prevent the Fund from selling or buying other securities to implement its investment strategies.

- Liquidity Risks. Certain securities in which the Fund invests may be less readily marketable and may be subject to greater fluctuation in price than other securities. These features may make it more difficult to sell or buy a security at a favorable price or time. Noninvestment-grade securities generally have less liquidity than investment-grade securities. Liquidity risk also refers to the possibility that the Fund may not be able to close out a derivative contract when it wants to. Over-the-counter derivative contracts generally carry greater liquidity risk than exchange-traded contracts.

- Tax Risks. In order to pay interest exempt from federal income tax, tax-exempt securities must meet certain legal requirements. Failure to meet such requirements may cause the interest received and distributed by the Fund to shareholders to be taxable. The federal income tax treatment of payments in respect of certain derivative contracts is unclear. The Fund also may invest in market discount bonds, enter into credit default swap arrangements and other derivative transactions, and engage in other permissible activities that will likely cause the Fund to realize a limited amount of ordinary income or short-term capital gains (which are treated as ordinary income for federal income tax purposes). Consequently, for each of these reasons, the Fund may receive payments, and make distributions, that are treated as ordinary income for federal income tax purposes.

- Leverage Risks. Leverage risk is created when an investment, which includes, for example, an investment in a derivative contract, exposes the Fund to a level of risk that exceeds the amount invested. Changes in the value of such an investment magnify the Fund's risk of loss and potential for gain. Investments can have these same results if their returns are based on a multiple of a specified index, security or other benchmark.

- Call Risks. The Fund's performance may be adversely affected by the possibility that an issuer of a security held by the Fund may redeem the security prior to maturity at a price below or above its current market value.

- Sector Risks. A substantial part of the Fund's portfolio may be comprised of securities issued or credit enhanced by companies in similar businesses, or with other similar characteristics. As a result, the Fund will be more susceptible to any economic, business, political or other developments which generally affect these entities.

- Prepayment Risks. When homeowners prepay their mortgages in response to lower interest rates, the Fund will be required to reinvest the proceeds at the lower interest rates available. Also, when interest rates fall, the price of municipal mortgage-backed securities may not rise to as great an extent as that of other fixed-income securities.

- Credit Enhancement Risk. The securities in which the Fund invests may be subject to credit enhancement (for example, guarantees, letters of credit or bond insurance). If the credit quality of the credit enhancement provider (for example, a bank or bond insurer) is downgraded, the rating on a security credit enhanced by such credit enhancement provider also may be downgraded. Having multiple securities credit enhanced by the same enhancement provider will increase the adverse effects on the Fund that are likely to result from a downgrading of, or a default by, such an enhancement provider. Adverse developments in the banking or bond insurance industries also may negatively affect the Fund.

- Risks Associated with Noninvestment-Grade Securities. The Fund may invest a portion of its assets in securities rated below investment grade (which are also known as junk bonds), which may be subject to greater economic, credit and liquidity risks than investment-grade securities.

- Risks Related to the Economy. Lower-grade bond returns are sensitive to changes in the economy. The value of the Fund's portfolio may decline in tandem with a drop in the overall value of the stock market based on negative developments in the U.S. and global economies.

- Risks of Investing in Derivative Contracts and Hybrid Instruments. Derivative contracts and hybrid instruments involve risks different from, or possibly greater than, risks associated with investing directly in securities and other traditional investments. Specific risk issues related to the use of such contracts and instruments include valuation and tax issues, increased potential for losses and/or costs to the Fund, and a potential reduction in gains to the Fund. Each of these issues is described in greater detail in this Prospectus. Derivative contracts and hybrid instruments may also involve other risks described in this Prospectus or the Fund's Statement of Additional Information (SAI), such as interest rate, credit, liquidity and leverage risks.

The Shares offered by this Prospectus are not deposits or obligations of any bank, are not endorsed or guaranteed by any bank and are not insured or guaranteed by the U.S. government, the Federal Deposit Insurance Corporation, the Federal Reserve Board or any other government agency.

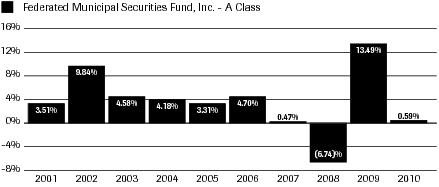

Performance: Bar Chart and Table

The bar chart and performance table below reflect historical performance data for the Fund and are intended to help you analyze the Fund's investment risks in light of its historical returns. The bar chart shows the variability of the Fund's A class total returns on a calendar year-by-year basis. The Average Annual Total Return table shows returns averaged over the stated periods, and includes comparative performance information. The Fund's performance will fluctuate, and past performance (before and after taxes) is not necessarily an indication of future results. Updated performance information for the Fund is available under the “Products” section at FederatedInvestors.com or by calling 1-800-341-7400.

The total returns shown in the bar chart do not reflect the payment of any sales charges or recurring shareholder account fees. If these charges or fees had been included, the returns shown would have been lower.

The Fund's A class total return for the three-month period from January 1, 2011 to March 31, 2011, was 0.33%.

Within the periods shown in the bar chart, the Fund's A class highest quarterly return was 7.91% (quarter ended September 30, 2009). Its lowest quarterly return was (5.51)% (quarter ended December 31, 2010).

Average Annual Total Return Table

In addition to Return Before Taxes, Return After Taxes is shown for the Fund's A class to illustrate the effect of federal taxes on Fund returns. After-tax returns are shown only for the A class and after-tax returns for the B, C and F classes will differ from those shown below for the A class. Actual after-tax returns depend on each investor's personal tax situation, and are likely to differ from those shown. After-tax returns are calculated using a standard set of assumptions. The stated returns assume the highest historical federal income and capital gains tax rates. These after-tax returns do not reflect the effect of any applicable state and local taxes. After-tax returns are not relevant to investors holding Shares through tax-deferred programs, such as IRA or 401(k) plans. Historical returns do not include the effect of a 1.00% front-end sales charge on C class shares purchased prior to February 1, 2007. Effective February 1, 2007, this sales charge was eliminated.

