|

|

PAGE |

|

D-1 | |

|

D-22 | |

|

D-24 | |

|

D-25 | |

|

D-27 | |

|

D-39 | |

|

D-73 | |

|

D-84 | |

|

D-107 | |

|

D-127 | |

|

D-138 |

The information contained in this section supplements the information about Chile corresponding to the headings below that is contained in Exhibit 99.D to Chile’s annual report on Form 18-K for the fiscal year ended December 31, 2016. To the extent the information in this section differs from the information contained in such annual report, you should rely on the information in this section. Capitalized terms not defined in this section have the meanings ascribed to them in the annual report.

THE ECONOMY

Gross Domestic Product

For the three months ended March 31, 2017, real GDP increased by 0.1% compared to the same period in 2016, consumption increased by 2.5% and exports decreased by 4.9%. During that period, aggregate domestic demand increased by 2.9%, gross fixed capital formation decreased by 2.4% and imports increased by 4.%, in each case compared to the same period in 2016.

Economic Performance Indicators

The following table sets forth certain macroeconomic performance indicators for the fiscal quarter indicated:

|

|

|

Current |

|

Real GDP |

|

Domestic |

|

|

2017 |

|

|

|

|

|

|

|

|

First quarter |

|

(1,014.1 |

) |

0.1 |

|

2.9 |

|

(1) Current account data for the periods indicated.

(2) % change from previous year at period end.

Source: Chilean Central Bank.

The following tables present GDP and expenditures measured at current prices and in chained volume at previous period prices, each for the periods indicated:

GDP and Expenditures

(at current prices for period indicated, in billions of Chilean pesos)

|

|

|

January/March |

|

January/March |

|

|

GDP |

|

41,003 |

|

42,754 |

|

|

Aggregate Domestic Demand |

|

40,008 |

|

42,360 |

|

|

Gross Fixed Capital Formation |

|

8,990 |

|

8,838 |

|

|

Change in Inventories |

|

(234 |

) |

442 |

|

|

Total Consumption |

|

31,252 |

|

33,079 |

|

|

Private Consumption |

|

26,129 |

|

27,371 |

|

|

Government Consumption |

|

5,123 |

|

5,708 |

|

|

Total Exports |

|

12,325 |

|

12,156 |

|

|

Total Imports |

|

11,331 |

|

11,762 |

|

|

Net Exports |

|

994 |

|

394 |

|

Source: Chilean Central Bank.

GDP and Expenditure

(chained volume at previous period prices, in billions of Chilean pesos)

|

|

|

January/March |

|

January/March |

|

|

GDP |

|

35,919 |

|

35,967 |

|

|

Aggregate Domestic Demand |

|

34,242 |

|

35,233 |

|

|

Gross Fixed Capital Formation |

|

7,426 |

|

7,244 |

|

|

Change in Inventories |

|

132 |

|

639 |

|

|

Total Consumption |

|

26,685 |

|

27,349 |

|

|

Private Consumption |

|

22,777 |

|

23,237 |

|

|

Government Consumption |

|

3,915 |

|

4,113 |

|

|

Total Exports |

|

11,333 |

|

10,774 |

|

|

Total Imports |

|

9,668 |

|

10,073 |

|

|

Net Exports |

|

1,666 |

|

702 |

|

Source: Chilean Central Bank.

Composition of Demand

For the three months ended March 31, 2017, consumption, as a percentage of GDP and measured at current prices, increased from 76.2% to 77.4% compared to the same period in 2016. Gross fixed capital formation decreased from 21.9% of GDP to 20.7% of GDP in the first three months of 2017 compared to the same period in 2016. Exports decreased from 30.8% of GDP to 28.7% of GDP and imports accounted for 27.6% of GDP compared to 27.5% of GDP in the first three months of 2016.

The following table presents GDP by categories of aggregate demand for the periods indicated:

GDP by Aggregate Demand

(percentage of total GDP, except as indicated)

|

|

|

January/March |

|

January/March |

|

|

GDP (in billions of pesos) |

|

41,003 |

|

42,754 |

|

|

Domestic Absorption |

|

97.6 |

|

99.1 |

|

|

Total Consumption |

|

76.2 |

|

77.4 |

|

|

Private Consumption |

|

63.7 |

|

64.0 |

|

|

Government Consumption |

|

12.5 |

|

13.4 |

|

|

Change in inventories |

|

(0.6 |

) |

1.0 |

|

|

Gross Fixed Capital Formation |

|

21.9 |

|

20.7 |

|

|

Exports of goods and services |

|

30.8 |

|

28.7 |

|

|

Imports of goods and services |

|

27.6 |

|

27.5 |

|

Source: Chilean Central Bank.

Savings and Investment

For the three months ended March 31, 2017, total gross savings (or domestic gross investment) increased as a percentage of GDP as a consequence of an increase in external savings.

The following table sets forth information for savings and investments for the periods indicated:

Savings and Investment

(% of GDP)

|

|

|

January/March |

|

January/March |

|

|

National Savings |

|

22.0 |

|

20.1 |

|

|

External Savings |

|

(0.6 |

) |

1.6 |

|

|

Total Gross Savings or Domestic Gross Investment |

|

21.4 |

|

21.7 |

|

Source: Chilean Central Bank.

Principal Sectors of the Economy

For the three months ended March 31, 2017, nominal GDP increased by 4.3% compared to the same period in 2016 to Ps.42.8 billion. While the services sector increased by 1.3% and the manufacturing sector increased by 0.8%, the primary sector decreased by 7.8%. Growth was driven mainly by domestic absorption, which reached 99.1% of GDP.

The following tables present the components of Chile’s GDP and their respective growth rates for the period indicated:

Nominal GDP by Sector

(% of GDP, except as indicated)

|

|

|

January/March |

|

January/March |

| ||

|

PRIMARY SECTOR: |

|

14.0 |

|

14.1 |

| ||

|

Agriculture, livestock and forestry |

|

5.7 |

|

5.1 |

| ||

|

Fishing |

|

0.6 |

|

1.0 |

| ||

|

Mining |

|

7.7 |

|

8.1 |

| ||

|

Copper |

|

7.1 |

|

7.2 |

| ||

|

Other |

|

0.7 |

|

0.8 |

| ||

|

|

|

|

|

|

| ||

|

MANUFACTURING SECTOR: |

|

11.3 |

|

11.0 |

| ||

|

Foodstuffs, beverages and tobacco |

|

4.7 |

|

5.1 |

| ||

|

Textiles, clothing and leather |

|

0.2 |

|

0.2 |

| ||

|

Wood products and furniture |

|

0.7 |

|

0.6 |

| ||

|

Paper and printing products |

|

1.1 |

|

1.0 |

| ||

|

Chemicals, petroleum, rubber and plastic products |

|

2.5 |

|

2.1 |

| ||

|

Non-metallic mineral products and base metal product |

|

0.5 |

|

0.4 |

| ||

|

Metal products, machinery and equipment and miscellaneous manufacturing |

|

1.6 |

|

1.7 |

| ||

|

|

|

|

|

|

| ||

|

SERVICES SECTOR: |

|

66.4 |

|

66.3 |

| ||

|

Electricity, oil and gas and water |

|

3.0 |

|

2.7 |

| ||

|

Construction |

|

5.8 |

|

5.7 |

| ||

|

Trade and catering |

|

10.8 |

|

10.9 |

| ||

|

Transport |

|

5.4 |

|

5.1 |

| ||

|

Communications |

|

2.9 |

|

2.9 |

| ||

|

Financial services |

|

15.1 |

|

14.8 |

| ||

|

Housing |

|

7.8 |

|

7.9 |

| ||

|

Personal services |

|

10.6 |

|

11.3 |

| ||

|

Public administration |

|

4.8 |

|

4.9 |

| ||

|

|

|

|

|

|

| ||

|

Subtotal |

|

91.7 |

|

91.4 |

| ||

|

Net adjustments for payments made by financial institutions, VAT and import tariffs |

|

8.3 |

|

8.6 |

| ||

|

Total GDP |

|

100 |

|

100 |

| ||

|

Nominal GDP (millions of Pesos) |

|

Ps. |

41,002,864 |

|

Ps. |

42,753,879 |

|

Source: Chilean Central Bank.

