UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

For the quarterly period ended September 30, 2023

OR

For the transition period from _____to_____

| Commission File Number | Registrant; State of Incorporation; Address; and Telephone Number | IRS Employer Identification No. | ||||||

(A Michigan Corporation)

(517 ) 788‑0550

(A Michigan Corporation)

(517 ) 788‑0550

| Securities registered pursuant to Section 12(b) of the Act: | ||||||||||||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

| Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. | |||||||||||||||||||||||||||||||||||

| CMS Energy Corporation: | ☒ | No | ☐ | Consumers Energy Company: | ☒ | No | ☐ | ||||||||||||||||||||||||||||

| Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S‑T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). | |||||||||||||||||||||||||||||||||||

| CMS Energy Corporation: | ☒ | No | ☐ | Consumers Energy Company: | ☒ | No | ☐ | ||||||||||||||||||||||||||||

| Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non‑accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b‑2 of the Exchange Act. | |||||||||||||||||||||||||||||||||||

| CMS Energy Corporation: | Consumers Energy Company: | ||||||||||||||||||||||||||||||||||

| ☒ | Large accelerated filer | ☐ | |||||||||||||||||||||||||||||||||

| Non‑accelerated filer | ☐ | ☒ | |||||||||||||||||||||||||||||||||

| Accelerated filer | ☐ | Accelerated filer | ☐ | ||||||||||||||||||||||||||||||||

| Smaller reporting company | Smaller reporting company | ||||||||||||||||||||||||||||||||||

| Emerging growth company | Emerging growth company | ||||||||||||||||||||||||||||||||||

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | |||||||||||||||||||||||||||||||||||

| CMS Energy Corporation: | ☐ | Consumers Energy Company: | ☐ | ||||||||||||||||||||||||||||||||

| Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b‑2 of the Exchange Act). | |||||||||||||||||||||||||||||||||||

| CMS Energy Corporation: | Yes | No | ☒ | Consumers Energy Company: | Yes | No | ☒ | ||||||||||||||||||||||||||||

Indicate the number of shares outstanding of each of the issuer’s classes of common stock at October 9, 2023: | |||||||||||||||||||||||||||||||||||

| CMS Energy Corporation: | |||||||||||||||||||||||||||||||||||

| Consumers Energy Company: | |||||||||||||||||||||||||||||||||||

| Consumers Common Stock, $10 par value, privately held by CMS Energy Corporation | |||||||||||||||||||||||||||||||||||

CMS Energy Corporation

Consumers Energy Company

Quarterly Report on Form 10‑Q to the Securities and Exchange Commission for the Period Ended September 30, 2023

Table of Contents

1

Glossary

Certain terms used in the text and financial statements are defined below.

| 2016 Energy Law | ||

| Michigan’s Public Acts 341 and 342 of 2016 | ||

| 2022 Form 10‑K | ||

| Each of CMS Energy’s and Consumers’ Annual Report on Form 10‑K for the year ended December 31, 2022 | ||

| 3G | ||

| Third generation technology | ||

| 4G | ||

| Fourth generation technology | ||

| ABATE | ||

| Association of Businesses Advocating Tariff Equity | ||

| Aviator Wind | ||

| Aviator Wind Holdings, LLC, a VIE in which Aviator Wind Equity Holdings holds a Class B membership interest | ||

| Aviator Wind Equity Holdings | ||

| Aviator Wind Equity Holdings, LLC, a VIE in which Grand River Wind, LLC, a wholly owned subsidiary of NorthStar Clean Energy, has a 51‑percent interest | ||

| Bay Harbor | ||

| A residential/commercial real estate area located near Petoskey, Michigan, in which CMS Energy sold its interest in 2002 | ||

| bcf | ||

| Billion cubic feet | ||

| CCR | ||

| Coal combustion residual | ||

| CEO | ||

| Chief Executive Officer | ||

| CERCLA | ||

| Comprehensive Environmental Response, Compensation, and Liability Act of 1980, as amended | ||

2

| CFO | ||

| Chief Financial Officer | ||

| Clean Air Act | ||

| Federal Clean Air Act of 1963, as amended | ||

| Clean Energy Plan | ||

| Consumers’ long-term strategy for delivering clean, reliable, resilient, and affordable energy to its customers; this plan was originally outlined and approved in Consumers’ 2018 integrated resource plan and subsequently updated and approved through its 2021 integrated resource plan | ||

| Clean Water Act | ||

| Federal Water Pollution Control Act of 1972, as amended | ||

| CMS Energy | ||

| CMS Energy Corporation and its consolidated subsidiaries, unless otherwise noted; the parent of Consumers and NorthStar Clean Energy | ||

| CMS Land | ||

| CMS Land Company, a wholly owned subsidiary of CMS Capital, L.L.C., a wholly owned subsidiary of CMS Energy | ||

| Consumers | ||

| Consumers Energy Company and its consolidated subsidiaries, unless otherwise noted; a wholly owned subsidiary of CMS Energy | ||

| Covert Generating Facility | ||

A 1,200-MW natural gas-fueled generation facility that was acquired by Consumers in May 2023 from New Covert Generating Company, LLC, a non-affiliated company | ||

| Craven | ||

| Craven County Wood Energy Limited Partnership, a VIE in which HYDRA‑CO Enterprises, Inc., a wholly owned subsidiary of NorthStar Clean Energy, has a 50-percent interest | ||

| CSAPR | ||

| Cross-State Air Pollution Rule of 2011, as amended | ||

| DB Pension Plans | ||

| Defined benefit pension plans of CMS Energy and Consumers, including certain present and former affiliates and subsidiaries | ||

| DB SERP | ||

| Defined Benefit Supplemental Executive Retirement Plan | ||

3

| DIG | ||

| Dearborn Industrial Generation, L.L.C., a wholly owned subsidiary of Dearborn Industrial Energy, L.L.C., a wholly owned subsidiary of NorthStar Clean Energy | ||

| Dodd-Frank Act | ||

| Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 | ||

| DTE Electric | ||

| DTE Electric Company, a non‑affiliated company | ||

| EGLE | ||

| Michigan Department of Environment, Great Lakes, and Energy | ||

| Endangered Species Act | ||

| Endangered Species Act of 1973, as amended | ||

| energy waste reduction | ||

| The reduction of energy consumption through energy efficiency and demand-side energy conservation, as established under the 2016 Energy Law | ||

| EPA | ||

| U.S. Environmental Protection Agency | ||

| EPS | ||

| Earnings per share | ||

| Exchange Act | ||

| Securities Exchange Act of 1934 | ||

| Federal Power Act | ||

| Federal Power Act of 1920 | ||

| FERC | ||

| Federal Energy Regulatory Commission | ||

| FTR | ||

| Financial transmission right | ||

| GAAP | ||

| U.S. Generally Accepted Accounting Principles | ||

4

| Genesee | ||

| Genesee Power Station Limited Partnership, a VIE in which HYDRA‑CO Enterprises, Inc., a wholly owned subsidiary of NorthStar Clean Energy, has a 50-percent interest | ||

| Grayling | ||

| Grayling Generating Station Limited Partnership, a VIE in which HYDRA‑CO Enterprises, Inc., a wholly owned subsidiary of NorthStar Clean Energy, has a 50-percent interest | ||

| IRS | ||

| Internal Revenue Service | ||

| kWh | ||

| Kilowatt-hour, a unit of energy equal to one thousand watt-hours | ||

| Ludington | ||

| Ludington pumped-storage plant, jointly owned by Consumers and DTE Electric | ||

| MATS | ||

| Mercury and Air Toxics Standards, which limit mercury, acid gases, and other toxic pollution from coal‑fueled and oil‑fueled power plants | ||

| MD&A | ||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations | ||

| MGP | ||

| Manufactured gas plant | ||

| Migratory Bird Treaty Act | ||

| Migratory Bird Treaty Act of 1918, as amended | ||

| MISO | ||

| Midcontinent Independent System Operator, Inc. | ||

| mothball | ||

| To place a generating unit into a state of extended reserve shutdown in which the unit is inactive and unavailable for service for a specified period, during which the unit can be brought back into service after receiving appropriate notification and completing any necessary maintenance or other work; generation owners in MISO must request approval to mothball a unit, and MISO then evaluates the request for reliability impacts | ||

| MPSC | ||

| Michigan Public Service Commission | ||

5

| MW | ||

| Megawatt, a unit of power equal to one million watts | ||

| NAAQS | ||

| National Ambient Air Quality Standards | ||

| Natural Gas Act | ||

| Natural Gas Act of 1938 | ||

| Newport Solar Holdings | ||

| Newport Solar Holdings III, LLC, a wholly owned subsidiary of Grand River Solar, LLC, a wholly owned subsidiary of NorthStar Clean Energy | ||

