Table of Contents

As filed with the Securities and Exchange Commission on March 1, 2024

No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Ferguson Enterprises Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 5070 | 38-4304133 | ||

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

751 Lakefront Commons

Newport News, Virginia 23606

+1-757-874-7795

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Ian Graham

Chief Legal Officer

751 Lakefront Commons

Newport News, Virginia 23606

+1-757-874-7795

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Sophia Hudson, P.C.

Asher Qazi

601 Lexington Avenue

New York, New York 10022

+1-212-446-4800

Approximate date of commencement of proposed sale of the securities to the public: As soon as practicable after this registration statement is declared effective and all other conditions to the Merger described in the enclosed proxy statement/prospectus have been satisfied or waived.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box: ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “non-accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☐ | |||

| Emerging growth company | ☐ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ☐

Exchange Act Rule 14d-l(d) (Cross-Border Third-Party Tender Offer) ☐

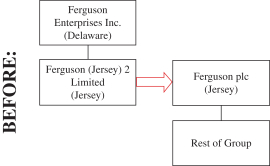

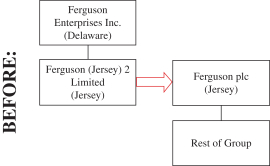

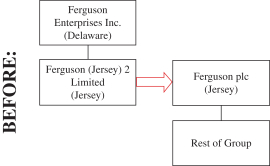

| * | Ferguson Enterprises Inc. (“New TopCo”) is a newly incorporated corporation under the laws of Delaware. Ferguson plc is a public company limited by shares incorporated in the Bailiwick of Jersey (“Jersey”). At the Effective Time (as defined below), on the terms and subject to the conditions set forth in the Merger Agreement described in the enclosed proxy statement/prospectus, Ferguson (Jersey) 2 Limited, a newly formed Jersey incorporated private limited company and direct, wholly owned subsidiary of New TopCo, is to be merged with and into Ferguson plc, resulting in Ferguson plc becoming a direct, wholly owned subsidiary of New TopCo and Ferguson (Jersey) 2 Limited ceasing to exist. The shares of common stock of New TopCo will be held by the former shareholders of Ferguson plc following the issuance of the shares registered pursuant to this registration statement on Form S-4. In accordance with Rule 12g-3 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the shares of common stock of the registrant, New TopCo, will be deemed to be registered under Section 12(b) of the Exchange Act as the successor to Ferguson plc. Upon the closing of the Merger, Ferguson plc will be renamed “Ferguson (Jersey) Limited.” |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary proxy statement/prospectus is not complete and may be changed. The registrant may not sell the securities described in this preliminary proxy statement/prospectus until the registration statement filed with the Securities and Exchange Commission is declared effective. This preliminary proxy statement/prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where such offer or sale is not permitted.

PRELIMINARY—SUBJECT TO COMPLETION, DATED MARCH 1, 2024

PROXY STATEMENT FOR

EXTRAORDINARY GENERAL MEETING OF

FERGUSON PLC (A JERSEY INCORPORATED COMPANY)

PROSPECTUS FOR

203,100,000 SHARES OF COMMON STOCK OF FERGUSON ENTERPRISES INC. (A DELAWARE CORPORATION) TO BE ISSUED IN A HOLDING COMPANY REORGANIZATION OF FERGUSON PLC (A JERSEY INCORPORATED COMPANY)

The board of directors (the “Ferguson Board”) of Ferguson plc, a public company limited by shares incorporated in Jersey, unanimously approved the merger (the “Merger”) of Ferguson (Jersey) 2 Limited (“Merger Sub”), a newly formed Jersey incorporated private limited company and direct, wholly owned subsidiary of Ferguson Enterprises Inc., a Delaware corporation (“New TopCo”), with and into Ferguson plc, with Ferguson plc surviving the Merger as a direct, wholly owned subsidiary of New TopCo and Merger Sub ceasing to exist, at 12:01 a.m. Eastern Time (5:01 a.m. U.K. Time) on August 1, 2024 (the “Effective Time”) and on the terms of and subject to the conditions of the Merger Agreement, dated as of February 29, 2024, by and among New TopCo, Merger Sub and Ferguson plc (as it may be amended from time to time, the “Merger Agreement”) which contains, among other things, the terms and means of effecting a proposed merger of Ferguson plc and Merger Sub under Part 18B (Mergers) of the Companies (Jersey) Law 1991 (as amended, modified, or re-enacted from time to time, the “Jersey Companies Law”), as more fully described elsewhere in this proxy statement/prospectus. Following completion of the transactions contemplated by the Merger Agreement, which are subject to the satisfaction of several conditions, including the approval by Ferguson Shareholders (as defined below) of the Merger Agreement at the extraordinary general meeting of Ferguson plc that will be held at [10:00 a.m.] Eastern Time ([3:00 p.m.] U.K. Time), on [May 30], 2024, at the offices of Freshfields Bruckhaus Deringer LLP, located at 100 Bishopsgate, London, EC2P 2SR, United Kingdom (the “Special Meeting”), New TopCo will be Ferguson plc’s parent company. If the transactions contemplated by the Merger Agreement are consummated, Ferguson Shareholders will become stockholders of New TopCo pursuant to the terms and conditions discussed in greater detail in this proxy statement/prospectus.

On the terms of, subject to the conditions of and/or in connection with the Merger Agreement at the Effective Time (as defined below), (i) each ordinary share, par value 10 pence per share, of Ferguson plc (collectively, the “Ferguson Shares” and each a, “Ferguson Share”) that is issued and outstanding at the Merger Record Time (as defined below) will automatically be cancelled without any repayment of capital and New TopCo will issue as consideration therefor new, duly authorized, validly issued, fully paid and non-assessable shares of common stock, par value $0.0001 per share, of New TopCo (the “New TopCo Common Stock”) to each Ferguson Shareholder on a one-for-one basis for each Ferguson Share held by such Ferguson Shareholder immediately preceding the Merger Record Time and (ii) each U.K. DI (as defined below) representing an issued and outstanding Ferguson Share at the Merger Record Time will be cancelled and a New TopCo U.K. DI (as defined below) representing one share of New TopCo Common Stock will be issued through CREST (as defined below) by the Depositary (as defined below) as consideration therefor to each holder of U.K. DIs on a one-for-one basis for each U.K. DI held by such holder immediately preceding the Merger Record Time. All Ferguson Shares held in treasury will be cancelled as a result of the Merger.

The Ferguson Shares are currently listed on the New York Stock Exchange (the “NYSE”) and the London Stock Exchange (the “LSE”) under the symbol “FERG.” On January 17, 2024, the last trading day before Ferguson publicly disclosed its intention to pursue the Merger, the closing price of the Ferguson Shares on the NYSE and LSE was $184.65 and £146.40 per share, respectively. On , 2024, the last practicable date before the mailing date of this proxy statement/prospectus, the closing price of the Ferguson Shares on the NYSE and LSE was $ and £ per share, respectively. Upon completion of the Merger, the shares of New TopCo Common Stock are expected to be listed on the NYSE and LSE under the symbol “FERG.” The New TopCo Common Stock will be the only outstanding class of stock of New TopCo upon the consummation of the Merger.

This proxy statement/prospectus provides Ferguson Shareholders with detailed information about the proposed Merger and other matters to be considered at the Special Meeting of Ferguson plc. We encourage you to read this entire document carefully and in its entirety, including the annexes attached hereto and the other documents referred to herein. You should also carefully consider the risk factors described in “Risk Factors” beginning on page 7 of this proxy statement/prospectus.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES REGULATORY AGENCY HAS APPROVED OR DISAPPROVED THE TRANSACTIONS DESCRIBED IN THIS PROXY STATEMENT/PROSPECTUS, PASSED UPON THE MERITS OR FAIRNESS OF THE MERGER OR RELATED TRANSACTIONS OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE DISCLOSURE IN THIS PROXY STATEMENT/PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY CONSTITUTES A CRIMINAL OFFENSE.

This proxy statement/prospectus is dated , 2024,

and is first being mailed to Ferguson Shareholders on or about , 2024.

