As filed with the Securities and Exchange Commission on November 20, 2023.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-1

REGISTRATION STATEMENT

Under

The Securities Act of 1933

Concord Health Limited

(Exact name of Registrant as specified in its charter)

| Cayman Islands | 8090 | Not Applicable | ||

| (State or other jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer | ||

| incorporation or organization) | Classification Code Number) | Identification Number) |

4th Floor, Harbour Place,

103 South Church Street,

P.O. Box 10240, Grand Cayman,

KY1-1002, Cayman Islands

Tel:+44 07761691306

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Copies to:

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933. Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☒

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a) may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities, and we are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

| I |

PRELIMINARY PROSPECTUS (Subject to Completion)

Dated November 20, 2023.

PRELIMINARY PROSPECTUS

Ordinary Shares

We are offering ordinary shares. This is the initial public offering of ordinary shares of Concord Health Limited. The offering price of our ordinary shares in this offering is expected to be $4.00 per share. Prior to this offering, there has been no public market for our ordinary shares.

We have applied to list our ordinary shares on the Nasdaq Capital Market under the symbol “HHGJ”. There is no assurance that such application will be approved, and if our application is not approved, this offering may not be completed.

Investing in our ordinary shares involves a high degree of risk. Before buying any shares, you should carefully read the discussion of material risks of investing in our ordinary shares in “Risk Factors”.

We are an “emerging growth company” as defined under the federal securities laws and, as such, will be subject to reduced public company reporting requirements. See “Prospectus Summary—Implications of Being an Emerging Growth Company” for additional information.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

We are a holding company incorporated in the Cayman Islands as a holding company. The Ordinary Shares offered in this prospectus are shares of the Cayman Islands holding company. For a description of our corporate structure, see “Corporate History and Structure.” See also “Risk Factors – Risks Relating to Our Corporate Structure.”

We expect our total cash expenses for this offering (including cash expenses payable to our underwriters for their out-of-pocket expenses) to be approximately $[●], exclusive of the above commissions. In addition, we will pay additional items of value in connection with this offering that are viewed by the Financial Industry Regulatory Authority, or FINRA, as underwriting compensation. These payments will further reduce proceeds available to us before expenses. See “Underwriting.”

PER SHARE | TOTAL | |||||||

| Initial public offering price | $ | $ | ||||||

| Underwriting discounts and commissions(1) | $ | $ | ||||||

| Proceeds, before expenses, to us | $ | $ |

| (1) | Does not include accountable and non-accountable expense allowance payable to underwriters. Please see the section of this prospectus entitled “Underwriting” for additional information regarding underwriter compensation. |

| II |

Neither we nor any of the underwriters have authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. Neither we nor any of the underwriters take responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date, regardless of the time of delivery of this prospectus or of any sale of our common stock.

For investors outside the United States: Neither we nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of our common stock and the distribution of this prospectus outside the United States.

Neither the Securities and Exchange Commission nor any state securities commission nor any other regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| III |

| IV |

This prospectus is part of a registration statement on Form F-1 that we filed with the Securities and Exchange Commission (the “SEC”). As permitted by the rules and regulations of the SEC, the registration statement filed by us includes additional information not contained in this prospectus. You may read the registration statement and the other reports we file with the SEC at the SEC’s website described below under the heading “Where You Can Find More Information”.

The information contained in this prospectus is accurate as of the date on the front of this prospectus only, regardless of the time of delivery of this prospectus or of any sale of our Common Shares. Our business, financial condition, results of operations and prospects may have changed since that date.

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information.

In this prospectus, unless the context otherwise requires:

| • | references to “Common Shares” or “our shares” refer to common shares of Concord Health Limited; | |

| • | references to the “Company,” “we,” “us,” “our” and “HHGJ” refer to Concord Health Limited; | |

| • | references to “dollars,” “U.S. dollars,” “USD,” “$,” and “US$” are to United States Dollars; | |

| • | “U.S. GAAP” refers to generally accepted accounting principles in the United States; | |

| • | references to the “SEC” are to the United States Securities and Exchange Commission. |

Market data and certain industry data and forecasts used in, or incorporated by reference in, this prospectus were obtained from sources we believe to be reliable, including market research databases, publicly available information, reports of governmental agencies and industry publications and surveys. We have relied on certain data from third-party sources, including internal surveys, industry forecasts and market research, which we believe to be reliable based on our management’s knowledge of the industry. Forecasts are particularly likely to be inaccurate, especially over long periods of time. In addition, we do not necessarily know what assumptions regarding general economic growth were used in preparing the third-party forecasts we cite. Statements as to our market position are based on the most currently available data. While we are not aware of any misstatements regarding the industry data presented in this prospectus, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” in this prospectus. Our historical results do not necessarily indicate our expected results for any future periods.

Certain figures included in this prospectus have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables may not be an arithmetic aggregation of the figures that precede them.

We have obtained the statistical data, market data and other industry data and forecasts used in this prospectus and in our SEC filings incorporated herein by reference from publicly available information. We have not sought the consent of the sources to refer to the publicly available reports in this prospectus.

| 1 |

INTERNATIONAL FINANCIAL REPORTING STANDARDS

Our financial statements are prepared in accordance with the International Financial Reporting Standards as issued by the International Accounting Standards Board. Our fiscal year ends on December 31 of each year as does our reporting year.

We have made rounding adjustments to some of the figures included in this prospectus. Accordingly, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that precede them.

This prospectus contains references to industry market data and certain industry forecasts. Industry market data and industry forecasts are obtained from publicly available information and industry publications. Industry publications generally state that the information contained therein has been obtained from sources believed to be reliable, but that the accuracy and completeness of that information is not guaranteed. Although we believe industry information to be accurate, it is not independently verified by us. Some data is also based on our good faith estimates, which are derived from our review of internal surveys or data, as well as the independent sources referenced above. Assumptions and estimates of our and our industry’s future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors.” These and other factors could cause future performance to differ materially from our assumptions and estimates. See “Cautionary Note Regarding Forward-Looking Statements.”

