UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One)

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report:

Commission File Number:

(Exact name of Registrant as specified in its charter)

Not applicable | |

(Translation of Registrant’s | (Jurisdiction of incorporation |

+1 (416) 346-7764

(Address of principal executive offices)

Copy to:

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of each class |

| Trading |

| Name of each exchange |

The | ||||

| The |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

The number of the issuer’s outstanding common shares as of March 31, 2024 was

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer, or an emerging growth company. See definition of “accelerated filer,” “large accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | ☐ | Accelerated filer | ☐ | ☒ | |

Emerging growth company |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act.

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b).☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ☐ | ☒ | Other ☐ |

If “Other” has been checked in response to the previous question indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

TABLE OF CONTENTS

|

| Page | ||

3 | ||||

5 | ||||

5 | ||||

5 | ||||

5 | ||||

34 | ||||

60 | ||||

60 | ||||

64 | ||||

82 | ||||

84 | ||||

85 | ||||

85 | ||||

99 | ||||

100 | ||||

104 | ||||

104 | ||||

MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS | 104 | |||

104 | ||||

105 | ||||

105 | ||||

105 | ||||

105 | ||||

105 | ||||

PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS | 105 | |||

105 | ||||

105 | ||||

106 | ||||

DISCLOSURE REGARDING FOREIGN JURISDICTION THAT PREVENT INSPECTIONS | 106 | |||

106 | ||||

106 | ||||

107 | ||||

107 | ||||

107 | ||||

107 |

2

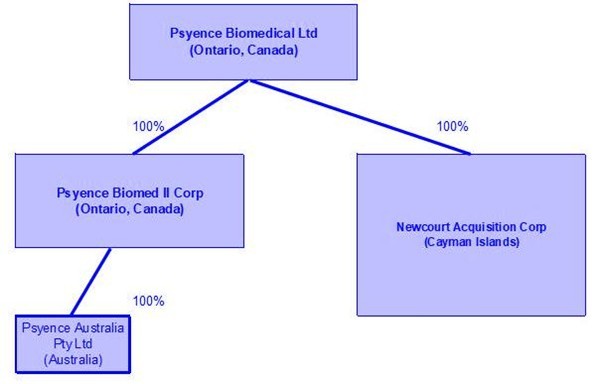

Except as otherwise indicated or required by context, references in this Annual Report on Form 20-F (the “Report”) to “we,” “us,” “our,” “Psyence Biomedical” or the “Company” refer to Psyence Biomedical Ltd., a corporation organized under the laws of Ontario, Canada.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Report and the documents incorporated by reference herein include forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements relate to, among others, our plans, objectives and expectations for our business, operations and financial performance and condition, and can be identified by terminology such as “may,” “should,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue” and similar expressions that do not relate solely to historical matters. Forward-looking statements are based on management’s belief and assumptions and on information currently available to management. Although we believe that the expectations reflected in forward-looking statements are reasonable, such statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by forward-looking statements.

Forward-looking statements in this Report and in any document incorporated by reference in this Report may include, but are not limited to, statements about:

| ● | the ability of Psyence Biomedical to realize the benefits expected from the Business Combination (as defined below) and to maintain the listing of the Common Shares or the Warrants on Nasdaq; |

| ● | risks that the Business Combination disrupts current plans of Psyence Biomedical or diverts management’s attention from Psyence Biomedical’s ongoing business operations and potential difficulties in Psyence Biomedical’s employee retention as a result of the Business Combination; |

| ● | volatility in the price of the securities of the Company due to a variety of factors, including changes in the competitive and highly regulated industries in which the Company operates, variations in performance across competitors, changes in laws and regulations affecting the Company’s business and changes in the Company’s capital structure; |

| ● | Psyence Biomedical’s success in retaining or recruiting, or changes required in, its officers, key employees or directors; |

| ● | factors relating to the business, operations and financial performance of the Company, including, but not limited to: |

| ● | the Company’s ability to achieve successful clinical results; |

| ● | the Company currently has no products approved for commercial sale; |

| ● | the Company’s ability to obtain regulatory approval for its product candidates, and any related restrictions or limitations of any approved products; |

| ● | the Company’s ability to obtain licensing of third-party intellectual property rights for future discovery and development of the Company’s product candidates; |

| ● | the Company’s ability to commercialize product candidates and achieve market acceptance of such product candidates; |

| ● | the Company’s success is dependent on product candidates which it licenses from third parties; |

| ● | the Company’s success is dependent on the supply of materials necessary to perform its clinical trials; and |

| ● | the ability to respond to general economic conditions; |

3

| ● | the Company has incurred significant losses since inception, and it expects to incur significant losses for the foreseeable future and may not be able to achieve or sustain profitability in the future; |

| ● | the Company requires substantial additional capital to finance its operations, and if it is unable to raise such capital when needed or on acceptable terms, it may be forced to delay, reduce, and/or eliminate one or more of its development programs or future commercialization efforts; |

| ● | the Company’s ability to develop and maintain effective internal controls; |

| ● | assumptions regarding interest rates and inflation; |

| ● | competition and competitive pressures from other companies worldwide in the industries in which the Company operates; and |

| ● | litigation and the ability to adequately protect the Company’s intellectual property rights. |

Forward-looking statements are subject to known and unknown risks and uncertainties and are based on potentially inaccurate assumptions that could cause actual results to differ materially from those expected or implied by the forward-looking statements. Actual results could differ materially from those anticipated in forward-looking statements for many reasons, including the factors discussed under the “Risk Factors” section below and in the Company’s other filings with the SEC. Accordingly, you should not rely on these forward-looking statements, which speak only as of the date of this Report. We undertake no obligation to publicly revise any forward-looking statement to reflect circumstances or events after the date of this Report or to reflect the occurrence of unanticipated events. You should, however, review the factors and risks described in the reports we will file from time to time with the SEC after the date of this Report.

Although we believe the expectations reflected in the forward-looking statements were reasonable at the time made, we cannot guarantee future results, level of activity, performance or achievements. Moreover, neither we nor any other person assume responsibility for the accuracy or completeness of any of these forward-looking statements. You should carefully consider the cautionary statements contained or referred to in this section in connection with the forward-looking statements contained in this Report and any subsequent written or oral forward-looking statements that may be issued by the Company or persons acting on its behalf.

4

PART I

ITEM 1.IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not Applicable.

ITEM 2.OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3.KEY INFORMATION

A.[Reserved.]

B.Capitalization and Indebtedness

Not applicable.

C.Reasons for the Offer and Use of Proceeds

Not applicable.

D.Risk Factors

Investing in our securities involves a high degree of risk. You should carefully consider the following information about these risks, together with the other information appearing elsewhere in this Report, including our financial statements, the notes thereto and the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” before deciding to invest in our securities. The occurrence of any of the following risks could have a material adverse effect on our business, reputation, financial condition, results of operations and future growth prospects, as well as our ability to accomplish our strategic objectives. As a result, the trading price of our securities could decline and you could lose all or part of your investment. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our business operations and the market price of our securities.

