UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One)

OR

For the fiscal year ended

OR

OR

Commission File Number:

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

(Jurisdiction of incorporation or organization)

(Address of principal executive offices)

Copy to:

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of each class |

Trading Symbol(s) |

Name of each exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer, or an emerging growth company. See definition of “accelerated filer,” “large accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer |

☐ |

Accelerated filer |

☐ |

☒ |

|

|

|

|

|

Emerging growth company |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ☐ |

☒ |

|

Other ☐ |

If “Other” has been checked in response to the previous question indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

Table of Contents

1 |

||

3 |

||

4 |

||

5 |

||

6 |

||

CAUTIONARY NOTE ABOUT FORWARD-LOOKING STATEMENTS AND RISK FACTOR SUMMARY |

7 |

|

9 |

||

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

9 |

|

|

9 |

|

|

9 |

|

|

9 |

|

9 |

||

9 |

||

|

9 |

|

|

9 |

|

|

9 |

|

|

9 |

|

45 |

||

|

45 |

|

|

46 |

|

|

89 |

|

|

89 |

|

90 |

||

90 |

||

|

90 |

|

|

107 |

|

|

120 |

|

|

120 |

|

|

120 |

|

121 |

||

|

121 |

|

|

123 |

|

|

123 |

|

|

125 |

|

|

125 |

|

|

F. DISCLOSURE OF A REGISTRANT’S ACTION TO RECOVER ERRONEOUSLY AWARDED COMPENSATION. |

126 |

(i)

126 |

||

|

126 |

|

|

127 |

|

|

129 |

|

130 |

||

|

130 |

|

|

131 |

|

131 |

||

|

131 |

|

|

131 |

|

|

131 |

|

|

131 |

|

|

131 |

|

|

131 |

|

131 |

||

|

131 |

|

|

131 |

|

|

131 |

|

|

131 |

|

|

132 |

|

|

139 |

|

|

140 |

|

|

140 |

|

|

140 |

|

|

140 |

|

ITEM 11. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISKS |

140 |

|

ITEM 12. DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES |

140 |

|

|

140 |

|

|

140 |

|

|

140 |

|

|

141 |

|

147 |

||

143 |

||

ITEM 14. MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS |

143 |

|

143 |

||

144 |

||

144 |

||

144 |

||

(ii)

144 |

|

ITEM 16D. EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES |

145 |

ITEM 16E. PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS |

145 |

145 |

|

145 |

|

145 |

|

ITEM 16I. DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS. |

145 |

145 |

|

145 |

|

147 |

|

147 |

|

147 |

|

147 |

|

149 |

(iii)

INTRODUCTORY NOTE

Except where the context otherwise requires or where otherwise indicated, the terms “Kaspi.kz,” “Kaspi,” the “Company,” “we,” “us,” “our,” “our company” and “our business” refer to Joint Stock Company Kaspi.kz, in each case together with its consolidated subsidiaries as a consolidated entity.

All references in this annual report to “tenge,” “KZT” or “₸” are to the Kazakhstan tenge and to “dollar,” “USD” or “$” are to the U.S. dollar.

All references in this annual report to the “Commission” or the “SEC” are to the United States Securities and Exchange Commission, to the “Exchange Act” are to the U.S. Securities Exchange Act of 1934, as amended, and to the “Securities Act” are to the U.S. Securities Act of 1933, as amended.

All references to “Kazakhstan” are to the Republic of Kazakhstan, to the “NBK” are to the National Bank of the Republic of Kazakhstan, to the “ARDFM” are to the Agency of the Republic of Kazakhstan for Regulation and Development of the Financial Market and to “Qazstat” are to the Bureau of National Statistics of the Agency for Strategic Planning and Reforms of the Republic of Kazakhstan.

With respect to our business and operations, all references to:

