UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-4

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

Senstar Technologies Corporation

(Exact name of Registrant as specified in its charter)

|

Ontario

|

8413

|

Not applicable

|

|

(State or other jurisdiction of

incorporation or organization)

|

(Primary Standard Industrial

Classification Code Number)

|

(I.R.S. Employer

Identification Number)

|

119 John Cavanaugh Drive

Ottawa, ON

Canada K0A 1L0

Tel: +1-613-839-5572

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Senstar Inc.

13800 Coppermine Road

2nd Floor Suite 221

Herndon, VA 20171

United States

Tel: +1-613-839-5572

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

|

Sharon A. Amir, Adv

Tuvia J. Geffen, Adv.

Idan Lidor, Adv.

Naschitz, Brandes, Amir & Co.

5 Tuval Street

Tel-Aviv 6789717, Israel

Tel: +972-3-623-5000

|

Steven J. Glusband, Esq.

Carter Ledyard & Milburn LLP

2 Wall Street

New York, NY 10005

Tel: (212) 238-8605

|

Rob Lando, Esq.

Kevin Feng, Esq.

Osler, Hoskin & Harcourt LLP

1 First Canadian Place

Toronto, ON M5X 1B8

Tel: (416) 362-2111

|

Approximate date of commencement of proposed sale of the securities to the public: As soon as practicable after this Registration Statement becomes effective and upon

completion of the merger described in the enclosed proxy statement/prospectus.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier

effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration

statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated

filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer ☐

|

Accelerated filer

|

☐ |

|

Non-accelerated filer ☒ (Do not check if a smaller reporting company)

|

Smaller reporting company

|

☐ |

| |

Emerging growth company

|

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to

Section 7(a)(2)(B) of the Securities Act. ☐

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

☐ Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer)

☐ Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer)

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically

states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act, or until the Registration Statement shall become effective on such dates as the Securities and Exchange Commission,

acting pursuant to said Section 8(a), may determine.

Information contained herein is subject to completion or amendment. A registration statement relating to these securities has been filed with the Securities and Exchange Commission.

These securities may not be sold nor may offers to buy be accepted prior to the time the registration statement becomes effective. This proxy statement/prospectus shall not constitute an offer to sell or the solicitation of an offer to buy, nor

shall there be any sale of such securities, in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to appropriate registration or qualification under the securities laws of such jurisdiction.

PRELIMINARY – SUBJECT TO COMPLETION – DATED SEPTEMBER 27, 2023

Senstar Technologies Ltd.

__________, 2023

To the Shareholders of Senstar Technologies Ltd.:

You are cordially invited to attend the Special General Meeting of Shareholders of Senstar Technologies Ltd. (“Senstar-Israel”),

to be held at Senstar-Israel’s principal executive offices, at 10th Floor, Gibor Sport Tower, 7 Menachem Begin Road, Ramat Gan 5268102, Israel, on _______, _________, 2023 at ___ a.m. (Israel time), and thereafter as it may be adjourned from time

to time (the “General Meeting”).

On September 26, 2023, Senstar-Israel entered into an Agreement and Plan of Merger (as it may be amended from time to time, the “Merger Agreement”) with a newly established Ontario corporation known as Senstar Technologies Corporation (“Senstar-Ontario”), and Can Co Sub Ltd.,

a company organized under the laws of the State of Israel and a wholly-owned subsidiary of Senstar-Ontario (“Merger Sub”), pursuant to which Senstar-Ontario will

become the parent company of Senstar-Israel as a result of the merger of Merger Sub with and into Senstar-Israel (the “Merger”), with Senstar-Israel surviving the

Merger as a wholly-owned subsidiary of Senstar-Ontario. The Merger is structured as a statutory merger pursuant to Sections 314-327 of the Companies Law, 5759-1999, of the State of Israel (the “ICL”).

As more fully described in the attached proxy statement/prospectus, upon completion of the Merger, Senstar-Israel’s shareholders as of immediately prior to the effective time of the Merger will be

entitled to receive one (1) validly issued, fully paid and nonassessable Common Share of Senstar-Ontario (the “Senstar-Ontario Common Share”), subject to applicable

withholding taxes, for each one (1) ordinary share, par value NIS 1.00 per share, of Senstar-Israel (the “Senstar-Israel Shares”) held as of immediately prior to

the effective time of the Merger.

The purpose of the Merger is to redomicile Senstar-Israel, the parent company of the Senstar group of companies (the “Senstar Group”), to be

an entity organized in the Province of Ontario, Canada instead of Israel. In addition, following the consummation of the Merger, Senstar-Israel intends to dissolve, and as part of the dissolution, Senstar-Israel will transfer to Senstar-Ontario

its interests in its subsidiaries by way of distribution.

While our incorporation in Israel has served us and our shareholders well, there are compelling reasons that support redomiciling to cause the parent company of our group to be an entity organized in

the Province of Ontario, Canada at this time.

After considering various factors, the Senstar-Israel Board of Directors (the “Senstar-Israel Board”) unanimously

determined that restructuring our corporate group to cause the parent company of our group to be an entity incorporated in Ontario is in the best interests of Senstar-Israel and its shareholders and will best help us accomplish our strategic

objectives. The vast majority of all of the Senstar Group’s employees and substantially all of our operating assets are in Canada. As a result, we think it is in the best interest of Senstar-Israel and its shareholders, to have our parent company

based in Ontario.

For you, our shareholders, much will remain unchanged following the time the Merger comes into effect. There will be some differences in your shareholder rights, given the differences in the laws

between Israel and Ontario. We have included a detailed chart outlining these differences in the attached proxy statement/prospectus in the section titled “Comparison of

Rights of Senstar-Israel Shareholders and Senstar-Ontario Shareholders.”

We currently anticipate that Redomiciliation will become effective in the fourth quarter of 2023, although we may abandon the Redomiciliation at any time prior to its completion, including after

obtaining shareholder approval.

Just as is the case today with Senstar Israel’s ordinary shares, we expect the common shares of Senstar-Ontario will trade on the Nasdaq Global Market, under the symbol “SNT.” We will remain subject

to the reporting requirements of the U.S. Securities and Exchange Commission, the mandates of the Sarbanes-Oxley Act of 2002 and the corporate governance rules of Nasdaq. We will continue to report our consolidated financial results in U.S. dollars

and under U.S. generally accepted accounting principles.

It is intended that holders of Senstar Israel ordinary shares and options to purchase Senstar Israel ordinary shares will not recognize any gain or loss for U.S. federal income tax purposes in

connection with the transaction.

With regard to Israeli capital gains taxation, in connection with the Merger Agreement, Senstar-Israel will seek a pre-ruling from the Israel Tax Authority (the “ITA”), on behalf of Senstar-Israel shareholders who purchased Senstar Israel ordinary shares in the ordinary course trading on Nasdaq and satisfies all the conditions stated in such ruling (which are

referred to in the ruling as the “Interested Public”), regarding the capital gains taxation arrangements that shall apply in respect of a transfer by such Interested Public of all Senstar-Israel ordinary shares in exchange for Senstar-Ontario

common shares (the “Tax Ruling”). It is expected that the Tax Ruling will find that capital gains taxation related to the Merger will be deferred until a later

disposition event and, as such, no tax will be due for the Interested Public at the time of the Merger, and Senstar-Ontario, the Exchange Agent, the surviving company and their respective agents shall be exempt from any obligation to withhold

Israeli Tax from the Merger Consideration, or clarifying that no such obligation exists. The Tax Ruling will not apply to shareholders classified as “Controlling

Shareholders” for purposes of the Israeli tax rules, interested parties or office holders. Please see “Material U.S. Federal Income Tax Consequences”, “Material Israeli Tax Consequences”, and “Material Canadian Federal Income Tax

Considerations” for a description of the material U.S. federal income tax consequences, Israeli tax consequences, and Canadian federal income tax considerations of the Merger to Senstar-Israel shareholders. Determining the actual tax

consequences of the Merger to you may be complex and will depend on your specific situation. We urge you to consult your tax advisor for a full understanding of the tax consequences of the Merger to you.

