Psilocybin-assisted psychotherapy

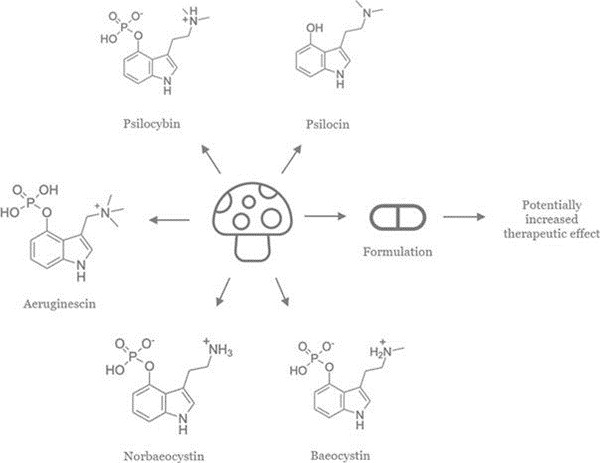

CBT has been shown to improve anxiety in patients diagnosed with incurable cancer, but appears to be less effective at improving depressive symptoms.30 Several recently published trials have examined the efficacy of psilocybin, a classic serotonergic psychedelic drug that induces its acute subjective effects through the agonism of serotonin 2A (5-HT2A) receptors, to treat depression and anxiety in patients with life -threatening cancer, amongst other psychiatric conditions.31,32,33,34 Psilocybin-assisted psychotherapy is a course of therapy involving single or multiple sessions in which a dose of psilocybin is administered in conjunction with psychotherapy, delivered by a suitably trained therapist in a controlled setting. This intervention consists of three therapy stages: (1) preparation, (2) dosing session(s), and (3) integration, which allow for a more patient-centric approach compared to other therapy models. The pharmacological effects of psilocybin, in synergy with the psychotherapy, are considered to give rise to increased neuroplasticity, which facilitates rapid and deep psychological transformation that may accelerate and augment the effects of the psychotherapy process.34

PAP has been demonstrated in various academic studies to cause expeditious, substantial, and sustained improvements in cancer-related anxiety and depression, existential distress, quality of life, and orientation toward death.32,33 For example, in an academic study32 of 29 patients with cancer-related depression and anxiety, at the 6.5-month follow up, psilocybin was associated with enduring anxiolytic and anti-depressant effects (approximately 60-80% of participants continued with clinically significant reductions in depression or anxiety respectively), sustained benefits in existential distress and quality of life, as well as improved attitudes towards death.35 In another study of 51 patients,33 similar results were reported. At 6-month follow-up, these changes were sustained, with about 80% of participants continuing to show clinically significant decreases in depressed mood and anxiety. Participants attributed improvements in attitudes about life/self, mood, relationships, and spirituality to the “high” experience resulting from the psilocybin, with over 80% endorsing moderately or greater increased well-being/life satisfaction.36,37,38,39,40,41,42

