As filed with the Securities and Exchange Commission on December 15, 2023

File No. 000-[•]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10

GENERAL FORM FOR REGISTRATION OF SECURITIES

PURSUANT TO SECTION 12(b) OR 12(g) OF

THE SECURITIES EXCHANGE ACT OF 1934

Stirling Hotels & Resorts, Inc.

(Exact name of registrant as specified in its charter)

| Maryland | 93-3514045 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

| 14185 Dallas Parkway, Suite 1200, Dallas, TX | 75254 | |

| (Address of principal executive offices) | (Zip Code) |

| (972) 490-9600 | ||

| (Registrant’s telephone number including area code) |

With copies to:

Robert H. Bergdolt

Laura K. Sirianni

DLA Piper LLP (US)

4141 Parklake Avenue, Suite 300

Raleigh, North Carolina 27612-2350

(919) 786-2002

Securities to be registered pursuant to Section 12(b) of the Act:

| Title of each class to be so registered | Name of each exchange on which each class is to be registered | |

| None | None |

|

Securities to be registered pursuant to Section 12(g) of the Act:

|

| Class S Common Stock, $0.01 par value per share |

| (Title of class) |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |

| Non-accelerated filer | x | Smaller reporting company | x | |

| Emerging growth company | x |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

TABLE OF CONTENTS

cautionary note regarding Forward-looking statements

Certain statements contained in this Form 10 of Stirling Hotels & Resorts, Inc. (the “Company,” “we,” “our,” “us”) other than historical facts may be considered forward-looking statements. Such statements include, in particular, statements about our plans, strategies, and prospects and are subject to certain risks and uncertainties, as well as known and unknown risks, which could cause actual results to differ materially from those projected or anticipated. Therefore, such statements are not intended to be a guarantee of our performance in future periods. Such forward-looking statements can generally be identified by our use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “could,” “intend,” “anticipate,” “plan,” “estimate,” “believe,” “potential,” “continue,” or other similar words. Specifically, we consider, among others, statements concerning future operating results and cash flows, our ability to meet future obligations, and the amount and timing of any future distributions to stockholders to be forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date this report is filed with the Securities and Exchange Commission (“SEC”). We make no representations or warranties (express or implied) about the accuracy of any such forward-looking statements contained in this Form 10, and we do not intend to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

Any such forward-looking statements are subject to unknown risks, uncertainties, and other factors and are based on a number of assumptions involving judgments with respect to, among other things, future economic, competitive, and market conditions, all of which are difficult or impossible to predict accurately. To the extent that our assumptions differ from actual results, our ability to meet such forward-looking statements, including our ability to generate positive cash flow from operations, provide distributions to stockholders, and maintain the value of our real estate properties, may be significantly hindered.

The following are some of the risks and uncertainties, although not all risks and uncertainties, that could cause our actual results to differ materially from those presented in our forward-looking statements:

| · | We are a newly formed entity with a limited operating history, and there is no assurance that we will achieve our investment objectives. |

| · | We have made a limited number of investments to date, and you will not have the opportunity to evaluate our investments before we make them. |

| · | We invest primarily in stabilized, income-producing hotels and resorts across all chain scales located primarily in the U.S. A sector focused investment portfolio is inherently more risky than a portfolio with more diversified investments. As a result, our results of operations may be adversely affected by a downturn in the hospitality sector or adverse economic developments in the geographic regions in which we invest. |

| · | Since there is no public trading market for shares of our common stock, repurchase of shares by us will likely be the only way to dispose of your shares. Our share repurchase plan provides stockholders with the opportunity to request that we repurchase their shares on a monthly basis, but we are not obligated to repurchase any shares and may choose to repurchase only some, or even none, of the shares that have been requested to be repurchased in any particular month in our discretion. In addition, repurchases will be subject to available liquidity and other significant restrictions. Further, our board of directors may make exceptions to, modify, suspend or terminate our share repurchase plan if in its reasonable judgment it deems a suspension to be in our best interest, such as when a repurchase request would place an undue burden on our liquidity, adversely affect our operations or risk having an adverse impact on the Company as a whole that would outweigh the benefit of the repurchase offer. As a result, our shares should be considered as having only limited liquidity and at times may be illiquid. |

| · | We cannot guarantee that we will make distributions, and if we do, we may fund such distributions from sources other than cash flow from operations, including, without limitation, the sale of our assets, borrowings or offering proceeds, and we have no limits on the amounts we may pay from such sources. |

i

| · | The purchase and repurchase price for shares of our common stock will generally be based on our prior month’s net asset value (“NAV”) and will not be based on any public trading market. Although there will be independent valuations of our properties from time to time, the valuation of properties is inherently subjective and our NAV may not accurately reflect the actual price at which our properties could be liquidated on any given day. |

| · | We have no employees and are dependent on our Stirling REIT Advisors, LLC (the “Advisor”) to conduct our operations. Our Advisor will face conflicts of interest as a result of, among other things, the allocation of investment opportunities among us and additional programs that invest in real estate focused in the hospitality sector (collectively, “Other Ashford Accounts”), the allocation of time of its investment professionals and the level of fees that we will pay to our Advisor. |

| · | If we are not able to raise a substantial amount of capital in the near term, our ability to achieve our investment objectives could be adversely affected. |

| · | In order to qualify as a real estate investment trust (“REIT”), we cannot directly operate our hotel properties, and our returns will depend on the management of our hotel properties by our property manager, one of whom is also an affiliate of Ashford Inc., our sponsor and the owner of the Advisor (together with its affiliates, “Ashford”). |

| · | Our property management agreements will require our taxable REIT subsidiaries (“TRSs”) to bear the operating risks of our hotel properties. Any increases in operating expenses or decreases in revenues may have a significant adverse impact on our earnings and cash flow. |

| · | On acquiring shares, you will experience immediate dilution in the net tangible book value of your investment. |

| · | Principal and interest payments on any borrowings will reduce the amount of funds available for distribution or investment in additional real estate assets. |

| · | There are limits on the ownership and transferability of our shares. See “Description of Capital Stock—Restrictions on Ownership and Transfer.” |

| · | If we fail to qualify as a REIT and no relief provisions apply, our NAV and cash available for distribution to our stockholders could materially decrease. |

| · | The acquisition of investment properties may be financed in substantial part by borrowing, which increases our exposure to loss. The use of leverage involves a high degree of financial risk and will increase the exposure of the investments to adverse economic factors. |

ii

| ITEM 1. | BUSINESS. |

Stirling Hotels & Resorts, Inc. is a Maryland corporation formed on September 1, 2023, primarily to acquire and own a diverse portfolio of stabilized income-producing hotels and resorts across all chain scales primarily located in the United States and operated under widely recognized brands licensed from hotel franchisors such as Marriott, Hilton, Hyatt, and Intercontinental Hotel Group. To a lesser extent, we may also invest in real estate debt secured by hotels and resorts and develop hotels and resorts. Where applicable in this Form 10, Stirling Hotels & Resorts, Inc. is referred to as the “REIT” and, together with its consolidated subsidiaries, including Stirling REIT OP, LP, a Delaware limited partnership, which we refer to herein as the “Operating Partnership”, as the “Company,” “we” or “us”. We are externally managed by our Advisor, a Delaware limited liability company. Our Advisor is an affiliate of Ashford.