At the General Meeting, you will be asked to consider and vote on a resolution for the approval of (i) the Merger Agreement; (ii) the merger of Merger Sub with and into Senstar-Israel in accordance

with Sections 314-327 of the ICL, following which Merger Sub will cease to exist as a separate legal entity and Senstar-Israel will become a wholly-owned subsidiary of Senstar-Ontario; (iii) the right to receive one (1) validly issued, fully paid

and nonassessable Senstar-Ontario Common Share, subject to applicable withholding taxes, for each one (1) ordinary share, par value NIS 1.00 per share, of Senstar-Israel held by Senstar-Israel’s shareholders as of immediately prior to the effective

time of the Merger; and (iv) all other transactions contemplated by the Merger Agreement and related to the Merger, as detailed in Senstar-Israel’s proxy statement/prospectus for the General Meeting (collectively, the “Redomiciliation Proposal”).

The Senstar-Israel Board has unanimously: (i) determined that the Merger Agreement, the Merger and the other

transactions contemplated by the Merger Agreement are advisable and fair to, and in the best interests of, Senstar-Israel and its shareholders and that, considering the financial position of the merging companies, no reasonable concern exists that

the surviving company will be unable to fulfill the obligations of Senstar-Israel to its creditors; (ii) approved the Merger Agreement, the Merger and the other transactions contemplated by the Merger Agreement; and (iii) determined to recommend

that the shareholders of Senstar-Israel approve the Merger Agreement, the Merger and the other transactions contemplated by the Merger Agreement, all upon the terms and

subject to the conditions set forth in the Merger Agreement.

SENSTAR-ISRAEL’S BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” APPROVAL OF THE REDOMICILIATION PROPOSAL.

Enclosed with this letter you will find a copy of the Notice of the Special General Meeting and the Proxy Statement for the General Meeting. The enclosed proxy statement/prospectus and the

attachments thereto contain important information about the General Meeting, the Merger Agreement, the Merger, all the other transactions contemplated by the Merger Agreement and the other agenda items, and you are urged to read them carefully and

in their entirety.

We urge you to read the accompanying proxy statement/prospectus, including the Annexes and the documents incorporated by reference, carefully and in its entirety. In particular, we

urge you to read carefully the section entitled “Risk Factors”.

YOUR VOTE IS IMPORTANT REGARDLESS OF THE NUMBER OF SENSTAR-ISRAEL SHARES YOU OWN. ACCORDINGLY, YOU ARE REQUESTED TO PROMPTLY COMPLETE, SIGN AND DATE THE ENCLOSED PROXY CARD AND

RETURN IT IN THE ENVELOPE PROVIDED, WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING. THIS WILL NOT PREVENT YOU FROM VOTING YOUR SENSTAR-ISRAEL SHARES IN PERSON IF YOU SUBSEQUENTLY CHOOSE TO ATTEND THE MEETING.

|

|

Thank you for your cooperation,

Gillon Beck

Chairman of the Board of Directors

|

Neither the Securities and Exchange Commission nor any state securities commission, including the Israel Securities Authority, has approved or disapproved of the securities to be

issued under this proxy statement/prospectus or determined if this proxy statement/prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This proxy statement/prospectus is dated _________, 2023 and is first being made available to the Senstar-Israel shareholders on or about _________, 2023.

SENSTAR TECHNOLOGIES LTD.

NOTICE OF SPECIAL GENERAL MEETING OF SHAREHOLDERS

To the Shareholders of Senstar Technologies Ltd. (“Senstar-Israel”):

Senstar-Israel cordially invites you to attend the Special General Meeting of Shareholders of Senstar-Israel (the “General

Meeting” or the “Meeting”) to be held at Senstar-Israel’s principal executive offices, at 10th Floor, Gibor Sport Tower, 7 Menachem Begin Road, Ramat Gan

5268102, Israel, on _______, _________, 2023 at ___ a.m. (Israel time) (the telephone number at that address is +972-74-794-5200), and thereafter, as it may be adjourned from time to time.

The following Redomiciliation Proposal is on the agenda for the General Meeting:

|

• |

the approval of (i) the Agreement and Plan of Merger dated as of September 26, 2023 (as it may be amended from time to time, the “Merger Agreement”)

by and among Senstar-Israel, a newly established Ontario corporation known as Senstar Technologies Corporation (“Senstar-Ontario”), and Can Co Sub Ltd., a company organized under the laws of the State

of Israel and a wholly-owned subsidiary of Senstar-Ontario (“Merger Sub”); (ii) the merger of Merger Sub with and into Senstar-Israel in accordance with Sections 314-327 of the Israeli Companies Law,

5759-1999 (the “ICL”), following which Merger Sub will cease to exist as a separate legal entity and Senstar-Israel will become a wholly-owned subsidiary of Senstar-Ontario (the “Merger”); (iii) the right to receive one (1) validly issued, fully paid and nonassessable common share of Senstar-Ontario, subject to applicable withholding taxes (the “Merger

Consideration”), for each one (1) ordinary share, par value NIS 1.00 per share, of Senstar-Israel held by Senstar-Israel’s shareholders as of immediately prior to the effective time of the Merger; and (iv) all other transactions

contemplated by the Merger Agreement and related to the Merger, as detailed in Senstar-Israel’s proxy statement/prospectus for the General Meeting (collectively, the “Redomiciliation Proposal”).

|

SENSTAR-ISRAEL’S BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE APPROVAL OF THE REDOMICILIATION PROPOSAL.

Further information regarding the Redomiciliation Proposal is included in the proxy statement/prospectus, which is being mailed to Senstar-Israel’s shareholders in advance of the General Meeting. The

proxy statement/prospectus is also being furnished to the United States Securities and Exchange Commission (the “SEC”) on Form 6-K and is available to the public on

the SEC’s website at http://www.sec.gov and Senstar-Israel’s website at www.senstartechnologies.com. A form of proxy card will be enclosed with the proxy statement/prospectus.

Record Date

Only shareholders of record at the close of business on _______, 2023 (the “Record Date”) will be entitled to

receive notice of, and to vote at, the General Meeting.

Quorum and Voting

A quorum must be present in order for the General Meeting to be held. Pursuant to Senstar-Israel’s Articles of Association, the quorum

required for the General Meeting consists of at least two shareholders present, in person or by proxy, who hold or represent at least twenty-five percent (25%) of Senstar-Israel’s issued and outstanding

share capital. Broker non-votes and abstentions will be counted as present at the General Meeting for the purpose of determining whether a quorum is present. A broker non-vote occurs when a bank, broker or other nominee holding Senstar-Israel

Shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that proposal and has not received voting instructions from the beneficial owner. While counted for

quorum purposes, abstentions and broker non-votes will not be treated as voting shares and will not have any effect on whether the requisite vote is obtained for all matters placed before shareholders for their vote. The Redomiciliation Proposal

at the General Meeting does not allow for discretionary voting by banks, brokers or other nominees. If within half an hour from the time ap-pointed for the meeting a quorum is not present, the meeting shall be adjourned to _______, 2023, at the

same time and place. At such adjourned meeting, the presence of at least two shareholders in person or by proxy (regardless of the voting power possessed by their shares) will constitute a quorum.

The approval of the Redomiciliation Proposal requires the affirmative vote of holders of at least a majority of the Senstar-Israel ordinary shares

present, in person or by proxy, and voting on the Redomiciliation Proposal (not taking into consideration abstentions), excluding any Senstar-Israel Shares that are held by Merger Sub, Senstar-Ontario or by any

person or entity holding at least 25% of the “means of control” (within the meaning of the ICL) of either Merger Sub or Senstar-Ontario (excluding, in accordance with the ICL, any holding resulting

solely from such person’s holding of Senstar-Israel Shares).

