As filed with the Securities and Exchange Commission on December 5, 2023

Registration No. 333-275195

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Amendment No. 1

to

Form F-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Silynxcom LTD.

(Exact name of registrant as specified in its charter)

| State of Israel | 3651 | Not Applicable | ||

| (State

or other jurisdiction of incorporation or organization) |

(Primary

Standard Industrial Classification Code Number) |

(I.R.S.

Employer Identification Number) |

19 Yad Ha’Harutzim St. Netanya, 4250519, Israel Tel: +972-9-8658-370 |

| (Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices) |

Silynx Communications Inc. Campus Drive 4630, Suite 109 Newport Beach, CA 92660 571-368-4423 |

| (Name, address, including zip code, and telephone number, including area code, of agent for service) |

Copies to:

Oded Har-Even, Esq. Ron Ben-Bassat, Esq. Eric Victorson, Esq. Sullivan & Worcester LLP 1633 Broadway New York, NY 10019 Tel: 212.660.3000 |

Reut Alfiah, Adv. Gal Cohen, Adv. Sullivan & Worcester Tel-Aviv (Har-Even & Co.) HaArba’a Towers 28 HaArba’a St. North Tower, 35th Floor Tel-Aviv, Israel 6473925 |

David Huberman, Esq. Gary Emmanuel, Esq. Win Rutherfurd, Esq. Greenberg Traurig, P.A. One Azrieli Center Round Tower, 30th Floor 132 Menachem Begin Rd Tel Aviv, Israel 6701101 Tel: +972 3.636.6033 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date hereof.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. ☒

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards † provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information contained in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state or jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED DECEMBER 5, 2023 |

1,075,000 Ordinary Shares

| Silynxcom Ltd. |

This is a firm commitment initial public offering of Silynxcom Ltd. We are offering 1,075,000 ordinary shares, no par value, of our Company, or the Ordinary Shares. Prior to this offering, there has been no public market for our Ordinary Shares. We anticipate that the initial public offering price of our shares will be between $4.00 and $6.00.

We intend to apply to list the Ordinary Shares on the NYSE American LLC, or the “NYSE American”, under the symbol “SYNX”. This offering is contingent upon the Ordinary Shares being listed. We will not complete this offering if the Ordinary Shares are not approved for listing.

We are an emerging growth company, as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, and a “foreign private issuer”, as defined in Rule 405 under the U.S. Securities Act of 1933, as amended, or the Securities Act, and are subject to reduced public company reporting requirements.

We are, and following the consummation of this offering will continue to be, a “controlled company” as defined under the Israeli Companies Law 5759-1999, or the Companies Law, and under the NYSE American rules because our existing controlling shareholders, Mr. Nir Klein and Mr. Ron Klein, will own 52.11% of the total voting power of our issued and outstanding Ordinary Shares immediately after the consummation of this offering, assuming the sale of all of the Ordinary Shares we are offering. As a result, Mr. Nir Klein and Mr. Ron Klein will be able to exercise a significant level of control over all matters requiring shareholder approval, including the election of directors, amendment of our amended and restated articles of association and approval of significant corporate transactions.

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 8.

Neither the Securities and Exchange Commission, or the SEC, nor any state or other foreign securities commission has approved nor disapproved these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Ordinary Share | Total | |||||||

| Initial public offering price | $ | $ | ||||||

| Underwriting discounts and commissions(1) | $ | $ | ||||||

| Proceeds to us (before expenses)(2) | $ | $ | ||||||

| (1) | Excludes a non-accountable expense allowance equal to 1.0% of the initial public offering price payable to the underwriters. See the section titled “Underwriting” beginning on page 94 of this prospectus for additional information regarding underwriters’ compensation. |

| (2) | We have granted the underwriters an option for a period of up to 45 days to purchase from us, at the public offering price, up to 161,250 additional Ordinary Shares, less underwriting discounts and commissions, to cover over-allotments, if any. |

The underwriters expect to deliver the Ordinary Shares on or about , 2023.

ThinkEquity

The date of this prospectus is , 2023

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus and any free writing prospectus prepared by or on behalf of us or to which we have referred you. We have not authorized anyone to provide you with information that is different. We are offering to sell the securities and seeking offers to buy the securities, only in jurisdictions where offers and sales are permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of the securities.

For investors outside of the United States: Neither we nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.

In this prospectus, “we,” “us,” “our,” the “Company”, “Silynx” and “Silynxcom” refer to Silynxcom Ltd., an Israeli corporation, Silynx Communications Inc., a Delaware corporation and Source of Sound Ltd., an Israeli corporation.

Our reporting currency and functional currency is the U.S. dollar. Unless otherwise expressly stated or the context otherwise requires, references in this prospectus supplement and the accompanying prospectus to “NIS” are to New Israeli Shekels, and references to “dollars” or “$” are to U.S. dollars.

We report under International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or the IASB. None of the financial statements were prepared in accordance with generally accepted accounting principles in the United States.

On August 6, 2023, a 5.612-for-one reverse split of our Ordinary Shares became effective. Furthermore, on November 28, 2023 a 1.065472054-for-one reverse split of our outstanding Ordinary Shares, or the November Reverse Split, became effective. Unless the context expressly indicates otherwise, all references to share and per share amounts referred to herein reflect the amounts after giving effect to the November Reverse Split. The number of Ordinary Shares currently issued and outstanding is 3,161,779.

This prospectus includes statistical, market and industry data and forecasts which we obtained from publicly available information and independent industry publications and reports that we believe to be reliable sources. These publicly available industry publications and reports generally state that they obtain their information from sources that they believe to be reliable, but they do not guarantee the accuracy or completeness of the information. Although we believe that these sources are reliable, we have not independently verified the information contained in such publications. While we believe the estimated market position, market opportunity and market size information included in this prospectus is generally reliable, such information, which is derived in part from management’s estimates and beliefs, is inherently uncertain and imprecise. Other market data and industry information is based on management’s knowledge of the industry and good faith estimates of management. All of the market data, panel data and industry information used in this prospectus involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. Projections, assumptions and estimates of our future performance and the future performance of the industry in which we operate are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors,” “Cautionary Note Regarding Forward-Looking Statements” and elsewhere in this prospectus. These and other factors could cause results to differ materially from those expressed in our estimates and beliefs and in the estimates prepared by independent parties.

i

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our securities. Before you decide to invest in our securities, you should read the entire prospectus carefully, including the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and related notes included elsewhere in this prospectus.

