UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

OR

For the fiscal year ended

OR

OR

For the transition period from to

Commission file number:

(Exact name of Registrant as specified in its charter)

(Jurisdiction of incorporation or organization)

T5@

(Address of principal executive offices)

T5@

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each

of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

☐

Yes ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

☐

Yes ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

☒

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | ☒ | |

| Accelerated filer | ☐ | Emerging growth company |

If an emerging growth company that prepares its

financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition

period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange

Act.

Indicate by check mark whether the registrant

has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or

issued its audit report.

If securities are registered pursuant to Section

12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction

of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| International Financial Reporting Standards as issued | Other ☐ | |

| by the International Accounting Standards Board ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities Exchange Act of 1934).

☐

Yes

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

☐ Yes ☐ No

Table of Contents

i

INTRODUCTION

Except where the context otherwise requires and for purposes of this annual report only the term:

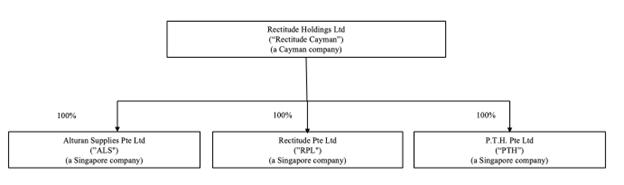

“ALS” means Alturan Supplies Pte. Ltd., a company incorporated in Singapore on September 15, 2009, and a wholly owned subsidiary of our Company.

“Amended and Restated Memorandum and Articles of Association” means collectively the Amended and Restated Memorandum of Association and Amended and Restated Articles of Association.

“Amended and Restated Articles of Association” means the amended and restated articles of association of our Company adopted on October 3, 2023, as amended from time to time.

“Amended and Restated Memorandum of Association” means the amended and restated memorandum of association of our Company adopted on October 3, 2023, as amended from time to time.

“Business Day” means a day (other than a Saturday, Sunday or public holiday in the U.S.) on which licensed banks in the U.S. are generally open for normal business to the public.

“CAGR” means compound annual growth rate.

“Chinese Yuan” means the lawful currency of the People’s Republic of China.

“Company,” “our Company,” or “Rectitude Cayman” means Rectitude Holdings Ltd, a exempted company incorporated in the Cayman Islands with limited liability on June 1, 2023.

“Companies Act” means the Companies Act (As Revised) of the Cayman Islands.

“COVID-19” means the Coronavirus Disease 2019.

“Directors” means the directors of our Company as at the date of this annual report, unless otherwise stated.

“Exchange Act” means the United States Securities Exchange Act of 1934, as amended.

“Executive Directors” means the executive Directors of our Company as at the date of this annual report, unless otherwise stated.

“Executive Officers” means the executive officers of our Company as at the date of this annual report, unless otherwise stated.

“Group,” “our Group,” “we,” “us,” or “our” means our Company and its subsidiaries or any of them, or where the context so requires, in respect of the period before our Company becoming the holding company of its present subsidiaries, such subsidiaries as if they were subsidiaries of our Company at the relevant time or the businesses which have since been acquired or carried on by them or as the case may be their predecessors.

“Independent Directors Nominees” means the independent non-executive director nominees of our Company as at the date of this annual report, unless otherwise stated.

“Independent Third Party” means a person or company who or which is independent of and is not a 5% owner of, does not control and is not controlled by or under common control with any 5% owner and is not the spouse or descendant (by birth or adoption) of any 5% owner of the Company.

ii

“JTC” means JTC Corporation, the lead government agency responsible for the management and development of industrial infrastructure in Singapore, as established under the Jurong Town Corporation Act 1968 of Singapore.

“MOM” means the Ministry of Manpower of Singapore.

“PRC” means the People’s Republic of China.

“PTH” means P.T.H. Pte. Ltd., a company incorporated in Singapore on November 3, 2008, and a wholly owned subsidiary of our Company.

“RPL” means Rectitude Pte Ltd, a company incorporated in Singapore on December 26, 1997, and a wholly owned subsidiary of our Company.

“S$” or “SGD” or “Singapore Dollars” means Singapore dollar(s), the lawful currency of Singapore.

“SEC” or “Securities and Exchange Commission” means the United States Securities and Exchange Commission.

“Securities Act” means the U.S. Securities Act of 1933, as amended.

“Singapore Companies Act” means the Companies Act 1967 of Singapore, as amended, supplemented or modified from time to time.

“WSH” means the Workplace Safety and Health Council of Singapore, a statutory body under the MOM.

“US$,” or “USD” or “United States Dollars” means United States dollar(s), the lawful currency of the United States of America.

Rectitude Holdings Ltd is a holding company that is incorporated in the Cayman Islands. As a holding company with no operations, we conduct all of our operations through our wholly-owned subsidiaries in Singapore. Our reporting currency is the U.S. Dollar. This annual report also contains translations of certain foreign currency amounts into U.S. dollars for the convenience of the reader. Assets and liabilities denominated in foreign currencies are translated at year-end exchange rates, income statement accounts are translated at average rates of exchange for the year and equity is translated at historical exchange rates. Any translation gains or losses are recorded in foreign currency translation reserve. Gains or losses resulting from foreign currency transactions are included in net income. The conversion of Singapore dollars into U.S. dollars are based on the exchange rates set forth in the H10 statistical release of the Federal Reserve Board. Unless otherwise stated, all translations of Singapore dollars into U.S. dollars for the financial year ended March 31, 2024 were made at S$1.3475 to US$1.00 and, the exchange rate set forth in the H10 statistical release of the Federal Reserve Board on March 31, 2024.

We obtained the industry and market data used in this annual report or any document incorporated by reference from industry publications, research, surveys and studies conducted by third parties and our own internal estimates based on our management’s knowledge and experience in the markets in which we operate. We did not, directly or indirectly, sponsor or participate in the publication of such materials, and these materials are not incorporated in this annual report other than to the extent specifically cited in this annual report. We have sought to provide current information in this annual report and believe that the statistics provided in this annual report remain up-to-date and reliable, and these materials are not incorporated in this annual report other than to the extent specifically cited in this annual report.

iii

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

This annual report contains forward-looking statements that reflect our current expectations and views of future events, all of which are subject to risks and uncertainties. Forward-looking statements give our current expectations or forecasts of future events. You can identify these statements by the fact that they do not relate strictly to historical or current facts. You can find many (but not all) of these statements by the use of words such as “approximates,” “believes,” “hopes,” “expects,” “anticipates,” “estimates,” “projects,” “intends,” “plans,” “will,” “would,” “should,” “could,” “may” or other similar expressions in this annual report. These statements are likely to address our growth strategy, financial results and product and development programs. You must carefully consider any such statements and should understand that many factors could cause actual results to differ from our forward-looking statements. These factors may include inaccurate assumptions and a broad variety of other risks and uncertainties, including some that are known and some that are not. No forward-looking statement can be guaranteed and actual future results may vary materially. Factors that could cause actual results to differ from those discussed in the forward-looking statements include, but are not limited to:

| ● | our goals and strategies; | |

| ● | our future business development, financial condition and results of operations; | |

| ● | introduction of new product and service offerings; | |

| ● | expected changes in our revenues, costs or expenditures; | |

| ● | our expectations regarding the demand for and market acceptance of our products and services; | |

| ● | expected growth of our customers, including consolidated account customers; | |

| ● | competition in our industry; | |

| ● | government policies and regulations relating to our industry; | |

| ● | the length and severity of the recent COVID-19 outbreak and its impact on our business and industry | |

| ● | any recurrence of the COVID-19 pandemic and scope of related government orders and restrictions and the extent of the impact of the COVID-19 pandemic on the global economy; | |

| ● | other factors that may affect our financial condition, liquidity and results of operations; and | |

| ● | other risk factors discussed under “Item 3. Key Information - 3.D. Risk Factors.” |

