0000019745DEF 14Afalse00000197452023-01-012023-12-31iso4217:USDiso4217:USDxbrli:shares00000197452022-01-012022-12-3100000197452021-01-012021-12-3100000197452020-01-012020-12-310000019745cpk:EquityAwardsReportedValueMemberecd:PeoMember2023-01-012023-12-310000019745cpk:EquityAwardAdjustmentsMemberecd:PeoMember2023-01-012023-12-310000019745cpk:EquityAwardsReportedValueMemberecd:PeoMember2022-01-012022-12-310000019745cpk:EquityAwardAdjustmentsMemberecd:PeoMember2022-01-012022-12-310000019745cpk:EquityAwardsReportedValueMemberecd:PeoMember2021-01-012021-12-310000019745cpk:EquityAwardAdjustmentsMemberecd:PeoMember2021-01-012021-12-310000019745cpk:EquityAwardsReportedValueMemberecd:PeoMember2020-01-012020-12-310000019745cpk:EquityAwardAdjustmentsMemberecd:PeoMember2020-01-012020-12-310000019745cpk:EquityAwardsReportedValueMemberecd:NonPeoNeoMember2023-01-012023-12-310000019745cpk:ChangeInPensionValueMemberecd:NonPeoNeoMember2023-01-012023-12-310000019745cpk:EquityAwardAdjustmentsMemberecd:NonPeoNeoMember2023-01-012023-12-310000019745cpk:EquityAwardsReportedValueMemberecd:NonPeoNeoMember2022-01-012022-12-310000019745cpk:ChangeInPensionValueMemberecd:NonPeoNeoMember2022-01-012022-12-310000019745cpk:EquityAwardAdjustmentsMemberecd:NonPeoNeoMember2022-01-012022-12-310000019745cpk:EquityAwardsReportedValueMemberecd:NonPeoNeoMember2021-01-012021-12-310000019745cpk:ChangeInPensionValueMemberecd:NonPeoNeoMember2021-01-012021-12-310000019745cpk:EquityAwardAdjustmentsMemberecd:NonPeoNeoMember2021-01-012021-12-310000019745cpk:EquityAwardsReportedValueMemberecd:NonPeoNeoMember2020-01-012020-12-310000019745cpk:ChangeInPensionValueMemberecd:NonPeoNeoMember2020-01-012020-12-310000019745cpk:EquityAwardAdjustmentsMemberecd:NonPeoNeoMember2020-01-012020-12-310000019745ecd:PeoMembercpk:EquityAwardsGrantedDuringTheYearUnvestedMember2023-01-012023-12-310000019745cpk:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMember2023-01-012023-12-310000019745cpk:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2023-01-012023-12-310000019745ecd:NonPeoNeoMembercpk:EquityAwardsGrantedDuringTheYearUnvestedMember2023-01-012023-12-310000019745cpk:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2023-01-012023-12-310000019745cpk:EquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2023-01-012023-12-310000019745ecd:PeoMembercpk:EquityAwardsGrantedDuringTheYearUnvestedMember2022-01-012022-12-310000019745cpk:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMember2022-01-012022-12-310000019745cpk:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2022-01-012022-12-310000019745ecd:NonPeoNeoMembercpk:EquityAwardsGrantedDuringTheYearUnvestedMember2022-01-012022-12-310000019745cpk:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2022-01-012022-12-310000019745cpk:EquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2022-01-012022-12-310000019745ecd:PeoMembercpk:EquityAwardsGrantedDuringTheYearUnvestedMember2021-01-012021-12-310000019745cpk:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMember2021-01-012021-12-310000019745cpk:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2021-01-012021-12-310000019745ecd:NonPeoNeoMembercpk:EquityAwardsGrantedDuringTheYearUnvestedMember2021-01-012021-12-310000019745cpk:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2021-01-012021-12-310000019745cpk:EquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2021-01-012021-12-310000019745ecd:PeoMembercpk:EquityAwardsGrantedDuringTheYearUnvestedMember2020-01-012020-12-310000019745cpk:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMember2020-01-012020-12-310000019745cpk:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2020-01-012020-12-310000019745ecd:NonPeoNeoMembercpk:EquityAwardsGrantedDuringTheYearUnvestedMember2020-01-012020-12-310000019745cpk:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2020-01-012020-12-310000019745cpk:EquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2020-01-012020-12-31000001974512023-01-012023-12-31000001974522023-01-012023-12-31000001974532023-01-012023-12-31

| | |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

|

| SCHEDULE 14A INFORMATION |

|

| Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 |

|

| (Amendment No. ) |

| | | | | |

| Filed by the Registrant [X] |

|

| Filed by a party other than the Registrant [ ] |

| |

| Check the appropriate box: |

| [ ] | Preliminary Proxy Statement |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [X] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material Under §240.14a-12 |

| | |

CHESAPEAKE UTILITIES CORPORATION |

| (Name of Registrant as Specified In Its Charter) |

|

| (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

| | | | | | | | |

|

| Payment of Filing Fee (Check the appropriate box): |

|

| [X] | No fee required. |

|

| [ ] | Fee paid previously with preliminary materials. |

|

| [ ] | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

March 26, 2024

Notice of Virtual 2024 Annual Meeting of Stockholders

Dear Stockholder,

On Wednesday, May 8, 2024, Chesapeake Utilities Corporation (the "Company") will hold its 2024 Annual Meeting of Stockholders (the "Meeting") at 9:00 a.m. Eastern Time. The Meeting will be held in a virtual meeting format only. There will be no physical location for stockholders to attend the Meeting. Stockholders will be able to listen, vote and submit questions by logging in at www.virtualshareholdermeeting.com/CPK2024. If you plan to participate in the virtual Meeting, please see the Meeting Attendance and Participation section in the accompanying Proxy Statement. Stockholders of record at the close of business on March 11, 2024 will be asked to vote on the following matters:

| | | | | | | | | | | | | | |

| Proposal | | Description of Proposal | | Board Recommendation |

| Proposal 1 | | Election of three Class I directors named in the Proxy Statement | | FOR each nominee |

| Proposal 2 | | Non-binding advisory vote to approve the compensation of the Company's Named Executive Officers | | FOR |

| Proposal 3 | | Non-binding advisory vote to ratify the appointment of the Company’s independent registered public accounting firm | | FOR |

Please read the accompanying Proxy Statement for additional information on the matters we are asking you to vote on. Stockholders will also transact any other business that is properly brought before the Meeting and at any adjournment or postponement of the Meeting. For any other business that is properly brought before the Meeting, the appointed proxies are authorized to vote pursuant to their discretion.

Your vote is important and we encourage you to vote as soon as possible even if you plan to participate in the virtual Meeting.

| | | | | | | | | | | |

| Internet | | Type www.proxyvote.com in your internet browser and enter the control number on your Notice of Proxy Materials or proxy card. | |

| Mobile Device | | Scan the QR Code on your Notice of Proxy Materials or proxy card with your mobile device and enter the control number. | |

| Telephone | | Dial toll free (800) 690-6903 and follow the telephone prompts. | |

| Mail | | If you receive a paper copy of the proxy materials by mail, cast your ballot, sign and date your proxy card, and mail it in the enclosed envelope. | |

If you own shares through your bank, broker or other institution, you will receive separate instructions on how you can vote the shares you own in those accounts.

Thank you for your investment in Chesapeake Utilities Corporation.

Sincerely,

James F. Moriarty

Executive Vice President, General Counsel, Corporate Secretary and Chief Policy and Risk Officer

Important Notice Regarding the Availability of Proxy Materials. This Notice for the Virtual 2024 Annual Meeting of Stockholders to be held on May 8, 2024, the Proxy Statement (which includes instructions for attending our virtual Annual Meeting), and our 2023 Annual Report are available at www.chpk.com/proxymaterials.

