false

2023

FY

0001985840

0001985840

2023-02-11

2023-12-31

0001985840

2023-06-30

0001985840

2024-03-28

0001985840

defi:HashdexBitcoinFuturesETFMember

2023-12-31

0001985840

defi:HashdexBitcoinFuturesETFMember

2023-02-11

2023-12-31

0001985840

2023-12-31

0001985840

defi:HashdexBitcoinFuturesETFMember

2023-02-10

0001985840

2023-02-10

0001985840

us-gaap:SubsequentEventMember

defi:TeucriumTradingLLCMember

2024-01-02

2024-01-03

0001985840

us-gaap:SubsequentEventMember

defi:HashdexBitcoinFuturesETFMember

2024-01-02

2024-01-03

0001985840

us-gaap:SubsequentEventMember

2024-01-03

0001985840

us-gaap:SubsequentEventMember

defi:HashdexBitcoinETFMember

defi:SpotBitcoinMember

2024-03-26

0001985840

us-gaap:SubsequentEventMember

defi:HashdexBitcoinETFMember

defi:CMETradedBitcoinFuturesContractsCashAndCashEquivalentsMember

2024-03-26

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

| ☒ |

Annual

report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| |

|

| for the

fiscal year ended December 31, 2023 |

OR

| ☐ |

Transition report

pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| |

|

| for

the transition period from _________ to _________ |

Commission

File Number: 001-41900

Tidal Commodities Trust I

|

| (Exact

name of registrant as specified in its charter) |

| Delaware |

|

92-6468665 |

(State

or other jurisdiction of

incorporation

or organization)

|

|

(I.R.S.

Employer

Identification No.)

|

234

West Florida Street, Suite 203 Milwaukee, WI 53204

(Address

of principal executive offices) (Zip code)

(844)

986-7700

(Registrant’s

telephone number, including area code)

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each Class |

Trading

Symbol |

Name

of each exchange on which registered |

| Shares

of beneficial interest, no par value, of Hashdex Bitcoin ETF, a series of the Registrant |

DEFI |

NYSE

Arca, Inc. |

Securities

registered pursuant to Section 12(g) of the Act: None

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒

No

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes

☒ No

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted

pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period

that the registrant was required to submit such files).

☒ Yes ☐ No

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| Non-accelerated

Filer |

☒ |

Smaller

reporting company |

☒ |

| |

|

Emerging

growth company |

☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13 (a) of the Exchange Act.

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report. ☐

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the

registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate

by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation

received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.1D-1(b) ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

As

of June 30, 2023 (the last business day of the registrant’s most recently completed second fiscal quarter), the registrant’s

securities were not publicly traded. Accordingly, there was no market value for the registrant’s common stock

on such date.

As

of March 28, 2024, there were 140,000 shares of beneficial interest, no par value, of Hashdex Bitcoin ETF issued and

outstanding.

DOCUMENTS

INCORPORATED BY REFERENCE:

NONE

Statement

Regarding Forward-Looking Statements

This

Annual Report on Form 10-K (this “Annual Report”) includes “forward-looking statements” which generally

relate to future events or future performance. In some cases, you can identify forward-looking statements by terminology such

as “may,” “will,” “should,” “expect,” “plan,” “anticipate,”

“believe,” “estimate,” “predict,” “potential” or the negative of these terms or

other comparable terminology. All statements (other than statements of historical fact) included in this Annual Report that address

activities, events or developments that will or may occur in the future, including such matters as movements in the commodities

markets and indexes that track such movements, our operations, our Sponsor’s plans and references to our future success

and other similar matters, are forward-looking statements. These statements are only predictions. Actual events or results may

differ materially. These statements are based upon certain assumptions and analyses our Sponsor has made based on its perception

of historical trends, current conditions and expected future developments, as well as other factors appropriate in the circumstances.

Whether or not actual results and developments will conform to our Sponsor’s expectations and predictions, however, is subject

to a number of risks and uncertainties, including the special considerations discussed in this Annual Report, general economic,

market and business conditions, changes in laws or regulations, including those concerning taxes, made by governmental authorities

or regulatory bodies, and other world economic and political developments. Consequently, all the forward-looking statements made

in this Annual Report are qualified by these cautionary statements, and there can be no assurance that actual results or developments

our Sponsor anticipates will be realized or, even if substantially realized, that they will result in the expected consequences

to, or have the expected effects on, our operations or the value of our Shares.

A

description of the risks and uncertainties that could cause our actual results to differ materially from those described by the

forward-looking statements in this Annual Report appears in the section captioned “Risk Factors” and elsewhere in

this Annual Report. Readers are cautioned not to place undue reliance on forward-looking statements because of the risks and uncertainties

related to them and to the risk factors. Except as may be required by law, we do not undertake any obligation to update the forward-looking

statements contained in this Annual Report to reflect any new information or future events or circumstances or otherwise.

Table

of Contents

PART

I

Item

1. Business

Overview

Tidal Commodities Trust I (“Trust”),

a Delaware statutory trust organized on February 10, 2023, is a series trust currently consisting of one series: Hashdex Bitcoin

ETF (f/k/a Hashdex Bitcoin Futures ETF) (“DEFI” or the “Fund”). The Fund is a commodity pool. The Fund

issues shares of beneficial interest, called “Shares,” representing fractional undivided beneficial interests in the

Fund. The Fund’s investment objective is for changes in the Shares’ net asset value (“NAV”) to reflect

the daily changes of the price of the Nasdaq Bitcoin Reference Price - Settlement (NQBTCS) (the “Benchmark”), less

expenses from the Fund’s operations. The Benchmark is designed to track the price performance of bitcoin. The Fund invests

in bitcoin, bitcoin futures contracts (“Bitcoin Futures Contracts”) listed on the Chicago Mercantile Exchange Inc.

(“CME”), and cash and cash equivalents. Because the Fund’s investment objective is to track the price of the

Benchmark, changes in the price of the Shares may vary from changes in the spot price of bitcoin.

The Trust and the Fund operate pursuant

to the Trust’s Amended and Restated Declaration of Trust and Trust Agreement (the “Trust Agreement”), dated March

10, 2023. On January 2, 2024, the initial Form S-1 for DEFI was declared effective by the U.S. Securities and Exchange Commission

(“SEC”). As noted below, the Fund is the successor to the Predecessor Fund (defined below), which commenced operations

in September 2022. However, as of December 31, 2023, the Fund was not operational and had not yet begun trading on the NYSE Arca

stock exchange (“NYSE Arca”). The current registration statement for DEFI was declared effective by the SEC on January

2, 2024 and registered an indeterminate number of Shares. BitGo Trust Company, Inc (the “Bitcoin Custodian”) is the

custodian for the Fund’s bitcoin holdings; and U.S. Bank, N.A. is the custodian for the Fund’s cash and cash equivalents

holdings (the “Cash Custodian” and together with the Bitcoin Custodian, the “Custodians”).

The Fund is the successor and surviving

entity from the merger (the “Merger”) of the Hashdex Bitcoin Futures ETF (the “Predecessor Fund”) into

the Fund. The Predecessor Fund was a series of the Teucrium Commodity Trust (the “Predecessor Trust”) sponsored by

Teucrium Trading, LLC (“Prior Sponsor”). The Merger closed on January 3, 2024. In connection with the Merger, the Predecessor

Fund shareholders received one Share for each share of the Predecessor Fund they owned prior to the Merger.

The sponsor of the Trust is Tidal Investments

LLC, a Delaware limited liability company (the “Sponsor”). The principal office of the Sponsor is Milwaukee, Wisconsin

and the Trust is located at 234 West Florida Street, Suite 203, Milwaukee, Wisconsin 53204. The Sponsor is registered as a commodity

pool operator (“CPO”) with the Commodity Futures Trading Commission (“CFTC”) and is a member of the National

Futures Association (“NFA”). The Fund intends to be treated as a partnership for U.S. federal income tax purposes.

The Sponsor has sponsored the Trust since 2023. Sponsoring the Fund is the Sponsor’s first experience in operating an

exchange traded product that invests in crypto-currency futures or directly in bitcoin. The Sponsor’s responsibilities are

discussed below in the section entitled “The Sponsor’s Operations.”