We base our forward-looking statements on our management’s beliefs and assumptions based on information available to our management at the time the statements are made. We caution you that actual outcomes and results may, and are likely to, differ materially from what is expressed, implied or forecast by our forward-looking statements. Accordingly, you should be careful about relying on any forward-looking statements. Except as required under the federal securities laws, we do not have any intention or obligation to update publicly any forward-looking statements after the distribution of this annual report, whether as a result of new information, future events, changes in assumptions, or otherwise.

iv

PART I

Item 1. Identity of Directors, Senior Management and Advisers

Not applicable for annual reports on Form 20-F.

Item 2. Offer Statistics and Expected Timetable

Not applicable for annual reports on Form 20-F.

Item 3. Key Information

3.A. Reserved

3.B. Capitalization and Indebtedness

Not applicable for annual reports on Form 20-F.

3.C. Reasons for the Offer and Use of Proceeds

Not applicable for annual reports on Form 20-F.

3.D. Risk Factors

Risk Factor Summary

You should carefully consider all of the information in this annual report before making an investment in our Ordinary Shares. Below please find a summary of the principal risks and uncertainties we face, organized under relevant headings. Our business is subject to a number of risks, including risks that may prevent us from achieving our business objectives or may adversely affect our business, financial condition, results of operations, cash flows, and prospects. These risks are discussed more fully below and include, but are not limited to, risks related to:

Risks related to Our Business and Industry

| ● | We are affected by regional and worldwide political, regulatory, social and economic conditions in the jurisdictions in which we and our customers and suppliers operate and in the jurisdictions which we intend to expand our business in (on page 4). | |

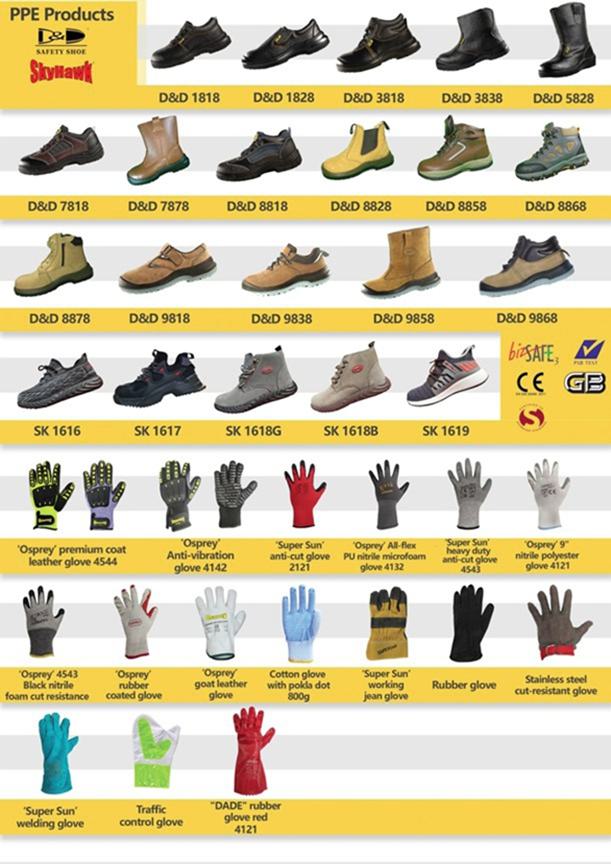

| ● | We are dependent on the need to continually maintain a wide range of safety equipment which are relevant to our customers’ needs (on page 4). |

| ● | We are susceptible to fluctuations in the prices and quantity of available safety equipment and industrial grade hardware (on page 5). |

| ● | Our continued success is dependent on our key management personnel and our experienced and skilled personnel, and our business may be severely disrupted if we are unable to retain them or to attract suitable replacements (on page 5). |

| ● | Our reputation and profitability may be adversely affected if there are major failures or malfunction in our safety equipment sold by or sold to our customers (on page 5). |

1

| ● | A significant failure or deterioration in our quality control systems could have a material adverse effect on our business and operating results (on page 5). |

| ● | We are exposed to disputes and claims arising from site accidents due to the usage of our safety equipment (on page 6). |

| ● | We may be affected if we are found to be in breach of any lease agreements entered into by us (on page 6). |

| ● | Increased competition in the safety equipment sales and rental business in Singapore and the region may affect our ability to maintain our market share and growth (on page 6). |

| ● | We are exposed to the credit risks of our customers (on page 6). |

| ● | Our business is subject to supply chain interruptions (on page 7). |

| ● | Our business and operations may be materially and adversely affected in the event of a re-occurrence or a prolonged global pandemic outbreak of COVID-19 (on page 8). |

| ● | We may be affected by an outbreak of other infectious diseases (on page 8). |

| ● | We are exposed to risks arising from fluctuations of foreign currency exchange rates (on page 8). |

| ● | We and/or our customers may not be able to obtain the necessary approvals or certifications for the use of our safety equipment in various jurisdictions (on page 8). |

| ● | We are subject to environmental, health and safety regulations and penalties, and may be adversely affected by new and changing laws and regulations (on page 9). |

| ● | Our insurance policies may be inadequate to cover our assets, operations and any loss arising from business interruptions (on page 9). |

| ● | We may be harmed by negative publicity (on page 9). |

| ● | If we are unable to maintain and protect our intellectual property, or if third parties assert that we infringe on their intellectual property rights, our business could suffer (on page 9). |

| ● | We are exposed to risks in respect of acts of war, terrorist attacks, epidemics, political unrest, adverse weather conditions and other uncontrollable events (on page 10). |

| ● | We may not be able to successfully implement our business strategies and future plans (on page 10). |

| ● | We are subject to risks related to product recalls, and our operation results and financial condition would suffer if we fail to adequately manage such risks (on page 10). |

