UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

OR

For

the fiscal year ended

OR

OR

For the transition period from to

Commission

file number:

(Exact name of Registrant as specified in its charter)

(Jurisdiction of incorporation or organization)

#09-13/14/15/16/17

(Address of principal executive offices)

#09-13/14/15/16/17

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate

the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered

by the annual report:

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

☐

Yes ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

☐

Yes ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

☒

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | ☒ | |

| Accelerated filer | ☐ | Emerging growth company |

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided

pursuant to Section 13(a) of the Exchange Act.

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report.

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☐ | as issued | Other ☐ | ||

| by the International Accounting Standards Board ☒ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities Exchange Act of 1934).

☐

Yes

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

☐ Yes ☐ No

Table of Contents

i

INTRODUCTION

Except where the context otherwise requires and for purposes of this annual report only the term:

“Amended and Restated Memorandum of Association” means the amended and restated memorandum of association of our Company as amended and restated by a resolution of shareholders passed on July 24, 2023 and as amended and or restated (as the case may be) from time to time.

“Amended and Restated Articles of Association” means the amended and restated articles of association of our Company as amended and restated by a resolution of shareholders passed on July 24, 2023, as amended and / or restated (as the case may be) from time to time.

“Amended and Restated Memorandum and Articles of Association” means, collectively, the Amended and Restated Memorandum of Association and the Amended and Restated Articles of Association.

“BCA” means Building and Construction Authority of Singapore.

“Business Day” means a day (other than a Saturday, Sunday, or public holiday in the U.S.) on which licensed banks in the U.S. are generally open for normal business to the public.

“BVI” means the British Virgin Islands.

“CAGR” means compound annual growth rate.

“Class A Shares” means a class of shares of the Company with no par value and entitled to one (1) vote per share.

“Class B Shares” means a class of shares of the Company with no par value and entitled to twenty (20) votes per share.

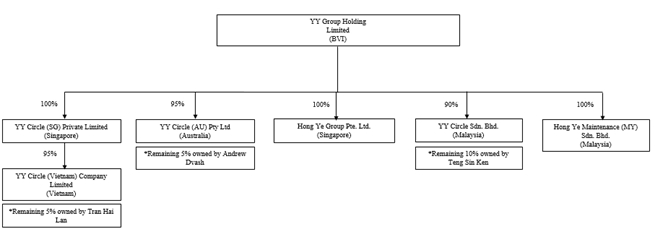

“Company” or “our Company” means YY Group Holding Limited, a company incorporated in the BVI on February 21, 2023.

“Companies Act” means the BVI Business Companies Act, 2004 (as amended) of the BVI.

“COVID-19” means the novel coronavirus, SARS-CoV-2 or COVID-19 (and all related strains and sequences), including any intensification, resurgence or any variants, evolutions or mutations thereof, and/or related or associated epidemics, pandemics, disease outbreaks or public health emergencies.

ii

“Directors” means the directors of our Company as at the date of this annual report, unless otherwise stated.

“Exchange Act” means the United States Securities Exchange Act of 1934, as amended.

“Executive Directors” means the executive Directors of our Company as at the date of this annual report, unless otherwise stated.

“Executive Officers” means the executive officers of our Company as at the date of this annual report, unless otherwise stated.

“Group,” “our Group,” “we,” “us,” or “our” means our Company and its subsidiaries or any of them, or where the context so requires, in respect of the period before our Company becoming the holding company of its present subsidiaries, such subsidiaries as if they were subsidiaries of our Company at the relevant time or the businesses which have since been acquired or carried on by them or as the case may be their predecessors.

“GST” means the Goods and Services Tax chargeable pursuant to the Goods and Services Tax Act 1993 of Singapore.

“HDB” means the Housing & Development Board of Singapore.

“Hong Ye (SG)” means Hong Ye Group Pte. Ltd.

“Hong Ye (MY)” means Hong Ye (Maintenance) (MY) Sdn Bhd.

“HR” means human resources.

“HRO” means human resources outsourcing.

“Independent Directors” means the independent non-executive Directors of our Company as at the date of this annual report, unless otherwise stated.

“Independent Third Party” means a person or company who or which is independent of and is not a 5% owner of, does not control and is not controlled by or under common control with any 5% owner and is not the spouse or descendant (by birth or adoption) of any 5% owner of the Company.

“IMDA” means the Infocomm Media Development Authority of Singapore.

“IoT” means the Internet of Things.

“MAS” means the Monetary Authority of Singapore.

“MICE” means Meetings, Incentives, Conferences, and Exhibitions.

“MOM” means the Ministry of Manpower of Singapore.

“NEA” means the National Environmental Agency of Singapore.

“RM” means Malaysian ringgit, the lawful currency of Malaysia.

iii

“S$” or “SGD” or “Singapore Dollars” means Singapore dollar(s), the lawful currency of Singapore.

“SEC” or “Securities and Exchange Commission” means the United States Securities and Exchange Commission.

“Securities Act” means the U.S. Securities Act of 1933, as amended.

“SBF” means the Singapore Business Federation.

“Singapore Companies Act” means the Companies Act 1967 of Singapore, as amended, supplemented or modified from time to time.

“US$,” “$” or “USD” or “United States Dollars” means United States dollar(s), the lawful currency of the United States of America.

“VCQ” means V Capital Quantum Sdn Bhd is a subsidiary of VCI Global Limited, a Nasdaq listed company.

“WSH” means the Workplace Safety and Health Council of Singapore, a statutory body under the MOM.

“YY Circle (MY)” means YY Circle Sdn Bhd.

“YY Circle (SG)” means YY Circle (SG) Private Limited.

YY Group Holding Ltd is a holding company with operations conducted in Singapore and Malaysia through its operating subsidiaries in Singapore and Malaysia. Our reporting currency is the U.S. Dollar. This annual report also contains translations of certain foreign currency amounts into U.S. dollars for the convenience of the reader. Assets and liabilities denominated in foreign currencies are translated at year-end exchange rates, income statement accounts are translated at average rates of exchange for the year and equity is translated at historical exchange rates. Any translation gains or losses are recorded in foreign currency translation reserve. Gains or losses resulting from foreign currency transactions are included in net income. The conversion of Singapore dollars into U.S. dollars are based on the exchange rates set forth in the statistical release of Monetary Authority of Singapore (“MAS”). Unless otherwise stated, all translations of Singapore dollars into U.S. dollars were made at a month-end spot rate of S$1.3517 to US$1.00 or an average rate of S$1.3437 to US$1.00 for the financial year ended December 31, 2021 amounts, a month-end spot rate of S$1.3446 to US$1.00 or an average rate of S$1.3792 to US$1.00 for the financial year ended December 31, 2022 amounts and a month-end spot rate of S$1.3186 to US$1.00 or an average rate of S$1.3414 to US$1.00 for the financial year ended December 31, 2023 amounts, in accordance with our internal exchange rate. We make no representation that the Singapore dollar or U.S. dollar amounts referred to in this annual report could have been or could be converted into U.S. dollars or Singapore dollars, as the case may be, at any particular rate or at all.