We own or have rights to various trademarks, service marks and trade names that we use in connection with the operation of our business. This prospectus also contains additional trademarks, trade names and service marks belonging to other companies. Solely for convenience, trademarks, trade names and service marks referred to in this prospectus may appear without the ®, ™ or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks, trade names and service marks. We do not intend our use or display of other parties’ trademarks, trade names or service marks to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of us by, these other parties.

| 2 |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Various statements contained in this prospectus, including those that express a belief, expectation or intention, as well as those that are not statements of historical fact, are forward-looking statements. These forward-looking statements may include projections and estimates concerning our possible or assumed future results of operations, financial condition, business strategies and plans, market opportunity, competitive position, industry environment, and potential growth opportunities. In some cases, you can identify forward-looking statements by terms such as “may”, “might”, “will”, “should”, “believe”, “expect”, “could”, “would”, “intend”, “plan”, “anticipate”, “estimate”, “continue”, “predict”, “project”, “potential”, “target,” “goal” or other words that convey the uncertainty of future events or outcomes. You can also identify forward-looking statements by discussions of strategy, plans or intentions. We have based these forward-looking statements on our current expectations and assumptions about future events. While our management considers these expectations and assumptions to be reasonable, because forward-looking statements relate to matters that have not yet occurred, they are inherently subject to significant business, competitive, economic, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. These and other important factors, including, among others, those discussed in this prospectus under the headings “Risk Factors”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business”, may cause our actual results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied by the forward-looking statements in this prospectus, including among other things:

| ● | our future financial performance, including our expectations regarding our revenue, cost of revenue, operating expenses, including capital expenditures related to asset-intensive offerings, our ability to determine reserves and our ability to achieve and maintain future profitability; |

| ● | risks inherent in an SERVICES-MISC HEALTH & ALLIED SERVICES, NEC business; |

| ● | our ability to develop and market new products; |

| ● | the continued market acceptance of our products; |

| ● | exposure to product liability claims and actions; |

| ● | risks associated with product recalls; |

| ● | the sufficiency of our cash, cash equivalents and investments to meet our liquidity needs; |

| ● | our ability to manage operations-related risk; |

| ● | our expectations and management of future growth; |

| ● | our expectations concerning relationships with third parties; |

| ● | the impact of COVID-19 on the Company; |

| ● | our ability to maintain, protect and enhance our intellectual property; |

| ● | our ability to successfully acquire and integrate companies and assets; |

| ● | the increased expenses associated with being a public company; |

| ● | exposure to product liability and defect claims; |

| ● | protection of our intellectual property rights; |

| ● | damage to our reputation due to negative publicity; |

| ● | changes in the laws that affect our operations; |

| ● | inflation and fluctuations in foreign currency exchange rates; |

| ● | our ability to obtain all necessary government support; |

| ● | certifications, approvals, and/or licenses to conduct our business; |

| ● | continued development of a public trading market for our securities; |

| ● | the cost of complying with current and future governmental regulations and the impact of any changes in the regulations on our operations; |

| ● | risks related to our international operations in the United Kingdom, including the implications of the United Kingdom’s recent withdrawal from the European Union; |

| 3 |

| ● | risks associated with expansion into new jurisdictions; |

| ● | managing our growth effectively; |

| ● | fluctuations in operating results; |

| ● | emerging market risks; |

| ● | global economy risks; |

| ● | our ability to maintain and enhance our market position; |

| ● | our ability to obtain and maintain adequate insurance coverage; |

| ● | our ability to identify and integrate strategic acquisitions, investments and partnerships and to manage our growth; |

| ● | our ability to continue to develop new technologies and/or upgrade our existing technologies; |

| ● | dependence on our senior management and key employees; |

| ● | our ability to maintain the listing of our securities on Nasdaq; |

| ● | our ability to continue to develop new technologies and/or upgrade our existing technologies;and |

| ● | other factors set forth under “Risk Factors.” |

We caution you that the foregoing list may not contain all of the forward-looking statements made in this prospectus.

You should not rely upon forward-looking statements as predictions of future events. We have based the forward-looking statements contained in this prospectus primarily on our current expectations and projections about future events and trends that we believe may affect our business, financial condition, results of operations and prospects. The outcome of the events described in these forward-looking statements is subject to risks, uncertainties and other factors, including those described in the section titled “Risk Factors” and elsewhere in this prospectus. Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this prospectus. We cannot assure you that the results, events and circumstances reflected in the forward-looking statements will be achieved or occur, and actual results, events or circumstances could differ materially from those described in the forward-looking statements.

These and other factors are more fully discussed in the “Risk Factors”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business” sections and elsewhere in this prospectus. These risks could cause actual results to differ materially from those implied by the forward-looking statements contained in this prospectus.

All forward-looking statements included herein attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. Any forward-looking statement that we make in this prospectus speaks only as of the date of this prospectus. Except as required by applicable law, we do not undertake any obligation to update or revise, or to publicly announce any update or revision to, any of the forward-looking statements in this prospectus, whether as a result of new information, future events or otherwise, after the date of this prospectus.

| 4 |

This summary highlights selected information contained elsewhere in this prospectus that we consider important. This summary does not contain all of the information you should consider before investing in our Common Shares. You should read this summary together with the entire prospectus, including the risks related to our business, our industry, investing in our Common Shares and our location in British that we describe under “Risk Factors” and our consolidated financial statements and the related notes before making an investment in our securities.

Our Mission

Concord Health Limited is a conglomerate that has developed from a travel agency to rely on tourism, create big data, and achieve a global alliance. The ten major sectors under the group company form a commercial ecosystem: 100 degree Travel and Life Club, Hehe International Travel Agency, Didong Personal Travel APP, Tourism Technology, Hehe Business District, Hehe Industrial Alliance (physical alliance, agricultural development, tourism investment), Hehe Well-to-do, cultural media, Hehe International Business School, and the big health industry.

Concord Health Limited is a company with a strong traditional Chinese cultural atmosphere. The company's vision is to trace the meaning of "Hehe" and use tourism to gather a group of people from all walks of life who pursue harmony and mutual assistance, group heating, resource integration, cooperation and sharing, creating a respected platform for a universal alliance. Concord Health Limited has three different positioning corporate environments: company=military+school+family. A military like environment, with all company members pursuing iron like discipline; In a school like environment, the company focuses on promoting the growth of every employee; In a family like environment, the company cares and takes care of every member like family members.

The goal of Concord Health Limited is to create an increasingly powerful altruistic assistance platform. Make personal entrepreneurship easier. Any great enterprise cannot do without a great mission, and profitability is not the ultimate goal pursued by a great enterprise. Our ultimate goal is to continuously empower mass entrepreneurs, aggregate more outstanding entrepreneurs, and jointly build a first-class digital ecological cloud sharing platform.

Concord Health Limited firmly believes that communication starts from the heart and takes customer satisfaction as its purpose. The company adheres to the Yi Jing cultural tenet of "harmony between people, harmony between heaven and earth", and promotes the spirit of "gratitude, altruism, respect, understanding, and tolerance" and the company values of "unity, morality, peers, and sharing". On the premise of recognizing the differences between "different" things, unify the different things into an interdependent and cohesive entity. And in the process of combining different things, absorb the advantages of each thing and overcome its disadvantages to achieve the best combination, thereby promoting the emergence of new things and promoting the development of things.

