UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One)

THE SECURITIES EXCHANGE ACT OF 1934

OR

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended

OR

THE SECURITIES EXCHANGE ACT OF 1934

OR

THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report:

Commission File Number:

(Exact name of Registrant as specified in its charter)

| Not applicable | State of | |

| (Translation of Registrant’s name into English) | (Jurisdiction of incorporation or organization) |

1-800-554-9041

(Address of principal executive offices)

Robert Powell

c/o

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered | ||

| The Stock Market LLC | ||||

| The Stock Market LLC |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by this Annual Report: ordinary shares and warrants to purchase ordinary shares (as of May 1, 2024).

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☒ | Emerging growth company |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act.

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting over Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b).

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| US GAAP ☒ | International Financial Reporting Standards as issued by the International Accounting Standards Board ☐ | Other ☐ |

If “Other” has been checked in response to the previous question indicate by check mark which financial statement item the registrant has elected to follow. Item17 ☐ Item18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐

TABLE OF CONTENTS

i

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 20-F (including information incorporated by reference herein, the “Annual Report”) contains or may contain forward-looking statements as defined in Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that involve significant risks and uncertainties. All statements other than statements of historical facts are forward-looking statements. These forward-looking statements include information about our possible or assumed future results of operations or our performance. Words such as “expects,” “intends,” “plans,” “believes,” “anticipates,” “estimates,” and variations of such words and similar expressions are intended to identify the forward-looking statements.

Unless the context otherwise requires, all references in this Annual Report to “we,” “us”, “our” or the “Company” refer to Holdco Nuvo Group D.G Ltd. following the consummation of the Business Combination, which operates the business of Nuvo Group Ltd. and its subsidiaries following the consummation of the Business Combination, and Nuvo Group Ltd. prior to the consummation of the Business Combination.

Forward-looking statements in this Annual Report may include, for example, statements about:

| ● | the benefits of the Business Combination |

| ● | the Company’s financial performance following the Business Combination; |

| ● | the ability to maintain the listing of Holdco Ordinary Shares on the Nasdaq Global Market and the Holdco Warrants on the Nasdaq Capital Market following the Business Combination; |

| ● | the projected financial information, anticipated growth rate, and market opportunity for the Company, and estimates of expenses and profitability; |

| ● | the potential liquidity and trading of public securities of Holdco; |

| ● | the ability to raise financing in the future by Holdco; |

| ● | the effectiveness and profitability of Nuvo’s collaborations and partnerships, its ability to maintain current collaborations and partnerships and enter into new collaborations and partnerships; |

| ● | estimates related to future revenue, expenses, capital requirements and need for additional financing; |

| ● | the impact of natural disasters or health epidemics/pandemics, including a resurgence of the COVID-19 pandemic; |

| ● | the effects of increased competition as well as innovations by new and existing competitors in our industry; |

| ● | geopolitical risk, including the impacts of the ongoing conflict between Russia and Ukraine, and the war between Israel and Hamas; |

| ● | Nuvo’s ability to demonstrate the feasibility of its INVU platform for commercial applications; |

| ● | Nuvo’s ability to generate revenue in accordance with its business model; |

| ● | Nuvo’s expectations regarding its ability to obtain and maintain intellectual property protection and not infringe on the rights of others; |

| ● | Nuvo’s ability to develop, market and sell its INVU platform; |

| ● | Nuvo’s ability to develop its sales and marketing organization; |

1

| ● | changes in applicable laws or regulations; |

| ● | the outcome of any known and unknown litigation and regulatory proceedings; and |

| ● | regulatory developments in the United States and foreign countries. |

By their nature, forward-looking statements involve known and unknown risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future and are based on potentially inaccurate assumptions. Forward-looking statements are not guarantees of future performance. The risks outlined above and others described in the section entitled (Risk Factors) are not exhaustive. Other sections of this Annual Report describe additional factors that could adversely affect the results of operations, financial condition, liquidity and the development of Nuvo and Holdco, the industry the Company operates in and risks relating to the Business Combination. New risks can emerge from time to time, and it is not possible to predict all such risks, nor can it be assessed the impact of all such risks on the Company’s business or to the extent which any such risks or combinations of risks and other factors may cause actual results to differ materially from those contained in any forward-looking statements. Given these results and uncertainties, you should not rely on forward-looking statements as a prediction of actual results.

Accordingly, you should not place undue reliance on these forward-looking statements, which speak only as of the date of this Annual Report. The Company does not undertake any obligation to publicly revise any forward-looking statement to reflect circumstances or events after the date of this Annual Report or to reflect the occurrence of unanticipated events. You should, however, review the factors and risks described in the reports filed by LAMF (prior to the SPAC Effective Time) or Holdco (after the Acquisition Effective Time) from time to time with the Securities and Exchange Commission (the “SEC”) after the date of this Annual Report.

The risk factors and cautionary language referred to or incorporated by reference in this Report provide examples of risks, uncertainties and events that may cause actual results to differ materially from the expectations described in our forward-looking statements, including among other things, the items identified in Item 3.D. “Risk Factors” of this Annual Report.

2

EXPLANATORY NOTE

On May 1, 2024, Holdco consummated the previously announced business combination pursuant to the Business Combination Agreement, dated as of August 17, 2023 (as amended, the “Business Combination Agreement”), by and among LAMF, Nuvo, Holdco, Assetco, and Merger Sub. Capitalized terms used in this section but not otherwise defined herein have the meanings given to them in the Business Combination Agreement. Pursuant to the Business Combination Agreement and the related ancillary agreements:

| ● | After the SPAC Effective Time on April 30, 2024, LAMF merged with and into Assetco (the “SPAC Merger”) with Assetco continuing as the surviving corporation (Assetco, in its capacity as the surviving entity of the SPAC Merger, the “SPAC Surviving Company”). |

| ● | Pursuant to the SPAC Merger, each Class A ordinary share of LAMF, par value $0.0001 per share (the “LAMF Class A Ordinary Shares”), issued and outstanding immediately prior to the SPAC Effective Time was automatically cancelled and converted into the right to receive outstanding ordinary shares of Holdco (“Holdco Ordinary Shares”). |

| ● | On May 1, 2024, the date of the closing of the Business Combination (the “Closing”), Merger Sub merged with and into Nuvo (the “Acquisition Merger”) with Nuvo continuing as the surviving corporation (Nuvo, in its capacity as the surviving entity of the Acquisition Merger, the “Acquisition Surviving Sub”). |

| ● | Pursuant to the Acquisition Merger, (i) each of the ordinary shares of Nuvo, par value NIS 0.01 per share (the “Nuvo Shares”), issued and outstanding immediately prior to Acquisition Effective Time were automatically cancelled and converted into the right to receive a number of Holdco Ordinary Shares determined pursuant to an equity exchange ratio of 96.139% (the “Equity Exchange Ratio”), which is equal to the equity value per share (determined by dividing an aggregate equity value of approximately $300 million upon achieving a commercial milestone (the “Equity Value”), by the fully diluted share capital of Nuvo), divided by $10.20 per share, (ii) each of the preferred shares of Nuvo, par value NIS 0.01 per share (the “Nuvo Crossover Preferred Shares”), issuable in connection with the securities purchase agreements Nuvo and Holdco entered into with certain investors prior to the execution of the Business Combination Agreement (the “Interim Financing”) issued and outstanding immediately prior to the effective time of the Acquisition Merger were automatically cancelled and converted into the right to receive a number of preferred shares of Holdco (the “Holdco Preferred Shares”) determined by the Equity Exchange Ratio, (iii) each warrant for the purchase of Nuvo Shares issued and outstanding immediately prior to the effective time of the Acquisition Merger were automatically cancelled and converted into the right to receive one warrant to purchase a number of Holdco Ordinary Shares determined by the Equity Exchange Ratio, and (iv) each outstanding and unexercised option to purchase Nuvo Shares, whether or not then vested or fully exercisable, were assumed by Holdco and converted into an option to purchase a number of Holdco Ordinary Shares as determined by the Equity Exchange Ratio, in each case subject to the adjustments described in the Business Combination Agreement. |

| ● | After the SPAC Merger and the Acquisition Merger, the SPAC Surviving Company distributed any amounts remaining in LAMF’s trust account (the “Trust Account”) to Holdco and was then liquidated (the “Liquidation”). |

The SPAC Merger, the Acquisition Merger, the Liquidation and the other transactions contemplated by the Business Combination Agreement are referred to as the “Business Combination”.