Change in GDP by Sector

(% change from same period in previous year)

|

|

|

January/March |

| |

|

PRIMARY SECTOR: |

|

(7.8 |

) | |

|

Agriculture, livestock and forestry |

|

0.0 |

| |

|

Fishing |

|

34.0 |

| |

|

Mining |

|

(13.8 |

) | |

|

Copper |

|

(14.4 |

) | |

|

Other |

|

(7.3 |

) | |

|

|

|

|

| |

|

MANUFACTURING SECTOR: |

|

0.8 |

| |

|

Foodstuffs, beverages and tobacco |

|

2.0 |

| |

|

Textiles, clothing and leather |

|

13.0 |

| |

|

Wood products and furniture |

|

4.9 |

| |

|

Paper and printing products |

|

(1.8 |

) | |

|

Chemicals, petroleum, rubber and plastic products |

|

(4.1 |

) | |

|

Non-metallic mineral products and base metal products |

|

(9.4 |

) | |

|

Metal products, machinery and equipment and miscellaneous manufacturing |

|

6.4 |

| |

|

|

|

|

| |

|

SERVICES SECTOR: |

|

1.3 |

| |

|

Electricity, oil and gas and water |

|

(0.5 |

) | |

|

Construction |

|

(2.2 |

) | |

|

Trade and catering |

|

4.5 |

| |

|

Transport |

|

0.4 |

| |

|

Communications |

|

2.7 |

| |

|

Financial Services |

|

(1.6 |

) | |

|

Housing |

|

1.8 |

| |

|

Personal Services |

|

4.3 |

| |

|

Public Administration |

|

1.5 |

| |

|

|

|

|

| |

|

Subtotal |

|

(0.4 |

) | |

|

Net adjustments for payments made by financial institutions, VAT and import tariffs |

|

3.8 |

| |

|

Total GDP |

|

0.1 |

| |

|

Real GDP (chained volume at previous year prices) |

|

Ps. |

35,967,096 |

|

Source: Chilean Central Bank.

Primary Sector

The Chilean economy’s primary sector’s direct contribution to GDP was 14.1% in the first three months of 2017, compared to 14.0% in the same period in 2016.

Agriculture, Livestock and Forestry

The agriculture, livestock and forestry sector contributed US$2.0 billion in exports for the three months ended March 31, 2017, or 13.4% of exports by value, compared to US$2.2 billion, or 15.5%, during the same period in 2016.

Fishing

For the three months ended March 31, 2017, the estimated catch was 1,094 million tons, of which sea-caught products accounted for 76.2%, and aquaculture accounted for 23.8%, compared to an estimated catch of 687 million tons in the same period in 2016, of which sea-caught products accounted for 54.7% and aquaculture accounted for 45.3%.

Mining

For the three months ended March 31, 2017, the mining sector accounted for 8.1% of GDP, compared to 7.7% during the same period in 2016, reflecting the impact on this sector of the increase in international copper prices. However, the mining sector was adversely affected by a labor conflict and a strike that impacted Chile’s largest copper mine, and contracted in real terms by 13.8% in the first three months of this year, compared to the same period in 2016. Mining products accounted for 48.2% and 48.0% of total exports, totaling approximately US$7.6 billion and US$7.2 billion for the first three months of each of 2017 and 2016, respectively.

Manufacturing Sector

The following table sets forth information regarding the output of manufacturing production for the periods indicated:

Output of Manufactured Products

(in billions of pesos and as a percentage of total)

|

|

|

January/ |

| ||

|

|

|

(Ps.) |

|

(%) |

|

|

Foodstuffs, beverages and tobacco |

|

2,183 |

|

46.3 |

|

|

Textiles, clothing and leather |

|

76 |

|

1.6 |

|

|

Wood products and furniture |

|

255 |

|

5.4 |

|

|

Paper and printing products |

|

427 |

|

9.1 |

|

|

Chemicals, petroleum, rubber and plastic products |

|

913 |

|

19.4 |

|

|

Non-metallic mineral products and base metal products |

|

158 |

|

3.3 |

|

|

Metal products, machinery and equipment and miscellaneous manufacturing |

|

706 |

|

15.0 |

|

|

Total |

|

4,717 |

|

100.0 |

|

Source: Chilean Central Bank.

For the three months ended March 31, 2017, the manufacturing sector increased by 0.8%, compared to the same period in 2016, mainly as a result of a an increase in the production of non-metallic mineral products and base metal products, which was offset by a decrease in the production of foodstuffs, beverages and tobacco.

For the three months ended March 31, 2017, exports of manufactured foodstuff products increased to US$2.3 billion, compared to US$2.0 billion the same period in 2016.

The chemicals, petroleum products, rubber and plastics industries exported approximately US$1.0 billion during the first three months of each of 2017 and 2016.

For the three months ended March 31, 2017, wine exports increased to US$0.5 billion, compared to US$0.4 billion in the same period in 2016.

Services Sector

Energy

For the three months ended March 31, 2017, the energy sector accounted for 2.7% of GDP, compared to 3.0% for the same period in 2016.

Personal Services

For the three months ended March 31, 2017, the personal services sector accounted for 11.3% of GDP, compared to 10.6% for the same period in 2016.

Financial Services

For the three months ended March 31, 2017, the financial services sector contributed 14.8% to GDP, compared to 15.1% for the same period in 2016.

As of March 31, 2017, the market capitalization of the Latin American Integrated Market (Mercado Integrado Latinoamericana, or MILA) totaled US$ 842.7 billion compared to US$800.6 billion for the same period in 2016.

Transport and Communications

Transport. For the three months ended March 31, 2017, the transport sector accounted for 5.1% of GDP, compared to 5.4% for the same period in 2016.

Communications. For the three months ended March 31, 2017, the communications sector remained at 2.9% of GDP, compared to the same period in 2016.

Housing

For the three months ended March 31, 2017, the housing sector accounted for 7.9% of GDP, compared to 7.8% in the same period in 2016.

Public Administration

For the three months ended March 31, 2017, the public administration sector accounted for 4.9% of GDP, compared to 4.8% in the same period in 2016.

Employment and Labor

Employment

As of March 31, 2017, the rate of unemployment stood at 6.6% compared to 6.2% as of December 31, 2016.

The following table presents information on employment and the labor force in Chile for the periods indicated:

Employment and Labor

(in thousands of persons or percentages)

|

|

|

Three months |

|

|

Nationwide: |

|

|

|

|

Labor force |

|

8,775 |

|

|

Employment |

|

8,195 |

|

|

Participation rate (%) |

|

59.5 |

|

|

Unemployment rate (%) |

|

6.6 |

|

|

Santiago: |

|

|

|

|

Labor force |

|

3,167 |

|

|

Employment |

|

2,922 |

|

|

Participation rate (%) |

|

61.2 |

|

|

Unemployment rate (%) |

|

7.7 |

|

Source: National Statistics Institute and University of Chile surveys.

For the three months ended March 31, 2017, the manufacturing sector employed 10.8% of Chile’s labor force and contributed 11.0% of GDP. For the same period, the agriculture, livestock, forestry and fishing sectors contributed 5.1% of GDP and employed 10.1% of Chile’s labor force. The mining sector, however, accounted for 8.1% of GDP and employed only approximately 2.4% of Chile’s labor force, due to the less labor-intensive nature of this sector.

The following table presents information regarding the average percentage of the labor force working in each sector of the economy for the periods indicated:

Employment(1)

(% of total labor force employed by sector)

|

|

|

Three months |

|

|

PRIMARY SECTOR |

|

12.4 |

% |

|

Agriculture, livestock and forestry and fishing |

|

10.1 |

|

|

Mining |

|

2.4 |

|

|

MANUFACTURING SECTOR |

|

10.8 |

|

|

SERVICES SECTOR |

|

76.7 |

|

|

Electricity, gas and water |

|

1.1 |

|

|

Construction |

|

8.7 |

|

|

Trade and catering |

|

19.4 |

|

|

Transport and communications |

|

13.0 |

|

|

Financial services |

|

1.9 |

|

|

Community and social services |

|

32.6 |

|

|

TOTAL |

|

100.0 |

% |

(1) Constitutes an average across each period indicated.