(For the Periods Ended December 31, 2010)

| Share Class | 1 Year | 5 Years | 10 Years |

Start of Performance |

| A: |

| Return Before Taxes | (3.94)% | 1.36% | 3.18% |

| Return After Taxes on Distributions | (3.94)% | 1.36% | 3.18% |

| Return After Taxes on Distributions and Sale of Fund Shares | (1.13)% | 1.78% | 3.35% |

| B: |

| Return Before Taxes | (5.61)% | 1.04% | 2.92% |

| C: |

| Return Before Taxes | (1.27)% | 1.39% | 2.75% |

| F: (start of performance 5/31/2007): |

| Return Before Taxes | (1.37)% | 1.20% |

|

S&P/Investortools Municipal Bond Investment Grade Index

1

(reflects no deduction for fees, expenses or taxes) |

2.26% | 3.93% | 4.82% |

|

Barclays Capital Municipal Bond Index

1

(reflects no deduction for fees, expenses or taxes) |

2.38% | 4.09% | 4.83% |

|

S&P/Investortools Municipal Bond Investment Grade, 3-year plus, Non-AMT

2

(reflects no deduction for fees, expenses or taxes) |

2.31% | 4.04% | 5.06% |

| Morningstar Municipal National Long Funds Category Average 3 | 1.65% | 2.78% | 3.79% |

| 1 | The Fund's investment adviser has elected to change the Fund's broad-based securities market index to the S&P/Investortools Municipal Bond Investment Grade Index (SPIMBIG) from the Barclays Capital Municipal Bond Index. The SPIMBIG is more representative of the securities in which the Fund invests. The SPIMBIG is the investment-grade component of the S&P/Investortools Municipal Bond Index (Main Index). The Main Index is a broad, comprehensive, market value-weighted index composed of approximately 55,000 bond issues that are exempt from U.S. federal income taxes or subject to the alternative minimum tax (AMT). Eligibility for inclusion in the Main Index include, but are not limited to: the bond issuer must be a state (including the Commonwealth of Puerto Rico and U.S. territories)or a local government or a state or local government entity where interest on the bond is exempt from U.S. federal income taxes or subject to the AMT; the bond must be held by a mutual fund for which Standard & Poor's Securities Evaluations, Inc. provides prices; it must be denominated in U.S. dollars and have a minimum par amount of $2 million; and the bond must have a minimum term maturity and/or call date greater than or equal to one calendar month. The Main Index is rebalanced monthly. The Barclays Capital Municipal Bond Index is a broad market performance benchmark for the tax exempt bond market. To be included in the Barclays Municipal Bond Index, bonds must have a minimum credit rating of at least Baa3/BBB-, an outstanding par value of at least $7 million and be issued as part of a transaction of at least $75 million. The bonds must be fixed rate, have an issue date after December 31, 1990 and must be at least one year from their maturity date. Remarketed issues, taxable municipal bonds, bonds with floating rates and derivatives are excluded from the index. |

| 2 | The S&P/Investortools Investment Grade, 3- year plus, Non-AMT represents the portion of the SPIMBIG composed solely of bonds with remaining maturities of 3 years or more that are subject to AMT. |

| 3 | Morningstar figures represent the average of the total returns reported by all of the mutual funds designated by Morningstar as falling into the respective categories indicated. |

The Fund's Investment Adviser (“Adviser”) is Federated Investment Management Company.

J. Scott Albrecht, Senior Portfolio Manager, has been the Fund's portfolio manager since May 1996.

purchase and sale of fund shares

You may purchase, redeem or exchange Shares of the Fund on any day the New York Stock Exchange (NYSE) is open. Shares may be purchased through a financial intermediary or directly from the Fund, by wire or by check. Please note that certain purchase restrictions may apply. Redeem or exchange Shares through a financial intermediary or directly from the Fund by telephone at 1-800-341-7400 or by mail.

The minimum investment amount for the Fund's A class, B class, C class and F class is generally $1,500 for initial investments and $100 for subsequent investments. The minimum investment for Systematic Investment Programs is $50.

It is anticipated that Fund distributions will be primarily dividends that are exempt from federal regular income tax, although a portion of the Fund's dividends may not be tax-exempt. Dividends may be subject to state and local taxes. Although the Fund does not seek to realize capital gains, the Fund may realize and distribute capital gains from time to time as a result of the Fund's normal investment activities. Any Fund distributions of capital gains are taxable at applicable capital gains rates. The Fund is generally not a suitable investment for retirement accounts.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and/or its related companies may pay the intermediary for the sale of Fund Shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary's website for more information.

What are the Fund's Investment Strategies?

While there is no assurance that the Fund will achieve its investment objective, it endeavors to do so by following the strategies and policies described in this Prospectus. The Fund pursues its objective by investing its assets so that, normally (except as discussed herein), distributions of annual interest income are exempt from federal regular income tax. The Fund's investment adviser (“Adviser”) also normally (except as discussed herein) will invest the Fund's assets entirely in securities whose interest is not subject to (or not a specific preference item for purposes of) the federal alternative minimum tax for individuals and corporations (AMT), such that, normally, distributions of annual interest income also are exempt from the AMT. However, in certain

circumstances (such as, for example, when there is a lack of supply of non-AMT securities, when there are advantageous market conditions, or if there are changes in the tax laws relating to AMT), to pursue the Fund's investment objective, the Adviser may invest the Fund's assets in securities that may be subject to AMT. When there is a lack of supply of non-AMT securities and/or other circumstances that exist, such circumstances may result in the Fund acquiring AMT securities that are consistent with the Fund's investment objective. These acquisitions may occur in the ordinary course or in connection with fund reorganization transactions i.e., transactions in which the Fund acquires the portfolio securities of other mutual funds), an issuer bankruptcy or another event or circumstance. In such circumstances, interest from the Fund's investments may be subject to the AMT.The Fund does not limit itself to securities of a particular maturity range. Currently, the Fund invests at least a majority of its assets in long-term, tax-exempt securities (i.e., securities with stated maturities of 10 years or more).

The Fund also will invest at least a majority of its assets in securities rated investment grade (or unrated securities of comparable quality) without regard to the maturity of the securities, and may purchase securities rated below investment grade (or unrated securities of comparable quality), which are also known as junk bonds, up to 49% of its assets.

The amount of the Fund's assets invested in long-term or investment-grade, tax-exempt securities will be determined at the time when tax-exempt securities are purchased. For example, a later increase or decrease in percentage resulting from any change in value or net assets, or from a downgrade in a security's rating/quality, will not require the Fund to sell any tax-exempt security held in the Fund's portfolio.