Prior to, upon and following the execution of the Business Combination Agreement, Nuvo and Holdco entered into securities purchase agreements (the “Interim Financing Agreements”) with certain investors (the “Interim Financing Investors”) pursuant to which (i) Nuvo issued Nuvo Crossover Preferred Shares to the Interim Financing Investors (which Nuvo Preferred Shares were exchanged for Holdco Preferred Shares in the Acquisition Merger) and (ii) upon the Closing, Holdco issued an aggregate of 3,823,530 Holdco Ordinary Shares to the Interim Financing Investors, which shares were not registered under the Securities Act in connection with the Business Combination Agreement, and which provided Nuvo with an aggregate of approximately $13,000,000 of gross proceeds as a result of the Interim Financing. Certain of the Interim Financing Investors are affiliated with LAMF and the Sponsor and invested an aggregate of $2,000,000 in the Interim Financing (such investors the “Sponsor Investors”). These affiliates are: (i) Jeffrey Soros, LAMF’s Chairman, who invested $500,000, (ii) Tamim Mourad, a strategic investor of LAMF and an affiliate of a member of the Sponsor, who invested $500,000 and (iii) Gaingels 10X Capital Diversity Fund I, LP, a Delaware limited partnership and an affiliate of a member of the Sponsor, that invested $1,000,000.

3

Concurrently with the consummation of the Business Combination shareholders and warrantholders of LAMF (including through units previously issued by LAMF) became shareholders and warrantholders of Holdco, other than those holders of the LAMF Class A Ordinary Shares who previously elected to redeem their LAMF Class A Ordinary Shares. The other shareholders and equityholders of Holdco include management of Nuvo and investors in Nuvo immediately before the Closing.

Bridge Financing

Since November 2023 Nuvo has been engaged in a bridge financing (the “Bridge Financing”), which involves the issuance of secured convertible bridge notes (individually, a “Bridge Financing Note”; collectively, the “Bridge Financing Notes”) to investors (“Bridge Financing Holders”).

The Bridge Financing Notes carry a 15% annual interest rate and upon conversion on the applicable Maturity Date (as defined in the Bridge Financing Notes), (i) Nuvo will pay the Holders all accrued interest on the Bridge Financing Notes up to the date of payment or conversion, and (ii) the Holders in their sole discretion, may choose to either (a) receive the principal amount of the Bridge Financing Note in cash; or (b) convert the principal amount of the investment into Nuvo Shares at a price per share of $7.0265 (or, post-Closing, the resulting number of Holdco Ordinary Shares after applying the equity exchange ratio of 96.139%).

As of the date hereof, approximately $8.5245 million in principal amount of Bridge Financing Notes has been received by Nuvo, and the offering of the Bridge Financing Notes remains ongoing.

From March 24, 2024 through April 8, 2024, Nuvo entered into amendments to all of the existing Bridge Financing Notes at that time representing $6.5732 million principal amount of the Bridge Financing Notes, to extend the maturity dates thereof (the “Bridge Financing Notes Amendments”). All new Bridge Financing Notes since April 8, 2024 include the amended maturity definition. Prior to the Bridge Financing Notes Amendments, the Bridge Financing Notes were scheduled to mature on the earlier of (i) twelve months from the issuance date thereof, (ii) the closing of the Business Combination, (iii) the closing of an initial public offering, or (iv) the closing of a bona fide financing by Nuvo for the principal purpose of raising capital, through the sale of Nuvo securities in whatever form or type (whether debt or equity) that raises in excess of $10,000,000 in gross proceeds. Pursuant to the Bridge Financing Notes Amendments, the maturity date of the amended Bridge Financing Notes was revised to be the earlier of (i) twelve months from the issuance date thereof, (ii) six (6) months following the closing of the Business Combination, (iii) six (6) months following the closing of an initial public offering, or (iv) the closing of a bona fide financing by Nuvo for the principal purpose of raising capital, through the sale of Nuvo securities in whatever form or type (whether debt or equity) that raises in excess of $25,000,000 in gross proceeds.

Each Bridge Financing Note is secured by all of Nuvo’s intellectual property, and Nuvo has filed collateral assignments/financing statements with the United States Patent & Trademark Office and is in the process of filing collateral assignments/financing statements with Nuvo’s Registrar in Israel. Gaingels 10x Capital Diversity Fund I, LP, a Bridge Financing Holder and an affiliate of a member of the Sponsor serves as collateral agent with respect to the collateral securing the Bridge Financing Notes. Upon the occurrence of any event of default described therein, the outstanding balance under the Bridge Financing Notes shall become immediately due and payable upon election of the Bridge Financing Holder and following a written demand notice sent to Nuvo.

In consideration for the services to be rendered under certain advisory services agreements between the Bridge Financing Holders and Nuvo, Nuvo issued a warrant to each Bridge Financing Holder, whereby the Bridge Financing Holder is given the right to purchase such number of Nuvo Shares (or, post-Closing, Holdco Ordinary Shares after applying the equity exchange ratio of 96.139%) equal to (2x) the principal amount of the Holder’s Bridge Financing Note divided by the same price per share noted above (i.e., $7.0265), at an exercise price of NIS 0.01.

This summary is qualified in its entirety by reference to the full text of each of the form of Bridge Financing Convertible Note, the form of Bridge Financing Warrant and the form of Bridge Financing Notes Amendment, which are filed as exhibits 4.10, 4.11 and 4.12, respectively, to this Annual Report.

Certain amounts that appear in this Annual Report may not sum due to rounding.

4

DEFINED TERMS

In this Annual Report:

“2024 Plan” means the proposed equity incentive plan for employees, directors and service providers of Holdco and its subsidiaries.

“Acquisition Effective Time” means such time as the Acquisition Merger became effective.

“Acquisition Merger” means the merger of Merger Sub with and into Nuvo.

“Amended Articles” means the amended and restated articles of association of Holdco effective immediately prior to the closing of the Business Combination.

“Assetco” means Nuvo Assetco Corp., a Cayman Islands exempted company and a wholly owned subsidiary of Holdco.

“Bridge Financing” means the bridge financing (the “Bridge Financing”) undertaken by Nuvo by issuing to investors Bridge Financing Notes since November 2023 which notes, if executed prior to April 2024, were amended in March and April 2024 to extend the maturity date thereof to no earlier than six months from the Closing.

“Bridge Financing Notes” means the secured convertible bridge notes issued in the Bridge Financing, as amended.

