UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(B) OR 12(G) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☐ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended __________________

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report: August 2, 2024

Commission File Number: 001-42205

Helport AI Limited

(Exact name of Registrant as specified in its charter)

| Not applicable | British Virgin Islands | |

| (Translation of Registrant’s name into English) | (Jurisdiction of incorporation or organization) |

9 Temasek Boulevard #07-00, Suntec Tower Two,

Singapore

038989

(Address of Principal Executive Offices)

Mr. Guanghai Li, Chief Executive Officer

9 Temasek Boulevard #07-00, Suntec Tower Two,

Singapore 038989

Tel:

+65 82336584

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||

| Ordinary Shares, $0.0001 par value per share | HPAI | The Nasdaq Stock Market LLC | ||

| Warrants to purchase Ordinary Shares | HPAIW | The Nasdaq Stock Market LLC |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the shell company report: As of August 8, 2024, the issuer has 37,132,968 ordinary shares and 18,844,987 warrants issued and outstanding.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐ No ☐

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☐ No ☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer, “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | Non-accelerated filer ☒ |

| Emerging growth company ☒ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive- based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| US GAAP ☒ | International Financial Reporting Standards as issued by the International Accounting Standards Board ☐ | Other ☐ |

If “Other” has been checked in response to the previous question indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☐

Table of Contents

i

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

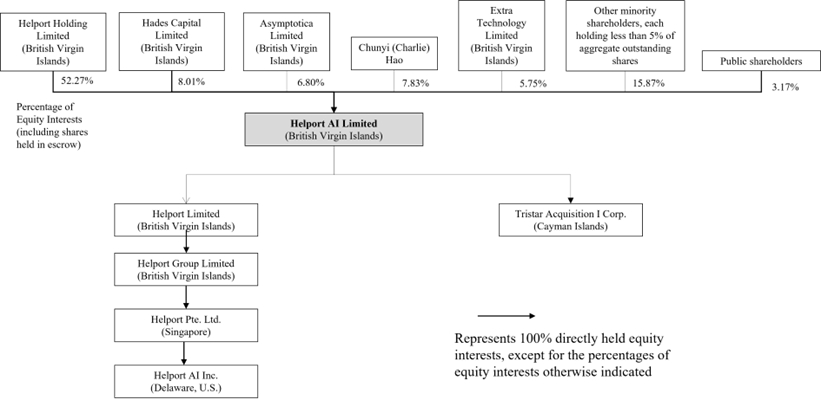

This Shell Company Report on Form 20-F (including information incorporated by reference herein, the “Report”) is being filed by Helport AI Limited, a British Virgin Islands business company (“PubCo”). Unless otherwise indicated, “we,” “us,” “our,” and “PubCo,” and similar terminology refers to Helport AI Limited, a company incorporated under the laws of the British Virgin Islands, and its subsidiaries subsequent to the Business Combination (defined below). References to “Helport,” the “Company” and “Helport Limited” refers to Helport Limited prior to the consummation of the Business Combination.

This Report contains or may contain forward-looking statements as defined in Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”) that involve significant risks and uncertainties. All statements other than statements of historical facts are forward-looking statements. These forward-looking statements include information about our possible or assumed future results of operations or our performance. Words such as “expects,” “intends,” “plans,” “believes,” “anticipates,” “estimates,” and variations of such words and similar expressions are intended to identify the forward-looking statements. The risk factors and cautionary language referred to in this Report provide examples of risks, uncertainties and events that may cause actual results to differ materially from the expectations described in our forward-looking statements, including among other things, the items identified in “Item 3. Key Information—D. Risk Factors” herein.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this Report. Although we believe that the expectations reflected in such forward-looking statements are reasonable, there can be no assurance that such expectations will prove to be correct. These statements involve known and unknown risks and are based upon a number of assumptions and estimates which are inherently subject to significant uncertainties and contingencies, many of which are beyond our control. Actual results may differ materially from those expressed or implied by such forward-looking statements. We undertake no obligation to publicly update or revise any forward-looking statements contained in this Report, or the documents to which we refer readers in this Report, to reflect any change in our expectations with respect to such statements or any change in events, conditions or circumstances upon which any statement is based.

ii

On November 12, 2023, Tristar Acquisition I Corp., a Cayman Islands exempted company (“Tristar”) entered into a certain Business Combination Agreement (as may be amended, supplemented or otherwise modified from time to time, the “Merger Agreement”), with Helport Limited, a British Virgin Islands business company (“Helport”), PubCo, Merger I Limited, a British Virgin Islands business company and a wholly-owned subsidiary of PubCo (“Merger Sub 1”), Merger II Limited, an exempted company incorporated with limited liability in the Cayman Islands and a direct wholly-owned subsidiary of PubCo (“Merger Sub 2”), Navy Sail International Limited, a British Virgin islands company, in the capacity as the representative from and after the effective time of the SPAC Merger (as defined below) (the “Effective Time”) for the shareholders of Purchaser (other than Helport shareholders as of immediately prior to the Effective Time and their successors and assignees) in accordance with the terms and conditions of the Business Combination Agreement (“Purchaser Representative”) and Extra Technology Limited, a British Virgin Islands business company, in the capacity as the representative from and after the Effective Time for the holders of Helport ordinary shares as of immediately prior to the Effective Time in accordance with the terms and conditions of the Business Combination Agreement (“Seller Representative”).

The Merger Agreement provided for a business combination which was effected in two steps. On August 1, 2024, (i) Merger Sub 1 merged with and into Helport (the “Initial Merger”), and Helport is the surviving corporation of the Initial Merger and a direct wholly owned subsidiary of PubCo, and on August 2, 2024, (2) following confirmation of the effectiveness of the Initial Merger, Merger Sub 2 merged with and into Tristar (the “SPAC Merger,” and, together with Initial Merger, the “Business Combination” or the “Mergers”), and Tristar is the surviving corporation of the SPAC Merger and a direct wholly owned subsidiary of PubCo.

On August 2, 2024, PubCo consummated the Business Combination pursuant to the terms of the Merger Agreement and Helport became a wholly owned subsidiary of PubCo. This Report is being filed in connection with the Business Combination.

On May 18, 2024, Tristar and Helport entered into subscription agreements with three investors on substantially the same terms, pursuant to which, among other things, Helport agreed to issue and sell to the investors (the “PIPE Investors”), and the investors agreed to subscribe for and purchase an aggregate of 1,388,889 shares at a purchase price of $10.80 per share, for an aggregate purchase price of $15,000,000, in a private placement (the “PIPE Investment”). The subscription agreements contained customary conditions to closing, including the consummation of the Business Combination.

On August 2, 2024, in connection with the consummation of the Business Combination, PubCo received aggregate gross proceeds of $5.5 million out of the $15 million PIPE Investment and issued an aggregate of 509,259 shares to the PIPE Investors for such subscription. The reduced amount of gross proceeds was due to the inability of one of the investors to remit substantially all of its subscription. Each of Tristar and PubCo reserve their rights with respect to such investor’s obligations, however, there are no assurances that the balance of such commitment will be remitted in a timely manner, if at all.

iii

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

A. Directors and Senior Management

The directors and executive officers are set forth in the section entitled “Item 6. Directors, Senior Management and Employees – A. Directors and Executive Officers.”