On December 6, 2023, we acquired four hotel assets (the “Initial Portfolio”) from Ashford Hospitality Limited Partnership (“Ashford Hospitality OP”) and Ashford TRS Corporation (“Ashford Hospitality TRS,” and together with Ashford Hospitality OP, the “Anchor Investor”), each a subsidiary of Ashford Hospitality Trust, Inc., in exchange for 1,400,943 Class I units of the Operating Partnership at a price per unit equal to $25.00 pursuant to the terms of the contribution agreement (the “Contribution Agreement”), by and among the Operating Partnership and the Anchor Investor. The net contribution value of the Initial Portfolio was approximately $35 million, which represents the appraised value of the Initial Portfolio as provided by an independent third-party appraiser of $56.2 million, the assumption of $30.2 million of existing indebtedness and approximately $9 million of net working capital and reserves, and is subject to customary post-closing working capital adjustments. See Item 3, “Properties” for more information on the Initial Portfolio.

In December 2023, we commenced a private offering of shares of our common stock pursuant to the exemption from registration provided by Section 4(a)(2) of the U.S. Securities Act of 1933, as amended (the “Securities Act”), and Regulation D promulgated thereunder, and other exemptions of similar import in the laws of the states and other jurisdictions where the offering is being made. We intend to engage Ashford Securities, LLC, as the dealer manager for the private offering (the “Dealer Manager”).

We are filing this Form 10 to register shares of our Class S common stock pursuant to Section 12(g) of the U.S. Securities Exchange Act of 1934 (the “Exchange Act”). As a result of our voluntary registration of our common stock pursuant to the Exchange Act, following the effectiveness of this Form 10, we will be subject to the requirements of the Exchange Act and the rules promulgated thereunder. In particular, we will be required to file Quarterly Reports on Form 10-Q, Annual Reports on Form 10-K, and Current Reports on Form 8-K and otherwise comply with the disclosure obligations of the Exchange Act applicable to issuers filing registration statements to register a class of securities pursuant to Section 12(g) of the Exchange Act. We are voluntarily registering shares of our common stock pursuant to Section 12(g) of the Exchange Act to provide our stockholders with access to public disclosure regarding our business and operations of the type required in the reports filed under the Exchange Act.

The Company

We intend to qualify as a REIT for U.S. federal income tax purposes beginning with our taxable year ending December 31, 2024. Our principal executive offices are located at 14185 Dallas Parkway, Suite 1200, Dallas, Texas 75254, and the telephone number of our principal executive offices is (972) 490-9600.

Ashford

Ashford is an alternative asset management company with a portfolio of strategic operating businesses that provides products and services primarily to clients in the real estate and hospitality industries. Ashford is led by a seasoned team of senior executives, each of whom has extensive experience in real estate investment and operations and who collectively have over 100 years of real estate investment and operations experience. During the past 40 years, Ashford has invested in and managed properties through multiple economic cycles and developed deep industry relationships. Ashford became a public company in November 2014, and its common stock is listed on the New York Stock Exchange American (NYSE American: AINC). Ashford is one of the nation’s largest advisors of lodging assets with approximately $8 billion of gross assets under management as of December 31, 2022.

Pursuant to the advisory agreement between us and our Advisor (the “Advisory Agreement”), our Advisor is responsible for sourcing, evaluating and monitoring our investment opportunities and making decisions related to the acquisition, management, financing and disposition of our assets in accordance with our investment objectives, guidelines, policies and limitations, subject to oversight by our board of directors. We expect that Ashford will also provide other products and services to us or our hotel properties through certain entities in which Ashford has an ownership interest. These products and services include, but are not limited to, hotel and restaurant management services; project management, architecture, construction, development, interior design and loss prevention services; debt placement and related services; audio visual, event production, venue, creative and digital services; real estate advisory and brokerage services; insurance services; air purification and hypoallergenic products and services; broker-dealer and distribution services; resort, ecotourism and destination services; and digital keyless entry technology products and services.

See Item 7, “Certain Relationships and Related Transactions, and Director Independence—The Advisory Agreement.”

3

Potential Competitive Strengths

Ashford and its affiliates have a long history of providing global asset management, investment management and related services to the real estate and hospitality sectors, including Ashford Hospitality Trust Inc., a publicly traded REIT on the NYSE (NYSE: AHT) (“AHT”) that completed its initial public offering in August of 2003, Braemar Hotels & Resorts Inc., a publicly traded REIT on the NYSE (NYSE: BHR) (“BHR”) that was spun-off from AHT in November of 2013, private investment funds and other third-party clients. Through its subsidiaries, Ashford provides: (i) advisory services; (ii) asset management services; (iii) hotel and restaurant management services (iv) project management, architecture, construction, development, interior design and loss prevention services, (v) debt placement and related services, (vi) audio visual, event production, venue, creative and digital services, (vii) real estate advisory and brokerage services, (viii) insurance services, (ix) air purification and hypoallergenic products and services, (x) broker-dealer and distribution services, (xi) resort, ecotourism and destination services, and (xiv) digital keyless entry technology products and services.

Ashford’s vertically integrated model creates a competitive advantage versus its peers, increases its influence over asset performance and improves its ability to effectively capitalize on opportunities and mitigate risk which we believe will lead to higher guest satisfaction at our properties and enhanced returns on our hotel and resort investments.

Ashford and its affiliates have completed acquisitions of over 200 hotel and resort assets for more than $7.8 billion, dispositions of 105 hotel and resort assets for $1.8 billion, and made hotel debt investments of over $850 million since inception. Together, Ashford and its affiliates have executed over $15 billion of hotel debt financings, over $1.7 billion of preferred equity issuances and over $2.6 billion of public common equity issuances since 2003. Under Ashford’s management, AHT and BHR collectively own approximately $8 billion of gross assets. The Ashford management team has broad and deep relationships within the hotel industry with brokers, owners, management companies, lenders, and consultants.

Advisory Services. In its capacity as advisor to us, AHT and BHR, Ashford implements the investment strategies and manages the day-to-day operations of us, AHT and BHR and their respective properties from an ownership perspective, in each case subject to the respective advisory agreements and the supervision and oversight of the respective boards of directors of us, AHT and BHR.

Asset Management Services. Alongside its advisory services, Ashford provides asset management services. Ashford follows a strategic approach of designating at least one asset manager to each property which allows Ashford to leverage its extensive portfolio of subject matter experts, including asset management, revenue optimization, capital management, legal and risk management, data analysis and property tax management. Ashford currently asset manages over 100 hotels and resorts and is one of the largest clients for some of the world’s largest hotel brands. Ashford has a long history of aggressively asset managing hotel assets to maximize their value. The Asset Management Group at Ashford currently has approximately 50 employees.

Hotel and Restaurant Management Services. Ashford provides hotel and restaurant management services to 118 properties, 61 properties owned by AHT, four properties owned by BHR, three owned by us, and 50 properties owned by third-parties through its subsidiary, Remington Lodging & Hospitality, LLC (“Remington Hospitality”). Hotel management services consist of hotel operations, sales and marketing, revenue management, budget oversight, guest service, asset maintenance (not involving capital expenditures) and related services. Remington Hospitality is currently the fifth largest third-party hotel management company in the country and currently manages hotels for 43 different ownership groups. Remington Hospitality currently has approximately 10,000 employees.

Property Management, Architecture, Design, Construction and Development Services. Ashford provides project management, architecture, design, construction and development services to certain properties owned by us, AHT and BHR and also to third-party clients primarily through its subsidiary, Project Management LLC (“Premier”). Premier oversees and implements all capital expenditures at AHT and BHR and has overseen over $2 billion in capital projects. Premier has completed projects for 38 clients and currently has approximately 130 employees.