2

Risks related to our Securities

| ● | An active trading market for our Ordinary Shares may not continue and the trading price for our Ordinary Shares may fluctuate significantly (on page 11). | |

| ● | We may not maintain the listing of our Ordinary Shares on Nasdaq which could limit investors’ ability to make transactions in our Ordinary Shares and subject us to additional trading restrictions (on page 11). |

| ● | The trading price of our Ordinary Shares may be volatile, which could result in substantial losses to investors (on page 11). |

| ● | Certain recent initial public offerings of companies with public floats comparable to the anticipated public float of our Company have experienced extreme volatility that was seemingly unrelated to the underlying performance of the respective company. We may experience similar volatility. Such volatility, including any stock-run up, may be unrelated to our actual or expected operating performance and financial condition or prospects, making it difficult for prospective investors to assess the rapidly changing value of our Ordinary Shares (on page 12). |

| ● | If securities or industry analysts do not publish research or reports about our business causing us to lose visibility in the financial markets or if they adversely change their recommendations regarding our Ordinary Shares, the market price for our Ordinary Shares and trading volume could decline (on page 12). |

| ● | Because we do not expect to pay dividends in the foreseeable future, you must rely on price appreciation of our Ordinary Shares for a return on your investment (on page 13). |

| ● | Short selling may drive down the market price of our Ordinary Shares (on page 13). |

| ● | If we are classified as a passive foreign investment company, United States taxpayers who own our securities may have adverse United States federal income tax consequences (on page 13). |

| ● | Our Controlling Shareholders have substantial influence over the Company. Their interests may not be aligned with the interests of our other shareholders, and they could prevent or cause a change of control or other transactions (on page 14). |

| ● | As a “controlled company” under the rules of Nasdaq Capital Market, we may choose to exempt our Company from certain corporate governance requirements that could have an adverse effect on our public shareholders (on page 14). |

| ● | As a company incorporated in the Cayman Islands, we are permitted to follow certain home country practices in relation to corporate governance matters in lieu of certain requirements under Nasdaq corporate governance listing standards. These practices may afford less protection to shareholders than they would enjoy if we complied fully with Nasdaq corporate governance listing standards (on page 14). |

| ● | You may face difficulties in protecting your interests, and your ability to protect your rights through U.S. courts may be limited, because we are incorporated under Cayman Islands law (on page 15). |

| ● | Certain judgments obtained against us or our auditor by our shareholders may not be enforceable (on page 15). |

| ● | We are an emerging growth company within the meaning of the Securities Act and may take advantage of certain reduced reporting requirements (on page 16). |

| ● | We are a foreign private issuer within the meaning of the Exchange Act, and as such we are exempt from certain provisions applicable to United States domestic public companies (on page 16). |

| ● | We may lose our foreign private issuer status in the future, which could result in significant additional costs and expenses to us (on page 16). |

| ● | Our compensation of directors and officers may not be publicly available (on page 17). |

| ● | We will incur significantly increased costs and devote substantial management time as a result of the listing of our Ordinary Shares on Nasdaq (on page 17). |

3

Risks Related to our Business and Industry

We are affected by regional and worldwide political, regulatory, social and economic conditions in the jurisdictions in which we and our customers and suppliers operate and in the jurisdictions which we intend to expand our business in.

We and our customers and suppliers are governed by the laws, regulations, and government policies in each of the various jurisdictions in which we and our customers and suppliers operate or into which we intend to expand our business and operations. Our business and future growth are dependent on the political, regulatory, social and economic conditions in these jurisdictions, which are beyond our control. Any economic downturn, changes in policies, currency and interest rate fluctuations, capital controls or capital restrictions, labor laws, changes in environmental protection laws and regulations, duties and taxation and limitations on imports and exports in these countries may materially and adversely affect our business, financial condition, results of operations and prospects.

Generally, we fund our purchases of safety equipment and industrial grade hardware products via our internal resources and short and long-term financing from banks and other financial institutions. Any disruption, uncertainty and volatility in the global credit markets may limit our ability to obtain the required working capital and financing for our business at reasonable terms and finance costs. If all or a substantial portion of our credit facilities are withdrawn and we are unable to secure alternative funding on acceptable commercial terms, our operations and financial position will be adversely affected. The interest rates for most of our credit facilities are subject to review from time to time by the relevant financial institutions. Given that we rely on these credit facilities to finance our purchase of safety equipment and that interest expenses represent a significant percentage of our expenses, any increase in the interest rates of the credit facilities extended to us may have a material adverse impact on our profitability.

In addition, such fluctuations and volatility in the global credit markets could limit credit lines of our current and potential customers from banks or financial institutions. Accordingly, such customers may not be able to obtain sufficient financing to purchase our safety equipment, or we may be required to lower our rates in order to cater to our customers’ current situation. This may have an adverse impact on our revenue and financial performance.

We are dependent on the need to continually maintain a wide range of safety equipment which are relevant to our customers’ needs.

The needs and preferences of our customers in terms of types and specifications of safety equipment may change as a result of evolving laws, regulations, standards and requirements and new developments in technology. Our future success depends on our ability to obtain and provide safety equipment that meet the evolving market demands of our customers. The preferences and purchasing patterns of our customers can change rapidly due to technological developments in their respective industries. There is no assurance that we will be able to respond to changes in the specifications of our customers in a timely manner. Our success depends on our ability to adapt our products to the requirements and specifications of our customers. There is also no assurance that we will be able to respond to changes sufficiently and promptly in customer preferences to make corresponding adjustments to our products or services, and failing to do so may have a material and adverse effect on our business, financial condition, results of operations and prospects.

As of March 31, 2023 and March 31, 2024, we had inventories of S$5.8 million and S$6.2 million respectively. Our revenue relies on customer demand for our safety equipment. Depending on the progress of technological development of safety equipment, our existing safety equipment may become prematurely obsolete or phased out. Any change in customer demand for our products may have an adverse impact on our product sales, which may in turn lead to inventory obsolescence, decline in inventory value or inventory write-off. In that case, our business, financial condition, results of operations and prospects may be materially and adversely affected.

4

We are susceptible to fluctuations in the prices and quantity of available safety equipment and industrial grade hardware.

We are exposed to fluctuations in the prices of safety equipment and industrial grade hardware. In the event that we are not able to source any specific product at acceptable prices, or if we face any delays or shortages in obtaining sufficient quantity of products, this may have a negative impact on our profitability.

Our continued success is dependent on our key management personnel and our experienced and skilled personnel, and our business may be severely disrupted if we are unable to retain them or to attract suitable replacements.

Since the commencement of our business, our Executive Director, Chairman and Chief Executive Officer, Mr. Zhang Jian has been instrumental in expanding our business from dealing with industrial grade hardware in 1997 to providing our current wide range of products and services in respect of safety equipment and electrical products today. We rely on the wide network and contacts of Mr. Zhang, which was built over the past two decades, in particular, sourcing for new safety equipment from new and existing suppliers and sales of our safety equipment.

Our performance depends on the continued service and performance of Mr. Zhang because he plays an important role in guiding the implementation of our business strategies and future plans. The working and business relationships that Mr. Zhang has developed with our main suppliers and customers over the years is important for the future development of our business. If Mr. Zhang were to terminate his employment, there is no assurance that we would be able to find suitable replacements with such a vast network of contacts in a timely manner. The loss of services of Mr. Zhang and/or the inability to identify, hire, train and retain other qualified technical and operations personnel in the future may materially and adversely affect our business, financial condition, results of operations and prospects.