Overview of Our Company

Concord Health Limited is a conglomerate that has developed from a travel agency to rely on tourism, create big data, and achieve a global alliance. The company adheres to the cultural tenet of "Harmony between People, Harmony between Heaven and Earth" in the Book of Changes, traces the meaning of "Harmony", and uses tourism to gather a group of people from all walks of life who pursue harmony and mutual assistance, group heating, resource integration, cooperation and sharing, creating a platform of universal alliance and respect. Create an increasingly powerful altruistic assistance platform. Make personal entrepreneurship easier. The group company attracts users through experiential tourism, utilizes users to connect with tourism routes and various commodities, and each industry sector operates independently and mutually assists in market operations, thereby transforming consumers into distributors, achieving a business ecosystem of universal alliance and supply and demand closed-loop, and fully responding to the call of "mass entrepreneurship and innovation". By providing personalized services and products, we can meet the needs of different groups of people and achieve long-term development and value creation for the enterprise.

| 5 |

The company aims to provide intelligent, visual, precise and ecological system solutions and products for the medical industry, health industry, pension industry, enterprises and families, to help the medical and health care industry achieve digital transformation and upgrading, to expand the scope of services, to enhance service capabilities, to enhance user stickiness and satisfaction, and to promote the health care industry.Build upstream digital intelligence software and hardware products, system solution research and development and integration, service midstream to do a good job in market operation and content services, create a good use experience for downstream customers, truly solve the pain points of users, form a virtuous circle of digital intelligence health ecosphere, create first-class products, constantly innovate application scenarios, expand product market occupancy. Finally, the strategic objectives such as data capitalization will be achieved.

There are four types of identity conversions in the Hehe business circle. Numerous consumers, suppliers, promoters, and partners have undergone identity transformations or multiple identity mergers due to single or multiple relationships with Hehe International Group in terms of commodity consumption, supply, promotion, and equity participation, thus forming a stable "Hehe Business Ecosphere" to promote the generation of big data. Establishing such a business circle will generate increasing domestic demand with the increase of data, which will make sales easier and provide a consumption environment for incubation and entrepreneurship. This is also our mission to make entrepreneurship easier!

Hehe International establishes a business ecosystem through ten major sectors, and generates big data by sharing tourism, business alliances, and enterprise alliances to lock in members; Deepen the tourism market by utilizing the tourism routes and Didong individual tours that are professionally operated by members of Hehe Travel Agency; We use Hehe Mall to professionally manage the products that connect with our members, and achieve a supply and demand cycle of tourism routes and various products among our members. Create a model of "global big capital+integrated production and sales new business", and achieve the beautiful dream of "using tourism to gather a group of people from all walks of life with pursuit, harmonious mutual assistance, group heating, resource integration, cooperation and sharing, and creating a universal alliance and respected platform".

History and Development

Concord Health Limited was established on November 8, 2023, with its registered address at 4th Floor, Harbour Place, 103 South Church Street, P.O. Box 10240, Grand Cayman KY1-1002, Cayman Islands. Since its establishment, the company has been committed to promoting the creation of the Wanye Alliance. Adhering to the cultural tenet of "Harmony between People, Harmony between Heaven and Earth" in the Book of Changes, tracing the meaning of "Harmony", we use tourism to gather a group of people from all walks of life who pursue harmony and mutual assistance, group heating, resource integration, cooperation and sharing, and create a respected platform for a universal alliance. Create an increasingly powerful altruistic assistance platform. By building an industrial relationship network with tourism as the focus, industrial development core and industrial chain, we will closely connect various sectors such as life clubs, tourism technology, commercial circles, industrial alliances, cultural media, Hehe International Business School, and the big health industry. We will continue to empower mass entrepreneurs, gather more outstanding entrepreneurs, and jointly create a first-class digital ecological cloud sharing platform.

By attracting users through experiential tourism, utilizing users to connect with tourism routes and various commodities, each industry sector operates independently and assists each other in market operations, thereby transforming consumers into distributors, achieving a business ecosystem of universal alliance and supply and demand closed-loop, and fully responding to the call for "mass entrepreneurship and innovation". By providing personalized services and products, we can meet the needs of different groups of people and achieve long-term development and value creation for the enterprise.

| 6 |

The company's pioneering exploration and deep cultivation in the field of AI has accumulated rich experience in software and hardware technology and commercial project cases, and has applied for more than 100 new patent monographs.At the same time, it has a complete software and hardware R & D team, from product design, mold opening, bottom drawing board, driver, operating system to upper application and back-end service development, forming a mature R & D system.The company has accumulated abundant upstream industry supply chain resources, formed stable strategic cooperative relations with major well-known enterprises, is sensitive to the downstream market, and has the leading conditions and market opportunities for R & D of technologically advanced products.

At the same time, we establish a business ecosystem through ten major sectors, and generate big data by sharing tourism, business alliances, and enterprise alliances to lock in members; Deepen the tourism market by utilizing the tourism routes and Didong individual tours that are professionally operated by members of Hehe Travel Agency; By using Hehe Mall to professionally manage the products that connect with members, we can achieve a tourism route and supply and demand cycle of various products among members, create a Hehe Business District, and form a commercial ecological community.

In summary, our company has been committed to promoting the construction of the Wanye Alliance and the commercial ecological community since its establishment. Adhering to the cultural tenet of "Harmony between People, Harmony between Heaven and Earth" in the Book of Changes, tracing the meaning of "Harmony", we use tourism to gather a group of people from all walks of life who pursue harmony and mutual assistance, group heating, resource integration, cooperation and sharing, and create a respected platform for a universal alliance.

The Industry

(1)Industry analysis

The tourism industry, is a comprehensive industry that relies on tourism resources and facilities, specifically or mainly engaged in attracting, receiving tourists, providing transportation, sightseeing, accommodation, catering, shopping, entertainment, and other six links. The tourism business should be composed of three parts: tourism industry, transportation and passenger transportation industry, and accommodation industry represented by hotels. They are the three pillars of the tourism industry. With the development of society and the improvement of people's living standards, the concepts and lifestyles of healthy living, happy living, and enjoying life have gradually been valued and welcomed by people. When people's living standards reach a certain level, they will invest their income into areas that meet higher-level needs. As a tourism industry that meets people's current needs, it undoubtedly has broad development space.

The tourism industry chain can be summarized using three verbs: "transportation", "travel", and "living". The tourism industry chain involves a wide range of segmented industries, including consumer services, transportation and other related industries. Among them, "travel" refers to industries related to travel, mainly involving transportation industries such as highways, railways, and aviation. "Tourism" refers to services directly related to residents' tourism, mainly involving tourist attractions or scenic spots, as well as enterprises that provide supporting operations, cultural promotion, and other related services for scenic spots. 'Accommodation' refers to the food and accommodation services required by residents during the tourism process, covering hotels, catering and other related enterprises.

