The information in this prospectus is not complete and may be changed. The securities described herein may not be sold until the registration statement filed with the U.S. Securities and Exchange Commission is effective. This prospectus is not an offer to sell such securities, and it is not soliciting an offer to buy such securities, in any state or jurisdiction where the offer or sale is not permitted.

Subject to Completion, Dated December 30, 2024

Preliminary Prospectus

59,058,271 Class A Shares

LandBridge Company LLC

Class A Shares

Representing Limited Liability Company Interests

This prospectus relates to the offer and sale, from time to time, by the selling shareholders identified in this prospectus (the “Selling Shareholders”) of up to an aggregate of 59,058,271 Class A shares representing limited liability company interests (“Class A shares”) in LandBridge Company LLC, a Delaware limited liability company (“LandBridge,” the “Company,” “we,” “us” or “our”), consisting of (i) 53,227,852 Class A shares that may be resold by LandBridge Holdings LLC upon redemption of an equal number of OpCo Units (as defined below) (together with the cancellation of an equal number of Class B shares (as defined below)) and (ii) 5,830,419 Class A shares issued to the other Selling Shareholders in the December Private Placement (as defined below).

The Selling Shareholders may offer, sell or distribute all or a portion of the Class A shares hereby registered publicly or through private transactions at prevailing market prices or at negotiated prices. We are not selling any Class A shares under this prospectus and will not receive any of the proceeds from the sale of the Class A shares by the Selling Shareholders. We will bear all costs, expenses and fees in connection with the registration of these securities, including with regard to compliance with state securities or “blue sky” laws. The Selling Shareholders will bear all commissions and discounts, if any, attributable to their sale of our Class A shares. The Class A shares may be resold by the Selling Shareholders directly to investors or to or through underwriters, dealers or other agents, as described in more detail in this prospectus. We do not know if, when or in what amounts a Selling Shareholder may offer Class A shares for resale. The Selling Shareholders may resell all, some or none of the Class A shares covered by this prospectus in one or multiple transactions. For more information, see the section titled “Plan of Distribution.”

Our Class A shares are listed on the New York Stock Exchange (the “NYSE”) under the symbol “LB.” The last reported sales price of our Class A shares on the NYSE on December 27, 2024 was $64.80 per Class A share.

We have two classes of authorized equity securities outstanding: Class A shares and Class B shares representing limited liability company interests (“Class B shares” and, together with Class A shares, “common shares”). Our Class B shares have no economic rights but entitle holders to one vote per Class B share on all matters to be voted on by shareholders generally. Holders of Class A shares and Class B shares vote together as a single class on all matters presented to our shareholders for their vote or approval, except as otherwise required by applicable law or by our Operating Agreement (as defined herein).

We are an “emerging growth company” and a “smaller reporting company” under applicable federal securities laws and, as such, we have elected to take advantage of certain reduced public company reporting requirements for this prospectus and future filings. Please see the section titled “Risk Factors.” We also are a “controlled company” within the meaning of the NYSE rules and, as a result, qualify for and rely on exemptions from certain corporate governance requirements. See “Management—Status as a Controlled Company” for additional information.

Investing in our Class A shares involves risks. See “Risk Factors” beginning on page 28 of this prospectus to read about factors you should consider before investing in our Class A shares. These risks include the following:

| • | Our revenues are substantially dependent on ongoing oil and natural gas exploration, development and production activity on or around our land. If E&P companies do not maintain drilling, completion and production activities on or around our land, the demand for the use of our land and resources, as well as the royalties we receive from the production of oil and natural gas and related activities on our land, could be reduced, which could have a material adverse effect on our results of operations, cash flows and financial position. |

| • | The willingness of E&P companies to engage in drilling, completion and production activities on and around our land is substantially influenced by the market prices of oil and natural gas, which are highly volatile. A substantial or extended decline in oil and natural gas prices may adversely affect our results of operations, cash flows and financial position. |