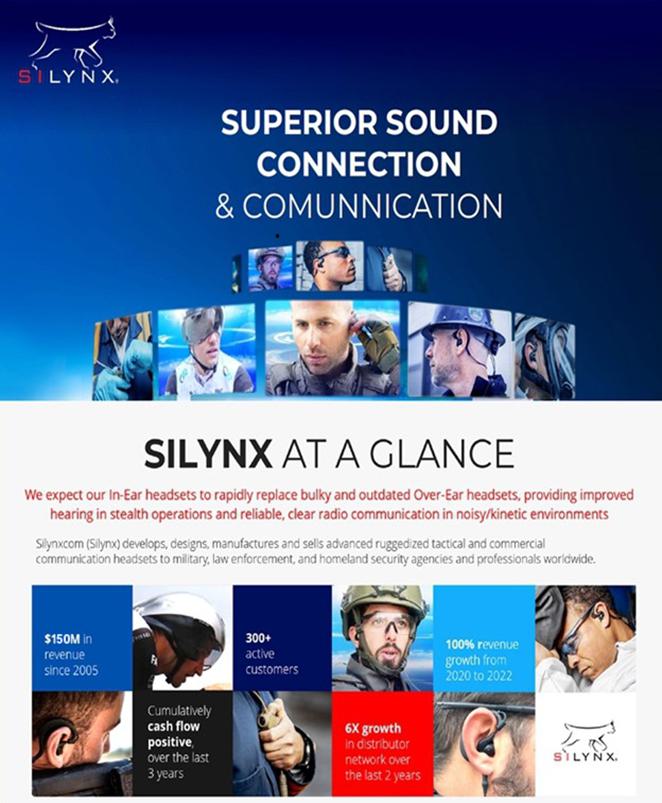

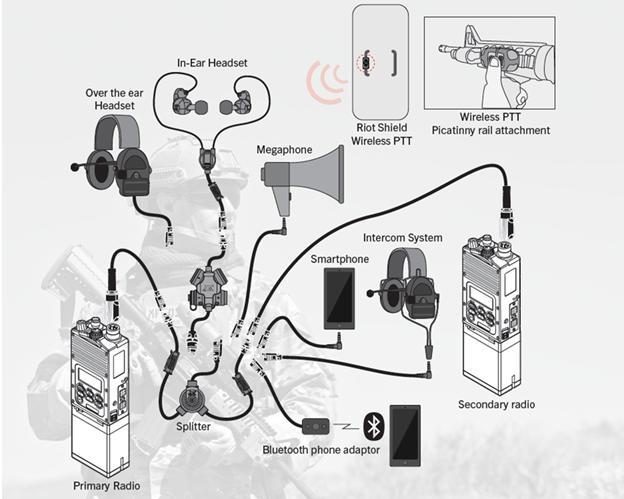

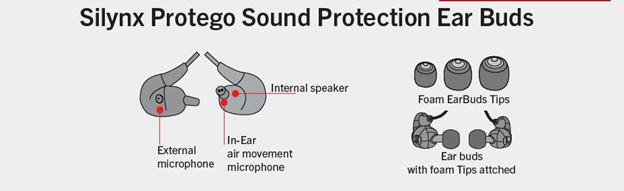

Our Company

For over a decade, we have been developing, manufacturing, marketing, and selling ruggedized tactical communication headset devices as well as other communication accessories, all of which have been field-tested and combat-proven. Our in-ear headset devices, or In-Ear Headsets, are used in combat, the battlefield, riot control, demonstrations and weapons training courses. Our In-Ear Headsets seamlessly integrate with third party manufacturers of professional-grade ruggedized radios that are used by soldiers in combat or police officers in riot situations. Our In-Ear Headsets also fit tightly into the protective gear to enable users to speak and hear clearly and precisely while they are protected from the hazardous sounds of combat, riots or dangerous situations.

Our sleek, lightweight, In-Ear Headsets include active sound protection to eliminate unsafe sounds, while maintaining ambient environmental awareness, giving our customers 360° situational awareness.

We work closely with our customers and seek to improve the functionality and quality of our products based on actual feedback from soldiers and police officers “in the field.” Our headset devices are compatible and easily integrate with the various communication equipment devices currently being used by tens of thousands of military and law enforcement personnel in leading military and law enforcement units globally.

We sell our In-Ear Headsets and communication accessories directly to military forces, police and other law enforcement units around the world. We also sell indirectly, through a specialized network of local distributors in each geography in which we operate, as well as through key strategic partnerships with radio equipment manufacturers. Our direct sales are generally conducted through government-run official tender processes. Our indirect sales are conducted through our distributor network, specialized agents, and strategic original equipment manufacturers, or OEMs. Our distributor network has grown by six times from 2020 to 2022. While our primary markets are currently in Israel, Europe, Asia and the United States, we intend to expand our sales, marketing and distribution network into new markets such as Southeast Asia and Latin America.

Recent Developments

On October 7, 2023, Hamas terrorists invaded southern Israel and launched thousands of rockets in a widespread terrorist attack on Israel. On the same day, the Israeli government declared that the country was at war. In the days that followed, the Israeli military began to call-up reservists for active duty and deploy units across all service branches to take positions in preparation for a war that, according to Israeli government officials, could last for months.

We sell our products directly and indirectly to the Israel Defense Forces. From October 10, 2023 until the date of this prospectus, we received purchase orders from the Israel Defense Forces and police forces in Israel, amounting to an aggregate of over $4.0 million to supply certain products in the near-term to be used by all branches of the Israel Defense Forces and police departments in Israel as well as in the longer term to resupply inventory stockpiles of equipment for the Israel Defense Forces. We expect to receive additional purchase orders as a result of the ongoing war. There is no assurance, however, that any further purchase orders will materialize in connection with this war. For further information, see “Business—Our Technology—Sales and Marketing” and “Risk Factors—Risks Related to Israeli Law and Our Operations in Israel”.

Corporate Information

We are an Israeli corporation and were incorporated under the name Silynxcom Ltd. Our principal executive offices are located at 19 Yad Haruzim Street in Netanya, Israel. Our telephone number in Israel is +972 9-8658-370. Our website address https://www.silynxcom.com. The information contained on, or that can be accessed through, our website is not part of this prospectus. We have included our website address in this prospectus solely as an inactive textual reference.

This prospectus contains trademarks, trade names and service marks, which are the property of their respective owners. Solely for convenience, trademarks, trade names and service marks referred to in this prospectus may appear without the ®, ™ or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent permitted under applicable law, our rights or the right of the applicable licensor to these trademarks, trade names and service marks. We do not intend our use or display of other parties’ trademarks, trade names or service marks to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of us by, these other parties.

1

Implications of Being an Emerging Growth Company and a Foreign Private Issuer

We are an “emerging growth company,” as defined in Section 2(a) of the Securities Act, as modified by the JOBS Act. As such, we are eligible to, and intend to, take advantage of certain exemptions from various reporting requirements applicable to other public companies that are not “emerging growth companies” such as not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act. We could remain an “emerging growth company” for up to five years, or until the earliest of (a) the last day of the first fiscal year in which our annual gross revenue exceeds $1.235 billion, (b) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the U.S. Securities Exchange Act of 1934, as amended, or the Exchange Act, which would occur if the market value of our Ordinary Shares that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (c) the date on which we have issued more than $1 billion in nonconvertible debt during the preceding three-year period.

Implications of being a Controlled Company under the Companies Law

The term “control” is defined in the Companies Law as the ability to direct the activities of a company, other than by virtue of being an office holder. A shareholder is presumed to be a controlling shareholder if the shareholder “holds” (within the meaning of the Companies Law) 50% or more of the voting rights in a company or has the right to appoint 50% or more of the directors of the company or its general manager. With respect to certain matters, a controlling shareholder is deemed to include a shareholder that holds 25% or more of the voting rights in a public company if no other shareholder holds more than 50% of the voting rights in the company but excludes a shareholder whose power derives solely from his or her position as a director of the company or from any other position with the company.