(1) |

(2) |

IMAGES

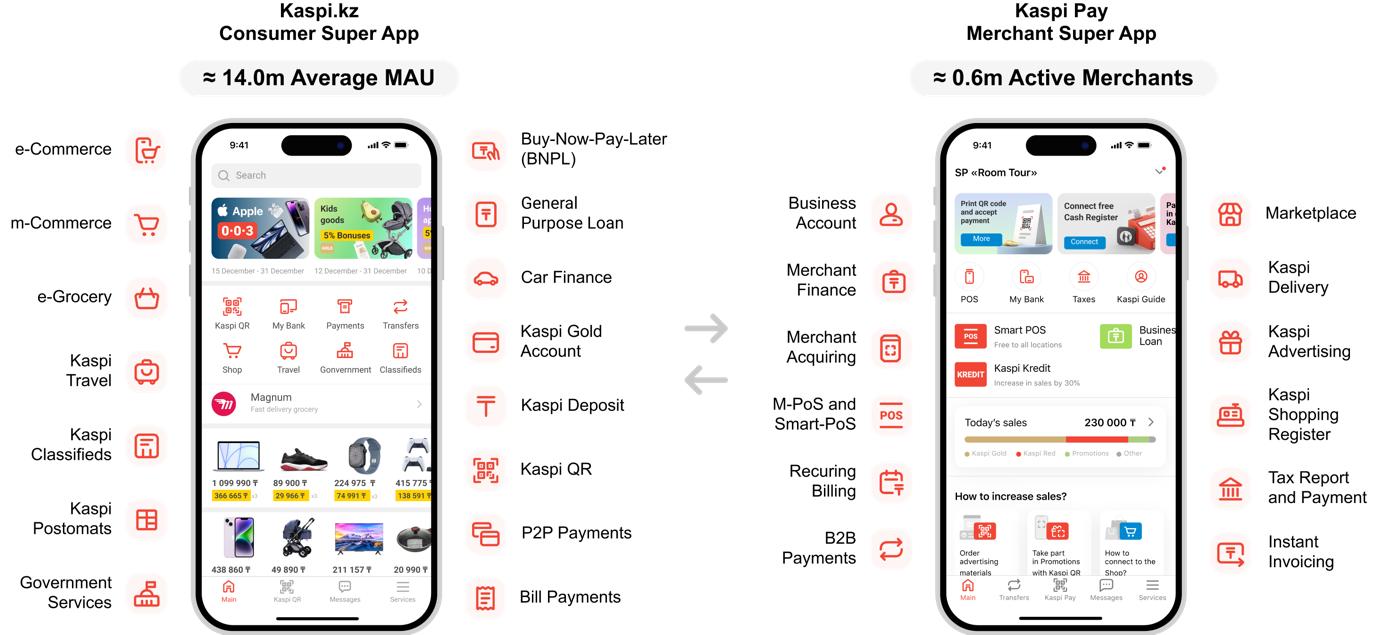

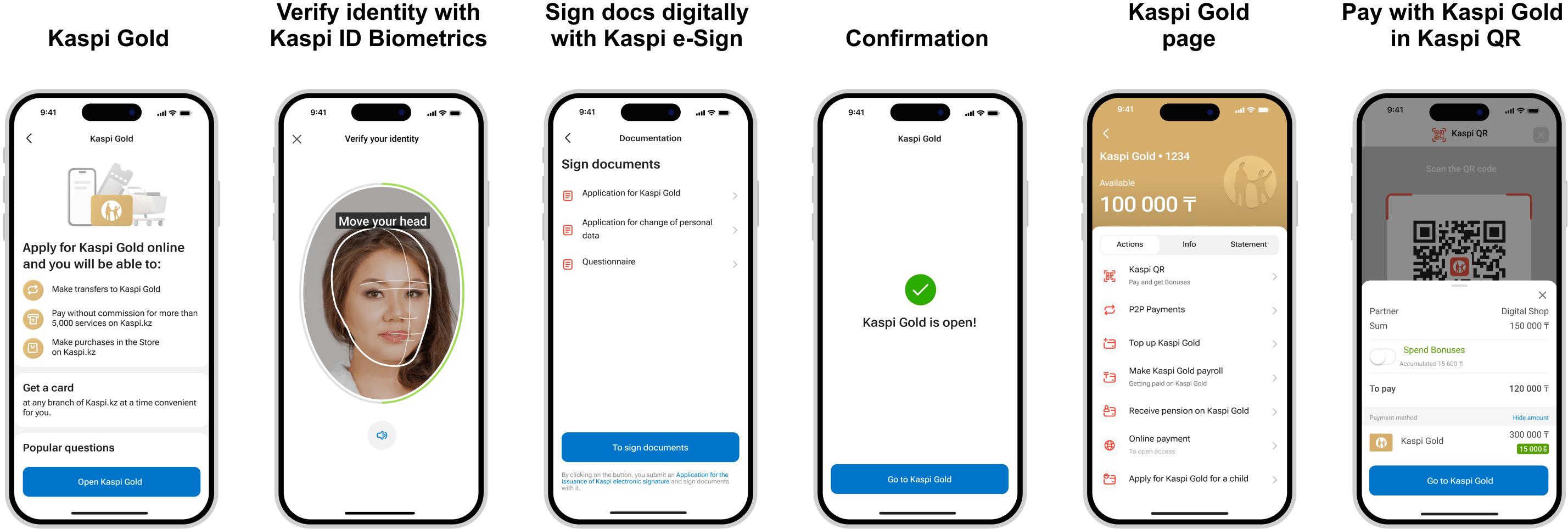

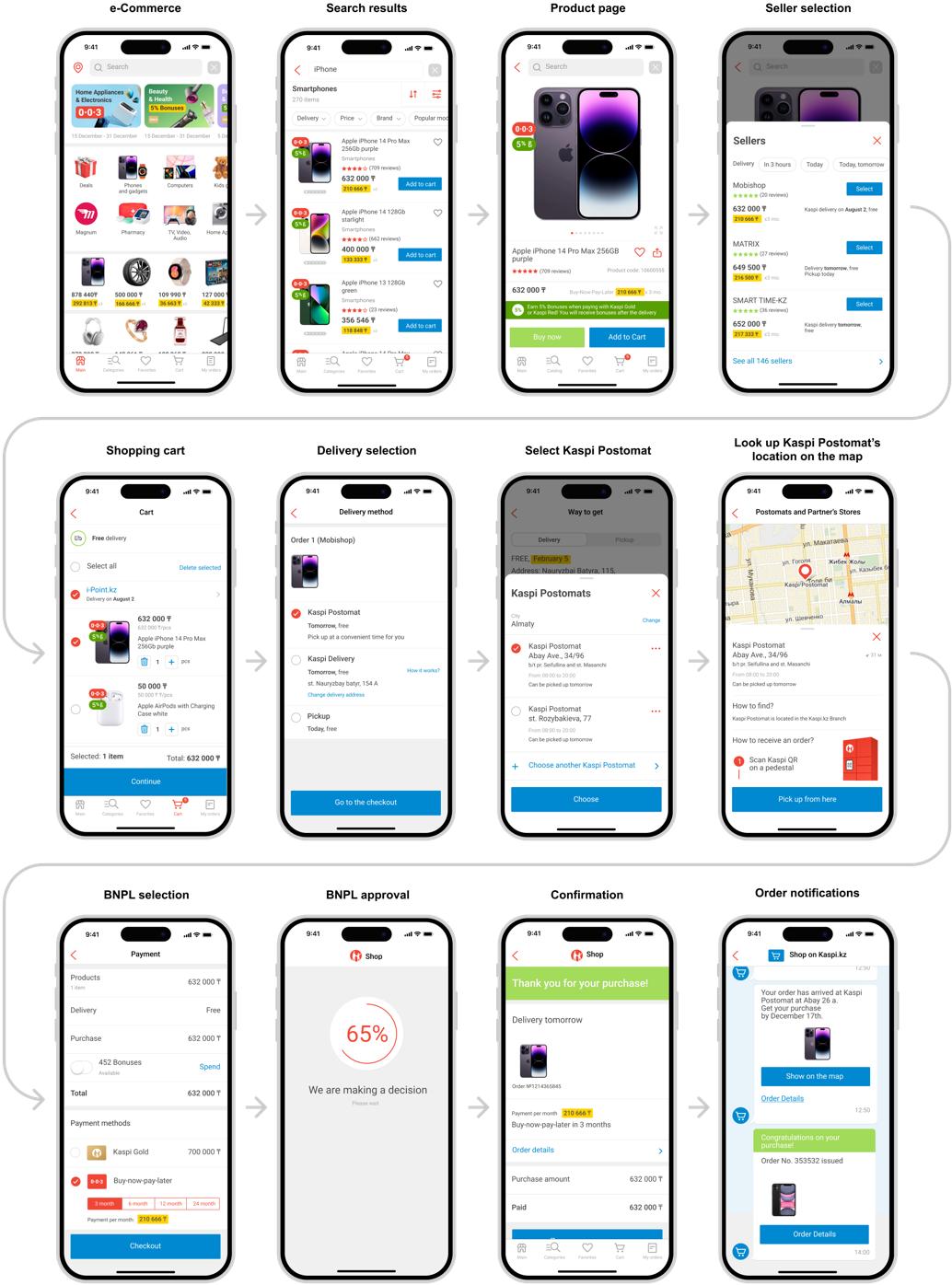

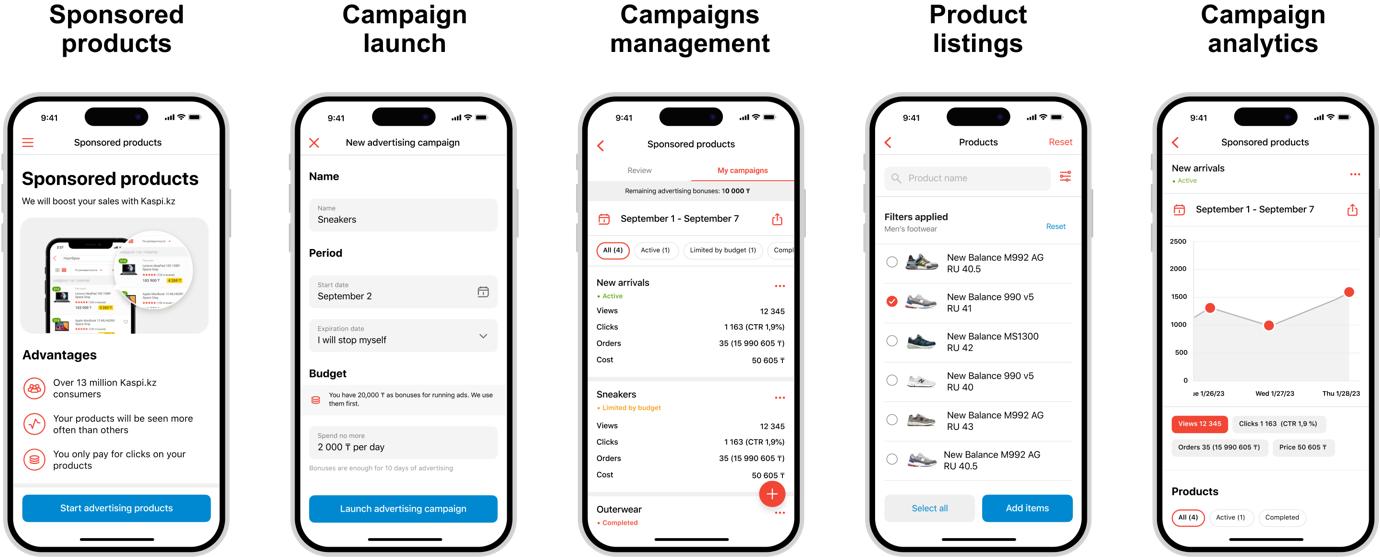

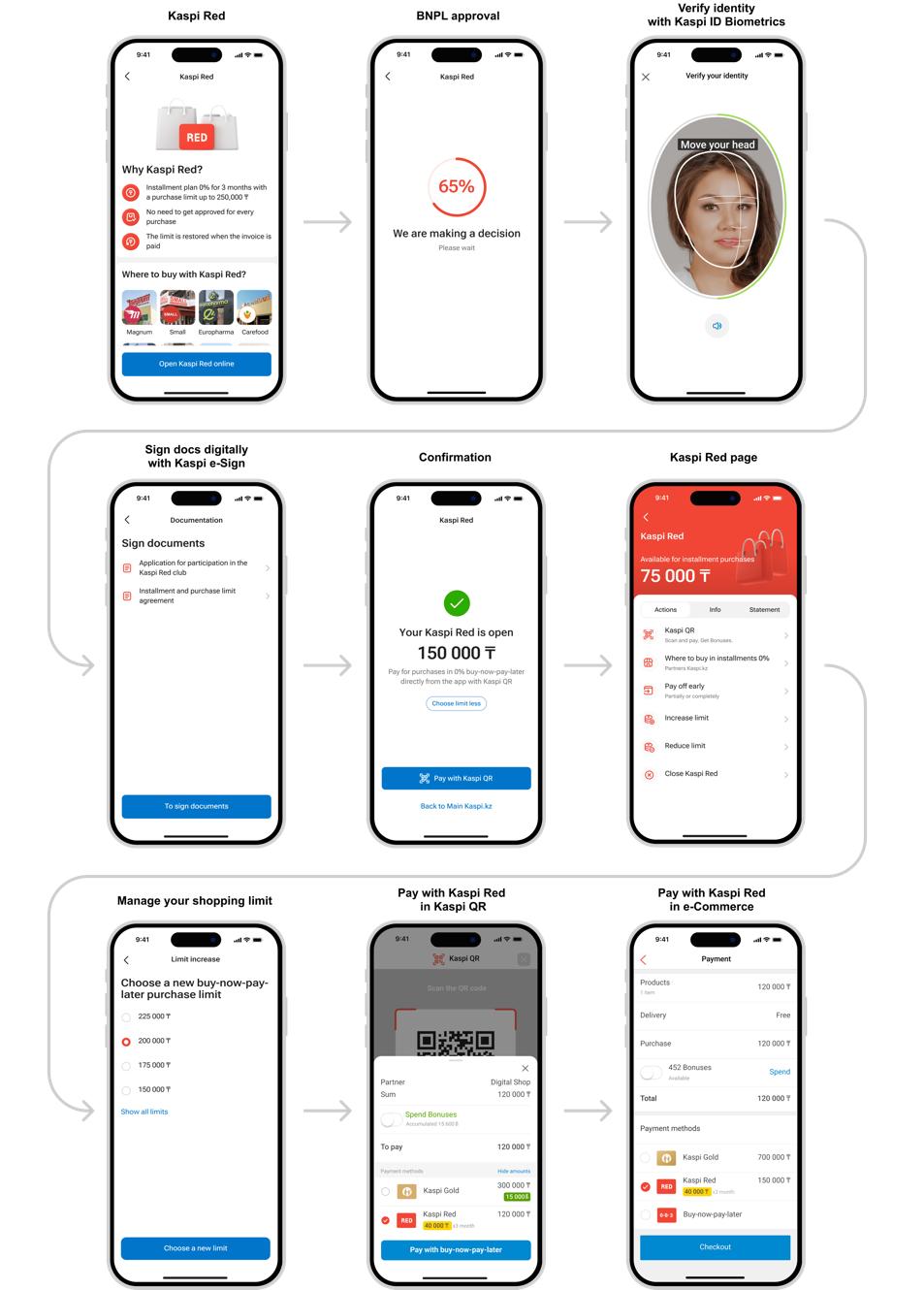

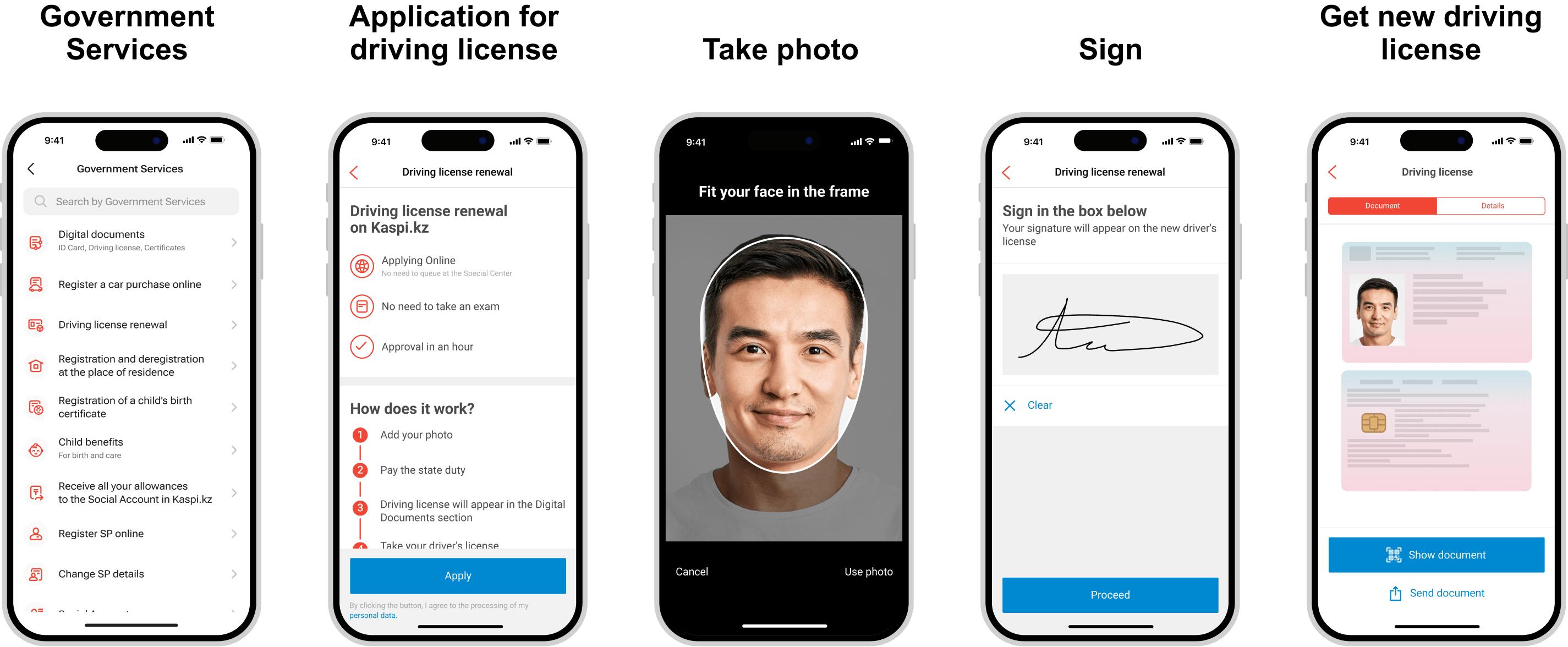

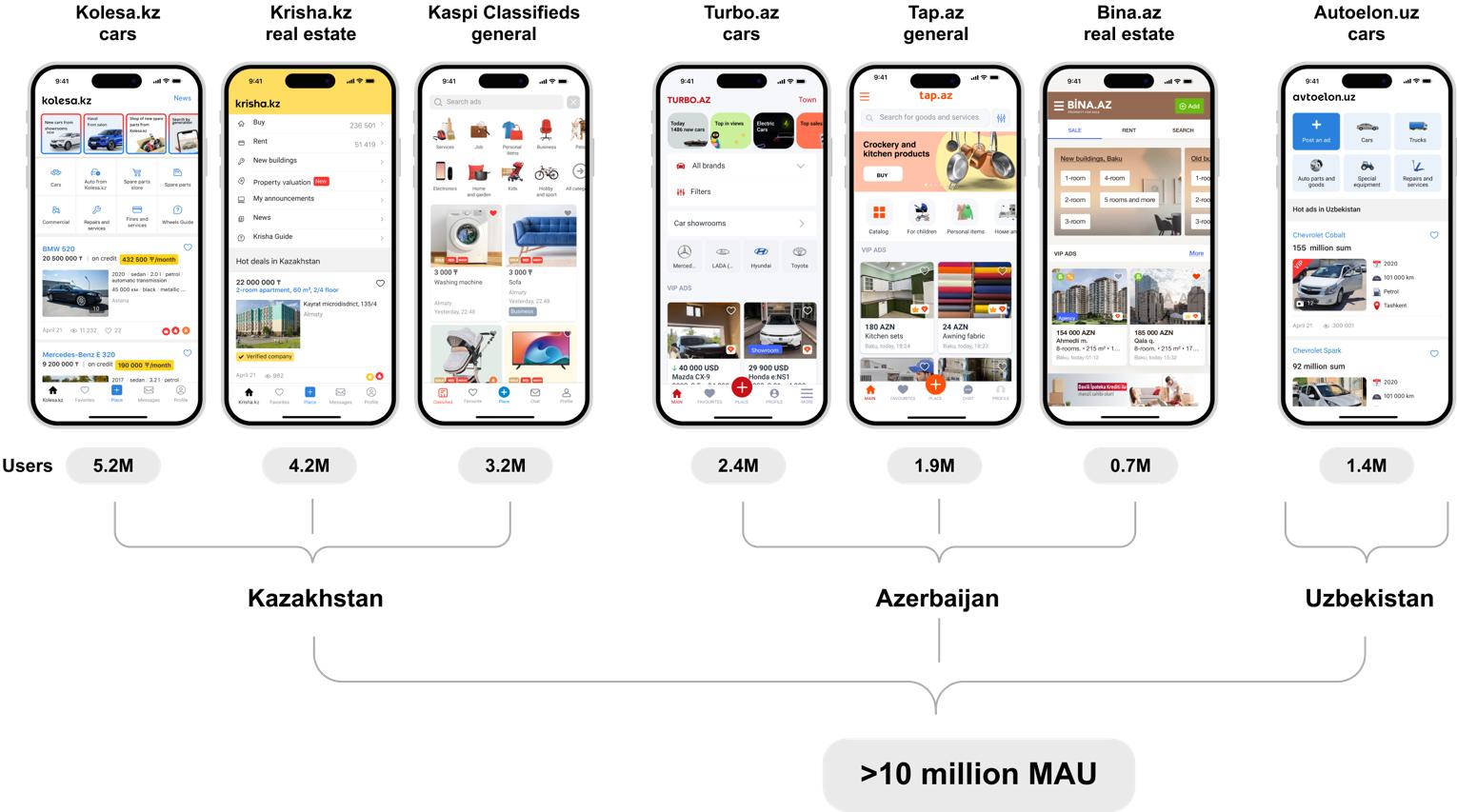

This annual report contains illustrative images of Kaspi.kz and Kaspi Pay Super Apps, except for language, which has been translated into English for presentation purposes. Certain images may represent designs and functionality currently in production and testing.

(3) |

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

We report under International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (the “IASB”).

The monetary unit we use as our functional currency is tenge, and we present our consolidated financial statements in tenge. Financial, operating and other data of the Company presented in U.S. dollars in this annual report were translated from tenge. The convenience translation and exchange rate used by us for the presentation of certain financial, operating and other data denominated in tenge and included in this annual report is ₸454.56 per $1 as of December 31, 2023.