Proposals by Shareholders

In accordance with Section 66(b) of the ICL, eligible shareholders, holding at least one percent of Senstar-Israel’s

outstanding ordinary shares, may present proper proposals for inclusion in the Meeting by submitting their proposals to Senstar-Israel no later than one week following the date hereof and, if Senstar-Israel determines that a shareholder proposal

is appropriate to be added to the agenda of the Meeting, it will publish a revised agenda with SEC on Form 6-K, and the revised agenda will be made available to the public on the SEC’s website at http://www.sec.gov and Senstar-Israel’s

website at www.senstartechnologies.com. The last date for submitting a request to include a proposal in accordance with Section 66(b) of the ICL is ________,

2023.

All shareholders are entitled to contact Senstar-Israel directly and receive the text of the proxy materials. Once made available to the public as described above, such documents will also be

available for inspection at Senstar-Israel’s offices, which are located at 10th Floor, Gibor Sport Tower, 7 Menachem Begin Road, Ramat Gan 5268102, Israel, during regular business hours and subject to prior coordination. Senstar-Israel’s phone

number is ++972-74-794-5200).

| |

By Order of the Board of Directors,

Gillon Beck

Chairman of the Board of Directors

|

IT IS IMPORTANT THAT THE ENCLOSED PROXY CARD BE

COMPLETED, SIGNED, DATED AND RETURNED PROMPTLY

PROXY STATEMENT

SPECIAL GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON _________, _______________, 2023

INTRODUCTION

This proxy statement/prospectus is being distributed to Senstar Technologies Ltd.’s (“Senstar-Israel”) shareholders

in connection with the solicitation by Senstar-Israel’s Board of Directors of proxies to be used at the Special General Meeting of Shareholders, as it may be adjourned or postponed from time to time (the “General Meeting” or the “Meeting”), to be held at Senstar-Israel’s principal executive offices located at 10th

Floor, Gibor Sport Tower, 7 Menachem Begin Road, Ramat Gan 5268102, Israel, on ___________, 2023, at ___ a.m. (Israel time) and thereafter as it may be adjourned from time to time.

At the General Meeting, shareholders will be asked to consider and vote on the following Redomiciliation Proposal:

|

• |

the approval of (i) the Agreement and Plan of Merger dated as of September 26, 2023 (as it may be amended from time to time, the “Merger Agreement”)

by and among Senstar-Israel, a newly established Ontario corporation known as Senstar Technologies Corporation (“Senstar-Ontario”), and Can Co Sub Ltd., a

company organized under the laws of the State of Israel and a wholly-owned subsidiary of Senstar-Ontario (“Merger Sub”); (ii) the merger of Merger Sub with and into Senstar-Israel in accordance with

Sections 314-327 of the Israeli Companies Law, 5759-1999 (the “ICL”), following which Merger Sub will cease to exist as a separate legal entity and Senstar-Israel will become a wholly-owned subsidiary

of Senstar-Ontario (the “Merger”); (iii) the right to receive one (1) validly issued, fully paid and nonassessable common share of Senstar-Ontario, subject to applicable withholding taxes (the “Merger Consideration”), for each ordinary share, par value NIS 1.00 per share, of Senstar-Israel held by Senstar-Israel’s shareholders as of immediately prior to the effective time of the Merger; and (iv)

all other transactions contemplated by the Merger Agreement and related to the Merger, as detailed in Senstar-Israel’s proxy statement/prospectus for the General Meeting (collectively, the “Redomiciliation

Proposal”).

|

Shareholders Entitled to Vote

Shareholders of record who held Senstar-Israel ordinary shares at the close of business on _________, 2023 (the “Record

Date”), are entitled to notice of, and to vote at, the General Meeting.

In addition, shareholders who, as of the Record Date, held Senstar-Israel ordinary shares through a bank, broker or other nominee which is a shareholder of record of Senstar-Israel or which appears

in the participant list of a securities depository, are considered to be beneficial owners of shares held in “street name.” These proxy materials are being forwarded to beneficial owners by your bank, broker or other nominee that is considered the

holder of record. Beneficial owners have the right to direct how their shares should be voted and are also invited to attend the General Meeting, but may not actually vote their shares in person at the General Meeting. For those beneficial owners,

the bank, broker or other nominee that is a shareholder of record has enclosed a voting instruction card for you to use in directing the holder of record how to vote the shares.

As of ________, 2023, the Record Date, there were ___________ Senstar-Israel ordinary shares issued, outstanding and entitled to one vote each upon each of the matters to be presented at the General

Meeting.

Quorum

A quorum must be present in order for the General Meeting to be held. Pursuant to Senstar-Israel’s Articles of Association, the quorum

required for the General Meeting consists of at least two shareholders present, in person or by proxy, who hold or represent at least twenty-five percent (25%) of Senstar-Israel’s issued and outstanding share capital. Broker non-votes and

abstentions will be counted as present at the General Meeting for the purpose of determining whether a quorum is present. A broker non-vote occurs when a bank, broker or other nominee holding Senstar-Israel Shares for a beneficial owner does not

vote on a particular proposal because the nominee does not have discretionary voting power with respect to that proposal and has not received voting instructions from the beneficial owner. While counted for quorum purposes, abstentions and broker

non-votes will not be treated as voting shares and will not have any effect on whether the requisite vote is obtained for all matters placed before shareholders for their vote. The Redomiciliation Proposal at the General Meeting does not allow

for discretionary voting by banks, brokers or other nominees. If within half an hour from the time ap-pointed for the meeting a quorum is not present, the meeting shall be adjourned to _______, 2023, at the same time and place. At such adjourned

meeting, the presence of at least two shareholders in person or by proxy (regardless of the voting power possessed by their shares) will constitute a quorum.

Vote Required

The approval of the Redomiciliation Proposal requires the affirmative vote of holders of at least a majority of the Senstar-Israel ordinary shares present, in person or by proxy, and voting on the

Redomiciliation Proposal (not taking into consideration abstentions), excluding any Senstar-Israel Shares that are held by Merger Sub, Senstar-Ontario or by any person

or entity holding at least 25% of the “means of control” (within the meaning of the ICL) of either Merger Sub or Senstar-Ontario (excluding, in accordance with

the ICL, any holding resulting solely from such person’s holding of Senstar-Israel Shares). Under the Merger Agreement, Senstar-Ontario has

represented that it does not own directly or indirectly any Senstar-Israel ordinary shares.

Each Senstar-Israel ordinary share is entitled to one vote on the Redomiciliation Proposal. If two or more persons are registered as joint owners of any Senstar-Israel ordinary shares, the right to

attend the General Meeting shall be conferred upon all of the joint owners, but the right to vote at the General Meeting and/or the right to be counted as part of the quorum required for the General Meeting shall be conferred exclusively upon the

senior among the joint owners attending the General Meeting, in person or by proxy, and for this purpose seniority shall be determined by the order in which the names appear on Senstar-Israel’s Shareholder Register.

Only Senstar-Israel ordinary shares that are voted will be counted towards determining whether the Redomiciliation Proposal. Senstar-Israel ordinary shares present at the General Meeting that are not

voted on a particular proposal or Senstar-Israel ordinary shares present by proxy where the shareholder properly withheld authority to vote on such proposal (including broker non-votes) will not be counted in determining whether such matter is

approved by shareholders, but will be counted for purposes of determining whether a quorum exists.

Proposed Resolution

It is proposed that the following resolution be adopted at the General Meeting to approve the Redomiciliation Proposal:

“RESOLVED, to approve (i) the Agreement and Plan of Merger dated as of September 26, 2023 (as it may be amended

from time to time, the “Merger Agreement”) by and among Senstar-Israel, a newly established Ontario corporation known as Senstar Technologies Corporation (“Senstar-Ontario”), and Can Co Sub Ltd., a company organized under the laws of the State of Israel and a wholly-owned subsidiary of Senstar-Ontario (“Merger Sub”); (ii) the merger of Merger Sub with and into Senstar-Israel in accordance with Sections 314-327 of the Israeli Companies Law, 5759-1999 (the “ICL”), following which Merger Sub will cease to exist as a separate legal entity and Senstar-Israel will become a wholly-owned subsidiary of Senstar-Ontario (the “Merger”); (iii) the right to receive one (1) validly issued, fully paid and nonassessable common share of Senstar-Ontario, subject to applicable withholding taxes (the

“Merger Consideration”), for each ordinary share, par value NIS 1.00 per share, of Senstar-Israel held by Senstar-Israel’s shareholders as of immediately prior to

the effective time of the Merger; and (iv) all other transactions contemplated by the Merger Agreement and related to the Merger, as detailed in Senstar-Israel’s proxy statement/prospectus for the General Meeting (collectively, the “Redomiciliation Proposal”).”