Risks Related to Our Business and Industry

We are a clinical-stage biotechnology company and have incurred significant losses since our inception. We anticipate that we will incur significant losses for the foreseeable future.

Investment in biotechnology product development is highly speculative because it entails substantial upfront capital expenditures and significant risk that any potential product candidate will fail to demonstrate effectiveness or an acceptable safety profile, gain regulatory approval and become commercially viable. All of Psyence’s product candidates will require substantial additional capital expenditures and development time, including extensive clinical research and resources, before it would be able to apply for and then receive marketing authorization and begin generating revenue from product sales.

Since its inception, Psyence has invested most of its resources in establishing strategic partnerships, securing intellectual property licensing rights, advancing its clinical trial program, raising capital, building its management team and providing general and administrative support for these operations. Psyence has incurred losses in each year since its inception and expects to incur significant losses for the foreseeable future. Psyence’s net loss for the years ended March 31, 2023 and March 31, 2024 was $3.12 million and $50.96 million, respectively. The March 31, 2024 net loss was driven by the deemed listing expense of $41.48 million which consisted of a deemed consideration amount of $37.3 million for the 7,794,659 shares issued to NCAC shareholders at a fair value of $4.79 per share and $4.1 million for the net liabilities acquired. To date, no products have been approved for commercial sale and Psyence has not generated any revenue. Psyence has financed operations solely through the sale of equity securities and convertible debt financings. Psyence continues to incur significant research and development and other expenses related to ongoing operations and expects to incur losses for the foreseeable future.

5

Due to the numerous risks and uncertainties associated with the development of its product candidates, Psyence is unable to predict the timing or amount of its expenses, or when it will be able to generate any meaningful revenue or achieve or maintain profitability, if ever. In addition, its expenses could increase beyond current expectations if Psyence is required by the Therapeutic Goods Administration in Australia (“TGA”), the U.S. Food and Drug Administration (“FDA”), the European Medicines Agency (“EMA”), Medicines and Healthcare products Regulatory Agency in the UK (“MHRA”), or other comparable foreign regulatory authorities, to perform preclinical studies or clinical trials in addition to those that Psyence currently anticipates, or if there are any delays in any of Psyence’s or its future collaborators’ clinical trials or the development of the existing product candidates and any other product candidates that Psyence may identify. Even if Psyence’s existing product candidates or any future product candidates that Psyence may identify are approved for commercial sale, Psyence anticipates incurring significant costs associated with commercializing any approved product and ongoing compliance efforts.

Psyence has a limited operating history and expects a number of factors to cause its operating results to fluctuate on an annual basis, which may make it difficult to predict the future performance of Psyence.

Psyence is a clinical stage biotechnology development company with a limited operating history. Consequently, any predictions made about Psyence’s future success or viability may not be as accurate as they could be if Psyence had a longer operating history and additional definitive partnership agreements in place. Psyence’s operating results are expected to significantly fluctuate from quarter-to-quarter or year-to-year due to a variety of factors, many of which are beyond its control. Factors relating to Psyence’s business that may contribute to these fluctuations include, but are not limited to:

| ● | any delays or issues in finding, and establishing successful business arrangements with, pharmaceutical and product development partners to assist in moving its product candidates through the development and commercialization processes; |

| ● | delays in the commencement, enrolment and timing of clinical trials; |

| ● | the success of its preclinical trials; |

| ● | potential side effects of its product candidates that could delay or prevent approval or license-out agreements or cause an approved product candidate to be eliminated; |

| ● | supply chain interruptions, which could delay Psyence in the process of developing its product candidates; |

| ● | its ability to obtain additional funding to develop its product candidates; |

| ● | its ability to attract and retain talented and experienced personnel to manage its business effectively; |

| ● | competition from existing psychedelic analogs companies or new psychedelic analogs companies that continue to emerge; |

| ● | assuming market authorization has been obtained for our product candidates, the ability of patients or healthcare providers to obtain coverage or sufficient reimbursement for such products; |

| ● | its ability to adhere to clinical study requirements directly or with third parties such as clinical research organizations (“CROs”); |

| ● | its dependency on third-party manufacturers to manufacture products and key ingredients; |

| ● | its ability to establish or maintain collaborations, licensing or other transactions; |

| ● | its ability to defend against any challenges to its intellectual property, including claims of patent infringement; |

| ● | its ability to enforce its intellectual property rights against potential competitors; |

| ● | its ability to secure additional intellectual property protection for its product candidates and associated manufacturing methods currently under development; |

6

| ● | a biological or chemical effect that Psyence does not predict; |

| ● | adverse economic circumstances; and |

| ● | potential liability claims. |

Accordingly, the results of any historical financial periods should not be relied upon as indications of future operating performance.

Psyence has never generated revenue and may never be profitable.

Psyence may never be able to develop or commercialize marketable products or achieve profitability. Revenue from the sale of any product candidate for which regulatory approval is obtained will be dependent, in part, upon the size of the markets in the territories for which Psyence gains regulatory approval, the accepted price for the product, the acceptance of the product by physicians and patients, the ability to obtain reimbursement at any price and whether Psyence owns the commercial rights for that territory. Psyence’s growth strategy depends on its ability to generate revenue. In addition, if the number of addressable patients is not as anticipated, the indication or intended use approved by regulatory authorities is narrower than expected, or the reasonably accepted population for treatment is narrowed by competition, physician choice or treatment guidelines, Psyence may not generate significant revenue from sales of such products, even if approved. Even if Psyence is able to generate revenue from the sale of any approved products, Psyence may not become profitable and may need to obtain additional funding to continue operations. Even if Psyence were to achieve profitability in the future, it may not be able to sustain profitability in subsequent periods.

Psyence’s failure to achieve sustained profitability would depress the value of the Company and could impair its ability to raise capital, expand the business, diversify its research and development pipeline, market its product candidates, if approved, and pursue or continue operations. Psyence’s prior losses, combined with expected future losses, have had and will continue to have an adverse effect on shareholders’ equity and working capital.

The Company will require substantial additional funding to achieve its business goals, and if it is unable to obtain this funding when needed and on acceptable terms, it could be forced to delay, limit or terminate its product development efforts.

Psyence’s clinical trial and product development pipeline currently consists of an approved Phase IIb Study in Australia. We have also obtained approval from the MHRA to conduct a Phase IIa study in the UK, which was not initiated due to certain cost-effective incentives provided by Australia. Once the Phase IIb Study in Australia is completed, a Phase III pivotal study program will begin, of which the size and number of trials will depend on the results of the Phase IIb Study, the advice given to Psyence from the regulatory authorities and whether the FDA will assess the program as being fast-tracked or eligible as a breakthrough therapy. If the assessment is the latter, the Phase III program could be smaller than anticipated and less than the usual required two pivotal studies to support market authorization.