Table of Contents

| Page | ||||

| i | ||||

| iv | ||||

| iv | ||||

| v | ||||

| vii | ||||

| 1 | ||||

| 6 | ||||

| 7 | ||||

| 26 | ||||

| 32 | ||||

| PROPOSAL NO. 2—THE ADVISORY ORGANIZATIONAL DOCUMENTS PROPOSALS |

38 | |||

| 38 | ||||

| 40 | ||||

| 41 | ||||

| 42 | ||||

| 44 | ||||

| 45 | ||||

| 47 | ||||

| 48 | ||||

| 49 | ||||

| 52 | ||||

| 58 | ||||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

63 | |||

| 65 | ||||

| 101 | ||||

| 105 | ||||

| 108 | ||||

| 123 | ||||

| 127 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

129 | |||

| 143 | ||||

| 144 | ||||

| 146 | ||||

| 146 | ||||

| 146 | ||||

| F-1 | ||||

| A-1 | ||||

| ANNEX B: FORM OF NEW TOPCO PROPOSED CERTIFICATE OF INCORPORATION |

B-1 | |||

| C-1 | ||||

| D-1 | ||||

| E-1 | ||||

Table of Contents

FERGUSON PLC

1020 Eskdale Road, Winnersh Triangle, Wokingham

Berkshire, RG41 5TS, United Kingdom

Dear fellow shareholders,

On behalf of Ferguson plc, it is my pleasure to invite you to an extraordinary general meeting (the “Special Meeting”) of the shareholders of Ferguson plc. The Special Meeting will be held at [10:00 a.m.] Eastern Time ([3:00 p.m.] U.K. Time), on [May 30], 2024, at the offices of Freshfields Bruckhaus Deringer LLP, located at 100 Bishopsgate, London, EC2P 2SR, United Kingdom.

Since 2019, our board of directors (the “Ferguson Board”) has considered North America to be the best long-term location for Ferguson plc and has worked methodically and transparently with shareholders on this transformative journey, creating an additional listing on the New York Stock Exchange (the “NYSE”) in 2021, and then moving Ferguson plc’s primary listing from London to New York in 2022. During this period, approximately two-thirds of Ferguson plc’s shareholder base has become American and Ferguson plc has been considered a U.S. domestic issuer under the applicable Securities and Exchange Commission rules since August 1, 2023.

At the Special Meeting, you will be asked to vote on a transaction that would result in a corporate reorganization, where Ferguson plc would become a direct, wholly owned subsidiary of a Delaware corporation, Ferguson Enterprises Inc. The transaction would entail the merger of Ferguson (Jersey) 2 Limited (a newly formed Jersey incorporated private limited company and direct, wholly owned subsidiary of Ferguson Enterprises Inc.), with and into Ferguson plc under Part 18B (Mergers) of the Jersey Companies Law (the “Merger”). Following completion of the Merger, Ferguson Enterprises Inc. will be Ferguson plc’s parent company. If the Merger is consummated, you will become stockholders of Ferguson Enterprises Inc. pursuant to the terms and conditions discussed in greater detail in the accompanying materials.

The below abbreviated organizational charts depict Ferguson’s current structure, with the arrow depicting the Merger, and the intended structure following the consummation of the Merger:

|

|

We believe the Merger is the next natural step in our journey, which will better align our headquarters and governance with our operations and leadership and will simplify our corporate governance requirements. Moreover, the Ferguson Board does not foresee any material downsides to making this change.

The accompanying materials describe the Merger in greater detail, including the legal procedures necessary to effect the Merger. For our shareholders, if the Merger is consummated, the key change would be that they will no longer hold shares of Ferguson plc, a public limited company formed in Jersey that is subject to Jersey law and the requirements of its organizational documents, but will instead hold common stock of Ferguson Enterprises Inc., a public corporation incorporated in Delaware that is subject to Delaware law and the requirements of its organizational documents that are more fully described in the accompanying materials. As with the Ferguson Shares, the shares of common stock of Ferguson Enterprises Inc. are expected to be listed on both the NYSE and the LSE.

The Ferguson Board appreciates the input of all shareholders. Representatives from Ferguson plc will be available at the Special Meeting to answer any questions you may have. Whether or not you are able to attend the Special Meeting, I urge you to promptly cast your vote on this important matter by following the instructions in the accompanying materials.

Your vote is very important. The Merger cannot be completed without satisfying certain conditions, the most important of which is the approval of the Merger Agreement by at least two-thirds (662/3%) of the total number of votes cast at the Special Meeting, pursuant to which the Merger will be effected.

I appreciate your attention to this proposal and your continued support of our company.

| Sincerely, |

| Geoff Drabble |

| Chairman of the Board |

Table of Contents

FERGUSON PLC

1020 Eskdale Road, Winnersh Triangle, Wokingham

Berkshire, RG41 5TS, United Kingdom

NOTICE OF EXTRAORDINARY GENERAL MEETING

TO BE HELD ON [MAY 30], 2024

TO THE SHAREHOLDERS OF FERGUSON PLC (“Ferguson Shareholders”):

NOTICE IS HEREBY GIVEN that an extraordinary general meeting (“Special Meeting”) of Ferguson plc, a public company limited by shares incorporated in Jersey (“Ferguson”), will be held at [10:00 a.m.] Eastern Time ([3:00 p.m.] U.K. Time), on [May 30], 2024, at the offices of Freshfields Bruckhaus Deringer LLP, located at 100 Bishopsgate, London, EC2P 2SR, United Kingdom. You are cordially invited to attend the Special Meeting, which will be held to consider and, if thought fit, to pass the following resolutions as ordinary and special resolutions of Ferguson (as the case may be, as indicated below):

SPECIAL RESOLUTION:

Proposal 1. The Merger Proposal (“Merger Proposal,” and together with the Advisory Organizational Documents Proposals (as defined below), collectively or as a subset thereof, as applicable, the “Proposals”)

RESOLVED, that the merger agreement entered into by and among Ferguson Enterprises Inc., a newly incorporated corporation under the laws of Delaware, Ferguson (Jersey) 2 Limited, a newly formed Jersey incorporated private limited company and Ferguson plc (as it may be amended from time to time, the “Merger Agreement”) and that states, among other things, the terms and means of effecting a merger (the “Merger”) of Ferguson (Jersey) 2 Limited and Ferguson plc under Part 18B (Mergers) of the Companies (Jersey) Law 1991 (as amended, modified, or re-enacted from time to time, the “Jersey Companies Law”) be hereby approved for all purposes, including (without limitation) for the purposes of Article 127F(1) of the Jersey Companies Law and the directors of Ferguson plc (or a duly authorized committee thereof) be and are authorized to take all such action as they may consider necessary or desirable for the implementation of the Merger pursuant to the terms and subject to the conditions contained in the Merger Agreement.

ORDINARY RESOLUTIONS:

Advisory Organizational Documents Proposal 2.A (“Advisory Organizational Documents Proposal 2.A”)

RESOLVED, that, on an advisory basis, (i) the proposed amended and restated certificate of incorporation (as amended from time to time, the “New TopCo Proposed Certificate of Incorporation”) of Ferguson Enterprises Inc. (“New TopCo”), once adopted, may be amended, altered or repealed in the manner prescribed by the Delaware General Corporation Law, as in effect from time to time and (ii) the proposed amended and restated bylaws of New TopCo, once adopted, may be amended, altered or repealed from time to time by the stockholders of New TopCo by the affirmative vote of holders of a majority of the voting power of the then outstanding shares of New TopCo entitled to vote thereon, and such additional vote as may be required by the New TopCo Proposed Certificate of Incorporation.

Advisory Organizational Documents Proposal 2.B (“Advisory Organizational Documents Proposal 2.B”)

RESOLVED, that, on an advisory basis, the proposed amended and restated bylaws of Ferguson Enterprises Inc. (“New TopCo”), once adopted, may be amended, altered or repealed from time to time by the board of directors of New TopCo without seeking any approval by the New TopCo stockholders, in accordance with the Delaware General Corporation Law, as in effect from time to time.

Advisory Organizational Documents Proposal 2.C (“Advisory Organizational Documents Proposal 2.C”)

RESOLVED, that, on an advisory basis, provisions in the proposed amended and restated bylaws of Ferguson Enterprises Inc. (“New TopCo”) and the proposed amended and restated certificate of incorporation of New TopCo that provide that all vacancies on the New TopCo board of directors be filled solely and exclusively by the affirmative vote of a majority of the remaining directors then in office, and not by the stockholders, be, and hereby are, authorized.