While investors will purchase and sell

Shares through their broker-dealer, the Fund continuously offers creation baskets consisting of 10,000 Shares (“Creation

Baskets”) at their net asset value (“NAV”) to certain financial institutions that have entered into an agreement

with the Sponsor (“Authorized Purchasers”).

Recent

Developments

Merger with Hashdex Bitcoin Futures

ETF

On

January 3, 2024, the Trust completed the Merger and acquisition of the Predecessor Fund, a series of the Predecessor Trust, into

the Fund, a series of the Trust. The Merger was effected pursuant to an Agreement and Plan of Partnership Merger and Liquidation

dated as of October 30, 2023 (the “Plan of Merger”) between the Predecessor Trust, on behalf of its Predecessor Fund

series, and the Trust, on behalf of its Fund series.

Pursuant

to the Plan of Merger, each Predecessor Fund shareholder received one share of the Fund for every one share of the Predecessor

Fund held immediately before the commencement of trading on the NYSE Arca on the Closing Date based on the net asset value per

share of the Predecessor Fund being equal to the net asset value per share of the Fund determined immediately prior to the Merger

closing. The share price used for the delivery of shares of the Predecessor Fund was the net asset value per share of the Predecessor

Fund determined after the close of business of NYSE Arca on January 2, 2024. Consequently, the Merger resulted in a one-for-one

exchange of shares between the Predecessor Fund and the Fund. Further, the Fund acquired in the Merger all the assets of the Predecessor

Fund and assumed all the liabilities of the Predecessor Fund. Effective the Merger closing, the Plan of Merger caused all of the

Predecessor Fund’s shares to be cancelled and the Predecessor Fund to be liquidated.

The

Merger did not materially modify the rights of Predecessor Fund shareholders with respect to their investment. The Fund has the

same investment objective, investment strategies and investment restrictions, and substantially identical investment risks, as

those had by the Predecessor Fund. Following the Merger, the Fund is now sponsored by the Sponsor, Tidal Investments LLC (f/k/a

Toroso Investments LLC), and the Fund is now managed by portfolio managers employed by the Sponsor. The Fund pays the same management

fee rate to the Sponsor, under the same terms, as previously paid by the Predecessor Fund to Teucrium Trading, LLC, the sponsor

of the Predecessor Trust and the Predecessor Fund.

The Fund’s shares commenced trading

on the NYSE Arca upon the effectiveness of the Merger under the ticker symbol “DEFI.”

Effect of Merger - Conversion to

U.S. Spot Bitcoin ETF

On March 26, 2024, the Trust announced

that the Fund would be permitted to have spot bitcoin holdings, and that it would track the Benchmark effective March 27, 2024.

The Predecessor Fund’s name was the Hashdex Bitcoin Futures ETF, and the Fund’s name is the Hashdex Bitcoin ETF. Going

forward and under normal market conditions, the Fund’s has a policy to maximize its holdings of physical bitcoin such that

it is expected that at least 95% of the Fund’s assets will be invested in spot bitcoin. Up to 5% of the Fund’s

assets may be invested in CME-traded bitcoin futures contracts and in cash and cash equivalents.

Fund Overview

The Fund is designed to provide investors

with a means to gain price exposure to the bitcoin market. The Fund issues Shares that trade on NYSE Arca under the symbol “DEFI.”

Shares can be purchased and sold by investors through their broker-dealer. Purchasing Shares of the Fund is subject to the risks

of bitcoin as well as the additional risks of investing in the Fund.

The Sponsor will employ a passive investment

strategy that is intended to track the changes in the Benchmark regardless of whether the Benchmark goes up or goes down. In order

to track the Benchmark as closely as possible, the Fund will aim to maximize its investment in bitcoin. Because the Fund’s

investment objective is to track the price of the Benchmark, the price of the Shares may vary from changes in the spot price of

bitcoin. The NYSE Arca rule under which the Shares will be listed and traded prevents the Fund from utilizing leverage. ICE Data

Indices, LLC calculates an approximate Fund NAV every 15 seconds throughout each day that the Fund’s Shares are traded on

NYSE Arca for as long as the CME’s main pricing mechanism is open.

The Fund, the Sponsor, and their service

providers, including the Custodians, will not loan or pledge the Fund’s assets, nor will the Fund’s assets serve as

collateral for any loan or similar arrangement except to the extent of need to collateralize margin accounts held by the Fund’s

futures commission merchants (“FCMs”).

Bitcoin Overview

Bitcoin

is a digital asset or cryptocurrency that is a unit of account on the bitcoin network (“Bitcoin Network”), an open

source, decentralized peer-to-peer computer network. The ownership and operation of bitcoin is determined by purchasers in the

Bitcoin Network. The Bitcoin Network connects computers that run publicly accessible, or open source, software that follows the

rules and procedures governing the Bitcoin Network. This is commonly referred to as the Bitcoin Protocol. Bitcoin may be held,

may be used to purchase goods and services or may be exchanged for fiat currency. No single entity owns or operates the Bitcoin

Network, and the value of bitcoin is not backed by any government, corporation or other entity. Instead the value of bitcoin is

determined in part by the supply and demand in markets created to facilitate the trading of bitcoin. Public key cryptography protects

the ownership and transaction records for bitcoin. Because the source code for the Bitcoin Network is open source, anyone can

contribute to its development. At this time, the ultimate supply of bitcoin is finite and limited to 21 million “coins”

with the number of bitcoin available increasing gradually as new bitcoin supplies are mined until the 21 million current protocol

cap is reached. The following factors, among others, may affect the price and market for bitcoin:

| ● | How

widely bitcoin is adopted, including the use of bitcoin as a payment. |

| ● | The

regulatory environment for cryptocurrencies, which continues to evolve in the U.S., and which may delay, impede, or restrict the

adoption or use of bitcoin. |

| ● | Speculative

activity in the market for bitcoin, including by holders of large amounts of bitcoin, which may increase volatility. |

| ● | Cyberattacks,

including the risk that malicious actors will exploit flaws in the code or structure of bitcoin, control the blockchain, steal

information or cause disruptions to the internet. |

| ● | Rewards

for mining bitcoin are designed to decline over time, which may lessen the incentive for miners to process and confirm transactions

on the Bitcoin Network. |

| ● | The

open-source nature of the Bitcoin Network may result in forks, or changes to the underlying code of bitcoin that result in the

creation of new, separate digital assets. |

| ● | Fraud,

manipulation, security failure or operational problems at bitcoin exchanges that result in a decline in adoption or acceptance

of bitcoin. |

| ● | Scalability

as the use of bitcoin expands to a greater number of users. |

The

Benchmark Methodology

The Benchmark is governed by the Nasdaq

Crypto Index Oversight Committee (“CIOC”), which is responsible for implementation, administration, and oversight of

the Benchmark, including its cessation. The CIOC shall approve any material changes to the methodology and review the Benchmark

methodology at least on an annual basis. The final Benchmark is calculated once every trading day and it is given by a weighted

average across the settlement prices of the following “Core Exchanges” (as of December 29, 2023); Bitstamp, Coinbase,

Gemini, itBit and Kraken.

The Benchmark was launched by Nasdaq, Inc

(“Nasdaq”) on June 9, 2021 and is designed to track the price performance of bitcoin. Specifically, the Benchmark attempts

to track the average bitcoin spot price by capturing the notional value of bitcoin USD transactions reported by selected public

data sources as measured by Nasdaq. The Benchmark applies a rules-based pricing methodology to a diverse collection of pricing

sources to provide a reference price for bitcoin and the pricing methodology is designed to account for variances in price across

a wide range of sources which have been vetted according to criteria identified in the methodology document. The Benchmark is owned

and administered by Nasdaq and may be changed from time to time. Detailed rules on the Benchmark administration and governance

may be found at Nasdaq’s website. The Benchmark does not track the overall performance of all digital assets generally, nor

the performance of any specific digital asset other than bitcoin. The Benchmark is calculated and published once a day on business

days at 3:00 p.m., New York Time by CF Benchmarks Limited (https://www.cfbenchmarks.com/data/indices/NQBTCS) or other Nasdaq

designated calculation agent.