Source: National Statistics Institute.

For the three months ended March 31, 2017, women accounted on average for 41% of the total labor force.

As of February 28, 2017, 9.1 million workers were enrolled in the unemployment insurance system, which manages total assets valued at US$6.8 billion, compared to US$6.2 billion as of August 31, 2016.

Wages

Real Wages

(% change from same period in 2016)

|

|

|

As of March 31, |

|

|

Average real wages |

|

1.5 |

|

|

Average change in productivity |

|

(0.4 |

) |

(1) Compared to the same period in 2016.

Sources: Chilean Central Bank and National Statistics Institute.

BALANCE OF PAYMENTS AND FOREIGN TRADE

Balance of Payments

Chile’s balance of payment recorded a deficit of US$(1,987) million for the three months ended March 31, 2017, compared to a surplus of US$137 million for the same period in 2016.

Current Account

Chile’s current account recorded a deficit of 1.6% of GDP for the three months ended March 31, 2017, compared to a deficit of 0.6% of GDP for the three months ended March 31,2016.

The merchandise trade surplus increased to US$1.0 billion for the three months ended March 31, 2017, from US$363 million for the same period in 2016.

For the three months ended March 31, 2017, merchandise exports totaled US$15.8 billion compared to US$15.1 billion for the same period in 2016 and imports totaled US$14.6 billion, compared to US$12.9 billion for the same period in 2016.

Capital Account and Financial Account

Chile’s capital account recorded a surplus of US$64 million for the three months ended March 31, 2017, compared to a surplus of US$2 million for the same period in 2016.

The financial account registered a deficit of US$(1.2) billion and a deficit of US$(2.5) billion for the three months ended March 31, 2016 and 2017, respectively, which represented 2.0% of GDP in 2016 and (3.9)% of GDP in 2017, due to volatility of the financial account when measured for short periods.

The following table sets forth Chile’s Balance of Payments for the periods indicated:

Balance of Payments

(in millions of US$)

|

|

|

January/March |

|

January/March |

| ||

|

Current account |

|

|

|

|

| ||

|

Current account, net |

|

US$ |

(363 |

) |

US$ |

(1,014 |

) |

|

Goods and Services, net |

|

1,434 |

|

632 |

| ||

|

Merchandise Trade Balance |

|

2,154 |

|

1,204 |

| ||

|

Exports |

|

15,079 |

|

15,795 |

| ||

|

Imports |

|

12,925 |

|

14,591 |

| ||

|

Services |

|

(720 |

) |

(573 |

) | ||

|

Credits |

|

2,412 |

|

2,687 |

| ||

|

Debits |

|

3,132 |

|

3,260 |

| ||

|

Interest, net |

|

(1,577 |

) |

(2,068 |

) | ||

|

Interest from investment |

|

(1,529 |

) |

(2,020 |

) | ||

|

Interest from direct investment(1) |

|

(1,481 |

) |

(1,930 |

) | ||

|

Abroad |

|

598 |

|

1,104 |

| ||

|

From abroad |

|

2,078 |

|

3,034 |

| ||

|

Interest from portfolio investment |

|

(3 |

) |

(36 |

) | ||

|

Dividends |

|

385 |

|

368 |

| ||

|

Interest |

|

(387 |

) |

(404 |

) | ||

|

Interest from other investment |

|

(46 |

) |

(54 |

) | ||

|

Credits |

|

165 |

|

200 |

| ||

|

Debits |

|

211 |

|

254 |

| ||

|

Current transfers, net |

|

506 |

|

422 |

| ||

|

Credits |

|

553 |

|

455 |

| ||

|

Debits |

|

(47 |

) |

(33 |

) | ||

|

|

|

|

|

|

| ||

|

Capital and financial accounts |

|

|

|

|

| ||

|

Capital and financial accounts, net |

|

(1,164 |

) |

(2,466 |

) | ||

|

Capital account, net |

|

2 |

|

64 |

| ||

|

Financial account, net |

|

1,161 |

|

(2,530 |

) | ||

|

Direct investment, net |

|

(2,560 |

) |

(635 |

) | ||

|

Direct investment abroad |

|

1,389 |

|

1,854 |

| ||

|

Shares and other capital |

|

877 |

|

591 |

| ||

|

Earnings reinvested |

|

349 |

|

984 |

| ||

|

Other capital |

|

163 |

|

279 |

| ||

|

Direct investment to Chile |

|

3,949 |

|

2,490 |

| ||

|

Shares and other capital |

|

1,851 |

|

708 |

| ||

|

Earnings reinvested |

|

1,048 |

|

1,943 |

| ||

|

Other capital(2) |

|

1,049 |

|

(162 |

) | ||

|

Portfolio investment, net |

|

3,617 |

|

1,075 |

| ||

|

Assets |

|

4,568 |

|

1,800 |

| ||

|

Liabilities |

|

951 |

|

726 |

| ||

|

Derived financial instruments, net |

|

169 |

|

(182 |

) | ||

|

Other Investment, net(3) |

|

(201 |

) |

(800 |

) | ||

|

Assets |

|

(841 |

) |

(2,007 |

) | ||

|

Commercial credits |

|

55 |

|

(450 |

) | ||

|

Loans |

|

(154 |

) |

158 |

| ||

|

Currency and deposits |

|

(676 |

) |

(1,709 |

) | ||

|

Other assets |

|

(67 |

) |

(6 |

) | ||

|

Liabilities |

|

(640 |

) |

(1,207 |

) | ||

|

Commercial credits |

|

(664 |

) |

(69 |

) | ||

|

Loans(3) |

|

(135 |

) |

(1,111 |

) | ||

|

Currency and deposits |

|

160 |

|

(27 |

) | ||

|

Other liabilities |

|

0 |

|

0 |

| ||

|

Assets in reserve, net |

|

137 |

|

(1,987 |

) | ||

|

Errors and omissions, net |

|

796 |

|

(1,580 |

) | ||

|

Financial account (excluding change in reserves) |

|

US$ |

(1,024 |

) |

US$ |

543 |

|

|

Total balance of payments |

|

US$ |

137 |

|

US$ |

(1,987 |

) |

(1) Includes interest.

(2) Net flows of liabilities by loans.

(3) Short term net flows.

Source: Chilean Central Bank.

Merchandise Trade

The primary countries of origin of Chile’s imports for the three months ended March 31, 2017 were China (from where 22.8% of total imports originated), the United States (18.1%), Brazil (8.1%), Argentina (4.5%), Germany (4.1%) and France (2.0%). The primary destinations of Chile’s exports for the three months ended March 31, 2017, were China (which received 24.1% of total exports), the United States (17.1%), Japan (9.8%), South Korea (6.0%), Brazil (5.0%), Mexico (1.9%) and Taiwan (1.8%). The origins and destinations of Chile’s exports for the three months ended March 31, 2017 have remained stable compared to the same period in 2016, except for exports to China that have decreased from 28.8% to 24.1%. During the three months ended March 31, 2017, Chile’s exports to Asia, as a percentage of total assets, decreased from 50.6% to 47.5%, while Chile’s exports to North America increased from 19.4% to 21.5%, as compared to the same period in 2016. Further, Chile’s geographical distribution of its imports during the three months ended March 31, 2017, experienced some changes, for example, imports from South America and North America (as a percentage of total imports) increased from 16.5% to 20.1% and 21.9% to 22.8% respectively, while imports from Asia have decreased from 37.1% to 35.7%.

In the three months ended March 31, 2017, merchandise exports totaled US$15.8 billion and imports totaled US$15.5 billion. Intermediate goods, such as oil and others fossil fuels, accounted for 49.2% of total imports in the three months ended March 31, 2017 compared to 48.5% for the same period in 2016. Consumer goods imports amounted to 31.3% in the three months ended March 31, 2017 compared to 29.4% for the same period in 2016. Imports of capital goods accounted for 19.5% of total imports for that period compared to 22.2% for the same period in 2016.

