|

The information in this pricing supplement is not complete and may be changed. A registration statement relating to these notes has been filed with the Securities and Exchange Commission. This pricing supplement and the accompanying prospectus supplement and prospectus are not an offer to sell these notes, nor are they soliciting an offer to buy these notes, in any state where the offer or sale is not permitted. SUBJECT TO COMPLETION, DATED MAY 18, 2023 | |

|

Pricing Supplement No. 2023-USNCH17296 to Prospectus Supplement and Prospectus each dated March 7, 2023 Filed Pursuant to Rule 424(b)(2) Registration Statement Nos. 333-270327 and 333-270327-01 Dated May ----, 2023 Citigroup Global Markets Holdings Inc. $-----Trigger In-Digital Notes |

|

Linked to Brent Crude Oil Futures Contracts Due On or About June 28, 2024

All payments due on the notes are fully and unconditionally guaranteed by Citigroup Inc.

| Investment Description |

The Trigger In-Digital Notes (the “notes”) are unsecured, unsubordinated debt obligations of Citigroup Global Markets Holdings Inc. (the “issuer”), guaranteed by Citigroup Inc. (the “guarantor”), with a return at maturity linked to the performance of Brent crude oil futures contracts (the “underlying commodity”). If the final commodity price is greater than or equal to the digital barrier and downside threshold (which are each equal to 60% of the initial commodity price), the issuer will repay the stated principal amount of the notes at maturity and pay a return equal to the digital return of between 11.00% and 12.40% (to be determined on the trade date). However, if the final commodity price is less than the digital barrier and downside threshold, you will be fully exposed to the negative performance of the underlying commodity and the issuer will pay you less than the stated principal amount of your notes, and possibly nothing, at maturity.

Investing in the notes involves significant risks. You may lose a substantial portion or all of your initial investment. You will not receive coupon payments during the term of the notes. In no event will you receive more than the digital return at maturity, even if the underlying commodity appreciates by significantly more than the digital return. The digital return applies only if you hold the notes to maturity. Any payment on the notes is subject to the creditworthiness of the issuer and the guarantor. If the issuer and the guarantor were to default on their obligations, you may not receive any amounts owed to you under the notes and you could lose your entire investment.

| Features |

|

q Digital Return Feature — If the final commodity price is greater than or equal to the digital barrier and downside threshold, the issuer will repay the stated principal amount of the notes at maturity and pay a return equal to the digital return. However, if the final commodity price is less than the digital barrier and downside threshold, you will be exposed to the decline in the underlying commodity from the initial commodity price to the final commodity price. q Downside Exposure — If the final commodity price is less than the digital barrier and downside threshold, you will be fully exposed to the negative commodity return and the issuer will pay you less than the stated principal amount of your notes, and possibly nothing, at maturity. The digital return applies only if you hold the notes to maturity. You might lose some or all of your initial investment. Any payment on the notes is subject to the creditworthiness of the issuer and the guarantor. If the issuer and the guarantor were to default on their obligations, you might not receive any amounts owed to you under the notes and you could lose your entire investment. |

| Key Dates1 | |

|

Trade date Settlement date Final valuation date,2 Maturity date |

May 25, 2023 May 31, 2023 June 25, 2024 June 28, 2024 |

|

1 Expected 2 See page PS-4 for additional details. | |

NOTICE TO INVESTORS: THE NOTES ARE SIGNIFICANTLY RISKIER THAN CONVENTIONAL DEBT SECURITIES. THE ISSUER IS NOT NECESSARILY OBLIGATED TO REPAY the stated principal amount of the notes AT MATURITY, AND THE NOTES CAN HAVE THE FULL DOWNSIDE MARKET RISK similar to THE UNDERLYING COMMODITY. THIS MARKET RISK IS IN ADDITION TO THE CREDIT RISK INHERENT IN PURCHASING A debt OBLIGATION OF CITIGROUP GLOBAL MARKETS HOLDINGS INC. THAT IS GUARANTEED BY CITIGROUP INC. YOU SHOULD NOT PURCHASE THE NOTES IF YOU DO NOT UNDERSTAND OR ARE NOT COMFORTABLE WITH THE SIGNIFICANT RISKS INVOLVED IN INVESTING IN THE NOTES.

YOU SHOULD CAREFULLY CONSIDER THE RISKS DESCRIBED UNDER “RISK FACTORS” BEGINNING ON PAGE PS-5 OF THIS PRICING SUPPLEMENT BEFORE PURCHASING ANY NOTES. EVENTS RELATING TO ANY OF THOSE RISKS, OR OTHER RISKS AND UNCERTAINTIES, COULD ADVERSELY AFFECT THE VALUE OF, AND THE RETURN ON, YOUR NOTES. YOU MAY LOSE SOME OR ALL OF YOUR INITIAL INVESTMENT IN THE NOTES. THE NOTES WILL NOT BE LISTED ON ANY SECURITIES EXCHANGE AND, ACCORDINGLY, MAY HAVE LIMITED OR NO LIQUIDITY.

| Note Offering |

We are offering Trigger In-Digital Notes Linked to Brent Crude Oil Futures Contracts. Any return at maturity will be determined by the performance of the underlying commodity. The notes are our unsecured, unsubordinated debt obligations, guaranteed by Citigroup Inc., and are offered for a minimum investment of 100 notes at the issue price described below. The initial commodity price, digital barrier, digital return and downside threshold will be set on the trade date.

| Underlying Commodity | Bloomberg Ticker* | Initial Commodity Price | Digital Barrier | Digital Return | Downside Threshold | CUSIP/ ISIN |

| Brent crude oil futures | CO1 | $ | $ , which is 60% of the initial commodity price | 11.00% to 12.40% | $ , which is 60% of the initial commodity price | 17331M485 / US17331M4859 |

*Bloomberg ticker symbols are being provided for reference purposes only. The commodity price of the underlying commodity will be determined as described under “Indicative Terms” in this pricing supplement.

See “Additional Terms Specific to the Notes” in this pricing supplement. The notes will have the terms specified in the accompanying prospectus supplement and prospectus, as supplemented by this pricing supplement.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of the notes or passed upon the accuracy or the adequacy of this pricing supplement or the accompanying prospectus supplement and prospectus. Any representation to the contrary is a criminal offense. The notes are not futures contracts and are offered pursuant to an exemption from regulation under the Commodity Exchange Act. Accordingly, you are not afforded any protection provided by the Commodity Exchange Act or any regulation promulgated by the Commodity Futures Trading Commission. The notes are not bank deposits and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency.

| Issue Price(1) | Underwriting Discount(2) | Proceeds to Issuer | |

| Per note | $10.00 | $0.20 | $9.80 |

| Total | $ | $ | $ |

| (1) | Citigroup Global Markets Holdings Inc. currently expects that the estimated value of the notes on the trade date will be at least $9.595 per note, which will be less than the issue price. The estimated value of the notes is based on proprietary pricing models of Citigroup Global Markets Inc. (“CGMI”) and our internal funding rate. It is not an indication of actual profit to CGMI or other of our affiliates, nor is it an indication of the price, if any, at which CGMI or any other person may be willing to buy the notes from you at any time after issuance. See “Valuation of the Notes” in this pricing supplement. |

| (2) | The underwriting discount is $0.20 per note. CGMI, acting as principal, expects to purchase from Citigroup Global Markets Holdings Inc., and Citigroup Global Markets Holdings Inc. expects to sell to CGMI, the aggregate stated principal amount of the notes set forth above for $9.80 per note. UBS Financial Services Inc. (“UBS”), acting as agent for sales of the notes, expects to purchase from CGMI, and CGMI expects to sell to UBS, all of the notes for $9.80 per note. UBS will receive an underwriting discount of $0.20 for each note it sells in this offering. UBS proposes to offer the notes to the public at a price of $10.00 per note. For additional information on the distribution of the notes, see “Supplemental Plan of Distribution” in this pricing supplement. In addition to the underwriting discount, CGMI and its affiliates may profit from expected hedging activity related to this offering, even if the value of the notes declines. See “Use of Proceeds and Hedging” in the accompanying prospectus. |

| Citigroup Global Markets Inc. | UBS Financial Services Inc. |

| Additional Terms Specific to the Notes |

The terms of the notes are set forth in the accompanying prospectus supplement and prospectus, as supplemented by this pricing supplement. The description in this pricing supplement of the particular terms of the notes supplements, and, to the extent inconsistent with, replaces, the descriptions of the general terms and provisions of the notes set forth in the accompanying prospectus supplement and prospectus. The accompanying prospectus supplement and prospectus contain important disclosures that are not repeated in this pricing supplement. It is important that you read the accompanying prospectus supplement and prospectus together with this pricing supplement before you decide whether to invest in the notes.