In addition, although we are dependent on certain key personnel, we do not have any key man life insurance policies on any such individual. Therefore, if any of our key management personnel dies or become disabled, we will not receive any compensation to assist with such individual’s absence. The loss of such person could materially and adversely affect our business, financial condition, results of operations and growth prospects.

Our reputation and profitability may be adversely affected if there are major failures or malfunction in our safety equipment sold by or sold to our customers.

Our operations are exposed to the risk of equipment failure which may arise due to wear and tear, quality control, risk of failure by our customers to follow procedures and protocols, as well as inherent risks in our customer’s operating environments, resulting in personal injury of the user of our safety equipment. In the event of such equipment failure, we may be forced to cease all, or part of our operations and we may be subject to legal and regulatory liabilities and actions such as directives, penalties, sanctions, or significant costs and expenses in any dispute as a result of such equipment failure. This may have an adverse impact on our operations and financial performance.

Since our establishment, we believe that we have built goodwill in our brands and thus customer loyalty. Hence, if there are any major lapses in our equipment sales and or due to circumstances beyond our control resulting in negative publicity, our reputation may be adversely affected, and our customers may lose confidence in our equipment. In such an event, our business and hence our profitability and financial performance may be adversely affected.

A significant failure or deterioration in our quality control systems could have a material adverse effect on our business and operating results.

The quality and safety of our products are critical to the success of our business and operations. As such, it is imperative that our (and our service providers’) quality control systems operate effectively and successfully. Quality control systems can be negatively impacted by the design of the quality control systems, the quality training programs and adherence by employees to quality control guidelines. Although we strive to ensure that all of our service providers have implemented and adhere to high-quality control systems, any significant failure or deterioration of such quality control systems could have a material adverse effect on our business and operating results.

5

We are exposed to disputes and claims arising from site accidents due to the usage of our safety equipment.

The infrastructure, building construction, and marine, and oil and gas industries are high-risk industries in which risks of accidents and fatalities are more likely to occur. Claims may be made against us for such job site accidents and/or fatalities on grounds caused by, inter alia, defective or malfunctioning safety equipment. In the event that we are required to pay damages arising from disputes, our reputation and profitability will be adversely affected.

Although we have sought to minimize the risk of such liabilities by regular inspection of the safety equipment we import from our suppliers, we believe that it is not possible for us to guard against every equipment defect or malfunction. If any accidents are not covered by our insurance policies and claims arising from such accidents are in excess of our insurance coverage or if any of our insurance claims are contested by any insurance company, we may be required to pay for such compensation, which may have a material and adverse impact on our financial performance. In addition, the payment by our insurers of such insurance claims may result in increases in the premiums payable by us for our insurance. This will also increase the costs of our operations and adversely affect our financial performance.

We may be affected if we are found to be in breach of any lease agreements entered into by us.

We have leased certain of our real properties from JTC and are subject to certain terms and conditions in respect of these real properties, such as the requirement to obtain approval from JTC for subletting. As such, we may be exposed to regulatory and enforcement risks, including but not limited to potentially costly fines, if we are found to be in breach of any of the terms and conditions of our leases.

Increased competition in the safety equipment business in Singapore and the region may affect our ability to maintain our market share and growth.

We operate in the safety equipment sales business, which is highly competitive. Our competitors may possess greater financial resources and more up-to-date equipment with better specifications. They may also have a larger customer base and offer a wider range of safety equipment coupled with greater marketing resources.

Entry of new competitors in the market or market consolidation could also increase the degree of competition within the industry. Our continued success depends on our ability to compete with our competitors as well as to be able to compete successfully in the future against existing or potential competitors or to adapt to changes in market conditions and demands. In the event we are unable to compete successfully against existing or potential competitors or to adapt to changes in market conditions and demands, our business and financial performance may be adversely affected.

We maintain good working relationships with our suppliers and customers and have a wide range of safety equipment for our customers’ needs. However, there is no assurance that our existing suppliers and customers will renew their agreements or continue to work with us. In the event our suppliers and customers choose to work with our competitors and/or our experienced and skilled employees choose to join our competitors, we may not be able to maintain our competitive position, and our business, financial condition, results of operations, and prospects may be materially and adversely affected.

We are exposed to the credit risks of our customers.

We extend credit terms to some of our customers. Our average accounts receivable turnover days were approximately 108 days, and 109 days for the financial year ended March 31, 2023, and 2024, respectively. Our customers may be unable to meet their contractual payment obligations to us, either in a timely manner or at all. The reasons for payment delays, cancellations, or default by our customers may include insolvency or bankruptcy, or insufficient financing or working capital due to late payments by their respective customers. While we did not experience any material order cancellations by our customers during the financial year ended March 31, 2022, 2023 and 2024, there is no assurance that our customers will not cancel their orders and/or refuse to make payment in the future in a timely manner or at all. We may not be able to enforce our contractual rights to receive payment through legal proceedings. In the event that we are unable to collect payments from our customers, we are still obliged to pay our suppliers in a timely manner and thus our business, financial condition and results of operations may be adversely affected.

6

Our business is subject to supply chain interruptions.

We work with third-party logistic providers for the import, export, and transportation of our safety equipment and industrial-grade hardware. We rely on such third-party service providers’ abilities to deliver our safety equipment as part of the supply chain logistics. The factors that can adversely affect our operations include, but are not limited to:

| ● | interruptions to our delivery capabilities; |

| ● | failure of third-party service providers to meet our standards or their commitments to us; |

| ● | increasing transportation costs, shipping constraint or other factors that could impact cost, such as having to find more expensive service providers which may or may not be readily available; and |

| ● | the COVID-19 and disruptions as a result of efforts to control or mitigate the pandemic (such as facility closures, governmental orders, outbreaks and/or transportation capacity). |

Our results of operations and capital resources have not been materially impacted by supply chain interruptions during the financial years ended March 31, 2022, 2023, and 2024 and there have not been any material impact for the financial years ended March 31, 2022, 2023 and 2024 because we have locked in the prices of most of our sales orders during these time periods. However, any increased costs from delays, cancellations, and insurance, or disruption to, or inefficiency in, the supply chain network of our third-party service providers, whether due to geopolitical conflicts, or other factors, could affect our revenue and profitability.

For the financial years ended March 31, 2022, 2023 and 2024, our business segments, products, lines of service, projects, or operations were not materially impacted by supply chain disruptions, especially in light of Russia’s invasion of Ukraine and the effectiveness of the Uyghur Forced Labor Protection Act (“UFLPA”). Moving forward, we also do not expect to experience such supply chain disruptions in the future because we source our goods from a number of suppliers. To the best of our knowledge, we have not received any information from our suppliers pertaining to any present or potential supply chain disruptions as well. Pertaining to the UFLPA, we understand from our suppliers based in the People’s Republic of China (PRC) that the safety products we have procured are not derived from raw materials obtained from forced labor in China’s Xinjiang Uyghur Autonomous Region. We intend to inform our suppliers of this material preference when placing orders and are considering plans to impose this as a non-negotiable term of our orders in the coming months. Should the opportunity arise, we plan to source more of our products from manufacturers and suppliers outside of the PRC to further diversify our supply chains.