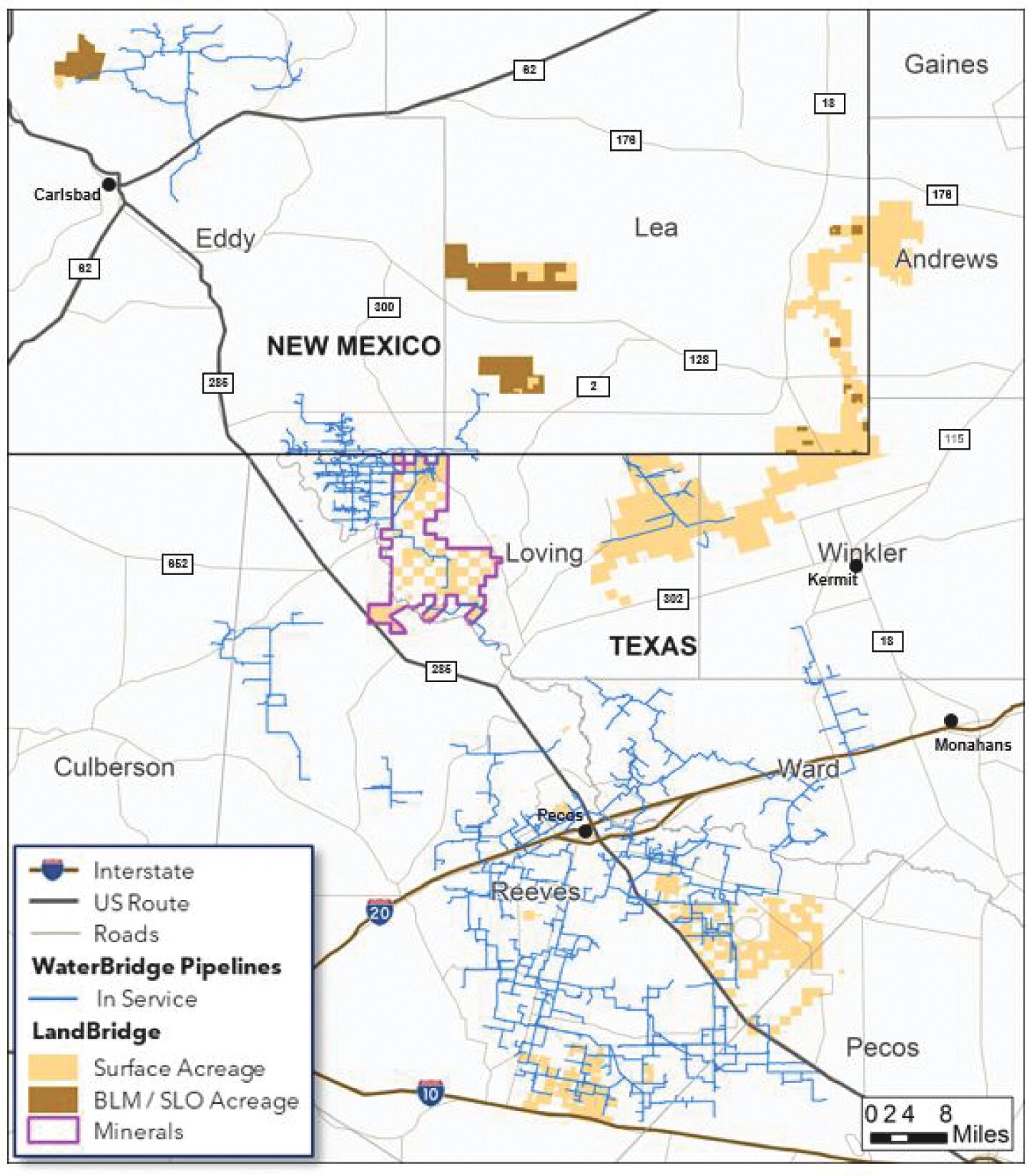

| • | Because a significant portion of our future revenue growth is expected to be derived from WaterBridge and Desert Environmental (each, as defined herein), any development that materially and adversely affects their business, operations or financial condition could have a material adverse impact on us. |

| • | Our reliance on WaterBridge and its personnel to manage and operate our business exposes us to certain risks. |

| • | LandBridge Holdings (as defined herein) has the ability to direct the voting of a majority of our common shares and control certain decisions with respect to our management and business, including certain consent rights and the right to designate more than a majority of the members of our board as long as it and its affiliates beneficially own at least 40% of our outstanding common shares, as well as lesser director designation rights as long as it and its affiliates beneficially own less than 40% but at least 10% of our outstanding common shares. LandBridge Holdings’ interests may conflict with those of our other shareholders. |

| • | LandBridge Holdings, Five Point (as defined herein) and WaterBridge, as well as their affiliates, are not limited in their ability to compete with us, and may benefit from opportunities that might otherwise be available to us. |

| • | There are certain provisions in our Operating Agreement regarding fiduciary duties of our directors, exculpation and indemnification of our officers and directors and the approval of conflicted transactions that differ from the Delaware General Corporation Law (the “DGCL”) in a manner that may be less protective of the interests of our public shareholders and restrict the remedies available to shareholders for actions taken by our officers and directors that might otherwise constitute breaches of fiduciary duties if we were subject to the DGCL. |

Neither the U.S. Securities and Exchange Commission (“SEC”) nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Prospectus dated , 2025.