You may access the accompanying prospectus supplement and prospectus on the SEC website at www.sec.gov as follows (or if such address has changed, by reviewing our filings for the relevant dates on the SEC website):

| ¨ | Prospectus Supplement and Prospectus each dated March 7, 2023: |

https://www.sec.gov/Archives/edgar/data/200245/000119312523063080/d470905d424b2.htm

You may revoke your offer to purchase the notes at any time prior to the time at which we accept such offer by notifying the applicable agent. We reserve the right to change the terms of, or reject any offer to purchase, the notes prior to the trade date. The applicable agent will notify you in the event of any material changes to the terms of the notes, and you will be asked to accept such changes in connection with your purchase of the notes. You may also choose to reject such changes, in which case the applicable agent may reject your offer to purchase the notes. References to “Citigroup Global Markets Holdings Inc.,” “we,” “our” and “us” refer to Citigroup Global Markets Holdings Inc. and not to any of its subsidiaries. References to “Citigroup Inc.” refer to Citigroup Inc. and not to any of its subsidiaries. In this pricing supplement, “notes” refers to the Trigger In-Digital Notes Linked to Brent Crude Oil Futures Contracts that are offered hereby, unless the context otherwise requires.

This pricing supplement, together with the documents listed above, contains the terms of the notes and supersedes all other prior or contemporaneous oral statements as well as any other written materials including preliminary or indicative pricing terms, correspondence, trade ideas, structures for implementation, sample structures, brochures or other educational materials of ours. The description in this pricing supplement of the particular terms of the notes supplements, and, to the extent inconsistent with, replaces, the descriptions of the general terms and provisions of the debt securities set forth in the accompanying prospectus supplement and prospectus. You should carefully consider, among other things, the matters set forth in “Risk Factors” in this pricing supplement, as the notes involve risks not associated with conventional debt securities. We urge you to consult your investment, legal, tax, accounting and other advisers before deciding to invest in the notes.

PS-2

| Investor Suitability |

The suitability considerations identified below are not exhaustive. Whether or not the notes are a suitable investment for you will depend on your individual circumstances, and you should reach an investment decision only after you and your investment, legal, tax, accounting and other advisers have carefully considered the suitability of an investment in the notes in light of your particular circumstances. You should also review “Risk Factors” beginning on page PS-5 of this pricing supplement and “Brent Crude Oil Futures” beginning on page PS-12 of this pricing supplement.

The notes may be suitable for you if, among other considerations:

| ¨ | You fully understand the risks inherent in an investment in the notes, including the risk of loss of your entire initial investment. |

| ¨ | You can tolerate a loss of all or a substantial portion of your initial investment and are willing to make an investment that may have the full downside market risk of a hypothetical investment in the underlying commodity. |

| ¨ | You believe that the final commodity price will be greater than or equal to the digital barrier and downside threshold and the underlying commodity will not increase by a greater percentage than the digital return over the term of the notes. |

| ¨ | You are willing to make an investment whose positive return is limited to the digital return, regardless of the potential appreciation in the price of the underlying commodity, which could be significant. |

| ¨ | You can tolerate fluctuations in the value of the notes prior to maturity that may be similar to or exceed the downside fluctuations in the price of the underlying commodity. |

| ¨ | You understand and accept the risks associated with the underlying commodity. |

| ¨ | You are willing to invest in the notes based on the digital return, digital barrier and downside threshold indicated on the cover page of this pricing supplement. |

| ¨ | You do not seek current income from your investment. |

| ¨ | You are willing and able to hold the notes to maturity, and accept that there may be little or no secondary market for the notes and that any secondary market will depend in large part on the price, if any, at which CGMI is willing to purchase the notes. |

| ¨ | You are willing to assume the credit risk of Citigroup Global Markets Holdings Inc. and Citigroup Inc. for all payments under the notes, and understand that if Citigroup Global Markets Holdings Inc. and Citigroup Inc. default on their obligations you might not receive any amounts due to you. |

The notes may not be suitable for you if, among other considerations:

| ¨ | You do not fully understand the risks inherent in an investment in the notes, including the risk of loss of your entire initial investment. |

| ¨ | You are willing to assume the credit risk of Citigroup Global Markets Holdings Inc. and Citigroup Inc. for all payments under the notes, and understand that if Citigroup Global Markets Holdings Inc. and Citigroup Inc. default on their obligations you might not receive any amounts due to you. You do not fully understand the risks inherent in an investment in the notes, including the risk of loss of your entire initial investment. |

| ¨ | You require an investment designed to guarantee a full return of the stated principal amount at maturity. |

| ¨ | You cannot tolerate the loss of all or a substantial portion of your initial investment, or you are not willing to make an investment that may have the full downside market risk of a hypothetical investment in the underlying commodity. |

| ¨ | You do not believe that the final commodity price will be greater than or equal to the digital barrier and downside threshold or you believe that the underlying commodity will increase by a greater percentage than the digital return over the term of the notes. |

| ¨ | You seek an investment that participates in the full appreciation in the price of the underlying commodity and whose positive return is not limited to the digital return. |

| ¨ | You cannot tolerate fluctuations in the value of the notes prior to maturity that may be similar to or exceed the downside fluctuations in the price of the underlying commodity. |

| ¨ | You do not understand or accept the risks associated with the underlying commodity. |

| ¨ | You are unwilling to invest in the notes based on the digital return, digital barrier and downside threshold indicated on the cover page of this pricing supplement. |

| ¨ | You seek current income from your investment. |

| ¨ | You are unwilling or unable to hold the notes to maturity, or you seek an investment for which there will be an active secondary market. |

| ¨ | You are not willing to assume the credit risk of Citigroup Global Markets Holdings Inc. and Citigroup Inc. for all payments under the notes. |

PS-3

| Indicative Terms |

| Issuer | Citigroup Global Markets Holdings Inc. |

| Guarantee | All payments due on the notes are fully and unconditionally guaranteed by Citigroup Inc. |

| Issue price | 100% of the stated principal amount per note |

| Stated principal amount | $10.00 per note |

| Term | Approximately one year and one month |

| Trade date1 | May 25, 2023 |

| Settlement date1 | May 31, 2023 |

| Final valuation date1, 2 | June 25, 2024 |

| Maturity date1 | June 28, 2024 |

| Underlying commodity | Brent crude oil futures (Ticker: CO1) |

| Digital barrier | 60% of the initial commodity price, as specified on the cover of this pricing supplement. |

| Downside threshold | 60% of the initial commodity price, as specified on the cover of this pricing supplement. |

| Digital return | 11.00% to 12.40% |

| Payment at maturity (per $10.00 stated principal amount of notes) |

If the final commodity price is greater than or equal to the digital barrier and downside threshold, we will pay you at maturity a cash payment per $10.00 stated principal amount of notes that provides you with the stated principal amount of $10.00 plus a return equal to the digital return, calculated as follows: $10.00 × (1+ digital return) If the final commodity price is less than the digital barrier and downside threshold, we will pay you at maturity a cash payment per $10.00 stated principal amount of notes that is less than your stated principal amount and may be zero, resulting in a loss that is proportionate to the negative commodity return, calculated as follows: $10.00 × (1 + commodity return) In this scenario, you will be exposed to the decline of the underlying commodity and will lose a substantial portion or all of your stated principal amount at maturity in an amount proportionate to the negative commodity return. |