“Business Combination” means the Mergers and the other transactions contemplated by the Business Combination Agreement, collectively.

“Business Combination Agreement” means the Business Combination Agreement, dated as of August 17, 2023 by and among Nuvo, Holdco, Nuvo Assetco, LAMF, and Merger Sub.

“Business Day” means any day other than a Friday, a Saturday, a Sunday or other day on which commercial banks in New York, New York, Israel or the Cayman Islands are authorized or required by legal requirements to close.

“Cayman Companies Act” or “Companies Act” means Companies Act (As Revised) of the Cayman Islands.

“Closing” means the consummation of the Business Combination.

“Closing Date” means May 1, 2024, the date on which the Business Combination was consummated.

“Code” means the Internal Revenue Code of 1986, as amended.

“Companies Law” means the Israeli Companies Law, 5759-1999, as amended from time to time, including the regulations promulgated thereunder, or any other law that may come in its stead, including all amendments made thereto.

“Eligible Nuvo Equityholder” means a holder of a Nuvo Share or a Nuvo Preferred Share, in each case outstanding immediately prior to the Acquisition Effective Time.

“Equity Exchange Ratio” means the quotient obtained by dividing (a) the Equity Value Per Share by (b) the Reference Price.

“Equity Value” means an amount equal to $299,999,993.

“Equity Value Per Share” means an amount equal to (a) the Equity Value divided by (b) the number of Fully Diluted Nuvo Equity Securities.

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

5

“Founder Shares” means the LAMF Class B Ordinary Shares held by Sponsor, which were converted into LAMF Class A Ordinary Shares on May 11, 2023.

“Fully Diluted Nuvo Equity Securities” means (a) the Nuvo Shares and Nuvo Preferred Shares, in each case outstanding immediately prior to the Acquisition Effective Time and (b) the Nuvo Shares that, immediately prior to the Acquisition Effective Time are issuable upon the exercise of Nuvo Warrants and Nuvo Options (whether or not vested or currently exercisable), provided, however, that Fully Diluted Nuvo Equity Securities shall not include any (i) Earnout Shares (as defined in the Business Combination Agreement) or (ii) Nuvo Shares issuable upon the conversion of then outstanding Nuvo Preferred Shares.

“Holdco” means Holdco Nuvo Group D.G Ltd., a limited liability company incorporated with limited liability under the laws of the State of Israel to serve as “Holdco” for all purposes under the Business Combination Agreement.

“Holdco Board” means the board of directors of Holdco.

“Holdco Ordinary Shares” means the ordinary shares of Holdco, no par value.

“Holdco Preferred Shares” means the preferred shares of Holdco, which shall be entitled to rights and preferences as is customary for the preferred stock of a company whose stock is traded on a national securities exchange, including those expressly set forth in the “Rights of Company Crossover Preferred Shares” attached as Exhibit E to the Business Combination Agreement and, upon conversion, they shall entitle the holder to receive Holdco Ordinary Shares.

“Holdco Securities” means collectively Holdco Ordinary Shares and Holdco Warrants.

“Holdco Shareholders” means the shareholders of Holdco.

“Holdco Warrant” means a warrant to purchase one Holdco Ordinary Share.

“IASB” means International Accounting Standards Board.

“Interim Financing” means the cross-over interim round of financing by Nuvo, whereby the Nuvo Crossover Preferred Shares were issued pursuant to the Interim Financing Agreements to the Interim Financing Investors (which Nuvo Preferred Shares were exchanged for Holdco Preferred Shares in the Acquisition Merger) and, in addition as an incentive, upon and subject to the Closing, Holdco issued Holdco Ordinary Shares to the Interim Financing Investors.

“Interim Financing Agreements” means the securities purchase agreements entered into by and between Nuvo, Holdco and the Interim Financing Investors in connection with the Interim Financing.

“Interim Financing Investors” means those certain investors in the Interim Financing.

“Investment Company Act” means the Investment Company Act of 1940, as amended.

“IPO” means LAMF’s initial public offering of LAMF Units, which was consummated on November 16, 2021.

“IRS” means the U.S. Internal Revenue Service.

“JOBS Act” means Section 2(a) of the Securities Act, as modified by the Jumpstart Our Business Startups Act of 2012, as amended.

6

“LAMF” means LAMF Global Ventures Corp. I, a Cayman Islands exempted company.

“LAMF Board” means the board of directors of LAMF.

“LAMF Class A Ordinary Shares” means LAMF’s Class A ordinary shares, par value $0.0001 per share.

“LAMF Class B Ordinary Shares” means LAMF’s Class B ordinary shares, par value $0.0001 per share.

“LAMF Exchange Ratio” means the exchange of LAMF Ordinary Shares for Holdco Ordinary Shares on a one-for-one basis.

“LAMF Insiders” means the Sponsor and certain officers and directors and advisors of LAMF.

“LAMF Ordinary Shares” means, collectively, the LAMF Class A Ordinary Shares and the LAMF Class B Ordinary Shares.

“LAMF Securities” means, collectively, the LAMF Ordinary Shares, the LAMF Warrants and the LAMF Units.

“LAMF Shareholders” means the holders of LAMF Ordinary Shares.

“LAMF Units” means the 25,300,000 LAMF units issued in connection with the IPO, each of which consists of one LAMF Class A Ordinary Share and one-half of one Public Warrant.

“LAMF Warrantholders” means holders of the LAMF Warrants.

“LAMF Warrants” means, collectively, the Public Warrants and the Private Placement Warrants.

“LAMF Warrant Agreement” means the Warrant Agreement, dated as of November 10, 2021, by and between LAMF and Continental Stock Transfer & Trust Company, as warrant agent.

“Merger Sub” means H.F.N Insight Merger Company Ltd., a limited liability company organized under the laws of the State of Israel and a wholly owned subsidiary of LAMF.

“Mergers” means the Acquisition Merger and the SPAC Merger.

“Nasdaq” means the Nasdaq Global Market.

“Nuvo” means Nuvo Group Ltd., a limited liability company organized under the laws of the State of Israel.

“Nuvo 2015 Plan” means Nuvo’s 2015 Share Incentive Plan.

“Nuvo Crossover Preferred Shares” means the preferred shares of Nuvo, with par value NIS 0.01 per share, issued in connection with the Interim Financing.

“Nuvo Convertible Loans” means the convertible loans made by certain investors pursuant to several loan agreements entered into from May 29, 2022 through June 30, 2023 (as amended in August 2023 in connection with the execution of the Business Combination Agreement), by and between Nuvo and each such investor, which loans represented an aggregate principal amount of approximately $7.9 million bear interest at a rate of 2% per month, matured on the Closing Date, at which time the principal amount and accrued interest on such loans were applied to the related Nuvo SAFEs issued to such investors in connection with provision of the Nuvo Convertible Loans.

“Nuvo Loan Amendment” means the amendments to the Nuvo Convertible Loans to cause each Nuvo Convertible Loan to be automatically converted prior to the Acquisition Effective Time into Nuvo Shares pursuant to the terms of such Nuvo Convertible Loan and under the terms of the Nuvo SAFE Amendment.

7

“Nuvo Options” means each outstanding and unexercised option to purchase Nuvo Shares, whether or not then vested or fully exercisable, granted prior to the Acquisition Effective Time to any current or former employee, officer, director or other service provider of Nuvo or its direct and indirect subsidiaries.

“Nuvo Optionholders” means the holders of the Nuvo Options.

“Nuvo Preferred Shares” means the Nuvo Crossover Preferred Shares.