Psyence intends to submit the NDA requesting assessment via the 505(b)(2) pathway. A 505(b)(2) application is an NDA that contains full reports of investigations of safety and effectiveness, where at least some of the information required for approval comes from studies not conducted by or for the applicant, and for which the applicant has not obtained a right of reference or use, including, for example, the agency’s finding of safety and/or effectiveness for a listed drug or published literature. This could potentially allow for a shorter development program along with less data that is developed by Psyence, as compared to a regular NDA submission. Despite the usage of psilocybin for decades, there have been relatively few studies pertaining to psilocybin products due to the ban on the research into psychedelics. However, recently, academic institutions have been allowed to conduct such studies.

7

Conducting clinical trials and developing biopharmaceutical products is expensive and time consuming, and we expect to require substantial additional capital to conduct research, preclinical studies and clinical trials for the current and future trials, seek regulatory approvals for our product candidates and launch and commercialize any products for which Psyence may receive regulatory approval, including building our own commercial sales, marketing and distribution organization. Our management and strategic decision makers have not made decisions regarding the future allocation of certain resources among Psyence’s pipeline of trials, but continue to evaluate the needs and opportunities with respect to each of these trials routinely and on a case-by-case basis. Because the outcome of any preclinical or clinical development and regulatory approval process is highly uncertain (including the size and quantum of the Phase III registrational program), Psyence cannot reasonably estimate the actual amounts necessary to successfully complete the development, regulatory approval process and potential commercialization of its product candidates and any future product candidates it may identify.

Psyence expects that the cash provided in the PIPE Financing (as defined below), assuming all tranches are consummated, together with Psyence’s existing cash, will be sufficient to fund operations beyond 12 months following the Closing Date. However, Psyence’s operating plan may change as a result of many factors currently unknown, including but not limited to the additional tranches of the PIPE Financing not being funded, and Psyence may need to seek additional funds sooner than planned, through public or private equity or debt financings, sales of assets or programs, other sources, such as strategic collaborations or license and development agreements, or a combination of these approaches. Even if Psyence believes that its funds are sufficient for its current or future operating plans, it may, subject to obtaining the necessary contractual consents, opportunistically seek additional capital if market conditions are favorable or for specific strategic considerations. Psyence’s spending will vary based on new and ongoing product development and business development activities. Any such additional fundraising efforts for Psyence may divert management from their day-to-day activities, which may adversely affect Psyence’s ability to develop and commercialize product candidates that Psyence may identify and pursue. Moreover, such financing may result in dilution to shareholders, imposition of debt covenants and repayment obligations, or other restrictions that may affect Psyence’s business. Changing circumstances, some of which may be beyond Psyence’s control, could cause Psyence to consume capital significantly faster than currently anticipated, and Psyence may need to seek additional funds sooner than planned. Psyence’s future funding requirements, both short-term and long-term, will depend on many factors, including, but not limited to:

| ● | the time and cost necessary to complete ongoing and planned clinical trials; |

| ● | the outcome, timing and cost of meeting regulatory requirements established by the TGA, FDA, the EMA, the MHRA and other comparable foreign regulatory authorities; |

| ● | the progress, timing, scope and costs of preclinical studies, clinical trials and other related activities for ongoing and planned clinical trials, and potential future clinical trials; |

| ● | the costs of obtaining clinical and commercial supplies of raw materials and drug products for Psyence’s product candidates, as applicable, and any other product candidates Psyence may identify and develop; |

| ● | Psyence’s ability to successfully identify and negotiate acceptable terms for third-party supply and contract manufacturing agreements with contract manufacturing organizations (“CMOs”); |

| ● | the costs of commercialization activities for any of Psyence’s product candidates that receive marketing approval, including the costs and timing of establishing product sales, marketing, distribution and manufacturing capabilities, or entering into strategic collaborations with third parties to leverage or access these capabilities; |

| ● | the amount and timing of sales and other revenues from Psyence’s product candidates, if approved, including the sales price and the availability of coverage and adequate third-party reimbursement; |

| ● | the cash requirements of developing Psyence’s programs and Psyence’s ability and willingness to finance their continued development; |

| ● | the cash requirements of any future acquisitions or discovery of product candidates; |

8

| ● | the time and cost necessary to respond to technological and market developments, including other products that may compete with one or more of Psyence’s product candidates; |

| ● | supply chain interruptions, which could delay Psyence in the process of developing its product candidates; |

| ● | the costs of acquiring, licensing or investing in intellectual property rights, products, product candidates and businesses; |

| ● | the costs of maintaining, expanding and protecting Psyence’s intellectual property portfolio; |

| ● | its ability to attract, hire and retain qualified personnel as Psyence expands research and development and establishes a commercial infrastructure; and |

| ● | the costs of operating as a public company in the United States and maintaining a listing on Nasdaq. |

Psyence cannot be certain that additional funding will be available on acceptable terms, or at all. Market volatility resulting from the COVID-19 pandemic and the related U.S. and global economic impact or other factors could also adversely impact the ability to access funds as and when needed. If adequate funds are not available to Psyence on a timely basis, Psyence may be required to delay, limit or terminate one or more research or development programs or trials or the potential commercialization of any approved products or be unable to expand operations or otherwise capitalize on business opportunities, as desired, which could materially affect Psyence’s business, prospects, financial condition and results of operations.

We depend on our current key personnel and our ability to attract and retain employees.

Our future growth and success depends on our ability to recruit, retain, manage and motivate our employees. We are highly dependent on our current management and scientific personnel, including Dr. Neil Maresky (Chief Executive Officer), Jody Aufrichtig (Executive Chairman), Warwick Corden-Lloyd (Chief Financial Officer), Dr. Clive Ward-Able (Medical Director) and Taryn Vos (General Counsel). The inability to hire or retain experienced management personnel could adversely affect our ability to execute our business plan and harm our operating results. Due to the specialized scientific and managerial nature of our business, we rely heavily on our ability to attract and retain qualified scientific, technical and managerial personnel. The competition for qualified personnel in the pharmaceutical field is intense and we may be unable to continue to attract and retain qualified personnel necessary for the development of our business or to recruit suitable replacement personnel.

Our historical financial results may not be representative of our results as a separate, stand-alone company.

Some of the historical financial information we have included in this Report has been derived from the financial statements and accounting records of Parent (as defined below) and does not necessarily reflect what our financial position, results of operations or cash flows would have been had we been a separate, stand-alone company during the periods presented. The historical information does not necessarily indicate what our results of operations, financial position, cash flows or costs and expenses will be in the future.