Senstar-Israel cannot complete the Merger and the Redomiciliation unless its shareholders approve the Redomiciliation

Proposal.

Senstar-Israel’s Board of Directors unanimously recommends a vote “FOR” approval of the Redomiciliation Proposal.

Proxies

All Senstar-Israel ordinary shares represented by properly executed proxies received by Senstar-Israel no later than four (4) hours prior to the General Meeting and not revoked prior to or at the

General Meeting in accordance with the procedure described below will be voted as specified in the instructions indicated in such proxies. If no instructions are indicated, such proxies will not be voted at the General Meeting.

Revocation of Proxies

A shareholder returning a proxy may revoke it at any time prior to commencement of the General Meeting by communicating such revocation in writing to Senstar-Israel or by executing and delivering a

later-dated proxy. In addition, any person who has executed a proxy and is present at the General Meeting may vote in person instead of by proxy, thereby canceling any proxy previously given, whether or not written revocation of such proxy has been

given. Any written notice revoking a proxy should be sent to Senstar-Israel at its principal executive offices located at 10th Floor, Gibor Sport Tower, 7 Menachem Begin Road, Ramat Gan 5268102, Israel, Attention: Chief Financial Officer.

Attendance without voting at the General Meeting will not in and of itself constitute revocation of a proxy.

Solicitation of Proxies

Senstar-Israel will bear the costs of solicitation of proxies for the General Meeting. In addition to solicitation by mail, Senstar-Israel’s directors, officers and employees may solicit proxies from

shareholders by telephone, email, personal interview or otherwise. Senstar-Israel’s directors, officers and employees will not receive additional compensation for such solicitation, but may be reimbursed for out-of-pocket expenses in connection

with such solicitation. Brokers, nominees, fiduciaries and other custodians have been requested to forward soliciting material to the beneficial owners of Senstar-Israel ordinary shares held of record by them, and such custodians will be reimbursed

for their reasonable expenses. Senstar-Israel may reimburse the reasonable charges and expenses of brokerage houses or other nominees or fiduciaries for forwarding proxy materials to, and obtaining authority to execute proxies from, beneficial

owners for whose accounts they hold Senstar-Israel Shares.

As a foreign private issuer, Senstar-Israel is exempt, among other things, from the rules under the Securities Exchange Act of 1934, as amended, related to the furnishing and content of proxy

statements. The circulation of this notice and proxy statement/prospectus should not be taken as an admission that Senstar-Israel is subject to such rules.

REFERENCES TO ADDITIONAL INFORMATION

This proxy statement/prospectus incorporates by reference important business and financial information about Senstar-Israel from other documents that are not included in or delivered with this proxy

statement/prospectus. For a listing of the documents incorporated by reference into this proxy statement/prospectus, see “Where You Can Find More Information.”

You can obtain any of the documents incorporated by reference into this proxy statement/prospectus without charge by requesting them in writing as follows:

Senstar Technologies Ltd.

10th Floor, Gibor Sport Tower

7 Menachem Begin Road

Ramat Gan 5268102, Israel

Attn: Chief Financial Officer

To receive timely delivery of the documents in advance of the General Meeting, you should make your request no later than __________, 2023, which is five business days before the

General Meeting.

You may also obtain copies of all documents incorporate by reference into this proxy statement/prospectus without charge through the SEC’s website (www.sec.gov). In addition, you may obtain copies of documents filed by Senstar-Israel with the SEC on Senstar-Israel’s Investor Relations page on Senstar-Israel’s website at www. senstartechnologies.com.

We are not incorporating the contents of the websites of the SEC, Senstar-Ontario, Senstar-Israel or any other entity into this proxy statement/prospectus. We are providing the

information about how you can obtain certain documents that are incorporated by reference into this proxy statement/ prospectus at these websites only for your convenience.

ABOUT THIS PROXY STATEMENT/PROSPECTUS

This proxy statement/prospectus, which forms part of a registration statement on Form F-4 filed with the SEC by Senstar-Ontario, constitutes a prospectus of Senstar-Ontario under Section 5 of the

Securities Act with respect to the Senstar-Ontario common shares to be issued to Senstar-Israel shareholders pursuant to the Merger Agreement. This proxy statement/prospectus also constitutes a notification with respect to the Special General

Meeting of Senstar-Israel shareholders.

You should rely only on the information contained in or incorporated by reference into this proxy statement/prospectus. No one has been authorized to provide you with information that is different

from that contained in, or incorporated by reference into, this proxy statement/prospectus. This proxy statement/prospectus is dated _____________, 2023. You should not assume that the information contained in this proxy statement/prospectus is

accurate as of any other date. You should not assume that the information incorporated by reference into this proxy statement/prospectus is accurate as of any date other than the date of the incorporated document. Neither our making available this

proxy statement/prospectus to Senstar-Israel shareholders nor the issuance by Senstar-Ontario of common shares pursuant to the Merger Agreement will create any implication to the contrary.

This proxy statement/prospectus does not constitute an offer to sell, or a solicitation of an offer to buy, any securities, or the solicitation of a proxy, in any jurisdiction to

or from any person to whom it is unlawful to make any such offer or solicitation.

All references in this proxy statement/prospectus to “Senstar-Ontario” refer to Senstar Technologies Corporation, the newly formed Ontario corporation formed for purposes of the Redomiciliation; all

references in this proxy statement/prospectus to “Senstar-Israel” refer to Senstar Technologies Ltd., a company organized under the laws of the State of Israel; all references to “Merger Sub” refer to Can Co Sub Ltd., a company organized under the

laws of the State of Israel and a wholly-owned subsidiary of Senstar-Ontario formed for the sole purpose of effecting the Merger, or its permitted assignees; unless otherwise indicated or as the context requires, all references in this proxy

statement/prospectus to the “Senstar Group,” “we,” “our” and “us” refer to Senstar-Israel and its subsidiaries collectively; unless otherwise indicated or as the context requires, all references to the “Merger Agreement” refer to the Agreement and

Plan of Merger, dated as of September 26, 2023 among Senstar-Ontario, Merger Sub and Senstar-Israel, a copy of which is attached to this proxy statement/prospectus as Annex

A; all references to the “Merger” refer to the merger of Merger Sub with and into Senstar-Israel, with Senstar-Israel as the surviving company.

TABLE OF CONTENTS

| |

Page |

|

|

i

|

|

|

1

|

|

|

2

|

|

Risk Factors Relating to the Merger and Redomiciliation

|

2

|

|

|

6

|

|

Senstar Technologies Ltd.

|

6

|

|

Senstar Technologies Corporation

|

6

|

|

Can Co Sub Ltd.

|

6

|

|

|

7

|

|

|

12

|

|

Effects of the Merger

|

12

|

|

Senstar-Israel’s Reasons for the Redomiciliation and the Merger; Recommendation of the Senstar-Israel Board

|

12

|

|

Treatment of Senstar-Israel Options

|

14

|

|

Dividend Policy

|

15

|

|

Nasdaq Listing of Senstar-Ontario Common Shares

|

15

|

|

|

16

|

|

The Merger

|

16

|

|

Structure of the Merger

|

16

|

|

Merger Consideration

|

16

|

|

Closing and Effective Time

|

17

|

|

Exchange Agent; Letter of Transmittal

|

17

|

|

Withholding

|

17

|

|

Dividends and Distributions

|

18

|

|

Representations and Warranties

|

18

|

|

Preparation of the Form F-4 and the Proxy Statement/Prospectus; Senstar-Israel Shareholder Meeting

|

19

|

|

Reasonable Best Efforts

|

19

|

|

Directors’ and Officers’ Indemnification and Insurance

|

20

|

|

Obligations of Senstar-Ontario and Merger Sub

|

20

|

|

Israeli Tax Ruling

|

21

|

|

Israel Securities Authority Approval

|

21

|

|

Conditions to Completion of the Merger

|

21

|

|

Termination of the Merger Agreement

|

22

|

|

Amendments, Extensions and Waivers

|

22

|

|

No Third Party Beneficiaries

|

22

|

|

Governing Law

|

22

|

|

|

23

|

|

|

26

|

|

|

28

|

|

|

32

|

|

|

33

|

|

|

34

|

|

|

40

|

|

|

44

|

|

|

57

|

|

|

57

|

|

|

57

|

|

|

57

|

|

|

58

|

|

Annex A

|

Merger Agreement

|

|

Annex B

|

Proxy Card

|

|

Annex C

|

Senstar Technologies Corporation Certificate and Articles of Incorporation

|

|

Annex D

|

Senstar Technologies Corporation By-laws

|

The following are some questions that you, as a shareholder of Senstar-Israel, may have regarding the Redomiciliation Proposal being considered at the General