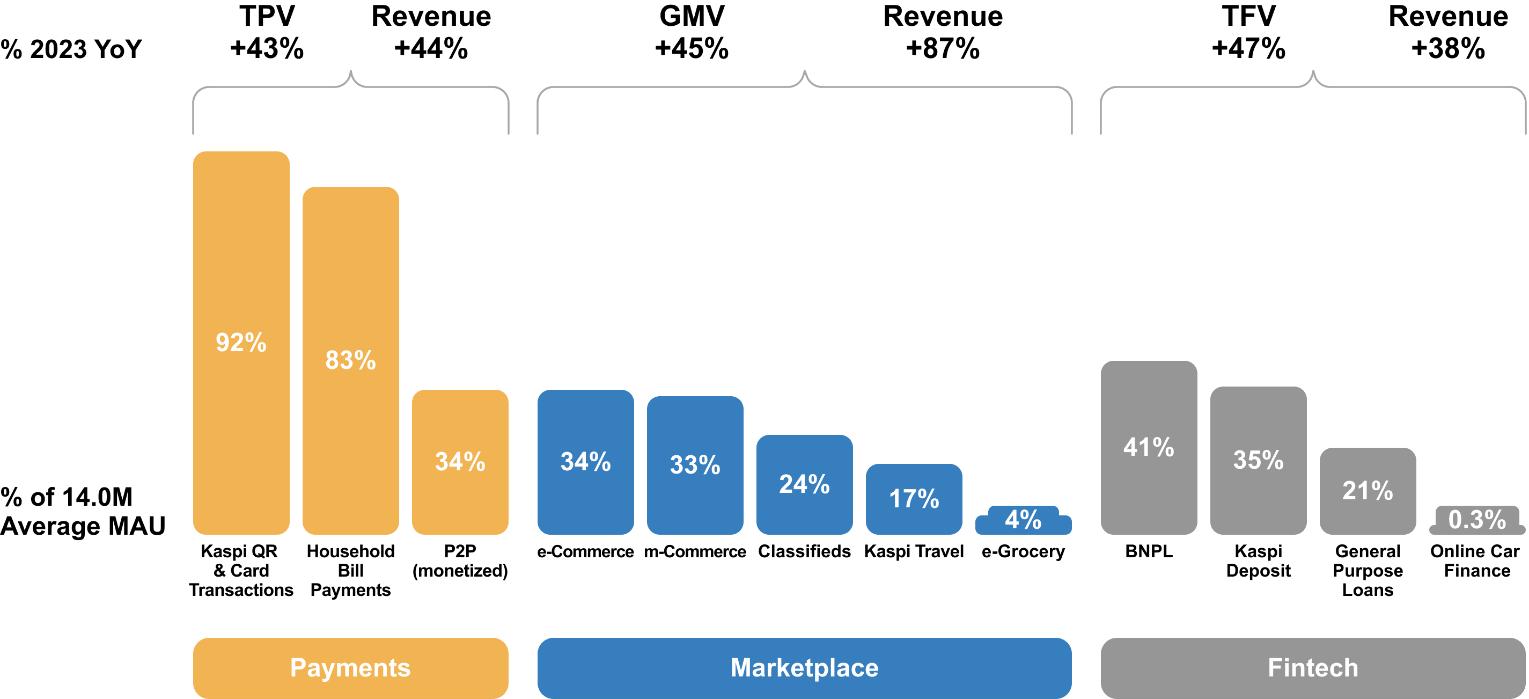

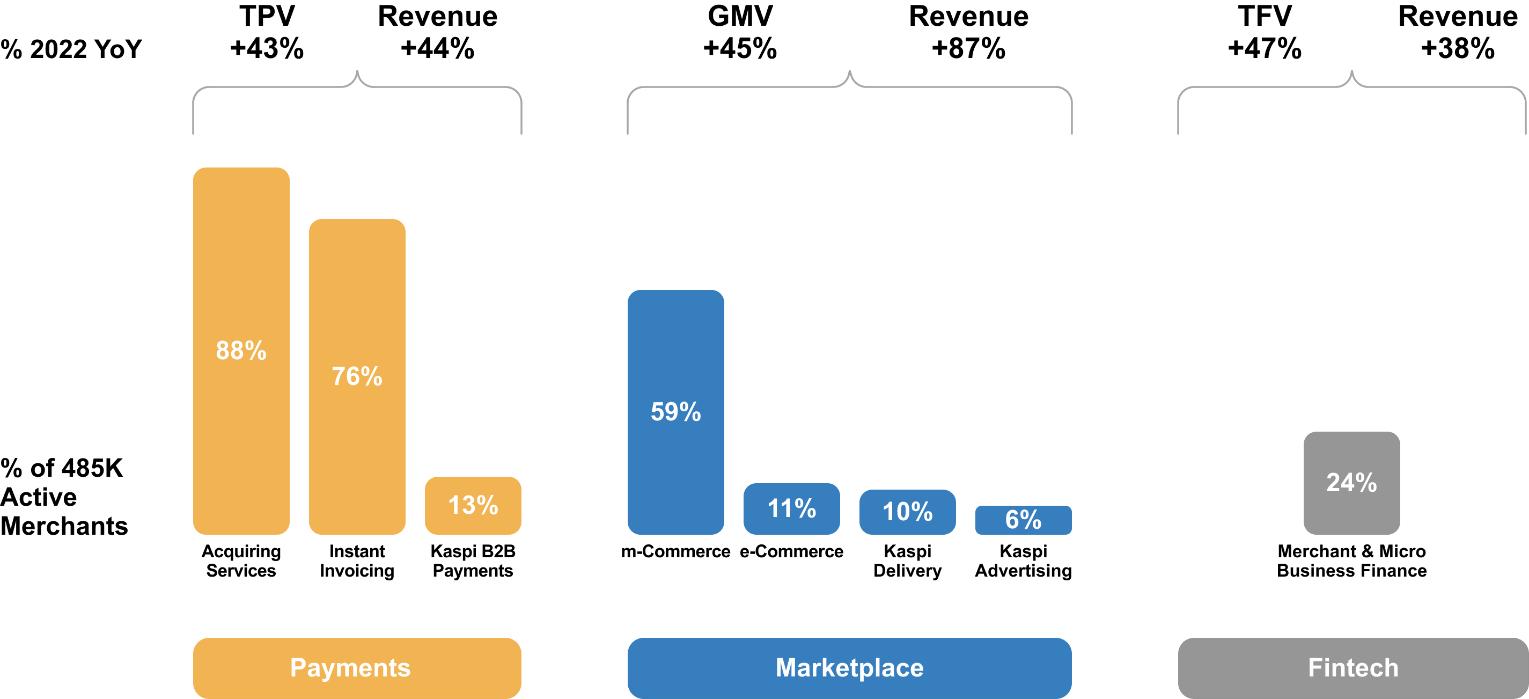

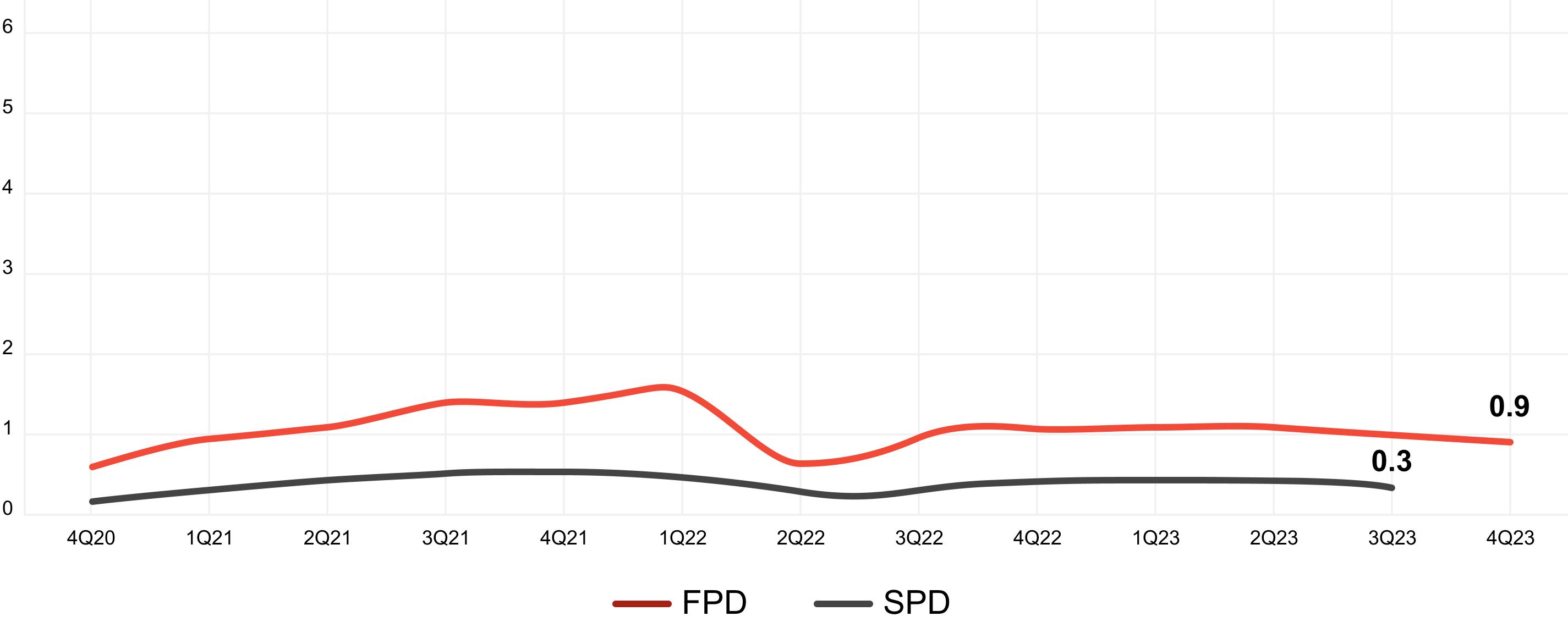

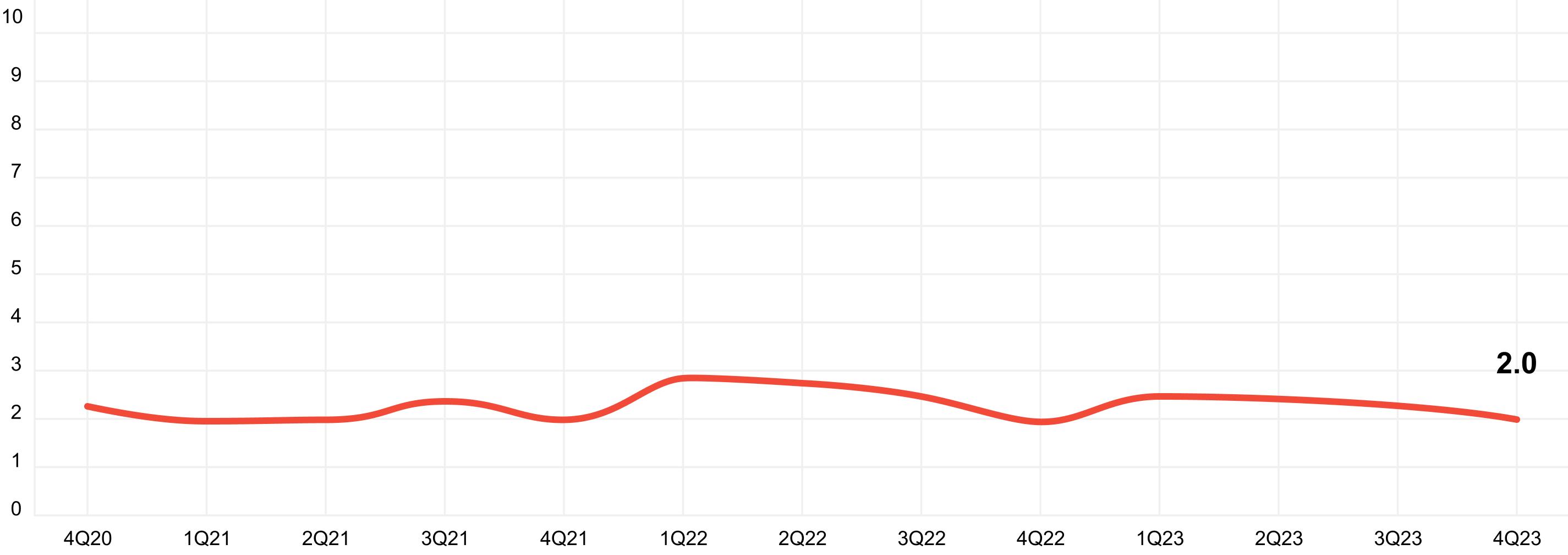

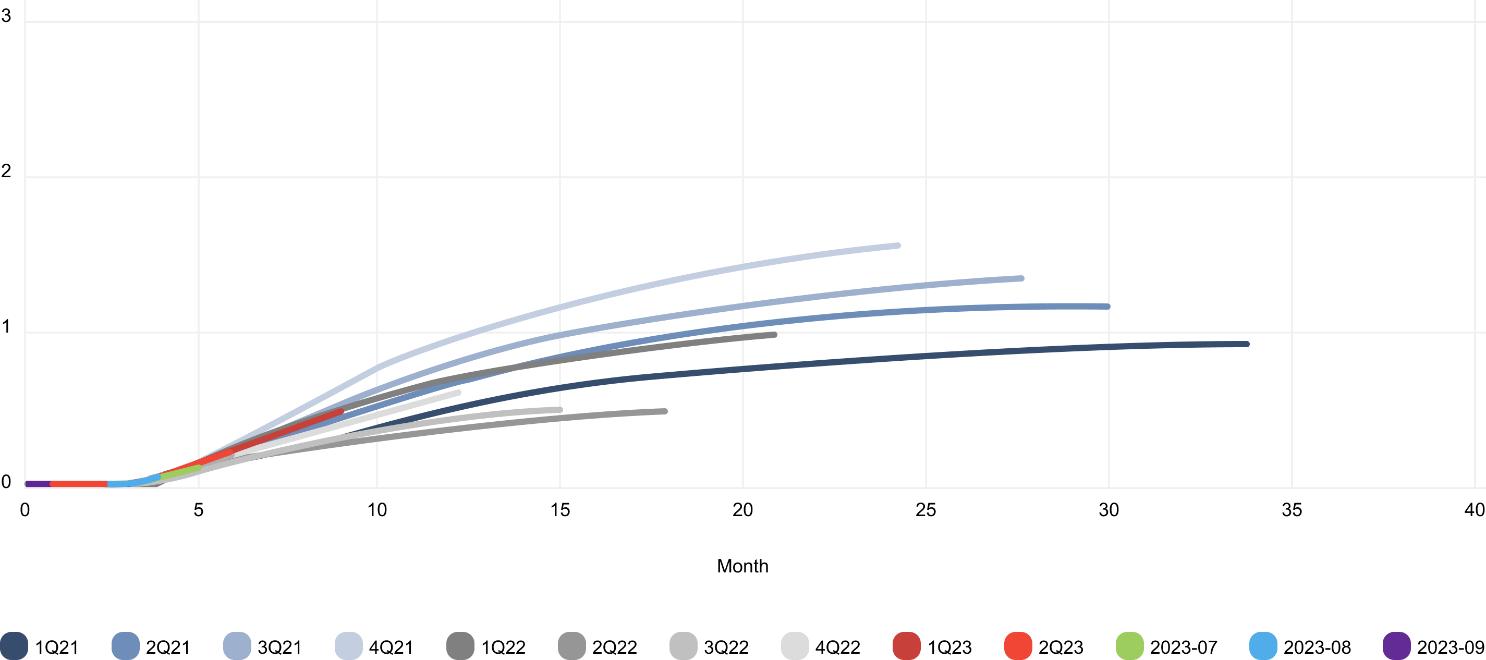

Other Key Financial and Operating Metrics

Certain parts of this annual report contain our key financial and operating metrics. The definitions of such measures are set out in the Introductory Note in this annual report, and include key operating metrics, such as Active Merchants, Average Balances on Current Accounts, Average DAU, Average MAU, Average DAU to Average MAU ratio, Average Net Loan Portfolio, Average Savings, Cost of Risk, Delinquency rate, Fintech Active Consumers (deposits), “Fintech Active Consumers (loans), Fintech Yield, First payment default rate, Loss rate vintages, Marketplace Active Consumers, Marketplace Gross Merchandise Value (GMV), Marketplace Purchases, Marketplace Take Rate, Monthly Transactions per Active Consumer, Payments Active Consumers, Payments Take Rate, Second payment default rate, TFV, TFV to Average Net Loan Portfolio Conversion Rate, TPV, TPV Payments Transactions, 90+ collection vintages.These key financial and operating metrics are used by management and our Board of Directors to assess the level of penetration of our different platforms into the economic environments we operate, the usefulness of our products and services to customers and how engaged our customers are with our platforms. These metrics are also frequently used by analysts, investors and other interested parties to evaluate us and other companies in our industry. Management believes it is useful to investors and analysts to evaluate these operating metrics on the same basis as management uses to evaluate our financial results.

Rounding

Certain figures and some percentages included in this annual report have been subject to rounding adjustments. Accordingly, the totals included in certain tables contained in this annual report may not correspond to the arithmetic aggregation of the figures or percentages that precede them.

(4) |

MARKET AND INDUSTRY DATA

We obtained the industry, market and competitive position data in this annual report from our own internal estimates and research, as well as from publicly available information, including statistics, industry and general publications and research, surveys and studies conducted by third parties, including the NBK, Qazstat, the International Monetary Fund (“IMF”), the World Bank, Euromonitor International Limited (“Euromonitor”) and data.ai.