The business address for each of PubCo’s directors and senior management is 9 Temasek Boulevard #07-00, Suntec Tower Two, Singapore 038989.

B. Advisors

Hunter Taubman Fischer & Li LLC acted as U.S. counsel for Helport upon the Business Combination. The address of Hunter Taubman Fischer & Li LLC is 950 Third Avenue, 19th Floor, New York, NY 10022.

Ogier acted as the British Virgin Islands counsel for Helport upon the Business Combination. The address of Ogier is Floor 11, Center Tower, 28 Queen’s Road Central, Central, Hong Kong.

C. Auditors

Enrome LLP acted as the independent registered public accounting firm of Helport, for its consolidated financial statements as of June 30, 2022 and 2023 and for the years then ended, and will be the Company’s independent registered public accounting firm following the Business Combination.

The address of Enrome LLP is 143 Cecil Street #19-03/04, GB Building, Singapore 069542.

Marcum LLP, acted as Tristar’s independent auditing firm for its financial statements as of December 31, 2022 and 2023 and for the years then ended.

The address of Marcum LLP is 730 3rd Ave 11th Floor, New York, NY 10017.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not Applicable.

A. [Reserved]

B. Capitalization and Indebtedness

The following table sets forth the capitalization of the Company on an unaudited pro forma condensed combined basis as of December 31, 2023, after giving effect to the Business Combination and the PIPE transactions.

| As of December 31, 2023 | Pro Forma Combined | |||

| Cash and cash equivalents | $ | 3,273,946 | ||

| Ordinary shares | 3,713 | |||

| Subscription receivable | (156 | ) | ||

| Additional paid-in capital | 2,197,276 | |||

| Retained earnings | 11,619,985 | |||

| Total Equity | 13,820,818 | |||

| Debt: | ||||

| Long term payables | 461,550 | |||

| Total capitalization | $ | 13,359,268 | ||

C. Reasons for the Offer and Use of Proceeds

Not applicable.

1

D. Risk Factors

Our business and our industry are subject to significant risks. You should carefully consider all of the information set forth in this Report and in our other filings with the SEC, including the following risk factors, in evaluating our business. If any of the following risks actually occur, our business, financial condition, results of operations, and growth prospects would likely be materially and adversely affected. This Report also contains forward-looking statements that involve risks and uncertainties. See the section entitled “Cautionary Note Regarding Forward-Looking Statements.

Summary of Risk Factors

Risks Related to Doing Business in the PRC

| ● | You may experience difficulties in effecting service of legal process, enforcing foreign judgments, or bringing actions in China against PubCo or its management that reside outside the United States based on foreign laws. It may also be difficult for you or overseas regulators to conduct investigations or collect evidence within China; | |

| ● | Recent greater oversight by the CAC over data security could adversely impact our business; | |

| ● | Changes in China’s economic, political, or social conditions or government policies could have a material adverse effect on Helport’s business and operations; | |

| ● | Uncertainties in the interpretation and enforcement of PRC laws and regulations and changes in policies, rules, and regulations in China, which may be quick with little advance notice, could limit the legal protection available to you and us; | |

| ● | Fluctuations in exchange rates could have a material and adverse effect on our results of operations and the value of your investment; | |

| ● | Each of our customers and suppliers has entered into an Authorization for Payment Agreement with our Singapore operating entity and a third- party agent. Our financial condition and liquidity position may be subject to credit risks of the third-party agent; and | |

| ● | If the PRC government imposes further restrictions and limitations on our PRC customers’ ability to transfer or distribute cash overseas., our business, financial condition, and results of operations could be materially adversely affected. |

Risks Related to Our Business

| ● | Our failure to anticipate or successfully implement new technologies could render our contact-center solution services less competitive and reduce our revenue and market share; | |

| ● | Our reliance on developer partners for AI product and system development is significant. If these third parties, or their critical staff members, are unable or unwilling to continue their cooperation with us, it could have a detrimental effect on our business; | |

| ● | The use of open-source software in our products may compromise our ability to protect the confidentiality of our proprietary information, potentially harming our business and competitive position; | |

| ● | Our inability to use software licensed from third parties, or our use of open-source software under license terms that interfere with our proprietary rights, could disrupt our business; |

2

| ● | We are in the highly competitive AI Contact Integrated Solutions Industry, and we may not be able to compete successfully against existing or new competitors, which could reduce our market share and adversely affect our competitive position and financial performance; | |

| ● | Our business may rely on a primary supplier or a few customers that account for more than 10% of our total purchases. Interruptions in operations in such major clients or supplier may have an adverse effect on our business, financial condition, and results of operations; | |

| ● | We rely on third-party cloud computing platforms to develop software and store data. If we fail to maintain our relationships with these platforms, or if the service fees charged by these platforms change to our detriment, our business may be adversely affected; | |

| ● | Our business generates and processes a large amount of data, and it is required to comply with laws and regulations in multiple jurisdictions relating to data privacy and security. The improper use or disclosure of data could have a material and adverse effect on our business and prospects; | |

| ● | The proper functioning of our technology systems and platforms is essential to our business. Any disruption to our information technology systems could materially affect our ability to maintain the satisfactory performance of our AI data analytic systems; | |

| ● | If we sustain cyber-attacks or other privacy or data security incidents that result in security breaches, we could be subject to increased costs, liabilities, reputational harm, or other negative consequences; | |

| ● | If we fail to manage our growth or execute our strategies and future plans effectively, we may not be able to take advantage of market opportunities or meet the demand of our customers; | |

| ● | Unauthorized use of our intellectual property by third parties and expenses incurred in protecting our intellectual property rights may adversely affect our business, reputation, and competitive edge; | |

| ● | Third parties may claim that we have infringe their proprietary intellectual property rights, which could cause us to incur significant legal expenses and prevent us from promoting our services; |

| ● | Non-compliance with laws and regulations on the part of any third parties with which we conduct business could expose us to legal expenses, compensation to third parties, penalties, and disruptions of our business, which may adversely affect our results of operations and financial performance; | |

| ● | Future acquisitions may have an adverse effect on our ability to manage our business; | |

| ● | A decline in general economic conditions or a disruption of financial markets may affect our target market or industry which in turn could adversely affect our profitability; | |

| ● | We may be adversely affected by the effects of inflation and a potential recession; | |

| ● | We face risks related to natural disasters, health epidemics, and other outbreaks, which could significantly disrupt our operations; | |

| ● | Any negative publicity about us, our services, and our management may materially and adversely affect our reputation and business; | |

| ● | If we fail to attract, recruit, or retain our key personnel, including our executive officers, senior management, and key employees, our ongoing operations and growth could be affected; and | |

| ● | We may from time to time be subject to claims, controversies, lawsuits, and legal proceedings, which could adversely affect our business, prospects, results of operations, and financial condition. |

3

Risk Relating to Doing Business in Singapore

| ● | We may rely on dividends and other distributions on equity paid by our subsidiary in Singapore to fund any cash and financing requirements we may have |