| Commodity return | final commodity price – initial commodity price initial commodity price |

| Initial commodity price | The commodity price of the underlying commodity on the trade date, as specified on the cover page of this pricing supplement |

| Final commodity price | The commodity price of the underlying commodity on the final valuation date |

| Commodity price | Except as otherwise specified under “Additional Terms of the Notes—Consequences of a Market Disruption Event; Postponement of the Final Valuation Date” or “—Discontinuation of Trading of the Underlying Commodity on the Relevant Exchange; Alternative Method of Calculation” below, the “commodity price” for the underlying commodity on any day means the settlement price per metric barrel of deliverable grade Brent blend crude oil on ICE Futures Europe (the “ICE”) for the first nearby futures contract stated in U.S. Dollars as made public by the ICE and displayed on Bloomberg Page “CO1 <CMDTY>” on that day |

INVESTING IN THE NOTES INVOLVES SIGNIFICANT RISKS. YOU MAY LOSE A SUBSTANTIAL PORTION OR ALL OF YOUR INITIAL INVESTMENT. ANY PAYMENT ON THE NOTES, INCLUDING ANY REPAYMENT OF THE STATED PRINCIPAL AMOUNT AT MATURITY, IS SUBJECT TO THE CREDITWORTHINESS OF THE ISSUER AND THE GUARANTOR. IF CITIGROUP GLOBAL MARKETS HOLDINGS INC. AND CITIGROUP INC. WERE TO DEFAULT ON THEIR OBLIGATIONS, YOU MIGHT NOT RECEIVE ANY AMOUNTS OWED TO YOU UNDER THE NOTES AND YOU COULD LOSE YOUR ENTIRE INVESTMENT.

| Investment Timeline |

| Trade date: | The digital return and the initial commodity price are set and the digital barrier and downside threshold are determined. | ||

|

|||

| Maturity date: |

The final commodity price is determined on the final valuation date and the commodity return is calculated.

If the final commodity price is greater than or equal to the digital barrier and downside threshold, we will pay you at maturity a cash payment per $10.00 stated principal amount of notes that provides you with the stated principal amount of $10.00 plus a return equal to the digital return, calculated as follows:

$10.00 × (1+ digital return)

If the final commodity price is less than the digital barrier and downside threshold, we will pay you at maturity a cash payment per $10.00 stated principal amount of notes that is less than your stated principal amount and may be zero, resulting in a loss that is proportionate to the negative commodity return, calculated as follows:

$10.00 × (1 + commodity return)

In this scenario, you will be exposed to the decline of the underlying commodity and will lose a substantial portion or all of your stated principal amount at maturity in an amount proportionate to the negative commodity return. |

| 1 | In the event that we make any changes to the expected trade date and settlement date, the final valuation date and maturity date may be changed to ensure that the stated term of the notes remains the same. |

| 2 | Subject to postponement as described under “Additional Terms of the Notes —Consequences of a Market Disruption Event; Postponement of the Final Valuation Date” in this pricing supplement. |

PS-4

| Risk Factors |

An investment in the notes is significantly riskier than an investment in conventional debt securities. The notes are subject to all of the risks associated with an investment in our conventional debt securities (guaranteed by Citigroup Inc.), including the risk that we and Citigroup Inc. may default on our obligations under the notes, and are also subject to risks associated with the underlying commodity. Accordingly, the notes are suitable only for investors who are capable of understanding the complexities and risks of the notes. You should consult your own financial, tax and legal advisers as to the risks of an investment in the notes and the suitability of the notes in light of your particular circumstances.

The following is a summary of certain key risk factors for investors in the notes. You should also carefully read the risk factors included in the accompanying prospectus supplement and in the documents incorporated by reference in the accompanying prospectus, including Citigroup Inc.’s most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q, which describe risks relating to the business of Citigroup Inc. more generally.

| ¨ | You may lose some or all of your investment — The notes differ from ordinary debt securities in that we will not necessarily repay the full stated principal amount of your notes at maturity. Instead, your return on the notes is linked to the underlying commodity and will depend on whether the final commodity price is greater than, equal to or less than the digital barrier and downside threshold (which are equal to each other). If the final commodity price is less than the digital barrier and downside threshold, you will lose 1% of the stated principal amount of the notes for every 1% by which the final commodity price is less than the initial commodity price. There is no minimum payment at maturity on the notes, and you may lose up to all of your investment in the notes. |

| ¨ | The digital return is contingent, and you will have full downside exposure to the underlying commodity if the final commodity price is less than the digital barrier and downside threshold — If the final commodity price is less than the digital barrier and downside threshold, you will not receive a positive return on the notes equal to the digital return and instead you will lose 1% of the stated principal amount of the notes for every 1% by which the final commodity price is less than the initial commodity price. In this circumstance, the notes will have full downside exposure to the decline of the underlying commodity. As a result, you may lose your entire investment in the notes. Further, the digital return feature applies only if you hold the notes to maturity. If you are able to sell the notes prior to maturity, you may have to sell them for a loss even if the price of the underlying commodity has not declined below the digital barrier and downside threshold. See “The value of the notes prior to maturity will fluctuate based on many unpredictable factors” below. |

| ¨ | The appreciation potential of the notes is limited by the digital return — Your potential positive return on the notes at maturity is limited by the digital return. If the final commodity price is greater than or equal to the digital barrier and downside threshold, we will repay the stated principal amount of the notes at maturity and pay a return equal to the digital return, regardless of any appreciation of the underlying commodity. Accordingly, the appreciation potential of the notes will be limited by the digital return, and the return on an investment in the notes may be significantly less than the return on a hypothetical direct investment in the underlying commodity. |

| ¨ | Your ability to receive the digital return may terminate on the final valuation date — If the final commodity price is less than the digital barrier and downside threshold, you will not be entitled to receive the digital return on the notes. |

| ¨ | The notes do not pay interest — Unlike conventional debt securities, the notes do not pay interest or any other amounts prior to maturity. You should not invest in the notes if you seek current income during the term of the notes. |

| ¨ | Investing in the notes is not equivalent to investing in Brent crude oil futures — The return on the notes will not reflect the return you would realize if you actually owned Brent crude oil futures. You will not have any entitlement to any commodity futures contract by virtue of your investment in the notes. |

| ¨ | Your payment at maturity depends on the commodity price of the underlying commodity on a single day — Because your payment at maturity depends on the commodity price of the underlying commodity solely on the final valuation date, you are subject to the risk that the commodity price on that day may be lower, and possibly significantly lower, than on one or more other dates during the term of the notes. If you had invested in another instrument linked to the underlying commodity that you could sell for full value at a time selected by you, or if the payment at maturity were based on an average of commodity prices of the underlying commodity, you might have achieved better returns. |

| ¨ | The probability that the underlying commodity will fall below the digital barrier and downside threshold on the final valuation date will depend in part on the volatility of the underlying commodity — “Volatility” refers to the frequency and magnitude of changes in the price of the underlying commodity. In general, the greater the volatility of the underlying commodity, the greater the probability that the underlying commodity will experience a large decline over the term of the notes and fall below the digital barrier and downside threshold on the final valuation date. The underlying commodity has historically experienced significant volatility. As a result, there is a significant risk that the underlying commodity will fall below the digital barrier and downside threshold on the final valuation date and that you will incur a significant loss on your investment in the notes. The terms of the notes are set, in part, based on expectations about the volatility of the underlying commodity as of the trade date. If expectations about the volatility of the underlying commodity change over the term of the notes, the value of the notes may be adversely affected, and if the actual volatility of the underlying commodity proves to be greater than initially expected, the notes may prove to be riskier than expected on the trade date. |

| ¨ | The notes are subject to the credit risk of Citigroup Global Markets Holdings Inc. and Citigroup Inc. — Any payment on the notes will be made by Citigroup Global Markets Holdings Inc. and is guaranteed by Citigroup Inc., and therefore is subject to the credit risk of both Citigroup Global Markets Holdings Inc. and Citigroup Inc. If we default on our obligations under the notes and Citigroup Inc. defaults on its guarantee obligations, you may not receive any payments that become due under the notes. As a result, the value of the notes prior to maturity will be affected by changes in the market’s view of our and Citigroup Inc.’s creditworthiness. Any decline, or |