“Nuvo SAFEs” means the Simple Agreements for Future Equity of the Company entered into by and between Nuvo and certain investors, service providers and lenders, from June 2020 through April 2023 (as amended in August 2023 pursuant to the Nuvo SAFE Amendment).

“Nuvo SAFE Amendment” means the amendments to cause each Nuvo SAFE to be automatically converted prior to the Acquisition Effective Time into Nuvo Shares pursuant to the terms of such Nuvo SAFEs.

“Nuvo Shares” means the ordinary shares of Nuvo, with par value NIS 0.01 per share.

“Nuvo Shareholders” means the shareholders of Nuvo.

“Nuvo Warrants” means the warrants issued on May 20, 2015 by Nuvo, exercisable to purchase up to 45,428 Nuvo Shares at an exercise price per share of NIS 0.01.

“Original Registration Rights Agreement” means that certain Registration Rights Agreement, dated as of November 10, 2021, by and among LAMF, Sponsor and certain other parties thereto.

“PFIC” means passive foreign investment company.

“Private Placement Units” means the 1,106,000 private placement units, purchased by the Sponsor at a price of $10.00 per Private Placement Unit in a private placement consummated concurrently with the closing of the IPO, each consisting of one LAMF Class A Ordinary Share and one-half of one Private Placement Warrant.

“Private Placement Warrants” means the warrants to purchase LAMF Class A Ordinary Shares purchased in a private placement in connection with the IPO, at an exercise price of $11.50 per share.

“Pro Rata Share” means, for each Eligible Nuvo Equityholder, a percentage determined by dividing (a) the sum of (i) the total number of Nuvo Shares issued and outstanding held by such Eligible Nuvo Equityholder immediately prior to the Acquisition Effective Time, plus (ii) the total number of Nuvo Preferred Shares issued and outstanding held by such Eligible Nuvo Equityholder immediately prior to the Acquisition Effective Time, by (b) the total number of Nuvo Shares and Nuvo Preferred Shares issued and outstanding as of immediately prior to the Acquisition Effective Time.

“Public Shareholders” means the holders of the Public Shares.

“Public Shares” means the LAMF Class A Ordinary Shares sold in the IPO (whether such shares were purchased in the IPO as part of the LAMF Units or thereafter in the open market).

“Public Warrants” means the warrants included in the LAMF Units sold in the IPO, each of which is exercisable for one LAMF Class A Ordinary Share, in accordance with its terms, at an exercise price of $11.50 per share.

“Redemption Right” means the right to redeem LAMF Class A Ordinary Shares in connection with the approval of the Business Combination.

“Reference Price” means $10.20.

“Registration Rights Agreement” means the registration rights agreement, dated as of May 1, 2024, by and among Holdco, Nuvo, LAMF, Sponsor, certain affiliates and members of the Sponsor and certain Nuvo Shareholders, which is in the form attached to the Business Combination Agreement as Exhibit C.

8

“SEC” means the U.S. Securities and Exchange Commission.

“Securities Act” means the Securities Act of 1933, as amended.

“Shareholder Support Agreement” means the Shareholder Support Agreement, dated as of August 17, 2023 by and among LAMF, the Nuvo Shareholders, Nuvo and Holdco.

“SPAC Effective Time” means such time as the SPAC Merger becomes effective.

“SPAC Exchange Ratio” means 1.00.

“SPAC Merger” means the merger of LAMF with and into Assetco upon the terms and subject to the conditions set forth in the Business Combination Agreement, the plan of merger relating to the SPAC Merger and in accordance with the applicable provisions of the Companies Act, whereupon the separate corporate existence of LAMF ceased and Assetco continued its existence under the Companies Act as the surviving company.

“Sponsor” means LAMF SPAC Holdings I LLC, a Cayman Islands limited liability company.

“Sponsor Shares” means the LAMF Class A Ordinary Shares and LAMF Class B Ordinary Shares held by Sponsor.

“Sponsor Support Agreement” means the Sponsor Support Agreement, dated as of August 17, 2023 by and among LAMF, Nuvo, Holdco, Sponsor and the LAMF directors and executive officers signatories thereto.

“Trading Day” means any day on which Holdco Ordinary Shares are tradeable on Nasdaq (or the principal securities exchange or securities market on which Holdco Ordinary Shares are then traded).

“Transaction Documents” means, collectively, the Business Combination Agreement, the Sponsor Support Agreement, the Shareholder Support Agreement, Registration Rights Agreement, the Amended Articles, the Interim Financing Agreements, the Warrant Assignment, Assumption and Amendment Agreement and all the agreements, documents, instruments and certificates entered into in connection therewith and any and all exhibits and schedules thereto.

“Transaction Expenses” means to the extent not paid prior to Closing, all out-of-pocket fees, costs and expenses of counsel, accountants, investment bankers, experts and consultants to a party to the Business Combination Agreement incurred by such party or on its behalf in connection with the consummation of the Transactions or related to the authorization, preparation, negotiation, execution and performance of the Business Combination Agreement.

“Transactions” means, collectively, the Mergers and each of the other transactions contemplated by the Business Combination Agreement or any of the other Transaction Documents.

“Trust Account” means the U.S.-based trust account at J.P. Morgan Chase Bank, N.A., with Continental acting as trustee, that held a portion of the proceeds of the IPO and the concurrent sale of the Private Placement Warrants.

“U.S.” means the United States.

“U.S. GAAP” means generally accepted accounting principles in the United States as are in effect from time to time.

“Warrant Assignment, Assumption and Amendment Agreement” means the warrant assignment, assumption and amendment agreement entered into by and among LAMF, Holdco and Continental at the SPAC Effective Time, pursuant to which LAMF assigned all its rights, title and interest in the LAMF Warrant Agreement to Holdco.

“Working Capital Loans” mean the $550,000 principal amount outstanding as of the Closing under the unsecured convertible promissory note issued by LAMF to the Sponsor on February 2, 2024, which converted pursuant to the terms of such note into 55,000 private placement units of LAMF, consisting of 55,000 LAMF Class A Ordinary Shares and 27,500 private LAMF Warrants immediately prior to the Closing.

9

RISK FACTOR SUMMARY

Investing in our securities entails a high degree of risk as more fully described under “Risk Factors.” You should carefully consider such risks before deciding to invest in our securities. These risks include, among others:

| ● | Nuvo is a development-stage company with a limited operating history, and may never be able to effectuate its business plan, achieve meaningful revenue or attain profitability. |

| ● | Nuvo is highly dependent on the successful development, marketing and sale of the INVU platform and the related products and services. |

| ● | Nuvo will need to obtain additional financing to fund its future operations and continue as a going concern. |

| ● | The manufacturing and supply of the INVU platform is subject to various factors outside Nuvo’s direct control, including those related to Nuvo’s dependence on third-party manufacturers and suppliers. |

| ● | Nuvo’s medical device operations are subject to pervasive and continuing FDA regulatory requirements, and failure to comply with these requirements could harm its business, financial condition and results of operations. |

| ● | Healthcare reform initiatives and other administrative and legislative proposals may harm Nuvo’s business. |

| ● | The results of Nuvo’s clinical trials may not support the INVU platform claims or may result in the discovery of adverse side effects. |

| ● | Conditions in Israel could materially and adversely affect Nuvo’s business. |

| ● | Nuvo may be unable to obtain and maintain patent or other intellectual property protection for any product it develops for its technology. |

| ● | Holdco will incur increased costs as a result of operating as a public company. |

| ● | A market for Holdco Ordinary Shares may not develop, which would adversely affect the liquidity and price of Holdco Ordinary Shares. |

| ● | The price of Holdco Ordinary Shares may be volatile. |

| ● | It is not expected that Holdco will pay dividends in the foreseeable future after the Business Combination. |

| ● | Holdco may not be able to timely and effectively implement controls and procedures required by Section 404(a) of the Sarbanes-Oxley Act that will be applicable to it. |

| ● | As a foreign private issuer and a company treated as an emerging growth company for certain purposes, Holdco has different disclosure and other requirements than U.S. domestic registrants and non-emerging growth companies. |

| ● | Holdco may lose its foreign private issuer status, which would then require Holdco to comply with the Exchange Act’s domestic reporting regime and cause Holdco to incur significant legal, accounting and other expenses. |

| ● | If securities or industry analysts do not publish research, or publish inaccurate or unfavorable research, about Holdco’s business, the price of Holdco Ordinary Shares and Holdco trading volume could decline. |

10

PART I

| ITEM 1. |

IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Not applicable.