According

to the Benchmark methodology, any deviations from the Benchmark methodology are made in the sole judgment and discretion of Nasdaq

so that the Benchmark continues to achieve its objective. Nasdaq will provide transparency over the decisions affecting the compilation

of the reference rate and any related determination process, including contingency measures in the event of absence of or insufficient

inputs, market stress or disruption, failure of critical infrastructure, or other relevant factors. Any contingency measures that

are not directly addressed in the Benchmark methodology shall be subject to CIOC governance processes.

The Sponsor, in its sole discretion, may

cause the Fund to track a benchmark other than the Benchmark at any time, with prior notice to investors. The Sponsor may change

the Fund’s benchmark if investment conditions change or the Sponsor believes that another benchmark or standard better aligns

with the Fund’s investment objective and strategy. The Sponsor, however, is under no obligation whatsoever to make such a

change in any circumstance.

To the extent CIOC implements a material

change to the calculation of the Benchmark, the Sponsor will issue a press release describing such change and its date of implementation

which press release will be filed with the SEC on Form 8-K.

To

the extent the Sponsor determines that in the best interest of the Fund to replace the Benchmark with another benchmark reference

price or index, the Sponsor shall issue a press release describing the replacement of the Benchmark and new benchmark at least

60 days in advance of such replacement and will file such press release under Form 8-K with the SEC.

Bitcoin

Futures Contracts

The CME currently offers two Bitcoin Futures

Contracts, one contract representing 5 bitcoin (“BTC Contracts”) and another contract representing 0.10 bitcoin (“MBT

Contracts”). The Fund will invest up to 5% of its assets in bitcoin BTC Contracts and MBT Contracts to the extent necessary

to achieve exposure to the bitcoin futures market. Because the Fund’s investment objective is to track the price of the Benchmark

by investing in bitcoin and Bitcoin Futures Contracts, changes in the price of the Shares may vary from changes in the spot price

of bitcoin.

The Fund will maintain long positions in

BTC Contracts and MBT Contracts to achieve exposure to the bitcoin futures market. As discussed under “the Fund’s Investment

Strategies,” the Sponsor expects to invest the Fund’s assets in spot bitcoin and will utilize Bitcoin Futures Contracts

to hedge the cash balance that the Sponsor deems necessary to meet the Fund’s liquidity needs for the cash payment of Share

redemption settlements and of other applicable expenses borne by the Fund. The Fund may purchase MBT Contracts if the Fund has

proceeds remaining from the sale of a Creation Basket that are less than the price of a BTC contract. BTC and MBT will count toward

an aggregate position limit.

BTC

Contracts began trading on the CME Globex trading platform on December 15, 2017 under the CME ClearPort ticker symbol “BTC”

and are cash settled in U.S. dollars. MBT Contracts began trading on the CME Globex trading platform on May 3, 2021 under the

CME ClearPort ticker symbol “MBT” and are also cash settled in U.S. dollars. The daily settlement prices for MBT Contracts

are derived directly from the settlements in the BTC Contracts. BTC Contracts and MBT Contracts are listed for trading in serial

months of six (6), quarterly in serial quarters of four (4). Additionally, when the listing schedule includes only a single futures

contract set to expire in December, an extra December contract will be listed for the subsequent year. This ensures that at any

given time, there are at least two December contracts available for trading.

Because

BTC Contracts and MBT Contracts are exchange-listed, they allow investors to gain price exposure to bitcoin without having to

hold the underlying cryptocurrency. Like a futures contract on a commodity or stock index, BTC Contracts and MBT Contracts provide

a means for investors to hedge investment positions or speculate on the future price of bitcoin.

The

Bitcoin Futures Contracts are cash-settled to the CME CF Bitcoin Reference Rate (BRR). The BRR is a daily reference rate of the

U.S. dollar price of one bitcoin calculated daily as of 4:00 p.m. London time provided by CF Benchmarks. It is calculated based

on the bitcoin trading activity on specified spot bitcoin trading platforms (“Constituent Exchanges”) during an observation

window between 3:00 p.m. and 4:00 p.m. London time, which currently include Bitstamp, Coinbase, Gemini, itBit Kraken and LMAX

Digital but may change from time to time.

Constituent exchanges for the BRR are selected

on the basis of the following criteria, which each must demonstrate that it continues to fulfill on an ongoing basis:

| |

● |

The exchange has policies to ensure fair and transparent market conditions at all times and has processes in place to identify and impede illegal, unfair or manipulative trading practices. |

| |

|

|

| |

● |

The exchange does not impose undue barriers to entry or restrictions on market participants, and utilizing the venue does not expose market participants to undue credit risk, operational risk, legal risk or other risks. |

| |

|

|

| |

● |

The exchange complies with applicable law and regulation, including, but not limited to capital markets regulations, money transmission regulations, client money custody regulations, know-your-client (KYC) regulations and anti-money-laundering (AML) regulations. |

| |

|

|

| |

● |

The exchange cooperates with inquiries and investigations of regulators and the Administrator upon request and has to execute data sharing agreements with the CME. |

Should the average daily contribution of a constituent

exchange fall below 3%, then the continued inclusion of the venue as a constituent exchange is assessed by the CME CF Oversight Committee.

Qualifying transactions from the constituent

exchanges that take place during the one-hour calculation window are added to a list, with the trade price and size for each transaction

recorded. The one-hour calculation is partitioned into twelve intervals of five minutes each, and for each partition, the volume-weighted

median trade price is calculated from the trade prices and sizes of relevant transactions. (A volume-weighted median differs from a standard

median in that a weighting factor, in this case trade size, is factored into the calculation.) The BRR is the equally-weighted average

of the volume-weighted medians of all twelve partitions.

Further details on the market share and volume

information for each constituent platforms used to calculate the CME CF Bitcoin Reference Rate (BRR)

The table below lists the six constituent

platforms that contribute transaction data to the BRR. It includes the aggregate volumes traded on their respective Bitcoin – US

Dollar markets over the preceding four calendar quarters.

| Aggregate Trading Volume of BTC-USD Markets of CME CF Constituent Platforms (US$) |

| Period |

itBit |

LMAX Digital |

Bitstamp |

Coinbase |

Gemini |

Kraken |

| 2022 Q4 |

565,768,617 |

6,829,541,020 |

3,580,171,427 |

46,447,674,416 |

1,586,986,170 |

5,254,252,281 |

| 2023 Q1 |

624,309,916 |

9,211,206,684 |

4,901,570,836 |

41,979,489,484 |

1,060,844,250 |

9,054,883,308 |

| 2023 Q2 |

758,737,186 |

8,322,968,385 |

5,133,173,679 |

31,402,570,192 |

1,004,667,694 |

8,975,159,682 |

| 2023 Q3 |

447,044,393 |

4,214,481,842 |

3,747,028,275 |

24,090,687,496 |

797,891,783 |

4,590,616,407 |

Source: CF Benchmarks

Considering the 12 highest volume Bitcoin

-USD markets operated by spot Bitcoin Trading Platforms, the following table shows the market share for BTC-USD trading of the six constituent

platforms over the past four calendar quarters:

| Spot Trading Platforms Market Share of BTC-USD Trading |

| Period |

itBit |

LMAX Digital |

Bitstamp |

Coinbase |

Gemini |

Kraken |

Others |

| 2022 Q4 |

0.65% |

7.87% |

4.13% |

53.53% |

1.83% |

6.05% |

25.94% |

| 2023 Q1 |

0.69% |

10.23% |

5.45% |

46.64% |

1.18% |

10.06% |

25.75% |

| 2023 Q2 |

1.08% |

11.85% |

7.31% |

44.69% |

1.43% |

12.77% |

20.87% |

| 2023 Q3 |

1.05% |

9.94% |

8.84% |

56.82% |

1.88% |

10.83% |

10.64% |

Source: CF Benchmarks

The

Fund’s Investment Strategies

The Fund seeks to achieve its investment

objective by primarily investing in bitcoin. The Fund will use Bitcoin Futures Contracts for the primary purpose of using such

Bitcoin Futures Contracts to acquire physical bitcoin through Exchange for Physical Transactions (“EFP”) transactions

and to offset cash and receivables for better tracking the Benchmark. Under normal market conditions, the Fund has a policy to

maximize its investments in physical bitcoin such that it is expected that at least 95% of the Fund’s assets will be invested

in bitcoin, and up to 5% may be invested in Bitcoin Futures Contracts and in cash and cash equivalents, such as short-term Treasury

bills, money market funds, and demand deposit accounts. The Sponsor does not have discretion in choosing the Fund’s investments.