There are several studies that address either specific market segments, or regional markets, within our industry. However, given the rapid changes in our industry and the markets in which we operate, no industry research that is generally available covers some of the market trends we view as key to understanding our industry and our place in it worldwide and in Kazakhstan, in particular. We believe that it is important that we maintain as broad a view on industry developments as possible. To assist us in formulating our long-term strategies and in anticipation of our initial public offering, in 2023, we retained Arthur D. Little (“ADL”), a third-party consulting firm, to provide an independent view of the total addressable market for certain of our products and services in Kazakhstan, including an overview of recent macroeconomic and market dynamics, analysis of underlying trends and potential growth factors of the markets, an assessment of the current competitive landscape and other relevant topics, in the report (the “ADL Report”). In connection with the preparation of the ADL Report, we furnished to ADL certain historical information about us and some data available on the competitive environment. ADL conducted research in preparation of the ADL Report, including a study of a broad range of secondary sources, including other market reports, association and trade press publications, other databases and sources. We use the data contained in the ADL Report to assist us in describing the nature of our industry and our position in it. Such information is included in this annual report in reliance on ADL’s authority as an expert in such matters.

Some of the industry information in this annual report has been derived from independent market research carried out by Euromonitor, which includes research estimates based on various official published sources and trade opinion surveys conducted by Euromonitor, and has been prepared primarily as a research tool. Euromonitor makes no warranties about the fitness of this intelligence for investment decisions. We have not commissioned any studies or reports prepared or published, or data collected or surveyed, by the NBK, Qazstat, the IMF, the World Bank, Euromonitor or data.ai.

Due to the evolving nature of our industry and competitors, we believe that it is difficult for any market participant, including us, to provide precise data on the market or our industry. Industry publications and forecasts generally state that the information they contain has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. We have not independently verified the accuracy or completeness of the data contained in these industry publications and reports. Although we are not aware of any misstatements regarding the industry data that we present in this annual report, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under “Item 3. Key Information—D. Risk Factors” and “Item 5. Operating and Financial Review and Prospects” in this annual report.

Some market data and statistical information contained in this annual report are also based on management’s estimates and calculations, which are derived from our review and interpretation of the independent sources, our internal market and brand research and our knowledge of our industry. Information that is based on estimates, forecasts, projections or similar methodologies is inherently subject to uncertainties, and actual events or circumstances may differ materially from events and circumstances that are assumed in this information. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as other forward-looking statements in this annual report. See “Cautionary Statement Regarding Forward-looking Statements and Risk Factor Summary.”

(5) |

TRADEMARKS, SERVICE MARKS AND TRADENAMES

We have proprietary rights to trademarks used in this annual report that are important to our business, many of which are registered under applicable intellectual property laws.

Solely for convenience, the trademarks, service marks, logos, copyrights and trade names referred to in this annual report are without the ® and ™ symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensors to these trademarks, service marks, logos, copyrights and trade names. This annual report contains additional trademarks, service marks, logos, copyrights and trade names of others, which are the property of their respective owners. All trademarks, service marks, logos, copyrights and trade names appearing in this annual report are, to our knowledge, the property of their respective owners. We do not intend our use or display of other companies’ trademarks, service marks, logos, copyrights or trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

(6) |

CAUTIONARY NOTE ABOUT FORWARD-LOOKING STATEMENTS AND RISK FACTOR SUMMARY

This annual report contains forward-looking statements within the meaning of the U.S. federal securities laws, which statements relate to our current expectations and views of future events. These forward-looking statements are contained principally in the sections entitled “Item 3. Key Information—D. Risk Factors,” “Item 5. Operating and Financial Review and Prospects” and “Item 4. Information on the Company.” These statements relate to events that involve known and unknown risks, uncertainties and other factors, including those listed under “Item 3. Key Information—D. Risk Factors,” which may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. You should read the discussion and analysis of our financial condition and results of operations under the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in conjunction with our consolidated financial statements and the related notes included elsewhere in this annual report.

In some cases, these forward-looking statements can be identified by words or phrases such as “believe,” “may,” “might,” “will,” “expect,” “estimate,” “could,” “should,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “potential,” “prospective,” “continue,” “is/are likely to” or other similar expressions. Forward-looking statements contained in this annual report include, but are not limited to, statements about the following, which also summarizes some of our most principal risks:

(7) |

We caution you that the foregoing list may not contain all of the forward-looking statements made in this annual report. These forward-looking statements are subject to risks, uncertainties and assumptions, some of which are beyond our control. In addition, these forward-looking statements reflect our current views with respect to future events and are not a guarantee of future performance. Actual outcomes may differ materially from the information contained in the forward-looking statements as a result of a number of factors, including, without limitation, the risk factors set forth in “Item 3. Key Information—D. Risk Factors.”

We operate in an evolving environment. New risks emerge from time to time, and it is not possible for our management to predict all risks, nor can we assess the effect of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

The forward-looking statements made in this annual report relate only to events or information as of the date on which the statements are made in this annual report. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. You should read this annual report and the documents that we have filed as exhibits to the annual report, completely and with the understanding that our actual future results or performance may be materially different from what we expect.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this annual report, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain, and investors are cautioned not to unduly rely upon these statements.

(8) |

PART I

ITEM 1. Identity of Directors, Senior Management and Advisers

Not applicable.

Not applicable.

Not applicable.

ITEM 2. Offer Statistics and Expected Timetable

Not applicable.

ITEM 3. Key Information

Not applicable.

Not applicable.

Investing in the ADSs involves a high degree of risk. You should carefully consider the risks described below before making an investment decision. Additional risks not presently known to us or that we currently deem immaterial may also impair our business operations. Our business, financial condition, results of operations and cash flows could be materially adversely affected by any of these risks. The trading price and value of the ADSs could decline due to any of these risks, and you may lose all or part of your investment. This annual report also contains forward-looking statements that involve risks and uncertainties. You should carefully review the “Cautionary Statement Regarding Forward-Looking Statements and Risk Factor Summary.” Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks faced by us described below and elsewhere in this annual report.

Risks Relating to Our Business and Industry

We may be unable to attract sufficient new customers, engage and retain our existing customers or sell additional functionality, products and services to them on our platforms.

The growth of our business depends on our ability to attract new customers and expand our existing customers’ usage of our platforms by offering additional functionality, products and services and further integrating our Super Apps. While our Super Apps have achieved wide acceptance in Kazakhstan by both consumers and merchants, we may be unable to continue to grow at historical rates. We continue to invest significant resources in our infrastructure, research and development and other areas in order to enhance our platform technology and our existing products and services, as well as to introduce new high-quality products and services aimed at increasing the number of transactions made on our platforms and through our Super Apps. The changes and developments taking place in our industry may also require us to re-evaluate our business model and adopt significant changes to our long-term strategies. Our failure to innovate and adapt to these changes could have a material adverse effect on our business, financial condition,results of operations and cash flows.

As the markets for our platforms mature, or as new or existing competitors introduce new products, services or functionality that compete with ours, we may face external pressures and be unable to retain current customers or attract sufficient new customers. Our ability to engage, retain and increase our customer base will require us to

(9) |

successfully create new products and implement new business segments, both independently and together with third parties, and consequently, we may face risks associated with expanding into areas in which we have limited or no experience. We may also introduce significant changes to our existing products or develop and introduce new and unproven products and services, which may require significant investments of time, money and resources. For example, in 2021, we launched our e-Grocery business in partnership with Magnum. Similarly, over the last two years, we have developed Government Services in partnership with the Kazakhstan government to digitalize usage of government services and we have expanded Kaspi Travel to include holiday packages. Performance of these and other new business lines, however, is inherently uncertain, and if new or enhanced products or services fail to engage our consumers or merchants, we may fail to attract or retain customers or to generate sufficient return to justify our investments, which may adversely affect our ,business, financial condition, results of operations and cash flows.

Our efforts to attract and retain customers may also require more sophisticated and costly development, sales or engagement efforts and could be impaired for a variety of reasons, including adverse reaction to changes in general economic conditions or other factors. We may also take actions that fail to generate short-term financial results, and there can be no assurance that these actions will produce long-term benefits. In particular, efforts to expand our customer base and enhance the customer experience, especially in new markets, and investments in new products, services and business initiatives could adversely affect our short-term financial results. Such investments may not provide economic benefits to us in the short-term or at all. If our efforts to attract and retain customers are not successful, or if our customers reduce or discontinue their usage of our platforms and Super Apps, our business, financial condition, results of operations and cash flows may be materially adversely affected.

We may fail to maintain and improve the network effects of our Super App business model.

Our ability to maintain a fully integrated Super App business model that creates strong network effects among consumers, merchants and other participants is critical to our success. The extent to which we are able to maintain and strengthen these network effects depends, among other things, on our ability to:

The network effects of our Super Apps also rest on our ability to attract and retain leading retailers as merchants, which can offer a wide selection of products and services for consumers at attractive prices. See “Item 3. Key Information—D. Risk Factors—Our business relies on merchants selling their products on our platforms, and we may be unable to partner with sufficient new merchants or maintain relationships with our existing merchant partners.” In addition, any changes we may make to our current operations to enhance and improve our Super App integration and balance the needs and interests of users of our Super Apps, or to comply with any regulatory requirements, may be viewed positively from one user group’s perspective, such as consumers, but may have negative effects from another group’s perspective, such as merchants. If we fail to balance the interests of all users of our Super Apps, consumers, merchants and other participants may spend less time on our platforms and Super Apps and conduct fewer transactions or use alternative platforms, any of which could result in a material adverse effect on our ,business, financial condition, results of operations and cash flows.

Failure to improve or maintain technology infrastructure could affect our business.

We rely on the efficiency, security, integrity, and availability of our technology infrastructure to protect the functionality and effectiveness of our software and platforms and in order to meet our business needs or the needs of our customers and partners. We frequently upgrade our platforms to provide increased scale, improved performance, additional built-in functionality (including functionality related to security) and additional capacity.

(10) |

Adoption of new products and maintaining and upgrading our technology infrastructure requires a significant investment of both time and resources. There can be no assurance that our financial resources will be sufficient to maintain the levels of investment required to support such development efforts, which may require substantial capital commitment. Additionally, our competitors may have the ability to devote more financial and operational resources than we can to the development of new technologies and services and, if successful, their development efforts could render our services less desirable to customers, resulting in the loss of customers or a reduction in the fees we can generate.

In addition, any failure to improve or maintain our technology infrastructure could result in unanticipated system disruptions, slower response times, impaired user experience and delays in reporting accurate operating and financial information. Such issues may be further compounded during periods when user activity is higher than usual on our platforms, or as we expand our business. Issues with the functionality and effectiveness of our software or platforms could have a material adverse effect on our business, financial condition, results of operations and cash flows.

Furthermore, security features and enhancements are frequently emerging to combat the rise of cybersecurity incidents and attacks. We have faced in the past and expect to continue to face attempted cyberattacks, such as phishing attacks, reverse engineering of our applications, Distributed Denial of Service (DDoS) attacks and ransomware attacks. While we have experienced cybersecurity incidents, to date, we do not believe that we experienced a material cybersecurity incident. The sophistication of cybersecurity threats, including through the use of artificial intelligence, continues to increase, and the preventative actions we take to reduce the risk of cybersecurity incidents and attacks, including the regular testing of our cybersecurity incident response plan, may be insufficient. In addition, new and emerging technologies that could result in greater operational efficiencies may further expose our computer systems to the risk of cybersecurity incidents. There are significant costs in both time and labor to ensure that we are maintaining adequate and up to date cybersecurity controls, including patching vulnerabilities in software and detecting security incidents. Any failure to timely upgrade our technology infrastructure or discover vulnerabilities may interrupt our ability to operate and conduct our business.