Investment-grade securities are securities that receive investment-grade ratings (i.e., generally ratings in the first, second, third or fourth highest rating category) by a nationally recognized statistical rating organization (NRSRO) or unrated securities of comparable quality. For example, securities rated “AAA,” “AA,” “A” or “BBB” by Standard & Poor's, an NRSRO, would be rated in the first, second, third or fourth ratings category, respectively. Securities rated below investment grade (or noninvestment-grade securities) are securities that do not receive investment-grade ratings (i.e., generally ratings below one of the four highest rating categories) by an NRSRO or unrated securities of comparable quality. For example, securities rated “B” or “BB” by Standard & Poor's, an NRSRO, would be noninvestment-grade securities.

The investment-grade, tax-exempt securities in which the Fund invests generally are subject to interest rate, issuer credit, counterparty credit, liquidity, tax, leverage, call, sector, prepayment, credit enhancement and economic risks, and the derivatives contracts and hybrid instruments in which the Fund invests are subject to these risks, as well as the risks of investment in derivatives contracts

and hybrid instruments, all as described in this Prospectus. The noninvestment-grade securities in which the Fund invests also are subject to interest rate, issuer credit, counterparty credit, liquidity, tax, leverage, call, sector, prepayment, credit enhancement and economic risks, as well as the risks of investing in noninvestment-grade securities as described in this Prospectus.The Adviser of the Fund actively manages the Fund's portfolio, seeking to manage the interest rate risk and credit risk assumed by the Fund and provide enhanced levels of after-tax total return.

The Adviser manages the Fund's interest rate risk by adjusting the duration of its portfolio. “Duration” measures the sensitivity of a security's price to changes in interest rates. The greater a portfolio's duration, the greater the potential change in the portfolio's value in response to a change in market interest rates. The Adviser will increase or reduce the Fund's portfolio duration based on its interest rate outlook. When the Adviser expects interest rates to fall, it will maintain a longer portfolio duration. When the Adviser expects interest rates to increase, it will shorten the portfolio duration. The Adviser uses hedging transactions for purposes of duration management. The Adviser considers a variety of factors in formulating its interest rate outlook, including (among others) the following:

- current and expected U.S. economic growth;

- current and expected interest rates and inflation;

- the Federal Reserve's monetary policy; and

- supply and demand factors related to the municipal market and the effect they may have on the returns offered for various bond maturities.

The Adviser manages credit risk by performing a fundamental credit analysis on tax-exempt securities before the Fund purchases such securities. The Adviser considers various factors, including (among others) the following:

- the economic feasibility of revenue bond financings and general purpose financings;

- the financial condition of the issuer or guarantor; and

- political developments that may affect credit quality.

The Adviser monitors the credit risks of all securities on an ongoing basis by reviewing, as the Adviser considers necessary or appropriate in accordance with its procedures, periodic financial data and ratings of NRSROs. The Fund's investments in noninvestment-grade securities will be more dependent on the Adviser's credit analysis than would be investment-grade securities, because noninvestment-grade securities, while generally offering higher yields, also involve greater risks. Consequently, in addition to the review process described above, the Adviser may, for example and when appropriate, visit the site that the issuer is developing with the proceeds of the offering and generally will engage in detailed discussions with the issuer regarding the offering.

The Adviser attempts to provide enhanced levels of after-tax total return. Total return consists of two components: (1) income received from the Fund's portfolio securities; and (2) changes in the market value of the Fund's portfolio securities and attendant increase or decrease in the net asset value (NAV) of Fund

Shares. The Adviser seeks total return on an after-tax basis, so that it will try to maximize tax-exempt income distributions; make limited ordinary income distributions; and minimize or eliminate capital gains distributions. In seeking to increase incremental after-tax total returns, the Fund may invest in tax-exempt securities that are trading at a price less than the original issue price (or market discount bonds), enter in credit default swap arrangements and other derivative transactions, and engage in other permissible activities that will likely cause the Fund to realize a limited amount of ordinary income or short-term capital gains (which are treated as ordinary income for federal income tax purposes) and, as a result, may result in taxable distributions to shareholders. The ordinary income derived from these investment strategies generally will be limited to approximately 5% or less of the Fund's annual distributions.The Adviser's ability to formulate an accurate interest rate outlook, coupled with effective management of the Fund's duration as described above, is critical to the Adviser's achievement of this component of its strategy. The Adviser will seek to further enhance after-tax total return by engaging in a relative value analysis; that is, the Adviser will assess the cost of a tax-exempt security compared with other tax-exempt securities and taxable securities such as U.S. Treasury obligations. The Adviser may also allocate investments in sectors of the tax-exempt market that offer the highest return.

The Fund may use derivative contracts and/or hybrid instruments to implement elements of its investment strategy. For example, the Fund may use derivative contracts or hybrid instruments to increase or decrease the portfolio's exposure to the investment(s) underlying the derivative or hybrid instrument in an attempt to benefit from changes in the value of the underlying investment(s) or to gain exposure to the municipal bond sector. Additionally, by way of example, the Fund may use derivative contracts in an attempt to:

- increase or decrease the effective duration of the Fund portfolio;

- obtain premiums from the sale of derivative contracts;

- realize gains from trading a derivative contract; or

- hedge against potential losses.

There can be no assurance that the Fund's use of derivative contracts or hybrid instruments will work as intended.

Because the Fund refers to municipal investments in its name, it has an investment policy that it will normally invest its assets so that at least 80% of the income that it distributes will be exempt from federal regular income tax. This policy may not be changed without shareholder approval.

The Fund may temporarily depart from its principal investment strategies by investing its assets in taxable securities or holding cash. It may do this in response to unusual circumstances, such as: adverse market, economic or other conditions (for example, to help avoid potential losses, or during periods when there is a shortage of appropriate tax-exempt securities); to maintain liquidity to meet

shareholder redemptions; or to accommodate cash inflows. It is possible that such temporary investments could affect the Fund's investment returns. If the Fund invests in taxable securities, it may receive and distribute taxable income to investors and to that extent fail to meet its investment objectives.What are the Fund's Principal Investments?

The following provides general information on the Fund's principal investments. The Fund's Statement of Additional Information (SAI) provides information about the Fund's non-principal investments and may provide additional information about the Fund's principal investments.

Tax-exempt securities are fixed-income securities that, in the opinion of bond counsel to the issuer or on the basis of another authority believed by the Adviser to be reliable, pay interest that is not subject to federal regular income taxes. Fixed-income securities pay interest, dividends or distributions at a specified rate. The rate may be a fixed percentage of the principal or adjusted periodically. In addition, the issuer of a fixed-income security must repay the principal amount of the security, normally within a specified time.