PS-5

anticipated decline, in either of our or Citigroup Inc.’s credit ratings or increase, or anticipated increase, in the credit spreads charged by the market for taking either of our or Citigroup Inc.’s credit risk is likely to adversely affect the value of the notes.

| ¨ | The notes will not be listed on any securities exchange and you may not be able to sell them prior to maturity — The notes will not be listed on any securities exchange. Therefore, there may be little or no secondary market for the notes. CGMI currently intends to make a secondary market in relation to the notes and to provide an indicative bid price for the notes on a daily basis. Any indicative bid price for the notes provided by CGMI will be determined in CGMI’s sole discretion, taking into account prevailing market conditions and other relevant factors, and will not be a representation by CGMI that the notes can be sold at that price, or at all. CGMI may suspend or terminate making a market and providing indicative bid prices without notice, at any time and for any reason. If CGMI suspends or terminates making a market, there may be no secondary market at all for the notes because it is likely that CGMI will be the only broker-dealer that is willing to buy your notes prior to maturity. Accordingly, an investor must be prepared to hold the notes until maturity. |

| ¨ | The estimated value of the notes on the trade date, based on CGMI’s proprietary pricing models and our internal funding rate, will be less than the issue price — The difference is attributable to certain costs associated with selling, structuring and hedging the notes that are included in the issue price. These costs include (i) the underwriting discount paid in connection with the offering of the notes, (ii) hedging and other costs incurred by us and our affiliates in connection with the offering of the notes and (iii) the expected profit (which may be more or less than actual profit) to CGMI or other of our affiliates in connection with hedging our obligations under the notes. These costs adversely affect the economic terms of the notes because, if they were lower, the economic terms of the notes would be more favorable to you. The economic terms of the notes are also likely to be adversely affected by the use of our internal funding rate, rather than our secondary market rate, to price the notes. See “The estimated value of the notes would be lower if it were calculated based on our secondary market rate” below. |

| ¨ | The estimated value of the notes was determined for us by our affiliate using proprietary pricing models — CGMI derived the estimated value disclosed on the cover page of this pricing supplement from its proprietary pricing models. In doing so, it may have made discretionary judgments about the inputs to its models, such as the volatility of the underlying commodity and interest rates. CGMI’s views on these inputs may differ from your or others’ views, and as an underwriter in this offering, CGMI’s interests may conflict with yours. Both the models and the inputs to the models may prove to be wrong and therefore not an accurate reflection of the value of the notes. Moreover, the estimated value of the notes set forth on the cover page of this pricing supplement may differ from the value that we or our affiliates may determine for the notes for other purposes, including for accounting purposes. You should not invest in the notes because of the estimated value of the notes. Instead, you should be willing to hold the notes to maturity irrespective of the initial estimated value. |

| ¨ | The estimated value of the notes would be lower if it were calculated based on our secondary market rate — The estimated value of the notes included in this pricing supplement is calculated based on our internal funding rate, which is the rate at which we are willing to borrow funds through the issuance of the notes. Our internal funding rate is generally lower than our secondary market rate, which is the rate that CGMI will use in determining the value of the notes for purposes of any purchases of the notes from you in the secondary market. If the estimated value included in this pricing supplement were based on our secondary market rate, rather than our internal funding rate, it would likely be lower. We determine our internal funding rate based on factors such as the costs associated with the notes, which are generally higher than the costs associated with conventional debt securities, and our liquidity needs and preferences. Our internal funding rate is not an interest rate that we will pay to investors in the notes, which do not bear interest. |

Because there is not an active market for traded instruments referencing our outstanding debt obligations, CGMI determines our secondary market rate based on the market price of traded instruments referencing the debt obligations of Citigroup Inc., our parent company and the guarantor of all payments due on the notes, but subject to adjustments that CGMI makes in its sole discretion. As a result, our secondary market rate is not a market-determined measure of our creditworthiness, but rather reflects the market’s perception of our parent company’s creditworthiness as adjusted for discretionary factors such as CGMI’s preferences with respect to purchasing the notes prior to maturity.

| ¨ | The estimated value of the notes is not an indication of the price, if any, at which CGMI or any other person may be willing to buy the notes from you in the secondary market — Any such secondary market price will fluctuate over the term of the notes based on the market and other factors described in the next risk factor. Moreover, unlike the estimated value included in this pricing supplement, any value of the notes determined for purposes of a secondary market transaction will be based on our secondary market rate, which will likely result in a lower value for the notes than if our internal funding rate were used. In addition, any secondary market price for the notes will be reduced by a bid-ask spread, which may vary depending on the aggregate stated principal amount of the notes to be purchased in the secondary market transaction, and the expected cost of unwinding related hedging transactions. As a result, it is likely that any secondary market price for the notes will be less than the issue price. |

| ¨ | The value of the notes prior to maturity will fluctuate based on many unpredictable factors — As described under “Valuation of the Notes” below, the payout on the notes could be replicated by a hypothetical package of financial instruments consisting of a fixed-income bond and one or more derivative instruments. As a result, the factors that influence the values of fixed-income bonds and derivative instruments will also influence the terms of the notes at issuance and the value of the notes prior to maturity. Accordingly, the value of your notes prior to maturity will fluctuate based on a number of factors, including the price and volatility of the underlying commodity, interest rates generally, the time remaining to maturity and our and Citigroup Inc.’s creditworthiness, as reflected in our secondary market rate. Changes in the price of the underlying commodity may not result in a comparable change in the value of your notes. You should understand that the value of your notes at any time prior to maturity may be significantly less than the issue price. The stated payout from the issuer only applies if you hold the notes to maturity. |

| ¨ | Immediately following issuance, any secondary market bid price provided by CGMI, and the value that will be indicated on any brokerage account statements prepared by CGMI or its affiliates, will reflect a temporary upward adjustment — The |

PS-6

amount of this temporary upward adjustment will decline to zero over the temporary adjustment period. See “Valuation of the Notes” in this pricing supplement.

| ¨ | If a commodity hedging disruption event occurs during the term of the notes, we may redeem the notes early for an amount that may result in a significant loss on your investment — See “Additional Terms of the Notes—Commodity Hedging Disruption Event” in this pricing supplement for information about the events that may constitute a commodity hedging disruption event. If a commodity hedging disruption event occurs, we may redeem the notes prior to the maturity date for an amount equal to the early redemption amount determined as of the early redemption valuation date. The early redemption amount will be determined in a manner based upon (but not necessarily identical to) CGMI’s then contemporaneous practices for determining secondary market bid prices for the notes and similar instruments, subject to the exceptions and more detailed provisions set forth under “Additional Terms of the Notes—Commodity Hedging Disruption Event” below. As discussed above, any secondary market bid price is likely to be less than the issue price and, absent favorable changes in market conditions and other relevant factors, is also likely to be less than the estimated value of the notes set forth on the cover page of this pricing supplement. Accordingly, if a commodity hedging disruption event occurs, there is a significant likelihood that the early redemption amount you receive will result in a loss on your investment in the notes. Moreover, in determining the early redemption amount, the calculation agent will take into account the relevant event that has occurred, and that event may have a significant adverse effect on the underlying commodity market and/or commodity markets generally, resulting in an early redemption amount that is significantly less than the amount you paid for your notes. You may lose up to all of your investment. |