Advisory Organizational Documents Proposal 2.D (“Advisory Organizational Documents Proposal 2.D”)

RESOLVED, that, on an advisory basis, provisions in the proposed amended and restated bylaws of Ferguson Enterprises Inc. (“New TopCo”) relating to the right of New TopCo stockholders to request a special meeting of New TopCo stockholders be, and are hereby, authorized.

Advisory Organizational Documents Proposal 2.E (“Advisory Organizational Documents Proposal 2.E”)

Table of Contents

RESOLVED, that, on an advisory basis, the provisions in the proposed amended and restated certificate of incorporation of Ferguson Enterprises Inc. (“New TopCo”) limiting personal liability for New TopCo directors and certain officers for monetary damages for breach of fiduciary duty as a director or as an officer to the fullest extent permitted under the Delaware General Corporation Law, as in effect from time to time, be, and are hereby, authorized.

Advisory Organizational Documents Proposal 2.F (“Advisory Organizational Documents Proposal 2.F”)

RESOLVED, that, on an advisory basis, the exclusive forum provisions in the proposed amended and restated certificate of incorporation of Ferguson Enterprises Inc. be, and are hereby, authorized.

Advisory Organizational Documents Proposal 2.G (“Advisory Organizational Documents Proposal 2.G”)

RESOLVED, that, on an advisory basis, the board of directors (the “New TopCo Board”) of Ferguson Enterprises Inc. (“New TopCo”) be, and is hereby, authorized to issue up to 100,000 shares of preferred stock of New TopCo, par value $0.0001 per share, in one or more series, with such terms and conditions and at such future dates as may be expressly determined by the New TopCo Board and as may be permitted by the Delaware General Corporation Law, as in effect from time to time.

Advisory Organizational Documents Proposal 2.H (“Advisory Organizational Documents Proposal 2.H” and together with Advisory Organizational Documents Proposal 2.A through 2.G, the “Advisory Organizational Documents Proposals”)

RESOLVED, that, on an advisory basis, the board of directors of Ferguson Enterprises Inc. (“New TopCo”) be, and is hereby, authorized to issue new shares of common stock, par value $0.0001 per share, of New TopCo in the future without offering pre-emptive rights.

Ferguson has specified that only those shareholders entered on the register of members of Ferguson on April [●], 2024 (the “Record Date”) are entitled to attend or vote at the Special Meeting (or, if the Special Meeting is adjourned, on the register of members of Ferguson not less than 10 days nor more than 60 days before the time of the adjourned meeting). If you are a Ferguson U.K. DI Holder, you will not be entitled to vote directly at the Special Meeting. Instead, you will be asked to provide voting instructions to the depositary of the U.K. DIs, Computershare Investor Services PLC (the “Depositary”). If you held a U.K. DI as of 6:00 p.m. U.K. Time on [May 23], 2024 (or, if the Special Meeting is adjourned, on such other date as is communicated to U.K. DI Holders), you are entitled to provide voting instructions to the Depositary in respect of the number of U.K. DIs registered in your name at that time. If you are a beneficial owner, please check with your broker, bank, or other nominee, as applicable, and carefully follow the voting procedures provided to you.

The accompanying materials and proxy card are being provided to Ferguson Shareholders in connection with the solicitation of proxies to be voted at the Special Meeting and at any adjournment of the Special Meeting. Whether or not you plan to attend the Special Meeting, all Ferguson Shareholders are urged to read these materials carefully and in their entirety, including the annexes attached thereto and the documents referred to therein, for a more complete description of the proposed Merger and related transactions and each of the Proposals. You should also carefully consider the risk factors described in the “Risk Factors” section beginning on page 7 of the proxy statement/prospectus, and the differences between Ferguson’s Memorandum and Articles of Association, as currently in effect, and New TopCo’s proposed certificate of incorporation and bylaws further described in the “Comparison of Corporate Governance and Shareholder Rights” section beginning on page 108 of the proxy statement/prospectus.

After careful consideration, the Ferguson Board has unanimously approved the Merger and recommends that Ferguson Shareholders vote “FOR” the Merger Proposal and “FOR” each of the Advisory Organizational Documents Proposals presented to Ferguson Shareholders in this Notice of Meeting and the accompanying materials.

The Merger Proposal is proposed as a special resolution, which means that for this resolution to be passed, at least two-thirds (662/3%) of the total number of votes cast at the Special Meeting must be cast in favor of this resolution. The Advisory Organizational Documents Proposals are proposed as ordinary resolutions, which means that for each of those resolutions to be passed more than half of the votes cast must be cast in favor of such resolution.

The consummation of the Merger is conditioned on the approval of the Merger Proposal. The approval of the Merger Proposal is not conditioned upon the approval of any other Proposal set forth in this Notice of Meeting and the accompanying materials. With respect to the Advisory Organizational Documents Proposals, although Ferguson is seeking a shareholder vote on such Proposals, a vote for each such Proposal is an advisory vote only, is not binding on Ferguson or the Ferguson Board, and approval of such Proposals is also not a condition to the closing of the Merger. However, Ferguson values the opinions expressed by shareholders and will consider the outcome of the vote on the Advisory Organizational Documents Proposals when making future decisions relating to the corporate governance practices of New TopCo.

Your vote is very important. Whether or not you plan to attend the Special Meeting, please vote as soon as possible by following the instructions in the accompanying materials to make sure that your Ferguson Shares are represented at

Table of Contents

the Special Meeting. If you are a Ferguson U.K. DI Holder, you will need to provide voting instructions to the Depositary. The transactions contemplated by the Merger Agreement will be consummated only if the Merger Proposal is approved at the Special Meeting.

All resolutions at the Special Meeting will be decided by a poll. We believe that this is a more transparent and equitable method of voting, as shareholder votes are counted according to the number of shares held, ensuring an exact and definitive result.

If you have any questions or need assistance voting your Ferguson Shares, please contact Morrow Sodali LLC, Ferguson’s proxy solicitor, by calling 800-662-5200 or banks and brokers can call collect at 203-658-9400, or by emailing ferg.info@investor.morrowsodali.com.

Thank you for your participation. Ferguson looks forward to your continued support.

| By Order of the Ferguson Board, |

|

|

| Katherine McCormick |

| Company Secretary |

| , 2024 |

Table of Contents

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The Securities and Exchange Commission (“SEC”) allows us to “incorporate by reference” information that Ferguson files with it, which means that we can disclose important information to you by referring you to those documents. The information incorporated by reference is an important part of this proxy statement/prospectus. References to “contained” or “included in” or similar words with respect this proxy statement/prospectus shall include the information incorporated by reference. Information in this proxy statement/prospectus supersedes information incorporated by reference that Ferguson filed with the SEC prior to the date of this proxy statement/prospectus, while information that Ferguson files later with the SEC will automatically update and supersede the information in this proxy statement/prospectus. We also incorporate by reference into this proxy statement/prospectus the documents listed below and any future filings made by Ferguson with the SEC (other than Current Reports or portions thereof furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits filed on such form that are related to such items and other portions of documents that are furnished, but not filed, pursuant to applicable rules promulgated by the SEC) that are filed by Ferguson with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the U.S. Securities Exchange Act, after the filing of this proxy statement/prospectus but prior to the date of the Special Meeting:

| • | Ferguson’s Annual Report on Form 10-K for the fiscal year ended July 31, 2023, filed with the SEC on September 26, 2023 (except for Item 8 and Item 9A); |

| • | Ferguson’s Quarterly Report on Form 10-Q for the quarter ended October 31, 2023, filed with the SEC on December 6, 2023; |

| • | Ferguson’s Definitive Proxy Statement on Schedule 14A, filed on October 17, 2023; and |

| • | Ferguson’s Current Reports on Form 8-K (other than information furnished rather than filed) filed with the SEC on November 29, 2023, December 4, 2023, January 12, 2024, January 18, 2024, and March 1, 2024. |

We will provide to each person, including any beneficial owner, to whom a proxy statement/prospectus is delivered, without charge upon written or oral request, a copy of any or all of the documents that are incorporated by reference into this proxy statement/prospectus but not delivered with the proxy statement/prospectus, including exhibits which are specifically incorporated by reference into such documents. You should direct any requests for documents to Ferguson’s Company Secretary in writing by mail at 1020 Eskdale Road, Winnersh Triangle, Wokingham, Berkshire, RG41 5TS, United Kingdom; by email at investor@ferguson.com; or by telephone at +44 (0) 118 927 3800. To obtain timely delivery of these materials, you must request the information no later than [May 22], 2024, which is five business days before the Special Meeting.