We obtained the industry and market data used in this annual report or any document incorporated by reference from industry publications, research, surveys and studies conducted by third parties and our own internal estimates based on our management’s knowledge and experience in the markets in which we operate. We did not, directly or indirectly, sponsor or participate in the publication of such materials, and these materials are not incorporated in this annual report other than to the extent specifically cited in this annual report. We have sought to provide current information in this annual report and believe that the statistics provided in this annual report remain up-to-date and reliable, and these materials are not incorporated in this annual report other than to the extent specifically cited in this annual report.

iv

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

This annual report contains forward-looking statements that reflect our current expectations and views of future events, all of which are subject to risks and uncertainties. Forward-looking statements give our current expectations or forecasts of future events. You can identify these statements by the fact that they do not relate strictly to historical or current facts. You can find many (but not all) of these statements by the use of words such as “approximates,” “believes,” “hopes,” “expects,” “anticipates,” “estimates,” “projects,” “intends,” “plans,” “will,” “would,” “should,” “could,” “may” or other similar expressions in this annual report. These statements are likely to address our growth strategy, financial results and product and development programs. You must carefully consider any such statements and should understand that many factors could cause actual results to differ from our forward-looking statements. These factors may include inaccurate assumptions and a broad variety of other risks and uncertainties, including some that are known and some that are not. No forward-looking statement can be guaranteed and actual future results may vary materially. Factors that could cause actual results to differ from those discussed in the forward-looking statements include, but are not limited to:

| ● | our goals and strategies; | |

| ● | our future business development, financial condition and results of operations; | |

| ● | introduction of new product and service offerings; | |

| ● | expected changes in our revenues, costs or expenditures; | |

| ● | our expectations regarding the demand for and market acceptance of our products and services; | |

| ● | expected growth of our customers, including consolidated account customers; | |

| ● | competition in our industry; | |

| ● | government policies and regulations relating to our industry; | |

| ● | the length and severity of the recent COVID-19 outbreak and its impact on our business and industry | |

| ● | any recurrence of the COVID-19 pandemic and scope of related government orders and restrictions and the extent of the impact of the COVID-19 pandemic on the global economy; | |

| ● | other factors that may affect our financial condition, liquidity and results of operations; and | |

| ● | other risk factors discussed under “Item 3. Key Information — 3.D. Risk Factors.” |

We base our forward-looking statements on our management’s beliefs and assumptions based on information available to our management at the time the statements are made. We caution you that actual outcomes and results may, and are likely to, differ materially from what is expressed, implied or forecast by our forward-looking statements. Accordingly, you should be careful about relying on any forward-looking statements. Except as required under the federal securities laws, we do not have any intention or obligation to update publicly any forward-looking statements after the distribution of this annual report, whether as a result of new information, future events, changes in assumptions, or otherwise.

v

PART I

Item 1. Identity of Directors, Senior Management and Advisers

Not applicable for annual reports on Form 20-F.

Item 2. Offer Statistics and Expected Timetable

Not applicable for annual reports on Form 20-F.

Item 3. Key Information

3.A. Reserved

3.B. Capitalization and Indebtedness

Not applicable for annual reports on Form 20-F.

3.C. Reasons for the Offer and Use of Proceeds

Not applicable for annual reports on Form 20-F.

3.D. Risk Factors

Risk Factor Summary

You should carefully consider all of the information in this annual report before making an investment in our Ordinary Shares. Below please find a summary of the principal risks and uncertainties we face, organized under relevant headings. Our business is subject to a number of risks, including risks that may prevent us from achieving our business objectives or may adversely affect our business, financial condition, results of operations, cash flows, and prospects. These risks are discussed more fully below and include, but are not limited to, risks related to:

Risks related to Our Business and Industry

| ● | Our key customers for our manpower outsourcing and cleaning service businesses contribute to a significant portion of our revenues in each of these business segments. A non-renewal of these contracts could have a material adverse effect on our business, financial condition and results of operations (on page 4). |

| ● | We depend on a small number of individuals who constitute our current management (on page 4). |

| ● | Our industry is subject to extensive government regulation and the imposition of additional regulations could materially harm our future earnings (on page 4). |

| ● | We may not be able to maintain and/or obtain approvals, licenses, and registrations necessary to carry on or expand our business (on page 4). |

| ● | We may from time to time be subject to legal and regulatory proceedings and administrative investigations (on page 5). |

| ● | Misconduct and errors by our employees could harm our business and reputation (on page 5). |

| ● | We may incur employment related claims or other types of claims and costs that could materially harm our business (on page 5). |

| ● | We operate in a highly competitive industry and may be unable to retain customer or market share (on page 6). |

| ● | Our manpower outsourcing business model has a short cashflow conversion cycle (on page 6). |

| ● | Our business model and growth strategy depend on our ability to attract users to our online platform in a cost-effective manner (on page 6). |

1

| ● | We rely heavily on Internet search engines and mobile application stores to direct traffic to our website and our mobile application, respectively (on page 7). |

| ● | If we fail to adopt new technologies or adapt our platform and systems to changing user requirements or emerging industry standards, our business may be materially and adversely affected (on page 7). |

| ● | Our business generates and processes a large amount of consumer data, and the improper use, collection or disclosure of such data could subject us to significant reputational, financial, legal and operational consequences (on page 7). |

| ● | We may be unable to adequately protect our intellectual property and proprietary rights or if third parties assert that we infringe on their intellectual property rights, our business could suffer (on page 8). |

| ● | We rely on certain technology and software licensed from third parties (on page 8). |

| ● | Our technology, software and systems are highly complex and may contain undetected errors or vulnerabilities (on page 9). |

| ● | Errors or inaccuracies in our business data and algorithms may adversely affect our business decisions and the customer experience (on page 9). |

| ● | Our business and operations may be materially and adversely affected in the event of a re-occurrence or a prolonged global pandemic outbreak of COVID-19 (on page 9). |

| ● | Any adverse changes in the political, economic, legal, regulatory taxation or social conditions in the jurisdictions that we operate in or intend to expand our business may have a material adverse effect on our operations, financial performance and future growth (on page 10). |

| ● | We are exposed to risks arising from fluctuations of foreign currency exchange rates (on page 10). |

| ● | Our insurance policies may be inadequate to cover our assets, operations and any loss arising from business interruptions (on page 10). |

| ● | We are critically dependent on workers’ compensation insurance coverage at commercially reasonable terms, and unexpected changes in claim trends on our workers’ compensation may negatively impact our financial condition (on page 11). |

| ● | We may not be able to successfully implement our business strategies and future plans (on page 11). |

2

Risks related to our Securities

| ● | We may not maintain the listing of our Class A Shares on Nasdaq which could limit investors’ ability to make transactions in our Class A Shares and subject us to additional trading restrictions (page 11). | |

| ● | The trading price of our Class A Shares may be volatile, which could result in substantial losses to investors (page 12).