Event Technology and Creative Communications Solutions. Ashford provides an integrated suite of event services, including audio-visual, event production, venue, and creative and digital services to third-party clients and numerous hotels owned by AHT and BHR. Ashford provides these services through Inspire Event Technologies Holdings, LLC, its subsidiary doing business as INSPIRE (“INSPIRE”). INSPIRE currently has contracts in place with 29 hotels owned by AHT, nine hotels owned by BHR, and 105 hotels & venues owned by third-parties. INSPIRE also provides services to clients at non-hotel locations. This service is called show services and currently represents approximately 20% of INSPIRE’s annual revenue. INSPIRE has operations in the U.S., Mexico, and the Dominican Republic and currently has approximately 690 employees.

4

Digital Keyless Entry Solutions. Ashford provides keyless entry technology, products and services to clients, through its subsidiary, OpenKey. OpenKey currently has contracts in place with eight hotels owned by AHT, three hotels owned by BHR, and 309 hotels owned by third parties. OpenKey currently has approximately 20 employees.

Curated Destination Leisure Activities, Travel, Concierge and Transportation Services. Ashford provides curated destination leisure activities, travel, concierge and transportation services to clients, through its subsidiary, RED Hospitality & Leisure LLC (“RED Hospitality & Leisure”). RED Hospitality & Leisure currently owns a fleet of 30 boats and has contracts in place with one hotel and resort owned by AHT, two hotels and resorts owned by BHR, and ten hotels and resorts owned by third-parties. RED Hospitality & Leisure currently operates in the U.S. in Florida and Hawaii, the U.S.V.I, Puerto Rico, and Turks & Caicos. RED Hospitality & Leisure currently has approximately 260 employees.

Air Purification and Hypoallergenic Products and Services. For real estate interior spaces, Ashford provides air purification and hypoallergenic products and services to clients through its subsidiary, PURE. PURE currently has approximately 12 employees.

Wholesaler, Dealer Manager and Broker-Dealer Services. Ashford provides wholesaler, dealer manager and other broker-dealer services to its affiliates through its subsidiary, Ashford Securities, which is also the Dealer Manager. Ashford Securities currently has approximately 29 employees.

For more information regarding our Advisor and Ashford’s business, see “Management—Our Advisor and Ashford” and “Investment Objectives and Strategies—Potential Competitive Strengths.”

Investment Objectives

Our investment objectives are to invest in a diversified portfolio of hospitality assets that will enable us to:

| · | provide attractive current income in the form of regular, stable cash distributions; |

| · | preserve and protect invested capital; |

| · | realize appreciation in NAV from proactive investment management and asset management; and |

| · | provide an investment alternative for investors seeking to allocate a portion of their long-term investment portfolios to hotel and resort commercial real estate with lower volatility than listed public real estate companies. |

We cannot assure you that we will achieve our investment objectives. In particular, we note that the NAV of non-traded REITs may be subject to volatility related to the values of their underlying assets.

Investment Strategy

Our investment strategy is to invest in a diverse portfolio of stabilized income-producing hotels and resorts across all chain scales primarily located in the United States and operated under widely recognized brands licensed from hotel franchisors such as Marriott, Hilton, Hyatt, and Intercontinental Hotel Group. To a lesser extent, we may also invest in real estate debt secured by hotels and resorts and develop hotels and resorts. We may purchase single properties or portfolios of properties, including from our affiliates. Our board of directors may adjust our investment focus from time to time based upon market conditions and other factors our board of directors deem relevant.

Our investment strategy is expected to capitalize on Ashford’s leading institutional-quality real estate investment platform and its experience as an alternative asset management company with a portfolio of strategic operating businesses that provide products and services to the real estate and hospitality industries. Our investment strategy seeks to capitalize on Ashford’s scale and the real-time information provided by its real estate holdings to identify and acquire our target investments at attractive pricing. We also seek to benefit from Ashford’s reputation and ability to transact at scale with speed and certainty, and its long-standing and extensive relationships within the hotel real estate industry. Our investments in primarily stabilized, income-generating hotel assets will focus on a range of lodging asset types. These may include select-service and full-service hotels and resorts in the luxury, upper upscale, upscale, midscale, and economy chain scales.

Our real estate debt investment strategy is focused on generating current income and contributing to our overall net returns. In its history, Ashford and its affiliates have made over $850 million of hotel debt investments. We believe hotel debt investments can be an attractive source of current income while generating attractive risk-adjusted returns. We believe that our structure as a perpetual-life REIT will allow us to acquire and manage our investment portfolio in a more active and flexible manner. We expect the structure to be beneficial to your investment, as we will not be limited by a pre-determined operational period and the need to provide a “liquidity event” at the end of that period.

5

We may enter into one or more joint ventures, tenant-in-common investments or other co-ownership arrangements for the acquisition, development or improvement of properties with third parties or affiliates of our Advisor, including present and future real estate limited partnerships and REITs sponsored by affiliates of our Advisor.

Investment Guidelines and Portfolio Allocation

Our board of directors, including our independent directors, will review our investment portfolio not less than quarterly. In addition, our board of directors has adopted investment guidelines which set forth, among other things, guidelines for investing in our targeted property types which we describe in more detail below. Our board of directors, including our independent directors, will review the investment guidelines on an annual basis or more frequently as it deems appropriate. Changes to our investment guidelines must be approved by our board of directors, including a majority of our independent directors. Our board of directors may revise our investment guidelines without the concurrence of our stockholders.

Our investment guidelines delegate to our Advisor authority to execute acquisitions and dispositions of investments in real estate and real estate related debt, in each case so long as such acquisitions and dispositions are consistent with our investment guidelines. Our board of directors will at all times have oversight over our investments and may change from time to time the scope of authority delegated to our Advisor with respect to acquisition and disposition transactions. In addition, under our investment guidelines our board of directors is required to approve any acquisition of a single property or portfolio of properties with a purchase price exceeding 10% of our most recent month-end total asset value (as measured under generally accepted accounting principles) plus the net proceeds expected in good faith to be raised in the private offering over the next 12 months.

We will seek to invest:

| · | 80% of our assets in hotels and resorts; and |

| · | up to 20% of our assets in hotel related debt, cash, cash equivalents and other investments. |

Notwithstanding the foregoing, the actual percentage of our portfolio that is invested in each investment type may from time to time be outside the levels provided above due to factors such as a large inflow of capital over a short period of time, our Advisor’s assessment of the relative attractiveness of opportunities, or an increase in anticipated cash requirements or repurchase requests and subject to any limitations or requirements relating to our intention to be treated as a REIT for U.S. federal income tax purposes. Certain investments could be characterized as either real estate or real estate debt depending on the terms and characteristics of such investments.

Investments in Properties

We intend to acquire stabilized income-producing hotels and resorts across all chain scales primarily located in the United States and operated under widely recognized brands licensed from hotel franchisors such as Marriott, Hilton, Hyatt, and Intercontinental Hotel Group.

Ownership Interests

Our Operating Partnership or one or more subsidiary entities controlled by our Operating Partnership will acquire properties on our behalf. In many cases, we will acquire the entire equity ownership interest in properties and exercise control over such properties. However, we may also enter into joint ventures, general partnerships, co-tenancies and other participation arrangements with other investors, including affiliates of our Advisor, to acquire properties. We generally will acquire fee simple interests for the properties (in which we own both the land and the building improvements), but may consider leasehold interests and other non-fee simple interests if we believe the investment is consistent with our investment strategy and objectives.