500 Energy Lane, Dover, DE 19901 ▪ www.chpk.com ▪ (888) 742-5275

TABLE OF CONTENTS

| | | | | | | | | | | |

| 1 | Proxy Statement | | |

| |

| 2 | Proposals | | |

| |

| |

| 3 | Audit Related Matters | | |

| |

| 4 | Board of Directors and Its Committees | | |

| |

| |

| |

| |

| |

| |

| |

| 5 | Corporate Governance and Stock Ownership | | |

| |

| |

| |

| 6 | Our Engaging Culture | | |

| 7 | Director and Executive Compensation | | |

| |

| |

| |

| |

| |

| 8 | Other Important Information | | |

| |

| |

| |

| |

| |

GLOSSARY OF TERMS

| | | | | |

| Terms, abbreviations and acronyms, as used in this Proxy Statement. |

| 2015 Cash Plan: | The Company's Cash Bonus Incentive Plan as approved by our stockholders in May 2015 |

| 2021 Equity Incentive Award(s): | An equity incentive award granted by the Compensation Committee pursuant to the 2013 SICP for the 2021-2023 performance period |

2022 Equity Incentive Award(s): | An equity incentive award granted by the Compensation Committee pursuant to the 2013 SICP for the 2022-2024 performance period |

2023 Equity Incentive Award(s): | An equity incentive award granted by the Compensation Committee pursuant to the 2023 SICP for the 2023-2025 performance period |

| Baker Tilly: | Baker Tilly US, LLP, the Company's independent registered public accounting firm, or our external audit firm |

| Bylaws: | The Company's Amended and Restated Bylaws, as amended through May 3, 2023 |

| Board: | The Company's Board of Directors |

| Cash Incentive Award: | A cash incentive award granted by the Compensation Committee pursuant to the 2015 Cash Plan |

CAGR: | Compound Annual Growth Rate |

| Chesapeake Utilities or Company: | Chesapeake Utilities Corporation, its divisions and subsidiaries, as appropriate in the context of the disclosure |

| FW Cook: | Frederic W. Cook & Co., Inc., the Compensation Committee's independent compensation consultant |

| Delmarva Peninsula: | A peninsula on the east coast of the U.S. occupied by Delaware and portions of Maryland and Virginia |

| EPS: | Basic earnings per share (unless otherwise noted) as defined under Generally Accepted Accounting Principles (GAAP) |

| Exchange Act: | The Securities Exchange Act of 1934, as amended |

Florida City Gas or FCG: | Pivotal Utility Holdings, Inc. d/b/a Florida City Gas, a wholly-owned subsidiary of Chesapeake Utilities that was acquired from Florida Power & Light Company on November 30, 2023 |

| IRS: | Internal Revenue Service |

Named Executive Officer or NEO: | An executive officer of the Company who is considered a "named executive officer" under Item 402(a)(3) of Regulation S-K |

NQDC Plan: | Non-qualified Deferred Compensation Plan, a non-qualified, deferred compensation plan under which compensation may be deferred by eligible participants |

| NYSE: | New York Stock Exchange |

PCAOB: | Public Company Accounting Oversight Board |

| Pension Plan: | A defined benefit pension plan sponsored by the Company which was terminated in 2021 |

| Pension SERP: | An unfunded supplemental executive retirement pension plan sponsored by the Company |

| Retirement Savings Plan: | The Company's qualified 401(k) retirement savings plan |

| ROE: | Return on equity |

| SEC: | Securities and Exchange Commission |

2013 SICP: | The Company's 2013 Stock and Incentive Compensation Plan as approved by our stockholders in May 2013 and amended by the Compensation Committee of the Board in January 2017 |

| 2023 SICP: | The Company's 2023 Stock and Incentive Compensation Plan as approved by our stockholders in May 2023 |

| TSR: | Total shareholder return |

1 - PROXY STATEMENT

Chesapeake Utilities Corporation (NYSE-traded: CPK) is providing stockholders with information on its 2024 Annual Meeting of Stockholders (the "Meeting"). The Notice of Virtual 2024 Annual Meeting of Stockholders, this Proxy Statement, and the Proxy Card are being furnished to our stockholders on or about March 26, 2024. We ask that you review each matter to be voted on at the Meeting and vote your shares using the methods described in this Proxy Statement. We encourage you to submit your vote prior to the Meeting using any one of the convenient methods provided in the Voting Information section of this Proxy Statement. The proxy materials describe each matter to be voted on by the stockholders, and information on the Company and its practices.

Voting Information

Meeting Attendance and Participation

Chesapeake Utilities Corporation's Virtual 2024 Annual Meeting of Stockholders (the "Meeting") will be held at 9:00 a.m. Eastern Time on Wednesday, May 8, 2024. The Meeting will be held in a virtual meeting format only. There will be no physical meeting location for stockholders to attend the Meeting. A virtual meeting format offers the same participation opportunities as those opportunities available to stockholders at in-person meetings. Stockholders will be able to listen, vote and submit questions. To participate in the Meeting, visit www.virtualshareholdermeeting.com/CPK2024 using your desktop or mobile device and enter your name and the control number included on your Notice of Internet Availability of Proxy Materials ("Notice of Proxy Materials") or proxy card. Once you login to www.virtualshareholdermeeting.com/CPK2024 and enter the control number included on your Notice of Proxy Materials or proxy card, you may submit questions until the adjournment of the Meeting. Only questions pertinent to matters related to the Meeting will be answered during the Meeting, subject to time constraints. Management will respond to any questions pertinent to matters related to the Meeting that cannot be answered during the Meeting due to time constraints either telephonically or by email communication after the Meeting. The virtual platform for the Meeting is supported across numerous browsers. If you need technical assistance with the meeting platform when logging into the Company's virtual Meeting or prior to adjournment of the Meeting, please call the dedicated technical support number provided at www.virtualshareholdermeeting.com/CPK2024. Representatives will be available beginning at 8:45 a.m. Eastern Time on Wednesday, May 8, 2024. A recording of the Meeting will not be available after the adjournment of the Meeting.

Who May Vote

Holders of the Company's common stock at the close of business on March 11, 2024, the record date established by the Board, are entitled to vote at the Meeting. As of the record date, there were 22,267,394 shares of our common stock outstanding. These shares of common stock are our only outstanding class of voting equity securities. Each share of common stock is entitled to one vote on each matter submitted to the stockholders for a vote. The Company's executive officers and directors, collectively, have the power to vote 1.66% of these shares.

Notice of Proxy Materials

In accordance with rules promulgated by the SEC, we are using the internet as our primary means of furnishing proxy materials to stockholders. Consequently, most stockholders will receive a Notice of Proxy Materials, which will provide instructions for electronically accessing our Proxy Statement and 2023 Annual Report, as well as instructions for requesting a paper copy of these materials. The Notice of Proxy Materials also provides instructions for methods available to submit your vote on the proposals described in this proxy statement.

Proposals Requiring Your Vote

The proposals to be voted on at the Meeting are provided below, along with the required vote for each proposal to be adopted, and the effect of abstentions and broker non-votes on each proposal. The named executive officers and directors intend to vote their shares of common stock FOR each nominee in Proposal 1, and FOR each of Proposals 2 and 3. With regard to Proposal 1, if elected, directors are subject to the Company’s Bylaws, including the current age eligibility requirement.

CHESAPEAKE UTILITIES CORPORATION - 2024 Proxy Statement - 1

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Proposal | | Description of Proposal | | Board

Recommendation | | Vote Required for the

Proposal to be Adopted | | Effect of

Abstentions | | Effect

of Broker

Non-Votes |

| Proposal 1 | | Elect three Class I directors | | FOR each nominee | | Plurality of the votes of the shares present in person or represented by proxy at the Meeting and entitled to vote | | No effect | | No effect |

| Proposal 2 | | Approve on an advisory non-binding basis the compensation of the Company's Named Executive Officers | | FOR | | Majority of the voting power of the stock present in person or represented by proxy at the Meeting and entitled to vote | | Treated as votes against proposal | | No effect |

| Proposal 3 | | Ratify the appointment of Baker Tilly as the Company’s independent registered public accounting firm | | FOR | | Majority of the voting power of the stock present in person or represented by proxy at the Meeting and entitled to vote | | Treated as votes against proposal | | No effect; Brokers

have discretion to vote |

The appointed proxies will vote pursuant to their discretion on any other matter that is properly brought before the Meeting and at any adjournment or postponement of the Meeting in accordance with our Bylaws. The Company is not aware of any other matter to be presented at the Meeting.

Voting Instructions

Stockholders of Record. If you are a registered stockholder and receive a Notice of Proxy Materials, you may vote by telephone or through the internet prior to or at the Meeting. You may not vote by marking the Notice of Proxy Materials and returning it. If you received a paper copy of the proxy materials by mail, you may also vote by completing and returning your proxy card. Your shares will be voted at the Meeting if your proxy card or other method of voting is properly submitted and not subsequently revoked. If your proxy card or other method of voting is incomplete or if you do not provide instructions with respect to any of the proposals, your shares will be voted in line with management's and the Board's recommendation for each Proposal and pursuant to the appointed proxy's discretion for any other business properly brought before the Meeting as permitted. If it is unclear as to how you intended to vote (e.g., multiple selections are made for one proposal), your proxy will be voted pursuant to the discretion of the appointed proxy as permitted.

Beneficial Ownership. If you held shares of our common stock through a bank, broker, trustee, nominee, or other institution (called “street name”) on March 11, 2024, you are entitled to vote on the matters described in this Proxy Statement. You will receive instructions through your bank, broker, trustee, nominee, or institution with regards to this Proxy Statement, any other solicitation materials, and voting. If you do not provide voting instructions to your bank, broker, trustee, nominee, or institution, your shares may constitute “broker non-votes” on certain proposals. Generally, broker non-votes occur on a non-routine proposal where a broker is not permitted to vote on that proposal without instructions from the beneficial owner. Broker non-votes are counted as present for purposes of determining whether there is a quorum, and the impact of broker non-votes on the approval of matters depends on the applicable voting standard. If you do not provide voting instructions, your institution will not be permitted to vote your shares on Proposal 1 - election of directors and Proposal 2 - non-binding advisory vote to approve the compensation of the Company's Named Executive Officers. If you do not provide voting instructions to your institution for Proposal 3 - non-binding advisory vote to ratify the appointment of our independent registered public accounting firm, which is considered a routine matter, your institution will be able to vote your shares in its discretion on such Proposal. If you hold shares in street name and plan to virtually attend the Meeting, you will need to receive a valid proxy from your broker institution if you intend to vote your shares at the Meeting.