Typically, states, counties, cities and other political subdivisions and authorities issue tax-exempt securities. The market categorizes tax-exempt securities by their source of repayment. Certain of these tax-exempt securities may be subject to credit enhancement.

The following describes the principal types of tax-exempt securities in which the Fund may invest:

General Obligation Bonds (A Type of Tax-Exempt Security)

General obligation bonds are supported by the issuer's power to exact property or other taxes. The issuer must impose and collect taxes sufficient to pay principal and interest on the bonds. However, the issuer's authority to impose additional taxes may be limited by its charter or state law.

Special Revenue Bonds (A Type of Tax-Exempt Security)

Special revenue bonds are payable solely from specific revenues received by the issuer such as specific taxes, assessments, tolls or fees. Bondholders may not collect from the municipality's general taxes or revenues. For example, a municipality may issue bonds to build a toll road and pledge the tolls to repay the bonds. Therefore, a shortfall in the tolls normally would result in a default on the bonds, or in certain cases, may result in a reduction in payments received in respect of the bonds.

Private Activity Bonds (A Type of Special Revenue Bond)

Private activity bonds are special revenue bonds used to finance private projects. A certain percentage of the proceeds from a private activity bond is used for a private business use or a certain percentage of the debt service regarding a private activity bond is paid directly or indirectly from a private business use. A private business use is a trade or business carried on by any person or entity

other than a governmental unit. Private activity bonds are secured primarily by revenues derived from loan repayments or lease payments due from the private entity, which may or may not be guaranteed by a parent company or otherwise secured. Private activity bonds generally are not secured by a pledge of the taxing power of the issuer of such bonds. For example, a municipality may issue bonds to finance a new factory to improve its local economy. The municipality would lend the proceeds from its bonds to the company using the factory, and the company would agree to make loan payments sufficient to cover interest and principal payments on the bonds. The bonds would be payable from the company's loan payments, and generally not from any other revenues of the municipality. Therefore, any default of the loan normally would result in a default on the bonds.Types of private activity bonds include, for example: bonds issued to obtain funds to provide water, sewage and solid waste facilities, qualified residential rental projects, certain local electric, gas and other heating and cooling facilities, qualified hazardous waste facilities, high speed intercity rail facilities, certain airports, docks, wharves and mass transportation facilities and qualified mortgages; qualified student loan bonds; qualified redevelopment bonds; and bonds used for certain organizations exempt from federal income taxation (qualified 501(c)(3) bonds).

The interest on many types of private activity bonds is subject to AMT. However, issues are available in the marketplace that are not subject to AMT due to qualifying tax rules.

Tax Increment Financing Bonds (A Type of Tax-Exempt Security)

Tax increment financing (TIF) bonds are payable from increases in taxes or other revenues attributable to projects within the TIF district. For example, a municipality may issue TIF bonds to redevelop a commercial area. The TIF bonds would be payable solely from any increase in sales taxes collected from the merchants in the area. The bonds could fail to pay principal or interest if merchants' sales, and related tax collections, failed to increase as anticipated.

Municipal Leases (A Type of Tax-Exempt Security)

Municipalities may enter into leases for equipment or facilities. In order to comply with state public financing laws, these leases are typically subject to annual appropriation. In other words, a municipality may end a lease, without penalty, by not providing for the lease payments in its annual budget. After the lease ends, the lessor can resell the equipment or facility but may lose money on the sale.

The Fund may invest in securities supported by pools of municipal leases. The most common type of lease-backed securities is certificates of participation (COPs). However, the Fund may also invest directly in individual leases.

Zero-Coupon Securities (A Type of Fixed-Income, Tax-Exempt Security)

Zero-coupon securities do not pay interest or principal until final maturity unlike debt securities that provide periodic payments of interest (referred to as a coupon payment). Investors buy zero-coupon securities at a price below the amount payable at maturity. The difference between the purchase price and the amount paid at maturity represents interest on the zero-coupon security. Investors must wait until maturity to receive interest and principal, which increases the interest rate and credit risks of a zero-coupon security. A zero-coupon, step-up security converts to a coupon security before final maturity.

There are many forms of zero-coupon securities. Some are issued at a discount and are referred to as zero-coupon or capital appreciation bonds. In addition, some securities give the issuer the option to deliver additional securities in place of cash interest payments, thereby increasing the amount payable at maturity. These are referred to as pay-in-kind or PIK securities.

Inverse Floaters (A Type of Fixed-Income, Tax-Exempt Security)

An inverse floater has a floating or variable interest rate that moves in the opposite direction of market interest rates. Inverse floaters are used to enhance the income from a bond investment by employing leverage. When short-term market interest rates go up, the interest rate paid on the inverse floater goes down; when short-term market interest rates go down, the interest rate paid on the inverse floater goes up. Inverse floaters generally respond more rapidly to market interest rate changes than fixed-rate, tax-exempt securities. Inverse floaters are subject to interest rate risks and leverage risks.

Municipal Mortgage-Backed Securities (A Type of Fixed-Income, Tax-Exempt Security)

Municipal mortgage-backed securities are special revenue bonds, the proceeds of which may be used to provide mortgage loans for single family homes or to finance multifamily housing. Municipal mortgage-backed securities represent interests in pools of mortgages. The mortgages that comprise a pool normally have similar interest rates, maturities and other terms. Mortgages may have fixed or adjustable rates. Municipal mortgage-backed securities generally have fixed interest rates.

Municipal mortgage-backed securities come in a variety of forms. The simplest forms of municipal mortgage-backed securities are unstructured bonds backed by the net interest and principal payments and prepayments from the underlying mortgages. As a result, the holders assume all interest rate and prepayment risks of the underlying mortgages. Other municipal mortgage-backed securities may have more complicated financial structures.

PACs (A Type of Municipal Mortgage-Backed Security)

PACs (planned amortization classes) are a sophisticated form of municipal mortgage-backed security issued with a companion class(es). PACs receive principal payments and prepayments at a specified rate. The companion classes receive principal payments and prepayments in excess of the specified rate. In addition, PACs will receive the companion classes' share of principal payments, if necessary, to cover a shortfall in the prepayment rate. This helps PACs to control prepayment risks by increasing the risks to their companion classes.