Any statement contained herein or in a document incorporated or deemed to be incorporated by reference into this proxy statement/prospectus will be deemed to be modified or superseded for purposes of the document to the extent that a statement contained in this proxy statement/prospectus or any other subsequently filed document that is deemed to be incorporated by reference into this proxy statement/prospectus modifies or supersedes the statement.

Table of Contents

Unless otherwise specified or the context otherwise requires, the terms “we,” “us,” “our,” the “Company,” “Ferguson” and other similar terms refer to Ferguson plc and its consolidated subsidiaries prior to the Effective Time and to Ferguson Enterprises Inc. and its consolidated subsidiaries after the Effective Time. In addition, as used in this proxy statement/prospectus, unless otherwise noted or the context otherwise requires, references to:

“Advisory Organizational Documents Proposal 2.A” are to the proposal, on an advisory basis, to authorize provisions in the New TopCo Proposed Certificate of Incorporation and New TopCo Proposed Bylaws under which, (i) the New TopCo Proposed Certificate of Incorporation, once adopted, may be amended, altered or repealed in the manner prescribed by the DGCL and (ii) the New TopCo Proposed Bylaws, once adopted, may be amended, altered or repealed from time to time by the stockholders of New TopCo by the affirmative vote of holders of a majority of the voting power of the then outstanding shares of New TopCo entitled to vote thereon, and such additional vote as may be required by the New TopCo Proposed Certificate of Incorporation;

“Advisory Organizational Documents Proposal 2.B” are to the proposal, on an advisory basis, to authorize provisions in the New TopCo Proposed Bylaws that provide that the New TopCo Proposed Bylaws, once adopted, may be amended, altered or repealed from time to time by the New TopCo Board without seeking any approval by the New TopCo stockholders, in accordance with the DGCL;

“Advisory Organizational Documents Proposal 2.C” are to the proposal, on an advisory basis, to authorize provisions in the New TopCo Proposed Certificate of Incorporation and the New TopCo Proposed Bylaws that provide that all vacancies on the New TopCo Board will be filled solely and exclusively by the affirmative vote of a majority of the remaining directors then in office, and not by the stockholders;

“Advisory Organizational Documents Proposal 2.D” are to the proposal, on an advisory basis, to authorize provisions in the New TopCo Proposed Bylaws relating to the right of New TopCo stockholders to request a special meeting of New TopCo stockholders;

“Advisory Organizational Documents Proposal 2.E” are to the proposal, on an advisory basis, to authorize provisions in the New TopCo Proposed Certificate of Incorporation limiting personal liability of New TopCo directors and certain officers for monetary damages for breach of fiduciary duty as a director or as an officer to the fullest extent permitted under the DGCL;

“Advisory Organizational Documents Proposal 2.F” are to the proposal, on an advisory basis, to authorize the exclusive forum provisions in the New TopCo Proposed Certificate of Incorporation;

“Advisory Organizational Documents Proposal 2.G” are to the proposal, on an advisory basis, to authorize New TopCo Board to issue up to 100,000 shares of New TopCo Preferred Stock in one or more series, with such terms and conditions and at such future dates as may be expressly determined by the New TopCo Board and as may be permitted by the DGCL;

“Advisory Organizational Documents Proposal 2.H” are to the proposal, on an advisory basis, to authorize the New TopCo Board to issue new shares of New TopCo Common Stock in the future without offering pre-emptive rights;

“Advisory Organizational Documents Proposals” are to Advisory Organizational Documents Proposals 2.A though 2.H, collectively;

“Assumed Ferguson Employee Share Plans” are to the Ferguson plc 2023 Omnibus Equity Incentive Plan, the Ferguson Group Employee Share Purchase Plan 2021, the Ferguson Group International Sharesave Plan 2019, the Ferguson Group Performance Ordinary Share Plan 2019, the Ferguson Group Ordinary Share Plan 2019 and the Ferguson Group Long Term Incentive Plan 2019;

“Audited Consolidated Financial Statements” are to the audited consolidated balance sheets of Ferguson plc and its subsidiaries as of July 31, 2023 and July 31, 2022 and to the related consolidated statements of earnings, comprehensive income, shareholders’ equity and cash flows for each of the three years in the period ended July 31, 2023, including the notes and all related compilations, reviews and other reports issued by Ferguson’s accountants with respect thereto;

“CAD” are to Canadian dollars;

“City Code” are to the City Code on Takeovers and Mergers, issued and administered by the Takeover Panel;

“Computershare” are to Computershare Trust Company N.A., the transfer agent of Ferguson;

“Consolidated Financial Statements” are to the Audited Consolidated Financial Statements and the Unaudited Interim Condensed Consolidated Financial Statements, together;

“Court of Chancery” are to the Court of Chancery of the State of Delaware;

i

Table of Contents

“CREST” are to the system for the paperless settlement of trades in securities and the holding of uncertificated securities operated by Euroclear in accordance with the Relevant System of which Euroclear is the “Operator” (as such term is defined in the CREST Regulations);

“CREST Regulations” are to the Uncertificated Securities Regulations 2001 (SI 2001 No. 3755), as amended from time to time;

“Depositary” are to Computershare Investor Services PLC, the issuer of the U.K. DIs;

“DGCL” are to the Delaware General Corporation Law, as in effect from time to time;

“DTR” are to the Disclosure Guidance and Transparency Rules produced by the FCA and forming part of the FCA Handbook;

“Effective Time” are to 12:01 a.m. Eastern Time (5:01 a.m. U.K. Time) on August 1, 2024;

“ESPP” are to the Ferguson Group Employee Share Purchase Plan 2021;

“FCA” are to the Financial Conduct Authority;

“Ferguson Articles” are to Ferguson plc’s Articles of Association, as currently in effect;

“Ferguson Board” are to the board of directors of Ferguson plc;

“Ferguson Employee Share Plans” are to the Omnibus Plan, the LTIP, the POSP, the OSP and the ESPP, together;

“Ferguson Governing Documents” are to Ferguson plc’s Memorandum and Articles of Association, as currently in effect;

“Ferguson Shareholders” are to the holders of Ferguson Shares;

“Ferguson Shares” are to the ordinary shares, par value 10 pence per share, of Ferguson plc;

“GBP” or “£” are to U.K. pounds sterling;

“Jersey” are to the Bailiwick of Jersey;

“Jersey Companies Law” are to Companies (Jersey) Law 1991, as amended, modified, or re-enacted from time to time;

“LSE” are to the London Stock Exchange;

“LTIP” are to the Ferguson Group Long Term Incentive Plan 2019;

“Merger” are to the merger of Ferguson plc and Merger Sub under Part 18B (Mergers) of the Jersey Companies Law, with Ferguson plc surviving the merger and becoming a direct, wholly owned subsidiary of New TopCo and Merger Sub ceasing to exist, pursuant to the terms and subject to the conditions provided in the Merger Agreement;

“Merger Agreement” are to the Merger Agreement, dated as of February 29, 2024, by and among New TopCo, Merger Sub and Ferguson plc (as it may be amended from time to time), a copy of which is attached to this proxy statement/prospectus as Annex A;

“Merger Proposal” are to the proposal to approve the Merger Agreement, pursuant to which, among other things, Merger Sub will merge with and into Ferguson plc in accordance with Part 18B (Mergers) of the Jersey Companies Law, with Ferguson plc surviving the Merger as a direct, wholly owned subsidiary of New TopCo and Merger Sub ceasing to exist, on the terms of and subject to the conditions of the Merger Agreement, as more fully described elsewhere in this proxy statement/prospectus;

“Merger Record Time” are to 6:00 p.m. Eastern Time on July 31, 2024;

“Merger Sub” are to Ferguson (Jersey) 2 Limited, a newly formed Jersey incorporated private limited company and direct, wholly owned subsidiary of New TopCo;