The psychedelic therapy and biotechnology industries are undergoing rapid growth and substantial change, which has resulted in an increase in competitors, consolidation and formation of strategic relationships. Acquisitions or other consolidating transactions could harm Psyence in a number of ways, including by losing strategic partners if they are acquired by or enter into relationships with a competitor, losing customers, revenue and market share, or forcing Psyence to expend greater resources to meet new or additional competitive threats, all of which could harm Psyence’s operating results.

The psychedelic therapy and biotechnology industries are intensely competitive and subject to rapid and significant technological change. Psyence has competitors in Canada, the United States, Europe and other jurisdictions, including major multinational pharmaceutical companies, established biotechnology companies, specialty pharmaceutical and generic drug companies and universities and other research institutions. Many of its competitors have greater financial and other resources, such as larger research and development staff and more experienced marketing and manufacturing organizations than it does. Large pharmaceutical companies, in particular, have extensive experience in, and substantial capital resources for, conducting research, molecular derivative development, obtaining regulatory approvals, obtaining intellectual property protection and establishing key relationships. These companies also have significantly greater sales and marketing capabilities and experience in completing collaborative transactions in Psyence’s target markets with leading companies and research institutions.

9

Psyence’s competitors may introduce new psychedelic analogs or develop technological advances that compete with Psyence. Psyence cannot predict the timing or impact of competitors introducing new psychedelic analogs or technological advances. Such competing psychedelic analogs may be safer, more effective, more effectively marketed, licensed or sold or have lower prices or superior performance features than Psyence’s psychedelic analogs, and this could negatively impact Psyence’s business and results of operations. Established pharmaceutical companies may also invest heavily to accelerate discovery and development of novel compounds or to in-license novel compounds that could make the psychedelic analogs that Psyence develops obsolete. As a result of any of these factors, Psyence’s competitors may succeed in obtaining patent protection or discovering, developing and commercializing psychedelic analogs before Psyence does or may develop psychedelic analogs that are deemed to be more effective or gain greater market acceptance than those of Psyence.

Smaller or early-stage companies may also prove to be significant competitors, particularly through collaborative transactions with large, established companies. In addition, many universities and private and public research institutions may become active in the development of novel compounds. Psyence’s competitors may succeed in developing, acquiring or licensing on an exclusive basis, technologies and psychedelic analogs that are more effective or less costly than any of the psychedelic analogs that Psyence is currently developing or that it may develop, which could render its psychedelic analogs obsolete or non-competitive. If Psyence’s competitors’ market psychedelic analogs that are more effective, safer or less expensive or that reach the market sooner than Psyence’s psychedelic analogs, if any, Psyence may not achieve commercial success. In addition, because of its limited resources, it may be difficult for Psyence to stay abreast of the rapid changes in each technology. If Psyence fails to stay at the forefront of technological change, it may be unable to compete effectively. Technological advances or products developed by its competitors may render its technologies or psychedelic analogs obsolete, less competitive or not economical.

Current and future preclinical and clinical studies will be conducted outside the United States, and the FDA may not accept data from such studies to support any NDAs submitted after completing the applicable developmental and regulatory prerequisites (absent an IND).

Psyence is conducting a preclinical and a clinical study outside the United States. Psyence has received full approval of a study in the UK from the MHRA, which was not initiated due to certain cost-effective incentives provided by Australia. Psyence has received full approval from the Australian Human Research Ethics Committees (HRECs), the body responsible for the review of research proposals involving human participants to ensure that they are ethically acceptable. The protocol under review in Australia will be reviewed as part of a Pre-IND (Investigational New Drug) application by the FDA. To the extent Psyence does not conduct these clinical trials under an IND, the FDA may not accept data from such trials. Although the FDA may accept data from clinical trials conducted outside the United States that are not conducted under an IND, the FDA’s acceptance of these data is subject to certain conditions. For example, the clinical trial must be well designed and conducted and performed by qualified investigators in accordance with ethical principles and all applicable FDA regulations. The trial population must also adequately represent the intended U.S. population, and the data must be applicable to the U.S. population and U.S. medical practice in ways that the FDA deems clinically meaningful. There can be no guarantee that the FDA will accept data from trials conducted outside of the United States. If the FDA does not accept the data from such clinical trials, this would likely result in the need for additional trials and the completion of additional regulatory steps, which would be costly and time-consuming and could delay or permanently halt the development of Psyence’s product candidates.

There is a high rate of failure for product candidates proceeding through clinical trials.

Psyence has no registered products on the market, and its new potential psilocybin-based product candidates are currently either in the preclinical or clinical development phase. Psyence’s ability to achieve and sustain profitability with respect to its product candidates in which psilocybin is featured as the active pharmaceutical ingredient depends on obtaining regulatory approvals for and, if approved, successfully commercializing, its product candidates, either alone or with third parties. Before obtaining regulatory approval for the commercial distribution of its current or future product candidates, Psyence or an existing or future collaborator must conduct extensive preclinical tests and clinical trials to demonstrate the safety, purity and potency of its product candidates.

10

Generally, there is a high rate of failure for product candidates proceeding through clinical trials. Psyence may suffer significant setbacks in its clinical trials similar to the experience of a number of other companies in the pharmaceutical and biotechnology industries, even after receiving promising results in earlier trials. Further, even if Psyence views the results of a clinical trial to be positive, applicable international regulatory authorities may disagree with Psyence’s interpretation of the data. In the event that Psyence obtains negative results from clinical trials for product candidates or other problems related to potential chemistry, manufacturing and control issues or other hurdles occur and its current or future product candidates are not approved, Psyence may not be able to generate sufficient revenue or obtain financing to continue its operations, its ability to execute on its current business plan may be materially impaired and its reputation in the industry and in the investment community might be significantly damaged. In addition, Psyence’s inability to properly design, commence and complete clinical trials may negatively impact the timing and results of its clinical trials and ability to seek approvals for its product candidates.

The testing, marketing and manufacturing of any new drug product for use in the U.S. will require approval from the FDA. Psyence cannot predict with any certainty the amount of time necessary to obtain such FDA approval and whether any such approval will ultimately be granted. Preclinical and clinical trials may reveal that one or more product candidates are ineffective or unsafe, in which event further development of such product candidates could be seriously delayed or terminated. Moreover, obtaining approval for certain product candidates may require testing on human subjects of substances whose effects on humans are not fully understood or documented. Delays in obtaining FDA or any other necessary regulatory approvals of any proposed drug and failure to receive such approvals would have an adverse effect on the drug’s potential commercial success and on Psyence’s business, prospects, financial condition and results of operations. In addition, it is possible that a proposed drug may be found to be ineffective or unsafe due to conditions or facts that arise after development has been completed and regulatory approvals have been obtained. In this event, Psyence may be required to withdraw such proposed drug from the market. To the extent that its success will depend on any regulatory approvals from government authorities outside of the U.S. that perform roles similar to that of the FDA, uncertainties similar to those stated above will also exist.