Against the background of Internet development, scientific and technological progress, and favorable policies, the "tourism+" industry has continued to develop. Especially since the outbreak of the COVID-19, people have increasingly attached importance to health management and free travel after the release of closures. The "tourism+" industry has accelerated to penetrate online, and the "tourism+" industry has developed rapidly. From this, it can be seen that the "tourism+" industry has broad prospects.

| 7 |

(2)Industry data

I. Market size of the "tourism+" industry

The COVID-19 epidemic has affected the global tourism industry to some extent. The long-term and sustained COVID-19 epidemic is both a challenge and an opportunity. After the lifting of long-term oppressive restrictions on daily life, there is an explosive growth in demand for travel. The "tourism+" industry can take the opportunity to undergo thorough reforms, fully utilize new trends that have emerged before the epidemic, and continue to explore the "tourism+" comprehensive service model.

Although global economic growth is expected to slow down in 2022, with the general increase in vaccination rates, countries have gradually relaxed epidemic control measures and introduced strategies to promote tourism recovery, resulting in a continued increase in the growth rate of the tourism economy. The growth rate of global tourism revenue in 2022 reached 21.1%, an increase of 2 percentage points from 19.1% in 2021; In 2022, the global economic growth rate was 3.2%, a decrease of 2.8 percentage points from the 6.0% in 2021.

The World Tourism Cities Federation previously released the "World Tourism Economic Trends Report (2023)", which showed that in 2022, the total number of global tourists reached 9.57 billion, and the total global tourism revenue reached 4.6 trillion US dollars, recovering to 66.1% and 79.6% in 2019, respectively. The growth momentum of the tourism industry in 2023 is even more encouraging. The above report predicts that the total number of global tourists will reach 10.78 billion in 2023, and the total global tourism revenue will reach 5 trillion US dollars, recovering to 74.4% and 86.2% in 2019, respectively.

II. Market Structure of the "Tourism+" Industry

Compared with the corresponding proportion of GDP in 2019 before the pandemic, the proportion of total tourism revenue in the five major regions in 2022 is about 90% in the Middle East, 82.7% in the Americas, 82.2% in Europe, 75% in Africa, and 50% in the Asia Pacific region. It is expected that in 2023, Asia Pacific tourism will experience a small peak of growth, with both the total number of tourists and the growth rate of total income exceeding 25%; The growth rate of total tourist arrivals and total tourism revenue in Africa exceeds 10%; The total number of tourists and the growth rate of total tourism revenue in Europe, the Americas, and the Middle East have all dropped to within 10%.

III. The scale of the "tourism+" comprehensive service market

In recent years, due to the rapid development of the Internet and the economy, the scale of the "tourism+" comprehensive service market has continued to grow. In particular, since the COVID-19 in 2020, isolation and containment at home has become the normal state of people's lives. People attach importance to free travel and health after the release of the containment. The "tourism+" industry has accelerated its penetration into the online market, and the scale of the "tourism+" comprehensive service market has grown rapidly.

IV. The industrial structure of the "tourism+" comprehensive service market

From the perspective of market structure, the products and services provided by the "tourism+" comprehensive service market can be roughly divided into multiple production and service fields closely related to outbound travel, such as travel plan management services, food recommendation, shopping recommendation, homestay hotels, and travel methods.

| 8 |

(3)Industry pain points

I. Since entering the new century, the continuous development of productivity and the gradual improvement of living standards have effectively promoted the popularization of tourism activities. Frequent international economic and cultural exchanges and the evolution of lifestyles have also further promoted the diversification and refinement of demand forms such as business tourism, knowledge seeking tourism, adventure tourism, vacation tourism, shopping tourism, reward tourism, etc. The overall upward trend of the world tourism industry will not change, but it is sensitive to changes in the external environment and is affected by various factors, resulting in fluctuations in its growth. Additionally, due to the strong regional nature of tourism resources, different regions have different endowments of tourism resources, and the constraints of tourism development strategies and capabilities in various countries, the development level of tourism industry in various countries is also uneven.

II. The recovery of the global tourism industry in an uncertain environment will face five characteristics: firstly, the global economy is trapped in a series of development difficulties, and the difficulty of the recovery of the world tourism industry is much greater than that of the economic stability period. Different countries and regions will face varying degrees and types of environmental complexity, demonstrating different coping abilities, and thus generating different tourism development patterns. The second is that the focus of post epidemic restoration in the tourism industry is gradually shifting from quantity to quality, relying on global industrial cooperation and further improving the governance capabilities of the tourism industry in various countries. The third is that the recovery level of the tourism industry, inflation level, and labor shortage are three key variables that affect the quality of the world's tourism industry's recovery in the short term. Fourthly, in the medium to long term, the further development of the world economy and tourism industry will depend more on the improvement of total factor productivity; Improving the industry penetration rate of technology, increasing the attractiveness of the industry to knowledge talents, and forming a more intelligent and clever tourism policy and governance system are the key paths to reshape the growth model of the tourism industry and promote the rise of total factor productivity in the tourism industry. Fifth, the world tourism landscape will be reshaped through innovation. Innovation will be the core driving force for the further development of the world tourism industry and the main force for reshaping the new pattern of world tourism. The world tourism industry is entering a century of innovation.

III. Low customer trust, intense market competition, and single and inefficient promotion channels. At present, the most common promotional method is to assign people around the enterprise to distribute flyers or pass them on to customers through word of mouth. Considering that people often take self driving trips or sign up for tour groups with large and well-known travel agencies when there is a travel demand, the customer coverage of unknown small travel agencies or related "tourism+" comprehensive service enterprises in the entire "tourism+" comprehensive service industry is relatively narrow, Whether it is with well-known, large travel agencies or equally positioned enterprises, the market competition is very fierce.

IV. The utilization of internet traffic dividends is still lacking, and online tourism is becoming increasingly popular. However, many people have a lower attitude towards online tourism than traditional tourism, and cannot better appreciate the humanistic feelings. At present, if the tourism industry cannot keep up with the internet wave, it will be eliminated. Embracing the internet and exploring healthier and sustainable business models is more advantageous.

V. The lack of data analysis leads to weak personalized services, vague and inaccurate data on the specific needs of members, and uneven service levels. There are also differences in the level of tourism services in various countries and regions. The uneven level of service personnel, uneven service quality, and inadequate supervision are urgent problems that many "tourism+" comprehensive service enterprises need to solve.

VI. Difficult to reach the pain points and needs of users, lacking customized "tourism+" comprehensive service management solutions for users of different ages and needs. In the traditional tourism industry, travel agencies have the problem of providing few specialized travel plans or high service costs, and lack personalized customized travel plans for users of different ages and needs.

| 9 |

(4)Industry Forecast

I. Policies promote the development of the "tourism+" industry

In recent years, multiple policies have been introduced in multiple regions to promote the development of the "tourism+" industry, and multiple plans for the tourism industry have been successively released to encourage innovative development of the "tourism+" industry. In 2020, COVID-19 will spread all over the world, bringing unprecedented impact to the tourism industry. Governments in many places will encourage residents to close their homes and promote the development of online travel, Internet technology and other industries. It is expected that with the assistance of government policies, the "tourism+" industry will develop rapidly, promoting market expansion of the "tourism+" industry.

