Table of Contents

As filed with the Securities and Exchange Commission on May 31, 2024

Registration No. 333-274767

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

PRE-EFFECTIVE AMENDMENT NO. 2

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Invesco Galaxy Ethereum ETF

(Exact name of registrant as specified in its charter)

| Delaware |

6221 |

93-6866177 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

c/o Adam Henkel, Esq.

Invesco Capital Management LLC

3500 Lacey Road, Suite 700

Downers Grove, IL 60515

800-983-0903

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Copy to:

| Paulita Pike, Esq. Ropes & Gray LLP 191 North Wacker Drive, 32nd Floor Chicago, IL 60606 |

Brian D. McCabe, Esq. Ropes & Gray LLP Prudential Tower, 800 Boylston Street Boston, MA 02199 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Securities Exchange Act of 1934.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ | |||

| Emerging growth company | ☒ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☒

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this Preliminary Prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This Preliminary Prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion

Preliminary Prospectus dated May 31, 2024

PRELIMINARY PROSPECTUS

INVESCO GALAXY ETHEREUM ETF

COMMON SHARES

Invesco Galaxy Ethereum ETF (the “Trust”) is an exchange-traded fund that issues common shares of beneficial interest (the “Shares”) that trade on Cboe BZX (“Cboe” or the “Exchange”) under the ticker symbol “QETH”. The Trust’s investment objective is to reflect the performance of the spot price of ether as measured using Lukka Prime Ethereum Reference Rate (the “Benchmark”), less the Trust’s expenses and other liabilities.

In seeking to achieve its investment objective, the Trust will hold ether. The Trust will value its Shares each Business Day as of 4:00 p.m. ET. The value of ether held by the Trust is determined based on the fair market value (“FMV”) price for ether, reflecting the execution price of ether on its principal market as determined each day by Lukka Inc., an independent third-party digital asset data company (the “Benchmark Provider”). The Benchmark is designed to provide an estimated fair market value price for ether, based on the execution price of ether on its principal market. In this regard, the Benchmark Provider seeks to identify a “principal market” for ether each day by evaluating eligible ether trading platforms across a variety of different criteria, including the trading platforms’ oversight and governance frameworks, microstructure efficiency, trading volume, data transparency and data integrity. Invesco Capital Management LLC (the “Sponsor” or “Invesco”) is the sponsor of the Trust, CSC Delaware Trust Company (the “Trustee”) is the trustee of the Trust, The Bank of New York Mellon is the Trust’s transfer agent (“Transfer Agent”) and will hold all of the Trust’s cash on the Trust’s behalf as cash custodian (“Cash Custodian”), and Coinbase Custody Trust Company, LLC (the “Ethereum Custodian”) will hold all of the Trust’s ether on the Trust’s behalf as custodian.

Shareholders who decide to buy or sell Shares of the Trust will place their trade orders through their brokers and may incur customary brokerage commissions and charges. Such trades may occur at a premium or discount relative to the net asset value per share (“NAV”) of the Shares of the Trust.

The Trust intends to issue Shares on a continuous basis and is registering an indeterminate number of Shares with the SEC in accordance with Rule 456(d) and 457(u) under the Securities Act of 1933, as amended (the “Securities Act”). The Trust will process all creations and redemptions of Shares in transactions with financial firms that are authorized to do so (known as “Authorized Participants”). When the Trust issues or redeems its Shares, it will do so only in blocks of 5,000 Shares (a “Creation Basket”) based on the quantity of ether attributable to each Share of the Trust (net of accrued but unpaid Sponsor fees and any accrued but unpaid expenses or liabilities).

Creation and redemption transactions initially will take place in cash. Subject to Cboe in the future receiving the necessary regulatory approval to permit the Trust to create and redeem Creation Baskets in-kind for ether (the “In-Kind Regulatory Approval”), these transactions may also take place in exchange for ether. The timing of the In-Kind Regulatory Approval and the related in-kind creation model is unknown and there is no guarantee that the Cboe will receive such approval. If Cboe receives the In-Kind Regulatory Approval and the Sponsor chooses to allow in-kind creations and redemptions, notice to Shareholders will be provided on the Trust’s website, in a prospectus supplement, through a current report on Form 8-K and/or in the Trust’s annual or quarterly reports.

When purchasing Creation Baskets, Authorized Participants will deliver cash to the Cash Custodian. Galaxy Digital Funds LLC (the “Execution Agent”) will be responsible for acquiring the requisite amount of ether on behalf of the Trust on an agency basis. Once the Execution Agent selects a counterparty or digital asset trading platform (“Ethereum Counterparty”), the Cash Custodian will transfer cash to the Ethereum Counterparty in payment for the requisite amount of ether. The ether acquired from the Ethereum Counterparty will be transferred to the Ethereum Custodian. After receipt of the ether by the Ethereum Custodian, the Transfer Agent will issue Creation Baskets of Shares to the creating Authorized Participant in satisfaction of the creation order.

When redeeming Creation Baskets, the Execution Agent will be responsible for selling the requisite amount of ether on behalf of the Trust on an agency basis. Once the Execution Agent selects an Ethereum Counterparty, the Ethereum Custodian will transfer ether to the Ethereum Counterparty in return for the requisite cash payment. The cash received from the Ethereum Counterparty will be delivered to the Cash Custodian. After receipt of the cash payment, the Transfer Agent will redeem the Shares and the Cash Custodian will distribute the resulting cash to the redeeming Authorized Participant in satisfaction of the redemption order.

In connection with both creation and redemption transactions, the Execution Agent, pursuant to the oversight of the Sponsor, will decide how and with which Ethereum Counterparty to transact on the Trust’s behalf. The Authorized Participants will deliver only cash to create Shares and will receive only cash when redeeming Shares. Further, Authorized Participants will not directly or indirectly purchase, hold, deliver, or receive ether as part of the creation or redemption process or otherwise direct the Trust or a third-party with respect to purchasing, holding, delivering, or receiving ether as part of the creation or redemption process. The Trust will create Shares by receiving ether from a third-party that is not the Authorized Participant and the Trust (through the Execution Agent, on an agency basis)—not the Authorized Participant—is responsible for selecting the third-party to deliver the ether. Further, the third-party will not be acting as an agent of the Authorized Participant with respect to the delivery of the ether to the Trust or acting at the direction of the Authorized Participant with respect to the delivery of the ether to the Trust. The Trust will redeem shares by delivering ether to a third-party that is not the Authorized Participant and the Trust (through the Execution Agent, on an agency basis)—not the Authorized Participant—is responsible for selecting the third-party to receive the ether. Further, the third-party will not be acting as an agent of the Authorized Participant with respect to the receipt of the ether from the Trust or acting at the direction of the Authorized Participant with respect to the receipt of the ether from the Trust.

The Trust expects to purchase or sell ether in connection with cash creation and redemption transactions, and to sell ether to pay certain expenses, including the Sponsor Fee. Each creating or redeeming Authorized Participant will be charged a transaction fee in connection with each creation or redemption transaction. Authorized Participants are expected to sell Shares to the public at prices that reflect, among other factors, the value of the Trust’s assets, supply and demand for the Shares and market conditions at the time of a transaction.

The Trust was seeded with $[ ] on [ ], 2024 through the sale of [ ] Shares. In this transaction, the Sponsor purchased [ ] Shares ([ ] Creation Baskets) at a price of $[ ] per Share based on the Benchmark price as of 4:00 p.m. ET on [ ], 2024. Accordingly, as of the market close on [ ], 2024, the Trust had total assets of $[ ], solely represented by ether held in custody by the Ethereum Custodian, and had [ ] Shares outstanding, entirely held by the Sponsor. The Sponsor acted as a statutory underwriter in connection with these purchases.