See “Use of Proceeds” The term “normal market conditions” includes, but is not limited to, the absence

of: trading halts in the applicable financial markets generally; operational issues (e.g., systems failure) causing dissemination

of inaccurate market information; or force majeure type events such as natural or man-made disaster, act of God, armed conflict,

act of terrorism, riot or labor disruption or any similar intervening circumstance. Similarly, the Fund will use bitcoin to acquire

Bitcoin Futures Contracts through EFP transactions, so the Fund can then sell the Bitcoin Futures Contracts for cash in order to

satisfy redemption orders.

The

percentage allocation to Bitcoin Futures Contracts is determined daily such that the Fund may maintain Bitcoin Futures Contracts

positions (with related cash reserves to meet applicable margin requirements) to hedge the cash balance that the Sponsor deems

necessary to meet the Fund’s liquidity needs for the cash payment of Share redemption settlements and of other applicable

expenses borne by the Fund.

When

the Fund needs to increase or decrease its allocation to physical bitcoin it will do so through EFP transactions, by exchanging

a physical bitcoin holding for an equivalent Bitcoin Futures Contracts position. The Fund’s futures contract positions will

be concentrated on the first to expire contracts and rolled on a monthly basis by closing out the first to expire contracts prior

to their final settlement date and then either entering on and EFP transaction to exchange that position for physical bitcoin

holdings or entering into the second to expire contracts which will become the new first to expire. A first to expire contract

is the contract with the nearest expiration date. A second to expire contract follows the first - it is the contract that will

expire second in line after the first contract has expired. For example, when a first to expire contract expires, the second to

expire contract becomes the first to expire contract.

Futures

contract rolling will take place on the market business day preceding the last trading day of the first to expire contract. The

last trading day of the first to expire contact is currently defined as the last business Friday of each month. By way of example,

as of the date hereof the Fund’s futures contract positions will be entered and exited according to the roll

schedule below.

| Hashdex

Bitcoin ETF (DEFI) – Roll Schedule Jan 2024 – Dec 2024 |

| |

| Roll

Date |

Contract

Expiring |

New

Contract |

First

to Expire Contract |

| |

(Exiting

Position) |

(Entering

Position) |

(Resulting

Position) |

| 1/25/2024 |

January

(BTCF4) |

February

(BTCG4) |

February

(BTCG4) |

| 2/22/2024 |

February

(BTCG4) |

March

(BTCH4) |

March

(BTCH4) |

| 3/28/2024 |

March

(BTCH4) |

April

(BTCJ4) |

April

(BTCJ4) |

| 4/25/2024 |

April

(BTCJ4) |

May

(BTCK4) |

May

(BTCK4) |

| 5/30/2024 |

May

(BTCK4) |

June

(BTCM4) |

June

(BTCM4) |

| 6/27/2024 |

June

(BTCM4) |

July

(BTCN4) |

July

(BTCN4) |

| 7/25/2024 |

July

(BTCN4) |

August

(BTCQ4) |

August

(BTCQ4) |

| 8/29/2024 |

August

(BTCQ4) |

September

(BTCU4) |

September

(BTCU4) |

| 9/26/2024 |

September

(BTCU4) |

October

(BTCV4) |

October

(BTCV4) |

| 10/31/2024 |

October

(BTCV4) |

November

(BTCX4) |

November

(BTCX4) |

| 11/28/2024 |

November

(BTCX4) |

December

(BTCZ4) |

December

(BTCZ4) |

| 12/26/2024 |

December

(BTCZ4) |

January

(BTCF5) |

January

(BTCF5) |

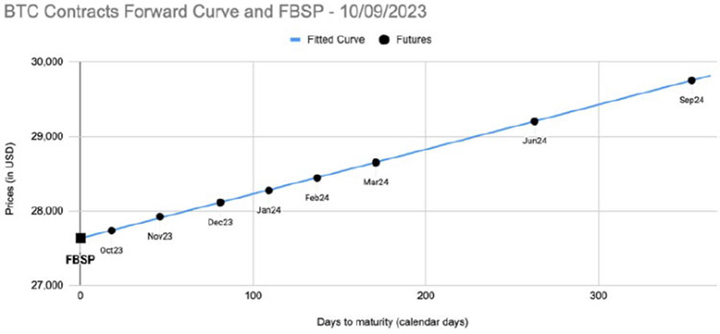

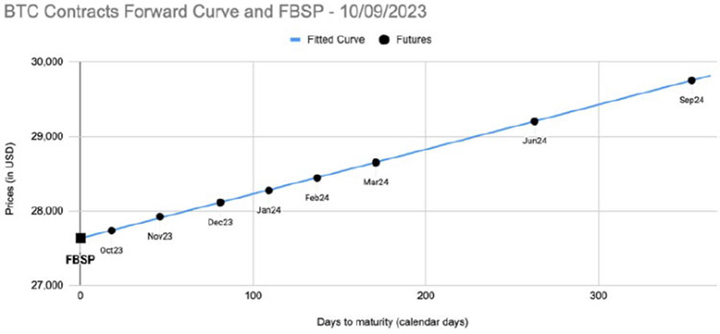

One

factor determining the total return from investing in futures contracts is the price relationship between soon to expire contracts

and later to expire contracts. Sometimes the Fund will have to pay more for longer maturity contracts to replace existing shorter

maturity contracts about to expire. This situation is known as “contango” in the futures markets. In the event of

a prolonged period of contango, and absent the impact of rising or falling bitcoin prices, this could have a negative impact on

the Fund’s NAV and total return, which in turn may have a negative impact on your investment in the Fund. By way of example,

during the period from 6/30/2020 to 6/30/2023, the market for Bitcoin Futures Contracts were in contango approximately 87% of

the time, which resulted in an average annual negative roll yield of approximately 4.5%. If the futures market is in a state of

backwardation (i.e., when the price of bitcoin in the future is to be less than the current price), the Fund will buy later to

expire contracts for a lower price than the soon to expire contracts that it sells.

Consistent

with applicable provisions of the Trust Agreement and Delaware law, the Fund has broad authority to make changes to the Fund’s

operations. The Fund may change its investment objective, benchmark, or investment strategies and Shareholders of the Fund will

not have any rights with respect to these changes. The Fund has no current intention to make any such change, and any change is

subject to applicable regulatory requirements, including, but not limited to, any requirement to amend applicable listing rules

of NYSE Arca.

The

reasons for and circumstances that may trigger any such changes may vary widely and cannot be predicted. However, by way of example,

the Fund may change the term structure or underlying components of the Bitcoin Futures Contracts holdings in furtherance of the

Fund’s investment objective of tracking the price of the Benchmark, due to market conditions, a potential or actual imposition

of position limits by the SEC, the CFTC or futures exchange rules, or the imposition of risk mitigation measures by a futures

commission merchant, restricts the ability of the Fund to invest in bitcoin or in Bitcoin Futures Contracts. The Fund would, among

other things, file a current report on Form 8-K and a prospectus supplement to describe any such change and the effective date

of the change. Shareholders may modify their holdings of the Fund’s Shares in response to any change by purchasing or selling

Fund Shares through their broker-dealer.

The

Fund invests in bitcoin and Bitcoin Futures Contracts without being leveraged or unable to satisfy its expected current or potential

margin or collateral obligations with respect to its investments. After fulfilling such margin and collateral requirements, the

Fund invests the remainder of its proceeds from the sale of baskets in short term financial instruments of the type commonly known

as “cash and cash equivalents.”