| NorthStar Clean Energy | ||

| NorthStar Clean Energy Company, a wholly owned subsidiary of CMS Energy, formerly known as CMS Enterprises Company | ||

| NOx | ||

| Nitrogen oxides | ||

| NPDES | ||

| National Pollutant Discharge Elimination System, a permit system for regulating point sources of pollution under the Clean Water Act | ||

| NREPA | ||

| Part 201 of Michigan’s Natural Resources and Environmental Protection Act of 1994, as amended | ||

| NWO Holdco | ||

NWO Holdco, L.L.C., a VIE in which NWO Holdco I, LLC, a wholly owned subsidiary of Grand River Wind, LLC, a wholly owned subsidiary of NorthStar Clean Energy, holds a Class B membership interest | ||

| OPEB | ||

| Other post-employment benefits | ||

| OPEB Plan | ||

| Postretirement health care and life insurance plans of CMS Energy and Consumers, including certain present and former affiliates and subsidiaries | ||

| PCB | ||

| Polychlorinated biphenyl | ||

| PPA | ||

| Power purchase agreement | ||

6

| PSCR | ||

| Power supply cost recovery | ||

| RCRA | ||

| Federal Resource Conservation and Recovery Act of 1976 | ||

| REC | ||

| Renewable energy credit | ||

| ROA | ||

| Retail Open Access, which allows electric generation customers to choose alternative electric suppliers pursuant to Michigan’s Public Acts 141 and 142 of 2000, as amended | ||

| SEC | ||

| U.S. Securities and Exchange Commission | ||

| securitization | ||

| A financing method authorized by statute and approved by the MPSC which allows a utility to sell its right to receive a portion of the rate payments received from its customers for the repayment of securitization bonds issued by a special-purpose entity affiliated with such utility | ||

| SOFR | ||

Secured overnight financing rate calculated and published by the Federal Reserve Bank of New York and selected as the recommended alternative to replace the London Interbank Offered Rate for dollar-denominated financial contracts by the Alternative Reference Rates Committee | ||

| TAES | ||

| Toshiba America Energy Systems Corporation, a non-affiliated company | ||

| TCJA | ||

| Tax Cuts and Jobs Act of 2017 | ||

| Term SOFR | ||

| The rate per annum that is a forward-looking term rate based on SOFR | ||

| T.E.S. Filer City | ||

| T.E.S. Filer City Station Limited Partnership, a VIE in which HYDRA‑CO Enterprises, Inc., a wholly owned subsidiary of NorthStar Clean Energy, has a 50-percent interest | ||

| VIE | ||

| Variable interest entity | ||

7

Wolverine Power | ||

Wolverine Power Supply Cooperative, Inc., a non-affiliated company | ||

8

Filing Format

This combined Form 10‑Q is separately filed by CMS Energy and Consumers. Information in this combined Form 10‑Q relating to each individual registrant is filed by such registrant on its own behalf. Consumers makes no representation regarding information relating to any other companies affiliated with CMS Energy other than its own subsidiaries.

CMS Energy is the parent holding company of several subsidiaries, including Consumers and NorthStar Clean Energy. None of CMS Energy, NorthStar Clean Energy, nor any of CMS Energy’s other subsidiaries (other than Consumers) has any obligation in respect of Consumers’ debt securities or preferred stock and holders of such securities should not consider the financial resources or results of operations of CMS Energy, NorthStar Clean Energy, nor any of CMS Energy’s other subsidiaries (other than Consumers and its own subsidiaries (in relevant circumstances)) in making a decision with respect to Consumers’ debt securities or preferred stock. Similarly, neither Consumers nor any other subsidiary of CMS Energy has any obligation in respect of securities of CMS Energy.

This report should be read in its entirety. No one section of this report deals with all aspects of the subject matter of this report. This report should be read in conjunction with the consolidated financial statements and related notes and with MD&A included in the 2022 Form 10‑K.

Available Information

CMS Energy’s internet address is www.cmsenergy.com. CMS Energy routinely posts important information on its website and considers the Investor Relations section, www.cmsenergy.com/investor-relations, a channel of distribution for material information. Information contained on CMS Energy’s website is not incorporated herein.

Forward-looking Statements and Information

This Form 10‑Q and other CMS Energy and Consumers disclosures may contain forward-looking statements as defined by the Private Securities Litigation Reform Act of 1995. The use of “will,” “might,” “may,” “could,” “should,” “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “seeks,” “projects,” “forecasts,” “predicts,” “assumes,” “goals,” “targets,” “objectives,” “guidance,” “possible,” “potential,” and other similar words is intended to identify forward-looking statements that involve risk and uncertainty. This discussion of potential risks and uncertainties is designed to highlight important factors that may impact CMS Energy’s and Consumers’ businesses and financial outlook. CMS Energy and Consumers have no obligation to update or revise forward-looking statements regardless of whether new information, future events, or any other factors affect the information contained in the statements. These forward-looking statements are subject to various factors that could cause CMS Energy’s and Consumers’ actual results to differ materially from the results anticipated in these statements. These factors include, but are not limited to, the following, all of which are potentially significant:

•the impact and effect of recent events, such as worsening trade relations, geopolitical tensions, war, acts of terrorism, and the responses to these events, and related economic disruptions including, but not limited to, inflation, energy price volatility, and supply chain disruptions

•the impact of new regulation by the MPSC, FERC, and other applicable governmental proceedings and regulations, including any associated impact on electric or gas rates or rate structures

9

•potentially adverse regulatory treatment, effects of a failure to receive timely regulatory orders that are or could come before the MPSC, FERC, or other governmental authorities, or effects of a government shutdown

•changes in the performance of or regulations applicable to MISO, Michigan Electric Transmission Company, LLC (a non‑affiliated company), pipelines, railroads, vessels, or other service providers that CMS Energy, Consumers, or any of their affiliates rely on to serve their customers

•the adoption of or challenges to federal or state laws or regulations or changes in applicable laws, rules, regulations, principles, or practices, or in their interpretation, such as those related to energy policy, ROA, the Public Utility Regulatory Policies Act of 1978, infrastructure integrity or security, cybersecurity, gas pipeline safety, gas pipeline capacity, energy waste reduction, the environment, regulation or deregulation, reliability, health care reforms, taxes, accounting matters, climate change, air emissions, renewable energy, the Dodd-Frank Act, and other business issues that could have an impact on CMS Energy’s, Consumers’, or any of their affiliates’ businesses or financial results

•factors affecting, disrupting, interrupting, or otherwise impacting CMS Energy’s or Consumers’ facilities, utility infrastructure, operations, or backup systems, such as costs and availability of personnel, equipment, and materials; weather and climate, including catastrophic weather-related damage and extreme temperatures; natural disasters; fires; smoke; scheduled or unscheduled equipment outages; maintenance or repairs; contractor performance; environmental incidents; failures of equipment or materials; electric transmission and distribution or gas pipeline system constraints; interconnection requirements; political and social unrest; general strikes; the government and/or paramilitary response to political or social events; changes in trade policies or regulations; accidents; explosions; physical disasters; global pandemics; cyber incidents; vandalism; war or terrorism; and the ability to obtain or maintain insurance coverage for these events

•the ability of CMS Energy and Consumers to execute cost-reduction strategies

•potentially adverse regulatory or legal interpretations or decisions regarding environmental matters, or delayed regulatory treatment or permitting decisions that are or could come before agencies such as EGLE, the EPA, FERC, and/or the U.S. Army Corps of Engineers, and potential environmental remediation costs associated with these interpretations or decisions, including those that may affect Consumers’ coal ash management or routine maintenance, repair, and replacement classification under New Source Review, a construction-permitting program under the Clean Air Act

•changes in energy markets, including availability, price, and seasonality of electric capacity and the timing and extent of changes in commodity prices and availability and deliverability of coal, natural gas, natural gas liquids, electricity, oil, gasoline, diesel fuel, and certain related products

•the price of CMS Energy common stock, the credit ratings of CMS Energy and Consumers, capital and financial market conditions, and the effect of these market conditions on CMS Energy’s and Consumers’ interest costs and access to the capital markets, including availability of financing to CMS Energy, Consumers, or any of their affiliates

•the ability of CMS Energy and Consumers to execute their financing strategies

10

•the investment performance of the assets of CMS Energy’s and Consumers’ pension and benefit plans, the discount rates, mortality assumptions, and future medical costs used in calculating the plans’ obligations, and the resulting impact on future funding requirements

•the impact of the economy, particularly in Michigan, and potential future volatility in the financial and credit markets on CMS Energy’s, Consumers’, or any of their affiliates’ revenues, ability to collect accounts receivable from customers, or cost and availability of capital

•changes in the economic and financial viability of CMS Energy’s and Consumers’ suppliers, customers, and other counterparties and the continued ability of these third parties, including those in bankruptcy, to meet their obligations to CMS Energy and Consumers