Joint Ventures and Other Co-Ownership Arrangements

We may enter into joint ventures, partnerships, tenant-in-common investments or other co-ownership arrangements with entities affiliated with our Advisor as well as third parties for the acquisition or improvement of properties. In many cases, we may not control the management of the affairs of the joint venture. In determining whether to invest in a particular joint venture, our Advisor will evaluate the real property that such joint venture owns or is being formed to own under the same criteria described elsewhere in this filing for our selection of real property investments.

6

The terms of any particular joint venture will be established on a case-by-case basis considering all relevant facts, including the nature and attributes of the potential joint venture partner, the proposed structure of the joint venture, the nature of the operations, the liabilities and assets associated with the proposed joint venture and the size of our interest in the venture. Other factors we will consider include: (1) our ability to manage and control the joint venture; (2) our ability to exit the joint venture; and (3) our ability to control transfers of interests held by other partners to the venture. Our interests may not be totally aligned with those of our partner.

In the event that the joint venture partner elects to sell property held in any such joint venture, we may not have sufficient funds to exercise any right of first refusal or other purchase right that we may have. Entering into joint ventures with Ashford affiliates will result in certain conflicts of interest.

Due Diligence

The Ashford personnel who perform investment management services for us pursuant to our Advisory Agreement will conduct due diligence on each property that our Advisor proposes to purchase on our behalf, including these four primary types:

| · | Financial Due Diligence. A preliminary review of each opportunity is conducted in order to screen the attractiveness of each transaction. The preliminary review is followed by an initial financial projection based on macro- and micro-economic analyses. Projection assumptions generally are developed from analysis of historical operating performance, discussions with local real estate contacts or sector experts and a review of published sources and data from Ashford’s other portfolios. If our Advisor deems appropriate, further due diligence will be conducted, as described below, to confirm the initial financial review. Our Advisor will forecast expected cash flows and analyze various scenarios and exit strategies utilizing its proprietary models and the financial information received. We believe that our Advisor’s approach to the analysis of potential investment opportunities will provide us with a competitive advantage. |

| · | Books and Records. Third-party accounting consultants will be used as necessary to review relevant books and records (for example, comparing rent rolls to leases for office buildings), confirm cash flow information provided by the seller and conduct other similar types of analysis. |

| · | Physical Due Diligence. This primarily will involve an analysis of environmental and engineering matters by third-party consultants. Conclusions will be incorporated from environmental/engineering reports into the financial projection analysis. Additionally, our Advisor will investigate each potential investment and comparable properties to assess relative market position, functionality and obsolescence. |

| · | Legal and Tax Due Diligence. Our Advisor will work closely with outside counsel to review, diligence and negotiate applicable legal and property specific documents pertaining to an investment (e.g., joint venture agreements, loan documents, leases, management agreements, purchase contracts, etc.). Additionally, our Advisor will work with internal and external tax advisors to structure investments in an efficient manner. |

Property Management

We have engaged Remington Hospitality, an Ashford subsidiary, to provide property management services to our properties. Remington Hospitality currently provides property management services to 61 properties owned by AHT, four properties owned by BHR, three owned by us, and 50 properties owned with third-parties. Management services consist of property operations, sales and marketing, revenue management, budget oversight, guest service, asset maintenance (not involving capital expenditures) and related services.

Exit Strategies

Our investment strategy is not reliant on prompt sale of the properties we acquire, and we anticipate that we will hold most properties for seven to ten years or longer. One of our Advisor’s primary considerations in evaluating any potential investment opportunity is the likely exit strategy. When determining whether to sell a particular asset, our Advisor will take the following steps:

| · | Evaluate Condition of the Property. Evaluate whether the asset is in the appropriate condition for a successful sale. |

| · | Monitor Market Conditions. Monitor the markets to identify favorable conditions for asset sales. |

7

| · | Assess Returns from the Property. Assess the returns from each investment to determine whether the expected sale price exceeds the net present value of our Advisor’s projected cash flows of the property. |

| · | Evaluate Status of Business Plan. Evaluate whether it has successfully completed any value creation plan that was established at acquisition. |

We believe that holding our target assets for a long period of time will enable us to execute our business plan, generate favorable cash-on-cash returns and drive long-term cash flow and NAV growth.

Generally, we will reinvest proceeds from the sale, financing or disposition of properties in a manner consistent with our investment strategy, although we may be required to distribute such proceeds to the stockholders in order to comply with REIT requirements.

Investments in Real Estate Equity, Debt and Debt Securities

Our real estate debt investments will focus on non-distressed public and private real estate debt, including, but not limited to, real estate related corporate credit, mortgages, loans, mezzanine loans and may also include derivatives. Our investments in real estate debt will be focused in the United States.

Our investments in loans may include commercial mortgage loans, bank loans, mezzanine loans, and other interests relating to real estate and debt of companies in the business of owning and/or operating real estate related businesses. Commercial mortgage loans are typically secured by single-family, multifamily or commercial property and are subject to risks of delinquency and foreclosure. The ability of a borrower to repay a loan secured by an income-producing property typically is dependent primarily upon the successful operation of such property rather than upon the existence of independent income or assets of the borrower.

We may also invest in real estate related derivatives, including, without limitation, total return swaps and credit default swaps that have real estate debt as reference assets. See “—Derivative Instruments and Hedging Activities.”

We do not intend to make loans to other persons or to engage in the purchase and sale of any types of investments other than those related to real estate.

Mezzanine loans may take the form of subordinated loans secured by a pledge of the ownership interests of either the entity owning the real property or an entity that owns (directly or indirectly) the interest in the entity owning the real property. These types of investments may involve a higher degree of risk than mortgage lending because the investment may become unsecured as a result of foreclosure by the senior lender.

Although our investments in real estate debt will be primarily in non-distressed debt instruments (based on our belief that there is a high likelihood of repayment), we may nonetheless invest in instruments of any credit quality at various levels of an issuer’s capital structure. Debt securities of below investment grade quality are regarded as having predominantly speculative characteristics with respect to capacity to pay interest and to repay principal, and are commonly referred to as “high yield” securities. Securities rated Caa or below and CCC or below are considered vulnerable to nonpayment and their issuers to be dependent on favorable business, financial and economic conditions to meet their financial commitments. Securities rated below Caa/CCC may include obligations already in default. Debt securities in the lowest investment grade category will likely possess speculative characteristics. Additionally, some of our investments may be structured as investments in real estate debt securities or loans but are intended to provide us with returns based on the performance of the related real estate. As such, these debt securities or loans may have risks that are similar to those which a real estate equity investment would possess.

We may also invest, without limit, in securities that are unregistered (but are eligible for purchase and sale by certain qualified institutional buyers) or are held by control persons of the issuer and securities that are subject to contractual restrictions on their resale.

Investment Process for Real Estate Debt

The following is a brief summary of certain key aspects of the real estate debt investment process our Advisor expects to generally utilize:

| · | Fundamental Analysis. Our Advisor expects to utilize an asset-by-asset valuation approach to evaluate potential investments with a focus on underlying cash flow projections, replacement costs and market-by-market supply/demand trends. |

8

| · | Disciplined Investment Approach. Our Advisor expects to employ rigorous underwriting and due diligence with respect to each investment while carefully assessing the impact of certain potential downside scenarios. |

| · | Leverage Proprietary Knowledge and Relationships. Our Advisor expects to utilize the knowledge, relationships and expertise of the existing Ashford team to evaluate potential investments. |

Derivative Instruments and Hedging Activities

We may use derivatives for hedging purposes and, subject to qualifying and maintaining our status as a REIT and compliance with any applicable exemption from being regulated as a commodity pool operator, we may also use derivatives for investment purposes and as a form of effective leverage. Our principal investments in derivative instruments may include investments in interest rate swaps, total return swaps, credit default swaps and indices thereon, and short sales (typically related to treasuries), but we may also invest in futures transactions, options and options on futures.