Signing the Proxy - Stockholder Representatives or Joint Stockholders If you are an authorized officer, partner or other agent voting shares on behalf of a corporation, limited liability company, partnership or other legal entity, you should sign in the entity name and indicate your name and title when the vote is submitted. If you are an agent, attorney, guardian or trustee voting on behalf of a registered stockholder, you should also indicate your title with your signature when the vote is submitted. If you own stock with multiple parties, each party should sign their individual name. If stock is registered in the name of a decedent and you are an executor, or an administrator, of the decedent’s estate, you should sign your name, indicate your title following your signature, and attach legal instruments showing your qualification and authority to act in this capacity.

CHESAPEAKE UTILITIES CORPORATION - 2024 Proxy Statement - 2

Methods Available for Voting

Your vote is important and we encourage you to vote as soon as possible, even if you plan to virtually attend the Meeting. You may virtually attend the Meeting and electronically cast your vote before voting is declared closed at the Meeting, even if you submitted your vote using any of the methods below. Each of the following voting methods are available to transmit your vote as provided on the proxy card.

| | | | | | | | |

| Internet | | Type www.proxyvote.com in your internet browser and enter the control number on your Notice of Proxy Materials or proxy card. |

| Mobile Device | | Scan the QR Code on your Notice of Proxy Materials or proxy card with your mobile device and enter the control number. |

| Telephone | | Dial toll free (800) 690-6903 and follow the telephone prompts. |

| Mail | | If you receive a paper copy of the proxy materials by mail, cast your ballot, sign and date your proxy card, and mail it in the enclosed envelope. |

If you own shares through your bank, broker or other institution, you will receive instructions through your representative with regards to this Proxy Statement, any other solicitation materials, and voting the shares you own in those accounts. We will reimburse the institutions for reasonable expenses incurred in connection with their solicitation.

Director Tribute

Currently, the Company has 10 directors on its Board. In accordance with the Company’s Bylaws, which provide that no person shall be eligible to serve as a director of the Company after the annual meeting of stockholders following their seventy-fifth birthday, Thomas P. Hill, Jr. will not stand for re-election at the Company’s 2024 Annual Meeting of Stockholders. We would like to recognize Mr. Hill for his extraordinary service to the Company and its stockholders and extend our gratitude and appreciation for Mr. Hill's leadership, wisdom, sound judgment, and significant contributions.

| | | | | | | | |

| | Thomas P. Hill, Jr. |

| Director, Member of the Audit Committee, and Chair of the Investment Committee |

| |

| Mr. Hill has served as a director of the Company for 18 years, including as a member of the Audit Committee since 2006 and as a member of the Investment Committee since 2016, including as its first non-executive Chair. Mr. Hill has extensive energy industry experience with generation, supply portfolios, and marketing and development. Mr. Hill's in-depth knowledge of utility finance and engineering principles and procedures, the regulatory environment, and utility operations has significantly contributed to the Company’s growth and success. As a result of the dedication and collective leadership of our accomplished Board and the active engagement of the many diverse and talented individuals across the enterprise, Chesapeake Utilities' capital expenditures totaled more than $3 billion over Mr. Hill's tenure, comprised of numerous and sizable capital investments and acquisitions. |

Director Nominations and Eligibility

Director Nominations. Throughout the year, the Corporate Governance Committee evaluates board composition and board succession over the near and long-term, including practices benchmarked against our peer companies and broader indices such as the S&P 500 and the top 100 U.S. public companies. Potential board candidates are identified by association within the business, civic, and legal communities or by third-party business partners. Prior to nominating a candidate, the Committee considers a multitude of factors, including the size of the Board, average age of directors, retirement policies, tenures, biographical and other background information, diversity of directors' perspectives, attributes, experiences and skills that reflect the industry and communities we serve, community involvement, a candidate’s availability and commitment level, the Company's governing documents, and whether a candidate is independent under applicable rules and listing standards. For incumbent directors, the Committee considers feedback received during the Board evaluation process. For new candidates, the Committee considers the results of the candidate’s interview, which is conducted by the Chair of the Board, the Lead Director, Corporate Governance Committee Chair, and others as requested, where topics such as depth of experience, business acumen, technical expertise, commitments and cultural fit are discussed. When evaluating the nomination of a potential director, the Committee also considers certain traits which are consistent with the Company's Director Eligibility Guidelines, including:

CHESAPEAKE UTILITIES CORPORATION - 2024 Proxy Statement - 3

•Be a leader in a field of expertise or demonstrate professional achievement through a position of significant responsibility;

•Promote equity, diversity and inclusion that represents and reflects the diverse communities we serve;

•Be open to different backgrounds, experiences and perspectives that enable the Board as a whole to evaluate and understand an ever-evolving business landscape;

•Exercise sound business judgment;

•Possess integrity and high ethics and adhere to and comply with the Company's Business Code of Ethics and Conduct;

•Listen and work in a collegial manner so that every voice is heard;

•Have a reputation that is consistent with our image and reputation;

•Avoid any conflict of interest that would impair the ability to represent the interests of our stockholders; and

•Be diverse in skills, knowledge and experience that enhance the Board's core competencies, enable differing points of view, further maximizes long-term stockholder value, and benefit the Company's stockholders, employees, customers and the communities we serve.

Following this process, and if appropriate, the Committee recommends to the Board the nomination of the candidate for election as a director. At each annual meeting, our stockholders vote to elect all director nominees for the applicable class. In the case of a director nominee appointed to fill a vacancy, the nominee will stand for election at our next annual meeting of stockholders, regardless of class. Once elected, a new director participates in our director orientation program which may be held virtually or at one of our facilities. The program familiarizes the director with various aspects of the Company, including our strategy, business structure, risk profile, financial performance and competitive landscape.

Stockholders may also nominate candidates for consideration by the Committee if they satisfy all of the requirements in our Bylaws, Corporate Governance Committee Charter, and Director Eligibility Guidelines. Stockholder submissions to nominate a candidate for election as a director must be sent in writing to our Corporate Secretary and received at the Company’s principal office (i) in the case of an annual meeting of stockholders, not earlier than the close of business on the 120th day and not later than the close of business on the 90th day prior to the first anniversary of the preceding year's annual meeting of stockholders; provided, however, that in the event the date of the annual meeting is more than 30 days before or more than 60 days after such anniversary date, notice by stockholders to be timely must be so received no earlier than the close of business on the 120th day prior to the date of such annual meeting and not later than the later of (x) the close of business on the 90th day prior to the date of such meeting and (y) the close of business on the 10th day following the date on which public announcement of the annual meeting is first made by the Company; and (ii) in the case of a special meeting of stockholders called for the purpose of electing directors, not later than the close of business on the 10th day following the date on which public announcement of the date of the special meeting at which directors are elected is first made by the Company.

