Stuart A. Barr Fried, Frank, Harris, Shriver & Jacobson LLP 801 17th Street, NW Washington, DC 20006 (202) 639-7000 | Kerry E. Johnson Anna K. Spence DLA Piper LLP (US) 444 West Lake Street, Suite 900 Chicago, Illinois (312) 368-4000 | ||

Large accelerated filer | ☐ | Accelerated filer | ☐ | ||||||

Non-accelerated filer | ☒ | Smaller reporting company | ☐ | ||||||

Emerging growth company | ☒ | ||||||||

Per Share | Total | |||||

Initial public offering price | $ | $ | ||||

Underwriting discounts and commissions(1) | $ | $ | ||||

Proceeds, before expenses, to us | $ | $ |

(1) | See “Underwriting” for additional information regarding underwriting compensation. |

MORGAN STANLEY | J.P. MORGAN | WELLS FARGO SECURITIES | BofA SECURITIES | ||||||

CAPITAL ONE SECURITIES | CIBC CAPITAL MARKETS | ||||||||

• | “2024 Equity Incentive Plan” means our 2024 Omnibus Equity and Incentive Plan, which we expect to adopt concurrently with the closing of this offering; |

• | “50/50 Joint Venture” means the joint venture previously held by our predecessor and entities representing certain Canadian investors for the ownership of 54 properties; |

• | “50/50 Joint Venture Acquisition” means our predecessor’s acquisition, for cash, of the remaining 50% interest held indirectly by our predecessor in the 50/50 Joint Venture; |

• | “ABS Notes” means the $253.8 million in aggregate principal amount outstanding of our net-lease mortgage notes; |

• | “ACM” means asbestos-containing materials; |

• | “ADA” means the Americans with Disabilities Act, as amended; |

• | “adjusted EBITDAre” means EBITDAre for the applicable period, as further adjusted to (i) reflect all investment and disposition activity that took place during the applicable period as if each transaction had |

• | “AFFO” means adjusted funds from operations, which is a modification of FFO to include other adjustments to GAAP net income related to certain non-cash or non-recurring revenues and expenses, including straight-line rents, cost of debt extinguishments, amortization of lease intangibles, amortization of debt issuance costs, amortization of net mortgage premiums, (gain) loss on interest rate swaps and other non-cash interest expense, realized gains or losses on foreign currency transactions, Internalization expenses, structuring and public company readiness costs, extraordinary items, and other specified non-cash items; |

• | “annualized adjusted EBITDAre” means adjusted EBITDAre for the applicable period divided by the number of months in the period multiplied by 12; |

• | “annualized base rent” or “ABR” means the annualized contractual cash rent due for the last month of the reporting period, and adjusted to remove rent from properties sold during the month and to include a full month of contractual cash rent for properties acquired during the last month of the reporting period; |

• | “Awards” means, collectively, under the 2024 Equity Incentive Plan, any of the following types of awards to an Eligible Individual: nonqualified stock options (“NQSO”); SARs; Restricted Stock; RSUs; Performance Awards; dividend equivalent rights; Share Awards; LTIP Units; and Cash-Based Awards; and, to certain Eligible Individuals in accordance with Section 422 of the Code, incentive stock options (“ISOs”); |

• | “bankruptcy proceeding” means any legal or equitable proceeding under any bankruptcy, insolvency, receivership, or other debtor’s relief statute or law; |

• | “Canadian Investment Entities” means the intermediate entities through which Canadian investors will hold interests in the OP that will be issued pursuant to the REIT Contribution Transactions; |

• | “Change in Control” means, for purposes of the 2024 Equity Incentive Plan, the occurrence of any of the following events with respect to the Company: (i) any person (other than directly from the Company) first acquires securities of the Company representing 50% or more of the combined voting power of the Company’s then outstanding voting securities, other than an acquisition by certain employee benefit plans, the Company or a related entity, or any person in connection with a non-control transaction; (ii) a majority of the members of the board of directors is replaced by directors whose appointment or election is not endorsed by a majority of the members of the board of directors serving immediately prior to such appointment or election; (iii) any merger, consolidation, or reorganization, other than in a non-control transaction; (iv) a complete liquidation or dissolution; or (v) sale or disposition of all or substantially all of the assets; |

• | “Code” means the Internal Revenue Code of 1986, as amended; |

• | “Code of Ethics” means our Code of Business Conduct and Ethics adopted by our board of directors, which applies to our directors, officers, and employees; |

• | “Common Stock” means shares of our common stock, $0.01 par value per share; |

• | “Contribution Agreements” means (i) the Contribution Agreement, to be dated as of the closing date of this offering, by and between certain individual investors in our predecessor and the OP, (ii) the Contribution Agreement, to be dated as of closing date of this offering, by and between the individual investors in one of the Subsidiary REITs and the OP, (iii) the Contribution Agreement, to be dated as of the closing date of this offering, by and between one of the Canadian Investment Entities and the OP, and (iv) the Contribution Agreement, to be dated as of the closing date of this offering, 2024, by and between the other Canadian Investment Entity and the OP; |

• | “Corporate Transactions” means, for purposes of the 2024 Equity Incentive Plan, a merger, consolidation, reorganization, recapitalization, or other similar change in the capital stock of the Company, or a liquidation or dissolution of the Company or a Change in Control; |

• | “Covered Person” means, under the terms of the OP Agreement, any current or a former general partner of the OP, a member of such general partner, an affiliate of a current or former general partner of the OP, any officer, director, stockholder, partner, member, advisor, representative or agent of the OP or of a current or former general partner of the OP or any of their respective affiliates; |

• | “CPI” means the Consumer Price Index for All Urban Consumers (CPI-U): U.S. City Average, All Items, as published by the U.S. Bureau of Labor Statistics, or other similar index which is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services; |

• | “Credit Agreement” means the Credit Agreement, dated as of September 6, 2024, among the OP, JPMorgan Chase Bank, N.A., as administrative agent, and the other lenders party thereto; |

• | “Dodd-Frank Act” means the Dodd-Frank Wall Street Reform and Consumer Protection Act, as amended; |

• | “EBITDA” means earnings before interest, income taxes, depreciation and amortization; |

• | “EBITDAre” means EBITDA, as adjusted to exclude gains (losses) on sales of depreciable property and provisions for impairment on investment in real estate; |

• | “ERISA” means the Employee Retirement Income Security Act of 1974, as amended; |

• | “ERISA Plan” means a Plan subject to Title I of ERISA or Section 4975 of the Code; |

• | “ESG” means environmental, social and governance; |

• | “Exchange Act” means the Securities and Exchange Act of 1934, as amended; |

• | “FATCA” means the Foreign Account Tax Compliance Act; |

• | “FASB” means the Financial Accounting Standards Board; |

• | “FCA” means the Financial Conduct Authority; |

• | “FCCR” means fixed charge coverage ratio; |

• | “FFO” means funds from operations, which is computed in accordance with the standards established by the Board of Governors of the Nareit. Nareit defines FFO as GAAP net income or loss adjusted to exclude net gains (losses) from sales of certain depreciated real estate assets, depreciation and amortization expense from real estate assets, gains and losses from change in control, and impairment charges related to certain previously depreciated real estate assets; |

• | “FINRA” means the Financial Industry Regulatory Authority, Inc.; |

• | “Founder” means Stephen Preston; |

• | “Fried Frank” means Fried, Frank, Harris, Shriver & Jacobson LLP; |

• | “fully diluted basis” means after the exchange of all outstanding OP Units for shares of our Common Stock on a one-for-one basis; |

• | “GAAP” means accounting principles generally accepted in the United States of America; |

• | “Interest Purchase Agreement” means the definitive purchase agreement, dated as of August 18, 2023, between one of our predecessor’s subsidiaries and our predecessor’s former 50/50 Joint Venture partner; |

• | “Internalization” means the internalization of the external management team, assets and functions previously performed for our predecessor by our external manager (controlled by our Founder) and its affiliates, pursuant to the terms of the Internalization Agreement, which will close contemporaneously with the closing of this offering; |

• | “Internalization Agreement” means the Amended and Restated Internalization Agreement, dated as of July 10, 2024, by and among the Company, the OP, NARS and certain affiliates of NARS; |

• | “Investment Company Act” means the Investment Company Act of 1940, as amended; |

• | “IRS” means the Internal Revenue Service; |

• | “JOBS Act” means the Jumpstart Our Business Startups Act; |

• | “LIBOR” means the London Interbank Offered Rate; |

• | “LTIP Units” means a special class of units in the OP that are structured to qualify as “profits interests” for U.S. federal income tax purposes; |

• | “Market Value” means the average of the closing trading price of our Common Stock on the NYSE for the 10 trading days before the day on which we received an OP Unit redemption notice; |

• | “MGCL” means the Maryland General Corporation Law; |

• | “MSAs” means metropolitan statistical areas in the United States; |

• | “NADG” means North American Development Group; |

• | “named executive officers” means Stephen Preston, Randall Starr, Timothy Dieffenbacher and Drew Ireland; |

• | “Nareit” means National Association of Real Estate Investment Trusts; |

• | “NARS” means North American Realty Services, LLLP, a Florida limited liability limited partnership, which is our predecessor’s external manager; |

• | “net debt” means debt less cash and cash equivalents and restricted cash; |

• | “net leases” or “net leased” means, collectively, triple net leases and non-triple net leases; |

• | “New Delayed Draw Term Loan” means our $200 million unsecured delayed draw term loan under the Credit Agreement that will become effective concurrently with the completion of this offering; |

• | “New Revolving Credit Facility” means our $250 million unsecured revolving credit facility under the Credit Agreement that will become effective concurrently with the completion of this offering; |

• | “NOL” means net operating loss; |

• | “non-control transaction” generally means, for purposes of the 2024 Equity Incentive Plan, any transaction in which (i) stockholders immediately before such transaction continue to own at least a majority of the combined voting power of such resulting entity following the transaction; (ii) a majority of the members of the board of directors immediately before such transaction continue to constitute at least a majority of the board of the surviving entity following such transaction, or (iii) with certain exceptions, no person other than any person who had beneficial ownership of more than 50% of the combined voting power of the Company’s then outstanding voting securities immediately prior to such transaction has beneficial ownership of more than 50% of the combined voting power of the surviving entity’s outstanding voting securities immediately after such transaction; |

• | “non-triple net leases” means leases for which the landlord responsibilities include one or more property operating expenses in addition to the limited landlord responsibilities included in our triple net leases; |

• | “NYSE” means the New York Stock Exchange; |

• | “occupancy” or a specified percentage of our portfolio that is “occupied” or “leased” means as of a specified date (i) the number of properties that are subject to a signed lease divided by (ii) the total number of properties in our portfolio; |

• | “OP” means FrontView Operating Partnership LP, a Delaware limited partnership; |