Cash, Cash Equivalents and Other Short-Term Investments

We hold cash, cash equivalents and other short-term investments. These types of investments may include the following, to the extent consistent with our intended qualification as a REIT:

| · | money market instruments, cash and other cash equivalents (such as high-quality short-term debt instruments, including commercial paper, certificates of deposit, bankers’ acceptances, repurchase agreements, interest-bearing time deposits and credit rated corporate debt securities); |

| · | U.S. government or government agency securities; and |

| · | credit-rated corporate debt or asset-backed securities of U.S. or foreign entities, or credit-rated debt securities of foreign governments or multi-national organizations. |

Other Investments

We may, subject to any required approvals from our board of directors, make investments other than as described above. At all times, we intend to make investments in such a manner consistent with qualifying and maintaining our qualification as a REIT under the Code and maintaining our status as a non-investment company under the Investment Company Act. We do not intend to underwrite securities of other issuers.

Borrowing Policies

We intend to use financial leverage to provide additional funds to support our investment activities. This allows us to make more investments than would otherwise be possible, resulting in a broader portfolio. Our target leverage ratio after our ramp-up period is approximately 40-50% of our gross real estate assets (measured using the greater of fair market value and purchase price), inclusive of property-level and entity-level debt and cash, but excluding debt on our securities portfolio. There is, however, no limit on the amount we may borrow with respect to any individual property or portfolio. Indebtedness incurred (i) in connection with funding a deposit in advance of the closing of an investment or (ii) as other working capital advances, will not be included as part of the calculation above.

Our real estate debt portfolio may have embedded leverage through the use of reverse repurchase agreements and may also have embedded leverage through the use of derivatives, including, but not limited to, total return swaps, securities lending arrangements and credit default swaps. During times of increased investment and capital market activity, but subject to the limitation on indebtedness for money borrowed in our corporate governance guidelines described below, we may employ greater leverage in order to quickly build a broader portfolio of assets. We may leverage our portfolio by assuming or incurring secured or unsecured property-level or entity-level debt. An example of property-level debt is a mortgage loan secured by an individual property or portfolio of properties incurred or assumed in connection with our acquisition of such property or portfolio of properties. An example of entity-level debt is a line of credit obtained by us or our Operating Partnership. We may seek to obtain lines of credit under which we would reserve borrowing capacity. Borrowings under lines of credit may be used not only to repurchase shares, but also to fund acquisitions or for any other corporate purpose.

Our actual leverage level will be affected by a number of factors, some of which are outside our control. Significant inflows of proceeds from the sale of shares of our common stock generally will cause our leverage as a percentage of our net assets, or our leverage ratio, to decrease, at least temporarily. Significant outflows of equity as a result of repurchases of shares of our common stock generally will cause our leverage ratio to increase, at least temporarily. Our leverage ratio will also increase or decrease with decreases or increases, respectively, in the value of our portfolio. If we borrow under a line of credit to fund repurchases of shares of our common stock or for other purposes, our leverage will increase and may exceed our target leverage. In such cases, our leverage may remain at the higher level until we receive additional net proceeds from our continuous offering or sell some of our assets to repay outstanding indebtedness.

9

Our board of directors reviews our aggregate borrowings at least quarterly. In connection with such review, our board of directors may determine to modify our target leverage ratio in light of then-current economic conditions, relative costs of debt and equity capital, fair values of our properties, general conditions in the market for debt and equity securities, growth and investment opportunities or other factors. We may exceed our targeted leverage ratio at times if our Advisor deems it advisable for us. For example, if we fund a repurchase under a line of credit, we will consider actual borrowings when determining whether we are at our leverage target, but not unused borrowing capacity. If, therefore, we are at a leverage ratio in the range of 40-50% and we borrow additional amounts under a line of credit, or if the value of our portfolio decreases, our leverage could exceed the range of 40-50% of our gross real estate assets. In the event that our leverage ratio exceeds our target, regardless of the reason, we will thereafter endeavor to manage our leverage back down to our target.

There is no limit on the amount we may borrow with respect to any individual property or portfolio.

Temporary Strategies

During periods in which our Advisor determines that economic or market conditions are unfavorable to investors and a defensive strategy would benefit us, we may temporarily depart from our investment strategy. During these periods, subject to compliance with the Investment Company Act, we may deviate from our investment guideline of investing at least 80% of our assets in hotels and resorts and up to 20% of our assets in hotel related debt, cash, cash equivalents and other investments, or invest all or any portion of our assets in U.S. government securities, including bills, notes and bonds differing as to maturity and rates of interest that are either issued or guaranteed by the U.S. Treasury or by U.S. government agencies or instrumentalities; non-U.S. government securities that have received the highest investment grade credit rating; certificates of deposit issued against funds deposited in a bank or a savings and loan association; commercial paper; bankers’ acceptances; fixed time deposits; shares of money market funds; credit-linked notes; repurchase agreements with respect to any of the foregoing; or any other fixed income securities that our Advisor considers consistent with this strategy. During these periods, we may also determine to pay down certain of our indebtedness and have indebtedness below our target leverage or we may borrow more to provide for additional liquidity causing us to exceed our target leverage. It is impossible to predict when, or for how long, our Advisor will use these alternative strategies. There can be no assurance that such strategies will be successful.

Issuing Securities for Property

Subject to limitations contained in our charter, we may issue, or cause to be issued, shares of our stock or limited partnership units in the Operating Partnership in any manner (and on such terms and for such consideration) in exchange for real estate. Our existing stockholders will have no preemptive rights to purchase any such shares of our stock or limited partnership units in the Operating Partnership, and any such issuance might cause a dilution of a stockholder’s initial investment. We may enter into additional contractual arrangements with contributors of property under which we would agree to repurchase a contributor’s units for shares of our common stock or cash, at the option of the contributor, at specified times. Although we may enter into such transactions, we do not currently intend to do so.

Ownership Structure

We intend to qualify as a REIT for U.S. federal income tax purposes beginning with our taxable year ending December 31, 2024. In general, a REIT is a company that:

| · | combines the capital of many investors to acquire or provide financing for real estate assets; |

| · | offers the benefits of a real estate portfolio under professional management; |

| · | satisfies the various requirements of the Internal Revenue Code of 1986, as amended (the “Code”), including a requirement to distribute to stockholders at least 90% of its REIT taxable income each year; and |

| · | is generally not subject to U.S. federal corporate income taxes on its net taxable income that it currently distributes to its stockholders, which substantially eliminates the “double taxation” (i.e., taxation at both the corporate and stockholder levels) that generally results from investments in a “C” corporation. |

10

A non-listed REIT is a REIT whose shares are not listed for trading on a stock exchange or other securities market. We use the term “perpetual-life REIT” to describe an investment vehicle of indefinite duration, whose shares of common stock are intended to be sold by the REIT monthly on a continuous basis at a price generally equal to the prior month’s NAV per share. In our perpetual-life structure, the investor may request that we repurchase their shares on a monthly basis, but we are not obligated to repurchase any shares and may choose to repurchase only some, or even none, of the shares that have been requested to be repurchased in any particular month in our discretion. Although we may consider a liquidity event at any time in the future, we are not obligated by our charter or otherwise to effect a liquidity event at any time.