Board Composition

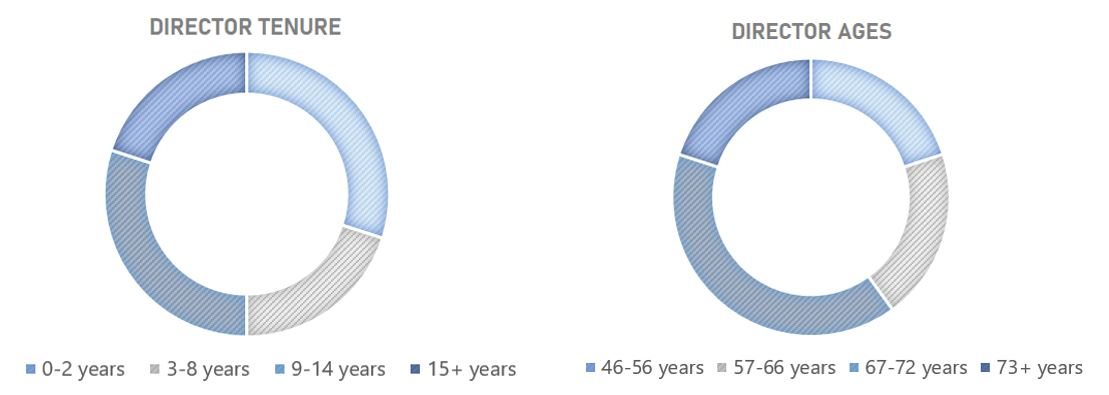

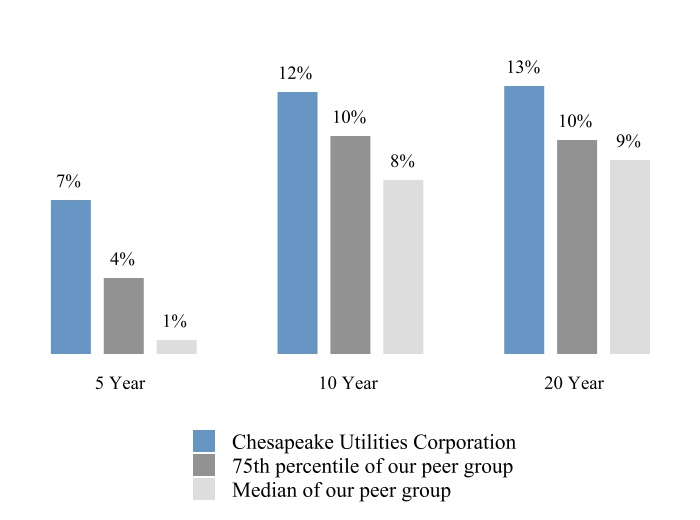

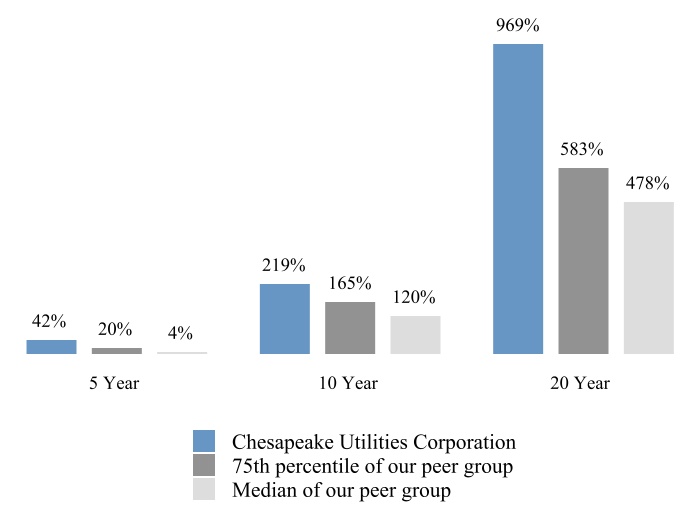

The diversity of our directors, including the nominees for re-election, contributes to the Company’s success and supports our continued growth, leading financial performance, and focus on long-term shareholder value. We believe our culture of equity, diversity and inclusion has contributed to our continued success over the long-term as evidenced by an average annualized shareholder return for the past 5, 10 and 20-year periods ended December 31, 2023 that ranged from approximately 7% to 13%. Additional information on the diverse backgrounds, expertise, skills and experiences represented on the Board as of March 11, 2024, the Company's record date, is provided below.

| | | | | | | | | | | | | | | | | | | | |

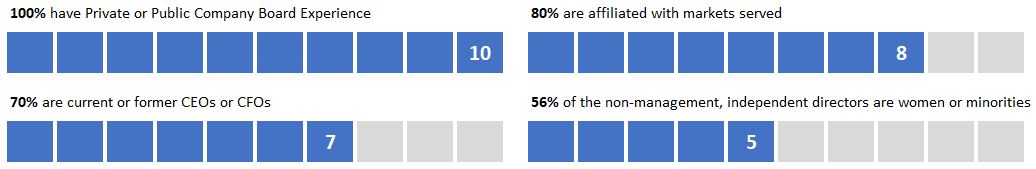

Summary Highlights as of March 11, 2024 100% INDEPENDENCE among the non-management directors serving on the Board. 56% BOARD DIVERSITY among the non-management independent directors, representing female and/or racial and ethnic diversity. GENDER AND/OR ETHNIC DIVERSITY represented on all Board committees. BOARD APPROVED GUIDELINES set the tone at the top for the promotion of equity, diversity and inclusion. DIRECTOR TENURE RANGES FROM 1 TO 22 YEARS, blending tenured experience and diversity, with four new directors added in the last four years. ESTABLISHED BOARD EVALUATION PROCESS and mandatory retirement age policy of 75. | |

| Director Nominees and Continuing Directors Comprise Between 40% to 100% of the Following Knowledge, Skills and Experience: |

|

| | | | |

| •Energy Industry | | •Equity, Diversity and Inclusion | |

| •Renewables, Renewable Natural Gas, Hydrogen, and Alternative Energy | | •Sustainability & Community Stewardship and Relationships | |

| •Human Capital Management/Organizational Development | | •Treasury, Capital Markets and Economic Environment | |

| •Strategic Planning/Development | | •Accounting and Finance | |

| •Legal/Regulatory/Government Affairs | | •Mergers and Acquisitions | |

| •Risk Management | | •Technology and Cybersecurity | |

| •Succession Planning | | •Marketing and Communications | |

CHESAPEAKE UTILITIES CORPORATION - 2024 Proxy Statement - 4

| | | | | | | | | | | | | | | | | | | | |

|

| Represents Certain Diversity of Experience on the Board as of March 11, 2024 | |

|

|

|

2 - PROPOSALS

| | | | | | | | |

Proposal | ELECTION OF DIRECTORS | |

| 1 | The Board recommends a vote FOR each of the director nominees - Lisa G. Bisaccia, Stephanie N. Gary, and Dennis S. Hudson, III.

|

Board Composition and Voting

General Information. As of the date of this Proxy Statement, the entire Board consists of ten directors. Directors are elected to serve three-year terms by a plurality of the votes cast by the holders of the shares present at the Meeting or represented by proxy and entitled to vote at the Meeting. Our director resignation policy in our Corporate Governance Guidelines applies when a director nominee receives more “withhold” votes than “for” votes in an uncontested director election at a stockholder meeting. Pursuant to the Company's Bylaws, a director appointed to fill a vacancy on the Board will hold office until the next annual meeting of stockholders, at which such director will be nominated for election.

Voting for Director Nominees. Each share of our common stock is entitled to one vote. You may authorize a proxy to vote your shares on the election of directors. A proxy that withholds authority to vote for a particular nominee will count neither for nor against the nominee.

Nominees for Election

Director Nomination Process. The Corporate Governance Committee considers each director candidate in the context of the full Board and seeks to nominate individuals with diverse backgrounds, perspectives, experiences and professional skills that reflect the industry and communities in which the Company operates and who demonstrate integrity, judgment, leadership and decisiveness in their business dealings. The Corporate Governance Committee evaluates, among other things, the ability and potential of each candidate for nomination to contribute to the Company’s success and to support our continued growth, leading financial performance, and focus on long-term shareholder value. Directors should be able to commit the requisite time for preparation and attendance at Board and Committee meetings, as well as be able to participate in other matters necessary to ensure good corporate governance. Additional information on the Corporate Governance Committee’s criteria and evaluation of potential director nominations is provided in the Director Nominations and Eligibility section of this Proxy Statement.

CHESAPEAKE UTILITIES CORPORATION - 2024 Proxy Statement - 5

Director Nominees. The Board currently consists of ten directors divided into three classes. In accordance with the Company's Bylaws, which provide that no person shall be eligible to serve as a director of the Company after the annual meeting of stockholders following his or her seventy-fifth birthday, Thomas P. Hill, Jr. will not stand for re-election at the Company's 2024 Annual Meeting of Stockholders. Accordingly, on February 20, 2024, the Board confirmed the size of the Board at nine directors to be effective as of the conclusion of the 2024 Annual Meeting of Stockholders. In order to balance the number of directors in each class, the Board has requested that Ms. Gary, who is currently a Class II director, agree to stand for election as a Class I director at the Annual Meeting. Ms. Gary has so agreed, and Ms. Gary will stand for election as a Class I director along with Ms. Bisaccia and Mr. Hudson. If Ms. Gary is elected as a Class I director at the Annual Meeting, Ms. Gary will cease being a Class II director at the time Ms. Gary becomes a Class I director. If Ms. Gary is not elected as a Class I director at the Annual Meeting, Ms. Gary will continue to serve as a Class II director through the remainder of Ms. Gary's term, which expires in 2025, and until Ms. Gary's successor is elected and qualified. Upon the Corporate Governance Committee’s recommendation, the Board nominated the following three incumbent directors: Lisa G. Bisaccia, Stephanie N. Gary, and Dennis S. Hudson, III to serve as Class I directors until the 2027 Annual Meeting of Stockholders and until their successors are elected and qualified. If elected, directors are subject to the Company’s Bylaws, including the current age eligibility requirement. If prior to the election any of the nominees becomes unable or unwilling to serve as a director of the Company, all proxies will be voted for any substitute nominee recommended by the Corporate Governance Committee and designated by the Board. The Company’s Bylaws provide the framework for director nominations and director eligibility for election or re-election as a director of the Company.

