As filed with the U.S. Securities and Exchange Commission on August 19, 2024.

Registration No. [___]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________

FORM

REGISTRATION STATEMENT

Under

the Securities Act of 1933

___________________

___________________

| | 7372 | 98-1776150 | ||

| (State or other jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer |

LeddarTech Holdings Inc.

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

___________________

LeddarTech USA Inc.

Corporation Trust Center

(Name, address, including zip code, and telephone number, including area code, of agent for service)

___________________

Copies to:

|

John T. Blatchford |

Pierre-Yves Leduc |

Barry I. Grossman |

___________________

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act.

____________

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated August 19, 2024

PRELIMINARY PROSPECTUS

Up to 18,181,818 Units, Each Unit Consisting of

One Common Share or One Pre-Funded Warrant to

Purchase One Common Share

and One Warrant to Purchase One Common Share

Up to 18,181,818 Common Shares Underlying the Warrants

Up to 18,181,818 Common Shares Underlying the Pre-Funded Warrants

We are offering on a best-efforts basis up to 18,181,818 units (the “Units”), each unit consisting of one common share, without par value (the “Common Shares”), and one warrant to purchase one Common Share pursuant to this prospectus (the “Purchase Warrants”). The assumed public offering price for each Unit is US$0.55 per Unit, which represents the closing price of our Common Shares on the Nasdaq Global Market on August 15, 2024, for estimated gross proceeds of up to US$10.0 million. The Purchase Warrants will have an exercise price of US$ per share (which is equal to 100% of the public offering price per Unit sold in this offering), will be exercisable immediately upon issuance and will expire five years from the date of issuance.

We are also offering to each purchaser of Units that would otherwise result in the purchaser’s beneficial ownership exceeding 4.99% of our outstanding Common Shares immediately following the consummation of this offering, the opportunity to purchase one pre-funded warrant (in lieu of one Common Share) (the “Pre-Funded Warrants”) plus one Purchase Warrant. The Units, Common Shares, Pre-Funded Warrants and Purchase Warrants shall be referred to herein, collectively, as the “Securities.” Subject to limited exceptions, a holder of Pre-Funded Warrants will not have the right to exercise any portion of its Pre-Funded Warrant if the holder, together with its affiliates, would beneficially own in excess of 4.99% (or, at the election of the holder, such limit may be increased to up to 9.99%) of the number of Common Shares outstanding immediately after giving effect to such exercise. Each Pre-Funded Warrant will be exercisable for one Common Share. The purchase price of each Unit including a Pre-Funded Warrant will be the purchase price for a Unit including a Common Share minus US$0.0001 and the exercise price of each Pre-Funded Warrant will equal US$0.0001 per Common Share. The Pre-Funded Warrants will be immediately exercisable (subject to the beneficial ownership cap) and may be exercised at any time until all of the Pre-Funded Warrants are exercised in full. For each Unit including a Pre-Funded Warrant that is issued (without regard to any limitation on exercise set forth therein), the number of Units including a Common Share that we are offering will be decreased on a one-for-one basis.

The Common Shares and Pre-Funded Warrants can each be subscribed for and/or acquired (as applicable) in this offering only with the accompanying Purchase Warrant as part of a Unit, but the components of the Units will immediately separate upon issuance. We are also offering the Common Shares that are issuable from time to time upon the exercise of the Purchase Warrants and the Pre-Funded Warrants, if any.

See “Description of Securities” in this prospectus for more information.

The Securities will be offered at a fixed price and are expected to be issued in a single closing. There is no minimum number of Securities to be sold or minimum aggregate offering proceeds for this offering to close. We expect this offering to be completed not later than two business days following the commencement of this offering and we will deliver all Securities issued in connection with this offering delivery versus payment/receipt versus payment upon our receipt of investor funds. Accordingly, neither we nor the Placement Agent (as defined below) have made any arrangements to place investor funds in an escrow account or trust account since the Placement Agent will not receive investor funds in connection with the sale of Securities offered hereunder.

We have engaged Maxim Group LLC to act as our exclusive placement agent in connection with this offering (the “Placement Agent” or “Maxim”). The Placement Agent has agreed to use its best efforts to arrange for the sale of the Securities offered by this prospectus. The Placement Agent is not purchasing or selling any of the Securities we are offering and the Placement Agent is not required to arrange the purchase or sale of any specific number of Securities or dollar amount.

We have agreed to pay to the Placement Agent the Placement Agent fees set forth in the table below, which assumes that we sell all of the Securities offered by this prospectus. There is no minimum offering requirement as a condition of closing of this offering. We may sell fewer than all of the Units offered hereby, which may significantly reduce the amount of proceeds received by us, and investors in this offering will not receive a refund if we do not sell all of the Units offered hereby. Because there is no escrow account and no minimum number of Securities or amount of proceeds, investors could be in a position where they have invested in us, but we have not raised sufficient proceeds in this offering to adequately fund the intended uses of the proceeds as described in this prospectus (see “Use of Proceeds”). We will bear all costs associated with the offering. See “Plan of Distribution” for more information regarding these arrangements.

Our Common Shares and Public Warrants (as defined herein) are currently listed on the Nasdaq Global Market (“Nasdaq”) under the symbols “LDTC” and “LDTCW,” respectively. On August 15, 2024, the last reported sale price of our Common Shares and Public Warrants as reported on Nasdaq was US$0.55 per Common Share and US$0.03 per Public Warrant. We do not intend to apply for a listing of the Units, the Purchase Warrants or the Pre-Funded Warrants on any securities exchange or other nationally recognized trading system. Without an active trading market, the liquidity of these securities will be limited.

We may amend or supplement this prospectus from time to time by filing amendments or supplements. You should read this entire prospectus and any amendments or supplements carefully before you make your investment decision.

We are an “emerging growth company” as that term is defined in the Jumpstart Our Business Startups Act of 2012 and, as such, are subject to reduced public company reporting requirements.

Our principal executive offices are located at 4535, boulevard Wilfrid-Hamel, Suite 240 Québec G1P 2J7, Canada.

Investing in our securities involves a high degree of risk. Before buying any securities, you should carefully read the discussion of material risks of investing in our securities in the section titled “Risk Factors” beginning on page 15 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

|

Per Unit(1) |

Total |

|||||

|

Public offering price |

$ |

|

$ |

|

||

|

Placement Agent fees(2) |

$ |

|

$ |

|

||

|

Net proceeds to us, before expenses(3) |

$ |

|

$ |

|

||

____________

(1) Units consist of one Common Share and one Purchase Warrant and assumes no issuance of Pre-Funded Warrants.

(2) We have agreed to pay the Placement Agent a cash fee equal to 7.0% of the aggregate gross proceeds raised in this offering, and to reimburse the Placement Agent for certain of its offering-related expenses. See “Plan of Distribution” for a description of the compensation to be received by the Placement Agent.

(3) We estimate the total expenses of this offering payable by us, excluding the Placement Agent fees, will be approximately US$350,000. Because there is no minimum number of Securities or amount of proceeds required as a condition to closing in this offering, the actual public offering amount, Placement Agent fees, and proceeds to us, if any, are not presently determinable and may be substantially less than the total maximum offering amounts set forth above. For more information, see “Plan of Distribution.”

Delivery of the Securities offered hereby is expected to be made on or about ________, 2024, subject to satisfaction of customary closing conditions.

Maxim Group LLC

Prospectus dated _______________, 2024

TABLE OF CONTENTS

|

Page |

||

|

1 |

||

|

Selected Consolidated Historical and Other Financial Information |

13 |

|

|

15 |

||

|

50 |

||

|

51 |

||

|

52 |

||

|

53 |

||

|

55 |

||

|

74 |

||

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

92 |

|

|

126 |

||

|

135 |

||

|

143 |

||

|

158 |

||

|

162 |

||

|

166 |

||

|

Material U.S. Federal Income Tax Considerations to U.S. Holders |

168 |

|

|

177 |

||

|

179 |

||

|

184 |

||

|

188 |

||

|

189 |

||

|

190 |

||

|

190 |

||

|

190 |

||

|

F-1 |

i

You should rely only on the information contained in this prospectus, any amendment or supplement to this prospectus or any free writing prospectus prepared by us or on our behalf. Neither we, nor the Placement Agent, have authorized any other person to provide you with different or additional information. Neither we, nor the Placement Agent, take responsibility for, nor can we provide assurance as to the reliability of, any other information that others may provide. Neither we, nor the Placement Agent, are making an offer to sell these Securities in any jurisdiction where the offer or sale is not permitted. The information contained in this prospectus is accurate only as of the date of this prospectus or such other date stated in this prospectus, and our business, financial condition, results of operations and/or prospects may have changed since those dates.