Meeting and the answers to those questions. Senstar-Ontario and Senstar-Israel urge you to carefully read the remainder of this proxy statement/prospectus because the information in this section does not provide all the information that might be

important to you with respect to the Redomiciliation Proposal being considered at the General Meeting. Additional important information is also contained in the annexes to, and the documents incorporated by reference into, this proxy

statement/prospectus. For more information, see “Where You Can Find More Information.”

| Q: |

Why is the General Meeting taking place and why am I receiving this proxy statement/prospectus?

|

| A: |

After considering various factors, the Senstar-Israel Board unanimously determined that restructuring our corporate group to cause Senstar-Israel to be an entity incorporated in Ontario

is in the best interests of Senstar-Israel and its shareholders and will best help us accomplish our strategic objectives.

|

In order to effect the Redomiciliation Proposal, Senstar-Ontario, Senstar-Israel and Merger Sub have agreed to a merger of Merger Sub with and into Senstar-Israel, with Senstar-Israel continuing as

the surviving company, under the terms of the Merger Agreement that is described in this proxy statement/prospectus. A copy of the Merger Agreement is attached to this proxy statement/prospectus as Annex A. The Merger Agreement is the legal document governing the Merger.

In order to consummate the Merger, Senstar-Israel shareholders must vote to approve and adopt the Redomiciliation Proposal described in this proxy statement/prospectus, and all other conditions to

the Merger must be satisfied or waived.

Senstar-Israel will hold the General Meeting to obtain this approval for the Redomiciliation Proposal. This proxy statement/prospectus contains important information about the Merger, the

Redomiciliation Proposal and the General Meeting, and you should read it carefully.

Your vote is important. We encourage you to vote as soon as possible.

| Q: |

Why do you want your ultimate parent company to be incorporated in Ontario rather than Israel?

|

| A: |

While Senstar-Israel’s incorporation in Israel has served us and our shareholders well, there are compelling reasons that support restructuring our corporate group to cause us to be an

entity organized in Ontario, Canada at this time.

|

In June 2021, Senstar-Israel completed the sale of its Integration Solution Division to Aeronautics Ltd., a subsidiary of RAFAEL Advanced Defense Systems Ltd., and as part of the acquisition,

Aeronautics also acquired Senstar-Israel’s principal facility in Israel.

Following such sale, the vast majority all of the Senstar Group’s employees and substantially all of our operating assets are in Canada. Senstar-Israel currently employs only two employees, including

our Chief Financial Officer.

After considering various factors, the Senstar-Israel Board determined that it was advisable to proceed with the Redomiciliation. The Senstar-Israel Board’s determination that Ontario is the

preferred jurisdiction of incorporation was based on many factors, including the following:

|

• |

Ontario offers predictable and well-established corporate laws;

|

|

• |

Ontario has a well-developed legal system which we believe encourages high standards of corporate governance and provides shareholders with substantial rights;

|

|

• |

the perception of an Ontario corporation among regulatory authorities, prospective customers, investors and creditors as being highly favorable; and

|

|

• |

Ontario corporate law provides significant flexibility around corporate transactions, including the issuance of equity and the payment of dividends, while at the

same time protecting the rights of shareholders.

|

As a result, we think it is in the best interest of Senstar-Israel and its shareholders, to have our parent company based in Ontario.

For a discussion of the factors that the Senstar-Israel Board considered in determining to recommend the approval and adoption of the Redomiciliation Proposal, see “The Merger— Senstar-Israel’s Reasons for the Redomiciliation and the Merger; Recommendation of the Senstar-Israel Board.”

Despite the potential benefits described above there are risks and we cannot assure you that the anticipated benefits of the Redomiciliation will be realized. Please see the discussion under “Risk Factors.”

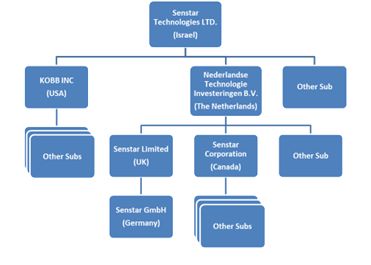

The following diagrams describe the stages of the Redomiciliation and our organizational structure immediately before and after the Merger (and prior to any potential liquidation process of Senstar

Israel):

Prior to Redomiciliation:

Post Restructuring Chart:

| Q: |

Are there any risks associated with the consummation of the Redomiciliation?

|

| A: |

While the Senstar-Israel Board has considered the potential risks associated with the Redomiciliation and has recommended that Senstar-Israel shareholders vote for approval of the

Redomiciliation Proposal, there are risks and we cannot assure you that the anticipated benefits of the Redomiciliation will be realized. For example:

|

|

• |

your rights as a shareholder will change due to differences between Israel and Ontario law and between the governing documents of Senstar-Israel and Senstar-Ontario; and

|

|

• |

the market for Senstar-Ontario Common Shares may differ from the market for Senstar-Israel Shares.

|

You should consider these risks carefully. For additional information, please see the discussion under “Risk Factors.”

| Q: |

Will the Redomiciliation affect our current or future day-to-day operations?

|

| A: |

The Redomiciliation will have no material impact on how we conduct our day-to-day operations.

|

| Q: |

How will ordinary shares of Senstar-Israel differ from the common shares of Senstar-Ontario?

|

| A: |

Senstar-Ontario common shares will be similar to Senstar-Israel’s ordinary shares. However, there are differences between what your rights as a common

shareholder will be under Ontario law and what they currently are as an ordinary shareholder under Israeli law. In addition, there are differences between the organizational documents of Senstar-Israel

and Senstar-Ontario.

|

We discuss these differences in detail under “Description of Senstar-Ontario Share Capital” and “Comparison of Rights of Senstar-Israel Shareholders and Senstar-Ontario Shareholders.” Senstar-Ontario’s Certificate and Articles

of Incorporation (as amended, the “Articles”) and By-laws (the “By-laws”) are

attached as Annex C and Annex D, respectively, to this proxy statement/prospectus.

| Q: |

Will the Merger dilute my economic interest?

|

| A: |

No, your fully-diluted relative economic ownership in Senstar will not change as a result of the Merger and Redomiciliation. Your Senstar-Israel ordinary shares will be exchanged for Senstar-Ontario common shares on a one-to-one basis.

|

| Q: |

How will the Redomiciliation affect our financial reporting and the information we provide to our shareholders?

|

| A: |

Upon completion of the Merger, Senstar-Ontario will be subject to the same reporting requirements of the SEC, the mandates of the Sarbanes-Oxley Act and the

applicable corporate governance rules of Nasdaq as Senstar-Israel before the Merger, and Senstar-Ontario will continue to report our consolidated financial results in U.S. dollars and in accordance with U.S. GAAP. Senstar-Ontario will

continue to file reports on Form 20-F and 6-K with the SEC, as we currently do. Senstar-Ontario will also comply with any additional reporting requirements of Ontario law.

|

| Q: |

Will the Merger and Redomiciliation have any impact on our ability to pay dividends or, if we elect, to buy back common shares?