“Morrow Sodali” are to Morrow Sodali LLC, Ferguson’s proxy solicitor for the Special Meeting;

“NED Plan” are to the Ferguson Non-Employee Director Incentive Plan 2022;

“New TopCo” are to Ferguson Enterprises Inc., a Delaware corporation;

“New TopCo Board” are to the board of directors of New TopCo;

“New TopCo Common Stock” are to the shares of common stock, par value $0.0001 per share, of New TopCo;

“New TopCo Preferred Stock” are to the shares of preferred stock, par value $0.0001 per share, of New TopCo;

ii

Table of Contents

“New TopCo Proposed Bylaws” are to the proposed amended and restated bylaws of New TopCo, substantially in the form attached hereto as Annex C, as amended from time to time;

“New TopCo Proposed Certificate of Incorporation” are to the proposed amended and restated certificate of incorporation of New TopCo, substantially in the form attached hereto as Annex B, as amended from time to time;

“New TopCo Proposed Organizational Documents” are to the New TopCo Proposed Certificate of Incorporation and the New TopCo Proposed Bylaws, together;

“New TopCo U.K. DIs” are to depositary interests issued through CREST by the Depositary representing a beneficial interest in New TopCo Common Stock;

“Non-Employee Directors” are, prior to the Effective Time, to the members of the Ferguson Board who are not employees of Ferguson and, after the Effective Time, to the members of the New TopCo Board who are not employees of New TopCo;

“NYSE” are to the New York Stock Exchange;

“Omnibus Plan” are to the Ferguson plc 2023 Omnibus Equity Incentive Plan;

“OSP” are to the Ferguson Group Ordinary Share Plan 2019;

“Overseas Shareholders” are to Ferguson Shareholders, other than those persons who are citizens, residents or nationals of Jersey, the United Kingdom and/or the United States;

“POSP” are to the Ferguson Group Performance Ordinary Share Plan 2019;

“Proposals” are to the Merger Proposal and the Advisory Organizational Documents Proposals, collectively or as a subset thereof, as applicable;

“Record Date” are to April [●], 2024, which is the date Ferguson plc has specified as the date on which only those shareholders entered on the register of members of Ferguson plc on such date are entitled to attend or vote at the Special Meeting (or, if the Special Meeting is adjourned, on the register of members of Ferguson plc not less than 10 days nor more than 60 days before the time of the adjourned meeting);

“Relevant System” are to any computer-based system, and procedures, which enable title to units of a share or security to be evidenced and transferred without a written instrument, and which facilitate supplementary and incidental matters in accordance with the CREST Regulations;

“Royal Court” are to the Royal Court of Jersey;

“Sarbanes-Oxley Act” are to the Sarbanes-Oxley Act of 2002;

“SEC” are to the U.S. Securities and Exchange Commission;

“Special Meeting” are to the extraordinary general meeting of Ferguson plc that will be held at [10:00 a.m.] Eastern Time ([3:00 p.m.] U.K. Time), on [May 30], 2024, at the offices of Freshfields Bruckhaus Deringer LLP, located at 100 Bishopsgate, London, EC2P 2SR, United Kingdom;

“Takeover Panel” are to the Panel on Takeovers and Mergers of the U.K;

“U.K.” are to the United Kingdom of Great Britain and Northern Ireland;

“U.K. DIs” are to depositary interests issued through CREST by the Depositary representing a beneficial interest in a Ferguson Share;

“U.K. Listing Rules” are to the U.K. Listing Rules in force from time to time, as published by the FCA;

“Unaudited Interim Condensed Consolidated Financial Statements” are to the unaudited condensed consolidated balance sheet of Ferguson plc and its subsidiaries as of October 31, 2023 and to the related condensed consolidated statements of earnings, comprehensive income, shareholders’ equity and cash flows for the three-month period ended October 31, 2023 and the three-month period ended October 31, 2022, including the notes thereto;”

“U.S.” are to the United States of America;

“USD” or “$” are to United States dollars;

“U.S. GAAP” are to accounting principles generally accepted in the U.S.;

“U.S. Securities Act” are to the Securities Act of 1933, as amended; and

“U.S. Securities Exchange Act” are to the Securities Exchange Act of 1934, as amended.

iii

Table of Contents

All trademarks, trade names and service marks appearing in this proxy statement/prospectus are the property of their respective owners. Solely for convenience, the trademarks and trade names in this proxy statement/prospectus are referred to without the symbols ® and ™, but such references should not be construed as any indication that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto. We do not intend to use or display other companies’ trademarks or trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

The information contained in this proxy statement/prospectus or incorporated by reference herein that has been sourced from third parties has been accurately reproduced and, as far as we are aware and able to ascertain from the information published by that third party, no facts have been omitted that would render the reproduced information inaccurate or misleading. Industry publications generally state that their information is obtained from sources they believe reliable but that the accuracy and completeness of such information is not guaranteed and that the projections they contain are based on a number of significant assumptions. We are not aware of any exhaustive industry or market reports that cover or address our specific markets.

iv

Table of Contents

FORWARD-LOOKING STATEMENTS AND RISK FACTORS SUMMARY

Certain information included in this proxy statement/prospectus is forward-looking, including within the meaning of the Private Securities Litigation Reform Act of 1995, and involves risks, assumptions and uncertainties that could cause actual results to differ materially from those expressed or implied by forward-looking statements. Forward-looking statements cover all matters which are not historical facts and include, without limitation, statements or guidance regarding or relating to the Merger, the benefits of the Merger, our ability to manage the risks relating to the Merger, our future financial position, results of operations and growth, projected interest in and ownership of our ordinary shares by investors including as a result of inclusion in North American market indices, plans and objectives for the future including our capabilities and priorities, risks associated with changes in global and regional economic, market and political conditions, ability to manage supply chain challenges, ability to manage the impact of product price fluctuations, our financial condition and liquidity, legal or regulatory changes, and other statements concerning the success of our business and strategies.

Forward-looking statements can be identified by the use of forward-looking terminology, including terms such as “believes,” “estimates,” “anticipates,” “expects,” “forecasts,” “intends,” “continues,” “plans,” “projects,” “goal,” “target,” “aim,” “may,” “will,” “would,” “could” or “should” or, in each case, their negative or other variations or comparable terminology and other similar references to future periods. Forward-looking statements speak only as of the date on which they are made. They are not assurances of future performance and are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Therefore, you should not place undue reliance on any of these forward-looking statements. Although we believe that the forward-looking statements contained in this proxy statement/prospectus are based on reasonable assumptions, you should be aware that many factors could cause actual results to differ materially from those in such forward-looking statements, including but not limited to:

| • | a delay or our inability to consummate the Merger due to, among other things, the failure to obtain approval by the requisite vote of Ferguson Shareholders at the Special Meeting; |

| • | unexpected costs relating to the Merger and other business uncertainties; |

| • | the outcome of any legal proceedings that may be instituted against us following announcement of the Merger and related transactions; |

| • | the risk that the Merger disrupts current plans and operations; |

| • | the risk that Ferguson’s effective tax rate may increase in the future, including as a result of the Merger; |

| • | the risk that Ferguson Shareholders may recognize taxable gain or other income with respect to their Ferguson Shares at the Effective Time; |

| • | unanticipated adverse tax consequences to Ferguson, New TopCo and/or our shareholders in connection with the Merger; |

| • | our ability to adapt to operating under the laws of the State of Delaware and changes in shareholder rights as a result of the Merger; |

| • | weakness in the economy, market trends, uncertainty and other conditions in the markets in which we operate, and other factors beyond our control, including disruption in the financial markets and any macroeconomic or other consequences of political unrest, disputes or war; |

| • | failure to rapidly identify or effectively respond to direct and/or end customers’ wants, expectations or trends, including costs and potential problems associated with new or upgraded information technology systems or our ability to timely deploy new omni-channel capabilities; |

| • | decreased demand for our products as a result of operating in highly competitive industries and the impact of declines in the residential and non-residential markets, as well as the repair, maintenance and improvement (“RMI”) and new construction markets; |

| • | changes in competition, including as a result of market consolidation or competitors responding more quickly to emerging technologies (such as generative artificial intelligence (“AI”)); |

| • | failure of a key information technology system or process as well as exposure to fraud or theft resulting from payment-related risks; |