• | “OP Units” means the units of limited partnership of the OP, other than LTIP Units; |

• | “outparcel properties” or “outparcels” means individual building properties (small or large formats) leased to one or more tenants that are in locations with direct frontage on high-traffic roads that are visible to consumers; |

• | “PCAOB” means The Public Company Accounting Oversight Board; |

• | “Plan” means any entity whose underlying assets are considered to include “plan assets” (within the meaning of Section 3(42) of ERISA) of any such plan, account, or arrangement; |

• | “plan asset regulations” means the regulations issued by the U.S. Department of Labor concerning the definition of what constitutes the assets of an employee benefit plan; |

• | “predecessor” means NADG NNN Property Fund LP, a Delaware limited partnership, and its subsidiaries; |

• | “QRS” means a qualified REIT subsidiary within the meaning of Section 856(i) of the Code; |

• | “QSR” means quick-service restaurants; |

• | “qualified stockholders” means certain non-U.S. publicly traded stockholders that meet certain record-keeping and other requirements; |

• | “REIT” means a real estate investment trust within the meaning of Sections 856 through 860 of the Code; |

• | “REIT Contribution Transactions” means the contributions of the interests in entities within our predecessor’s private REIT fund structure that directly or indirectly own our predecessor’s properties, pursuant to the terms of the Contribution Agreements, which will close contemporaneously with the closing of this offering; |

• | “REIT Requirements” means the REIT qualification requirements set forth under Sections 856 through 860 of the Code and the applicable U.S. Treasury Regulations; |

• | “rent coverage ratio” means the ratio of tenant-reported or, when unavailable, management’s estimate, based on tenant-reported financial information, of annual EBITDA, and cash rent attributable to the leased property (or properties, in the case of a master lease) to the annualized base rental obligation as of a specified date; |

• | “restaurant” means quick service and fast casual / full service restaurants; |

• | “Restricted Stock” means restricted stock grants; |

• | “Revolving Credit Facility” means the $202.5 million secured revolving credit facility, dated March 8, 2021 and amended on July 31, 2021 by and among the OP, CIBC Bank USA, as Administrative Agent and the other Lenders parties thereto, as amended from time to time; |

• | “RCG” means Rosen Consulting Group, a nationally recognized real estate consulting firm; |

• | “RSUs” means restricted stock units; |

• | “SARs” means stock appreciation rights; |

• | “Sarbanes-Oxley” means the Sarbanes-Oxley Act of 2002, as amended; |

• | “SEC” means the Securities and Exchange Commission; |

• | “Securities Act” means the Securities Act of 1933, as amended; |

• | “Similar Laws” means Section 4975 of the Code, including an individual retirement account (“IRA”), or provisions under any other federal, state, local, non-U.S., or other laws or regulations that are similar to such provisions of ERISA or the Code; |

• | “SOFR” means the Secured Overnight Financing Rate, which is a new index calculated by short-term repurchase agreements, backed by Treasury securities; |

• | “Subsidiary OP” means the operating partnership entity within our predecessor’s private REIT fund structure whose interests will be contributed to the OP upon completion of this offering pursuant to the REIT Contribution Transactions; |

• | “Subsidiary REITs” means the REIT entities within our predecessor’s private REIT fund structure whose interests will be contributed to the OP upon completion of this offering pursuant to the REIT Contribution Transactions; |

• | “Term Loan Credit Facility” means the $17.0 million loan and security facility, dated as of March 31, 2022 by and among the 50/50 Joint Venture and CIBC Bank USA, as Administrative Agent, and the other parties thereto, as amended from time to time; |

• | “triple net leases” means leases for which the tenant is generally responsible for materially all property operating expenses, including property taxes, insurance, and property maintenance and repairs; however, certain of our triple net leases contain limited landlord responsibilities for one or more of the following: property maintenance and repairs related to the roof, structure or parking lot or certain utilities; |

• | “TRSs” means taxable REIT subsidiaries within the meaning of Section 856(l) of the Code; |

• | “UBTI” means unrelated business taxable income as defined in Section 512 of the Code; |

• | “UPREIT” means an umbrella partnership real estate investment trust; |

• | “USRPI” means a United States real property interest as defined in Section 897 of the Code; |

• | “U.S. holder” means a beneficial owner of shares of our Common Stock that is for U.S. federal income tax purposes: |

• | a citizen or resident of the United States; |

• | a corporation, or other entity taxable as a corporation, created or organized under the laws of the United States or any state thereof (or the District of Columbia); |

• | a trust if it (i) is subject to the primary supervision of a court within the United States and one or more U.S. persons have the authority to control all substantial decisions of the trust, or (ii) has a valid election in effect under applicable U.S. Treasury Regulations to be treated as a U.S. person; or |

• | an estate that is subject to U.S. federal income tax on its income regardless of its source; and |

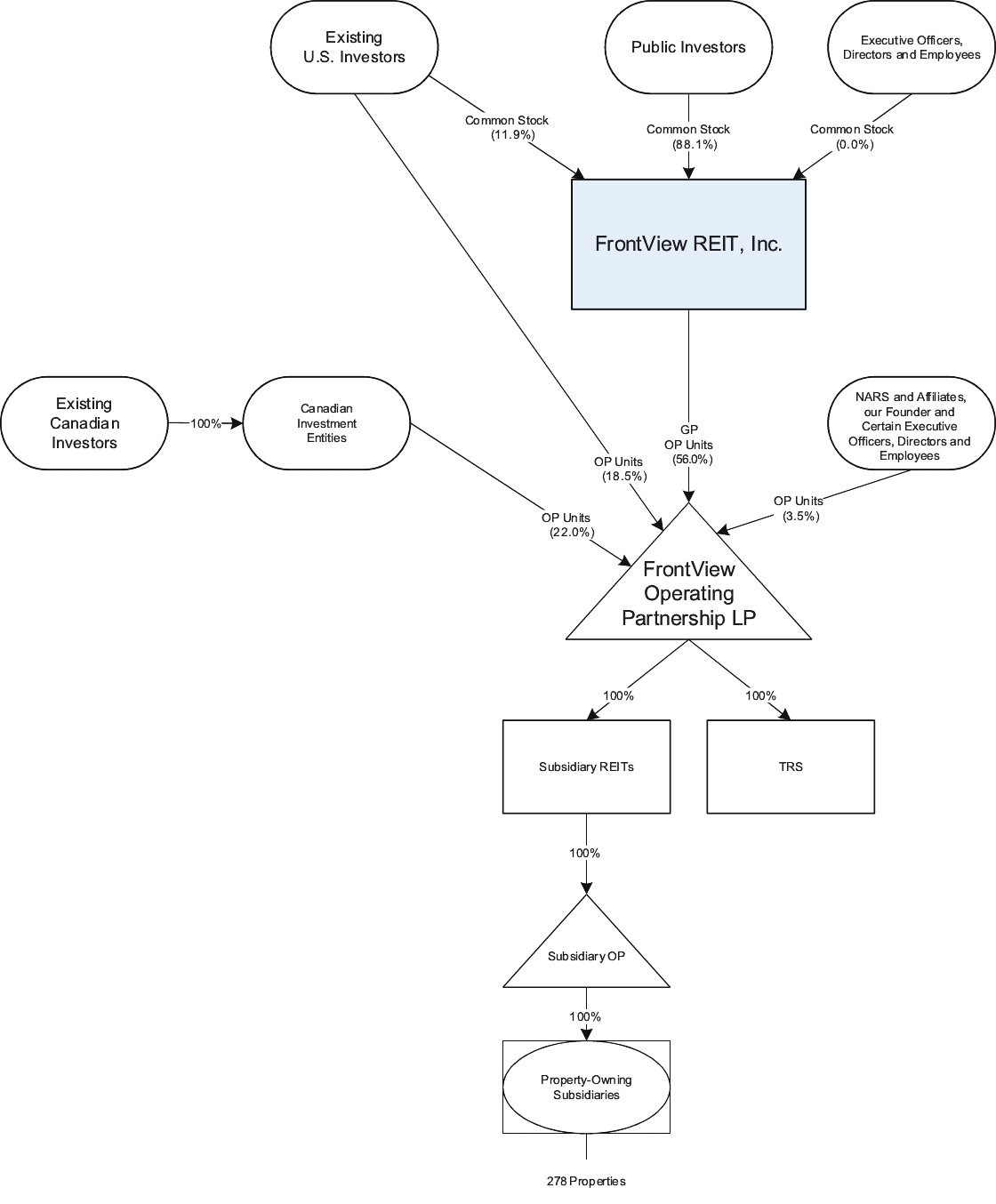

• | “we,” “our,” “us,” “FrontView,” and “Company” mean FrontView REIT, Inc., a Maryland corporation, together with its consolidated subsidiaries, including the OP, after giving effect to the REIT Contribution Transactions and Internalization, except where it is clear from the context that the term only means |

• | Focused Portfolio of Well-Located Net-Lease Outparcel Properties. Pursuant to our “real estate first” investment strategy, we have acquired a highly curated portfolio of outparcel properties that are in prominent locations with direct frontage on high-traffic roads that are highly visible to consumers, which we believe is important to our tenants’ operations and success. We are selective in acquiring outparcels and frequently decline opportunities that may otherwise pass certain financial tests if we do not believe in the quality and long-term viability of the real estate. In 2016, we made a strategic decision to acquire outparcel properties with frontage on high-traffic roads and today we have developed an extensive track-record in acquiring, owning and managing outparcel properties. As a result, we believe we are a market leader in acquiring, owning and managing outparcel properties and therefore are well positioned for future growth. We believe we have a differentiated strategy and competitive positioning, given our acquisition history and experience, that will enable us to aggregate assets within the outparcel market at scale efficiently. |