Variable Rate Demand Instruments (A Type of Tax-Exempt Security)

Variable rate demand instruments are tax-exempt securities that require the issuer or a third party, such as a dealer or bank (the “Demand Provider”), to repurchase the security for its face value upon demand. The securities also pay interest at a variable rate intended to cause the securities to trade at their face value. Some variable rate demand instruments are “conditional,” so that the occurrence of certain conditions discharges the Demand Provider's obligation to repurchase the security. Other variable rate demand instruments are “unconditional,” so that there are no conditions under which the Demand Provider's obligation to repurchase the security can terminate. The Fund treats variable rate demand instruments as short-term securities even though their maturity may extend beyond 397 days because, within 397 days, their variable interest rate adjusts in response to changes in market rates and the repayment of their principal amount can be demanded. Certain variable rate demand instruments that may be invested in by the Fund, referred to as “synthetic” variable rate demand instruments, have certain features, such as call features, that make it possible that the Fund will realize capital gains.

Municipal Notes (A Type of Tax-Exempt Security)

Municipal notes are short-term, tax-exempt securities. Many municipalities issue such notes to fund their current operations before collecting taxes or other municipal revenues. Municipalities may also issue notes to fund capital projects prior to issuing long-term bonds. The issuers typically repay the notes at the end of their fiscal year, either with taxes, other revenues or proceeds from newly issued notes or bonds.

Municipal Auction Rate Securities (A Type of Tax-Exempt Security)

Municipal auction rate securities are tax-exempt securities that are issued (without a demand feature) generally for a specified term, during which the interest rate may be reset at specified intervals (such as, for example, every 7, 28, 35 or 49 days) by means of a “Dutch Auction” or similar competitive process. These securities may be referred to as “municipal auction rate notes.” In the auction, holders of such securities, and investors who seek to acquire such securities, indicate their interest in continuing to hold, or to purchase, the securities at rates that they specify to broker-dealers that serve as auction agents for the auction. If the auction is successful, a holder of such securities will be able to sell them at par value through the auction process. A “failed auction” occurs when, for example, the auction agent does not receive enough bids to cover the

aggregate amount of securities that have been put up for sale at the auction, or the lowest interest rate at which all of the securities that have been put up for sale at the auction would be above the “maximum interest rate” set forth in the documentation for the securities, or some other reason. When a failed auction occurs, a holder of the securities may not be able to sell all or a portion of the securities it desired to sell at the auction, in which case the affected securities would pay the maximum interest rate set forth in their documentation until the next successful auction. The maximum interest rate may be a multiple of a specified index or a fixed rate and may be dependent on other factors, such as the credit rating of the securities at the time of auction. Municipal auction rate securities may be subject to interest rate, credit, credit enhancement, prepayment, liquidity and economic risks.Derivative contracts are financial instruments that require payments based upon changes in the values of designated securities, commodities, indices or other assets or instruments including other derivative contracts (each a “Reference Instrument” and collectively, “Reference Instruments”). Each party to a derivative contract is referred to as a counterparty. Some derivative contracts require payments relating to an actual, future trade involving the Reference Instrument. These types of derivatives are frequently referred to as “physically settled” derivatives. Other derivative contracts require payments relating to the income or returns from, or changes in the market value of, a Reference Instrument. These types of derivatives are known as “cash settled” derivatives, since they require cash payments in lieu of delivery of the Reference Instrument.

Many derivative contracts are traded on securities or commodities exchanges. In this case, the exchange sets all the terms of the contract except for the price. Investors make payments due under their contracts through the exchange. Most exchanges require investors to maintain margin accounts through their brokers to cover their potential obligations to the exchange. Parties to the contract make (or collect) daily payments to the margin accounts to reflect losses (or gains) in the value of their contracts. This protects investors against potential defaults by the counterparty. Trading contracts on an exchange also allows investors to close out their contracts by entering into offsetting contracts.

The Fund may also trade derivative contracts over-the-counter (OTC) in transactions negotiated directly between the Fund and the counterparty. OTC contracts do not necessarily have standard terms, so they may be less liquid and more difficult to close out than exchange-traded contracts. In addition, OTC contracts with more specialized terms may be more difficult to value than exchange-traded contracts, especially in times of financial stress.

Depending on how the Fund uses derivative contracts and the relationships between the market value of a derivative contract and the Reference Instrument, derivative contracts may increase or decrease the Fund's exposure to the risks of the Reference Instrument, and may also expose the Fund to liquidity and leverage risks. OTC contracts also expose the Fund to credit risks in the event that a counterparty defaults on the contract.

Payment obligations arising in connection with derivative contracts are frequently required to be secured with collateral (in the case of OTC contracts) or margin (in the case of exchange-traded contracts, as previously noted). To the extent necessary to meet such requirements, the Fund may purchase U.S. Treasury and/or government agency securities.

The Fund may invest in a derivative contract if it is permitted to own, invest in or otherwise have economic exposure to the Reference Instrument. The Fund is not required to own a Reference Instrument in order to buy or sell a derivative contract relating to that Reference Instrument. The Fund may trade in the following specific types and/or combinations of derivative contracts:

Futures Contracts (A Type of Derivative)

Futures contracts provide for the future sale by one party and purchase by another party of a specified amount of a Reference Instrument at a specified price, date and time. Entering into a contract to buy a Reference Instrument is commonly referred to as buying a contract or holding a long position in the asset. Entering into a contract to sell a Reference Instrument is commonly referred to as selling a contract or holding a short position in the Reference Instrument. Futures contracts are considered to be commodity contracts. The Fund has claimed an exclusion from the definition of the term “commodity pool operator” under the Commodity Exchange Act and, therefore, is not subject to registration or regulation as a commodity pool operator under that Act. Futures contracts traded OTC are frequently referred to as forward contracts. The Fund can buy or sell financial futures (such as interest rate futures, index futures and security futures).

Option Contracts (A Type of Derivative)

Option contracts (also called “options”) are rights to buy or sell a Reference Instrument for a specified price (the “exercise price”) during, or at the end of, a specified period. The seller (or writer) of the option receives a payment, or premium, from the buyer, which the writer keeps regardless of whether the buyer uses (or exercises) the option. A call option gives the holder (buyer) the right to buy the Reference Instrument from the seller (writer) of the option. A put option gives the holder the right to sell the Reference Instrument to the writer of the option. Options can trade on exchanges or in the OTC market and may be bought or sold on a wide variety of Reference Instruments. Options that are written on futures contracts will be subject to margin requirements similar to those applied to futures contracts.