Risks Related to Our Securities

| ● | If Helport or PubCo fails to implement and maintain an effective system of internal controls or remediate the material weaknesses in its internal control over financial reporting that have been identified, PubCo may be unable to accurately report its results of operations, meet its reporting obligations, or prevent fraud, and investor confidence and the market price of PubCo Ordinary Shares may be materially and adversely affected; |

| ● | PubCo may or may not pay cash dividends in the foreseeable future; |

| ● | Provisions in PubCo’s Amended and Restated Memorandum and Articles of Association may inhibit a takeover of PubCo, which could limit the price investors might be willing to pay in the future for PubCo’s securities and could entrench management; |

| ● | PubCo is an “emerging growth company,” and it cannot be certain if the reduced SEC reporting requirements applicable to emerging growth companies will make PubCo Ordinary Shares less attractive to investors, which could have a material and adverse effect on PubCo, including its growth prospects; and |

| ● | As a “foreign private issuer” under the rules and regulations of the SEC, PubCo is permitted to file less or different information with the SEC than a company incorporated in the United States or otherwise subject to these rules and is permitted to follow certain home-country corporate governance practices in lieu of certain Nasdaq requirements applicable to U.S. issuers. |

Risks Relating to Doing Business in the PRC

You may experience difficulties in effecting service of legal process, enforcing foreign judgments, or bringing actions in China against PubCo or its management that reside outside the United States based on foreign laws. It may also be difficult for you or overseas regulators to conduct investigations or collect evidence within China.

As a company incorporated under the laws of the British Virgin Islands, we conduct our operations through our subsidiary in Singapore, but are reliant upon customers who are based in China. In addition, three out of PubCo’s six directors and officers, namely Guanghai Li, Jun Ge, and Xinyue (Jasmine) Geffner, reside in the PRC. All or a substantial portion of the assets of PubCo’s directors and officers are located outside the United States. As a result, it may be difficult for you to effect service of process upon those persons inside mainland China. It may be difficult for you to enforce judgments obtained in U.S. courts based on civil liability provisions of the U.S. federal securities laws against PubCo and its officers and directors who do not currently reside in the U.S. or have substantial assets in the U.S. In addition, there is uncertainty as to whether the courts of the British Virgin Islands or the PRC would recognize or enforce judgments of U.S. courts against PubCo or such persons predicated upon the civil liability provisions of the securities laws of the U.S. or any state.

The recognition and enforcement of foreign judgments are provided for under the PRC Civil Procedures Law. PRC courts may recognize and enforce foreign judgments in accordance with the requirements of the PRC Civil Procedures Law based either on treaties between China and the country where the judgment is made or on principles of reciprocity between jurisdictions. China does not have any treaties or other forms of written arrangement with the United States that provide for the reciprocal recognition and enforcement of foreign judgments. In addition, according to the PRC Civil Procedures Law, the PRC courts will not enforce a foreign judgment against PubCo or its directors and officers if they decide that the judgment violates the basic principles of PRC laws or national sovereignty, security, or public interest. As a result, it is uncertain whether and on what basis a PRC court would enforce a judgment rendered by a court in the United States.

4

It may also be difficult for you or overseas regulators to conduct investigations or collect evidence within China. For example, in China, there are significant legal and other obstacles to obtaining information needed for shareholder investigations or litigation outside China or otherwise with respect to foreign entities. Although the authorities in China may establish a regulatory cooperation mechanism with counterparts of another country or region to monitor and oversee cross border securities activities, such regulatory cooperation with the securities regulatory authorities in the United States may not be efficient in the absence of a practical cooperation mechanism. Furthermore, according to Article 177 of the PRC Securities Law (“Article 177”), which became effective in March 2020, no overseas securities regulator is allowed to directly conduct investigations or evidence collection activities within the territory of the PRC. Article 177 further provides that Chinese entities and individuals are not allowed to provide documents or materials related to securities business activities to foreign agencies without prior consent from the securities regulatory authority of the State Council and the competent departments of the State Council. While detailed interpretation of or implementing rules under Article 177 have yet to be promulgated, the inability for an overseas securities regulator to directly conduct investigations or evidence collection activities within China may further increase difficulties faced by you in protecting your interests.

Recent greater oversight by the CAC over data security could adversely impact our business.

On December 28, 2021, 13 governmental departments of the PRC, including the Cybersecurity Administration of China, or the CAC, jointly promulgated the Cybersecurity Review Measures, which became effective on February 15, 2022. The Cybersecurity Review Measures provide that net platform operators engaging in data processing activities that affect or may affect national security must be subject to cybersecurity review by the Cybersecurity Review Office of the PRC. On November 14, 2021, the CAC published the Draft Regulations on the Network Data Security Administration (Draft for Comments), which provides that data processing operators engaging in data processing activities that affect or may affect national security must be subject to cybersecurity review by the relevant Cyberspace Administration of the PRC.

Although we have no operating entity in the PRC, so far all of our revenue is generated from customers located in the PRC. Our products do not collect personal data from contact center activities, nor do we store any data from such activities. Therefore, as of the date of this Report, neither PubCo nor any subsidiaries thereof have received any notice from any authorities requiring PubCo or any of its subsidiaries to go through cybersecurity review or network data security review. However, since the use of our AI Assist software nevertheless involves the collection of data and information contained in contact center operations of our customers in the PRC, we may be subject to certain laws and regulations in China in the future. If any such new laws, regulations, rules, or implementation and interpretation come into effect, we expect to take all reasonable measures and actions to comply and to minimize the adverse effect of such laws on it. We cannot guarantee, however, that we will not be subject to cybersecurity review and network data security review in the future. During such reviews, Helport may be required to suspend their operations or experience other disruptions to their operations. Cybersecurity review and network data security review could also result in negative publicity with respect to PubCo, and diversion of its managerial and financial resources, which could materially and adversely affect its business, financial conditions, and results of operations.

Changes in China’s economic, political, or social conditions or government policies could have a material adverse effect on our business and operations.

Although we have no operating entity in the PRC, so far all of our customers are located in the PRC. Accordingly, our business, financial condition, results of operations, and prospects may be influenced to a significant degree by political, economic, and social conditions in China generally. The Chinese economy differs from the economies of most developed countries in many respects, including the level of government involvement, level of development, growth rate, control of foreign exchange, and allocation of resources.

Although the Chinese government has implemented measures emphasizing the utilization of market forces for economic reform, including the reduction of state ownership of productive assets and the establishment of improved corporate governance in business enterprises, a substantial portion of productive assets in China is still owned by the government. In addition, the Chinese government continues to play a significant role in regulating industry development by imposing industrial policies. The Chinese government also exercises significant control over China’s economic growth by allocating resources, controlling payment of foreign currency-denominated obligations, setting monetary policy, and providing preferential treatment to particular industries or companies.