The following tables set forth information regarding exports and imports for the periods indicated:

Geographical Distribution of Merchandise Trade

(% of total exports/imports)

|

|

|

January/March |

|

January/March |

|

|

EXPORTS (FOB) |

|

|

|

|

|

|

Americas: |

|

|

|

|

|

|

Argentina |

|

1.0 |

% |

1.4 |

% |

|

Brazil |

|

4.5 |

% |

5.0 |

% |

|

Mexico |

|

2.1 |

% |

1.9 |

% |

|

United States |

|

15.5 |

% |

17.1 |

% |

|

Other |

|

10.5 |

% |

11.5 |

% |

|

Total Americas: |

|

33.5 |

% |

37.0 |

% |

|

Europe: |

|

|

|

|

|

|

France |

|

1.3 |

% |

1.2 |

% |

|

Germany |

|

1.2 |

% |

1.6 |

% |

|

Italy |

|

1.2 |

% |

1.2 |

% |

|

United Kingdom |

|

1.2 |

% |

1.1 |

% |

|

EFTA |

|

0.8 |

% |

0.6 |

% |

|

Other |

|

8.5 |

% |

8.7 |

% |

|

Total Europe: |

|

14.2 |

% |

14.4 |

% |

|

Asia: |

|

|

|

|

|

|

Japan |

|

8.7 |

% |

9.8 |

% |

|

South Korea |

|

6.8 |

% |

6.0 |

% |

|

Taiwan |

|

1.8 |

% |

1.8 |

% |

|

China |

|

28.8 |

% |

24.1 |

% |

|

Other |

|

4.4 |

% |

5.8 |

% |

|

Total Asia: |

|

50.6 |

% |

47.5 |

% |

|

Other:(1) |

|

1.6 |

% |

1.2 |

% |

|

Total exports: |

|

100.0 |

|

100.0 |

|

|

|

|

|

|

|

|

|

IMPORTS (CIF) |

|

|

|

|

|

|

Americas: |

|

|

|

|

|

|

Argentina |

|

4.0 |

% |

4.5 |

% |

|

Brazil |

|

7.2 |

% |

8.1 |

% |

|

United States |

|

17.5 |

% |

18.1 |

% |

|

Other |

|

11.1 |

% |

13.9 |

% |

|

Total Americas: |

|

39.8 |

% |

44.6 |

% |

|

Europe: |

|

|

|

|

|

|

France |

|

3.9 |

% |

2.0 |

% |

|

Germany |

|

3.8 |

% |

4.1 |

% |

|

Italy |

|

1.9 |

% |

1.7 |

% |

|

United Kingdom |

|

0.9 |

% |

0.8 |

% |

|

EFTA |

|

0.7 |

% |

0.5 |

% |

|

Other |

|

8.6 |

% |

7.0 |

% |

|

Total Europe: |

|

19.9 |

% |

16.2 |

% |

|

Asia: |

|

|

|

|

|

|

Japan |

|

3.6 |

% |

3.4 |

% |

|

South Korea |

|

2.6 |

% |

3.5 |

% |

|

Taiwan |

|

0.6 |

% |

0.4 |

% |

|

China |

|

24.9 |

% |

22.8 |

% |

|

Other |

|

5.4 |

% |

5.6 |

% |

|

Total Asia: |

|

37.1 |

% |

35.7 |

% |

|

Other:(1) |

|

3.2 |

% |

3.6 |

% |

|

Total imports: |

|

100.0 |

|

100.0 |

|

(1) Includes Africa, Oceania and other countries, including countries in tax free zones.

Source: Chilean Central Bank.

Services Trade

For the three months ended March 31, 2017, exported services increased by 11.4% and imported services increased by 4.1%, compared to the same period in 2016.

MONETARY AND FINANCIAL SYSTEM

Monetary and Exchange Rate Policy, General Overview

Inflation

As of March 31, 2017, the inflation rate stood at 2.7% (year-on-year). The TPM, decreased to 3.1% throughout the first quarter of 2017.

The following table shows changes in the CPI and the PPI for the periods indicated.

Inflation

|

|

|

Percentage Change from Previous |

| ||

|

|

|

CPI |

|

PPI (1) |

|

|

2017 (March) (2)(3) |

|

2.7 |

|

7.6 |

|

(1) Manufacturing, mining and electricity, water and gas distribution industries.

(2) CPI data for 2017 corresponds to variation from March 2016 to March 2017.

(3) PPI data for 2017 corresponds to variation from March 2016 to March 2017.

Source: CPI, Chilean Central Bank. PPI, National Institute of Statistics

Exchange Rate Policy

The dollar discontinued its appreciation, with the Chilean peso trading at Ps. 662.7/US$ 1.00 on March 31, 2017, after reaching a rate of Ps. 673.4/ US$ 1.00 on January 4, 2017.

The following table shows the high, low, average and period-end peso/U.S. dollar exchange rate for the first quarter of 2017.

Observed Exchange Rates(1)

(pesos per US$)

|

|

|

High |

|

Low |

|

Average(2) |

|

Period-End |

|

|

Three Months Ended March 31, 2017 |

|

673.4 |

|

638.4 |

|

655.2 |

|

662.7 |

|

(1) The table presents the annual high, low, average and period-end observed rates for the period.

(2) Represents the average of average monthly rates for the periods indicated.

Source: Chilean Central Bank.

International Reserves

International reserves of the Chilean Central Bank totaled approximately US$39.0 billion as of March 31, 2017.

The following table shows the composition of net international reserves of the Chilean Central Bank as of the dates indicated:

Net International Reserves of the Chilean Central Bank

(in millions of US$)

|

|

|

As of March 31, 2016 |

|

As of March 31, 2017 |

|

|

Chilean Central Bank: |

|

|

|

|

|

|

Assets: |

|

|

|

|

|

|

Gold |

|

10 |

|

10 |

|

|

SDRs |

|

762 |

|

734 |

|

|

Reserve position in the IMF |

|

231 |

|

217 |

|

|

Foreign exchange and bank deposits |

|

5,680 |

|

5,591 |

|

|

Securities |

|

32,847 |

|

32,465 |

|

|

Other assets |

|

23 |

|

4 |

|

|

Total |

|

39,553 |

|

39,022 |

|

|

|

|

|

|

|

|

|

Liabilities: |

|

|

|

|

|

|

Reciprocal Credit Agreements |

|

— |

|

— |

|

|

Bonds and promissory notes |

|

582 |

|

511 |

|

|

Accounts with international organizations |

|

86 |

|

85 |

|

|

SDR allocations |

|

1,151 |

|

1,109 |

|

|

Total |

|

1,819 |

|

1,705 |

|

|

Total international reserves, net |

|

37,734 |

|

37,317 |

|

Source: Chilean Central Bank

Money Supply

The following tables set forth the monthly average monetary base and the average monetary aggregates as of the dates indicated:

Monetary Base(1)

(in billions of pesos)

|

|

|

As of March 31, 2016 |

|

As of March 31, 2017 |

|

|

Currency in circulation |

|

5,684 |

|

6,088 |

|

|

Bank reserves |

|

39,553 |

|

39,022 |

|

|

Monetary base |

|

9,965 |

|

10,171 |

|

(1) There are no demand deposits at the Chilean Central Bank.

Source: Chilean Central Bank.

Monetary Aggregates

(in billions of pesos)

|

|

|

As of March 31, |

|

|

|

|

|

|

|

Currency in circulation |

|

6,088 |

|

|

Demand deposits at commercial banks |

|

23,313 |

|

|

M1(1) |

|

29,401 |

|

|

Total time and savings deposits at banks |

|

75,488 |

|

|

Others |

|

1,166 |

|

|

M2(2) |

|

106,055 |

|

|

Foreign currency deposits at Chilean Central Bank |

|

15,525 |

|

|

Documents of Chilean Central Bank |

|

8,640 |

|

|

Letters of Credit |

|

259 |

|

|

Private Bonds |

|

20,877 |

|

|

Others |

|

38,131 |

|

|

M3(3) |

|

189,488 |

|

(1) M1: Currency in circulation plus checking accounts net of float, demand deposits at commercial banks other than the former and other than demand savings deposits.

(2) M2: M1 plus time deposits, time savings deposits, shares of mutual funds invested in up to one-year term debt instruments and collections by saving and credit cooperatives (excluding time deposit of the mutual funds previously mentioned and of saving and credit cooperatives).