Because the results of preclinical studies and earlier clinical trials are not necessarily predictive of future results, Psyence may not have favorable results in its planned and future clinical trials.

Successful development of therapeutic products is highly uncertain and is dependent on numerous factors, many of which are beyond Psyence’s control. Product candidates that appear promising in the early phases of development may fail to reach the market for several reasons, including, but not limited to:

| ● | preclinical or clinical study results that may show the product to be less effective than desired (e.g., the study failed to meet Psyence’s primary objectives) or to have harmful or problematic side effects; |

| ● | failure to receive the necessary regulatory approvals or a delay in receiving such approvals. Among other things, such delays may be caused by slow enrollment in clinical studies, length of time to achieve study endpoints, additional time requirements for data analysis or regulatory requests for additional preclinical or clinical data or unexpected safety or manufacturing issues; |

| ● | manufacturing costs, pricing, or reimbursement issues or other factors that make the product not economical; and |

| ● | the proprietary rights of others and their competing products and technologies that may prevent the product from being commercialized. |

Any positive results from preclinical testing of Psyence’s prospective product candidates may not necessarily be predictive of the results from planned or future clinical trials for such product candidates. Many companies in the pharmaceutical and biotechnology industries have suffered significant setbacks in clinical trials after achieving positive results in preclinical and early clinical development, and Psyence cannot be certain that it will not face similar setbacks. These setbacks have been caused by, among other things, preclinical findings while clinical trials were underway or safety or efficacy observations in clinical trials, including adverse events. If Psyence fails to produce positive results in its planned clinical trials for its product candidates as described in the section titled “Business”, or its future clinical trials, the development timeline and regulatory approval and commercialization prospects for such product candidates, and, correspondingly, Psyence’s business and financial prospects, would be materially adversely affected.

11

Negative results from clinical trials or studies of others and adverse safety events involving Psyence’s psychedelic analogs could have a material adverse effect on Psyence’s business.

From time to time, studies or clinical trials on medical-grade psilocybin mushroom products may be conducted or sponsored by academics, research institutions or others, including government agencies. The publication of negative results of studies or clinical trials related to Psyence’s proposed products or the therapeutic areas in which Psyence’s proposed products will compete could have a material adverse effect on Psyence’s business, prospects, financial condition and results of operations.

Supply chain interruptions could delay Psyence in the process of developing its product candidates.

There are few licensed suppliers of input materials for the manufacture of Psyence’s product candidates. Any loss of stored materials or facilities through fire, theft or other causes could have an adverse effect on Psyence’s ability to procure the product candidate materials and continue product development activities. Furthermore, Psyence is largely dependent on Filament, for the supply of PEX010 (a capsule containing 25mg naturally sourced psilocybin and product being used in Psyence’s Phase IIb Study), and any interruption in Filament’s supply chain (or the supply chain of any other suppliers engaged by Pyence) will lead to delays in Psyence’s drug development timelines. Furthermore, Filament, as well as any other suppliers engaged by Pyence, will be required to continue to meet regulatory requirements applicable to the PEX010 product candidate and maintain GMP compliant standards which dictate the minimum requirements for the methods, facilities and controls used in manufacturing, processing and packing of a drug product. There can be no assurances that Filament or any CMOs will be able to meet Psyence’s timetable and requirements or carry out their contractual obligations in accordance with the applicable regulations. In addition, the drug product supplied to Psyence may not meet its specifications and quality policies and procedures nor may they be able to supply the drug product in commercial quantities when the time comes. If Psyence is unable to arrange for alternative third-party supply sources on commercially reasonable terms or in a timely manner, it may delay the development of its product candidates and could have a material adverse effect on Psyence’s business operations and financial condition.

Further, the failure of CMOs to operate in compliance with GMP or other applicable quality related regulations could result in, among other things, certain product liability claims in the event such failure to comply results in defective products that caused injury or harm. In general, Psyence’s dependence upon third parties for the supply of Psyence’s drug product may adversely affect profit margins and Psyence’s ability to develop and deliver viable end products on a timely and competitive basis.

Psyence’s proprietary information, or that of its strategic business partners, may be lost or Psyence may suffer security breaches.

In the ordinary course of its business, Psyence collects and stores sensitive data, including valuable and commercially sensitive intellectual property, clinical trial data, proprietary business information and that of Psyence’s strategic business partners, as well as the personally identifiable information of clinical trial subjects, employees and patients, in and on Psyence’s networks. Despite security measures, information technology and infrastructure may be vulnerable to attacks by hackers or breached due to employee error, malfeasance or other disruptions. Any such breach could compromise Psyence’s networks and the information stored there could be accessed, publicly disclosed, lost or stolen. Any such access, disclosure or other loss of information could result in legal claims or proceedings, liability under laws that protect the privacy of personal information, regulatory penalties, disruption of operations, damage to Psyence’s reputation, and cause a loss of confidence in Psyence’s ability to conduct clinical trials, which could adversely affect Psyence’s business, prospects, financial condition and results of operations.

12

Costs associated with compliance with numerous laws and regulations could impact our financial results. In addition, we could become subject to increased enforcement and/or litigation risks associated with the psychedelic therapeutics industry.

The manufacture, labeling and distribution of products containing psilocybin or other psychedelic analogs is governed by various federal, state and local agencies. To the extent we are able to successfully commercialize any of our currently contemplated product candidates via the FDA’s NDA approval pathway, the presence of psychedelic analogs as active or inactive ingredients, as applicable, may give rise to heightened regulatory scrutiny and greater risk of consumer litigation, either of which could further restrict the permissible scope of our marketing claims about such products or our ability to sell them in the United States at all. The shifting compliance environment and the need to build and maintain robust systems to comply with different psychedelic-related regulations in jurisdictions may increase costs and/or the risk that we may violate one or more applicable regulatory requirements. If our operations, or any of our activities or prospective products, are found to be in violation of any such laws or any other governmental regulations that apply to the manufacture, distribution, or sale of prescription drug products, generally, and to products containing psychedelic analogs, we may be subject to penalties, including, without limitation, civil and criminal penalties, damages, fines, the curtailment or restructuring of our operations, any of which could adversely affect our ability to operate our business or our financial results.

Failure to comply with any applicable regulatory requirements, relating to psilocybin or otherwise, may result in, among other things, injunctions, product withdrawals, recalls, product seizures, fines and criminal prosecutions. Additionally, advertising and labeling laws are often enforced by governmental officials, and any action based on potentially misleading or deceptive advertising is often followed by costly class-action complaints under consumer-protection laws.

Psyence may acquire businesses or products, or form additional strategic alliances, in the future, and may not realize the benefits of such acquisitions.