Prior to this offering, pursuant to this Prospectus, there has been no public market for the Shares. The Shares are expected to be listed for trading, subject to notice of issuance, on the Exchange under the ticker symbol QETH. Investing in the Trust involves risks similar to those involved with an investment directly in ether, as well as other significant risks. See “Risk Factors” beginning on page 11.

The offering of the Trust’s Shares is registered with the Securities and Exchange Commission (the “SEC”) in accordance with the Securities Act. The offering is intended to be a continuous offering and is not expected to terminate until either all of the registered Shares have been sold or three years from the date of the original offering, whichever is earlier, unless extended as permitted by applicable rules under the Securities Act. The Trust is not a mutual fund, is not registered under the Investment Company Act of 1940, as amended (the “1940 Act”) and is not subject to regulation under the 1940 Act. The Trust is not a commodity pool for purposes of the Commodity Exchange Act of 1936, as amended (the “CEA”), and the Sponsor is not subject to regulation by the Commodity Futures Trading Commission (the “CFTC”) as a commodity pool operator or a commodity trading advisor. The Trust’s Shares are neither interests in, nor obligations of, the Sponsor or the Trustee.

AN INVESTMENT IN THE TRUST INVOLVES SIGNIFICANT RISKS AND MAY NOT BE SUITABLE FOR SHAREHOLDERS THAT ARE NOT IN A POSITION TO ACCEPT RISKS RELATED TO ETHER. THE SHARES ARE SPECULATIVE SECURITIES. THEIR PURCHASE INVOLVES A HIGH DEGREE OF RISK, AND YOU COULD LOSE YOUR ENTIRE INVESTMENT. YOU SHOULD CONSIDER ALL RISK FACTORS BEFORE INVESTING IN THE TRUST. PLEASE REFER TO “RISK FACTORS ” BEGINNING ON PAGE 11.

THE SHARES OF THE TRUST ARE NEITHER INTERESTS IN NOR OBLIGATIONS OF THE SPONSOR, THE TRUSTEE, THE BENCHMARK PROVIDER, THE ADMINISTRATOR, THE TRANSFER AGENT, THE EXECUTION AGENT, THE CASH CUSTODIAN, THE ETHEREUM CUSTODIAN, THE MARKETING AGENT OR ANY OF THEIR RESPECTIVE AFFILIATES. THE SHARES ARE NOT INSURED OR GUARANTEED BY THE FEDERAL DEPOSIT INSURANCE CORPORATION OR ANY OTHER GOVERNMENTAL AGENCY.

NEITHER THE SEC NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THE SECURITIES OFFERED IN THIS PROSPECTUS, OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

THE TRUST IS AN “EMERGING GROWTH COMPANY” AS THAT TERM IS USED IN THE JUMPSTART OUR BUSINESS STARTUPS ACT AND, AS SUCH, MAY ELECT TO COMPLY WITH CERTAIN REDUCED REPORTING REQUIREMENTS.

The date of this Prospectus is June [ ], 2024

Table of Contents

| Page | ||||

| iii | ||||

| 1 | ||||

| 2 | ||||

| 11 | ||||

| 44 | ||||

| 52 | ||||

| 58 | ||||

| 60 | ||||

| 63 | ||||

| 66 | ||||

| 69 | ||||

| 70 | ||||

| 71 | ||||

| 72 | ||||

| 78 | ||||

| 79 | ||||

| 79 | ||||

| 79 | ||||

| 81 | ||||

| 84 | ||||

| 87 | ||||

| 87 | ||||

| 87 | ||||

| 87 | ||||

| 88 | ||||

| 88 | ||||

| 88 | ||||

| 88 | ||||

| 93 | ||||

| 94 | ||||

| 94 | ||||

| 95 | ||||

| 97 | ||||

| A-1 | ||||

-i-

Table of Contents

This Prospectus contains information you should consider when making an investment decision about the Shares of the Trust. You may rely on the information contained in this Prospectus. The Trust and the Sponsor have not authorized any person to provide you with different information and, if anyone provides you with different or inconsistent information, you should not rely on it. This Prospectus is not an offer to sell the Shares in any jurisdiction where the offer or sale of the Shares is not permitted.

The Shares of the Trust are not registered for public sale in any jurisdiction other than the United States (the “U.S.”).

-ii-

Table of Contents

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Prospectus includes “forward-looking statements” that generally relate to future events or future performance. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential” or the negative of these terms or other comparable terminology. All statements (other than statements of historical fact) included in this Prospectus that address activities, events or developments that will or may occur in the future, including such matters as movements in the digital asset markets, the Trust’s operations, the Sponsor’s plans and references to the Trust’s future success and other similar matters, are forward-looking statements. These statements are only predictions. Actual events or results may differ materially. These statements are based upon certain assumptions and analyses the Sponsor has made based on its perception of historical trends, technology developments regarding the use of ether and other digital assets, including the systems used by the Sponsor and the Trust’s Ethereum Custodian in their provision of services to the Trust, current conditions and expected future developments, as well as other factors appropriate in the circumstances. Whether or not actual results and developments will conform to the Sponsor’s expectations and predictions, however, is subject to a number of risks and uncertainties, including the special considerations discussed in this Prospectus, general economic, market and business conditions, changes in laws or regulations, including those concerning taxes, made by governmental authorities or regulatory bodies, and other economic and political developments. Consequently, all the forward-looking statements made in this Prospectus are qualified by these cautionary statements, and there can be no assurance that actual results or developments the Sponsor anticipates will be realized or, even if substantially realized, that they will result in the expected consequences to, or have the expected effects on, the Trust’s operations or the value of its Shares. None of the Trust, the Sponsor, or the Trustee or their respective affiliates is under a duty to update any of the forward-looking statements to conform such statements to actual results or to a change in the Sponsor’s expectations or predictions.

-iii-

Table of Contents

EMERGING GROWTH COMPANY STATUS

The Trust is an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act (the “JOBS Act”) and, as such, may elect to comply with certain reduced reporting requirements. For as long as the Trust is an emerging growth company, unlike other public companies, it will not be required to:

| • | provide an auditor’s attestation report on management’s assessment of the effectiveness of its system of internal control over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act of 2002; |

| • | comply with any new requirements adopted by the Public Company Accounting Oversight Board (“PCAOB”) requiring mandatory auditor rotation or a supplement to the auditor’s report in which the auditor would be required to provide additional information about the audit and the financial statements of the issuer; |

| • | comply with any new audit rules adopted by the PCAOB after April 5, 2012, unless the Securities and Exchange Commission determines otherwise; |

| • | provide certain disclosure regarding executive compensation required of larger public companies; or |

| • | obtain shareholder approval of any golden parachute payments not previously approved. |

The Trust will cease to be an “emerging growth company” upon the earliest of (i) when it has $1.235 billion or more in annual revenues; (ii) when it is deemed to be a large accelerated filer under Rule 12b-2 promulgated pursuant to the Securities Exchange Act of 1934; (iii) when it issues more than $1.0 billion of non-convertible debt over a three-year period; or (iv) the last day of the fiscal year following the fifth anniversary of its initial public offering.

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies; however, the Trust is choosing to “opt out” of such extended transition period, and as a result, the Trust will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for non-emerging growth companies. Section 107 of the JOBS Act provides that the Trust’s decision to opt out of the extended transition period for complying with new or revised accounting standards is irrevocable.

-1-

Table of Contents

INVESCO GALAXY ETHEREUM ETF

TICKER: QETH

CUSIP: 143494113

This is only a summary of the Prospectus and, while it contains material information about the Trust and its Shares, it does not contain or summarize all of the information about the Trust and the Shares contained in the Prospectus that is material and/or that may be important to you. You should read this entire Prospectus before making an investment decision about the Shares. For a glossary of defined terms, see Appendix A.