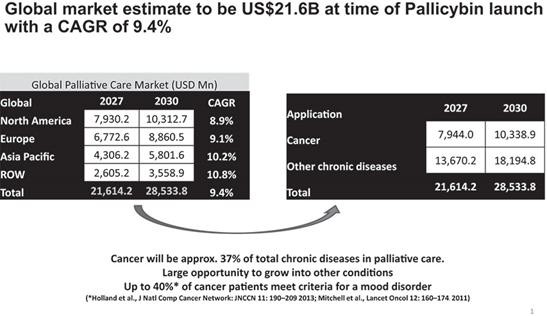

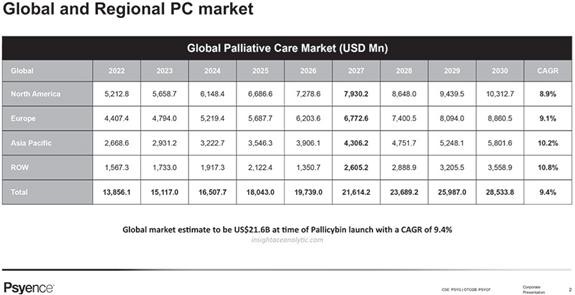

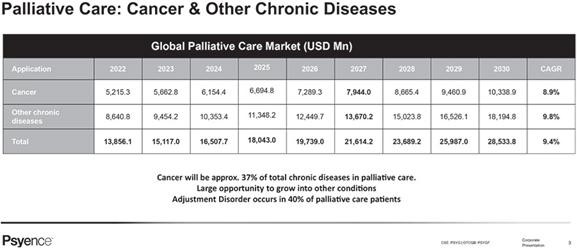

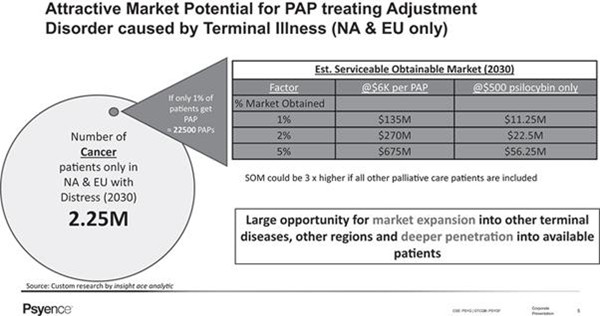

A number of factors provide rationale for focusing on patients with AjD following a diagnosis of incurable cancer as the target population. The size of the cancer population, which generally makes up approximately 30% of target country palliative patients, provides justification for research, in regard to both the magnitude of needs and the access to participant recruitment. Additionally, previous clinical trials have demonstrated the feasibility and efficacy of PAP for people with depression and anxiety symptoms, both within and outside of the palliative care setting, highlighting the versatility and universality of this intervention. Moreover, the sustained reductions in anxiety and depression amongst palliative care patients suggest the longevity of positive outcomes mediated by PAP and the potential to dramatically improve patient quality of life, in what remains of their life.

30 Hayes SC, Luoma JB, Bond FW, Masuda A, Lillis J. Acceptance and commitment therapy: model, processes and outcomes. Behav Res Ther. 2006;44:1 – 25.

31 Carhart-Harris R, Giribaldi B, Watts R, Baker-Jones M, Murphy-Beiner A, Murphy R, et al. Trial of Psilocybin versus Escitalopram for Depression. N Engl J Med. 2021;384:1402 – 1411.

32 Grob CS, Danforth AL, Chopra GS, Hagerty M, McKay CR, Halberstadt AL, et al. Pilot study of psilocybin treatment for anxiety in patients with advanced-stage cancer. Arch Gen Psychiatry. 2011;68:71 – 78.

33 Griffiths RR, Johnson MW, Carducci MA, Umbricht A, Richards WA, Richards BD, et al. Psilocybin produces substantial and sustained decreases in depression and anxiety in patients with life-threatening cancer: A randomized double-blind trial. J Psychopharmacol. 2016;30:1181 – 1197.

34 Brouwer A, Carhart-Harris RL. Pivotal mental states. J Psychopharmacol. 2021;35:319 – 352.

35 Agin-Liebes GI, Malone T, Yalch MM, Mennenga SE, Ponté KL, Guss J, et al. Long-term follow-up of PAP for psychiatric and existential distress in patients with life-threatening cancer. J Psychopharmacol. 2020;34:155 – 166.

36 Carhart-Harris RL, Bolstridge M, Rucker J, Day CMJ, Erritzoe D, Kaelen M, et al. Psilocybin with psychological support for treatment-resistant depression: an open-label feasibility study. Lancet Psychiatry. 2016;3:619 – 627.

37 Carhart-Harris RL, Bolstridge M, Day CMJ, Rucker J, Watts R, Erritzoe DE, et al. Psilocybin with psychological support for treatment-resistant depression: six-month follow-up. Psychopharmacology. 2018;235:399 – 408.

38 Davis AK, Barrett FS, May DG, Cosimano MP, Sepeda ND, Johnson MW, et al. Effects of PAP on Major Depressive Disorder: A Randomized Clinical Trial. JAMA Psychiatry. 2021;78:481 – 489.

39 Bogenschutz MP, Forcehimes AA, Pommy JA, Wilcox CE, Barbosa PCR, Strassman RJ. Psilocybin- assisted treatment for alcohol dependence: a proof-of-concept study. J Psychopharmacol. 2015;29:289 – 299.

40 Johnson MW, Garcia-Romeu A, Cosimano MP, Griffiths RR. Pilot study of the 5-HT2AR agonist psilocybin in the treatment of tobacco addiction. J Psychopharmacol. 2014;28:983 – 992.

41 Moreno FA, Wiegand CB, Taitano EK, Delgado PL. Safety, tolerability, and efficacy of psilocybin in 9 patients with obsessive-compulsive disorder. J Clin Psychiatry. 2006;67:1735 – 1740.

42 Griffiths RR, Johnson MW, Carducci MA, Umbricht A, Richards WA, Richards BD, et al. Psilocybin produces substantial and sustained decreases in depression and anxiety in patients with life-threatening cancer: A randomized double-blind trial. J Psychopharmacol. 2016;30:1181 – 1197.