Except as otherwise set forth in this prospectus, neither we nor the Placement Agent have taken any action to permit a public offering of these Securities outside the United States of America (“U.S.” or the “United States”) or to permit the possession or distribution of this prospectus outside the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about and observe any restrictions relating to the offering of these Securities and the distribution of this prospectus outside the United States.

IMPORTANT INFORMATION ABOUT IFRS

Our financial statements are prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board and referred to in this prospectus as “IFRS.”

INDUSTRY AND MARKET DATA

The industry and market data relating to our business included in this prospectus is based on our internal estimates and research, as well as publications, research, surveys and studies conducted by independent third parties not affiliated to us. Industry publications, studies and surveys generally state that they were prepared based on sources believed to be reliable, although there is no guarantee of accuracy. While we believe that each of these studies and publications is reliable, we have not independently verified the market and industry data provided by third-party sources. In addition, while we believe our internal research is reliable, such research has not been verified by any independent source. We note that assumptions underlying industry and market data are subject to risks and uncertainties, including those discussed under “Forward-Looking Statements” and “Risk Factors” of this prospectus.

TRADEMARKS, TRADE NAMES AND SERVICE MARKS

We and our subsidiaries and affiliates own or have rights to trademarks, trade names and service marks that they use in connection with the operation of their respective businesses. In addition, their names, logos and website names and addresses are their trademarks or service marks, including, but not limited to, LeddarVision™, LeddarSense™ and VayaVision™. Other trademarks, trade names and service marks appearing in this prospectus are the property of their respective owners. Solely for convenience, in some cases, the trademarks, trade names and service marks referred to in this prospectus are listed without the applicable ®, ™ and SM symbols, but they will assert, to the fullest extent under applicable law, their rights to these trademarks, trade names and service marks.

ii

FREQUENTLY USED TERMS

As used in this prospectus, unless the context otherwise requires or indicates otherwise, references to “we,” “us,” “our,” or the “Company” refer to LeddarTech Holdings Inc., a company incorporated under the laws of Canada, and its consolidated subsidiaries; references to “LeddarTech” refer to LeddarTech Inc., our predecessor company prior to the consummation of the Business Combination.

In this document:

“5% Holder” means a purchaser whose beneficial ownership of the Common Shares would exceed 4.99% immediately following the consummation of this offering.

“Amalgamation” means the amalgamation of Prospector Canada and NewCo in accordance with the terms of the Arrangement.

“Arrangement” means an arrangement under Section 192 of the CBCA on the terms and subject to the conditions set out in the Plan of Arrangement, subject to any amendments or variations to the Plan of Arrangement made in accordance with the terms of the Business Combination Agreement and the Plan of Arrangement or made at the direction of the Court in the Final Order with the prior written consent of Prospector and the Company, such consent not to be unreasonably withheld, conditioned or delayed.

“Business Combination” means the transactions contemplated by the BCA.

“BCA” means the Business Combination Agreement, dated as June 12, 2023, as amended as of September 25, 2023, and as may be further amended, by and among Prospector, LeddarTech and NewCo.

“CBCA” means the Canada Business Corporations Act.

“Change of Control Transaction” means any transaction or series of related transactions (a) under which any person(s) that are affiliates or that are acting as a group, directly or indirectly, acquires or otherwise purchases (i) another person or any of its affiliates or (ii) all or a material portion of assets, businesses or equity securities of another Person, or (b) that results, directly or indirectly, in the shareholders of a person as of immediately prior to such transaction holding, in the aggregate, less than fifty percent (50%) of the voting shares of such person (or any successor or parent company of such Person) immediately after the consummation thereof (excluding, for the avoidance of doubt, any Company Earnout Non-Voting Special Shares and the Company Common Shares issuable upon conversion thereof) (in the case of each of clause (a) and (b), whether by amalgamation, merger, consolidation, arrangement, tender offer, recapitalization, purchase or issuance of equity securities, tender offer or otherwise).

“Class A Non-Voting Special Shares” means (a) prior to the Company Amalgamation, the Class A Non-Voting Special Shares in the capital of AmalCo, and (b) from and after the Company Amalgamation, the Class A Non-Voting Special Shares in the capital of the Company.

“Class B Non-Voting Special Shares” means (a) prior to the Company Amalgamation, the 999,963 Class B Non-Voting Special Shares in the capital of AmalCo, and (b) from and after the Company Amalgamation, the 999,963 Class B Non-Voting Special Shares in the capital of the Company.

“Class C Non-Voting Special Shares” means (a) prior to the Company Amalgamation, the 999,963 Class C Non-Voting Special Shares in the capital of AmalCo, and (b) from and after the Company Amalgamation, the 999,963 Class C Non-Voting Special Shares in the capital of the Company.

“Class D Non-Voting Special Shares” means (a) prior to the Company Amalgamation, the 999,963 Class D Non-Voting Special Shares in the capital of AmalCo, and (b) from and after the Company Amalgamation, the 999,963 Class D Non-Voting Special Shares in the capital of the Company.

“Class E Non-Voting Special Shares” means (a) prior to the Company Amalgamation, the Class 999,963 E Non-Voting Special Shares in the capital of AmalCo, and (b) from and after the Company Amalgamation, the 999,963 Class E Non-Voting Special Shares in the capital of the Company.

“Class F Non-Voting Special Shares” means (a) prior to the Company Amalgamation, the 999,963 Class F Non-Voting Special Shares in the capital of AmalCo, and (b) from and after the Company Amalgamation, the 999,963 Class F Non-Voting Special Shares in the capital of the Company.

iii

“Closing” means the consummation of the transactions contemplated by the Business Combination Agreement, including the Business Combination, on December 21, 2023.

“Common Shares” or “Company Common Shares” means the common shares of the Company, without par value.

“Company Earnout Non-Voting Special Shares” means, collectively, the Company’s Class B Non-Voting Special Shares, Class C Non-Voting Special Shares, Class D Non-Voting Special Shares, Class E Non-Voting Special Shares and Class F Non-Voting Special Shares.

“Continuance” means the continuance of Prospector from the Cayman Islands under the Companies Act to Canada as a corporation existing under the CBCA.

“Director Awards” means the outstanding restricted stock units and/or stock options, as applicable, held by directors of the Company.

“First Registration Statement” means the registration statement on Form F-1 (File No. 333-277045), as amended, that registers the issuance of Common Shares upon the exercise of our Public Warrants and the resale of Common Shares by, among others, the Sponsor, certain directors and officers of LeddarTech and the Company and certain lenders, which was declared effective by the SEC on May 8, 2024.

“First Shelf Primary Shares” means the 10,833,333 Common Shares issuable upon exercise of the Public Warrants and registered under the First Registration Statement.

“First Shelf Secondary Shares” means the 40,582,699 Common Shares registered under, and offered by the Selling Securityholders named in, the First Registration Statement.

“Incentive Plan” means the Omnibus Incentive Plan substantially in the form attached as Exhibit E to the BCA, subject to any amendments or variations to which the Company and Prospector may mutually agree.

“IQ” means Investissement Québec, a legal person established under the Act Respecting Investissement Québec, acting as agent for the government of Québec as part of the Fonds de développement économique and Fonds Propre.

“LeddarTech Holders” means the prior shareholders of LeddarTech that are holders of Common Shares in connection with the Business Combination.

“Legacy Director Warrants” means the privately placed warrants held by certain individuals, including certain current Company directors, who served as directors of the Company’s predecessor, LeddarTech Inc.

“Legacy SPAC Warrants” means the outstanding Prospector Warrants assumed by the Company that became warrants of the Company upon the consummation of the Business Combination, which are comprised of the Private Placement Warrants together with the Public Warrants.

“Lender Warrants” means privately placed warrants held by certain Selling Securityholders other than Sponsor.

“Maxim” or the “Placement Agent” means Maxim Group LLC.

“Nasdaq” means the Nasdaq Global Market.

“NewCo” means LeddarTech Holdings Inc. prior to the Amalgamation.

“PIPE Financing” means the PIPE Investors’ purchase of secured convertible notes of LeddarTech in accordance with the terms of the Subscription Agreement, in an aggregate principal amount of at least US$43,000,000.

“PIPE Investors” means those certain investors, including Sponsor and an affiliate of the Sponsor, who have entered into the Subscription Agreement to purchase convertible notes of LeddarTech in the PIPE Financing.