5

While the Chinese economy has experienced significant growth over the past decades, growth has been uneven, both geographically and among various sectors of the economy. Any adverse changes in economic conditions in China, in the policies of the Chinese government, or in the laws and regulations in China could have a material adverse effect on the overall economic growth of China. Such developments could adversely affect our business and operating results, reduce demand for their products, and weaken their competitive position. The Chinese government has implemented various measures to encourage economic growth and guide the allocation of resources. Some of these measures may benefit the overall Chinese economy but may have a negative effect on us. For example, our financial condition and results of operations may be adversely affected by government control over capital investments or changes in tax regulations. In addition, in the past the Chinese government has implemented certain measures, including interest rate adjustments, to control the pace of economic growth. These measures may cause decreased economic activities in China, which may adversely affect our business and operating results. These negative events and circumstances include, but may not be limited to, the following:

| ● | an economic downturn in China; | |

| ● | political instability that could adversely affect our ability to deliver our products to consumers in a timely fashion; | |

| ● | changes in laws and regulations, in particular those with little advance notice; | |

| ● | tariffs and other trade barriers which could make it more expensive for us to deliver our products to consumers; and | |

| ● | new administrative and compliance requirements resulting in an increase in transactional costs with our suppliers and customers. |

Uncertainties in the interpretation and enforcement of PRC laws and regulations and changes in policies, rules, and regulations in China, which may be quick with little advance notice, could limit the legal protection available to you and us.

The PRC legal system is based on written statutes. Unlike common law systems, it is a system in which legal cases have limited value as precedents. In the late 1970s, the PRC government began to promulgate a comprehensive system of laws and regulations governing economic matters in general. The legislation over the past five decades has significantly increased the protection afforded to various forms of foreign or private-sector investment in China. Since these laws and regulations are relatively new and the PRC legal system continues to rapidly evolve, however, the interpretations of many laws, regulations, and rules are not always uniform and enforcement of these laws, regulations, and rules involves uncertainties.

Although we have no operating entity in the PRC, currently all of the Company’s customers are located in China. Therefore, from time to time, we and our subsidiaries may have to resort to administrative and court proceedings in China to enforce their legal rights. Since PRC administrative and court authorities have significant discretion in interpreting and implementing statutory and contractual terms, however, it may be more difficult to evaluate the outcome of administrative and court proceedings and the level of legal protection we and our subsidiaries enjoy in the PRC legal system than in more developed legal systems. Furthermore, the PRC legal system is based in part on government policies, internal rules, and regulations (some of which are not published in a timely manner or at all) that may have retroactive effect and may change quickly with little advance notice. As a result, we and our subsidiaries may not be aware of their violation of these policies and rules until sometime after the violation. Such uncertainties, including uncertainties over the scope and effect of their contractual, property (including intellectual property), and procedural rights, and any failure to respond to changes in the regulatory environment in China could materially and adversely affect our business and impede our ability to continue operations.

Fluctuations in exchange rates could have a material and adverse effect on our results of operations and the value of your investment.

During the six months ended December 31, 2023 and the fiscal years ended June 30, 2023 and 2022, our sales to the China market accounted for substantially all of our revenue. Our sales to customers located in the PRC are denominated in U.S. dollar, with the actual settlement amount converted to an amount denominated in Renminbi (“RMB”) at the time of payment. Our Singapore operating entity’s functional currency is Singapore dollar. As a result, fluctuations in the exchange rate among the U.S. dollar, Singapore dollar and RMB will affect the relative purchasing power, in Singapore dollar or RMB terms, of our U.S. dollar assets and the proceeds from our initial public offering. Gains and losses from the re-measurement of assets and liabilities receivable or payable in Singapore dollar or RMB are included in our consolidated statements of operations. The re-measurement has caused the U.S. dollar value of our results of operations to vary with exchange rate fluctuations, and the U.S. dollar value of our results of operations will continue to vary with exchange rate fluctuations.

A fluctuation in the value of Singapore dollar or RMB relative to the U.S. dollar could reduce our profits from operations and the translated value of our net assets when reported in U.S. dollars in our financial statements. This change in value could negatively impact our business, financial condition, or results of operations as reported in U.S. dollars. In the event that we decide to convert our Singapore dollar or RMB into U.S. dollars to make payments for dividends on our ordinary shares (the “Ordinary Shares” or “PubCo Ordinary Shares”) or for other business purposes, appreciation of the U.S. dollar against the Singapore dollar or RMB will harm the U.S. dollar amount available to us. In addition, fluctuations in currencies relative to the periods in which the earnings are generated may make it more difficult to perform period-to-period comparisons of our reported results of operations.

6

It is difficult to predict how market forces or the Singapore, PRC or U.S. government policy may impact the exchange rate among the U.S. dollar, Singapore dollar and RMB in the future. Any significant appreciation or depreciation of the Singapore dollar or RMB may materially and adversely affect our revenues, earnings and financial position, and the value of, and any dividends payable on, our Ordinary Shares in U.S. dollars. To date, we have not entered into any hedging transactions in an effort to reduce our exposure to foreign currency exchange risk. While we may decide to enter into hedging transactions in the future, the availability and effectiveness of these hedges may be limited and we may not be able to adequately hedge our exposure or at all. If the exchange rate between the U.S. dollar, Singapore dollar and RMB fluctuates in an unanticipated manner, our business, financial condition, and results of operations could be materially adversely affected.

Each of our customers and suppliers has entered into an Authorization for Payment Agreement with our Singapore operating entity and a third- party agent. Our financial condition and liquidity position may be subject to credit risks of the third-party agent.

Since we have not yet established relevant entities or subsidiaries in the PRC, and so far all our customers and suppliers are located in the PRC, each of our customers and suppliers has entered into an Authorization for Payment Agreement (the “Agreement”) with our Singapore operating entity, Helport Pte Ltd (“Helport Singapore”), and a third party agent, Xinsheng Technology (Tianjin) Co., Ltd. (“Xinsheng”), through whom we make payments to our suppliers and receive payments from our customers. The payment amount in each of the Agreement is denoted in U.S. dollars. For details, see “Item 4. Information of the Company — B. Business Overview — Major Supplier” and “Item 4. Information of the Company — B. Business Overview — Customers, Sales, and Marketing.” As of the date of this Report, Xinsheng has fulfilled its obligations to transfer payment guaranteed in each of the Agreement. However, there is no assurance that, in the future, we will be able to successfully enforce Xinsheng’s guarantee, or any other such payment agents’ guarantee. These third-party agents are subject to their own unique operational and financial risks, which are beyond our control. In the event that such agents fail to function properly or breach or terminate their cooperation with us, we may be unable to recover payment from our customers or transfer payment to our suppliers in a timely manner, or at all. This could disrupt our cash flow and lead to a breakdown of our contractual relationship with customers and suppliers. If we are unable to address these issues in a timely and cost-effective manner, our business, financial condition, and results of operations may be adversely affected.

If the PRC government imposes further restrictions and limitations on our PRC customers’ ability to transfer or distribute cash overseas., our business, financial condition, and results of operations could be materially adversely affected.

The PRC government has imposed controls on the convertibility of the RMB into foreign currencies and, in certain cases, the remittance of currency out of China. For instance, the Circular on Promoting the Reform of Foreign Exchange Management and Improving Authenticity and Compliance Review, or “SAFE Circular 3,” issued on January 26, 2017, provides that banks shall, when dealing with dividend remittance transactions from a domestic enterprise to its offshore shareholders of more than $50,000, review the relevant board resolutions, original tax filing form, and audited financial statements of such domestic enterprise based on the principle of genuine transaction. There is no guarantee that the PRC government will not further intervene or impose other restrictions on our PRC customers’ ability to transfer or distribute cash outside the PRC. In the event that the foreign exchange control system prevents our PRC customers from remitting their payments to Singapore, we may not be able to receive a substantial portion of our revenue. As a result, our business, financial condition, and results of operations may be adversely affected.