Our business model does not heavily rely on third-party software or services, particularly those that are directly integrated into our products or operations. This reduces our dependency on external technology and lessens the potential impact of cybersecurity breaches or disruptions originating from these third-party entities. Additionally, our emphasis on physical retail shops and warehouses provides an inherent buffer against cyberattacks. Currently, we only receive a small number of inquiries via our website at www.rectitude.com.sg. Sales to end users through e-commerce platforms such as Shopee and Lazada are also minimal, total amounting only to S$30,057, S$17,085 and S$26,003 (US$19,297), for the financial years ended March 31, 2022, 2023, and 2024 with sales via our physical stores and through third party vendors accounting for the rest of our sales. While data breaches and operational disruptions can still occur, the physical presence of our business allows for alternative methods of product distribution and customer service, reducing the overall impact of cybersecurity related incidents on our operations. Despite our perception of the lower risk of cybersecurity related incidents materially affecting our operations, we plan to prioritize the implementation of cybersecurity measures to maintain a secure and reliable business environment. For example, we plan to (i) conduct more rigorous assessments of potential suppliers’ cybersecurity practices, including penetration testing and vulnerability assessments; (ii) incorporate cybersecurity clauses into our business contracts; (iii) include specific security requirements and data protection protocols in our vendor contracts to ensure consistent cybersecurity standards across our supply chain; (iv) educate our employees on cybersecurity threats by providing training for employees to recognize and report phishing attempts, social engineering tactics, and other cyber threats; and (v) implement cybersecurity awareness tools and simulations to test employees’ knowledge and response to potential threats. By implementing these measures, we hope that our ability to respond to and recover from any eventual cybersecurity incidents will be enhanced.

7

Our business and operations may be materially and adversely affected in the event of a re-occurrence or a prolonged global pandemic outbreak of COVID-19.

The global pandemic outbreak of COVID-19 announced by the World Health Organization in early 2020 had disrupted our operations, and the operations of our customers, suppliers, and/or sub-contractors. If the development of the COVID-19 outbreak becomes more severe and/or new variants of COVID-19 evolve to be more transmissible and virulent than the existing strains, this may result in a re-tightening of restrictions and regulations on businesses. If we or our customers, suppliers, and sub-contractors are forced to close their businesses with prolonged disruptions to their operations, we may experience a delay or shortage of supplies and/or services by our suppliers and sub-contractors, or termination of our orders and contracts by our customers. In addition, if any of our employees are suspected of having contracted COVID-19, some or all of our employees may be quarantined thus causing a shortage of labor and we will be required to disinfect our workplace and our production and processing facilities. In such event, our operations may be severely disrupted, which may have a material and adverse effect on our business, financial condition, and results of operations.

In addition, we have also faced difficulties in hiring suitable manpower from overseas jurisdictions due to travel restrictions imposed by the Singapore Government as a result of the COVID-19 pandemic during the financial years ended December 31, 2023 and 2022 respectively. While the situation has greatly improved for the financial year 2024, this has led to a stagnation in our workforce strength for the financials years ended December 31, 2023 and 2022, thereby affecting our potential growth as we rely heavily on manual labor. We have since taken measures to mitigate the impact of potential shortages in the future by introducing robots to our operations. For example, at our hardware store and warehouse located at Defu Industrial City, #03-28, 8 Defu South Street 1, Singapore 533758, we have engaged the use of robots that are able to engage in simple tasks such as customer reception, displaying the availability and description of various products available in the store and direct customers to the shelf where a particular product is located. This reduces the number of workers we require at the store.

We may be affected by an outbreak of other infectious diseases.

An outbreak of infectious diseases such as severe acute respiratory syndrome and avian influenza or new forms of infectious diseases in the future may potentially affect our operations as well as the operations of our customers and suppliers. In the event that any of the employees in any of our offices or worksites or those of our customers and suppliers are affected by any infectious disease, we or our customers and suppliers may be required to temporarily shut down our or their offices or worksites to prevent the spread of the diseases. This may have an adverse impact on our revenue and financial performance.

We are exposed to risks arising from fluctuations in foreign currency exchange rates.

Our reporting currency is Singapore dollars. Our overseas sales is denominated in Singapore Dollars and procurement from our overseas suppliers are denominated in Chinese Yuan. We may be exposed to foreign currency exchange gains or losses arising from transactions in currencies other than our reporting currency.

We and/or our customers may not be able to obtain the necessary approvals or certifications for the use of our safety equipment in various jurisdictions.

Various jurisdictions may require different licenses, approvals and certifications for the use and operation of certain safety equipment, such as in Singapore, Malaysia, Cambodia and Australia.

As we offer safety equipment and firefighting equipment to our customers within Singapore, we will need to maintain such approvals and certifications in order to carry out such services. In addition, we are guided by a set of safety regulations imposed on us as described in the “4.B. Business Overview — Regulation” section on page 19 below. We are subject to monetary fines and/or other penalties if there is an infringement of any of the applicable safety regulations. Our business operations are regulated by various governmental bodies and authorities in Singapore as disclosed in “Item 4.B. Business Overview — Regulation” section of this annual report on page 32. Any such new regulations or any imposition of new licensing requirements that may be applicable to our business operations and/or the products that we supply may have an adverse impact on our operations and financial performance.

8

In addition, compliance with changes in government legislation, regulations, or policies may increase our costs and any significant increase in compliance costs arising from such changes may adversely affect our financial performance. In such event, our business and profitability would be materially and adversely affected.

We are subject to environmental, health, and safety regulations and penalties, and may be adversely affected by new and changing laws and regulations.

We are subject to laws, regulations, and policies relating to the protection of the environment and to workplace health and safety. We are required to adopt measures to control the discharge of polluting matters, wastewater discharge and hazardous substances, and noise at our servicing and maintenance workshop and storage facilities in accordance with such applicable laws and regulations and to implement such measures that ensure the safety and health of our employees. Changes to current laws, regulations, or policies or the imposition of new laws, regulations, and policies in the safety equipment industry could impose new restrictions or prohibitions on our current practices. We may incur significant costs and expenses and need to budget additional resources to comply with any such requirements, which may have a material and adverse effect on our business, financial condition, results of operations, and prospects.

Our insurance policies may be inadequate to cover our assets, operations, and any loss arising from business interruptions.

We face the risk of loss or damage to our equipment due to fire, theft, or other natural disasters in Singapore. Such events may also cause a disruption or cessation in our business operations, and thus may adversely affect our financial results. Our insurance coverage may not be sufficient to cover all of our potential losses. If there are losses that exceed the insurance coverage or are not covered by our insurance policies, we will remain liable for any liability, debt, or other financial obligation related to such losses. We do not have any insurance coverage for business interruptions.

Due to the nature of our operations, there is also a risk of accidents occurring either to our employees or to third parties on our customers’ job sites during the course of operations. In the event that any claims arise in respect of such occurrences and liability for such claims are attributed to us or that our insurance coverage is insufficient, we may be exposed to losses which may adversely affect our profitability and financial position.

We may be harmed by negative publicity.