| • | privacy and protection of sensitive data failures, including failures due to data corruption, cybersecurity incidents or network security breaches; |

v

Table of Contents

| • | ineffectiveness of or disruption in our domestic or international supply chain or our fulfillment network, including delays in inventory availability at our distribution facilities and branches, increased delivery costs or lack of availability; |

| • | failure to effectively manage and protect our facilities and inventory or to prevent personal injury to customers, suppliers or associates, including as a result of workplace violence; |

| • | unsuccessful execution of our operational strategies; |

| • | failure to attract, retain and motivate key associates; exposure of associates, contractors, customers, suppliers and other individuals to health and safety risks; |

| • | inherent risks associated with acquisitions, partnerships, joint ventures and other business combinations, dispositions or strategic transactions; |

| • | regulatory, product liability and reputational risks and the failure to achieve and maintain a high level of product and service quality; |

| • | inability to renew leases on favorable terms or at all, as well as any remaining obligations under a lease when we close a facility; |

| • | changes in, interpretations of, or compliance with tax laws may adversely affect us or our shareholders; |

| • | our indebtedness and changes in our credit ratings and outlook; |

| • | fluctuations in product prices (e.g., commodity-priced materials, inflation/deflation) and foreign currency; |

| • | funding risks related to our defined benefit pension plans; |

| • | legal proceedings as well as failure to comply with domestic and foreign laws, regulations and standards, as those laws, regulations and standards or interpretations and enforcement thereof may change, or the occurrence of unforeseen developments such as litigation; |

| • | our failure to comply with the obligations associated with being a U.S. domestic issuer and the costs associated therewith; |

| • | the costs and risk exposure relating to environmental, social and governance (“ESG”) matters, including sustainability issues, regulatory or legal requirements, and disparate stakeholder expectations; |

| • | adverse impacts caused by a public health crisis; and |

| • | other risks and uncertainties set forth in this proxy statement/prospectus, including under the heading “Risk Factors” in this proxy statement/prospectus and in other filings we make with the SEC in the future. |

Additionally, forward-looking statements regarding past trends or activities should not be taken as a representation that such trends or activities will continue in the future. Other than in accordance with our legal or regulatory obligations, we undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

vi

Table of Contents

The following questions and answers below highlight only selected information from this proxy statement/prospectus and only briefly address some commonly asked questions about the Proposals to be presented at the Special Meeting, including with respect to the Merger. The following questions and answers may not include all the information that is important to Ferguson Shareholders. Ferguson Shareholders are urged to read this proxy statement/prospectus carefully and in its entirety, including the annexes attached hereto and the documents referred to herein, to fully understand the Merger and the voting procedures for the Special Meeting.

QUESTIONS AND ANSWERS ABOUT THE MERGER

| Q: | WHAT IS THE MERGER? |

| A: | The Ferguson Board believes that it is in your and Ferguson’s best interest for the ultimate parent company of Ferguson plc and its subsidiaries to be a corporation incorporated under the laws of the State of Delaware, which will be effected through the Merger. At the Effective Time, on the terms of and subject to the conditions set forth in the Merger Agreement, Merger Sub will merge with and into Ferguson plc, with Merger Sub ceasing to exist and Ferguson plc continuing as the surviving entity (the “Surviving Entity”). The Surviving Entity will change its name to “Ferguson (Jersey) Limited,” will change its status to a private company, and will be a direct, wholly owned subsidiary of New TopCo. Following completion of the transactions contemplated by the Merger Agreement, New TopCo will be Ferguson plc’s parent company and the New TopCo Common Stock is expected to be listed on the NYSE and the LSE under the symbol “FERG.” If the transactions contemplated by the Merger Agreement are consummated, you will become a stockholder of New TopCo pursuant to the terms and conditions discussed in greater detail in this proxy statement/prospectus. |

Please read the section “Comparison of Corporate Governance and Shareholder Rights” for a description of the material differences between the Ferguson Governing Documents and the New TopCo Proposed Organizational Documents.

| Q: | WHO IS NEW TOPCO? |

| A: | Ferguson Enterprises Inc., which we refer to as New TopCo, is a corporation newly incorporated under the laws of Delaware. If the Merger is completed, New TopCo will become the ultimate parent company of Ferguson plc and its subsidiaries. At the Effective Time, all Ferguson Shareholders will be issued an identical number of shares of New TopCo Common Stock as the number of Ferguson Shares they held immediately preceding the Merger Record Time. |

| Q: | WHO IS MERGER SUB? |

| A: | Ferguson (Jersey) 2 Limited, which we refer to as Merger Sub, is a newly formed Jersey incorporated private limited company and direct, wholly owned subsidiary of New TopCo. Prior to the Merger, Merger Sub will have no property, assets, liabilities or operations, other than those incident to its formation. At the Effective Time, Merger Sub will merge with and into Ferguson plc, with Ferguson plc surviving the Merger as a direct, wholly owned subsidiary of New TopCo and Merger Sub ceasing to exist, on the terms of and subject to the conditions set forth in the Merger Agreement. |

| Q: | WHAT WILL HAPPEN TO THE FERGUSON SHARES AND U.K. DIS UPON THE CONSUMMATION OF THE MERGER? |

| A: | On the terms of, subject to the conditions of and/or in connection with the Merger Agreement, at the Effective Time, (i) each Ferguson Share that is issued and outstanding at the Merger Record Time will automatically be cancelled without any repayment of capital and New TopCo will issue as consideration therefor new, duly authorized, validly issued, fully paid and non-assessable shares of New TopCo Common Stock to each Ferguson Shareholder on a one-for-one basis for each Ferguson Share held by such Ferguson Shareholder immediately preceding the Merger Record Time, and (ii) each U.K. DI representing an issued and outstanding Ferguson Share at the Merger Record Time will be cancelled and a New TopCo U.K. DI representing one share of New TopCo Common Stock will be issued through CREST by the Depositary as consideration therefor to each holder of U.K. DIs on a one-for-one basis for each U.K. DI held by such holder immediately preceding the Merger Record Time. All Ferguson Shares held in treasury will be cancelled as a result of the Merger. |

The New TopCo U.K. DIs will be created and issued under the terms of a deed poll made by the Depositary constituting the New TopCo U.K. DIs (the “New TopCo U.K. DI Deed”), which will govern the relationship between the Depositary and the holders of the New TopCo U.K. DIs. The New TopCo U.K. DI Deed is available on request from the Depositary. Holders of U.K. DIs should consult with the Depositary regarding any arrangements to be made to ensure timely payment of dividends to their accounts following consummation of the Merger.

vii

Table of Contents

| Q: | WILL THE NEW TOPCO COMMON STOCK ISSUED UNDER THE MERGER BE LISTED ON AN EXCHANGE? |

| A: | Yes. The New TopCo Common Stock is expected to be listed on the NYSE and the LSE under the trading symbol “FERG.” The Ferguson Shares currently trade on the NYSE and the LSE under the trading symbol “FERG.” When the Merger is completed, the Ferguson Shares currently listed on the NYSE and the LSE under the trading symbol “FERG” will cease to be traded on the NYSE and the LSE, and will be deregistered under the U.S. Securities Exchange Act. |

| Q: | HOW DO I RECEIVE SHARES OF NEW TOPCO COMMON STOCK? |

| A: | Beneficial holders of shares held in “street name” through a bank, broker or other nominee and record owners of shares held in book-entry form will not be required to take any action. Your ownership of shares of New TopCo Common Stock will be recorded in book-entry form by your nominee (for shares held in “street name”) or directly on the New TopCo share register to be maintained by Computershare (for shares held by record owners in book-entry form), without the need for any additional action on your part. Holders of shares in book-entry form will receive a statement of their holdings in New TopCo after the Merger. Holders of Ferguson Shares represented in the form of U.K. DIs will not be required to take any action, with New TopCo U.K. DIs being automatically credited to their CREST participant accounts. To the extent possible, all holder account numbers, email addresses, bank account details and shareholder elections recorded by Computershare will remain valid and applied to the share register of New TopCo. |