Director Family Relationships. There are no family relationships among any of our directors, nominees for directors, or executive officers.

Director Biographies, Key Attributes, Experience and Skills. Descriptions of the director nominees and continuing directors' principal occupation and employment, principal business, affiliations, and other business experience during the past five years are provided below.

| | | | | | | | | | | | | | |

| DIRECTOR NOMINEES - CLASS I - TERMS EXPIRE IN 2027 |

| | | | | | | | | | | |

| | | LISA G. BISACCIA Ms. Bisaccia retired in 2021 as Executive Vice President and Chief Human Resources Officer of CVS Health. At CVS Health, Ms. Bisaccia focused on employee engagement, organizational culture, talent management and leadership development, integration of large-scale acquisitions, diversity and inclusion, and corporate social responsibility and philanthropy. Ms. Bisaccia is the Chair of the Board of Trustees of Trinity College and serves as a member of its Evaluation & Success Committee, serves on the National Board of Governors for the Boys and Girls Clubs of America and as Chair of its HR and Compensation Committee, and volunteers at the Care New England Health Care System as a member of the Quality Committee of Women and Infants Hospital. Ms. Bisaccia formerly served as a Director of Aramark Corporation and a member of its Nominating and Corporate Governance Committee and Compensation and Human Resources Committee. Ms. Bisaccia previously served as National Chair for Go Red for Women, on the Board of Directors of the Human Resources Policy Association and the American Health Policy Institute, and as Vice Chair of the Center for Executive Compensation. Ms. Bisaccia was recognized in Women in Leadership 2023 published by The Forum of Executive Women and previously in the Worldwide Top 100 Chief Human Resources Officer list published by TopCHRO. |

| | |

Director since 2021 Independent Director Age 67 Compensation Committee Chair | | |

| | Key Attributes and Skills: •Extensive expertise in compensation, benefits, and human capital management practices •Leader in organizational diversity and inclusion and corporate social responsibility and philanthropy •Strategic and operations leadership in a regulated industry |

| | |

CHESAPEAKE UTILITIES CORPORATION - 2024 Proxy Statement - 6

| | | | | | | | | | | |

| | | STEPHANIE N. GARY Ms. Gary was appointed Chief Financial Officer in 2022 and continues to serve as Vice President of Finance at TidalHealth (June 2021-present), a Maryland-based health system of hospitals and specialty offices. Ms. Gary leads the finance functions at TidalHealth, including accounting and financial reporting, strategic financial planning and analysis, budgeting, forecasting and decision support. Prior to TidalHealth, Ms. Gary held management positions at Methodist Health System (2016-2021) and The University of Texas Southwestern Medical Center (2012-2016), where Ms. Gary managed operating and capital budgets, strategic planning, and the finance and business operations. Ms. Gary is a Certified Public Accountant and Fellow of The American College of Healthcare Executives. Ms. Gary currently serves on the advisory board for the University of Maryland Eastern Shore and formerly served on the Board of Duncanville and Cedar Hill Chambers of Commerce in Texas. Ms. Gary also previously served as Treasurer of a non-profit organization that provides community programs and services to residents in the Dallas County area. Ms. Gary was recognized in Women in Leadership 2023 published by The Forum of Executive Women. |

| |

| | |

Director since 2022 Independent Director Age 47 Audit Committee Member and Financial Expert | | |

| | Key Attributes and Skills: •Extensive oversight of the finance functions, including strategic financial planning and analysis, forecasting and decision support •In-depth knowledge of markets throughout the Delmarva Peninsula •Financial expertise, leadership and oversight in a regulated industry |

|

| | | | | | | | | | | |

| | | DENNIS S. HUDSON, III Mr. Hudson served as the Executive Chairman of the Board of Seacoast Banking Corporation of Florida (“Seacoast”) and Seacoast National Bank (“Seacoast Bank”) from January 2021 until February 2022. Mr. Hudson served as Chairman of the Board of Seacoast (2005-2020) and continues to serve as a member of the Board (since 1984). Mr. Hudson served as Chief Executive Officer of Seacoast (1998-2020) and Seacoast Bank (1992-2020), was the President and Chief Operating Officer of these entities, and held various other managerial positions. Mr. Hudson served as a Director and member of the Audit Committee of Florida Public Utilities Company prior to its acquisition by Chesapeake Utilities. Mr. Hudson serves on the Boards of Visiting Nurses Association of Florida, and the Community Foundation of Palm Beach and Martin Counties where Mr. Hudson also serves as Treasurer. Mr. Hudson is a general partner of Sherwood Partners, Ltd., a family partnership. Mr. Hudson previously served as an independent Trustee, member of the Audit Committee, and Chair of the Nominating Committee of Penn Capital Funds, a member of the Boards of Martin Health System, Helping People Succeed, and United Way of Martin County, Chair of the Economic Council of Martin County, and a member of the Miami Board of Directors of the Federal Reserve Bank of Atlanta. |

| | |

Director since 2009 Independent Director Age 68 Corporate Governance Committee Chair Audit Committee Member and Financial Expert

| | |

| | Key Attributes and Skills: •Extensive public company, leadership, and banking experience •In-depth knowledge of the Florida markets •Financial and Audit Committee expertise |

|

CHESAPEAKE UTILITIES CORPORATION - 2024 Proxy Statement - 7

CONTINUING DIRECTORS - CLASS II - TERMS EXPIRE IN 2025

| | | | | | | | | | | |

| | | JEFFRY M. HOUSEHOLDER Mr. Householder was appointed as President and Chief Executive Officer of Chesapeake Utilities Corporation effective January 1, 2019, and as Chair of the Board effective May 3, 2023. Mr. Householder previously served as President of Florida Public Utilities Company from 2010-2018. In 2023, under Mr. Householder’s leadership, Chesapeake Utilities Corporation successfully completed the acquisition of Florida City Gas, the largest acquisition in the Company’s history, including more than doubling our customer base and natural gas infrastructure in the State of Florida. Mr. Householder has more than 40 years of experience in the energy industry and has served in leadership positions with TECO Energy Peoples Gas, West Florida Gas Company, Florida City Gas, and Tallahassee Utilities. Mr. Householder is a member and also serves on the Boards of the American Gas Association, the Edison Electric Institute, and the Southern Gas Association. Mr. Householder is a member of the Delaware Business Roundtable and serves on its Executive Committee, which focuses on the business and economic climate of Delaware. |

| | |

Director since 2019 Chair of the Board, President and CEO, Chesapeake Utilities Corporation Age 66 | | |

| | Key Attributes and Skills: •Extensive natural gas industry and regulatory experience •Proven leadership capabilities and strategic foresight •Knowledge and insight of the business and economic climates in our service territories |

| | |

| | | | | | | | | | | |

| | | LILA A. JABER Ms. Jaber is Owner and President of Jaber Group Inc. where Ms. Jaber focuses and consults on business, regulatory, and economic development issues. Ms. Jaber is a managing member of Maclay Investments, L.L.C. With 30 years of expertise, Ms. Jaber retired in 2019 from Gunster Yoakley & Stewart as Regional Managing Shareholder and leader of a statewide regulatory and legislative government affairs practice. Ms. Jaber served two terms as both Commissioner and Chair of the Florida Public Service Commission (1995-2005) overseeing the state’s economic regulatory policy and procedures for the energy, natural gas, water, and telecommunications industries. Ms. Jaber is the architect of Florida’s Women in Energy Leadership Forum and The Leadership Academy for Women in Energy and Water. Since 2020, Ms. Jaber has served on the Board of Corix Group of Companies, a privately held corporation, and serves as a member of its HR Committee. Ms. Jaber was recognized in Women in Leadership 2023 published by The Forum of Executive Women, and in 2023 by the Florida Trend as one of Florida’s Most Influential Leaders (Energy). Ms. Jaber serves as a trustee of Stetson University and Chair of its Committee on Trusteeship. Ms. Jaber previously served as Chair of General Counsel of Leadership Florida, an Advisory Board member and Vice-Chair of Florida Civic Advance, Vice-Chair and founding member of the Big Bend Minority Chamber of Commerce, and inaugural chair of the City of Tallahassee’s Independent Ethics Board. |

| | |

Director since 2020 Independent Director Age 57 Corporate Governance Committee Member Investment Committee Member | | |

| | Key Attributes and Skills: •Extensive experience in strategy, ethics, and government affairs, with active and recognized support of diversity and inclusion, including as founder of Florida's Women in Energy Leadership Forum •In-depth knowledge of the Florida markets •In-depth knowledge of the energy industry and regulatory policy, including recognition as one of Florida Trend's 500 Influential Leaders in Florida (Energy) |