“Placement Agency Agreement” means the Placement Agency Agreement entered into by the Company and Maxim Group LLC on the date of the final prospectus.

iv

“Plan of Arrangement” means the plan of arrangement (including the Business Combination) in substantially the form attached as Annex C to the prospectus forming a part of the registration statement on Form F-4, filed by the Company with the SEC on November 29, 2023.

“Pre-Funded Warrants” means pre-funded warrants, each to purchase one Common Share, that 5% Holders have the option to acquire as part of the Units in lieu of Common Shares comprising such Units pursuant to the prospectus.

“Private Placement Warrants” means the Prospector Warrants purchased by Sponsor in the IPO.

“Prospector” means Prospector Capital Corp., a Cayman Islands exempted company.

“Prospector Canada” means Prospector as it will exist under the laws of Canada following the Continuance.

“Prospector Class A Shares” means Prospector’s Class A ordinary shares, US$0.0001 par value.

“Prospector Class B Holders” means the holders of Prospector Class B Shares immediately prior to the Business Combination.

“Prospector Class B Shares” means Prospector’s Class B ordinary shares, US$0.0001 par value.

“Prospector Non-Redeeming Shareholder” means each holder of a Prospector Class A Share that elects not to participate in the Prospector Shareholder Redemption.

“Prospector Shareholder Redemption” means the redemption of Prospector Class A Shares on the terms and subject to the conditions set forth in Prospector’s governing documents.

“Prospector Warrants” means each warrant to purchase one Prospector Class A Share at an exercise price of US$11.50 per share, subject to adjustment, upon the terms and conditions in the Warrant Agreement and Sponsor Letter Agreement, and shall include the Prospector Vesting Sponsor Warrants.

“Public Warrants” means the publicly traded Legacy SPAC Warrants.

“Purchase Warrants” means warrants to purchase one Common Share pursuant to this prospectus.

“SEC” means the U.S. Securities and Exchange Commission.

“Securities” means, collectively, the Common Shares, Units, Purchase Warrants and Pre-Funded Warrants.

“Securities Act” means the Securities Act of 1933, as amended.

“Securities Purchase Agreement” means the Securities Purchase Agreement entered into by the Company and each purchaser identified therein on the date of the final prospectus.

“Selling Securityholders” means, as applicable, the selling securityholders named in the First Registration Statement.

“SEPA” means the Standby Equity Purchase Agreement entered into by the Company and Yorkville on April 8, 2024 and effective on April 15, 2024.

“SEPA Advance Shares” means the up to 19,836,637 Common Shares the Company has the right to issue and sell to Yorkville under the SEPA.

“SEPA Commitment Shares” means the 163,363 Common Shares issued to Yorkville in satisfaction of the upfront commitment fee under the SEPA.

“SEPA Registration Statement” means the registration statement on Form F-1 (File No. 333-279803) that registers the resale of Common Shares issued to Yorkville pursuant to the SEPA, including the SEPA Commitment Shares and the SEPA Advance Shares.

“SEPA Shares” means the SEPA Advance Shares together with the SEPA Commitment Shares.

“Sponsor” means Prospector Capital Sponsor, LLC, a Cayman Islands limited liability company.

v

“Subscription Agreement” means the Subscription Agreement, dated as of June 12, 2023 and amended as of October 30, 2023, among LeddarTech Inc. and the PIPE Investors.

“Trading Day” means any day on which Company Common Shares are actually traded on the principal securities exchange or securities market on which Company Common Shares are then traded.

“Trust Account” means the trust account which held the proceeds of Prospector’s initial public offering.

“Units” means the units offered under this prospectus, each unit consisting of one Common Share or one Pre-Funded Warrant and one Purchase Warrant.

“Warrant Agency Agreement” means the Warrant Agency Agreement entered into by the Company and Continental Stock Transfer & Trust Company on the date of the final prospectus.

“Warrant Agreement” means the Warrant Agreement, dated as of January 7, 2021, by and between Prospector and Continental Stock Transfer & Trust Company, as trustee, as amended by the Warrant Amendment Agreement and Form of Warrant Certificate, dated as of December 21, 2023, by and among Prospector Capital Corp., LeddarTech Holdings Inc. and Continental Stock Transfer & Trust Company.

“Warrant Exercise Price Adjustment” means the adjustment of the Warrant exercise price from US$11.50 per Warrant to US$11.17 per Legacy SPAC Warrant, as more fully described under “Description of Securities — Legacy SPAC Warrants — Adjustment to Warrant Exercise Price Following Consummation of Business Combination.”

“Yorkville” means YA II PN, Ltd.

References to “dollar,” “USD,” and “US$” are to U.S. dollars and references to “$,” “C$” and “Cdn. $” are to Canadian dollars.

vi

EXCHANGE RATE INFORMATION

The following table sets forth, for the periods presented, the rates of exchange of one United States dollar, expressed in Canadian dollars, (i) the high and low exchange rates during each period, (ii) the average of the exchange rates on the last day of each month during each period, and (iii) the exchange rate at the end of each period. These rates are based on the data published by the Bank of Canada.

|

High |

Low |

Average |

End |

|||||||||

|

Year ended December 31, 2021 |

$ |

1.2942 |

$ |

1.2040 |

$ |

1.2535 |

$ |

1.2678 |

||||

|

Year ended December 31, 2022 |

$ |

1.3856 |

$ |

1.2451 |

$ |

1.3011 |

$ |

1.3544 |

||||

|

Year ended December 31, 2023 |

$ |

1.3875 |

$ |

1.3128 |

$ |

1.3497 |

$ |

1.3226 |

||||

|

January 2024 |

$ |

1.3522 |

$ |

1.3316 |

$ |

1.3425 |

$ |

1.3397 |

||||

|

February 2024 |

$ |

1.3574 |

$ |

1.3404 |

$ |

1.3501 |

$ |

1.3570 |

||||

|

March 2024 |

$ |

1.3626 |

$ |

1.3457 |

$ |

1.3539 |

$ |

1.3510 |

||||

|

April 2024 |

$ |

1.3826 |

$ |

1.3527 |

$ |

1.3675 |

$ |

1.3780 |

||||

|

May 2024 |

$ |

1.3731 |

$ |

1.3599 |

$ |

1.3669 |

$ |

1.3642 |

||||

|

June 2024 |

$ |

1.3778 |

$ |

1.3626 |

$ |

1.3706 |

$ |

1.3695 |

||||

|

July 2024 |

$ |

1.3850 |

$ |

1.3615 |

$ |

1.3717 |

$ |

1.3806 |

||||

|

August 2024 (through August 15) |

$ |

1.3877 |

$ |

1.3708 |

$ |

1.3772 |

$ |

1.3732 |

||||

All information in this table is based on the daily average exchange rate published by the Bank of Canada on each business day by 4:30 PM ET.

On August 15, 2024, the daily average exchange rate published by the Bank of Canada was US$1.00 equals $1.3732. The U.S./Canadian dollar exchange rate has varied significantly over the last several years, and investors are cautioned that the exchange rates presented here are historical and are not indicative of future exchange rates.

vii

Prospectus Summary

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our Securities. Before making an investment decision, you should read this entire prospectus carefully, especially the section titled “Risk Factors” and the financial statements and related notes thereto. Some of the statements in this prospectus constitute forward-looking statements that involve significant risks and uncertainties. See “Forward-Looking Statements” for more information.

As used in this prospectus, unless the context otherwise requires or indicates, references to “we,” “us,” “our,” “NewCo,” “LeddarTech” and the “Company,” at all times prior to consummation of the Business Combination, refer to LeddarTech Inc. and its consolidated subsidiaries, and at all time following consummation of the Business Combination, refer to LeddarTech Holdings Inc., a corporation existing under the laws of Canada, and its consolidated subsidiaries.

Our Company

The Company is at the forefront of the automotive industry evolution, from driver awareness to active safety and advanced autonomy. Our mission is to deliver high-performance AI automotive software that enables the market to deploy ADAS features reducing the number of road accidents and making transportation more enjoyable and efficient. We pursue our mission by developing innovative artificial intelligence (“AI”) based low-level fusion (“LLF”) and perception software technology, which closely replicates elements of human perception. We believe that AI-based LLF is the cornerstone of next generation of automotive advanced driver assistance systems (“ADAS”) and autonomous driving (“AD”) systems.

Founded in 2007 as LeddarTech Inc., the Company is an automotive software company headquartered in Quebec City Canada, with other main development centers in Montréal, Toronto and Tel Aviv and business development offices in various locations around the world.