We operate in highly competitive industries and there are other companies in the market that offer similar products for sales and rental and complementary services which we offer. We derive most of our customers through word of mouth and we rely on the positive feedback of our customers. Thus, customer satisfaction with our safety equipment products is critical to the success of our business as this will also result in potential referrals to new customers from our existing customers. If we fail to meet our customers’ expectations, there may be negative feedback regarding our products and/or services, which may have an adverse impact on our business and reputation. In the event we are unable to maintain a high level of customer satisfaction or any customer dissatisfaction is inadequately addressed, our business, financial condition, results of operations and prospects may also be adversely affected.

Our reputation may also be adversely affected by negative publicity in reports, publications such as major newspapers and forums, or any other negative publicity or rumours. There is no assurance that our Group will not experience negative publicity in the future or that such negative publicity will not have a material and adverse effect on our reputation or prospects. This may result in our inability to attract new customers or retain existing customers and may in turn adversely affect our business and results of operations.

If we are unable to maintain and protect our intellectual property, or if third parties assert that we infringe on their intellectual property rights, our business could suffer.

Our business depends, in part, on our ability to identify and protect proprietary information and other intellectual property such as our client lists and information and business methods. We rely on contractual arrangements and trademark laws to protect our intellectual property rights. However, we may not adequately protect these rights, and their disclosure to, or use by, third parties may harm our competitive position. Our inability to detect unauthorized use of, or to take appropriate or timely steps to enforce, our intellectual property rights may harm our business. Also, third parties may claim that our business operations infringe on their intellectual property rights. These claims may harm our reputation, be a financial burden to defend, distract the attention of our management and prevent us from offering some services. Intellectual property is increasingly stored or carried on mobile devices, such as laptop computers, which increases the risk of inadvertent disclosure if the mobile devices are lost or stolen, and the information has not been adequately safeguarded or encrypted. This also makes it easier for someone with access to our systems, or someone who gains unauthorized access, to steal information and use it to our disadvantage.

9

We are exposed to risks with respect of acts of war, terrorist attacks, epidemics, political unrest, adverse weather conditions, and other uncontrollable events.

Unforeseeable circumstances and other factors such as power outages, labor disputes, adverse weather conditions or other catastrophes, epidemics, or outbreaks may disrupt our operations and cause loss and damage to our storage facilities, workshop, and office, and acts of war, terrorist attacks or other acts of violence may further materially and adversely affect the global financial markets and consumer confidence. Our business may also be affected by macroeconomic factors in the countries in which we operate, such as general economic conditions, market sentiment, social and political unrest, and regulatory, fiscal, and other governmental policies, all of which are beyond our control. Any such events may cause damage or disruption to our business, markets, customers, and suppliers, any of which may materially and adversely affect our business, financial condition, results of operations, and prospects.

We may not be able to successfully implement our business strategies and future plans.

As part of our business strategies and future plans, we intend to expand our safety equipment portfolio and increase our storage facilities and capabilities as well as consider potential business opportunities through mergers and acquisitions and joint ventures. While we have planned such expansion based on our outlook regarding our business prospects, there is no assurance that such expansion plans will be commercially successful or that the actual outcome of those expansion plans will match our expectations. The success and viability of our expansion plans are dependent upon our ability to successfully predict the types of safety equipment which are tradable amongst our customers, hire and retain skilled employees to carry out our business strategies and future plans and implement strategic business development and marketing plans effectively and upon an increase in demand for our products and services by existing and new customers in the future.

Further, the implementation of our business strategies and future plans may require substantial capital expenditure and additional financial resources and commitments. There is no assurance that these business strategies and future plans will achieve the expected results or outcome such as an increase in revenue that will be commensurate with our investment costs or the ability to generate any costs savings, increased operational efficiency and/or productivity improvements to our operations. There is also no assurance that we will be able to obtain financing on terms that are favorable, if at all. If the results or outcome of our future plans do not meet our expectations, if we fail to achieve a sufficient level of revenue or if we fail to manage our costs efficiently, we may not be able to recover our investment costs and our business, financial condition, results of operations and prospects may be adversely affected.

We are subject to risks related to product recalls, and our operation results and financial condition would suffer if we fail to adequately manage such risks.

We have implemented measures in our sourcing and certification processes, that are designed to prevent and detect defects and contaminants in our products. See “Item 4.B. Business Overview — Sales Process Flow” and “4.B. Business Overview —Certifications” sections for more information. Such measures, however, may not prevent, reveal or detect defects in our products, and such defects may not become apparent until after our products have been sold into the market or in the event of an actual workplace accident. Consequently, there is a risk that product defects may occur and such defects will require a product recall. Any product recalls and related remedial actions can be costly to our operations and could have a material adverse effect on our business, results of operations and financial condition. Furthermore, product recalls could result in negative publicity and public concerns regarding the safety of our products, which could harm the reputation of our products and our business and could cause the market value of our shares to decline.

10

Risks Related to our Securities

An active trading market for our Ordinary Shares may not continue and the trading price for our Ordinary Shares may fluctuate significantly.

We cannot assure you that a liquid public market for our Ordinary Shares will continue. If the active public market for our Ordinary Shares does not continue, the market price and liquidity of our Ordinary Shares may be materially and adversely affected. The public offering price for our Ordinary Shares in this offering was determined by negotiation between us and the underwriter based upon several factors, and we can provide no assurance that the trading price of our shares after this offering will not decline below the public offering price. As a result, investors in our shares may experience a significant decrease in the value of their shares.

We may not maintain the listing of our Ordinary Shares on Nasdaq which could limit investors’ ability to make transactions in our Ordinary Shares and subject us to additional trading restrictions.

In order to continue listing our Ordinary Shares on Nasdaq, we must maintain certain financial and share price levels and we may be unable to meet these requirements in the future. We cannot assure you that our Ordinary Shares will continue to be listed on Nasdaq in the future.

If Nasdaq delists our Ordinary Shares and we are unable to list our Ordinary Shares on another national securities exchange, we expect our Ordinary Shares could be quoted on an over-the-counter market in the United States. If this were to occur, we could face significant material adverse consequences, including:

| (a) | a limited availability of market quotations for our Ordinary Shares; |

| (b) | reduced liquidity for our Ordinary Shares; |

| (c) | a determination that our Ordinary Shares are “penny stock,” which will require brokers trading in our Ordinary Shares to adhere to more stringent rules and possibly result in a reduced level of trading activity in the secondary trading market for our Ordinary Shares; |

| (d) | a limited amount of news and analyst coverage; and |

| (e) | a decreased ability to issue additional securities or obtain additional financing in the future. |

As long as our Ordinary Shares are listed on Nasdaq, U.S. federal law prevents or pre-empts individual states from regulating their sale. However, the law does allow the states to investigate companies if there is a suspicion of fraud, and, if there is a finding of fraudulent activity, then the states can regulate or bar their sale. Further, if we were no longer listed on Nasdaq, we would be subject to regulations in each state in which we offer our Ordinary Shares.

The trading price of our Ordinary Shares may be volatile, which could result in substantial losses to investors.