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

| ITEM 3. | KEY INFORMATION |

| A. | [Reserved] |

| B. |

Capitalization and Indebtedness |

Not applicable.

| C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

| D. | Risk Factors |

Investing in our securities involves a high degree of risk. The risk factors described below disclose both material and other risks, and are not intended to be exhaustive and are not the only risks facing us. Additional risks not currently known to us or that we currently deem to be immaterial, or which are not identified because they are generally common to businesses, also may materially adversely affect our business, financial condition, results of operations and cash flows in future periods.

The occurrence of one or more of the events or circumstances described in these risk factors, alone or in combination with other events or circumstances, may have a material adverse effect on the business, financial condition, results of operations, cash flows and future prospects of Nuvo, in which event the market price of Holdco Ordinary Shares could decline, and you could lose part or all of your investment.

11

Risks Related to Our Business and Our INVU Platform

We are a development-stage company with a limited operating history. We may never be able to effectuate our business plan, achieve meaningful revenue or attain profitability.

We are a development-stage company and are subject to all of the risks inherent in the establishment of a new business enterprise. We have a limited operating history and only a preliminary and unproven business plan upon which investors may evaluate our prospects. We have not yet scaled commercial adoption of our INVU platform. Additionally, our INVU platform is currently cleared by the FDA for only limited monitoring capabilities, and the future commercial interest in our INVU platform, if any, will require FDA and other regulatory clearances or approvals for additional capabilities, and we may never obtain such clearances or approvals. Our ability to generate significant revenue from our operations and, ultimately, achieve profitability will depend on, among others things, whether we can commercialize our INVU platform as currently planned, whether we can complete the development of other features of our INVU platform, whether we can utilize the data we capture to make predictive recommendations and monetize these capabilities, our obtaining additional regulatory clearances, commercial adoption of our INVU platform, whether we can manufacture INVU on a commercial scale in such amounts and at such costs as we anticipate would be required to begin to achieve commercial success, and whether we can achieve market acceptance of our INVU platform and business model. We may never generate meaningful revenue or operate on a profitable basis. Even if we achieve profitability, we may not be able to sustain it.

It is difficult to predict our future revenues and appropriately budget for our expenses, and we have limited insight into trends that may emerge and affect our business. If actual results differ from our estimates or we adjust our estimates in future periods, our operating results and financial position could be materially affected.

We have a history of net losses, and we expect to continue to incur losses for the foreseeable future. If we ever achieve profitability, we may not be able to sustain it.

We have incurred losses since our inception, and we expect to continue to incur losses for the foreseeable future. For the years ended December 31, 2023, 2022 and 2021, we reported net losses of $33.655 million, $20.679 million and $34.512 million, respectively. As a result of these losses, as of December 31, 2023, 2022 and 2021, we had an accumulated deficit of $143.774 million, $110.119 million and $89.440 million, respectively. We expect to continue to incur significant sales and marketing expenses as we expand our sales and marketing efforts to increase adoption of our INVU platform, including through scaling our business in the United States and globally, expanding relationships with care providers, payer networks and strategic partners, and increasing awareness of our solutions among expectant mothers and their clinicians. In addition, we expect to continue to incur significant research and development and other expenses as we develop and utilize the measurements within our capabilities, expand our offerings by seeking clearance to provide some of these measurements to expectant mothers and clinicians, conduct additional clinical trials and studies on our INVU platform, and maintain and grow our intellectual property portfolio. In addition, we expect our general and administrative expenses to increase following the Business Combination due to the additional costs associated with being a public company. The net losses that we incur may fluctuate significantly from period to period. We will need to generate significant revenue and maintain or improve our gross margins to achieve and sustain profitability. Even if we achieve profitability, we may not remain profitable for any substantial period of time.

Our business model contemplates, among other things, an expansion of the approved uses for our INVU platform, proof to payers of reduced cost of delivering quality healthcare to expectant mothers, and additional collaborations with partners willing to recommend and prescribe the use of our INVU platform, all of which are subject to numerous risks and uncertainties and could result in the failure of our business model.

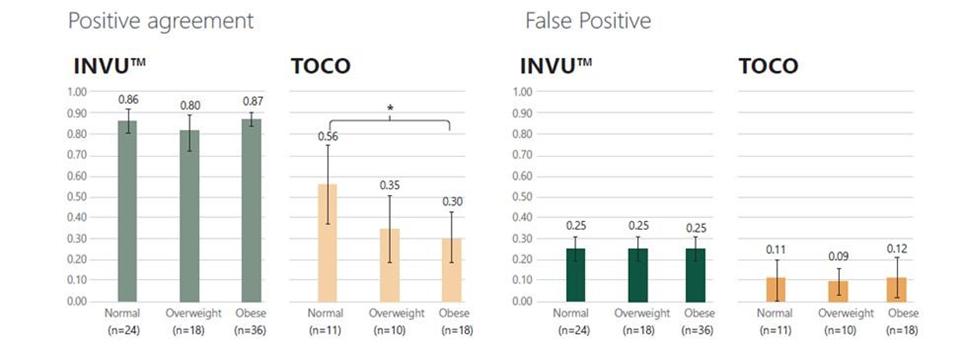

We have not yet demonstrated the feasibility of our INVU platform for commercial applications, including its ability to provide clinical-quality remote pregnancy care on a commercial scale. Currently, our INVU platform is cleared by the FDA to measure FHR, MHR and MUA during the antepartum period and the provision of remote NSTs. In addition, the ability to deliver MHR and FHR data is not necessarily novel and therefore may not enable us to gain or sustain a competitive advantage. Our business plan contemplates that our INVU platform ultimately provides monitoring for additional data and metrics. We may not be able to develop and utilize such additional measurements and include such measurements in our offerings, and even if we are able to do so, such data may not be of medical quality or equivalent to the data obtained from current standard of care. The expansion of our INVU platform’s usable capabilities, or the modification of our existing FDA cleared platform in response to feedback from third parties, such as medical professionals, also requires additional FDA clearance, which we may never receive, and any delay in receiving such clearance could also have a material adverse effect on our business. Additionally, we intend to expand globally and our INVU platform may be subject to the regulatory regimes of other non-U.S. jurisdictions, such as in Europe where we filed for a CE mark in March 2023 to offer NSTs using our FHR, MHR and MUA capabilities. Approval or clearance from the FDA, or comparable regulatory agency in other jurisdictions, to capture certain measurements and perform certain tests using our INVU platform, is not guaranteed and may take longer than planned. Also, regulatory approval in one jurisdiction does not mean that we will succeed in obtaining regulatory approval in other jurisdictions.