II. The increase in demand for outbound travel has boosted the development of the "tourism+" industry

From 2020 to 2025, due to the continuous improvement of residents' income level and quality of life and the lifting of the closure of the COVID-19, the awareness and concept of consumption such as health care and life enjoyment will gradually deepen, and the transition to a healthy and high-quality life demand will significantly increase residents' demand for travel consumption, and the consumption level will also continue to improve.

III. The intelligence of the "tourism+" industry drives the development of the tourism industry

With the popularization of the Internet and the improvement of technology, the intelligence level of the tourism industry is constantly improving, allowing people to enjoy scenic spots without leaving their homes, or to provide personalized services and customized travel management solutions for people with travel needs, taking into account all aspects of clothing, food, housing, and transportation, bringing great convenience to people, increasing their demand for travel, and driving the development of other economies through the tourism industry.

The World Tourism City Development Report 2022 shows that the development level of urban tourism informatization services and digital tourism development index are very high, with an average of 91, far higher than the 73 in 2021. This indicates that tourism cities have improved their application and popularity of tourism informatization, with a higher proportion of tourism related apps and online ticket purchases in scenic areas. Most cities transmit various information from official tourism apps, official websites, and social media accounts.

IV. The structural adjustment of the "tourism+" comprehensive service market and the rapid expansion of the "tourism+" comprehensive service market scale

Due to the impact of the epidemic, long-term home lockdowns have led to people's increasing emphasis on health management and travel, affecting traditional tourism management and increasing the trend of online tourism. In recent years, due to the rapid development of the Internet, the size of the online tourism market has continued to grow. In particular, since the closure of the COVID-19 was lifted, free travel has become one of people's consumption needs. The "tourism+" industry has attracted people's attention and accelerated its penetration into the online market. The scale of the online "tourism+" comprehensive service market has grown rapidly.

V. The "tourism+" comprehensive service market structure is enriched and optimized, and the market penetration rate is gradually increasing

From the perspective of market structure, the products and services provided by the "tourism+" comprehensive service market can be roughly divided into multiple production and service fields closely related to outbound travel, such as travel plan management services, food recommendation, shopping recommendation, homestay hotels, and travel methods. In recent years, with the demand for free travel and the development of technology, the penetration rate of the "tourism+" service market has been continuously increasing.

| 10 |

Our Solution

(1)Main consumer groups of products or services

With the continuous development of economic level, people gradually become wealthy. After meeting their basic survival needs, they often pursue higher spiritual needs. After the COVID-19 epidemic swept the world, people's awareness and concept of medical treatment have been accelerated.The outbreak and spread of the epidemic has made people deeply aware of the importance of protecting their health.In addition to focusing on basic prevention and control measures and vaccination, people are also paying more attention to improving their own immunity and health awareness to enhance their ability to resist diseases. At the same time, after the closure of the COVID-19 epidemic was lifted, people were forced to stay at home for a long time, which made them increasingly eager to go out and travel.

(2)The main reasons why consumers purchase products or services

I. With the development of the economy and the gradual prosperity of people, their attention to their own health and higher spiritual needs will continue to increase. Concord Health Limited provides a series of business opportunities and solutions to meet the needs of people to enjoy high-quality life and broaden their horizons and broaden their horizons.

II. With the lifting of the closure and control of the COVID-19, people are more and more aware of the value of life and the insignificance of human beings. Forced to maintain long-term home control makes people increasingly eager to travel, which will make scenic spots around the world welcome people's retaliatory travel after the COVID-19 epidemic.When people travel, they find that they have sub-health problems after a long period of inactivity, which also makes people more focused on improving their physical fitness and healthy life.

III. The process of determining a specific travel plan is very cumbersome, requiring not only the determination of the travel location, but also the arrangement of subsequent clothing, food, accommodation, and transportation. This will consume people's enthusiasm and patience for traveling, and many people are discouraged in determining their travel plans. As a big data "tourism+" comprehensive conglomerate, Concord Health Limited provides travel plan services and recommendations for subsequent travel arrangements for this group of people.At the same time, it recommends relevant service products for users according to their personal needs.In addition to the basic needs of food and hotels, many users have great interest in traditional Chinese medicine and health care service products.

Ⅳ. With the increase of people's age and the aggravation of the problem of population aging, people's attention to their own health and pension problems will continue to increase.How to prevent diseases, alleviate pain and improve the quality of life is the core issue of the health care industry.Hehe International Company has launched a digital and intelligent health care solution.Facing the elderly and their children, community workers and nurses, as well as doctors and nurses in the medical industry, this project provides them with data management of elderly archives, pension institutions, medical institutions, health care, life services, spiritual entertainment and other aspects of service management, intelligent monitoring, intelligent notification, medical advice and other intelligent services.The home-based and community-based pension model will have advantages in resource utilization and cost control.In the future, with the development of community pension services, the proportion of community pension will continue to increase, and the real-time information allocation of service and demand side will become an important opportunity for the development of Internet pension services.

(3) The company's current position and target position in the industry

Concord Health Limited is a conglomerate that has developed from a travel agency to rely on tourism, create big data, and achieve a global alliance. Since its establishment, the company has been committed to promoting the creation of the Wanye Alliance. Adhering to the cultural tenet of "Harmony between People, Harmony between Heaven and Earth" in the Book of Changes, tracing the meaning of "Harmony", we use tourism to gather a group of people from all walks of life who pursue harmony and mutual assistance, group heating, resource integration, cooperation and sharing, and create a respected platform for a universal alliance. Create an increasingly powerful altruistic assistance platform.

| 11 |

At present, the company attracts users through experiential tourism, utilizing users to connect with tourism routes and various products. Each industry sector operates independently and assists each other in market operations, thereby transforming consumers into distributors, achieving a business ecosystem of a global alliance and supply and demand loop, and fully responding to the call for "mass entrepreneurship and innovation". By providing personalized services and products, we can meet the needs of different groups of people and achieve long-term development and value creation for the enterprise.

The company aims to provide intelligent, visual, precise and ecological system solutions and products for the medical industry, health industry, pension industry, enterprises and families, to help the medical and health care industry achieve digital transformation and upgrading, to expand the scope of services, to enhance service capabilities, to enhance user stickiness and satisfaction, and to promote the health care industry.Build upstream digital intelligence software and hardware products, system solution research and development and integration, service midstream to do a good job in market operation and content services, create a good use experience for downstream customers, truly solve the pain points of users, form a virtuous circle of digital intelligence health ecosphere, create first-class products, constantly innovate application scenarios, expand product market occupancy.Finally, the strategic objectives such as data capitalization will be achieved.