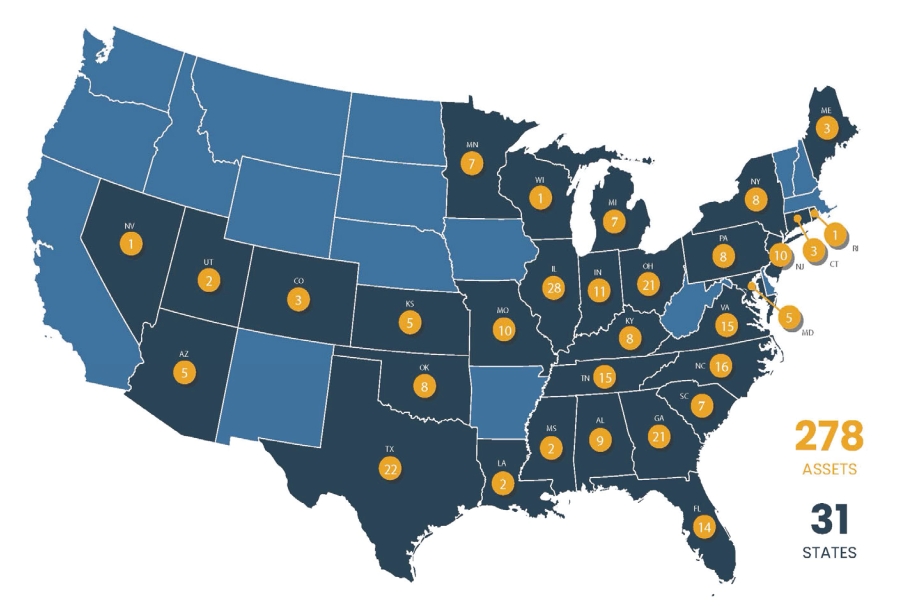

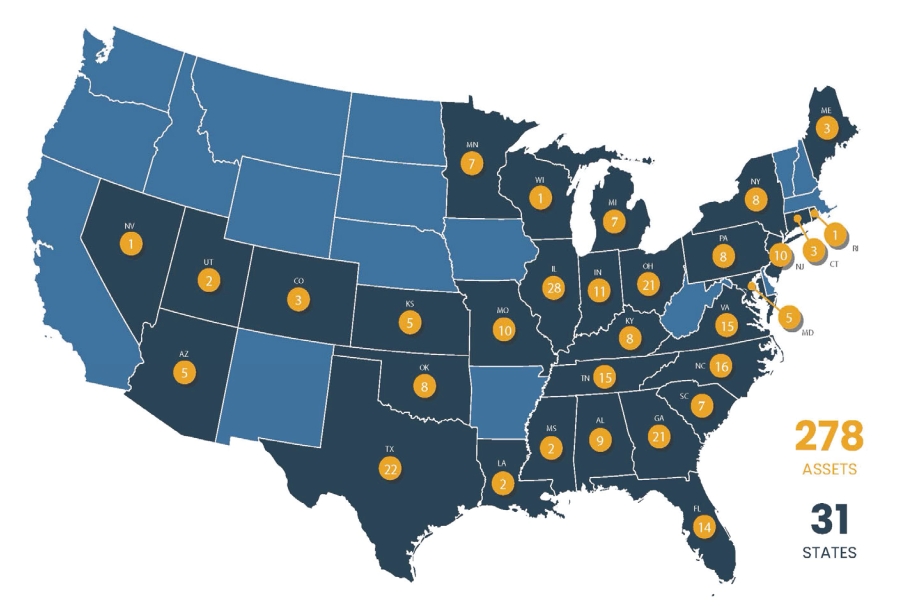

• | Highly-Diversified Tenants, Brands, Industries, and Geographic Reach. Our portfolio is highly diversified based on tenant brands, industries and geography and is cross-diversified within each (e.g., tenant diversification within a geographic concentration). As of June 30, 2024, we had 292 tenants that operated 137 different brands. Our top 10 tenant brands (based on ABR) represented approximately 23.3% of our portfolio ABR as of June 30, 2024, with no single tenant brand representing more than 3.4% of our ABR. As of June 30, 2024, our outparcel properties were located in 96 MSAs in 31 U.S. states, with no single state exceeding 12.1% of our ABR. We believe this diversification positions us well for significant growth and helps mitigate the risks inherent in a concentration in only one or a few tenants, brands or geographies, including risks presented by tenant bankruptcies, adverse industry trends, and economic downturns or changes in a particular geographic area. |

• | Creditworthiness of Tenants. We believe that underlying credit or financial wherewithal of a tenant is one of the more important criteria when evaluating an acquisition. When appropriate information is available, we focus on evaluating a tenant’s financial statements to understand performance, liquidity, leverage and key ratios, as well as sales volume and rent to sales coverage, at both the parent/corporate guarantor level and unit level. In addition, as part of our review of tenant creditworthiness we evaluate the details of each tenant’s brand, industry, and management team expertise and experience, amongst other factors. Substantially all of our leases are with the parent or corporate entity (direct or guarantee) for a tenant brand. As of June 30, 2024, approximately 40.0% of our tenants had an investment-grade credit rating. |

• | Scalable Net-Lease Platform Well Positioned for Significant Growth. We expect to have approximately 15 employees upon completion of the Internalization. Our senior leadership, asset management and property management teams collectively have an average of more than 20 years of real estate and/or net lease real estate experience. We also have dedicated industry specialists who provide significant capabilities across real estate underwriting and origination, development, acquisition, financing, and property and asset management, and believe our platform is highly scalable. Given our management team and organizational structure, we expect that as our portfolio grows, we will not need to make a significant number of additional hires. |

• | Value-Enhancing Asset and Property Management Teams. Our asset and property management teams focus on creating value and maximizing cash flow post-acquisition through active tenant engagement and risk monitoring and mitigation. Our experienced team of professionals work closely with tenants to identify their needs to help minimize tenant turnover, which in turn supports our strong occupancy levels. Our portfolio’s occupancy rate was 98.9% as of June 30, 2024. Overall, our value-enhancing asset and property management strategies are key to long-term success in the net-lease real estate industry. |

• | Strong Balance Sheet with Conservative Leverage Profile. As of June 30, 2024, on a pro forma basis, we had approximately $249.9 million of total debt outstanding (net of fees), with a variable interest rate of SOFR plus 1.2% and approximately $71.5 million of cash and cash equivalents. Upon completion of this offering and after giving effect to the repayment of debt with the net proceeds of this offering and borrowings under our New Revolving Credit Facility and New Delayed Draw Term Loan, we expect to have a net debt-to-annualized adjusted EBITDAre ratio of approximately 4.28x, based on our pro forma annualized adjusted EBITDAre for the six months ended June 30, 2024. |

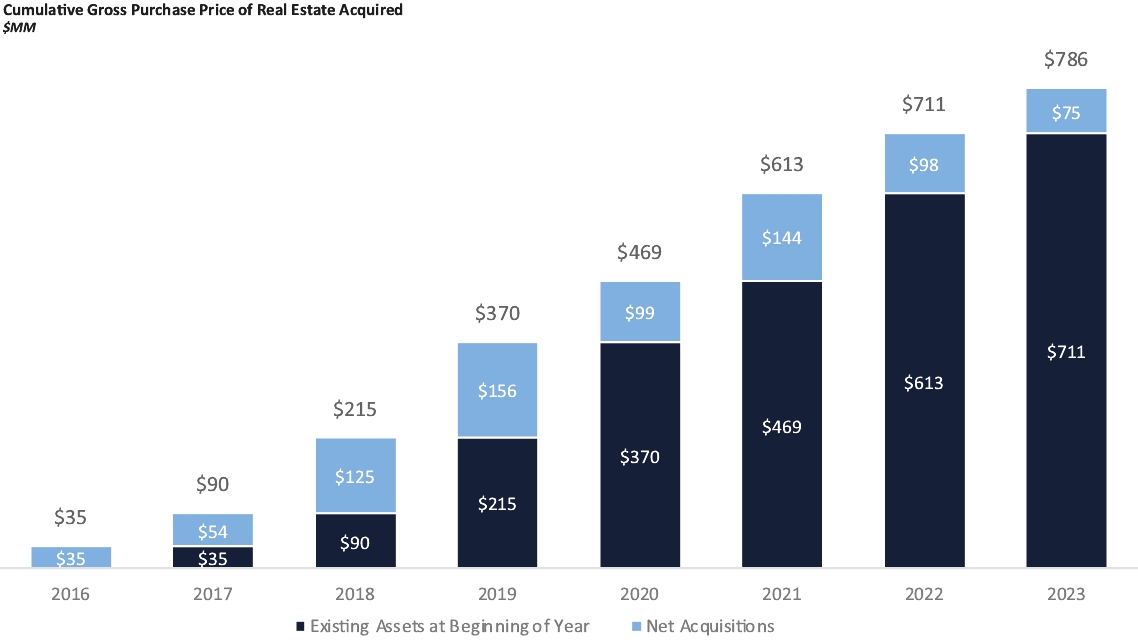

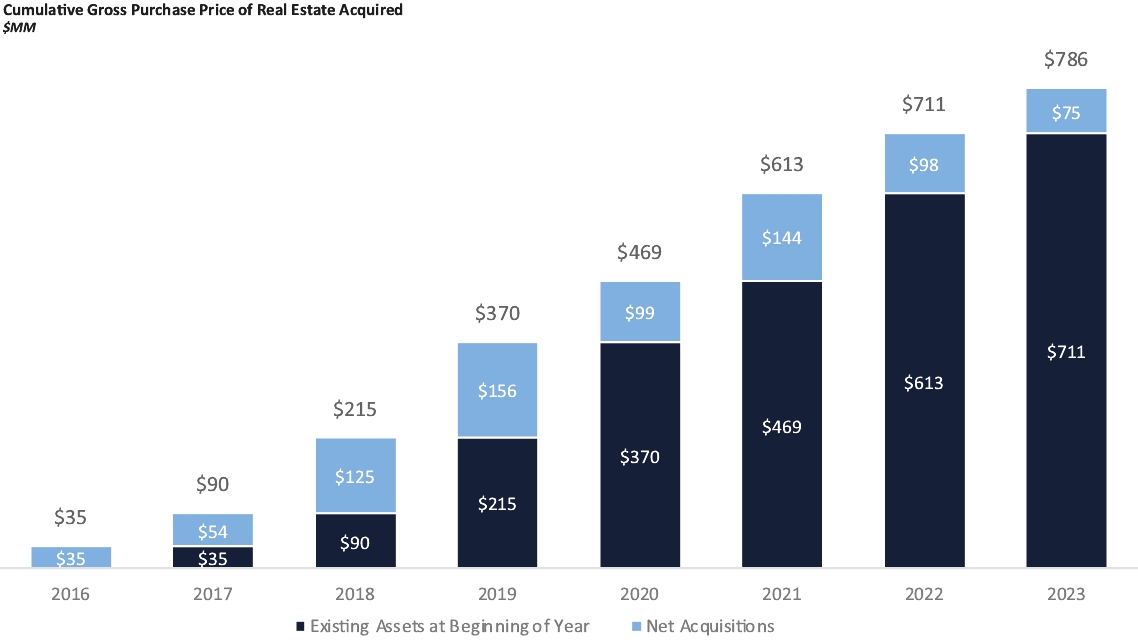

• | Experienced and Innovative Senior Leadership Team. Our senior management team has significant net-lease real estate, acquisition, development, finance, and capital markets experience, including working together since 2016 to collectively manage our operations from the ground up. Our senior management team has a strong investment track record and reputation as a proven and focused buyer of outparcels, having invested on behalf of our predecessor a total of approximately $786.0 million to acquire 278 net-lease outparcel properties as of June 30, 2024. Mr. Preston, our Founder, Chairman of the Board, co-Chief Executive Officer and co-President has more than 24 years of real estate and finance experience with outparcels and other real estate asset classes. Randall Starr, our co-Chief Executive Officer, co-President and member of our board of directors, has more than 20 years of experience in real estate, finance and corporate executive leadership. Messrs. Preston and Starr also have an extensive network of relationships in the net-lease real estate business, including with real estate brokers, financial advisors, and lenders, which we believe will continue to promote our growth and success. Following consummation of this offering and Internalization, Messrs. Preston and Starr will own an aggregate of approximately 2.3% of the outstanding shares of our Common Stock on a fully diluted basis, which we believe promotes a strong alignment of interest with our stockholders. |