| |

| ● | If securities or industry analysts do not publish research or reports about our business, or if they adversely change their recommendations regarding our Class A Shares, the market price for our Class A Shares and trading volume could decline (page 12). | |

| ● | Because we do not expect to pay dividends in the foreseeable future, you must rely on price appreciation of our Class A Shares for a return on your investment. You may not realize a return on your investment in our shares and you may even lose your entire investment (page 13). | |

| ● | Short selling may drive down the market price of our Class A Shares (page 13).

| |

| ● | If we are classified as a passive foreign investment company, United States taxpayers who own our securities may have adverse United States federal income tax consequences (page 13). | |

| ● | Our controlling shareholder has substantial influence over the Company. Its interests may not be aligned with the interests of our other shareholders, and it could prevent or cause a change of control or other transactions (on page 14). | |

| ● | As a “controlled company” under the rules of Nasdaq Capital Market, we may choose to exempt our Company from certain corporate governance requirements that could have an adverse effect on our public shareholders (page 14). | |

| ● | As a company incorporated in the BVI, we are permitted to follow certain home country practices in relation to corporate governance matters in lieu of certain requirements under Nasdaq corporate governance listing rules. These practices may afford less protection to shareholders than they would enjoy if we complied fully with Nasdaq corporate governance listing standards (page 14). | |

| ● | You may face difficulties in protecting your interests, and your ability to protect your rights through U.S. courts may be limited, because we are incorporated under British Virgin Islands law (page 15). | |

| ● | Certain judgments obtained against us by our shareholders may not be enforceable (page 15). | |

| ● | We are an “emerging growth company” and the reduced disclosure requirements applicable to emerging growth companies may make our Class A Shares less attractive to investors (page 16). | |

| ● | We are a foreign private issuer within the meaning of the Exchange Act, and as such we are exempt from certain provisions applicable to United States domestic public companies (page 16). | |

| ● | We may lose our foreign private issuer status in the future, which could result in significant additional costs and expenses to us (page 16).

| |

| ● | Further issuances of Class B Shares may result in a dilution of the percentage ownership of the existing holders of Class A Ordinary Shares as a total proportion of Ordinary Shares in the Company (page 17). |

| ● |

Further issuances of Class A Shares pursuant to the 2023 Employee Share Incentive Plan (“ESIP”) may result in a dilution of the percentage ownership of the existing holders of Class A Ordinary Shares as a total proportion of Ordinary Shares in the Company (page 17).

| |

| ● |

As a company incorporated in the British Virgin Islands, we are permitted to follow certain home country practices in relation to corporate governance matters in lieu of certain requirements under the Nasdaq Capital Market listing standards. These practices may afford less protection to shareholders than they would enjoy if we complied fully with the Nasdaq Capital Market Listing standards (page 17).

| |

| ● | Our stock option plan may adversely impact our financial results, and, in turn, could adversely impact the trading price of our shares (page 17). |

| ● | We incur increased costs as a result of being a public company and will incur further costs after we cease to qualify as an emerging growth company (page 17). |

3

Risks Related to our Business and Industry

Our key customers for our manpower outsourcing and cleaning service businesses contribute to a significant portion of our revenues in each of these business segments. A non-renewal of these contracts could have a material adverse effect on our business, financial condition and results of operations.

Our key customers for our manpower outsourcing and cleaning service businesses contribute to a significant portion of our revenues in each of these business segments. For the fiscal years ended December 31, 2023, 2022, and 2021, our top five customers accounted for 35%, 24% and 30% of total revenue related to our manpower outsourcing services respectively. For the fiscal years ended December 31, 2023, 2022, and 2021, our top five customers accounted for 31%, 41% and 37% of total revenue related to our cleaning services respectively. Additionally, our business relationships with these key customers may be influenced by various factors beyond our control, such as changes in their business strategies, financial health, or industry dynamics. In the event that one or more of these customers were to face challenges or undergo structural changes that lead them to reassess their outsourcing and cleaning service needs, our revenue streams could be significantly disrupted should there be a non-renewal of these contracts. This could have a material adverse effect on our business, financial condition and results of operations.

We depend on a small number of individuals who constitute our current management.

We highly depend on the services of our senior management team and other key employees such as (i) Mr. Fu Xiaowei, (ii) Ms. Zhang Fan, (iii) Mr. Jason Phua Zhi Yong, (iv) Ms. Rachel Xu Lin Pu and (v) Mr. Teng Sin Ken at our corporate headquarters and on our management’s ability to recruit, retain, and motivate key employees. Competition for such employees can be intense, and the inability to attract and retain the additional qualified employees required to expand our activities, or the loss of current key employees including, without limitation, as a result of the COVID-19 pandemic, could adversely affect our operating efficiency and financial condition. In addition, our growth strategy may place strains on our management who may become distracted from day-to-day duties.

Our industry is subject to extensive government regulation and the imposition of additional regulations could materially harm our future earnings.

Our business is subject to extensive government regulation, particularly the cleaning segment of our business. We incur significant costs to comply with these regulations, and any changes to such regulations or the imposition of new regulations could affect our ability to be profitable. Additionally, if we fail to comply with government regulation, we could be subject to significant civil or criminal penalties which could jeopardize the continuance of our operations. Increases or changes in government regulation of the workplace, mandatory wage requirements, or of the employer-employee relationship, or judicial or administrative proceedings related to such regulation, could materially harm our business.

We may not be able to maintain and/or obtain approvals, licenses and registrations necessary to carry on or expand our business

We require certain approvals, licenses and registrations to conduct our business. Our applications for approvals, licenses and registrations are subject to review by the relevant government authorities. These approvals, licenses and registrations are also subject to periodic renewal by the relevant government authorities, and the standards of compliance may change. Accordingly, we are subject to the supervision of these authorities with the power to revoke, grant, to extend and amend our approvals, licenses and/or registrations.

While we have obtained all necessary approvals, licenses and registrations required for our business operations and have not encountered any instances of failure to obtain or renew any of our approvals, licenses and registrations, there is no guarantee that we will be able to do so in future or that we will be able to renew our existing approvals, licenses or registrations in a timely manner, or at all. Additionally, in the event we breach the conditions of our approvals, licenses, registrations or other government regulation or regulatory requirement, this will expose us to penalties or the risk that our approvals may be suspended, revoked or amended by the relevant government authority to our detriment. While there have not been any such incidents in the past, the occurrence of any of these events may be costly, require us to cease our business in whole or in part, cause us to default on our obligations to our customers and counterparties, harm our reputation or otherwise adversely affect our business, financial condition, and results of operations.

4

We may from time to time be subject to legal and regulatory proceedings and administrative investigations.

We may from time to time be subject to various legal and regulatory proceedings arising in the ordinary course of our business. Claims and complaints arising out of actual or alleged violations of laws and regulations could be asserted against us by contractors, customers, employees, ex-employees and other platforms, industry participants or governmental entities in administrative, civil or criminal investigations and proceedings or by other entities.