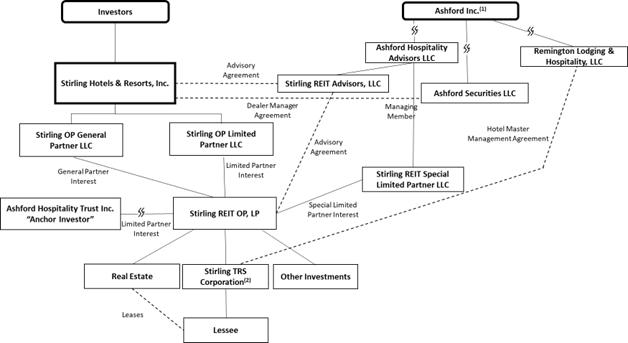

We plan to own all or substantially all of our assets through the Operating Partnership. We are the sole member of the sole general partner of the Operating Partnership. Stirling REIT Special Limited Partner LLC (the “Special Limited Partner”), a Delaware limited partnership and an affiliate of Ashford, owns a special limited partner interest in the Operating Partnership. The use of our Operating Partnership to hold all of our assets is referred to as an Umbrella Partnership Real Estate Investment Trust (“UPREIT”). Using an UPREIT structure may give us an advantage in acquiring properties from persons who want to defer recognizing gain for U.S. federal income tax purposes.

In addition, in order for the income from any hotel property investments to constitute “rents from real properties” for purposes of the gross income test required for REIT qualification, the income we earn cannot be derived from the operation of any of these hotels. Therefore, we will lease each hotel property to a subsidiary of our operating partnership, which is (and we intend to be treated as) a taxable REIT subsidiary, or TRS.

The following chart shows our current ownership structure and our relationships with Ashford Inc. (which acts as our sponsor), Stirling REIT Advisors, LLC (which acts as our Advisor) and the Special Limited Partner along with other affiliates of Ashford who will provide services to us in connection with our operations and the private offering.

(1) Mr. Monty J. Bennett, our Chief Executive Officer and affiliated director, is Chairman and Chief Executive Officer of Ashford. As of September 30, 2023, Mr. Monty Bennett, together with his father, Mr. Archie Bennett, Jr., Chairman Emeritus of AHT, owned approximately 610,261 shares of Ashford common stock, which represented an approximately 19.0% ownership interest in Ashford, and owned 18,758,600 shares of Ashford Series D Convertible Preferred Stock, which, along with all unpaid accrued and accumulated dividends thereon, is convertible at a price of $117.50 per share into an additional approximate 4,154,013 shares of Ashford common stock, which if converted as of September 30, 2023 would have increased Mr. Monty J. Bennett and Mr. Archie Bennett, Jr.’s ownership interest in Ashford to approximately 64.7%. The 18,758,600 shares of Series D Convertible Preferred Stock owned by the Bennetts include 360,000 shares owned by trusts.

(2) Our TRS has entered a property management agreement with Remington Hospitality and other “eligible independent contractors,” for the management of our properties.

11

The Board of Directors

We operate under the direction of our board of directors. We have three directors, two of whom are independent of us, our Advisor, Ashford and its affiliates. Our independent directors are responsible for reviewing the performance of our Advisor and approving the compensation paid to our Advisor and its affiliates. Our directors are elected annually by our stockholders. The names and biographical information of our directors are provided under Item 5, “Directors and Executive Officers.”

Fees Paid to the Advisor and its Affiliates

We pay our Advisor, the Dealer Manager, and their affiliates the fees and expense reimbursements described below in connection with performing services for us. In addition, income of the Operating Partnership is allocated to the Special Limited Partner for its performance participation interest. Our independent directors have approved the compensation to our Advisor, the Special Limited Partner, the Dealer Manager, and their affiliates described below. We may engage our Advisor or its affiliates to provide services to us on terms that are different than described herein provided that any such arrangements must be approved by our related party transactions committee. Although we have no current intention to do so, we or our Operating Partnership may also issue equity incentive compensation to employees of our Advisor or its affiliates. Any equity incentive compensation will not reduce the management fee or performance participation allocation.

|

Type of Compensation and Recipient |

Determination of Amount | |

| Upfront Selling Commissions and Dealer Manager Fees—The Dealer Manager |

The Dealer Manager is entitled to receive upfront selling commissions of up to 3.0%, and upfront dealer manager fees of 0.5%, of the transaction price of each Class T share sold in the primary offering; however, such amounts may vary based on agreements between the Dealer Manager and certain selected dealers, provided that the sum of the upfront selling commissions and dealer manager fees will not exceed 3.5% of the transaction price. The Dealer Manager is entitled to receive upfront selling commissions of up to 3.5% of the transaction price of each Class S share sold in the primary offering. The Dealer Manager is entitled to receive upfront selling commissions of up to 1.5% of the transaction price of each Class D share sold in the primary offering. The Dealer Manager anticipates that all or a portion of the upfront selling commissions and dealer manager fees will be retained by, or reallowed (paid) to, selected dealers.

No upfront selling commissions or dealer manager fees are paid with respect to purchases of Class I shares or shares of any class sold pursuant to our distribution reinvestment plan. |

| Distribution fees—The Dealer Manager |

We pay the Dealer Manager selling commissions over time as distribution fees:

· with respect to our outstanding Class T shares, equal to 0.85% per annum of the aggregate NAV of our outstanding Class T shares, consisting of a representative distribution fee of 0.65% per annum, and a dealer distribution fee of 0.20% per annum, of the aggregate NAV of our outstanding Class T shares; however, with respect to Class T shares sold through certain selected dealers, the representative distribution fee and the dealer distribution fee may be other amounts, provided that the sum of such fees will always equal 0.85% per annum of the NAV of such shares;

· with respect to our outstanding Class S shares, equal to 0.85% per annum of the aggregate NAV of our outstanding Class S shares; and

· with respect to our outstanding Class D shares, equal to 0.25% per annum of the aggregate NAV of our outstanding Class D shares.

|

12

|

Type of Compensation and Recipient |

Determination of Amount | |

|

We will not pay a distribution fee with respect to our outstanding Class I shares.

In calculating the distribution fees, we will use the aggregate NAV of the applicable class before giving effect to accruals for the distribution fee or distributions payable on our shares.

The distribution fees are paid monthly in arrears. The Dealer Manager reallows (pays) all or a portion of the distribution fees to selected dealers and servicing broker-dealers, and will rebate distribution fees to us to the extent a broker-dealer is not eligible to receive them.

The ongoing distribution fees listed above accrue on a class-specific basis and borne by all holders of the applicable class. Because the distribution fees are calculated based on our NAV of our Class T, Class S and Class D shares, they will reduce the NAV and/or the distributions payable with respect to the shares of each such class, including shares of each such class issued under our distribution reinvestment plan.