As of the date of this prospectus, Mr. Nir Klein, the Company’s Chief Executive Officer, owns more than 50% of our voting power.

Following the consummation of the offering, Mr. Nir Klein and Mr. Ron Klein may not own, in the aggregate, more than 50% of the voting rights in the Company. The Board will periodically assess and decide whether any person(s) retain control of our Company within the meaning of the Companies Law.

For so long as we have one or more controlling shareholder(s) (as defined above) following the consummation of the offering, any transaction which involves the controlling shareholder(s) must be approved by a special majority of our shareholders general meeting, in addition to other required approvals under Companies Law, without taking the controlling shareholder(s) vote into consideration in the said matter. Certain exemptions may apply to transactions with our controlling shareholder(s), as described in the Companies Law regulations.

Additionally, for so long as the Company has a controlling shareholder(s), members of the audit and compensation committees of the board of directors may not be an employee or service provider of the controlling shareholder(s).

Under regulations promulgated pursuant to the Companies Law, in case we do not have a controlling shareholder(s) in the future, the Board may adopt exemptions from various corporate governance requirements of the Companies Law, so long as such company satisfies the requirements of applicable foreign country laws and regulations, including applicable stock exchange rules, that apply to companies organized in that country and relating to the appointment of independent directors and the composition of audit and compensation committees. Such exemptions include an exemption from the requirement to appoint external directors and the requirement that an external director be a member of certain committees, as well as exemption from limitations on directors’ compensation.

Implications of being a Controlled Company under NYSE American Rules

In addition for purposes of the NYSE American rules, we are a “controlled company”, meaning a company over which 50% of the voting power for the election of directors is held by an individual a group, or another company.

Since Mr. Ron Klein and Mr. Nir Klein hold together 52.11% of our Ordinary Shares, which means that they control 52.11% of our voting power, we are eligible for exemptions from certain NYSE American corporate governance standards.

Under these rules, a controlled company may elect to be exempt from the requirements that a majority of its board of directors are independent and that the compensation committee is composed entirely of independent directors. We intend to utilize these exemptions available for controlled companies. As a result, you will not have the same protection afforded to shareholders of companies that are subject to all of the NYSE American corporate governance requirements See “Risk Factors – Risks Relating to this Offering and Ownership of our Securities – We are a “controlled company” within the meaning of the rules of the NYSE American. As a result, we qualify for exemptions from certain corporate governance requirements that would otherwise provide protection to shareholders of other companies.”

2

Implications of being a “Foreign Private Issuer”

We are subject to the information reporting requirements of the Exchange Act that are applicable to “foreign private issuers,” and under those requirements, we file reports with the SEC. As a foreign private issuer, we are not subject to the same requirements that are imposed upon U.S. domestic issuers by the SEC. Under the Exchange Act, we are subject to reporting obligations that, in certain respects, are less detailed and less frequent than those of U.S. domestic reporting companies. For example, we are not required to issue quarterly reports, proxy statements that comply with the requirements applicable to U.S. domestic reporting companies, or individual executive compensation information that is as detailed as that required of U.S. domestic reporting companies. We also have four months after the end of each fiscal year to file our annual report with the SEC and are not required to file current reports as frequently or promptly as U.S. domestic reporting companies. Our officers, directors, and principal shareholders are exempt from the requirements to report transactions in our equity securities and from the short-swing profit liability provisions contained in Section 16 of the Exchange Act. As a foreign private issuer, we are not subject to the requirements of Regulation FD (Fair Disclosure) promulgated under the Exchange Act. In addition, as a foreign private issuer, we are permitted to follow certain home country corporate governance practices instead of those otherwise required under the NYSE American rules for domestic U.S. issuers and are not required to be compliant with all NYSE American rules as of the date of our initial listing on the NYSE American as would domestic U.S. issuers. These exemptions and leniencies will reduce the frequency and scope of information and protections available to you in comparison to those applicable to a U.S. domestic reporting company. We intend to take advantage of the exemptions available to us as a foreign private issuer during and after the period we qualify as an “emerging growth company.”

Risk Factor Summary

Our business is subject to numerous risks, as more fully described in the section entitled “Risk Factors” immediately following this prospectus summary. You should read these risks before you invest in the Ordinary Shares. In particular, our risks include, but are not limited to, the following:

Risks Related to Our Business and Industry

| ● | Our consolidated financial statements contain an explanatory paragraph regarding substantial doubt about our ability to continue as a going concern, which could prevent us from obtaining new financing on reasonable terms or at all. |

| ● | A reduction in the spending patterns of government agencies or delays in obtaining government approval for our products could materially and adversely affect our net sales, results of operations, earnings and cash flow. |

| ● | The markets in which we compete are highly competitive and some of our competitors have greater financial and other resources than we do. The competitive pressures faced by us could materially and adversely affect our business, results of operations and financial condition. |

| ● | A significant portion of our revenues is derived from certain customers. |

| ● | If any customer accounts for a significant portion of our revenue in our operations, the loss of any such customers or a material decline in the transaction would have an adverse effect on our operating results |

| ● | We generally do not have long-term contracts with our distributors, which makes forecasting our revenues and operating results difficult. |

Risks Related to the Supply and Manufacturing of our Products

| ● | Disruptions of our production could adversely affect our operating results. |

| ● | We use a variety of raw materials, supplier-provided parts, electronic and acoustic among other components, local manufacturing sub-contractors and contract manufacturing services, and significant shortages, capacity constraints, production disruptions or price increases could increase our operating costs and adversely impact the competitive positions of our products. |

| ● | Security, geopolitical and political conditions in Israel and across the world may adversely impact our financial conditions and business operations in particular impact on access to acquire components and raw material and other supply chain disruptions. |

| ● | Our customers who purchase our products for defense applications typically incorporate our products into their products, which are sold to the U.S. government under contracts. U.S. government contracts generally are not fully funded at inception and may be terminated or modified prior to completion, which could adversely affect our business. |

| ● | Unfavorable outcomes in legal proceedings may harm our business and results of operations. |

3

Risks Related to Intellectual Property

| ● | Any loss or limitations on our right to use intellectual property licensed from third parties could have a material adverse effect on our business, operating results and financial condition. |

| ● | We consider our industry know-how proprietary but own no registered intellectual property or technology, and others may seek to copy it without compensating us. |

| ● | Our results of operations may be adversely affected if we are subject to a protracted infringement claim or a claim that results in a significant damage award. |

Risks Related to this Offering and Ownership of Our Securities

| ● | The market price of our Ordinary Shares may be highly volatile, and you may not be able to resell your shares at or above the initial public offering price. |

| ● | We will incur significantly increased costs and devote substantial management time as a result of operating as a public company. |

| ● | Section 404 of the Sarbanes-Oxley Act requires us to assess the effectiveness of our internal controls over financial reporting, which assessment, as a private company, we have not yet performed. |

| ● | Raising additional capital would cause dilution to our existing shareholders and may adversely affect the rights of existing shareholders. |

| ● | If you purchase Ordinary Shares in this offering, you will incur immediate and substantial dilution in the book value of your shares. |

| ● | Since we are deemed to be a controlled company under the Companies Law and NYSE American Rules, we qualify for exemptions from certain corporate governance requirements that would otherwise provide protection to shareholders of other companies. The controlling shareholder(s) will continue to be able to exert significant control over matters submitted to our shareholders for approval. Investors often perceive disadvantages in owning shares in companies with controlling shareholders which may adversely affect the trading price for our Ordinary Shares. |