|

| A: |

Generally, we expect that Ontario law will be more flexible than Israeli law as to these matters.

|

| Q: |

What do I need to do now?

|

| A: |

After you have carefully read and considered the information contained in or incorporated by reference into this proxy statement/prospectus, please either join us at the General Meeting

to vote in person or vote by submitting your proxy card by following the instructions in “The Senstar-Israel Special General Meeting—Vote Required at the Meeting,” and “—Voting Procedures.”

|

Questions and Answers about the Redomiciliation Proposal and Special General Meeting

| Q: |

When and where is the General Meeting?

|

| A: |

The General Meeting will be held on __________, 2023 at ____ a.m. (Israel time), at Senstar-Israel’s principal executive offices at 10th Floor, Gibor Sport Tower, 7 Menachem Begin Road,

Ramat Gan 5268102, Israel.

|

| Q: |

Who is entitled to vote at the General Meeting?

|

| A: |

Only Senstar-Israel shareholders with Senstar-Israel ordinary shares registered in his, her, its or their name or names as of the close of trading on __________, 2023, the record date,

will be entitled to vote at the General Meeting or at any adjournment thereof. As of the close of trading on ____________, 2023, the record date, Senstar-Israel had __________ outstanding ordinary shares, each of which is entitled to one

vote upon the matter presented at the General Meeting.

|

| Q: |

What proposal will be considered at the General Meeting?

|

| A: |

At the General Meeting, you will be asked to consider and vote on the approval of (i) the Merger Agreement; (ii) the Merger; (iii) the Merger Consideration; and (iv) all other

transactions contemplated by the Merger Agreement and related to the Merger, as detailed in Senstar-Israel’s proxy statement/prospectus for the General Meeting (collectively, the “Redomiciliation Proposal”).

|

| Q: |

What constitutes a quorum?

|

| A: |

No less than two Senstar-Israel shareholders present in person or by proxy, and holding or representing between them at least twenty-five percent (25%) of Senstar-Israel’s issued and

outstanding share capital, shall constitute a quorum at the General Meeting. If within one-half hour from the time appointed for the holding of the General Meeting a quorum is not present, the General Meeting shall be adjourned to _______,

2023, at the same time and place. At such adjourned meeting, the presence of at least two Senstar-Israel shareholders in person or by proxy (regardless of the voting power possessed by their shares) will constitute a quorum.

|

Broker non-votes and abstentions will be counted as present at the General Meeting for the purpose of determining whether a quorum is present. A broker non-vote occurs when a bank, broker or other

nominee holding Senstar-Israel Shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that proposal and has not received instructions from the beneficial

owner. While counted for quorum purposes, abstentions and broker non-votes will not be treated as voting shares and will not have any effect on whether the requisite vote is obtained for all matters placed before shareholders for their vote.

| Q: |

What vote of Senstar-Israel shareholders is required to approve the Redomiciliation Proposal?

|

| A: |

The approval of the Redomiciliation Proposal requires the affirmative vote of holders of a majority of the Senstar-Israel Shares present, in person or by proxy, and voting on the

Redomiciliation Proposal (not taking into consideration abstentions) excluding any Senstar-Israel Shares that are held by Merger Sub, Senstar-Ontario or by any person or entity holding at least 25% of the

“means of control” (within the meaning of the ICL) of either Merger Sub or Senstar-Ontario (excluding, in accordance with the ICL, any holding resulting solely from such person’s holding of

Senstar-Israel Shares).

|

| Q: |

How does the Senstar-Israel Board recommend that I vote?

|

| A: |

The Senstar-Israel Board unanimously recommends a vote “FOR” the Redomiciliation Proposal.

|

For a discussion of the factors that the Senstar-Israel Board considered in determining to recommend the approval and adoption of the Redomiciliation Proposal, see “The Merger— Senstar-Israel’s Reasons for the Redomiciliation and the Merger; Recommendation of the Senstar-Israel Board.”

| Q: |

Do any of Senstar-Israel’s directors or executive officers have any interests in the Merger that may be different from, or in addition to, my interests as a

Senstar-Israel shareholder?

|

| A: |

Except for the indemnification and insurance arrangements of the directors and executive officers, no person who has been a director or executive officer of

Senstar-Israel at any time since the beginning of the last fiscal year, or any associate of any such person, has any substantial interest in the Merger, except for any interest arising from his or her ownership of securities of

Senstar-Israel.

|

| A: |

A proxy is another person you authorize to vote on your behalf. Senstar-Israel is asking its shareholders to vote, or to instruct their proxy how to vote, their Senstar-Israel ordinary

shares so that all their shares may be voted at the General Meeting even if the holders do not attend the General Meeting.

|

| Q: |

What do I need to do now?

|

| A: |

After carefully reading and considering the information contained in this proxy statement/prospectus, including the annexes and the other documents incorporated by reference in this

proxy statement/prospectus, please ensure your Senstar-Israel ordinary shares are voted at the General Meeting by completing, dating, signing and mailing the enclosed proxy in the envelope provided at your earliest convenience and in any

event so as to be received in a timely manner as discussed in this proxy statement/prospectus.

|

Your shares can be voted at the General Meeting only if you are present or represented by a valid proxy.

| Q: |

How do I cast my vote if I am a Senstar-Israel shareholder of record?

|

| A: |

If you are a Senstar-Israel shareholder of record, you may vote in person at the General Meeting or by submitting a proxy for the General Meeting. In order for a proxy to be counted, it

must be a duly executed proxy and received prior to the General Meeting. This will be deemed to have occurred only if such proxy is received either by Senstar-Israel at its principal executive offices at 10th Floor, Gibor Sport Tower, 7

Menachem Begin Road, Ramat Gan 5268102, Israel, at any time prior to the commencement of the General Meeting (other than proxies that are revoked or superseded before they are voted). If you submit an executed proxy but do not specify how

to vote your proxy, your Senstar-Israel ordinary shares will not be voted at the General Meeting.

|

Senstar-Israel ordinary shares represented by any proxy received after the times specified above will not be counted as present at the meeting and will not be voted. For more detailed instructions on

how to vote, see “The Senstar-Israel Special General Meeting—Vote Required at the Meeting” and “—Voting Procedures.”

If two or more persons are registered as joint owners of any Senstar-Israel ordinary shares, the right to attend the General Meeting shall be conferred upon all of the joint owners, but the right to

vote at the General Meeting and/or the right to be counted as part of the quorum required for the General Meeting shall be conferred exclusively upon the senior among the joint owners attending the General Meeting, in person or by proxy, and for

this purpose seniority shall be determined by the order in which the names appear on Senstar-Israel’s Shareholder Register.

| Q: |

How do I cast my vote if my Senstar-Israel ordinary shares are held in “street name” by my broker?

|

| A: |

If you hold your Senstar-Israel ordinary shares in “street name” through a bank, broker or other nominee you should follow the instructions on the form you receive from your bank,

broker or other nominee. If your Senstar-Israel Shares are held in “street name” and you wish to vote such shares by attending the General Meeting in person, you will need to obtain a proxy from your bank, broker or other nominee. If your

Senstar-Israel ordinary shares are held in “street name,” you must contact your bank, broker or other nominee to change or revoke your voting instructions.

|

| Q: |

What will happen if I abstain from voting on the Redomiciliation Proposal?

|

| A: |

Proxies submitted with instructions to abstain from voting and broker non-votes will not be considered to be votes “FOR” or “AGAINST” the Redomiciliation Proposal and will have no

effect on the result of the vote.

|

| Q: |

Can I change my vote after I have delivered my proxy?

|

| A: |

You may revoke your proxy at any time before the vote is taken at the General Meeting by (a) delivering to Senstar-Israel at its principal executive offices located at 10th Floor, Gibor