These investigations, claims and complaints could be initiated or asserted under or on the basis of a variety of laws in different jurisdictions, including intellectual property laws, unfair competition laws, anti-monopoly laws, data protection and privacy laws, labor and employment laws, securities laws, finance services laws, tort laws, contract laws and property laws. There is no guarantee that we will be successful in defending ourselves in legal and administrative actions or in asserting our rights under various laws. If we fail to defend ourselves in these actions, we may be subject to restrictions, fines or penalties that will materially and adversely affect our business, prospects, financial condition and results of operations. Even if we are successful in our defense, the process of communicating with relevant regulators, defending ourselves and enforcing our rights against the various parties involved may be expensive, time-consuming and ultimately futile. These actions could expose us to negative publicity, substantial monetary damages and legal defense costs, injunctive relief and criminal and civil fines and penalties, including but not limited to suspension or revocation of licenses to conduct business. Under such circumstances, our business, prospects, financial condition and results of operations would be negatively and adversely impacted.

Misconduct and errors by our employees could harm our business and reputation.

We operate in an industry in which integrity and the confidence of our users and customers are of critical importance. During our daily operations, we are subject to the risk of errors, misconduct and illegal activities by our employees including:

| ● | engaging in misrepresentation or fraudulent activities when marketing or performing our services to users and customers; |

| ● | improperly acquiring, using or disclosing confidential information of our users and customers or other parties; |

| ● | concealing unauthorized or unsuccessful illegal activities; or |

| ● | otherwise not complying with applicable laws and regulations or our internal policies or procedures. |

Errors, misconduct and illegal activities by our employees, or even unsubstantiated allegations of them, could result in a material adverse effect on our reputation and our business. It is not always possible to identify and deter misconduct or errors by employees, and the precautions we take to detect and prevent this activity may not be effective in controlling unknown or unmanaged risks or losses. If any of our employees engages in illegal or suspicious activities or other misconduct, we could suffer economic losses and may be subject to regulatory sanctions and significant legal liability, and our financial condition, customer relationships and our ability to attract new customers may be adversely affected as a result. If any sanction was imposed against an employee during his employment with us, even for matters unrelated to us, we may be subject to negative publicity which could adversely affect our brand, public image and reputation, as well as potential challenges, suspicions, investigations or alleged claims against us. We could also be perceived to have facilitated or participated in the illegal activities or misconduct, and therefore be subject to civil or criminal liability. In addition, if any third-party service providers become unable to continue to provide services to us or cooperate with us as a result of regulatory actions, our business, results of operations and financial condition may also be materially and adversely affected.

We may incur employment related claims or other types of claims and costs that could materially harm our business.

We are in the business of employing people and providing manpower in the workplaces of our customers. We incur a risk of liability for claims for personal injury, wage and hour violations, immigration, discrimination, harassment, and other liabilities arising from the actions of our customers and/or temporary workers. Some or all of these claims may give rise to negative publicity, litigation, settlements, or investigations. As a result, we may incur costs, charges or other material adverse impacts on our financial statements.

5

We maintain insurance with respect to some potential claims and costs with deductibles. We cannot be certain that our insurance will be available, or if available, will be of a sufficient amount or scope to cover claims that may be asserted against us. Should the ultimate judgments or settlements exceed our insurance coverage, they could have a material effect on our business. We cannot be certain we will be able to obtain appropriate types or levels of insurance in the future, that adequate replacement policies will be available on acceptable terms, or at all, or that our insurance providers will be able to pay claims we make under such policies.

We operate in a highly competitive industry and may be unable to retain customers or market share.

Our industry is highly competitive and rapidly innovating. We compete in national, regional and local markets with full-service and specialized temporary staffing companies. Our competitors offer a variety of flexible workforce solutions. Therefore, there is no assurance that we will be able to retain customers or market share in the future, nor can there be any assurance that we will, in light of competitive pressures, be able to remain profitable or maintain our current profit margins.

Our manpower outsourcing business model has a short cashflow conversion cycle.

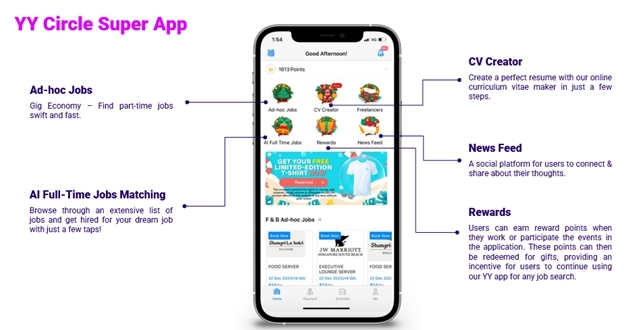

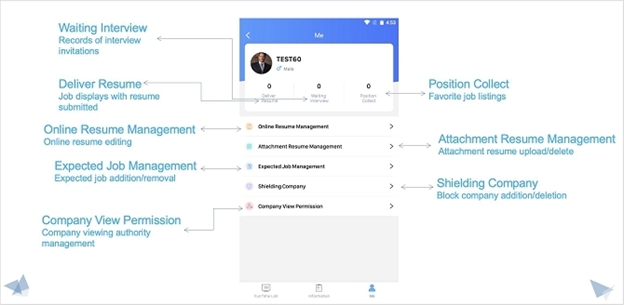

Our manpower outsourcing business model relies on the efficient management of our working capital, including the collection of receivables from our customers. We have a short cashflow conversion cycle, where we typically collect payment from customers 1 to 2 months after we provided them with their temporary staffing needs, but we must pay the users of the YY App who have worked on these part time jobs within a week. Therefore, if we experience delays in collecting payment from our customers, our cashflow and liquidity could be adversely affected, which could harm our business, financial condition, and results of operations.

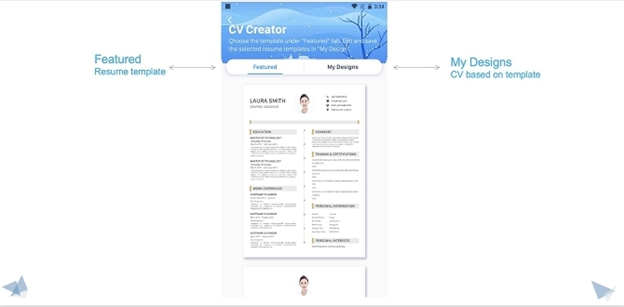

Our business model and growth strategy depend on our ability to attract users to our online platform in a cost-effective manner.

The success of our manpower outsourcing business segment depends, in part, on our ability to attract users to our online platform in a cost-effective manner. Our mobile application is our primary channel for meeting users. We also rely heavily on traffic generated from search engines and other sources to acquire customers and users. We use a variety of methods in our marketing efforts to drive traffic, including online marketing such as social media marketing, paid search advertising, and targeted email communications, and offline marketing through promotional events and out-of-home advertising. We intend to continue to invest resources in our marketing efforts.

These marketing efforts may not succeed for a variety of reasons, including changes to search engine algorithms, ineffective campaigns across marketing channels, and limited experience in certain marketing channels like television. External factors beyond our control may also affect the success of our marketing initiatives, such as filtering of our targeted communications by email servers, users and customers failing to respond to our marketing initiatives, and competition from third parties. Any of these factors could reduce the number of customers and users on our YY App. We also anticipate that our marketing efforts will become increasingly expensive as competition increases and we seek to expand our business in existing markets. Generating a meaningful return on our marketing initiatives may be difficult. If our strategies do not attract users and customers efficiently, our business, prospects, financial condition, and results of operations may be adversely affected.