(3) M3: M2 plus deposits in foreign currency, documents issued by the Chilean Central Bank, Chilean treasury bonds, letters of credit, commercial papers, corporate bonds, shares of the other mutual funds and shares of pension funds in voluntary savings (excluding mutual funds’ and pension funds’ investments in M3 securities).

Source: Chilean Central Bank.

The following table shows selected monetary indicators for the periods indicated:

Selected Monetary Indicators

(in % change from same period in 2016)

|

|

|

January/March 2017 |

|

|

M1 (% change) |

|

6.8 |

|

|

M2 (% change) |

|

5.3 |

|

|

Credit from the financial system (% change) (1) |

|

(0.2 |

) |

|

Average annual peso deposit rate(2) |

|

0.3 |

|

(1) As of February 2017.

(2) Represents real interest rates for a period of 120 to 365 days.

Source: Chilean Central Bank.

The following table shows liquidity and credit aggregates as of the dates indicated:

Liquidity and Credit Aggregates

(in billions of pesos)

|

|

|

As of February 28, |

| ||

|

|

|

2016 |

|

2017 |

|

|

Liquidity aggregates (at period end) |

|

9,881.9 |

|

10,225.2 |

|

|

Monetary base: |

|

|

|

|

|

|

Currency, excluding cash in vaults at banks |

|

5,701.5 |

|

6,118.7 |

|

|

M1(1) |

|

28,335.8 |

|

29,083.7 |

|

|

M2(2) |

|

100,423.0 |

|

103,731.2 |

|

|

M3(3) |

|

173,792.3 |

|

187,033.0 |

|

|

|

|

|

|

|

|

|

Credit aggregates (at period end): |

|

|

|

|

|

|

Private sector credit |

|

132,031.7 |

|

138,040.2 |

|

|

Public sector credit |

|

-551.5 |

|

-1,368.2 |

|

|

|

|

|

|

|

|

|

Total domestic credit(4) |

|

105,811.9 |

|

109,332.0 |

|

|

|

|

|

|

|

|

|

Deposits(4): |

|

|

|

|

|

|

Chilean peso deposits |

|

113,536.9 |

|

120,415.9 |

|

|

Foreign-currency deposits |

|

20,998.6 |

|

21,541.0 |

|

|

|

|

|

|

|

|

|

Total deposits |

|

134,535.5 |

|

141,956.9 |

|

(1) Currency in circulation plus peso-denominated demand deposits.

(2) M1 plus peso-denominated savings deposits.

(3) M2 plus deposits in foreign currency, principally U.S. dollars. Does not include government time deposits at Chilean Central Bank.

(4) Includes capital reserves and other net assets and liabilities.

Source: Chilean Central Bank.

Financial Sector

General Overview of Banking System

The following tables provide certain statistical information on the financial system:

|

|

|

As of March 31, 2016 |

| ||||||||||||||

|

|

|

Assets |

|

Loans |

|

Deposits |

|

Shareholders’ Equity(1) |

| ||||||||

|

|

|

Amount |

|

Market |

|

Amount |

|

Market |

|

Amount |

|

Market |

|

Amount |

|

Market |

|

|

Domestically owned private-sector banks |

|

252,355 |

|

83.7 |

% |

180,304 |

|

86.2 |

% |

142,924 |

|

81.6 |

% |

20,222 |

|

88.4 |

% |

|

Foreign- owned private-sector banks |

|

1,253 |

|

0.4 |

% |

129 |

|

0.1 |

% |

219 |

|

0.1 |

% |

458 |

|

2.0 |

% |

|

Private-sector total |

|

253,607 |

|

84.2 |

% |

180,433 |

|

86.2 |

% |

143,143 |

|

81.7 |

% |

20,681 |

|

90.4 |

% |

|

Banco Estado |

|

47,735 |

|

15.8 |

% |

28,857 |

|

13.8 |

% |

32,033 |

|

18.3 |

% |

2,203 |

|

9.6 |

% |

|

Total banks |

|

301,342 |

|

100.0 |

% |

209,290 |

|

100.0 |

% |

175,177 |

|

100.0 |

% |

22,884 |

|

100.0 |

% |

|

|

|

As of March 31, 2017 |

| ||||||||||||||

|

|

|

Assets |

|

Loans |

|

Deposits |

|

Shareholders’ Equity(1) |

| ||||||||

|

|

|

Amount |

|

Market |

|

Amount |

|

Market |

|

Amount |

|

Market |

|

Amount |

|

Market |

|

|

Domestically owned private-sector banks |

|

268,867 |

|

83.2 |

% |

196,764 |

|

86.1 |

% |

148,764 |

|

81.0 |

% |

23,575 |

|

89.2 |

% |

|

Foreign- owned private-sector banks(2) |

|

1,623 |

|

0.5 |

% |

115 |

|

0.1 |

% |

193 |

|

0.1 |

% |

490 |

|

1.9 |

% |

|

Private-sector total |

|

270,489 |

|

83.7 |

% |

196,879 |

|

86.2 |

% |

148,956 |

|

81.1 |

% |

24,066 |

|

91.0 |

% |

|

Banco Estado |

|

52,572 |

|

16.3 |

% |

31,592 |

|

13.8 |

% |

34,680 |

|

18.9 |

% |

2,375 |

|

9.0 |

% |

|

Total banks |

|

323,061 |

|

100.0 |

% |

228,471 |

|

100.0 |

% |

183,636 |

|

100.0 |

% |

26,440 |

|

100.0 |

% |

(1) Corresponds to the “Capital Básico”. This item included capital and reserves.

(2) Foreign-owned subsidiaries of foreign banks are classified as domestically owned private-sector banks. If classified as foreign-owned private-sector banks, the market share of foreign-owned private-sector banks would be as follows: as of March 31, 2016: assets: 30.6%, loans: 30.9%, deposits: 27.5%, shareholders’ equity: 31.6%, and as of March 31, 2017: assets: 31.1%, loans: 31.1%, deposits: 28.0%, shareholders’ equity: 30.1%, with the corresponding reduction in the market share of domestically owned private-sector banks.

Source: SBIF.

The following tables set forth the total assets of the four largest Chilean private-sector banks, the state-owned Banco Estado and other banks in the aggregate for the period indicated:

|

|

|

As of March 31, 2016 |

| ||

|

|

|

in billions of Pesos |

|

Market Share % |

|

|

|

|

|

|

|

|

|

Banco Santander-Chile |

|

34.8 |

|

17.0 |

% |

|

Banco Estado |

|

32.6 |

|

15.8 |

% |

|

Banco de Chile |

|

31.1 |

|

15.1 |

% |

|

Banco de Crédito e Inversiones |

|

29.4 |

|

14.3 |

% |

|

Itaú Corpbanca |

|

29.9 |

|

14.6 |

% |

|

Other banks |

|

47.6 |

|

23.2 |

% |

|

Total Banking System |

|

205.5 |

|

100.0 |

% |

Source: SBIF.

|

|

|

As of March 31, 2017 |

| ||

|

|

|

in billions of Pesos |

|

Market Share % |

|

|

|

|

|

|

|

|

|

Banco Santander-Chile |

|

36.7 |

|

17.2 |

% |

|

Banco de Chile |

|

34.8 |

|

16.3 |

% |

|

Banco Estado |

|

31.8 |

|

14.9 |

% |

|

Itaú Corpbanca |

|

31.2 |

|

14.6 |

% |

|

Banco de Crédito e Inversiones |

|

29.0 |

|

13.6 |

% |

|

Other banks |

|

50.1 |

|

23.5 |

% |

|

Total Banking System |

|

213.6 |

|

100.0 |

% |

Source: SBIF.

The following table sets forth information on bank operation efficiency indicators for the periods indicated:

Indicators of Financial System Efficiency

(%)

|

|

|

Three months ended |

| ||

|

|

|

March 31, 2016 |

|

March 31, 2017 |

|

|

|

|

|

|

|

|

|

Return on assets |

|

0.2 |

|

0.3 |

|

|

Return on equity |

|

3.0 |

|

3.5 |

|

|

Non-performing loans as a percentage of total loans |

|

0.9 |

|

0.8 |

|

|

Gross operational margin/assets |

|

1.1 |

|

1.1 |

|

|

Operating expenses/operating revenue |

|

51.1 |

|

48.8 |

|

|

Operating expenses/average total assets |

|

0.5 |

|

0.5 |

|

|

Regulatory capital to risk-weighted assets |

|

12.9 |

|

13.6 |

|

Source: SBIF.