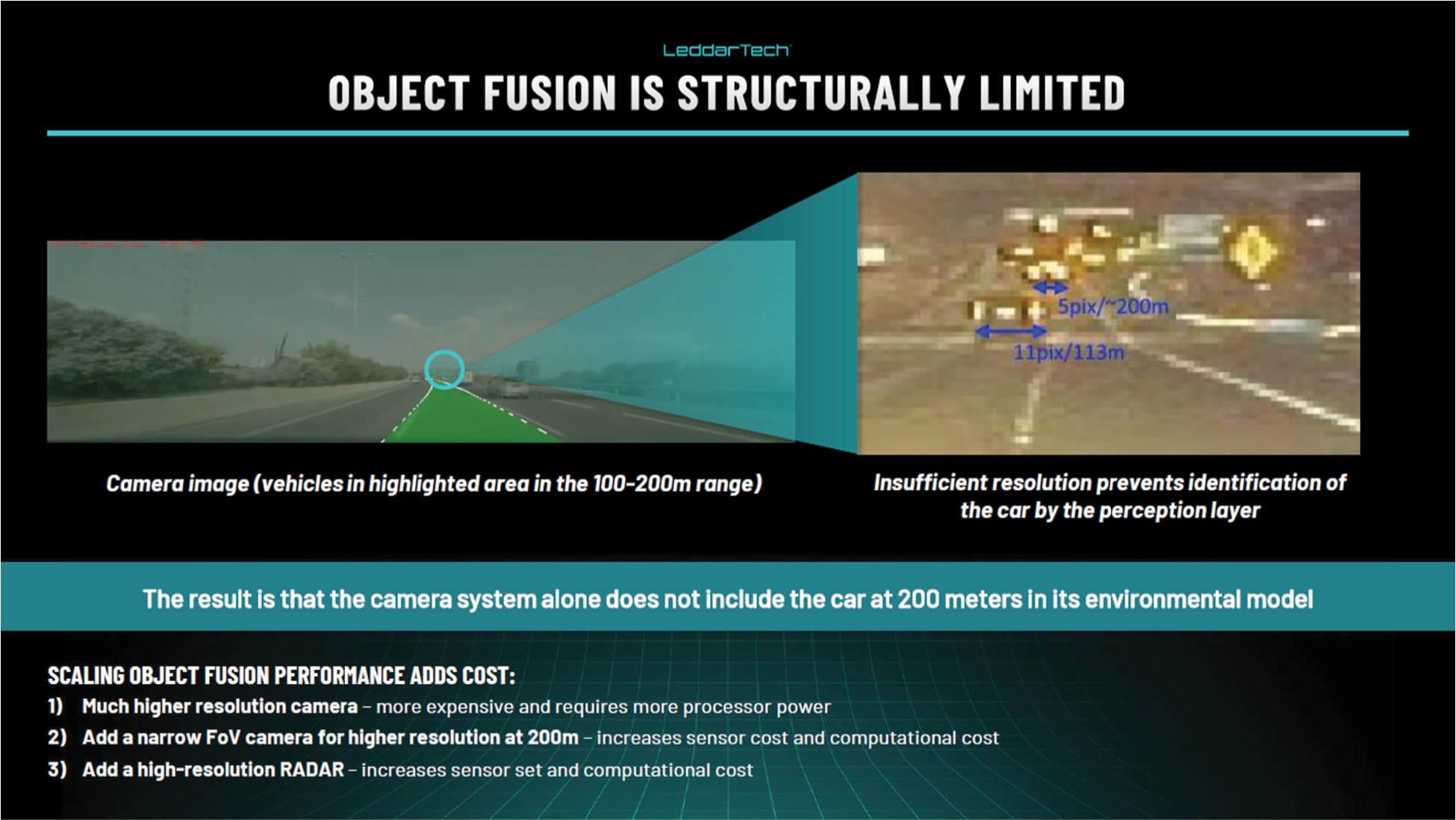

We offer a crucial piece of the software stack for ADAS and AD applications, which provides vehicles with environmental models of their surroundings. This software-only solution seeks to solve the limitations in currently used systems, such as their inability to scale up efficiently and cost-effectively to the level of safety required to adhere to new regulations and meet consumers’ expectations. Our software achieves this by providing an innovative environmental sensing software solution based on what is called “AI-based low-level” sensor fusion and perception, which is sensor and processor-agnostic. We have been developing and refining this innovative software solution for seven years and, as a result, have built a strong and defendable IP and technology moat that is recognized by industry leaders and that we believe has given us a first-mover market advantage. Our main target markets are automotive ADAS and AD applications for original equipment manufacturers (“OEMs”) and automotive system integrators that are direct suppliers to OEMs (“Tier 1” suppliers).

Prior to 2020, we focused our business on software and signal processing for smart sensing solutions, and revenue came primarily from the sale of hardware modules and components for the ADAS market, which generally relied on object-level fusion. Recognizing the limitations of current object-level sensor fusion technology and the potential of AI-based LLF software, in 2020 we identified and acquired a 60% controlling interest in VayaVision Sensing Ltd. (“VayaVision”), an Israeli company that had developed a low-level sensor fusion and perception software stack that was very complementary to our developed software. As more fully described below, LeddarTech acquired the remaining 40% of VayaVision in November 2023, following which VayaVision became a wholly-owned subsidiary of LeddarTech. In 2022, we made the strategic decision to divest our hardware business of modules and components to focus solely on fusion and perception software centered on AI-based LLF for ADAS and AD. Our LiDAR components business was discontinued in late 2022 and we are in the process of winding down our hardware modules business through a last-time buy process. We are retaining the IP related to these businesses for future licensing opportunities only. In connection with our transition to an exclusive focus on fusion and perception software, we have reduced headcount by approximately 70 employees who were engaged primarily in engineering, system architecture, applications and product management functions related to our modules and components businesses, and we are selling remaining inventory and have recognized restructuring and other charges. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Restructuring Activities.” To date, we have not generated any material revenue under our new business model.

1

We believe that we are the first company to demonstrate an automotive-embedded, AI-based low-level sensor fusion and perception product. Our leadership is reflected in industry awards from CES Innovation Awards, TECH.AD Detroit, and Konnect Cariad, and our first-mover position is evidenced by substantial foundational intellectual property.

Led by a team with deep experience and expertise in artificial intelligence, machine learning and automotive software development, we developed the LeddarVision™ LLF and perception software stack, which we believe enables higher performance and lower-cost ADAS for the automotive industry and automated operations for off-road vehicles. As of October 2023, we are in various stages of discussion with vehicle makers and ADAS/AD system and component suppliers and system integrators, covering more than 30 design win opportunities in automotive and off-road markets, some of whom are actively evaluating LeddarVision™ towards making a formal selection for their programs or end customer programs. We have previously publicly announced strategic collaborations with two Tier 1 suppliers in the automotive industry, covering deployment of LeddarVision in production vehicles for in-development passenger vehicle parking applications and in offroad and commercial vehicle applications, in order to provide operator assistance and safety function automation. See “Risk Factors — Risks Related to Our Business — We have entered into strategic collaborations, but not yet signed commercial agreements, with two Tier 1 suppliers. If we fail to sign commercial agreements with those prospective customers, or to subsequently achieve an OEM design win with such customers, our future business, results of operations and financial condition would be adversely affected.”