Psyence may acquire additional businesses or products, form additional strategic alliances, or create joint ventures with third parties that it believes will complement or augment its existing business. Any of these relationships may require Psyence to incur non-recurring and other charges, increase Psyence’s near and long-term expenditures, issue securities that dilute Psyence’s existing shareholders or disrupt Psyence’s management and business. In addition, we face significant competition in seeking appropriate strategic partners and the negotiation process is time-consuming and complex. If Psyence acquires businesses with promising markets or technologies, it may not be able to realize the benefit of acquiring such businesses if it is unable to successfully integrate them with its existing operations and company culture. Psyence may encounter numerous difficulties in developing, manufacturing, and marketing any new products resulting from a strategic alliance or acquisition that delay or prevent it from realizing their expected benefits or enhancing its business. There is no assurance that, following any such acquisition, Psyence will achieve the synergies expected in order to justify the transaction, which could result in a material adverse effect on its business and prospects.

We will need substantial additional financing to develop our product candidates and implement our operating plans. If we fail to obtain additional financing, we may be unable to complete the development and commercialization of our product candidates.

We expect to spend a substantial amount of capital in the development and manufacturing of our product candidates, and we will need substantial additional financing to do so. In particular, we will require substantial additional financing to enable commercial production of our product candidates and initiate and complete registrational trials for multiple products in multiple regions. Further, if approved, we will require significant additional capital in order to launch and commercialize our product candidates.

As of March 31, 2024 , 2024 we had USD$762,799 in cash and cash equivalents and restricted cash. Changing circumstances may cause us to consume capital significantly faster than we currently anticipate, and we may need to spend more money than currently expected because of circumstances beyond our control. We may also need to raise additional capital sooner than we currently anticipate if we choose to expand more rapidly than we presently plan. In any event, we will require additional capital for the further development and commercialization of our product candidates.

We cannot be certain that additional funding will be available on acceptable terms, or at all. We have no committed source of additional capital. If we are unable to raise additional capital in sufficient amounts or on terms acceptable to us, we may have to significantly delay, scale back or discontinue the development or commercialization of our product candidates or other research and development initiatives. We could be required to seek collaborators for our product candidates at an earlier stage than otherwise would be desirable or on terms that are less favorable than might otherwise be available or relinquish or license on unfavorable terms our rights to our product candidates in markets where we otherwise would seek to pursue development or commercialization ourselves.

13

Any of the above events could significantly harm our business, prospects, financial condition and results of operations and cause the price of our securities to decline.

In addition, future changes in regulations, changes in legal status of psilocybin-containing products, more vigorous enforcement thereof or other unanticipated events could require extensive changes to Psyence’s operations, increased compliance costs or give rise to material liabilities, which could have a material adverse effect on the business, results of operations and financial condition of Psyence.

We rely on third parties to conduct our clinical trials. If these third parties do not properly and successfully carry out their contractual duties or meet expected deadlines, we may not be able to obtain regulatory approval of, or commercialize, our product candidates.

Psyence relies on iNGENū to conduct clinical development activities with Psyence’s product candidates, which activities involve trial design, regulatory submissions, clinical patient recruitment, clinical trial monitoring, clinical data management and analysis, safety monitoring and project management.

Additionally, we expect to utilize and depend upon independent investigators and collaborators, such as medical institutions, CROs, CDMOs and strategic partners to conduct our preclinical studies under agreements with us and in connection with our clinical trials. We expect to have to negotiate budgets and contracts with CROs, trial sites and CDMOs, which may result in delays to our development timelines and increase costs. We will rely heavily on these third parties over the course of our clinical trials, and we control only certain aspects of their activities. As a result, we have less direct control over the conduct, timing and completion of these clinical trials and the management of data developed through clinical trials than would be the case if we were relying entirely upon our own staff. Nevertheless, we are responsible for ensuring that each of our studies is conducted in accordance with applicable protocol, legal and regulatory requirements and scientific standards and our reliance on third parties does not relieve us of our regulatory responsibilities. We and these third parties are required to comply with good clinical practices (“GCPs”), which are regulations and guidelines enforced by the FDA and comparable foreign regulatory authorities for product candidates in clinical development. Regulatory authorities enforce these GCPs through periodic inspections of trial sponsors, principal investigators and trial sites. If we or any of these third parties fail to comply with applicable GCP regulations, the clinical data generated in our clinical trials may be deemed unreliable and the FDA or comparable foreign regulatory authorities may require us to perform additional clinical trials before approving our marketing applications. We cannot assure you that, upon inspection, such regulatory authorities will determine that any of our clinical trials comply with the GCP regulations. Our failure or any failure by these third parties to comply with these regulations or to recruit a sufficient number of patients may require us to repeat clinical trials, which would delay the regulatory approval process. Moreover, our business may be implicated if any of these third parties violates federal or state fraud and abuse or false claims laws and regulations or healthcare privacy and security laws.

Any third parties conducting our clinical trials are not and will not be our employees and, except for remedies available to us under our agreements with such third parties, we cannot control whether or not they devote sufficient time and resources to our product candidates. These third parties may also have relationships with other commercial entities, including our competitors, for whom they may also be conducting clinical trials or other drug development activities, which could affect their performance on our behalf. If these third parties do not successfully carry out their contractual duties or obligations or meet expected deadlines, if they need to be replaced or if the quality or accuracy of the clinical data they obtain is compromised due to the failure to adhere to our clinical protocols or regulatory requirements or for other reasons, our clinical trials may be extended, delayed or terminated and we may not be able to complete development of, obtain regulatory approval of or successfully commercialize our product candidates. As a result, our financial results and the commercial prospects for our product candidates would be harmed, our costs could increase and our ability to generate revenue could be delayed.

Switching or adding third parties to conduct our clinical trials involves substantial cost and requires extensive management time and focus. In addition, changes in manufacturers often involve changes in manufacturing procedures and processes, which could require that we conduct bridging studies between our prior clinical supply used in our clinical trials and that of any new manufacturer. We may be unsuccessful in demonstrating the comparability of clinical supplies which could require the conduct of additional clinical trials. Additionally, there is a natural transition period when a new third party commences work. As a result, delays occur, which can materially impact our ability to meet our desired clinical development timelines.

14

We are dependent on licensed intellectual property. If we were to lose our rights to licensed intellectual property, we may not be able to continue developing or commercializing our product candidates, if approved. If we breach any of the agreements under which we license the use, development and commercialization rights to our product candidates or technology from third parties or, in certain cases, we fail to meet certain development deadlines, we could lose license rights that are important to our business.

We do not currently own any patents, and we are heavily reliant upon a number of license agreements under which we are granted rights to intellectual property that are important to our business and we may need or choose to enter into additional license agreements in the future.