| Q. | WILL THE MERGER DILUTE MY ECONOMIC INTEREST? |

| A: | No, your fully diluted relative economic ownership will not change as a result of the Merger. At the Effective Time, your Ferguson Shares will be automatically cancelled and New TopCo will issue to you as consideration therefor new, duly authorized, validly issued, fully paid and non-assessable shares of New TopCo Common Stock on a one-for-one basis for each Ferguson Share you hold immediately preceding the Merger Record Time. Following the Effective Time, all Ferguson Shareholders will hold an identical number of shares of New TopCo Common Stock as the number of Ferguson Shares they held prior to the Merger. New TopCo will be the direct or indirect owner of all the assets and liabilities of Ferguson following the Merger. |

| Q. | IS THERE ANY RESTRICTION ON SELLING FERGUSON SHARES PRIOR TO COMPLETION OF THE MERGER? |

| A: | No. Ferguson Shares will continue to trade on the NYSE and the LSE up to and including the Effective Time. Following the Effective Time, the New TopCo Common Stock is expected to be listed on the NYSE and the LSE. Generally speaking, holders of Ferguson Shares may sell their shares for cash at any time up to and including the Effective Time. |

| Q. | HOW WILL THE MERGER AFFECT THE PUBLIC DISCLOSURE FERGUSON PROVIDES TO ITS SHAREHOLDERS? |

| A: | Upon completion of the Merger, New TopCo will be subject to the same reporting requirements of the SEC, the mandates of the Sarbanes-Oxley Act of 2002 and the applicable corporate governance rules of the NYSE as Ferguson plc before the Merger. New TopCo will be required to file periodic reports with the SEC on Forms 10-K, 10-Q and 8-K and comply with the proxy rules applicable to U.S. domestic issuers. In addition, as a company listed on the LSE, New TopCo will be subject to the same U.K. reporting and corporate governance requirements as Ferguson plc before the Merger, including, for example, certain requirements under the U.K. Listing Rules, the DTR and the U.K. Market Abuse Regulation. |

| Q. | WHAT HAPPENS TO OUTSTANDING FERGUSON COMPENSATION AND BENEFIT PLANS IN CONNECTION WITH THE MERGER? |

| A: | In connection with the Merger, New TopCo will assume or, as applicable, substitute with substantially similar entitlements, all compensation or benefit plans, policies and arrangements previously maintained by Ferguson plc. With respect to Ferguson plc’s equity incentive plans, New TopCo will assume the Assumed Ferguson Employee Share Plans and all outstanding incentive awards issued thereunder. Each outstanding Ferguson plc incentive award previously granted under the Assumed Ferguson Employee Share Plans will be converted to an equivalent New TopCo incentive award. The incentive awards granted by New TopCo as a result of such conversion will be subject to substantially the same terms and conditions as the previously held Ferguson plc incentive awards, except, in the case of equity-based Ferguson plc incentive awards, the security issuable upon exercise or settlement of the relevant New TopCo incentive award, as applicable, will be New TopCo Common Stock (or its cash equivalent) rather than Ferguson Shares (or their cash equivalent). |

viii

Table of Contents

| Q. | ARE THERE ANY CONDITIONS TO COMPLETING THE MERGER? |

| A: | Yes. Under the Merger Agreement the Merger is conditioned upon: |

| • | Ferguson having given notice to all of its creditors (if any) in accordance with Article 127FC(1) of the Jersey Companies Law and having published the contents of such notice in accordance with Article 127FC(5) of the Jersey Companies Law, and each applicable date as set out in Article 127FJ(3) of the Jersey Companies Law having passed; |

| • | Merger Sub having given notice to all of its creditors (if any) in accordance with Article 127FC(1) of the Jersey Companies Law and having published the contents of such notice in accordance with Article 127FC(5) of the Jersey Companies Law, and each applicable date as set out in Article 127FJ(3) of the Jersey Companies Law having passed; |

| • | the date as set out in Article 127FJ(3)(a) of the Jersey Companies Law having passed (if applicable); |

| • | the delivery to the registrar of companies in Jersey of all documents required in accordance with Article 127FJ of the Jersey Companies Law for the purposes of effecting the Merger; |

| • | no order by any court or other tribunal of competent jurisdiction will have been entered and will continue to be in effect and no law will have been adopted or be effective, in each case that temporarily or permanently prohibits, enjoins or makes illegal the consummation of the Merger; |

| • | no suit, action or proceeding will have been brought by any governmental entity, and remain pending, that seeks an order that would prohibit, enjoin or make illegal the consummation of the Merger; |

| • | all material consents and authorizations of, filings or registrations with, and notices to, any governmental or regulatory authority required to consummate the Merger, have been obtained or made; |

| • | Ferguson Shareholders will have approved the Merger in accordance with Ferguson Governing Documents and the Jersey Companies Law, as further described in this proxy statement/prospectus; |

| • | Merger Sub will have approved the Merger in accordance with Merger Sub’s memorandum of association and articles of association and the Jersey Companies Law; |

| • | the filing and approval of a U.K. prospectus with respect to the New TopCo Common Stock by the FCA and such U.K. prospectus having been made available to the public in accordance with the Prospectus Regulation Rules of the FCA; and |

| • | the registration statement on Form S-4, to which this proxy statement/prospectus forms a part, with respect to the New TopCo Common Stock to be issued pursuant to the Merger will be effective, and there will be no stop order suspending such effectiveness. |

| Q: | WHEN DO YOU EXPECT THE MERGER TO BE COMPLETED? |

| A: | It is currently anticipated that the Merger will be consummated on August 1, 2024, subject to the approval of the Merger Proposal by the Ferguson Shareholders. However, we cannot assure you of when or if the Merger will be completed. It is possible that factors outside of the control of Ferguson could result in the Merger being completed at a different time or not at all. Ferguson must first obtain the approval of Ferguson Shareholders for the Merger Proposal, and Ferguson, Merger Sub and New TopCo must also satisfy other closing conditions. |

| Q: | WILL THE BUSINESS OF FERGUSON CHANGE FOLLOWING THE MERGER? |

| A: | No. New TopCo will continue to pursue Ferguson’s current strategic initiatives and business operations. |

| Q: | WILL THE NEW TOPCO COMMON STOCK HAVE THE SAME IDENTIFICATION NUMBERS AS THE FERGUSON SHARES? |

| A: | Following the Merger, the New TopCo Common Stock will have different identification numbers than the Ferguson Shares, which include Committee on Uniform Security Identification Procedures (“CUSIP”) and International Securities Identification Number (“ISIN”) identifiers. The New TopCo Common Stock will have the CUSIP number and ISIN . Additionally, New TopCo Common Stock will be registered on the LSE with ISIN and stock exchange daily official list (“SEDOL”) number . However, when admitted to trading on the NYSE and the LSE, the New TopCo Common Stock is still expected trade under the symbol “FERG.” |

ix

Table of Contents

| Q: | WILL THE DIVIDEND POLICY OF NEW TOPCO BE DIFFERENT FROM THE DIVIDEND POLICY FERGUSON PLC? |

| A: | No. Following the completion of the Merger, the New TopCo Board anticipates that cash dividends will be paid on a quarterly basis in amounts comparable to dividends paid by Ferguson plc in prior periods as permitted by the DGCL. There are expected to be no changes in Ferguson’s current dividend policy prior to the completion of the Merger. |

| Q: | WHO WILL BE THE DIRECTORS AND EXECUTIVE OFFICERS OF NEW TOPCO FOLLOWING THE MERGER? |

| A: | The persons who currently serve as the directors and executive officers of Ferguson plc (other than Ms. Sammie Long, who will retire from her position at Ferguson plc, effective July 31, 2024) are expected to serve as the directors and executive officers of New TopCo following the Merger, subject to the appointment, death, resignation or removal of any directors or executive officers on or prior to the Effective Time. See “Management of New TopCo” for additional information. |

| Q: | WHAT ARE THE MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES OF THE MERGER FOR SHAREHOLDERS? |

| A: | As discussed more fully under “Material U.S. Federal Income Tax Considerations,” it is intended that the Merger will constitute either a “reorganization” within the meaning of Section 368(a) of the U.S. Internal Revenue Code of 1986, as amended (the “Code”), or a tax-free transaction within the meaning of Section 351 of the Code, or both. Assuming the Merger so qualifies, U.S. Holders (as defined in “Material U.S. Federal Income Tax Considerations—U.S. Holders”) generally will not recognize gain or loss as a result of the Merger, which for U.S. federal income tax purposes would be treated as a deemed exchange of Ferguson Shares (including Ferguson Shares underlying U.K. DIs) for New TopCo Common Stock. A U.S. Holder’s aggregate tax basis in New TopCo Common Stock received pursuant to the Merger will equal the U.S. Holder’s aggregate tax basis in the Ferguson Shares (including Ferguson Shares underlying U.K. DIs) exchanged therefor. |

Non-U.S. Holders (as defined in “Material U.S. Federal Income Tax Considerations—Non-U.S. Holders”) generally will not be subject to U.S. federal income tax on any gain realized on the exchange of Ferguson Shares (including Ferguson Shares underlying U.K. DIs) and the issuance of New TopCo Common Stock in the Merger. A Non-U.S. Holder generally will not recognize any loss realized on the exchange of Ferguson Shares (including Ferguson Shares underlying U.K. DIs) and the issuance of New TopCo Common Stock in the Merger for U.S. federal income tax purposes.