Our “first-party” e-Grocery operations are new to our business, and we may fail to successfully execute the new business model and reach sustained profitability of the e-Grocery operations.

We launched our e-Grocery business in partnership with Magnum in 2021, and in 2023, we acquired a 90.01% stake in Magnum E-commerce Kazakhstan. Following the acquisition, we changed the business model of our e-Grocery operations from a “third-party” business to a “first-party” business due to the more complex operational and logistical requirements of the grocery business. As a result, unlike in our other Marketplace business which we operate on a “third-party” basis, we are now primarily responsible for holding and accounting for e-Grocery’s inventory. We also rely on the timely delivery of quality produce and other food products from suppliers. Development of a grocery business requires significant start-up expenses, particularly for acquiring or leasing real estate for our dark stores. Due to our lack of experience in operating a “first-party” model, as well as risks inherent in the grocery business, we may not be able to replicate the profitability and growth in e-Grocery as we have in our other businesses. The grocery industry is generally characterized by relatively low profit margins.

In addition, the development of our e-Grocery business may prove more expensive than we currently anticipate, and we may not succeed in increasing its revenue and the number of purchases, if at all, in an amount sufficient to offset our expenses and to maintain profitability. As the online or digital grocery market in Kazakhstan is still nascent, it may be difficult to predict the size and growth rate of our target market and customer demand for our e-Grocery products or encourage customers to move away from more traditional in-store food shopping. Given the different profitability model of the e-Grocery business, we expect a reduction in the profit margin of our Marketplace Platform. If the revenue attributable to our e-Grocery operations does not grow over the long term, the e-Grocery business may fail to achieve and maintain profitability, and our business, financial condition, results of operations and cash flows may be materially adversely affected.

Our business relies on merchants selling their products on our platforms, and we may be unable to partner with sufficient new merchants or maintain relationships with our existing merchant partners.

We derive a significant and growing portion of our revenue from fees through our Marketplace, and revenue generated from our Payments and Fintech businesses relies on merchants offering and selling their products and services on our platforms and Super Apps. As of December 31, 2023, we had approximately 581,000 Active Merchants. We attempt to engage and retain our merchant partners by offering them additional functionality, products and services so they can reach more consumers. If our attempts to attract and retain merchants are not

(11) |

successful or if our merchants reduce their usage of our platforms, our business, financial condition, results of operations and cash flows may be materially adversely affected.

Our business depends on consumers’ consumption and income levels.

The mass-market online payments, marketplace, fintech and e-grocery industries in Kazakhstan in which we operate are highly dependent on economic stability and growth, continuing increases in consumers’ average disposable income and levels of consumer spending. Demand for the products and services offered on our platforms and through our Super Apps may decrease if there is a deterioration in the future performance of Kazakhstan’s economy or any stagnation or reduction in levels of personal income, individual purchasing power or consumer confidence in Kazakhstan. Consumer spending habits are affected by, among other things, levels of employment, salaries, consumer confidence and perception of economic conditions, inflation, prevailing interest rates, income tax rates, consumer debt levels, housing and utilities costs and consumer aspirations.

During periods of economic stagnation or decline, consumers tend to become more price-sensitive, which may lead to a decrease in demand for our products and services. The Kazakhstan economy has faced, and might face in the future, challenges, primarily due to the decline in prices of oil and other commodities which are principal exports and important drivers of its economy, as well as the effects of any downturns in the economies of the country’s key trading partners, including Russia or China. See “Item 3. Key Information—D. Risk Factors—Risks Relating to Kazakhstan—Kazakhstan is heavily dependent upon export trade and commodity prices.” These factors have also contributed to the volatility of the tenge. See “Item 3. Key Information—D. Risk Factors—Risks Relating to Kazakhstan—Exchange rate fluctuations could have a material adverse effect on our ,business, financial condition, results of operations and cash flows.”

According to Qazstat, Kazakhstan’s GDP grew by 4.3% in 2021, 3.2% in 2022 and approximately 5.1% in 2023. According to the NBK, annual consumer price inflation for the years ended December 31, 2023, 2022 and 2021 was 9.8%, 20.3% and 8.4%, respectively. A further period of sustained inflation, coupled with high interest rates, or any other deterioration of Kazakhstan’s economy, could lead to a reduction in levels of personal income, individual purchasing power or consumer confidence, weakening consumer spending and savings and increasing insolvencies. As a result, the size of operations within our platforms may grow at a slower rate or even decrease, resulting in a slowdown or decrease in all or any sources of revenue (interest, fee and retail revenue), which could have a material adverse effect on our ,business, financial condition, results of operations and cash flows.

With the introduction of a new Citizens Bankruptcy Law in December 2022, which for the first time introduced the concept of bankruptcy of individuals that are not individual entrepreneurs, any reduction in levels of personal income and savings can lead to an increasing number of individuals being unable to repay the loans and being declared bankrupt. As a result, Kaspi Bank may become exposed to significant debt write-offs in the future and may not be able to attract consumer borrowings from such individuals within five years following the declaration of such individuals’ bankruptcy. See “Item 4. Information on the Company—B. Business Overview—Regulation—Bankruptcy of Individuals.”

We may fail to effectively manage the growth of our business and operations.

Our business has grown rapidly and significantly in recent years as we have evolved from a banking services provider in Kazakhstan to a unique two-sided Super App business model. Because of the significant growth in our operations, our exposure to business risks has increased. This growth will continue to require improved monitoring and control procedures with respect to our operations, as well as continued investment in our financial and information management systems, recruitment and training of employees, marketing, monitoring of the consistency of customer service and increased operational costs. In addition, overall growth in our business requires greater allocation of management resources away from day-to-day operations and may create significant operational challenges, including the ability of our information technology systems to adequately handle the rate of growth of operations, the ability to design, implement and follow appropriate risk management procedures in respect of a much larger volume of operations, an increased variety of offered products and the ability to properly monitor our financial performance. Similarly, our future growth may also depend on our ability to grow our other businesses, including those businesses we have acquired or invested in and new business initiatives we may explore in the future. In particular, we face risks associated with expanding into industries in which we have limited experience, including e-Grocery (see “Item 3. Key Information—D. Risk Factors—Our ‘first-party’ e-Grocery operations are new to our business, and we may fail to successfully execute the new business model and reach sustained profitability of the e-Grocery operations”). Any failure to manage our growth while at the same time maintaining adequate focus

(12) |

on our existing operating segments may have a material adverse effect on our ,business, financial condition, results of operations and cash flows.

Growth opportunities may also involve expansion into international markets, which carries the risk of increased expenses to manage market, legal, regulatory, taxation and operational burdens. See “Item 3. Key Information—D. Risk Factors—Acquisitions, strategic alliances and investments may be difficult to integrate and may not generate the expected return on our investment.” Such limitations in growth could materially adversely affect our business, financial condition, results of operations and cash flows.

We face credit, liquidity and market risks.

Credit risk

We are exposed to credit risk, which is the risk that a customer will be unable to pay amounts in full when due. Our credit risk exposure arises primarily from our consumer finance, merchant finance and micro business finance through our Fintech Platform. To manage credit risk during loan origination, we centralized all processes related to decision-making, verification and accounting through our headquarters. We have developed an automated, centralized and big data-driven proprietary loan approval process that enables us to make instant credit decisions. The risk management department is responsible for maintaining scoring models and the decision-making process. The quality of approved loans is monitored by the risk management department on a day-to-day basis with periodic validation of the models. As of December 31, 2023, 2022 and 2021, NPLs represented 5.5%, 6.3% and 4.7%, respectively, of our loan portfolio.

However, the scoring techniques and checks used by us to evaluate the creditworthiness of applicants for our loan products may not always present a complete and accurate picture of each customer’s financial condition or be able to accurately evaluate the impact of various changes. Such changes may include changes in the macroeconomic environment, which could significantly and quickly alter a customer’s financial profile. For example, our proprietary and highly adaptable scoring model and our regular access to data from credit bureaus, which allows us to assess the credit quality of our potential and current customers, cannot always accurately ascertain what the current indebtedness of any particular current or potential customer may be. Additionally, we have no tools to prevent our customers from taking an additional loan from other financial institutions or otherwise taking steps that heighten the risk that a customer may default on a loan from us. As a result, we may not always be able to correctly evaluate the current financial condition of each prospective customer and accurately determine the ability of our customers to repay their loans, which will result in increased loan losses.

There can be no guarantee that our risk management strategies will protect us from increased levels of Cost of Risk and NPLs, particularly when confronted with risks that we did not identify or anticipate from our existing portfolio. There can be no assurance that our current level of loan recovery will be maintained in the future and any failure to accurately assess the credit risk of potential borrowers or acceptance of a higher degree of credit risk in the course of lending operations may result in a deterioration of our loan portfolio and a corresponding increase in loan impairments, which would have a material adverse effect on our business, financial conditions or results of operations.

In addition, the vast majority of our loan portfolio is unsecured. While we have no significant industry or single borrower concentrations in our loan portfolio, in the event of defaults by a sizable number of borrowers due to, for example, an economic downturn, we may be unable to recover a significant proportion of the balance of such loans, which may have a material adverse effect on our business, financial conditions or results of operations.

Liquidity risk

We are exposed to liquidity risk arising out of the mismatches between the maturities of our assets and liabilities, which may result in us being unable to meet our obligations in a timely manner. We are exposed to daily calls on our available cash resources from current accounts, maturing deposits and loan drawdowns. Although a significant portion of our customer accounts (80% as of December 31, 2023) are held in term deposits, our customers have a right to withdraw their term deposits prior to maturity. We do not maintain cash resources to meet all of these needs as experience shows that a minimum level of rollover of maturing funds can be predicted with a high level of certainty. We calculate and monitor liquidity ratios on a daily basis in accordance with the NBK’s requirements.

(13) |

We meet a significant portion of our funding requirements using customer accounts (primarily deposits from retail customers), which increased to ₸5,441,456 million as of December 31, 2023 from ₸4,000,690 million as of December 31, 2022 and ₸2,763,043 million as of December 31, 2021. Over the past several years, we have primarily relied on funding from our retail customers’ deposits and current accounts. As of December 31, 2023, our retail customers’ term deposits and current accounts represented 79% and 15%, respectively of our total customer accounts (76% and 18%, respectively, of our total customer accounts as of December 31, 2022). Any unexpected and significant withdrawal of deposits may impact our ability to meet our funding requirements. The other portion of funding is primarily provided through the placement of local bonds (debt securities issued) and subordinated debt, which amounted to 2.8% and 4.8% of total liabilities as of December 31, 2023 and December 31, 2022, respectively. Any deterioration in our credit ratings could undermine confidence in us and limit our access to capital markets, which could require us to seek alternative, more expensive sources of funding.

Furthermore, our customers may be susceptible to the deliberate spread of rumors or false information about our financial condition and state of our business. In the past, there have been several occasions on which misleading information regarding the instability of certain Kazakhstan banks, including Kaspi Bank, was circulated on the Internet. For example, in February 2014, retail customers were alarmed by rumors and temporary instability in Kazakhstan’s financial sector as a result of a significant devaluation of the tenge, which resulted in deposit withdrawals in Kaspi Bank. While this particular event had no material adverse effect on us, any dissemination of false information or rumors and resulting significant withdrawals of deposits may have a material adverse effect on the stability of our deposit base and may cause significant outflow of deposits.