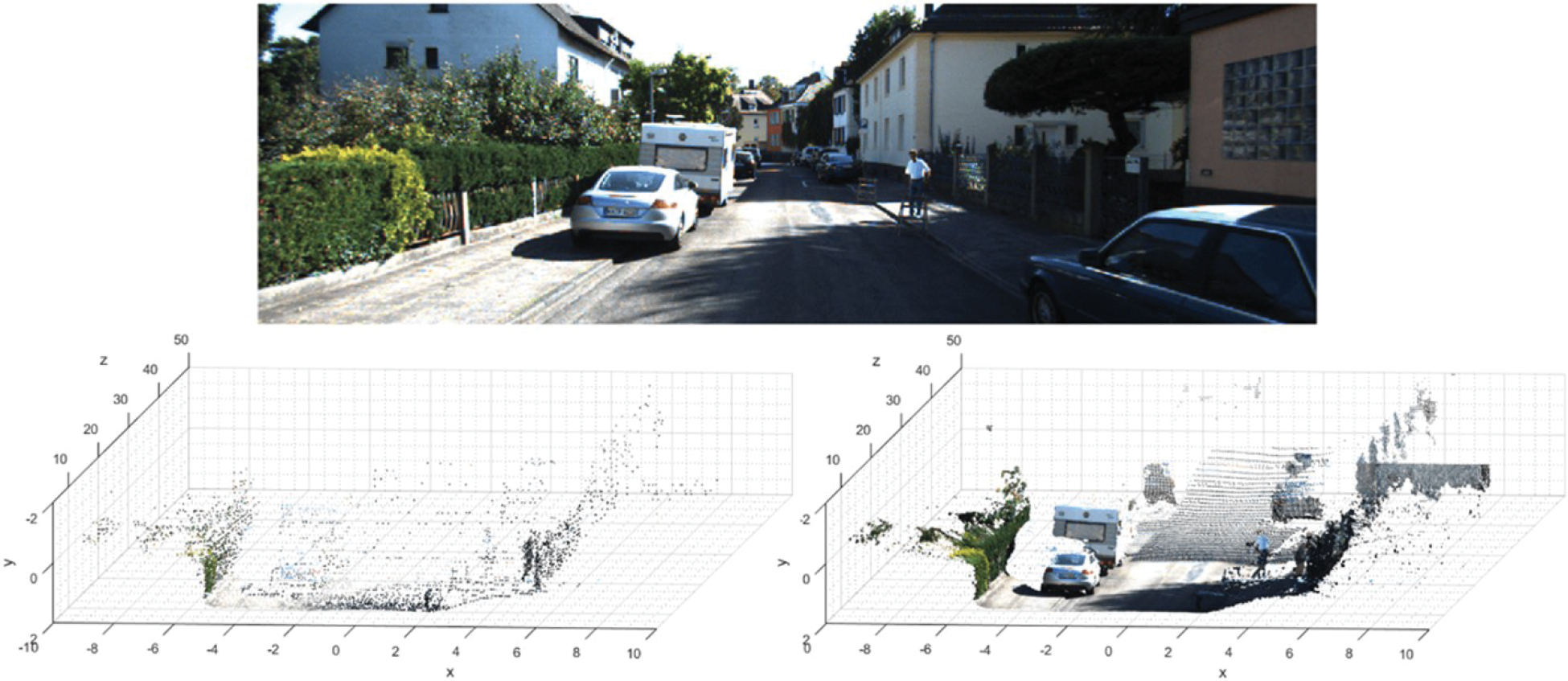

Leveraging the advantages of LLF, LeddarTech delivers high perception performance with nearly 2x range and greater reliability, at a nearly 30-40% lower sensor cost, than current object-level fusion alternatives adopted today. Because LeddarTech’s LLF and perception software stack is centralized, sensor agnostic and scalable, it provides OEMs and Tier 1 suppliers a range of cost saving and design-flexibility benefits, including, but not limited to, the following:

• reduced costs by allowing use of fewer and less expensive sensors, which no longer require integrated software;

• allowing inter-operability of sensors, thereby reducing dependency on single suppliers for sensors with integrated software;

• operability with varying numbers and types (camera, radar, LiDAR, sonar) of sensors, allowing for efficient use of a single software platform across multiple vehicle makes and models, which gives OEMs the ability to change or upgrade sensors without major recoding and AI retraining of fusion software;

• reduced processing requirements and greater processor flexibility, which lowers costs and power consumption, increasingly important features for electric vehicles; and

• capability for “over-the-air” and “backwards compatible” upgrades to meet evolving regulatory requirements and consumer demand.

We believe that the industry’s evolution to accident avoidance will be powered by AI-based low-level sensor fusion and perception technology. That shift is underway, and our software solution is well-positioned to drive vehicle manufacturers’ successful transition towards “software defined vehicles.”

Our Strengths and Strategy

We believe the following strengths position us for continued leadership in, and to capitalize on the opportunities for, providing sensor fusion and perception software solutions to the automotive ADAS and AD market:

• Higher performance than competing solutions. As the market demand grows for safer and more efficient ADAS and AD solutions, LeddarTech’s disruptive AI-based LLF and perception software solution differentiates itself in the market through several years of investments in a low-level fusion solution, rather than legacy object-level fusion. LeddarTech’s solution is hardware independent and software-only. OEMs and Tier 1 and Tier 2 suppliers are increasingly requiring LLF, which favorably positions LeddarTech. LeddarVision software processes sensor data at a low-level, before filtering, to efficiently achieve a more reliable understanding of the vehicle’s environment required for navigation decision making and safer driving. Low-level sensor fusion utilizes all the raw information output

2

from each sensor without filtering at the sensor level for better and more reliable operation. As a result, this low-level sensor data fusion and perception solution provides superior performance, surpassing object-level fusion limitations in adverse scenarios like occluded objects, objects separation, camera/radar false alarms, blinding light (e.g., sun, tunnel) or distance/heading estimation.

• Lower costs than object-level fusion alternatives. LeddarTech’s LLF and perception software stack requires fewer sensors and lower computing requirements, and provides sensor cost savings of up to 30-40% in comparison to object-level fusion. In contrast to object-level fusion’s reliance on a high number of sensors, which number is expected to increase with the complexity of the driving automation level, by combining the raw data from all sensors through a unified software platform that reuses trained algorithms, LLF delivers higher performance, such as nearly doubling the effective range, with fewer and less expensive sensors.

• Decoupling of perception software from sensors hardware. Hardware dependence of current perception software means that any change in sensor position or characteristics requires significant perception software recoding, training and testing to achieve required performance and safety. By decoupling its AI-based LLF and perception software from hardware vendors (sensors and computing), LeddarTech provides an architecturally light solution, with shorter development cycles, less data collection and AI retraining for OEM’s and lower costs than heavier architectures (e.g., multiple software stacks to maintain, train, verify, validate and certify).

• Standard, scalable solutions. LeddarTech’s AI-based and software-only solution seeks to solve the limitation in currently used systems that are unable to scale efficiently either across features, sensors and sensor positions that vary across brands and models, or up to the level of sensory awareness required to adhere to new regulations and meet consumers’ expectations. LeddarTech’s standard, hardware-independent solutions integrate well with different models and numbers of sensors. This results in a single software platform capable of serving multiple brands and models, minimizing customization efforts. Thus, LeddarTech offers flexibility to work with the sensor and computing platforms that best meet the needs and interests of customers, with computing, maintenance, sensor and processor costs expected to be nearly 50% lower than those of current entry-level systems.

• Strong and defendable IP moat and recognized global leadership. LeddarTech has invested extensively in automotive software for over a decade and has developed significant IP and expertise, including over 150 patent applications (80 granted) that cover the spectrum from localization and tracking to signal acquisition, and from fusion and perception to upsampling algorithms that leverage the most advanced automotive AI software to efficiently reconstruct a high-definition, unified 3D model with context-aware algorithms. Significant investments have been made in data collection, annotation and associated tools, including dedicated test and data collection vehicles to support the training of deep neural nets for object classification. Our extensive IP portfolio and long-term research and investment contributes to limit development costs and accelerate time-to-market. LeddarTech also developed the models to calibrate, unfold and match the data from multiple sensors. Our first-mover position is reinforced by substantial foundational intellectual property. Leading companies in the ADAS and autonomous driving industry, including BMW, GM, Toyota, Cruise (GM), Baidu, Waymo, Motional, Huawei, Aptiv, Mobileye, Bosch, ZOOX (Amazon) and Luminar, have recognized the existence of our patents as prior art and we believe our portfolio to be fundamental to the field of ADAS and autonomous driving. We believe LeddarTech is the first to demonstrate an automotive-embedded, low-level sensor fusion product. Additionally, the automotive industry has affirmed our technical innovation and leadership with multiple industry awards, including, but not limited to, the following:

• CES Innovation Award, 2023 Consumer Technology Association, in recognition of LeddarTech’s innovative contributions to automotive sensing and perception technologies;

• First Prize, Sensor Fusion and Perception Category, 2022 Tech.AD Detroit, in recognition of LeddarVision™’s 3D Environment Simulation Dashboard that enables customers to experience the company’s LeddarVision™ technology demonstrated in real-world scenarios; and

3

• Winner, Volkswagen Group Innovation Tel Aviv 2022 Konnect and CARIAD Startup Challenge, in recognition of its sensor fusion and perception technology, with CARIAD expressing enthusiasm for working with LeddarTech to create an AI safety-related proof of concept.

Recent Developments

August 2024 Bridge Financing

On August 19, 2024, the Company, as borrower, and VayaVision, as guarantor, entered into a financing offer letter (the “Bridge Facility”) with Fédération des caisses Desjardins du Québec (“Desjardins”), FS LT Holdings II LP, an affiliate of one of our principal shareholders (“FS”), and Investissement Québec (“IQ,” and collectively with Desjardins and FS, the “Bridge Lenders”) pursuant to which the Bridge Lenders agreed to lend to the Company an aggregate of up to US$9.0 million in loans (the “Bridge Loans”) in order to meet the Company’s near-term obligations while the Company continues to seek to close one or more additional equity financing transactions generating gross proceeds of not less than US$35.0 million (the “Equity Financing”).