As used below, “Ethereum” with an uppercase “E” is used to describe the system as a whole that is involved in maintaining the ledger of ether ownership and facilitating the transfer of ether among parties. When referring to the digital asset within the Ethereum network, “ether” is written with a lowercase “e.”

Overview of the Trust

Invesco Galaxy Ethereum ETF (the “Trust”) is an exchange-traded fund that issues common shares of beneficial interest (the “Shares”) that trade on Cboe BZX (the “Exchange”) under the ticker symbol QETH.

Invesco Capital Management LLC (the “Sponsor”) is the sponsor of the Trust.

The Trust’s investment objective is to reflect the performance of the spot price of ether as measured using the Lukka Prime Ethereum Reference Rate (the “Benchmark”), less the Trust’s expenses and other liabilities. The Trust is passively-managed and the Sponsor does not actively manage the ether held by the Trust. This means that the Sponsor does not sell ether at times when its price is high or acquire ether at low prices in the expectation of future price increases. It also means that the Sponsor does not make use of any of the hedging techniques available to professional ether investors to attempt to reduce the risks of losses resulting from price changes. The Trust, the Sponsor and the service providers will not loan or pledge the Trust’s assets, nor will the Trust’s assets serve as collateral for any loan or similar arrangement. The Trust will not utilize leverage, derivatives or any similar arrangements in seeking to meet its investment objective. The Trust is not a registered investment company under the Investment Company Act of 1940 (the “1940 Act”) and is not required to register under the 1940 Act. The Sponsor is not registered with the SEC as an investment adviser and is not subject to regulation by the SEC as such in connection with its activities with respect to the Trust. The Trust is not a commodity pool for purposes of the Commodity Exchange Act (the “CEA”), and the Sponsor is not subject to regulation by the CFTC as a commodity pool operator or a commodity trading advisor in connection with its activities with respect to the Trust.

The Trust intends to continuously offer Shares but may suspend the issuance of Shares at any time.

In seeking to achieve its investment objective, the Trust will hold ether. The Trust will value its Shares each Business Day as of 4:00 p.m. ET. The value of ether held by the Trust is determined based on the estimated fair market value (“FMV”) price for ether, reflecting the execution price of ether on its principal market as determined each day by Lukka Inc., an independent third-party digital asset data company (the “Benchmark Provider”). In this regard, the Benchmark Provider seeks to identify a “principal market” for ether each day, by evaluating eligible ether trading platform across a variety of different criteria, including the trading platforms’ oversight and governance frameworks, microstructure efficiency, trading volume, data transparency and data integrity.

CSC Delaware Trust Company (the “Trustee”) is the trustee of the Trust, The Bank of New York Mellon is the Trust’s transfer agent (“Transfer Agent”) and will hold all of the Trust’s cash on the Trust’s behalf as cash custodian (“Cash Custodian”), and Coinbase Custody Trust Company, LLC (the “Ethereum Custodian”) will hold all of the Trust’s ether on the Trust’s behalf as custodian.

The Trust will process all creations and redemptions of Shares in transactions with financial firms that are authorized to do so (known as “Authorized Participants”). When the Trust issues or redeems its Shares, it will do so only in blocks of 5,000 Shares (a “Creation Basket”) based on the quantity of ether attributable to each Share of the Trust (net of accrued but unpaid Sponsor fees and any accrued but unpaid expenses or liabilities).

Creation and redemption transactions initially will take place in cash. Subject to Cboe in the future receiving the necessary regulatory approval to permit the Trust to create and redeem Creation Baskets in-kind for ether (the “In-Kind Regulatory Approval”), these transactions may also take place in exchange for ether. The timing of the In-Kind Regulatory Approval and the related in-kind creation model is unknown and there is no guarantee that the Cboe will receive such approval. If Cboe receives the In-Kind Regulatory Approval and the Sponsor chooses to allow in-kind creations and redemptions, notice to Shareholders will be provided on the Trust’s website, in a prospectus supplement, through a current report on Form 8-K and/or in the Trust’s annual or quarterly reports.

When purchasing Creation Baskets, Authorized Participants will deliver cash to the Cash Custodian. Galaxy Digital Funds LLC (the “Execution Agent”) will be responsible for acquiring the requisite amount of ether on behalf of the Trust on an agency basis. Once the Execution Agent selects a counterparty or digital asset trading platform (“Ethereum Counterparty”), the Cash Custodian will transfer cash to the Ethereum Counterparty in payment for the requisite amount of ether. The ether acquired from the Ethereum Counterparty will be transferred to the Ethereum Custodian. After receipt of the ether by the Ethereum Custodian, the Transfer Agent will issue Creation Baskets of Shares to the creating Authorized Participant in satisfaction of the creation order.

When redeeming Creation Baskets, the Execution Agent will be responsible for selling the requisite amount of ether on behalf of the Trust on an agency basis. Once the Execution Agent selects an Ethereum Counterparty, the Ethereum Custodian will transfer ether to the Ethereum Counterparty in return for the requisite cash payment. The cash received from the Ethereum Counterparty will be delivered to the Cash Custodian. After receipt of the cash payment, the Transfer Agent will redeem the Shares and the Cash Custodian will distribute the resulting cash to the redeeming Authorized Participant in satisfaction of the redemption order.

In connection with both creation and redemption transactions, the Execution Agent, pursuant to the oversight of the Sponsor, will decide how and with which Ethereum Counterparty to transact on the Trust’s behalf. The Authorized Participants will deliver only cash to create Shares and will receive only cash when redeeming Shares. Further, Authorized Participants will not directly or indirectly purchase, hold, deliver, or receive ether as part of the creation or redemption process or otherwise direct the Trust or a third-party with respect to purchasing, holding, delivering, or receiving ether as part of the creation or redemption process. The Trust will create Shares by receiving ether from a third-party that is not the Authorized Participant and the Trust (through the Execution Agent, on an agency basis)—not the Authorized Participant—is responsible for selecting the third-party to deliver the ether. Further, the third-party will not be acting as an agent of the Authorized Participant with respect to the delivery of the ether to the Trust or acting at the direction of the Authorized Participant with respect to the delivery of the ether to the Trust. The Trust will redeem shares by delivering ether to a third-party that is not the Authorized Participant and the Trust (through the Execution Agent, on an agency basis)—not the Authorized Participant—is responsible for selecting the third-party to receive the ether. Further, the third-party will not be acting as an agent of the Authorized Participant with respect to the receipt of the ether from the Trust or acting at the direction of the Authorized Participant with respect to the receipt of the ether from the Trust. Each creating or redeeming Authorized Participant will be charged a transaction fee in connection with each creation or redemption transaction.

The Trust expects to purchase or sell ether in connection with cash creation or redemption transactions, and may sell ether to pay certain expenses, including the Sponsor Fee. In this capacity, the Sponsor has entered into an agreement with Execution Agent to facilitate the purchase or sale of ether by the Trust.

The quantity of ether required to create each Creation Basket (“Creation Basket Deposit”) changes from day to day. On each day that the Exchange is open for regular trading, the Sponsor will publish the Creation Basket after market close, which is composed of an amount of ether that will be used to determine the amount of cash required to purchase a Creation Basket the following day. After the Trust’s NAV is struck on a Business Day (as defined herein), The Bank of New York Mellon (the “Administrator”) adjusts the quantity of ether constituting the Creation Basket Deposit as appropriate to reflect accrued expenses. The computation is made by the Administrator as promptly as practicable after 4:00 p.m. ET. The Administrator calculates the Creation Basket Deposit for a given day by multiplying the NAV by the number of Shares in a Creation Basket (5,000) divided by the price of ether at 4:00 p.m. ET as determined consistent with the Benchmark to determine the cash amount required for a Creation Basket. Fractions of an ether smaller than .000000001 are disregarded for purposes of the computation of the Creation Basket Deposit. Although the Administrator applies the ether price to the calculate of the Creation Basket value, the Administrator plays no role in the determination of the ether price used by the Trust; rather the ether price used in calculating the cash value of a Creation Basket is identical to the ether price used in determining the Trust’s NAV.