Specifically, our business and active Phase IIb Study is highly dependent on the Research IP Agreement with Filament, which expires in April 2027 and covers the Phase IIb Study only. Until we develop our own product candidates, the termination, non-renewal or hinderance of use of the license granted under the Research IP Agreement could have a material adverse effect on our ability to develop our product candidates. Furthermore, following the completion of the Phase IIb Study, we will be required to enter into agreements with alternative suppliers for the supply and licensing of alternative drug products for use in our pivotal Phase III studies in palliative care, and there can be no guarantees that such agreements will be finalized. The Company continues to evaluate its bridging program into Phase III in this regard, which bridging program will require regulatory agency approval, and there can be no guarantees that such approvals will be obtained.

Our existing license agreements impose, and we expect that future license agreements will impose on us, various development, regulatory and/or commercial diligence obligations, payment of milestones and/or royalties and other obligations. If we fail to comply with our obligations under these agreements, the licensor may have the right to terminate the license, in which event we would not be able to market products covered by the license. Our business could suffer, for example, if any current or future licenses terminate, if the licensors fail to abide by the terms of the license, if the licensed patents or other rights are found to be invalid or unenforceable, or if we are unable to enter into necessary licenses on acceptable terms.

Licensing of intellectual property is of critical importance to our business and involves complex legal, business and scientific issues. Disputes may arise between us and our licensors regarding intellectual property subject to a license agreement, including:

| ● | the scope of rights granted under the license agreement and other interpretation-related issues; |

| ● | whether and the extent to which our technology and processes infringe on intellectual property of the licensor that is not subject to the licensing agreement; |

| ● | our right to sublicense patent and other rights to third parties; |

| ● | our diligence obligations with respect to the use of the licensed technology in relation to our development and commercialization of our product candidates, and what activities satisfy those diligence obligations; |

| ● | our obligation to pursue, or license others to pursue, development of indications we are not currently pursuing; |

| ● | the ownership of inventions and know-how resulting from the joint creation or use of intellectual property by our licensors and us and our partners; |

| ● | our right to transfer or assign the license; and |

| ● | the effects of termination. |

If disputes over intellectual property that we have licensed prevent or impair our ability to maintain our current licensing arrangements on acceptable terms, we may be unable to successfully develop and commercialize the affected product candidates.

15

We may enter into additional licenses to third-party intellectual property that are necessary or useful to our business. Our current licenses and any future licenses that we may enter into may impose various royalty payment, milestone, and other obligations on us. Under some license agreements, we may not control prosecution of the licensed intellectual property, or may not have the first right to enforce the intellectual property. In those cases, we may not be able to adequately influence patent prosecution or enforcement, or prevent inadvertent lapses of coverage due to failure to pay maintenance fees. If we fail to comply with any of our obligations under a current or future license agreement, the licensor may allege that we have breached our license agreement, and may accordingly seek to terminate our license. Termination of any of our current or future licenses could result in our loss of the right to use the licensed intellectual property, which could materially adversely affect our ability to develop and commercialize a product candidate or product, if approved, as well as harm our competitive business position and our business prospects. Under some license agreements, termination may also result in the transfer of or granting in rights under certain of our intellectual property and information related to the product candidate being developed under the license, such as regulatory information.

The agreements under which we license intellectual property or technology to or from third parties are complex, and certain provisions in such agreements may be susceptible to multiple interpretations. The resolution of any contract interpretation disagreement that may arise could narrow what we believe to be the scope of our rights to the relevant intellectual property or technology or increase what we believe to be our financial or other obligations under the relevant agreement, either of which could have a material adverse effect on our business, financial condition, results of operations and prospects. Moreover, if disputes over intellectual property that we have licensed prevent or impair our ability to maintain our current licensing arrangements on commercially acceptable terms, we may be unable to successfully develop and commercialize the affected product candidates.

In addition, if our licensors fail to abide by the terms of the license, if the licensors fail to prevent infringement by third parties, if the licensed patents or other rights are found to be invalid or unenforceable, or if we are unable to enter into necessary licenses on acceptable terms, our business could suffer. Moreover, our licensors may own or control intellectual property that has not been licensed to us and, as a result, we may be subject to claims, regardless of their merit, that we are infringing, misappropriating or otherwise violating the licensor’s rights.

Similarly, if we are unable to successfully obtain rights to required third-party intellectual property rights or maintain the existing intellectual property rights we have, we may have to seek alternative options, such as developing new product candidates with design-around technologies, which may require more time and investment, or abandon development of the relevant research programs or product candidates and our business, financial condition, results of operations and prospects could suffer.

We (or iNGENū in conducting our clinical trials) will depend on enrollment of patients in our clinical trials for our product candidates. If we encounter difficulties enrolling patients in our clinical trials, our clinical development activities could be delayed or otherwise adversely affected.

Identifying and qualifying patients to participate in clinical trials of our product candidates will be critical to our success. We may experience difficulties in patient enrollment in our clinical trials for a variety of reasons. The timely completion of clinical trials in accordance with their protocols depends, among other things, on our ability to enroll a sufficient number of patients who remain in the study until its conclusion. The enrollment of patients depends on many factors, including:

| ● | the patient eligibility criteria defined in the protocol; |

| ● | the number of patients with the disease or condition being studied; |

| ● | the perceived risks and benefits of the product candidate in the trial; |

| ● | clinicians’ and patients’ perceptions as to the potential advantages of the product candidate being studied in relation to other available therapies, including any new drugs that may be approved for the indications we are investigating or drugs that may be used off-label for these indications; |

| ● | the size and nature of the patient population required for analysis of the trial’s primary and secondary endpoints; |

| ● | the proximity of patients to study sites; |

16

| ● | the design of the clinical trial; |

| ● | our ability to recruit clinical trial investigators with the appropriate competencies and experience; |

| ● | competing clinical trials for similar therapies or other new therapeutics not involving psychedelic therapies; |

| ● | our ability to obtain and maintain patient consents; |

| ● | disruptions to health care systems caused by the coronavirus pandemic or outbreaks of other infections; |

| ● | the risk that patients enrolled in clinical trials will drop out of the clinical trials before completion of their treatment; and |

| ● | other public health factors, including the coronavirus pandemic or outbreaks of other infections. |

Moreover, because our product candidates represent a departure from more commonly used methods for AjD treatment, potential study participants and their doctors may be inclined to use conventional therapies, such as pure psychotherapy, rather than participate in our clinical trials.

Delays in patient enrollment may result in increased costs or may affect the timing or outcome of the planned clinical trials, which could prevent completion of these clinical trials and adversely affect our ability to advance the development of our product candidates. In addition, many of the factors that may lead to a delay in the commencement or completion of clinical trials may also ultimately lead to the denial of regulatory approval of our product candidates.

Psyence’s insurance coverage may be inadequate or expensive.

Psyence’s business is subject to a number of risks and hazards generally, including adverse clinical trial results, accidents, labor disputes and changes in the regulatory environment. Such occurrences could result in damage to assets, personal injury or death, environmental damage, delays in operations, monetary losses and possible legal liability.