12

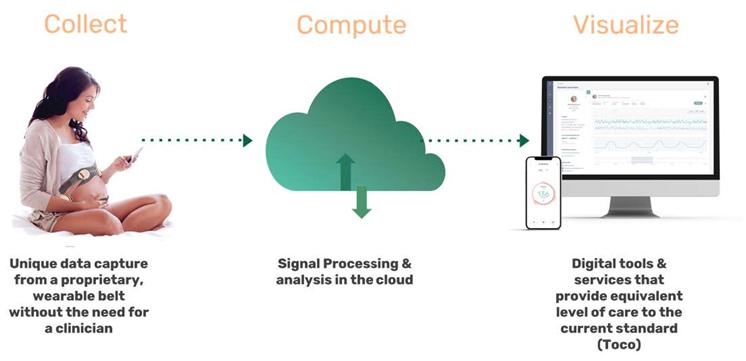

The software component of our INVU platform uses a cloud computing environment that processes and analyzes data and, ultimately, transmits personalized reports on maternal and fetal health metrics to the expectant mother and her clinician through digital visualization tools. The development of this cloud computing environment requires a considerable investment of technical, financial, and legal resources, which may not be available to us. It may also require separate regulatory clearances or approvals. Furthermore, it may not be technically viable for care providers and our partners to integrate the cloud with their businesses or platforms. There may also be public concerns regarding privacy and compliance with restrictive laws or regulations, including those with respect to management of health data, as well as concerns regarding hardware and software security and reliability issues associated with third-party mobile devices such as smartphones that would be used to access our cloud services.

Further, our business model contemplates the collection of a significant amount of personalized health data to develop a database sufficient for us to develop algorithms that may allow for effective and accurate predictive tools. We have yet to develop such a database, and we are not yet cleared to provide any such analytics, nor have we yet applied for or sought such clearances. Furthermore, even if we are able to develop such a database, we may not successfully develop effectively predictive algorithms. As a result, we may never ultimately develop our planned capabilities, or, if we do, care providers, expectant mothers or payers may not find such capabilities useful or cost effective.

The success of our business model also depends on our ability to:

| ● | generate widespread awareness, acceptance and adoption of our INVU platform and future products or services; |

| ● | prove out cost savings such that providers and payers clearly see value in the prescribing and use of our INVU platform; |

| ● | develop enhanced or new technologies or features that improve the convenience, efficiency, safety or perceived safety, and productivity of our INVU platform and future products or services, including the receipt of all regulatory clearances and approvals necessary for such enhanced or new technologies and features; |

| ● | significantly expand our commercial and strategic partnerships with enterprise-level entities in order to develop necessary product awareness and scale; |

| ● | properly identify customer needs and deliver new products or services or product enhancements to address those needs; |

| ● | obtain the regulatory approvals in a timely and cost-effective manner; attract and retain qualified personnel and collaborators; |

| ● | maintain quality control as we continue to commercialize our INVU platform; |

| ● | protect our inventions with patents or otherwise develop proprietary products and processes; and |

| ● | secure sufficient capital resources to expand both our continued research and development, and sales and marketing efforts. |

Given the foregoing, our success depends significantly upon, among other things, our ability to obtain additional regulatory approvals for our INVU platform’s more advanced capabilities and further expand such capabilities, materially expand our strategic partnerships to drive brand awareness and product usage, and prove that INVU reduces the cost of delivering quality healthcare for expectant mothers in order to help convince payers that INVU should be regularly prescribed and used. Our failure to successfully accomplish the foregoing could have a material adverse effect on our business, prospects, results of operation and financial position.

13

Our operating results may fluctuate from quarter to quarter, which makes our future results difficult to predict.

Our operating results and financial condition may fluctuate from quarter-to-quarter and year-to-year and are likely to vary due to a number of factors, many of which will not be within our control. Our operating results in any given quarter can be influenced by numerous factors, many of which are unpredictable or outside of our control, including:

| ● | the degree of market acceptance of our INVU platform and future products; |

| ● | our ability to compete with competitors and new entrants into our markets; |

| ● | the timing of our sales and deliveries of our INVU platform and future products to customers; |

| ● | changes in our pricing policies or those of our competitors, including our response to price competition; |

| ● | the effectiveness of our securing new orders and fulfilling existing orders; |

| ● | changes in the amount that we spend to develop and manufacture new products or technologies; |

| ● | changes in the amounts that we spend to promote our solutions; |

| ● | our ability to introduce new features and services and enhance our existing platform and our ability to generate significant revenue from new features and services and personalization to the products; |

| ● | our ability to respond to competitive developments, including pricing changes and the introduction of new products and services by our competitors; |

| ● | changes in the cost of satisfying our warranty obligations and servicing our products; |

| ● | litigation related expenses and/or liabilities; |

| ● | developments or disputes concerning our intellectual property or proprietary rights or our solutions, or third-party intellectual property or proprietary rights; |

| ● | fluctuations in currency exchange rates; |

| ● | general economic and political conditions and government regulations in the countries where we currently have significant numbers of systems, or where we currently operate or may expand in the future; and |

| ● | natural disasters, such as earthquakes, hurricanes, wildfires, and threats to public health, such as a resurgence of the COVID-19 pandemic. |

The impact of one or more of the foregoing and other factors may cause our operating results to vary significantly. As such, quarter-to-quarter comparisons of our operating results may not be meaningful and should not be relied upon as an indication of future performance. If we fail to meet or exceed the expectations of investors or securities analysts, the trading price of the Holdco Ordinary Shares could fall substantially, and we could face costly lawsuits, including securities class action suits.

14

Our business model contemplates a revenue model that is yet to be proven viable and is subject to numerous risks and uncertainties.

Our ability to generate significant revenue, and ultimately achieve profitability, will depend on securing commercial contracts on favorable economic terms. Currently, we have signed over a dozen commercial contracts with health systems, large private practice groups, and independent women’s health practices in the United States and Israel. We plan to focus on long-term enterprise level agreements with larger obstetrician-physician practice management groups and U.S. healthcare systems. We have entered into a strategic partnership with Philips primarily focused on providing a jointly integrated remote fetal monitoring solution targeted toward hospital networks in the U.S. However, we may not prove the benefits of our INVU platform, or such entities may not find our pricing to be attractive, either of which could cause our pricing model to fail. Ultimately, we aim to seek long-term contracts with payers, where we expect to receive revenue based, at least in part, on a percentage of cost-savings achieved by the applicable payers. We may not be able to develop a substantial body of data to prove to care providers and payers that the use of our INVU platform reduces medical care costs, and even if we are able to collect such data, we may not demonstrate cost savings, including as a result of the improvement of cost baseline in the long term, whether due to the success of our INVU platform or as other cost-effective offerings become available, or demonstrate improved quality of care and healthcare outcomes, in order to incentivize payers to encourage their obstetrician networks and expectant mothers to utilize our INVU platform. Our revenue model is also subject to many other factors, including the following:

| ● | payment models for remote healthcare solutions are still evolving, and the pricing arrangement we favor may not be accepted by care provider or payers; |

| ● | we may not be able to find a sufficient number of implementers to stimulate market interest or reach the scale necessary to make our INVU platform a cost-effective solution, which is a key factor for acceptance by care providers and ultimately the payers; |

| ● | even if we can demonstrate cost savings from use of our INVU platform, we may be unable to secure arrangements with payers that share any cost-saving with us, on favorable terms to us or at all; |

| ● | we may not be able to secure meaningful up-front and ongoing payments; |

| ● | contracted payment terms will likely vary among counterparties, making it difficult to predict revenues; |

| ● | manufacturing or maintenance costs may be higher than expected and we may not be able to adjust our pricing model to accommodate for these increases, which will increase our operating expenses and reduce our margins; and |

| ● | we may not be able to accumulate sufficient data of the type and quality we need to develop predictive tools, and even if we are able to do so, we may not be successful in generating revenue from these tools. |