Swap Contracts (A Type of Derivative)

A swap contract (also known as a “swap”) is a type of derivative contract in which two parties agree to pay each other (swap) the returns derived from Reference Instruments. Swaps do not always involve the delivery of the Reference Instruments by either party, and the parties might not own the Reference Instruments underlying the swap. The payments are usually made on a net basis so that, on any given day, the Fund would receive (or pay) only the amount by which its payment under the contract is less than (or exceeds) the

amount of the other party's payment. Swap agreements are sophisticated instruments that can take many different forms and are known by a variety of names. Common types of swaps in which the Fund may invest include interest rate swaps, total return swaps, credit default swaps and caps and floors.OTHER INVESTMENTS, TRANSACTIONS, TECHNIQUES

The Fund may invest in securities that have credit enhancement. Credit enhancement consists of an arrangement in which a company agrees to pay amounts due on a fixed-income security (including a tax-exempt security) if the issuer defaults. In some cases the company providing credit enhancement makes all payments directly to the security holders and receives reimbursement from the issuer. Normally, the credit enhancer may have greater financial resources and liquidity than the issuer. For this reason, the Adviser may evaluate the credit risk of a fixed-income security based solely upon its credit enhancement.

Common types of credit enhancement include guarantees, letters of credit, bond insurance and surety bonds. Credit enhancement also includes arrangements where securities or other liquid assets secure payment of a fixed-income security. If a default occurs, these assets may be sold and the proceeds paid to the security's holders. Either form of credit enhancement reduces credit risks by providing another source of payment for a fixed-income security.

Hybrid instruments combine elements of two different kinds of securities or financial instruments (such as a derivative contract). Frequently, the value of a hybrid instrument is determined by reference to changes in the value of a Reference Instrument (that is a designated security, commodity, index or other asset or instrument including a derivative contract). The Fund may use hybrid instruments only in connection with permissible investment activities. Hybrid instruments can take on many forms including, but not limited to, the following forms. First, a common form of a hybrid instrument combines elements of a derivative contract with those of another security (typically a fixed-income security). In this case all or a portion of the interest or principal payable on a hybrid security is determined by reference to changes in the price of a Reference Instrument. Second, hybrid instruments may include convertible securities with conversion terms related to a Reference Instrument.

Depending on the type and terms of the hybrid instrument, its risks may reflect a combination of the risks of investing in the Reference Instrument with the risks of investing in other securities and derivative contracts. Thus, an investment in a hybrid instrument may entail significant risks in addition to those associated with traditional investments or the Reference Instrument. Hybrid instruments are also potentially more volatile than traditional securities or the Reference Instrument. Moreover, depending on the structure of the particular hybrid, it may expose the Fund to leverage risks or carry liquidity risks.

Delayed Delivery Transactions

Delayed delivery transactions, including when-issued transactions, are arrangements in which the Fund buys securities for a set price, with payment and delivery of the securities scheduled for a future time. During the period between purchase and settlement, no payment is made by the Fund to the issuer and no interest accrues to the Fund. The Fund records the transaction when it agrees to buy the securities and reflects their value in determining the price of its Shares. Settlement dates may be a month or more after entering into these transactions so that the market values of the securities bought may vary from the purchase prices. Therefore, delayed delivery transactions create interest rate risks for the Fund. Delayed delivery transactions also involve credit risks in the event of a counterparty default. These transactions create leverage risks.

In order to secure its obligations in connection with derivative contracts or special transactions, the Fund will either own the underlying assets, enter into offsetting transactions or set aside cash or readily marketable securities. This requirement may cause the Fund to miss favorable trading opportunities, due to a lack of sufficient cash or readily marketable securities. This requirement may also cause the Fund to realize losses on offsetting or terminated derivative contracts or special transactions.

Investment Ratings for Investment-Grade Securities

The Adviser will determine whether a security is investment-grade based upon the credit ratings given by one or more NRSROs. For example, Standard & Poor's, an NRSRO, assigns ratings to investment-grade securities (“AAA,” “AA,” “A” and “BBB”) based on their assessment of the likelihood of the issuer's inability to pay interest or principal (default) when due on each security. Lower credit ratings correspond to higher credit risk. If a security has not received a rating, the Fund must rely entirely upon the Adviser's credit assessment that the security is comparable to investment grade.

As disclosed in this Prospectus, the Fund may invest up to 49% of its assets in securities rated below investment grade (or unrated securities of comparable quality). The Fund does not have a specific minimum quality rating requirement.

If a security is downgraded below any minimum quality grade discussed above, the Adviser will reevaluate the security, but will not be required to sell it.

What are the Specific Risks of Investing in the Fund?

The following provides general information on the risks associated with the Fund's principal investments. Any additional risks associated with the Fund's non-principal investments are described in the Fund's SAI. The Fund's SAI also may provide additional information about the risks associated with the Fund's principal investments.

INTEREST RATE RISKS

Prices of fixed-income securities (including tax-exempt securities) rise and fall in response to changes in the interest rate paid by similar securities. Generally, when interest rates rise, prices of fixed-income securities fall. However, market factors, such as the demand for particular fixed-income securities, may cause the price of certain fixed-income securities to fall while the prices of other securities rise or remain unchanged.

Interest rate changes have a greater effect on the price of fixed-income securities with longer durations. Duration measures the price sensitivity of a fixed-income security to changes in interest rates. Certain factors, such as the presence of call features, may cause a particular fixed-income security, or the Fund as a whole, to exhibit less sensitivity to changes in interest rates.

Certain of the Fund's investments may also be valued, in part, by reference to the relative relationship between interest rates on tax-exempt securities and taxable securities, respectively. When the market for tax-exempt securities underperforms (or outperforms) the market for taxable securities, the value of these investments may be negatively affected (or positively affected).

Issuer credit risk is the possibility that an issuer will default on a security by failing to pay interest or principal when due. Noninvestment-grade securities generally have a higher default risk than investment grade securities. If an issuer defaults, the Fund will lose money.

Many fixed-income securities (including tax-exempt securities) receive credit ratings from NRSROs such as Standard & Poor's and Moody's Investors Service, Inc. These NRSROs assign ratings to securities by assessing the likelihood of issuer default. Lower credit ratings correspond to higher perceived credit risk and higher credit ratings correspond to lower perceived credit risk. Credit ratings do not provide assurance against default or other loss of money. If a security has not received a rating, the Fund must rely entirely upon the Adviser's credit assessment.