• | Target Well-Located Outparcel Properties While Maintaining a Highly-Diversified Portfolio. We plan to continue our focused acquisition strategy to target well-located, net-leased outparcel properties that we believe are compelling real estate opportunities while maintaining our portfolio’s overall diversification based on tenants, brands, industries and geographic markets. We target specific acquisition opportunities in a highly selective manner using our “real estate first” investment approach. We are focused on acquiring outparcel properties that are well located, providing high visibility to consumers. We primarily seek e-commerce resistant tenants whose business operations are service-oriented, such as restaurants, cellular stores, financial institutions, automotive stores and dealers, medical and dental providers, pharmacies, convenience and gas stores, car washes, home improvement stores, grocery stores, professional services, as well as general retail tenants. We intend to pursue acquisitions of individual properties already subject to a net lease, including through sale leaseback transactions, and we also may pursue portfolio acquisitions that are significantly larger based on the desirability of the portfolio. We also believe that our ability to offer OP Units in tax-deferred transactions under current tax laws could give us flexibility in structuring and consummating acquisitions. |

• | Broad Market Relationships Drive Acquisition Pipeline. We believe our reputation and in-depth knowledge of properties based upon our operating history will enable us to continue to expand our market relationships and enhance our acquisition activity. Since our founding in 2016, we have rapidly built our portfolio and established a reputation as a proven and focused buyer of outparcels. We intend to continue to leverage the relationships we have developed with brokers and sellers based upon our successful historical activity to help identify acquisition opportunities early, to help source off market opportunities and to help pursue obtaining other opportunities, all of which we believe will help to enhance our ability to source compelling acquisitions. |

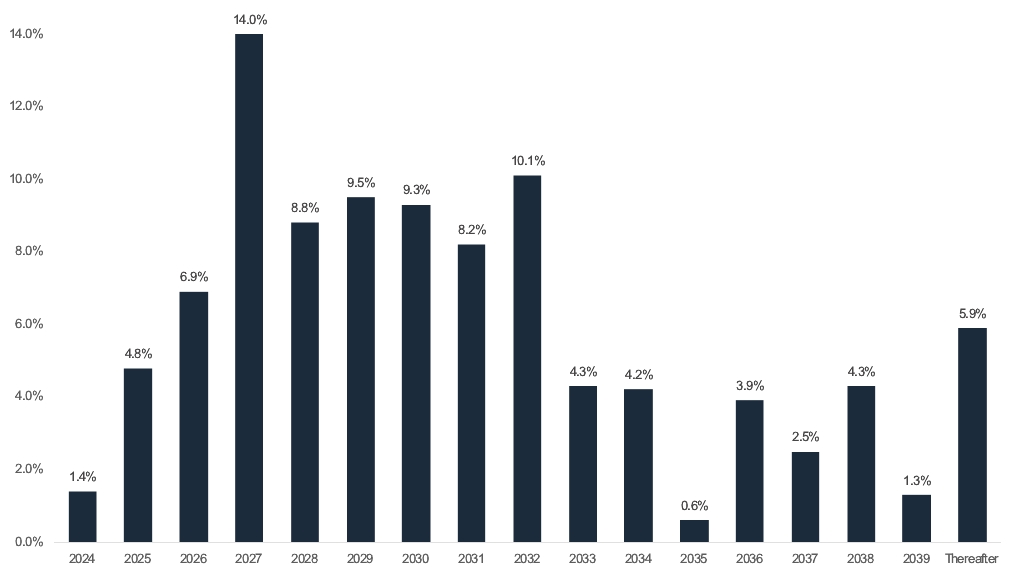

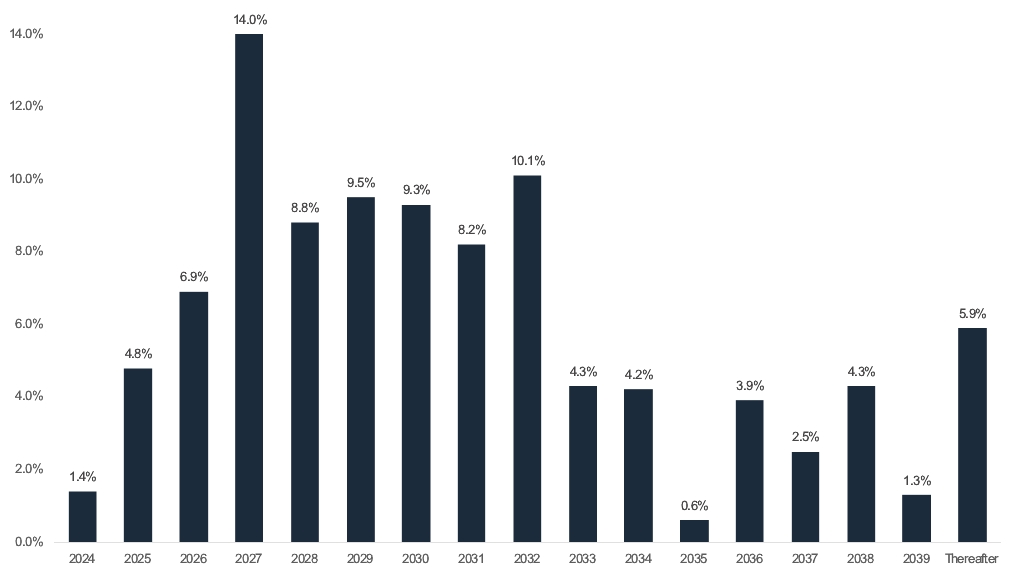

• | Consistent Internal Growth through Long-Term Net Leases with Strong Contractual Rent Escalations. We seek to acquire properties with long-term net leases in place that include contractual rent escalations over the lease term. As of June 30, 2024, substantially all of the properties in our portfolio were subject to net leases with an ABR weighted average remaining lease term of approximately 7.0 years, excluding renewal options. Approximately 96.6% of our leases (based on ABR) had contractual rent escalations, including, in some cases, pursuant to options terms, with an ABR weighted average minimum increase of approximately 1.7% per annum. As of June 30, 2024, approximately 93.2% of our leases (based on ABR) contained fixed annual rent increases or periodic escalations over the term of the lease (e.g., a 10% increase every five years) and approximately 3.4% of our leases (based on ABR) contained annual lease escalations based on increases in the CPI. |

• | Proactively Manage Our Portfolio. We believe our proactive approach to asset management and property management helps enhance the performance of our portfolio through risk mitigation strategies. These strategies include active rent collection monitoring, potential property sales, lease extension or renewals and, when applicable, the repositioning of a non-performing property. We have successfully re-tenanted, re-merchandised and sold outparcel properties as vacancies have arisen in our portfolio. Our experience in the industry over the years has allowed our management team to develop a wide array of tenant / tenant representative and brokerage relationships that are key to the successful re-tenanting of an outparcel property. We believe that our proactive approach to asset management helps to identify and address issues, such as tenant credit deterioration, changes in real estate fundamentals, and general market disruption. |

• | Actively Manage Our Balance Sheet to Maximize Capital Efficiency. We seek to maintain a prudent balance between debt and equity financing, to obtain various funding sources, including both fixed and floating rate debt, and to reduce interest rate risk by minimizing exposure to floating rate debt in the current economic climate. As of June 30, 2024, on a pro forma basis, we had approximately $249.9 million of total debt outstanding (net of fees) and approximately $71.5 million of cash and cash equivalents. Upon completion of this offering, and after giving effect to the repayment of debt with the net proceeds of this offering and borrowings under our New Revolving Credit Facility and New Delayed Draw Term Loan, we will have a pro forma net debt-to-annualized adjusted EBITDAre ratio of approximately 4.28x based on our pro forma annualized EBITDAre for the six months ended June 30, 2024. Our long-term goal is to target a net debt-to-annualized adjusted EBITDAre ratio of 6.0x or below. In addition, our New Revolving Credit Facility and New Delayed Draw Term Loan will provide additional sources of debt funding of up to $250 million and $200 million, respectively. We plan to use net proceeds from this offering to repay in full the outstanding balance of the Revolving Credit Facility and Term Loan Facility and pay approximately $0.3 million of debt service obligations under the ABS Notes using cash on hand. We anticipate using a portion of our New Revolving Credit Facility and New Delayed Draw Term Loan to repay our obligations under the ABS Notes in December 2024. |

• | Prime Properties in Desirable High-Traffic Locations. We selectively acquire outparcel properties that offer high-traffic locations with prime street frontage. We seek high-demand locations that provide certain inherent advantages such as advertising and brand building characteristics, high-customer traffic and, in some cases, drive thru-optionality that make these locations attractive for tenants and their business operations. In addition, we seek outparcel properties that offer high quality buildings and signage. We evaluate site locations using average daily traffic counts, typically seeking property locations with 15,000 cars or more at the closest corresponding intersection. |

• | Clearly Defined Target MSAs and Sub-Markets with Favorable Demographic Characteristics. We typically consider acquisition opportunities that are in MSAs and trade areas that have at least 50,000 residents within a 10-mile radius. Our acquisition team utilizes MSA data and other sources to pursue outparcel sites within locales exhibiting favorable demographic trends such as population growth, strong household incomes, locations of schools, offices, businesses and other demographic drivers. Excluding the State of California, we have acquired properties in each of the eight largest MSAs and 24 of the largest 30 MSAs in the United States. |

• | E-Commerce Resistant Tenants. We seek to acquire properties in locations that are typically sought-after by e-commerce resistant, service-based tenants. We believe high-traffic locations are attractive to these tenants, which often outperform the broader market during market downturns and have historically been more resilient. |

• | Favorable Physical Characteristics, Layout, and Site Position within Broader or Mixed-Use Location. We review the site location for each acquisition opportunity within the context of the overall development and the overall trade area. We focus on acquiring properties with favorable physical characteristics, including, but not limited to, the ability to add drive-thrus where appropriate, the ability to provide a significant number of parking spaces, sufficient land acreage to serve a variety of building types and tenants, easy access and unobstructed visibility from main roads. |

• | Locations that Appeal to Diverse Tenant Types. For each acquisition opportunity, we consider the site’s desirability for different tenant types, the site’s positioning within and size of the marketplace, the site’s zoning rights and restrictions and generally the site’s ability to accommodate different tenant industries. |