•population changes in the geographic areas where CMS Energy and Consumers conduct business

•national, regional, and local economic, competitive, and regulatory policies, conditions, and developments

•loss of customer demand for electric generation supply to alternative electric suppliers, increased use of self-generation including distributed generation, energy waste reduction, or energy storage

•loss of customer demand for natural gas due to alternative technologies or fuels or electrification

•ability of Consumers to meet increased renewable energy demand due to customers seeking to meet their own sustainability goals in a timely and cost-efficient manner

•the reputational or other impact on CMS Energy and Consumers of the failure to achieve or make timely progress on their greenhouse gas reduction goals related to reducing their impact on climate change

•adverse consequences of employee, director, or third‑party fraud or non‑compliance with codes of conduct or with laws or regulations

•federal regulation of electric sales, including periodic re‑examination by federal regulators of CMS Energy’s and Consumers’ market-based sales authorizations

•any event, change, development, occurrence, or circumstance that could impact the implementation of the Clean Energy Plan, including any action by a regulatory authority or other third party to prohibit, delay, or impair the implementation of the Clean Energy Plan

•the availability, cost, coverage, and terms of insurance, the stability of insurance providers, and the ability of Consumers to recover the costs of any insurance from customers

•the effectiveness of CMS Energy’s and Consumers’ risk management policies, procedures, and strategies, including strategies to hedge risk related to interest rates and future prices of electricity, natural gas, and other energy-related commodities

•factors affecting development of electric generation projects, gas transmission, and gas and electric distribution infrastructure replacement, conversion, and expansion projects, including factors related to project site identification, construction material pricing, schedule delays, availability of qualified construction personnel, permitting, acquisition of property rights, community opposition, environmental regulations, and government actions

•changes or disruption in fuel supply, including but not limited to supplier bankruptcy and delivery disruptions

11

•potential costs, lost revenues, reputational harm, or other consequences resulting from misappropriation of assets or sensitive information, corruption of data, or operational disruption in connection with a cyberattack or other cyber incident

•potential disruption to, interruption or failure of, or other impacts on information technology backup or disaster recovery systems

•technological developments in energy production, storage, delivery, usage, and metering

•the ability to implement and integrate technology successfully, including artificial intelligence

•the impact of CMS Energy’s and Consumers’ integrated business software system and its effects on their operations, including utility customer billing and collections

•adverse consequences resulting from any past, present, or future assertion of indemnity or warranty claims associated with assets and businesses previously owned by CMS Energy or Consumers, including claims resulting from attempts by foreign or domestic governments to assess taxes on or to impose environmental liability associated with past operations or transactions

•the outcome, cost, and other effects of any legal or administrative claims, proceedings, investigations, or settlements

•the reputational impact on CMS Energy and Consumers of operational incidents, violations of corporate policies, regulatory violations, inappropriate use of social media, and other events

•restrictions imposed by various financing arrangements and regulatory requirements on the ability of Consumers and other subsidiaries of CMS Energy to transfer funds to CMS Energy in the form of cash dividends, loans, or advances

•earnings volatility resulting from the application of fair value accounting to certain energy commodity contracts or interest rate contracts

•changes in financial or regulatory accounting principles or policies (e.g., the adoption of the hypothetical liquidation at book value method of accounting for certain non‑regulated renewable energy projects)

•other matters that may be disclosed from time to time in CMS Energy’s and Consumers’ SEC filings, or in other public documents

All forward-looking statements should be considered in the context of the risk and other factors described above and as detailed from time to time in CMS Energy’s and Consumers’ SEC filings. For additional details regarding these and other uncertainties, see Part I—Item 1. Financial Statements—MD&A—Outlook and Notes to the Unaudited Consolidated Financial Statements—Note 1, Regulatory Matters and Note 2, Contingencies and Commitments; and Part I—Item 1A. Risk Factors in the 2022 Form 10‑K.

12

Part I—Financial Information

Item 1. Financial Statements

Index to Financial Statements

13

CMS Energy Corporation

Consumers Energy Company

Management’s Discussion and Analysis of Financial Condition and Results of Operations

This MD&A is a combined report of CMS Energy and Consumers.

Executive Overview

CMS Energy is an energy company operating primarily in Michigan. It is the parent holding company of several subsidiaries, including Consumers, an electric and gas utility, and NorthStar Clean Energy, primarily a domestic independent power producer and marketer. Consumers’ electric utility operations include the generation, purchase, distribution, and sale of electricity, and Consumers’ gas utility operations include the purchase, transmission, storage, distribution, and sale of natural gas. Consumers’ customer base consists of a mix of primarily residential, commercial, and diversified industrial customers. NorthStar Clean Energy, through its subsidiaries and equity investments, is engaged in domestic independent power production, including the development and operation of renewable generation, and the marketing of independent power production.

CMS Energy and Consumers manage their businesses by the nature of services each provides. CMS Energy operates principally in three business segments: electric utility; gas utility; and NorthStar Clean Energy, its non‑utility operations and investments. Consumers operates principally in two business segments: electric utility and gas utility. CMS Energy’s and Consumers’ businesses are affected primarily by:

•regulation and regulatory matters

•state and federal legislation

•economic conditions

•weather

•energy commodity prices

•interest rates

•their securities’ credit ratings

The Triple Bottom Line

CMS Energy’s and Consumers’ purpose is to achieve world class performance while delivering hometown service. In support of this purpose, CMS Energy and Consumers employ the “CE Way,” a lean operating model designed to improve safety, quality, cost, delivery, and employee morale.

CMS Energy and Consumers measure their progress toward the purpose by considering their impact on the “triple bottom line” of people, planet, and profit, which is underpinned by performance; this consideration takes into account not only the economic value that CMS Energy and Consumers create for customers and investors, but also their responsibility to social and environmental goals. The triple bottom line balances the interests of employees, customers, suppliers, regulators, creditors, Michigan’s residents,

14

the investment community, and other stakeholders, and it reflects the broader societal impacts of CMS Energy’s and Consumers’ activities.

CMS Energy’s Environmental, Social, Governance and Sustainability Report, which is available to the public, describes CMS Energy’s and Consumers’ progress toward world class performance measured in the areas of people, planet, and profit.

People: The people element of the triple bottom line represents CMS Energy’s and Consumers’ commitment to their employees, their customers, the residents of local communities in which they do business, and other stakeholders.

The safety of employees, customers, and the general public is a priority of CMS Energy and Consumers. Accordingly, CMS Energy and Consumers have worked to integrate a set of safety principles into their business operations and culture. These principles include complying with applicable safety, health, and security regulations and implementing programs and processes aimed at continually improving safety and security conditions. Over the last ten years, Consumers’ Occupational Safety and Health Administration recordable incident rate has decreased by 34 percent.

CMS Energy and Consumers also place a high priority on customer value and on providing a hometown customer experience. Consumers’ customer-driven investment program is aimed at improving safety and increasing electric and gas reliability.

In September 2023, Consumers filed its Reliability Roadmap, an update to its previous Electric Distribution Infrastructure Investment Plan filed in 2021, with the MPSC. The Reliability Roadmap outlines a five-year strategy to improve Consumers’ electric distribution system and the reliability of the grid. The plan proposes the following spending for projects designed to reduce the number and duration of power outages to customers through investment in infrastructure upgrades, forestry management, and grid modernization:

•capital expenditures of $7 billion over the next five years; this amount is $3 billion higher than proposed in the previous plan

•maintenance and operating spending of $1.7 billion over the next five years, reflecting an increase of $300 million over the previous plan

Consumers will request rate recovery of these proposed expenditures in future electric rate cases.

15

Central to Consumers’ commitment to its customers are the initiatives it has undertaken to keep electricity and natural gas affordable, including:

•replacement of coal-fueled generation and PPAs with a cost-efficient mix of renewable energy, less-costly dispatchable generation sources, and energy waste reduction and demand response programs

•targeted infrastructure investment to reduce maintenance costs and improve reliability and safety

•supply chain optimization

•economic development to increase sales and reduce overall rates

•information and control system efficiencies

•employee and retiree health care cost sharing

•tax planning

•cost-effective financing

•workforce productivity enhancements

While CMS Energy and Consumers have experienced some supply chain disruptions and inflationary pressures, they have taken steps to mitigate the impact on their ability to provide safe and reliable service to customers.

Planet: The planet element of the triple bottom line represents CMS Energy’s and Consumers’ commitment to protect the environment. This commitment extends beyond compliance with various state and federal environmental, health, and safety laws and regulations. Management considers climate change and other environmental risks in strategy development, business planning, and enterprise risk management processes.