We will cease paying the distribution fee with respect to any Class T share, Class S share or Class D share held in a stockholder’s account at the end of the month in which the Dealer Manager and/or our Company in conjunction with our transfer agent determine(s) that total upfront selling commissions, dealer manager fees and distribution fees paid with respect to the shares held by such stockholder within such account would equal or exceed, in the aggregate, 8.75% (or a lower limit as set forth in the applicable agreement between the Dealer Manager and a selected dealer at the time such shares were issued) of the gross proceeds from the sale of such shares (including the gross proceeds of any shares issued under our distribution reinvestment plan with respect thereto) (collectively, the “Distribution Fee Limit”). At the end of such month, each such Class T share, Class S share or Class D share in such account (including shares in such account purchased through the distribution reinvestment plan or received as a stock dividend) will convert into a number of Class I shares (including any fractional shares) with an equivalent aggregate NAV as such share. See “Plan of Distribution.” Although we cannot predict the length of time over which the distribution fee will be paid due to potential changes in the NAV of our shares, in the case of a limit of 8.75% of gross proceeds, this fee would be paid with respect to a Class T share or Class S share over approximately seven years from the date of purchase and with respect to a Class D share over approximately 30 years from the date of purchase, assuming payment of the full upfront selling commissions and dealer manager fees, opting out of the distribution reinvestment plan and a constant NAV per share. Under these assumptions and assuming a constant NAV per share of $25.00, if a stockholder holds his or her shares for these time periods, this fee with respect to a Class T share or Class S share would total approximately $1.39 and with respect to a Class D share would total approximately $1.85.

If not already converted into Class I shares upon a determination that total upfront selling commissions, dealer manager fees and distribution fees paid with respect to such shares would exceed the applicable Distribution Fee Limit, each Class T share, Class S share and Class D share held in a stockholder’s account (including shares in such account purchased through the distribution reinvestment plan or received as stock dividend) will automatically and without any action on the part of the holder thereof convert into a number of Class I shares (including fractional shares) with an equivalent NAV as such share on the earliest of (i) a listing of Class I shares, (ii) our merger or consolidation with or into another entity in which we are not the surviving entity or (iii) the sale or other disposition of all or substantially all of our assets. Further, immediately before any liquidation, dissolution or winding up of our company, each Class T share, Class S share and Class D share will automatically convert into a number of Class I shares (including any fractional shares) with an equivalent NAV as such share. |

13

|

Type of Compensation and Recipient |

Determination of Amount | |

| Organization and Offering Expense Reimbursement—Our Advisor |

Through December 31, 2024, our Advisor has agreed to advance all expenses on our behalf in connection with our formation and the raising of equity capital, including (without limitation) the following: legal, accounting, investment banking and other advisory fees; regulatory and other filing fees; expenses of qualification of the sale of our shares under federal and state laws, including taxes and fees and accountants’ and attorneys’ fees; printing, engraving and mailing costs; expenses of the marketing and distribution of the shares, reasonable bona fide due diligence expenses of the Dealer Manager and selected dealers supported by detailed and itemized invoices, costs in connection with sales and marketing materials, design and website expenses, salaries of employees while engaged in sales activity, fees and expenses of the Dealer Manager’s attorneys, costs related to investor and broker-dealer sales meetings, including fees to attend retail seminars sponsored by the Dealer Manager or selected dealers and reimbursements to the Dealer Manager and selected dealers for customary travel, lodging and meals; charges of administrators, transfer agents, registrars, trustees, escrow holders, depositaries and experts; but excluding upfront selling commissions and dealer manager fees and ongoing distribution fees. The costs of an audit of the financial statements of the Company for the year ended December 31, 2023 will be considered an organization expense for this purpose as will all costs associated with the contribution of properties to the Operating Partnership prior to the private offering. We will reimburse our Advisor for all such advanced expenses ratably over the 60 months commencing January 1, 2025.

As of January 1, 2025, we will reimburse our Advisor for any organization and offering expenses that it incurs on our behalf as and when incurred. After the termination of the primary offering and again after termination of the offering under our distribution reinvestment plan, our Advisor has agreed to reimburse us to the extent that the organization and offering expenses that we incur exceed 15% of our gross proceeds from the applicable offering.

| |

| Acquisition Expense Reimbursement—Our Advisor | We do not intend to pay our Advisor any acquisition or other similar fees in connection with making investments. We will, however, reimburse our Advisor for out-of-pocket expenses in connection with the selection and acquisition of properties and real estate related debt, whether or not such investments are acquired, and make payments to third parties in connection with making investments.

| |

| Management Fee and Expense Reimbursements—Our Advisor |

We pay our Advisor an annual management fee (payable monthly in arrears) of 1.25% of aggregate NAV represented by the Class T, Class S, Class D and Class I shares. Additionally, to the extent that our Operating Partnership issues Class T, Class S, Class D or Class I Operating Partnership units to parties other than us, our Operating Partnership will pay our Advisor a management fee equal to 1.25% of the aggregate NAV of the Operating Partnership attributable to such Class T, Class S, Class D and Class I Operating Partnership units not held by us per annum payable monthly in arrears. No management fee will be paid with respect to Class E shares or Class E units of our Operating Partnership. The management fee is allocated on a class-specific basis and borne by all holders of the applicable class. |

14

|

Type of Compensation and Recipient |

Determination of Amount | |

|

In calculating the management fee, we use the aggregate NAV of the applicable share class of Operating Partnership units not held by us before giving effect to monthly accruals for the management fee, performance participation allocation, distribution fees (if any), or distributions payable on our shares our Operating Partnership units.

In addition to the organization and offering expense and acquisition expense reimbursements described above, we will reimburse our Advisor for out-of-pocket costs and expenses it incurs in connection with the services it provides to us, including, but not limited to, (i) the actual cost of goods and services used by us and obtained from third parties, including fees paid to administrators, consultants, attorneys, technology providers and other service providers, and brokerage fees paid in connection with the purchase and sale of investments, (ii) expenses of managing and operating our properties, whether payable to an affiliate or a non-affiliated person, and (iii) expenses related to personnel of the Advisor performing services for us other than those who provide investment advisory services or serve as our executive officers. See “Management—The Advisory Agreement—Management Fee, Performance Participation and Expense Reimbursements.”

Our Advisor will advance on our behalf certain of our general and administrative expenses through December 31, 2024, at which point we will reimburse our Advisor for all such advanced expenses ratably over the 60 months following such date.

The management fee may be paid, at our Advisor’s election, in cash, Class E shares or Class E units of our Operating Partnership. If our Advisor elects to receive any portion of its management fee in our Class E shares or Class E units of our Operating Partnership, we may be obligated to repurchase such Class E shares or Class E units from our Advisor at a later date. Repurchases of Class E shares will be outside our share repurchase plan and thus will not be subject to the repurchase limits of our share repurchase plan or any Early Repurchase Deduction. The Operating Partnership will repurchase any such Class E units for Class E shares of our common stock or cash (at our Advisor’s election) unless our board of directors determines that any such repurchase for cash would be prohibited by applicable law or the Operating Partnership’s partnership agreement, in which case such Class E units will be repurchased for Class E shares of our common stock. Repurchase requests for Class E units will not be subject to the one-year hold period provided for other limited partners.

Any Class E shares paid as a management fee (or received upon conversion of Class E units paid as a management fee) will have registration rights if our shares are listed on a national securities exchange. |

| Performance Participation Allocation—The Special Limited Partner |

So long as our Advisory Agreement has not been terminated (including by means of non-renewal), the Special Limited Partner will hold a performance participation interest in the Operating Partnership that entitles it to receive an allocation from our Operating Partnership equal to 12.5% of the Total Return, subject to a 5% Hurdle Amount and a High-Water Mark, with a Catch-Up (each term as defined below). Such allocation will be measured on a calendar year basis, made quarterly and accrued monthly. Because the portion of the Total Return attributable to Class E units of the Operating Partnership will be excluded from all performance participation calculations, no portion of the allocation will accrue to Class E units of the Operating Partnership.

|

15

|

Type of Compensation and Recipient |

Determination of Amount | |

|

Promptly following the end of each calendar quarter that is not also the end of a calendar year, the Special Limited Partner will be entitled to a performance participation allocation as described above calculated in respect of the portion of the year to date, less any performance participation allocation received with respect to prior quarters in that year (the “Quarterly Allocation”). The performance participation allocation that the Special Limited Partner is entitled to receive at the end of each calendar year will be reduced by the cumulative amount of Quarterly Allocations that year.