Manufacturers of medical devices have a history of price competition, and we may not be able to achieve or maintain satisfactory pricing for our INVU platform. If we are forced to lower the price we charge for our INVU platform, our gross margins will decrease, which will harm our ability to invest in and grow our business. If we are unable to maintain our prices, or if our costs increase and we are unable to offset such increase with an increase in our prices, our margins could erode. We may be subject to significant pricing pressure, which could harm our business and results of operations. Any of these risks and uncertainties could cause our revenue model to fail.

Our success depends in large part on our ability to develop, market and sell our INVU platform. If we are unable to successfully develop, market and sell this product, our business prospects will be significantly harmed and we may be unable to achieve revenue growth or profitability.

Our future financial success will depend substantially on our ability to further development, and effectively and profitably market and sell, our INVU platform. Our products may not gain market acceptance in the United States or internationally or otherwise attain and maintain any level of market share.

15

The commercial success of our INVU platform and any of our planned or future products will depend on a number of factors, including, but not limited to, the following:

| ● | the actual and perceived effectiveness, safety and reliability, and clinical benefit, of our INVU platform, especially relative to the current standard of care obtained within healthcare facilities; |

| ● | the degree to which expectant mothers, care providers, such as large healthcare systems obstetrician- physician practice management groups, and payer networks adopt and continue to use and prescribe our INVU platform; |

| ● | the degree to which expectant mothers use our INVU platform correctly and consider it a valuable tool during their pregnancies; |

| ● | the availability, relative cost and perceived advantages and disadvantages of alternative technologies for pregnancy monitoring; |

| ● | the results of additional clinical and other studies relating to the health, safety, economic or other benefits of our INVU platform; |

| ● | whether key thought leaders in the medical community adopt our INVU platform over alternatives and products offered by our competitors, and the extent to which we are successful in educating physicians and healthcare providers about the benefits of our INVU platform; |

| ● | the success of our strategic partnerships and our current and future strategic partners; |

| ● | our ability to successfully market, sell and distribute our INVU platform and any related platform products, including, without limitation, any of our planned cloud-based solutions derived from the data we expect to collect from expectant mothers, including our plan to identify patterns and trends associated with certain risks and outcomes from which we may derive predictive recommendations that could be useful to individual expectant mothers; |

| ● | our reputation among care providers, such as obstetrician-physician management groups; |

| ● | our ability to obtain, maintain, protect and enforce our intellectual property rights in and to our INVU platform; |

| ● | our ability to maintain compliance with all regulatory requirements applicable to our INVU platform; and |

| ● | our ability to continue to maintain quality control and real-time data processing ability as we continue to commercialize our INVU platform. |

If we fail to successfully market and sell our products cost-effectively and develop, maintain and expand our market share, we will not be able to achieve profitability, which will harm our business, financial condition and results of operations. Our ability to grow our revenue in future periods will depend on our ability to successfully penetrate our target markets and increase sales of our product, which will, in turn, depend in part on our success in driving adoption and increased use of our products as well as the prices we can charge.

We are highly dependent on the successful development, marketing and sale of our INVU platform and the related products and services.

Our INVU platform comprises the basis of our business. As a result, the success of our business plan is highly dependent on our ability to develop, manufacture and commercialize our INVU platform and related products and services, and our failure to do so could cause our business to fail. Successful commercialization of medical devices, such as our INVU platform, is a complex and uncertain process, dependent on the efforts of management, manufacturers, medical professionals, third-party payers, our strategic partners, as well as general economic conditions, among other factors. Any factor that adversely impacts the development and commercialization of our INVU platform will have a negative impact on our business, financial condition, results of operations and prospects. Some potential factors include:

16

| ● | our ability to significantly scale our pregnancy care population, together with the necessary increase in manufacturing capacity that would be required to produce the hardware components of our INVU platform to serve a much larger population of expectant mothers; |

| ● | our ability to adapt our INVU platform to the extent necessary to work for a substantial majority of expectant mothers; |

| ● | our ability to achieve sufficient market acceptance by expectant mothers, strategic partners, commercial customers, and other medical and clinical professionals, third-party payers and others in the medical community; |

| ● | our ability to compete with existing pregnancy care solutions, such as currently standard in-person, non-remote, monitoring solutions and current or future competing remote solutions; |

| ● | our ability to establish, maintain and expand our sales, marketing and distribution networks, such as the Philips distribution channel; |

| ● | our ability to obtain or maintain necessary regulatory approvals, including with respect to any changes to our products based upon feedback from third parties such as medical professionals; and |

| ● | our ability to effectively protect our intellectual property. |

Our inability to successfully obtain clearance or approval for and subsequently commercialize our INVU platform or related products and services would have a material adverse effect on our business, financial condition, results of operations and prospects.

Our commercial success will depend upon attaining significant market acceptance of our INVU platform among expectant mothers, care providers, payers and others in the medical community. If we are unable to successfully achieve substantial market acceptance and adoption of our INVU platform, our business, financial condition and results of operations would be harmed.

Our commercial success will depend in large part on the acceptance of our INVU platform by expectant mothers, care providers, payers and others in the medical community as safe for both an expectant mother and her unborn baby, useful and cost-effective. We cannot predict how quickly, if at all, care providers, such as obstetrician-physician practice management groups, hospitals and healthcare systems, and payers will accept our INVU platform. These participants may not readily accept our INVU platform over current standard of care obtained within healthcare facilities or competing products or alternatives in the near term or at all. Additionally, expectant mothers may prefer the current standard of care, including in-office visits during which they have the in-person attention of a medical professional. Further, some expectant mothers may be unwilling to use our INVU platform given that it represents new technology without a significant history of use and results. Care providers, or value analysis committees at their hospitals, as well as third-party payers, may also perceive our products to be too costly, or may believe that the benefits of our INVU platform and results from clinical trials, such as relative ease of use, are not sufficiently greater than other alternatives to justify our INVU platform’s pricing. This perception may continue to be heightened due to any budgetary and financial constraints faced by care providers, including hospitals and other facilities. Moreover, the medical community may be unwilling to depart from the current standard of care for pregnancy monitoring and pregnancy care management. Medical professionals tend to be slow to change their medical diagnostic practices because of perceived liability risks arising from the use of new technology or products, and they may not recommend our INVU platform or other products integrated with our technology until there is long-term clinical evidence to convince them to alter or modify their existing pregnancy monitoring methods. The use of wearable technology, artificial intelligence, machine learning and other technology-based platforms to provide pregnancy monitoring and care management is a recent phenomenon, and therefore, our INVU platform may not become broadly accepted by physicians, patients, hospitals and others in the medical community, even if it is approved by the appropriate regulatory authorities for marketing and sale. Our efforts to educate expectant mothers, care providers, payers and others in the medical community on the benefits of our INVU platform require significant resources and may not be successful. Our efforts to educate the marketplace may require more resources than are required by conventional technologies marketed by our competitors. Moreover, in the event that our INVU platform or other products integrated with our technology are the subject of guidelines, clinical studies or scientific publications that are unfavorable or damaging, or otherwise call into question its benefits. Our ability to grow sales of our INVU platform and drive market acceptance will depend on successfully educating expectant mothers, care providers, such as obstetrician-physician practice management groups, payers and others in the medical community of the relative benefits of our INVU platform and its cost-effectiveness.