6

We rely heavily on Internet search engines and mobile application stores to direct traffic to our website and our mobile application, respectively.

We rely heavily on Internet search engines, such as Google, Bing, and Yahoo!, to drive traffic to our website and on mobile application stores, such as the Apple iTunes Store and the Android Play Store, to promote downloads of our mobile application. The number of visitors to our YY App and downloads depends in large part on how and where our mobile application ranks in Internet search results and mobile application stores, respectively. While we use search engine optimization to help our web pages rank highly in search results, maintaining our search result rankings is not within our control. Internet search engines frequently update and change their ranking algorithms, referral methodologies, or design layouts, which determine the placement and display of a user’s search results. In some instances, Internet search engines may change these rankings to promote their own competing services or the services of one or more of our competitors. Similarly, mobile application stores can change how they display searches and how mobile applications are featured. For instance, editors at the Apple iTunes Store can feature prominently editor-curated mobile applications and cause the mobile application to appear larger than other applications or more visibly on a featured list. Listings on our website and mobile application have experienced fluctuations in search result and mobile application rankings in the past, and we anticipate fluctuations in the future. If our website or listings on our website fail to rank prominently in Internet search results, our website traffic could decline. Likewise, a decline in our website and mobile application traffic could reduce the number of customers for our services, which may in turn adversely affect our business, prospects, financial condition, and results of operations.

If we fail to adopt new technologies or adapt our platform and systems to changing user requirements or emerging industry standards, our business may be materially and adversely affected.

We seek to continually enhance and improve the functionality, effectiveness and features of our online website and mobile application. However, our existing technologies and systems could be rendered obsolete at any time due to rapid technological evolution, changes in customer requirements and preferences, frequent introductions of new products and services embodying new technologies and/or the emergence of new industry standards and practices. The success of our online platform will depend, in part, on our ability to identify, develop, acquire, or license technologies useful in our business, and respond to technological advances and emerging industry standards and practices in a cost-effective and timely way. We must also continue to enhance and improve the ease of use, functionality, and features of our mobile application.

The development of our mobile application and other technologies entails significant technical and business risks. Furthermore, such new features, functions and services may not achieve market acceptance or serve to enhance our brand loyalty. We cannot assure you that we will be able to successfully develop or effectively use new technologies, recoup the costs of developing new technologies or adapt our website, mobile application, proprietary technologies, and systems to meet customer requirements or emerging industry standards. If we are unable to adapt in a cost-effective and timely manner in response to changing market conditions or user preferences, whether for technical, legal, financial, or other reasons, our business, prospects, financial condition, and results of operations may be materially and adversely affected.

Our business generates and processes a large amount of consumer data, and the improper use, collection or disclosure of such data could subject us to significant reputational, financial, legal, and operational consequences.

We regularly collect, store, and use customer information and personal data during our business and marketing activities. The collection and use of personal data is governed by the various data privacy and protections laws and regulations in Singapore and Malaysia, and we are required to comply with applicable laws, rules and regulations relating to the collection, use, storage, transfer, disclosure, and security of personal data. We face risks inherent in handling and protecting a large amount of data that our business generates and processes from the significant number of job listings our platform facilitates, such as protecting the data hosted on our system against attacks on our system or fraudulent behavior or improper use by our employees. Although we employ comprehensive security measures to prevent, detect, address, and mitigate these risks (including access controls, data encryption, vulnerability assessments, and maintenance of backup and protective systems), these threats may still materialize. We also cannot guarantee the effectiveness of the policies and measures undertaken by the business partners on our platform. If any of our or our customer’s security measures are compromised, information of our customers or other data belonging to our users and customers may be misappropriated or publicly disseminated, which may result in enforcement action being taken against our Group by the relevant data protection regulatory bodies, such as fines, revocation of licenses, suspension of relevant operations or other legal or administrative penalties. Furthermore, any failure or perceived failure by us or our business partners to comply with all applicable data privacy and protection laws and regulations may result in negative publicity, which may, in turn, damage our reputation, cause customers to lose trust and confidence in us, and stop using our platform altogether. We may also incur significant costs to remedy such security breaches, such as repairing any system damage and compensation to customers and users. If any of these risks were to materialize, it could have a material adverse effect on our business and results of operations.

7

Additionally, privacy regulations continue to evolve and, occasionally, may be inconsistent from one jurisdiction to another. Compliance with applicable privacy regulations may increase our operating costs. If we fail to comply with any of the applicable laws and regulations, depending on the type and severity of any such violation, we may be subject to, amongst others, warnings from relevant authorities, imposition of fines and/or criminal liability, being ordered to close down our business operations and/or suspension of relevant licenses and permits. As a result, our reputation may be harmed and our business, prospects, financial condition, and results of operations could be materially and adversely affected.

We may be unable to adequately protect our intellectual property and proprietary rights or if third parties assert that we infringe on their intellectual property rights, our business could suffer.

Our success and ability to compete depends in part on our intellectual property. As at the date of this annual report, we have four (4) registered trademarks in Singapore of which one (1) is material to our business operations. Please refer to the section entitled “Business – Intellectual Property Rights” for more information on our intellectual property rights.

Any use of trademarks by third parties which are similar or identical to ours may also result in imitation of our platform, which may adversely affect our business, prospects, financial condition and results of operation.

We seek to protect our proprietary technology and intellectual property primarily through a combination of intellectual property laws as well as confidentiality procedures and contractual restrictions. Our employees are subject to confidentiality obligations under the terms of their respective employment contracts and we also require external consultants with access to our proprietary information to enter into non-disclosure agreements. However, there can be no assurance that these measures are effective, or that infringement of our intellectual property rights by other parties does not exist now or will not occur in the future. In addition, our intellectual property rights may not be adequately protected because:

| (a) | other parties may still misappropriate, copy or reverse engineer our technology despite our internal governance processes or the existence of laws or contracts prohibiting it; and |

| (b) | policing unauthorized use of our intellectual property may be difficult, expensive and time consuming, and we may be unable to determine the extent of any unauthorized use. |

To protect our intellectual property rights and maintain our competitiveness, we may file lawsuits against parties who we believe are infringing upon our intellectual property rights. Such proceedings may be costly and may divert management attention and other resources away from our business. In certain situations, we may have to bring lawsuits in foreign jurisdictions, in which case we are subject to additional risks as to the result of the proceedings and the amount of damages that we can recover. Any of our intellectual property rights may also be challenged by others or invalidated through administrative processes or litigations. We can provide no assurance that we will prevail in such litigations, and, even if we do prevail, we may not obtain a meaningful relief. Any inability to adequately protect our proprietary rights may have a material negative impact on our ability to compete, to generate revenue and to grow our business. Under such circumstances, our business, prospects, financial condition, and results of operations would be materially and adversely affected.

Also, third parties may claim that our business operations infringe on their intellectual property rights. These claims may harm our reputation, be a financial burden to defend, distract the attention of our management and prevent us from offering some services.