The early redemption amount may be significantly less than the amount you would have received had we not elected to redeem the notes and had you been able instead to hold them to maturity. For example, the early redemption amount may be determined during a market disruption that has a significant adverse effect on the early redemption amount. That market disruption may be resolved by the time of the originally scheduled maturity date and, had your payment on the notes been determined on the scheduled final valuation date rather than on the early redemption valuation date, you might have achieved a significantly better return.

| ¨ | The calculation agent may make discretionary determinations in connection with a commodity hedging disruption event and the early redemption amount that could adversely affect your return upon early redemption — The calculation agent will be required to exercise discretion in determining whether a commodity hedging disruption event has occurred. If the calculation agent determines that a commodity hedging disruption event has occurred and as a result we elect to redeem the notes upon the occurrence of a commodity hedging disruption event, you may incur a significant loss on your investment in the notes. |

In addition, the calculation agent has broad discretion to determine the early redemption amount, including the ability to make adjustments to proprietary pricing models and inputs to those models in good faith and in a commercially reasonable manner. The fact that the calculation agent is our affiliate may cause it to have interests that are adverse to yours as a holder of the notes. Under the terms of the notes, the calculation agent has the authority to make determinations that may protect our economic interests while resulting in a significant loss to you on your investment in the notes.

| ¨ | The notes provide exposure to Brent crude oil futures and not direct exposure to crude oil — The price of a crude oil futures contract reflects the expected value of crude oil upon delivery in the future, whereas the spot price of crude oil reflects the immediate delivery value of crude oil. A variety of factors can lead to a disparity between the expected future price of crude oil and the spot price at a given point in time, such as the cost of storing crude oil for the term of the futures contract, interest charges incurred to finance the purchase of crude oil and expectations concerning supply and demand for crude oil. The price movement of a futures contract is typically correlated with the movements of the spot price of the reference commodity, but the correlation is generally imperfect and price movements of the spot price may not be reflected in the futures market (and vice versa). |

In addition, the difference between a futures price and a spot price is typically greater the longer the remaining term of the futures contract (in other words, futures prices converge toward spot prices as the expiration of the futures contract nears). As a result, the commodity price of the underlying commodity on the final valuation date will be influenced in part by how much time remains to expiration of the Brent crude oil futures on the final valuation date. Had the final valuation date occurred with a different length of time remaining to expiration of the Brent crude oil futures, your return on the notes might have been more favorable.

| ¨ | Investments linked to commodities are subject to sharp fluctuations in settlement prices — Investments, such as the notes, linked to the prices of commodities are subject to sharp fluctuations in the prices of commodities and commodity futures over short periods of time for a variety of reasons, including: changes in supply and demand relationships; weather; climatic events; the occurrence of natural disasters; wars; political and civil upheavals; acts of terrorism; trade, fiscal, monetary, and exchange control programs; domestic and foreign political and economic events and policies; disease; pestilence; technological developments; changes in interest rates; and trading activities in commodities and commodity futures. These factors may affect the commodity price and the value of the notes in varying and potentially inconsistent ways. As a result of these or other factors, the commodity prices of the underlying commodity may be, and recently have been, highly volatile. |

| ¨ | Single commodity prices tend to be more volatile than, and may not correlate with, the prices of commodities generally — The notes are not linked to a diverse basket of commodities or a broad-based commodity index. Instead, the notes are linked to Brent crude oil futures. The commodity price may not correlate to the price of commodities generally and may diverge significantly from the prices of commodities generally. Because the notes are linked solely to Brent crude oil futures, they carry greater risk and may be more volatile than securities linked to the prices of a larger number of commodities or a broad-based commodity index. The price of futures contracts on Brent crude oil may be, and has recently been, highly volatile, and we can give you no assurance that the volatility will lessen. See “Brent Crude Oil Futures” in this pricing supplement. |

| ¨ | The market price of Brent crude oil futures may change unpredictably and affect the value of the notes in unforeseen ways — The price of Brent crude oil futures is primarily affected by the demand for and supply of Brent crude oil, but is also influenced significantly from time to time by speculative actions and by currency exchange rates. Crude oil prices are generally highly volatile and subject to dislocation. Demand for refined petroleum products by consumers, as well as the agricultural, manufacturing and transportation industries, affects the price of crude oil. Crude oil’s end-use as a refined product is often as transport fuel, industrial fuel |

PS-7

and in-home heating fuel. Potential for substitution in most areas exists. Because the precursors of demand for petroleum products are linked to economic activity, demand will tend to reflect economic conditions. Demand is also influenced by government regulations, such as environmental or consumption policies. In addition to general economic activity and demand, prices for crude oil are affected by political events, labor activity and, in particular, direct government intervention (such as embargos) or supply disruptions in major oil-producing regions of the world. Such events tend to affect oil prices worldwide, regardless of the location of the event. Supply for crude oil may increase or decrease depending on many factors. These include production decisions by OPEC and other crude oil producers. Crude oil prices are determined with significant influence by OPEC. OPEC has the potential to influence oil prices worldwide because its members possess a significant portion of the world’s oil supply. In the event of sudden disruptions in the supplies of oil, such as those caused by war, natural events, accidents or acts of terrorism, prices of oil futures contracts could become extremely volatile and unpredictable. Also, sudden and dramatic changes in the futures market may occur, for example, upon a cessation of hostilities that may exist in countries producing oil, the introduction of new or previously withheld supplies into the market or the introduction of substitute products or commodities. Brent crude oil prices may also be affected by short-term changes in supply and demand because of trading activities in the oil market and seasonality (e.g., weather conditions such as hurricanes).

| ¨ | Brent crude oil futures prices differ from other benchmark measures of crude oil price — In particular, the Brent crude oil futures prices referenced by the notes differ from NYMEX light sweet crude oil futures. Brent crude oil futures may be more indicative of European and Asian crude oil prices, while NYMEX light sweet crude oil futures may be more indicative of the North American market for crude oil. Events and circumstances specific to the market for Brent crude oil may have a negative impact on Brent crude oil futures without necessarily having a significant effect on NYMEX light sweet crude oil futures prices. The performance of Brent crude oil futures over the term of the notes may differ significantly from, and may be significantly less favorable than, the performance of NYMEX light sweet crude oil futures. |

| ¨ | Futures contracts on Brent crude oil are the benchmark crude oil contracts in European and Asian markets and may be affected by economic conditions in Europe and Asia — Because futures contracts on Brent crude oil are the benchmark crude oil contracts in European and Asian markets, they will be affected by economic conditions in Europe and Asia. A decline in economic activity in Europe or Asia could result in decreased demand for Brent crude oil and for futures contracts on Brent crude oil, which could adversely affect the commodity price of Brent crude oil futures and, therefore, the notes. |

| ¨ | There are risks relating to the commodity price of Brent crude oil futures being determined by ICE Futures Europe — The commodity price of Brent crude oil futures will be determined by reference to the official settlement price per barrel on ICE Futures Europe of the first nearby month futures contract for Brent crude oil, stated in U.S. dollars, as made public by ICE Futures Europe and displayed on the applicable Bloomberg page. Investments in notes linked to the value of commodity futures contracts that are traded on non-U.S. exchanges, such as ICE Futures Europe, involve risks associated with the markets in foreign countries, including risks of volatility in those markets and governmental intervention in those markets. |

| ¨ | A decision by ICE Futures Europe to increase margin requirements for Brent crude oil futures contracts may affect the commodity price — If ICE Futures Europe increases the amount of collateral required to be posted to hold positions in the futures contracts on Brent crude oil (i.e., the margin requirements), market participants who are unwilling or unable to post additional collateral may liquidate their positions, which may cause the commodity price of the underlying commodity to decline significantly. |