In furtherance of the Fund’s policy

to maximize its holdings in bitcoin, the Sponsor will use cash received through the creation process to purchase Bitcoin Futures

Contracts to be exchanged for bitcoin such that at least 95% of the assets of the Fund will be in bitcoin. In the extraordinary

event that Bitcoin Futures Contracts are unable to be readily exchanged for bitcoin, the Fund will continue to hold Bitcoin Futures

Contracts. The Sponsor does not have discretion in choosing the Fund’s investments. See “Use of Proceeds.” The

Fund’s investment strategy is designed to permit investors generally to purchase and sell the Fund’s Shares for the

purpose of investing indirectly in the bitcoin market in a cost-effective manner. The Sponsor expects that the Fund’s average

daily tracking error against the Benchmark will be less than 10 percent over any period of 30 trading days. However, the Fund incurs

certain expenses in connection with its operations, which cause imperfect correlation between changes in the Fund’s NAV and

changes in the Benchmark because the Benchmark does not reflect expenses or income. As a result, investors may incur a partial

or complete loss of their investment even when the performance of the Benchmark is positive.

Investors

may purchase and sell Shares through their broker-dealers. However, the Fund creates and redeems Shares only in blocks called

Creation Baskets and Redemption Baskets, respectively, and only Authorized Purchasers may purchase or redeem Creation Baskets

or Redemption Baskets. An Authorized Purchaser is under no obligation to create or redeem baskets, and an Authorized Purchaser

is under no obligation to offer to the public Shares of any baskets it does create. Baskets are generally created when there is

a demand for Shares, including, but not limited to, when the market price per Share is at (or perceived to be at) a premium to

the NAV per Share. Similarly, baskets are generally redeemed when the market price per Share is at (or perceived to be at) a discount

to the NAV per Share. Retail investors seeking to purchase or sell Shares on any day are expected to affect such transactions

in the secondary market, on NYSE Arca, at the market price per Share, rather than in connection with the creation or redemption

of baskets.

The

Sponsor believes that by investing in bitcoin and Bitcoin Futures Contracts, the Fund’s NAV will closely track the Benchmark.

The Sponsor also believes that because of market arbitrage opportunities, the market price at which investors will purchase and

sell Shares through their broker-dealer will closely track the Fund’s NAV. The Sponsor believes that the net effect of these

relationships is that the Fund’s market price on NYSE Arca at which investors purchase and sell Shares will closely track

the bitcoin market, as measured by the Benchmark.

The

CFTC and U.S. designated contract markets, such as the CME, have established position limits and accountability levels on the

maximum net long or net short Bitcoin Futures Contracts that the Fund may hold, own or control. The current CME established position

limit level for investments in BTC Contracts for the spot month is 4,000 contracts. A position accountability level of 5,000 contracts

will be applied to positions in single months outside the spot month and in all months combined. The MBT Contracts have a spot

month limit of 200,000 contracts and a position accountability level of 250,000 contracts. Open positions in MBT Contracts will

count as 1/50 of a BTC Contract for the purposes of determining the aggregate position limit. Accountability levels are not fixed

ceilings but rather thresholds above which the exchange may exercise greater scrutiny and control over an investor, including

limiting the Fund to holding no more Bitcoin Futures Contracts than the amount established by the accountability levels. The potential

for the Fund to reach position or accountability limits will depend on if and how quickly the Fund’s net assets increase.

In

addition to position limits and accountability limits, the CME and other exchanges have set dynamic price fluctuation limits on

Bitcoin Futures Contracts. The dynamic price limit functionality under the special price fluctuation limits mechanism assigns

a price limit variant which equals a percentage of the prior trading day’s settlement price, or a price deemed appropriate.

During the trading day, the dynamic variant is utilized in continuous rolling 60-minute look-back periods to establish dynamic

upper and lower price fluctuation limits. Once the dynamic price fluctuation limit has been reached in a particular Bitcoin Futures

Contract, no trades may be made at a price beyond that limit. The CME has adopted daily dynamic price fluctuation limit functionality

effective March 11, 2019, specifically, Rule 589 which is found in the following link: https://www.cmegroup.com/content/dam/cmegroup/notices/ser/2019/03/SER-8351.pdf.

Since dynamic price fluctuation limits were introduced, price limits have been triggered 89 times and there has been one “hard

limit move.” A hard limit move is when the price of Bitcoin Futures Contracts exceeds a price limit that defines the minimum/maximum

price to which such Bitcoin Futures Contracts can move for the given trade date. If the hard limit is reached, trade matching

will not occur at prices above the maximum price or below the minimum price.

In determining the value of Bitcoin Futures

Contracts, U.S. Bank Global Fund Services (“Global Fund Services”), the Fund’s “Sub-Administrator,”

uses primarily the settlement price for the Bitcoin Futures Contracts, as reported on the CME. CME Group staff determines the daily

settlements for the Bitcoin Futures Contracts based on trading activity on CME Globex exchange between 14:59:00 and 15:00:00 Central

Time (CT), the settlement period. In situations where a two-sided market is not available during the closing period, the CME will

derive a settlement price using the carry calculation method based on the CME CF Bitcoin Reference Rate (BRR). This method calculates

the settlement price as the reference rate plus an adjustment factoring in the days to expiration and the interest rate. Specifically,

the settlement price is determined by the formula: BRR + [(Days to Expiration / 365) × Interest Rate × BRR]. When a

Bitcoin Futures Contracts has closed at its daily price fluctuation limit, that limit price will be the daily settlement price

that the CME publishes.

In exceptional circumstances when: (i)

Bitcoin Futures Contracts settlement prices are not readily available; or (ii) when a trading halt closes CME or the Bitcoin Futures

Market early, including if trading were halted for an entire trading day or several trading days; or (iii) when a Bitcoin Futures

Contracts close at its price fluctuation limit for the day, the fair value of such contracts are determined by the Sponsor in good

faith and in a manner that assesses the Bitcoin Futures Contracts’ value based on a consideration of all available facts

and all available information on the valuation date. The fair value of Bitcoin Futures Contracts is determined by attempting to

estimate the price at which such Bitcoin Futures Contract would be trading in the absence of the price fluctuation limit (either

above such limit when an upward limit has been reached or below such limit when a downward limit has been reached). Typically,

this estimate will be made primarily using a carry calculation described above that uses the BRR at 4:00 p.m. E.T. on settlement

day as a reference price. The fair value of BTC Contracts and MBT Contracts may not reflect such investments’ market value

or the amount that the Fund might reasonably expect to receive for the BTC Contracts and MBT Contracts upon its current sale.

Position

limits, accountability limits and dynamic price fluctuation limits may limit the Fund’s ability to invest the proceeds of

Creation Baskets in bitcoin or Bitcoin Futures Contracts. As a result, when the Fund offers to sell Creation Baskets it may be

limited in its ability to invest in bitcoin or Bitcoin Futures Contracts. The Fund may hold larger amounts of cash and cash equivalents,

which will impair the Fund’s ability to meet its investment objective of tracking the Benchmark.

There

is a minimum number of baskets and associated Shares specified for the Fund. If the Fund experiences redemptions that cause the

number of Shares outstanding to decrease to the minimum level of Shares required to be outstanding, until the minimum number of

Shares is again exceeded through the purchase of a new Creation Basket, there can be no more redemptions by an Authorized Purchaser.

In such cases, market makers may be less willing to purchase Shares from investors in the secondary market, which may in turn

limit the ability of Shareholders of the Fund to sell their Shares in the secondary market. These minimum levels for the Fund

are 50,000 Shares, representing five baskets. The minimum level of Shares specified for the Fund is subject to change.

Market

Outlook

The

Bitcoin Industry

Bitcoin

Bitcoin

is a digital asset that serves as the unit of account on an open-source, decentralized, peer-to-peer computer network. Bitcoin

may be used to pay for goods and services, stored for future use, or converted to a fiat currency. As of the date of this update,

the adoption of bitcoin for these purposes has been limited. The value of bitcoin is not backed by any government, corporation,

or other identified body.