Sport Tower, 7 Menachem Begin Road, Ramat Gan 5268102, Israel, Attention: Chief Financial Officer, a written notice of revocation, bearing a later date than the proxy, stating that the proxy is revoked, (b) by properly submitting a

later-dated proxy relating to the same Senstar-Israel Shares or (c) by attending the General Meeting and voting in person (although attendance at the General Meeting will not, by itself, revoke a proxy). Senstar-Israel Shares represented by

properly executed proxies received by us no later than four (4) hours prior to the General Meeting will, unless such proxies have been previously revoked or superseded, be voted at the General Meeting in accordance with the directions on

the proxies. Written notices of revocation and other communications concerning the revocation of a previously executed proxy should be addressed to us at our principal executive offices located at 10th Floor, Gibor Sport Tower, 7 Menachem

Begin Road, Ramat Gan 5268102, Israel, Attention: Chief Financial Officer.

|

If your Senstar-Israel Shares are held in “street name,” you must contact your bank, broker or other nominee to change or revoke your voting instructions.

| Q: |

If I hold my Senstar-Israel ordinary shares in certificated form, should I send in my share certificates now?

|

| A: |

No. Following the Effective Time, the exchange agent (the “Exchange Agent”), will mail to each Senstar-Israel shareholder instructions regarding

surrendering the Senstar-Israel ordinary shares whether they are certificated or not and making required certifications of the applicability of tax withholding.

|

If you are a Senstar-Israel shareholder with Senstar-Israel ordinary shares held in “street name,” which means your shares are held in an account at a broker, bank or other nominee, you will receive

instructions from your broker, bank or other nominee. For further information, see “The Merger Agreement – Exchange Agent; Letter of Transmittal.”

| Q: |

Am I entitled to exercise dissenters’ rights or appraisal rights instead of receiving the Merger Consideration for my Senstar-Israel ordinary shares?

|

| A: |

No. Under Israeli law, holders of Senstar-Israel ordinary shares are not entitled to statutory appraisal rights in connection with the Merger.

|

Questions and Answers about the Merger

| Q: |

What will happen in the Merger?

|

| A: |

Under the terms of the Merger Agreement, Merger Sub will merge with and into Senstar-Israel, with Senstar-Israel continuing as the surviving company and as a wholly-owned subsidiary of

Senstar-Ontario.

|

For Senstar-Israel shareholders much will remain unchanged following the time the Merger. Just as is the case today with our ordinary shares, we expect the common shares of Senstar-Ontario will trade

on the Nasdaq Global Market under the symbol “SNT.” We will remain subject to the reporting requirements of the SEC, the mandates of the Sarbanes-Oxley Act of 2002 and the corporate governance rules of Nasdaq. We will continue to report our

consolidated financial results in U.S. dollars and under U.S. generally accepted accounting principles.

There will be some differences in shareholder rights, given the differences in the laws between Israel and Ontario. We have included a detailed chart outlining these differences in the attached proxy

statement/prospectus in the section titled “Comparison of Rights of Senstar-Israel Shareholders and Senstar-Ontario Shareholders.”

After the Merger, Senstar-Israel will no longer be a publicly held company, but rather a wholly-owned subsidiary of Senstar-Ontario. As described above, following the consummation of the Merger,

Senstar-Israel intends to dissolve, and as part of the dissolution, Senstar-Israel will transfer to Senstar-Ontario its interests in its subsidiaries by way of distribution.

| Q: |

What is required to complete the Merger?

|

| A: |

Each of Senstar-Ontario’s and Senstar-Israel’s obligation to consummate the Merger is subject, as relevant, to a number of conditions specified in the Merger Agreement, including the

following:

|

|

• |

approval of the Merger Agreement, the Merger and the other transactions contemplated thereby by Senstar-Israel shareholders as described in this proxy statement/prospectus;

|

|

• |

obtaining all required governmental authorizations;

|

|

• |

the SEC declaring effective this registration statement on Form F-4 to be filed by Senstar-Ontario with respect to the Senstar-Ontario common shares to be issued in the Merger;

|

|

• |

the Senstar-Ontario common shares to be issued in the Merger being approved for listing on Nasdaq;

|

|

• |

the expiration of certain statutory waiting periods under the ICL;

|

|

• |

if required, the submission by Senstar-Ontario to the Israel Innovation Authority (the “IAA”) of a written undertaking in customary form to

comply with the provisions of the Israeli Encouragement of Research, Development and Technological Innovation in the Industry Law, 1984 (the “Innovation Law”) following the Merger;

|

|

• |

the accuracy of the representations and warranties of each party (subject to certain materiality standards);

|

|

• |

the material compliance by each party with its obligations under the Merger Agreement; and

|

|

• |

Senstar-Ontario shall have obtained a no-action letter from the Israel Securities Authority that exempts the issuance of the Senstar-Ontario common shares to Senstar-Israel’s Israeli

shareholders from, and confirms that the Israel Securities Law, 5728-1968 (the “Israel Securities Law”) will not take action against Senstar-Ontario in respect of, the requirements of the Israel

Securities Law that would otherwise require the publication of a prospectus in Israel (the “ISA No-Action Letter”).

|

For more information, see “The Merger Agreement—Conditions to Completion of the Merger” as well as the copy of the

Merger Agreement attached to this proxy statement/prospectus as Annex A and incorporated herein by reference.

| Q: |

When do you expect the Merger to be completed?

|

| A: |

Senstar-Ontario and Senstar-Israel expect the closing of the Merger (the “Closing”) to occur in the fourth quarter of the 2023 calendar year

(such date that the Closing occurs, the “Closing Date”). However, the Merger is subject to various regulatory approvals and the satisfaction or waiver of other conditions, and it is possible that

factors outside the control of Senstar Group could result in the Merger being completed at an earlier time, a later time or not at all. There may be a substantial amount of time between the date on which the General Meeting is held and the

date of the completion of the Merger. The Merger will become effective following the satisfaction or waiver of the conditions to Closing upon the issuance by the Companies Registrar of the State of Israel (the “Israeli Companies Registrar”) of a certificate of merger (the “Effective Time”).

|

| Q: |

In the Merger, what will Senstar-Israel shareholders receive for their shares?

|

| A: |

If the Merger is consummated, each Senstar-Israel ordinary share that is issued and outstanding immediately prior to the Effective Time will be automatically acquired by

Senstar-Ontario in consideration of the issuance by Senstar-Ontario of one (1) Senstar-Ontario common share, subject to applicable withholding taxes. For more information, see “The Merger Agreement—Merger

Consideration.”

|

| Q: |

After the Merger, how much of Senstar-Ontario will Senstar-Israel shareholders own?

|

| A: |

The Senstar-Israel shareholders immediately prior to the Effective Time will own 100% of Senstar-Ontario.

|

| Q: |

Will Senstar-Israel shareholders be able to trade the common shares of Senstar-Ontario that they receive in the transaction?

|

| A: |

Yes. The common shares of Senstar-Ontario are expected to be listed on Nasdaq under the symbol “SNT.” The common shares of Senstar-Ontario received in exchange for Senstar-Israel

ordinary shares in the Merger will be freely transferable under U.S. federal securities laws.

|

| Q: |

What will happen to my outstanding Senstar-Israel Options in the Merger?

|

| A: |

For information regarding the treatment of the Senstar-Israel Options, see “The Merger Agreement—Treatment of Senstar-Israel Options.”

|

| Q: |

How will I receive the Merger Consideration to which I am entitled?

|

| A: |

After receiving the proper documentation from holders of Senstar-Israel ordinary shares, subject to the terms and conditions set forth in the Merger Agreement, the Exchange Agent in the

transaction will transfer to such holders the Senstar-Ontario common shares to which such holders are entitled. More information on the documentation required to be delivered to the Exchange Agent may be found in “Material Israeli Tax Consequences.”

|

| Q: |

Do I need to do anything with my certificates representing Senstar-Israel ordinary shares now?

|

| A: |

No. After the Merger is consummated, if you held certificates representing Senstar-Israel ordinary shares prior to the Merger, the Exchange Agent will send you instructions for

exchanging your Senstar-Israel ordinary shares for the Merger Consideration.

|

| Q: |

What happens if the Merger is not completed?

|

| A: |

If the Redomiciliation Proposal is not approved by Senstar-Israel’s shareholders or if the Merger is not completed for any other reason, Senstar-Israel shareholders will not receive the

Merger Consideration in exchange for their Senstar-Israel ordinary shares. Instead, Senstar-Israel will remain a public company and Senstar-Israel ordinary shares will continue to be listed and traded on Nasdaq.

|

| Q: |

What are the U.S. federal income tax consequences of the exchange of Senstar-Israel ordinary shares for the Merger Consideration?

|

| A: |

It is intended that holders of Senstar-Israel ordinary shares will not recognize any gain or loss for U.S. federal income tax purposes on the Merger but the closing of the Merger is not

conditioned upon the receipt of any opinion or tax ruling from the IRS to that effect. Please refer to “Material U.S. Federal Income Tax Consequences” for a description of material U.S. federal

income tax consequences of the Merger to Senstar-Israel shareholders.

|

A holder may be subject to special circumstances or rules. Each holder should consult its own tax advisors concerning the U.S. federal income tax consequences relating to the Merger in light of its

particular circumstances and any consequences arising under the laws of any state, local or non-U.S. taxing jurisdiction. A more complete description of the material U.S. federal income tax consequences of the Merger is provided in the “Material U.S. Federal Income Tax Consequences.”