Risks Related to Our Business

Our failure to anticipate or successfully implement new technologies could render our contact-center solution services less competitive and reduce our revenue and market share.

We provide data-driven AI technologies to our customers endeavoring to maximize the revenue-generation and customer-retention potential capacities of their contact centers. See “Item 4. Information of the Company — B. Business Overview —Competitive Strengths”. As of the date of this Report, we have filed six patent applications in Singapore. These applications are currently awaiting approval from the authorities and focus on technologies enhancing the utility of contact centers. We have also designed and developed effective systems of Gateways to integrate our AI Assist software into contact centers. Nonetheless, the AI Contact Integrated Solutions Industry is characterized by rapid technological advancement, constant improvement of AI products’ learning capabilities and resultant heightening of customers’ expectations, disruption by innovative entrants, and evolving business models and industry standards. This requires us to anticipate well in advance, which technologies we must implement and take advantage of to make our AI products and services competitive in the market. As such, we need to continue to invest significant financial resources in research and development to keep pace with technological advances in order to make our technologies competitive in the market, especially those relating to the intelligence and analytic capability of our core AI product. However, development activities are inherently uncertain, and our expenditures on research and development may not generate commensurate benefits. Given the fast pace with which AI technology has been and will continue to be developed, we may not be able to timely upgrade our data analytics and AI-based technologies, or the algorithm or engines required thereby in an efficient and cost-effective manner, or at all. New technologies in our industry could render the technologies and services that we are developing or expect to develop in the future obsolete or uncompetitive, thereby potentially resulting in a decline in our revenues and market share.

7

Our reliance on developer partners for AI product and system development is significant. If these third parties, or their critical staff members, are unable or unwilling to continue their cooperation with us, it could have a detrimental effect on our business.

The business model we have implemented depends upon our collaboration with our developer partners. We currently rely on one key developer partner, Tianjin Youfei Shuke Technology Group (“Youfei Shuke”), to develop AI-driven products applied to our contact center solutions and our BPO platform. Our partnership typically involves co-modeling and co-developing efforts based on our designs of the AI product and its expected application, and Youfei Shuke’s provision of basic AI infrastructure. For details, see “Item 4. Information of the Company — B. Business Overview — Major Supplier”. While we retain a significant level of control over the core technology involved and the development process, the heavy involvement of our developer partner and the technical staff Youfei Shuke provides means that our engagement with them may expose us to risks beyond our control. For instance, miscommunication between our technical team and that of Youfei Shuke could result in the developed software deviating from our original design, leading to functional discrepancies or unforeseen issues arising only in the later stages of a development process, or only during real-world application scenarios. In such circumstances, the resolution of these potential issues could cost us in extra expenses, resources and time. This could also jeopardize our research and development efforts, or could potentially harm the reputation of our brand, which may negatively impact our revenue and results of operations.

We own the end product resulting from collaborative development efforts with Youfei Shuke, and all service agreements between Helport Singapore and Youfei Shuke include mutual confidentiality obligations. However, we cannot guarantee that Youfei Shuke will not breach these confidentiality obligations during the term of the agreements or after their expiration. If Youfei Shuke, in violation of their confidentiality obligations, appropriates our technology or the end product of co-development efforts for its own use or for the benefit of our competitors, we may lose our competitive edge in the industry and market share, which may lead to a reduction in our revenue and materially impact our business operations.

We engaged Youfei Shuke in three three-year service agreements in 2022, but there is no assurance that we will continue to maintain our cooperation with Youfei Shuke after the term of the current agreements expire. Similar uncertainties may apply to our potential engagement with other developer partners in the future. However, as of the date of this proxy Report, we can provide no assurance that we will successfully enter into such engagements. Any such third-party developer partners will be subject to their own unique operational and financial risks, which will be beyond our control. If any such third-party developer partners fail to function properly or breach or terminate their cooperation with us, we must secure substitute developer partners to maintain our business. If we are unable to address these issues in a timely and cost-effective manner, our business, financial condition, and results of operations may be adversely affected.

We are in the highly competitive AI Contact Integrated Solutions Industry, and we may not be able to compete successfully against existing or new competitors, which could reduce our market share and adversely affect our competitive position and financial performance.

The industry of contact-center AI technology worldwide is competitive and rapidly evolving, with new companies increasingly joining the competition in recent years. AI products and service models in the industry are constantly evolving to adapt new technologies, increase cost efficiency, and meet customers’ rising expectation for more intelligent products. We compete for bringing about profitability increase, managerial efficiency enhancement, and agent mistake reduction to customers’ contact centers, which is often determined by factors such as AI efficiency, system integration abilities and industry experience. As of the date of this Report, we believe that we are well-positioned to effectively compete in the AI contact-center solutions industry primarily due to (i) our AI technology; (ii) our professional knowledge base; (iii) our industry experience and client base; and (iv) our business model and product offerings. See “Item 4. Information of the Company — B. Business Overview —Competition.” Nonetheless, as advancement in AI technology is often accompanied by revolutionary effects on its application, sudden and intensive competition can take place unexpectedly in the future. The increased competition may lead to increased costs for customer acquisition and retention, which may result in reduced margins and a loss of market share for us. We compete with other competitors on the following bases:

| ● | the effectiveness and quality of our AI solutions; | |

| ● | vertical industry knowledge and domain expertise; | |

| ● | operational capabilities; | |

| ● | business model; | |

| ● | brand recognition; | |

| ● | quality of services both in the initial system installment phase and the subsequent operation maintenance phase; | |

| ● | effectiveness of sales and marketing efforts; and | |

| ● | hiring and retention of talented staff. |

8

Our competitors may operate with different business models, have different service structures, and may be more successful or more adaptable to new regulatory, technological, and other developments. They may in the future achieve greater market acceptance and recognition and gain a greater market share. It is also possible that potential new competitors may emerge and acquire a significant market share. If existing or potential new competitors develop or offer services that provide significant performance, price, creative optimization, or other advantages over those offered by us, our business, results of operations, and financial condition could be negatively affected. Our existing and potential competitors may enjoy competitive advantages over us, such as greater brand recognition, larger customer base, and better value-added services. We may lose customers if we fail to compete successfully, which could adversely affect our financial performance and business prospects. We cannot guarantee that our strategies will remain competitive or successful in the future. Increasing competition may result in pricing pressure and loss of our market share, either of which could have a material adverse effect on our financial condition and results of operations.

The use of open-source software in our products may compromise our ability to protect the confidentiality of our proprietary information, potentially harming our business and competitive position.

The software we developed for our technology includes the use of open-source software that is subject to the terms and conditions of the applicable open-source software licenses that grant us permission to use such software. The owner of any such proprietary information or technology also might not enforce or otherwise protect its rights in the proprietary information or technology with the same vigilance that we would, which would allow competitors to use such proprietary information and technology without having to adhere to a license agreement with the owner.