CMS Energy and Consumers continue to focus on opportunities to protect the environment and to reduce their carbon footprint. As a result of actions already taken through 2022, CMS Energy and Consumers have:

•decreased their combined percentage of electric supply (self-generated and purchased) from coal by 17 percentage points since 2015

•reduced carbon dioxide emissions by over 30 percent since 2005

•reduced methane emissions by more than 20 percent since 2012

•reduced the amount of water used to generate electricity by over 35 percent since 2012

•reduced landfill waste disposal by over 1.7 million tons since 1992

•enhanced, restored, or protected over 6,500 acres of land since 2017

Since 2005, Consumers has reduced its sulfur dioxide and particulate matter emissions by over 90 percent and its NOx emissions by over 80 percent. Consumers began tracking mercury emissions in 2007; since that time, it has reduced such emissions by nearly 90 percent.

The 2016 Energy Law:

•raised the renewable portfolio standard to 15 percent in 2021; Consumers has met the 15‑percent requirement and expects to continue meeting the requirement going forward with a combination of newly generated RECs and previously generated RECs carried over from prior years

•established a goal of 35‑percent combined renewable energy and energy waste reduction by 2025; Consumers achieved 33‑percent combined renewable energy and energy waste reduction through 2022

•authorized incentives for demand response programs and energy efficiency programs, referring to the combined initiatives as energy waste reduction programs

•established an integrated planning process for new electric capacity and energy resources

16

Consumers’ Clean Energy Plan details its strategy to meet customers’ long-term energy needs. The Clean Energy Plan was most recently revised and approved by the MPSC in June 2022. Under its Clean Energy Plan, Consumers will meet the requirements of the 2016 Energy Law using its clean and lean strategy, which focuses on increasing the generation of renewable energy, helping customers use less energy, and offering demand response programs to reduce demand during critical peak times.

The Clean Energy Plan outlines Consumers’ long-term strategy for delivering clean, reliable, resilient, and affordable energy to its customers, including plans to:

•end the use of coal-fueled generation in 2025, 15 years sooner than initially planned

•purchase the Covert Generating Facility, a natural gas-fueled generation facility with 1,200 MW of nameplate capacity, allowing Consumers to continue to provide controllable sources of electricity to customers; this purchase was completed in May 2023

•solicit up to 700 MW of capacity through PPAs from sources able to deliver to Michigan’s Lower Peninsula beginning in 2025

•expand its investment in renewable energy, adding nearly 8,000 MW of solar generation by 2040

Under the Clean Energy Plan, Consumers earns a return equal to its weighted-average cost of capital on payments made under new competitively bid PPAs with non‑affiliated entities approved by the MPSC.

The Clean Energy Plan will allow Consumers to exceed its breakthrough goal of at least 50‑percent combined renewable energy and energy waste reduction by 2030.

Presented in the following illustration is Consumers’ 2021 capacity portfolio and its future capacity portfolio under its Clean Energy Plan. This illustration includes the effects of purchased capacity and energy waste reduction and uses the nameplate capacity for all energy sources:

1 Does not include RECs.

17

2 These amounts and fuel sources will vary and are dependent on a one‑time competitive solicitation to acquire up to 700 MW of capacity through PPAs from sources able to deliver to Michigan’s Lower Peninsula beginning in 2025.

In addition to Consumers’ plan to eliminate its use of coal-fueled generation in 2025, CMS Energy and Consumers have set the net‑zero emissions goals discussed below.

Net-zero methane emissions from natural gas delivery system by 2030: Under its Methane Reduction Plan, Consumers plans to reduce methane emissions from its system by about 80 percent, from 2012 baseline levels, by accelerating the replacement of aging pipe, rehabilitating or retiring outdated infrastructure, and adopting new technologies and practices. The remaining emissions will likely be offset by purchasing and/or producing renewable natural gas. To date, Consumers has reduced methane emissions by more than 20 percent.

Net-zero carbon emissions from electric business by 2040: This goal includes not only emissions from owned generation, but also emissions from the generation of power purchased through long-term PPAs and from the MISO energy market. Consumers expects to meet 90 percent of its customers’ needs with clean energy sources by 2040 through execution of its Clean Energy Plan. New technologies and carbon offset measures including, but not limited to, carbon sequestration, methane emission capture, forest preservation, and reforestation may be used to close the gap to achieving net-zero carbon emissions.

Net-zero greenhouse gas emissions target for the entire business by 2050: This goal, announced in March 2022, incorporates greenhouse gas emissions from Consumers’ natural gas delivery system, including suppliers and customers, and has an interim goal of reducing customer emissions by 20 percent by 2030. Consumers expects to meet this goal through carbon offset measures, renewable natural gas, energy efficiency and demand response programs, and the adoption of cost-effective emerging technologies once proven and commercially available.

Additionally, to advance its environmental stewardship in Michigan and to minimize the impact of future regulations, Consumers set the following targets in 2022:

•to enhance, restore, or protect 6,500 acres of land by 2026; in 2022, Consumers enhanced, restored, or protected over 700 acres of land

•to reduce water usage by 1.5 billion gallons by 2026; in 2022, Consumers reduced water usage by more than 750 million gallons

•to increase the rate of waste diverted from landfills (through waste reduction, recycling, and reuse) to 90 percent from a baseline of 88 percent through 2023; in 2022, Consumers’ rate of waste diverted from landfills was 92 percent

CMS Energy and Consumers are monitoring numerous legislative, policy, and regulatory initiatives, including those to regulate and report greenhouse gases, and related litigation. While CMS Energy and Consumers cannot predict the outcome of these matters, which could affect them materially, they intend to continue to move forward with their clean and lean strategy.

Profit: The profit element of the triple bottom line represents CMS Energy’s and Consumers’ commitment to meeting their financial objectives and providing economic development opportunities and benefits in the communities in which they do business. CMS Energy’s and Consumers’ financial strength allows them to maintain solid investment-grade credit ratings and thereby reduce funding costs for the benefit of customers and investors, to attract and retain talent, and to reinvest in the communities they serve.

For the nine months ended September 30, 2023, CMS Energy’s net income available to common stockholders was $571 million, and diluted EPS were $1.96. This compares with net income available to

18

common stockholders of $659 million and diluted EPS of $2.27 for the nine months ended September 30, 2022. In 2023, lower gas and electric sales, due primarily to unfavorable weather, and higher service restoration costs attributable to storms were partially offset by gas and electric rate increases and gains on the extinguishment of debt. A more detailed discussion of the factors affecting CMS Energy’s and Consumers’ performance can be found in the Results of Operations section that follows this Executive Overview.

Over the next five years, Consumers expects weather-normalized electric and gas deliveries to remain relatively stable compared to 2022. This outlook reflects the effects of energy waste reduction programs offset largely by modest growth in electric and gas demand.

Performance: Impacting the Triple Bottom Line

CMS Energy and Consumers remain committed to achieving world class performance while delivering hometown service and positively impacting the triple bottom line of people, planet, and profit. During 2023, CMS Energy and Consumers:

•were selected to receive a $100 million grant from the U.S. Department of Energy to fund investments in its electric distribution system, improving the reliability of Michigan’s electric grid

•participated in the state’s economic development efforts that have resulted in commitments by large third-party manufacturers to construct facilities for electric vehicle batteries and battery components in Michigan

•met all requirements for inclusion in the MSCI ESG Leaders Indexes; these indexes are designed to represent the performance of companies that have high Environmental, Social, and Governance ratings relative to their sector peers

•announced plans for an 85-MW solar array to be constructed at the former D.E. Karn coal-generating facilities, which were retired earlier in 2023

•opened a state-of-the-art natural gas training facility in Flint, Michigan that will facilitate employee training that is critical to keeping workers, customers, and the public safe

•announced plans to install more than 120 automatic transfer reclosers to improve electric reliability and help prevent power outages

•completed the first phase of its Mid-Michigan Pipeline Project, part of Consumers’ commitment to providing safe, reliable, and affordable natural gas to Michigan homes and businesses

•announced new efforts to install electric vehicle chargers at apartment buildings, condominiums, and overnight community locations across the state of Michigan

CMS Energy and Consumers will continue to utilize the CE Way to enable them to achieve world class performance and positively impact the triple bottom line. Consumers’ investment plan and the regulatory environment in which it operates also drive its ability to impact the triple bottom line.

Investment Plan: Over the next five years, Consumers expects to make significant expenditures on infrastructure upgrades, replacements, and clean generation. While it has a large number of potential investment opportunities that would add customer value, Consumers has prioritized its spending based on the criteria of enhancing public safety, increasing reliability, maintaining affordability for its customers, and advancing its environmental stewardship. Consumers’ investment program is expected to result in annual rate-base growth of over seven percent. This rate-base growth, together with cost-control measures, should allow Consumers to maintain affordable customer prices.