• | Sites with Potential for Value Creation. We also assess the potential for value creation over time by applying our asset management capabilities. For each acquisition opportunity, we review data to understand the performance of tenants within the marketplace, rents within the marketplace, tenant presence, duplicate tenant categories, void analysis and competing marketplaces or trade areas which help to understand market rent growth and potential occupancy trends. |

Tenant | ABR (in thousands) | % of ABR | ||||

Verizon | $1,761 | 3.4% | ||||

Oak Street Health | $1,310 | 2.5% | ||||

Adams Auto Group | $1,284 | 2.5% | ||||

Raising Canes | $1,262 | 2.4% | ||||

IHOP | $1,213 | 2.3% | ||||

Mammoth Car Wash | $1,198 | 2.3% | ||||

CVS | $1,081 | 2.1% | ||||

AT&T | $1,050 | 2.0% | ||||

Walgreens | $1,014 | 1.9% | ||||

Chili’s | $959 | 1.9% | ||||

Other | $39,870 | 76.7% | ||||

Total | $52,002 | 100.0% | ||||

• | our board of directors will not be classified, with each of our directors subject to election annually, and our charter provides that we may not elect to be subject to the elective provision of the MGCL that would classify our board of directors without the affirmative vote of a majority of the votes cast on the matter by stockholders entitled to vote generally in the election of directors; |

• | our stockholders will have the ability to amend our bylaws by the affirmative vote of a majority of the votes entitled to be cast on the matter; |

• | a majority of our directors will be “independent” in accordance with NYSE listing standards; |

• | we will have a fully independent Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee; |

• | at least one of our directors serving on the Audit Committee will qualify as an “audit committee financial expert” as defined by the SEC; |

• | we have opted out of the business combination and control share acquisition statutes in the MGCL, and we may only opt back in with the affirmative vote of a majority of the votes cast on the matter by stockholders entitled to vote generally in the election of directors; and |

• | we do not have a stockholder rights plan, and we will not adopt a stockholder rights plan in the future without (i) the approval of our stockholders or (ii) seeking ratification from our stockholders within 12 months of adoption of the plan if the board of directors determines, in the exercise of its duties under applicable law, that it is in our best interest to adopt a rights plan without the delay of seeking prior stockholder approval. |

• | Outparcel properties involve significant risks of tenant defaults and tenant vacancies, which could materially and adversely affect us. |

• | We have limited opportunities to increase rents under our long-term leases with tenants, which could impede our growth and materially and adversely affect us. |

• | Our financial results have and may continue to fluctuate in the future, which makes predicting our revenues, costs and expenses difficult, and any volatility in our future financial results could materially and adversely affect us. |

• | We may not be able to achieve growth through acquisitions at a rate that is comparable to our historical results, which could materially and adversely affect us. |

• | We may not be able to effectively manage our growth and any failure to do so could materially and adversely affect us. |

• | As we continue to acquire outparcel properties pursuant to our growth strategy, our portfolio may become less diversified which could materially and adversely affect us. |

• | The departure of any of our key personnel with long-standing business relationships could materially and adversely affect us. |

• | Our portfolio is concentrated in certain states and MSAs and any adverse developments and/or economic downturns in these geographic markets could materially and adversely affect us. |

• | Our portfolio of outparcel properties is also concentrated in certain tenant brands and industries, and any adverse developments relating to one or more of these brands or industries could materially and adversely affect us. |

• | Our portfolio of outparcel properties is concentrated among tenants with non-investment grade credit ratings, and any adverse developments affecting the credit of these tenants could materially and adversely affect us. |

• | The decrease in demand for restaurant outparcel properties may materially and adversely affect us. |

• | We may be unable to renew leases, re-lease outparcel properties as leases expire, or lease vacant spaces on favorable terms or at all, which, in each case, could materially and adversely affect us. |

• | Our business is subject to significant re-leasing risk, particularly for specialty outparcel properties that are suitable for only one use, which could materially and adversely affect us. |

• | We may experience tenant defaults, particularly from tenants that do not have an investment grade credit rating, which could materially and adversely affect us. |

• | Increases in interest rates may decrease the value of our properties, which could materially and adversely affect us. |

• | Inflation may materially and adversely affect us and our tenants, which could materially and adversely affect us. |

• | As of June 30, 2024, on a pro forma basis, we had approximately $249.9 million principal balance of indebtedness outstanding (net of fees), which may expose us to the risk of default under our debt obligations. |

• | Market conditions could adversely affect our ability to refinance existing indebtedness on acceptable terms or at all, which could materially and adversely affect us. |

• | An increase in market interest rates could increase our interest costs on existing and future debt and could adversely affect our stock price, and a decrease in market interest rates could lead to additional competition for the acquisition of real estate, any of which could materially and adversely affect us. |

• | Our ABS Notes, New Revolving Credit Facility and New Delayed Draw Term Loan contain various covenants which, if not complied with, could accelerate our repayment obligations, thereby materially and adversely affecting us. |

• | Cash interest expense and financial covenants relating to our indebtedness, including covenants in our New Revolving Credit Facility and New Delayed Draw Term Loan that will restrict us from paying distributions if a default or event of default exists, other than distributions required to maintain our REIT status, may limit or eliminate our ability to make distributions to holders of our Common Stock. |

• | We are a holding company with no direct operations and rely on funds received from the OP to pay liabilities. |

• | Failure to qualify as a REIT would materially and adversely affect us and the value of our Common Stock. |

• | There has been no public market for our Common Stock prior to this offering and an active trading market for our Common Stock may not develop following this offering. |

• | The market price and trading volume of shares of our Common Stock may be volatile following this offering. |

• | We may not be able to make distributions to our stockholders at the times or in the amounts we expect, or at all. |

• | You will experience immediate and substantial dilution from the purchase of the shares of Common Stock sold in this offering. |

• | Increases in market interest rates may result in a decrease in the value of shares of our Common Stock. |

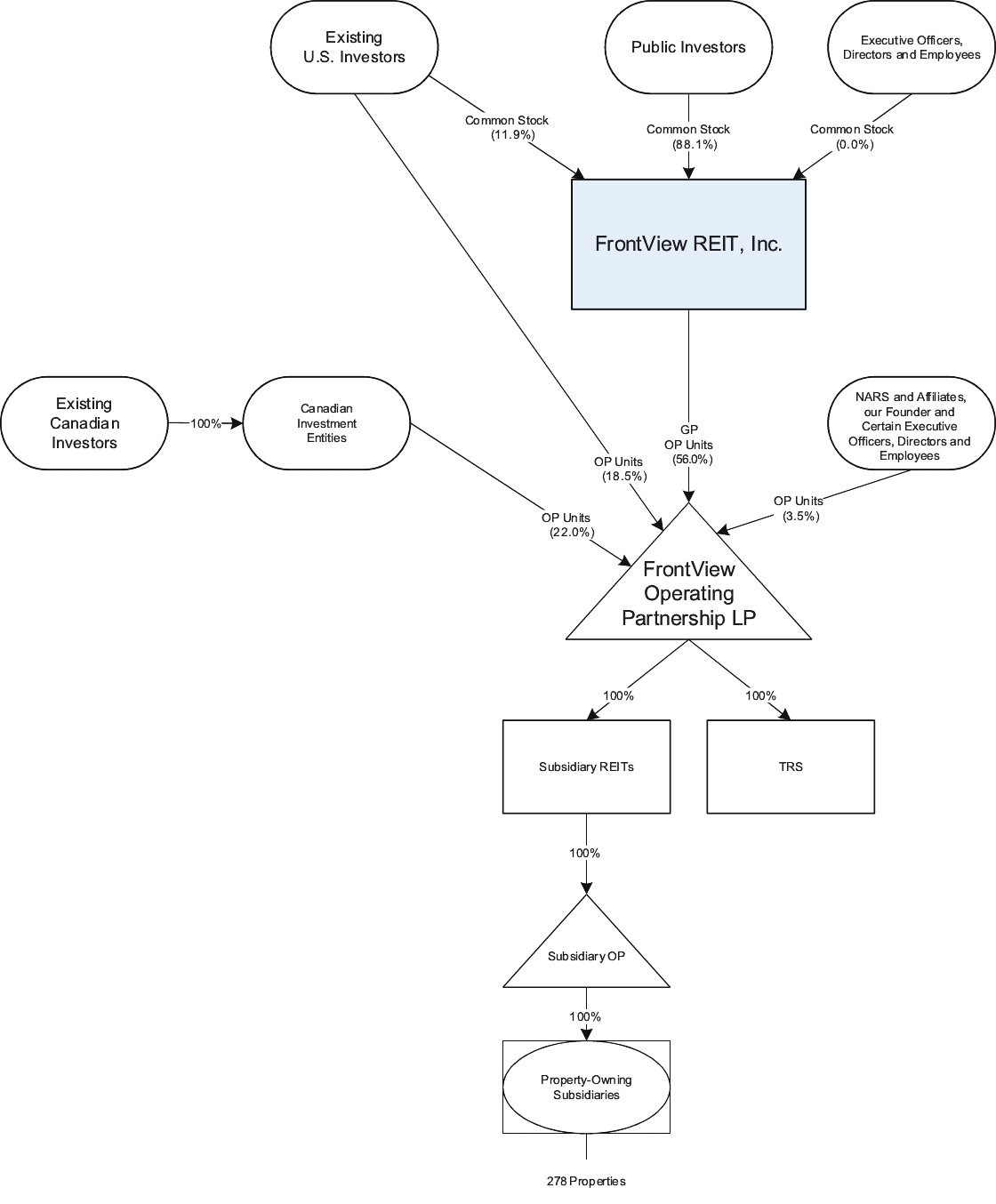

• | Prior to the REIT Contribution Transactions, our predecessor’s private REIT will effect a 250 for-one split of its common units. Following that unit split, pursuant to the Contribution Agreements, our predecessor’s common unit holders will exchange their common units (or interest in the entity that owns the common units in our predecessor’s private operating partnership) for OP Units or shares of Common Stock on a one-for-one basis. Following that unit split and exchange, such contributing investors will receive an aggregate of 5,742,303 OP Units and 1,777,310 shares of Common Stock, representing approximately 28.1% of our outstanding shares of our Common Stock on a fully diluted basis (based on the midpoint of the price range set forth on the cover page of this prospectus). The shares of Common Stock issued in the REIT Contribution Transactions will not be listed on the NYSE until 180 days after the closing of this offering. For more information, see “REIT Contribution Transactions and Internalization—REIT Contribution Transactions.” |