In addition, some open-source licenses require that source code subject to the license be made available to the public and that any modifications to or derivative works of open-source software continue to be licensed under open-source licenses. These open-source licenses typically mandate that proprietary software, when combined in specific ways with open-source software, become subject to the open-source license. If we combine our proprietary solutions in such ways with certain open-source software, we could be required to release the source code of our proprietary solutions.

We take steps to ensure that our proprietary solutions are not combined with, and do not incorporate, open-source software in ways that would require our proprietary solutions to be subject to many of the restrictions in an open-source license. However, the manner in which these licenses may be interpreted and enforced is subject to some uncertainty. Additionally, we rely on software programmers, including the technical staffs of Youfei Shuke, to design our proprietary technologies, and although we take steps to prevent our programmers from including objectionable open-source software in the technologies and software code that they design, write and modify, we do not exercise complete control over the development efforts of our programmers and we cannot be certain that our programmers have not incorporated such open-source software into our proprietary solutions and technologies or that they will not do so in the future. In the event that portions of our proprietary technology are determined to be subject to an open-source license, we could be required to publicly release the affected portions of our source code, re-engineer all or a portion of our technologies, or otherwise be limited in the licensing of our technologies, each of which could reduce or eliminate the value of our services and technologies and materially and adversely affect our business, results of operations and prospects.

Our inability to use software licensed from third parties, or our use of open-source software under license terms that interfere with our proprietary rights, could disrupt our business.

Our products, including our technology and methods used, include the use of open-source software that is subject to the terms and conditions of the applicable open-source software licenses that grant us permission to use such software. Although we monitor our use of open-source software, the terms of many open-source licenses to which we are subject have not been interpreted by U.S. or foreign courts, and there is a risk that such licenses could be construed in a manner that imposes unanticipated conditions or restrictions on our ability to provide our technology to our customers. Moreover, we cannot ensure that we have not incorporated additional open-source software in our products in a manner that is inconsistent with the terms of the applicable license or our current policies and procedures. In the future, we could be required to seek licenses from third parties in order to continue offering our solutions, which licenses may not be available on terms that are acceptable to us, or at all. Claims related to our use of open-source software could also result in litigation, require us to purchase costly licenses or require us to devote additional research and development resources to change the software underlying our technology, any of which would have a negative effect on our business, financial condition and operating results and may not be possible in a timely manner. We and our customers may also be subject to suits by parties claiming infringement due to the reliance by our products on certain open-source software, and such litigation could be costly for us to defend or subject us to injunctions enjoining us from the sale of our products that contain open-source software.

9

Alternatively, we may need to re-engineer our products or discontinue using portions of the functionality provided by our products. In addition, the terms of open-source software licenses may require us to provide software that we develop using such software to others on unfavorable terms, such as by precluding us from charging license fees, requiring us to disclose our source code, requiring us to license certain of our own source code under the terms of the applicable open-source license or requiring us to provide notice on our products using such code. Any such restriction on the use of our own software, or our inability to use open-source or third-party software, could result in disruptions to our business or operations, or delays in our development of future products or enhancements of our existing products, including the AI Assist software and the Helphub Crowdsourcing Platform, which could impair our business.

Our business may rely on a primary supplier or a few customers that each account for more than 10% of our total purchases. Interruptions in operations in such major clients or supplier may have an adverse effect on our business, financial condition, and results of operations.

We rely on a few customers that each account for more than 10% of our total sales, who are all contact-center BPO companies for whom we provide our AI Assist product. For the six months ended December 31, 2023, we had two significant customers, namely Beijing Baojiang Science and Technology Co., Ltd. (“Baojiang”) and Shenyang Pengbosheng Network Technology Co., Ltd. (“Pengbosheng”), which accounted for 26.7% and 47.3% of our total sales, respectively. For the fiscal year ended June 30, 2023, we had two significant customers, Baojiang and Pengbosheng, which accounted for 28.4% and 46.3% of our total sales, respectively. For the fiscal year ended June 30, 2022, Pengbosheng accounted for 51.4% of our total sales, and Baojiang accounted for 34% of our total sales. No other customers accounted for more than 10% of our total sales during the six months ended December 31, 2023 and the fiscal years ended June 30, 2023 and 2022.

As an example of a typical transaction, in accordance with a System Information Technology Service Agreement dated February 1, 2022 between Baojiang and Helport Singapore, our Singapore operating entity, Helport Singapore is required to provide to Baojiang system functional modules for contact centers, as well as custom development and efficiency management services that accompany the modules. For details, see “Item 4. Information of the Company — B. Business Overview — The Business Model”. The final and billable service fee will be invoiced to Baojiang every month, and the invoice amount shall be confirmed by Baojiang within three business days. The agreement includes a six-month trial period. If Baojiang decides to continue engaging Helport Singapore’s service after the trial period ends, the fees generated during the trial will become payable.

We also rely on Youfei Shuke as our provider of AI infrastructure and developer partner, who has been our primary technology supplier for the six months ended December 31, 2023 and the fiscal years ended June 30, 2023 and 2022. Our partnership typically involves co-modeling and co-developing efforts based on our designs of the AI product and its expected application, and Youfei Shuke’s provision of AI infrastructure. In the six months ended December 31, 2023 and the fiscal years ended June 30, 2023 and 2022, there have been three service agreements between Youfei Shuke and Helport Singapore, all of which relate to the development of AI-driven products designed to enhance our existing products and systems.

Since Youfei Shuke is our primary supplier, our engagement with it may expose us to risks beyond our control. There is the risk that Youfei Shuke may breach or terminate its contracts with us or experience significant disruptions to its operations, causing our contractual relationship to end with little or no prior notice. Since we retain significant control over the development process and the core technology involved, disruptions to our business operations and development efforts in such circumstances would be limited to some extent. However, the heavy involvement of Youfei Shuke in our R&D projects as our developer partner, including the technical staff they provide, means that in the event Youfei Shuke disengages from us, we would need to find other technology suppliers as a substitute. If we cannot immediately engage alternative suppliers capable of providing and substituting all of Youfei Shuke’s functions after its potential disengagement, the process of our product development efforts could be delayed, disrupted, or even discontinued. This could render us less competitive and potentially reduce our market share and revenue. As a result, we are actively communicating with other capable suppliers with a view to diversifying our supply source.

In view of the above, there is no guarantee that we will not have a concentration of customers or suppliers in the future. Such customers and third-party suppliers are independent entities with their own operational and financial risks that are beyond our control. If any of these customers or suppliers breach or terminate their contracts with us, or experience significant disruptions to their operations, we will be required to find and enter into contracts with one or more customers or suppliers as replacement. It could be costly and time-consuming to find alternative customers and suppliers, and these customers or suppliers may not be available to us at reasonable terms or at all. As a result, this could harm our business and financial results and result in lost or deferred revenue.

10

We rely on third-party cloud computing platforms to develop software and store data. If we fail to maintain our relationships with these platforms, or if the service fees charged by these platforms change to our detriment, our business may be adversely affected.