To the extent there is a difference between the price actually paid by the Trust to acquire a Creation Basket worth of ether in the creation process compared to the cash value of the Creation Basket (i.e., if there is a difference between the amount paid by the Execution Agent on behalf of the Trust to purchase the requisite amount of ether and the valuation of ether as part of the Trust’s NAV calculation), that difference will also be charged to the creating Authorized Participant in the form of a variable fee.

To support the ability of Authorized Participants to provide liquidity at prices that reflect the value of the Trust’s assets and to facilitate orderly transactions in the Shares, the Trust will ordinarily process redemptions of Creation Baskets on the next day when the Exchange is open for regular trading (a “Business Day”) following receipt of a redemption request by an Authorized Participant.

-2-

Table of Contents

Creation Baskets are expected to be created when there is sufficient demand for Shares, including when the market price per Share is at a premium to the net asset value per Share (“NAV”). Authorized Participants are expected to sell such Shares to the public at prices that reflect, among other factors, the value of the Trust’s assets, supply of and demand for Shares and market conditions at the time of a transaction. Similarly, Creation Baskets are expected to be redeemed when the market price per Share is at a discount to the NAV. Investors (other than Authorized Participants) seeking to purchase or sell Shares on any day are expected to transact in the secondary market, on the Exchange or other national securities exchanges, at the market price per Share, rather than through the creation or redemption of Creation Baskets. Shares initially comprising the same Creation Basket but offered by the Authorized Participants to the public at different times may have different offering prices, which depend on various factors, including the supply and demand for Shares, the value of the Trust’s assets, and market conditions at the time of a transaction.

The Sponsor believes that the design of the Trust will enable investors to effectively and efficiently implement strategic and tactical asset allocation strategies that use ether by investing in the Shares rather than directly in ether.

The Trust’s Expenses

The Trust will pay the Sponsor a unified fee of [●]% per annum (the “Sponsor Fee”) as compensation for services performed under the Trust Agreement (as defined herein). The Trust’s only ordinary recurring expense is the Sponsor Fee.

The Sponsor Fee will be accrued daily and paid monthly in arrears in U.S. dollars, and will be calculated by the Administrator. The Administrator will calculate the Sponsor Fee on a daily basis by applying the [●]% annualized rate to the Trust’s total net assets. To cover the Sponsor Fee, and extraordinary expenses not assumed by the Sponsor, the Sponsor or its delegate will cause the Trust (or its delegate) to instruct the Execution Agent to convert ether held by the Trust into U.S. dollars. The NAV of the Trust and the number of ether represented by a Share will decline each time the Trust accrues the Sponsor Fee or any Trust expenses not assumed by the Sponsor. The Trust is not responsible for paying any costs associated with the transfer of ether to or from the Trust in connection with paying the Sponsor Fee or in connection with creation and redemption transactions.

Except as noted below, the Sponsor has agreed to pay all of the Trust’s ordinary expenses out of the Sponsor’s unified fee, including, but not limited to, the Trustee’s fees, the fees of The Bank of New York Mellon (for its services as the “Administrator,” “Transfer Agent,” and “Cash Custodian”), the fees of the Ethereum Custodian, the fees of the Execution Agent, Exchange listing fees, Securities and Exchange Commission (“SEC”) registration fees, printing and mailing costs, legal costs and audit fees. The Sponsor also paid the costs of the Trust’s organization.

The Trust may incur certain extraordinary expenses that are not assumed by the Sponsor. These include, but are not limited to, taxes and governmental charges, any applicable brokerage commissions, financing fees, Ethereum network fees and similar transaction fees, expenses and costs of any extraordinary services performed by the Sponsor (or any other service provider) on behalf of the Trust to protect the Trust or the interests of Shareholders (including, for example, in connection with any fork of the Ethereum blockchain), any indemnification of the Sponsor, Cash Custodian, Ethereum Custodian, Administrator or other agents, service providers or counterparties of the Trust and extraordinary legal fees and expenses, including any legal fees and expenses incurred in connection with litigation, regulatory enforcement or investigation matters.

The Trust from time to time will be required to sell ether in such quantities as necessary to permit payment of the Sponsor Fee and any Trust expenses and liabilities not assumed by the Sponsor. The Sponsor has engaged the Execution Agent to sell ether on the Trust’s behalf in such circumstances. At the direction of the Trust, the Execution Agent will seek to sell ether at approximately the price at which it is valued by the Trust and in the smallest amounts required to permit such payments as they become due, with the intention of minimizing the Trust’s holdings of assets other than ether. Accordingly, the amount of ether to be sold may vary from time to time depending on the level of the Trust’s expenses and liabilities and the market price of ether.

The Trust’s Legal Structure

The Trust is a Delaware statutory trust, formed on September 27, 2023, pursuant to the Delaware Statutory Trust Act (“DSTA”). The Trust continuously issues common shares representing fractional undivided beneficial interest in and ownership of the Trust that may be purchased and sold on the Exchange. The Trust operates pursuant to its Amended and Restated Declaration of Trust and Trust Agreement, dated as of May 31, 2024 (the “Trust Agreement”). CSC Delaware Trust Company, a Delaware trust company, is the Delaware trustee of the Trust (the “Trustee”). The Trust is managed and controlled by the Sponsor. Shareholders will have very limited voting rights, which will limit their ability to influence matters such as amendment of the Trust Agreement, change in the Trust’s basic investment policy, dissolution of the Trust, or the sale or distribution of the Trust’s assets.

-3-

Table of Contents

The Lukka Prime Ethereum Reference Rate

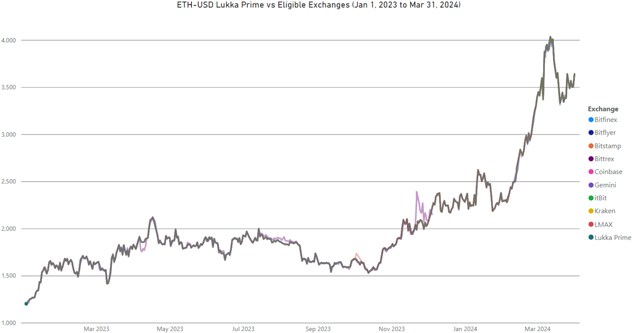

The Benchmark is designed to provide an estimated fair market value (“FMV”) for ether, in a manner that aligns with accounting principles generally accepted in the United States (“U.S. GAAP”) and International Financial Reporting Standards Foundation (“IFRS”) accounting guidelines regarding fair market value measurements. In this regard, the Benchmark Provider seeks to identify a “principal market” for ether each day, by evaluating eligible ether trading platforms across a variety of different criteria, including the trading platforms’ oversight and governance frameworks, microstructure efficiency, trading volume, data transparency and data integrity. As of May 2024, the following trading platforms are considered to be eligible trading platforms by the Benchmark Provider: Binance, Bitfinex, Bitflyer, Bitstamp, Coinbase, Crypto.com, Gate.io, Gemini, HitBTC, Huobi, itBit, Kraken, KuCoin, LMAX, MEXC Global, OKEx and Poloniex (collectively, “Benchmark Pricing Sources”). The Benchmark Provider reviews trading platforms eligible for inclusion in the Benchmark quarterly. In determining which trading platforms to include Benchmark Pricing Sources, the Benchmark Provider evaluates each trading platform using proprietary ratings criteria. The Benchmark Provider periodically reassesses the trading platforms eligible to be considered Benchmark Pricing Sources, and makes adjustments as needed.