Risks Related to Israeli Law and Our Operations in Israel

| ● | Potential political, economic and military instability in the State of Israel, where our headquarters, members of our management team, our production and research and development facilities are located, may adversely affect our results of operations. |

| ● | Our financial performance is subject to risks associated with changes in the value of the U.S. dollar, Israeli shekel, versus local currencies. |

| ● | We may not be able to enforce covenants not-to-compete under current Israeli law that might result in added competition for our products. |

| ● | We may be required to pay monetary remuneration to our Israeli employees for their inventions, even if the rights to such inventions have been duly assigned to us. |

| ● | It may be difficult to enforce a judgment of a U.S. court against us and our executive officers and directors and the Israeli experts named in this prospectus in Israel or the United States, to assert U.S. securities laws claims in Israel or to serve process on our executive officers and directors and these experts. |

4

THE OFFERING

| Issuer | Silynxcom Ltd. | |

| Ordinary Shares offered by us | 1,075,000 Ordinary Shares. | |

| Ordinary Shares currently issued and outstanding | 3,161,779. | |

| Ordinary Shares to be issued and outstanding after this offering | 5,075,000 Ordinary Shares (or 5,236,250 Ordinary Shares if the underwriters exercise in full the over-allotment option to purchase additional Ordinary Shares). | |

| Over-allotment option | We have granted the underwriters an option for a period of up to 45 days to purchase, at the public offering price, up to 161,250 additional Ordinary Shares, representing 15%, less underwriting discounts and commissions, to cover over-allotments, if any. | |

| Use of proceeds |

We expect to receive approximately $4.0 million in net proceeds from the sale of the securities offered by us in this offering (approximately $4.74 million if the underwriters exercise their over-allotment option in full ), based upon an assumed public offering price of $5.00 per Ordinary Share, which is the midpoint of the price range set forth on the cover page of this prospectus, and after deducting the underwriting discounts and commissions and estimated offering expenses payable by us.

We currently expect to use the net proceeds from this offering for the following purposes:

● approximately $1.5 million for marketing and business development;

● approximately $1.0 million for research and development ; and

● the remainder for working capital and general corporate purposes.

The amounts and schedule of our actual expenditures will depend on multiple factors. As a result, our management will have broad discretion in the application of the net proceeds of this offering.

See “Use of Proceeds” on page 30 of this prospectus for a more complete description of the intended use of proceeds from this offering as well as “Risk Factors — Risks Related to this Offering and Ownership of Our Securities.” |

5

| Risk factors | Investing in our securities involves a high degree of risk. You should read the “Risk Factors” section starting on page 8 of this prospectus for a discussion of factors to consider carefully before deciding to invest in the Ordinary Shares. | |

| Listing | We intend to apply to list our shares on the NYSE American, under the symbol SYNX. |

The number of the Ordinary Shares to be outstanding immediately after this offering as shown above assumes that all of the Ordinary Shares offered hereby are sold and is based on 3,161,779 Ordinary Shares outstanding as of June 30, 2023. This number excludes:

| ● | 454,105 Ordinary Shares issuable upon the exercise of options to directors, employees and consultants under our Employee Share Option Plan, or the ESOP, outstanding as of June 30, 2023, at a weighted average exercise price in the range of $1.27-$14.44, of which 454,105 were vested as of June 30, 2023; | |

| ● | 53,624 Ordinary Shares issuable upon exercise of warrants issued to an employee, at an exercise price of NIS 2.965; and |

| ● | 696,171 Ordinary Shares reserved for future issuance under our ESOP. |

Unless otherwise indicated, all information in this prospectus assumes or gives effect to:

| ● | no exercise of the Representative’s Warrants; | |

| ● | no exercise of the underwriters’ over-allotment option; | |

| ● | no exercise of the outstanding options described above;

| |

| ● | 102,346 Ordinary Shares issuable upon the conversion of certain equity investment agreements, which we refer to as Simple Agreements for Future Equity, or SAFEs, for aggregate proceeds of NIS 1.14 million (approximately $342 thousand), which will automatically convert upon the consummation of this offering, based on an offering price of $5.00, which is the midpoint of the price range set forth on the cover page of this prospectus; and | |

| ● | 735,875 Ordinary Shares to be issued upon consummation of this offering under the Investors Agreement (as defined below). |

6

SUMMARY FINANCIAL DATA

The following table summarizes our financial data. We have derived the following statements of operations data for the years ended December 31, 2022 and 2021 from our audited consolidated financial statements, which are included elsewhere in this prospectus. We have derived the following statements of operations data for the six months ended June 30, 2023 and 2022, and balance sheet data as of June 30, 2023 from our unaudited interim consolidated financial statements, which are included elsewhere in this prospectus. Our consolidated financial statements have been prepared in accordance with IFRS, as issued by the IASB and its interpretations. Our historical results are not necessarily indicative of the results that may be expected in the future and interim results are not necessarily indicative of the results that may be achieved in an entire fiscal year. The following summary financial data should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes thereto, which are included elsewhere in this prospectus.

| Year

Ended December 31, | Six

Months Ended June 30, | |||||||||||||||

| U.S. dollars in thousands, except share and per share data | 2022 | 2021 | 2023 | 2022 | ||||||||||||

| (Unaudited) | ||||||||||||||||

| Consolidated Statement of Comprehensive Income: | ||||||||||||||||

| Revenues | 7,264 | 9,581 | 3,096 | 1,980 | ||||||||||||

| Cost of revenue | 4,836 | 6,379 | 1,901 | 1,318 | ||||||||||||

| Gross Profit | 2,428 | 3,202 | 1,195 | 662 | ||||||||||||

| Research and development expenses | 439 | 448 | 569 | 200 | ||||||||||||

| Selling and marketing expenses | 672 | 852 | 1,989 | 348 | ||||||||||||

| General and administrative expenses | 837 | 1,255 | 965 | 392 | ||||||||||||

| Other income | - | 166 | - | - | ||||||||||||

| Operating profit (loss) | 480 | 813 | (2,328 | ) | (278 | ) | ||||||||||

| Finance income | 1,443 | - | 35 | 69 | ||||||||||||

| Finance expenses | 123 | 964 | 37 | 1,356 | ||||||||||||

| Income (loss) before income tax | 1,800 | (151 | ) | (2,326 | ) | 1,009 | ||||||||||

| Income tax expenses | 2 | 2 | - | - | ||||||||||||

| Net income (loss) | 1,798 | (153 | ) | (2,326 | ) | 1,009 | ||||||||||

| Other comprehensive income (loss) | ||||||||||||||||

| Gain (loss) from remeasurement of defined benefit plans | 16 | (5 | ) | - | - | |||||||||||

| Total comprehensive income (loss) | 1,814 | (158 | ) | (2,326 | ) | 1,009 | ||||||||||

| Basic earnings (loss) per share | 0.605 | (0.051 | ) | (0.783 | ) | 0.339 | ||||||||||

| Diluted earnings (loss) per share | 0.577 | (0.051 | ) | (0.783 | ) | 0.305 | ||||||||||