| |

CHESAPEAKE UTILITIES CORPORATION - 2024 Proxy Statement - 8

| | | | | | | | | | | |

| | | PAUL L. MADDOCK, JR. Mr. Maddock is the Chief Executive Officer and Manager of Palamad, LLC, a real estate holding company located in Palm Beach, Broward, and Dade counties. Mr. Maddock is a member of the Board, Corporate Governance, and Executive Committees of W.C. & A.N. Miller Company, a real estate company in Washington, D.C. Mr. Maddock served as a Director and member of the Audit, Compensation and Executive Committees of Florida Public Utilities Company prior to its acquisition by Chesapeake Utilities. Mr. Maddock previously served as Director, Audit Committee Chair, and Executive Committee member of Lydian Bank and Trust, as well as a member of the Boards of PRB Energy, Inc., Wachovia Bank of Florida, 1st United Bank and Trust, and Island National Bank and Trust. Mr. Maddock is the President of THRIFT, Inc., a Palm Beach charitable organization, Member and Director of The Everglades Club, and Director of The Brown University Sports Foundation. Mr. Maddock is a former Director of the Good Samaritan Hospital. |

| | |

Director since 2009 Independent Director Age 74 Compensation Committee Member Corporate Governance Committee Member | | |

| | |

| | Key Attributes and Skills: •Extensive public company board and utility experience, including bank board experience •Expertise in a broad range of real estate matters •In-depth knowledge of the Florida markets |

|

| | | | | | | | | | | | | | |

| CONTINUING DIRECTORS - CLASS III - TERMS EXPIRE IN 2026 |

| | | | | | | | | | | |

| | | THOMAS J. BRESNAN Mr. Bresnan was appointed as the independent Lead Director of the Board of Chesapeake Utilities Corporation effective May 3, 2023. Mr. Bresnan, an entrepreneur and former public company executive, retired in 2023 as Chief Executive Officer and President of Denver Accounting Services, which Mr. Bresnan owned since 2014. Mr. Bresnan also owned Bresnan Enterprises, Inc. prior to its dissolution in 2023 and served as President of the Career School of the Rockies from 2012 to 2020. Mr. Bresnan served as President of Global LT, a language and cross-cultural training company, from 2017 until 2019 and has served as a member of its Board since 2014. From 2008-2012, Mr. Bresnan served as a majority stockholder, President and Chief Executive Officer of Schneider Sales Management, LLC. Mr. Bresnan previously served as a member of the Board, and President and Chief Executive Officer of New Horizons Worldwide, Inc., a publicly traded information technology training company. Mr. Bresnan also served as President of Capitol American Life Insurance, Chief Financial Officer at Capitol American Finance, and held positions at Arthur Andersen & Co. |

| |

| | |

Director since 2001 Independent Lead Director Age 71 Audit Committee Chair and Financial Expert Investment Committee Member | | |

| | Key Attributes and Skills: •Extensive public company, leadership, technology, sales and marketing experience •In-depth experience in acquisitions and the post integration process •Financial, Accounting and Audit Committee expertise |

|

CHESAPEAKE UTILITIES CORPORATION - 2024 Proxy Statement - 9

| | | | | | | | | | | |

| | | RONALD G. FORSYTHE, JR. Dr. Forsythe has served as Chief Executive Officer of Qlarant Corporation, and its predecessor company Quality Health Strategies Corporation, since 2015. Dr. Forsythe served as President of Quality Health Strategies (2015-2018) and as its Chief Operating Officer (2012-2015). Dr. Forsythe previously served as Chief Information Officer and Vice President of Technology and Commercialization at the University of Maryland Eastern Shore, and as an IT consultant for a large water and wastewater utility. Dr. Forsythe formerly served as a member of the Regional Advisory Board of a predecessor company of Truist Financial, Board of the Peninsula Regional Medical Center Foundation, and on the Higher Education Advisory Boards for Sprint Corporation and Gateway Computers. Dr. Forsythe also previously served as a member of Quality Health Foundation and Horizons® at the Salisbury School. Dr. Forsythe is a NACD Board Leadership Fellow and was formerly recognized by Savoy Magazine as one of the Most Influential Black Corporate Directors. |

| |

| | |

Director since 2014 Independent Director Age 55 Audit Committee Member and Financial Expert Compensation Committee Member | | |

| | Key Attributes and Skills: •Extensive experience in leadership, technology including cybersecurity, organizational positioning, and energy •In-depth knowledge of markets throughout the Delmarva Peninsula •Financial and Audit Committee expertise |

|

| | | | | | | | | | | |

| | | SHEREE M. PETRONE Ms. Petrone served as Executive Vice President and head of the retail electricity business of Dynegy Inc., a major national power company, until her retirement in 2018. Prior to Dynegy, Ms. Petrone served as vice president of commercial and retail divisions at Exelon and in financial roles at PECO, an Exelon company. Ms. Petrone also previously served in management positions at Trigen Energy and Westinghouse. Ms. Petrone currently serves as President of Atwater Advisory where Ms. Petrone focuses on strategic growth strategies and value creation. Ms. Petrone has deep experience across the entire value chain, including management, business development and customer service in competitive power generation markets and regulated transmission and distribution businesses. Ms. Petrone is an executive mentor at the University of Delaware’s Alfred Lerner College of Business & Economics. Ms. Petrone serves as a Trustee of Magee Rehabilitation Hospital Foundation and past Chair of its Strategic Planning Committee. Ms. Petrone is a member of The Forum of Executive Women and was recognized in its Women in Leadership 2023 publication. Ms. Petrone is also a member of the Women’s Council on Energy and the Environment in Washington, D.C., and Alliance Française de Philadelphie where Ms. Petrone also serves as Treasurer. |

| | |

Director since 2022 Independent Director Age 67 Compensation Committee Member Investment Committee Member | | |

| | Key Attributes and Skills: •Strategic and operations leadership with extensive experience in the energy industry, from power generation to the customer experience •Expertise in finance, customer service, and business development integration •In-depth knowledge of the Pennsylvania energy markets |

| | |

CHESAPEAKE UTILITIES CORPORATION - 2024 Proxy Statement - 10

| | | | | | | | |

| Proposal | NON-BINDING ADVISORY VOTE TO APPROVE THE COMPENSATION OF THE COMPANY'S NAMED EXECUTIVE OFFICERS | |

| 2 | The Board recommends that stockholders vote FOR the approval of the compensation of the Company's NEOs. | |

Say-on-Pay

General Information. Although the Compensation Committee is directly responsible for the oversight and administration of our executive compensation program, we are providing you with the means to express your view on this matter. Your vote will not create or imply any change to our fiduciary duties or create or imply any additional fiduciary duties for the Compensation Committee or the Board. As an advisory vote, this proposal is non-binding. However, the Board values the opinions that our stockholders express in their votes and may consider the outcome of the vote when making future executive compensation decisions.

The advisory resolution, commonly known as a "say-on-pay" proposal, provides you the opportunity to express your views on our executive compensation program for the Company's NEOs. The resolution is required by Section 14A of the Exchange Act. We ask you to vote FOR the following resolution: "RESOLVED, that the stockholders of Chesapeake Utilities Corporation approve, on a non-binding, advisory basis, the compensation of the Named Executive Officers as disclosed in this Proxy Statement for the 2024 Annual Meeting of Stockholders."

Voting for the Approval of the Compensation of the Company's NEOs. Proposal 2 will be deemed to be approved, on an advisory basis, if a majority of the Company's outstanding common stock present at the Meeting or represented by proxy and entitled to vote affirmatively votes in favor of this proposal. Abstentions will have the same effect as a vote against this proposal. Broker non-votes will have no effect on the outcome of the advisory vote.

Compensation Committee Role

General Information. The Compensation Committee is responsible for the oversight and administration of the Company's executive compensation program. The Committee designs, recommends to the Board for adoption, and administers the policies and practices related to executive compensation. We promote a pay-for-performance culture by designing an executive compensation program that includes base salary, as well as short and long-term performance-based incentive awards. Our Compensation Committee considers the alignment of total compensation with our business objectives, thereby focusing on stockholder value. The Committee, to the extent that it deems appropriate (and, in the case of any of the Company's employee benefit plans, to the extent permitted by the plan), may delegate the day-to-day administration of matters under its authority to employees, or a subcommittee, of the Company and its subsidiaries, subject in all cases to the Committee's oversight.

Independence of Committee Members. On February 20, 2024, the Board determined that none of the Compensation Committee members had any material relationship with the Company in accordance with the NYSE Listing Standards and the Company's Corporate Governance Guidelines. Thus, each member of the Compensation Committee is independent and, other than in their capacity as a director and member of the Compensation Committee and other Board committees, has no other relationship or arrangement with the Company or any of the NEOs. Each member of the Compensation Committee also meets the definition of a "Non-Employee Director" under Rule 16b-3 promulgated by the SEC under the Exchange Act.