For purposes of financial reporting, the Trust will determine the principal market for ether in accordance with ASC Topic 820-10, and such determination is considered from the Trust’s perspective. Procedures will be implemented to review and confirm the prices utilized to value ether reflect fair value in accordance with ASC Topic 820 and will be reviewed by the Sponsor’s Valuation Committee on a periodic basis.

With respect to the Trust’s Authorized Participants, the Trust has no authority over which trading platforms the Authorized Participants or their affiliates might transact on, although the Trust expects that most Authorized Participants or their affiliates may transact on several of the trading platforms used by the Benchmark Provider. The Trust notes that for transactions in which it is selling ether, it may do so in principal-to-principal transactions, although the Trust is eligible to execute trades on all of the trading platforms used by the Benchmark Provider. While the principal to principal market is the market in which the Execution Agent, on the Trust’s behalf, would normally transact for sales of ether, in considering all information reasonably available in accordance with the guidance in ASC 820-10-35-5A, the Trust notes that the identification of a principal market is completed by the Benchmark Provider based on a variety of different criteria including but not limited to trading platforms’ oversight and governance frameworks, microstructure efficiency, trading volume, data transparency and data integrity. The Trust views this evidence to the contrary as an appropriate basis to determine a primary market that is not the principal-to-principal market, in accordance with the guidance in ASC 820-10-35-5A.

The Trust’s Service Providers

The Sponsor

Invesco Capital Management LLC is the Sponsor of the Trust. The Sponsor arranged for the creation of the Trust and is responsible for the ongoing registration of the Shares for their public offering, the listing of Shares on the Exchange and valuing the ether held by the Trust. The Sponsor is a limited liability company formed in the State of Delaware on February 7, 2003, and is a wholly-owned subsidiary of Invesco Ltd. Invesco Ltd. and its subsidiaries, including the Sponsor, are an independent global investment management group. The Sponsor’s principal address is 3500 Lacey Road, Suite 700, Downers Grove, IL 60515.

The Trustee

CSC Delaware Trust Company, a Delaware trust company, acts as the Trustee of the Trust as required to create a Delaware statutory trust in accordance with the Trust Agreement and the DSTA. The Trustee’s principal address is located at 251 Little Falls Drive, Wilmington, DE 19808.

The Administrator

The Bank of New York Mellon (“BNYM”) serves as the Trust’s Administrator. Under the trust administration and accounting agreement, the Administrator provides necessary administrative, tax and accounting services and financial reporting for the maintenance and operations of the Trust, including calculating the NAV of the Trust, determining the net assets of the Trust, and calculating the size of the Creation Baskets. The Administrator’s principal address is 240 Greenwich Street, New York, New York 10286.

The Transfer Agent

BNYM also serves as the Transfer Agent for the Trust. The Transfer Agent is responsible for (1) issuing and redeeming Shares in connection with creation and redemption transactions, (2) responding to correspondence by holders of the Shares (“Shareholders”) and others relating to its duties, (3) maintaining Shareholder accounts and (4) making periodic reports to the Trust. The Transfer Agent’s principal address is 240 Greenwich Street, New York, New York 10286.

The Ethereum Custodian

Coinbase Custody Trust Company, LLC serves as the Trust’s Ethereum Custodian. The Trust has entered into a prime brokerage and custody agreement with the Ethereum Custodian (the “Ether Custody Agreement”), pursuant to which the Ethereum Custodian will hold in custody all of the Trust’s ether, other than that which may be maintained in a trading account with Coinbase, Inc. from time to time. See “Prospectus Summary – Custody of the Trust’s Assets,” below. The Ethereum Custodian is chartered as a limited purpose trust company by the New York State Department of Financial Services (“NYSDFS”) and is authorized by the NYSDFS to provide digital asset custody services. The Ethereum Custodian is a wholly-owned subsidiary of Coinbase Global, Inc.

The Ethereum Custodian is a third-party limited purpose trust company that was chartered in 2018 upon receiving a trust charter from the NYSDFS. The Ethereum Custodian is subject to regulation by the NYSDFS and has a long track record of providing custodial services for digital asset private keys. The Sponsor believes that the Ethereum Custodian’s policies, procedures, and controls for safekeeping, exclusively possessing, and controlling the Trust’s ether holdings are consistent with industry best practices to protect against theft, loss, and unauthorized and accidental use of the private keys. The Trust Ethereum Account and Sponsor Ethereum Account (each as defined herein) are segregated accounts and are therefore not commingled with the Ethereum Custodian’s corporate or other customer assets.

Although the Ethereum Custodian carries insurance for the benefit of its account holders, the Ethereum Custodian’s insurance does not cover any loss in value to ether and only covers losses caused by certain events such as fraud or theft and, in such covered events, it is unlikely the insurance would cover the full amount of any losses incurred by the Trust.

-4-

Table of Contents

The Cash Custodian

BNYM also serves as the cash custodian for the Trust (the “Cash Custodian”) pursuant to a custody agreement (the “Cash Custody Agreement”). The Cash Custodian is responsible for holding the Trust’s cash, including in connection with creation and redemption transactions effected in cash. The Cash Custodian is a New York state-chartered bank and a member of the Federal Reserve System. The Cash Custodian’s principal address is 240 Greenwich Street, New York, New York 10286.

The Execution Agent

The Sponsor has entered into an agreement with Galaxy Digital Funds LLC, a subsidiary of Galaxy Digital LP (“Galaxy” or the “Execution Agent”) to serve as Execution Agent. At the direction of the Sponsor, the Execution Agent is responsible for selling ether on behalf of the Trust to the extent necessary to permit the payment of the Trust’s expenses. The Trust also will utilize the services of the Execution Agent to purchase or sell ether in connection with cash creations and redemptions. When acquiring or disposing of ether on behalf of the Trust in connection with a creation or redemption transaction, the Sponsor will provide instructions to the Execution Agent, who will identify an Ethereum Counterparty. In connection with both creation and redemption transactions, the Execution Agent, pursuant to the oversight of the Sponsor, will decide how and with which Ethereum Counterparty to transact on the Trust’s behalf. In addition, as part of this agreement, the Execution Agent has agreed to co-brand and co-market the Trust and the Sponsor has licensed the use of certain Execution Agent trademarks, service marks and trade names in connection with the Trust. The Execution Agent’s principal address is 300 Vesey Street, New York City, New York 10282.

Galaxy is a subsidiary of Galaxy Digital Holdings LP (“Galaxy Holdings”). Galaxy Digital Holdings Ltd., which holds a limited partner interest in Galaxy Holdings, is listed on the Toronto Stock Exchange under the symbol “GLXY.”

Authorized Participants

The Trust will process all creations and redemptions of Shares in transactions with financial firms that are authorized to do so (known as “Authorized Participants”). Creation and redemption transactions initially will take place in cash. Subject to Cboe receiving the necessary regulatory approval to permit the Trust to create and redeem Creation Baskets in-kind for ether (the “In-Kind Regulatory Approval”), these transactions may also take place in exchange for ether. If Cboe receives the In-Kind Regulatory Approval and the Sponsor chooses to allow in-kind creations and redemptions, notice to Shareholders will be provided on the Trust’s website, in a prospectus supplement, through a current report on Form 8-K and/or in the Trust’s annual or quarterly reports.

When purchasing Creation Baskets, Authorized Participants will deliver cash to the Cash Custodian. The Execution Agent will be responsible for acquiring the requisite amount of ether on behalf of the Trust on an agency basis. Once the Execution Agent selects a counterparty or digital asset trading platform (“Ethereum Counterparty”), the Cash Custodian will transfer cash to the Ethereum Counterparty in payment for the requisite amount of ether. The ether acquired from the Ethereum Counterparty will be transferred to the Ethereum Custodian. After receipt of the ether by the Ethereum Custodian, the Transfer Agent will issue Creation Baskets of Shares to the creating Authorized Participant in satisfaction of the creation order.