We rely on certain technology and software licensed from third parties.

As part of our business, we employ certain technology and software licensed from third parties, such as Amazon Web Services for our Smart iClean app and Tencent Cloud and Firebase for our manpower outsourcing application, the YY App. We typically do not enter into long-term agreements for the licensing of such software and tools, and the license agreements are typically on an annual subscription basis. Accordingly, there is no assurance that such third parties will continue to extend such licenses to us after the expiry of the current license period, and if such licenses are renewed, whether such renewals will be on terms favorable to us. Although we believe that there are commercially reasonable alternatives to the third-party software we currently license, this may not always be the case, or it may be difficult or costly to replace. Any failure to maintain the existing licenses or to obtain new licenses on favorable terms or at all may cause a disruption to our apps, platform and service offerings.

8

In addition, we may be susceptible to undetected errors or defects in the third-party software or technology, which would in turn impair the usage of our technology, disrupt our apps, platform operations, and delay or impede our service offerings to customers. This may cause customers to lose confidence in our apps, and platform and also cause damage to our reputation, which would in turn adversely affect our business, prospects, financial condition, and results of operations.

Our technology, software and systems are highly complex and may contain undetected errors or vulnerabilities.

Our platform is based on underlying technology, software, and systems, which are highly complex and may contain undetected errors or vulnerabilities, some of which may only be discovered after their implementation. Despite our development and testing processes in place, we may still encounter technical issues with such software and technology from time to time. Any technical errors, inefficiencies or vulnerabilities discovered in our software and systems after release could delay or reduce the quality of our services and/or disrupt our customers’ access to and use of our platform. This could result in damage to our reputation, result in unexpected costs incurred and result in an adverse effect on our business, prospects, financial condition, and results of operations.

Errors or inaccuracies in our business data and algorithms may adversely affect our business decisions and the customer experience.

We regularly rely on and analyze our business data and algorithms to predict and evaluate growth trends, measure our performance, and make strategic decisions. Much of this data is generated and calculated internally through our own processes, without independent verification by a third-party source. While we believe our processes in place ensure that the calculations used are reasonable, interpretation of such data is inherently subjective and subject to human error. We cannot guarantee that the data, or the calculations of such data, are accurate. Errors or inaccuracies in the data could result in incurring unnecessary costs, improper allocation of resources or misinformed strategic initiatives. For instance, if we overestimate the number of active users on our platform, we may not allocate sufficient resources in our marketing strategies to attract new customers. In such situations, our business, prospects, financial condition, and results of operations may be materially and adversely affected.

We also use our business data and algorithms to inform our matching technology for our full-time job matching feature. If there are any lapses in such business data or algorithms, such as failure of our matching technology to accurately match users with customers, we may be unable to successfully complete transactions or to attract users and customers to transact on our platform. As a result, there may be a loss in customer confidence and brand reputation, which could adversely impact our business, prospects, financial condition and results of operations.

Our business and operations may be materially and adversely affected in the event of a re-occurrence or a prolonged global pandemic outbreak of COVID-19 or other infectious diseases.

Our business and operations may be materially and adversely affected in the event of a re-occurrence or a prolonged global pandemic outbreak of COVID-19 or any other infectious disease. The global pandemic outbreak of COVID-19 announced by the World Health Organization in early 2020 has already disrupted our operations, as well as the operations of our customers. If the development of the COVID-19 outbreak becomes more severe and/or new variants of COVID-19 evolve to be more transmissible and virulent than the existing strains, this may result in a tightening of restrictions and regulations on businesses.

If we or our customers are forced to close down our businesses due to prolonged disruptions, we may experience a shortage of available work or termination of contracts by our customers. Furthermore, if any of our employees are suspected of having contracted COVID-19 or any other infectious disease, there is a possibility that some or all of our employees or users may be quarantined. This could cause a shortage of labor, requiring disinfection of our workplace, production, and processing facilities. In such an event, our operations may be severely disrupted, which would have a material and adverse effect on our business, financial condition, and results of operations.

9

In addition to the COVID-19 pandemic, we also face the risk of outbreaks of other infectious diseases, such as severe acute respiratory syndrome and avian influenza, or the emergence of new forms of infectious diseases in the future. If any of our employees, customers, or suppliers are affected by these infectious diseases, we, or they, may be required to temporarily shut down our or their offices or worksites to prevent the spread of the diseases. This would have an adverse impact on our revenue and financial performance.

It is important for us to monitor and assess the risks associated with infectious diseases, implement appropriate health and safety measures, and have contingency plans in place to mitigate the potential impact on our business and operations. However, there remains inherent uncertainty and unpredictability surrounding the occurrence and severity of infectious disease outbreaks, making it challenging to fully anticipate their exact impact on our business.

Any adverse changes in the political, economic, legal, regulatory taxation or social conditions in the jurisdictions that we operate in or intend to expand our business may have a material adverse effect on our operations, financial performance and future growth.

Our business, prospects, financial condition, and results of operations are dependent on and may be adversely affected by political, economic, social and legal developments that are beyond our control in each of the jurisdictions that we operate in or in which we intend to expand our business and operations. Such political and economic uncertainties may include risks of war, terrorism, nationalism, expropriation or nullification of contracts, changes in interest rates, economic growth, national fiscal and monetary policies, inflation, deflation, methods of taxation and tax policy. Negative developments in the socio-political climate of these regions may also adversely affect our business, prospects, financial condition and results of operations. These developments may include, but are not limited to, changes in political leadership, nationalization, price and capital controls, sudden restrictive changes to government policies, introduction of new taxes on goods and services and introduction of new laws, as well as demonstrations, riots, coups and war. These may result in the nullification of contracts and/or prohibit us from continuing our business operations.

The jurisdictions that we operate in or in which we intend to expand our business and operations may be in a state of rapid political, economic and social changes, and may also be subject to unforeseeable circumstances such as natural disasters and other uncontrollable events, which will entail risks to our business and operations if we are to expand in the region in the future. There can also be no assurance that we will be able to adapt to the local conditions, regulations and business practices and customs of the regions in which we operate in the future. Any changes implemented by the government of these regions resulting in, amongst others, currency and interest rate fluctuations, capital restrictions and changes in duties and taxes detrimental to our business could materially and adversely affect our business, prospects, financial condition and results of operations.

We are exposed to risks arising from fluctuations of foreign currency exchange rates.

Our reporting currency is United States dollars and fees generated from our manpower outsourcing and cleaning business is denominated in Singapore dollars and Malaysian Ringgit. Therefore, we may be exposed to foreign currency exchange gains or losses arising from transactions in currencies other than our reporting currency.

Our insurance policies may be inadequate to cover our assets, operations and any loss arising from business interruptions.

We face the risk of loss or damage to our equipment due to fire, theft, or other natural disasters in Singapore. Such events may also cause a disruption or cessation in our business operations, and thus may adversely affect our financial results. Our insurance coverage may not be sufficient to cover all of our potential losses. If there are losses which exceed the insurance coverage or are not covered by our insurance policies, we will remain liable for any liability, debt or other financial obligation related to such losses. We do not have any insurance coverage for business interruptions.