Psyence’s insurance may not cover all the potential risks associated with its operations. Psyence may also be unable to maintain insurance to cover these risks at economically feasible premiums. Insurance coverage may not be available (or generally available on acceptable terms) or may not be adequate to cover any resulting liability. The successful assertion of one or more large claims against us that exceed available insurance coverage, or the occurrence of changes in our insurance policies, including premium increases or the imposition of large retention, or deductible, or co-insurance requirements, could have an adverse effect on our business, financial condition and results of operations.

Certain significant personnel may allocate their time to other businesses, which may cause conflicts of interest in their determination as to how much time to devote to our affairs and potentially competitive fiduciary and pecuniary interests that conflict with our interests.

Certain of Psyence’s directors and officers do not devote their full time to the affairs of Psyence and certain of Psyence’s directors and officers are also directors, officers and shareholders of other biotechnology and research and development companies or other public companies in general, and as a result they may find themselves in a position where their duty to another company conflicts with their duty to Psyence. Although Psyence has policies which address such potential conflicts and the Business Corporations Act (Ontario) has provisions governing directors in the event of such a conflict, there is no assurance that any such conflicts will be resolved in favor of Psyence. If any such conflicts are not resolved in favor of Psyence, Psyence may be adversely affected.

17

We have received research and development incentives from the Australian government. If we don’t qualify for future research and development incentives, we may encounter difficulties in funding research and development projects, which could harm our operating results.

We have previously received a research and development (R&D) cash rebate through the Australian Government’s Research and Development Tax Incentive program, which provides up to a 43.5% rebate on qualifying R&D expenses in Australia.

For Psyence Australia Pty Ltd.’s fiscal year ended June 30, 2023, our subsidiary, Psyence Australia Pty Ltd., received a cash refund of AUD $1,336,622. To receive this research and development cash rebate, we qualified for certain conditions under the R&D Tax Incentive legislation (Income Tax Assessment Act 1997 (Cth), Division 355) in Australia including, but not limited to, having a company incorporated under Australian law, all R&D activities being conducted solely within Australia; the Company’s aggregated group turnover not being equal to, or more than, AU$20M for relevant period; all R&D activities are conducted by, or will be conducted for, the Company; and all CRO expenditures have been physically undertaken in Australia.

Entitlement to tax benefits under the Research and Development Tax Incentive for eligible R&D purposes is based on an annual application to the Australian Government. We believe that we continue to be eligible for the tax benefits. If these tax benefits are reduced, cancelled, or discontinued, or if we fail to meet certain conditions, we may encounter difficulties funding further funding R&D projects, which could harm our operating results.

Risks Related to Regulatory Matters

If we fail to comply with healthcare regulations, we could face substantial enforcement actions, including civil and criminal penalties and our business, operations and financial condition could be adversely affected.

The research and development, studying, manufacturing, packaging, labeling, advertising and distribution of Psyence’s planned product candidates are subject to regulation by one or more governmental authorities, and various agencies of the federal, provincial, state and localities in which Psyence intends to commercialize its products. These governmental authorities may attempt to regulate any of its products that fall within their jurisdiction. Such governmental authorities may not accept the evidence of safety for any ingredients that Psyence may want to market, may determine that a particular product or product ingredient presents an unacceptable health risk and may determine that a particular statement of nutritional support that Psyence wants to use is an unacceptable claim. Such a determination would prevent Psyence from marketing particular products or using certain statements of nutritional support on its products. Psyence also may be unable to disseminate third-party literature that supports its products if the third-party literature fails to satisfy certain requirements. In addition, governmental authorities could require Psyence to remove a particular product from the market. Any recall or removal would result in additional costs to Psyence, including lost revenues from any products that it is required to remove from the market, any of which could be material. Any such product recalls or removals could lead to liability, substantial costs and reduced growth prospects, all of which could be material.

Our prospective products will be subject to the various federal and state laws and regulations relating to health and safety and failure to comply with, or changes in, these laws or regulations could have an adverse impact on our business.

We are in the process of developing an investigational new drug for which we intend to pursue FDA approval via the New Drug Application (“NDA”) process.

In connection with our development and future commercialization (if applicable) of the above- described prospective products, we and each contemplated product candidate are subject to the Federal Food Drug and Cosmetic Act (FDCA). The FDCA is intended to assure the consumer, in part, that drugs and devices are safe and effective for their intended uses and that all labeling and packaging is truthful, informative, and not deceptive. The FDCA and FDA regulations define the term “drug,” in part, by reference to its intended use, as “articles intended for use in the diagnosis, cure, mitigation, treatment, or prevention of disease” and “articles (other than food) intended to affect the structure or any function of the body of man or other animals.” Therefore, almost any ingested or topical or injectable product that, through its label or labeling (including internet websites, promotional pamphlets, and other marketing material), that is claimed to be beneficial for such uses will be regulated by FDA as a drug. The definition also includes components of drugs, such as active pharmaceutical ingredients. Drugs must generally either receive premarket approval by FDA through the NDA process or conform to a “monograph” for a particular drug category, as established by FDA’s Over-the-Counter (OTC) Drug Review. If the FDA does not award premarket approval for our product candidates through the NDA process, this could have a material adverse effect on our business, financial condition and results of operations.

18

The FDA will accept data from studies performed in other countries, as long as the study complies with GCP and ICH guidelines. FDA will review the Phase IIb protocol prior to the start of the study to provide advice on what and how aspects of the trial will be captured. Advice from a pre-IND meeting with the FDA was received in July 2023, which informed the Phase IIb Study design and may also inform the phase III program we plan to do.

Clinical trials are expensive, time-consuming, uncertain and susceptible to change, delay or termination. The results of clinical trials are open to differing interpretations.

Clinical testing is expensive, time consuming, and uncertain as to outcome and may be more costly than anticipated due various factors including, but not limited to, regulatory environment, legal compliance, supply and demand of services and inflationary costs. We cannot guarantee that any clinical trials will be conducted as planned or completed on schedule, or at all. Failures in connection with one or more clinical trials can occur at any stage of testing.

Regulatory agencies may analyze or interpret the results of clinical trials differently than Psyence. Even if the results of the clinical trials are favorable, the clinical trials for the product candidates are expected to continue for several years and may take significantly longer to complete. Events that may prevent successful or timely completion of clinical development include:

| ● | delays in reaching a consensus with regulatory authorities on trial design and other trial related matters; |

| ● | delays in reaching agreement on acceptable terms with prospective third party service providers assisting the CROs in the conduct of the trial; |

| ● | actual or perceived lack of effectiveness of the product candidate during clinical trials; |

| ● | discovery of serious or unexpected toxicities or side effects experienced by trial participants or other safety issues, such as drug interactions; |

| ● | slower than expected rates of subject recruitment and enrollment rates in clinical trials; |