19

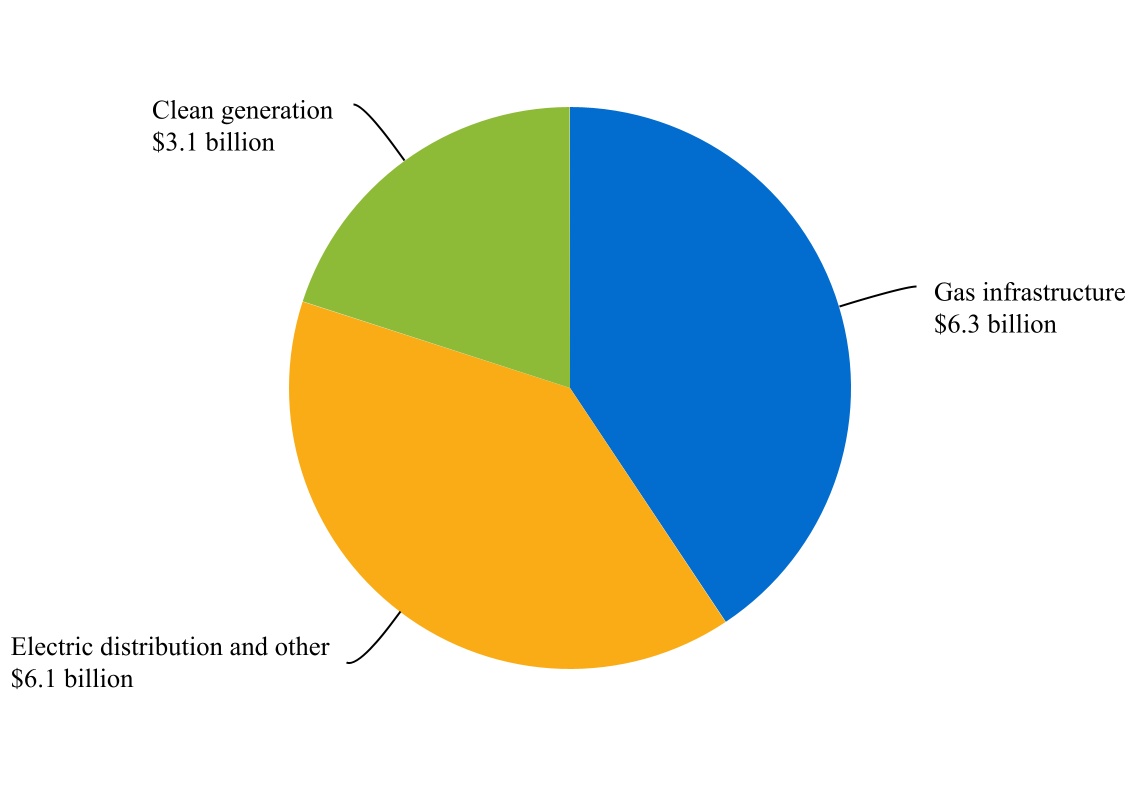

Presented in the following illustration are Consumers’ planned capital expenditures through 2027 of $15.5 billion, which does not yet incorporate incremental capital spending proposed in our updated Reliability Roadmap:

Of this amount, Consumers plans to spend $12.4 billion over the next five years to primarily maintain and upgrade its gas infrastructure and electric distribution systems in order to enhance safety and reliability, improve customer satisfaction, reduce energy waste on those systems, and facilitate its clean energy transformation. The gas infrastructure projects comprise $6.3 billion to sustain deliverability, enhance pipeline integrity and safety, and reduce methane emissions. Electric distribution and other projects comprise $6.1 billion primarily to strengthen circuits and substations, replace poles, and interconnect clean energy resources. Consumers also expects to spend $3.1 billion on clean generation, which includes investments in wind, solar, and hydroelectric generation resources.

Regulation: Regulatory matters are a key aspect of Consumers’ business, particularly rate cases and regulatory proceedings before the MPSC, which permit recovery of new investments while helping to ensure that customer rates are fair and affordable. Important regulatory events and developments not already discussed are summarized below.

2022 Gas Rate Case: In December 2022, Consumers filed an application with the MPSC seeking an annual rate increase of $212 million, based on a 10.25‑percent authorized return on equity for the projected 12‑month period ending September 30, 2024. In June 2023, Consumers reduced its requested annual rate increase to $175 million, based on a 10.25‑percent authorized return on equity. In August 2023, the MPSC approved a settlement agreement authorizing an annual rate increase of $95 million, based on a 9.9‑percent authorized return on equity, effective October 1, 2023.

2023 Electric Rate Case: In May 2023, Consumers filed an application with the MPSC seeking a rate increase of $216 million, made up of two components. First, Consumers requested a $207 million annual rate increase, based on an authorized return on equity of 10.25 percent for the projected 12‑month period ending February 28, 2025. The filing requested authority to recover costs related to new infrastructure investment primarily in distribution system reliability and cleaner energy resources. Second, Consumers

20

requested approval of a surcharge for the recovery of $9 million of distribution investments made in 2022 that exceeded the rates authorized in accordance with the December 2021 electric rate order. In September 2023, Consumers revised its requested increase to $169 million.

2022 Electric Rate Case: In January 2023, the MPSC approved a settlement agreement authorizing an annual rate increase of $155 million, based on a 9.9‑percent authorized return on equity. The MPSC also approved a surcharge for the recovery of $6 million of depreciation, property tax, and interest expense related to distribution investments made in 2021 that exceeded what was authorized in rates in accordance with the December 2020 electric rate order. The new rates became effective January 20, 2023.

Looking Forward

CMS Energy and Consumers will continue to consider the impact on the triple bottom line of people, planet, and profit in their daily operations as well as in their long-term strategic decisions. Consumers will continue to seek fair and timely regulatory treatment that will support its customer-driven investment plan, while pursuing cost-control measures that will allow it to maintain sustainable customer base rates. The CE Way is an important means of realizing CMS Energy’s and Consumers’ purpose of achieving world class performance while delivering hometown service.

21

Results of Operations

CMS Energy Consolidated Results of Operations

| In Millions, Except Per Share Amounts | |||||||||||||||||||||||||||||||||||||||||

| Three Months Ended | Nine Months Ended | ||||||||||||||||||||||||||||||||||||||||

| September 30 | 2023 | 2022 | Change | 2023 | 2022 | Change | |||||||||||||||||||||||||||||||||||

| Net Income Available to Common Stockholders | $ | 174 | $ | 163 | $ | 11 | $ | 571 | $ | 659 | $ | (88) | |||||||||||||||||||||||||||||

| Basic Earnings Per Average Common Share | $ | 0.60 | $ | 0.56 | $ | 0.04 | $ | 1.96 | $ | 2.27 | $ | (0.31) | |||||||||||||||||||||||||||||

| Diluted Earnings Per Average Common Share | $ | 0.60 | $ | 0.56 | $ | 0.04 | $ | 1.96 | $ | 2.27 | $ | (0.31) | |||||||||||||||||||||||||||||

| In Millions | |||||||||||||||||||||||||||||||||||||||||

| Three Months Ended | Nine Months Ended | ||||||||||||||||||||||||||||||||||||||||

| September 30 | 2023 | 2022 | Change | 2023 | 2022 | Change | |||||||||||||||||||||||||||||||||||

| Electric utility | $ | 187 | $ | 194 | $ | (7) | $ | 404 | $ | 501 | $ | (97) | |||||||||||||||||||||||||||||

| Gas utility | 4 | (13) | 17 | 181 | 239 | (58) | |||||||||||||||||||||||||||||||||||

| NorthStar Clean Energy | 16 | 11 | 5 | 26 | 26 | — | |||||||||||||||||||||||||||||||||||

| Corporate interest and other | (33) | (29) | (4) | (40) | (107) | 67 | |||||||||||||||||||||||||||||||||||

| Net Income Available to Common Stockholders | $ | 174 | $ | 163 | $ | 11 | $ | 571 | $ | 659 | $ | (88) | |||||||||||||||||||||||||||||

Amounts in the following tables are presented pre-tax, with the exception of income tax changes.