| ¨ | Changes in exchange methodology may affect the value of your notes. — The commodity price of the underlying commodity will be determined by reference to the price determined by the relevant exchange. The relevant exchange may from time to time change any rule or bylaw or take emergency action under its rules, any of which could adversely affect the commodity price of the underlying commodity and, in turn, your investment in the notes. |

| ¨ | Legal and regulatory changes could adversely affect the return on and value of your notes — Commodity futures contracts are subject to legal and regulatory regimes in the United States and, in some cases, in other countries that may change in ways that could adversely affect the underlying commodity. For example, in October 2020, the CFTC adopted rules to establish revised or new limits on the size of the positions any person may hold in 25 agricultural, metals and energy futures contracts and futures, options and swaps that are economically equivalent to those futures contracts. The limits apply to a person’s combined position in the specified 25 futures contracts and options on futures (“core referenced futures contracts”), futures and options on futures directly or indirectly linked to the core referenced futures contracts, and economically equivalent swaps. These rules came into effect on January 1, 2022 for covered futures and options on futures contracts and on January 1, 2023 for covered swaps. The rules may reduce liquidity in the exchange-traded market for futures contracts on Brent crude, which may, in turn, have an adverse effect on your payment at maturity. Market participants may decide, or be required, to sell their positions in futures contracts on Brent crude oil as a result of these rules. While the effects of these or other regulatory developments are difficult to predict, if broad market selling were to occur, it would likely lead to declines, possibly significant declines, in the price of futures contracts on Brent crude oil and therefore, the value of the notes. |

| ¨ | Holders of the notes will not benefit from regulatory protections of the Commodity Futures Trading Commission — The notes are our direct obligations. The net proceeds to be received by us from the sale of the notes will not be used to purchase or sell the underlying commodity for the benefit of the holders of notes. An investment in the notes does not constitute an investment in a commodity or commodity futures contract, and holders of the notes will not benefit from the regulatory protections of the Commodity Futures Trading Commission (the “CFTC”) afforded to persons who trade in such contracts. |

| ¨ | Distortions or disruptions of market trading in Brent crude oil futures could adversely affect the value of and return on the notes — The commodity markets are subject to temporary distortions or other disruptions due to various factors, including the lack of liquidity in the markets, the participation of speculators and government regulation and intervention. These circumstances could adversely affect the commodity prices of the underlying commodity and, therefore, the value of and return on the notes. In addition, if the scheduled final valuation date is not a scheduled trading day or a market disruption event occurs on that day, the final valuation date will be subject to postponement, as described under “Additional Terms of the Notes” in this pricing supplement. If the final valuation |

PS-8

date is not postponed in these circumstances, the calculation agent will determine the commodity price on the final valuation date in its discretion. The calculation agent’s determination of the final commodity price may result in an unfavorable return on the notes.

| ¨ | Our offering of the notes is not a recommendation of the underlying commodity — The fact that we are offering the notes does not mean that we believe that investing in an instrument linked to the underlying commodity is likely to achieve favorable returns. In fact, as we are part of a global financial institution, our affiliates may have positions (including short positions) in the underlying commodity or in instruments related to the underlying commodity and may publish research or express opinions, that in each case are inconsistent with an investment linked to the underlying commodity. These and other activities of our affiliates may affect the price of the underlying commodity in a way that has a negative impact on your interests as a holder of the notes. |

| ¨ | Trading and other transactions by our affiliates, or by UBS or its affiliates may impair the value of the notes — We expect to hedge our exposure under the notes through CGMI or other of our affiliates, who will likely enter into derivative transactions, such as over-the-counter options or exchange-traded instruments, relating to the underlying commodity and may adjust such positions during the term of the notes. It is possible that our affiliates could receive substantial returns from these hedging activities while the value of the notes declines. Our affiliates and UBS and its affiliates may also engage in trading in instruments linked to the underlying commodity on a regular basis as part of their respective general broker-dealer and other businesses, for proprietary accounts, for other accounts under management or to facilitate transactions for customers, including block transactions. Such trading and hedging activities may affect the price of the underlying commodity and reduce the return on your investment in the notes. Our affiliates or UBS or its affiliates may also issue or underwrite other securities or financial or derivative instruments with returns linked or related to the underlying commodity. By introducing competing products into the marketplace in this manner, our affiliates or UBS or its affiliates could adversely affect the value of the notes. Any of the foregoing activities described in this paragraph may reflect trading strategies that differ from, or are in direct opposition to, investors’ trading and investment strategies relating to the notes. |

| ¨ | The calculation agent, which is an affiliate of ours, will make important determinations with respect to the notes — If certain events occur, such as market disruption events or the discontinuance of the underlying commodity, CGMI, as calculation agent, will be required to make discretionary judgments that could significantly affect what you receive at maturity. Such judgments could include, among other things, any price required to be determined under the notes. In addition, if certain events occur, CGMI will be required to make certain discretionary judgments that could significantly affect your payment at maturity. Such judgments could include, among other things: |

| ¨ | determining whether the scheduled final valuation date is a disrupted day or whether a commodity hedging disruption event has occurred; |

| ¨ | if the scheduled final valuation date is a disrupted day, determining whether to postpone the scheduled final valuation date; |

| ¨ | if the scheduled final valuation date is a disrupted day and it is not postponed, determining the commodity price on that day; |

| ¨ | if a commodity hedging disruption event occurs, determining the early redemption amount; |

| ¨ | if the relevant exchange discontinues trading in the underlying commodity, selecting a successor commodity price, successor relevant exchange or successor underlying commodity, as applicable; and |

| ¨ | if the relevant exchange discontinues trading in the underlying commodity or if the method of calculating the commodity price is changed in a material respect, determining the commodity price on the final valuation date. |

In making these judgments, the calculation agent’s interests as an affiliate of ours could be adverse to your interests as a holder of the notes.

| ¨ | The U.S. federal tax consequences of an investment in the notes are unclear. — There is no direct legal authority regarding the proper U.S. federal tax treatment of the notes, and we do not plan to request a ruling from the Internal Revenue Service (the “IRS”). Consequently, significant aspects of the tax treatment of the notes are uncertain, and the IRS or a court might not agree with the treatment of the notes as prepaid forward contracts. If the IRS were successful in asserting an alternative treatment of the notes, the tax consequences of the ownership and disposition of the notes might be materially and adversely affected. Moreover, future legislation, Treasury regulations or IRS guidance could adversely affect the U.S. federal tax treatment of the notes, possibly retroactively. |

If you are a non-U.S. investor, you should review the discussion of withholding tax issues in “United States Federal Tax Considerations—Non-U.S. Holders” below.

You should read carefully the discussion under “United States Federal Tax Considerations” in this pricing supplement. You should also consult your tax adviser regarding the U.S. federal tax consequences of an investment in the notes, as well as tax consequences arising under the laws of any state, local or non-U.S. taxing jurisdiction.

PS-9

| Hypothetical Examples |

Hypothetical terms only. Actual terms may vary. See the cover page for actual offering terms.

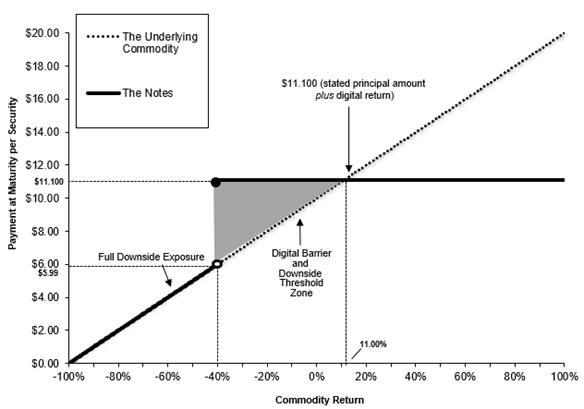

The diagram below illustrates your hypothetical payment at maturity for a range of hypothetical percentage changes of the underlying commodity from the initial commodity price to the final commodity price. The diagram below is based on a hypothetical digital return of 11.00% (the actual digital return will be determined on the trade date).