In connection with the Bridge Facility, an affiliate of FS has agreed to convert US$1.5 million aggregate principal amount of its PIPE Convertible Notes (as defined below) into Common Shares of the Company at a conversion price of US$2.00 per share not later than September 2, 2024. In addition, pursuant to the terms of the Bridge Facility, each of FS and IQ will have the right, but not the obligation, to convert its Bridge Loan into Common Shares at a conversion price of US$5.00 per share.

The Bridge Facility is comprised of two tranches, with the first tranche in the amount of US$6.0 million to be funded in equal amounts by the Bridge Lenders on August 19, 2024, and the second tranche in the amount of US$3.0 million to be funded in equal amounts by the Bridge Lenders on or about October 15, 2024. The second tranche of the Bridge Facility would be conditioned on the absence of a default under the Bridge Loans and the receipt by the Company of a commitment, in form and substance satisfactory to the Bridge Lenders, from a strategic investor to invest a minimum amount of US$5.0 million in the Equity Financing.

Amounts outstanding under the Bridge Loans bear interest at the US base rate (currently 9.0%), plus 4.00%. Interest under the Bridge Loans is to be capitalized monthly (instead of being payable in cash) and added to the outstanding principal amount of the Bridge Loans. The Bridge Loans have a maturity date of November 15, 2024, and will be due and payable earlier upon the occurrence of certain other events, such as a change in control or the failure to receive a commitment from a strategic investor for a minimum amount of US$5.0 million in the Equity Financing on or prior October 14, 2024.

The up to US$6.0 million of Bridge Loans to be funded by IQ and FS are to be issued at a 25% original issue discount (meaning that US$8.0 million of Bridge Facility debt would be issued by the Company in exchange for US$6.0 million in gross proceeds), provided, however, that no interest would accrue or be payable in respect of the amount of original issue discount.

Upon completion of one or more Equity Financing transactions generating gross proceeds of not less than US$35.0 million (including US$6.0 million of the Bridge Facility to be converted into equity):

• FS and IQ would be obligated to convert their Bridge Loans (including the amount of the original issue discount) into securities of the Company issued in the Equity Financing at a price reflecting an approximately 11% discount to the offer price in the Equity Financing; and

• the Company would be obligated to repay (i) first, to Desjardins, in respect of its Bridge Loan, the outstanding principal amounts under the Desjardins Bridge Loan and pay all other amounts owing to Desjardins under the Bridge Facility and (ii) second, to Desjardins, as lender under the existing Desjardins Credit Facility, any amount then payable under the existing Desjardins Credit Facility, with the maximum aggregate amount of Equity Financing proceeds to be repaid by the Company to Desjardins under the Bridge Facility and under the existing Desjardins Credit Facility upon completion of the Equity Financing not to exceed US$4.5 million.

4

In the event the Company raises less than US$35.0 million in one or more Equity Financing transactions, FS and IQ would each have the right, but not the obligation, to convert their Bridge Loans (including the amount of original issue discount) into securities of the Company issued in the Equity Financing at a price reflecting an approximately 11% discount to the offer price in the Equity Financing.

The Bridge Facility contains certain affirmative and negative covenants, including without limitation, those set forth below:

• Provision to the Bridge Lenders of certain information, including updates on the status of the Equity Financing; and

• Limitations on debt incurrence, investments, dividends, repayments on the PIPE Convertible Notes or on the IQ Loan Agreement, liens, asset dispositions and capital expenditures.

The Company has agreed to grant to the Bridge Lenders a first ranking hypothec and, if applicable, security interest on the universality of each of the Company’s and VayaVision’s movable (personal) and immovable (real) property, tangible and intangible, present and future, including their respective intellectual property, computer equipment, office supplies, furniture and equipment applicable, in each case to secure the obligations of the Company and VayaVision under the Bridge Facility.

Transactions Related to Completion of the Business Combination

On June 12, 2023, NewCo entered into the Business Combination Agreement, as amended on September 25, 2023 (the “BCA”), by and among NewCo, Prospector Capital Corp., a Cayman Islands exempted company (“Prospector”), and LeddarTech.

On December 21, 2023 (the “Closing Date”), as contemplated in the BCA, Prospector, LeddarTech and NewCo completed a series of transactions:

• Prospector continued as a corporation existing under the laws of Canada (the “Continuance” and Prospector as so continued, “Prospector Canada”);

• Prospector Canada and NewCo amalgamated (the “Prospector Amalgamation” and Prospector Canada and NewCo as so amalgamated, “AmalCo”);

• the preferred shares of LeddarTech converted into common shares of LeddarTech and, on the terms and subject to the conditions set forth in a plan of arrangement (the “Plan of Arrangement”), AmalCo acquired all of the issued and outstanding common shares of LeddarTech from LeddarTech’s shareholders in exchange for common shares of AmalCo having a negotiated aggregate equity value of US$200 million (valued at US$10.00 per share) plus an amount equal to the aggregate exercise price of LeddarTech’s outstanding “in the money” options immediately prior to the Prospector Amalgamation (the “Share Exchange”) plus additional AmalCo “earnout” shares (with the terms set forth in the BCA);

• LeddarTech and AmalCo amalgamated (the “Company Amalgamation” and LeddarTech and AmalCo as so amalgamated, the “Company”); and

• in connection with the Company Amalgamation, the securities of AmalCo converted into an equivalent number of corresponding securities in the Company (other than as described in the BCA with respect to the Prospector Class B ordinary shares) and each of LeddarTech’s equity awards (other than options to purchase LeddarTech’s class M shares) were cancelled for no compensation or consideration and LeddarTech’s equity plans were terminated (and the options to purchase LeddarTech’s class M shares became options to purchase common shares of the Company (the “Company Common Shares” or the “Common Shares”)).

The Continuance, the Prospector Amalgamation, the Share Exchange, the Company Amalgamation and the other transactions contemplated by the BCA are hereinafter referred to as the “Business Combination.”

On June 12, 2023, concurrently with the execution of the BCA, LeddarTech entered into a subscription agreement (the “Subscription Agreement”) with certain investors, including investors who subsequently joined the Subscription Agreement (the “PIPE Investors”), pursuant to which the PIPE Investors agreed to purchase

5

secured convertible notes of LeddarTech (the “PIPE Convertible Notes”) in an aggregate principal amount of approximately US$44.0 million (the “PIPE Financing”). PIPE Investors in certain tranches of the PIPE Convertible Notes received at the time of issuance of such notes warrants to acquire Class D-1 preferred shares of LeddarTech (the “Class D-1 Preferred Shares” and the warrants, the “PIPE Warrants”). All of the PIPE Warrants were exercised, and the Class D-1 Preferred Shares issued upon exercise of the PIPE Warrants entitled the PIPE Investors to receive approximately 8,553,434 Common Shares upon the closing of the Business Combination. Accordingly, the PIPE Investors held approximately 42.8% of the 20 million LeddarTech common shares outstanding immediately prior to the Closing. The PIPE Convertible Notes are convertible into the number of Common Shares determined by dividing the then-outstanding principal amount by the conversion price of US$10.00 per Common Share. The final tranche of the PIPE Financing closed on the Closing Date after the Business Combination.

Prior to the Closing Date, holders of an aggregate of 855,440 Prospector Class A ordinary shares, par value US$0.0001 per share (the “Prospector Class A Shares”) representing approximately 39% of the total Prospector Class A Shares then outstanding, exercised their right to redeem those shares for approximately US$10.93 per share, or a total of approximately US$9.3 million paid from Prospector’s trust account (the “SPAC Redemption”) in accordance with the terms of Prospector’s amended and restated memorandum and articles of association, as amended.

Following the SPAC Redemption, and as part of a series of related steps in connection with the consummation of the Business Combination, Prospector distributed 1,338,616 Prospector Class A Shares to the holders on the Closing Date of the 1,338,616 Prospector Class A Shares that were not redeemed in connection with the Business Combination (the “Prospector Share Dividend”). The Prospector Share Dividend was not made with respect to any other Prospector or LeddarTech shares issued and outstanding prior to or upon consummation of the Business Combination.