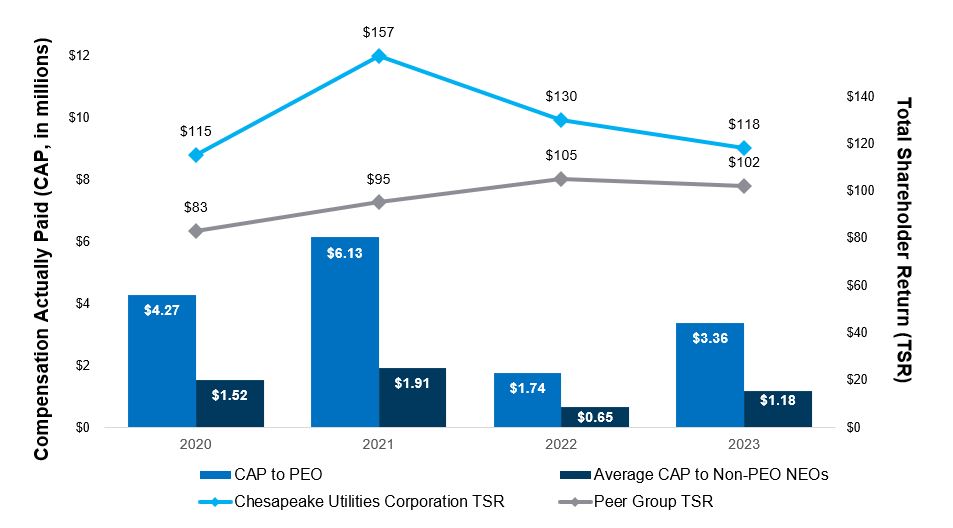

Philosophy and Design of Executive Compensation Program. In the Compensation Discussion and Analysis and Executive Compensation sections of this Proxy Statement, we provide additional narrative and information regarding our current executive compensation program, including our philosophy, the design of our program, and the mix of compensation that the Compensation Committee believes aligns the financial interests of the executive officers with the interests of our stockholders. The Committee annually reviews and approves the executive compensation program and considers several elements, including, but not limited to: (i) the effectiveness of the program in attracting and retaining highly qualified individuals that have a solid foundation and comprehensive perspective of the Company, its operations and competitive environment; (ii) the complex nature of our operations as a diversified energy delivery company; and (iii) the long-term focus on our strategic planning process. The Committee promotes a pay-for-performance culture by including short-term cash and long-term equity incentive awards based on achievement of pre-established performance criteria set by the Committee. This puts a substantial portion of an executive's total direct compensation at-risk with the long-term equity incentive award comprising the largest component.

CHESAPEAKE UTILITIES CORPORATION - 2024 Proxy Statement - 11

The Compensation Committee works directly with FW Cook, its independent compensation consultant, in designing the executive compensation program. FW Cook provides the Committee with market analyses that compare the Company's executive compensation against market information for companies in our peer group and a published survey source. The analyses assess the competitiveness of total compensation for the Company's NEOs. The independent compensation consultant’s report concluded that for the 2023 executive compensation program: (i) target total direct compensation for the NEOs was, in aggregate, within a competitive range of the market median for the survey data; and (ii) the executive compensation program promotes a culture of pay-for-performance as a majority of compensation is at risk.

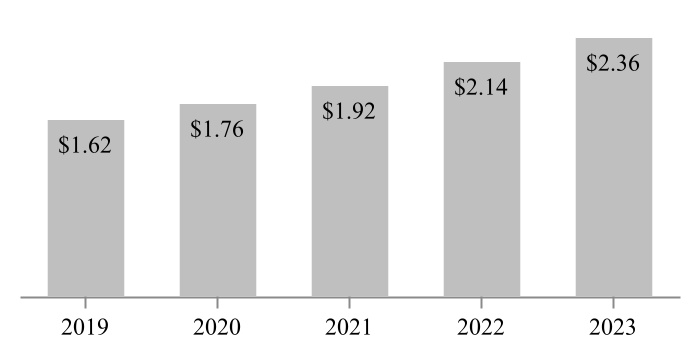

Compensation Committee Practices and Business Performance. Our executive compensation program is designed to provide fair, reasonable and competitive compensation that also aligns total compensation to our business objectives, performance and creation of stockholder value. This is evidenced by 63 years of consecutive annual dividends, our strong earnings growth, and an average annualized shareholder return that ranged from approximately 7% to 13% for the past 5, 10 and 20-year periods ended December 31, 2023. Our executive compensation practices include, but are not limited to:

•The Compensation Committee is comprised of independent directors who retain discretion over the administration of our executive compensation program and discretion in determining the achievement of performance;

•Each incentive award features a cap on the maximum amount that can be earned for any performance period;

•Dividends on equity incentive awards that vest based on the achievement of performance goals accrue as dividend equivalents during the performance period and are paid only on the actual shares earned, if any:

•Stock ownership requirements are in place for named executive officers;

•A compensation recovery policy that complies with the Dodd-Frank Wall Street Reform and Consumer Protection Act and related NYSE rules which requires the repayment by a NEO if an incentive award was calculated based upon the achievement of certain financial results or other performance metrics that, in either case, were subsequently found to be materially inaccurate for any reason (including, without limitation, by reason of a financial restatement, mistake in calculations, or other administrative error); and

•NEOs participate in the same benefits that are available to other employees of the Company. A Company vehicle is available for personal use but is treated as compensation to the executive.

| | | | | | | | |

Proposal | NON-BINDING ADVISORY VOTE TO RATIFY THE APPOINTMENT OF THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

| 3 | The Board recommends a vote FOR the ratification of the appointment of Baker Tilly US, LLP as the Company’s independent registered public accounting firm for 2024.

|

Appointment of External Audit Firm

The Audit Committee is solely responsible for the appointment, oversight, retention, and termination of the work of the Company's independent registered public accounting firm (also referred to in this Proxy Statement as “external audit firm”), including the approval of all engagement fees, terms, and the annual audit plan. On February 19, 2024, the Audit Committee approved the reappointment of Baker Tilly to serve as our external audit firm for 2024. Baker Tilly (independently or through a legacy firm) has served as the Company’s external audit firm since 2007. In determining whether to reappoint Baker Tilly as the Company’s external audit firm, the Audit Committee took into consideration several factors, including an assessment of the professional qualifications and past performance of the Lead Audit Partner and the audit team, the quality and level of transparency of the Audit Committee’s relationship and communications with Baker Tilly, and the length of time the firm has been engaged. The Audit Committee considered, among other things, Baker Tilly’s energy experience and the knowledge and skills of Baker Tilly’s auditing experts that would be providing services to the Company.

Evaluation of External Audit Firm

The Audit Committee previously established criteria and procedures used to evaluate the quality of the audit services. The evaluation focuses on the qualifications and performance of Baker Tilly; the quality and candor of the external audit firm’s communications with the Audit Committee and Company management; and the external audit firm’s independence and objectivity. In 2023, each member of the Audit Committee, as well as certain members of management and the Company's internal audit team, completed an evaluation of

CHESAPEAKE UTILITIES CORPORATION - 2024 Proxy Statement - 12

the quality of the audit services rendered in 2022. The questions were specifically developed for each respondent given the individual's relationship with the external audit firm. The Audit Committee analyzed the results of the assessment, which provided the Audit Committee with additional insight into the effectiveness and objectivity of the Company's external audit firm. The Chair of the Audit Committee and the Chief Financial Officer communicated the results of the evaluation process to Baker Tilly’s Lead Audit Partner. We will undertake the same process in 2024 for audit services performed in 2023.

The Audit Committee takes additional measures to ensure the audit team is independent and has the experience to facilitate an audit of the highest quality. These measures include, but are not limited to: (i) independently meeting with the external audit firm to discuss communications and other appropriate matters, (ii) pre-approving the audit and non-audit services performed by the external audit firm in order to assure that they do not impair the auditor’s independence, (iii) overseeing the process for the rotation or transition of the Lead Audit Partner to ensure the Lead Audit Partner has the knowledge, experience and quality to sustain the integrity of the Company’s audits and the requisite knowledge of the Company’s business and expected areas of future growth, and (iv) periodically overseeing the process to solicit proposals from external audit firms to review, among other things, the experience, qualifications, technical abilities, and competitiveness of the audit fees prior to appointment of the external audit firm.

Non-Binding Advisory Vote to Ratify the External Audit Firm

The Audit Committee is directly responsible for selecting and retaining the external audit firm. However, we are providing you with the means to express your view on this matter. While this vote is not binding, in the event that stockholders fail to ratify the appointment of Baker Tilly, the Audit Committee will take the vote into consideration in its evaluation of the external audit firm. Even if the appointment is ratified, the Audit Committee, in its discretion, may direct the appointment of a different external audit firm at any time during the year if the Audit Committee determines that such a change would be in the best interests of the Company and its stockholders.

Proposal 3 will be deemed to be approved, on an advisory basis, if a majority of the shares present at the Meeting or represented by proxy and entitled to vote affirmatively votes in favor of this proposal. Abstentions will have the same effect as a vote against this proposal. Brokers will have discretion to vote on this proposal.

A representative from Baker Tilly will be available at the Meeting to respond to appropriate questions. A formal statement will not be made.