See “Risk Factors—Investing in the notes is not equivalent to investing in Brent crude oil futures” above.

The following table and hypothetical examples below illustrate the payment at maturity per $10.00 stated principal amount of notes for a hypothetical range of performances for the underlying commodity from -100.00% to +100.00% and assume an initial commodity price of $100, a digital barrier of $60 (60% of the initial commodity price), a downside threshold of $60 (60% of the initial commodity price) and a digital return of 11.00%. The hypothetical initial commodity price, digital barrier and downside threshold have been chosen for illustrative purposes only and do not represent the actual initial commodity price, digital barrier and downside threshold. The actual initial commodity price, digital barrier and downside threshold are listed on the cover page of this pricing supplement. The hypothetical payment at maturity examples set forth below are for illustrative purposes only and may not be the actual returns applicable to a purchaser of the notes. The actual payment at maturity may be more or less than the amounts displayed below and will be determined based on the actual terms of the notes, including the initial commodity price, digital barrier, downside threshold, digital return and the final commodity price. You should consider carefully whether the notes are suitable to your investment goals. The numbers appearing in the table and in the examples below have been rounded for ease of analysis.

| Final Commodity Price | Commodity return | Payment at Maturity | Total Return on Notes at Maturity(1) |

| $200.00 | 100.00% | $11.100 | 11.00% |

| $190.00 | 90.00% | $11.100 | 11.00% |

| $180.00 | 80.00% | $11.100 | 11.00% |

| $170.00 | 70.00% | $11.100 | 11.00% |

| $160.00 | 60.00% | $11.100 | 11.00% |

| $150.00 | 50.00% | $11.100 | 11.00% |

| $140.00 | 40.00% | $11.100 | 11.00% |

| $130.00 | 30.00% | $11.100 | 11.00% |

| $120.00 | 20.00% | $11.100 | 11.00% |

| $111.00 | 11.00% | $11.100 | 11.00% |

| $110.00 | 10.00% | $11.100 | 11.00% |

| $105.00 | 5.00% | $11.100 | 11.00% |

| $100.00 | 0.00% | $11.100 | 11.00% |

| $90.00 | -10.00% | $11.100 | 11.00% |

| $80.00 | -20.00% | $11.100 | 11.00% |

| $70.00 | -30.00% | $11.100 | 11.00% |

PS-10

| $60.00 | -40.00% | $11.100 | 11.00% |

| $59.99 | -40.01% | $5.999 | -40.01% |

| $50.00 | -50.00% | $5.000 | -50.00% |

| $40.00 | -60.00% | $4.000 | -60.00% |

| $30.00 | -70.00% | $3.000 | -70.00% |

| $20.00 | -80.00% | $2.000 | -80.00% |

| $10.00 | -90.00% | $1.000 | -90.00% |

| $0.00 | -100.00% | $0.000 | -100.00% |

1 The “Total Return on Notes at Maturity” is calculated as (a) the payment at maturity per note minus the $10.00 issue price per note divided by (b) the $10.00 issue price per note.

Example 1 — The final commodity price increases by 60% from the initial commodity price of $100 to a final commodity price of $160. Because the final commodity price is greater than the digital barrier and downside threshold, we would pay you a payment at maturity of $11.100 per $10.00 stated principal amount of notes (a total return at maturity of 11.00%*), calculated as follows:

$10.00 x (1 + digital return)

$10.00 x (1 + 11.00%) = $11.100

As this example illustrates, if the underlying commodity appreciates, you will receive the digital return at maturity, regardless of the extent of that appreciation. In this example, the commodity return is significantly greater than the digital return, and as a result an investment in the notes would significantly underperform a direct investment in the underlying commodity.

Example 2 — The final commodity price decreased by 10% from the initial commodity price of $100 to a final commodity price of $90. Because the final commodity price is greater than the digital barrier and downside threshold, we would pay you a payment at maturity of $11.100 per $10.00 stated principal amount of notes (a total return at maturity of 11.00%*), calculated as follows:

$10.00 x (1 + digital return)

$10.00 x (1 + 11.00%) = $11.100

As this example illustrates, you will receive the digital return at maturity even if the underlying commodity depreciates, so long as the final commodity price is greater than or equal to the digital barrier and downside threshold.

Example 3 — The final commodity price decreased by 70% from the initial commodity price of $100 to a final commodity price of $30. Because the final commodity price is less than the digital barrier and downside threshold, we would pay you a payment at maturity of $3.00 per $10.00 stated principal amount of notes (a total return at maturity of -70.00%*), calculated as follows:

$10.00 × (1 + commodity return)

$10.00 × (1 + -70.00%) = $3.00

If the final commodity price is less than the digital barrier and downside threshold, you will not receive the digital return at maturity and instead will be fully exposed to the negative commodity return, resulting in a loss on the stated principal amount that is proportionate to the percentage decline in the price of the underlying commodity. Under these circumstances, you will lose a significant portion or all of the stated principal amount at maturity. Any payment on the notes is subject to the creditworthiness of the issuer and the guarantor, and if the issuer and the guarantor were to default on their obligations, you could lose your entire investment.

* The total return at maturity is calculated as (a) the payment at maturity per note minus the $10.00 issue price per note divided by (b) the $10.00 issue price per note.

PS-11

| Brent Crude Oil Futures |

Brent crude oil futures contracts trade on ICE Futures Europe (the “ICE”). The commodity price of Brent crude oil futures on any day is the settlement price per metric barrel of deliverable grade Brent blend crude oil on the ICE for the first nearby futures contract stated in U.S. Dollars as made public by the ICE and displayed on Bloomberg Page “CO1 <CMDTY>” on that day.

ICE Futures Europe is a London-based futures exchange, offering benchmark energy and emissions futures and options contracts cleared by ICE Clear Europe. ICE Futures Europe is supervised by the U.K. Financial Conduct Authority.

The Brent crude oil futures contract represents the right to receive a future delivery of 1,000 net barrels of Brent blend crude oil per unit and is quoted at a price that represents one barrel of Brent blend crude oil. The delivery point of crude oil underlying the contract is Sullom Voe, Scotland. The Brent crude oil futures contract is a deliverable contract based on an Exchange of Futures for Physical (“EFP”) delivery mechanism with an option to cash settle. This mechanism enables companies to take delivery of physical crude supplies through EFP or, alternatively and more commonly, open positions that can be cash settled at expiration against a physical price index. Trading in a given futures contract will cease at the end of the designated settlement period on the last business day of the second month preceding the relevant contract month (e.g., the futures contract that is settled in March will cease trading on the last business day of January). The official settlement price is determined by ICE Futures Europe based on the weighted average price of trades during a two minute settlement period from 19:28:00, London time.

The graph below illustrates the performance of Brent crude oil futures from January 2, 2013 to May 16, 2023. The commodity price of Brent crude oil futures on May 16, 2023 was $74.91. We obtained the commodity prices of Brent crude oil futures from Bloomberg, and we have not participated in the preparation of or verified such information. The historical commodity prices of Brent crude oil futures should not be taken as an indication of future performance and no assurance can be given as to the final commodity price or any future commodity price of Brent crude oil futures. We cannot give you assurance that the performance of Brent crude oil futures will result in a positive return on your initial investment and you could lose a significant portion or all of the stated principal amount at maturity.

PS-12

| Additional Terms of the Notes |

General

The terms of the notes are set forth in the accompanying prospectus supplement and prospectus, as supplemented by this pricing supplement. The accompanying prospectus supplement and prospectus contain important disclosures that are not repeated in this pricing supplement. It is important that you read the accompanying prospectus supplement and prospectus together with this pricing supplement before deciding whether to invest in the notes.