Therefore, should any sources of short and, in particular, long-term funding become unexpectedly unavailable, or if maturity mismatches between our assets and liabilities occur, or if we are required to increase the interest rates on deposits to attract funding, particularly in light of a shortage of liquidity due to unfavorable economic conditions, this may result in liquidity gaps that we may not be able to cover without incurring additional expenses, if at all. Any inability to meet our liquidity needs in these circumstances could lead to a material adverse effect on the development of our business, financial condition, results of operations and cash flows in the longer term.

Market risk

We have exposure to interest rate risk resulting from movements in market interest rates that affect income, expense or the value of financial instruments. For example, instruments on both the asset and liability side may exhibit different sensitivities to changes in interest rates, including changes in long-term and short-term interest rates relative to one another. In 2022, higher than normal interest rates directly contributed to declining profitability in the Fintech segment of our business. While we consistently monitor interest rate fluctuations and our asset-liability tenors in order to mitigate such interest rate risk, any significant interest rate movement on either domestic or international markets may have a material adverse effect on our ,business, financial condition, results of operations and cash flows.

Our assets and liabilities are denominated in several currencies, with the majority of assets (loans to customers) and liabilities (customer accounts) denominated in tenge, although a portion of deposits are denominated in foreign currencies, principally the U.S. dollar. Foreign currency risk arises when the actual or forecasted assets in a foreign currency are either greater or less than the liabilities in that currency. In order to manage foreign currency risk, our treasury function controls open foreign currency positions on a daily basis and uses derivative instruments to reduce the risk exposure. We enter into a variety of derivative financial instruments to manage our exposure to interest rate and foreign exchange rate risk, including foreign exchange forward contracts, interest rate swaps and cross currency swaps. All derivative financial instruments are classified as held for trading, measured at fair value through profit or loss and are not designated for hedge accounting. Any significant volatility in the money market or material exchange rate fluctuations may have a material adverse effect on our ,business, financial condition, results of operations and cash flows.

Our securities portfolio (which predominantly comprises Kazakhstan government debt securities and quasi-government debt securities, representing 94% and 99% of total investment securities and derivatives as of December 31, 2023 and December 31, 2022, respectively) is subject to fluctuations in the value of financial instruments caused by changes in market prices, whether caused by factors specific to the individual instrument or factors affecting all instruments traded in the market. Interest rate and price movements on both domestic and international markets may (including as a result of any downgrade in Kazakhstan’s sovereign credit ratings) affect the value of our securities portfolio, which in turn may have a material adverse effect on our business, financial condition, results of operations and cash flows.

(14) |

Adverse developments affecting the financial services industry, such as actual events or concerns involving liquidity, defaults or non-performance by financial institutions or transactional counterparties, could have a material adverse effect on our business, financial condition, results of operations and cash flows.

Our banking activities comprise a significant part of our business. For the year ended December 31, 2023 and the year ended December 31, 2022, our Fintech segment generated 34% and 40% of our net income, respectively. Actual events involving limited liquidity, defaults, non-performance or other adverse developments that affect financial institutions, transactional counterparties or other companies in the financial services industry or the financial services industry generally, or concerns or rumors about any events of these kinds or other similar risks, have in the past and may in the future lead to market-wide liquidity problems.

In 2023, several U.S. banks were placed into receivership or closed, including Silicon Valley Bank, Signature Bank and First Republic Bank. Similarly, on March 19, 2023, UBS agreed to purchase Credit Suisse, following the withdrawal of deposits with Credit Suisse worth $75.2 billion in the first three months of 2023. While we held no deposits or securities with SVB, Signature Bank, First Republic Bank or Credit Suisse at the time each was placed into receivership or closed (or, in the case of Credit Suisse, purchased), defaults by such institutions have led to weakened market conditions and have limited global liquidity. This may adversely impact merchants on our platforms who are exposed to global market conditions, and any such decline in engagement from merchants may lead to lower consumer interaction, which could have a material adverse effect on our ,business, financial condition, results of operations and cash flows. In addition, concerns regarding the United States or international financial systems could result in our retail customers withdrawing their deposits they hold with us or enhanced regulatory oversight of financial institutions such as Kaspi Bank (see “Item 3. Key Information—D. Risk Factors—We face credit, liquidity and market risks”), which may have a material adverse effect on our business, financial condition, results of operations and cash flows.

Although we assess our banking and customer relationships as we believe necessary or appropriate, our business and results of operations, as well as our access to funding sources and other credit arrangements in amounts adequate to finance or capitalize our current and projected future business operations, could be significantly impaired by factors that affect us or the financial services industry or economy in general. These factors could include, among others, events such as liquidity constraints or failures, the ability to perform obligations under various types of financial, credit or liquidity agreements or arrangements, disruptions or instability in the financial services industry or financial markets, or concerns or negative expectations about the prospects for companies in the financial services industry. The results of events or concerns that involve one or more of these factors could include a variety of material adverse effects on our ,business, financial condition, results of operations and cash flows.

Any harm to our brand or failure to maintain the trusted status of our platforms and Super Apps may limit our future growth and adversely affect our business.

We have built our business on consumer and merchant confidence, based on a strong brand name and reputation for our Super Apps in Kazakhstan. Any loss of trust in our business could affect our reputation and brand, and may result in consumers, merchants, brands and other counterparties reducing their activity on our platforms, which could in turn adversely affect our revenues. Our ability to maintain our position as a business used by people in Kazakhstan for all aspects of their day-to-day spending relies, among other things, on:

(15) |

Our management believes that the brand identity that we have developed through the strength of our platforms and customer focus has significantly contributed to the success of our business. We also believe that maintaining and enhancing our brand is critical to expanding our consumer base, network of merchants and other business partners. Maintaining and enhancing our brand will largely depend on our ability to maintain our status as an industry leader (including by maintaining relationships with merchants) and a provider of high-quality and reliable services. If we fail to maintain and enhance the trusted status of our platforms and Super Apps and the strength of our brand, our business, financial condition, results of operations and cash flows could be materially adversely affected.

Customer complaints or negative publicity about us could also diminish consumer confidence in our services and our reputation with customers. The significant scale of our business heightens the need for prompt and attentive customer service to resolve irregularities or customer dissatisfaction. In our e-Commerce business, our merchants primarily manage customer issues and complaints directly with the customer, and if they do not do so to the satisfaction of customers, our brand and reputation may be adversely affected. From time to time, we may also be the target of incomplete, inaccurate and misleading or false statements about our company and our business that could damage our brand and deter customers from using our Super Apps. Our reputation may be affected by instances of misconduct by our employees, as well as employees’ failure to comply with our compliance procedures and any applicable legislative requirements. In addition, any significant problems with collection practices employed by external collection agencies, to which we outsource collections of our NPLs, could also adversely affect our reputation and brand. Our reputation may also be affected by events beyond our control. For example, in June 2023, a man took several of our employees hostage in one of our bank offices in Astana. While the crisis was resolved with no casualties and the hostages were successfully released by the police, any adverse press reports on this or similar events may harm our brand and customer confidence in us. If we are unable to handle customer complaints or negative publicity effectively, our reputation may suffer and we may lose customers’ confidence, which could have a material adverse effect on our ,business, financial condition, results of operations and cash flows.

We depend upon talented employees, including our senior management, to grow, operate and improve our business. If we are unable to retain and motivate our personnel and attract new talent, or to maintain our corporate culture, we may not be able to achieve our strategic objectives.

Our ability to maintain our competitive position and to implement our business strategy is dependent on the skills and abilities of our senior management team. Our business has significantly benefited in the past from the vision and contributions of a small number of our key senior managers. In particular, Mr. Mikheil Lomtadze, the chairman of our management board and our significant shareholder, has been crucial to the development of our culture and strategic direction. Competition in Kazakhstan’s technology and financial industries for personnel with relevant expertise is intense due to the relatively small number of available qualified individuals. Further increases in competition may lead to difficulties in recruiting and retaining qualified and experienced employees, including increased costs of salaries and bonuses, as well as a greater length of time taken to identify and recruit such employees or increased costs of recruitment. In order to attract and recruit qualified and experienced employees and minimize the possibility of their departure to other companies, we provide packages of compensation and non-financial incentives that are consistent with the evolving standards in Kazakhstan’s labor market. The loss of or diminution in the services of members of our senior management team, or an inability to retain and attract additional senior management personnel, may impair our ability to achieve our strategic objectives.

Our management also believes that a critical contributing factor to our success has been our corporate culture, which values and fosters teamwork and innovation. If we do not maintain the beneficial aspects of our corporate culture as we grow and implement more complex organization management structures, this would adversely affect our business, financial condition, results of operations and cash flows.

(16) |

If adoption of online or mobile device payment methods does not continue to increase and consumption patterns do not change as anticipated, our ability to expand could be affected.

The growth of our business, as well as the development of the mass-market online payments, e-commerce, fintech and e-grocery industries in Kazakhstan in which we operate, largely depends on the development of online and mobile consumption patterns and wider consumer understanding and continued acceptance of products offered online and of new products and solutions that we intend to offer, primarily through our Super Apps. The level of adoption of financial, e-commerce and e-grocery services offered through mobile applications and online in Kazakhstan is relatively low compared to those in more developed countries. As part of our strategy, we focus on increasing user engagement in our Super Apps, which integrate all products and services offered by us. Our ability to expand our operations, however, may be affected if the adoption of online or mobile device payment methods does not grow, if online and mobile consumption patterns do not further develop or if we are unable to attract a significant number of new mobile customers and increase levels of mobile engagement.

If we fail to keep pace with rapid technological developments to provide innovative services, our business may be adversely affected.

Our future success will depend on our ability to keep pace with the evolving needs of our customers and the evolution of our industry on a timely and cost-effective basis and to pursue new market opportunities that develop as a result of technological advances. In addition to our own innovations, we rely in part on third parties for the development of, and access to, modern technologies. Any rapid and significant technological developments, including developments in mobile technologies, authentication, virtual currencies and distributed ledger technologies, near-field communication and other proximity payment devices such as contactless payments, may result in the emergence of technologies superior to those currently employed by us and render our technologies obsolete. Developing and incorporating innovative technologies into our business may require substantial expenditure, take considerable time or ultimately may not be successful.

In particular, we face risks related to the development and implementation of our AI and machine learning capabilities, which are foundational to our AI virtual assistance, risk management models and user experience personalization across our products and services. As with many developing technologies, AI presents risks and challenges that could affect its further development, adoption, and use, and therefore our business. AI algorithms may be flawed, datasets may be insufficient, of poor quality, or contain biased information. Inappropriate or controversial data practices by data scientists, engineers, and end-users of our systems could impair the acceptance of AI solutions. If the recommendations or analyses that AI applications assist in producing are deficient or inaccurate, we could be subjected to competitive harm, potential legal liability, and brand or reputational harm. Furthermore, local and international laws and regulations regarding the use of AI may adversely impact our ability to use, develop, or implement our AI solutions.

We may not be able to implement changes to our systems and operations necessary to capitalize on our future growth opportunities.