When redeeming Creation Baskets, the Execution Agent will be responsible for selling the requisite amount of ether on behalf of the Trust on an agency basis. Once the Execution Agent selects an Ethereum Counterparty, the Ethereum Custodian will transfer ether to the Ethereum Counterparty in return for the requisite cash payment. The cash received from the Ethereum Counterparty will be delivered to the Cash Custodian. After receipt of the cash payment, the Transfer Agent will redeem the Shares and the Cash Custodian will distribute the resulting cash to the redeeming Authorized Participant in satisfaction of the redemption order.

In connection with both creation and redemption transactions, the Execution Agent, pursuant to the oversight of the Sponsor, will decide how and with which Ethereum Counterparty to transact on the Trust’s behalf. The Authorized Participants will deliver only cash to create Shares and will receive only cash when redeeming Shares. Further, Authorized Participants will not directly or indirectly purchase, hold, deliver, or receive ether as part of the creation or redemption process or otherwise direct the Trust or a third-party with respect to purchasing, holding, delivering, or receiving ether as part of the creation or redemption process. The Trust will create Shares by receiving ether from a third-party that is not the Authorized Participant and the Trust (through the Execution Agent, on an agency basis)—not the Authorized Participant—is responsible for selecting the third-party to deliver the ether. Further, the third-party will not be acting as an agent of the Authorized Participant with respect to the delivery of the ether to the Trust or acting at the direction of the Authorized Participant with respect to the delivery of the ether to the Trust. The Trust will redeem shares by delivering ether to a third-party that is not the Authorized Participant and the Trust (through the Execution Agent, on an agency basis)—not the Authorized Participant—is responsible for selecting the third-party to receive the ether. Further, the third-party will not be acting as an agent of the Authorized Participant with respect to the receipt of the ether from the Trust or acting at the direction of the Authorized Participant with respect to the receipt of the ether from the Trust.

Authorized Participants are expected to sell Shares to the public at prices that reflect, among other factors, the value of the Trust’s assets, supply of and demand for Shares and market conditions at the time of a transaction.

The Marketing Agent

Invesco Distributors, Inc. (the “Marketing Agent”) is responsible for: (1) working with the Transfer Agent to review and approve, or reject, purchase and redemption orders of Shares placed by Authorized Participants with the Transfer Agent; and (2) reviewing and approving the marketing materials prepared by the Trust for compliance with applicable SEC and Financial Industry Regulatory Authority (“FINRA”) advertising laws, rules, and regulations. The Marketing Agent’s principal address is 11 Greenway Plaza, Suite 1000, Houston, TX 77046.

Custody of the Trust’s Assets

The Ethereum Custodian will keep the private keys associated with the Trust’s ether in a “cold storage” environment where the private keys are generated and secured (the “Prime Custody Vault”). From time to time, such as when the Trust’s ether is being processed in connection with certain creation or redemption transactions or it is being sold, the Trust’s ether may be maintained in a trading account (the “Trading Balance”) with Coinbase, Inc. (“Coinbase” or the “Prime Broker”), an affiliate of the Ethereum Custodian. The Trust’s ether will be maintained by the Ethereum Custodian and Coinbase in accounts that are required to be segregated from the assets held by the Ethereum Custodian or Coinbase as principal and, when held in the Prime Custody Vault, the assets of their other customers. “Cold storage” refers to a safeguarding method by which the private keys corresponding to the Trust’s ethers are generated and stored in an offline manner using computers or devices that are not directly connected to the internet, which is intended to make them more resistant to hacking, or similarly secure technology. All of the Trust’s ether will be held in the Prime Custody Vault unless it is maintained in the Trading Balance in connection with certain creation or redemption transactions or it is being sold to pay the Sponsor Fee or Trust expenses not assumed by the Sponsor. The Trust will not participate in the proof-of-stake validation mechanism of the Ethereum network (i.e., the Trust will not “stake” its ether) to earn additional ether or seek other means of generating income from its ether holdings.

The ether in the Trust’s account at the Ethereum Custodian may be held across multiple wallets, any of which will feature the following safety and security measures to be implemented by the Ethereum Custodian:

Cold Storage: Cold storage in the context of ether means keeping the reserve of ether offline, which is a widely-used security precaution, especially when dealing with a large amount of ether. Ether held under custodianship with the Ethereum Custodian will be kept in high-security, offline, multi-layer cold storage vaults. This means that the private key materials, the cryptographic components that allow a user to access ether, are stored offline on hardware that has never been directly connected to the internet. Storing private key materials offline minimizes the risk of the ether being stolen. The Sponsor expects that all of the Trust’s ether will be held in cold storage of the Ethereum Custodian in the Prime Custody Vault on an ongoing basis, except as noted above. In connection with certain creations or redemptions, the Trust may process creations and redemptions by selling ether from its Prime Custody Vault balance.

Private Keys: All private keys are securely protected using multiple layers of high-quality encryption and in Ethereum Custodian-owned offline hardware in physically secure environments. No customers or third parties are given access to the Ethereum Custodian’s private keys.

Whitelisting: Transactions are only sent to vetted, known addresses. The Ethereum Custodian’s platform supports pre-approval and test transactions. The Ethereum Custodian requires authentication when adding or removing addresses for whitelisting. All instructions to initiate a whitelist addition or removal must be submitted via the Ethereum Custodian’s platform. When a whitelist addition or removal request is initiated, the initiating user will be prompted to authenticate their request using a two-factor authentication key. A consensus mechanism on the Ethereum Custodian’s platform dictates how many approvals are required in order for the consensus to be achieved to add or remove a whitelisted address. Only when the consensus is met is the underlying transaction considered officially approved. An account’s roster and user roles are maintained by the Ethereum Custodian in a separate log, an Authorized User List (“AUL”). Any changes to the account’s roster must be reflected on an updated AUL first and executed by an authorized signatory.

-5-

Table of Contents

Audit Trails: Audit trails exist for all movement of ether within Ethereum Custodian-controlled ether wallets and are audited annually for accuracy and completeness by an independent external audit firm.

In addition to the above measures, in accordance with the Ether Custody Agreement, ether held in custody with the Ethereum Custodian will be segregated from both the proprietary property of the Ethereum Custodian and the assets of any other customer in accounts that clearly identify the Trust as the owner of the accounts.

The Ethereum Custodian has insurance coverage as a subsidiary under its parent company, Coinbase Global, Inc., which procures fidelity (e.g., crime) insurance to protect the organization from risks such as theft of funds. Specifically, the fidelity program provides coverage for the theft of funds held in hot or cold storage. The insurance program is provided by a syndicate of industry-leading insurers. The insurance program does not cover, insure or guarantee the performance of the Trust. The Ethereum Custodian is not FDIC-insured.

The Trust relies on the Cash Custodian to hold or transfer any cash related to the purchase or sale of ether in connection with cash creation and redemption transactions, or held for payment of expenses not assumed by the Sponsor, such as the Sponsor Fee. In its role, the Cash Custodian helps facilitate the creations and redemptions of Shares done in exchange for cash.

Net Asset Value

NAV means the value of the total assets of the Trust including, but not limited to, all ether and cash (if any) less the total liabilities of the Trust (including accrued but unpaid expenses), divided by the number of outstanding Shares.

The Administrator determines the NAV of the Trust on each day that the Exchange is open for regular trading. In determining the Trust’s NAV, the Administrator values the ether held by the Trust based on the price established by the Benchmark Provider as of 4:00 p.m. ET each Business Day.

The amount of ether represented by the Shares will be reduced during the life of the Trust each time the Trust accrues the Sponsor Fee or pays for any extraordinary expenses. This dynamic will occur irrespective of whether the value of the Trust’s assets, or the trading price of the Shares, rises or falls. See “Risk Factors—Risks Related to the Trust and the Shares—The amount of ether represented by the Shares will decline over time” and “Calculation of NAV.”