Consequences of a Market Disruption Event; Postponement of the Final Valuation Date

If the scheduled final valuation date is not a scheduled trading day, the final valuation date will be postponed with to the next succeeding day that is a scheduled trading day. In addition, if the scheduled final valuation date is not a trading day or a market disruption event occurs or is continuing on the scheduled final valuation date (such scheduled final valuation date, a “disrupted day”), the calculation agent may, but is not required to, postpone the final valuation date to the next succeeding trading day that is not a disrupted day. However, in no event will the scheduled final valuation date be postponed more than five trading days after the originally scheduled final valuation date as a result of a disrupted day occurring on the scheduled final valuation date. If the final valuation date is a disrupted day and the final valuation date is not postponed, then the commodity price of the underlying commodity on the final valuation date will be the calculation agent’s good faith estimate of the commodity price on the final valuation date that would have prevailed but for the final valuation date being a disrupted day.

If the final valuation date is postponed so that it falls fewer than three business days prior to the scheduled maturity date, the maturity date will be postponed to the third business day after the final valuation date as postponed. If the scheduled maturity date is not a business day, the payment required to be made on the maturity date will be made on the next succeeding business day with the same force and effect as if made on the originally scheduled maturity date. No interest will be payable as a result of the delay in payment.

A “scheduled trading day” means a day, as determined by the calculation agent, on which the relevant exchange is scheduled to open for trading for its regular trading session.

A “trading day” means a day, as determined by the calculation agent, on which trading is generally conducted on the relevant exchange.

The “relevant exchange” means the ICE Futures Europe or, if there is a successor commodity futures contract to the futures underlying the notes, the primary exchange or market of trading for the successor commodity futures contract.

A “market disruption event” means, as determined by the calculation agent:

| · | any material suspension, absence or limitation of trading in the underlying commodity on the relevant exchange; |

| · | any event that materially disrupts or impairs the ability of market participants to effect transactions in, or obtain market values for, the underlying commodity; |

| · | the commodity price is a “limit price,” meaning that the commodity price for a day has increased or decreased from the previous day’s commodity price by the maximum amount permitted under the rules of the relevant exchange; or |

| · | a failure by the relevant exchange or other price source to announce or publish the commodity price. |

Commodity Hedging Disruption Event

If, on any day during the term of the notes up to but excluding the final valuation date, the calculation agent determines that a commodity hedging disruption event has occurred, we will have the right, but not the obligation, to redeem the notes, in whole and not in part, by providing written notice of our election to exercise that right to the trustee (the date of such notice, the “early redemption notice date”) on a redemption date of our election that is no later than the 30th business day immediately following the early redemption notice date or earlier than the fifth business day following the early redemption notice date. A commodity hedging disruption event need not be continuing on the early redemption notice date or on the redemption date. The amount due and payable on the notes upon such redemption will be equal to the early redemption amount determined as of the early redemption valuation date.

A “commodity hedging disruption event” means any event or condition following which we or our affiliates are unable, after using commercially reasonable efforts, to (i) acquire, establish, re-establish, substitute, maintain, unwind or dispose of any security, option, future, derivative, currency, instrument, transaction, asset or arrangement that the calculation agent deems necessary to hedge the risk of entering into and performing our obligations with respect to the notes, whether in the aggregate on a portfolio basis or incrementally on a trade by trade basis (each a “hedge position”) or (ii) realize, recover or remit the proceeds of any such hedge position, in each case including (without limitation) if those hedge positions (in whole or in part) are (or, but for the consequent disposal thereof, would otherwise be) in excess of any allowable position limit(s) in relation to the underlying commodity traded on any exchange(s) or other trading facility (it being within the sole and absolute discretion of the calculation agent to determine which of the hedge positions are counted towards that limit).

The “early redemption amount” will be the fair value of the notes determined by the calculation agent as of the early redemption valuation date in good faith and in a manner based upon (but not necessarily identical to) CGMI’s then contemporaneous practices for determining a secondary market bid price for the notes and similar instruments, taking into account the commodity hedging disruption event that has occurred. In determining the early redemption amount, the calculation agent may take into account proprietary pricing models and may make adjustments to those models or inputs to those models in good faith and in a commercially reasonable manner. The calculation agent may also take into account other facts, whether or not unique to us or our affiliates, in determining the early redemption amount so long as it is in good faith and commercially reasonable. The early redemption amount may result in a loss of a significant amount or all of your investment in the notes. See “Risk Factors--If a commodity hedging disruption event occurs during the term of the notes, we may redeem the notes early for an amount that may result in a significant loss on your investment” in this pricing supplement.

PS-13

The “early redemption valuation date” is the early redemption notice date.

Under the terms of the notes, the calculation agent will be required to exercise discretion under certain circumstances, including (i) determining whether a market disruption event or a commodity hedging disruption event has occurred; (ii) if the scheduled final valuation date is a disrupted day, determining whether to postpone the final valuation date; (iii) if the final valuation date is a disrupted day and the final valuation date is not postponed, determining the commodity price on that day; (iv) if a commodity hedging disruption event occurs, determining the early redemption amount; and (v) if trading in the underlying commodity is discontinued on the relevant exchange, determining a successor relevant exchange or a successor commodity futures contract (as defined below). In exercising this discretion, the calculation agent will be required to act in good faith and in a commercially reasonable manner, but it may take into account any factors it deems relevant, including, without limitation, whether the applicable event materially interfered with our or our affiliates’ ability to adjust or unwind all or a material portion of any hedge with respect to the notes.

Discontinuation of Trading of the Underlying Commodity on the Relevant Exchange; Alternative Method of Calculation

If the relevant exchange discontinues trading in the underlying commodity, the calculation agent may, in its sole discretion, replace the underlying commodity with another futures contract that references Brent crude oil and that the calculation agent, in its sole discretion, determines to be substantially similar to the discontinued underlying commodity (such replacement futures contract will be referred to herein as a “successor commodity futures contract”), and the commodity price on the final valuation date will be determined by reference to the official settlement price of the successor commodity futures contract on the relevant exchange for the successor commodity futures contract on that day. In such event, the calculation agent will make such adjustments to any price of the commodity futures contract used for purposes of the notes as it determines are appropriate in the circumstances. Upon any selection by the calculation agent of a successor commodity futures contract, the calculation agent will cause written notice thereof to be promptly furnished to us and to the holders of the notes.

If the relevant exchange discontinues trading in the underlying commodity prior to, and that discontinuation is continuing on, the final valuation date, and the calculation agent determines, in its sole discretion, that no successor commodity futures contract is available at that time, or if the calculation agent has previously selected a successor commodity futures contract for the underlying commodity and trading in such successor commodity futures contract is discontinued prior to, and that discontinuation is continuing on, the final valuation date, then the calculation agent will determine the commodity price of the underlying commodity or a successor commodity futures contract, as applicable, for that date in its sole discretion.

Notwithstanding these alternative arrangements, discontinuation of trading of the underlying commodity on the relevant exchange may adversely affect the value of the notes.

If at any time the method of calculating the official settlement price of the underlying commodity is changed in a material respect by the relevant exchange, or if the reporting thereof is in any other way modified so that the commodity price does not, in the opinion of the calculation agent, fairly represent the value of the underlying commodity, the calculation agent will, at the close of business in New York City on each day on which the commodity price is to be determined, make such calculations and adjustments as, in the good faith judgment of the calculation agent, may be necessary in order to arrive at a value for the underlying commodity. The calculation agent shall cause written notice of such calculations and adjustments to be furnished to the holders of the notes.

Events of Default and Acceleration

In case an event of default (as defined in the accompanying prospectus) with respect to the notes shall have occurred and be continuing, the amount declared due and payable upon any acceleration of the notes will be determined by the calculation agent and will equal, for each note, the payment at maturity, calculated as though the final valuation date were the date of such acceleration.

In case of default in payment at maturity of the notes, no interest will accrue on such overdue payment either before or after the maturity date.