17

The degree of market acceptance by both care providers and expectant mothers of our INVU platform will depend on a number of additional factors, including:

| ● | regulatory requirements regarding product labeling or product inserts; |

| ● | limitations or warnings contained in the labeling cleared or approved by the FDA or other regulatory authorities; |

| ● | the existence of current in-person monitoring for expectant mothers, including that certain expectant mothers may prefer in-person care by a medical professional; |

| ● | coverage determinations and reimbursement levels of third party payers; |

| ● | pricing and cost of our INVU platform in relation to alternative products and methods; |

| ● | timing of market introduction of competing products and the sales and marketing initiatives of such products; |

| ● | the access to, ease of use, stability of device performance and error rate of our INVU platform by both care providers and expectant mothers relative to alternative products and methods; |

| ● | the willingness and ability of expectant mothers to adopt new technology, including its perceived safety and ease of use; |

| ● | our ability to provide incremental clinical and economic data that show the safety, clinical efficacy and cost-effectiveness of, and benefits from, our INVU platform; and |

| ● | the effectiveness of our sales and marketing efforts for our INVU platform. |

If we are unable to successfully achieve substantial market acceptance and adoption of our INVU platform, our business, financial condition and results of operations would be harmed. Even if our INVU platform achieves market acceptance, it may not maintain that market acceptance over time if competing products or technologies, which are more cost effective or received more favorably, are introduced. Failure to achieve or maintain market acceptance or market share would limit our ability to generate revenue and would significantly harm our business, financial condition and results of operations.

We currently have a limited sales and marketing organization. If we are unable to develop our sales and marketing capability on our own or through collaborations with marketing partners, we will not be successful in commercializing our INVU platform.

Currently, our sales and marketing team consists of our VP Marketing, Product Specialist and our business development team in Israel and, as a result, we have no meaningful marketing and sales capabilities. We intend to sell our INVU platform primarily to and through our implementers in the near term, and ultimately through third-party payers. We also intend to utilize the data we capture to make predictive recommendations and monetize these capabilities. However, we may not be successful in doing so. To the extent that we enter into co-promotion or other licensing arrangements, our INVU platform revenue is likely to be lower than if we directly marketed or sold our INVU platform. In addition, any revenue we receive will depend in whole or in part upon the efforts of such third parties, which may not be successful and are generally not within our control. If we are unable to enter into such arrangements on acceptable terms or at all, we may not be able to successfully commercialize our INVU platform. If we are not successful in commercializing our INVU platform, either on our own or through collaborations with one or more third parties, our future revenue will suffer and we may incur significant additional losses.

18

The success of our business may be dependent on our strategic partnerships and collaborations.

Strategic relationships with our implementers and validators are and will be important to the success of our business. See Item 4.B. “Business Overview—Sales and Marketing.” We anticipate deriving a significant portion of revenues in the near term from our implementers, which are provider partners with an installed base of clinicians that understand how to prescribe and use our INVU platform for the expectant mothers they care for. We currently have over a dozen enterprise-level agreements, and our future success depends on our ability to enter into such agreements with additional implementers. Our prospects also depend on our validators to build robust clinical evidence based on our already developed INVU platform, as well as research experts, mainly academic centers, to analyze our data signals and help determine predictive markers through such data. Our strategic partners may have the right to abandon the use of our INVU platform and terminate applicable agreements, including payment obligations, prior to or upon the expiration of the agreed-upon agreement terms. We may not be successful in establishing strategic partnerships or collaborative arrangements on acceptable terms or at all, our collaborative partners may terminate any such agreements prior to their stated terms, our collaborative arrangements may not result in successful product development, validation or commercialization and we may not derive any revenues from such arrangements. If we do not successfully develop and maintain strategic partnerships or collaborative arrangements, our business, financial condition and results of operations would be materially and adversely affected.

Any strategic partnerships or collaborative arrangements that we have established or may establish in the future may not be successful or we may otherwise not realize the anticipated benefits from these strategic partnerships or collaborations. We do not control third parties with whom we have or may have strategic partnerships or collaborative arrangements, and we will rely on them to achieve results which may be significant to us. In addition, any current or future strategic partnerships or collaborative arrangements may place the development and commercialization of our technology outside our control, may require us to relinquish important rights or may otherwise be on terms unfavorable to us.

We have entered into certain, and expect to enter into additional, strategic partnerships or collaborative arrangements with respect to the development, validation and commercialization of our INVU platform with different relevant industry participants, including our implementers and validators. Any future potential strategic partnerships or collaborative arrangements may require us to rely on external consultants, advisors and experts for assistance in several key functions, including research and development, manufacturing, regulatory, intellectual property, commercialization and distribution. We cannot and will not control these third parties, but we may rely on them to achieve results, which may be significant to us. Relying upon these strategic partnerships or collaborative arrangements subjects us to a number of risks, including:

| ● | we may not be able to control the amount and timing of resources that our partners or collaborators may devote to our technology; |

| ● | should a partner or collaborator fail to comply with applicable laws, rules or regulations when performing services for us, we could be held liable for such violations; |

| ● | we may be required to relinquish important rights, such as marketing and distribution rights, including the ability to distribute to hospital networks without Philips in accordance with the exclusivity terms set by the Philips MPA, pursuant to meeting certain sales targets; |

| ● | business combinations or significant changes in a partner or collaborator’s business strategy may adversely affect such person’s willingness or ability to complete its obligations under any arrangement; |

| ● | our partners or collaborators may default on their payments to us or fail to deliver standby letters of credit or financial guarantees, and it may be time consuming and difficult to enforce such payment obligations and obligations to provide standby letters of credit and financial guarantees in various jurisdictions, and we may be unsuccessful in enforcing such obligations; |

19

| ● | our current or future partners or collaborators may utilize our proprietary information in a way that could expose us to competitive harm; |

| ● | our partners or collaborators could obtain ownership or other control over intellectual property that is material to our business, or we may be required to jointly own certain of our intellectual property with such third parties; and |

| ● | strategic partnerships or collaborative arrangements are often terminated or allowed to expire or remain unformalized by a written agreement, which could delay the ability to commercialize our technology. |

In addition, if disputes arise between us and any of our partners or collaborators, it could result in the delay or termination of the development, validation or commercialization of products containing our technology, lead to protracted and costly legal proceedings, or cause partners or collaborators to act in their own interest, which may not be in our interest. As a result, the strategic partnerships or collaborative arrangements that we have entered into or may enter into may not achieve their intended goals.

If any of these scenarios materialize, they could have a material adverse effect on our business, financial condition, results of operations and prospects.

The audited consolidated financial statements for the year ended December 31, 2023, include an explanatory paragraph in our independent registered public accounting firm’s audit report stating that there are conditions that raise substantial doubt about our ability to continue as a going concern, and we will need to obtain additional financing to fund our future operations and continue as a going concern. If we are unable to obtain such financing, we may be unable to complete the development and commercialization of our INVU platform.