Stock Exchanges

The table below summarizes recent value and performance indicators for the Santiago Stock Exchange:

Indicators for the Santiago Stock Exchange

|

As of March 31, |

|

Market Capitalization |

|

Annual Trading Volume |

|

IGPA(1) |

|

IPSA(2) |

|

|

2017 |

|

237.9 |

|

n.a. |

|

23,967.87 |

|

4,783.42 |

|

(1) The General Stock Price Index (Índice General de Precios de Acciones, or IGPA) is an index weighted by market capitalization that measures the price variations of any stocks listed on the Santiago Stock Exchange with an annual trading volume of at least UF10,000 (US$399,479 as of March 31, 2017).

(2) The Selective Stock Price Index (Índice de Precios Selectivo de Acciones, or IPSA) is an index tied to the stocks on the Santiago Stock Exchange with a market capitalization of at least US$200 million.

Source: Santiago Stock Exchange.

Institutional Investors

The following table sets forth the amount of assets of the various types of institutional investors in Chile as of the indicated dates:

Total Assets of Institutional Investors (in billions of US$)

|

As of March 31, |

|

Pension |

|

Insurance |

|

Mutual |

|

Investment |

|

Foreign |

|

Total |

|

|

2016 |

|

163.3 |

|

43.2 |

|

40.1 |

|

n.a. |

|

n.a. |

|

246.6 |

|

|

2017 |

|

186.2 |

|

47.8 |

|

51.4 |

|

n.a. |

|

n.a. |

|

285.4 |

|

(1) Includes international investment funds.

Source: SVS, SP.

Pension Funds and the Chilean Pension System

As of March 31, 2017, the pension funds held aggregate financial assets totaling approximately US$186.7 billion.

PUBLIC SECTOR FINANCES

Public Sector Accounts and Fiscal Statistics

Fiscal Responsibility Law

Pension Reserve Fund

The table below sets forth the total contribution to, and total withdrawals from, the Pension Reserve Fund (“FRP”) for the three months ended March 31, 2017, as well as the total assets of the FRP at such date:

|

|

|

Contribution |

|

Withdrawals |

|

Total Assets at |

|

|

For the three months ended March 31, 2017 |

|

0 |

|

0 |

|

9,096.99 |

|

Economic and Social Stabilization Fund

The table below sets forth the total contribution to, and total withdrawals from, the Economic and Social Stabilization Fund (“FEES”) as of March 31, 2017, as well as the total assets of the FEES at such date:

|

|

|

Contribution |

|

Withdrawals |

|

Total Assets at |

|

|

For the three months ended March 31, 2017 |

|

0 |

|

0 |

|

14,070.31 |

|

Budget Law and Political Initiatives

The following table sets forth a summary of public sector accounts during the three months ended March 31, 2016 and 2017 (calculated on an accrual basis and as a percentage of GDP for the periods indicated):

Public Sector Finances

(in billions of US$ and % of total GDP)

|

|

|

January 1, 2016 — March 31, 2016 |

|

January 1, 2017 — March 31, 2017 |

| ||||

|

|

|

(US$) |

|

(%) |

|

(US$) |

|

(%) |

|

|

Current Revenues and Expenditures |

|

|

|

|

|

|

|

|

|

|

Revenues |

|

14.3 |

|

5.9% |

|

14.8 |

|

5.7% |

|

|

Net taxes(1) |

|

11.5 |

|

5.1% |

|

11.9 |

|

4.6% |

|

|

Copper revenues(2) |

|

0.2 |

|

0.1% |

|

0.2 |

|

0.1% |

|

|

Social Security contributions |

|

1.0 |

|

0.3% |

|

1.0 |

|

0.4% |

|

|

Donations |

|

0.0 |

|

0.0% |

|

0.0 |

|

0.0% |

|

|

Real property incomes |

|

0.2 |

|

0.1% |

|

0.2 |

|

0.1% |

|

|

Operational revenues |

|

0.4 |

|

0.1% |

|

0.4 |

|

0.1% |

|

|

Other revenues |

|

1.0 |

|

0.2% |

|

1.0 |

|

0.4% |

|

|

Expenditures |

|

12.4 |

|

4.7% |

|

12.8 |

|

5.0% |

|

|

Wages and salaries |

|

3.2 |

|

1.2% |

|

3.3 |

|

1.3% |

|

|

Goods and services |

|

1.1 |

|

0.4% |

|

1.1 |

|

0.4% |

|

|

Interest on public debt |

|

0.9 |

|

0.3% |

|

1.0 |

|

0.4% |

|

|

Transfer payments |

|

4.6 |

|

1.7% |

|

4.7 |

|

1.8% |

|

|

Transfers to social security |

|

2.6 |

|

1.0% |

|

2.7 |

|

1.1% |

|

|

Others |

|

0.0 |

|

0.0% |

|

0.0 |

|

0.0% |

|

|

Capital Revenues and Expenditures |

|

|

|

|

|

|

|

|

|

|

Revenues |

|

|

|

|

|

|

|

|

|

|

Asset sales |

|

0.0 |

|

0.0% |

|

0.0 |

|

0.0% |

|

|

Expenditures |

|

|

|

|

|

|

|

|

|

|

Investment |

|

0.9 |

|

0.4% |

|

0.9 |

|

0.3% |

|

|

Capital transfers |

|

1.0 |

|

0.4% |

|

1.0 |

|

0.4% |

|

|

Central government balance |

|

1.2 |

|

0.5% |

|

0.1 |

|

0.0% |

|

(1) Taxes collected net of refunds.

(2) Excludes transfers from Codelco under Law No. 13,196. This law (Ley Reservada del Cobre), which is not publicly disclosed, earmarks 10% of Codelco’s revenues from the export of copper and related byproducts for defense spending and these funds are therefore excluded from the central government’s current revenues. Defense spending is considered an extra-budgetary expense in accordance with IMF accounting guidelines.

Source: Chilean Budget Office.

Government Revenue

Taxation

Tax revenues accounted for 4.6% of GDP for the first three months of 2017, compared to 5.1% of GDP for the same period in 2016.

Government-owned Enterprises

The following table sets forth the government’s share ownership and total assets of the principal state-owned enterprises as of March 31, 2017, and revenue and net income (loss) for the three month period ended March 31, 2017:

|

|

|

Percentage of |

|

Total Assets as |

|

Revenue for the |

|

Net Income (Loss) |

|

|

Main Public Sector Enterprises: |

|

|

|

|

|

|

|

|

|

|

Banco Estado (financial) |

|

100.0 |

|

52,456 |

|

497.3 |

|

69.2 |

|

|

Codelco (copper) |

|

100.0 |

|

33,376 |

|

3,028.2 |

|

42.4 |

|

|

ENAP (oil and gas) |

|

100.0 |

|

6,129 |

|

1,577.4 |

|

10.0 |

|

|

Enami (mining) |

|

100.0 |

|

754 |

|

289.5 |

|

(9.1 |

) |

|

EFE (railway) |

|

100.0 |

|

n.a |

|

n.a |

|

n.a |

|

|

Metro S.A. (Santiago’s subway) |

|

100.0 |

|

6,902 |

|

112.8 |

|

(13.9 |

) |

n.a.= Not available for the three month period ended March 31, 2017.

Source: Chilean Budget Office.

Banco Estado

In the three month period ended March 31, 2017, Banco Estado recorded revenues of US$497 million, an 13.3% increase compared to the same period in 2016. In the three month period ended March 31, 2017, Banco Estado had a net income of US$69 million, a 17.3% decrease compared to the same period in 2016.

Codelco

In the three month period ended March 31, 2017, Codelco recorded revenues of US$3,028 million, an 11.4% increase compared to the same period in 2016. In the three month period ended March 31, 2017, Codelco had a net profit of US$42 million, a 134% increase compared to the same period in 2016.

ENAP

In the three month period ended March 31, 2017, ENAP recorded revenues of US$1,577 million, an 40.5% increase compared to the same period in 2016. In the three month period ended March 31, 2017, ENAP had a net income of US$10 million, a 74.4% decrease compared to the same period in 2016.