Plan of Distribution

The Trust is an exchange-traded fund. Shareholders who decide to buy or sell Shares of the Trust will place their trade orders through their brokers and may incur customary brokerage commissions and charges, as well as any bid-ask spread. Such trades may occur at a premium or discount relative to the NAV of the Trust.

The Trust will process all creations and redemptions of Shares in transactions with financial firms that are authorized to do so (known as “Authorized Participants”). Creation and redemption transactions initially will take place in cash. Subject to Cboe in the future receiving the In-Kind Regulatory Approval, these transactions may also take place in exchange for ether. If Cboe receives the In-Kind Regulatory Approval and the Sponsor chooses to allow in-kind creations and redemptions, notice to Shareholders will be provided on the Trust’s website, in a prospectus supplement, through a current report on Form 8-K and/or in the Trust’s annual or quarterly reports.

When purchasing Creation Baskets, Authorized Participants will deliver cash to the Cash Custodian. The Execution Agent will be responsible for acquiring the requisite amount of ether on behalf of the Trust on an agency basis. Once the Execution Agent selects an Ethereum Counterparty, the Cash Custodian will transfer cash to the Ethereum Counterparty in payment for the requisite amount of ether. The ether acquired from the Ethereum Counterparty will be transferred to the Ethereum Custodian. After receipt of the ether by the Ethereum Custodian, the Transfer Agent will issue Creation Baskets of Shares to the creating Authorized Participant in satisfaction of the creation order.

When redeeming Creation Baskets, the Execution Agent will be responsible for selling the requisite amount of ether on behalf of the Trust on an agency basis. Once the Execution Agent selects an Ethereum Counterparty, the Ethereum Custodian will transfer ether to the Ethereum Counterparty in return for the requisite cash payment. The cash received from the Ethereum Counterparty will be delivered to the Cash Custodian. After receipt of the cash payment, the Transfer Agent will redeem the Shares and the Cash Custodian will distribute the resulting cash to the redeeming Authorized Participant in satisfaction of the redemption order.

Authorized Participants are expected to sell such Shares to the public at prices that reflect, among other factors, the value of the Trust’s assets, supply of and demand for Shares and market conditions at the time of a transaction.

Prior to this offering, there has been no public market for the Shares. The Shares are expected to be listed for trading, subject to notice of issuance, on the Exchange under the ticker symbol QETH.

Federal Income Tax Considerations

It is expected that owners of Shares will be treated, for U.S. federal income tax purposes, as if they own a proportionate share of the assets of the Trust, as if they directly receive a proportionate share of any income of the Trust, and as if they incur a proportionate share of the expenses of the Trust. Consequently, each sale of ether by the Trust (which includes, under current Internal Revenue Service guidance, using ether to pay expenses of the Trust, including the Sponsor Fee) would give rise to taxable gain or loss to Shareholders. See “U.S. Federal Income Tax Consequences—Taxation of U.S. Shareholders.”

-6-

Table of Contents

Use of Proceeds

Proceeds received by the Trust from the issuance of Creation Baskets will initially consist of cash deposits. Such cash deposits are held by the Cash Custodian on behalf of the Trust until (i) transferred in connection with the purchase of ether, (ii) delivered to Authorized Participants in connection with a redemption of Creation Baskets or (iii) transferred to pay the Sponsor Fee or for extraordinary expenses and liabilities not assumed by the Sponsor.

The Trust’s ether is held by the Ethereum Custodian (or held temporarily in the Trading Balance with Coinbase) on behalf of the Trust until sold by the Execution Agent to pay the Sponsor Fee or to pay for extraordinary expenses and liabilities not assumed by the Sponsor.

Ether and the Ethereum Network

Ether is a digital asset, also referred to as a digital currency or cryptocurrency, which serves as the unit of account on the open-source, decentralized, peer-to-peer Ethereum network (“Ethereum” or “Ethereum network”). Ether may be used to pay for goods and services, including to provide “gas” in connection with executing specific operations on the Ethereum network, stored for future use, or converted to a fiat currency, such as the U.S. dollar, at rates determined on digital asset trading platforms, or in individual end-user-to-end-user transactions under a barter system. In addition, ether is used to compensate node operators on the Ethereum network for using computational resources to confirm transactions and secure the network. Furthermore, the Ethereum network also allows users to write and implement smart contracts—that is, general-purpose code that executes on every computer in the network and can instruct the transmission of information and value based on a sophisticated set of logical conditions. Using smart contracts, users can create markets, store registries of debts or promises, represent the ownership of property, move funds in accordance with conditional instructions and create digital assets other than ether on the Ethereum network. Smart contract operations are executed on the Ethereum Blockchain in exchange for payment of ether. The Ethereum network is one of a number of projects intended to expand blockchain use beyond just a peer-to-peer money system. The value of ether is not backed by any government, corporation, or other identified body.

The value of ether is determined in part by the supply, of and demand for, ether in the markets for exchange that have been organized to facilitate the trading of ether. Ether is the second largest cryptocurrency by market capitalization behind bitcoin. As of [•], ether had a total market capitalization of approximately $[•] and represented approximately [•]% of the entire digital asset market. Ether is maintained on the Ethereum network. No single entity owns or operates the Ethereum network. The Ethereum network is accessed through software and governs ether’s creation and movement. The source code for the Ethereum network is open-source, and anyone can contribute to its development.

The Ethereum software source code allows for the creation of decentralized applications (“DApps”) that are supported by a transaction protocol referred to as “smart contracts,” which includes the cryptographic operations that verify and secure ether transactions. A smart contract operates by a predefined set of rules (i.e., “if/then statements”) that allows it to automatically execute code the same way on any Ethereum node on the network. Such actions taken by the predefined set of rules are not necessarily contractual in nature but are intended to eliminate the arbitration of a third party for carrying out code execution on behalf of users, making the system decentralized, while empowering developers to create a wide range of applications layering together different smart contracts. Although there are many alternatives, the Ethereum network is the oldest and largest smart contract platform in terms of market cap, availability of decentralized applications, and development activity. Smart contracts can be utilized across several different applications ranging from art to finance. Currently, one of the most popular applications is the use of smart contracts for underpinning the operability of decentralized financial services (“DeFi”), which consist of numerous highly interoperable protocols and applications. DeFi is believed by some to offer many opportunities for innovation and to have the potential to create an open, transparent, and immutable financial infrastructure, with democratized access.

Because the Ethereum network has no central authority, the release of updates to the network’s source code by developers does not guarantee that the updates will be automatically adopted by the other participants. Users and validators must accept any changes made to the source code by downloading the proposed modification and that modification is effective only with respect to those users and validators who choose to download it. As a practical matter, a modification to the source code becomes part of the Ethereum network only if it is accepted by participants that collectively have a majority of the processing power on the Ethereum network.

-7-

Table of Contents

If a modification is accepted by only a percentage of users and miners, a division will occur such that one network will run the pre-modification source code and the other network will run the modified source code. Such a division is known as a “fork.” A fork may be intentional such as the Ethereum “Merge.” The Merge represents the Ethereum Network’s shift from proof-of-work to proof-of-stake. This means that instead of being required to solve complex mathematical problems validators are required to stake ether.

New ether is created as a result of “staking” of ether by validators. Validators are required to stake ether in order to be selected to perform validation activities and then once selected, as a reward, they earn newly created ether. Validation activities include verifying transactions, storing data, and adding to the Ethereum blockchain. Investors must stake at least 32 ether to become an Ethereum validator. The Ethereum network provides the ability to execute peer-to-peer transactions to realize, via smart contracts, automatic, conditional transfer of value and information, including money, voting rights, and property.