| As of June 30, 2023 | ||||||||

| U.S. dollars in thousands | Actual | Pro Forma asAdjusted(1) | ||||||

| Consolidated Balance Sheet Data: | (Unaudited) | |||||||

| Cash and cash equivalents | 351 | 4,422 | ||||||

| Total assets | 4,541 | 8,612 | ||||||

| Total non-current liabilities | 155 | 155 | ||||||

| Accumulated loss | (19,780 | ) | (21,065 | ) | ||||

| Total shareholders’ equity | 1,276 | 5,569 | ||||||

| (1) | Pro forma as adjusted data gives effect to: (a) the sale of 1,075,000 Ordinary Shares in this offering, at an assumed public offering price of $5.00 per Ordinary Share, which is the midpoint of the price range set forth on the cover page of this prospectus, and after deducting underwriting discounts and commissions and estimated offering expenses (assuming no exercise of the over-allotment option and no exercise of any of the Representative’s Warrants issued pursuant to this offering), (b) the issuance of 102,346 Ordinary Shares to be issued upon the conversion of the SAFEs upon the consummation of this offering, and (c) the issuance of 735,875 Ordinary Shares to be issued upon consummation of this offering based on the Investors Agreement as if such events had occurred on June 30, 2023. |

7

You should carefully consider the risks and uncertainties described below and the other information in this prospectus before making a decision to invest in our securities. Additional risks and uncertainties not presently known to us, or that we currently deem immaterial, may also impair our business operations. Our business, financial condition, or results of operations could be materially and adversely affected by any of these risks and uncertainties. The trading price and value of our securities could decline due to any of these risks and uncertainties and you may lose all or part of your investment. This prospectus also contains forward-looking statements that involve risks and uncertainties. See “Special Note Regarding Forward-Looking Statements.” Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks and uncertainties faced by us described below and elsewhere in this prospectus.

Risks Related to Our Business and Industry

Our consolidated financial statements contain an explanatory paragraph regarding substantial doubt about our ability to continue as a going concern, which could prevent us from obtaining new financing on reasonable terms or at all.

Our independent registered public accounting firm has included in its report for the year ended December 31, 2022 an explanatory paragraph expressing substantial doubt about our ability to continue as a going concern. Our consolidated financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the discharge of liabilities in the normal course of business. Our ability to continue as a going concern is contingent upon, other factors, our ability to raise additional capital through sales of our securities, including this offering, and incurrence of debt. Additionally, future capital requirements will depend on many factors, including the rate of revenue growth, the selling price of our products, the expansion of sales and marketing activities, and the continuing market acceptance of our products. These factors raise substantial doubt about our ability to continue as a going concern. There is no assurance that additional financing will be available at terms acceptable to us or at all. If we cannot continue as a viable entity, this could materially adversely affect the value of the shares of Ordinary Shares.

A reduction in the spending patterns of government agencies or delays in obtaining government approval for our products could materially and adversely affect our net sales, results of operations, earnings and cash flow.

The demand for our products sold to the military market, the homeland security market and other government agencies is, in large part, driven by available government funding. Government budgets are set annually and may fluctuate. A significant reduction in available government funding could result in declines in our net sales, results of operations, earnings and cash flow.

A significant portion of our sales are made to government agencies (such as ministries of defense and ministries of interior affairs) or municipal parties (such as police departments, security departments and fire services), which operate in accordance with multi-year investment and work plans that are approved and budgeted by relevant government authorities. Our sales may be impacted if these government agencies divert funds to other areas, such as to the purchase of weapons or other needs. Further, because some government contracts are often for long term periods, such as three or five years, we may lose customer business for a significant period if we lose a government tender and such contract will not be reopened for bidding until such long term period nears expiration.

The markets in which we compete are highly competitive and some of our competitors have greater financial and other resources than we do. The competitive pressures faced by us could materially and adversely affect our business, results of operations and financial condition.

The military and law enforcement market and the homeland security market are highly competitive, with participants ranging in size from small companies focusing on single types of similar communication products, to large multinational corporations that manufacture and supply many types of safety products. Our main competitors vary by region and product. We believe that participants in this industry compete primarily on the basis of product characteristics (such as functional performance, technology, cost of ownership, comfort, design and style), price, service and delivery, customer support, the ability to meet the special requirements of customers, brand name trust and recognition. Some of our competitors have greater financial and other resources than we do and our business could be adversely affected by competitors’ new product innovations, technological advances made to competing products and pricing changes made by us in response to competition from existing or new competitors. We may not be able to compete successfully against current and future competitors and the competitive pressures faced by us could have a material adverse effect our business, consolidated results of operations and financial condition.

A significant portion of our revenues is derived from certain customers.

We have one customer that comprised 65.91% of our total revenues in 2021 but none of our total revenues in 2022 and 6.76% of our total revenues in the six months ended June 30, 2023. We have another customer that comprised 3.49% of our total revenues in 2021, 55.3% of our total revenues in 2022 and 14.1% of our total revenues in the six months ended June 30, 2023. The contracts entered into with these customers are generally one-off and repeated individual orders, without a term of any specific duration. There were no other customers that comprised greater than 10% of our total revenues during these years. While we consider our relationships with our major customers to be good, the reduction, delay or cancellation of orders from this customer or any delays in payments beyond their payment terms, for any reason, would reduce our revenue and operating income and could materially and adversely affect our business, operating results and financial condition in other ways.

8

If any customer accounts for a significant portion of our revenue, the loss of any such customer or a material decline in our transactions with such customer would have an adverse effect on our operating results.

Our management’s strategy plans to avoid customer concentration and is expanding the customer base by growing our distributor and agent network. However, one customer accounted for a significant portion of our revenue in the year ended December 31, 2021 and another customer accounted for a significant portion of our revenue for the year ended December 31, 2022. In the six months ended June 30, 2023, two customers exceeded 10% of total revenue but no single customer exceeded 15% of our total revenue for the period. Despite our efforts to expand our customer base, we cannot assure you that we will be able to create a wide customer base in future periods.

Although we continually seek to diversify our customer base, we cannot assure you that such customer concentration will not persist. Dependence on a limited number of major customers exposes us to the risks of substantial losses if any of them reduces or ceases business with us. Specifically, any one of the following events, among others, may cause material fluctuations or declines in our revenues and have a material and adverse effect on our business, results of operations, financial condition and prospects:

| ● | an overall decline in the business of one or more of our significant customers; |

| ● | the decision by one or more of our significant customers to switch to our competitors; |

| ● | the reduction in the prices of our products agreed by one or more of our significant customers; |

| ● | the failure or inability of any of our significant customers to make timely payment for our products; or |

| ● | regulatory developments that may negatively affect the business of one or more of our significant customers or cryptocurrency mining activities in general. |

There are inherent risks whenever a large percentage of total revenues are concentrated in a limited number of customers. It is not possible for us to predict the future level of demand for our services that will be generated by these customers. In addition, revenues from these larger customers may fluctuate from time based on deal-flow, the timing of which may be affected by market conditions or other facts, some of which may be outside of our control. If any of these customers experience declining or delayed sales due to market, economic or competitive conditions, we could be pressured to reduce the prices we charge for our services and products which could have an adverse effect on our margins and financial position and could negatively affect our revenues and results of operations and/or trading price of our Ordinary Shares. If any of our large customers cease to procure from us, such cessation would negatively affect our revenues and results of operations and/or trading price of our Ordinary Shares. There is no assurance that we will be successful in our efforts to convince customers to accept our products. Our failure to sell our products could have a material adverse effect on our financial condition and results of operations.