Due to the nature of our operations, there is also a risk of accidents occurring either to our employees or to third parties on our premises and/or on our customers’ jobsites during the course of operations. In the event that any claims arise in respect of such occurrences and liability for such claims are attributed to us or that our insurance coverage is insufficient, we may be exposed to losses which may adversely affect our profitability and financial position.

10

We are critically dependent on workers’ compensation insurance coverage at commercially reasonable terms, and unexpected changes in claim trends on our workers’ compensation may negatively impact our financial condition.

We employ workers for whom we provide workers’ compensation insurance. Our workers’ compensation insurance policies are renewed annually and may be revised upon renewal. The loss of our workers’ compensation insurance coverage would prevent us from operating as a staffing services business in the majority of our markets. Further, we cannot be certain that our current and former insurance carriers will be able to pay claims we make under such policies. If we have to pay out of our own resources for any uninsured claims, our business, financial condition and results of operations may be materially and adversely affected.

Unexpected changes in claim trends, including the severity and frequency of claims, changes in state laws regarding benefit levels and allowable claims, actuarial estimates, or medical cost inflation, could result in costs that are significantly higher. There can be no assurance that we will be able to increase the fees charged to our customers in a timely manner and in a sufficient amount to cover increased costs as a result of any changes in claims-related liabilities.

Our efforts to actively manage the safety of our workers and actively control costs with internal staff and our network of workers’ compensation related service providers may not be sufficient to prevent material increases to our workers’ compensation costs.

We may not be able to successfully implement our business strategies and future plans.

As part of our business strategies and future plans, we intend to strengthen our market position in the Southeast Asian region and continue development of our YY App as well as consider potential business opportunities through joint ventures. While we have planned such expansion based on our outlook regarding our business prospects, there is no assurance that such expansion plans will be commercially successful or that the actual outcome of those expansion plans will match our expectations. The success and viability of our expansion plans are dependent upon our ability to obtain the proper financing, favorable market conditions, hire and retain skilled employees to carry out our business strategies and future plans and implement strategic business development and marketing plans effectively and upon an increase in demand for our services by existing and new customers in the future.

Further, the implementation of our business strategies and future plans may require substantial capital expenditure and additional financial resources and commitments. There is no assurance that these business strategies and future plans will achieve the expected results or outcome such as an increase in revenue that will be commensurate with our investment costs or the ability to generate any costs savings, increased operational efficiency and/or productivity improvements to our operations. There is also no assurance that we will be able to obtain financing on terms that are favorable, if at all. If the results or outcome of our future plans do not meet our expectations, if we fail to achieve a sufficient level of revenue or if we fail to manage our costs efficiently, we may not be able to recover our investment costs and our business, financial condition, results of operations and prospects may be adversely affected.

Risks Related to our Securities

We may not maintain the listing of our Class A Shares on Nasdaq which could limit investors’ ability to make transactions in our Class A Shares and subject us to additional trading restrictions.

In order to continue listing our shares on Nasdaq, we must maintain certain financial and share price levels and we may be unable to meet these requirements in the future. We cannot assure you that our shares will continue to be listed on Nasdaq in the future.

If Nasdaq delists our Class A Shares and we are unable to list our shares on another national securities exchange, we expect our shares could be quoted on an over-the-counter market in the United States. If this were to occur, we could face significant material adverse consequences, including:

| (a) | a limited availability of market quotations for our Class A Shares; |

| (b) | reduced liquidity for our Class A Shares; |

11

| (c) | a determination that our Class A Shares are “penny stock”, which will require brokers trading in our shares to adhere to more stringent rules and possibly result in a reduced level of trading activity in the secondary trading market for our Class A Shares; |

| (d) | a limited amount of news and analyst coverage; and |

| (e) | a decreased ability to issue additional securities or obtain additional financing in the future. |

As long as our Class A Shares are listed on Nasdaq, U.S. federal law prevents or pre-empts individual states from regulating their sale. However, the law does allow the states to investigate companies if there is a suspicion of fraud, and, if there is a finding of fraudulent activity, then the states can regulate or bar their sale. Further, if we were no longer listed on Nasdaq, we would be subject to regulations in each state in which we offer our shares.

The trading price of our Class A Shares may be volatile, which could result in substantial losses to investors.

The trading price of our Class A Shares may be volatile and could fluctuate widely due to factors beyond our control. This may happen because of the broad market and industry factors, like the performance and fluctuation of the market prices of other companies with business operations located mainly in Singapore that have listed their securities in the United States. In addition to market and industry factors, the price and trading volume for our shares may be highly volatile for factors specific to our own operations, including the following:

| ● | fluctuations in our revenues, earnings and cash flow; |

| ● | changes in financial estimates by securities analysts; |

| ● | additions or departures of key personnel; |

| ● | release of lock-up or other transfer restrictions on our outstanding equity securities or sales of additional equity securities; and |

| ● | potential litigation or regulatory investigations. |

Any of these factors may result in significant and sudden changes in the volume and price at which our shares will trade.

In the past, shareholders of public companies have often brought securities class action suits against those companies following periods of instability in the market price of their securities. If we were involved in a class action suit, it could divert a significant amount of our management’s attention and other resources from our business and operations and require us to incur significant expenses to defend the suit, which could harm our results of operations. Any such class action suit, whether or not successful, could harm our reputation and restrict our ability to raise capital in the future. In addition, if a claim is successfully made against us, we may be required to pay significant damages, which could have a material adverse effect on our financial condition and results of operations.

If securities or industry analysts do not publish research or reports about our business, or if they adversely change their recommendations regarding our Class A Shares, the market price for our Class A Shares and trading volume could decline.

The trading market for our shares will be influenced by research or reports that industry or securities analysts publish about our business. If one or more analysts downgrade our shares, the market price for our shares would likely decline. If one or more of these analysts cease to cover us or fail to regularly publish reports on us, we could lose visibility in the financial markets, which in turn could cause the market price or trading volume for our shares to decline.

12

Because we do not expect to pay dividends in the foreseeable future, you must rely on price appreciation of our Class A Shares for a return on your investment.

We currently intend to retain all of our available funds and any future earnings to fund the development and growth of our business. As a result, we do not expect to pay any cash dividends in the foreseeable future. Therefore, you should not rely on an investment in our shares as a source for any future dividend income. Our board of Directors has complete discretion as to whether to distribute dividends, subject to certain requirements of BVI and Singaporean law. Even if our board of Directors decides to declare and pay dividends (by way of a simple majority decision of our Directors),, the timing, amount and form of future dividends, if any, will depend on, among other things, our future results of operations and cash flow, our capital requirements and surplus, the amount of distributions, if any, received by us from our subsidiary, our financial condition, contractual restrictions and other factors as determined by our board of Directors. Accordingly, the return on your investment in our Class A Shares will likely depend entirely upon any future price appreciation of our Class A Shares. There is no guarantee that our Class A Shares will appreciate in value or even maintain the price at which you purchased our shares. You may not realize a return on your investment in our shares and you may even lose your entire investment.