The trading price of our Ordinary Shares may be volatile and could fluctuate widely due to factors beyond our control. This may happen because of the broad market and industry factors, like the performance and fluctuation of the market prices of other companies with business operations located mainly in Singapore that have listed their securities in the United States. In addition to market and industry factors, the price and trading volume for our shares may be highly volatile for factors specific to our own operations, including the following:

| ● | fluctuations in our revenues, earnings and cash flow; |

| ● | changes in financial estimates by securities analysts; |

| ● | additions or departures of key personnel; |

| ● | release of lock-up or other transfer restrictions on our outstanding equity securities or sales of additional equity securities; and |

| ● | potential litigation or regulatory investigations. |

11

Any of these factors may result in significant and sudden changes in the volume and price at which our shares will trade.

In the past, shareholders of public companies have often brought securities class action suits against those companies following periods of instability in the market price of their securities. If we were involved in a class action suit, it could divert a significant amount of our management’s attention and other resources from our business and operations and require us to incur significant expenses to defend the suit, which could harm our results of operations. Any such class action suit, whether or not successful, could harm our reputation and restrict our ability to raise capital in the future. In addition, if a claim is successfully made against us, we may be required to pay significant damages, which could have a material adverse effect on our financial condition and results of operations.

Certain recent initial public offerings of companies with public floats comparable to the anticipated public float of our Company have experienced extreme volatility that was seemingly unrelated to the underlying performance of the respective company. We may experience similar volatility. Such volatility, including any stock-run up, may be unrelated to our actual or expected operating performance and financial condition or prospects, making it difficult for prospective investors to assess the rapidly changing value of our Ordinary Shares.

Recently, there have been instances of extreme stock price run-ups followed by rapid price declines and strong stock price volatility with recent initial public offerings, especially among those with relatively smaller public floats. As a relatively small-capitalization company with relatively small public float, we may experience greater stock price volatility, extreme price run-ups, lower trading volume and less liquidity than large-capitalization companies. In particular, our Ordinary Shares may be subject to rapid and substantial price volatility, low volumes of trades and large spreads in bid and ask prices. Such volatility, including any stock-run up, may be unrelated to our actual or expected operating performance and financial condition or prospects, making it difficult for prospective investors to assess the rapidly changing value of our Ordinary Shares.

In addition, if the trading volumes of our Ordinary Shares are low, persons buying or selling in relatively small quantities may easily influence prices of our Ordinary Shares. This low volume of trades could also cause the price of our Ordinary Shares to fluctuate greatly, with large percentage changes in price occurring in any trading day session. Holders of our Ordinary Shares may also not be able to readily liquidate their investment or may be forced to sell at depressed prices due to low volume trading. Broad market fluctuations and general economic and political conditions may also adversely affect the market price of our Ordinary Shares. As a result of this volatility, investors may experience losses on their investment in our Ordinary Shares. A decline in the market price of our Ordinary Shares also could adversely affect our ability to issue additional shares of Ordinary Shares or other of our securities and our ability to obtain additional financing in the future. No assurance can be given that an active market in our Ordinary Shares will develop or be sustained. If an active market does not develop or be sustained, holders of our Ordinary Shares may be unable to readily sell the shares they hold or may not be able to sell their shares at all.

If securities or industry analysts do not publish research or reports about our business, or if they adversely change their recommendations regarding our Ordinary Shares, the market price for our Ordinary Shares and trading volume could decline.

The trading market for our shares will be influenced by research or reports that industry or securities analysts publish about our business. If one or more analysts downgrade our shares, the market price for our shares would likely decline. If one or more of these analysts cease to cover us or fail to regularly publish reports on us, we could lose visibility in the financial markets, which in turn could cause the market price or trading volume for our shares to decline.

12

Because we do not expect to pay dividends in the foreseeable future, you must rely on price appreciation of our Ordinary Shares for a return on your investment.

We currently intend to retain all of our available funds and any future earnings after this offering to fund the development and growth of our business. As a result, we do not expect to pay any cash dividends in the foreseeable future. Therefore, you should not rely on an investment in our shares as a source for any future dividend income. Our Board has complete discretion as to whether to distribute dividends, subject to certain requirements of Cayman Islands and Singapore law. Even if our Board decides to declare and pay dividends (by way of a simple majority decision of our Directors), the timing, amount and form of future dividends, if any, will depend on, among other things, our future results of operations and cash flow, our capital requirements and surplus, the amount of distributions, if any, received by us from our subsidiaries, our financial condition, contractual restrictions and other factors as determined by our Board. Accordingly, the return on your investment in our Ordinary Shares will likely depend entirely upon any future price appreciation of our Ordinary Shares. There is no guarantee that our Ordinary Shares will appreciate in value after this offering or even maintain the price at which you purchased our shares. You may not realize a return on your investment in our shares and you may even lose your entire investment.

Short selling may drive down the market price of our Ordinary Shares.

Short selling is the practice of selling shares that the seller does not own but rather has borrowed from a third party with the intention of buying identical shares back at a later date to return to the lender. The short seller hopes to profit from a decline in the value of the shares between the sale of the borrowed shares and the purchase of the replacement shares, as the short seller expects to pay less in that purchase than it received in the sale. As it is in the short seller’s interest for the price of the shares to decline, many short sellers publish, or arrange for the publication of, negative opinions and allegations regarding the relevant issuer and its business prospects in order to create negative market momentum and generate profits for themselves after selling the shares short. These short attacks have, in the past, led to selling of shares in the market. If we were to become the subject of any unfavorable publicity, whether such allegations are proven to be true or untrue, we could have to expend a significant number of resources to investigate such allegations and/or defend ourselves. While we would strongly defend against any such short seller attacks, we may be constrained in the manner in which we can proceed against the relevant short seller by principles of freedom of speech, applicable state law or issues of commercial confidentiality.

If we are classified as a passive foreign investment company, United States taxpayers who own our securities may have adverse United States federal income tax consequences.

We are a non-U.S. corporation and, as such, we will be classified as a passive foreign investment company, which is known as a PFIC, for any taxable year if, for such year, either:

| ● | At least 75% of our gross income for the year is passive income; or |

| ● | The average percentage of our assets (determined at the end of each quarter) during the taxable year that produce passive income or that are held for the production of passive income is at least 50%. |

Passive income generally includes dividends, interest, rents, royalties (other than rents or royalties derived from the active conduct of a trade or business) and gains from the disposition of passive assets.

If we are determined to be a PFIC for any taxable year (or portion thereof) that is included in the holding period of a U.S. taxpayer who holds our securities, the U.S. taxpayer may be subject to increased U.S. federal income tax liability and may be subject to additional reporting requirements.

While we do not expect to become a PFIC, because the value of our assets for purposes of the asset test may be determined by reference to the market price of our Ordinary Shares, fluctuations in the market price of our Ordinary Shares may cause us to become a PFIC for the current or subsequent taxable years. The determination of whether we will be or become a PFIC will also depend, in part, on the composition of our income and assets. If we determine not to deploy significant amounts of cash for active purposes, our risk of being a PFIC may substantially increase. Because there are uncertainties in the application of the relevant rules and PFIC status is a factual determination made annually after the close of each taxable year, there can be no assurance that we will not be a PFIC for the current taxable year or any future taxable year.