22

Presented in the following table is a summary of changes to net income available to common stockholders for the three and nine months ended September 30, 2023 versus 2022:

| In Millions | |||||||||||||||||||||||||||||

| Three Months Ended | Nine Months Ended | ||||||||||||||||||||||||||||

| September 30, 2022 | $ | 163 | $ | 659 | |||||||||||||||||||||||||

| Reasons for the change | |||||||||||||||||||||||||||||

| Consumers electric utility and gas utility | |||||||||||||||||||||||||||||

| Electric sales | $ | (28) | $ | (108) | |||||||||||||||||||||||||

| Gas sales | — | (100) | |||||||||||||||||||||||||||

| Electric rate increase | 74 | 147 | |||||||||||||||||||||||||||

| Gas rate increase | 21 | 119 | |||||||||||||||||||||||||||

| Lower other maintenance and operating expenses | 18 | 24 | |||||||||||||||||||||||||||

| Higher other income, net of expenses | 2 | 19 | |||||||||||||||||||||||||||

| Lower income tax expense | 14 | 14 | |||||||||||||||||||||||||||

| Higher service restoration costs | (35) | (93) | |||||||||||||||||||||||||||

| Higher interest charges | (29) | (84) | |||||||||||||||||||||||||||

| Higher depreciation and amortization | (17) | (37) | |||||||||||||||||||||||||||

| 2023 voluntary separation program expenses | (5) | (33) | |||||||||||||||||||||||||||

| Higher property taxes, reflecting higher capital spending, and other | (5) | (23) | |||||||||||||||||||||||||||

| $ | 10 | $ | (155) | ||||||||||||||||||||||||||

| NorthStar Clean Energy | 5 | — | |||||||||||||||||||||||||||

| Corporate interest and other | (4) | 67 | |||||||||||||||||||||||||||

| September 30, 2023 | $ | 174 | $ | 571 | |||||||||||||||||||||||||

23

Consumers Electric Utility Results of Operations

Presented in the following table are the detailed changes to the electric utility’s net income available to common stockholders for the three and nine months ended September 30, 2023 versus 2022:

| In Millions | |||||||||||||||||||||||||||||

| Three Months Ended | Nine Months Ended | ||||||||||||||||||||||||||||

| September 30, 2022 | $ | 194 | $ | 501 | |||||||||||||||||||||||||

| Reasons for the change | |||||||||||||||||||||||||||||

Electric deliveries1 and rate increases | |||||||||||||||||||||||||||||

| Rate increase, including return on higher renewable capital spending | $ | 74 | $ | 147 | |||||||||||||||||||||||||

| Higher energy waste reduction program revenues | 6 | 24 | |||||||||||||||||||||||||||

| Lower revenue due primarily to unfavorable weather and sales mix | (30) | (103) | |||||||||||||||||||||||||||

| Higher (lower) other revenues | 2 | (5) | |||||||||||||||||||||||||||

| $ | 52 | $ | 63 | ||||||||||||||||||||||||||

| Maintenance and other operating expenses | |||||||||||||||||||||||||||||

| Lower distribution and generation expenses | 5 | 14 | |||||||||||||||||||||||||||

| Higher service restoration costs due primarily to increased storm activity | (35) | (93) | |||||||||||||||||||||||||||

| Higher energy waste reduction program costs | (6) | (24) | |||||||||||||||||||||||||||

| 2023 voluntary separation program expenses | (3) | (20) | |||||||||||||||||||||||||||

| Lower mutual insurance distribution | — | (9) | |||||||||||||||||||||||||||

| Higher other maintenance and operating expenses | — | (10) | |||||||||||||||||||||||||||

| (39) | (142) | ||||||||||||||||||||||||||||

| Depreciation and amortization | |||||||||||||||||||||||||||||

| Increased plant in service, reflecting higher capital spending | (15) | (24) | |||||||||||||||||||||||||||

| General taxes | |||||||||||||||||||||||||||||

| Higher property taxes, reflecting higher capital spending, and other | (4) | (13) | |||||||||||||||||||||||||||

| Other income, net of expenses | |||||||||||||||||||||||||||||

| Higher interest income | 5 | 15 | |||||||||||||||||||||||||||

| Higher non-operating retirement benefits expenses | (4) | (6) | |||||||||||||||||||||||||||

| Higher other income, net of expenses | 2 | 11 | |||||||||||||||||||||||||||

| 3 | 20 | ||||||||||||||||||||||||||||

| Interest charges | (17) | (49) | |||||||||||||||||||||||||||

| Income taxes | |||||||||||||||||||||||||||||

| Lower electric utility pre-tax earnings | 5 | 37 | |||||||||||||||||||||||||||

Deferred tax liability reversal2 | — | 9 | |||||||||||||||||||||||||||

| Lower renewable energy tax credits | — | (6) | |||||||||||||||||||||||||||

| Lower other income taxes | 8 | 8 | |||||||||||||||||||||||||||

| 13 | 48 | ||||||||||||||||||||||||||||

| September 30, 2023 | $ | 187 | $ | 404 | |||||||||||||||||||||||||

1For the three months ended September 30, deliveries to end-use customers were 9.8 billion kWh in 2023 and 10.2 billion kWh in 2022. For the nine months ended September 30, deliveries to end-use customers were 27.5 billion kWh in 2023 and 28.5 billion kWh in 2022.

2See Note 7, Income Taxes.

24

Consumers Gas Utility Results of Operations

Presented in the following table are the detailed changes to the gas utility’s net income available to common stockholders for the three and nine months ended September 30, 2023 versus 2022:

| In Millions | |||||||||||||||||||||||||||||

| Three Months Ended | Nine Months Ended | ||||||||||||||||||||||||||||

| September 30, 2022 | $ | (13) | $ | 239 | |||||||||||||||||||||||||

| Reasons for the change | |||||||||||||||||||||||||||||

Gas deliveries1 and rate increases | |||||||||||||||||||||||||||||

| Rate increase | $ | 21 | $ | 119 | |||||||||||||||||||||||||

| Higher energy waste reduction program revenues | 4 | 12 | |||||||||||||||||||||||||||

| Lower revenue due primarily to unfavorable weather | (2) | (105) | |||||||||||||||||||||||||||

| Higher other revenues | 2 | 5 | |||||||||||||||||||||||||||

| $ | 25 | $ | 31 | ||||||||||||||||||||||||||

| Maintenance and other operating expenses | |||||||||||||||||||||||||||||

| Lower distribution, transmission, and compression expenses | 9 | 18 | |||||||||||||||||||||||||||

| Absence of 2022 Ray Compressor Station impairment | — | 10 | |||||||||||||||||||||||||||

| 2023 voluntary separation program expenses | (2) | (13) | |||||||||||||||||||||||||||

| Higher energy waste reduction program costs | (4) | (12) | |||||||||||||||||||||||||||

| Lower other maintenance and operating expenses | 4 | 1 | |||||||||||||||||||||||||||

| 7 | 4 | ||||||||||||||||||||||||||||

| Depreciation and amortization | |||||||||||||||||||||||||||||

| Increased plant in service, reflecting higher capital spending | (2) | (13) | |||||||||||||||||||||||||||

| General taxes | |||||||||||||||||||||||||||||

| Higher property taxes, reflecting higher capital spending, and other | (1) | (10) | |||||||||||||||||||||||||||

| Other income, net of expenses | |||||||||||||||||||||||||||||

| Higher non-operating retirement benefits expenses | (5) | (11) | |||||||||||||||||||||||||||

| Higher other income, net of expenses | 4 | 10 | |||||||||||||||||||||||||||

| (1) | (1) | ||||||||||||||||||||||||||||

| Interest charges | (12) | (35) | |||||||||||||||||||||||||||

| Income taxes | |||||||||||||||||||||||||||||

| Lower (higher) gas utility pre-tax earnings | (4) | 6 | |||||||||||||||||||||||||||

Deferred tax liability reversal2 | — | 4 | |||||||||||||||||||||||||||

Absence of 2022 accelerated tax amortizations2 | 3 | (46) | |||||||||||||||||||||||||||

| Lower other income taxes | 2 | 2 | |||||||||||||||||||||||||||

| 1 | (34) | ||||||||||||||||||||||||||||

| September 30, 2023 | $ | 4 | $ | 181 | |||||||||||||||||||||||||

1For the three months ended September 30, deliveries to end-use customers were 30 bcf in 2023 and 31 bcf in 2022. For the nine months ended September 30, deliveries to end-use customers were 198 bcf in 2023 and 222 bcf in 2022.

2See Note 7, Income Taxes.

25

NorthStar Clean Energy Results of Operations

Presented in the following table are the detailed changes to NorthStar Clean Energy’s net income available to common stockholders for the three and nine months ended September 30, 2023 versus 2022:

| In Millions | |||||||||||||||||||||||||||||

| Three Months Ended | Nine Months Ended | ||||||||||||||||||||||||||||

| September 30, 2022 | $ | 11 | $ | 26 | |||||||||||||||||||||||||

| Reason for the change | |||||||||||||||||||||||||||||

| Higher renewable energy tax credits | $ | 9 | $ | 9 | |||||||||||||||||||||||||

| Lower operating earnings, primarily at DIG | (5) | (6) | |||||||||||||||||||||||||||

| Other income tax benefit (expense) | 1 | (3) | |||||||||||||||||||||||||||

| September 30, 2023 | $ | 16 | $ | 26 | |||||||||||||||||||||||||

Corporate Interest and Other Results of Operations

Presented in the following table are the detailed changes to corporate interest and other results for the three and nine months ended September 30, 2023 versus 2022:

| In Millions | |||||||||||||||||||||||||||||

| Three Months Ended | Nine Months Ended | ||||||||||||||||||||||||||||

| September 30, 2022 | $ | (29) | $ | (107) | |||||||||||||||||||||||||

| Reasons for the change | |||||||||||||||||||||||||||||

Gain on extinguishment of debt1 | $ | 17 | $ | 101 | |||||||||||||||||||||||||

| Higher interest earnings and other | 5 | 11 | |||||||||||||||||||||||||||

| Higher income tax expense due to higher pre-tax earnings | (19) | (30) | |||||||||||||||||||||||||||

| Higher interest charges | (7) | (12) | |||||||||||||||||||||||||||

| Lower discontinued operations | — | (3) | |||||||||||||||||||||||||||

| September 30, 2023 | $ | (33) | $ | (40) | |||||||||||||||||||||||||

1See Note 3, Financings and Capitalization.