Enami

In the three month period ended March 31, 2017, Enami recorded revenues of US$290 million, a 3.3% increase compared to the same period in 2016. In the three month period ended March 31, 2017, Enami had a net loss of US$(9.1) million, a 71.7% increase compared to the same period in 2016.

EFE

In 2015, the latest available data, EFE had operating revenues derived from passenger transport (54.2%), cargo (30.0%) and real estate management (15.8%).

Metro

In the three month period ended March 31, 2017, Metro recorded revenues of US$113 million, an 8.4% increase compared to the same period in 2016. In the three month period ended March 31, 2017, Metro had a net loss of US$14 million, a 157.5% decrease compared to the same period in 2016.

CERTAIN DEFINED TERMS AND CONVENTIONS

Exchange Rates

For your convenience, Chile has provided translations of certain amounts into U.S. dollars at the rates specified below unless otherwise indicated.

|

|

|

Exchange Rate(1) |

| |

|

At December 31, 2011 |

|

Ps.521.46 per US$ |

1.00 |

|

|

Average for year ended December 31, 2011 |

|

Ps.483.36 per US$ |

1.00 |

|

|

At December 31, 2012 |

|

Ps.478.60 per US$ |

1.00 |

|

|

Average for year ended December 31, 2012 |

|

Ps.486.75 per US$ |

1.00 |

|

|

At December 31, 2013 |

|

Ps.523.76 per US$ |

1.00 |

|

|

Average for year ended December 31, 2013 |

|

Ps.495.00 per US$ |

1.00 |

|

|

At December 31, 2014 |

|

Ps.607.38 per US$ |

1.00 |

|

|

Average for year ended December 31, 2014 |

|

Ps.570.40 per US$ |

1.00 |

|

|

At December 31, 2015 |

|

Ps. 707.34 per US$ |

1.00 |

|

|

Average for year ended December 31, 2015 |

|

Ps. 654.25 per US$ |

1.00 |

|

|

At December 31, 2016 |

|

Ps. 667.29 per US$ |

1.00 |

|

|

Average for year ended December 31, 2016 |

|

Ps. 676.83 per US$ |

1.00 |

|

(1) As reported by the Chilean Central Bank in accordance with paragraph 2 of article 44 of its Constitutional Organic Act.

For amounts relating to a period, Chilean pesos are translated into U.S. dollar amounts using the average exchange rate for that period. For amounts at period end, Chilean pesos are translated into U.S. dollar amounts using the exchange rate at the period end.

The Chilean Central Bank reported the exchange rate for Chile’s formal exchange market at Ps.666.28 per US$1.00 as of June 9, 2017. The Federal Reserve Bank of New York does not report a noon buying rate for Chilean pesos.

Presentation of Financial Information

All annual information presented in this prospectus is based upon January 1 to December 31 periods, unless otherwise indicated. Totals in tables in this prospectus may differ from the sum of the individual items in those tables due to rounding.

Since Chile’s official financial and economic statistics are subject to review by the Central Bank, the information in this prospectus may be adjusted or revised. The information and data contained in this prospectus for December 31, 2016 and thereafter is preliminary and subject to further revision. The government believes that this review process is substantially similar to the practices of many industrialized nations. The government does not expect revisions to be material, although it cannot assure you that material changes will not be made.

Defined Terms

This prospectus defines the terms set forth below as follows:

· Gross domestic product or GDP means the total value of final products and services produced in Chile during the relevant period.

· Imports are calculated based upon (i) for purposes of foreign trade, statistics reported to Chilean customs upon entry of goods into Chile on a cost, insurance and freight included, or CIF, basis and (ii) for purposes of balance of payments, statistics collected on a free on board, or FOB, basis at a given departure location.

· Exports are calculated based upon statistics reported to Chilean customs upon departure of goods from Chile on an FOB basis.

· Rate of inflation or inflation rate is the change in the consumer price index, or CPI, for the relevant calendar year, unless otherwise specified. The CPI is calculated on a weighted basket of consumer goods and services using a monthly averaging method. The rate of inflation is measured by comparing the CPI indices in December of the latest year against the indices for the prior December. See “Monetary and Financial System—Inflation.”

· An Unidad de Fomento (UF) is an inflation-indexed, Chilean peso-denominated monetary unit that is set daily based on the Chilean CPI of the immediately preceding 30 days as calculated and published daily by the Chilean Central Bank. The main use of this index is in connection with “re-adjustable” payment obligations denominated in Chilean pesos.

Unless otherwise indicated, all annual rates of growth are average annual compounded rates, and all financial data are presented in current prices.

This prospectus refers to the state-owned companies and institutions as indicated below:

|

Banco Central de Chile |

|

Chilean Central Bank |

|

Banco del Estado de Chile |

|

Banco Estado |

|

Corporación de Fomento de la Producción |

|

CORFO |

|

Corporación Nacional del Cobre de Chile |

|

Codelco |

|

Empresa Nacional del Petróleo |

|

ENAP |

|

Empresa de Transporte de Pasajeros Metro S.A. |

|

Metro |

|

Empresa Nacional de Minería |

|

Enami |

|

Empresa de los Ferrocarriles del Estado |

|

EFE |

This prospectus and any prospectus supplement may contain forward-looking statements.

Forward-looking statements are statements that are not about historical facts, including statements about Chile’s beliefs and expectations. These statements are based on current plans, estimates and projections, and therefore, you should not place undue reliance on them. Forward-looking statements speak only as of the date they are made. Chile undertakes no obligation to update publicly any of these forward-looking statements in light of new information or future events, including changes in Chile’s economic policy or budgeted expenditures, or to reflect the occurrence of unanticipated events.

Forward-looking statements involve inherent risks and uncertainties. Chile cautions you that a number of important factors could cause actual results to differ materially from those expressed in any forward-looking statement. These factors include, but are not limited to:

· Adverse external factors, such as high international interest rates, low copper and mineral prices and recession or low growth in Chile’s trading partners. High international interest rates could negatively affect Chile’s current account and could increase budgetary expenditures. Low copper and mineral prices could decrease the government’s revenues and could negatively affect the current account. Recession or low growth in Chile’s trading partners could lead to fewer exports from Chile and lower growth in Chile;

· Instability or volatility in the international financial markets, including in particular continued or increased distress in the financial markets of the European Union, could lead to domestic volatility, which may adversely affect the ability of the Chilean government to achieve its macroeconomic goals. This could also lead to declines in foreign investment inflows, in particular portfolio investments;

· Adverse domestic factors, such as a decline in foreign direct and portfolio investment, increases in domestic inflation, high domestic interest rates and exchange rate volatility. Each of these factors could lead to lower growth or lower international reserves; and

· Other adverse factors, such as energy deficits or restrictions, climatic or seismic events, international or domestic hostilities and political uncertainty.

This summary highlights information contained elsewhere in this prospectus. It is not complete and may not contain all the information that you should consider before investing in the debt securities. You should read the entire prospectus and any prospectus supplement carefully.