For a more detailed discussion of the application of the PFIC rules to us and the consequences to U.S. taxpayers if we were determined to be a PFIC, see “Item 10.E. Taxation— Passive Foreign Investment Company Considerations.”

13

Our Controlling Shareholders have substantial influence over the Company. Their interests may not be aligned with the interests of our other shareholders, and they could prevent or cause a change of control or other transactions.

Mr. Zhang and Ms. Xu Yukai (collectively “the Controlling Shareholders”) together own 72.7% of our issued and outstanding Ordinary Shares, assuming the underwriters do not exercise their over-allotment option.

Accordingly, our Controlling Shareholders have considerable influence or control over the outcome of any corporate transactions or other matters submitted to the shareholders for approval, including (i) mergers, consolidations, (ii) the election or removal of Directors, (iii) the sale of all or substantially all of our assets, (iv) making amendments to our Amended and Restated Memorandum and Articles of Association, (v) whether to issue additional shares, including to him, (vi) employment, including compensation arrangements, and (vii) the power to prevent or cause a change in control. The interests of our largest shareholder may differ from the interests of our other shareholders. Without the consent of our Controlling Shareholders, we may be prevented from entering into transactions that could be beneficial to us or our other shareholders. The concentration in the ownership of our shares may cause a material decline in the value of our shares. For more information regarding our principal shareholders and their affiliated entities, see “4.A. History and Development of the Company”.

As a “controlled company” under the rules of the Nasdaq Capital Market, we may choose to exempt our Company from certain corporate governance requirements that could have an adverse effect on our public shareholders.

Our directors and officers beneficially own a majority of the voting power of our issued and outstanding Ordinary Shares. Under the Rule 4350(c) of the Nasdaq Capital Market, a company of which more than 50% of the voting power is held by an individual, group or another company is a “controlled company” and may elect not to comply with certain corporate governance requirements, including:

| ● | an exemption from the rule that a majority of our Board must be independent directors; |

| ● | an exemption from the rule that the compensation of our chief executive officer must be determined or recommended solely by independent directors; and |

| ● | An exemption from the rule that our director nominees must be selected or recommended solely by independent directors. |

The exemption we intend to rely on is that a majority of our Board need not be independent directors. As a result, you may not have the same protection afforded to shareholders of companies that are subject to these corporate governance requirements.

As a company incorporated in the Cayman Islands, we are permitted to follow certain home country practices in relation to corporate governance matters in lieu of certain requirements under Nasdaq corporate governance listing rules. These practices may afford less protection to shareholders than they would enjoy if we complied fully with Nasdaq corporate governance listing standards.

As a foreign private issuer that has listed our Ordinary Shares on the Nasdaq Capital Market, we rely on a provision in Nasdaq corporate governance listing standards that allows us to follow Cayman Islands law with regard to certain aspects of corporate governance. This allows us to follow certain corporate governance practices that differ in significant respects from the corporate governance requirements applicable to U.S. companies listed on the Nasdaq Capital Market.

These practices may afford less protection to shareholders than they would enjoy if we complied fully with corporate governance listing requirements of Nasdaq. We rely on home country practice to be exempted from certain of the corporate governance requirements of Nasdaq, namely (i) a majority of the Directors on our Board are not required to be independent Directors; (ii) there will not be a necessity to have regularly scheduled executive sessions with independent Directors; and (iii) there will be no requirement for the Company to obtain Shareholder approval prior to an issuance of securities in connection with (a) the acquisition of stock or assets of another company; (b) equity-based compensation of officers, directors, employees or consultants; (c) a change of control; and (d) transactions other than public offerings.

14

You may face difficulties in protecting your interests, and your ability to protect your rights through U.S. courts may be limited, because we are incorporated under Cayman Islands law.

We are a Cayman Islands company limited by shares incorporated under the laws of the Cayman Islands. Our corporate affairs are governed by our Amended and Restated Memorandum and Articles of Association, the Companies Act and the common law of the Cayman Islands.

The rights of shareholders to take action against the directors, actions by minority shareholders and the fiduciary duties of our directors to us under Cayman Islands law are governed by the Companies Act and the common law of the Cayman Islands. The common law of the Cayman Islands is derived in part from comparatively limited judicial precedent in the Cayman Islands as well as from the common law of England, the decisions of whose courts are of persuasive authority, but are not binding, on a court in the Cayman Islands. The rights of our shareholders and the fiduciary duties of our directors under Cayman Islands law are not as clearly established as they would be under statutes or judicial precedent in some states in the United States. In particular, the Cayman Islands has a less developed body of securities laws than the United States. Some U.S. states have more fully developed and judicially interpreted bodies of corporate law than the Cayman Islands. In addition, Cayman Islands companies may not have the standing to initiate a shareholder derivative action in a federal court of the United States.

Holders of our ordinary shares will have no general right under Cayman Islands law to inspect or obtain copies of our list of shareholders or our corporate records. This may make it more difficult for you to obtain the information needed to establish any facts necessary for a shareholder motion or to solicit proxies from other shareholders in connection with a proxy contest.

As a result of all of the above, shareholders may have more difficulty in protecting their interests in the face of actions taken by our management, members of the Board or Controlling Shareholders than they would as shareholders of a company incorporated in a U.S. state. For a discussion of significant differences between the provisions of the Companies Act and the laws applicable to companies incorporated in a U.S. state and their shareholders, see “Certain Cayman Islands Company Considerations — Differences in Corporate Law.”

Certain judgments obtained against us or our auditor by our shareholders may not be enforceable.

We are a Cayman Islands company. Our operating subsidiaries were incorporated and are located in Singapore. Substantially all of our assets are located outside of the United States. In addition, all of our current Directors and officers are nationals and residents of countries other than the United States and substantially all of the assets of these persons are located outside the United States. As a result, it may be difficult for a shareholder to effect service of process within the United States upon these persons or to enforce against us, our Directors and officers, or our auditor judgments obtained in United States courts, including judgments predicated upon the civil liability provisions of the securities laws of the United States or any state in the United States. Even if you are successful in bringing an action of this kind, the laws of the Cayman Islands and Singapore may render you unable to enforce a judgment against our assets or the assets of our Directors and officers. For more information regarding the relevant laws of the Cayman Islands and Singapore, see “Enforceability of Civil Liabilities.” As a result of all of the above, our shareholders may have more difficulties in protecting their interests through actions against us, our officers, Directors, or major shareholders, than would shareholders of a corporation incorporated in a jurisdiction in the United States.

15

We are an emerging growth company within the meaning of the Securities Act and may take advantage of certain reduced reporting requirements.

We are an “emerging growth company,” as defined in the JOBS Act, and we may take advantage of certain exemptions from various requirements applicable to other public companies that are not emerging growth companies including, most significantly, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act for so long as we are an emerging growth company. As a result, if we elect not to comply with such auditor attestation requirements, our investors may not have access to certain information they may deem important.