Short selling may drive down the market price of our Class A Shares.

Short selling is the practice of selling shares that the seller does not own but rather has borrowed from a third party with the intention of buying identical shares back at a later date to return to the lender. The short seller hopes to profit from a decline in the value of the shares between the sale of the borrowed shares and the purchase of the replacement shares, as the short seller expects to pay less in that purchase than it received in the sale. As it is in the short seller’s interest for the price of the shares to decline, many short sellers publish, or arrange for the publication of, negative opinions and allegations regarding the relevant issuer and its business prospects in order to create negative market momentum and generate profits for themselves after selling the shares short. These short attacks have, in the past, led to the selling of shares in the market. If we were to become the subject of any unfavorable publicity, whether such allegations are proven to be true or untrue, we could have to expend a significant number of resources to investigate such allegations and/or defend ourselves. While we would strongly defend against any such short seller attacks, we may be constrained in the manner in which we can proceed against the relevant short seller by principles of freedom of speech, applicable state law or issues of commercial confidentiality.

If we are classified as a passive foreign investment company, United States taxpayers who own our securities may have adverse United States federal income tax consequences.

We are a non-U.S. corporation and, as such, we will be classified as a passive foreign investment company, which is known as a PFIC, for any taxable year if, for such year, either

| ● | At least 75% of our gross income for the year is passive income; or |

| ● | The average percentage of our assets (determined at the end of each quarter) during the taxable year that produce passive income or that are held for the production of passive income is at least 50%. |

Passive income generally includes dividends, interest, rents, royalties (other than rents or royalties derived from the active conduct of a trade or business) and gains from the disposition of passive assets.

If we are determined to be a PFIC for any taxable year (or portion thereof) that is included in the holding period of a U.S. taxpayer who holds our securities, the U.S. taxpayer may be subject to increased U.S. federal income tax liability and may be subject to additional reporting requirements.

While we do not expect to become a PFIC, because the value of our assets for purposes of the asset test may be determined by reference to the market price of our Class A Shares, fluctuations in the market price of our Class A Shares may cause us to become a PFIC for the current or subsequent taxable years. The determination of whether we will be or become a PFIC will also depend, in part, on the composition of our income and assets. If we determine not to deploy significant amounts of cash for active purposes, our risk of being a PFIC may substantially increase. Because there are uncertainties in the application of the relevant rules and PFIC status is a factual determination made annually after the close of each taxable year, there can be no assurance that we will not be a PFIC for the current taxable year or any future taxable year.

13

For a more detailed discussion of the application of the PFIC rules to us and the consequences to U.S. taxpayers if we were determined to be a PFIC, see “Material Tax Considerations — Passive Foreign Investment Company Considerations.”

Our controlling shareholder has substantial influence over the Company. Its interests may not be aligned with the interests of our other shareholders, and it could prevent or cause a change of control or other transactions.

Mr. Fu Xiaowei indirectly controls approximately 42.22% and 100% of our issued and outstanding Class A Shares and Class B Shares on April 22, 2024 respectively.

Accordingly, our controlling shareholder has considerable influence or control over the outcome of any corporate transactions or other matters submitted to the shareholders for approval, including (i) mergers, consolidations, (ii) the election or removal of Directors, (iii) the sale of all or substantially all of our assets, (iv) making amendments to our Amended and Restated Memorandum and Articles of Association, (v) whether to issue additional shares, including to him, (vi) employment, including compensation arrangements, and (vii) the power to prevent or cause a change in control. The interests of our largest shareholder may differ from the interests of our other shareholders. Without the consent of our controlling shareholder, we may be prevented from entering into transactions that could be beneficial to us or our other shareholders. The concentration in the ownership of our shares may cause a material decline in the value of our shares. For more information regarding our principal shareholders and their affiliated entities, see “Principal Shareholders”.

As a “controlled company” under the rules of Nasdaq Capital Market, we may choose to exempt our Company from certain corporate governance requirements that could have an adverse effect on our public shareholders.

Our directors and officers beneficially own a majority of the voting power of our issued and outstanding Class A Shares. Under the Rule 4350(c) of Nasdaq Capital Market, a company of which more than 50% of the voting power is held by an individual, group or another company is a “controlled company” and may elect not to comply with certain corporate governance requirements, including the requirement that a majority of our directors be independent, as defined in Nasdaq Capital Market Rules, and the requirement that our compensation and nominating and corporate governance committees consist entirely of independent directors. Although we do not intend to rely on the “controlled company” exemption under Nasdaq listing rules, we could elect to rely on this exemption in the future. If we elect to rely on the “controlled company” exemption, a majority of the members of our Board of Directors might not be independent directors and our nominating and corporate governance and compensation committees might not consist entirely of independent directors. Accordingly, during any time while we remain a controlled company relying on the exemption and during any transition period following a time when we are no longer a controlled company, you would not have the same protections afforded to shareholders of companies that are subject to all of Nasdaq Capital Market corporate governance requirements. Our status as a controlled company could cause our Class A Shares to look less attractive to certain investors or otherwise harm our trading price.

As a company incorporated in the BVI, we are permitted to follow certain home country practices in relation to corporate governance matters in lieu of certain requirements under Nasdaq corporate governance listing rules. These practices may afford less protection to shareholders than they would enjoy if we complied fully with Nasdaq corporate governance listing standards.

As a company incorporated in the BVI, we are permitted to adopt certain home country practices in relation to corporate governance matters that differ significantly from the corporate governance listing requirements of Nasdaq. These practices may afford less protection to Shareholders than they would enjoy if we complied fully with corporate governance listing requirements of Nasdaq. We rely on home country practice to be exempted from certain of the corporate governance requirements of Nasdaq, namely (i) there will not be a necessity to have regularly scheduled executive sessions with independent Directors; and (ii) there will be no requirement for the Company to obtain Shareholder approval prior to an issuance of securities in connection with (a) the acquisition of stock or assets of another company; (b) equity-based compensation of officers, directors, employees or consultants; and (c) a change of control.

14

You may face difficulties in protecting your interests, and your ability to protect your rights through U.S. courts may be limited, because we are incorporated under British Virgin Islands law.

We are a BVI business company limited by shares incorporated under the laws of the BVI. Our corporate affairs are governed by our Amended and Restated Memorandum and Articles of Association, the Companies Act and the common law of the BVI.

The rights of shareholders to take action against the directors, actions by minority shareholders and the fiduciary duties of our directors to us under British Virgin Islands law are governed by the Companies Act and the common law of the BVI . The common law of the BVI is derived in part from comparatively limited judicial precedent in the BVI as well as from the common law of England, the decisions of whose courts are of persuasive authority, but are not binding, on a court in the BVI . The rights of our shareholders and the fiduciary duties of our directors under British Virgin Islands law are not as clearly established as they would be under statutes or judicial precedent in some states in the United States. In particular, the BVI has a less developed body of securities laws than the United States. Some U.S. states have more fully developed and judicially interpreted bodies of corporate law than the BVI . In addition, BVI companies may not have the standing to initiate a shareholder derivative action in a federal court of the United States.