For most of our sales and customers, we do not have long-term contracts. No assurance can be given that our customers will continue to do business with us. The loss of any of our significant customers will have a material adverse effect on our business, results of operations, financial condition and liquidity. In addition, the uncertainty of product orders can make it difficult to forecast our sales and allocate our resources in a manner consistent with actual sales, and our expense levels are based in part on our expectations of future sales. If our expectations regarding future sales are inaccurate, we may be unable to reduce costs in a timely manner to adjust for sales shortfalls.

We generally do not have long-term contracts with our distributors, which makes forecasting our revenues and operating results difficult.

We generally do not enter into long-term agreements with our distributors obligating them to purchase our products. Our business is characterized by short-term purchase orders with shipment schedules within six months and we generally permit orders to be canceled or rescheduled before shipment without significant penalty. As a result, our distributors may cease purchasing our products at any time, which makes forecasting our revenues and operating results difficult. In addition, due to the absence of substantial non-cancelable backlog, we typically plan our production and inventory levels based on our distributors’ and partners’ forecasts of customer demand, which can fluctuate substantially. The uncertainty of product orders makes it difficult for us to forecast our sales and allocate our resources in a manner consistent with our actual sales. Moreover, our expense levels and the amounts we invest in capital equipment and new product development costs are based in part on our expectations of future sales and, if our expectations regarding future sales are inaccurate, we may be unable to reduce costs in a timely manner to adjust for sales shortfalls and our results of operations and financial condition could be materially adversely affected.

Fluctuations in operating results make financial forecasting difficult and could adversely affect the price of our Ordinary Shares.

Our interim and annual revenues and operating results may fluctuate significantly for numerous reasons, including:

| ● | the timing of receiving purchase orders may result in revenue recognition shift due to delivery schedule;

| |

| ● | availability of electronic components to build our products; | |

| ● | the timing and cancellation of customer orders | |

| ● | cancellation of government contracts; and

| |

| ● | our ability to secure agreements from our direct and indirect distributers for the purchase of our products. |

9

As a result of these and other factors, our revenues and our operating results for any one period or year may not be indictive of our future revenues or operating results. If our revenues or results of operations fall below expectations of investors or market analysts, the price of our Ordinary Shares could fall substantially.

We may incur significant costs or liabilities to satisfy obligations under the terms of the warranties we supply and the contractual terms under which we sell our products and services.

With respect to our products, we typically offer a warranty against any defects in manufacture or workmanship for a period up to one year from the date of purchase. Our customers may extend the warranty period for additional payment. An exercise of the warranty within such time is unusual based on our historical records and the expense is therefore negligible. However, we provide a reserve for these potential warranty expenses, which is based on an analysis of historical warranty issues. There is no assurance that future warranty claims will be consistent with past history and in the event that we experience a significant increase in warranty claims, there is no assurance that our reserves will be sufficient. Excessive warranty claims could have a material adverse effect on our business, financial condition and results of operations.

Our business is affected by the security, geopolitical and political conditions in the United States, Israel and across the world. Such trend may affect the demand for tactical speech and audio accessories as our Communication Devices products which may affect our business and operations.

Our business is affected by the security, geopolitical and political conditions in the United States, Israel and across the world. Unstable security conditions in the United States and Israel in particular may increase the demand for our communication devices products. Precarious political conditions may trigger sanctions, cancellation of export licenses or the stopping of manufacturing activities in a certain country which may affect our business and operations.

A cancellation of our authorized supplier approval issued by the Israeli Ministry of Defense, our security clearance and non-compliance with preconditions, rules and other regulations may affect our future revenues, cash flow and financial results for contracts with Israeli government or its agencies.

We are an authorized supplier of the Israeli Ministry of Defense and we maintain security clearance required for conducting business with them and, accordingly, we are required to comply with preconditions, rules and other regulations that apply to its engagement with the Ministry of Defense and contracts with the Israeli government or it agencies. If our authorized supplier approval with the Ministry of the Defense is cancelled or if we fail to comply with preconditions, rules and other applicable regulations it could have a material adverse effect on our operations and future revenues, cash flow and financial results.

Our earnings and margin depend on our ability to perform on our contracts.

When agreeing to contractual terms, our management team makes assumptions and projections about future conditions and events. The accounting for our contracts and programs requires assumptions and estimates about these conditions and events. These projections and estimates assess:

| ● | the productivity and availability of labor;

| |

| ● | the complexity of the work to be performed;

| |

| ● | the cost and availability of materials and components; and

| |

| ● | schedule requirements. |

10

If there is a significant change in one or more of these circumstances, estimates or assumptions, or if the risks under our contracts are not managed adequately, the profitability of contracts could be adversely affected. This could affect earnings and margin materially.

Our earnings and margin depend in part on subcontractor and supplier performance.

We rely on other companies to provide materials, components and subsystems for our products. We depend on these subcontractors and suppliers to meet their contractual obligations in full. We manage our supplier base carefully to avoid or minimize customer issues. We sometimes rely on only one or two sources of supply that, if disrupted, could have an adverse effect on our ability to meet our customer commitments. Our ability to perform our obligations may be materially adversely affected if one or more of these suppliers is unable to provide the agreed-upon materials, perform the agreed-upon services in a timely and cost-effective manner, or engages in misconduct or other improper activities.

Damage to our reputation or the reputation of one or more of our product brands could adversely affect our business.

Developing, maintaining and enhancing our reputation, as well as the reputation of our brands, is a critical factor in our relationship with customers, distributors and others. Our inability to address negative publicity or other issues, including concerns about product safety or quality, real or perceived, could negatively impact our business which could have a material adverse effect on our business, consolidated results of operations and financial condition. In addition, any errors, defects, disruptions, or other performance problems with our products could harm our brand and may damage the safety of our end-users.

Our future success depends in part on our ability to continue to develop and improve our products and technologies and maintain a qualified workforce to meet the needs of our customers.

Many of the products and services we provide involve sophisticated technologies and engineering, with related complex manufacturing and system-integration processes. Our customers’ requirements may change and evolve. Accordingly, our future performance depends in part on our ability to continue to develop, manufacture and provide innovative products and services and bring those offerings to market quickly at cost-effective prices. Some new products must meet extensive and time-consuming regulatory requirements that are often outside our control and may result in unanticipated delays. Additionally, due to the highly specialized nature of our business, we must hire and retain the skilled and qualified personnel. To the extent that the demand for skilled personnel exceeds supply, we could experience higher labor, recruiting or training costs in order to attract and retain such employees. If we were unable to develop new products that meet customers’ changing needs and satisfy regulatory requirements in a timely manner or successfully attract and retain qualified personnel, our future revenue and earnings may be materially adversely affected.

Claims of injuries or potential safety issues related to alleged product defects, or quality concerns against us could have a material adverse effect on our business, operating results, financial condition and liquidity.