Selected Financial Information(1)

|

|

|

2012 |

|

2013 |

|

2014 |

|

2015 |

|

2016 |

|

|

THE ECONOMY |

|

|

|

|

|

|

|

|

|

|

|

|

Gross Domestic Product (GDP)(2) |

|

266,971 |

|

278,541 |

|

261,147 |

|

242,472 |

|

247,074 |

|

|

Real GDP (in billions of pesos)(3) |

|

132,516 |

|

137,876 |

|

140,509 |

|

143,674 |

|

145,957 |

|

|

% Change from prior year |

|

5.3 |

% |

4.0 |

% |

1.9 |

% |

2.3 |

% |

1.6 |

% |

|

Consumer price index (percentage change from previous year at period end) |

|

1.5 |

% |

3.0 |

% |

4.6 |

% |

4.4 |

% |

2.7 |

% |

|

Producer price index (percentage change from previous year at period end) |

|

(0.7 |

)% |

(2.8 |

)% |

(3.3 |

)% |

(10.7 |

)% |

10.2 |

% |

|

Unemployment rate (annual average) |

|

6.4 |

% |

5.9 |

% |

6.4 |

% |

6.2 |

% |

6.5 |

% |

|

BALANCE OF PAYMENTS |

|

|

|

|

|

|

|

|

|

|

|

|

Trade balance(4) |

|

(66 |

) |

(1,410 |

) |

2,769 |

|

47 |

|

2,119 |

|

|

Current account |

|

(10,706 |

) |

(11,524 |

) |

(4,501 |

) |

(4,670 |

) |

(3,574 |

) |

|

Financial and capital account (including change in reserves) |

|

(11,962 |

) |

(12,825 |

) |

(5,926 |

) |

(2,704 |

) |

(2,948 |

) |

|

Errors and omissions |

|

(1,280 |

) |

(1,323 |

) |

(1,446 |

) |

616 |

|

612 |

|

|

Chilean Central Bank, international reserves (period-end) |

|

41,649 |

|

41,094 |

|

40,447 |

|

38,643 |

|

40,494 |

|

|

Number of months of import coverage(5) |

|

5.5 |

|

5.5 |

|

5.8 |

|

6.5 |

|

7.1 |

|

|

PUBLIC FINANCE |

|

|

|

|

|

|

|

|

|

|

|

|

Central government revenue |

|

59,107 |

|

58,345 |

|

53,691 |

|

51,342 |

|

51,772 |

|

|

% of GDP |

|

22.3 |

% |

21.0 |

% |

20.7 |

% |

21.4 |

% |

21.1 |

% |

|

Central government expenditure |

|

57,612 |

|

60,009 |

|

57,921 |

|

56,555 |

|

58,561 |

|

|

% of GDP |

|

21.7 |

% |

21.6 |

% |

22.4 |

% |

23.5 |

% |

23.9 |

% |

|

Central government surplus (deficit) |

|

1,495 |

|

(1,664 |

) |

(4,230 |

) |

(5,213 |

) |

(6,790 |

) |

|

% of GDP |

|

0.6 |

% |

(0.6 |

)% |

(1.6 |

)% |

(2.2 |

)% |

(2.8 |

)% |

|

Consolidated non-financial public sector surplus (deficit)(6) |

|

6,021 |

|

791 |

|

(1,228 |

) |

(3,839 |

) |

n.a |

|

|

% of GDP |

|

2.3 |

% |

0.3 |

% |

(0.5 |

)% |

(1.6 |

)% |

n.a |

|

|

PUBLIC DEBT |

|

|

|

|

|

|

|

|

|

|

|

|

Central government external debt |

|

6,135 |

|

5,160 |

|

6,544 |

|

7,777 |

|

10,081 |

|

|

Central government external debt/GDP |

|

2.3 |

% |

1.9 |

% |

2.5 |

% |

3.2 |

% |

4.1 |

% |

|

Central government external debt/exports(7) |

|

6.5 |

% |

5.7 |

% |

7.4 |

% |

9.1 |

% |

14.0 |

% |

(1) In millions of U.S. dollars, except as otherwise indicated.

(2) GDP in U.S. dollars calculated by translating the nominal GDP in pesos at the average exchange rate of each period.

(3) Calculated using chained volumes at prices for the immediately preceding year.

(4) Trade balance consists of goods and services.

(5) Imports consist of goods and services.

(6) The non-financial public sector includes the central government, municipalities and public-owned enterprises, but does not include Banco Estado and the Chilean Central Bank.

(7) Exports consist of goods and services.

n.a.= Not available.

Source: Chilean Central Bank, Chilean Budget Office and National Statistics Institute (Instituto Nacional de Estadísticas, or INE).

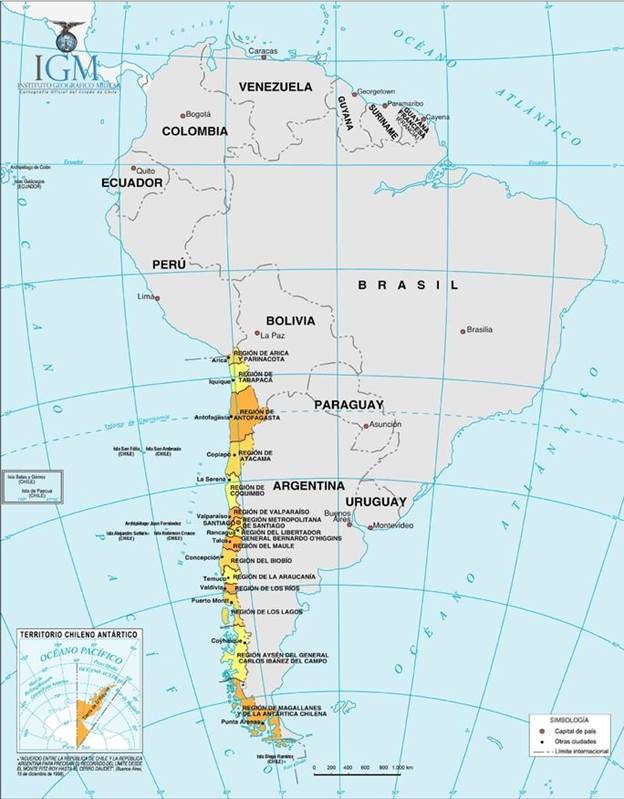

Area and Population

Chile covers an area of approximately 756,626 square kilometers (excluding the Antarctic territory, which covers approximately 1,250,000 square kilometers). Continental Chile occupies a narrow strip of land, with an average width of 177 kilometers, extending approximately 4,270 kilometers along South America’s west coast. It borders Peru to the north, the Antarctic territory to the south, Bolivia and Argentina to the east and the Pacific Ocean to the west. Continental Chile’s geography is dominated by a range of Pacific coastal mountains in the west, the Andes Mountains in the east and a valley that lies between these two ranges. Southern Chile is mostly an archipelago, with Cape Horn at its tip. Chile’s territory also includes several islands, including Easter Island, Juan Fernández Island and Salas y Gómez Island.

Continental Chile has five well-defined geographic regions: the northern desert, the high Andean sector, the central valley, the southern lakes district and the archipelago region. Approximately 22.9% of Chile’s land area is forested, while the remaining non-urban areas consist primarily of agricultural areas, deserts and mountains. The northern desert region is rich in mineral resources. The climate is dry and hot in the north, temperate in the central regions and cool and wet in the south.

Chile’s population, industry and arable land are mainly concentrated in the central valley, which includes the nation’s capital and largest city, Santiago, and its two largest ports, San Antonio and Valparaíso.

According to the national census conducted in 2002, Chile’s population was approximately 15.1 million, with an annual average growth rate of 1.2% per year from June 1992 to June 2002. The 2002 national census showed that the population in Chile was highly urbanized, with approximately 87.0% living in cities, with approximately 40.0% of urban dwellers residing in the Santiago metropolitan area, which includes the city of Santiago and the surrounding region. Spanish is Chile’s official language. Although a national census was conducted during the first half of 2012, the results were not satisfactory to the National Institute of Statistics. Therefore, a new national census was conducted on April 19, 2017. The estimated population of Chile as of December 31, 2016 was 18.2 million.

Chile considers itself an upper-middle income economy. The following table provides selected comparative statistics as set forth in the Central Intelligence Agency (CIA) 2016 World Factbook:

|

|

|

Argentina |

|

Brazil |

|

Chile |

|

Colombia |

|

Mexico |

|

Venezuela |

|

United |

|

|

Per capita GDP(1) (in US$) |

|

20,200 |

|

14,800 |

|

24,000 |

|

14,100 |

|

18,900 |

|

15,100 |

|

57,300 |

|

|

Life expectancy at birth (in years) |

|

77.10 |

|

73.80 |

|

78.80 |

|

75.70 |

|

75.90 |

|

75.80 |

|

79.8 |

|

|

Infant mortality (deaths per 1,000 live births) |

|

10.10 |

|

18.00 |

|

6.70 |

|

14.10 |

|

11.9 |

|

12.5 |

|

5.80 |

|

|

Literacy rate |

|

98.1 |

% |

92.6 |

% |

97.5 |

% |

94.7 |

% |

95.1 |

% |

96.3 |

% |

99.0 |

%(2) |

(1) Figures are adjusted by purchasing power parity (PPP).

(2) Data corresponds to 2003 estimation.

Source: CIA 2016 World Factbook.