Our anticipated future growth will depend, to a significant degree, on the ability of our executive officers and other members of senior management to operate effectively, our ability to further improve and develop our financial and management information systems, controls and procedures and our ability to anticipate and implement competitive product and service offerings to continue to attract customers to our platforms and increase the number of transactions made by our customers on our platforms and through our Super Apps. We expect to have to adapt our existing systems and introduce new systems to cater to the increasing sophistication of the consumer financial services market, evolving fraud and information security landscape, and regulatory developments relating to existing and projected business activities, train and manage our employees and improve and expand our marketing capabilities. Further, as we grow, our business becomes increasingly complex. To effectively manage and capitalize on our growth, we must continue to focus on innovative product and service developments. Our continued growth could strain our existing resources, and we could experience ongoing operating difficulties in managing our business, including difficulties in hiring, training and managing our employee base. Continued growth could also strain our ability to maintain the quality and reliability of our platforms, products and services, impact development and improvement of our operational, financial, legal and management controls and enhance our reporting systems and procedures. If we are unable to successfully implement necessary changes to our systems and operations as we continue to grow, our ,business, financial condition, results of operations and cash flows could be materially adversely affected.

(17) |

We rely on third-party providers, including software and hardware suppliers, delivery services, credit bureaus and debt collection agencies. Any adverse changes in these relationships could adversely affect our business, financial condition, results of operations and cash flows.

In carrying out our operations, we rely on a variety of third-party services. Our technology infrastructure and services incorporate software, systems and technologies developed by third parties, as well as hardware purchased or commissioned from third-party suppliers. As our technology infrastructure and services expand and become increasingly complex, we face increased risks relating to the performance and security of our technology, including risks relating to incompatibility of the components produced by third parties, as well as service failures or delays or back-end procedures on hardware and software. Additionally, we grant certain third-party providers limited access to certain data in our systems at their request to effectively operate our business, which may pose additional security risks and challenges in protecting our technology infrastructure. Although we vet our third-party providers and contractually require them to implement reasonable cybersecurity controls, a compromise of their systems could have an adverse impact on our ability to operate and expose data that we have provided them. We cannot provide assurance that the contractual requirements related to the use, security and privacy regarding the information technology assets (and the data thereon) that we impose on our third-party suppliers will be followed or will be adequate to prevent misuse. Any misuse, compromise, or failure to adequately abide by these contractual requirements could result in liability, protracted and costly litigation and, with respect to misuse of personal information of our customers, lost revenue and reputational harm.

We also rely on facilities, components and services supplied by third parties, including data center facilities. For example, we depend on third parties in connection with our risk management processes, including external data from credit bureaus in Kazakhstan and the Kazakhstan State Pension Payment Center (the “Pension Center”) to perform credit assessments. As such, any risks related to the interruption of such credit bureaus’ or the Pension Center’s operations, the accuracy of the data kept thereby and the availability of such data generally, may impact our consumer finance origination process. Furthermore, as part of our debt collection process, we outsource certain debt collection functions to third-party debt collection agencies, which collect up to 65% of our NPLs, and any interruption in the operations of such agencies could negatively impact our debt collection efforts or increase the cost of debt collection services and cost of risk. If these third parties cease to provide the facilities or services, experience operational interference or disruptions, breach their agreements with us, fail to perform their obligations or meet our expectations, do not renew their licenses or otherwise cease to make their services or products available at a reasonable cost or at all, our operations could be disrupted or otherwise adversely impacted, which in turn could result in a material adverse effect on our ,business, financial condition, results of operations and cash flows.

Interruptions to, or failures in, third-party logistics and delivery services that we use to fulfill and deliver orders placed on our Kaspi.kz Super App could prevent the timely or proper delivery of products to our consumers, which would harm the reputation of our business. These interruptions may be due to events that are beyond our control or the control of the logistics and delivery companies that we use, such as inclement weather, natural disasters, transportation disruptions or labor unrest. These logistics and delivery services could also be affected or interrupted by industry consolidation, insolvency or government shut-downs. We may not be able to find alternative logistics and delivery companies to provide logistics and delivery services in a timely and reliable manner or at all. If the products sold on our Marketplace Platform are not delivered in proper condition or on a timely basis, our business, financial condition, results of operations and cash flows could be materially adversely affected.

Our business is subject to competition. We may fail to compete successfully against existing or new competitors, which may reduce demand for our services, reduce operating margins and result in loss of market share, departures of qualified employees and increased capital expenditures.

Our Payments Platform competes with foreign and domestic payment service providers and with retail banks (both domestic banks and subsidiaries of foreign banks) that look to gain a competitive edge through contracts with merchants. Our Marketplace Platform competes with global marketplace platforms and online and offline retailers operating in Kazakhstan. Our Fintech Platform competes with retail banks (both domestic banks and subsidiaries of foreign banks) that seek to differentiate themselves by offering retail deposits and consumer loans through their branch networks and points of sale at stores and shopping centers.

Some of our competitors may have longer operating histories or greater merchant bases, experience, scale and resources, which may provide them with competitive advantages, including more established relationships with customers. They may devote greater resources to the development, promotion, sale of products and services in the areas in which we operate, and they may offer lower prices or more effectively introduce and market their own innovative products and services that may in turn adversely impact our growth. Mergers and acquisitions by our

(18) |

competitors may lead to the emergence of even larger competitors with greater resources. Competing services tied to established brands might engender greater confidence in the quality and efficacy of their services relative to those offered by us. Any initiatives undertaken by the NBK to enhance the efficiency and decrease the costs of financial services may also increase competition. Furthermore, changes in the legal or regulatory framework in Kazakhstan relating to the industries in which we operate (such as the establishment of a “Sunqar” fast payment system) may increase the number of competitors or may more positively impact our competitors as compared to us, either of which could diminish our competitive advantage, which could have a material adverse effect on our ,business, financial condition, results of operations and cash flows.

The largest merchants that currently sell goods through our Marketplace Platform may decide, for any reason (including commercial considerations), to collectively negotiate the level of fees that we charge, or they may establish a separate marketplace. In addition, emerging start-ups may be able to innovate and provide some of the products and services faster than we can.

If our customers move to our competitors for any reason, including due to the pricing or terms of any such competitors’ products, or due to our inability to continue developing and providing our customers with high-quality and up-to-date services or to appropriately coordinate our services with market opportunities, it may become less attractive to merchants and other business partners, which could have a material adverse effect on our business, financial condition, results of operations and cash flows.

Our platforms may be used for fraudulent, illegal or improper purposes.

Despite measures we have taken and continue to take, our platforms remain susceptible to potentially illegal or improper uses. These may include use of our platforms (in particular, Payments or Marketplace) in connection with fraudulent or counterfeited sales of goods or bank fraud, which are becoming increasingly sophisticated. There can be no assurance that measures implemented by us, which are aimed at preventing our business from being used as a vehicle for money laundering, fraud or other illegal activities, will effectively identify, monitor and manage these risks, and that no incidents of fraud or other illegal activities will occur in the future. We cannot monitor with absolute certainty the sources of customers’ or counterparties’ funds or the ways in which they use them. In addition, an increase in fraudulent transactions could harm our reputation and reduce customer confidence in the use of our platforms or lead to regulatory intervention, which could require us to take steps to reduce fraud risk leading to an increase in our costs.

In addition, we may be subject to allegations and lawsuits claiming that items listed on our Marketplace Platform are pirated, counterfeit or illegal. The measures adopted by us to verify the authenticity of products sold on our Marketplace Platform and minimize the risk of any potential infringement of third-party intellectual property rights may not be successful. For example, in order for a merchant to become a participant of our Marketplace Platform, we and the merchant sign an agreement whereby the merchant accepts the rules of our Marketplace Platform and represents to us that any product sold through our Marketplace Platform has been certified for sale by applicable laws. While we generally do not act as seller, we may become subject to allegations of civil or criminal liability for unlawful activities carried out by third parties through our Marketplace Platform. In the event that alleged counterfeit, infringing or pirated products are listed or sold on our platforms, we could face claims for such listings, sales or alleged infringement or for the failure to act in a timely or effective manner to restrict or limit such sales or infringement. A merchant whose content is removed or services are suspended or terminated, regardless of our compliance with the applicable laws, may dispute our actions and commence an action against us for damages based on breach of contract or other causes of action or may make public complaints or allegations against us.

Continued public perception that counterfeit or pirated items are commonplace on our Marketplace Platform, perceived delays in the removal of these items, even if factually incorrect, or an increase in fraudulent transactions on our platforms could damage our reputation, reduce consumer confidence in the use of our platforms, result in lower list prices for goods sold through our Marketplace Platform and have a material adverse effect on our business, financial condition, results of operations and cash flows.

(19) |

Acquisitions, strategic alliances and investments may be difficult to integrate and may not generate the expected return on our investment.

We may enter into select strategic alliances and potential strategic acquisitions that are complementary to our business and operations, including opportunities that can help us further improve our technology system. For example, we recently acquired a 90.01% share of Magnum E-commerce Kazakhstan, our e-Grocery subsidiary. These acquisitions and strategic alliances with third parties could subject us to a number of risks, including risks associated with sharing proprietary information, non-performance or default by counterparties and increased expenses in establishing these new alliances, any of which may have a material adverse effect on our business, financial condition, results of operations and cash flows. We may have limited ability to control or monitor the actions of our strategic partners. To the extent a strategic partner suffers any negative publicity as a result of its business operations, our reputation may be negatively affected by virtue of our association with such party.

Strategic acquisitions and subsequent integrations of newly acquired businesses would require significant managerial and financial resources and could result in a diversion of resources from our existing business. Acquired businesses or assets may not generate expected financial results, integration opportunities, synergies and other benefits immediately, or at all, and may incur losses. Additionally, we may face operational and structural challenges in integrating IT systems, retaining relationships with key employees of acquired businesses, and increased regulatory and compliance requirements. The cost and duration of integrating newly acquired businesses could also materially exceed our expectations, which could negatively affect our results of operations.

In light of our strategy to extend our geographical reach, these risks may be more likely to occur if we pursue strategic alliances and acquisitions in markets outside Kazakhstan and Azerbaijan. Further, as our business is technology driven, we will require a high level of real-time technology integration for efficient operations, customized and developed for the regions in which we may plan to operate. Our inability to obtain such technology in a timely manner and at the envisaged cost may have a material adverse effect on our business, financial condition, results of operations and cash flows. Our operations outside of Kazakhstan may also be subject to local political, economic and other risks that may impact our businesses there. We have operated in Azerbaijan since 2019 and intend to continue to explore international opportunities across Central Asia, the Caucasus region, and Central and Eastern Europe, as well as other select markets. In October 2021, we acquired 100% of Portmone Group, a payments company operating in Ukraine, although it represented only 0.1% of our total assets as of December 31, 2023 and 0.05% of our net income for the year ended December 31, 2023.

We may further incur reputational or financial losses in resolving outstanding litigations, contractual liabilities or financial indebtedness we inherit from our acquisitions, strategic alliances and investments. If any of such challenges are not resolved in our favor, we could lose opportunities in strategic acquisitions and alliances, which could have a material adverse effect on our business, financial condition, results of operations and cash flows.

Systems failures and resulting interruptions in the availability of our platforms and Super Apps could affect our business.