The

value of bitcoin is determined in part by the supply of (which is limited), and demand for, bitcoin in the markets for exchange

that have been organized to facilitate the trading of bitcoin. By design, the supply of bitcoin is limited to 21 million bitcoins.

As of the date of this update, there are approximately 19 million bitcoins in circulation.

Bitcoin

is maintained on the Bitcoin Network. No single entity owns or operates the Bitcoin Network. The Bitcoin Network is accessed through

software and governs bitcoin’s creation and movement. The source code for the Bitcoin Network, often referred to as the

Bitcoin Protocol, is open-source, and anyone can contribute to its development.

Price movements

for bitcoin are influenced by, among other things, the environment, natural or man-made disasters, governmental oversight and regulation,

demographics, economic conditions, infrastructure limitations, existing and future technological developments, and a variety of

other factors now known and unknown, any and all of which can have an impact on the supply, demand, and price fluctuations in the

bitcoin markets. More generally, cryptocurrency prices may be influenced by economic and monetary events such as changes in interest

rates, changes in balances of payments and trade, U.S. and international inflation rates, currency valuations and devaluations,

U.S. and international economic events, and changes in the philosophies and emotions of market purchasers. Because the Predecessor

Fund invested in futures contracts in a single cryptocurrency, it was not a diversified investment vehicle, and therefore may have

been subject to greater volatility than a diversified portfolio of stocks or bonds or a more diversified commodity or cryptocurrency

pool. Likewise, because the Fund invests in spot bitcoin and futures contracts in a single cryptocurrency, it is not a diversified

investment vehicle, and therefore may be subject to greater volatility than a diversified portfolio of stocks or bonds or a more

diversified commodity or cryptocurrency pool.

The

Bitcoin Network

The

infrastructure of the Bitcoin Network is collectively maintained by participants in the Bitcoin Network, which include miners,

developers, and users. Miners validate transactions and are currently compensated for that service in bitcoin. Developers maintain

and contribute updates to the Bitcoin Network’s source code, often referred to as the Bitcoin Protocol. Users access the

Bitcoin Network using open-source software. Anyone can be a user, developer, or miner.

Bitcoin

is “stored” on a digital transaction ledger commonly known as a “blockchain.” A blockchain is a type of

shared and continually reconciled database, stored in a decentralized manner on the computers of certain users of the digital

asset and is protected by cryptography. The Bitcoin Blockchain contains a record and history for each bitcoin transaction.

New

bitcoin is created by “mining.” Miners use specialized computer software and hardware to solve a highly complex mathematical

problem presented by the Bitcoin Protocol. The first miner to successfully solve the problem is permitted to add a block of transactions

to the Bitcoin Blockchain. The new block is then confirmed through acceptance by a majority of users who maintain versions of

the blockchain on their individual computers. Miners that successfully add a block to the Bitcoin Blockchain are automatically

rewarded with a fixed amount of bitcoin for their effort plus any transaction fees paid by transferors whose transactions are

recorded in the block. This reward system is the means by which new bitcoin enter circulation and is the mechanism by which versions

of the blockchain held by users on a decentralized network are kept in consensus.

The

Bitcoin Protocol

The

Bitcoin Protocol is an open source project with no official company or group in control. Anyone can review the underlying code

and suggest changes. There are, however, a number of individual developers that regularly contribute to a specific distribution

of bitcoin software known as the “Bitcoin Core.” Developers of the Bitcoin Core loosely oversee the development of

the source code. There are many other compatible versions of the bitcoin software, but Bitcoin Core is the most widely adopted

and currently provides the de facto standard for the Bitcoin Protocol. The core developers are able to access, and can alter,

the Bitcoin Network source code and, as a result, they are responsible for quasi-official releases of updates and other changes

to the Bitcoin Network’s source code.

However,

because bitcoin has no central authority, the release of updates to the Bitcoin Network’s source code by the core developers

does not guarantee that the updates will be automatically adopted by the other purchasers. Users and miners must accept any changes

made to the source code by downloading the proposed modification and that modification is effective only with respect to those

bitcoin users and miners who choose to download it. As a practical matter, a modification to the source code becomes part of the

Bitcoin Network only if it is accepted by participants that collectively have a majority of the processing power on the Bitcoin

Network. If a modification is accepted by only a percentage of users and miners, a division will occur such that one network will

run the pre-modification source code and the other network will run the modified source code. Such a division is known as a “fork.”

The

Sponsor’s Operations

Under

the Trust Agreement, the Sponsor is solely responsible for management and conducts or directs the conduct of the business of the

Trust, the Fund, and any series of the Trust that may from time to time be established and designated by the Sponsor. The Sponsor

is required to oversee the purchase and sale of Shares by Authorized Purchasers and to manage the Fund’s investments, including

to evaluate the credit risk of FCMs and swap counterparties and to review daily positions and margin/collateral requirements.

The Sponsor has the power to enter into agreements as may be necessary or appropriate for the offer and sale of the Fund’s

Shares and the conduct of the Trust’s activities. Accordingly, the Sponsor is responsible for selecting the Trustee, Administrator,

Marketing Agent, the independent registered public accounting firm of the Trust, and any legal counsel employed by the Trust.

The Sponsor is also responsible for preparing and filing periodic reports on behalf of the Trust with the SEC and will provide

any required certification for such reports. The Sponsor may determine to engage marketing agents who will assist the Sponsor

in marketing the Shares. See “Plan of Distribution” below for more information. The Sponsor has discretion to appoint

one or more of its affiliates as additional Sponsors. No person other than the Sponsor and its principals was involved in the

organization of the Trust or the Fund. The Sponsor maintains a public website on behalf of the Fund, which contains information

about the Trust, the Fund, and the Shares, and oversees certain services for the benefit of Shareholders. Please

note that information contained on or accessible through the Sponsor’s website is not considered part of this Annual Report.

The Fund pays the Sponsor a management

fee, monthly in arrears, in an amount equal to 0.90% per annum of the daily NAV of the Fund (the “Management Fee”).

The Management Fee is paid in consideration of the Sponsor’s services related to the management of the Fund’s business

and affairs, including the provision of commodity futures trading advisory services. The Fund is newly organized and as of the

date of this Annual Report has not paid any management fees to the Sponsor. The Sponsor pays all of the routine operational, administrative

and other ordinary expenses of the Fund, generally as determined by the Sponsor, including but not limited to, fees and expenses

of the Tidal ETF Services LLC (the “Administrator”), the Sub-Administrator, Custodians, marketing agent, transfer agent,

licensors, accounting and audit fees and expenses, tax preparation expenses, legal fees, ongoing SEC registration fees, individual

Schedule K-1 preparation and mailing fees, and report preparation and mailing expenses.

Shareholders

have no right to elect the Sponsor on an annual or any other continuing basis or to remove the Sponsor. If the Sponsor voluntarily

withdraws, the holders of a majority of the Trust’s outstanding Shares (excluding for purposes of such determination Shares

owned by the withdrawing Sponsor and its affiliates) may elect its successor. Prior to withdrawing, the Sponsor must give ninety

days’ written notice to the Shareholders and the Trustee.

The Sponsor is majority owned and controlled

by Mr. Guillermo Trias, Mr. Michael Venuto, and FTV-Toroso, Inc,. a non-officer member, who have all provided working capital to

the Sponsor. Messrs. Trias and Venuto each currently own, directly or indirectly, 15% of the Sponsor while FTV-Toroso, Inc., a

non-officer member holds approximately 37.15% of the Sponsor (but only 24.9% of Sponsor’s voting units). FTV-Toroso, Inc.

is controlled by FTV VI, L.P. and Michael Vostrizansky is the voting member of FTV VI, L.P. The Administrator is a wholly-owned

subsidiary and affiliate of the Sponsor.

The

Sponsor has an information security program and policy in place. The program takes reasonable care to look beyond the security

and controls developed and implemented for the Trust and the Fund directly to the platforms and controls in place for the key

service providers. Such review of cybersecurity and information technology plans of key service providers are part of the Sponsor’s

disaster recovery and business continuity planning. The Sponsor provides regular training to all employees of the Sponsor regarding

cybersecurity topics, in addition to real-time dissemination of information regarding cybersecurity matters as needed. The information

security plan is reviewed and updated as needed, but at a minimum on an annual basis.