Assets in the Ethereum network are held in accounts. Each account, or “wallet,” is made up of at least two components: a public address and a private key. An Ethereum private key controls the transfer or “spending” of ether from its associated public ether address. An ether “wallet” is a collection of public Ethereum addresses and their associated private key(s). This design allows only the owner of ether to send ether, the intended recipient of ether to unlock it, and the validation of the transaction and ownership to be verified by any third party anywhere in the world.

“Gas” refers to the unit that measures the amount of computational effort required to execute specific operations on the Ethereum network. Since each Ethereum transaction requires computational resources to execute, those resources have to be paid for to ensure Ethereum is not vulnerable to spam and cannot get stuck in infinite computational loops. Payment for computation is made in the form of a gas fee. The gas fee is the amount of gas used to do some operation, multiplied by the cost per unit gas. The Ethereum Improvement Proposal 1559 simplified the transaction fee process. Instead of performing complex calculations to estimate the gas, users instead pay an algorithmically determined transaction fee set by the protocol itself. Gas price is often a small fraction of ether, which is denoted in the unit of Gwei (10^9 Gwei = 1 ether). Gas is essential in sustaining the Ethereum network. It motivates validators to process and verify transactions for a monetary reward. Gas price fluctuates with supply and demand for processing power since validators can choose to not process transactions when gas prices are low. Gas has another important function in preventing unintentional waste of energy. Because the coding language for Ethereum is Turing-complete, there is a possibility of a program running indefinitely, and a transaction can be left consuming a lot of energy. A gas limit is imposed as the maximum price users are willing to pay to facilitate transactions. When gas runs out, the program will be terminated, and no additional energy would be used.

Ether may be regarded as a currency or digital commodity depending on its specific use in particular transactions. Ether may be used as a medium of exchange or unit of account. Although a number of large and small retailers accept ether as a form of payment in the United States and foreign markets, there is relatively limited use of ether for commercial and retail payments. Similarly, ether may be used as a store of value (i.e., an asset that maintains its value rather than depreciating), although it has experienced significant periods of price volatility.

There can be no assurance as to the future performance of ether; the past performance and volatility of ether should not be taken as an indication of future performance or volatility.

The Ethereum Market

Ether had a total market capitalization of approximately $[●] billion as of [●]. Ether spot trading occurs on venues in the U.S. that are licensed to conduct that business by the NYSDFS, other venues in the U.S. and non-U.S. venues. In addition, ether futures and options trading occurs on trading platforms in the U.S. regulated by the CFTC. The market for NYSDFS-licensed and CFTC-regulated trading of ether and ether derivatives has developed substantially. Ether market conditions in the three months ending on [●] are briefly summarized as follows:

| • | Ether: There are over 20 NYSDFS-licensed entities operating trading platforms with order books for spot trading of ether. Among the top NYSDFS-licensed trading platforms, year-to-date as-of [●], the average daily trading volume is approximately $[●] million. Across these venues, the average daily deviation of prices was less than [●]%. The largest NYSDFS-licensed trading platform by volume had an average bid-ask spread during the period of less than [●]%. |

| • | Futures: There are currently three CFTC-regulated trading platforms, two of which are open and facilitate trading of ether futures, with a total average daily trading volume of approximately $[●] billion. |

| • | Options: One CFTC-regulated trading platform facilitates trading of options on ether futures, with average monthly trading volume of approximately $[●] billion. |

-8-

Table of Contents

Principal Investment Risks of an Investment in the Trust

An investment in the Trust involves risks. You should consider carefully the risks summarized below, which are described in more detail under “Risk Factors.”

Shareholders may choose to use the Trust as means of investing indirectly in ether. Shareholders considering a purchase of Shares of the Trust should carefully consider how much of their total assets should be exposed to the ether market, and should fully understand, be willing to assume, and have the financial resources necessary to withstand, the risks involved in the Trust’s investment strategy, and be in a position to bear the potential loss of their entire investment in the Trust.

There is no assurance as to whether the Trust will be profitable or meet its expenses and liabilities. Any investment made in the Trust may result in a total loss of the investment.

Risks Related to Ether

Market and Volatility Risk. Ether has historically exhibited high price volatility relative to more traditional asset classes, which may be due to speculation regarding potential future appreciation in value. The value of the Trust’s investments in ether could decline rapidly, including to zero.

Some market observers have asserted that the ether market periodically experiences pricing “bubbles” and have predicted that, in time, the value of ether will fall to a fraction of its current value, or even to zero. Ether has not been in existence long enough for market participants to assess these predictions with any precision, but if these observers are even partially correct, an investment in the Shares may turn out to be substantially worthless.

Adoption Risk. The further development and acceptance of the Ethereum network, which is part of a new and rapidly changing industry, is subject to a variety of factors that are difficult to evaluate. The slowing, stopping or reversing of the development or acceptance of the Ethereum network may adversely affect the price of ether and therefore an investment in the Shares.

Currently, there is relatively limited use of ether in the retail and commercial marketplace in comparison to relatively extensive use as a store of value. Tax treatment of the use of ether as a medium of exchange and other factors could hinder expansion of ether into retail and commercial markets. A lack of expansion by ether into retail and commercial markets, or a contraction of such use, may result in damage to the public perception of ether and the utility of ether as a payment system, increased volatility or a reduction in the value of ether, all of which could adversely impact an investment in the Shares. Furthermore, while ether was among the first widely used digital assets, many other digital assets besides ether have also been created. To the extent market participants come to prefer these other digital assets, the value of ether, and therefore an investment in the Shares, may be adversely affected.

Regulatory Risk. Regulatory changes or actions may alter the nature of an investment in ether or restrict the use of ether or the operations of the Ethereum network or venues on which ether trades in a manner that adversely affects the price of ether and an investment in the Shares. For example, it may become difficult or illegal to acquire, hold, sell or use ether in one or more countries, which could adversely impact the price of ether.

-9-

Table of Contents

Cybersecurity Risk Related to Ether. In the past, flaws in the source code for ether have been discovered, including those that resulted in the theft of users’ ether. Several errors and defects have been publicly found and corrected, including those that disabled some functionality for users and exposed users’ personal information. Discovery of flaws in or exploitations of the source code that allow malicious actors to take or create money in contravention of known network rules has occurred.

Additionally, if a malicious actor or botnet (i.e., a volunteer or hacked collection of computers controlled by networked software coordinating the actions of the computers) obtains control of more than 50% of the processing power of the Ethereum network, such actor or botnet could alter the digital transaction ledger, or “blockchain,” that records transactions in and ownership of ether and adversely affect the value of ether.

By using computers that appear to be participating in the Ethereum network, but that are not in fact connected to the network (so-called “cancer nodes”), a malicious actor can disconnect the target user from the ether economy entirely by refusing to relay any blocks or transactions.

Separate from the cybersecurity risks of the Ethereum protocol, entities that custody or facilitate the transfers or trading of ether have been frequent and successful targets of cybersecurity attacks, leading to significant theft of ether. If any of these exploitations or attacks occur, it could result in a loss of public confidence in ether, a decline in the value of ether and, as a result, adversely impact an investment in the Shares.

Risks Related to the Trust and the Shares

Expense Risk. The Trust’s returns will not match the performance of ether because the Trust incurs the Sponsor Fee and may incur other expenses.

Risk That Market Price of Shares May Reflect a Discount or Premium to NAV. The NAV of the Trust may not always correspond to the market price of its Shares for a number of reasons, including price volatility, levels of trading activity, differences between the normal trading hours for the Trust and the underlying ether market, the calculation methodology of the NAV, demand or supply for Shares of the Trust in excess of an Authorized Participant’s ability to create or redeem Shares and/or the closing of ether trading platforms due to fraud, failure, security breaches or otherwise. As a result, the NAV of the Shares included in Creation Baskets may differ from the market price of the Shares.

-10-

Table of Contents