26

Cash Position, Investing, and Financing

At September 30, 2023, CMS Energy had $184 million of consolidated cash and cash equivalents, which included $27 million of restricted cash and cash equivalents. At September 30, 2023, Consumers had $34 million of consolidated cash and cash equivalents, which included $27 million of restricted cash and cash equivalents.

Operating Activities

Presented in the following table are specific components of net cash provided by operating activities for the nine months ended September 30, 2023 versus 2022:

| In Millions | ||||||||

CMS Energy, including Consumers | ||||||||

| Nine Months Ended September 30, 2022 | $ | 667 | ||||||

| Reasons for the change | ||||||||

| Lower net income | $ | (93) | ||||||

Non‑cash transactions1 | (28) | |||||||

Favorable impact of changes in core working capital,2 due primarily to higher collections, higher prices on gas sold to customers, and lower prices on gas purchased in 2023 | 1,306 | |||||||

Favorable impact of changes in other assets and liabilities, due primarily to recovery in 2023 of 2022 power supply costs,3 offset partially by higher voluntary separation program payments | 52 | |||||||

| Nine Months Ended September 30, 2023 | $ | 1,904 | ||||||

| Consumers | ||||||||

| Nine Months Ended September 30, 2022 | $ | 761 | ||||||

| Reasons for the change | ||||||||

| Lower net income | $ | (168) | ||||||

Non‑cash transactions1 | 74 | |||||||

Favorable impact of changes in core working capital,2 due primarily to higher collections, higher prices on gas sold to customers, and lower prices on gas purchased in 2023 | 1,304 | |||||||

Unfavorable impact of changes in other assets and liabilities, due primarily to higher income tax payments to CMS Energy and voluntary separation program payments, offset partially by recovery in 2023 of 2022 power supply costs3 | (5) | |||||||

| Nine Months Ended September 30, 2023 | $ | 1,966 | ||||||

1Non‑cash transactions comprise depreciation and amortization, changes in deferred income taxes and investment tax credits, and other non‑cash operating activities and reconciling adjustments.

2Core working capital comprises accounts receivable, accrued revenue, inventories, accounts payable, and accrued rate refunds.

3For information regarding the underrecovery of power supply costs, see Note 1, Regulatory Matters.

27

Investing Activities

Presented in the following table are specific components of net cash used in investing activities for the nine months ended September 30, 2023 versus 2022:

| In Millions | ||||||||

| CMS Energy, including Consumers | ||||||||

| Nine Months Ended September 30, 2022 | $ | (1,808) | ||||||

| Reasons for the change | ||||||||

| Higher capital expenditures | $ | (61) | ||||||

Purchase of Covert Generating Facility1 | (812) | |||||||

| Other investing activities, primarily absence of proceeds from sale of assets in 2022 | (56) | |||||||

| Nine Months Ended September 30, 2023 | $ | (2,737) | ||||||

| Consumers | ||||||||

| Nine Months Ended September 30, 2022 | $ | (1,715) | ||||||

| Reasons for the change | ||||||||

| Higher capital expenditures | $ | (16) | ||||||

Purchase of Covert Generating Facility1 | (812) | |||||||

| Other investing activities, primarily absence of proceeds from sale of assets in 2022 | (49) | |||||||

| Nine Months Ended September 30, 2023 | $ | (2,592) | ||||||

1See Note 12, Transition Activities.

28

Financing Activities

Presented in the following table are specific components of net cash provided by financing activities for the nine months ended September 30, 2023 versus 2022:

| In Millions | ||||||||

CMS Energy, including Consumers | ||||||||

| Nine Months Ended September 30, 2022 | $ | 860 | ||||||

| Reasons for the change | ||||||||

| Higher debt issuances | $ | 1,556 | ||||||

| Higher debt retirements | (1,754) | |||||||

| Higher issuances of notes payable | 227 | |||||||

| Higher payments of dividends on common stock | (25) | |||||||

| Lower proceeds from sales of membership interests in VIEs to tax equity investors | (32) | |||||||

| Higher contributions from noncontrolling interest | 4 | |||||||

| Other financing activities, primarily higher debt issuance costs, offset partially by the absence of a payment of a long-term contract liability | (1) | |||||||

| Nine Months Ended September 30, 2023 | $ | 835 | ||||||

| Consumers | ||||||||

| Nine Months Ended September 30, 2022 | $ | 1,020 | ||||||

| Reasons for the change | ||||||||

| Higher debt issuances | $ | 671 | ||||||

| Higher debt retirements | (1,625) | |||||||

| Higher issuances of notes payable | 227 | |||||||

| Lower repayments of borrowings from CMS Energy | 392 | |||||||

| Lower stockholder contribution from CMS Energy | (210) | |||||||

| Lower payments of dividends on common stock | 132 | |||||||

| Other financing activities, primarily higher debt issuance costs | (7) | |||||||

| Nine Months Ended September 30, 2023 | $ | 600 | ||||||

Capital Resources and Liquidity

CMS Energy and Consumers expect to have sufficient liquidity to fund their present and future commitments. CMS Energy uses dividends and tax-sharing payments from its subsidiaries and external financing and capital transactions to invest in its utility and non‑utility businesses, retire debt, pay dividends, and fund its other obligations. The ability of CMS Energy’s subsidiaries, including Consumers, to pay dividends to CMS Energy depends upon each subsidiary’s revenues, earnings, cash needs, and other factors. In addition, Consumers’ ability to pay dividends is restricted by certain terms included in its articles of incorporation and potentially by FERC requirements and provisions under the Federal Power Act and the Natural Gas Act. For additional details on Consumers’ dividend restrictions, see Notes to the Unaudited Consolidated Financial Statements—Note 3, Financings and Capitalization—Dividend Restrictions. During the nine months ended September 30, 2023, Consumers paid $461 million in dividends on its common stock to CMS Energy.

Consumers uses cash flows generated from operations and external financing transactions, as well as stockholder contributions from CMS Energy, to fund capital expenditures, retire debt, pay dividends, and fund its other obligations. Consumers also uses these sources of funding to contribute to its employee benefit plans.

29

Financing and Capital Resources: CMS Energy and Consumers rely on the capital markets to fund their robust capital plan. Barring any sustained market dislocations or disruptions, CMS Energy and Consumers expect to continue to have ready access to the financial and capital markets and will continue to explore possibilities to take advantage of market opportunities as they arise with respect to future funding needs. If access to these markets were to diminish or otherwise become restricted, CMS Energy and Consumers would implement contingency plans to address debt maturities, which could include reduced capital spending.

CMS Energy has entered into forward sales transactions that it may either settle physically by issuing shares of its common stock at the then-applicable forward sale price specified by the agreement or settle net by delivering or receiving cash or shares. CMS Energy may settle the contracts at any time through their maturity dates, and presently intends to physically settle the contracts by delivering shares of its common stock. As of September 30, 2023, these contracts have an aggregate sales price of $444 million, maturing through December 2024. For more information on these forward sale contracts, see Notes to the Unaudited Consolidated Financial Statements—Note 3, Financings and Capitalization—Issuance of Common Stock.

At September 30, 2023, CMS Energy had $530 million of its revolving credit facility available and Consumers had $1.3 billion available under its revolving credit facilities. CMS Energy and Consumers use these credit facilities for general working capital purposes and to issue letters of credit. An additional source of liquidity is Consumers’ commercial paper program, which allows Consumers to issue, in one or more placements, up to $500 million in aggregate principal amount of commercial paper notes with maturities of up to 365 days at market interest rates. These issuances are supported by Consumers’ revolving credit facilities. While the amount of outstanding commercial paper does not reduce the available capacity of the revolving credit facilities, Consumers does not intend to issue commercial paper in an amount exceeding the available capacity of the facilities. At September 30, 2023, there were $247 million commercial paper notes outstanding under this program. For additional details on CMS Energy’s and Consumers’ secured revolving credit facilities and commercial paper program, see Notes to the Unaudited Consolidated Financial Statements—Note 3, Financings and Capitalization.