On the Closing Date, the following securities issuances were made by the Company to Prospector’s securityholders following the SPAC Redemption and in connection with the above-referenced share distribution: (i) each outstanding Prospector Class A Share was exchanged for one Company Common Share, (ii) each outstanding non-voting special share of Prospector, a new class of shares in the capital of Prospector convertible into Prospector Class A Shares, was exchanged for one non-voting special share of the Company and (iii) each outstanding warrant of Prospector (the “Prospector Warrants”), which includes (A) 965,749 Prospector Warrants that were issued upon conversion of the amount accrued under Prospector’s convertible note with the Sponsor to finance Prospector’s transaction costs in connection with its initial business combination (the “Prospector Private Warrants”) and (B) Prospector Warrants that were listed on The Nasdaq Stock Market LLC (the “Prospector Public Warrants”), was assumed by the Company and became a warrant of the Company (“Legacy SPAC Warrant”). At such time, the Prospector Private Warrants became the “Private Placement Warrants” and the Prospector Public Warrants became the “Public Warrants.”

On the Closing Date, following the SPAC Redemption and the foregoing issuances, LeddarTech’s shareholders immediately prior to the consummation of the Business Combination, including investors in the PIPE Financing, received Company Common Shares pursuant to the BCA representing approximately 69.5% of the Company Common Shares outstanding immediately following consummation of the Business Combination.

On December 22, 2023, the Common Shares and Warrants became listed on the Nasdaq Global Market (“Nasdaq”) under the symbols “LDTC” and “LDTCW”, respectively.

Adjustment to Warrant Exercise Price

On February 9, 2024, after considering the effects of the Prospector Share Dividend and in accordance with the terms of the Warrant Agreement, the Company adjusted the exercise price of the Warrants to US$11.17 per share from US$11.50 per share. The adjustment to the warrant exercise price was based on an opinion from an investment banking firm of recognized national standing, as required by the Warrant Agreement. See “Description of Securities — Legacy SPAC Warrants — Adjustment to Warrant Exercise Price Following Consummation of Business Combination.”

6

Standby Equity Purchase Agreement

On April 8, 2024, the Company entered into a Standby Equity Purchase Agreement (“SEPA”) with YA II PN, Ltd., a Cayman Islands exempt limited partnership (“Yorkville”), effective April 15, 2024, pursuant to which the Company, assuming satisfaction of certain conditions and subject to the limitations set forth in the SEPA, has the right from time to time to issue and sell to Yorkville up to US$50.0 million in Common Shares until the earlier of May 1, 2027 or the date on which the facility has been fully utilized. We will initiate each sale under the SEPA (an “Advance”), if any, by delivering a written request for such sale (an “Advance Notice”) to Yorkville. The Common Shares will be purchased at a price equal to (i) 96% of the VWAP of the Common Shares during the period commencing upon receipt by us of written confirmation of acceptance of an Advance Notice by Yorkville, and ending on 4:00 p.m. New York City time on the applicable Advance Notice date, subject to a volume threshold as described in the SEPA (“Option 1”) or (ii) 97% of the lowest daily VWAP of the Common Shares during the three consecutive trading days commencing on the applicable Advance Notice date (“Option 2”); provided, however, that with respect to any Option 2 Advance, we may establish a minimum acceptable price in each Advance Notice below which we will not be obligated to make any sales to Yorkville; provided, further, that we are subject to certain caps on the amount of Common Shares that we may sell on any single day.

The timing, frequency, and the price at which we issue Common Shares pursuant to the SEPA are subject to market prices and management’s decision to sell Common Shares, if at all. In accordance with our obligations under the SEPA, we have filed the SEPA Registration Statement with the Securities and Exchange Commission (the “SEC”) to register under the Securities Act the resale by Yorkville of (i) up to 19,836,637 Common Shares that we may, in our discretion, elect to issue and sell to Yorkville (the “SEPA Advance Shares”) from time to time and (ii) 163,363 Common Shares that we issued to Yorkville in satisfaction of an upfront commitment fee under the SEPA (the “SEPA Commitment Shares” and, together with the SEPA Advance Shares, the “SEPA Shares”). For more information, see “Management’s Discussion and Analysis of Financial Condition and Results of Operation — Financing Transactions — Standby Equity Purchase Agreement.” Any future issuance and resale of SEPA Shares could also have adverse effects on the market for our Common Shares, including increasing volatility, limiting the availability of an active market and/or resulting in a significant decline in the public trading price. See “Risk Factors — Risks Related to Ownership of Our Securities.”

Implications of Being an Emerging Growth Company and a Foreign Private Issuer

We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). As an emerging growth company, we may take advantage of certain exemptions from specified disclosure and other requirements that are otherwise generally applicable to public companies. These exemptions include:

• not being required to comply with the auditor attestation requirements for the assessment of our internal control over financial reporting provided by Section 404 of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”);

• reduced disclosure obligations regarding executive compensation; and

• not being required to hold a non-binding advisory vote on executive compensation or seek shareholder approval of any golden parachute payments not previously approved.

The Company will remain an emerging growth company under the JOBS Act until the earliest of (i) the last day of the fiscal year in which it has total annual gross revenue of US$1.07 billion or more during such fiscal year (as indexed for inflation), (ii) the date on which it has issued more than US$1.0 billion in non-convertible debt in the prior year period, (iii) the last day of the fiscal year following the fifth anniversary of the Prospector’s initial public offering, or (iv) when it has qualified as a “large accelerated filer,” which refers to when it (1) has an aggregate worldwide market value of voting and shares of common equity securities held by non-affiliates of US$700 million or more, as of the last business day of its most recently completed second fiscal quarter, (2) has been subject to the requirements of Section 13(a) or 15(d) of the Exchange Act, for a period of at least twelve calendar months, (3) has filed at least one annual report pursuant to Section 13(a) or 15(d) of the Exchange Act, and (4) is not eligible to use the requirements for “smaller reporting companies,” as defined in the Exchange Act.

7

We are also considered a “foreign private issuer” and will report under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as a non-U.S. company with foreign private issuer status. This means that, even after we no longer qualify as an emerging growth company, as long as we qualify as a foreign private issuer under the Exchange Act, we will be exempt from certain provisions of the Exchange Act that are applicable to U.S. domestic public companies, including:

• the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act;

• the sections of the Exchange Act requiring insiders to file public reports of their stock ownership and trading activities and liability for insiders who profit from trades made in a short period of time; and

• the rules under the Exchange Act requiring the filing with the SEC of quarterly reports on Form 10-Q containing unaudited financial and other specified information, or current reports on Form 8-K, upon the occurrence of specified significant events.

We may take advantage of these exemptions until such time as we are no longer a foreign private issuer. We would cease to be a foreign private issuer at such time as more than 50% of our outstanding voting securities are held by U.S. residents and any of the following three circumstances applies: (i) the majority of our executive officers or directors are U.S. citizens or residents, (ii) more than 50% of our assets are located in the United States or (iii) our business is administered principally in the United States.

We may choose to take advantage of some but not all of these reduced burdens. We have taken advantage of reduced reporting requirements in this prospectus. Accordingly, the information contained herein may be different from the information you receive from our competitors that are public companies, or other public companies in which you have made an investment.

Summary of Risk Factors

Investing in our securities entails a high degree of risk as more fully described in the “Risk Factors” section of this prospectus beginning on page 15. You should carefully consider such risks before deciding to invest in our securities. Listed below is a summary of the principal risks we face. These risks are discussed more fully in the section titled “Risk Factors.”

• We have an unproven business model in a new market and face significant challenges in a rapidly evolving industry. LeddarTech’s prospects may be considered speculative and any failure to commercialize LeddarTech’s strategic plans would have an adverse effect on LeddarTech’s operating results and business, harm LeddarTech’s reputation and could result in substantial liabilities that exceed LeddarTech’s resources.

• We have incurred significant operating losses and net cash outflows since inception, and it is uncertain when, if ever, we will generate meaningful revenue and profitability under LeddaTech’s new business model.

• We have not achieved any OEM design wins, and while we have invested significant time, funds and efforts seeking OEM and Tier 1 selection of our solutions, our solutions ultimately may not be chosen for use in production models. If we fail to achieve OEM design wins after incurring substantial expenditures in these efforts, our future business, results of operations and financial condition would be adversely affected.

• Our financial statements contain disclosure regarding the significant doubt about our ability to continue as a going concern. Our ability to execute our business plan, to fund our operations and to continue as a going concern depends on our ability to raise capital and the continuous support of our creditors.

• LeddarTech has limited sources of available liquidity and if it does not raise additional capital is expected to operate under an alternative operating plan. A reduction in LeddarTech’s operating costs may materially adversely affect LeddarTech in a number of ways.

8

• Our historical financial information, historical financial results and operating and business history, which were achieved under our prior sensory hardware-focused business model, may not be representative of our future results under a sensory software-focused business model.