3 - AUDIT RELATED MATTERS

Audit Committee Report

To the Stockholders of Chesapeake Utilities Corporation:

The primary functions of the Audit Committee include assisting the Board of Directors in fulfilling its fiduciary responsibilities by providing informed, diligent, and effective oversight of:

•The Company’s accounting policies, procedures and controls;

•The performance of the internal audit function;

•The appointment, retention, termination, compensation and oversight (including the assessment of the qualifications and independence) of the independent auditors;

•The quality and integrity of the Company’s consolidated financial statements and related reports;

•The Company's risk management processes, including oversight of cybersecurity risk; and

•The Company’s compliance with legal and regulatory requirements.

The Committee acts under a charter, which is reviewed at least annually and can be found on the Company’s website. All of our members are independent directors and determined to be “financial experts.” As a Committee, we assess our performance at least annually with a goal of continually finding ways to enhance our oversight performance.

This Audit Committee Report is being submitted in conjunction with the Company’s audited financial statements for the year ended December 31, 2023. In conjunction with our oversight responsibilities, prior to the issuance of the Company’s unaudited quarterly financial statements and annual audited financial statements, the Committee reviewed and discussed the earnings press releases,

CHESAPEAKE UTILITIES CORPORATION - 2024 Proxy Statement - 13

consolidated financial statements and required footnotes, and disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” (including significant accounting policies and judgments) with the Company’s management, internal auditors, and independent registered public accounting firm, Baker Tilly US, LLP (“Baker Tilly”). The Committee also reviewed the Company’s policies and practices with respect to financial risk assessment, as well as conferred with Baker Tilly on the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (the "PCAOB") and the Securities and Exchange Commission (the "SEC").

The Committee discussed with Baker Tilly the overall scope and plan for its audit and approved the terms of its engagement letter. The Committee also reviewed and approved certain audit services performed by Baker Tilly in conjunction with the acquisition of Florida City Gas. The Committee also reviewed the Company's internal audit plan. The Committee met with Baker Tilly and with the Company's internal auditor, in each case, with and without other members of management present, to discuss the results of their respective examinations, the evaluation of the Company’s internal controls and the overall quality and integrity of the Company’s financial reporting. The Committee also met regularly with management to discuss accounting, auditing, internal control, financial reporting, earnings and risk management processes and matters, including cybersecurity. The Committee has received the written disclosures and the letter from Baker Tilly required by applicable requirements of the PCAOB regarding Baker Tilly’s communications with the Committee concerning independence, and has discussed with Baker Tilly its independence. The Committee and Baker Tilly engaged in annual discussions regarding the definition of a Critical Accounting Matter ("CAM"). These discussions included the nature of potential CAMs for the Company, Baker Tilly’s basis for the determination of the CAM included in their audit report and how the CAM will be described therein. For both 2022 and 2023, the discussion of the CAM in Baker Tilly’s report captures and is consistent with our dialogue regarding these matters.

Based on the Committee’s review and the discussions referred to above, the Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 for filing with the SEC.

The Audit Committee has appointed Baker Tilly to serve as our independent registered public accounting firm for the fiscal year ending December 31, 2024. In determining whether to appoint Baker Tilly, the Audit Committee took into consideration various factors, including the historical and recent performance of Baker Tilly on the audit; the professional qualifications of the firm and the Lead Audit Partner; the quality of ongoing discussions with Baker Tilly; the results of internal surveys of Baker Tilly’s service, quality and efficiency; the appropriateness of fees; external data on audit quality and performance; and evidence supporting the firm’s independence, objectivity and professional skepticism. Although the Audit Committee has sole authority to appoint the independent registered public accounting firm, the Committee has recommended that the Board seek stockholder ratification of the appointment at the Annual Meeting.

The information in this Audit Committee Report shall not be considered to be “soliciting material” or be “filed” with the SEC, nor shall this information be incorporated by reference into any previous or future filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent that the Company incorporated it by specific reference. This Audit Committee Report is provided by the following independent directors, who comprise the Audit Committee:

THE AUDIT COMMITTEE

| | | | | | | | | | | | | | |

| | | | |

Thomas J. Bresnan, Chair | Ronald G. Forsythe, Jr. | Stephanie N. Gary | Thomas P. Hill, Jr. | Dennis S. Hudson, III |

Fees and Services of the Company's Independent Auditors

The following provides information on fees for professional services rendered by Baker Tilly for the two years ended December 31, 2023 and 2022.

Audit Fees

The aggregate fees that Baker Tilly billed to the Company and its subsidiaries in 2023 and 2022 totaled $1,489,202 and $909,017, respectively. Fees for professional services rendered included fees associated with matters in connection with the audits of the

CHESAPEAKE UTILITIES CORPORATION - 2024 Proxy Statement - 14

financial statements included in our Annual Reports on Form 10-K including the impacts of recently completed acquisitions; the reviews of the financial statements included in our Quarterly Reports on Form 10-Q; the audits of certain of our subsidiaries or operations typically performed for statutory and regulatory filings or engagements; the audits of internal control over financial reporting as required by Section 404 of the Sarbanes-Oxley Act of 2002; services related to the Florida City Gas acquisition; and the issuance of their consents associated with our registration statements filed with the SEC during 2023.

Audit-Related Fees, Tax and Other Fees

The aggregate fees billed for audit-related services were $51,765 and $51,765 for 2023 and 2022, respectively. During 2023 and 2022, Baker Tilly performed annual audits on our benefit plans for the plan years ended December 31, 2022 and 2021, respectively. The Company did not engage Baker Tilly to provide any tax services or any services other than those described above.

Audit and Non-Audit Services Pre-Approval Policies and Procedures

The Audit Committee pre-approves the audit and non-audit services performed by the Company's external audit firm in order to assure that they do not impair the external audit firm’s independence. The Audit Committee may also pre-approve tax services provided by the external audit firm, if any. In November 2023, the Audit Committee reviewed its Audit and Non-Audit Services Pre-Approval Policy and made no changes. Under this policy, the Audit Committee may pre-approve specific services in advance or may pre-approve one or more categories of audit and non-audit services. For all proposed services, the Audit Committee will, among other things, consider whether the external audit firm is the best positioned to provide the proposed services most effectively and efficiently based on its familiarity with our industry, business, people, culture, accounting systems, risk profile and other factors, and whether the services are likely to enhance our ability to manage risk or improve audit quality. The Audit Committee may establish ceilings on the level of fees and costs of generally pre-approved services that may be performed.

The Audit Committee has delegated to the Chair of the Audit Committee (who may delegate authority to any other member of the Audit Committee) authority to pre-approve up to $40,000 in audit and non-audit services, which authority may be exercised when the Audit Committee is not in session. At least annually, the external audit firm is required to report to the Audit Committee on the specific services provided and the amounts that have been paid to the external audit firm. The Chief Financial Officer is required to report to the Audit Committee on the specific services provided and the amounts paid by the Company. The Company's internal audit team is responsible for monitoring and reporting on the performance of all services provided by the external audit firm and to determine whether these services comply with the Audit Committee’s policy. In 2023 and 2022, the Audit Committee approved all audit and non-audit services provided to the Company by Baker Tilly.

4 - BOARD OF DIRECTORS AND ITS COMMITTEES

Board of Directors

Board Oversight. The Board is elected by the Company's stockholders to oversee the direction and strategy of the business and to ensure that the Company continues to operate in the best interests of all stakeholders. As fiduciaries, Board members are committed to overseeing the sustainability of the Company, its safety and operational compliance practices, and the promotion of equity, diversity and inclusion that reflects the diverse communities we serve. The Board and its Committees monitor corporate performance, the integrity of financial controls, and the effectiveness of our compliance and enterprise risk management programs, including cybersecurity. The Board also oversees plans for the succession of key executives and is integrally involved in the strategic planning and capital budget processes, as well as establishing key financial and operational metrics. This year-round oversight process is facilitated through the diversity of our Board's broad range of personal and professional skills, experiences, backgrounds, perspectives, and expertise in cybersecurity, risk mitigation, leadership, corporate governance, board service, energy, economics, finance, public affairs, academia, and entrepreneurism. Several current Board members have served as chief executive officers or in other C-suite roles at various organizations and bring skillful business acumen to the boardroom. Collectively, the incumbent Board has a vast amount of diverse experience and established personal and professional relationships in the communities we serve. Directors may not serve on more than two other public company boards in accordance with our Corporate Governance Guidelines.

Board Leadership. Currently, our Board is comprised entirely of directors who are independent within the meaning of the NYSE’s Listing Standards and the Company’s director independence standards, other than Jeffry M. Householder who is our Chair of the Board, President and Chief Executive Officer. The Board’s Audit Committee, Compensation Committee, Corporate Governance Committee, and Investment Committee are all comprised solely of independent directors.

CHESAPEAKE UTILITIES CORPORATION - 2024 Proxy Statement - 15