• | Pursuant to the REIT Contribution Transactions, existing preferred unit holders will exchange their interests in our predecessor’s private operating partnership (or interest in the entity that owns the preferred interests in our predecessor’s private operating partnership) for OP Units. Based on the midpoint of the price range set forth on the cover page of this prospectus, such contributing investors will receive an aggregate of 5,080,877 OP Units, representing approximately 19.0% of our outstanding shares of our Common Stock on a fully diluted basis. The number of OP Units to be issued to such contributing investors will be calculated by dividing the fixed liquidation preference of the preferred units in our predecessor’s private operating partnership ($10,400 per unit, plus any accrued and unpaid preferred return, or approximately $103.7 million in the aggregate) by the sum of the initial public offering price per share of our Common Stock and $1.40 (which represents the preferred unit holders' proportional share of the cost of the Internalization). If the initial public offering price is at the low end of the price range, then the aggregate number of OP Units to be issued to existing preferred unit holders will be 5,696,897. Conversely, if the initial public offering price is at the high end of the price range, then the aggregate number of OP Units to be issued to the preferred unit holders will be 4,584,052. For more information, see “REIT Contribution Transactions and Internalization—REIT Contribution Transactions.” |

• | The purchase price for the Internalization will be payable in 931,490 OP Units, representing approximately 3.5% of our outstanding shares of our Common Stock on a fully diluted basis (based on the midpoint of the price range set forth on the cover page of this prospectus). For more information, see “REIT Contribution Transactions and Internalization—Internalization.” |

• | At the closing of the Internalization, we will hire approximately 15 employees and we will enter into employment agreements with each of our named executive officers. |

• | At the closing of the Internalization, we will enter into an outsourcing agreement with an entity of NADG not affiliated with us that will provide us with the property accounting services and the human resources we need. The outsourcing agreement will have a term of three years with automatic one-year renewal options and can be terminated at any time for any reason by either party upon six months’ advance notice and will provide an option for us to directly hire the full-time personnel providing the property accounting and human resources services. |

• | The management and other fees, and carried interest provisions, in the existing OP agreement that were paid by our predecessor will be eliminated. |

• | At the closing of the Internalization, the OP will acquire all of the assets reasonably necessary to operate and manage our portfolio of outparcel properties, including the assumption of an office lease and certain operating liabilities. |

• | NARS and certain of its affiliates have made representations and warranties in the Internalization Agreement for our benefit that will survive until six months after the closing of the Internalization. |

• | The Internalization Agreement includes a non-compete clause that restricts Messrs. Preston and Starr from engaging in certain competitive businesses in any geographic area in which our business is conducted as of the closing date of the Internalization for one year following the closing of the Internalization. |

Name and Principal Position | OP Units to be received in the Internalization | One-time Grant of RSUs | ||||

Stephen Preston, Co-Chief Executive Officer and Co-President | 427,818 | 263,158 | ||||

Randall Starr, Co-Chief Executive Officer and Co-President | 178,258 | 171,053 | ||||

Timothy Dieffenbacher, Chief Financial Officer, Treasurer and Secretary | — | 52,632 | ||||

Drew Ireland, Chief Operating Officer | 9,616 | 52,632 | ||||

Robert S. Green, Director | 71,303 | — | ||||

Ernesto Perez, Independent Director | — | 4,737 | ||||

Noelle LeVeaux, Independent Director Nominee | — | 2,369 | ||||

Daniel Swanstrom, Independent Director Nominee | — | 2,369 | ||||

Elizabeth Frank, Independent Director Nominee | — | 2,369 | ||||

Other FrontView Employees | 6,915 | 5,398 | ||||

NARS and Affiliates | 237,580 | — | ||||

Total | 931,490 | 556,717 | ||||

(1) | Excludes 1,722,719 shares of our Common Stock reserved for future issuance under the 2024 Equity Incentive Plan, as more fully described in “Executive Compensation—Material Terms of the 2024 Equity Incentive Plan,” a portion of which will be used to issue a total of 556,717 RSUs to our named executive officers, other employees and non-employee directors shortly after the closing of this offering. |

(2) | Includes 1,777,310 shares of Common Stock to be issued to existing common unit holders in our predecessor’s private REIT fund structure. |

(3) | Approximately 43.2% of the total number of OP Units includes 5,080,877 OP Units to be issued to existing preferred unit holders in our predecessor’s private REIT fund structure, which was determined by dividing the fixed liquidation preference of the preferred units by the midpoint of the price range set forth on the cover page of the prospectus. If the initial public offering price is at the low end of the price range, then the aggregate number of OP Units to be issued to existing preferred unit holders will be 5,696,897. Conversely, if the initial public offering price is at the high end of the price range, then the aggregate number of OP Units to be issued to the preferred unit holders will be 4,584,052. The remaining 56.8% of the total number of OP Units includes 5,742,303 OP Units to be issued to existing common unit holders in our predecessor’s private REIT fund structure and 931,490 OP Units to be issued in the Internalization, which are fixed and do not depend on the initial public offering price. Common Stock includes 1,777,310 shares of Common Stock to be issued to existing common unit holders in our predecessor’s private REIT fund structure. |

Six months ended June 30, | Years ended December 31, | |||||||||||||||||

(in thousands, except share and per share amounts) | Company Pro Forma Condensed Consolidated (unaudited) 2024 | Historical Condensed Consolidated (unaudited) 2024 | Historical Condensed Consolidated (unaudited) 2023 | Company Pro Forma Consolidated (unaudited) 2023 | Historical Consolidated 2023 | Historical Consolidated 2022 | ||||||||||||

Revenues | ||||||||||||||||||

Rental revenues | $29,156 | $29,869 | $22,300 | $57,891 | $48,266 | $39,863 | ||||||||||||

Operating expenses | ||||||||||||||||||

Depreciation and amortization | 14,249 | 14,296 | 11,156 | 28,860 | 24,730 | 21,801 | ||||||||||||

Property operating expenses | 3,664 | 3,691 | 2,627 | 6,549 | 5,826 | 4,498 | ||||||||||||

Property management fees | — | 1,007 | 725 | — | 1,616 | 918 | ||||||||||||

Asset management fees | — | 2,068 | 2,070 | — | 4,139 | 3,638 | ||||||||||||

General and administrative expenses | 6,471 | 1,361 | 3,081 | 12,475 | 8,054 | 1,184 | ||||||||||||

Total operating expenses | 24,384 | 22,423 | 19,659 | 47,884 | 44,365 | 32,039 | ||||||||||||

Other expenses (income) | ||||||||||||||||||

Interest expense | 8,738 | 13,292 | 7,268 | 17,517 | 18,377 | 12,464 | ||||||||||||

Loss/ (gain) on sale of real estate | — | (337) | 332 | — | (725) | 201 | ||||||||||||

Impairment loss | 591 | 591 | — | — | 407 | — | ||||||||||||

Income taxes | 281 | 281 | 158 | 390 | 316 | 430 | ||||||||||||

Total other expenses | 9,610 | 13,827 | 7,758 | 17,907 | 18,375 | 13,095 | ||||||||||||

Operating loss | (4,838) | (6,381) | (5,117) | (7,900) | (14,474) | (5,271) | ||||||||||||

Gain from acquisition of equity method investment | — | — | — | — | 12,988 | — | ||||||||||||

Equity (loss)/ income from investment in an unconsolidated entity | — | — | 60 | — | (38) | (109) | ||||||||||||

Net loss | (4,838) | (6,381) | (5,057) | (7,900) | (1,524) | (5,380) | ||||||||||||

Net loss attributable to convertible non-controlling preferred interests | — | 1,743 | 1,364 | — | 424 | 910 | ||||||||||||

Net loss attributable to NADG NNN Property Fund LP | — | 4,638 | 3,693 | — | 1,100 | 4,470 | ||||||||||||

Net loss attributable to non-controlling interests in the OP | 2,127 | — | — | 3,474 | — | — | ||||||||||||

Net loss attributable to common stockholders | $(2,711) | $— | $— | $(4,426) | $— | $— | ||||||||||||

Basic and Diluted net loss per share | $(0.18) | $(0.30) | ||||||||||||||||

As of June 30, | As of December 31, | |||||||||||

(in thousands) | Company Pro Forma Condensed Consolidated (unaudited) 2024 | Historical Condensed Consolidated (unaudited) 2024 | Historical Consolidated 2023 | Historical Consolidated 2022 | ||||||||

Total real estate held for investment, at cost | $640,264 | $640,264 | $647,180 | $462,923 | ||||||||

Total assets | 798,372 | 745,466 | 772,007 | 626,790 | ||||||||

Total debt, net | 249,869 | 427,435 | 436,452 | 281,307 | ||||||||

Total liabilities | 278,817 | 455,791 | 471,321 | 311,103 | ||||||||

Total convertible non-controlling preferred interests, partners' capital and stockholders' equity | 519,555 | 289,675 | 300,687 | 315,687 | ||||||||

Six months ended June 30, | Years ended December 31, | |||||||||||||||||

(in thousands) | Company Pro Forma Condensed Consolidated (unaudited) 2024 | Historical Condensed Consolidated (unaudited) 2024 | Historical Condensed Consolidated (unaudited) 2023 | Company Pro Forma Consolidated (unaudited) 2023 | Historical Consolidated 2023 | Historical Consolidated 2022 | ||||||||||||

FFO(1) | $9,411 | $7,578 | $7,287 | $20,960 | $11,031 | $19,007 | ||||||||||||

AFFO(1) | 12,406 | 9,939 | 11,110 | 26,801 | 20,812 | 21,049 | ||||||||||||

EBITDA(1) | 19,333 | 22,403 | 16,307 | 38,867 | 46,953 | 34,217 | ||||||||||||

EBITDAre(1) | 19,333 | 22,066 | 16,379 | 38,867 | 32,980 | 34,418 | ||||||||||||

(1) | FFO, AFFO, EBITDA and EBITDAre are non-GAAP financial measures that are often used by analysts and investors to compare the operating performance of REITs. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Non-GAAP Financial Measures” for definitions of these metrics and reconciliations of these metrics to the most directly comparable GAAP measures. |

• | general market conditions, including, but not limited to, credit availability, marketplace liquidity, inflation and increasing and/or fluctuating interest rates; |

• | the market’s perception of our growth potential; |

• | our current cash and debt levels; |

• | our current and expected future earnings; |

• | the composition and performance of our portfolio; |

• | our cash flow and cash distributions; and |

• | the market price per share of our Common Stock. |

• | invest in enhanced operational systems that can scale as our portfolio grows in size, including recent investments in updated systems; |

• | attract, integrate, and retain operations personnel as our Company grows in complexity, including our recent hires of additional employees that could add to our expenses; and |

• | identify, supervise and/or implement a number of suitable third-parties to provide services to us. |

• | inability to collect rents from tenants due to financial hardship, including bankruptcy, financial difficulties, or lease defaults by tenants; |