• LeddarTech’s liquidity position is further constrained by the requirement to maintain a minimum cash balance of at least $5.0 million (as temporarily reduced). If LeddarTech is not able to maintain compliance with the minimum cash balance requirements, its debt obligations may be declared due and payable at a time when LeddarTech does not have sufficient resources to repay such debt obligations.

• The Company will need to raise additional funds to meet its capital requirements, and such funds may not be available on commercially reasonable terms, or at all, which could materially and adversely affect LeddarTech’s business, results of operations or financial condition and its ability to continue as a going concern.

• ADAS and AD systems rely on a complex set of technologies, and there is no assurance that the rate of acceptance and adoption of these technologies will increase in the near future or that a market for fully autonomous vehicles will fully develop.

• We operate in an industry that is new and rapidly evolving. The estimates and forecasts of market and industry projections included in this presentation are subject to significant uncertainty. If markets for sensor fusion products develop more slowly than we expect, or long-term end-customer adoption rates and demand are slower than we expect, our operating results and growth prospects could be harmed.

• Our business, results of operations and financial condition may be adversely affected by changes in automotive safety regulations regarding autonomous driving, which may increase our costs or delay or halt adoption of our sensor fusion solutions.

• The Common Shares being offered for sale in this prospectus, and for resale by Yorkville in prospectus that is part of the SEPA Registration Statement and by the Selling Securityholders in the prospectus that is part of the First Registration Statement represent a substantial percentage of our outstanding Common Shares, and the sales of such shares, or the perception that these sales could occur, could cause the market price of our Common Shares to decline significantly.

• If you purchase Common Shares in this offering, you will experience immediate and substantial dilution in your investment. You will experience further dilution if we issue additional equity or equity-linked securities in the future.

• We may not be able to maintain compliance with Nasdaq’s listing standards, which could limit shareholders’ ability to trade our Common Shares.

Corporate Information

LeddarTech Holdings Inc. was incorporated on April 12, 2023 under the laws of Canada as a corporation solely for the purpose of effectuating the Business Combination, which was consummated on December 21, 2023. It is governed by Articles of Amalgamation dated December 21, 2023.

Our principal executive office is located at 4535, boulevard Wilfrid-Hamel, Suite 240 Québec G1P 2J7, Canada and our phone number is (418) 653-9000. Our agent for service of process in the United States is LeddarTech USA Inc. located at 1209 Orange Street Wilmington DE 19801.

Our principal website address is http://www.leddartech.com. The information contained on or accessible through our website does not form a part of, and is not incorporated by reference into, this prospectus.

9

Summary Terms of the Offering

The summary below describes the principal terms of this offering. The “Description of Securities” section of this prospectus contains a more detailed description of our Common Shares and other securities. See “Frequently Used Terms” for definitions of capitalized terms used herein and not otherwise defined.

|

Units being offered |

Up to 18,181,818 Units, each Unit consisting of one Common Share or one Pre-Funded Warrant and one Purchase Warrant. The Common Shares or the Pre-Funded Warrants and the Purchase Warrants comprising the Units are immediately separable and will be issued separately in this offering. |

|

|

Assumed public offering price |

US$0.55 per Unit. |

|

|

Purchase Warrants |

Each Purchase Warrant will have an exercise price of US$ per share (equal to 100% of the public offering price of each Unit sold in this offering), will be immediately exercisable, and will expire on the five year anniversary of the original issuance date. This prospectus also relates to the offering of the Common Shares issuable upon exercise of the Purchase Warrants. For more information regarding the Purchase Warrants, see “Description of Securities.” |

|

|

Pre-Funded Warrants |

We are also offering to each purchaser, with respect to the purchase of Units that would otherwise result in the purchaser’s beneficial ownership exceeding 4.99% of our outstanding Common Shares immediately following the consummation of this offering, the opportunity to acquire one Pre-Funded Warrant in lieu of one Common Share. A holder of Pre-Funded Warrants will not have the right to exercise any portion of its Pre-Funded Warrant if the holder, together with its affiliates, would beneficially own in excess of 4.99% (or, at the election of the holder, such limit may be increased to up to 9.99%) of the number of Common Shares outstanding immediately after giving effect to such exercise. Each Pre-Funded Warrant will be exercisable for one Common Share. The purchase price of each Unit including a Pre-Funded Warrant will be the purchase price for a Unit including a Common Share minus $0.0001 and the exercise price of each Pre-Funded Warrant will equal US$0.0001 per Common Share. The Pre-Funded Warrants will be immediately exercisable (subject to the beneficial ownership cap) and may be exercised at any time until all of the Pre-Funded Warrants are exercised in full. The Units will not be certificated or issued in stand-alone form. This prospectus also relates to the offering of the Common Shares issuable upon exercise of the Pre-Funded Warrants. For more information regarding the Pre-Funded Warrants, see “Description of Securities.” |

|

|

Best efforts offering |

We have agreed to offer and sell the Units offered hereby to the purchasers through the Placement Agent. The Placement Agent is not required to buy or sell any specific number or dollar amount of the Units offered hereby, but will use their reasonable best-efforts to solicit offers to purchase the securities offered by and under this prospectus. See “Plan of Distribution.” |

|

|

Common Shares issued and outstanding prior to this offering |

|

|

|

Common Shares to be issued and outstanding immediately after this offering(1) |

|

10

|

Common Shares to be issued and outstanding after this offering, assuming no Pre-Funded Warrants are issued and after giving effect to (i) the exercise of the maximum number of Purchase Warrants issuable in this offering, (ii) the issuance of all Common Shares registered under the SEPA Registration Statement, and (iii) the issuance of all Common Shares that may be resold under the First Registration Statement that are issuable upon exercise, vesting or conversion, as applicable |

|

|

|

Use of proceeds |

Assuming the maximum number of Units are sold in this offering at an assumed public offering price of US$0.55 per Unit, which represents the closing price of our Common Shares on Nasdaq on August 15, 2024, we estimate that the net proceeds from our sale of Units in this offering will be approximately US$9.0 million, after deducting the Placement Agent fees and estimated offering expenses payable by us. However, this is a best effort offering with no minimum number of securities or amount of proceeds as a condition to closing, and we may not sell all or any of these securities offered pursuant to this prospectus; as a result, we may receive significantly less in net proceeds. |

|

We expect to use the net proceeds of this offering for working capital and general corporate purposes. See “Use of Proceeds.” |

||

|

Market for our Common Shares |

Our Common Shares and Public Warrants (as defined herein) are currently listed on Nasdaq under the symbols “LDTC” and “LDTCW,” respectively. We do not intend to apply for a listing of the Units, the Purchase Warrants or the Pre-Funded Warrants on any securities exchange or other nationally recognized trading system. Without an active trading market, the liquidity of the Purchase Warrants and the Pre-Funded Warrants will be limited. |

|

|

Risk factors |

Investing in our securities involves substantial risks. See “Risk Factors” beginning on page 15 of this prospectus for a description of certain of the risks you should consider before investing in our Common Shares. |

|

|

Lock-up |

We, each of our officers and directors and executive officers, and any other holder(s) of 10% or more of the outstanding Common Shares have agreed, subject to certain exceptions, not to offer, issue, sell, contract to sell, encumber, grant any option for the sale of or otherwise dispose of any Common Shares or other securities convertible into or exercisable or exchangeable for our common stock for a period of 45 days after this offering is completed without the prior written consent of the Placement Agent. See “Plan of Distribution” for more information. |

|

|

Transfer agent and warrant agent |

The transfer agent and registrar for our Common Shares is Continental Stock Transfer & Trust Company. Continental Stock Transfer & Trust Company is also acting as the warrant agent for the Purchase Warrants and Pre-Funded Warrants. |

____________

(1) The number of Common Shares outstanding immediately after this offering is based on 29,453,676 Common Shares outstanding as of August 15, 2024 and assumes no Pre-Funded Warrants are issued in the offering, and excludes:

• 18,181,818 Common Shares issuable upon the exercise of Purchase Warrants;

• 17,465,749 Common Shares issuable upon the exercise of warrants at an exercise price of $11.17 per Common Share, subject to adjustment;

11

• 13,890 Common Shares issuable upon the exercise of warrants at an exercise price of $138.68 per Common Share, subject to adjustment;

• 449,013 Common Shares issuable upon the exercise of the Legacy Director Warrants;

• 4,400,106 Common Shares issuable upon the conversion of our outstanding secured convertible notes convertible at $10.00 per Common Share, before giving effect to any PIK Accrual, and the contemplated conversion of convertible notes as described under “Prospectus Summary — Recent Developments — August 2024 Bridge Financing”;