(4) Sales channels

I. Promotion of new media network platform: build your own brand on social media platforms such as Twitter, ins, Tiktok, promote your own services and products, establish contacts with potential customers, and increase exposure and popularity.

II. Franchise chain regional agency: By seizing the agency rights in the city, district, and county regions, opening multiple branches in the region based on specific market conditions, forming a franchise chain platform for Concord Health Limited, and expanding the coverage of Hehe business district.

III. Member system digital import and joint promotion platform: Through big data analysis, advertise to potential customers at appropriate times and scenarios, such as providing solution management services and entrepreneurial empowerment for those with tourism plan management needs and entrepreneurial intentions.

IV. Wanye Alliance and Hehe Business Ecosphere: Through the establishment of Wanye Alliance and Hehe Business Ecosphere, enterprises are empowered to optimize industrial efficiency, improve information accuracy, integrate relevant resources, reduce operational costs and risks, and help expand new opportunities in the digital business ecosystem market.

V. Partner marketing: Collaborate with relevant business franchisees, such as hotels, travel clubs, etc., to recommend their services and products to customers, increase awareness and exposure.

VI. Recommendation and word-of-mouth marketing: By providing high-quality services and products, customers who purchase services and products are satisfied and leave positive reviews, allowing more potential customers in the wait-and-see stage to understand and serve, and improving awareness and exposure.

Our Products And Services

Under the promotion of the overall environment, Concord Health Limited, relying on tourism, has created a first-class digital ecological cloud sharing platform, and possesses multiple advanced technologies and patents. It has dedicated itself to developing various series of products, which are roughly listed as follows:

(1)A platform centered on tourism: Concord Health Limited has launched the 100 degree Travel and Life Club, Hehe International Travel Agency, Didong Personal Travel APP, and Tourism Technology. Each platform has played a different role and provided great help to facilitate mutual cooperation among other sections. For example:

| 12 |

I. 100 degree travel and life club. Create an online and offline chain service platform for travel enthusiasts and members. The club provides services for members' travel, travel information, travel legal information, friend gatherings, member supermarkets, and more. Club Mission: Shared Tourism+Big Health+Entrepreneurship Incubation. Club Vision: Becoming a destination for global travel enthusiasts' physical and mental entertainment. Club culture: Happy and happy, making money while playing.

II. Hehe International Travel Agency. Hehe International Travel Agency implements butler style services to create a unique travel experience. Tourism has shifted from a sightseeing style "one visit" to a customized deep experience and free travel. The company develops routes, connects users to hometown scenic spots, and connects with local community supply routes. With the support of big data, the development of branches and service outlets nationwide has completed capital listing, original stock allocation, government linkage, and good services to drive local tourism economy. Unique route design enhances the experience and creates a happy journey.

III. Didong, a game app. Passengers can determine their destination through the app and communicate with local tourism agents (pick ups) to negotiate travel strategies through an intelligent interactive system. After receiving the order, the recipient can mobilize the large database system to provide reasonable and professional advice. During the game, tourists can also choose local specialties through alliance merchants and send them directly to their homes through logistics, achieving a relaxed travel and shopping experience. The APP public welfare system can achieve charitable acts for tourists while traveling to the local area, and the interactive system can provide convenience for tourism experts to enjoy beautiful scenery and delicious food. Online ride hailing has its own advantages, while free travel has its own advantages.

IV. Tourism technology is committed to allocating technology for the tourism industry. A professional technology research and development team will make tourism high-tech: artificial intelligence, augmented reality, autonomous delivery, blockchain, neural interfaces, quantum computing, space tourism, virtual reality, etc. will bring changes to the tourism industry.

(2)Business District and Industrial Alliance:

I. Hehe Business District (Business Alliance). Hehe International shares big data with various businesses. The company drives consumption through tourism, uses the Didong individual game app to connect with merchants, carries out online and offline linkage promotion, and ultimately creates the Wanye Alliance merchant platform.

II. Hehe Industrial Alliance. Hehe International Group is relying on tourism to establish big data, create a business ecosystem of the Wanye Alliance, and achieve a closed-loop supply and demand. At the same time, it is deeply integrating the supply chain and establishing an industrial alliance through equity, providing opportunities for entrepreneurs and industrialists to develop together.

(3)Cultural media company: Build a new media platform, focusing on presenting interesting professional content. Based on the platform's big data, the company's flagship travel and cultural media platform "Wanlv Lantern Story". Either with a clear perspective or a lingering charm, using stories to warm people's hearts and enriching spiritual life with culture. With this as the core, we will create new media matrices such as WeChat public platform, Tiktok short video, and explore multiple vertical fields such as literature, video, publishing, and women's growth. In the future, we will operate in a "content+video+alliance business district" model, leveraging the advantages of online communication to help various enterprises and businesses promote and promote. At the same time, we will continue to work closely with well-known brands and outstanding elites from all walks of life, constantly explore and innovate, and aspire to become a leading cultural life brand in the country, connecting a wider audience, creating higher value, and warming more people with culture.

| 13 |

(4) Hehe International Business School: Through training professional mentors, Hehe International Business School is committed to disseminating Chinese culture to the general public and utilizing the Hehe Supply and Demand 3.0 mechanism. Hehe International Confucian Business School provides professional incubation and guidance for alliance enterprises, customizes market solutions for alliance merchants, and systematically builds and builds business teams, making entrepreneurship easier.

(5) Medical and health industry: Hehe International has launched the Hehe Well-off and Big Health sector. At present, Concord Health Limited has a series of popular health products in the field of big health, such as Nuoli fruit enzyme solution, fragrant moxibustion, etc., which are also closely related to our daily food safety series, always safeguarding our health.In addition, the company has also developed a digital intelligent health care product, which has the function of health housekeeper + and the intelligent service system for enjoying the old life. It can collect health data and provide related health management services, such as:

Ⅰ. Didong health housekeeper + function.It provides health management services for chronic diseases, and has the characteristics of detecting the health status of the body at any time and anywhere, and automatically storing health data.In the case of abnormal health data, it will send an alarm signal.In specific emergency situations, it will send rescue signals to relevant people, institutions, etc.

Ⅱ. Intelligent service system for enjoying old life.The intelligent service system for enjoying the old life is a comprehensive system.It has online consultation management service system, healthy diet service system, health exercise video tutorial and family doctor contract service platform.The system contracts professional doctors, provides online consultation medical services, provides effective health management for customers, carries out one-stop safety management, and realizes the enjoyment of digital and intelligent home-based pension life.