Fixed-income securities generally compensate for greater credit risk by paying interest at a higher rate. The difference between the yield of a security and the yield of a U.S. Treasury security or other appropriate benchmark with a comparable maturity (the “spread”) measures the additional interest paid for risk. Spreads may increase generally in response to adverse economic or market conditions. A security's spread may also increase if the security's rating is lowered, or the security is perceived to have an increased credit risk. An increase in the spread will cause the price of the security to decline.

Finally, the securities in which the Fund invests may include those issued by a state or local government, or other political subdivisions or authorities, or directly or indirectly supported by taxes, assessments, tolls, fees or other revenue collected by or otherwise derived by or through such issuers. Such securities, like other securities that may be invested by the Fund, have credit risk. Like other issuers, there is no guarantee that the issuers of such securities will have sufficient

revenues to satisfy their obligations (such as, for example, the payment of interest or principal when due) with respect to such securities invested in by the Fund. For example, in the case of certain of these issuers, legal, economic, political or other developments may raise impairments (such as, for example, limitations under state law on the issuer's authority to raise taxes, prolonged budgetary processes, declining real estate values and declining tax revenues) to such an issuer's budgetary flexibility and liquidity and its ability to satisfy its obligations with respect to such securities invested in by the Fund. Such impairments may cause a downgrade in the credit ratings of such an issuer, or the securities issued or supported by it, and may cause such an issuer to defer payment of certain obligations, reduce or eliminate appropriations, and/or default on its obligations. In such situations, the credit risk of such securities invested in by Fund will increase. Like other issuers and securities, the likelihood that the credit risk associated with such issuers and such securities will increase is greater during times of economic stress and financial instability. As a result, in such situations, there would be heightened risk that there could be an interruption in payments to bondholders in some cases. There also could be a reduction in the market value of the bonds held by the Fund, which could adversely affect the Fund's net asset value or the distributions paid by the Fund.Counterparty credit risk includes the possibility that a party to a transaction involving the Fund will fail to meet its obligations. This could cause the Fund to lose the benefit of the transaction or prevent the Fund from selling or buying other securities to implement its investment strategy.

Trading opportunities are more limited for fixed-income securities (including tax-exempt securities) that have not received any credit ratings, have received any credit ratings below investment grade or are not widely held. Trading opportunities also are more limited for inverse floaters that have complex terms or that are not widely held. These features may make it more difficult to sell or buy a security at a favorable price or time. Consequently, the Fund may have to accept a lower price to sell a security, sell other securities to raise cash or give up an investment opportunity, any of which could have a negative effect on the Fund's performance. Infrequent trading of securities may also lead to an increase in their price volatility. Noninvestment-grade securities generally have less liquidity than investment-grade securities.

Liquidity risk also refers to the possibility that the Fund may not be able to sell a security or close out a derivative contract when it wants to. If this happens, the Fund will be required to continue to hold the security or keep the position open, and the Fund could incur losses.

OTC derivative contracts generally carry greater liquidity risk than exchange- traded contracts. This risk may be increased in times of financial stress, if the trading market for OTC derivative contracts becomes restricted.

Tax Risks

In order to pay interest that is exempt from federal regular income tax, tax-exempt securities must meet certain legal requirements. Failure to meet such requirements may cause the interest received and distributed by the Fund to shareholders to be taxable.

Changes or proposed changes in federal or state tax laws may cause the prices of tax-exempt securities to fall and/or may affect the tax-exempt status of the securities in which the Fund invests.

The federal income tax treatment of payments in respect of certain derivative contracts is unclear. Additionally, the Fund may not be able to close out certain derivative contracts when it wants to. The Fund also may invest in market discount bonds, enter into credit default swap arrangements and other derivative transactions, and engage in other permissible activities that will likely cause the Fund to realize a limited amount of ordinary income or short-term capital gains (which are treated as ordinary income for federal income tax purposes). Consequently, for each of these reasons, the Fund may receive payments, and make distributions, that are treated as ordinary income for federal income tax purposes.

Leverage risk is created when an investment, which includes, for example, an investment in a derivative contract, exposes the Fund to a level of risk that exceeds the amount invested. Changes in the value of such an investment magnify the Fund's risk of loss and potential for gain. Investments can have these same results if their returns are based on a multiple of a specified index, security or other benchmark.

Call risk is the possibility that an issuer may redeem a fixed-income security (including a tax-exempt security) before maturity (a “call”) at a price below or above its current market price. An increase in the likelihood of a call may reduce the security's price. If a fixed-income security is called, the Fund may have to reinvest the proceeds in other fixed-income securities with lower interest rates, higher credit risks or other less favorable characteristics.

A substantial part of the Fund's portfolio may be comprised of securities issued or credit-enhanced by companies in similar businesses or with other similar characteristics. As a result, the Fund will be more susceptible to any economic, business, political or other developments which generally affect these issuers or entities. Developments affecting companies with similar characteristics might include changes in interest rates, changes in economic cycle affecting credit losses and regulatory changes.

PREPAYMENT RISKS

Unlike traditional fixed-income securities (including tax-exempt securities), which pay a fixed rate of interest until maturity (when the entire principal amount is due) payments on municipal mortgage-backed securities include both interest and a partial payment of principal. Partial payment of principal may be comprised of scheduled principal payments as well as unscheduled payments from the voluntary prepayment, refinancing or foreclosure of the underlying loans. These unscheduled prepayments of principal create risks that can adversely affect a fund holding municipal mortgage-backed securities.

For example, when interest rates decline, the values of municipal mortgage-backed securities generally rise. However, when interest rates decline, unscheduled prepayments can be expected to accelerate, and the Fund would be required to reinvest the proceeds of the prepayments at the lower interest rates then available. Unscheduled prepayments would also limit the potential for capital appreciation on municipal mortgage-backed securities.

Conversely, when interest rates rise, the values of municipal mortgage-backed securities generally fall. Since rising interest rates typically result in decreased prepayments, this could lengthen the average lives of municipal mortgage-backed securities, and cause their value to decline more than traditional fixed-income securities.

Generally, municipal mortgage-backed securities compensate for the increased risk associated with prepayments by paying a higher yield. The additional interest paid for risk is measured by the difference between the yield of a municipal mortgage-backed security and the yield of a U.S. Treasury security or other appropriate benchmark with a comparable maturity (the “spread”). An increase in the spread will cause the price of the municipal mortgage-backed security to decline. Spreads generally increase in response to adverse economic or market conditions. Spreads may also increase if the security is perceived to have an increased prepayment risk or is perceived to have less market demand.