Management

of the Sponsor

The Trust has no directors, officers or

employees and is managed by the Sponsor. The Sponsor has sponsored the Fund and advises three investment company complexes comprising

a total of 82 exchange-traded funds, as of the date of this Annual Report, registered and regulated under the Investment Company

Act of 1940. Sponsoring the Fund is the Sponsor’s first experience in operating an exchange traded product that invests in

crypto-currency futures and spot bitcoin. In general, under the Sponsor’s Amended and Restated Limited Liability Company

Operating Agreement, as amended from time to time, the Sponsor is managed by a board of managers, who have delegated day-to-day

operational matters to the officers of the Sponsor. The Chief Executive Officer of the Sponsor is responsible for the overall strategic

direction of the Sponsor and has general control of its business. The Chief Investment Officer and President of the Sponsor is

primarily responsible for new investment product development with respect to the Fund. The Chief Operating Officer has primary

responsibility for trade operations, trade execution, and portfolio activities with respect to the Fund. The Chief Financial Officer

acts as the Sponsor’s principal financial and accounting officer.

Furthermore, certain fundamental actions

regarding the Sponsor, such as the removal of officers, the addition or substitution of members, or the incurrence of liabilities

other than those incurred in the ordinary course of business and de minimis liabilities, may not be taken without

the affirmative vote of a majority of the members. The Sponsor has a board of managers, however, and the Trust has no board of

directors or officers. The six Executive Officers of the Sponsor are: Messrs. Guillermo Trias, Ronnie Riven, Michael Venuto, Dan

Carlson, Michael Vostrizansky, and Doug Rescho.

Below

is background information relating to the Executive Officers of the Sponsor, all of whom are members of the Sponsor:

Guillermo Trias, born in

1976, has served as the Co-Founder and CEO of Tidal Investments LLC since November 1, 2015. In his role, he oversees the overall

strategic direction, management, and operational aspects of the firm’s ETF investment platforms. Mr. Trias was approved as

a Principal of the Sponsor by the NFA on February 7, 2022. He holds a Business Administration degree from CUNEF and an MBA from

the Kellogg School of Management at Northwestern University.

Mr. Ronnie Riven, born in

1984, is the Chief Financial Officer of the Sponsor, a Tidal Financial Group company. Before joining the Sponsor in March 2024,

Ronnie served as Head of Finance & Business Management at Global X ETFs, which manages over 100 funds and over $40 billion in

assets under management. At Global X since 2018, Ronnie oversaw all finance and accounting operations, as well as leading the

firm’s IT, Human Resources, and other business management functions. Ronnie began his career as a public accountant working

for BDO USA, LLP from 2006-2012. He has also served as Manager of Financial Reporting at National Grid USA from 2012-2015 and

Director of Accounting and Finance at Barclays Center from 2016-2018. Ronnie holds a BS degree in Accounting from Hofstra University

and is a Certified Public Accountant in the state of New York.

Mr. Michael Venuto, born

in 1977, has been the Chief Investment Officer at Tidal Investments LLC since March 12, 2012. His responsibilities at Tidal include

the strategic planning and execution of ETF-based investment strategies, focusing on innovation and market responsiveness. Mr.

Venuto was approved as a Principal of the Sponsor by the NFA on February 25, 2022.

Mr. Dan Carlson, born in

1955, has been the Chief of Staff at Tidal Investments LLC since March 2024 and previously served as CFO and CCO from between March

2012 and March 2024. His responsibilities involve overseeing the company's financial operations, human resource management and overall business risk management.

He holds a BS degree in Accounting from the University of Illinois, Champaign-Urbana. Mr. Carlson was approved as a Principal of

the Sponsor by the NFA on February 7, 2022.

Mr. Eric Falkeis, born in

1973, has been the Chief Growth Officer at Tidal Investments LLC since November 1, 2018, and co-founded Tidal ETF Services. His

role at Tidal involves leading business development and growth strategy initiatives. Mr. Falkeis is a CPA and holds a BS degree

in Accounting from Marquette University. As of the date hereof, his application to be listed as a Principal of the

Sponsor is currently pending with the NFA.

Mr. Gavin Filmore, born in

1984, joined Tidal Investments LLC as the Head of Product Development in August 2021 and was promoted to COO in July 2022. Before

joining Tidal, he worked at Barclays Investment Bank, a leading global investment bank offering services in investment management,

wealth management, and corporate banking, from August 2017 to September 2021. His focus at Barclays was on Exchange Traded Products.

Mr. Filmore holds a BS in Finance from Northeastern University. He was approved as a Principal of Tidal Investments LLC and registered

as an Associated Person of the Sponsor by the NFA on March 8, 2022.

Mr. William Woolverton,

born in 1951, has been the Chief Compliance Officer of Tidal Investments LLC, Tidal ETF Trust, and Tidal Trust II since November

10, 2022. Prior to joining Tidal, he was a Senior Principal Consultant at ACA Group, a firm specializing in governance, risk, and

compliance services for financial institutions, from March 2020 to October 2022. Before ACA Group, Mr. Woolverton served as Managing

Director - US at Waystone, a company offering comprehensive fund governance, risk, compliance, and administration services to the

asset management industry, from April 2016 to December 2019. Mr. Woolverton received his M.A. from King’s College, Cambridge

University, and a law degree from Columbia University School of Law. He was approved as a Principal of the Sponsor by the NFA on

April 5, 2023.

The

Fund’s Service Providers

Sponsor

The

Sponsor is responsible for investing the assets of the Fund in accordance with the objectives and policies of the Fund. In addition,

the Sponsor arranges for one or more third parties to provide administrative, custodial, accounting, transfer agency and other

necessary services to the Fund. For these third-party services, the Fund pays the fees set forth in the table below entitled “Contractual

Fees and Compensation Arrangements with the Sponsor and Third-Party Service Providers.” For the Sponsor’s services,

the Fund is contractually obligated to pay a monthly Management Fee to the Sponsor.

Administrator

The

Fund employs Tidal ETF Services LLC as the Fund’s administrator (the “Administrator”). In turn, the Administrator

has engaged U.S. Bancorp Fund Services, LLC, doing business as U.S. Bank Global Fund Services (“Global Fund Services”)

to act as sub-administrator. The Administrator is a wholly-owned subsidiary of Sponsor. The Administrator is located at 234 West

Florida Street, Suite 203, Milwaukee, Wisconsin 53204. The Administrator also assists the Fund and the Sponsor with certain functions

and duties relating to marketing, which include the following: marketing and sales strategy, and marketing related services.

Cash Custodian, Registrar, Transfer Agent, Fund Sub-Administrator

In

its capacity as the Fund’s custodian, the Custodian, currently U.S. Bank, N.A., holds the Fund’s securities, cash

and/or cash equivalents pursuant to a custodial agreement. Global Fund Services, an entity affiliated with U.S. Bank, N.A., is

the registrar and transfer agent for the Fund’s Shares. In addition, Global Fund Services also serves as sub-administrator

for the Fund, performing certain sub-administrative, and accounting services, and support in preparing certain SEC and CFTC reports

on behalf of the Fund. The Custodian is located at 1555 North Rivercenter Drive, Suite 302, Milwaukee, Wisconsin 53212. U.S. Bank

N.A. is a nationally chartered bank, regulated by the Office of the Comptroller of the Currency, Department of the Treasury, and

is subject to regulation by the Board of Governors of the Federal Reserve System. The principal address for Global Fund Services

is 615 East Michigan Street, Milwaukee, WI, 53202.