Ⅲ. Digital Intelligence Health Extension Service.The product will further set up digital intelligence early warning service platform, health management platform, operation management platform, business expansion platform, mall operation platform and other platforms to realize health examination system, health management system and health data through four aspects of health service, safety service, medical service and convenient service system for the elderly.Personal and family security guard, health warning care system, doctor service system and appointment service system complement each other, video calls, profiles, shopping one-click.

In the future, Concord Health Limited will continue to develop and improve product and system platforms based on the different needs of consumer groups, continuously empower mass entrepreneurs, gather more outstanding entrepreneurs, and jointly create a first-class digital ecological cloud sharing platform.

Our business model

Concord Health Limited fully utilizes innovation, integration, fusion, and cross-border integration, utilizes its technological background advantages, strengthens internet thinking, adheres to complementary advantages, and promotes the expansion of the Hehe business ecosystem, mainly through the following four modes:

(1) The "tourism+" model: The commodity society and market economy have fully entered the era of meager profits. In the era of meager profits, we need to win by quantity, and Hehe International Group has provided a platform for Wanye Alliance and resource integration through the "tourism+" business model. At the same time, the huge growth of the global tourism market and the demand for group development in various industries have also facilitated the use of the Didong Personal Game App by Hehe Group to lock in terminals and generate big data. Each merchant can use Didong Geyou to establish a connection, and merchants can achieve alliance sharing between supply and demand through their own product sales revenue and the revenue from alliance with other merchants' products. Tourism drives consumption, consumption drives supply! The "tourism+" alliance model can form a closed-loop supply and demand, achieving an internal consumption cycle.

| 14 |

(2) Business ecosystem: Hehe International establishes a business ecosystem through the transformation of other sectors, as well as the four identities of consumers, suppliers, promoters, and partners. It generates big data by sharing tourism and locking in members through business alliances and enterprise alliances, and deepens tourism demand through the professional operation of Hehe Travel Agency's member docking tourism routes and Didong individual tours; We use Hehe Mall to professionally manage the products that connect with our members, and achieve a supply and demand cycle of tourism routes and various products among our members. Due to the accumulation of 10% of the revenue generated by connecting routes and various products as consumption points, the cyclic snowball effect has generated greater purchasing power, further increasing the increment of connecting member data. By generating new product consumption from new members and importing it into tourism in various regions, consumption can once again be generated and involved in various resources, alliance development, and expanding the business circle.

(3) The circular consumption economic model of re-sale-reproduction-redistribution: In the traditional sales model, whether it is agency system, direct sales or e-commerce, the channel team accounts for 40% -80% of the sales, and the additional costs generated by the sales channels need to be paid by consumers.Hehe International Company has broken the restrictions of the traditional sales model, boldly adopted the circular consumption economic model of "re-sale-reproduction-redistribution", reduced the sales volume occupied by sales intermediaries, and improved the enthusiasm of users for consumption.Users consume 10,000 yuan, resell and redistribute, and can get up to 30,000 expected distribution rights (in kind or options or cash). If there is no sale, there will be no distribution.Under the e-commerce mode of the merchant APP, you can get a free share after purchasing the product, which is the basis for calculating the weighted distribution of sales. According to personal needs, you can get points by transferring the share through different ways, and the points can be exchanged for the physical goods or options or cash that users need.This model promotes the prosperity of the company's product side, the happiness of the agent seller, and the satisfaction of the user buyer, and achieves the unity of the three parties in the sales process.

(4) "Amoeba"business model: The company takes each"Amoeba" as the core, implements self-planning, independent accounting, promotes the independent growth of employees, makes every employee the protagonist, guarantees the participation of all employees in the operation, and achieves the rapid development of the enterprise by creating a passionate collective, relying on the wisdom and efforts of all employees to achieve business objectives.

Our Competitive Strengths

Concord Health Limited, through its unique and powerful online and offline linkage capabilities, builds an industrial relationship network with tourism as the focus, industrial development core, and industrial chain, closely connects sections such as life clubs, tourism technology, commercial districts, industrial alliances, cultural media, Hehe International Business School, and the big health industry, continuously empowering mass entrepreneurs and aggregating more outstanding entrepreneurs, Jointly build a first-class digital ecological cloud sharing platform.

By attracting users through experiential tourism, utilizing users to connect with tourism routes and various commodities, each industry sector operates independently and assists each other in market operations, thereby transforming consumers into distributors, achieving a business ecosystem of universal alliance and supply and demand closed-loop, and fully responding to the call for "mass entrepreneurship and innovation". By providing personalized services and products, we can meet the needs of different groups of people and achieve long-term development and value creation for the enterprise.

In the trend of economic globalization, the demand for tourism industry and healthcare is constantly increasing. Combined with the development plan of Concord Health Limited, its competitive advantages can be summarized as follows:

(1) User data. Concord Health Limited, through its unique and powerful online and offline linkage capabilities, accurately matches individual needs with a powerful digital system. The combination of online and offline methods can attract more user traffic and help Concord Health Limited effectively expand its market share.

| 15 |

(2) Professional services. Concord Health Limited can conduct comprehensive digital construction and transformation of traditional tourism management and business alliance products and services based on proprietary technology paths. Utilizing big data to analyze object demand data and providing personalized services and products that are more suitable for individuals based on the data provided by intelligent systems can meet the needs of different groups of people.

(3) Brand awareness. Concord Health Limited will create and form a high visibility brand benefit through various advertising investments and distribution, as well as its own high-quality service level, diversified service content, and innovative business scope that keeps up with the times, to help the company stand out in the fierce market competition.

(4) Diversified service content. Concord Health Limited will provide diversified service content based on the different needs of social groups, including online and offline services, to help users better meet their needs, improve user satisfaction and loyalty, and lock in user traffic.

(5) Social media channels. Concord Health Limited will promote through various social media channels. This can help enterprises promote their services and attract more users. At the same time, through online social platforms, Concord Health Limited can better promote communication and interaction between enterprises and users, and gain a deeper understanding of users' needs for travel and related activities in the contemporary economic and cultural conditions of society.

Our Challenges

(1) The market competition is fierce. When it comes to comprehensive tourism enterprises, we have to mention American Express. American Express is the world's largest global company in tourism services, comprehensive finance, financial investment, and information processing. American Express was founded in 1850 and is headquartered in New York, USA. American Express is the world's largest global company in tourism services and comprehensive finance, financial investment, and information processing. It holds a leading position in credit cards, traveler's checks, tourism, financial planning, and international banking. It is the only service company among the top 30 companies in the Dow Jones Industrial Average that reflect the US economy.

American Express is headquartered in New York City and operates primarily through its three major branches: American Express Travel Related Services, American Express Financial Advisors, and American Express Bank. American Express Travel Related Services is one of the world's largest travel agencies with over 1700 travel offices worldwide. American Express Travel related services provide personal customers with charge cards, credit cards, and traveler's checks, as well as company cards and expense management tools to help companies manage their expenses in business travel, social activities, and procurement. The company also provides travel and related consulting services to individuals and companies around the world.