Our mission, reputation and business success rely on our ability to design and provide safe, high quality and reliable products that earn and maintain customer trust. Our products are often used in high-risk and unpredictable environments, and we face an inherent business risk of exposure to product liability claims. In the event the parties using our products are injured or any of our products are alleged to be defective, we could be subject to claims. In addition, we may be required to or may voluntarily recall or redesign certain products or components due to concern about product safety, quality, or reliability. Any significant claims, recalls or field actions that result in significant expense or negative publicity against us could have a material adverse effect on our business, operating results, financial condition and liquidity, including any successful claim brought against us in excess or outside of available insurance coverage.

We derive a significant portion of our revenues from international sales and are exposed to the risks of doing business in multiple countries.

In 2022, our primary markets for deriving our revenues were Israel and the United States. Our non-Israel and U.S. customers, which includes international military sales, accounted for approximately 60.3% of our revenues. We expect that sales from a variety of international markets will continue to account for a significant portion of our revenues for the foreseeable future. As a result, we are exposed to the risks of doing business in multiple countries.

Government policies on international trade and investment and changes in regulatory requirements can affect the demand for our products, impact the competitive position of our products or prevent us from being able to sell or manufacture products in certain countries. The implementation of more restrictive trade policies, such as higher tariffs or new barriers to entry, in countries in which we sell large quantities of products and services could negatively impact our business, financial condition and results of operations. For example, a government’s adoption of “buy national” policies or retaliation by another government against such policies could have a negative impact on our results of operations. If we were unable to navigate the foreign regulatory environment, or if we were unable to enforce our contract rights in foreign countries, our business could be adversely impacted. Any of these events could reduce our sales, limit the prices at which we can sell our products, interrupt our supply chain or otherwise have an adverse effect on our operating performance. Furthermore, volatility in international political and economic environments changes in governments’ national priorities and budgets can lead to delays or fluctuations in orders.

11

While the impact of these factors is difficult to predict, any one or more of these factors could adversely affect our operations in the future. For example, changing tax treaties between Israel and countries to which we ship products may levy tariffs or taxes on us, which would affect our cash flow. Impacts from these or future potential tariffs, or deterioration in trade relations between Israel and one or more other countries, sanctions and other trade restrictions could have a material adverse impact on our financial position, results of operations and cash flows.

We are subject to various U.S and foreign tax laws and any changes in these laws related to the taxation of businesses and resolutions of tax disputes could adversely affect our results of operations.

The U.S. Congress, the Organization for Economic Co-operation and Development or, OECD, and other government agencies in jurisdictions in which we and our affiliates invest or do business, including the Israeli Tax Authority, have maintained a focus on issues related to the taxation of multinational companies. The OECD has changed numerous long-standing tax principles through its base erosion and profit shifting project which could adversely impact our effective tax rate.

We are subject to regular review and audit by both foreign and domestic tax authorities. While we believe our tax positions will be sustained, the final outcome of tax audits and related litigation may differ materially from the tax amounts recorded in our consolidated financial statements, which could have a material adverse effect on our consolidated results of operations, financial condition and cash flows.

We depend on the recruitment and retention of qualified personnel, including our key executives, and our failure to attract, train and retain such personnel and to maintain our corporate culture and high ethical standards could seriously harm our business.

Due to the specialized nature of our business, our future performance is highly dependent upon the continued services of our key technical personnel and executive officers, the development of additional management personnel, and the hiring of new qualified technical, manufacturing, marketing, sales and management personnel for our operations. Our defense business in particular requires qualified personnel with security clearances due to our classified programs. Competition for personnel is intense and we may not be successful in attracting, training or retaining qualified personnel with the requisite skills or security clearances. In addition, certain existing personnel may be required to receive various security clearances and substantial training in order to work on certain programs or perform certain tasks. Necessary security clearances may be delayed, which may impact our ability to perform on our U.S. government contracts. To the extent that we lose experienced personnel, it is critical that we develop other employees, hire new qualified personnel and successfully manage the transfer of critical knowledge. In addition, new qualified personnel may have different expectations from our current workforce, which could result in difficulties attracting and retaining new employees. Loss of key employees, increased attrition for various reasons, failure to attract new qualified employees or adequately train them, delays in receiving required security clearances, or delays in hiring key personnel could seriously harm our business. Moreover, we believe that a critical element of our ability to successfully attract, train and retain qualified personnel is our corporate culture, which we believe fosters innovation, collaboration, diversity and inclusion, and a focus on execution, all in an environment of high ethical standards. Our global operations may present challenges in maintaining these important aspects of our corporate culture. Any failure to maintain these elements of our corporate culture could negatively impact our ability to attract, train and retain essential qualified personnel who are vital to our business and the value of our company. Further, we rely on our key personnel to lead with integrity and to meet our high ethical standards that promote excellent performance and cultivate diversity, equity and inclusion. To the extent any of our key personnel were to behave in a way that is inconsistent with our values, including with respect to product safety or quality, legal or regulatory compliance, financial reporting or people management, we could experience a materially adverse impact to our reputation and our operating results.

The loss of top management and key personnel could significantly harm our business, and our ability to put in place a succession plan and recruit experienced, competent management is critical to the success of the business.

The continuity of our officers and executive team is vital to the successful implementation of our business model and growth strategy designed to deliver sustainable, consistent profitability.

Because of the specialized, technical nature of our business, we are highly dependent on certain members of our management, sales, engineering and technical staff. A top management priority has been the development and implementation of a formal written succession plan to mitigate the risks associated with the loss of senior executives. While we have a formal written succession plan in place, there is no guarantee that we will be successful in our efforts to effectively implement our succession plan. The loss of these employees could have a material adverse effect on our business, financial condition and results of operations. Our ability to effectively pursue our business strategy will depend upon, among other factors, the successful retention of our key personnel, recruitment of additional highly skilled and experienced managerial, sales, engineering and technical personnel, and the integration of such personnel obtained through business acquisitions. We cannot be certain that we will be able to retain or recruit this type of personnel. An inability to hire sufficient numbers of people or to find people with the desired skills could result in greater demands being placed on limited management resources which could delay or impede the execution of our business plans and have other material adverse effects on our business, financial condition and results of operations.

12

Our business and financial performance may be adversely affected by cyber-attacks on information technology infrastructure and products.