The securities in which the Fund invests may be subject to credit enhancement (for example, guarantees, letters of credit or bond insurance). Credit enhancement is designed to help assure timely payment of the security; it does not protect the Fund against losses caused by declines in a security's value due to changes in market conditions. Securities subject to credit enhancement generally would be assigned a lower credit rating if the rating were based primarily on the credit quality of the issuer without regard to the credit enhancement. If the credit quality of the credit enhancement provider (for example, a bank or bond insurer) is downgraded, the rating on a security credit enhanced by such credit enhancement provider also may be downgraded.

A single enhancement provider may provide credit enhancement to more than one of the Fund's investments. Having multiple securities credit enhanced by the same enhancement provider will increase the adverse effects on the Fund that are likely to result from a downgrading of, or a default by, such an enhancement

provider. Adverse developments in the banking or bond insurance industries also may negatively affect the Fund, as the Fund may invest in securities credit enhanced by banks or by bond insurers without limit. Bond insurers that provide credit enhancement for large segments of the fixed-income markets, including the municipal bond market, may be more susceptible to being downgraded or defaulting during recessions or similar periods of economic stress.Risks Associated with Noninvestment-Grade Securities

Securities rated below investment grade (i.e., noninvestment-grade securities or unrated securities of comparable quality), also known as junk bonds, generally entail greater economic, credit and liquidity risks than investment-grade securities. For example, their prices are more volatile, economic downturns and financial setbacks may affect their prices more negatively, and their trading market may be more limited. The Fund will invest at least a majority of its assets in securities rated investment grade (or unrated securities of comparable quality), and may purchase securities rated below investment grade (or unrated securities of comparable quality) up to 49% of its assets.

Lower-grade bond returns are sensitive to changes in the economy. The value of the Fund's portfolio may decline in tandem with a drop in the overall value of the stock market based on negative developments in the U.S. and global economies.

Risks of Investing in Derivative Contracts and Hybrid Instruments

The Fund's exposure to derivative contracts and hybrid instruments (either directly or through its investment in another investment company) involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other traditional investments. First, changes in the value of the derivative contracts and hybrid instruments in which the Fund invests may not be correlated with changes in the value of the underlying Reference Instruments or, if they are correlated, may move in the opposite direction than originally anticipated. Second, while some strategies involving derivatives may reduce the risk of loss, they may also reduce potential gains or, in some cases, result in losses by offsetting favorable price movements in portfolio holdings. Third, there is a risk that derivative contracts and hybrid instruments may be erroneously priced or improperly valued and, as a result, the Fund may need to make increased cash payments to the counterparty. Fourth, exposure to derivative contracts and hybrid instruments may have tax consequences to the Fund and its shareholders. For example, derivative contracts and hybrid instruments may cause the Fund to realize increased ordinary income or short-term capital gains (which are treated as ordinary income for federal income tax purposes) and, as a result, may increase taxable distributions to shareholders. In addition, under certain circumstances certain derivative contracts and hybrid instruments may cause the Fund to: (a) incur an excise tax on a portion of the income related to those contracts

and instruments; and/or (b) reclassify, as a return of capital, some or all of the distributions previously made to shareholders during the fiscal year as dividend income. Fifth, a common provision in OTC derivative contracts permits the counterparty to terminate any such contract between it and the Fund, if the value of the Fund's total net assets declines below a specified level over a given time period. Factors that may contribute to such a decline (which usually must be substantial) include significant shareholder redemptions and/or a marked decrease in the market value of the Fund's investments. Any such termination of the Fund's OTC derivative contracts may adversely affect the Fund (for example, by increasing losses and/or costs, and/or preventing the Fund from fully implementing its investment strategies). Sixth, the Fund may use a derivative contract to benefit from a decline in the value of a Reference Instrument. If the value of the Reference Instrument declines during the term of the contract, the Fund makes a profit on the difference (less any payments the Fund is required to pay under the terms of the contract). Any such strategy involves risk. There is no assurance that the Reference Instrument will decline in value during the term of the contract and make a profit for the Fund. The Reference Instrument may instead appreciate in value creating a loss for the Fund. Finally, derivative contracts and hybrid instruments may also involve other risks described in this Prospectus or in the Fund's SAI, such as interest rate, credit, liquidity and leverage risks.CALCULATION OF NET ASSET VALUE

When the Fund receives your transaction request in proper form (as described in this Prospectus), it is processed at the next calculated net asset value of a Share (NAV) plus any applicable front-end sales charge (“public offering price”). A Share's NAV is determined as of the end of regular trading on the New York Stock Exchange (NYSE) (normally 4:00 p.m. Eastern time), each day the NYSE is open. The Fund calculates the NAV of each class by valuing the assets allocated to the Share's class, subtracting the liabilities allocated to the class and dividing the balance by the number of Shares of the class outstanding. The Fund's current NAV and/or public offering price may be found at FederatedInvestors.com, via online news sources and in certain newspapers.

You can purchase, redeem or exchange Shares any day the NYSE is open.

When the Fund holds fixed-income securities that trade on days the NYSE is closed, the value of the Fund's assets may change on days you cannot purchase or redeem Shares.

In calculating its NAV, the Fund generally values investments as follows:

- Fixed-income securities acquired with remaining maturities greater than 60 days are fair valued using price evaluations provided by a pricing service approved by the Board of Directors (“Board”).

- Fixed-income securities acquired with remaining maturities of 60 days or less are valued at their cost (adjusted for the accretion of any discount or amortization of any premium).

- Derivative contracts listed on exchanges are valued at their reported settlement or closing price, except that options are valued at the mean of closing bid and asked quotations.

- Over-the-counter (OTC) derivative contracts are fair valued using price evaluations provided by a pricing service approved by the Board.

If the Fund cannot obtain a price or price evaluation from a pricing service for an investment, the Fund may attempt to value the investment based upon the mean of bid and asked quotations, or fair value the investment based on price evaluations, from one or more dealers. If any price, quotation, price evaluation or other pricing source is not readily available when the NAV is calculated, the Fund uses the fair value of the investment determined in accordance with the procedures described below. There can be no assurance that the Fund could purchase or sell an investment at the price used to calculate the Fund's NAV.

Shares of other mutual funds are valued based upon their reported NAVs. The prospectuses for these mutual funds explain the circumstances under which they will use fair value pricing and the effects of using fair value pricing.

Fair Valuation and Significant Events Procedures