There is fierce competition in the "tourism+" market, and major companies are entering this field to provide various innovative solutions. For a newly established big data "tourism+" comprehensive conglomerate, it is difficult to stand out in the market compared to competitors who have already established brands and customer groups.

(2) Technical challenges. Big data "tourism+" integrated group companies need advanced technological capabilities to meet users' needs for real-time data, virtual reality, and augmented reality technologies. But the development and application of these technologies require a large amount of capital and human resources investment, especially for startups, which often find it difficult to bear these risks and costs.

(3) Lack of a stable profit model. In the field of "tourism+" comprehensive management and operation, the profit model is not clear, and companies often rely on hotels, amusement projects, or cooperation with tourist attractions to obtain income. However, due to fierce market competition, the platforms on which advertisers are willing to invest funds are limited, and collaborating with brands also requires establishing a reliable user base and brand image, which is a challenge for startups.

| 16 |

(4) It is difficult to cultivate and retain users. Big data "tourism+" comprehensive group companies need to attract users, cultivate user stickiness, and maintain user activity. However, this requires continuous provision of valuable content and experiences, as well as interaction and participation with users. For start-up companies, they often lack sufficient resources and capabilities to meet user needs, leading to user churn.

(5) Regulatory and policy limitations. The operation of "tourism+" comprehensive services involves the collection, storage, and use of user data. Some countries and regions have formulated strict regulations and policies regarding personal privacy and data security. Big data "tourism+" comprehensive group companies need to spend a lot of effort and resources to ensure compliance with relevant protection of user privacy and data security.

Overall, big data "tourism+" comprehensive conglomerate companies face operational weaknesses in fierce market competition, technological challenges, unstable profit models, difficulties in user cultivation and retention, and regulatory and policy restrictions. To solve these problems, companies need to have innovative capabilities, financial strength, and effective market promotion strategies. At the same time, they need to cooperate with relevant government departments and industry institutions to jointly promote the development of the healthcare industry.

Our market opportunity

Against the backdrop of current internet development, technological advancements, and favorable policies, the tourism and healthcare industry is showing a sustained trend of development. Especially since the outbreak of the COVID-19, people's attention to physical health and the demand for going out after being forced to stay at home for a long time have been constantly improving, which has also accelerated the pace of online penetration of the tourism and medical health industry, and the tourism scheme management business has developed rapidly.

However, in the open social sphere, it is currently difficult to form a dominant situation. Due to the diversification of market demand, people have varying preferences for the content of health management plans, resulting in multiple competitors participating in the competition together. Although the market competition is fierce, it also provides opportunities for Concord Health Limited to seize the market opportunity.

As a competitive enterprise, Concord Health Limited should actively adapt to changes in market demand, actively seek development opportunities, and seize the opportunity in the current international situation. Firstly, the company should closely monitor consumers' needs and preferences for tourism plan management services, and launch more personalized and differentiated products and services for different groups of people. Secondly, the company should strengthen cooperation with relevant enterprises and achieve rapid development through resource sharing and mutually beneficial cooperation models. At the same time, the company also needs to increase investment in technological innovation, utilize advanced technologies such as artificial intelligence big data analysis, and improve the efficiency of product research and operation, providing consumers with a higher quality experience.

In addition, when facing the international market, Concord Health Limited should also actively expand overseas markets and seek more partners and customers. By formulating a scientific internationalization strategy and combining local market demand and cultural characteristics, we aim to promote the company's rapid development in overseas markets.

In short, the current international situation provides broad development space for Concord Health Limited to seize the market opportunity. Companies can achieve rapid development and market leadership by closely monitoring market demand, strengthening cooperation, increasing investment in technological innovation, and expanding overseas markets.

| 17 |

What we do

Concord Health Limited is a comprehensive group company that has developed from a travel agency to rely on tourism, create big data, and achieve the "Tourism+" big data alliance. By attracting users through experiential tourism, utilizing users to connect with tourism routes and various commodities, each industry sector operates independently and assists each other in market operations, thereby transforming consumers into distributors, achieving a business ecosystem of universal alliance and supply and demand closed-loop, and fully responding to the call for "mass entrepreneurship and innovation". By providing personalized services and products, we can meet the needs of different groups of people and achieve long-term development and value creation for the enterprise.

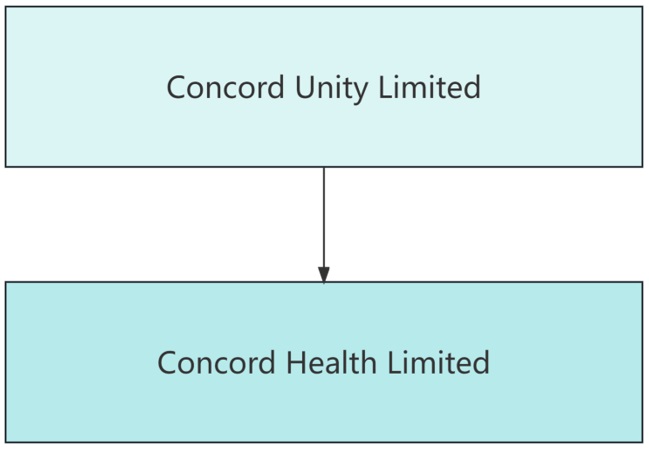

Our Corporate Structure

Our company implements a general manager responsibility system under the leadership of the board of directors, with the CEO of the product company leading the heads of finance, administration, human resources, marketing, operations, IT, and strategic planning departments. Xiaobin Mei serves as the Chairman, Jinxin Dong serves as the Chief Financial Officer, Huahua Huang serves as the Chief Marketing Officer, and Kaijin Duan serves as the Chief Technical Officer. The management team consists of several core personnel to ensure that the company operates in a legal and compliant manner while also ensuring business development.

Organizational Chart of the Group Company

| 18 |

Our Strategy

(1) 2023 Enterprise Planning and Preparation Period:

The establishment of the franchise chain platform of Concord Health Limited has been completed; By utilizing users to connect with tourism routes and various commodities, each industry sector operates independently and assists each other in market operations, thereby transforming consumers into distributors and achieving a business ecosystem of a global alliance and a closed-loop supply and demand.

(2) Promotion and expansion of financing mergers and acquisitions in 2024:

I. Utilize the membership system of government departments and relevant associations to promote the establishment of the Hehe Business District membership system on the digital cloud sharing ecological platform of Concord Health Limited;

II. Build a business headquarters base for Concord Health Limited, forming a new ecological environment for the integration and mutual development of multiple business formats and promotion of entrepreneurship;