• | changes in global, national, regional, or local economic, demographic, or real estate market conditions in the markets in which we operate, including the supply and demand for individual tenant outparcel properties in the restaurant, cellular store, financial institution, automotive store and dealer, medical and dental provider, pharmacy, convenience and gas store, car wash, home improvement store, professional services and general retail sectors; |

• | competition from other properties; |

• | changes in consumer trends and preferences that affect the demand for products and services offered by our tenants; |

• | inability to lease or sell properties upon expiration or termination of existing leases and renewal of leases at lower rental rates; |

• | the subjectivity of real estate valuations and changes in such valuations over time; |

• | the illiquid nature of real estate compared to most other financial assets; |

• | changes in laws, government rules, regulations, and fiscal policies, including changes in tax, real estate, environmental, access closure or changes, condemnation proceedings and zoning laws; |

• | changes in interest rates and availability of financing, including changes in the terms of available financing such as more conservative loan-to-value requirements and shorter debt maturities; |

• | unexpected expenditures relating to age of building, quality of construction, construction defects and physical or weather-related damage to properties; |

• | labor shortages, supply chain issues and increased material and labor costs; |

• | the potential risk of functional obsolescence of properties over time; |

• | acts of terrorism and war; |

• | pandemics and natural disasters; |

• | acts of God and other factors beyond our control; and |

• | increased competition for real property acquisitions targeted by our investment strategy. |

• | our cash flow may be insufficient to meet our required principal and interest payments; |

• | cash interest expense and financial covenants relating to our indebtedness, including covenants in our New Revolving Credit Facility and New Delayed Draw Term Loan that will restrict us from paying distributions if a default or event of default exists, other than distributions required to maintain our REIT status, may limit or eliminate our ability to make distributions to holders of our Common Stock; |

• | we may be unable to borrow additional funds as needed or on favorable terms, which could, among other things, adversely affect our ability to capitalize upon investment opportunities or meet operational needs; |

• | we may be unable to refinance our indebtedness at maturity or the refinancing terms may be less favorable than the terms of our original indebtedness; |

• | because a portion of our debt bears interest at variable rates, increases in interest rates would increase our interest expense; |

• | we may be unable to hedge floating rate debt, counterparties may fail to honor their obligations under any hedge agreements we enter into, such agreements may not effectively hedge interest rate fluctuation risk, and, upon the expiration of any hedge agreements we enter into, we would be exposed to then-existing market rates of interest and future interest rate volatility; |

• | we may be forced to dispose of properties, possibly on unfavorable terms or in violation of certain covenants to which we may be subject; |

• | we may default on our obligations and the lenders or mortgagees may foreclose on our properties or our interests in the entities that own the properties that secure their loans and receive an assignment of rents and leases; |

• | any foreclosures by lenders of our outparcel properties could create taxable income without accompanying cash proceeds, which could hinder our ability to meet the REIT distribution requirements imposed by the Code; |

• | we may be restricted from accessing some of our excess cash flow after debt service if certain of our tenants fail to meet certain financial performance metric thresholds; |

• | fluctuations in interest rates and available liquidity in the marketplace; |

• | we may violate restrictive covenants in our loan documents, which would entitle the lenders to accelerate our debt obligations; and |

• | our default under any loan with cross default provisions could result in a default on other indebtedness. |

• | actual receipt of an improper personal benefit or profit in money, property, or services; or |

• | active and deliberate dishonesty by the director or officer that was established by a final judgment as being material to the cause of action adjudicated. |

• | we would not be allowed a deduction for distributions to stockholders in computing our taxable income and would be subject to U.S. federal income tax at the corporate rate; |

• | we also could be subject to increased state and local income taxes; |

• | unless we are entitled to relief under applicable statutory provisions of the Code, we could not elect to be taxed as a REIT for four taxable years following the year during which qualification was lost; and |

• | for the five years following re-election of REIT status, upon a taxable disposition of an asset owned as of such re-election, we would be subject to corporate level tax with respect to any built-in gain inherent in such asset at the time of re-election. |

• | In order to qualify as a REIT, we must distribute annually at least 90% of our REIT taxable income to our stockholders (computed without regard to the dividends paid deduction and our net capital gain), and to the extent that we satisfy the distribution requirement but distribute less than 100% of our REIT taxable income (computed without regard to the dividends paid deduction and including our net capital gain), we will be subject to U.S. federal corporate income tax on the undistributed income, as well as applicable state and local income taxes. |

• | If we should fail to distribute, or fail to be treated as having distributed, with respect to each calendar year at least the sum of (i) 85% of our REIT ordinary income for such year, (ii) 95% of our REIT capital gain net income for such year, and (iii) any undistributed taxable income from prior periods, we would be subject to a 4% nondeductible excise tax on the excess of such required distribution over the sum of (a) the amounts actually distributed and (b) the amounts we retained and upon which we paid U.S. federal income tax at the corporate level. |

• | If we have (i) net income from the sale or other disposition of “foreclosure property” that is held primarily for sale to customers in the ordinary course of business or (ii) other non-qualifying net income from foreclosure property, we will be subject to tax at the U.S. federal corporate income tax rate on such income. To the extent that income from “foreclosure property” is otherwise qualifying income for purposes of the 75% gross income test, this tax is not applicable. |

• | If we have net income from prohibited transactions (which are, in general, certain sales or other dispositions of property held primarily for sale to customers in the ordinary course of business, other than sales of foreclosure property and sales that qualify for certain statutory safe harbors), such income will be subject to a 100% tax. |

• | We may be subject to tax on gain recognized in a taxable disposition of assets acquired from a non-REIT C corporation by way of a carryover basis transaction, when such gain is recognized on a disposition of an asset during a five-year period beginning on the date on which we acquired the asset. To the extent of any “built-in gain,” such gain will be subject to U.S. federal income tax at the federal corporate income tax rate. Built-in gain means the excess of (i) the fair market value of the asset as of the beginning of the applicable recognition period over (ii) our adjusted basis in such asset as of the beginning of such recognition period. |

• | actual or anticipated declines in our quarterly operating results or distributions; |

• | changes in government regulations; |

• | changes in laws affecting REITs and related tax matters; |

• | the announcement of new contracts by us or our competitors; |

• | reductions in our FFO, AFFO, or earnings estimates; |

• | publication of research reports about us or the real estate industry; |

• | increases in market interest rates that lead purchasers of shares of our Common Stock to demand a higher yield; |

• | future equity issuances, or the perception that they may occur, including issuances of Common Stock upon exercise or vesting of Awards under the 2024 Equity Incentive Plan or redemption of OP Units; |

• | changes in market valuations of similar companies; |

• | adverse market reaction to any increased indebtedness we incur in the future; |

• | additions or departures of key management personnel; |

• | actions by institutional stockholders; |

• | differences between our actual financial and operating results and those expected by investors and analysts; |

• | changes in analysts’ recommendations or projections; |

• | speculation in the press or investment community; and |

• | the realization of any of the other risk factors presented in this prospectus. |

• | approximately $159.9 million to repay borrowings under the Revolving Credit Facility; and |

• | approximately $16.0 million to repay borrowings under the Term Loan Credit Facility. |

Indebtedness to be Repaid | Maturity Date | Interest Rate | ||||

Revolving Credit Facility | March 8, 2025 | SOFR plus 2.36% | ||||

Term Loan Credit Facility | March 31, 2027 | SOFR plus 1.80% | ||||

(in thousands) | |||

Pro forma net loss for the year ended December 31, 2023 | $(7,900) | ||

Less: Pro forma net loss for the six months ended June 30, 2023 | (3,633) | ||

Add: Pro forma net loss for the six months ended June 30, 2024 | (4,838) | ||

Pro forma net loss for the 12 months ended June 30, 2024 | (9,105) | ||

Add: Estimated net increases in contractual lease revenues(1) | 648 | ||

Add: Real estate depreciation and amortization | 28,265 | ||

Add: Non-cash impairment charges | 591 | ||

Add: Non-cash interest expense | 1,584 | ||

Add: Non-cash compensation expense(2) | 3,943 | ||

Add: Amortization of lease intangibles(3) | 1,809 | ||

Less: Net decrease in contractual lease revenues, due to tenant lease expirations, dispositions, and other vacancies(4) | (1,340) | ||

Less: Estimated recurring capital expenditure(5) | (210) | ||

Less: Straight-line rent adjustment(6) | (1,554) | ||

Estimated cash available for distribution for the 12 months ending June 30, 2025 | $24,631 | ||

Our stockholders' share of estimated cash available for distribution(7) | 13,793 | ||

Non-controlling interests' share of estimated cash available for distribution(8) | 10,838 | ||

Estimated initial annual distribution per share of Common Stock and per OP Unit | 0.81 | ||

Total estimated initial annual distributions to stockholders(9) | 12,131 | ||

Total estimated initial annual distribution to non-controlling interests(10) | 9,521 | ||

Total estimated initial annual distribution to stockholders and non-controlling interests | 21,652 | ||

Payout ratio(11) | 87.9% | ||

(1) | Represents contractual increases in rental revenue from: |

- | Scheduled fixed rent increases; |

- | Contractual increases including (a) increases that have already occurred but were not in effect for the entire 12 months ended June 30, 2024 and (b) actual increases that have occurred from July 1, 2024 to July 31, 2024); and |

- | Net increases from new leases or renewals that were not in effect for the entire 12 months ended June 30, 2024 or that will go into effect during the 12 months ending June 30, 2025 based upon leases entered into through July 31, 2024. |

(2) | Represents non-cash stock-based compensation expense related to equity-based awards granted to non-employee directors, executive officers and other employees after the completion of this offering and reflected in our pro forma net income for the 12 months ended June 30, 2024. |

(3) | Represents non-cash amortization of lease intangibles through revenue during the 12 months ended June 30, 2024 on a pro forma basis. |

(4) | Represents decreases in lease revenue due to leases that (a) expired, terminated, or were disposed of during the 12 months ended June 30, 2024 and the period from July 1, 2024 to July 31, 2024 in each case, that were not re-leased as of July 31, 2024, or (b) will expire during the 12 months ending June 30, 2025 based upon leases entered into through July 31, 2024. |

(5) | Represents estimated recurring capital expenditures to be made during the 12 months ending June 30, 2025. Substantially all of our properties are net leased to tenants who are required to pay substantially all property-level operating expenses. As a result, we historically have had limited capital expenditure requirements. |

(6) | Represents the difference between the straight-line lease revenue recognized for GAAP purposes, and the contractual amounts due under our long-term net leases during the 12 months ended June 30, 2024 on a pro forma basis. |

(7) | Based on estimated ownership by our Company of approximately 56.0% of the general and limited partnership interests in the OP, based on the midpoint of the price range set forth on the cover page of this prospectus. |

(8) | Represents the share of our estimated cash available for distribution for the 12 months ending June 30, 2025 attributable to the holders of limited partnership interests in the OP other than our Company, based on the midpoint of the price range set forth on the cover page of this prospectus. |