Specifically, the Special Limited Partner will be allocated a performance participation in an amount equal to:

· First, if the Total Return for the applicable period exceeds the sum of (i) the Hurdle Amount for that period and (ii) the Loss Carryforward Amount (any such excess, “Excess Profits”), 100% of such Excess Profits until the total amount allocated to the Special Limited Partner equals 12.5% of the sum of (x) the Hurdle Amount for that period and (y) any amount allocated to the Special Limited Partner pursuant to this clause (this is commonly referred to as a “Catch-Up”); and

· Second, to the extent there are remaining Excess Profits, 12.5% of such remaining Excess Profits.

“Total Return” for any period since the end of the prior calendar year shall equal the sum of:

(i) all distributions accrued or paid (without duplication) on the Class T units, Class S units, Class D units and Class I units of the Operating Partnership (collectively referred to as, the “Performance Participation OP Units”) outstanding at the end of such period since the beginning of the then-current calendar year plus

(ii) the change in aggregate NAV of the Performance Participation OP Units since the beginning of the year, before giving effect to (x) changes resulting solely from the proceeds of issuances of the Performance Participation OP Units, (y) any allocation/accrual to the performance participation interest related to the Performance Participation OP Units and (z) applicable distribution fee expenses related to the Performance Participation OP Units (including any payments made to us for payment of such expenses).

For the avoidance of doubt, the calculation of Total Return will (i) include any appreciation or depreciation in the NAV of the Performance Participation OP Units issued during the then-current calendar year but (ii) exclude the proceeds from the initial issuance of such Performance Participation OP Units and any upfront selling commissions and dealer manager fees.

“Hurdle Amount” for any period during a calendar year means that amount that results in a 5% annualized internal rate of return on the NAV of the Performance Participation OP Units outstanding at the beginning of the then-current calendar year and all Performance Participation OP Units issued since the beginning of the then-current calendar year, taking into account the timing and amount of all distributions accrued or paid (without duplication) on all such Performance Participation OP Units and all issuances of Performance Participation OP Units over the period and calculated in accordance with recognized industry practices. The ending NAV of the Performance Participation OP Units used in calculating the internal rate of return will be calculated before giving effect to any allocation/accrual to the performance participation interest related to the Performance Participation OP Units and applicable distribution fee expenses related to the Performance Participation OP Units. For the avoidance of doubt, the calculation of the Hurdle Amount for any period will exclude any Performance Participation OP Units repurchased during such period, which units will be subject to the performance participation allocation upon repurchase as described below.

|

16

|

Type of Compensation and Recipient |

Determination of Amount | |

|

Except as described in “Loss Carryforward Amount” below, any amount by which the Total Return falls below the Hurdle Amount will not be carried forward to subsequent periods.

“Loss Carryforward Amount” shall initially equal zero and shall cumulatively increase by the absolute value of any negative annual Total Return and decrease by any positive annual Total Return, provided that the Loss Carryforward Amount shall at no time be less than zero and provided further that the calculation of the Loss Carryforward Amount will exclude the Total Return related to any Performance Participation OP Units repurchased during such year, which units will be subject to the performance participation allocation upon repurchase as described below. The effect of the Loss Carryforward Amount is that the recoupment of past annual Total Return losses will offset the positive annual Total Return for purposes of the calculation of the Special Limited Partner’s performance participation. This is referred to as a “High Water Mark.”

The Special Limited Partner will also be allocated a performance participation with respect to all Performance Participation OP Units that are repurchased at the end of any month (in connection with repurchases of our shares in our share repurchase plan) in an amount calculated as described above with the relevant period being the portion of the year for which such unit was outstanding, and proceeds for any such unit repurchase will be reduced by the amount of any such performance participation.

If a Quarterly Allocation is made and at the end of a subsequent calendar quarter in the same calendar year the Special Limited Partner is entitled to less than the previously received Quarterly Allocation(s) (a “Quarterly Shortfall”), then subsequent distributions of any Quarterly Allocations or year-end performance participation allocations in that calendar year will be reduced by an amount equal to such Quarterly Shortfall, until such time as no Quarterly Shortfall remains. If all or any portion of a Quarterly Shortfall is not applied pursuant to the previous sentence by the end of such calendar year, distributions of any Quarterly Allocations and year-end performance participation allocations in the subsequent four calendar years will be reduced by (i) the remaining Quarterly Shortfall plus (ii) an annual rate of 5% on the remaining Quarterly Shortfall measured from the first day of the calendar year following the year in which the Quarterly Shortfall arose and compounded quarterly (collectively, the “Quarterly Shortfall Obligation”) until such time as no Quarterly Shortfall Obligation remains; provided, that the Special Limited Partner (or its affiliate) may make a full or partial cash payment to reduce the Quarterly Shortfall Obligation at any time; provided, further, that if any Quarterly Shortfall Obligation remains following such subsequent four calendar years, then the Special Limited Partner (or its affiliate) will promptly pay the Operating Partnership the remaining Quarterly Shortfall Obligation in cash.

Distributions on the performance participation interest may be distributable in cash or Class E units at the election of the Special Limited Partner. To the extent that the Special Limited Partner elects to receive such distributions in Class E units, the Special Limited Partner may request that the Operating Partnership repurchase such Class E units for cash at the then-current NAV per unit. Repurchase requests for Class E units will not be subject to the one-year hold period provided for other limited partners. |

17

|

Type of Compensation and Recipient |

Determination of Amount | |

|

The Operating Partnership will repurchase any such Class E units for Class E shares of our common stock or cash (at the Special Limited Partner’s election) unless our board of directors determines that any such repurchase for cash would be prohibited by applicable law or the Operating Partnership’s partnership agreement, in which case such Class E units will be repurchased for Class E shares of our common stock.

See “Summary of Our Operating Partnership Agreement—Special Limited Partner Interest.”

We have agreed to negotiate in good faith to provide registration rights to the Special Limited Partner with respect to any shares it holds or issuable to it in exchange for Operating Partnership units in the event of a listing of our common stock. |

| Hotel and Restaurant Management Fees —Remington Lodging & Hospitality, LLC, an affiliate of our Advisor |

Remington Hospitality provides hotel and restaurant management services for some of our hotels and may provide such services for hotels we acquire in the future. For providing these services, Remington Hospitality will receive a monthly base fee on assets managed that is equal to the greater of (i) $16,897 (to be increased annually based on any increases in CPI over the preceding annual period) or (ii) 3% of a property’s gross revenues.

Remington Hospitality may also earn an incentive management fee that is equal to the lesser of (i) 1% of a hotel’s gross revenues for each fiscal year and (ii) the amount by which the actual house profit exceeds the budgeted house profit determined on a property-by-property basis.

| |

| Project Management Fees —Project Management LLC, an affiliate of our Advisor |

Premier will provide design, construction, architecture, development or project management, procurement and other project related services to us and our properties.