Our business may be impacted by disruptions to our own or third-party information technology (IT) infrastructure, which could result from, among other causes, cyber-attacks on or failures of such infrastructure or compromises to its physical security. Cybersecurity threats are evolving and include, but are not limited to, both attacks on our IT infrastructure and attacks on the IT infrastructure of our customers, suppliers, subcontractors and other third parties with whom we do business routinely, both on premises and in the cloud, attempting to gain unauthorized access to our confidential or other proprietary information, classified information, or information relating to our employees, customers and other third parties, or to disrupt our systems. We have experienced cyber-based attacks, and due to the evolving threat landscape, may continue to experience them going forward, potentially with more frequency. The threats we face vary from attacks common to most industries to more advanced and persistent, highly organized adversaries, including nation states, which target us and other defense contractors. We continue to make investments and adopt measures designed to enhance our protection, detection, response, and recovery capabilities, and to mitigate potential risks to our technology, products, services and operations from potential cybersecurity threats. However, given the unpredictability, nature and scope of cyber-attacks, it is possible that we are unable to prevent cyber-attacks, that potential vulnerabilities could go undetected for an extended period, that we may be unsuccessful in defending an attack against those vulnerabilities, or that we may otherwise be unable to mitigate other potential consequences of these attacks. We could be exposed to production downtimes, operational delays, other detrimental impacts on our operations or ability to provide products to our customers, the compromise of confidential information, intellectual property or otherwise protected information, misappropriation, destruction or corruption of data, security breaches, other manipulation or improper use of our or third-party systems, networks or products, financial losses from remedial actions, loss of business, or potential liability, penalties, fines and/or damage to our reputation, any of which could have a material adverse effect on our competitive position, results of operations, financial condition or liquidity. Some of these risks may be heightened due to our Company and its suppliers and other third parties operating with a significant number of employees working remotely. Due to the evolving nature of such risks, the impact of any potential incident cannot be predicted. Further, our insurance coverage may not be adequate to cover all related costs and we may not otherwise be fully indemnified for them.

Unauthorized access to our information and systems could negatively impact our business.

We face certain security threats, including threats to the confidentiality, availability and integrity of our data and systems. We maintain an extensive network of technical security controls, policy enforcement mechanisms, monitoring systems and management oversight in order to address these threats. While these measures are designed to prevent, detect and respond to unauthorized activity in our systems, certain types of attacks, including cyber-attacks, could result in significant financial or information losses and/or reputational harm. If we cannot prevent the unauthorized access, release and/or corruption of our confidential, classified or personally identifiable information, our reputation could be damaged, and/or we could face financial losses.

Business disruptions could seriously affect our future sales, results of operations and financial condition or liquidity and competitive position or increase our costs and expenses.

Our business may be impacted by disruptions including threats to physical security, information technology, or cyber-attacks or failures, damaging or extreme weather (including effects of climate change), or other acts of nature and pandemics or other public health crises. Any of these disruptions could affect our internal operations or our suppliers’ operations and delay delivery of products and services to our customers. Any significant production delays, or any destruction, manipulation or improper use of our Company or our suppliers’ data, information systems or networks could impact our sales, results of operations, financial condition or liquidity and competitive position or increase our expenses and/or have an adverse effect on our reputation and of our products and services.

The U.S. government may modify, curtail or terminate one or more of our contracts.

The U.S. government contracting party may modify, curtail or terminate its contracts and subcontracts with us, without prior notice and either at its convenience or for default based on performance. In addition, funding pursuant to our U.S. government contracts may be reduced or withheld as part of the U.S. Congressional appropriations process due to fiscal constraints, changes in U.S. national security strategy and/or priorities or other reasons. Further uncertainty with respect to ongoing programs could also result in the event that the U.S. government finances its operations through temporary funding measures such as “continuing resolutions” rather than full-year appropriations. Any loss or anticipated loss or reduction of expected funding and/or modification, curtailment or termination of one or more large programs could have a material adverse effect on our financial position, results of operations and/or cash flows.

Global inflationary pressure could negatively impact our operations and cash flows.

While inflation in the U.S. has significantly reduced, we nonetheless still face two possible inflationary pressures: a general pressure from a global inflation-related economic slowdown and the effect on the price of raw materials due to inflation. The former inflationary pressure was initially triggered by the slowdown in production and disruption to supply chains due to governmental responses to COVID-19, which was then subsequently exacerbated by the Russian Invasion of Ukraine, or the Invasion, which led to a resulting increase in fuel prices, which in turn led to worsening economic conditions stemming from a decrease in worldwide productivity. Our business has managed to maintain a continuous supply of components and raw materials to meet its customers’ needs despite increased costs and delayed shipment times. There is, however, still a risk that this global inflationary pressure could potentially impact operations and cash flows if global disruptions to the supply chain continue or are exacerbated by certain fallouts from the Invasion.

Global interest rate increases may affect our borrowing and financing costs.

Fluctuations in market interest rates may negatively affect our financial condition, the cost of financing projects, increased costs for components, higher outsourced labor costs and results of operations. We are exposed to floating interest rate risk on cash deposit and borrowings rate, and the risks due to changes in interest rates are not material. We have not used any derivative financial instruments to manage our interest risk exposure.

13

Risks Related to Legal and Regulatory Matters

Our ability to market and sell our products is subject to existing government laws, regulations and standards, including by the Israeli Defense Export Control Agency within the Israeli Ministry of Defense, or DECA, and the U.S. State Department’s Directorate of Defense Trade Controls, or DDTC. Changes in such laws, regulations and standards (in Israel and in the United States) or our failure to comply with them could materially and adversely affect our results of operations.

Most of our products are required to meet performance and test standards designed to protect the safety of people around the world. Our inability to comply with these standards could result in declines in revenue, profitability and cash flow. Changes in laws and regulations could reduce the demand for our products or require us to re-engineer our products, thereby creating opportunities for our competitors. Regulatory approvals for our products may be delayed or denied for a variety of reasons that are outside of our control. Additionally, market anticipation of significant new standards can cause customers to accelerate or delay buying decisions.

In particular, our operations are subject to U.S. and foreign anti-corruption and trade control laws and regulations, such as the Foreign Corrupt Practices Act, or FCPA, export controls and economic sanctions programs, including those administered by the U.S. Treasury Department’s Office of Foreign Assets Control, or OFAC, the State Department’s Directorate of Defense Trade Controls, or DDTC, and the Bureau of Industry and Security, or BIS, of the Department of Commerce. As a result of doing business in foreign countries and with foreign customers, we are exposed to a heightened risk of violating anti-corruption and trade control laws and sanctions regulations.

As part of our business, we may deal with state-owned business enterprises, the employees of which are considered foreign officials for purposes of the FCPA’s prohibition on providing anything of value to foreign officials for the purposes of obtaining or retaining business or securing any improper business advantage. In addition, the provisions of anti-bribery and anti-corruption laws in some jurisdictions extend beyond bribery of foreign public officials and also apply to transactions with individuals that a government does not employ. Some of the international locations in which we may operate lack a developed legal system and have higher than normal levels of corruption. Our continued expansion worldwide could increase the risk of FCPA, OFAC or other similar violations in the future.

We may be subject, both directly and indirectly, to the adverse impact of existing and potential future government regulation of our products, technology, operations and markets. For example, the marketing and export of defense related equipment, services, ‘know-how’ are subject to DECA’s regulation under the Defense Export Act, collectively, Israeli Trade Control Laws, which impact our operations, for example by limiting our ability to sell, export, or otherwise transfer our products or technology, or to release controlled technology to non-Israeli companies.

In the U.S., these laws include the International Traffic in Arms Regulations, or ITAR, administered by the DDTC, the Export Administration Regulations, or EAR, administered by the BIS and trade sanctions against embargoed countries and destinations administered by OFAC and collectively, American Trade Control Laws. The EAR governs products, parts, technology and software which present military or weapons proliferation concerns, so-called “dual use” items, and ITAR governs military items listed on the United States Munitions List, or USML. Prior to shipping certain items, we must obtain an export license or verify that license exemptions are available. Any failures to comply with these laws and regulations could result in fines, adverse publicity and restrictions on our ability to export our parts, and repeat failures could carry more significant penalties.