Certain of CMS Energy’s and Consumers’ credit agreements contain covenants that require CMS Energy and Consumers to maintain certain financial ratios, as defined therein. At September 30, 2023, no default had occurred with respect to any financial covenants contained in CMS Energy’s and Consumers’ credit agreements. CMS Energy and Consumers were each in compliance with these covenants as of September 30, 2023, as presented in the following table:

| Limit | Actual | |||||||

| CMS Energy, parent only | ||||||||

Debt to Capital1 | < 0.70 to 1.0 | 0.59 to 1.0 | ||||||

| Consumers | ||||||||

Debt to Capital2 | < 0.65 to 1.0 | 0.50 to 1.0 | ||||||

1Applies to CMS Energy’s revolving credit agreement and letter of credit reimbursement agreement, and a term loan agreement of a subsidiary of NorthStar Clean Energy.

2Applies to Consumers’ revolving credit agreements.

30

Outlook

Several business trends and uncertainties may affect CMS Energy’s and Consumers’ financial condition and results of operations. These trends and uncertainties could have a material impact on CMS Energy’s and Consumers’ consolidated income, cash flows, or financial position. For additional details regarding these and other uncertainties, see Forward-looking Statements and Information; Notes to the Unaudited Consolidated Financial Statements—Note 1, Regulatory Matters and Note 2, Contingencies and Commitments; and Part II—Item 1A. Risk Factors.

Consumers Electric Utility Outlook and Uncertainties

Clean Energy Plan: Consumers’ Clean Energy Plan details its strategy to meet customers’ long-term energy needs and provides the foundation for its goal to achieve net-zero carbon emissions from its electric business by 2040. Under this net-zero goal, Consumers plans to eliminate the impact of carbon emissions created by the electricity it generates or purchases for customers. Additionally, through its Clean Energy Plan, Consumers continues to make progress on expanding its customer programs, namely its demand response, energy efficiency, and conservation voltage reduction programs, as well as increasing its renewable energy and pumped storage generation.

The Clean Energy Plan was most recently revised and approved by the MPSC in June 2022. Under this plan, Consumers will eliminate the use of coal-fueled generation in 2025 and expects to meet 90 percent of its customers’ needs with clean energy sources by 2040. Specifically, the Clean Energy Plan provides for:

•the retirement of the D.E. Karn coal-fueled generating units, totaling 515 MW of nameplate capacity; these units closed in June 2023

•the retirement of the J.H. Campbell coal-fueled generating units, totaling 1,407 MW of nameplate capacity, in 2025

•the retirement of the D.E. Karn oil and gas-fueled generating units, totaling 1,219 MW of nameplate capacity, in 2031

The MPSC has authorized Consumers to issue securitization bonds to finance the recovery of and return on the D.E. Karn coal-fueled generating units. Consumers plans to issue securitization bonds in the fourth quarter of 2023. Additionally, the MPSC has authorized regulatory asset treatment for Consumers to recover the remaining book value of the J.H. Campbell coal-fueled generating units, as well as a 9.0‑percent return on equity, commencing in 2025.

Under the Clean Energy Plan, Consumers:

•purchased the Covert Generating Facility, a natural gas-fueled generation facility with 1,200 MW of nameplate capacity in Van Buren County, Michigan in May 2023

•conducted a one‑time competitive solicitation for and is evaluating the acquisition of up to 700 MW of capacity through PPAs from sources able to deliver to Michigan’s Lower Peninsula beginning in 2025; of this amount, up to 500 MW was solicited from dispatchable sources

These actions are expected to help Consumers continue to provide controllable sources of electricity to customers while expanding its investment in renewable energy. The Clean Energy Plan forecasts renewable energy capacity levels of 30 percent in 2025, 43 percent in 2030, and 61 percent in 2040, including the addition of nearly 8,000 MW of solar generation. Additionally, Consumers plans to deploy battery storage beginning in 2024, with 75 MW of energy storage by 2027 and an additional 475 MW by 2040.

31

Under its Clean Energy Plan, Consumers bids new capacity competitively and will own and operate approximately 50 percent of new capacity, with the remainder being built and owned by third parties. Additionally, Consumers earns a return equal to its weighted-average cost of capital on payments made under new competitively bid PPAs with non‑affiliated entities approved by the MPSC.

As a result of requests for proposals, Consumers has entered into PPAs to purchase renewable capacity, energy, and RECs from solar generating facilities and build transfer agreements to purchase solar generating facilities. Presented in the following illustration is the aggregate renewable capacity that Consumers expects to add to its portfolio as a result of these agreements:

In support of its Clean Energy Plan, Consumers issued a request for proposals in September 2022 to acquire up to 700 MW of capacity through PPAs from sources able to deliver to Michigan’s Lower Peninsula beginning in 2025. Specifically, Consumers solicited offers to acquire 500 MW of capacity from dispatchable sources and 200 MW of capacity from intermittent resources and dispatchable, non‑intermittent clean capacity resources (including battery storage resources).

Renewable Energy Plan: Michigan has established a 15‑percent renewable portfolio standard. Under this standard, Consumers is required to submit RECs, which represent proof that the associated electricity was generated from a renewable energy resource, in an amount equal to at least 15 percent of Consumers’ electric sales volume each year. Under its renewable energy plan, Consumers has met the 15‑percent requirement and expects to continue meeting the requirement going forward with a combination of newly generated RECs and previously generated RECs carried over from prior years.

Under Consumers’ renewable energy plan, the MPSC has approved the acquisition of up to 525 MW of new wind generation projects and authorized Consumers to earn a 10.7‑percent return on equity on any projects approved by the MPSC. Specifically, the MPSC has approved the following:

•purchase and construction of a 150‑MW wind generation project in Gratiot County, Michigan; the project became operational and Consumers took full ownership in 2020

32

•purchase of a 166‑MW wind generation project in Hillsdale, Michigan; the project became operational and Consumers took full ownership in 2021

•purchase of a wind generation project under development, with capacity of up to 201 MW, in Gratiot County, Michigan; Consumers expects to take full ownership and begin commercial operation of the project in the fourth quarter of 2023

The MPSC also approved the execution of a 20-year PPA under which Consumers will purchase 100 MW of renewable capacity, energy, and RECs from a 149‑MW solar generating facility to be constructed in Calhoun County, Michigan; the facility is targeted to be operational in 2024.

Voluntary Large Customer Renewable Energy Program: Consumers provides service under a program that provides large full-service electric customers with the opportunity to advance the development of renewable energy beyond the requirements of the 2016 Energy Law. In 2021, the MPSC approved Consumers’ request to amend its renewable energy plan to remove the annual subscription limit associated with this program. The MPSC also approved up to 1,000 MW of new wind and solar generation projects between 2024 and 2027 to meet customer demand for the program. Consumers will competitively solicit for additional renewable energy assets based on customer applications and will construct the assets based on customer subscriptions to the program.

As part of this program, a 2022 request for proposals resulted in the execution of a build transfer agreement for a 309‑MW solar generating facility to be constructed in Calhoun County, Michigan; the facility is targeted to be operational in 2025. The build transfer agreement was approved by the MPSC in September 2023. Additionally, the request for proposals resulted in the selection of a solar generation project that Consumers will develop and construct at its D.E. Karn generating site, with a capacity of up to 85 MW. The facility is expected to be operational in 2026.

Electric Customer Deliveries and Revenue: Consumers’ electric customer deliveries are seasonal and largely dependent on Michigan’s economy. The consumption of electric energy typically increases in the summer months, due primarily to the use of air conditioners and other cooling equipment. In addition, Consumers’ electric rates, which follow a seasonal rate design, are higher in the summer months than in the remaining months of the year. Each year in June, electric residential customers transition to a summer peak time-of-use rate that allows them to take advantage of lower-cost energy during off-peak times during the summer months. Thus, customers can reduce their electric bills by shifting their consumption from on‑peak to off‑peak times.

Over the next five years, Consumers expects weather-normalized electric deliveries to remain relatively stable compared to 2022. This outlook reflects the effects of energy waste reduction programs offset largely by modest growth in electric demand. Actual delivery levels will depend on:

•energy conservation measures and results of energy waste reduction programs

•weather fluctuations

•Michigan’s economic conditions, including utilization, expansion, or contraction of manufacturing facilities, population trends, electric vehicle adoption, and housing activity

Electric ROA: Michigan law allows electric customers in Consumers’ service territory to buy electric generation service from alternative electric suppliers in an aggregate amount capped at ten percent of Consumers’ sales, with certain exceptions. At September 30, 2023, electric deliveries under the ROA program were at the ten‑percent limit. Of Consumers’ 1.9 million electric customers, fewer than 300, or 0.02 percent, purchased electric generation service under the ROA program.

The 2016 Energy Law established a path to ensure that forward capacity is secured for all electric customers in Michigan, including customers served by alternative electric suppliers under ROA. The law

33