(9) | Based on a total of 14,977,310 shares of our Common Stock expected to be outstanding upon completion of this offering, based on the midpoint of the price range set forth on the cover page of this prospectus. |

(10) | Based on a total of 11,754,670 OP Units expected to be outstanding upon completion of this offering (excluding OP Units held by our Company), based on the midpoint of the price range set forth on the cover page of this prospectus. |

(11) | Calculated as total estimated initial annual distribution to stockholders divided by our stockholders’ share of estimated cash available for distribution for the 12 months ending June 30, 2025. If the underwriters exercise in full their option to purchase additional shares of Common Stock, our total estimated initial annual distribution to stockholders and non-controlling interests would be $23.3 million and our payout rate would be 94.4%. |

• | the historical capitalization of our predecessor as of June 30, 2024, on an actual basis; |

• | our unaudited pro forma capitalization as of June 30, 2024, on a pro forma basis to give effect to the REIT Contribution Transactions and Internalization; and |

• | our unaudited pro forma capitalization as of June 30, 2024, on a pro forma as adjusted basis to give effect to the transactions described in the preceding bullet and the issuance by us of 13,200,000 shares of Common Stock in this offering at the initial public offering price of $19.00 per share, the midpoint of the price range set forth on the cover page of this prospectus, and the use of proceeds therefrom as described under “Use of Proceeds.” |

As of June 30, 2024 | |||||||||

(in thousands, except share and per share amounts) | Historical | Pro Forma (unaudited) | Pro Forma As Adjusted (unaudited) | ||||||

Cash, cash equivalents and restricted cash | $16,621 | $17,150 | $71,455 | ||||||

Debt, net(1) | 427,435 | 427,435 | 249,869 | ||||||

Convertible non-controlling preferred interests | 103,724 | — | — | ||||||

Equity: | |||||||||

Partners' capital | 185,951 | — | — | ||||||

Common Stock, par value $0.01 per share | |||||||||

Common Stock, 400,000,000 shares authorized, 100 shares issued and outstanding, historical; 1,777,310 shares issued and outstanding, pro forma; and 14,977,310 shares issued and outstanding, pro forma as adjusted(2) | — | 18 | 150 | ||||||

Additional paid-in capital | 1 | 45,795 | 274,343 | ||||||

Non-controlling interests in the OP(3) | — | 245,062 | 245,062 | ||||||

Total equity | $185,952 | $290,875 | $519,555 | ||||||

Total capitalization | $717,111 | $718,310 | $769,424 | ||||||

(1) | Upon completion of this offering, we expect our New Revolving Credit Facility to have $250 million of availability. |

(2) | Pro forma shares issued and outstanding excludes the shares of Common Stock to be issued in this offering. |

(3) | Pro forma and pro forma as adjusted non-controlling interests includes (1) an aggregate of 5,742,303 OP Units to be issued in connection with the U.S. and Canadian common unit holders’ REIT Contribution Transactions, (2) an aggregate of 5,080,877 OP Units to be issued in connection with the preferred unit holders’ REIT Contribution Transactions, and (3) an aggregate of 931,490 OP Units to be issued in connection with the Internalization. |

Assumed initial public offering price per share of Common Stock | $19.00 | |||||

Net tangible book value per share of our predecessor before the REIT Contribution Transactions, the Internalization and this offering(1) | $15.59 | |||||

Net decrease in pro forma net tangible book value per share attributable to the REIT Contribution Transactions and the Internalization | (1.04) | |||||

Increase in pro forma net tangible book value per share attributable to this offering | 1.37 | |||||

Pro forma net tangible book value per share of our Company after the REIT Contribution Transactions, the Internalization and this offering(2) | 15.92 | |||||

Dilution in pro forma net tangible book value per share to new investors(3) | $3.08 | |||||

(1) | Net tangible book value per share of our predecessor before the REIT Contribution Transactions, the Internalization and this offering, is determined by dividing the net tangible book value of our predecessor as of June 30, 2024 by 12,600,490 shares of our Common Stock and OP Units to be issued pursuant to the REIT Contribution Transactions to our contributing investors (based on the midpoint of the price range set forth on the cover page of this prospectus), excluding the OP units issued pursuant to the Internalization and the RSUs to be issued to our Founder, our executive officers, certain of our other employees and our non-employee directors shortly after the consummation of this offering. |

(2) | Based on pro forma net tangible book value of our Company of approximately $425.7 million divided by the number of shares of our Common Stock and OP Units to be outstanding upon completion of this offering (based on the midpoint of the price range set forth on the cover page of this prospectus), which amount excludes the shares and related proceeds that may be issued or received by us if the underwriters exercise in full their option to purchase additional shares of our Common Stock. |

(3) | Dilution is determined by subtracting pro forma net tangible book value per share of our Company after giving effect to the REIT Contribution Transactions, the Internalization and this offering from the assumed initial public offering price paid by a new investor for a share of our Common Stock. |

Shares/OP Units Issued | Pro Forma Net Tangible Book Value of Contributions/ Cash(1) | Average Price Per Share/OP Unit | |||||||||||||

Number | Percent | Amount | Percent | Amount | |||||||||||

Existing Investors(2) | 13,531,980 | 50.6% | $196,970,234 | 46.3% | $14.56 | ||||||||||

New investors | 13,200,000 | 49.4% | $228,679,766 | 53.7% | $17.32 | ||||||||||

Total | 26,731,980 | 100.0% | $425,650,000 | 100.0% | $15.92 | ||||||||||

(1) | Represents pro forma net tangible book value as of June 30, 2024 after giving effect to the REIT Contribution Transactions, the Internalization and this offering. |

(2) | Includes OP Units to be issued in connection with the REIT Contribution Transactions and the Internalization and shares of Common Stock to be issued in connection with the REIT Contribution Transactions, but excluding any shares that may be issued by us if the underwriters exercise in full their option to purchase additional shares of our Common Stock. |

Six months ended June 30, | Years ended December 31, | |||||||||||||||||

(in thousands, except share and per share amounts) | Company Pro Forma Condensed Consolidated (unaudited) 2024 | Historical Condensed Consolidated (unaudited) 2024 | Historical Condensed Consolidated (unaudited) 2023 | Company Pro Forma Consolidated (unaudited) 2023 | Historical Consolidated 2023 | Historical Consolidated 2022 | ||||||||||||

Revenues | ||||||||||||||||||

Rental revenues | $29,156 | $29,869 | $22,300 | $57,891 | $48,266 | $39,863 | ||||||||||||

Operating expenses | ||||||||||||||||||

Depreciation and amortization | 14,249 | 14,296 | 11,156 | 28,860 | 24,730 | 21,801 | ||||||||||||

Property operating expenses | 3,664 | 3,691 | 2,627 | 6,549 | 5,826 | 4,498 | ||||||||||||

Property management fees | — | 1,007 | 725 | — | 1,616 | 918 | ||||||||||||

Asset management fees | — | 2,068 | 2,070 | — | 4,139 | 3,638 | ||||||||||||

General and administrative expenses | 6,471 | 1,361 | 3,081 | 12,475 | 8,054 | 1,184 | ||||||||||||

Total operating expenses | 24,384 | 22,423 | 19,659 | 47,884 | 44,365 | 32,039 | ||||||||||||

Six months ended June 30, | Years ended December 31, | |||||||||||||||||

(in thousands, except share and per share amounts) | Company Pro Forma Condensed Consolidated (unaudited) 2024 | Historical Condensed Consolidated (unaudited) 2024 | Historical Condensed Consolidated (unaudited) 2023 | Company Pro Forma Consolidated (unaudited) 2023 | Historical Consolidated 2023 | Historical Consolidated 2022 | ||||||||||||

Other expenses (income) | ||||||||||||||||||

Interest expense | 8,738 | 13,292 | 7,268 | 17,517 | 18,377 | 12,464 | ||||||||||||

Loss/ (gain) on sale of real estate | — | (337) | 332 | — | (725) | 201 | ||||||||||||

Impairment loss | 591 | 591 | — | — | 407 | — | ||||||||||||

Income taxes | 281 | 281 | 158 | 390 | 316 | 430 | ||||||||||||

Total other expenses | 9,610 | 13,827 | 7,758 | 17,907 | 18,375 | 13,095 | ||||||||||||

Operating loss | (4,838) | (6,381) | (5,117) | (7,900) | (14,474) | (5,271) | ||||||||||||

Gain from acquisition of equity method investment | — | — | — | — | 12,988 | — | ||||||||||||

Equity (loss)/ income from investment in an unconsolidated entity | — | — | 60 | — | (38) | (109) | ||||||||||||

Net loss | (4,838) | (6,381) | (5,057) | (7,900) | (1,524) | (5,380) | ||||||||||||

Net loss attributable to convertible non-controlling preferred interests | — | 1,743 | 1,364 | — | 424 | 910 | ||||||||||||

Net loss attributable to NADG NNN Property Fund LP | — | 4,638 | 3,693 | — | 1,100 | 4,470 | ||||||||||||

Net loss attributable to non-controlling interests in the OP | 2,127 | — | — | 3,474 | — | — | ||||||||||||

Net loss attributable to common stockholders | $(2,711) | $— | $— | $(4,426) | $— | $— | ||||||||||||

Basic and Diluted net loss per share | $(0.18) | $(0.30) | ||||||||||||||||

As of June 30, | As of December 31, | |||||||||||

(in thousands) | Company Pro Forma Condensed Consolidated (unaudited) 2024 | Historical Condensed Consolidated (unaudited) 2024 | Historical Consolidated 2023 | Historical Consolidated 2022 | ||||||||

Total real estate held for investment, at cost | $640,264 | $640,264 | $647,180 | $462,923 | ||||||||

Total assets | 798,372 | 745,466 | 772,007 | 626,790 | ||||||||

Total debt, net | 249,869 | 427,435 | 436,452 | 281,307 | ||||||||

Total liabilities | 278,817 | 455,791 | 471,321 | 311,103 | ||||||||

Total convertible non-controlling preferred interests, partners' capital and stockholders' equity | 519,555 | 289,675 | 300,687 | 315,687 | ||||||||

Six months ended June 30, | Years ended December 31, | |||||||||||||||||

(in thousands) | Company Pro Forma Condensed Consolidated (unaudited) 2024 | Historical Condensed Consolidated (unaudited) 2024 | Historical Condensed Consolidated (unaudited) 2023 | Company Pro Forma Consolidated (unaudited) 2023 | Historical Consolidated 2023 | Historical Consolidated 2022 | ||||||||||||

FFO(1) | $9,411 | $7,578 | $7,287 | $20,960 | $11,031 | $19,007 | ||||||||||||

AFFO(1) | 12,406 | 9,939 | 11,110 | 26,801 | 20,812 | 21,049 | ||||||||||||