We develop software and store data on third-party cloud computing platforms, such as AWS, Google Could Platform and Microsoft Azure. We use the infrastructure-as-a-service (“IaaS”) and platform-as-a-service (“PaaS”) they provide, including cloud server and cloud cybersecurity measures. IaaS offers on-demand access to cloud-hosted physical and virtual servers, storage and networking, which is the backend IT infrastructure for running applications and workloads in the cloud. PaaS offers on-demand access to a complete, ready-to-use, cloud-hosted platform for developing, running, maintaining and managing applications.

We are subject to these third-party platforms’ standard terms and conditions for application developers. Our business would be harmed if:

| ● | the platform providers discontinue or limit our access to their platforms; |

| ● | governments or private parties, such as internet providers, impose bandwidth restrictions or increase charges or restrict or prohibit access to those platforms; |

| ● | the platforms increase the fees they charge us, or may bill us more frequently for fees accrued if they reasonably suspect that our account registered with the platform is fraudulent or at risk of non-payment; |

| ● | the platforms modify their algorithms, communication channels available to developers, respective terms of service, or other policies; |

| ● | the platforms adopt changes or updates to their technology that impede integration with other software systems or otherwise require us to modify our technology for the continuing use of the platforms; |

| ● | the platforms impose restrictions or data storage; |

| ● | the platforms change how the personal information of end-users of the developed content is made available to developers; or |

| ● | we are unable to comply with the platform providers’ terms of service. |

If any of the above happen, we could be adversely impacted. Furthermore, any changes in the fee-charging terms stipulated by these platforms may materially impact our revenue and profitability, and cash flow. These platforms may also experience security breaches or other issues with their functionalities. In addition, disputes with the platforms, such as disputes relating to intellectual property rights, distribution fee arrangements, and billing issues, may also arise from time to time and we cannot assure you that we will be able to resolve such disputes in a timely manner or at all. If our collaboration with a third-party platform terminates for any reason, we may not be able to find a replacement in a timely manner or at all, and the progress of our developing projects may be adversely affected. This may disrupt our arrangements with developer partners, and may delay the launching of new products, which will have a material adverse effect on our business, financial condition, and results of operations.

Our business generates and processes a large amount of data, and it is required to comply with laws and regulations in multiple jurisdictions relating to data privacy and security. The improper use or disclosure of data could have a material and adverse effect on our business and prospects.

As a product for assisting contact-center agents, AI Assist only collects data from the contact center operating agents, but does not collect any data from consumers who engage with the agents. Typically, the product collects data on agents’ operational activities, such as the actions they take and the length and frequency of call, and agents’ basic information, such as their name and contacts. These are common data collected for the type of business we are engaged in. Because AI Assist is installed on our customers’ own cloud database, the data collected by our product is stored on our customers’ cloud database. Our access to customers’ systems is limited, and we have no access to any of their operational data and confidential information. As a result, we do not store any customer or agent data. Data of contact center conversations is transmitted directly to providers of Automatic Speech Recognition technology such as AWS. Our technical staff in charge of assisting customers to build our AI technology into their system only operate on the premises of the customers and on their computer systems. For details, see “Item 4. Information of the Company — B. Business Overview — Data Privacy and Security”.

11

On December 28, 2021, 13 governmental departments of the PRC, including the Cybersecurity Administration of China, or the CAC, jointly promulgated the Cybersecurity Review Measures, which became effective on February 15, 2022. The Cybersecurity Review Measures provide that net platform operators engaging in data processing activities that affect or may affect national security must be subject to cybersecurity review by the Cybersecurity Review Office of the PRC. On November 14, 2021, the CAC published the Draft Regulations on the Network Data Security Administration (Draft for Comments), which provides that data processing operators engaging in data processing activities that affect or may affect national security must be subject to cybersecurity review by the relevant Cyberspace Administration of the PRC.

Although we have no operating entity in the PRC, currently all of our revenue is generated from customers located in the PRC. Our products do not collect personal data from contact center activities, nor do we store any data from such activities. As of the date of this Report, neither PubCo nor has any subsidiaries thereof received any notice from any authorities requiring PubCo or Helport or any of their subsidiaries to undergo any cybersecurity review or network data security review. However, since the use of our AI Assist software involves the collection of data and information contained in contact center operations of our customers in the PRC, we may be subject us to certain laws and regulations in China in the future. If any such new laws, regulations, rules, or implementation and interpretations come into effect that may impact PubCo or Helport or any of their subsidiaries, we expect to take all reasonable measures and actions to comply and to minimize the adverse effect of such laws. We cannot guarantee, however, that such entities will not be subject to cybersecurity review and network data security review in the future. During such reviews, Helport may be required to suspend its operations or experience other disruptions to its operations. Cybersecurity review and network data security review could also result in negative publicity with respect to PubCo and diversion of its managerial and financial resources, which could materially and adversely affect its business, financial conditions, and results of operations.

As a result of our plans for global expansion of our operations, we may be subject to a variety of laws and regulations in various jurisdictions where we operate, as well as contractual obligations, regarding data privacy, protection, and security. Some of these laws and regulations require obtaining data subjects’ consent to the collection and use of their data, honoring data subjects’ requests to delete their data or limit the processing of their data, providing notifications in the event of a data breach, and setting up the proper legal mechanisms for cross-border data transfers. Some downstream customers may refuse to provide consent to have the data of their contact-center agents collected or may restrict the use of such data. In many cases, these laws and regulations apply not only to the collection and processing of agent data from third-party downstream customers with whom we may not have any contractual relationship, but also to the sharing or transfer of information between or among us, our subsidiaries, and other third parties with which we have commercial relationships, such as our business partners and contact-center BPO customers. The regulatory framework for data privacy, protection, and security worldwide is continuously evolving and developing and, as a result, interpretation and implementation standards and enforcement practices are likely to remain uncertain for the foreseeable future.

The legislative and regulatory landscapes for data privacy and security continue to evolve in jurisdictions worldwide, with an increasing focus on privacy and data protection issues with the potential to affect our business. In the United States, such privacy and data security laws and regulations include federal laws and regulations such as the federal Controlling the Assault of Non-Solicited Pornography and Marketing Act (“CANPAM Act”), the Telephone Consumer Protection Act, the Do-Not-Call Implementation Act, and rules and regulations promulgated under the authority of the Federal Trade Commission and state laws like the California Consumer Privacy Act (“CCPA”) and the varying data breach notification laws that have been enacted in all 50 U.S. states and the District of Columbia. Further, there currently are a number of additional proposals related to data privacy or security pending before federal, state, and foreign legislative and regulatory bodies, including in a number of U.S. states considering consumer protection laws similar to the CCPA. For example, in March 2021, Virginia enacted the Virginia Consumer Data Protection Act, and in June 2021, Colorado passed the Colorado Privacy Act, both of which are comprehensive privacy statutes that share similarities with the CCPA and CPRA and became effective on January 1, 2023 and July 1, 2023, respectively. Such legislation may add complexity, variation in requirements, restrictions, and potential legal risk, require additional investment in resources to compliance programs, may also impact strategies and availability of previously useful data, and could result in increased compliance costs and/or changes in business practices and policies.