Additionally, the Merger may cause Non-U.S. Holders to become subject to U.S. federal income withholding taxes on any amounts treated as dividends paid in respect of such Non-U.S. Holder’s New TopCo Common Stock after the Merger. In general, any distributions made to a Non-U.S. Holder with respect to New TopCo Common Stock, to the extent paid out of New TopCo’s current or accumulated earnings and profits (as determined under U.S. federal income tax principles), will constitute dividends for U.S. federal income tax purposes and, provided such dividends are not effectively connected with such Non-U.S. Holder’s conduct of a trade or business within the U.S. (and, if required by an applicable income tax treaty, attributable to a U.S. permanent establishment or fixed base maintained by such Non-U.S. Holder), will be subject to withholding tax from the gross amount of the dividend at a rate of 30%, unless such Non-U.S. Holder is eligible for a reduced rate of withholding tax under an applicable income tax treaty and provides proper certification of its eligibility for such reduced rate (usually on an IRS Form W-8BEN or W-8BEN-E, as applicable). Dividends paid by New TopCo to a Non-U.S. Holder that are effectively connected with such Non-U.S. Holder’s conduct of a trade or business within the U.S. (and, if required by an applicable income tax treaty, attributable to a U.S. permanent establishment or fixed base maintained by such Non-U.S. Holder) will generally not be subject to U.S. federal withholding tax, provided such Non-U.S. Holder complies with certain certification and disclosure requirements (usually by providing an IRS Form W-8ECI). Instead, such dividends will generally be subject to U.S. federal income tax, net of certain deductions, at the same graduated individual or corporate rates applicable to U.S. Holders. If the Non-U.S. Holder is a corporation, dividends that are effectively connected income may also be subject to a “branch profits tax” at a rate of 30% (or such lower rate as may be specified by an applicable income tax treaty).

The tax consequences of the Merger are complex and will depend on a holder’s particular circumstances. All holders should consult their tax advisors regarding the tax consequences to them of the Merger, including the applicability and effect of U.S. federal, state, local and non-U.S. tax laws. For a more complete discussion of the material U.S. federal income tax considerations of the Merger, see “Material U.S. Federal Income Tax Considerations.”

x

Table of Contents

| Q: | WHAT ARE THE MATERIAL U.K. TAX CONSEQUENCES OF THE MERGER FOR SHAREHOLDERS? |

| A: | As discussed more fully under “Material U.K. Tax Considerations”, the Merger should not be treated as involving a distribution subject to U.K. tax as income, and the Merger should be treated as a reorganization of share capital for the purposes of U.K. taxation of chargeable gains (“U.K. CGT”). Accordingly, U.K. Holders (as defined in “Material U.K. Tax Considerations”) who receive New TopCo Common Stock should not be treated as making a disposal of all or part of their holding of Ferguson Shares and no liability to U.K. CGT should arise. Instead, the New TopCo Common Stock acquired and the Ferguson Shares which cease to exist should, for U.K. CGT purposes, be treated as the same asset and as having been acquired at the same time as the Ferguson Shares. |

The tax consequences of the Merger are complex and will depend on a holder’s particular circumstances. All holders should consult their tax advisors regarding the tax consequences to them of the Merger. For a more complete discussion of the material U.K. tax considerations of the Merger, see “Material U.K. Tax Considerations.”

| Q: | WHAT WILL HAPPEN TO FERGUSON IF, FOR ANY REASON, THE MERGER IS NOT COMPLETED? |

| A: | If for any reason the Merger is not completed, the ultimate parent company of the Ferguson group of companies would still be Ferguson plc, a public limited company in Jersey, and Ferguson Shares would continue to be listed on the NYSE and the LSE under the trading symbol “FERG,” subject to compliance with NYSE and LSE continued listing requirements. |

| Q: | WHERE CAN I FIND MORE INFORMATION ABOUT FERGUSON AND THE MERGER? |

| A: | You can find out more information about Ferguson, the Merger Agreement and the transactions contemplated thereby, including the Merger, by reading this proxy statement/prospectus and from various sources described in the section entitled “Where You Can Find More Information.” |

QUESTIONS AND ANSWERS ABOUT THE SPECIAL MEETING

| Q: | WHY AM I RECEIVING THIS PROXY STATEMENT/PROSPECTUS? |

| A: | You are receiving this proxy statement/prospectus and accompanying materials because you are a registered shareholder or beneficially own Ferguson Shares as of April [●], 2024 (the “Record Date”) and are entitled to vote at the Special Meeting. The Ferguson Board has made these materials available to you in connection with the Ferguson Board’s solicitation of proxies on behalf of Ferguson for use at the Special Meeting. |

The Merger cannot be completed unless Ferguson Shareholders approve the Merger Proposal set forth in this proxy statement/prospectus. With respect to the Advisory Organizational Documents Proposals, although Ferguson is seeking a shareholder vote on such Proposals, a vote for each such Proposal is an advisory vote only, is not binding on Ferguson or the Ferguson Board, and approval of such Proposals is also not a condition to the closing of the Merger. However, Ferguson values the opinions expressed by shareholders and will consider the outcome of the vote on the Advisory Organizational Documents Proposals when making future decisions relating to the corporate governance practices of New TopCo.

| Q: | WHEN AND WHERE IS THE SPECIAL MEETING? |

| A: | The Special Meeting will be held at [10:00 a.m.] Eastern Time ([3:00 p.m.] U.K. Time), on [May 30], 2024, at the offices of Freshfields Bruckhaus Deringer LLP, located at 100 Bishopsgate, London, EC2P 2SR, U.K. |

| Q: | WHO MAY ATTEND AND VOTE? |

| A: | Registered shareholders. Ferguson, pursuant to Article 186(b) of the Ferguson Articles, has specified that only those persons entered on the register of members of Ferguson as of the Record Date (or, if the Special Meeting is adjourned, on the register of members of Ferguson not less than 10 days nor more than 60 days before the time of the adjourned meeting) are entitled to attend and vote at the Special Meeting. Subsequent changes to the entries on the register of members of Ferguson plc after the Record Date will be disregarded in determining the rights of any person to attend or vote at the Special Meeting. In the case of joint holders of a share, the vote of the senior who tenders a vote, whether in person or by proxy, will be accepted to the exclusion of the votes of the other joint holders. Seniority is determined by the order in which the names of the holders stand in the register. Registered shareholders must present photographic identification to attend and vote at the Special Meeting. All joint shareholders may attend and speak. Any corporate entity which is a shareholder can appoint one or more representatives who may exercise all of its powers on its behalf. See “—Can a corporate shareholder appoint a representative to act on its behalf at the Special Meeting?” below for more information. |

xi

Table of Contents

Beneficial owners. If your shares are held in a stock brokerage account or by a broker, bank or other nominee, you are considered the beneficial owner of the shares, and this proxy statement/prospectus is being made available or forwarded to you by or on behalf of your broker, bank or other nominee. Only those beneficial owners holding shares as of the Record Date or, if the Special Meeting is adjourned, on such other date as is communicated to beneficial owners are entitled to vote on the resolutions in respect of such shares. As a beneficial owner, if you wish to attend or vote at the Special Meeting, you must obtain a legal proxy from your broker, bank or other nominee and present it, along with photographic identification, to Ferguson’s Company Secretary or other Ferguson representative, at the Special Meeting.