Q: What are the Israeli tax consequences of the exchange of Senstar-Israel Shares for the Merger Consideration?

A: The following statements are only a summary of certain material Israeli tax consequences of the Merger.

As a consequence of the Merger, holders of Senstar-Israel ordinary shares will be treated as having sold their Senstar-Israel ordinary shares in the Merger. When an Israeli

company is sold, regardless of whether the consideration in the sale is cash or stock, its shareholders are generally subject to Israeli taxation.

The ITO distinguishes between ‘Real Capital Gain’ and ‘Inflationary Surplus’. The Inflationary Surplus is the portion of the total capital gain which is equivalent to the increase of the relevant

asset’s purchase price which is attributable to the increase in the Israeli CPI or, in certain circumstances, a foreign currency exchange rate, between the date of purchase and the date of sale. The Real Capital Gain is the excess of the total

capital gain over the Inflationary Surplus.

The capital gains tax rate applicable to the Real Capital Gain is 25% for individuals (and if such individual is holding or is entitled to purchase, directly or indirectly,

alone or together with such person’s relative or another person who collaborates with such person on a permanent basis, one of the following: (i) at least 10% of the issued and outstanding Senstar-Israel ordinary shares, (ii) at least 10% of the

voting rights of Senstar-Israel, (iii) the right to receive at least 10% of Senstar-Israel’s profits or its assets upon liquidation, (iv) the right to appoint a manager/director, or (v) the right to instruct any other person to do any of the

foregoing (a “Major Shareholder”) on the date of sale or on any date falling within the 12-month period preceding that date of sale, such Major Shareholder would be subject to Israeli taxation at the rate of 30%) and 23% for corporations. An

additional tax at a rate of three percent on the Real Capital Gain may be imposed upon individual shareholders whose annual income from all sources that is taxable in Israel exceeds a certain amount. The Inflationary Surplus is generally exempt

from tax, provided that the shares being sold were acquired after December 31, 1993.

Senstar-Israel intends to request a tax ruling from the Israel Tax Authority permitting Senstar-Israel shareholders who purchased Senstar Israel ordinary

shares in the ordinary course trading on Nasdaq and satisfies all the conditions stated in such ruling (which are referred to in the ruling as the “Interested Public”), to defer the obligation (if any) to pay Israeli tax on the exchange of the

Senstar-Israel ordinary shares for Senstar-Ontario common shares in accordance with the provisions of Section 104H of the ITO until a later disposition event, and exempting Senstar-Ontario, the Exchange Agent, the surviving company and their

respective agents from any obligation to withhold Israeli Tax from the Merger Consideration, or clarifying that no such obligation exists (the “Tax Ruling”). The

Tax Ruling is not applicable for “Controlling Shareholders”, interested parties and office holders. For such “Controlling shareholders”, interested parties and office holders the provisions of the ITO or any other provisions given by the Israeli

Tax Authority under separate specific ruling (if any) shall apply. The term “Controlling Shareholders” is defined under the ITO as a person who holds, or is entitled to purchase, directly or indirectly, alone or together with a relative, one of the

following: (1) at least 5% of the issued share capital of the company; (2) at least 5% of the voting rights in the company; (3) the right to receive at least 5% of the company’s profits or assets upon liquidation; (4) the right to appoint a manager

to the company. If and when the Tax Ruling is finalized, Senstar-Israel will issue a press release and furnish a Form 6-K or other document with the SEC describing the scope of the exemptions provided by the ruling. There can be no assurance that such ruling will be granted before the Closing or at all or that, if obtained, such ruling will be granted under the conditions requested by

Senstar-Israel.

Whether or not a particular Senstar-Israel shareholder is actually subject to Israeli capital gains tax in connection with the Merger, absent receipt by Senstar-Israel of a Tax

Ruling from the Israel Tax Authority prior to Closing, all Senstar-Israel shareholders will be subject to Israeli tax withholding at the rate of 25% (for individuals) and 23% (for corporations) on the gross Merger Consideration (unless the

shareholder requests and obtains an individual certificate of exemption or a reduced tax rate from the Israeli Tax Authority, as described below), and Senstar-Ontario or the Exchange Agent will be required to withhold an amount equal to 25%, 23% or

such other reduced tax rate as stipulated in the certificate obtained, as applicable, of the gross Merger Consideration received by such shareholder. For details, please see “

The Merger Agreement withholding”.

Regardless of whether Senstar-Israel obtains the requested Tax Ruling from the Israel Tax Authority, any holder of Senstar-Israel Shares who believes that it is entitled to such

an exemption (or reduced tax rate) may separately apply to the Israel Tax Authority to obtain a certificate of exemption from withholding or an individual tax ruling providing for no withholding or withholding at a reduced rate, and submit such

certificate of exemption or ruling to the Exchange Agent at least five business days prior to the date that is 180 days following the Closing Date. If Senstar-Ontario or the Exchange Agent receive a valid exemption certificate or tax ruling (as

determined in Senstar-Ontario’s or the Exchange Agent’s discretion) at least five business days prior to the date that is 180 days following the Closing Date, then the withholding (if any) of any amounts under the ITO, from the Merger Consideration

payable shall be made only in accordance with the provisions of such Israeli tax certificate or tax ruling, subject to delivery by such holder concurrently with such certificate of the withholding amount, if and to the extent required under such

certificate or tax ruling (such withholding amount to be increased by interest plus linkage differences, as defined in Section 159A(a) of the ITO, for the period between the 15th day of the calendar month following the month during which the

Closing occurs and the time that the Merger Consideration is delivered).

You are urged to consult with your own tax advisor for a full understanding of the tax consequences of the Merger to you, including the consequences under any applicable, state,

local, foreign or other tax laws.

For a more detailed description of the material Israeli tax consequences of the Merger, see the section entitled “Material Israeli Tax Consequences.”

| Q: |

Who can help answer my questions?

|

| A: |

If you have questions about the Merger or Redomiciliation or desire additional copies of this proxy statement/prospectus or additional proxy cards, you should contact ___________, the

Exchange Agent for the Merger, at ___________.

|

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This proxy statement/prospectus and the documents incorporated by reference into this proxy statement/prospectus contain forward-looking statements within the meaning of the safe harbor provisions of

the Private Securities Litigation Reform Act of 1995 and forward-looking information within the meaning of the Securities Act (Ontario), which we refer to

collectively as forward-looking statements. These forward-looking statements are not limited to historical facts, but reflect Senstar-Ontario’s and Senstar-Israel’s current beliefs, expectations or intentions regarding future events. Words such as

“may,” “will,” “could,” “should,” “expect,” “plan,” “project,” “intend,” “anticipate,” “believe,” “seek,” “estimate,” “predict,” “potential,” “pursue,” “target,” “continue,” and similar expressions are intended to identify such forward-looking

statements. These forward‑looking statements include, without limitation, the manner in which the parties plan to effect the proposed Merger; the expected benefits and costs of the proposed Merger; the expected timing of the completion of the