Efforts to comply with these and other data privacy and security restrictions that may be enacted could require us to modify our data processing practices and policies and increase the cost of our operations. Failure to comply with such restrictions could subject us to criminal and civil sanctions and other penalties. In part due to the uncertainty of the legal climate, complying with regulations, and any applicable rules or guidance from regulatory authorities or self-regulatory organizations relating to privacy, data protection, information security, and consumer protection, may result in substantial costs and may necessitate changes to our business practices, which may compromise our growth strategy, adversely affect our ability to attract or retain customers, and otherwise adversely affect our business, reputation, legal exposure, financial condition and results of operations.

12

Any failure or perceived failure by us to comply with our standard privacy policies, our privacy-related obligations to customers or other third parties, or any other legal obligations or regulatory requirements relating to privacy, data protection, or information security may result in governmental investigations or enforcement actions, litigation, claims (including class actions), or public statements against us by consumer advocacy groups or others and could result in significant liability, cause our customers to lose trust in us, and otherwise materially and adversely affect our reputation and business. Furthermore, the costs of compliance with, and other burdens imposed by, the laws, regulations, and policies that are applicable to us may limit the adoption and use of, and reduce the overall demand for, our products. Additionally, if third parties we work with, such as our service providers or product developer partners, violate applicable laws, regulations, or agreements, such violations may put our users’ and/or employees’ data at risk, could result in governmental investigations or enforcement actions, fines, litigation, claims (including class action claims) or public statements against us by consumer advocacy groups or others and could result in significant liability, cause our customers to lose trust in us and otherwise materially and adversely affect our reputation and business. Further, public scrutiny of, or complaints about, technology companies or their data handling or data protection practices, even if unrelated to our business, industry, or operations, may lead to increased scrutiny of technology companies, including us, and may cause government agencies to enact additional regulatory requirements, or to modify their enforcement or investigation activities, which may increase our costs and risks.

In addition, in some cases, we are dependent upon our cloud computing platform providers, such as AWS, Google Could Platform and Microsoft Azure to solicit, collect, and provide us with information regarding our products that is necessary for compliance with these various types of regulations. Our business, including our ability to operate and expand internationally, could be adversely affected if laws or regulations are adopted, interpreted, or implemented in a manner that is inconsistent with our current business practices and that requires changes to these practices, the design of our products, features or our privacy policy. These platform providers may dictate rules, conduct, or technical features that do not properly comply with federal, state, local, and foreign laws, regulations, and regulatory codes and guidelines governing data privacy, data protection, and security, including with respect to the collection, storage, use, processing, transmission, sharing, and protection of personal information and other consumer data. In addition, these platforms may dictate rules, conduct, or technical features relating to the collection, storage, use, transmission, sharing, and protection of personal information and other customer data, which may result in substantial costs and may necessitate changes to our business practices, which in turn may compromise our growth strategy, adversely affect our ability to attract, monetize or retain customers, and otherwise adversely affect our business, reputation, legal exposures, financial condition and results of operations. Any failure or perceived failure by us to comply with these platform-dictated rules, conduct, or technical features may result in platform-led investigations or enforcement actions, litigation, or public statements against us, which in turn could result in significant liability or temporary or permanent suspension of our business activities with these platforms, cause our customers to lose trust in us, and otherwise compromise our growth strategy, adversely affect our ability to attract, monetize or retain customers, and otherwise adversely affect our business, reputation, legal exposures, financial condition and results of operations.

Customers we engaged are subject to our privacy policy and terms of service. If we fail to comply with privacy policy or terms of service in service agreements, or if we fail to comply with existing privacy-related or data protection laws and regulations, it could result in complaints by data subjects or proceedings or litigation against us by governmental authorities or others, which could result in fines or judgments against us, damage our reputation, impact our financial condition, and harm our business. If regulators, the media, or consumers raise any concerns about our privacy and data protection or consumer protection practices, even if unfounded, this could also result in fines or judgments against us, damage our reputation, and negatively impact our financial condition and damage our business.

The proper functioning of our technology systems and platforms is essential to our business. Any disruption to our information technology systems could materially affect our ability to maintain the satisfactory performance of our AI data analytic systems.

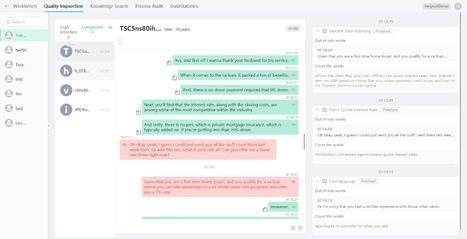

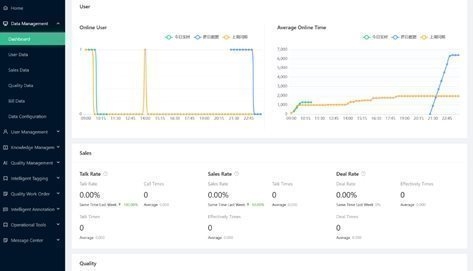

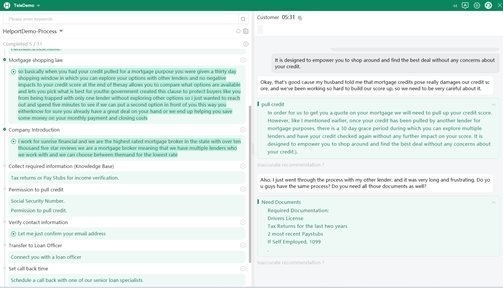

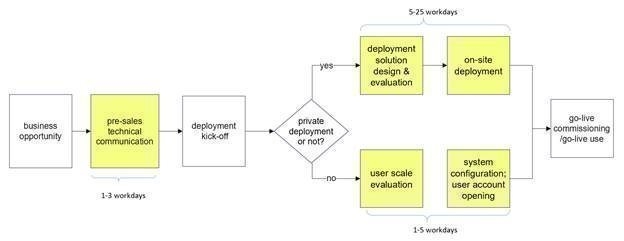

The proper functioning of our technology and analytics systems and platforms, such as the AI Assist software, the Helphub Crowdsourcing Platform, and the Gateways that allow our data to seamlessly flow to our customers’ systems, is essential to improve the efficiency of our administrative processes and product publishing services. See “Item 4. Information of the Company — B. Business Overview —The Business Model.” The satisfactory performance, reliability, and availability of our information technology systems are critical to our ability to maintain efficient and well-functioning contact centers for our customers and our own BPO platform, as these factors affect the ability of our software and platform to analyze user data in order to better understand both contact center interactions and platform user needs. Our technology or infrastructure, however, may not function properly at all times. Any system interruptions caused by computer viruses, hacking, or other attempts to harm the systems could result in the unavailability or a slowdown of our system or platforms and compromise the quality of the AI assistance services provided thereon. Our servers may also be vulnerable to computer viruses, physical or electronic break-ins, and similar disruptions, which could lead to system interruptions, software slowdown or unavailability, or loss of data. Any of such occurrences could cause severe disruption to the operational functioning of our software products. As such, our reputation may be materially and adversely affected, our market share could decline, and we could be subject to liability claims.

13

If we sustain cyber-attacks or other privacy or data security incidents that result in security breaches, we could be subject to increased costs, liabilities, reputational harm, or other negative consequences.