Bitcoin Custodian

Holdings of the Fund can also consist of

bitcoin. Such investments are held by BitGo Trust Company, Inc. (the “Bitcoin Custodian”) on behalf of the Fund. The

Bitcoin Custodian will keep custody of all of the Fund’s bitcoin in a multi-layer, multi-party cold storage or similarly

secure technology. The Bitcoin Custodian is responsible for safekeeping passwords, keys or phrases that allow transfers of digital

assets (“Security Factors”) safe, secure and confidential. 100% of the private keys will be held in cold storage. The

Bitcoin Custodian will establish the Bitcoin Accounts on the Bitcoin Network solely for the Fund. The Bitcoin Custodian will follow

valid instructions given by the Sponsor to use the Fund’s Security Factors to effect transfers to and from the Bitcoin Accounts.

The Fund’s bitcoin will be held in segregated wallets and will not be commingled with the assets of other customers. The

Bitcoin Custodian has an insurance policy that covers, at least partially, risks such as the loss of client assets held in cold

storage, including from employee collusion or fraud, physical loss including theft, damage of key material, security breach or

hack, and fraudulent transfer.

Marketing

Agent

The

Fund employs Foreside Fund Services, LLC, a wholly-owned subsidiary of Foreside Financial Group, LLC (d/b/a ACA Group) as the

Marketing Agent for the Fund. The Marketing Agent Agreement among the Marketing Agent and the Trust calls for the Marketing Agent

to work with the Custodian in connection with the receipt and processing of orders for Creation Baskets and Redemption Baskets

and the review and approval of all Fund sales literature and advertising material. The Marketing Agent’s principal business

address is Three Canal Plaza, Suite 100, Portland, Maine 04101. The Marketing Agent is a broker-dealer registered with the SEC

and a member of FINRA.

Support

Agent

The Administrator also assists the Fund

and the Sponsor with certain functions and duties relating to administration and marketing, which include the following: marketing

and sales strategy and marketing related services.

Digital

Asset Adviser

Hashdex Asset Management Ltd. (“Hashdex”

or the “Digital Asset Adviser”) is a Cayman Islands investment manager (and an Exempt Reporting Advisor under SEC rules)

that specializes in, among other things, the management, research, investment analysis and other investment support services of

funds and ETFs with investment strategies involving bitcoin and other crypto assets. As Digital Asset Adviser, Hashdex is responsible

for providing the Sponsor and the Administrator with research and analysis regarding bitcoin and bitcoin markets for use in the

operation and marketing of the Fund. Hashdex has no role in maintaining, calculating or publishing the Benchmark. Hashdex also

has no responsibility for the investment or management of the Fund’s portfolio or for the overall performance or operation

of the Fund.

Support

Agreement

The Sponsor, Administrator, Digital Asset

Adviser and the Prior Sponsor (collectively, the “Parties”) have entered into an agreement, as amended (the “Support

Agreement”) that sets forth the terms and conditions applicable to the launch, marketing, promotion, development, and ongoing

operation of the Predecessor Fund and the Fund, as well the respective rights in profits and obligations for expenses. Specifically,

Hashdex and the Sponsor have experience in the digital asset and exchange-traded fund industry, and seek to offer a bitcoin futures

based fund as part of their long-term business goals.

The primary responsibilities and rights

of each Party under the Support Agreement, with respect to the Fund, are described below:

●

The

Sponsor will serve as the sponsor of the Fund as a series of the Trust, as described in this Annual Report.

●

The

Administrator will provide fund administration and related services for the Fund.

●

Hashdex

will provide to the Sponsor research and analysis regarding bitcoin and bitcoin markets for use in the operation and marketing

of the Fund.

●

The

Prior Sponsor will be entitled to receive a monthly amount equal to 7% of the Management Fee paid to the Sponsor by the Fund; provided,

however, that such fee will never be less than 0.04% of monthly average net assets of the Fund. After an additional deduction of

operational costs from the Management Fee, the resulting profits and losses will be shared equally among the Sponsor and Hashdex.

From the Management Fee, the Sponsor will pay all of the routine operational, administrative and other ordinary expenses of the

Fund, generally as determined by the sub-administrator, including but not limited to, fees and expenses of the sub-administrator,

Custodian, Marketing Agent, Transfer Agent, licensors, accounting and audit fees expenses, tax preparation expenses, legal fees,

ongoing SEC registration fees, individual Schedule K-1 preparation and mailing fees, and report preparation and mailing expenses.

For the period ended December 31, 2023 the Fund was not operation and did not incur expenses.

The

Trustee

The

sole Trustee of the Trust is Wilmington Trust, a national banking association. The Trustee’s principal offices are located

at 1100 North Market Street, Wilmington, Delaware 19890-0001. The Trustee is unaffiliated with the Sponsor. The Trustee’s

duties and liabilities with respect to the offering of Shares and the management of the Trust and the Fund are limited to its

express obligations under the Trust Agreement.

The

Trustee will accept service of legal process on the Trust in the State of Delaware and will make certain filings under the Delaware

Statutory Trust Act. The Trustee does not owe any other duties to the Trust, the Sponsor or the Shareholders. The Trustee is permitted

to resign upon at least sixty (60) days’ notice to the Sponsor. If no successor trustee has been appointed by the Sponsor

within such sixty-day period, the Trustee may, at the expense of the Trust, petition a court to appoint a successor. The Trust

Agreement provides that the Trustee is entitled to reasonable compensation for its services from the Sponsor or an affiliate of

the Sponsor (including the Trust), and is indemnified by the Sponsor against any expenses it incurs relating to or arising out

of the formation, operation or termination of the Trust, or any action or inaction of the Trustee under the Trust Agreement, except

to the extent that such expenses result from the fraud, or the gross negligence or willful misconduct of the Trustee. The Sponsor

has the discretion to replace the Trustee.

The Trustee has not signed this Annual Report and is not subject to issuer

liability under the federal securities laws for the information contained in this Annual Report and under federal securities laws with

respect to the issuance and sale of the Shares. Under such laws, neither the Trustee, either in its capacity as Trustee or in its individual

capacity, nor any director, officer or controlling person of the Trustee is, or has any liability as, the issuer or a director, officer

or controlling person of the issuer of the Shares.

Under

the Trust Agreement, the Trustee has delegated to the Sponsor the exclusive management and control of all aspects of the business

of the Trust and the Fund. The Trustee has no duty or liability to supervise or monitor the performance of the Sponsor, nor does

the Trustee have any liability for the acts or omissions of the Sponsor.

Because

the Trustee has delegated substantially all of its authority over the operation of the Trust to the Sponsor, the Trustee itself

is not registered in any capacity with the CFTC.

The

Clearing Brokers

Currently,

StoneX Financial Inc. (“StoneX”) and Phillip Capital Inc. (“Phillip Capital”) serve as the Fund’s

clearing brokers to execute and clear futures contracts and provide other brokerage-related services. StoneX and Phillip Capital

are each registered as a FCM with the CFTC and are members of the NFA. The clearing brokers are registered as broker-dealers with

the SEC and are each a member of FINRA. StoneX and Phillip Capital are each clearing members of ICE Futures U.S., Inc., Chicago

Board of Trade, Chicago Mercantile Exchange, New York Mercantile Exchange, and all other major United States commodity exchanges.

Except

as indicated below, there have been no material civil, administrative, or criminal proceedings pending, on appeal, or concluded

against the Clearing Brokers or its principals in the past five (5) years.

Litigation

disclosure for StoneX

Listed

below are material administrative, civil, enforcement, or criminal complaints or actions filed against StoneX Financial Inc. –

FCM Division (f/k/a INTL FCStone Financial Inc. - FCM Division) where such complaints or actions have not concluded and any material

enforcement actions or complaints filed against the StoneX Financial Inc. - FCM Division in the past three years.

| |

● |

On March 16, 2023, the Clearing House Risk Committee

at CME Group found that StoneX Financial, Inc. violated Customer Gross Margining Technical Overview Requirements and CME Rule

980.G. Pursuant to an offer of settlement in which StoneX Financial, Inc. neither admitted nor denied the rule violations

upon which the penalty is based, the Clearing House Risk Committee imposed a $100,000.00 fine which was effective on March

16, 2023. |

| |

● |

On January 20, 2023, the Clearing House Risk

Committee at CME Group found that StoneX Financial Inc. violated CME Rules 930.A and 930.F. Pursuant to an offer of settlement